Assessing India’s Readiness to Assume a Greater Role in Global Semiconductor Value Chains

India has the potential to play a much more significant role in global semiconductor value chains, provided the government upholds its investment policies, maintains a conducive regulatory and business environment, and avoids measures that create unpredictability.

KEY TAKEAWAYS

Key Takeaways

Contents

Why India Should Seek to Deepen Its Presence in Global Semiconductor Value Chains. 4

India’s Semiconductor Moment. 8

The Semiconductor Value Chain. 14

India’s Semiconductor State of Play and Market Opportunities. 16

Semiconductor and Electronics Manufacturing Policy Environment. 21

India’s Semiconductor Supply Chain. 32

Opportunities In India’s States. 33

Lessons Learned From Leading U.S. Semiconductor States. 36

India-U.S. Partnership in Semiconductors. 39

Introduction

On May 24, 2022, India and the United States announced the joint initiative on Critical and Emerging Technology (iCET), which committed the two countries to expand strategic technology partnerships and defense industrial cooperation between their nations’ businesses, academic institutions, and government agencies. As part of the inaugural meeting of the iCET in January 2023, the Semiconductor Industry Association (SIA) in the United States and the India Electronics and Semiconductor Association (IESA), agreed to develop a “readiness assessment” to identify near-term industry opportunities, facilitate the longer-term strategic development of their complementary semiconductor ecosystems, and make recommendations to the U.S. Department of Commerce and the Government of India Semiconductor Mission (ISM). This assessment also informs the U.S.-India Semiconductor Supply Chain and Innovation Partnership, established through a Memorandum of Understanding (MOU) in March 2023.[1] The Information Technology and Innovation Foundation (ITIF), a Washington DC-based science and technology policy think tank, was commissioned by SIA and IESA to undertake the assessment. In May 2023 and again in October 2023, an ITIF representative undertook fact-finding trips to India for this purpose, including conducting interviews with dozens of stakeholders from government, enterprises, industry associations, and think tanks. (At certain points, this report draws conclusions based on those interviews.) A summary of initial findings was delivered to the Indian and U.S. governments in June 2023; this is the final deliverable for the readiness assessment.[2]

The report proceeds by considering why India wants to compete in the global semiconductor industry and examining the opportune moment that stands before the country, before turning to consider the current state of play in India’s semiconductor sector and assessing its semiconductor policy environment. The report then pivots to examine the state of India’s regulatory and business environment, considering topics from talent and infrastructure to taxes and tariffs, before exploring the key supporting actors in India’s semiconductor ecosystem. It then examines the strategies several Indian states have fielded in an attempt to attract semiconductor activity and provides lessons from several U.S. states in that regard. The report closes with policy recommendations.

Why India Should Seek to Deepen Its Presence in Global Semiconductor Value Chains

India faces a unique moment and opportunity in time. The aftershocks from the COVID-19 pandemic; increasing efforts globally to rebalance supply chains; rising labor and broader production costs in China; transformative, emerging technologies such as artificial intelligence (AI) and electric vehicles (EVs); demographic shifts; and a host of other factors have led multinational enterprises to reassess the structure of their global value chains in a quest for enhanced diversification, resilience, sustainability, and cost competitiveness. Likewise, governments are paying dramatically increased attention to the supply chains that underpin their businesses’ and citizens’ ability to access critical and advanced emerging technologies—from biopharmaceuticals and information and communications technology (ICT) products to advanced batteries and critical minerals. As multinational businesses react to these trends and look to make their supply chains more diverse and resilient, governments have an opportunity to present their countries’ value proposition for how they can compete in high-tech industries to a global economy that’s reorganizing in real time.[3]

Amidst this rapid reordering of the global economy, India’s value proposition as an investment and production destination for high-tech industries—from clean energy and medical devices to electronics and ICT hardware—is particularly strong. The country has already recorded notable early successes, particularly attracting Apple’s eye to the extent it may produce up to one-quarter of its phones in India by 2025.[4] Moreover, for several decades, India has been the home of significant semiconductor design activity, accounting for 20 percent of the world’s chip design talent. More recently, India has turned its attention to semiconductor manufacturing, notably semiconductor fabrication (“fabs”) and post-production assembly, test, and packaging (ATP), where semiconductors are tested and assembled into sophisticated packages.[5] Here too India has notched a considerable success, with the announcement from semiconductor memory chip manufacturer Micron in June 2023 that it will launch a major ATP facility for dynamic random-access memory (DRAM) and NAND products in Sanand, Gujarat.[6]

Semiconductor manufacturers may consider as many as 500 discrete factors—ranging from countries’ and states’ talent, tax, trade, and technology policies to labor rates and laws and customs policies—as they evaluate where to situate multi-billion-dollar fab investments.

But global competition for semiconductor investment is fierce, as nations—and the states, regions, and cities therein—have become price takers, not price makers, in the intense quest to attract globally mobile investment in high-value-added, high-tech industries, such as semiconductors.[7] In fact, leading semiconductor manufacturers may consider as many as 500 discrete factors—ranging from countries’ and states’ talent, tax, trade, and technology policies to labor rates and laws and customs policies—as they evaluate where to situate multi-billion-dollar fab investments.

Fabricating semiconductors is perhaps the most complex manufacturing activity humanity undertakes; the design and operation of fabs is so nuanced and sophisticated that it takes into account details as minute and granular as the gravitational effects of the moon on assembly lines. And so, in a like manner, if countries—and states or regions therein—wish to compete successfully for semiconductor-sector investment, then the policy and business environments they foster must be equally finely tuned, well-crafted, and deeply sophisticated, a fact that applies equally to the United States as to China, Korea, and Japan—or India. To win semiconductor investment, locales not only need to get some 500 factors right, but the strength of their “checkmarks” on those 500 factors needs to be stronger than other countries that are courting the same investment. That is the challenge confronting India: to create a business and policy environment that doesn’t just attract one-off investments, but that fosters the emergence of a deep and vibrant semiconductor ecosystem active in all the key phases of semiconductor production—research and development (R&D), design, fabrication, and ATP—with a network of suppliers and supporting institutions that power a globally cost- and innovation-competitive semiconductor ecosystem.

Semiconductors represent the heartbeat of the modern global digital economy, an industry that’s expected to grow to become a $588 billion industry in 2024 and which stimulates another $7 trillion in global economic activity annually and underpins a range of downstream applications such as AI and big data.[8] And because semiconductors power (both literally, through power management, and figuratively, through computational capacity) virtually every modern device—from smartphones and EVs to toaster ovens—it means that the countries, and the industries and enterprises therein, that have access to the most-sophisticated semiconductors enjoy a first-mover advantage in the ability to develop and manufacture the most-innovative products. Put simply, semiconductors are foundational to the ability of enterprises and nations alike to compete in the global economy; they truly represent the “commanding heights” of the modern global digital economy.

It should also be observed that semiconductors—and the capacity to continue to innovate and deploy them—will be indispensable to helping society achieve global climate and sustainability goals. For instance, studies estimate that ICT solutions will help reduce global greenhouse gas emissions by up to 15 percent by 2030 while being responsible for only 1.4 percent of the global carbon footprint.[9]

As this report details, India’s government is prepared to offer some of the world’s most generous investment incentives to attract greater levels of semiconductor investment. However, given the myriad challenges India faces and limited budget it possesses (much like the United States or any other country, frankly), why should India prioritize semiconductor investment—especially capital-intensive manufacturing facilities—over many other competing priorities? The question merits a considered response; the following evaluates five key justifications.

