Tip of the Iceberg: Understanding the Full Depth of Big Tech’s Contribution to US Innovation and Competitiveness

KEY TAKEAWAYS

Key Takeaways

Contents

Recognize and Account for the “Full Iceberg” 33

Introduction

As late as the early 2010s, large U.S. information technology companies were celebrated by politicians, media, and academics. Now they attack big tech as too powerful and greedy. Liberals complain that they are surveilling society, spreading harmful content, and undermining democracy. Conservatives say that they are censoring free speech, influencing elections, and undermining traditional American values. Both sides believe that they are harming children and both right and left populists want to break them up.[1]

This “voguish” critique is based on at best a superficial understanding of what these companies do: Apple makes iPhones; Amazon makes an online store; Alphabet makes a search engine; Microsoft makes Word, Excel, and PowerPoint; and Meta makes social networks. Especially for those who dismiss social media as at best trivial entertainment, this view sees only the tip of the iceberg of the massive benefits large technology companies provide to the world and the United States.

At the same time critics attack big tech, they also argue that U.S. corporations don’t invest enough in the long term—in research and development (R&D), in capital investment, in efforts that have high risks and long-term returns. If only these “quarterly capitalism” companies would act better, everyone would be better off. And yet, big tech is doing the opposite of quarterly capitalism, and those efforts should be praised rather than excoriated.

While many major U.S. technology firms—including Cisco, Qualcomm, and Nvidia—demonstrate similar innovation patterns and positive spillovers, space constraints limit this report to examining five: Apple, Amazon, Alphabet, Meta, and Microsoft.

R&D: In 2024, the five largest U.S. technology companies invested $227 billion in R&D, exceeding the federal government’s non-defense R&D budget and outpacing the annual R&D expenditures of most countries.[2] These investments were not limited to core business lines. Research by the Information Technology and Innovation Foundation (ITIF) finds that approximately 78 percent of non-manufacturing R&D growth came from just four industries: electronic shipping and electronic auctions; data processing, hosting, and related services (e.g., cloud providers); software publishers; and other information (e.g., Internet companies).[3] Big tech companies also fund long-horizon research into artificial intelligence (AI), quantum computing, and semiconductors; they underwrite experimental “moonshot” projects that may fail commercially but advance technical capabilities; and they generate spillovers that diffuse across academia, startups, and industry more broadly.[4]

Capital Investment: In 2024, these companies invested over $250 billion in capital expenditures, and cumulatively, they have invested over $1 trillion in the 21st century.[5] Training a competitive large language model can cost more than $100 million in compute resources.[6] Developing quantum processors requires billion-dollar fabrication facilities and programs extending over a decade or more.[7] Building global satellite constellations or hyperscale cloud infrastructure involves up-front investments in the tens of billions of dollars.[8] Amazon, Alphabet, Microsoft, Meta, and Apple finance data centers, subsea cables, renewable energy projects, and custom semiconductor platforms that underpin not only their own operations but also the broader digital economy.[9]

Public Knowledge Generation: Big tech firms publish thousands of research papers annually, release open source frameworks, and make large datasets and models available to universities and startups.[10] Initiatives such as Google DeepMind’s AlphaFold, which mapped 200 million protein structures and released them freely, accelerate biomedical research worldwide.[11] This openness distinguishes U.S. firms from more traditional corporate R&D models, wherein proprietary knowledge rarely circulates outside company boundaries.

STEM (Science, Technology, Engineering, and Math) Skill Development: These companies serve as training grounds for highly skilled researchers and engineers who later move into startups, universities, and government laboratories. Alums have founded thousands of companies, raising tens of billions of dollars in venture funding and diffusing organizational knowledge about building scalable systems.[12] In sectors such as AI, where global competition for talent is intense, this clustering effect strengthens the U.S. ecosystem as a whole.[13]

Funding for Startups: Acquisitions and partnerships link large firms to the startup ecosystem, providing capital, technical infrastructure, and global reach. While critics describe this as anticompetitive, empirical evidence shows that acquisition activity often validates markets and attracts further venture investment.[14] High-profile cases, such as that of YouTube and Android, demonstrate how integration with larger platforms can rescue promising technologies from collapse and scale them to have a global impact.[15] Blocking acquisitions, by contrast, has at times produced the opposite of the intended result, leading to firm failure and strategic losses to foreign competitors.[16]

Innovations Beyond the Information Sector: Big Tech is primarily about information—generation, storage, analysis, and transmission. But it is about much more than that. These companies are innovating in a range of important areas, including national defense, transportation, agriculture, education, health care, space travel, and more.

The United States finds itself in an existential techno-economic war with China, where the Chinese Communist Party (CCP) is seeking to dominate all advanced industries, including manufacturing and information.[17] And it has core advantages, including a closed domestic market, massive government subsidies, and favorable antitrust rules that encourage size and scale. Given the severe U.S. government fiscal constraints, it is not realistic to expect the U.S. government to match the financial largess the CCP bestows on its big tech champions. If the United States does not want to lose to China, it needs to strengthen, not weaken, its large technology companies.

Too many have defaulted to adopting the European model of hobbling, Gulliver-like, America’s large technology companies through taxes, regulations, fines, antitrust breakups, and other restrictions.[18]The idea that doing so will boost U.S. innovation and competitors is so farcical that it’s amazing that anyone can believe it. If we continue down that Brussels path, the result will be clear: an America where, in a decade or two’s time, today’s big tech firms are looked at nostalgically the way we look at past tech leaders such as Xerox, RCA, Lucent, and Kodak.

That is why, at the very least, what the U.S. policy can do with regard to its own big tech companies is no harm. Doing so will certainly strengthen America’s global competitiveness and the jobs big tech creates at home. It will also support U.S national security.[19] American advances in AI, semiconductors, and quantum computing are overwhelmingly driven by private R&D. The Pentagon adapts these capabilities for defense applications, benefiting from billions in commercial investment that government contracts alone would not reproduce at a similar scale or speed.[20] And it will help enable innovation across a range of traditional sectors where traditional firms are underinvesting in high-risk activities.

Overall, the prevailing discourse reduces these firms to consumer platforms and market power, overlooking the broader system of innovation, infrastructure, and security that depends on their scale. Policies that treat big tech primarily as a problem risk weakening assets that underpin U.S. competitiveness. A more complete assessment requires recognizing the positive externalities they generate.

Societal Benefits

Innovation Investment

R&D determines which nations lead in technological advancement and economic competitiveness.[21] The source and scale of R&D funding shape what technologies get developed, how quickly they reach market, and which countries capture the resulting economic benefits. Today, private corporations have emerged as the dominant funders of R&D, with five U.S. technology companies alone investing more than the entire federal government and most other countries.

This concentration of research capacity creates distinctive advantages, namely the ability to sustain decade-long losses on experimental technologies, pursue innovations requiring billions in up-front investment, maintain portfolio approaches to high-risk research, and compete with state-backed entities without direct government support.

These investments are fundamentally profit driven. But while companies pursue R&D to maintain a competitive advantage and capture future markets, they also generate substantial positive externalities. The technologies, knowledge, and capabilities developed through corporate R&D frequently diffuse beyond the investing firms, creating benefits for competitors, academia, and society at large that exceed the private returns captured by the companies themselves.

Unique Financial Capacity for High-Risk R&D

Transformative technologies typically require extended periods of investment, with highly uncertain returns. The transistor took 23 years from its invention at Bell Labs to reach widespread commercial adoption.[22] The Internet evolved over decades with government support before private commercialization.[23] These extended timelines, combined with high failure rates, don’t make it very desirable to fund research that may take decades to pay off, if ever. Traditional capital markets demand returns within 5–10 years. Government grants operate on even shorter cycles. This mismatch between innovation timelines and funding horizons constrains breakthrough research.

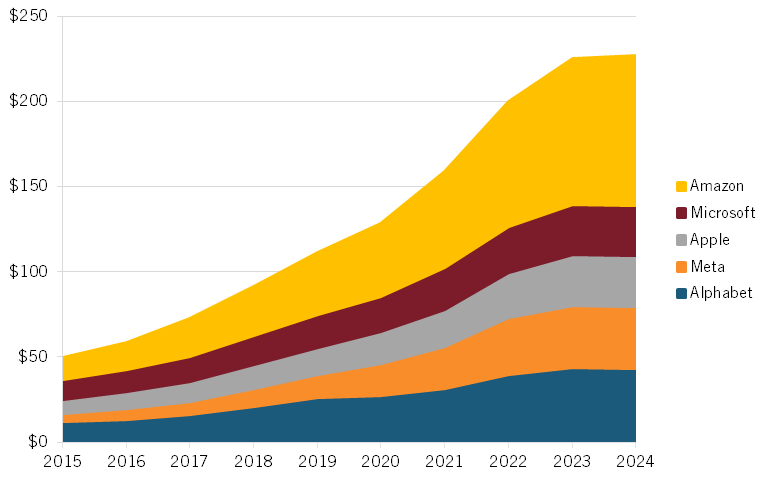

Figure 1: Big tech companies’ R&D spending, 2015–2024 (billions)[24]

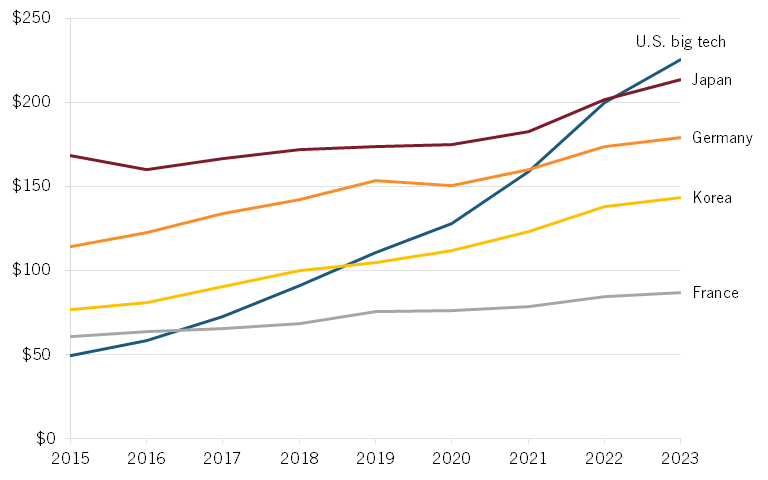

The leading five U.S. technology companies—Amazon, Apple, Alphabet, Meta, and Microsoft—invested $227 billion in R&D in 2024.[25] This exceeds the $172 billion U.S. federal R&D budget and the total annual R&D expenditure of most countries in 2023.[26] The scale represents not just large numbers but also a qualitative difference in innovation capacity. When individual companies deploy tens of billions of dollars annually on research, they can sustain projects that would exhaust traditional funding sources.

