Beyond Force: A Realist Pathway Through the Green Transition

Trying to force adoption of clean energy with subsidies, regulations, and exhortations will fail. The only realistic way to spur the green transition is to develop clean technologies that can reach effective price and performance parity with dirty ones. Then markets will adopt them at scale.

KEY TAKEAWAYS

Key Takeaways

Contents

Once P3 Is Achieved, Markets Are the Key Lever for Decarbonization. 10

Climate Change Is Global, So the Green Transition Must Be Global 12

We Have All the Tech We Need—Perhaps, But Not at P3. 15

Forcing Policies That Ignore P3 Will Fail 19

Introduction

The climate crisis has rightly galvanized policy and policymakers. Yet, most policy is based on the core premise that governments must force the green transition within their respective borders, because without that, the switch to clean energy will not happen. By “force,” we mean a set of policies that seek to impose solutions that absent force would not be broadly adopted. Thus, we have massive subsidies of clean energy; taxes and proposed bans on dirty energy; regulatory mandates for clean energy; and exhortations on companies and consumers to “go green,” including calls for “degrowth.”

If global warming were a set of national problems, especially where the main problems lie in rich Western countries, perhaps this forcing strategy could possibly work, at least in some sectors and some regions. Some countries might be willing to bear significant costs to transition away from fossil fuels—although even in rich countries there is widespread opposition to policy-induced cost increases.[1] Even in the United States, there is no serious appetite to adopt more expensive greener alternatives.

But climate change is not a national issue; global warming is global, and as such requires global solutions—specifically, solutions that work in all nations, especially low-income countries where emissions continue to grow rapidly with an expanding population, economic growth, urbanization, and electrification. So effective solutions can only be those that all consumers, corporations, and nations can adopt with little or no extra cost or reduced performance. The current strategy of forcing more expensive and often less functional clean energy solutions onto users cannot, therefore, scale globally and is not even likely to scale in wealthy countries that are most fervently committed to addressing climate change. This is not pessimism; this is realism.

It is time then for a fundamentally new strategy: We must use government policy not to force change but to enable change through the widespread development of technologies that meet the price and the performance levels of dirty energy (“price/performance parity,” or P3). (See box 1.) That central strategy should be reflected in all climate policies. Without that, the world will not transition to clean fuels, no matter how many severe weather events we get, how many roads activists block, or how many speeches climate activists give. But once technology does get to P3, then market forces, coupled with the willingness of most organizations and individuals to want to help address climate change, will do almost all the work.

It is time for a fundamentally new strategy: We must use government policy not to force change but to enable change through the widespread development of technologies that meet the price and the performance levels of dirty energy.

Other policies, such as regulations, taxes, or selected subsidies, can still help (for specific purposes, as we will see ahead), although the odds are against the further introduction of large subsidies even in the United States. Most rich nations face deep fiscal holes because of the expanding retiree population, past expansion of debt, and slow productivity growth. As such, the odds of a fiscal surplus that could fund expensive green subsidies are minimal. And there is opposition in most countries to higher taxes (e.g., carbon taxes), even if pitched as revenue neutral.

Moreover, reliance on these mechanisms is based on a misunderstanding. The implicit question behind almost all countries’ climate policy is simple: “Will this policy reduce emissions nationally?” Unfortunately, that’s the wrong question. Instead, we need to ask, “Does this policy help drive the supported technology getting to P3?” Because only P3 enables worldwide adoption of clean energy and, after all, it’s global warming that matters, not American warming, British warming, or Korean warming. The dominant guiding narrative of climate policy is based on the false presumption that all countries will take sufficient action to dramatically reduce emissions, even with the higher costs involved.

Box 1: What Is Price/Performance Parity (P3)?

P3 means that for a given level of performance, a green technology has reached price parity with an existing dirty technology without subsidies or taxes on the dirty technologies. So, for example, P3 for electric vehicles (EVs) will be achieved when the lifecycle costs of EVs are the same as equivalent internal combustion engine (ICE) vehicles, and have approximately the same performance in terms of reliability, refueling, range, acceleration, cargo capacity, etc.

“Performance” captures the wide range of product characteristics beyond price—availability, quality, terms and conditions of sale, delivery, reliability, and much more—from the perspective of the end user. For example, if solar energy could be produced at the same cost as coal-fired power, it would still not be at P3 if the electric grid became unreliable or if it could only deliver power for eight hours a day. Factors such as availability and reliability play heavily in purchasing decisions, so they must all be part of the parity equation. P3 therefore requires that green technologies must be close to price competitive on an apples-to-apples basis; price and performance are both essential parts of the equation.

Let us be clear. This does not mean we are market absolutists, or that we believe that the market will solve the climate crisis on its own. The energy market is profoundly influenced by numerous factors beyond the simple cost to supply energy and the price at which customers will buy it. Energy prices are the net result of all those variables, which include a vast pile of existing regulations, subsidies, policies, and preferences. What we do believe is that the net result is politically sticky. It is hard to shift, especially in countries where protests are possible and potentially powerful. We argue that it is very hard to move the price of dirty energy upward in most countries, and hence that solutions which require upward movement in energy prices won’t be successful. This is reality. It’s not necessarily the world we want, but it’s the one we’ve got.

The current policy environment has been driven partly—perhaps largely—by the urgency of environmentalists, who have successfully pitched a narrative of “emergency” and “climate crisis.” Every extreme weather event is now interpreted as further evidence that the climate ecosystem is on the brink. And in that context, activist demands are about urgency (“Do it now!”) and scale (“It’s not enough!”). These pressures are useful counterweights to a status quo still dominated by fossil fuels, a status quo that, after all, has enormous inertia.

But this urgency has some downsides. It has led to a “kitchen sink problem” in which we try to do everything everywhere all at once, without considering trade-offs, cost, or even effectiveness. It has encouraged us to believe that the climate crisis is so catastrophic that we must simply force change as quickly and widely as possible, even if doing so would place completely unachievable burdens on our economies and our societies and, most importantly, a dramatically reduced focus on getting to P3.

The dominant guiding narrative of climate policy is based on the false presumption that all countries will take sufficient action to dramatically reduce emissions, even with the higher costs involved.

In contrast, we propose a realist approach to the climate crisis, defined by five key pillars that, together, will help us encourage prioritization and accelerate the green transition:

1. All solutions ultimately must be global. Mandating the sale of EVs in the United States, even if successful, is not a global solution. Large subsidies (e.g., the $7,500 available under the Inflation Reduction Act) are not feasible in poorer countries, and other rich-country solutions that add significant cost won’t work either. So, the West should focus primarily not on implementing expensive solutions at home but rather on developing technology and solutions that will work in the entire world—especially the low-income world. That means solutions that will reach price parity with dirty energy, without reliance on forcing mechanisms such as subsidies or carbon taxes.

2. Recognize the growth imperative. When all countries—especially low-income countries—are forced to choose between green and growth, they will (understandably) choose growth, productivity, and lower costs. It’s no surprise that India just sought bids for 121 new coal mines (see box 4). To be effective, any climate solution must ensure that the choice is not between green and growth, but between clean growth and dirty growth.

3. Price and performance both matter to P3. Wind and solar are certainly price competitive in certain regions with fossil energy—but only when the wind is blowing, or the sun is shining. Parity would require that renewables meet the price and reliability of fossil fuels, and not just for eight hours a day. All markets specify quality as well as price; for clean energy, that means matching the performance of fossil fuels, not just the price.

4. P3 must be measured at the point of delivery, not the point of production. Despite the claims of many advocates that we have all the technologies needed to solve global warming, few current solutions are cost competitive without subsidies at the point of delivery. (See box 5.) The costs of wind and solar at the point of production have declined very sharply over the past two decades, and they are now P3 competitive in certain locations, for some of the time. But it’s the cost at the point of end use that matters, not the cost at the point of generation. Against that metric, for most end users much of the time, even wind and solar are still not at P3.