Semiconductors are foundational to the ability of enterprises and nations alike to compete in the global economy; they truly represent the commanding heights of the modern global digital economy.

First, there’s certainly a prestige factor at play. India is to be celebrated and commended for its recent lunar vehicle landing, making it one of only four nations to achieve that incredibly impressive feat.[10] That India should now wish to join a select group of nations—less than two dozen—that manufacture semiconductors at commercial scale is certainly understandable. Moreover, Indian Prime Minister Narendra Modi has made attracting semiconductor manufacturing activity a key commitment of his administration and a key objective of his “Make In India” (part of the “Atmanirbhar Bharat” or “self-reliant India”) program, which seeks “to promote India as the most preferred global manufacturing destination.”[11]

Second, India runs a large trade deficit in semiconductor products, which it seeks to balance through greater levels of domestic production. India’s imports of electrical and electronics equipment reached $67.6 billion in 2022.[12] This included an estimated $15.6 billion in semiconductors, a near doubling from India’s $8.1 billion in semiconductor imports the prior year.[13] Over the past three years, India’s chip imports have increased by 92 percent.[14] An estimated 70 percent of India’s electronics imports come from China and Hong Kong, with an additional 13 percent coming from Singapore.[15]

Third, bolstering manufacturing activity in high-tech sectors such as semiconductors not only provides a significant source of high-value-added, high-paying employment opportunities, but can produce significant employment, and economic, multiplier effects. This is certainly true in the United States, where the semiconductor industry’s jobs multiplier is 6.7, meaning that for each U.S. worker directly employed by the semiconductor industry, an additional 5.7 jobs are supported across the wider U.S. economy.[16] (In total, the U.S. semiconductor industry supports 277,000 jobs directly and 1.6 million more jobs indirectly.) Those jobs are highly productive, and thus remunerative, with the average U.S. semiconductor job paying $177,000, compared with the average U.S. wage of $61,900.[17] Semiconductors also produce significant economic multipliers. As one report finds, “Every dollar added to U.S. GDP by the electronics manufacturing sector creates $1.32 elsewhere in the economy. Additionally, every dollar in electronics manufacturing output generates $1.05 of output elsewhere in the economy.”[18] Just as U.S. semiconductor jobs produce and pay more, and deliver significant economic and employment multipliers, so too would and do Indian semiconductor-sector jobs. Indeed, one study finds that the employment multiplier for jobs in India’s computer, electronic, and optical equipment industry is 16.[19]

Fourth, semiconductor manufacturing can produce tremendous spillover and “learning by doing” effects across the rest of India’s high-tech economy. As Carnegie India’s Konark Bhandari noted, “A robust manufacturing base ensures that the knowledge gained from ‘learning by doing’ is transferred to domestic firms as well.”[20] Or, as Rajat Kathuria, former director and CEO of the Indian Institute for International Economic Relations (ICRIER), explained, “Economic growth is influenced by levels of ‘sophistication’ in a country’s production. The nature of production matters for economic growth. Countries that specialize in the production of goods with higher productivity are better placed to achieve higher growth.”[21]

Kathuria noted how the economists Ricardo Hausmann and Bailey Klinger developed the notion of “product space” to illustrate how a country’s initial pattern of specialization impacts their ability to expand competitiveness in adjacent industries. As Hausmann and Klinger wrote,

“The location in the product space is a crucial determinant of a country’s potential to develop comparative advantage in certain products. Countries progress by exploiting the relatedness of products requiring similar inputs including skills and technology.”[22] Thus, countries’ economic development, “is not merely advancement in general attributes such as education, health, rule of law and infrastructure but also the development of ancillary support systems and activities that are specific to an industry.”[23] For India, its extant capabilities in semiconductor design and electronics manufacturing can serve as a platform to enter the manufacturing-oriented elements of semiconductor production. If India can enter the semiconductor manufacturing “product space,” this in turn could power its future ability to compete in other high-tech manufacturing sectors, such as robotics.

Finally, there are significant “learning by doing” effects in the policymaking strategies needed to attract investment in high-tech industries such as semiconductors. Indeed, the knowledge spillovers for Indian policymakers of what it takes to attract semiconductor manufacturing—to the extent it informs how India competes for other high-tech sectors such as biopharmaceuticals or renewable energy and how it manages its broader policy and business environment—are likely to be far more powerful than even the technical “learning by doing” that occurs on the factory floor.

India’s Semiconductor Moment

This section explores the market opportunity that exists for India in semiconductors and electronics and how well it complements the currently ongoing reorganization of global high-tech value chains.

Rapidly Expanding Market Size

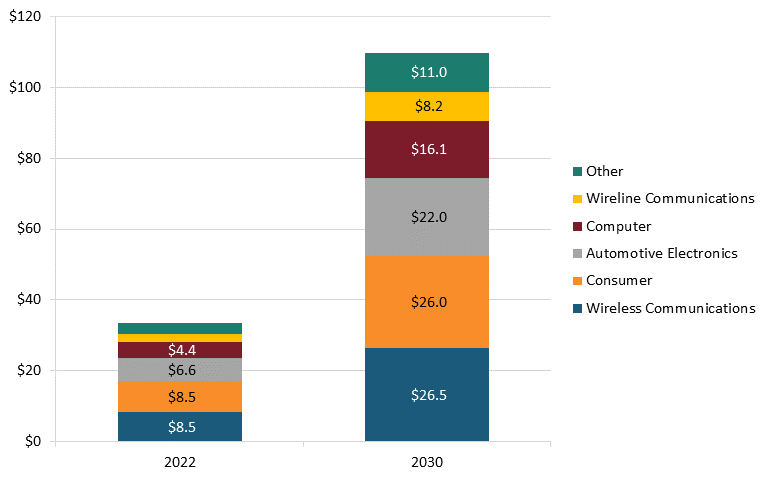

India’s semiconductor marketplace is rapidly growing. According to a report from IESA and Counterpoint Research, India’s semiconductor consumption is expected to reach $64 billion by 2026, tripling in size from $22 billion in 2019, with a projected 16 percent compound annual growth rate (CAGR) over that period.[24] That amount is expected to nearly double again to reach $110 billion by 2030, at which point analysts anticipate India will account for an approximately 10 percent share of direct global semiconductor consumption.[25] By 2030, analysts predict wireless communications ($26.5 billion), consumer goods ($26 billion), and automotives ($22 billion) will be the largest components of India’s semiconductor market. (See figure 1.)

Figure 1: India’s semiconductor market, 2022 (actual) and 2030 forecast ($billions)[26]

Source: Invest India

In 2021, only 9 percent of India’s semiconductor components were locally sourced.[27] India intends to increase its local sourcing of semiconductors to 17 percent by 2026, which would translate into a sixfold increase in locally sourced semiconductor revenue between 2019 and 2026.[28]

However, India already represents a far larger market for semiconductors than is generally recognized. That’s because, although statistics show that only about 4 percent of direct global semiconductor sales occurred in India in 2022, India actually already accounts for closer to 10 percent of real global semiconductor consumption.[29] That’s because, in many cases, the bill of lading for a semiconductor may indicate a point of sale in Hong Kong or Singapore, but that semiconductor is put into an electronic design kit and immediately shipped to India for integration into an electronic device or consumer good. Even though those goods may be re-exported to third-party markets, the transformation or installation of the semiconductor into a final good is often happening in India.