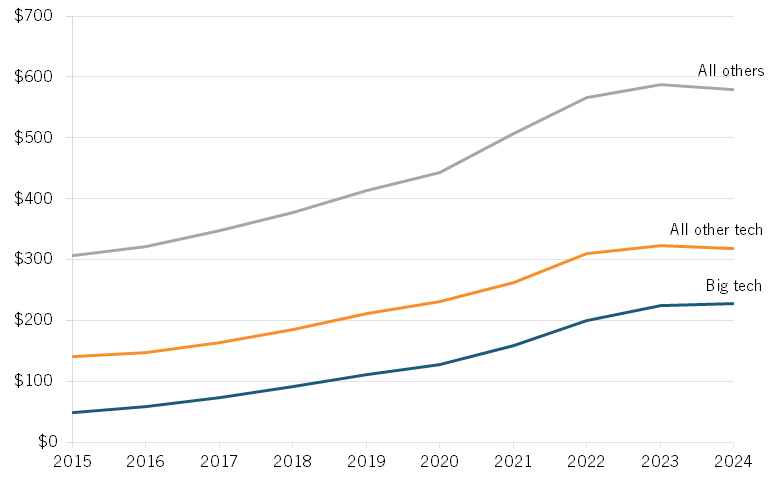

Figure 2: U.S. private sector R&D spending, 2015–2024 (billions)

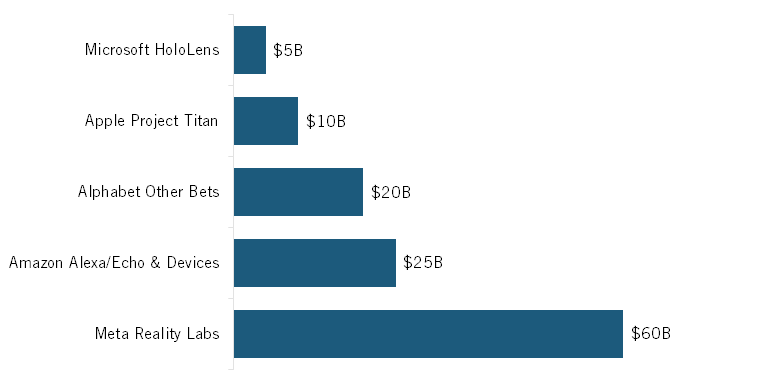

Google’s parent company, Alphabet, demonstrates this capacity through its experimental X division. In 2016, the division reported quarterly losses of $859 million pursuing “moonshot” projects, with estimated annual losses between $3 billion and $4 billion.[27] These projects included Internet-delivery balloons, glucose-monitoring contact lenses, and autonomous vehicles—technologies with uncertain commercial prospects but potentially transformative impacts. Despite the losses, Alphabet’s stock rose 6 percent after the earnings announcement, reflecting investor acceptance of long-term research investments supported by profitable core businesses.

Figure 3: U.S. big tech companies’ R&D spending vs. select countries’ totals, 2015–2024 (billions)[28]

Alphabet’s experimental X division reported quarterly losses of $859 million pursuing moonshot projects. Despite the losses, Alphabet’s stock rose 6 percent, reflecting investor acceptance of long-term research investments.

Amazon’s approach to hardware development illustrates sustained commitment despite commercial failure. The company’s devices division, centered on Alexa-enabled products, lost over $25 billion between 2017 and 2021.[29] In just the first quarter of 2022, the division lost another $3 billion.[30] The company sold Echo devices at or below cost, hoping to generate revenue through voice commerce that never materialized. Yet, Amazon sustained these losses for nearly a decade, advancing voice recognition and natural language processing technologies in the process.

Custom semiconductor development represents another domain where only the largest technology companies can compete. Apple’s transition to proprietary silicon required years of development and billions in investment, culminating in chips that now power its entire product line. This vertical integration, designing processors specifically optimized for their software and AI workloads, requires sustained investment that few companies can match.

Figure 4: Subset of big tech companies’ losses on high-risk, high-reward moonshot projects[31]

This financial capacity derives from profitable core businesses that generate massive cash flows. Amazon Web Services (AWS) produced $62 billion in revenue in 2021 with operating margins exceeding 30 percent.[32] Alphabet’s advertising business generates over $200 billion annually.[33] Big tech companies funnel significant shares of profits to research portfolios that no other entities can easily match in scale or duration. The private sector cross-subsidization model bypasses capital market constraints that would terminate unprofitable research in traditional settings.

Scale Creates Fundamentally Different Innovation Possibilities

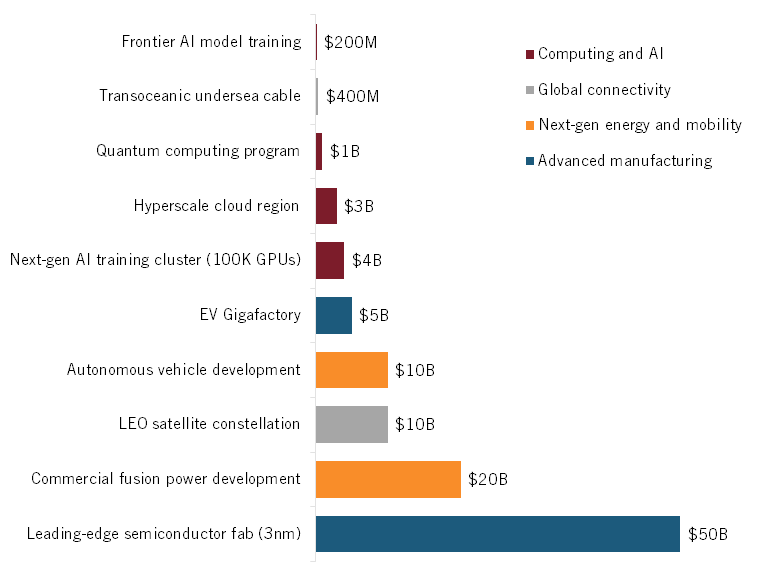

Frontier technologies exhibit escalating capital requirements that create natural barriers to participation. Breakthroughs in AI, quantum computing, and autonomous systems demand massive up-front investments. These requirements stem from fundamental technical constraints rather than artificial barriers.

Training large language models exemplifies the scale. OpenAI’s GPT-3 required over $4.6 million in compute costs alone for a single training run.[34] GPT-4 pushed costs above $100 million.[35] Industry estimates suggest that next-generation models will require billions of dollars in infrastructure investment. The exponential relationship between model capability and computational requirements, wherein each order of magnitude improvement demands roughly two orders of magnitude more compute, creates mounting barriers to entry.[36]

Figure 5: R&D and infrastructure costs for frontier technologies[37]

Only organizations with exceptional resources can develop AI models that rely on dedicated access to hundreds of thousands of specialized processors. When OpenAI needed to scale GPT-4 training, it secured resources through an expanded partnership with Microsoft, which provided both funding and exclusive access to Azure infrastructure.[38] Smaller organizations, regardless of technical talent, cannot access comparable computational resources because the cost is simply too great.

Autonomous vehicle development presents similar scale requirements. Alphabet’s Waymo has invested over $5 billion since its inception, funding not just research but also extensive infrastructure.[39] The program requires custom sensor development, high-definition mapping of entire metropolitan areas, sophisticated simulation environments processing millions of virtual miles, and real-world testing fleets. Each component demands specialized expertise and sustained funding that few organizations can provide.

Quantum computing pushes scale requirements even further. Alphabet’s 2019 achievement of quantum supremacy marked the culmination of 13 years of sustained investment.[40] The program required custom fabrication facilities for quantum processors, cryogenic systems maintaining temperatures near absolute zero, and interdisciplinary teams spanning physics, computer science, and engineering.[41] Amazon, IBM, and Microsoft are pursuing similar programs, each investing billions without near-term revenue prospects.[42]

These examples illustrate how technological complexity drives capital concentration. As innovations require integration across multiple disciplines, longer development cycles, and more sophisticated infrastructure, the minimum viable investment rises correspondingly. This creates a natural filter where only organizations with exceptional financial capacity can pursue frontier technologies.

