How to Build Back Better the Transatlantic Data Relationship

Transatlantic data flows are essential to organizations of all sizes and industries—not just large technology firms. The EU and United States must establish clear, consistent legal mechanisms for data transfers so both sides can thrive in an increasingly digital global economy.

KEY TAKEAWAYS

Key Takeaways

The EU and United States Need to Repair and Reinforce the Digital Transatlantic Relationship. 5

The Role and Value of Data Flows and Digital Trade in the Transatlantic Relationship. 6

What’s at Stake: The Valuable Role of Transatlantic Data Flows Across Sectors 12

Introduction

Cross-border data transfers—involving both personal and nonpersonal data—enable firms of all sectors and sizes to engage in transatlantic commerce. Government agencies also need firms to be able to transfer data across borders as part of financial oversight, drug approval, law enforcement, counterterrorism, and other responsibilities. The European Union’s (EU) General Data Protection Regulation (GDPR) was supposed to bring a more predictable and harmonized approach to data protection within the EU and provide a range of tools for firms to transfer EU personal data overseas. Instead, successive court challenges have made it harder and more complex—and without political intervention, the situation will devolve into an irrevocably severed transatlantic digital relationship. EU and U.S. policymakers need to step in and avoid taking a narrow and legalistic approach to the challenges facing transatlantic data flows and instead build back better in terms of creating a new and efficient transatlantic data framework.

Transatlantic digital policy cooperation has faced a decade of turmoil—but it has never been as dire as now. For the second time, the EU’s top court (in the Schrems II case) invalidated the framework that manages transatlantic transfers of EU personal data (the EU-U.S. Privacy Shield), after finding that U.S. laws do not sufficiently protect data about EU citizens stored in the United States.[1] The challenge for policymakers is to reconcile the EU’s data protection laws with U.S. surveillance policies and practices. Unfortunately, the current stalemate makes transatlantic data transfers increasingly difficult, if not impossible, and imperils other major transatlantic interests around commercial access to data for trade and innovation and government cooperation on law enforcement, national security, and regulatory issues.

It is impossible to fully localize any digital process, good, or service without some level of impact or disruption. The underlying data storage infrastructure does not necessarily rely on the ability to exchange data across borders, but the services built on it certainly do.

Potential legal challenges and restrictive policy proposals by the European Data Protection Board (EDPB) and others are raising concerns about whether firms will still be able to use standard contractual clauses (SCCs), which are the last broadly accessible legal tool for U.S. and EU firms to transfer EU personal data.[2] Indicative of where this is heading, the EDPB has already issued guidance that “strongly encourages” EU institutions considering new contracts with service providers “to avoid processing activities that involve transfers of personal data to the United States.”[3] Another major (and restrictive) policy reaction is making firms (no matter how big or small) responsible for assessing each storage destination’s surveillance and government access laws—and that the hypothetical potential for any data disclosure is reason enough to not transfer EU personal data. This is an unrealistic legal and practical threshold for firms to meet given it fails to account for the actual potential of government access and the difficulty in understanding different and constantly changing legal frameworks around the world.

Transatlantic data flows may be suddenly severed through another legal challenge or reduced over time as new restrictive requirements are defined and enforced against firms by the EDPB and individual EU member state data protection authorities. Within this challenge of rebuilding the transatlantic digital relationship, it is important to reinforce the central point that data transfers, data-driven innovation, and data protection are not mutually exclusive. Firms cannot undermine local data privacy, protection, and other related laws by transferring data to another country because they are held accountable for how they manage data, meaning local legal requirements travel with the data, regardless of where it is stored and processed.[4] This contrasts with the European focus on the geography of data storage. Making international transfers of EU personal data increasingly difficult, costly, and legally uncertain leaves local data storage and processing as the only viable option, which is the end goal for many privacy advocates and policymakers in Europe. As it stands, the EU’s approach to data privacy is creating the world’s largest de facto data localization framework. The EU’s only peer is China’s broad and growing explicit data localization regime, with laws that make local data storage and processing the norm and transfers the exception. At some point, the pressure on U.S. policymakers to reciprocate with equally restrictive rules preventing EU firms such as Volkswagen, Phillips, Siemens, and Sanofi from transferring data from their U.S. operations to their EU headquarters will become significant enough to spur retaliatory action.

It is infeasible for firms to build out local human resources, management, research and development (R&D), regulatory compliance, and information technology (IT) and customer support services in each and every market that has local data storage requirements. Such requirements undermine the ability of all firms—especially globally engaged ones—to leverage the distributed power of the Internet and centralized IT systems to manage local, regional, and global business operations and compliance activities. It is impossible to fully localize any digital process, good, or service without some level of impact or disruption. While it may be technically possible for a company—particularly a large one—to fully localize data storage, there would be major disruptions and changes to the type and quality of services, as well as limits on the use of technologies such as artificial intelligence (AI) wherein algorithms improve with larger datasets. The underlying data storage infrastructure does not necessarily rely on the ability to exchange data across borders, but the services built on it certainly do.

Transatlantic data flows have enormous economic implications. Two-way EU-U.S. digital trade grew from an estimated $166 billion in 2005 to $292 billion in 2015. The sectoral case studies in this report show what is at stake. Despite the popular misconception that data flows only benefit search engines and social networks, severing transatlantic data flows would have wide-reaching impacts across the global economy. Yet, some EU policymakers think that restricting or cutting off data flows and digital trade with the United States is a good thing as it aligns with their “digital sovereignty” goals, believing that if it hurts leading U.S. tech firms, then it must be good—without realizing or appreciating the broader and much larger costs. This stance ignores the fact that doing so would also hurt the hundreds of European firms that used Privacy Shield and SCCs to manage data transfers between their headquarters and offices and operations in the United States.[5] Unfortunately, this protectionist impulse is also evident in Europe’s ongoing effort to define its own digital economy framework, such as the European Commission’s data strategy and its Data Governance Act.[6]

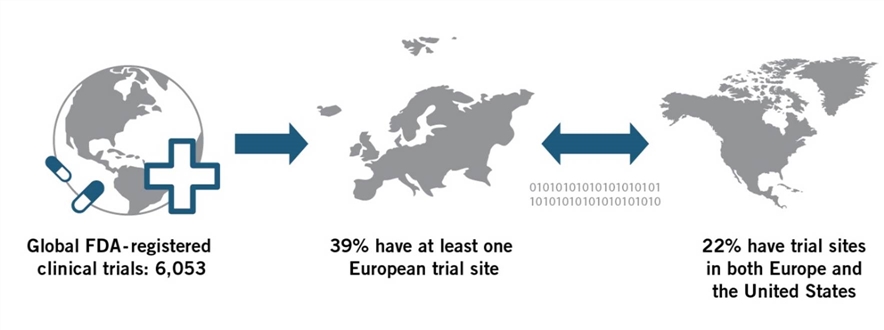

But the impact is not only trade and innovation-related—governments on both sides of the Atlantic depend on firms being able to transfer data as part of day-to-day regulatory requirements, whether for financial oversight of the banking, financial, and payments sectors (for financial stability, counter-terrorism financing, or anti-money-laundering purposes) or the review of clinical trials by respective public health agencies. This is obviously in addition to law enforcement and national security cooperation.

This report starts by outlining the history of the transatlantic digital relationship to show how both the EU and Unites States have continuously recognized the value in working together to address issues as they arise. However, this report also makes the case that this relationship should not be based on troubleshooting, but ideally, on a broader digital agenda, given both sides share many values and interests. It then analyzes estimates of the economic value of transatlantic digital trade, before providing a series of sectoral case studies to show how firms in a diverse range of sectors—from automotive and other advanced manufacturers to life sciences to consumer Internet services to financial and banking services—use transatlantic data flows.

Finally, this report provides recommendations to build a better, stronger, and broader transatlantic digital relationship:

1. Policymakers should negotiate a new Privacy Shield. Long term, the two sides could work toward legislation and a treaty agreement that would codify some of their commitments. In an ideal world, the United States and Europe would work together with like-minded countries to develop a “Geneva Convention for Data,” which would create consensus on issues around government access to data.

2. The EU should redouble efforts to build new data transfer mechanisms under GDPR. This would be in addition to the more immediate need to make existing legal tools (SCCs and binding corporate rules) clear, reasonable, and accessible.

3. The United States and EU should conclude negotiations to improve transatlantic access to electronic evidence for law enforcement investigations.

4. The EU and United States should build a broader agenda for pragmatic cooperation on data and digital policy issues—one based on “digital realpolitik.” Such cooperation would be economically beneficial to both sides given their extensive economic connections. Furthermore, while there are points of conflict, overall, their shared values stand in stark contrast to those of authoritarian digital powers such as China and Russia. Such an agenda could work on how to develop data sharing frameworks; develop and apply the appropriate regulation of AI, such as via algorithmic accountability; develop interoperable electronic identity systems; build pre-standardization cooperation for new and emerging technologies; develop a coordinated strategy to counter China’s efforts to unduly influence international standards setting for AI and digital policies; and cooperate and coordinate investment screening and export controls that increasingly deal with data and digital technologies.

The EU and United States Need to Repair and Reinforce the Digital Transatlantic Relationship

Despite constant pressure over the last decade—and as reactions to the Snowden revelations continue to reverberate—both the EU and United States have kept the transatlantic data and digital relationship going. Despite the challenges, there is largely bipartisan support in the United States for EU-U.S. digital engagement.