Moreover, analysts expect India’s demand for semiconductors to grow rapidly as Indian electronics production continues to flourish. India’s electronics production, valued at $101 billion in 2022, is expected to triple to $300 billion by 2026, including an anticipated doubling of mobile phone production from $44 billion in 2023 to an estimated $110 billion in output by 2026.[30] India has already doubled its share of global smartphone production (to 19 percent) over the past five years, and is now the world’s second-largest mobile phone manufacturer. India’s exports of electronics (which tripled from March 2018 to April 2023), are expected to grow another nearly fivefold over the next three years, from $25 billion in FY 2023 to $120 billion in FY 2026.[31] (For reference, India’s total quarterly merchandise exports have remained above $100 billion for nine consecutive quarters since Q2 FY 2022.)[32]

Many interviewees emphasized that, going forward, there’s not an emerging economy anywhere in the world that offers the scale India does as a rapidly growing marketplace for consumer and business demand alike, presenting a ready-made market to consume the semiconductors India aims to produce. India is now the world’s most-populous country, with over 1.4 billion citizens. India overtook the United Kingdom to become the fifth-largest economy in September 2022, and if current growth rates persist, India could become the world’s third-largest economy by 2027, and possibly second-largest by 2075.[33] The International Monetary Fund (IMF) predicts that India will be the fastest-growing of the world’s 20 largest economies in 2023.[34]

No emerging market in the world offers the scale India does as a rapidly growing marketplace for consumer and business demand alike, presenting a ready-made market to consume the semiconductors India hopes to produce.

Indicative of India’s growing market power, its consumer market is set to become the world’s third largest by 2027, growing at 7.8 percent annually, with analysts predicting a 29 percent increase in real Indian household spending by then.[35] By that year, India’s household spending should exceed $3 trillion, as disposable income rises by a compounded 14.6 percent annually until 2027, when a projected 25.8 percent of Indian households will reach $10,000 in annual disposable income.[36] According to BMI Research, one-third of India’s population in 2027 will be 20 to 33 years of age, with this demographic spending heavily on electronics, with spending on telecommunications growing to $76.2 billion due to a “technology-literate, urban middle class with increasing amounts of disposable income that would encourage expenditures on aspirational products such as consumer electronics.”[37] The number of Indian citizens owning a smartphone is expected to double from 601 million today to 1.2 billion by 2027.

Other sectors will drive semiconductor consumption as well. For instance, India’s $222 billion automotive sector, which produces 32.5 million vehicles (including two- and three-wheel vehicles and quadricycles), is expected to grow to $300 billion by 2030.[38] Only 8 percent of Indian households own a car today.[39] India is also one of the world’s fastest-growing electric vehicle (EV) markets (although more than 90 percent of its 2.3 million EVs are two- or three-wheel vehicles).[40] EVs will devour semiconductors; while the average modern car has 1,400-1,500 chips, the average EV will have about 3,000.[41] Similarly, India’s medical device market, currently Asia’s fifth-largest, is expected to nearly quintuple, from $11 billion today to $50 billion by 2030.[42] In summary, India’s rapidly growing economy will likely dramatically expand its demand for semiconductors in the coming years, making the country potentially more attractive to semiconductor producers.

A final point on growing demand is that, aside from India’s market specifically, analysts expect the global semiconductor industry to also continue to boom in coming years. As the McKinsey Global Institute (MGI) explained, “[T]he global semiconductor industry is poised for a decade of growth and is projected to become a trillion-dollar industry by 2030.”[43] Over 70 new semiconductor fabs are expected to be constructed worldwide by 2030 to satisfy this growing demand.[44] India will certainly be one of the many counties competing for this growth.

Reorganization of Global High-Tech Value Chains

Multinational companies are reassessing their global value chains in real time in response to multiple factors, including the COVID-19 pandemic; natural disasters or challenges including earthquakes, floods, freezes, droughts, and climate change; geopolitical risk and instability; and emerging threats such as cybertheft and terrorism. As a recent MGI study concludes, enterprises have learned over the past several years that the risk, severity, and expense from supply chain disruptions have all increased.[45] MGI’s report estimates that companies should expect supply chain disruptions of one to two weeks occurring at least once every 2 years; 2 to 4 weeks occurring once every 2.8 years; 1 to 2 months every 3.7 years; and 2 months or more every

4.9 years.[46]

Nations now confront an opportunity to present their value proposition for how they can compete in high-tech industries to a global economy that’s reorganizing in real time.

In recent years, growing geopolitical tensions have resulted in multinational companies turning to a “China-plus-one” (or “China-plus-two”) strategy in order to bolster their supply chain resilience. For instance, consulting firm Kearney’s “2022 Reshoring Index” report finds that “80 percent of companies across almost all industries are now on a path to reshore.”[47] In fact, in a survey released by the American Chamber of Commerce in Shanghai in September 2023, some 40 percent of companies responded that they “are moving investments elsewhere [from China].”[48] A study conducted by the UBS Evidence Lab finds that 71 percent of U.S. companies with manufacturing in China were either in the process of or planning to shift operations to other countries.[49] And another survey finds 87 percent of U.S. firms expressing pessimism regarding the outlook for the relationship between the world’s two largest economies.[50]

Overall, according to MGI surveys, 93 percent of global business executives are seeking to bolster their firm’s supply chain resilience, and 44 percent are willing to do so at the expense of short-term profitability.[51] As a result of these forces, MGI estimated that 16 to 26 percent of world exports, worth between $2.9 billion and $4.6 billion in 2018, are likely to have moved their manufacturing base between 2018 and year-end 2023.[52] Similarly, a Digital Supply Chain Institute and Bain & Company study finds that 60 percent of companies identify flexibility as a priority, up from 35 percent.[53] Moreover, 41 percent value resilience (up from 14 percent) and 36 percent value reducing cost (down from 63 percent).[54]

That’s one reason Kearney found that India (along with Cambodia, Thailand, and Vietnam) is emerging as “one of the early beneficiaries of the move away from semiconductor manufacturing in China, and to a lesser extent, Taiwan.”[55] Similarly, as the Economist Intelligence Unit wrote, “India is well-placed to benefit from geopolitical and economic trends that are driving the diversification of Asia’s manufacturing supply chains.”[56] As an alternative production location, India offers companies a large domestic market with a population of over 1.4 billion people, competitive labor costs, and a skilled labor force.[57] In fact, one study finds that, for the year 2022, average Indian labor rates in “consumer electronics technology” manufacturing jobs averaged $2.19, a lower rate than in peer countries such as Mexico and Vietnam.[58] Moreover, the Indian government is providing incentives and concessions to encourage foreign direct investment (FDI), benefitting companies that establish production hubs in the country.[59]