Risk-Taking That Drives Breakthrough Innovation

Innovation inherently involves exploring multiple technical paths with uncertain outcomes. Historical analysis of major technologies reveals consistent patterns: numerous failed approaches preceded each breakthrough, success often emerged from unexpected directions, and the ultimate applications differed from initial visions.[43] Effective innovation systems must therefore support portfolio approaches, pursuing multiple competing solutions simultaneously while maintaining tolerance for failure.

Business scholar Clayton Christensen and others long criticized U.S. corporations for focusing on what he termed incremental, rather than breakthrough, innovation.[44] The former is making small, gradual improvements to existing products for current customers rather than pursuing transformative technologies. And he was right. Too many companies became too risk-averse, losing market share to foreign companies often backed by the deep pockets of the state.

Large technology companies have focused significantly on breakthrough innovation and incorporated significant risk-taking practices, which are difficult for traditional organizations to match. Many of these projects fail and never make it to full commercialization, but at least these companies took the risk. Other projects do succeed. Microsoft has pursued topological quantum computing since 2005, investing billions of dollars in an unproven approach that could revolutionize the field or prove impossible.[45] Meta funds neural interface research through its Reality Labs, exploring electromyography (EMG) wristband technology for human-computer interaction despite long development horizons.[46] Microsoft has committed to purchasing electricity from Helion Power’s fusion reactors starting in 2028, although no company has yet successfully produced commercial fusion power.[47] This tolerance for extreme technical risk enables the pursuit of transformative technologies wherein theoretical feasibility remains unproven.[48]

The portfolio strategy extends beyond simple failure tolerance. These companies pursue multiple competing technical approaches simultaneously, hedging against technical uncertainty. In AI, major firms maintain investments across different model architectures, training approaches, and application domains rather than commit to single paths. Microsoft invests in both its own AI research and the OpenAI partnership. Alphabet both develops Tensor Processing Units (TPUs) and maintains GPU infrastructure.[49] This parallel exploration increases the probability that at least one approach succeeds.

Nvidia exemplifies this strategy through its multi-track chip development, which runs three design teams simultaneously on staggered 18- to 24-month cycles, allowing for continuous innovation while hedging against the failure of any single architecture.[50] The company invested nearly $10 billion developing its B200 Blackwell chip alone, while maintaining parallel investments in its software ecosystem: over 900 CUDA (Compute Unified Device Architecture) libraries that ensure its hardware advantages translate into practical applications.[51]

Financial resilience enables countercyclical R&D investment, increasing research spending during economic downturns when competitors retreat. Academic research demonstrates that companies that maintain R&D investment through recessions emerge with significant advantages during recovery.[52] While smaller firms must cut research spending in order to survive downturns, and larger, more traditional firms cut to keep their share price up, large technology companies can accelerate investment when resources (talent, equipment, facilities) become more available and affordable.

The risk capacity manifests in the willingness to pursue technologies with extreme uncertainty. Google Brain began as a speculative project with unclear commercial applications.[53] The team explored whether deep learning techniques, largely abandoned by the AI community, could achieve breakthrough results with sufficient scale. The project consumed massive computational resources with no guarantee of success. Today, the technologies developed generate over $10 billion annually through search improvements and cloud services.

Competing With State-Backed Chinese Competitors

China’s innovation model poses a systematic challenge to market-based systems through the coordinated use of state resources. The Chinese government allocated over $450 billion to R&D in 2023, representing an 8.1 percent increase aimed at sustaining growth above 7 percent annually.[54] This spending operates within an integrated system in which state-owned enterprises, research institutes, and nominally private companies align with national objectives. Recent initiatives include a $138 billion fund for quantum computing, AI, and semiconductors.[55]

These state subsidies constitute more than aggressive competition; they violate fundamental principles of international trade. As ITIF has documented extensively, China’s systematic use of below-market financing, production subsidies, and state-directed overcapacity represents predatory innovation mercantilism designed to capture entire industries rather than compete on merit.[56] These strategies violate World Trade Organization (WTO) subsidy rules, antidumping principles, and the basic reciprocity underlying global trade.[57]

Against China’s coordinated state-capital model, traditional market competition proves insufficient. Startups and mid-sized companies lack the resources to compete with entities backed by sovereign wealth and fight decade-long price wars.

The state-directed approach demonstrates effectiveness through market dominance in targeted sectors. Chinese solar manufacturers control over 80 percent of global production after sustained below-cost pricing drove out international competitors.[58] Government subsidies enabled this strategy, accepting losses that would bankrupt private firms. In telecommunications, state backing allowed Huawei to underbid Western competitors by 30–40 percent while investing more in R&D than did Nokia and Ericsson combined.[59] The pattern repeats across strategic industries from batteries to drones.[60]

Against this coordinated model, traditional market competition proves insufficient. Startups and mid-sized companies lack the resources to compete with entities backed by sovereign wealth and fight decade-long price wars.[61] Government research grants, while valuable, operate at scales that are inadequate and inconsistent for competing with national industrial strategies.[62] The structural mismatch between dispersed market actors and coordinated state capital threatens technological leadership.

American technology companies provide the essential counterweight through concentrated private resources. The $227 billion in R&D spending by five firms approaches Chinese state investment while maintaining market discipline.[63] These companies possess the scale to sustain long-term competition, absorb temporary losses, and invest in next-generation technologies without government direction.

The competition extends beyond financial resources to innovation models. While China excels at scaling proven technologies through state support, U.S. corporate laboratories maintain advantages in breakthrough innovation. Private companies alone cannot counter China’s state-coordinated approach; the United States requires more comprehensive policy responses, from strategic industrial support to coordinated trade enforcement. Yet, large technology companies provide critical leverage in this competition.

Open Research and Talent Concentration

Another complaint levied against U.S. corporations is that too much of their research focuses on the development side of the continuum rather than on earlier-stage research. In fact, leading American tech companies spend considerable amounts on basic research and openly publish their research findings. They also release tools freely available to developers and provide computing infrastructure to universities and independent researchers. This openness creates knowledge spillovers and enables research capabilities across the broader innovation ecosystem.

Open Research Model

Open research speeds up innovation. When companies publish their findings, other researchers can build on that work immediately instead of starting from scratch. This creates faster progress across the entire field. The benefits extend throughout the economy—startups can use published AI models without developing their own, universities can access datasets they couldn’t afford to create, and engineers can adopt proven methods rather than reinvent solutions. Economic analyses show that open data generates 0.5 percent more gross domestic product (GDP) annually compared with data requiring payment, with global economic impact estimates ranging from $3 trillion to $5 trillion per year.[64]

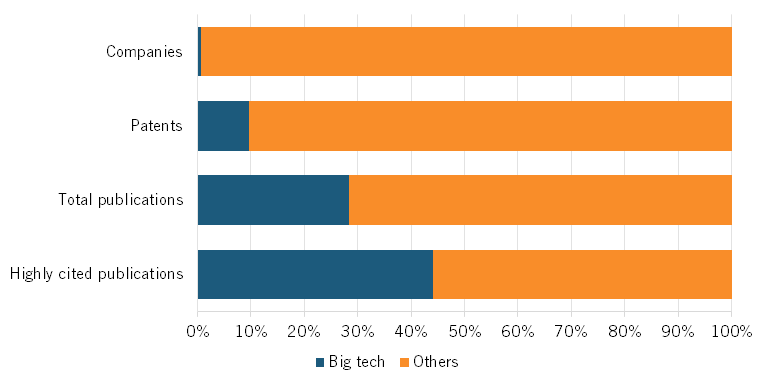

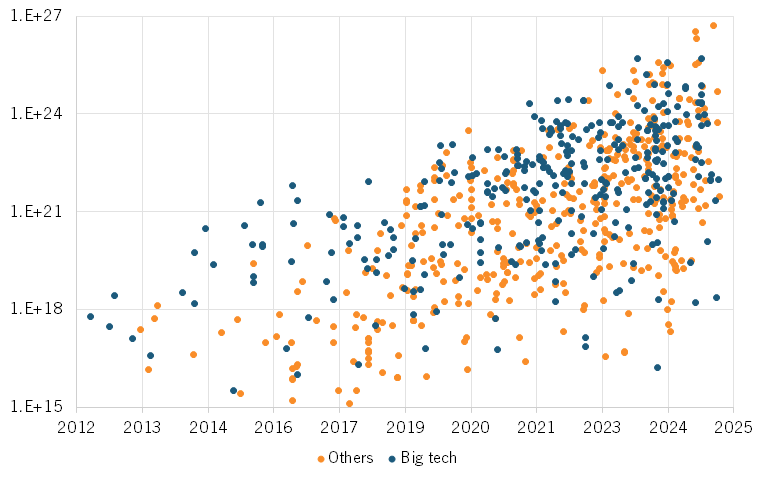

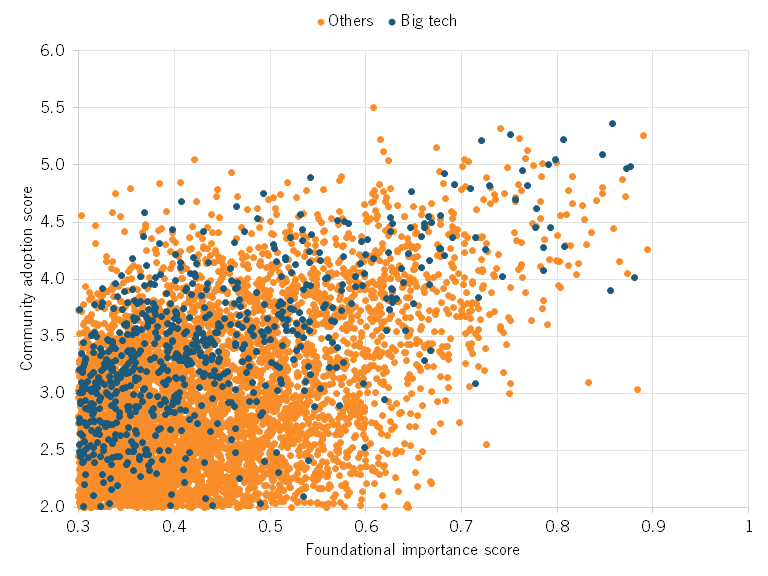

Figure 6: Big tech vs other companies’ contributions to AI advancement[65]