There was substantial continuity across the Obama and Trump administrations, which is likely to continue in the Biden administration. In 2014, President Obama issued presidential policy directive number 28 on “Signals Intelligence Activities,” which included safeguards for non-U.S. persons in signals intelligence.[7] Privacy Shield was signed under President Obama, and was also supported by the Trump administration. The U.S. Federal Trade Commission enforced Privacy Shield throughout both administrations. Meanwhile, the U.S. Congress continues to debate a comprehensive U.S. data privacy bill that would no doubt improve the overall context for engagement with the EU. However, data privacy legislation would not address the fundamental disagreement over U.S. government surveillance that is at the heart of Schrems II.

Without political intervention, it is likely that transatlantic data transfers will eventually be cut off.

Given this, rebuilding a strong transatlantic relationship will require action on both sides. Most of the focus has been on the United States, which has already made changes to account for EU concerns and signaled its willingness to consider further changes. Yet, ongoing conflict over EU policy remains. The United States should take into consideration European concerns as it updates its laws and policies around government access to data and data protection. However, the EU should also consider policy and legal reforms to GDPR and other digital policies as part of constructive efforts to build both short- and long-term tools to address both new and ongoing issues regarding international data governance. EU member states also need to be consistent in addressing data privacy and surveillance issues. National security is not a European Commission or EU competency, so doing so will require EU member engagement. If the EU continues to take a largely hands-off approach about the need to address all related issue—not just privacy, but trade and national security—it will lead to ruin as it leaves privacy advocates, the EDPB, and the courts in the driver’s seat of a critically important part of the transatlantic relationship.[8] Without political intervention, it is likely that transatlantic data transfers will eventually be cut off.

The stakes involved in building a successful transatlantic digital relationship are already high, but they grow even higher, given the many global debates about data and digital technologies. If the EU and United States want to truly work together on these issues—as the European Commission frequently calls for—they both need to show that they can address their own issues in a way that presents a model for other countries. Absent such an outcome, calls for transatlantic cooperation on global issues would be seen as meaningless.

The Role and Value of Data Flows and Digital Trade in the Transatlantic Relationship

Digital trade—including both digital and digitally enabled services—is an increasingly important component of the global economy. As the sectoral case studies show, cross-border transfers of data underpin virtually all business processes in international trade and investment.[9]

Estimating the value of transatlantic data flows and digital trade is challenging.[10] For example, approximating value by the aggregate volume of data transfers has significant limitations.[11] The value of data depends on its content.[12] Data is also highly context specific. An individual person’s data may be valuable to that person, but only hold broader value when aggregated with data from many other individuals and other sources of data. The value of data is temporal in that it may only become valuable when used as part of future analysis. Furthermore, some data flows may be non-monetized—representing intra-company transfers that are commercially valuable, but not captured in a formal transaction. Similarly, gross domestic product (GDP) and other economic statistics do not measure the value of consumer surplus, such as when consumers access digital goods and services at no financial cost.[13] While estimating the value of the specific underlying data and its transfer is difficult, it is clear that continuous data aggregation and analysis by firms creates enormous value, in what the Organization for Economic Cooperation and Development (OECD) calls the “global data value cycle.”[14]

While precise, comprehensive, and consistent measurement of the value of data and digital trade in and between the United States and EU is not yet possible, there are a range of estimates that support what we know anecdotally—that data and digital trade represent an important and fast-growing part of the global economy.[15] In August 2020, the U.S. Department of Commerce’s report “New Digital Economy Estimates” calculated that the digital economy accounted for 9 percent of U.S. GDP in 2018, which ranked it just below the manufacturing sector (which accounted for 11.3 percent) and just above finance and insurance (7.6 percent).[16] From 2006 to 2018, the U.S. digital economy’s real value added grew at an annual rate of 6.8 percent. It supported 8.8 million jobs, which represented 5.7 percent of U.S. total employment.[17] In Europe, the value added from the information and communication technology (ICT) sector in 2017 was equivalent to at least 3.9 percent of GDP, 2.5 percent of total employment, and 18.6 and 20.6 percent of the total R&D personnel and researchers in the EU, respectively.[18] Employment in the EU’s ICT services sector grew by 22.7 percent between 2012 and 2017.[19] And as of 2020, one of the fastest-growing aspects of the global digital economy, the “app economy,” accounts for over 2 million jobs in the U.S. and EU alike.[20]

Data and digital trade represent an important and fast-growing part of the global economy.

Traditional trade statistics capture some of the EU-U.S. digital trade relationship, but not all.[21] The United States is both the largest (non-EU) market for Europe’s digitally enabled services and its largest supplier.[22] Indicative of this, about half of all data flows in both the United States and Europe are transatlantic transfers.[23] In 2018, digitally enabled services accounted for the majority of U.S. services exports (55 percent), nearly half of U.S. services imports (48 percent), and a full 69 percent of U.S. global surplus in services.[24] The U.S. also accounted for 32 percent of exports and 39 percent of imports of digitally enabled services from and to the EU.[25]

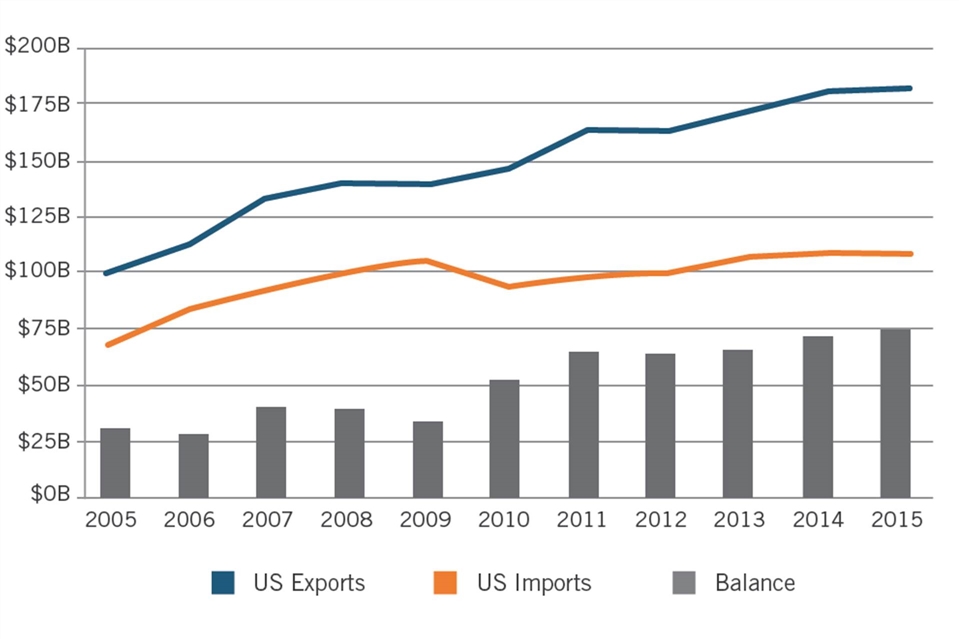

The U.S. Department of Commerce’s ICT and potential-ICT based digital trade data provides the broadest, and most recent, estimate of transatlantic digital trade, which in total, was worth $295 billion in 2018. It captures both ICT services that are used to facilitate information processing and communication (e.g., computer and telecommunication services) and potentially ICT-enabled services that can predominantly be delivered remotely over ICT networks, such as financial, insurance, intellectual property, professional and management services, and R&D services, among others.[26] The data estimates that, in 2018, ICT and potential-ICT based digital trade between the United States and Europe was $188 billion in exports to, and $107 billion in imports from, the EU, respectively (see figure 1).

Figure 1: U.S. exports and imports of ICT and potential ICT-based digital trade with the EU (2018)[27]

Updating the U.S. Department of Commerce’s “digitally deliverable services” (DDS) estimate—which comprises a more narrow set of services than those included in the estimates above—is more readily comparable across countries (using trade in value added (TiVA) and Eurostat databases), but does not have data for recent years (most recent data is for 2015). Analysis of DDS trade captures a mix of transactions that are entirely digital, somewhat digital, or entirely non-digital.[28] It also shows that transatlantic trade is large and growing. U.S. DDS exports to the EU rose from $98 billion to $183 billion between 2005 and 2015, while EU DDS exports to the United States rose from $67 billion to $108 billion (see figure 2).

Figure 2: U.S. exports and imports of digitally delivered services with the EU (2005-1015)[29]