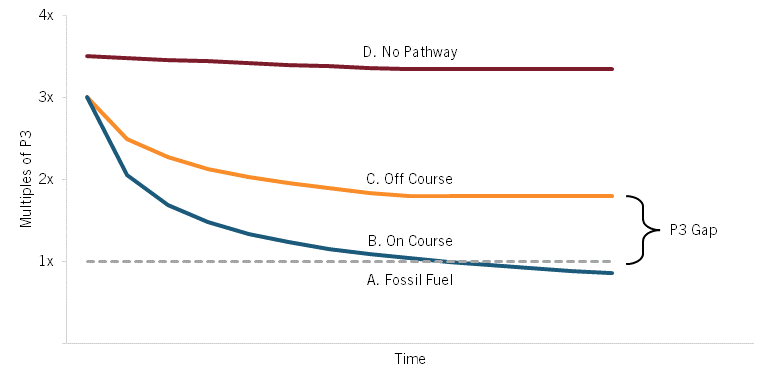

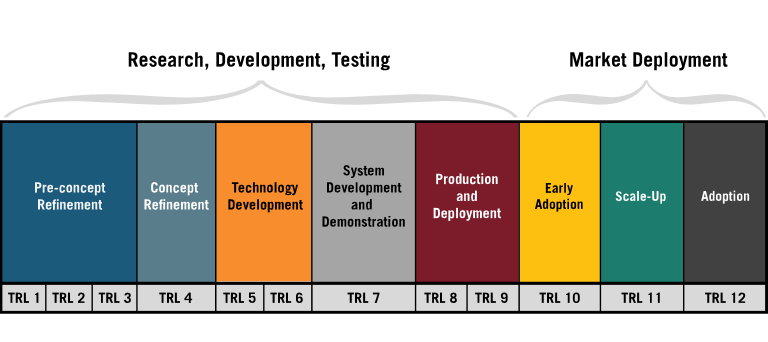

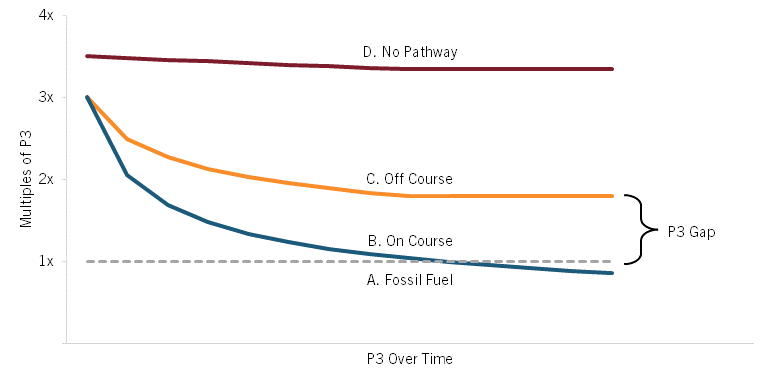

5. Differentiate technology pathways using P3. The P3 lens helps us distinguish between technologies and hence define appropriate government policies. While some technologies are on the path to P3 and may need government help to move down the cost curve (e.g., subsidies for adoption), in other cases, a particular technology may never achieve P3 no matter the scale of production. In these cases, meeting the P3 market test requires substantial and ongoing innovation—often transformative innovation. Many key decarbonizing technologies are currently far from P3, and scale economies and incremental improvement from government-supported demand expansion won’t sufficiently close those gaps, so adoption will lag and net-zero targets will be missed (see figure 1).

The four curves in figure 1 illustrate A) the existing price/performance for a fossil fuel technology; B) the pathway for a green technology that is on course to achieve P3 as demand increases; C) a pathway for a green technology that will not achieve P3 on the current technology pathway; and D) technologies for which there is no conceivable pathway to P3.

Current policy often fails to differentiate between B and C or even D technologies. So enormous efforts are made to grow demand for C and D technologies, but since neither will ever reach P3, neither will be adopted globally. Instead, for solutions to certain emissions challenges that are essentially pipedreams, policymakers should simply focus on mitigation, such as offsetting carbon capture. For the many technologies on curve C, the challenge is to shift the curve down entirely by developing new technology solutions; for example, batteries based on chemistries other than lithium-ion. The current pathway for curve C will never intersect with P3, leaving only expensive, endless, and ultimately fruitless efforts to fill the gap with subsidies or regulations. Instead, policy should focus on innovation, seeking to generate and develop alternative technologies that can shift the cost curve downward until it achieves P3.

For those technologies that are on track to reach P3 (B technologies), policy should focus on accelerating movement down the existing cost curve until we reach P3. These policies are detailed in the section titled “The Power of the P3 Lens.”

Figure 1: Four price/performance pathways

Innovation is central and should be targeted at achieving P3 for the most important technologies.[2] Because they see the climate crisis as imminent and overwhelming, many advocates refuse to accept the obvious reality that much more innovation is needed for an effective green transition. Yet, that is indeed the reality. In part, this means encouraging incremental improvements—often linked to increased scale of production—to move curve B technologies down the cost curve toward P3. In sectors with technologies currently on curve C, which will never reach P3, more radical innovation is needed—not just movement along the existing cost curve but a shift of the entire curve downward so that it can eventually reach P3. Both kinds of innovation will be critically important, but government policy should be focused particularly on the transformative technologies needed to shift cost curves, where the private sector likely won’t invest enough because risks and costs are higher.

Once P3 is achieved, markets will be the primary lever. At that point, markets can and will do most of the heavy lifting. The scale of the climate crisis is such that only markets are big enough to drive the change that’s needed. The International Energy Agency (IEA) has estimated that the necessary global investments will be $84 trillion by 2050, while the McKinsey Global Institute put the cost at $275 trillion.[3] But governments collectively cannot and will not provide that level of funding or anything like it. Only the spending and investment of market actors making economically self-interested decisions has the leverage and scale to deploy all the products and technologies needed.

This does not mean, as some free-market conservatives would believe, that markets alone can manage the green transition. Like almost all technology transitions since the Industrial Revolution, it will take concerted effort from both governments and the private sector focused and organized around getting to P3. And that should be the lodestar for climate policy in all nations.

What we propose, therefore, is fundamentally a “realist” approach to climate change, which must become the bedrock on which effective policies should be built. Using the P3 framework, the overriding imperative must be to create cost-competitive solutions that work globally and will be voluntarily adopted via the market. And for that, we must find ways to get to P3 for climate-critical technologies.

This realist approach may just seem like common sense, but the P3 lens is important precisely because the climate debate is largely dominated by other voices. The remainder of this paper explains why a force approach will fail and then presents a realist approach to climate policy—one that will simultaneously address the urgency of climate change AND effectively reflect the political and economic realities of the 2020s and beyond. Finally, the report provides pathways through the policy space and through the technical, financial, and political constraints that bind the available options for climate policy in the United States and elsewhere.

Recognizing these economic, political, and social realities does not mean we must surrender on climate change. Far from it. It is current efforts to force less than P3 solutions on the world that are unrealistic.

Schools of Force

There are at least four major schools or groupings in the force approach: radical optimists, nation-centric climate advocates, Cassandras, and hair-shirters. In many ways, they offer different perspectives, but their messages all fundamentally lean in the same direction: We must act now in ways or at speeds that without force we would not.

Force-firsters (which includes virtually all climate advocates) believe that force is the only way to solve climate change, focused in particular on forcing policies within their own nation. President Biden, for example, talks about decarbonizing the U.S. electric grid and vehicle fleet, largely through force (regulations and subsidies), but this kind of forcing can only work if most of the world adopts it, which is very unlikely, no matter how much pressure is exerted. As noted in the next section, because climate advocates see the crisis as so severe and action is needed immediately, almost all their recommendations rely on getting individuals, organizations, and governments to take actions they would, in the absence of climate change, not normally take. This includes mandating solutions, subsidizing solutions, taxing and otherwise limiting dirty energy, and pressuring organizations, individuals, and other governments to take action.

There are, of course, differences among force-first proponents. Radical optimists (e.g., Stanford professor Mark Jacobson) offer no guidance in making difficult choices because they wrongly deny choices are necessary.[4] For him and many climate activists today, most if not all technologies are on curve B already, with wind and solar, for example, being perceived as cheaper than dirty energy. As we show in box 5, this is false. A related argument is that the clean transition will be net positive economically, because it creates jobs and spurs investment. (See box 6.) But this is only true if we get to P3 and beyond.

In the West, the nation-centric advocates largely driving climate policy in their own nation ignore the core observation that climate is truly a global issue. Focusing on policy in rich countries misses the key point: While forcing the green transition through subsidies and regulations will not work in most rich countries (for reasons laid out ahead), those mechanisms will definitely not work in low-income nations, where the lion’s share of the world’s population lives and most of the growth in energy consumption will come from.