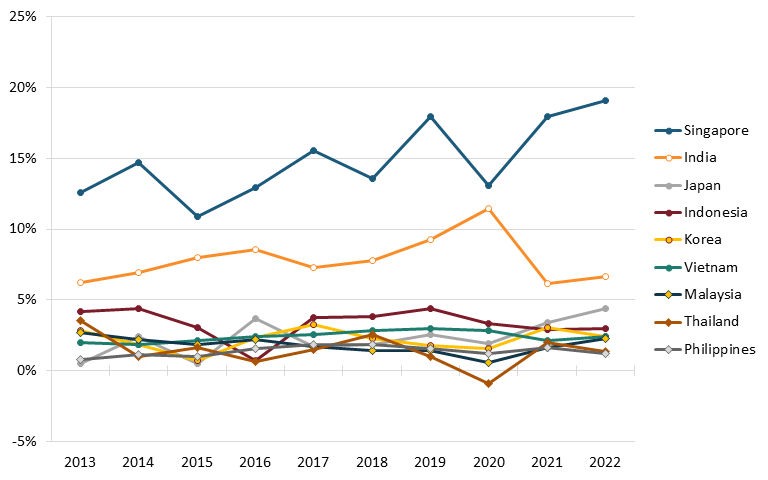

Early evidence suggests India may be beginning to benefit from these trends. India’s share of total Asian inbound FDI flows increased from 14 percent in 2018 to 22 percent in 2019. (See figure 2.) In comparison, other major Asian economies’ share of FDI has stayed relatively stable, with the exception of Singapore.

Figure 2: FDI (inward flow), share of Asian total, 2013–2022[60]

Source: United Nations Conference on Trade and Development

Apple has been one of the first movers, and may rely on India for as much as one-quarter of its iPhone production by 2025, in part driven by disruptions to its operations in China.[61] Morgan Stanley estimated that China’s COVID policies will result in an “iPhone Pro model shortfall at about 6 million units this year [2022].”[62] Others have estimated that China’s COVID regulations have resulted in iPhone shortages that “reached as low as 35 percent of typical holiday inventory” in stores.[63] Google is similarly “scouting for suppliers in India to assemble its Pixel smartphones … to diversify beyond China.”[64]

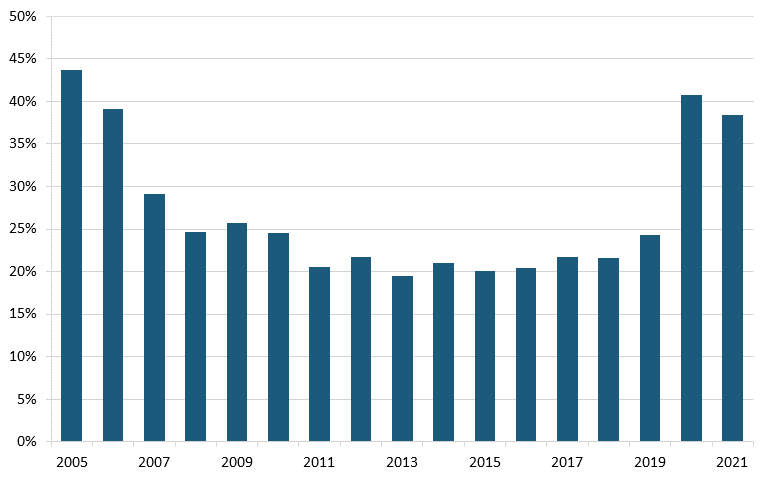

Indeed, a not-insignificant portion of the increased inbound FDI is flowing into Indian manufacturing activity, complementing increased domestic investments in the sector. In fact, whereas manufacturing investments accounted for nearly 45 percent of all investment in India in 2005, this share fell to barely 20 percent from 2011 to 2019, but now the share has rebounded back to over 35 percent since 2019.[65] (See figure 3.)

Figure 3: Manufacturing investment in India as share of total investment, 2005–2021[66]

Source: Economist Intelligence Unit; Centre for Monitoring Indian Economy

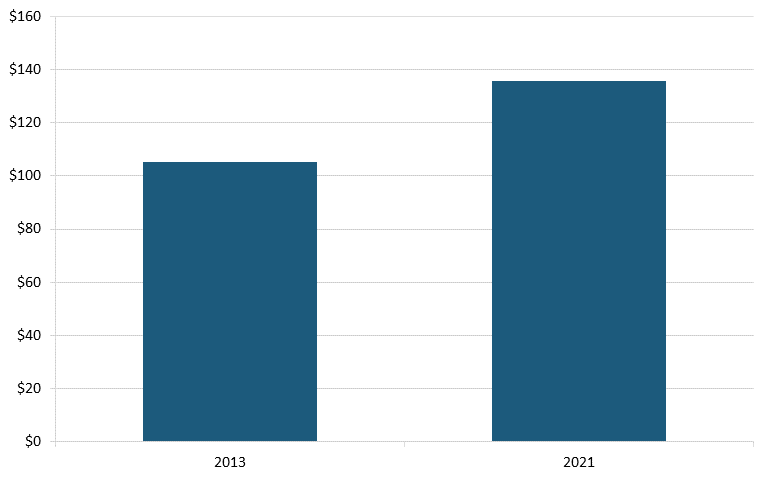

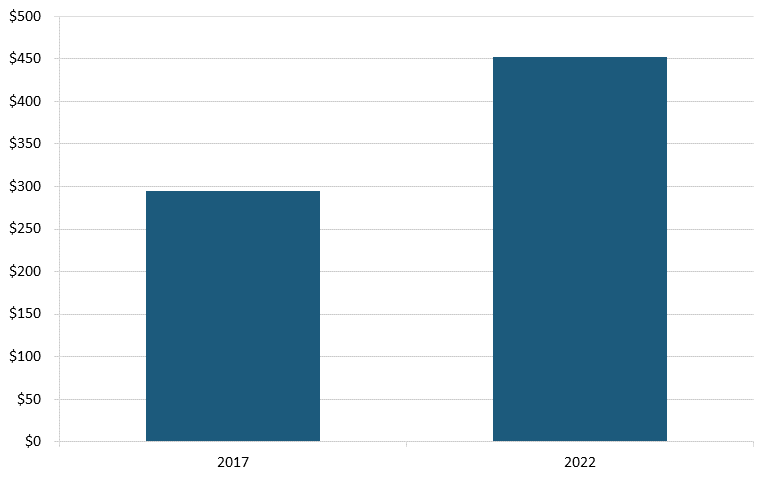

The increasing FDI into India signals that some companies have already diversified their supply chains and established production hubs in the country, as evidenced also by India’s increased export levels. From 2013 to 2021, India’s provision of intermediate goods to the global economy increased from $105.2 billion to $135.8 billion, signaling that more companies are relying on the country’s manufacturing capabilities. (See figure 4.) Moreover, from 2017 to 2022, India’s total exports of goods increased from $294 billion to $452 billion, meaning that countries are increasingly turning to India for its products. (See figure 5.) In particular, India’s exports to the United States almost doubled from $46 billion to $80 billion in the same period. In summary, the current geopolitical moment offers a tremendous opportunity for India to attract increased investment in globally mobile high-tech industries.