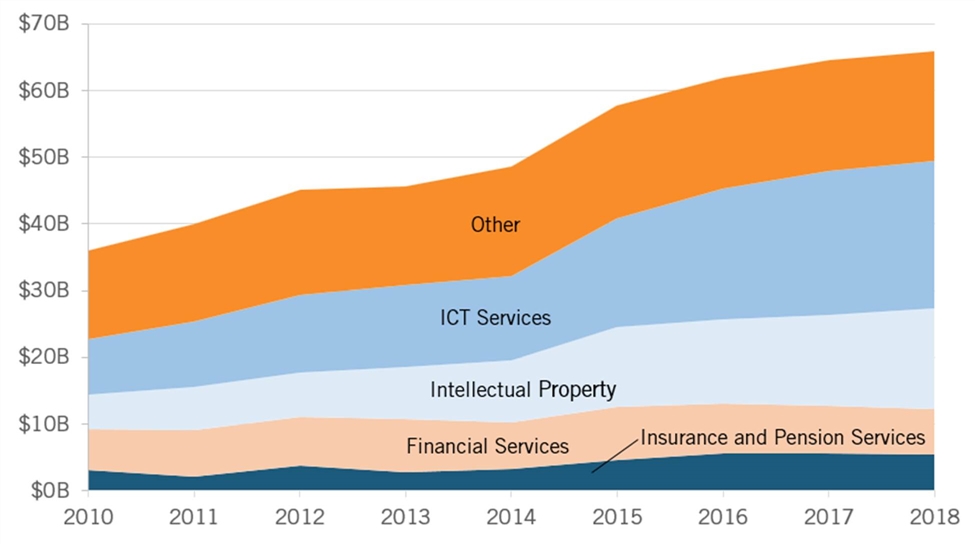

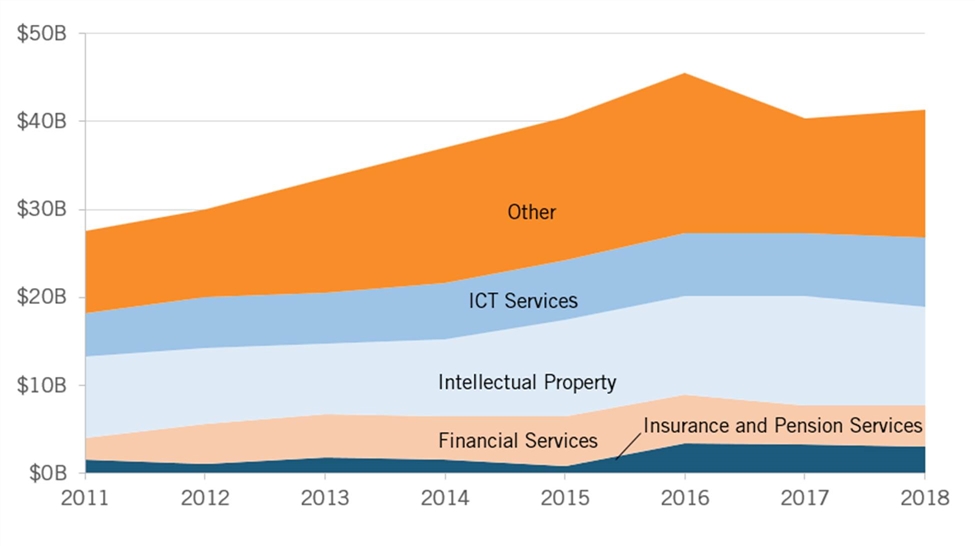

The EU’s DDS exports vary considerably by member state, which highlights the economic differences between member states and their use of data, services, and ICTs.[30] According to TiVA data, Germany has seen consistently rising DDS exports, growing from $36 billion in 2010 to $65 billion in 2018 (see figure 4). France has also seen its DDS exports grow, from $27 billion in 2011 to $41 billion in 2018 (see figure 5). By contrast, Italy’s exports have barely grown (see figure 6), increasing only from $6.1 billion to $8.6 billion between 2010 and 2018. The Netherlands’ DDS exports declined, falling from $41 billion in 2010 to $26 billion to 2018. Despite that country’s low overall DDS exports, however, DDS services remain important to the Netherlands, exhibiting a high degree of DDS export intensity (DDS exports as a percentage of total service exports).

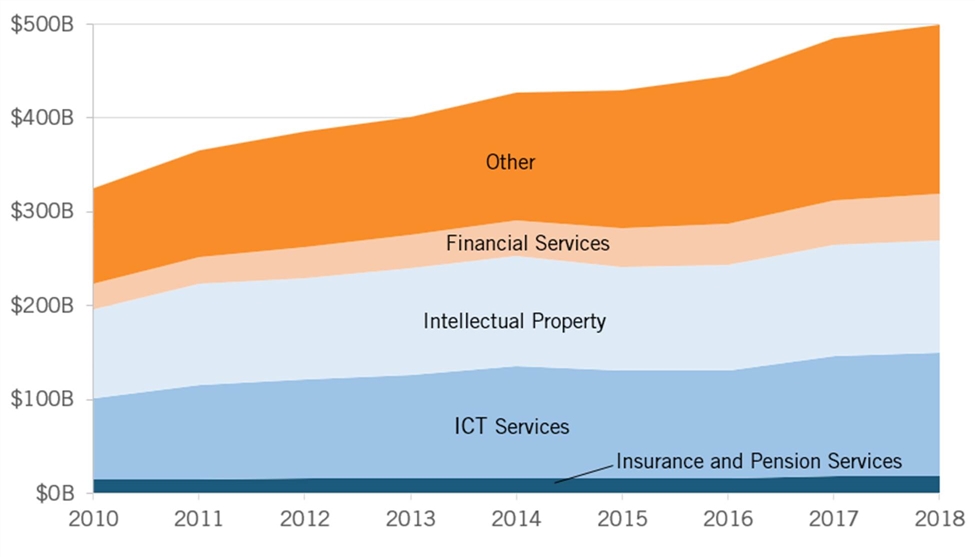

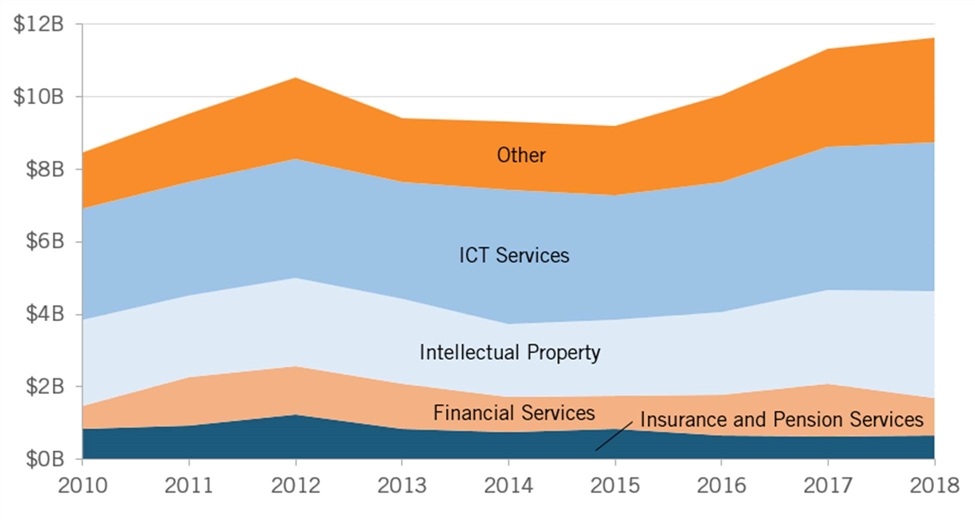

Parsing out DDS exports by industry shows further variation between the United States and the EU. In the United States, “other” DDS exports, represented by services (e.g., the legal, scientific, and architectural fields), has dominated in recent years (see figure 3). Royalties and licensing, as well as financial services, are also both significant drivers of DDS exports. IT services dominate in Germany (growing from $11.6 billion in 2012 to $22 billion in year 2018), while “other” remains at a close second, indicating a heavy IT focus in Germany relative to other EU countries (see figure 4). In France, licensing and “other” services take the lead, followed by IT and financial services (see figure 5). IT services also dominate in Italy, with that sector outweighing licensing and “other” related DDS exports (see figure 6). The EU will continue to remain a key region for many DDS sectors going forward, rivaled by the United States, Japan, and increasingly, China.

Figure 3: U.S. exports of digitally delivered services globally, by product group (2010-2018)[31]

Figure 4: Germany’s exports of digitally delivered services outside the EU, by product group (2010-2018)[32]

Figure 5: France’s exports of digitally delivered services outside the EU, by product group (2011-2018)[33]

Figure 6: Italy’s exports of digitally delivered services outside the EU, by product group (2010-2018)[34]

A comprehensive assessment of transatlantic digital trade needs to take into account valuable (but non-monetized) intra-firm data transfers that represent services supplied via affiliates located in both Europe and the United States.[35] As in 2018, about two-thirds of the services provided internationally both by and to the United States were through affiliates.[36] Many (if not all) multinational companies in the United States and EU rely on cross-border data transfers to support their international business operations. Again, there are measurement issues as differences in coverage and classification make it difficult to compare trade in services with services supplied through affiliates.[37] However, they are still useful in showing that the data displayed in figure 5 and figure 6 are conservative estimates of the full value of digital and digitally enabled services in the transatlantic economic relationship.[38]

A comprehensive assessment of transatlantic digital trade needs to take into account valuable (but non-monetized) intra-firm data transfers that represent services supplied via affiliates located in both Europe and the United States.