Cassandras warn that, absent even more force, catastrophe awaits. Case in point, Simon Sharpe’s book Five Times Faster: Rethinking the Science, Economics, and Diplomacy of Climate Change. A better title for the book might have been Five Times More Force, as Sharpe argues that we must decarbonize at a rate five times faster than today, and the way to do that is to motivate governments even more by 1) developing risk models that significantly increase damage estimates; 2) having climate cost-benefit models that significantly ratchet up the cost and benefits; and 3) encouraging countries to cooperate on specific climate projects. Given that climate warnings are now an almost daily part of many people’s lives, it’s not clear that more alarming models will get much more done. These warnings could easily backfire as well, leading people to tune out.

Because climate advocates see the crisis as so severe and that action is needed immediately, almost all their recommendations rely on getting individuals, organizations, and governments to take actions they would, in the absence of pressure, not take.

Finally, hairshirt environmentalists believe that people must be goaded or shamed into giving up much that they now enjoy—that people can be persuaded to adopt a radically reduced carbon footprint, walking to work, no longer flying, becoming vegans, and “living simply.” The United Nations tells people that they can solve the climate crisis through their individual actions, such as keeping their house colder in the winter, giving up their car, eating less meat, buying fewer clothes.[5] But exhortation on climate hasn’t worked in the past and it won’t work in the future: It hasn’t worked in rich countries, and it certainly won’t in poor ones. It is especially damning that the United Nations, an organization that should reflect, above all, the interests of low-income nations, is arguing that low-income countries should suppress their aspirations and aim instead to live at levels poor people in developed nations would reject out of hand.

Box 2: Political Failures of Force

Taxes on dirty energy are one tool for forcing change. Economists have argued that carbon taxes are the best way to solve the climate crisis, using price mechanisms to drive shifts in demand. However, it appears that noneconomists are not so keen. Lessons from both the United States and France demonstrate how sensitive energy prices are, and why politicians have become so reluctant to impose carbon taxes on energy.

Failure to Pass Cap-and-Trade Carbon Pricing in the United States

Numerous U.S. attempts to implement a carbon price have failed. The last concerted effort was the 2009 American Clean Energy and Security Act, widely known as the Waxman-Markey cap-and-trade legislation. It passed the House of Representatives by just seven votes (despite the 79-seat Democratic majority) but was not brought up for a vote in the U.S. Senate and quietly died at the close of the legislative session. Major opposition came from large energy companies, labor and consumer organizations, and environmental groups. Energy providers opposed the cost increase on most fossil fuels and the complicated structure of allowances, credits, phase-ins, carbon banking, etc.[6] Environmental groups such as Greenpeace opposed free allowance allocation—more than 85 percent of proposed allocation through 2026—as giveaways to special interests. Large trade organizations such as the American Petroleum Institute, the American Gas Association, the U.S. Chamber of Commerce, and the National Association of Manufacturers, alongside some national labor groups such as the United Mine Workers Association, also opposed the legislation. Legislative timing—during the Great Recession—further weakened support.

Waxman-Markey offers some key lessons, pointing to the failure of force mechanisms like carbon pricing. To attract sufficient support, policies that raise the price of fossil energy must include significant carve-outs, concessions, offsets, and other giveaways to special interests. These “outs” reduce the policy’s effectiveness, and while they are designed to increase industry and public support, they also expand opposition from some environmental groups. Today, the latter largely oppose price-based mechanisms in favor of regulations and prohibitions. The failure of Waxman-Markey demonstrates that an explicit price on carbon is unlikely to be imposed in the foreseeable future in the United States, and price-based policies continue to be unpopular among a wide range of political constituencies. Of course polling is far from conclusive on this, but n one reputable recent poll, less than 38 percent of Americans were willing to pay just $1 a month as a carbon fee, down 14 percentage points from 2021. Only 21 percent said they would be willing to spend $100 a month.[7]

The Gilets Jaunes Protests

The Gilets Jaunes, or Yellow Vest Protests, a series of civil protests and unrest in France that involved tens of thousands of people on a weekly basis, started in November 2018. They kicked off after the national government announced a modest fuel price increase as part of its climate strategy (about 8 Euro cents per liter or about a 5 percent increase). This “green tax” explicitly aimed to increase the price of gasoline and diesel fuel, and to encourage drivers to conserve, carpool, walk, bike, or take public transport to cut emissions.[8] However, the fuel price hike disproportionately affected rural and outer-urban residents who relied more heavily on personal vehicles (given fewer public transportation options). Many also felt that the national government—based in the urban environment of Paris—did not understand the personal financial difficulties imposed by increased fuel taxes.

The protests were a national phenomenon and lasted for more than a year. Protestors also challenged other national economic policies such as the low minimum wage, recission of the national wealth tax, and the ongoing cost of living crisis. National support for the Yellow Vests (named for the obligatory yellow safety vests all French drivers must keep in the boot of their cars) was high, polling at around 70 percent throughout the protests. As a result, French President Emmanuel Macron was quite quickly forced to rescind the proposed fuel tax increase.[9]

The Yellow Vests Protests further highlight the weaknesses of mechanisms such as carbon taxes that impose additional costs on consumers. Such price increases were enormously unpopular and quickly generated overwhelming pushback across the political spectrum, even in an affluent county such as France.

Once P3 Is Achieved, Markets Are the Key Lever for Decarbonization

The scale of the change needed to address climate change is unprecedented, and it requires extraordinary acceleration to meet the demands of a warming world. Typically, it takes decades for foundational technologies to gain even a foothold in the market, much less dominance. True, technology shifts have become faster in recent decades, but the climate transition is still in a class by itself (see Box 3).

IEA’s 2021 net-zero road map calls for extraordinary and sustained investment in clean energy (~$84 trillion by 2050).[10] That is a formidable challenge, but it is just the start of issues related to scale. Rapidly rising demand for scarce minerals spiked the price of lithium by more than 200 percent in 2022. Many critical inputs have only a few sources and will be very hard to scale up. Even land for big solar and wind farms is becoming scarcer and more distant from population centers.

Building enough production is itself a challenge. The IEA pathway requires enormous additions of wind and solar annually—far more than 2022 levels—as well as massive increases in the production and use of hydrogen, plus necessary investments in supply chains and infrastructure.

Critical enabling technologies will be needed. Wind and solar, for example, require long-term storage if they are to replace 24/7 reliable fossil fuels. Existing storage technologies, including batteries, are too expensive and too difficult to scale. Similarly, fossil fuels can be included in the energy mix if carbon capture, storage utilization and storage (CCUS) become readily available at costs that don’t move P3 out of reach. Currently, the cheapest blue hydrogen (which uses carbon capture) costs about three times as much as hydrogen made without it.[11] And while the global retreat from nuclear has slowed and small modular nuclear reactors may be transformative, a massive scale-up of nuclear seems a long way off.

For the green transition to be successful, it must rely on markets—and for markets to work, any new competitor against existing products or services must provide approximately the same performance for about the same price if it is to be successful.

These clean production technologies must then reach end users. Electrification is the primary pathway for a decarbonizing world, but the current electric grid is creaking at the seams. Bloomberg New Energy Finance claims that $4.1 trillion in investment is needed to maintain existing electrical infrastructure, and $17.4 trillion more will be required to meet new demand.[12] That includes 80 million kilometers of electric grid expansion globally, doubling the existing global grid. Hydrogen transportation infrastructure is largely absent at the scale needed, while the introduction of CCUS at scale means deploying hundreds of thousands of miles of dedicated carbon dioxide (CO2) transportation pipelines globally, along with hundreds of sequestration sites. All these costs must be included when estimating P3 for clean production technologies.

These components of the green transition require extraordinary investments, so scarce resources must be allocated across hundreds—probably thousands—of large and small projects around the globe. The scale, speed, and complexity of this transition can be addressed only through the application of market forces, as only markets can provide the scale (governments certainly won’t) or the speed (governments can’t) that’s needed. And the sheer complexity of the resource allocation problem can also only be solved primarily (though not entirely) through markets.

By focusing on P3 technologies, we can use and guide the enormous power of markets to which the economies of almost all countries—even China, even Russia—are now irrevocably committed (North Korea being the only obvious exception). Markets have undeniably raised average living standards and created enormous wealth (albeit in highly unequal ways). Even countries with strong collectivist traditions now accept that they must work within a market-oriented future. We need to harness those markets for the green transition. Archimedes allegedly said, “Give me a lever long enough and I will move the Earth.” For the green transition, only markets are a lever long enough and strong enough to meet the need.

