Reducing Trade Friction Can Strengthen the U.S.–India Technology Partnership

The Trump administration raised the effective tariff rate on Indian imports to 50 percent in August 2025, citing India’s continued purchases of Russian oil (on top of previously announced reciprocal tariffs). Since this announcement, U.S. and Indian officials have worked to negotiate two parallel deals. The first, focused on reducing tariffs between the two countries, is expected to be closed by the end of 2025, while analysts expect a more comprehensive bilateral trade agreement to be finalized in 2026. Concluding these negotiations quickly and lowering trade barriers is vital for strengthening the growing tech partnership between the two countries and boosting U.S. technological competitiveness.

As U.S. corporations have shifted supply chains away from China, India has become a prime relocation destination, particularly in the tech sector. With more than 800,000 engineering graduates annually (nearly six times as many graduates as in the United States) and over 20 percent of the global semiconductor design workforce, many companies view India as the next global hub for technology and advanced manufacturing. Both the Biden and Trump administrations have pursued trade and investment agreements seeking to increase integration between the two countries.

In February, the Trump and Modi administrations launched the India-U.S. Transforming the Relationship Utilizing Strategic Technology (TRUST), aimed at strengthening the relationship between the two countries through partnerships in critical technologies, including artificial intelligence (AI), pharmaceuticals, semiconductors, aerospace, and critical minerals. And even amid trade and tariff tensions, this agreement, built on the back of prior agreements under the Biden administration, has accelerated investment in AI data center infrastructure, research exchanges, biopharmaceutical partnerships, and critical minerals exploration.

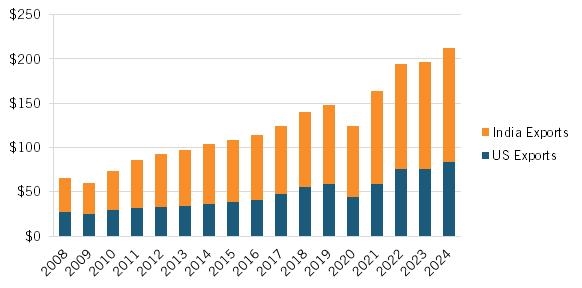

Between 2021 and 2023, 984 international companies from the United States and elsewhere registered to operate in India, up from just 320 in the two years previous. Trade between the two nations has also soared. As the ninth-largest trading partner with the United States, two-way trade with India totaled over $212 billion in 2024, nearly four times the $65 billion in 2008. (See figure 1.)

Figure 1: U.S.-India two-way trade (billions of USD)

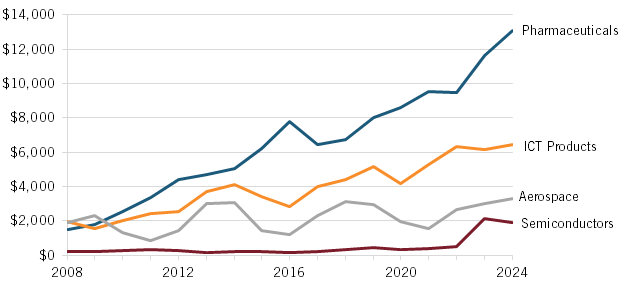

A significant share of this trade growth has been in advanced technology products. Between 2008 and 2024, trade in semiconductor products has increased by over 900 percent, pharmaceutical trade by 766 percent, and trade in information and communication technologies by 233 percent (figure 2).

Figure 2: U.S.-India two-way trade in critical technologies (millions of USD)

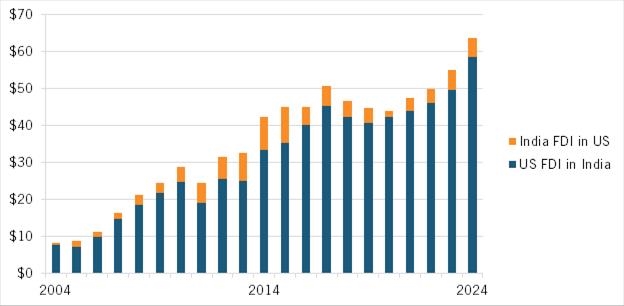

Bilateral foreign direct investment (FDI) has also grown over the past two decades. Several U.S. tech firms, including Google, Meta, Microsoft, and Micron, have invested billions of dollars in cloud computing, AI infrastructure, and semiconductor fabrication in India, making the United States India’s third-largest foreign direct investor. Although less than domestic investment, FDI from India to the United States has also grown. In 2024, Indian FDI in the United States was valued at about $5 billion, with a large share in the software, IT, and pharmaceuticals industries. Since 2004, bilateral FDI flows have grown by 11 percent annually on average, reaching over $63 billion in 2024. (See figure 3).

Figure 3: FDI between India and the United States (billions of USD)

Repairing the friction in the U.S.-India economic relationship is essential for American technological and economic competitiveness. Ending negotiations with reduced trade barriers and continuing to encourage robust investment flows between countries will allow firms in both nations to strengthen supply chain integration, expand production networks, and improve security on both economic and geopolitical fronts.