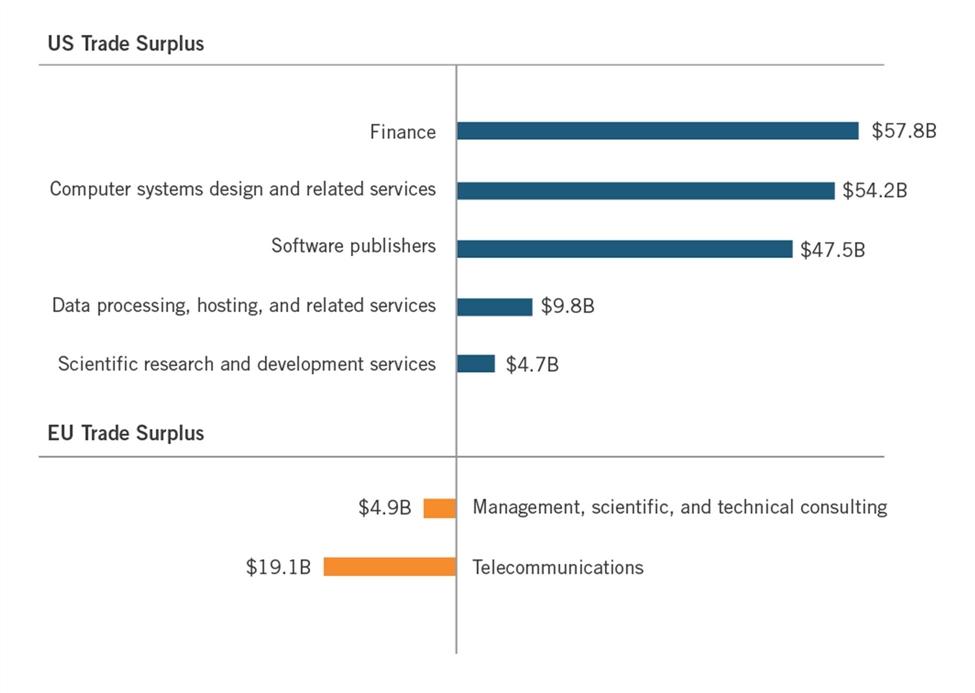

The U.S. Department of Commerce estimated that 53 percent of the $839 billion in services provided in Europe by U.S. affiliates in 2017 was digitally enabled. That year, U.S. affiliates in Europe supplied $444 billion in digitally enabled services, whereas European affiliates in the United States supplied only $269 billion in digitally enabled services.[39] The United States enjoys continued trade surpluses with the EU in many key digitally enabled services delivered via affiliates. For example, in 2018, U.S. software firms exported over $51 billion worth of services to the EU, whereas the United States only imported around $3.6 billion worth of software services from the EU. However, the EU did have advantages in areas such as management consulting, where it enjoyed a $4.9 billion surplus vis-à-vis the United States (see figure 7).

Figure 7: U.S.-EU trade surpluses in key digitally enabled services by affiliates (2018)[40]

What’s at Stake: The Valuable Role of Transatlantic Data Flows Across Sectors

Transatlantic data flows and digital trade matter to a broad range of sectors, and are a critical complement to the use of traditional trade statistics in understanding the role and value of data transfers.[41]

Industrial, Transport, and Automotive Sectors: Of Machines and Data

IT is transforming global manufacturing by digitizing virtually every step in how products are designed, fabricated, transported, serviced, and used—a phenomenon called “smart manufacturing” in the United States and “Industry 4.0” in Europe.[42] Indicative of this, as of 2017, digital services provided an estimated 25 percent of manufacturing inputs.[43] The increasingly global nature of manufacturing design, production, and customer and after-sales support processes mean that modern manufacturing firms increasingly rely on cross-border data flows. This section outlines how automotive and industrial firms rely on data and data flows, including a detailed analysis of the automotive sector and case studies on Scania and Volkswagen.

The global race for innovation advantage in modern manufacturing comes down, in no small part, to how firms and their broader production network are able to integrate data from all relevant stakeholders—wherever they are around the world. As part of this race, the United States and Europe have much to share and benefit from in terms of integrating digital manufacturing operations and associated services. German President Angela Merkel has directly engaged in promoting Industry 4.0, noting, “We have reached a critical moment, a point where the digital agenda is fusing with industrial production.” She’s also identified the failure to lead in smart manufacturing as a threat to Germany’s industrial prowess, “We have to execute quickly, otherwise those who are already leading in digital will snatch the industrial production from us.”[44] Europe regards smart manufacturing as a core component of the European strategy on “smart specialization,” which aims to strengthen the comparative advantage of the EU in terms of ICT skills, R&D capability, industrial output, and infrastructure. In other words, in Europe, smart manufacturing is being pursued at a regional level to make European regional-manufacturing clusters more globally competitive.[45]

Smart manufacturing provides manufacturers with a comprehensive view of what’s occurring at every single point in the production system, along with the insights to make real-time adjustments in order to optimize production. A “plugged in” manufacturer can receive real-time information from suppliers to adapt to supply chain disruptions or use data analytics from across the supply chain to adjust to meet shifting demand.[46] As Robert Hardt, president and CEO of Siemens Canada, explained, smart manufacturing entails nothing less than “the availability of all relevant information in real time, through interconnection of all instances of value creation, and the capacity to derive from this data an optimal value creation flow at any point in time.”[47] Cloud services and data flows level the playing field between small and large firms as it makes it easier for the smaller companies to access best-in-class, enterprise-level software and IT solutions.[48]

Manufacturing, transport, and industrial firms need a legal framework to transfer personal and nonpersonal data just as much as any other sector of the economy. Indicative of this, in October 2020, European trade associations from the road, air, maritime, rail, manufacturing, and logistics sectors outlined how they increasingly rely on the exchange of large amounts of personal and nonpersonal data between multiple actors, and explained why the EU needs to create a clear framework for the governance of these business-to-business data transfers.[49] Building on this, on November 26, 2020, a joint report and survey of nearly 300 firms (mainly EU firms (75 percent) headquartered across 25 countries, from all major industries, and a mix of company sizes) by Business Europe, DIGITAL EUROPE, the European Round Table for Industry, and European Automobile Manufacturers Association found that nearly 85 percent use SCCs. Manufacturing firms represented the second-largest users of SCCs (22 percent), behind firms in the ICT sector.[50]

The role of data flows within the global development of smart manufacturing is best demonstrated by cloud computing; additive manufacturing; sensor technologies and networked machine-to-machine (M2M) devices; data analytics and generative design; new business models involving data-dependent after-sales service; the use of AI for predictive and preventative maintenance and repair; and data-driven global research collaboration.

Cloud computing is transforming virtually every part of modern manufacturing. Even by 2015, a majority of manufacturing firms used cloud applications.[51] Expansive cloud-based networks store and process the massive amount of data necessary to manage modern manufacturing operations.[52] Whether it’s how manufacturing enterprises operate, how they integrate into supply chains, or how products are designed, fabricated, and used by customers, cloud computing is helping manufacturers innovate, reduce costs, and increase their competitiveness. Cloud computing allows manufacturers to use new production systems, from 3D printing and high-performance computing (HPC) to the Internet of Things (IoT) and industrial robots. This “Industrial IoT” increasingly relies on cloud computing and data transfers, as there are a number of individuals, objects, and other sensors connected to a growing network of smart devices and sensors.[53] Cloud computing alongside other foundational technologies such as advanced sensors, HPC, and computer-aided design, engineering, and manufacturing (CAD/CAE/CAM) software represents an essential component of the smart manufacturing revolution.[54] One study estimates that manufacturers allocate an average of 8.1 percent of their R&D budgets to developing these types of digital tools.[55]

Business-to-business and M2M cross-border data flows are powering much of the digital transformation sweeping industrial sectors around the world. These business-to-business data transfers don’t get nearly as much attention as consumer Internet services, but they’re increasingly critical to the global economy. In contrast to the popular perception about the major role played by personal data, individual consumers, and smartphones, Cisco estimated that out of the approximately 18.4 billion networked devices in use in 2018, nearly one-quarter (24 percent) served business customers. Cisco’s Annual Internet Report (2018–2023) outlines how a growing number of M2M applications, such as smart meters, transportation, and package and asset tracking are now major drivers in the growth of Internet-connected devices—and that by 2023, M2M connections will account for about half of the world’s total devices and connections. M2M connections will be the fastest-growing device and connections category (faster than smartphone use), growing nearly 2.4-fold during the forecast period (19 percent compound annual growth rate (CAGR)) to 14.7 billion connections by 2023.[56]

Business-to-business data transfers don’t get nearly as much attention as consumer Internet services, but they’re increasingly critical to the global economy.

Additive manufacturing is becoming more common for product prototyping and some mass production. For example, Ford uses 3D printing to make prototypes of auto parts, including cylinder heads, brake rotors, shift knobs, and vents.[57] In 2014, GE Aviation announced plans to begin mass production of its LEAP 3D-printed jet-engine fuel nozzles.[58] Similarly, Boeing has replaced machining with 3D printing for over 20,000 units of 300 distinct parts.[59] Firms are also using additive manufacturing to personalize products. Both Nike and Under Armour are exploring how additive manufacturing can revolutionize how they manufacture footwear, ultimately allowing the shoemakers to customize a sneaker to each athlete’s foot.[60] 3D printing allows Nike to produce a shoe with just a few parts instead of dozens, resulting in up to 80 percent less waste.[61] Siemens uses additive manufacturing to create in-the-ear hearing aids that are individually adapted to the wearer’s auditory canal.[62] The prosthetics industry has been revolutionized by 3D-printed limbs tailored to patients’ specific structural needs and design desires.[63]

Data analytics, machine learning, and AI improve operations across industrial firms—not just on the factory floor. For example, data-driven insights can enable more innovative and efficient product design processes.[64] “Generative design,” a process by which a computer algorithm tests thousands (or even millions) of design possibilities based on parameters entered by designers or engineers, accelerates innovation by rapidly generating possibilities that humans alone may not have discovered.[65] Human-machine interaction can also improve production processes, as workers collaborating with automated machines allows for more dynamic and adaptive processes.[66] In each of these approaches, data flows are necessary to enable cross-border, multi-team collaboration.