This is not to claim that simply unleashing free markets will solve the climate crisis. That’s obviously not true, or we would not have a climate crisis today; private companies would have solved it already. But given its global character and the scale of the green transition—far beyond the capacity of governments to fund or manage—there is no driver close to matching the power of the market. Change at this scale depends on private sector investments (which reflect investor choices). But markets will only work effectively when the cost of green energy becomes price/performance competitive with fossil fuels. Until that happens, investors will reward market winners, which are the dirty technologies. For the green transition to be successful, it must rely on markets—and for markets to work, any new competitor against existing products or services must provide approximately the same performance for about the same price if it is to be successful. This is P3. It reflects the harsh but undeniable reality that green energy won’t replace gasoline, natural gas, or coal if it costs more or if its performance is worse.

Box 3: Scaling for the Green Transition: A Global Challenge[13]

To serve the expanded scale of low-carbon technologies by 2050, significant global expansions will be needed to meet net-zero targets. Some perspectives on the scale needed are the following:

Production

§ Global annual clean energy investment must grow from about $1 trillion in 2022 to $4 trillion by 2030 and maintain that level for 20 years through mid-century.

§ IEA notes that continued additions in renewables are required to meet mid-century goals. By 2030, global annual additions of wind and solar will have to reach 390 gigawatts (GW) and 630 GW each year. In 2022, the world added 75 GW of wind energy and 191 GW of solar, which represented impressive growth but was still far below where 2030 growth must be.

§ Global hydrogen demand increases dramatically between now and 2050. Current demand for conventional hydrogen is 90 megatonnes per year (MT/y), with demand expected by IEA to increase to 200 MT/y by 2030 and 530 MT/y by 2050. This global growth necessitates a rapid increase in electrolyzers capable of producing low-carbon hydrogen, alongside an entirely new transportation infrastructure for hydrogen, including pipelines and shipping via barge and rail.

Transmission

§ Electric grids must expand rapidly globally to meet the net-zero challenge. Bloomberg New Energy Finance noted that global grid investment will need to top $21.4 trillion by 2050, $4.1 trillion to maintain existing electrical infrastructure and $17.4 trillion to expand the grid. Some 80 million kilometers of electric grid expansion will be needed by 2050—doubling the global grid infrastructure.

§ CCUS must expand at unprecedented rates. The IEA NZE roadmap models 7.6 billion tonnes (GT) of annual CCUS capacity by 2050, from a current level of 250 MT in 2022, a 30X expansion in roughly 25 years. This includes 6.6 GT CCUS in the electricity, industrial, and fuel supply sectors, and 1 GT of direct air capture sequestration. This equates to hundreds of thousands of miles of dedicated CO2 transportation pipelines and hundreds of sequestration sites.

End Users

EV sales need to go from 14 percent today to 60 percent by 2030, per IEA. There are 26 million EVs on the road today around the world, and about 1.5 billion ICE vehicles.

Decarbonizing heat for both residential consumers and manufacturers is an IEA priority. Heat pumps met only 10 percent of global space heating needs in 2021; by 2050, IEA estimates that heat pumps will be used in 40 percent of residential buildings in emerging markets, and 55 percent in total.

Climate Change Is Global, So the Green Transition Must Be Global

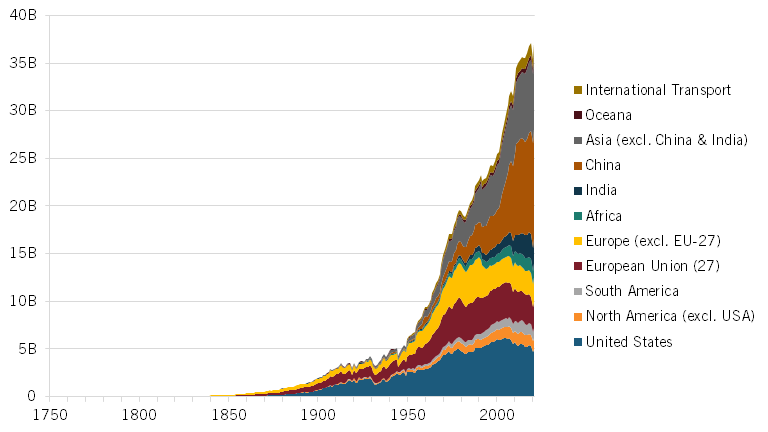

By its nature, climate itself is global. That global character is acknowledged in almost every article written about climate change—and is then promptly forgotten. The United States accounts for 12.6 percent of CO2 emissions (see figure 2).[14] When combined with the rest of the Organization for Economic Cooperation and Development (OECD), the total reaches 35 percent, and both figures are declining.[15] CO2 emissions from outside OECD are close to two-thirds of all emissions, and both their share and total emissions from low-income countries are growing, as their needs expand rapidly and they mainly use the cheapest (and dirtiest) technologies to meet their needs.[16]

Figure 2: Global CO2 emissions by region (billions of tonnes)[17]

So, the future of greenhouse gas (GHG) emissions and hence of the green transition lies not in the EU and not in the United States. It lies in the low-income countries. Indeed, to the extent the green transition takes hold in the West, the center of gravity for GHG emissions shifts more heavily elsewhere. That reality is reinforced by demographic shifts—80 percent of the world’s population growth between 2022 and 2050 will come from Africa and Asia, and predominantly in the poorest countries in the world.[18] Many green technologies will be developed and deployed first in the West, and will also perhaps reach P3 in the West, but the relevant markets for those technologies are global, and adoption by low-income countries will follow regardless of where the tech is developed, once it reaches P3.

This doesn’t mean, as some have argued, that the rich countries should be off the climate hook until all countries—or even just the big low-income countries—agree to cut emissions. The rich countries built their economies on the back of GHG emissions, so they bear substantial responsibility for addressing climate change. And of course, the rich countries are best placed financially to do so.

Nor does it mean low-income countries lack interest in climate policy. On the contrary, especially as there are close connections between burning fossil fuels and the disastrous air pollution enveloping many cities in low-income countries, as well as the predicted rise in sea level and more intense weather generally, going green seems to be an attractive option. China, for example, knows that it cannot grow indefinitely on the back of coal.[19] In fact, we believe that in the right circumstances, low-income countries will cut emissions and will eventually reach net zero.

The challenge, though, is formidable. Take India, for example, which has formally committed to net zero by 2070 and is ramping up renewables. Yet, despite these good intentions and considerable activity, India’s use of coal is still growing fast and will continue to do so (see box 4). It has huge coal reserves that are cheap to exploit, and coal has been the backbone of electricity generation in India for decades. It recently auctioned rights for 121 new coal mines, while existing mines are also being expanded quickly.[20] China’s use of coal is similar.

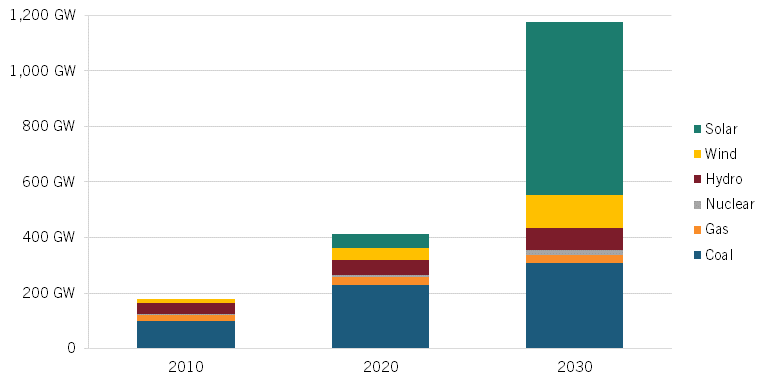

Box 4: India—Power Demand Increases and Supply Choices

India’s CO2 emissions will increase as power demand grows to serve an expanding and urbanizing population (1.8 billion by 2040). An additional 4,600 terra-watt hours (TWh) of additional power will be needed by 2050, a fourfold increase over 2020 power production.[21] Renewables will provide a growing percentage of total power production, but coal-powered energy will still grow substantially in absolute terms (see figure 3).[22] The Modi government aims to add some 500 GW of renewables capacity by 2030 (15x the current renewable capacity in California). Solar, in particular, is becoming price competitive for utility-scale power generation in some parts of India, but system-level costs, the load profile, and the low production costs of fully depreciated fossil-generation assets are slowing adoption.[23],[24]

However, the government also plans to substantially expand use of coal; output will approximately triple by 2050.[25] There is simply no way for renewables to provide the growth in cheap power that India is prioritizing.

The renewables’ share of total power production varies considerably by state in India. States with more coal production have less renewable power. Interstate energy trading is limited, so utilization rates are not maximized, which negatively affects the economics of renewables.