Figure 4: India’s exports of intermediate goods to the world (billions)[67]

Source: World Bank, World Integrated Trade Solution (WITS)

Figure 5: India’s total exports to the world (billions)[68]

Source: World Bank, World Integrated Trade Solution (WITS)

The Semiconductor Value Chain

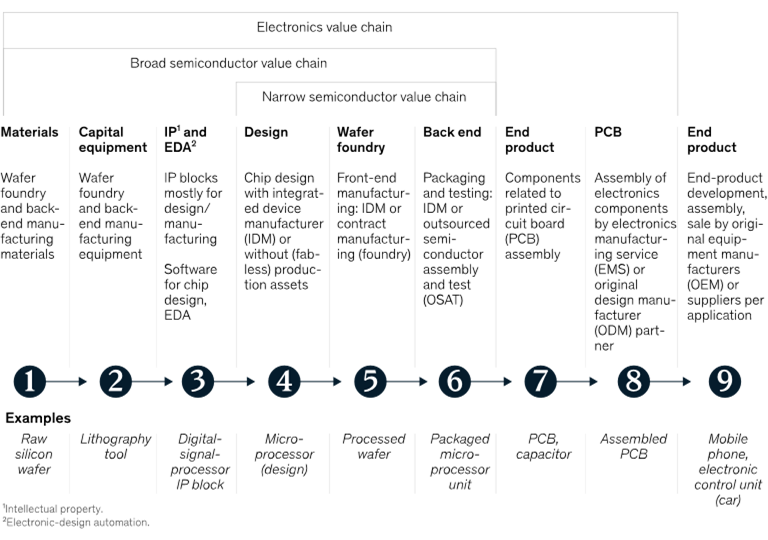

Semiconductors—the world’s fourth-most-traded product—have perhaps the most complex and geographically dispersed value chain of any industry in the world.[69] When all production phases are considered, the entire semiconductor production process extends from material procurement to end-product manufacturing.[70] (See figure 6.) However, this report focuses mainly on the following facets of the semiconductor production process: semiconductor R&D and chip design, semiconductor fabrication, and semiconductor ATP. The semiconductor design process includes important additions of core intellectual property (IP)—which consists of reusable modular portions of designs, allowing firms to license and incorporate them in their designs—as well as electronic design automation (EDA) software tools.

Figure 6: Facets of the semiconductor value chain[71]

Source: Graphic Courtesy McKinsey Global Institute

Distinctive business models characterize the industry. Integrated device manufacturers (IDMs) represent firms that conduct all key facets of semiconductor manufacturing, especially design and fabrication, internally. Infineon, Intel, Micron, Renesas, Samsung, SK Hynix, and Texas Instruments are leading IDMs. Meanwhile, many semiconductor design firms (such as AMD, NVIDIA, and Qualcomm) are “fabless,” meaning they have no production capability, but outsource production to “foundries” such as TSMC or Global Foundries.[72] The three most-prevalent types of semiconductors are logic chips, memory (usually DRAM) chips, and analog chips (those that generate a signal or transform signal characteristics, and are especially prevalent in automotive and audio applications). The most-sophisticated semiconductors operate at the smallest process node sizes (measured in nanometers). The most-sophisticated leading-edge logic chips operate at 2–3 nm, while older-process-generation legacy chips may be designed above 28 nm.

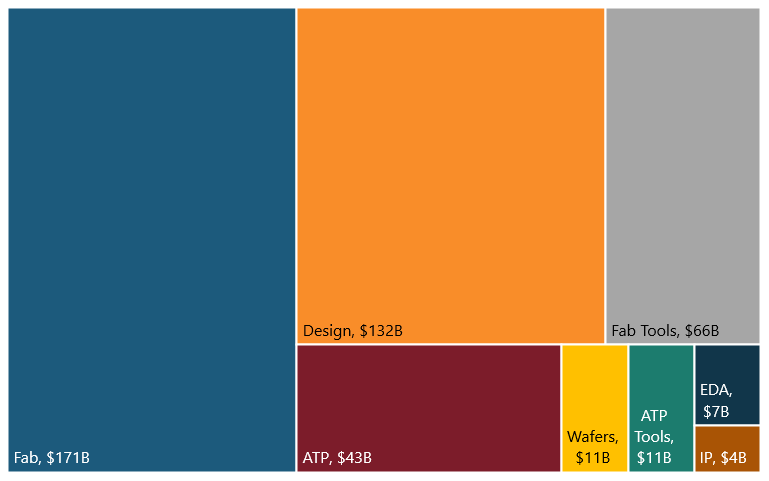

In considering the value added by the various facets of semiconductor manufacturing globally—$445 billion in total output as of 2019—analysts estimate that fabrication adds 38.4 percent of global value to the industry ($171 billion), followed by design activities at 29.8 percent ($132 billion), production of fab tooling at 14.9 percent ($66 billion), and ATP at 9.6 percent ($43 billion). That’s rounded out by wafers (2.5 percent), ATP tools (2.4 percent), EDA (1.5 percent), and core IP (0.9 percent). (See figure 7.) (As noted, the global semiconductor industry is expected to grow to $588 billion in 2024, but these percentages still reflect the relative value addition contributed by various core activities in the semiconductor supply chain.)[73]

Figure 7: Value added by segments of the semiconductor production process, 2019 ($445 billion, total)[74]

Source: Center for Security and Emerging Technology

India’s Semiconductor State of Play and Market Opportunities

India is currently strongest in the R&D and design facets of the semiconductor value chain but desires to build expanded manufacturing capability, starting with the ATP market and seeking to move into the semiconductor fabrication side of the business. A subsequent section of this report examines the broader semiconductor ecosystem support actors in India (such as research institutes and materials and components suppliers), while this section focuses on the key phases of R&D/design, manufacturing (fabs and ATP), and semiconductor manufacturing equipment. As figure 8 shows, India already has a number of important players operating in each of these phases of the semiconductor value chain.

Figure 8: Key actors in India’s semiconductor ecosystem

Semiconductor R&D and Design

Integrated circuit (IC) design is undoubtedly India’s greatest semiconductor industry strength. The country employs approximately 20 percent of the world’s semiconductor design engineers, or about 125,000 individuals.[75] About 3,000 individual ICs are designed in India each year.[76] In terms of very large-scale integration (VLSI)—which refers to the process of creating an IC by combining millions or billions of MOS (metal-oxide) transistors onto a single chip—India accounts for 15 percent of their global production.[77] Almost every one of the world’s top-25 semiconductor design companies—including Intel, Texas Instruments, NVIDIA, and Qualcomm—have design and R&D centers in India.[78] Much of this presence is centered in the south Indian city of Bangalore (Bengalaru) in the state of Karnataka.

Texas Instruments (TI) was the first global technology company to set up an R&D center in India, in Bangalore in 1985.[79] TI retains one of the largest semiconductor presences in the country, employing over 2,500 (mainly engineers) and working closely with over 1,000 engineering colleges across the country.