Data flows also allow for critical after-sales service and manufacturers to create new services-based business models. For example, maintenance crews can receive diagnostics from an airplane while it’s still in-flight, and vehicle manufacturers can remotely monitor their products and alert drivers when repairs are needed.[67] It’s becoming more common for manufacturing firms to eschew selling individual products in favor of selling products as integrated services. For example, GE’s medical devices division no longer sells individual radiological equipment (e.g., MRI or X-ray machines) to hospitals; rather, it sells radiological services, taking over management of a hospital’s entire suite of radiological assets and installing devices with remote-monitoring capabilities that allow GE to both monitor whether they are operating and functioning properly and diagnose and detect maintenance issues.[68] Similarly, Kaeser Kompressoren, a German-based manufacturer of compressed air systems and services, launched an “air-as-a-service” business model in which customers no longer purchase Kaeser compressors but rather lease the compressors and pay only for the compressed air itself. It means customers can scale consumption up or down as the needs of their manufacturing operations change, without needing to purchase new equipment.[69]

One of smart manufacturing’s biggest benefits is in predictive and preventative maintenance and repair, which allows firms to shift from a maintenance model of “repair and replace” to “predict and prevent.”[70] The McKinsey Global Institute has estimated that the use of predictive maintenance techniques reduces factory equipment maintenance costs by up to 40 percent, while reducing equipment downtime by up to 50 percent, and capital-equipment investment costs (to replace defective equipment) by 5 percent.[71] For example, Intel uses predictive modeling to anticipate failures, prioritize inspections, and cut monitoring costs at its chip-manufacturing plants.[72] Manufacturers are also integrating predictive-maintenance data into their enterprise resource planning systems to improve workflow scheduling, thus optimizing repair schedules and minimizing machine downtime. Taleris, which supports airline and cargo-carrier operations, uses this technology to predict aircraft-maintenance faults and thus minimize flight delays. Likewise, Germany’s ThyssenKrupp AG and Kaeser Kompressoren use tens of thousands of networked equipment sensors to identify and predict maintenance issues, which reduces unscheduled downtime and helps avoid unnecessary repair trips.[73]

The Automotive and Transport Sectors Rely on Data Flows to Support Drivers, Connected Vehicles, and Related Services

Digital technologies and data flows are particularly critical to the automotive and transport sector. As Swedish commercial vehicle manufacturer Scania’s Hakan Schildt told the Financial Times in 2018, “[T]ransport is becoming a data business.”[74] As connected devices, data-driven insights, and advancements in AI accelerate innovation in this sector, the ability to exchange data is crucial to improving the quality and safety of vehicles and transportation systems.[75] Cisco’s Annual Internet Report (2018–2023) predicts that connected car applications, which include fleet management, in-vehicle entertainment systems, emergency calling, Internet, vehicle diagnostics, and navigation, will be the fastest-growing category of M2M application, with a 30 percent CAGR.[76] The next generation of trade and innovation between the closely integrated EU-U.S. automotive and transport sectors will be put at risk if the rules and regulations around data are not carefully designed so as to allow the reasonable and responsible collection, processing, and transferring of personal and nonpersonal data associated with connected vehicles.

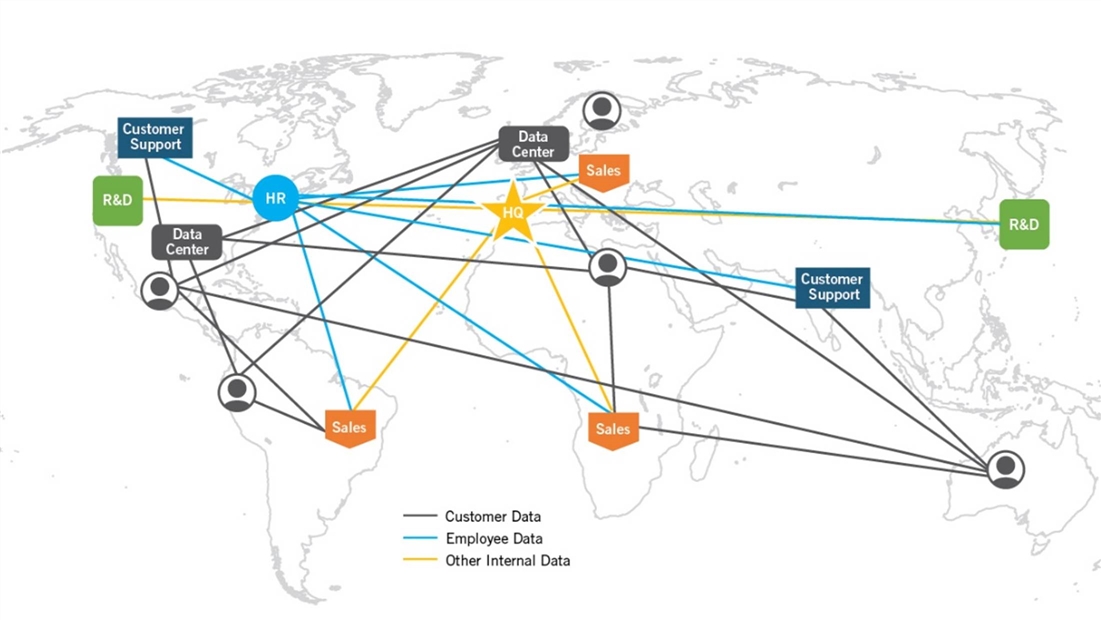

Automotive and transport manufacturers receive, exchange, and process increasing amounts of both personal and nonpersonal data from individuals and vehicles around the world, including data about the vehicles themselves (e.g., vehicle identification, configurations, maintenance information, and network information such as IP address or Bluetooth name); data about drivers and other users (e.g., driving behavior, geolocation, user-provided information, and contractual data); and data from outside the vehicle (e.g., temperature, weather conditions for automatic lights or wipers, and images and videos from outside the vehicle).[77] For instance, modern vehicles collect map and personal data for real-time analysis and use. Automated and autonomous vehicles rely on AI that uses cameras and sensors to analyze the vehicles’ environment, including detecting road signs and other road users, and then shares that data with the cloud to ensure the information is accurate and the cars operate as safely as possible. Similarly, sensors monitor drivers’ attention and detect drowsiness. Figure 8 is indicative of the data transfers that an EU-headquartered, globally engaged, manufacturing or transport firm would be engaged with in having R&D, human resources, engineering, sales, and customer support centers around the world.

Figure 8: The data transfers for a (generic) EU-headquartered manufacturing/transport firm with global operations

This data is not only critical to vehicle and driver performance, but also to future innovation, as firms increasingly rely on data to design and deliver better products and services. This will become more important to automotive competitiveness as autonomous vehicles, connected vehicles, and smart cities become more common.[78] Automotive and transport firms will increasingly depend on data transfers to build large and diverse training datasets for product development. For example, to maximize product performance in countries around the world, firms need to ensure their training data captures the variations in environments, traffic conditions, and other variables that reflect the “real world” context in which their products operate.

Smart manufacturing is transforming the automotive industry (see the case studies on Scania and Volkswagen). For example, BMW has set a goal of knowing the real-time status of all major production equipment at each of its component suppliers. Accordingly, upstream tier 1 and tier 2 suppliers such as Austrian brake-pad manufacturer Miba AG have IoT-enabled their production equipment to track and communicate production machines’ operational status to its original equipment manufacturer customers.[79] Similarly, Ford has placed sensors on virtually every piece of production equipment at its River Rouge facility outside Detroit.[80] Connected devices and smart manufacturing also dramatically improve automotive companies’ ability to manage their supply chains. For example, Toyota reduces the time and cost of recalls by knowing exactly which machine produces each component of each vehicle, thereby enabling the company to track and isolate defective parts (or the defective equipment that produces them) much more rapidly. Smart manufacturing, data connectivity, and connected vehicles also allow products to convey information about how they are consumed and serviced, which firms can feed back into the design process to improve future versions of those products.[81] For instance, heavy-equipment manufacturer John Deere previously manufactured multiple versions of engines with different horsepower levels for its tractors, harvesters, and gins. Today, it manufactures just a single, standard engine and uses software to alter the horsepower level for different applications.[82]

Smart manufacturing is also changing after-sales service. For example, in 2013, Tesla sent an over-the-air software update to all Model S vehicles after batteries fires in two of its vehicles were found to have been caused by a manufacturing flaw that caused the chassis on some of its vehicles to sit too close to the ground.[83]

Case Study: Scania

Scania—a leading Swedish manufacturer of commercial vehicles—is, as one Financial Times article put it, “increasingly hindered as much by international obstructions to its data as roadblocks on its lorries.”[84] Indicative of the importance of global data transfers, Scania uses a single, global telematics (the field that encompasses telecommunications, vehicular technologies, electrical engineering, and computer science) service platform.[85] Scania has manufacturing centers in Europe and Latin America and is responsible for managing fleets of trucks around the world.[86] Much like with other automotive companies, as a Scania truck is driven through the EU, a small box sends diagnostic data—speed, fuel use, engine performance, even driving technique—to the company’s headquarters in Sweden. As of 2017, Scania had more than 280,000 vehicles connected to its Scania One and Scania Digital Services software. The company had 91 percent of its vehicles connected in Europe; globally, it had 60 percent connected.[87] Indicative of the growing role of software and data, Scania is developing an open, brand-neutral platform (the RIO platform) and operating system for software that will host its telematics services as well as software from third parties, thus making it easier for its partners and other transport manufacturers to adopt and use.[88] Scania has likewise increasingly transitioned to a services-based business model focused on fleet management services including logistics, repair, and others. In fact, Scania now generates one-sixth of its revenues through new services enabled by the data-connected devices built into its vehicles.[89]

Hakan Schildt has stated that “the world is moving towards an autonomous, electrified transport system, and that needs data … transport is becoming a data business,” and that “the free flow of data is part of free trade.”[90] Data transfers and analytics improve Scania’s product development process by allowing the company to gain insight into the on-the-ground performance of its vehicles and identify areas for potential improvements.[91] Allowing Scania and vehicle owners to coordinate and control entire fleets of connected and autonomous vehicles leads to improved environmental outcomes, especially reduced CO2 emissions.[92] For example, collecting and sharing personal and nonpersonal data allows Scania to “coach” drivers to help them improve, such as with braking points and coasting.[93]