IEA estimates that net zero by 2070 in India would require more than $160 billion in investment annually, equivalent to about 5 percent of the nation’s annual gross domestic product (GDP). India’s recently announced investment of $4.3 billion in clean energy is less than 0.15 percent of the total needed.[26]

India’s continuing emphasis on new coal mines and coal energy shows that it will not regulate against fossil fuels if doing so results in higher energy prices or lower energy availability. Growth trumps green every time, and—given India’s profound need for growth—any Indian government that promotes green over growth could be seen as betraying its citizens.

The P3 lens focuses attention on other issues as well. We’ve seen that P3 must be measured at the point of consumption, not at the point of production. So India needs an efficient and universal grid to transmit renewable power from where it’s produced to where it’s needed. If renewables cannot reach parity with coal at the point of consumption, coal will continue to dominate the energy mix.

Figure 3: India’s installed and projected energy capacity (gigawatts)[27]

India is just one example. Around the globe, no government will abandon growth. Poor countries in particular will not abandon growth to become green, even where the climate crisis is most apparent (e.g., in Bangladesh, where flooding displaces 50,000–200,000 people annually).[28] The focus on growth is a matter of survival for governing elites, and there is a history here too, as many low-income countries previously imposed painful cuts to food or energy subsidies under International Monetary Fund (IMF) or World Bank pressure.[29] Their elites subsequently learned that higher food or energy prices are an exceptionally effective method for generating demands for regime change.[30] Indeed, China’s path has been based explicitly on a social contract that provides for growth in exchange for authoritarian government. That contract is increasingly a model for other low-income countries. Green isn’t part of the equation.

In this context, the clear message from the South at COP26 was entirely predictable: They want a green economy, will work toward it, but cannot and will not pay a substantial premium for it. That message has both a practical and a moral dimension. Practically, social contracts everywhere limit what governments can impose, and those limits are far lower than the cost of the green transition in poor countries that need to grow fast. Poor countries cannot and will not pay a substantial green energy premium; and COP26 and COP27 showed that the West—while it will contribute something—will not pay anywhere close to that premium for poor countries either. The seven countries that committed to Loss and Damage contributions at COP27 offered a total of $275 million, which is not a serious amount for a transition that will cost trillions of dollars.[31] In fact, despite recent large investments, the West won’t even pay for its own transition.

That’s the practical picture. But the moral dimension is also important. Over the ~150 years since the start of the Industrial Age, industrialization in the West has created the climate crisis. So poor countries see no reason to pay for the cleanup. They believe they didn’t benefit and that they didn’t cause the mess, so they shouldn’t pay to fix the problem.[32] Whatever the truth of arguments about core/periphery, North/South, imperialists/colonies—whatever the justice of these arguments—they are the granite reality into which climate policy will crash. Poor countries are politically unable to pay a heavy price to fix a climate problem that until recently they didn’t even cause (aggregate emissions since the industrial revolution have of course predominantly come from rich countries).

These realities suggest we are not going to meet the 2050 timeline to net zero. But they also provide a very specific roadmap that can direct us toward a better approach. If low-income countries will always choose growth over green, then growth and green cannot be cast as alternatives. P3 gives us the tools to avoid that choice.

Poor countries cannot and will not pay a substantial green energy premium; and COP26 and COP27 showed that the West—while it will contribute something—will not pay anywhere close to that premium for poor countries either.

While few countries will pay the green premium needed to install high-cost clean technologies, many will accelerate their green transition if the cost is low enough. So green technologies must become cheap enough to compete directly and effectively with the status quo. Costs for green tech must shift downward until the green premium eventually vanishes. When that happens, we can have our cake and eat it too. We can continue to grow—a practical and politically imperative, even in the West—while at the same time shrinking GHG emissions to reach the eventual goal of net zero.

We Have All the Tech We Need—Perhaps, But Not at P3

We need cheap green technologies, so can current technologies become cheap enough quickly enough? Are they all effectively on curve B? It’s become a mantra among certain parts of the policy crowd that we have all the tech we need. Mark Jacobson’s recent book No Miracles Needed is one example, summarized in a recent Guardian article:[33]

[T]he best solution is one that can be implemented quickly and at low cost. Enter wind, water and solar (WWS). WWS includes energy from the wind (onshore and offshore wind electricity), the water (hydroelectricity, tidal and ocean current electricity, wave electricity, geothermal electricity and geothermal heat), and the sun (solar photovoltaic electricity, concentrated solar power electricity and heat, and direct solar heat).

When combined with electricity storage, heat storage, cold storage and hydrogen storage; techniques to encourage people to shift the time of their electricity use (demand response); a well-interconnected electrical transmission system; and nifty and efficient electrical appliances, such as heat pumps, induction cooktops, electric vehicles and electric furnaces for industry, WWS can solve the ginormous problems associated with climate change at low cost worldwide.

This is both true and false. Many existing green technologies will underpin the green transition and become cheaper as they scale up. But there is a formidable gap between the existing price/performance of most green technologies and that of the cheap and energy-rich fossil fuels they must displace. Rather than grappling with climate realities, Jacobson and others simply adopt a game of let’s pretend: Let’s pretend that the green transition is not only cost free but that we will all magically become richer while paying for it—and that the massive investment required will be paid back within six years. Let’s just pretend that the variability problems of wind and solar will suddenly vanish, and that “a well-connected electrical transmission system will magically spring up around the globe (when it has not done so in the 100 years of grid deployment to date).[34] Jacobson’s solutions will also apparently reduce the amount of energy needed on a global basis by 44 percent (the math apparently works if we add in the magical appearance of “some efficiency improvements beyond what is expected”), even though, as we have seen, global energy demands are growing rapidly.

Jacobson is not alone. Indeed, 15 years ago in An Inconvenient Truth (his 2006 documentary), Al Gore claimed that “we have all the technology we need”—and various Biden administration officials have argued much the same.[35] This approach assumes that countries (and the citizens they represent) will not sign up for an arduous, expensive, and uncertain transition to a green future. We agree. But instead of accepting this reality and working to change it, the solution on offer simply applies magical thinking. It just insists that the green transition will be painless, profitable, quick, and certain, using technologies we already have.

That’s just not true. And in the end, “we have all the tech we need” is a disastrous message. It suggests that the green transition will be cost-free and easy, hence the only missing ingredient is willpower. We just need to focus our efforts and we will emerge into the sunlit uplands of a green economy that is cheap, more efficient, and cost free.[36] We just have to believe that people will ditch their gas stoves, junk their second-most-expensive asset (ICE cars), install geothermal heating along with a heat pump and electric water heater, solve the energy storage and electricity transmission problems so we can ignore the daily, seasonal, and annual variability of wind and solar, replace 136,000 TWh of fossil fuels primarily with solar and wind, and generate and deliver enough green hydrogen to decarbonize heavy industry, transportation, and aviation.[37] It’s all just an easy lift that requires no significant new technologies at all; just the will to save the planet.

Box 5: We Do Not Have All the Clean Tech We Need at a Price Competitive With Dirty Tech

In November 2021, as the Biden administration was gearing up for COP26 in Glasgow, it published a white paper setting forth how the United States could cut emissions by investing in renewables, along with other measures. The paper asserts that the strategy would result in a net economic benefit to the United States between now and 2050. It cites 11 studies from energy think tanks, environmental organizations, and universities in support of this conclusion. But what the administration did not say, and what the cited studies do not make clear, is that those net economic benefits are contingent on continued steady declines in renewable energy costs.

All studies rely on a single set of cost projections that are updated annually, the National Renewable Energy Laboratory’s (NREL) Annual Technology Baseline (ATB).[38] These projections are fed into varying energy models to predict future overall renewable energy deployment and total system-wide transition costs. Notably, to achieve ambitious climate targets with a net benefit to the economy, continued declines far beyond today’s already low costs will be necessary.

For instance, the projections for offshore wind through 2030 imply cost reductions between 25 and 43 percent. With its higher-capacity factors and fewer land-use constraints than traditional onshore wind, offshore wind is seen as vital to a high-renewables grid. Similarly, utility-scale battery storage, which will dramatically expand renewables deployment, is expected to decline in cost by between 33 and 60 percent by 2030. If the energy transition models relied on today’s costs rather than this projected decline, the system transition would be very costly, rather than provide a net benefit.

What might upend these projections? To be sure, cost declines are likely as more units are deployed, driving innovation in design, deployment, and management. However, scale and learning effects eventually exhaust themselves, and history suggests they may do so unexpectedly. The recent uptick in renewable costs should serve as a wake-up call, even if it proves to be transitory. IEA, for example, notes that investment costs for utility-scale wind and solar projects could increase by as much as 25 percent over the next few years before inflationary pressures in global commodity markets subside.[39] Continued investment in hardware, software, and soft-cost innovation are crucial to achieving a low-carbon future.