Figure 7: U.S. companies’ AI models by training compute (FLOPS, log scale)[66]

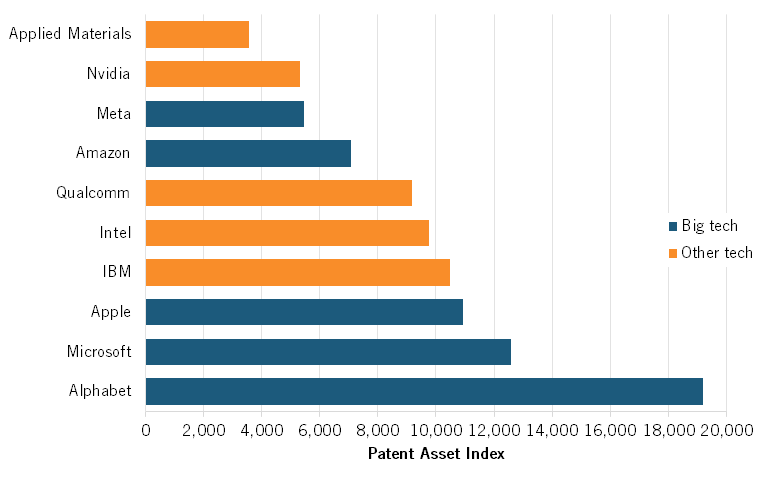

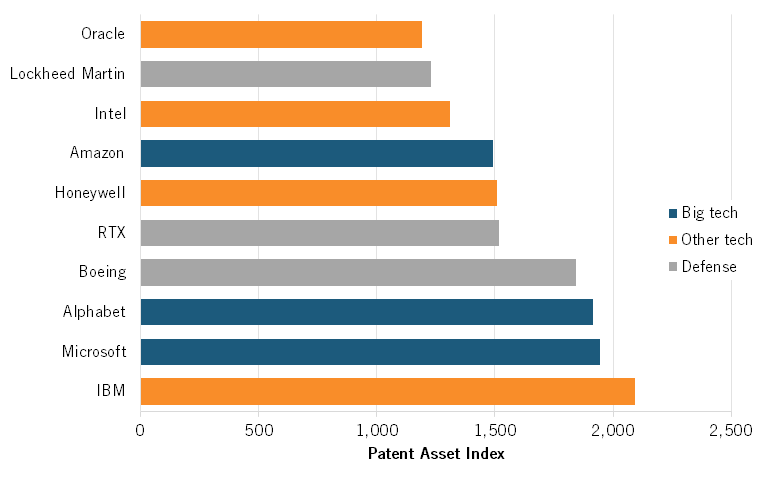

Figure 8: Top 10 critical tech patent contributors (excluding life sciences)[67]

Figure 9: Top 10 patent contributors to U.S. defense tech[68]

NeurIPS, ICML, and ICLR are the top three influential AI conferences based on Google Scholar metrics, with acceptance rates usually between 20 and 25 percent.[69] At these top-tier conferences, Alphabet released over 500 research papers in 2023, with DeepMind researchers presenting more than 80 papers at ICML 2023 and Microsoft submitting over 100 accepted papers at NeurIPS 2024.[70] Industry research produced 51 notable machine learning models in 2023, compared with 15 from academia.[71] This volume establishes tech companies as the largest contributors to top-tier AI conferences alongside leading universities.

At top-tier AI conferences, industry research produced 51 notable machine learning models in 2023, compared with 15 from academia.

The real economic impact comes through open source infrastructure. TensorFlow and PyTorch, developed by Alphabet and Meta, respectively, are software frameworks that enable developers to build and deploy AI applications.[72] These frameworks provide the essential building blocks, from basic mathematical operations to complex neural network architectures, that developers need to create AI systems. Without them, each organization would need to write thousands of lines of foundational code before even beginning its actual AI work. TensorFlow commands 37 percent market share and PyTorch 25 percent among machine learning tools.[73] PyTorch’s adoption by 80 percent of research papers at major conferences demonstrates how quickly open tools can become industry standards.[74] Developing a production-grade machine learning framework requires substantial investment in terms of engineering teams, infrastructure, and years of refinement. By providing these tools freely, big tech companies eliminate redundant development efforts across thousands of organizations.

Figure 10: Big tech contributions to critical open source infrastructure (indexed scores by CSET)[75]

AlphaFold is a prime example of the benefits of open research. Google DeepMind’s protein structure prediction system, cited over 20,000 times since release, accelerates research across pharmaceuticals, agriculture, and materials science.[76] The Drugs for Neglected Diseases Initiative uses it to develop treatments for diseases that affect billions but generate little profit.[77] Academic labs apply it to antibiotic resistance and cancer research.[78] Industrial researchers use it to design new enzymes and materials.[79] This single open release may accelerate hundreds of drug development programs by years.

Big tech companies naturally maintain significant proprietary research operations because their core products and competitive advantages depend on it. Yet, compared with traditional corporate R&D models, wherein virtually all research remains internal, big tech has normalized publishing academic research and releasing foundational tools while competing fiercely in product markets. This balance distinguishes their contribution to the innovation landscape.

Talent Multiplier Effects

Advances in AI, semiconductors, and complex software require large teams of specialized researchers and engineers. Companies and countries compete intensely for this talent. Success depends not just on recruiting individuals but also on building talent clusters in which people can move between organizations, share knowledge, and start new ventures.

These clusters extend far beyond Silicon Valley. In Pittsburgh, Pennsylvania, Carnegie Mellon has attracted research labs and offices from prominent companies such as Apple, Intel, Alphabet, Microsoft, Disney, Facebook, IBM, and others to its campus, creating a hub that city officials describe as “the nation’s most concentrated AI hub outside of Silicon Valley.”[80] In Chicago, the University of Illinois Systems Discovery Partners Institute runs programs that include partnerships with AWS, Alphabet, Microsoft, and dozens of other tech companies, training nearly 30 students from universities including University of Illinois Urbana-Champaign, University of Illinois Chicago, and City Colleges of Chicago.[81]These geographic expansions demonstrate how big tech companies anchor innovation ecosystems nationwide, training talent who later work across the economy.

Amazon’s robotics investments further demonstrate this ecosystem-building effect. The company employs over 750,000 robots across its operations and has hired thousands of robotics engineers, creating a critical mass of automation talent.[82] These engineers develop expertise that later diffuses throughout the economy as they move to startups and other industries, helping establish U.S. leadership in industrial automation.[83]

Big tech’s role in talent development extends well beyond its direct employees. Companies invest heavily in K-12 and university STEM education programs that build the broader talent pipeline. Microsoft’s TEALS (Technology Education and Literacy in Schools) program exemplifies this commitment.[84] It pairs over 1,650 volunteers from more than 700 companies with high school teachers to co-teach computer science, operating in 31 states and serving 17,000 students annually. [85] Microsoft Research’s fellowship program has supported over 700 Ph.D. students globally.[86] Thousands more cycle through internships, postdoctoral positions, and visiting researcher programs annually. These positions provide not just funding but also access to mentorship, datasets, and infrastructure unavailable in academia.

The Nvidia-University of Florida (UF) partnership demonstrates how industry investments create ecosystem-wide benefits. Through $25 million in hardware, software, and training support, Nvidia enabled UF to share AI resources with all 12 Florida state universities.[87] The partnership trained over 800 students through certified instructors and extended advanced computing access to institutions traditionally excluded from such resources.[88]

The entrepreneurial impact is also substantial. Former Alphabet employees founded 14 of the top 50 AI startups that have collectively raised $14.7 billion at a combined valuation of $71.61 billion as of October 2024.[89] The broader ecosystem extends far beyond AI—2,300 companies founded by Google alumni have raised $98.2 billion across all sectors, while Microsoft alumni have created 5,923 companies, raising $69 billion in total.[90] Meta demonstrates the highest funding success rate at 62.9 percent despite fewer total startups, with alumni founding critical AI companies including OpenAI and Harvey.[91]

Big tech companies actively support this talent circulation through structured programs that maintain connections with the entrepreneurial ecosystem. Google’s AI Futures Fund provides equity investment and early access to DeepMind models, Microsoft for Startups offers up to $100,000 in Azure credits with technical mentorship through its GrowthX Accelerator, and Meta’s Llama Startup Program provides $6,000 monthly in cloud inference costs.[92]

Strategic Infrastructure

Leading American tech companies build hyperscale data centers, submarine cables, and renewable energy infrastructure. This infrastructure strengthens U.S. economic competitiveness, enhances national security capabilities, and creates positive spillovers for other industries.