Case Study: Volkswagen

Volkswagen—Europe’s biggest automotive manufacturer—is going digital, including through the extensive use of Amazon cloud computing services.[94] As one VW executive put it, “[G]oing forward, our Volkswagens will increasingly become digital devices on wheels.”[95]

VW is using data, software, and associated services to differentiate itself from the competition. In 2020, some 1.5 million VW vehicles with no online access could connect with the Internet thanks to the “Volkswagen Connect” (a retrofit solution). In the future, VW will connect every one of the estimated five million vehicles it plans to manufacture each year.[96] VW has over 80 IT specialists, data scientists, programmers, and others at its “Data: Lab Munich” incorporating AI and other digital tools throughout its business, including in production, sales forecasts, predictive maintenance, and autonomous driving.[97] VW is also using AI and other digital technologies to become a “smart enterprise.”[98] For example, the Volkswagen Group is the world's first automotive company to intensively test the use of quantum computers, such as to predict vehicle traffic patterns in Barcelona to help taxi and transport firms.[99] Florian Neukart, principal scientist at Volkswagen's CODE Lab in San Francisco, stated, “What makes the now-developed solution so special is the possibility to scale it to any city.”[100] However, VW and other firms that seek to use quantum computing would obviously depend on data transfers to deploy this technology, given it would be prohibitively expensive to deploy it to every market.

Volkswagen—Europe’s biggest automotive manufacturer—is going digital, including through the extensive use of Amazon cloud computing services.

VW’s digital operations are embedded within its transatlantic operations. In 2020, VW announced that its factories in Chattanooga (Tennessee, the United States) and Puebla and Silao (Mexico) would be the first Volkswagen factories outside Europe to connect with VW’s global “Industrial Cloud” initiative—which uses Amazon Web Services (AWS). VW’s 18 factories in Europe were already networked with its Industrial Cloud, which is designed to gather and analyze data from all connected VW facilities on a real-time basis to help increase efficiency and productivity. It also allows central, standardized access to software applications, much like an app store on a smartphone. VW’s Industrial Cloud links not only all of VW’s global factories, but also (in a second step) its suppliers in order to simplify the exchange of data across systems and plants.[101] Volkswagen and AWS plan to open the Industrial Cloud to other firms, thus making it a marketplace for industrial applications.[102]

A Connected or Fragmented Transatlantic Manufacturing Network?

Automotive and transport firms are increasingly dependent on the ability to transfer personal and nonpersonal data around the world. As Scania put it, “[V]ehicles would not function effectively without transferring data, and neither would repairs.”[103] The automotive and transport sectors are affected just as much as other data-driven sectors by a globally fragmented Internet. Like other sectors, it would be overly expensive and complicated, if not impossible, for these firms to set up duplicative IT and the growing range of support services in each and every market in which their vehicles are used. Doing so would add unnecessary costs and simply lead automotive and transport firms to cut off critical services to restrictive markets.[104]

Automotive and transport firms are clearly capable of developing sophisticated legal compliance frameworks to use and protect data as per local laws, especially given they already operate in a heavily regulated industry with a host of vehicle safety and performance standards.[105] For example, Volvo, VW, BMW, and many other major car manufacturers use standard contractual clauses to transfer European personal data overseas. The invalidated EU-U.S. Privacy Shield was used by 37 firms in the automotive sector (and 28 firms in the aerospace and defense sector).[106] Firms want a clear, predictable, and reasonable legal framework that allows them to protect data according to local privacy laws, while still using it to design and deliver innovative new products and services. As a position paper from the European Automobile Manufacturers Association (EAMA) cautions, “It is important to stress the use of global data and the implementation of clear guidelines and processes for sharing data between countries … otherwise, the value of the data will be lost.”[107] While the 2018 Roadmap for EU-USA S&T Cooperation notes that “there is a clear interest in continuing collaborating in areas where interoperability is necessary to ensure smooth and secure transatlantic/global data flows,” including “automated driving and road automation in general, air quality and low-emission freight transport systems, [and] multi-modal inter-urban transport,” such cooperation is at the mercy of the broader transatlantic conflict over data privacy and surveillance.[108]

Automotive and transport firms are increasingly dependent on the ability to transfer personal and nonpersonal data around the world.

Beyond Schrems II’s impact on Privacy Shield and SCCs, the EDPB’s generally restrictive approach to regulating the personal data relating to connected vehicles highlights the many and varied challenges to automotive firms that operate on both sides of the Atlantic. The EDPB views most data collected via connected vehicles to be personal, and that data controllers (i.e., the car manufacturers) should, whenever possible, not transfer personal data outside the vehicle (never mind outside the EU). The EDPB thinks that this local processing of personal data keeps drivers in control of their data, as well as their vehicle.[109] While the EDPB makes brief references to the possibility of joint controllership of vehicle data, it has given no firm guidance around the extent to which joint controllership might apply to common use cases in the connected car context, such as data sharing between vehicle manufacturers, data aggregators, and other third parties (e.g., insurance firms).[110] In response, EAMA cautions the EDPB to develop and apply nuanced sector-specific privacy rules for connected vehicles, as the draft guidelines it has issued have been overly broad, ill-fitting, and restrictive.[111]

Data restrictions in other countries offer a glimpse of the potential consequences for automotive and manufacturing firms should the United States and EU fail to build a legal framework to allow firms to transfer personal and nonpersonal data across the Atlantic. India requires gateways and application servers that support the Internet of Things to be located inside the country.[112] China has data localization for both personal and mapping data (as well as restrictions on whom can collect and use this mapping data). This includes the high-definition maps that are critical to the operation of automotive vehicles.[113] Indicative of the duplicative and unnecessary impact on automotive manufacturers, Tesla (which has a large factory in China) has moved its user data from the United States to China to comply with local data storage requirements.[114]

Turkey requires all new cars to provide e-call services, carry local eSIM cards, and store all relevant data in Turkey. Turkey’s restrictive rules are broad in that they apply to all M2M communications.[115] Vehicle manufacturers and associated service providers need to transfer and share this type of data, such as with insurance companies to determine coverage; geographic location data with tow-truck operators for emergency help; and performance data to help firms develop better safety systems.[116] In Turkey, major automotive producers have mostly chosen to shut down e-call services for cars already in the marketplace and have stopped exporting new cars. So it’s hardly a win for automotive safety, never mind trade.

Financial, Payment, and Insurance Services: Key Enablers of Global Digital Trade

Banking, finance, and insurance services depend on data flows to engage and support trade. Consumers and firms want these services to seamlessly manage the considerable challenges of managing cross-border transactions, while maintaining a high level of security and privacy.[117] This is a challenge, as these services are already among the most heavily regulated in the global economy. For example, as part of a Committee on Payments and Market Infrastructures (a global standards-setting forum for central banks and others) survey, payment service providers cited anti-money-laundering, know-your-customer, risk-mitigation, and consumer-protection requirements as the most significant costs and challenges to their business, especially for cross-border payments.[118] Adding new data-related restrictions further complicates efforts to address these domestic regulations that act as a bottleneck to the use of these services in global trade. This section analyzes the role of data in global financial, payment, and insurance services.

Data and digital technologies have transformed the financial, banking, and insurance sectors. Internet banking is increasingly the norm for consumers and businesses around the world. The many leading U.S. and European providers need to be able to seamlessly transfer tremendous amounts of data for their own operations (e.g., human resources and IT development) and between subsidies (to complete transactions), but also as part of both exchanging information with third parties and the day-to-day business of checking and processing payments, fund investments, and other transactions.

New data-driven services are at the heart of the fierce competition that is underway between incumbent firms and fintech start-ups.[119] The basis for competition in these sectors increasingly revolves around their ability to develop and deploy new payment services, AI, and other innovations, whether as part of improved cybersecurity, digital identity, digital assistants (e.g., natural language processing robo-advisors), or blockchain services. Indicative of this, in 2017, JP Morgan had 4,000–5,000 software developers working on applications.[120] Traditional banks are fighting back against new fintech entrants by providing end-to-end services across the banking and payments sector, including through partnerships with new entrants.[121] Meanwhile, new fintech entrants are providing new means of payments, often as part of a broader set of digital services.[122] At the big end, this is perhaps best demonstrated by Chinese insurance firm Ping An’s technological prowess and its use of a vast platform of services to become a “fintech super-app.”[123]

Cloud computing allows all payment, banking, and insurance firms to handle high-volume, complex computations at sometimes irregular intervals, while maintaining stringent cybersecurity protections and allowing access to data for compliance purposes (e.g., for anti-money-laundering and counter-terrorism financing). Given the sensitivity of the data and processes involved, some of these firms have been reluctant to move away from in-house data storage. Yet, more and more firms are shifting to public cloud services that are increasingly able to provide the strict cybersecurity services and compliance processes these firms need.[124] Given the sensitivity of the data being managed and the strict regulatory oversight in place, if these firms can use public cloud services on a global scale, so should pretty much any firm.

Insurance, reinsurance, financial, and payment firms rely on data and data flows in similar, but sometimes different, ways.

Unnecessarily restrictive data-related rules make it costlier and more complex, if not impossible, for financial, payment, and insurance firms to transfer and use data as part of seamless, standardized, and centralized service offerings.