Synopsys works in India to provide solutions across markets including high-performance computing, automotive, security, and manufacturing solutions by employing over 5,500 across the country. The company’s recent announcements include MOUs with IIT Bombay and IISc Bangalore on research partnerships, educational software and curriculums, and faculty development programs to support workforce development.[80] Additionally, through collaborations with the Indian government’s Chips to Startup (C2S) and Synopsys SARA programs, Synopsys is working with more than over 400 universities for talent creation in various domains.[81]

In July 2023, semiconductor developer Advanced Micro Devices (AMD) announced a five-year, $400 million investment in India that includes a new campus in Bangalore that will serve as the company’s largest design center, as well as the addition of approximately 3,000 new engineering roles, bringing AMD’s total workforce in India to nearly 10,000 by 2028.[82]

Beyond IC design, India is also a hub of semiconductor manufacturing equipment design. In 2000, Lam Research Corporation—a U.S. manufacturer of equipment for thin film deposition, plasma etch, photoresist strip, and wafer cleaning processes—launched Lam Research India. The unit, which now employs over 2,000 Indian workers, focuses on software development and support, hardware engineering, global operations management, and analytics. In particular, Lam India’s hardware team designs subassemblies and subsystems for all Lam’s product lines.[83] In June 2023, Lam announced plans to train up to 60,000 Indian engineers through its Semiverse Solutions virtual fabrication platform to accelerate India’s semiconductor education and workforce development goals. In support of the skilling initiative, Lam signed an MoU with the Centre for Nano Science and Engineering (CeNSE) at the Indian Institute of Science (IISc) in Bengaluru to support skilling of 60,000 Indian engineers.[84] Lam also proposed a $25 million investment to set up a new lab in the state of Karnataka.[85] In June 2023, Applied Materials, another semiconductor toolmaker, announced plans to invest $400 million over four years to launch a new engineering center in India, which will support more than $2 billion of planned investments and create over 500 new advanced engineering jobs.[86]

Most of the design work performed in India services foreign multinationals, and hasn’t thus far given rise to a significant local design ecosystem, although that’s slowly evolving. As of February 2023, India had fielded an estimated 21 start-ups between the semiconductor design and manufacturing space, with that number expected to grow to 50 by the end of 2023.[87]

One such start-up of note is Mindgrove Technologies, a Chennai-based systems-on-a-chip (SoC) developer specializing in designing 28 nm chips for connected devices such as automobiles, medical devices, wearables, smart electricity and water meters, and home appliances.[88] As Sharan Srinivas J, Mindgrove Technologies co-founder and chief technology officer (CTO), explained, “We felt the competitive market featured a set of players that prioritized low-cost, power-optimized, reliable chips, but with slower processing speeds, while other competitors emphasized more-powerful processing speeds, but which increased cost and power consumption.”[89] Mindgrove seeks to target the middle of those markets, developing SoC products “for a market which is emerging from entry level and moving to a higher level of optimization, premiumization, and performance” and “which are tailored initially to India-specific use cases, markets, and operating environments (i.e., temperate, moisture, etc.).”[90] Mindgrove estimates that chip-based biometrics solutions alone will represent a $500 million market in India.

Other notable Indian design start-ups include Saankhya Labs and Signalchip. Established in 2006, Saankhya Labs was India’s first fabless semiconductor solutions company and developer of the world’s first production software-defined radios chipsets.[91] A premier wireless communication and semiconductor solutions company, Saankhya develops products for broadband, satellite, and broadcast applications including 5G, Direct To Mobile (D2M) broadcast, rural broadband connectivity, and satellite communication modems for Internet of Things (IoT) applications. Similarly, Signalchip is a fabless design company developing innovative chips to enable high-speed wireless communication standards such as 4G-LTE/3G-WCDMA and 5G-NR.[92]

Most of the semiconductor design work performed in India services foreign multinationals, and hasn’t thus far given rise to a significant local design ecosystem.

India’s domestic fabless design ecosystem has considerable room to grow, if it can overcome certain barriers. One such barrier is India’s lack of semiconductor manufacturing capabilities (i.e., foundries), such that India’s chip designers must send their designs abroad for prototype development and testing. Culturally, as Mindgrove CEO Shaswath TR explained, “Our semiconductor designers are great at receiving a specification and designing it, but historically they haven’t been great at conceptualizing that spec themselves. So what’s really required [for domestic Indian players to get competitive in building their own semiconductor design businesses] is a mindset change.”[93]

India’s fledgling start-up culture, while growing, has faced challenges attracting venture capital (VC) investment. One article notes that “venture capitalists typically refrain from investing in a semiconductor startup because it demands consistent funding with a long time before the returns start materializing,” as long as 8 to 10 years. In 2022, VC investment in India declined by 38 percent to $20.9 billion, down from $33.8 billion. While certainly some of that drop was COVID-19 induced, India’s level of VC investment was considerably lower than the $69.5 billion invested in China in 2022, with India accounting for only 5.1 percent of all global VC investment in 2022.[94] Certainly, more liquid risk capital markets will be needed if India is to meet its fabless semiconductor design aspirations.

Compound semiconductors, which are semiconductors made from two or more elements from the groups of the periodic table, represent an emerging area of semiconductor design innovation.[95] Compound semiconductors such as silicon carbide (SiC) or gallium nitride (GaN) are particularly well suited for applications requiring both high power and frequency, as they limit energy loss. As MGI explained, “Increased sustainability and electrification is spurring the adoption of SiC and GaN power devices, and the CAGR for both categories is expected to far exceed the 5 percent growth forecasted for the power semiconductor market as a whole.”[96] The market for GaN semiconductors reached $2.17 billion in 2022 and is expected to grow at a 25.4 percent CAGR from 2023 to 2030.[97]

This emerging field could be one in which Indian competitors can compete. For instance, the Indian start-up Agnit Technologies is working on developing GaN semiconductors, particularly relevant for 5G amplifiers. But as Agnit Technologies CEO Hareesh Chandraeskar noted, “Funding and lack of infrastructure are the prime challenges.”[98]

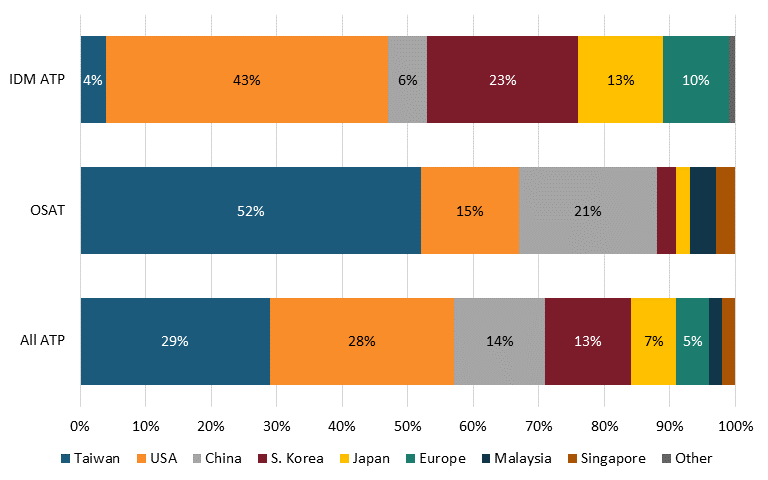

Semiconductor Assembly, Test, and Packaging

ATP generally occurs through one of two business models: 1) as in-house ATP services performed by integrated device managers and foundries after fabrication, or 2) by outsourced assembly and test (OSAT) firms, which perform ATP activities for third-party customers.[99] ATP is typically labor intensive and lower value added than design and fabrication, explaining why, historically, firms have set up ATP facilities to a larger extent in developing countries.[100] By firm headquarters, Taiwan and the United States lead in terms of the companies instigating the most global ATP activity, accounting for 29 and 28 percent of the market, respectively, in 2019, followed by China (14 percent), South Korea (13 percent), Japan (7 percent), and Malaysia (5 percent). (See figure 9.) In terms of OSAT, Taiwan dominated, with their enterprises accounting for over half the market, followed by China (21 percent) and the United States (15 percent). In turn, the United States led in IDM ATP activity (43 percent), followed by South Korea (23 percent) and Japan (13 percent).