Private Capital Fills Critical Infrastructure Gaps

Digital infrastructure has become as essential to the modern economy as roads and electricity, yet the scale of investment required exceeds what governments can provide alone. While the benefits of digital infrastructure are clear, the U.S. government lacks the necessary funds to lead.[93] The federal government invests $208 billion annually in R&D, but this funding primarily supports basic research rather than the massive capital deployments needed for data centers, subsea cables, and computational infrastructure.[94] A report from the Center for Strategic and International Studies emphasizes that “companies’ participation and collaboration with governments are essential,” particularly where “governments alone often cannot provide sufficient technological advancement.”[95]

Digital infrastructure has become as essential to the modern economy as roads and electricity, yet the scale of investment required exceeds what governments can provide alone.

The U.S. technology sector now invests over $300 billion annually in AI infrastructure alone, filling gaps that traditional government programs cannot address due to budget constraints, procurement delays, and the rapid pace of technological change.[96] Amazon committed $150 billion to data center expansion over 15 years, exceeding the federal government’s entire annual R&D budget.[97] Alphabet owns or leases stakes in at least 16 subsea cables, creating redundant data pathways that enhance both commercial efficiency and national security.[98] These investments represent strategic bets on unproven technologies rather than conventional capital expenditures.

Modern digital infrastructure requires technical capabilities beyond traditional engineering. Hyperscale data centers need breakthrough innovations in cooling, power management, and network architecture. When commercial semiconductors proved inadequate for AI workloads, companies developed custom silicon—Alphabet’s Tensor Processing Units, Amazon’s Graviton processors, and Microsoft’s Azure Maia chips—investing billions without guaranteed returns. Meta built AI training clusters with 24,576 H100 GPUs, computational resources that exceed most government capabilities.[99]

Technology companies pursue infrastructure investments in emerging technologies with no clear path to profitability. Alphabet achieved quantum supremacy in 2019, following a decade of investment that yielded no immediate commercial applications. AWS provides access to quantum computing through Braket, subsidizing million-dollar systems for researchers. Microsoft experiments with underwater data centers and novel cooling technologies that may take decades to yield a return. These long-term bets on frontier technologies would fail traditional investment criteria, but prove essential for maintaining technological leadership.

Infrastructure Ownership as Geopolitical Leverage

Digital infrastructure control translates directly into geopolitical influence. When nations and businesses integrate their operations with global technology platforms, they align with the infrastructure owners’ technical standards, governance models, and operational practices. These relationships deepen over time as economies build innovative capabilities on these platforms, creating technical interconnections and shared interests that strengthen international partnerships. Infrastructure ownership thus generates influence through technological integration.

American cloud providers dominate with 62–67 percent of global cloud infrastructure, enabling them to establish technical standards through market adoption rather than regulatory mandates.[100] When AWS implements security requirements for 90 percent of Fortune 500 companies, these protocols become global best practices, as companies align their operations with the platform’s capabilities.[101] Singapore’s Smart Nation initiative leverages American cloud platforms, with government agencies using AWS, Microsoft Azure, and Google Cloud to deliver advanced urban services and digital governance.[102] Estonia has built its pioneering e-government system through these platforms, enabling everything from digital identity verification to seamless tax collection.[103]

American cloud providers dominate with 62–67 percent of global cloud infrastructure, enabling them to establish technical standards through market adoption rather than regulatory mandates.

Platform capabilities enable coordinated responses during geopolitical crises through commercial mechanisms. Following Russia’s 2022 invasion of Ukraine, Microsoft, Google Cloud, and AWS restricted services to sanctioned entities while ensuring continued support for Ukrainian agencies and their allies.[104] These actions required no government infrastructure or military resources. Private companies enforced terms of service that align with international sanctions, demonstrating how commercial decisions support diplomatic objectives.

The business logic driving platform expansion creates these strategic advantages through commercial competition. Cloud providers are pursuing international markets to capture projected spending of $679 billion in 2024, necessitating a global presence to achieve economies of scale.[105] Amazon plans $100 billion in capital expenditure for 2025, primarily for AWS infrastructure that will serve both commercial and government customers worldwide.[106] Competition for enterprise clients drives continuous security improvements that benefit all users, while platform companies maintain high standards to protect brand reputation. These commercial imperatives consistently produce outcomes that align with democratic governance principles and strengthen America’s partnerships with allies.

Figure 11: GPU cluster market share[107]

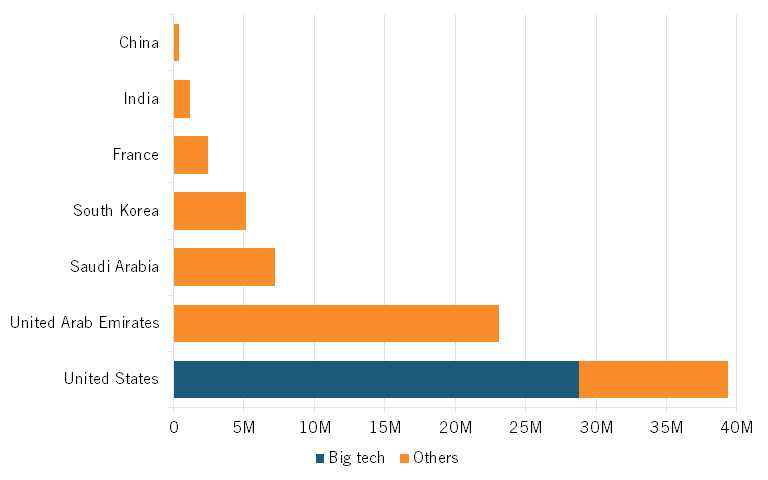

Strategic Competition for Global Digital Infrastructure

China’s aggressive expansion of its digital infrastructure threatens American technological leadership and access to emerging markets. Beijing has weaponized infrastructure investment to create exclusive economic zones where American companies cannot compete—when Huawei builds a nation’s 4G network, U.S. firms lose that market for mobile services, cloud computing, and digital payments. This infrastructure competition determines whether American companies can access the 3 billion users coming online in developing markets and whether U.S. technical standards will govern the global digital economy. Losing this competition means ceding control of the world’s fastest-growing economies to China.

China has invested heavily through its Digital Silk Road initiative, with $79 billion deployed by 2018 and continued significant investments since.[108] Huawei controls 70 percent of Africa’s 4G networks, creating Chinese-dominated markets across the continent.[109] These deployments require exclusive Chinese suppliers and mandate routing data to be processed through Beijing’s systems. Zimbabwe agreed to share facial data with CloudWalk to help train its AI systems.[110] Each Chinese infrastructure win locks out American companies for decades—once a country builds on Huawei equipment, switching costs make changing to U.S. systems economically impossible.

American companies counter through commercial innovation that keeps markets open. Alphabet’s $1 billion Equiano cable provides 20 times more West African capacity, creating $7 billion in GDP growth that American businesses can capture.[111] AWS and Microsoft cloud services let countries build digital economies that remain accessible to U.S. firms.[112] Meta’s Llama and Google’s TensorFlow establish American AI standards globally through voluntary adoption by millions of developers.[113] Meta’s expansion of Llama access to NATO, EU institutions, and key allied nations for defense applications creates a shared AI infrastructure that excludes China while strengthening democratic technological cooperation.[114] These investments ensure that American companies can compete in emerging markets rather than being locked out by Chinese infrastructure monopolies.

Business incentives drive American success more effectively than government programs do. Companies invest to capture growth in markets such as Africa, which is projected to reach $712 billion by 2050.[115] Commercial competition pushes firms to offer superior technology and transparent terms. Open sourcing creates global developer communities trained on American platforms. While companies pursue profits, their infrastructure investments secure U.S. economic interests by keeping emerging markets open to American business and preventing Chinese monopolization of the digital future.

Dual-Use Technologies and National Security

U.S. technology companies invest over $200 billion annually in R&D for AI, quantum computing, and advanced semiconductors—technologies that define modern military advantage.[116] This commercial investment creates a dual-use dividend: the Pentagon gains access to capabilities developed through market competition rather than government contracts alone, while companies expand their innovations into defense applications. The result strengthens both U.S. economic competitiveness and national security without requiring separate development tracks.

The Commercial Technology Foundation for Defense Innovation

AI enables military systems to process vast amounts of data and identify threats more quickly than humans ever could. AI algorithms can scan satellite imagery covering thousands of square miles to detect military vehicles, analyze patterns across millions of intercepted communications to predict attacks, and identify potential equipment failures before they occur.[117] In practice, this means U.S. forces can detect Chinese naval movements across the Pacific, track terrorist networks through digital signatures, and maintain aircraft with unprecedented efficiency. The same AI capabilities drive drug discovery for biodefense and optimize military supply chains.

Quantum computing poses a threat to break the encryption protecting military communications, financial systems, and critical infrastructure. Current encryption relies on mathematical problems that would take classical computers billions of years to solve. Quantum computers could crack these codes in hours by evaluating multiple solutions simultaneously.[118] China has invested $15 billion in quantum research and claims quantum advances that could challenge U.S. technological superiority.[119] The United States allocated $1.2 billion through the National Quantum Initiative Act of 2018, but commercial development by IBM, Alphabet, and others provides the bulk of American quantum capabilities.[120] Beyond code breaking, quantum computers will design new materials for hypersonic vehicles, optimize logistics across global supply chains, and enable quantum encryption that cannot be broken even by other quantum computers.