Insurance firms rely on data to provide products to individuals and firms around the world. Personal insurance products are increasingly being sold and policies managed online and on mobile phones. The basic customer interface depends on data flows, in terms of accessing their policies, especially if they move or are part of an international business operation. The underwriting process that is central to insurers depends on data transfers and analytics, which are necessary to understanding their clients, assessing risk, and pricing and tailoring packages of insurance products for clients.[125] For example, real-time data analytics allow insurance firms to predict and react to events such as severe weather and natural disasters, in addition to how likely someone’s car is to be stolen in a given month or whether a person is likely to face a health issue. Also, when clients voluntarily provide more data on their behavior through telematics—such as sensors in vehicles to assess how they drive—it allows insurers to better understand their clients and encourage less-risky behavior. Greater access and use of data and data analytics can also dramatically reduce administrative costs for insurance and reinsurance firms, which is important as claims settlement, acquisition, and administration are expensive, taking up about 33 cents out of every dollar a policyholder pays to an insurer. For instance, when claims are made, improved data analytics and access to large pools of data aid insurers in identifying genuine versus fraudulent claims.[126]

Both insurance firms and reinsurance firms—which take on portions of risk portfolios of other insurers—need to be able transfer data in order to build large datasets and provide better and cheaper products. Indicative of this, as Kai-Uwe Schanz and Fabian Sommerrock of The Geneva Association noted, “In the digital age, traditional information asymmetries in insurance are likely to disappear, with both insurers and policyholders benefitting from much improved information at much lower cost.”[127] For example, while major insurance firms underwrite processes in each client’s home country, for regional and global products and customers, this happens at a higher level that thereby makes it necessary to transfer personal and other data. Likewise, reinsurance relies on transfers of personal and other data, as the client taking on the reinsurance needs to assess the underlying data in order to assess the associated risk. Furthermore, reinsurance contracts often involve a firm in one of only a few global hubs, namely Switzerland, Bermuda, Singapore, New York, or Munich, even if the two parties are outside of these countries (e.g., between an Argentinian insurance company and a reinsurance client in Uruguay). Personal data therefore needs to be able to flow between these hubs and the multiple parties involved in a transaction.

Data is also central to the role payment services play in global trade. A growing number of individuals and firms that travel and engage in worldwide trade have come to expect payment providers to do likewise. Indicative of this, payment networks clear and settle transaction information, not funds. Ensuring that consumers and firms in every market can access new, low-cost, and innovative electronic payment options is critical to supporting domestic commerce and global trade. There is a clear trend in the payment services space toward new partnerships and digital technologies, so companies can provide a more personalized, secure, and seamless suite of services embedded in mobile apps, e-commerce marketplaces, emails, and elsewhere. In this way, payment services represent a critical part of the suite of online services that together make it much easier and cheaper for firms of all sizes to access customers around the world. These services increasingly go beyond payments and money transfers to include financial dashboards, credit score management, customized loan/insurance plans, and investment services.

Unnecessarily restrictive data-related rules make it costlier and more complex, if not impossible, for financial, payment, and insurance firms to transfer and use data as part of seamless, standardized, and centralized service offerings. Payment and financial are among the most commonly targeted types of data in the world, alongside personal data. Restrictions on the movement of data undermine firms’ ability to aggregate and analyze data from the broadest range of sources.[128] They also have a significant impact on trade, effectively prohibiting foreign firms from bringing to bear their globally distributed data analytics platforms—such as for fraud and money-laundering prevention, cybersecurity, and other data-driven services—which is a key part of their competitive offering.

Having all relevant regulatory compliance and service support expertise in every market isn’t viable.

Fraud, for instance, is not limited by national boundaries. Preventing payment firms from working with global datasets undermines their ability to use data analytics to combat it.[129] Data analytics use behavioral, temporal, and spatial techniques to assess a consumer’s behavior and whether a transaction is out of the normal or not. When a transaction is initiated, hundreds of pieces of information (e.g., about the customer, merchant, place, and time, all compared against years’ worth of prior transactions) are gathered and sent for analysis by the payment processer’s predictive model to determine if it is likely a genuine or fraudulent transaction. For payment firms, this process happens tens of thousands of times daily, ultimately involving billions of pieces of data.[130] These data-driven systems are powerful and fast enough to detect fraud in real time by using models based on historical data (and deep learning). Similarly, big data analytics are used to detect money laundering disguised as legitimate payments.

Ultimately, forcing payment service firms to use an artificially altered (i.e., only local) database for analysis would render them unable to provide the most accurate prediction for customers as it relates to fraud and other activities.[131] In the case of data localization, this would mean firms would only be able to identify local patterns of fraud, and thus would be blind to wider fraud patterns and threats, which would have the unintended and undesirable consequence of benefiting criminals. Consumers, financial institutions, and regulators all stand to lose if firms are not able to use data from around the world to prevent this type of unwanted activity.

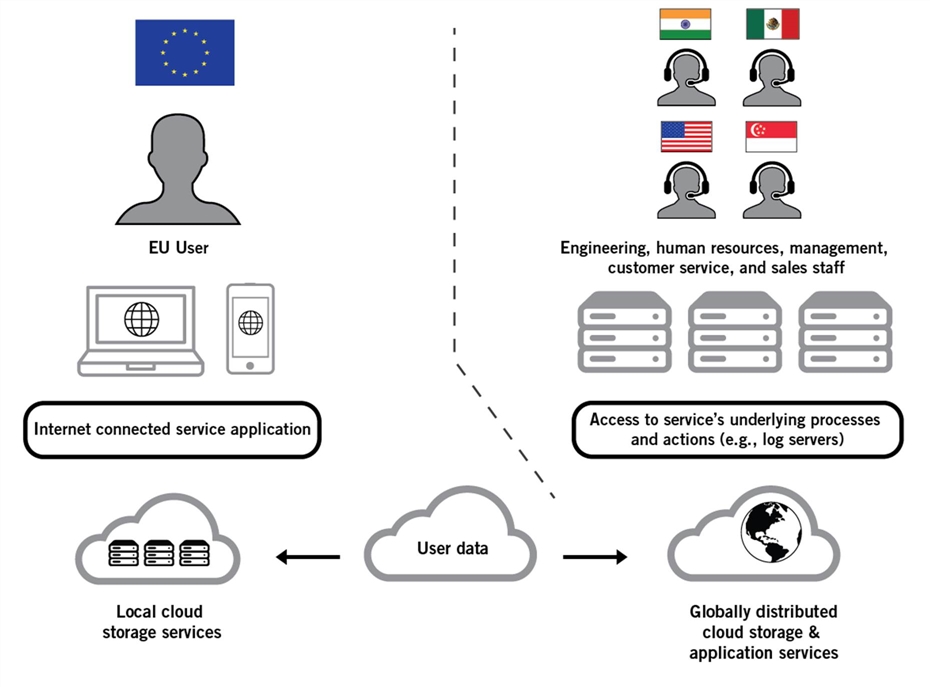

Data localization’s impact is much broader. U.S. and European financial, payment, and insurance firms must transfer data as part of their global IT network and data engineering, regulatory compliance, and customer support teams and operations they have in their home country. Having all relevant regulatory compliance and service support expertise in each and every market isn’t viable. Obviously, many firms set up country and regional support teams, such as to ensure compliance with GDPR or U.S. financial regulators, but they all report to, and benefit from, seamless engagement with central support teams based in their home country. For example, if an EU customer identifies an issue with a firm’s service, the firm may well need an engineer or customer service representative based in the United States, India, or elsewhere to access the issue, user data, and local IT systems in order to resolve it (see figure 9).

Figure 9: Cross-border implications for EU users and U.S. firms that rely on data flows and cloud-based services

It is unreasonable to expect that firms would not only set up local data center infrastructure but also duplicative full-service engineering and customer support operations in each market, so the right person to fix an issue is based locally (and personal data doesn’t need to be transferred as part of a fix). Given the cost and operational efficiencies, and in order to provide more secure services and responsive regulatory services, banks and payment and insurance firms (like most global firms) want IT operations to be centralized. Upskilling staff, licensing technology tools and utilities, and providing adequate support and maintenance become significantly more complex and expensive (or even prohibitive) in a decentralized system wherein firms must unnecessarily expand and add duplicative services to their IT network.

This does not mean these firms don’t set up substantial operations outside their home markets—they obviously do. But these firms are often driven by commercial and other considerations as they set up locations as part of strategic corporate plans. For example, many U.S. financial firms have regional compliance and tech support teams in Dublin, Ireland, as part of their European headquarters. But these are not simply compliance services: Mastercard’s and Citi’s Dublin centers, for instance, were each set up for global R&D and service. Mastercard’s tech hub will grow to over 2,000 employees in the next few years and serve customers across Europe and the rest of the world.[132] It will also need to integrate with the company’s other global technology centers in Vancouver, New York, St. Louis, Pune-Vadodara (India), and Sydney.[133] Similarly, Citi’s service center provides support services to customers across Europe and the world—and includes the company’s first Innovation Lab, which is dedicated to R&D in the financial services industry.[134]

Given their critical supporting role in global trade and economic activity, financial, insurance, and payment firms need to have a clear legal framework to transfer data for both commercial and regulatory purposes. Even before Schrems II, this was challenging. For example, U.S. financial firms faced regulatory issues in Europe related to their need to provide data to the U.S. Office of Foreign Assets Control and requirements for them to do screening for terrorism-related transactions.[135] Many banks and insurance and payment firms rely on SCCs to transfer data around the world—not just between the EU and the United States—as they are the most flexible legal tool to manage a diverse range of tasks. Previously, as in other sectors, Privacy Shield was a complementary legal tool used in the financial services sector. As at October 2020, 156 financial service firms relied on Privacy Shield as their primary mechanism for EU-U.S. data transfers.[136] For financial, insurance, and payment firms, adjusting to the uncertainty and changes in the EU’s data protection regime with GDPR and Schrems II will be challenging, even with their extensive, existing legal compliance capabilities.