Figure 9: IDM ATP, OSAT, and all ATP country market share, by firm headquarters, 2019[101]

Source: Center for Security and Emerging Technology

However, the above data considers only countries’ share of ATP instigation by where firms are headquartered. In terms of where ATP is actually conducted, Asia accounts for 81 percent of total global ATP activity, with China alone accounting for 38 percent of global ATP activity, and Taiwan about 37 percent.[102] In fact, of the 373 OSAT facilities worldwide (as of November 2022), 111 were located in China and 107 in Taiwan. (Forty-six are located in the Americas, primarily the United States, but the United States accounts for only 3 percent of the market.)[103]

However, as Chris Miller, renowned author of Chip Wars, observed, “If you look at the way that Korea, Taiwan, and Singapore entered the chip industry, they entered with assembly, testing and packaging before moving to fabrication.”[104] He continued, “[T]here’s a lot of scope for India to win investments in that sphere, particularly because it’s right adjacent to the device assembly, smartphone assembly, and PC assembly, where India is also in the early stages of winning a lot of market share.”[105] However, while ATP is certainly more labor intensive than semiconductor manufacturing, executives interviewed observed that labor only accounts for approximately 5 percent of total ATP production costs. They also noted that India is cost competitive with China in this regard, with one executive noting that his firm’s assessment concluded that Indian hourly labor costs (in ATP) are within $0.01 of China’s.

In June 2023, India’s efforts to move into the more manufacturing-oriented elements of the semiconductor ecosystem paid dividends, with memory chip maker Micron announcing it would undertake a major investment to build a semiconductor assembly and test facility in India, with the company contributing approximately 30 percent of the cost (up to $825 million), the Indian government contributing 50 percent ($1.375 billion), and the state of Gujarat kicking in 20 percent ($550 million).[106] Micron began construction on the facility in September 2023, with the project’s first phase to be operational by late 2024 and a second phase coming online in the latter half of the decade. The facility, which will focus on transforming wafers into ball grid array (BGA) integrated circuit packages, memory modules, and solid-state drives, is expected to create up to 5,000 new direct Micron jobs and 15,000 community jobs over the next several years.[107]

Analysts view Micron’s investment as a significant catalyst toward India’s semiconductor ambitions.[108] Indeed, after Micron announced its investment, the Indian government received at least three to five additional ATP project proposals (as well as proposals from compound semiconductor and memory players).[109] As Indian communications and IT minister Ashwini Vaishnaw explained, India’s ability to attract Micron “is giving a lot of confidence to people that, yes, this is a government very clearly focused on execution, and we should see, in the coming months, a lot more interest in the Indian semiconductor story.”[110]

Semiconductor Fabrication

By 2023, catalyzed by the official Semicon India Programme (i.e., India’s semiconductor policy) launched in December 2021, a number of conglomerates were showing interest for collaborations and considering bids to launch semiconductor fabrication facilities. Proposals have been submitted to the ISM from Singapore-based IGSS Ventures, the International Semiconductors Consortium (ISMC), and a joint venture between Vedanta Group and Taiwan’s Foxconn. However, for various reasons, those proposals have yet to reach the desired fruition. The policy underwent a small revision in October 2022, which both made it more attuned to ease of doing business aspects and enhanced the incentive packages for semiconductors. Indeed, coming on the heels of the Micron announcement, Indian officials revealed that they expect to receive multiple “high-quality” proposals for semiconductor fabrication facilities.[111]

In particular, Vedanta, a diversified multinational mining company, recently confirmed that it’s in talks with three potential technology partners in a plan to set up a foundry fab and an outsourced assembly and testing electronics hub. As Vedanta CEO Anil Agarwal told reporters at the July 2023 Semicon India summit, "In 2.5 years, we will give you Vedanta made-in-India chips.”[112]

While India might wish to be manufacturing semiconductors at the sub-7 nm leading edge, it need not necessarily be, for there’s a large and compelling global and domestic market for legacy chips, and there’s likely a sweet spot for India to produce chips particularly suited for automotive, white goods, and industrial applications such as power base stations, solar panels, and wind turbines. In fact, the majority of chips sold worldwide are legacy chips (with two-thirds of them using technologies commercialized before 2005) and industries such as automotive, medical devices, consumer electronics, infrastructure, industrial automation, and defense relying heavily on them.[113] In fact, 95 percent of the chips used in the automotive industry are legacy chips, and the global automotive semiconductor market is expected to grow from $38.7 billion in 2020 to $116.6 billion by 2030.[114] Interviewees noted that as India expands its renewable energy production and revamps its electric grid, deploys EVs, and electrifies its railroads, there will be significant demand for legacy chips in this space.

Indeed, as one report notes, “Areas like cloud computing, machine learning, connected cars/automotive, IoT and AI will continue to drive the need for a new breed of chips that gives an opportunity to shift focus from improving silicon performance to increasing learning ability & decreasing power usage.”[115] India would be in a prime position to manufacture these types of chips. In summary, there is a strong possibility that India will break its commercial fab drought in this decade.

Semiconductor Equipment

India is also seeing increased interest for semiconductor equipment manufacturing. After Foxconn withdrew from the proposed deal with Vedanta to launch a fab, it signed a letter of intent with the government of Karnataka to invest Rs 5,000 crore for two projects: semiconductor equipment manufacturing (in partnership with Applied Materials) and phone enclosure manufacturing.[116]

Semiconductor and Electronics Manufacturing Policy Environment

The Indian government has extended some of the world’s most generous incentives to attract semiconductor ATP and fabrication activity. In December 2022, India established the ISM, a government organization to guide the promulgation of central government policy and incentive packages to attract semiconductor-sector investment across each key phase of semiconductor production: design, fabrication, and ATP (with additional incentives to attract display fabs).[117] The heart of the effort is the Rs 76,000-crore (approximately $10 billion) “Semicon India Programme,” which includes a variety of mechanisms designed to accelerate development of various facets of India’s semiconductor ecosystem.

The program’s flagship fiscal incentive devotes $10 billion to a match package, wherein the Indian central government offers to cover 50 percent of the project cost—with the relevant Indian state kicking another 20 to 25 percent—to companies establishing semiconductor foundries (at any node level), ATP/OSAT facilities, or display fabs (e.g., LCDs or AMOLED). Additional target sectors include MEMS (micro-electrical mechanical systems), sensors, compound semiconductors, and discrete devices.[118] The Indian government makes the matching funds available on a “pari passu” basis, meaning the money is made available immediately upfront to the company. India’s federal government semiconductor investment package, offering this 50 percent match, is currently the world’s most generous. The Indian government has announced that it is accepting proposals under this scheme through December 2024.

To accelerate the development of India’s semiconductor design ecosystem, India has created its Design-linked incentive (DLI) scheme, which offers a matching 50 percent “product-design linked” investment from the Indian government to support enterprise launch, as well as “deployment-linked” incentives of 4–6 percent, based on factors such as use of Indian-made content (e.g., printed circuit boards or indigenously produced IP) and year-over-year additionality in firm sales. The target segments for the DLI are ICs, chipsets, SoCs, systems and IP cores, and semiconductor-linked designs. The DLI is designed for indigenous companies engaged in semiconductor design and IP development. The Indian government also offers Indian start-ups in this space infrastructure support tools, such as acquiring licenses for EDA tools (i.e., helping acquire licenses for the software used to design integrated circuits).