While the United States lost semiconductor manufacturing leadership to Asia decades ago, American technology companies maintain dominance in chip design—the high-value intellectual property that drives innovation.[121] Companies such as Nvidia, Apple, and AMD invest billions in developing architectures that advance computing capabilities, creating innovations the military adapts for defense applications.[122]

American technology companies drive advancement in all three domains through commercial R&D.[123] The military adapts these commercially developed technologies rather than funding them from scratch.[124] This arrangement benefits both sides: companies gain defense contracts and technical challenges that push innovation boundaries, while the military accesses capabilities that defense budgets alone could never create.[125] Unlike China’s military-civil fusion strategy that mandates technology transfer from companies to military institutions, the United States relies on voluntary commercial innovation in which technology companies’ market-driven R&D creates capabilities the military can adapt.[126]

Table 1: Major big tech defense contracts[127]

|

Company |

Contract or Program |

Value |

Duration |

Status |

Key Technologies |

|

Microsoft |

IVAS (AR Headsets) |

$22B |

10 years |

Transferring to Anduril |

HoloLens AR, mixed reality |

|

JWCC (Cloud) |

Share of $9B |

2022–2028 |

Active |

Azure cloud services |

|

|

CIA C2E (Cloud) |

Share of “tens of billions” |

15 years |

Active |

Multi-cloud infrastructure |

|

|

Amazon (AWS) |

NSA Wild & Stormy |

$10B |

10 years |

Active (sole source) |

Top-secret cloud infrastructure |

|

JWCC |

Share of $9B |

2022–2028 |

Active |

Cloud computing |

|

|

CIA C2E |

Share of “tens of billions” |

15 years |

Active |

Intelligence cloud services |

|

|

CIA C2S (Legacy) |

$600M |

2013–2023 |

Completed |

First major IC cloud contract |

|

|

Alphabet |

JWCC |

Share of $9B |

2022–2028 |

Active |

Cloud services |

|

CIA C2E |

Share of “tens of billions” |

15 years |

Active |

Multi-cloud platform |

|

|

CDAO AI Contract |

$200M |

2025–2026 |

Active |

Frontier AI capabilities |

|

|

Meta |

Anduril Partnership |

TBD |

Development |

In negotiation |

AR/VR combat systems |

|

Llama for Defense |

Open source |

Ongoing |

Available |

AI language models |

|

|

Apple |

FlexTech Alliance |

Minimal |

2015-present |

Limited involvement |

Flexible electronics R&D |

Military Adaptation of Commercial Platforms

The transformation of commercial technologies for military use has evolved from an opportunistic practice to a strategic necessity. Modern military systems increasingly incorporate technologies originally developed for civilian markets, adapted through specialized integration and hardening processes. This approach leverages billions of dollars in commercial R&D while adding military-specific capabilities that traditional defense contractors typically develop.

Cloud computing infrastructure exemplifies the successful transfer of commercial technology to the military. The Joint Warfighting Cloud Capability contract, valued at up to $9 billion through 2028, relies exclusively on commercial providers: AWS, Microsoft Azure, Google Cloud, and Oracle Cloud Infrastructure.[128] Each vendor brings distinct capabilities shaped by their commercial focus—AWS’s experience hosting the CIA’s classified systems since 2013, Azure’s enterprise integration tools refined through serving Fortune 500 companies, Alphabet’s AI and machine learning services developed for consumer applications, and Oracle’s database technologies proven in commercial financial systems.[129] The multivendor approach provides resilience and prevents single-point failures while maintaining competition for task orders.

Microsoft’s Integrated Visual Augmentation System demonstrates both the potential and challenges of militarizing consumer technology. Based on the HoloLens 2 augmented reality headset, IVAS aims to provide soldiers with enhanced situational awareness through thermal imaging, navigation aids, and tactical overlays.[130] The program’s evolution reflects the iterative nature of commercial-to-military adaptation. Initial versions faced significant challenges—soldiers reported discomfort, reliability issues, and concerns about combat effectiveness. However, the commercial foundation enabled rapid iteration, with version 1.2 incorporating soldier feedback to improve ergonomics and performance.[131] Despite ongoing challenges that led to a program restructuring in 2025, the ability to leverage billions in commercial AR investment provided capabilities that purpose-built military development could not have achieved within similar timeframes.

Modern military platforms contain thousands of processors manufactured in commercial facilities. For example, the F-35 fighter jet’s systems depend entirely on chips produced alongside commercial electronics.

AI represents perhaps the most significant domain of commercial-to-military technology transfer. Project Maven, which applies AI to analyze drone footage and identify targets, has evolved from initial controversy over Alphabet’s participation to a multi-vendor effort involving Alphabet, Microsoft, Amazon, Palantir, and numerous specialized firms.[132] These companies adapt computer vision algorithms originally developed for autonomous vehicles, medical imaging, and consumer photography to military intelligence applications. The commercial AI ecosystem provides not just algorithms but entire development frameworks, training methodologies, and computational infrastructure that accelerate military AI deployment.

The dependence on commercial semiconductor supply chains underscores how thoroughly military capabilities rely on commercial technology. Modern military platforms contain thousands of processors manufactured in commercial facilities. For example, the F-35 fighter jet’s systems depend entirely on chips produced alongside commercial electronics.[133] When military systems require specialized components such as radiation-hardened processors for space applications, commercial foundries modify their standard processes rather than establish dedicated military production lines. This approach provides access to cutting-edge manufacturing capabilities while maintaining economic viability.

Spillovers Into Other Strategic Sectors

Avoiding the advice of former GE CEO Jack Welch, large technology companies are willing to engage in businesses in which they are not the dominant one or two players. In fact, they actively pursue research in health care, materials science, transportation, space, agriculture, and climate—fields far from their core businesses. These initiatives leverage computational infrastructure, AI expertise, and data processing capabilities to tackle problems for which these resources can accelerate progress. The pattern reveals companies directing significant R&D investments toward challenges beyond their commercial domains, creating spillover effects that benefit entire industries through both discoveries and open knowledge sharing.

Health Care and Biomedical Research

Biological systems involve interactions among thousands of molecules, each with complex three-dimensional structures. Traditional structure determination methods such as X-ray crystallography require extensive time and resources—the Protein Structure Initiative spent $1.4 billion over a decade to determine just 13,000 structures.[134] Drug development faces similar constraints, with the average new drug taking 10–15 years and $2.6 billion to bring to market, largely because preclinical screening cannot accurately predict human outcomes.[135]

The computational approach changes these economics. AlphaFold predicted structures for 200 million proteins in 18 months—work that would have required centuries of traditional crystallography based on historical productivity rates.[136] By making the database freely available, Google DeepMind has enabled researchers worldwide to skip structure determination entirely. Over 500,000 researchers now use the resource, with studies citing AlphaFold appearing in journals at a rate of 17 per day by 2024.[137]

Microsoft’s AI evaluated 32.6 million potential battery materials in 80 hours—screening that would traditionally take decades.

Microsoft’s approach to drug discovery addresses the screening bottleneck. Working with Pacific Northwest National Laboratory, Microsoft’s AI evaluated 32.6 million potential battery materials in 80 hours—screening that would traditionally take decades.[138] Applied to tuberculosis research, its AI system achieved a 125-fold improvement in identifying effective inhibitors compared with random screening.[139] This demonstrates how computational methods can transform trial-and-error processes into targeted searches.

Apple’s contribution comes through scale and accessibility. The Apple Heart Study enrolled 400,000 participants in eight months, detecting atrial fibrillation with an 84 percent positive predictive value.[140] Published in the New England Journal of Medicine, the study demonstrates how consumer devices enable population-scale medical research.[141] Traditional cardiac arrhythmia clinical trials typically enroll hundreds to thousands of participants over multiple years, making Apple’s approach a significant methodological advance.[142]

Manufacturing and Materials Science

Materials discovery has historically proceeded through iterative experimentation. Synthesizing and characterizing a new compound typically takes months, with computational studies suggesting that researchers test thousands of candidates to find one viable material.[143] The vast space of possible element combinations means most efforts eliminate nonviable options rather than develop useful materials.

Computational modeling bypasses physical synthesis entirely. Google DeepMind’s GNoME discovered 2.2 million crystal structures by simulating atomic interactions, identifying stable configurations without creating them physically.[144] The 380,000 stable materials include 528 lithium-ion conductors—critical for battery technology.[145] External validation came when laboratories synthesized 736 materials, confirming computational predictions.[146] By adding discoveries to the open Materials Project database, the work expanded the searchable space of materials tenfold.

Microsoft’s MatterGen takes a different approach, generating materials with specified properties rather than searching existing possibilities.[147] Creating structures harder than diamond (bulk modulus exceeding 400 gigapascals) demonstrates that computational design can exceed natural materials. [148] Open-sourcing these models democratizes materials discovery—institutions without supercomputers can now participate in materials innovation.