So, costs will likely continue to decline thanks to scale economies, incremental innovation, and market forces, but they very well might not, and either way the declines might or might not lead to P3. The cost declines assumed in the models are not necessarily impossible, exaggerated, or somehow deceptive, but policymakers, entrepreneurs, and scholars must avoid the trap of thinking that they describe a future reality. They offer only one version of that reality, and there are numerous and formidable pitfalls on the way. We need to unpack the hidden assumptions that the models use to derive these positive outcomes—especially assumptions about continued policy support—and then take steps to guard against contingencies that could derail the expected progress.

To bolster their claims, proponents also argue the climate transition, rather than costing money and reducing productivity, will boost economic growth and jobs. Green technologies will not create net growth or net jobs unless their cost is lower than the cost of dirty energy (also including simply spending a lot of money). In this case, trillions of dollars have no effect on moderate- to long-term economic growth, unless the new technology is more productive than the old. (See box 6.)

Box 6: Unless We Get to P3, Climate Solutions Will Not Grow the Economy

Many claim that climate solutions will be good for the economy because they will create jobs and spur investment. After all, the thinking goes, the trillions of dollars in needed investment will spur new jobs and economic stimulus. As an article in Foreign Affairs states, “[R]ather than being viewed as a cost to be borne, the needed projects should be seen as strategic investments with the capacity to boost growth in both the short and the long run.”[40] Another study states that “replacing these [dirty] plants with local solar or wind would drive $589 billion in local capital investment that could support economic diversification, job creation, and tax revenue.”[41]

But these statements are not true. Unless a national economy is in recession, added spending that does not boost productivity only leads to inflation. If added clean energy is not more productive than dirty energy (e.g., the cost of energy output is lower), then it will lower per capita incomes, not increase them. Even if new clean energy plants are at P3, scrapping usuable existing dirty assets and replacing them with new ones will also reduce global GDP, because the existing capital will not have been fully amortized. As long as clean energy requires more resources (financial and labor) for energy production, fewer resources will be available to produce other goods and services.

There are only two ways clean energy investments can grow the economy. The first is if clean energy costs less than dirty energy. If this is the case, then society gets the same amount of energy with fewer societal inputs, and those saved inputs can be used to produce other things (e.g., haircuts, furniture, health care, etc.) The common claim that clean energy investments will create jobs is a reflection of the current ineffeicency of clean energy. If it takes 1,000 workers to produce x BTUs from oil and 1,200 workers to create the equivalent energy from wind or solar, then yes, jobs will be created, but real GDP will decline because those extra 200 workers are not working to produce other things. It would be like saying that we can create jobs if we ban farm tractors. Yes, we would get more jobs in farming, but food prices would go up (making everyone poorer), and employment in other industries would decline. That is why getting to or beyond P3 is so important, because we can have our cake and eat it to: GHG reduction and the same or higher productivity.

A related way is if the externality costs of dirty energy are included. If these costs are greater than the added costs of clean energy then global net benefit would be greater. But, importantly, these benefits are global, and the costs are national (or local). So few countries will include these costs in their decision-making.

The second possible way clean energy investments can grow the economy is if a nation expands its exports because it gains competitive advantage in clean energy sectors. This allows a nation’s terms of trade to improve, letting its currency appreciate and making imports relatively cheaper. And it is certainly possible, and desirable, for the United States to gain competitive advantage in the clean energy industry. But success is anything but assured, especially given China’s clean energy mercantilism. Moreover, competitive advantage is a zero-sum game: If the United States gains, other nations must, by definition, lose. In other words, the global trade balance in any good, including clean energy goods, must be zero (exports must equal imports on a global basis). Additional exports might make the United State better off, but that argument does not hold globally.

As the British say, if wishes were horses, beggars would ride. To address the climate crisis, instead of wishing it out of existence, we must adopt a realist approach tightly focused on helping technologies meet the P3 test. However, we first need a deeper dive into the currently dominant model, which seeks to force the adoption of clean technologies.

Forcing Policies That Ignore P3 Will Fail

Broadly, there are four kinds of forcing policies: 1) regulation to directly force adoption of green technology or to outlaw existing fossil-based technologies; 2) subsidies that reduce the cost of green technologies; 3) taxes that increase the cost of dirty technologies; and 4) exhortation: simply demanding that companies, individuals, and other governments change their behaviors and adapt to a low-to-no carbon world. None of these approaches will work to enable global climate solutions.

Regulation

Regulation is used by governments to legally require (or prevent) an action. Regulation can make dirty products more expensive, block their use altogether, or require the adoption of cleaner products. For example, governments could seek to ban gas stoves, gas water heaters, and gas space heaters; block drilling for fossil fuel, fossil fuel pipelines, and fossil fuel exports; eliminate ICE cars; close coal fired power plants or short-haul flights; ban meat advertisements or meat altogether; the use of plastic bags, and much more.[42]

Instead of providing end users with choices that will lead to a change in their behavior, regulation imposes change—usually but not always on the producers of goods rather than on consumers.[43] Can we simply impose green energy by fiat? Simply mandate the end of fossil fuel use by a set end date—such as California’s recently mandated phase-out of ICE vehicle sales by 2035?[44]

This is superficially plausible, even attractive. It seems to address GHG emissions without needing to meet the P3 test—indeed, without confronting end users at all. Usefully, it centralizes decision-making, so political pressure can be more effective. In the United States and similar federal systems, federal-level regulation can help avoid the slow strangulation of policy by conflicting power centers, while also addressing the free-rider problem between and within countries (some U.S. states, for example, are much more skeptical about the climate crisis and the need for potentially costly mitigation and hence may simply free ride on the efforts of California and other bright-green states).

Regulation also reflects the shared assumptions of most economists—including such conservative icons as Hayek and Friedman—that capitalism requires a regulatory framework.[45] That sets boundaries for acceptable economic activity—boundaries that go well beyond obvious guardrails around marketplace activity (fraud, stock manipulation, etc.). Humans have regulated the wider economy since the beginning of recorded history through rules governing currency, trade, apprenticeships, and even who is allowed to buy what. Time after time, new regulation has been accompanied by warnings of direct economic consequences, dating back to the first trade unions, child labor laws, the income tax, and early trade policy. Many of these broad regulations have been effective. Starting in the late 1960s, regulation has, for example, achieved impressive successes in requiring clean air and safe water.[46] It’s now the failures in these areas that are newsworthy— and the costs have long ago been integrated into the general cost of doing business.[47] The Cuyahoga River near Cleveland no longer catches fire, and London is no longer blanketed in crushing fog every winter, now that coal and wood fires have been banned.

Why will this top-down approach fail to spur the green transition we need? It will fail because regulatory successes share some key characteristics that make the political and economic costs of regulation bearable, and climate regulation doesn’t meet those tests:

▪ Concealment. In most cases, the costs of regulation are largely hidden from end users. Consumers don’t know that plastic chairs got more expensive because in the late 20th century plastics companies were forced to address environmental externalities. That’s a hidden cost. There is no “Clean Water Tax” line on the U.S. 1040 tax form. Efforts that are more public are, conversely, much harder to implement. The Federal gas tax in the United States has, for example, not been raised since 1993, even though inflation has eaten away half its value.

▪ Scale. The size of the new regulatory burden must be manageable given the productivity and the wealth of the specific society. Clearly, this implies that rich countries are much more able to afford a higher regulatory burden than poor countries.

▪ Feasibility. All aircraft flights that generate GHG emissions could be banned tomorrow. But that’s not feasible because there is no practical transportation alternative to flying across oceans and for long distances. Regulations must offer existing industries an effective pathway forward.

▪ Limited impact on competition. Some ways of doing things die out, but differences in readiness to accept them do not reshape the balance of power within an industry. The decision to ban DDT was important, but it did not significantly affect even the pesticide industry—the same manufacturers in general just moved on to new legal products.[48]

▪ Costs and benefits are aligned across time and geography. The Clean Air and Clean Water reforms of the early 1970s worked largely because the costs and benefits aligned. Society picked up the costs (via increased regulation) but also received the benefits: clean air and clean water improved life across the United States. Climate is a different problem. The benefits are widely distributed around the entire globe, while the costs are concentrated in energy-producing and energy-intensive industries along with selected energy end users, and regulatory impacts are experienced quite differently between countries and regions, rich and poor, and urban and rural populations. Costs also apply now, while benefits may emerge only decades later in the entirely imperceptible form of global warming foregone.