Cutting off financial, insurance, and payment data transfers between the EU and United States (and between the EU and the rest of the world) would mean fewer, more expensive, and less-than-best-in-class services, as the many firms and sectors that rely on these services to engage in transatlantic and global trade would inevitably be affected. Longer term, it would affect competition and innovation in these sectors, as it would disproportionality disadvantage new small and medium-sized fintech firms that otherwise could use access transatlantic markets in order to scale and compete with incumbents. EU and U.S. policymakers need to avoid making the regulatory-compliance situation any worse in these sectors and ensure that all these firms have a reasonable data transfer framework to manage varying local legal requirements (whether privacy or financial-oversight related), without unnecessarily inhibiting their role in global trade and innovation.

Data Flows Support the Growth of Small and Medium-Sized Enterprises

Restrictions on transatlantic data flows would disproportionately affect start-ups and small and medium-sized enterprises (SMEs), regardless of whether they are trade-orientated, given it would affect their ability to use the most useful and competitive services (in Europe or the United States) and easily and seamlessly find and serve customers on both sides of the Atlantic.[137] In this way, restrictive data rules undermine one the central benefits of the Internet—reducing, or removing, the impact geography has on small firms’ ability to engage in cross-border trade and use the best-in-class services (e.g., those in the United States). Ultimately, the direct and indirect impacts of restrictions on data transfers will affect the broader start-up and SME ecosystem by affecting firms’ ability to scale.

Restrictions on transatlantic data flows would disproportionately affect start-ups and small and medium-sized enterprises, regardless of whether they are trade-orientated.

Ironically, given European policymakers’ focus on large tech firms, the slide to ever greater restrictions on data transfers would make the European digital market inaccessible to all but the largest firms. Data privacy laws and international data transfer rules need to be easy to apply so SMEs and start-ups can build to a reasonable legal requirement from the start. This would allow them to focus on growing their ideas and businesses through trade and the best digital tools available, rather than on ever-changing and costly administrative compliance. In particular, start-ups are often early users of new digital technologies and therefore do not have to deal with the legacy IT systems of older firms. For example, many start-ups have been able to outcompete their more established rivals by virtue of being “born digital,” meaning they have been better able to leverage productivity gains of newer technologies. Limitations on data flows would restrict EU start-ups from leveraging new U.S.-based technologies, especially from other start-ups and smaller firms that have not established a European presence. This would put EU start-ups, as well as other EU SMEs, at a disadvantage to their foreign competitors.

The survival and success of SMEs and tech start-ups increasingly depend on seamless and affordable access to data and digital tools. For example, surveys show that 74 percent of SMEs in the United States and 55 percent of EU start-ups and scale-up firms use cloud services.[138] Should cloud services providers and similar enterprise services take on higher compliance costs or halt data exchanges outside the EU, start-ups may face increased costs or less-optimal alternatives. SMEs greatly benefit from a range of digital tools that allow them to operate seamlessly in both their home and international markets: to develop, for example, an online presence, such as via online directory listings, websites, and mobile apps; social media for customer engagement, sales, and marketing; data analytics to gain customer insights or inform business decisions; customer acquisition via e-commerce marketplace platforms; and internal productivity tools, such as cloud-based software, video conferencing, and corporate social networks.[139] The COVID-19 pandemic has accelerated the broader digital transformation of SMEs, with more and more turning to online solutions to connect with customers and sell their products.[140] Start-ups and SMEs do not look at countries of origin when choosing their IT, software, and Internet services. Whether it comes to cloud services, marketing and advertising, customer relations, or some other service, data flows allow these firms to select the services that best align with their needs.

Small firms’ ability to go global with only limited IT spending and little complexity will be undermined if major marketssuch as that of the EU require them to build out or pay for duplicative local services and infrastructure in each market. Access to inexpensive cloud and other ICT services has also been a key leveler in the playing field between SMEs and start-ups versus larger firms. As Allied for Startups (a worldwide network of 45 advocacy organization) has stated, every additional layer of regulatory complexity and cost makes it harder for EU start-ups to emerge from or enter into a new market, and effectively ring-fences bigger firms from greater competition.[141] Previously, a lot of firm and venture capital had to be invested in expensive IT. Inexpensive global cloud services are now the norm. Yet, growing data restrictions could reverse that. It is simply not feasible for each and every service provider with a few customers in a given market to build out local infrastructure and operations, which means many will simply not serve certain markets (given the growing threat of fines). Data-transfer restrictions would force firms to choose local service providers that may not be the most competitive, cost-effective, or comprehensive in providing international services.

This would be a sad result, as the United States and Europe are developing a more connected and dynamic tech start-up scene involving venture capital, people, and ideas.[142] Start-ups in both the United States and EU have thus far been able to rely on data flows to grow and expand on both sides of the Atlantic. The United States is an important market for fledgling European start-ups, as it is home to four of the top ten start-up ecosystems in the world.[143] However, European start-ups, bolstered by cross-border opportunities, are catching up. Europe produced about 36 percent of start-ups worldwide between 2009 and 2019, and hubs such as Stockholm, Paris, Amsterdam, and Berlin are emerging.[144]

Small firms’ ability to go global with only limited IT spending and little complexity will be undermined if major markets such as that of the EU require them to build out or pay for duplicative local services and infrastructure in each market.

Greater transatlantic engagement between start-up ecosystems would benefit everyone. A recent National Bureau of Economic Research study into cross-border venture capital, technology spillovers, and start-ups in the United States from 1976 to 2015 demonstrates the depth of the connections and the benefits. Of the 524 firms that had non-U.S. corporate investors, 11.5 percent of their investors were from Germany and 6.9 percent were from France. Both countries were in the top six home countries of foreign firms that invested in U.S. start-ups.[145] In addition, by studying subsequent patenting and citations in specific technology classes, the study finds that a country learns about a technology class from investing in a U.S. start-up that specializes in that class of technology.[146]

While the United States offers a single large market for European start-ups, small companies must overcome barriers to entry in 28 different countries to reach a similar market size without leaving the EU.[147] Despite ongoing efforts to build a more integrated EU “Digital Single Market,” scaling across Europe is still not easy. In one study, 55 percent of SMEs in the EU, including 57 percent of start-ups and 60 percent of scale-ups, listed regulatory obstacles or administrative burden as one of the three biggest problems for their enterprise. By comparison, only 30 percent of SMEs in the United States indicated it as among their greatest concerns.[148] The ability to scale globally is critical to start-ups on both sides of the Atlantic. While about half of U.S. unicorns (start-ups with a $1 billion or more valuation) established a global presence in order to reach unicorn stage, the same is true for 70 percent of their European counterparts.[149]

The regulatory back and forth surrounding EU-U.S. data flows leave SMEs and start-ups in a constant state of legal uncertainty, even if new rules are not immediately enforced on them.[150] For those seeking to gain a foothold outside of the EU, or for globalizing U.S. start-ups seeking to enter the European market, transfer mechanisms are critical, such as EU-U.S. Privacy Shield, which was a clear and accessible legal framework firms of all sizes and sectors could use.[151] Without Privacy Shield, SMEs and start-ups are turning to SCCs. But with the Schrems II ruling putting greater responsibility on data exporters and importers to determine whether SCCs are sufficient, this solution is at best inelegant and costly—and at worst, infeasible.[152]

Even for the smallest businesses, legal fees for developing SCCs can easily reach thousands of dollars.[153] The rush to align with new compliance standards also swells demand for—and with it, the cost of—legal services and other necessary external expertise, which further disadvantages firms with fewer resources. Indicative of the cost, a study by the New Economics Foundation and UCL European Institute estimates that the impact of a no-adequacy decision for the United Kingdom (and a shift to SCCs) would cost $4,120 each for micro businesses, $13,730 for small business, and nearly $27,000 for medium-sized business.[154] Given that the shift to SCCs is just one part of the impact, the total cost is likely to be higher given the impact on IT networks, staffing, and other operations.[155] These costs will price many small firms out of digital trade. [156]

Start-ups have long called for policymakers to give greater recognition to the impact data transfer rules have on them, arguing that they need to be accessible to firms of all sizes, and that they need more dedicated support to comply with new rules and regulations. U.S. and EU policymakers need to ensure their understanding of who relies on data transfers reflects reality—as it is not just large tech firms, but a diverse range of firms, including many SMEs and start-ups. In an open letter to European leadership, representatives from 14 European start-up advocacy organizations argued, “EU institutions have a responsibility to address a fundamental question: Do they stand behind a mechanism whereby data transfers to the US and elsewhere is [sic] possible and feasible for SMEs and startups?”[157]

SMEs and start-ups will become collateral damage if policymakers view the issue through the lens that data flows only matter to large tech firms. This fear is valid: In a 2018 Allied for Startups survey, 81 percent of respondents agreed that “the principle of designing policy and/or legislation in order to target specific companies (i.e., global giants) could lead to poor outcomes that inadvertently hurt or hinder tech start-ups.”[158] As Atomico’s “State of European Tech 2019” outlines, while the tech sector has grown in Europe, EU policymakers focus more on U.S. big tech than on helping and championing existing European tech successes.[159] Start-ups and SMEs need policymakers to rectify this past lack of attention and keep them in mind as they work on next steps and new data transfer mechanisms.

Consumer Internet Services: Connected, Personalized, and Valuable? Or Disconnected, Generic, and Less Valuable?