Agriculture and Food Security

Agricultural productivity faces information asymmetry: expertise concentrates in research institutions while farming happens in rural areas with limited access to specialists. According to the Food and Agriculture Organization (FAO), plant diseases cause global crop losses of 20–40 percent annually, costing the global economy over $220 billion.[149] McKinsey research indicates that precision agriculture technologies can improve yields by 1520 percent through optimized resource use, but deploying sensors and analytics across millions of small farms presents economic challenges.[150]

Smartphones change this equation. Google’s AI detects cassava diseases with 98 percent accuracy using phone cameras—but the innovation isn’t the accuracy; it’s making the model run offline on basic phones.[151] TensorFlow Lite versions work without Internet connectivity, crucial for rural deployment.[152] Agricultural ministries in Kenya, Tanzania, and Uganda have prevented $60 million in crop losses using these free tools.[153]

Microsoft’s FarmBeats demonstrates how publishing complete technical specifications multiplies impact. The system reduces water usage by 30 percent while maintaining yields, but Microsoft hasn’t commercialize it.[154] Instead, publishing sensor designs and data pipelines have enabled agricultural universities to build systems locally. Technology transfer programs have reached 10,000 farms in India and Africa—scale achieved through replication rather than direct deployment.[155]

Environmental Science and Climate

Climate science requires computational infrastructure beyond most institutions’ reach. The European Centre for Medium-Range Weather Forecasts (ECMWF) operates high-performance computing facilities with procurement costs exceeding €50 million (~$58.7 million) and substantial annual operating expenses.[156] Processing satellite data for deforestation tracking requires petabyte-scale storage and computing power. This concentration of resources in wealthy nations creates gaps in climate monitoring for regions most vulnerable to climate change.

Google DeepMind’s GraphCast breaks this constraint. The model produces 10-day forecasts that are more accurate than ECMWF but runs on a single machine in under one minute.[157] By open sourcing GraphCast, Alphabet enables any institution with a workstation to generate world-class weather predictions.[158] For developing nations, this transforms disaster preparedness—accurate cyclone predictions become possible without massive infrastructure investment.

Data center energy optimization demonstrates how sharing methodologies creates compound benefits. Alphabet’s AI has reduced cooling requirements by 40 percent, achieving 1.1 Power Usage Effectiveness.[159] Publishing detailed methodologies has enabled competitors to achieve 20–30 percent reductions.[160] With data centers responsible for approximately 1 percent of global electricity consumption according to the International Energy Agency, industry-wide efficiency improvements have a significant climate impact.[161]

Nuclear Energy

Technology companies have emerged as critical catalysts for nuclear energy development, with Alphabet, Microsoft, and Amazon signing major agreements to develop new reactors and restart decommissioned ones.[162] Alphabet signed an agreement with Kairos Power to deliver six or seven small modular reactors (SMRs) between 2030 and 2035, Amazon anchored a $500 million investment round in X-energy, and Microsoft’s 20-year power purchase agreement enabled the restart of a reactor at Three Mile Island.[163] These investments provide crucial early market demand for SMRs, which, according to ITIF research, are “the only realistic path to significantly scale nuclear power in the United States” and could become “an important strategic export industry” over the next two decades.[164]

Technology companies’ willingness to sign long-term power purchase agreements at premium prices provides the financial certainty needed for SMR manufacturers to achieve production scale.

The spillover effects extend well beyond powering data centers. SMRs can provide thermal energy for industrial processes at temperatures suitable for chemicals production, petroleum refining, and desalination, creating decarbonization opportunities across multiple industries.[165]Technology companies’ willingness to sign long-term power purchase agreements at premium prices provides the financial certainty needed for SMR manufacturers to achieve production scale, while their expertise in simulation and modeling accelerates regulatory approvals. This private sector leadership is particularly important, as China currently has 58 reactors built and 29 under construction, with Russia’s Rosatom expanding into 13 countries, making technology companies’ investments essential for maintaining U.S. competitiveness in advanced nuclear technology.[166]

Transportation and Urban Mobility

Autonomous vehicles face a testing paradox: proving safety requires billions of miles of real-world driving, but deploying vehicles without proof creates liability. No single company can generate sufficient data. Traditional automotive testing—controlled tracks and simulations—doesn’t capture edge cases that cause accidents.

Waymo’s decision to share safety methodologies after 71 million autonomous miles has created industry-wide benefits.[167] Demonstrating 85 percent fewer injury-causing crashes than human drivers matters less than publishing complete data and methodologies.[168] Competitors, including Cruise and Aurora, have adopted these standards, accelerating their development by years. The spillover effect has accelerated industry-wide progress toward reducing traffic fatalities, which claimed 38,824 lives in the United States in 2020, according to NHTSA.[169]

Last-mile delivery represents 28 percent of total transportation costs, according to supply chain analyses, but has resisted optimization due to computational complexity.[170] Amazon’s routing algorithms solve problems with millions of variables—which packages go on which trucks in what order to minimize time and fuel.[171] Publishing these algorithms has enabled UPS, FedEx, and regional carriers to achieve 15–20 percent time reduction and 12 percent fuel savings.[172] The aggregate impact across the logistics industry exceeds Amazon’s own efficiency gains.

Quantum Computing Breakthroughs

Quantum computing is still in its early stages because building stable quantum systems with low error rates requires solving novel physics problems. The challenge isn’t just engineering but also discovering new states of matter and developing advanced error correction for quantum decoherence.

Alphabet’s creation of time crystals—matter in perpetual motion without energy input—represents new physics with implications for quantum memory.[173] Publishing complete protocols in nature has enabled replication at Stanford and Oxford, advancing the field collectively.[174] Microsoft’s multidecade investment in topological qubits based on Majorana zero modes, shared through academic publications rather than patents, provides alternative approaches to quantum stability.[175] These parallel paths increase the probability of achieving fault-tolerant quantum computing, with applications from drug discovery to cryptography.

There is a pattern across these contributions: technology companies address computational and data processing bottlenecks that limit progress in other fields. By sharing discoveries and methodologies rather than monopolizing them, they create spillover effects such that the collective benefit exceeds private returns—strengthening the broader innovation ecosystem beyond direct business interests.

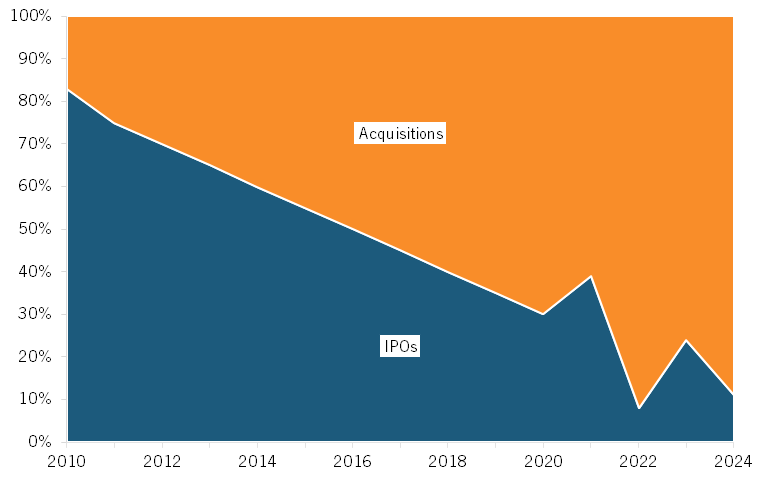

Nurturing the Startup Ecosystem

The U.S. technology ecosystem thrives on complementary capabilities between startups and established firms. While big tech companies conduct substantial internal R&D, certain types of innovation emerge more naturally from startups unburdened by existing business models and organizational structures. Conversely, breakthrough technologies often require capital intensity and infrastructure scale that only large platforms can provide. The median startup now requires approximately 11 years to reach IPO (Initial Public Offering), up from 5 years in 2000, during which time most need multiple funding rounds and operational support.[176] This extended timeline creates opportunities for productive collaboration, wherein startups bring agility and fresh perspectives while large firms provide patient capital, global distribution, and technical infrastructure. The result is an ecosystem wherein strategic acquisitions have become the dominant exit path, with only 11 percent of unicorn exits occurring through IPOs in 2024, down from 83 percent in 2010.[177]

Figure 12: Unicorn exit composition: IPOs vs. acquisitions, 2010–2024[178]

Creating Exit Markets and Providing Capital

The traditional IPO pathway has constricted dramatically. Annual technology IPOs in the United States declined from a 1980–2019 median of 158 to just 72 in 2024, despite venture investment reaching $209 billion that year.[179] The median time from first venture funding to IPO exit has extended from 3.8 years in 2000 to over 8 years today.[180] This creates a liquidity challenge: with 741 U.S. unicorns currently awaiting exits and only 15 achieving them in the past 12 months, the theoretical backlog would take 49 years to clear at current rates.⁵ When capital remains trapped in illiquid positions, venture funds cannot return money to limited partners, constraining future investment capacity.

Large technology companies have evolved into essential liquidity providers for the venture ecosystem. Alphabet’s portfolio through GV includes over 700 investments, while Microsoft’s M12 has backed more than 100 companies since 2016.[181] These corporate venture arms don’t just provide capital—they establish valuation benchmarks that enable subsequent funding rounds. Facebook’s $1 billion Instagram acquisition in 2012, though controversial at the time, validated social media platform valuations.[182] Beyond direct investment, infrastructure support programs such as AWS Activate have provided over $7 billion in credits to startups since 2013, with more than 330,000 startups participating globally.[183] This enables companies to delay fundraising while proving product-market fit, with some qualifying for up to $100,000 in credits to offset cloud infrastructure costs.[184]

Critics argue that big tech creates “kill zones” wherein venture capitalists avoid funding potential competitors.[185] However, empirical evidence challenges this narrative. Research shows that sectors experiencing recent big tech acquisitions actually attract increased venture investment, as successful exits demonstrate achievable returns and validate market opportunities.[186] The Instagram acquisition illustrates this dynamic: rather than deterring investment, it has catalyzed increased funding for social platforms by proving that billion-dollar valuations were achievable. Similarly, Google’s YouTube acquisition didn’t eliminate video platform competition but instead validated the market, leading to the emergence of TikTok, Twitch, and other successful platforms. The concern about predatory acquisitions remains valid for specific cases, but aggregate data suggests that acquisition activity generally correlates with increased rather than decreased startup formation.