Regulations to ban GHG emissions fail all five of these tests. They would transform the competitive landscape in many industries; they would be extremely public; closing the P3 gap via regulation implies an enormous new cost burden; some regulations (e.g., banning ICEs immediately) are currently not feasible; and the benefits are global and distant, while the costs are local and immediate.

What would happen if ICEs were banned overnight? The pitchforks would be out almost as quickly. There is no supply chain to support deployment of millions of non-ICE vehicles. Green energy sources today don’t have the capacity to power the millions of non-ICE vehicles that would be needed. Most consumers won’t buy them willingly except at P3. And the millions of ICE vehicles now on the road (300 million in the United States alone) represent an enormous pool of assets that would become worthless overnight. So even the most aggressive green regulators have built in a looooong runway. For instance, California has banned just the sale (not the use) of new ICE-powered light vehicles by 2035; millions of those vehicles will be on the road for many years after that.

Of course, not all regulations ban something. And regulatory reforms that accelerate change will be welcome—in fact, they will be needed. We will certainly need a better regime for deploying nuclear power, and for moving much more electricity more effectively across the grid to where it is needed. Regulations that shift the cost of externalities to emitting industries from the society at large could help, but again, these will not be implemented in many places because of costs that ultimately will be borne by consumers.

Relying on the regulatory option would leave us all poorer—if that were even possible—and there is no political constituency for doing so in either the West or low-income countries. Regulation can sometimes help grow demand when the pathway to P3 is viable (curve B), but reliance on regulation will fail, especially when faced with curve C technologies.

Box 7: Beyond the Black Box

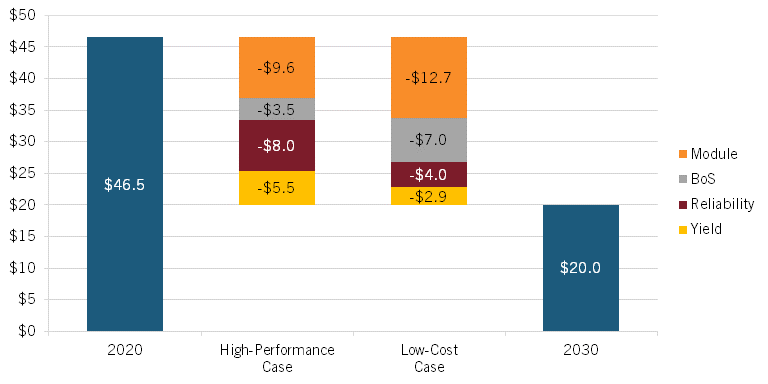

Economists and modelers have long treated innovation as a black box, something that just occurs as technologies developed, scaled, and deployed. But the black box approach is too simplistic, given the stakes for the climate of sustaining innovation to create better, cheaper solutions to achieve a zero-carbon electricity grid by 2035 and economy-wide deep decarbonization by 2050.

The Department of Energy’s (DOE’s) 2021 Solar Futures Study opens up the black box of climate-tech innovation.[49] The study lays out two innovation pathways that could achieve a 57 percent cost reduction by 2030. Following either pathway could spur vast investment and widespread deployment of solar power with a cumulative range of 760 GW to 1,000 GW by 2035.

One pathway (“low cost”) relies primarily on demand-side drivers to cut the costs of solar PV modules and balance of system (BoS) components through mass production. Key policies that would this pathway could include innovations in financing, such as those that made third-party ownership models, commonplace. These models lowered the up-front cost of installation and brought solar to previously uninterested states such as Georgia and North Carolina.

The other pathway (“high performance”) cuts costs mostly as a result of breakthroughs on the supply side, especially new module hardware that is more efficient, durable, and reliable. Thanks in part to Chinese government subsidies, the dominant solar cell material today is crystalline-silicon (c-Si), which is approaching a performance ceiling. Newer materials, such as perovskites, offer capacity and application benefits, but they are costlier, and the global know-how and supply chains to support them are not well developed. To enable this pathway for solar PV technology, the United States will have to continue to invest in targeted research, development, and demonstration (RD&D) and support for manufacturing innovation.

Both pathways to very low solar costs are schematics designed to shed light on how components of the overall cost stack might change, but they are definitely not predictions and should not be treated as though they are are. Given the intrinsic uncertainty of further solar innovation, and energy markets more broadly, we should be betting on innovation and scale to deliver solar at P3—a comprehensive solar PV innovation policy pushing for more breakthroughs in solar technology (e.g., improving technologies’ physical characteristics) while also accelerating scale and process innovation by strengthening demand.

The United States has made good progress developing and deploying low-cost renewable energy. But the modeling is clear: Building a reliable grid that will serve as the backbone for a cleaner, more-electrified economy without raising energy costs will require technological improvements that drastically drive down the costs and improve performance. Telling Americans that the nation can make this transition with today’s technology without paying more for energy is not only misleading, it makes it harder to generate support for innovation policies.

Figure 4: Department of Energy NREL Solar Future study of low-cost solar pathways (cost per MWh)

Subsidies

Subsidies encourage rather than require change. Subsidies are the carrots offered by governments to induce the adoption of green technology and can powerfully influence the development and adoption of new technologies. Seeding markets via subsidies can drive adoption in a new market, such as in solar energy, where feed-in tariffs have clearly had a dramatic impact on demand.[50] Such subsidies can help draw in early adopters and, at a larger scale, encourage the demand from more mainstream users that may be needed to drive scale-up.

The massive tax incentives for clean energy in the Inflation Reduction Act are an example of subsidies, as are existing tax credits for installing solar or wind generation or buying an EV. More widely, proposals for debt relief for low-income nations in exchange for climate action are in fact just subsidies.[51]

Subsidies can be effective. Take Norway, where 79 percent of new cars sold are electric.[52] But that is not because most Norwegian consumers prefer EVs; it is because the Norwegian government made consumers an offer they could not refuse, including reduced taxes, reduced toll-road charges, access to bus lanes and priority parking, subsidized charging stations, an abundance of cheap hydroelectricity, and more. On top of that, Norway imposes $2.84 in taxes per gallon of gasoline—10 times more than U.S. gas taxes.[53]

So why not just subsidize our way through the green transition? The answers are scale and timing. Subsidies by definition cost money, so the bigger the gap between P3 and the cost of new technologies, the larger the subsidy must be. Similarly, the longer the period before green technologies are market competitive, the larger the overall burden of subsidy. And some technologies are likely on curve C and will never become price competitive, and will therefore need subsidies in perpetuity.

That $7,500 in EV subsidies is a substantial amount, but it’s only about 11 percent of median household income in the United States. In India, that would be about 349 percent of household income; in Nigeria it would be 361 percent.

Subsidies thus carry three main risks: First, they may be very expensive. Second, they may lead to permanent (and unnecessary) expenses. Finally, they are usually highly persistent and difficult to reduce or eliminate. They will therefore be hugely expensive if there is a substantial P3 gap between the cost of current dirty technologies and new clean technologies, where the period of subsidization is long. The acceptable level of subsidy varies with the financial capacity and willingness of different governments, but large permanent subsidies are simply not feasible, even in richer countries—and far less so in poorer countries.

So, while there is a role for subsidies, the core problem is cost, as end-user energy subsidies tend to be expensive. Take the new EV subsidy in the United States: up to $7,500 per vehicle for EVs manufactured in the United States (there are other restrictions).[54] About 15 million vehicles are sold annually in the United States, so subsidizing all of them would cost about $112 billion annually.[55] Obviously, the available subsidy will cover a much lower share than that, but the scale of subsidy needed to make a serious dent in ICE sales is formidable, even in the United States.

But that’s not the most important cost question. We already know that the low-income world is where the green transition must work. That $7,500 in EV subsidies is a substantial amount, but it’s only about 11 percent of median household income in the United States.[56] In India, that would be about 349 percent of household income, in Nigeria it would be 361 percent, in Indonesia it would be 325 percent, and even in China it would be 158 percent.[57] And while the cost of EVs designed for these markets might be lower (though it also might not), that scale of subsidy is not feasible in poorer countries, which is where the climate crisis is most urgent and where emissions are still rising rapidly.[58]

EVs are just one example, but they show quite dramatically that subsidies for green technologies at scale are not in themselves the primary solution, even in the United States and Europe. Given the scale of the transformations needed to address climate change, a subsidy-driven approach across all sectors and technologies would simply be far too expensive. And given the massive U.S. federal budget deficit and political pressures to not increase spending or taxes, there is little chance that a political coalition can be formed behind further green subsidies, let alone to levels that would drive accelerated change at the required scale.

The challenges for subsidy-based policies are much worse in low-income countries. There the mismatch between resources and need is enormous, and there is no evidence at all that the resources needed for a subsidy-driven solution will be made available, either from internal resources (they are too poor) or from the rich countries (which so no sign of paying the piper). Finding pathways to the green transition in the United States and Western Europe is important, and subsidies will likely play a role, but deep and extended subsidies are very difficult to imagine politically and economically in the West—and are just not viable at all in the low-income world.[59]

Taxes

If we can’t lower prices of clean technology throughout the world with subsidies, many argue that governments should raise the price of dirty technologies through taxes or tariffs. We have no problem with that concept. Of course, dirty technologies should pay for the external damage they cause, and a carbon tax would be an elegant way to impose those costs. Standard economic theory indicates that productivity is maximized when the full costs of existing production—including the social externalities associated with it—are borne by the producer. That’s what’s behind the push for carbon taxes and various attempts to develop markets for carbon related to energy production. Such policies would be rational and helpful.

Unfortunately, political realities are different. Many nations subsidize oil and gasoline, and would face a political revolt if they eliminated the subsidies to raise the price. Many nations, such as the United States, have not been able to impose a carbon tax, and even nations that have done so mostly impose only limited taxes that are insufficient to move the climate needle. The IMF reported that “only about one-fifth of global emissions are covered by pricing programs, and the global average price is only $3 a ton. That’s a far cry from the global carbon price of about $75 a ton needed to reduce emissions enough to keep global warming below 2°C.”[60]

The point here is simple: We can pretend that governments will summon the political courage to impose and keep the levels of carbon taxation needed to change behavior. Or we can look at the reality—such as the total failure of the United States to increase the federal gas tax, or the success of the Gilets Jaunes in France in forcing the Macron government to rollback very modest fuel tax increases (see box 2). Those indicators identify the limits of a tax-led policy.

Exhortation

As advocates realize the difficulties of changing public policy, they are increasingly turning to exhortation, of individuals, companies, and governments.

Exhorting Individuals

Some environmentalists have proposed a different option: a no-growth or even de-growth pathway that calls for the radical reduction of energy use. These environmentalists believe profoundly that the green transition can be induced by persuading the masses to change their behavior and give up their material aspirations. A number, such as Jason Hickel, call explicitly for de-growth, especially in the West, and for replacing current societies by a low energy/low carbon future.[61]

The hairshirt brigade has made a difference, much of it positive.[62] The sheer centrality of climate in politics today—and in the plans of corporations and governments—is largely due to the extraordinary volume and impact of environmental concern and protests over the past decade. Dating back beyond Rachel Carson’s pivotal book Silent Spring, environmentalists have shown—sometimes dramatically—how modern economies have carelessly offloaded negative externalities onto the environment, with the climate crisis only the most recent case. The Clean Air Act and Clean Water Act were direct responses to pollution in the United States, and set the table for the politics of the climate crisis by demonstrating that change is possible, that protest matters, and that corporate complaints about additional costs or delays can be overcome.[63] Determined environmentalists and the much-improved science of climate change have therefore helped transform the context in which environmental and economic policies are made. Indeed, the movement’s greatest success is that we no longer debate these as entirely separate topics; today, economic policy is also environmental policy.

Activists assume that if enough pressure and guilt can be brought to bear, often sugarcoated as “this is good for you,” widespread action will result. Don’t fly. Don’t have kids. Don’t consume. Don’t eat meat. Turn down your swimming pool heater.[64] Lower your thermostat in winter and raise it in summer. Install a “green roof.”[65] And, eat insects.[66]

Box 8: The False Lesson of the Montreal Protocol

Despite the endless list of delays and broken promises, some people retain a touching faith in the power of international cooperation to solve major probelms such as climate change. People such as Simon will argue that it is necessary for countries to come together to address global problems. They often cite the 1987 Montreal Protocol on Substances that Deplete the Ozone Layer that regulates the production and consumption of nearly 100 “ozone depleting substances.” After all, the depletion of ozone, like the build up of GHGs, affects the entire planet, not just one country. Presumably, the incentives for freeriding might be similar. Yet, every nation signed the agreement.

The Protocol is not a model for climate change for two reasons. The transition involved was relatively minor—replacing about 100 chemicals with alternatives. Compared with the massively expensive task of transitioning the entire world to clean tech, this was child’s play. Moreover, the costs were relatively minor. As Cass Sunstein wrote:

To the United States, the monetized benefits of the Montreal Protocol dwarfed the monetized costs, and hence the circumstances were extremely promising for American support and even enthusiasm for the agreement. Remarkably, the United States had so much to lose from depletion of the ozone layer that it would have been worthwhile for the nation to act unilaterally to take the steps required by the Montreal Protocol.[67]

In contrast, the costs of addressing global warming are orders of magnitude greater.

In addition, the technical challenges for coming up with ozone-safe alternatives, while real, were relatively straightforward, and industry quickly responded. Growing demand for air conditioning also meant that costs were allocaated in aa growing market, and incumbent manufacturers were not severely disadvantaged.

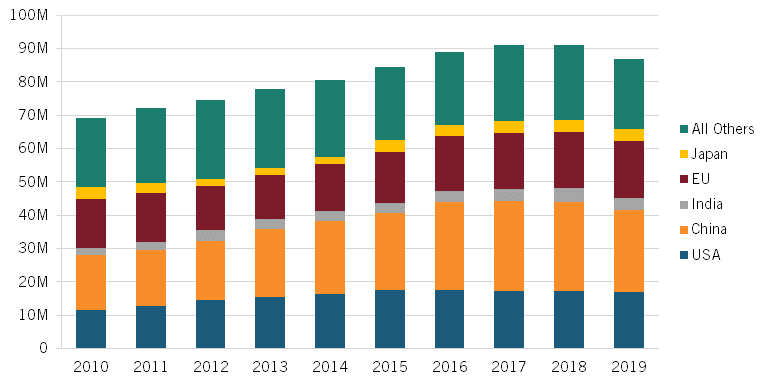

Even in rich countries, hairshirts just don’t work. Trade-offs that involved some personal sacrifice—some actual cost—have been rejected. The eat-local movement—which has the added benefit of offering fresher food—is a barely visible pimple on the enormous backside of the United States grocery business.[68] Similarly, efforts to persuade people to walk or bike more and take public transport have had some impact at the margin—the notion of the 15-minute city has gained some currency among city planners and local government (although it has also generated pushback). But these efforts are effective only in certain quite limited geographies for a quite limited demographic; most modern cities are built for and require access to a car, and there is simply no sign that auto sales will fall, even though cars are no longer the cultural badge they were, even for young people. Global light-vehicle sales reflect this reality (see figure 5). Recent efforts by the Dutch government to force farmers to cut nitrogen use as part of its climate policy led to massive protests and the rise of a new political party.[69]

Figure 5: Annualized sales of new vehicles in 2010–2019 (millions of units)[70]

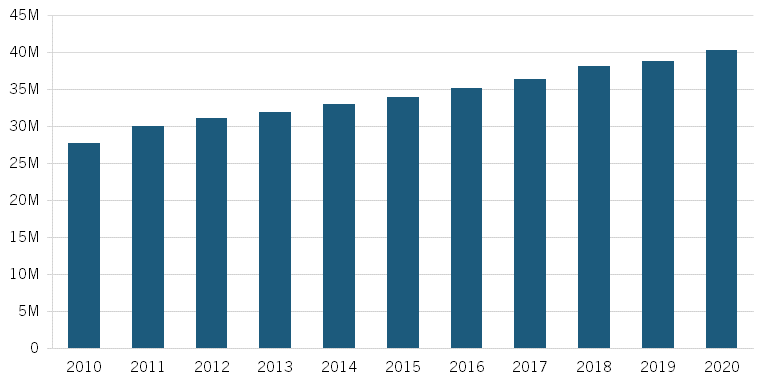

Similarly, the anti-flying movement has had no discernible impact, aside from ritualized attacks on private jets. GHG emissions are simply not a concern for consumers as they buy airline tickets. The growth in the global number of air passengers continues to accelerate and was (pre-pandemic) growing faster than the long-term trend (see figure 6). Even private jet travel—the target of hairshirt activists—continues to soar.[71]