Rescuing and Scaling Promising Technologies

Strategic acquisitions often provide struggling startups with the resources needed to achieve their potential. YouTube faced existential challenges when Google acquired it for $1.65 billion in 2006—the company was burning through $1 million monthly in bandwidth costs while facing copyright lawsuits that threatened its survival.[187] Google’s infrastructure and legal resources enabled YouTube to reduce costs dramatically while resolving content disputes, growing into a platform that generated $50 billion in combined advertising and subscription revenue over the four quarters ending Q3 2024.[188]

Android presents an even more dramatic transformation. Google acquired the struggling startup for just $50 million in 2005 when Android was nearly out of funding.[189] That investment enabled Android to become the operating system powering 71 percent of global smartphones, creating an app economy worth hundreds of billions annually.[190]

Recent blocked acquisitions demonstrate how regulatory intervention can produce outcomes opposite to intended goals. When European regulators blocked Amazon’s $1.7 billion iRobot acquisition in January 2024 to preserve competition in robotic vacuums, iRobot collapsed within months—eliminating 572 jobs (51 percent of workforce), posting $145.5 million in losses, and forcing the company to explore strategic alternatives, including potential bankruptcy.[191] The company that pioneered consumer robotics and held 64 percent market share in 2016 now trades below $20 per share, while Chinese competitors Ecovacs and Roborock have captured the premium segments iRobot created.[192]

When European regulators blocked Amazon’s iRobot acquisition to preserve competition, iRobot collapsed within months—eliminating 572 jobs and exploring bankruptcy.

ARM Holdings immediately laid off 1,000 employees (15 percent of the workforce) when regulators blocked Nvidia’s $40 billion acquisition in 2022, abandoning growth investments the merger would have enabled during the AI boom.[193] China’s strategic use of merger review demonstrates the geopolitical dimension: blocking Qualcomm’s $44 billion NXP acquisition after eight other jurisdictions approved it, preventing American semiconductor consolidation while Chinese competitors strengthened their position in automotive chips.[194]

Not every acquisition succeeds—Google’s $12.5 billion Motorola purchase resulted in significant losses. However, the documented destruction from blocked deals raises questions about current regulatory frameworks designed for 20th-century industrial markets. Modern technology competition often requires scale for fundamental technical reasons: AI model training demands massive computational resources, semiconductor manufacturing requires billion-dollar fabrication facilities, and global platforms need extensive infrastructure to serve billions of users reliably.

The challenge lies in distinguishing genuinely anticompetitive acquisitions from partnerships that enable innovation requiring patient capital and global scale. When promising technologies fail because they lack resources to compete globally, when American semiconductor technology transfers to China through forced divestitures, and when regulatory protection leads to bankruptcy rather than independence, the framework itself requires reconsideration. A more nuanced approach would recognize that while vigilance against anticompetitive conduct remains essential, reflexively blocking consolidation while global competitors advance through strategic integration may ultimately harm the innovation ecosystem regulators seek to protect.

American Soft Power

“Soft power” proved decisive in America’s Cold War victory, with jazz ambassadors, Hollywood films, and consumer culture winning hearts and minds behind the Iron Curtain more effectively than military might could alone.[195] The State Department’s cultural diplomacy programs—from Dizzy Gillespie’s concerts in Eastern Europe to Radio Free Europe’s broadcasts—demonstrated that influence through attraction could transform global alignments without firing a shot.[196]

Today, the United States faces a similar ideological competition with China, yet it has reduced foreign aid spending by 92 percent while China invests heavily in digital infrastructure across the developing world.[197] American technology companies, pursuing commercial expansion in emerging markets, now incidentally project U.S. influence in ways that echo Cold War cultural diplomacy. When countries adopt digital platforms, they import more than technology; they adopt the governance models, economic systems, and cultural norms embedded within those platforms. American companies pursuing profits in these markets create dependencies that favor open markets, free expression, and the rule of law—values essential to their business models and also aligned with U.S. strategic interests.[198] This commercial expansion generates two primary forms of soft power: cultural influence through platforms that shape global discourse and development outcomes that would otherwise require government investment.

Today, the United States faces a similar ideological competition with China, yet it has reduced foreign aid spending by 92 percent while China invests heavily in digital infrastructure across the developing world.

Culture and Narrative

Cultural influence represents a critical dimension of soft power, shaping how billions worldwide perceive American values, consume information, and organize economically. In the competition with China for global influence, control over information flows and cultural production translates directly into strategic advantage. When populations adopt American platforms for communication, entertainment, and education, they integrate into systems that embed American assumptions about free expression, individual agency, and market economics.[199]

American technology platforms have achieved unprecedented global cultural reach through purely commercial expansion. Facebook’s 3.07 billion users, YouTube’s 2.54 billion, and Instagram’s 2 billion dwarf Chinese alternatives—WhatsApp maintains 73 percent usage in middle-income countries compared with 36 percent for TikTok.[200] The creator economy is large and growing—market researchers estimate that it will reach approximately $150 billion in 2024, with projections of nearly $1.1 trillion by 2034. Separately, analysis of platform engagement indicates that U.S./English language content commands outsized global reach, reinforcing American production norms and monetization models.[201] YouTube alone contributes $35 billion to the U.S. GDP while training millions of international creators in American production methods and business practices.[202]

Platform algorithms and monetization structures reinforce American cultural and economic norms without government intervention. English dominates, accounting for approximately 50 percent of online content, as creators worldwide optimize their content for English-speaking audiences to maximize revenue.[203] Netflix’s 277.65 million subscribers globally dedicate 60 percent of their viewing to U.S.-produced content.[204] These commercial systems project influence more efficiently than government programs do, though their strategic value depends on continued alignment between corporate profits and national interests.

These benefits exist because commercial incentives align with U.S. interests. TikTok’s rapid growth demonstrates how quickly cultural influence can shift, and the United States cannot depend entirely on corporate platforms for cultural influence—but given competition with state-backed Chinese alternatives, failing to recognize their strategic value would be shortsighted.

Development Substitution

American foreign aid has historically served strategic purposes beyond humanitarian goals—preventing instability that breeds terrorism, building partnerships, and creating markets for U.S. goods. With the potential elimination of over 90 percent of USAID programs, removing $60 billion across 120 countries, a significant tool of American influence might disappear. Technology companies pursuing commercial opportunities in emerging markets now incidentally achieve development objectives that would otherwise require government funding.

Alphabet’s health care initiatives demonstrate this dynamic. The company has screened over 600,000 people for diabetic retinopathy while building relationships with health systems for future commercialization, with plans for 3 million screenings in India and Thailand.[205] Microsoft has invested $165 million in AI for Good across 72 countries, creating Microsoft-trained workforces while addressing health challenges.[206] Digital payment platforms seeking transaction fees have lifted hundreds of thousands from poverty—in Kenya alone, mobile money has enabled 185,000 women to leave farming for business, reducing extreme poverty by 22 percent.[207]

These corporate programs cannot replace government aid—they follow commercial logic, ignore unprofitable markets, and may abandon regions when business models change. Yet, their activities achieve certain strategic objectives at zero taxpayer cost, filling gaps where government programs have been eliminated. Supporting American platforms competing globally costs less than traditional aid while generating development outcomes that benefit U.S. interests.

Recognize and Account for the “Full Iceberg”

Current tech policy debates focus overwhelmingly on potential harms while ignoring documented benefits that large technology companies generate beyond their core business activities. Regulatory impact assessments measure market concentration and privacy concerns without weighing them against contributions to economic dynamism and technological progress, leading to policies that may address narrow concerns while undermining broader U.S. competitive advantages.

Big tech companies generate substantial positive spillovers: their R&D produces knowledge that diffuses throughout the economy, their infrastructure investments create capabilities that thousands of businesses rely on, and their workforce programs train millions in critical digital skills. These benefits accrue to competitors, startups, and unrelated industries, yet rarely factor into policy decisions.

Policymakers need frameworks that capture these ecosystem-wide effects. A regulation that reduces big tech R&D spending by 10 percent might achieve its narrow objective (e.g., collecting revenue through fines) while eliminating billions in spillover benefits. Without measuring these trade-offs, policymakers operate with incomplete information. The same applies to infrastructure investments—when regulations increase compliance costs, companies may scale back investments in data centers, submarine cables, and edge computing facilities that serve as critical infrastructure for thousands of other businesses.

The global context makes recognizing these contributions urgent. China explicitly leverages its tech champions’ spillover benefits for national development, while European policies focus primarily on holding down American tech companies so EU ones can hopefully emerge. In this environment, failing to account for positive externalities means systematically undervaluing a critical source of American competitive advantage. Policy decisions should reflect complete cost-benefit analyses that include innovation diffusion, infrastructure provision, and workforce development alongside traditional regulatory concerns.

Regulations designed to address narrow concerns may inadvertently eliminate billions in spillover benefits, undermine critical infrastructure development, and weaken the very ecosystem advantages that distinguish the United States from competitors.

Conclusion