To support development of supply chain actors that would underpin development of India’s semiconductor ecosystem, the country has created the Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS). SPECS offers a 25 percent incentive for eligible capital equipment (CapEx), including into plant, machinery, equipment, R&D, and utilities, targeting segments such as semiconductor-grade chemicals and gases, capital goods needed in semiconductor manufacturing (e.g., lithography tools), and engineering and R&D activities supporting the development of semiconductor capital goods.[119]

India’s semiconductor investment package, offering a 50 percent match by the central government and 20 to 25 percent by the relevant state government, is currently the world’s most generous.

Separately from its specifically semiconductor-focused incentive packages, a key component of India’s strategy to accelerate its path to becoming a global hub for electronics manufacturing is its $20 billion Production Linked Incentive (PLI) scheme. To support electronics manufacturing, this includes $7 billion in incentive funding for: 1) PLI for mobile phones, components, and hardware; 2) CapEx-linked incentives for components and sub-assemblies; and 3) development of electronics manufacturing clusters. To support “Allied sectors,” $13 billion in PLI funds are earmarked for related sectors, including: 1) advanced chemistry cells; 2) automobiles and auto components; 3) telecommunications and networking; 4) solar photovoltaic (PV) cell modules; and 5) white goods.[120]

India launched the PLI scheme in April 2020, seeking to boost domestic manufacturing by offsetting costs in India compared with other locales. Indian manufacturers sat down with the government in 2019 and conducted a deep-dive analysis into the costs of manufacturing in India compared with comparable Southeast Asian manufacturing locations (e.g., China, Indonesia, Malaysia, etc.), calculating an overall 8–9 percent handicap (based on factors such as labor, infrastructure, regulatory, etc. costs).[121] The PLI offers an incentive of 4–6 percent (calculated based on extent of use of domestic content and increases in firms’ year-over-year net sales), with the opportunity to gain additional percentage points if the electronics company is sourcing inputs (e.g., parts, components, assemblies, etc.) domestically. (In theory, a firm’s PLI could reach as high as 11 percent.) Thus, the intent of the PLI is to accelerate the development of India’s domestic electronics manufacturing ecosystem (while replacing foreign-sourced content in the process). In total, PLI schemes are operational in 14 sectors of the Indian economy, including other flagship Indian industrial sectors such as vehicles & auto components, pharmaceuticals, steel, and textiles.[122]

To stimulate semiconductor-sector R&D, 2.5 percent of Semicon India Programme funding has been allocated for R&D activity, especially targeting advanced logic, packaging R&D, compound/power semiconductors, and chip design and EDA activities.[123] To advance this, India has proposed establishment of a India Semiconductor Research Center (ISRC), characterizing it as an independent, nonprofit, world-class semiconductor research center.[124] These investments are welcomed and needed, but they do point to India’s need to bolster its national R&D intensity (national R&D investment as a share of GDP). As a National Institution for Transforming India (NITI) Aayog (the Indian government’s leading internal, economics-focused think tank) study itself states, India’s R&D spend “is amongst the lowest in the world” and in fact fell from 0.8 percent of GDP in 2008–2009 to 0.7 percent in 2022.[125] India’s BRIC peers each invest more in R&D than does India, with Brazil, Russia, and China investing around 1.2 percent, 1.1 percent, and 2.4 percent, respectively.[126] To meet its long-term aspirations of accelerating its innovation-based, high-tech economy, India will need to bolster its R&D investments, at both government and enterprise levels.

In alignment with the National Policy on Electronics 2019 (NPE-2019), the Ministry of Electronics and Information Technology (MeitY) also launched the C2S initiative, which aims to train 85,000 industry-ready engineers over five years to act as catalysts for growth of domestic start-ups involved in fabless chip design.[127]

Regulatory Environment

As India seeks to expand its semiconductor industry, it will need to foster a regulatory environment that provides stability, certainty, predictability, and transparency to investors (domestic and foreign alike). This section first examines lessons from India’s effort to attract semiconductor manufacturers such as Micron and then considers specific regulatory policy issues, such as taxation, labor market policy, tariffs and import policies, and customs and trade facilitation.

Lessons From Attracting Micron’s Semiconductor ATP Investment

As noted, Micron’s commitment to launch a world-class ATP facility represented a major victory for India. The ISM and the broader Indian government learned several lessons through the process. Observers noted that Indian policymakers demonstrated flexibility in their approach, notably revising the initial Semicon India Programme by increasing the central government match from 35 to 50 percent and by making that deal available for proposals to manufacture semiconductors at any process node (whereas before the most-generous incentives were only available for proposals to manufacture leading-edge chips). Also, the ISM initially imposed a 45-day window for applications, which has now been removed (it will accept applications through December 2024). Observers also noted that the work on the Micron deal serves as an important reference, contributing to the development of contractual clauses that could be reused in future engagements.

Particularly notable was how rapidly the Indian government, ISM, and Micron were able to affect a closure on the Advanced Pricing Agreement (APA), which specifies the tax treatment of relevant transactions (including intercompany transactions) for both the tax administrator and the taxpayers for the period covered.[128] Typically, it can take multinational companies and governments three to four years to finalize these agreements, but it was possible to finalize the APA in less than six months on the strength of clear substantives that were submitted by Micron, and the diligence of the teams working on the agreement. ISM, officials from the Ministry of Finance, Department of Revenue, Central Board of Direct Taxes (CBDT), and MeitY collectively enabled the Micron investment in India.[129]

In June 2023, India’s annual finance bill made an amendment to Section 65A of India’s Customs Tariff Act that raised concerns for beneficiaries of PLI schemes. Under the amendment, the Indian government removed the integrated goods and services tax (IGST) exemption on inputs imported by a duty-free bonded warehouse meant for export production, and instead planned to impose an 18 percent IGST on such goods.[130] Under India’s manufacturing and other operations in a customs-bonded warehouse (MOOWR) scheme, in these “Customs Bonded Warehouses,” manufacturers can import (and store) components to be used in domestic production for goods intended for export purposes. MOOWR-bound imports historically did not attract any import duties or other customs taxes.[131] India’s intent in creating the MOOWR scheme was to reduce the cost of capital and maintain the availability of working capital to promote domestic manufacturing.[132] The planned 18 percent IGST would have significantly disrupted these economics and, as a result of industry feedback, the Indian government announced in September 2023 an official exemption for the semiconductor and electronics manufacturing sector from the IGST duties under Section 65A.

If India is to attract multi-billion-dollar semiconductor industry (let alone other advanced-technology industry) investments, the country will have to prioritize a regulatory environment marked by stability, certainty, consistency, and predictability—one that doesn’t introduce business uncertainty or change the terms of investment deals over time.

Evolution of India’s Regulatory Environment

Indian government and state officials have underscored that India’s approach to industry has evolved from “red tape” to “red carpet” in the fiercely contested global competition to attract high-value-added, globally mobile semiconductor industry (and broader high-tech) investment.[133] While India has some ways to go here, several palpable and important improvements to India’s regulatory environment are visible.

In January 2021, India launched a “Regulatory Compliance Burden Reduction” initiative, whereby India’s central and state governments were instructed to identify, in consultation with industry, compliance procedures that were either cumbersome and could be simplified or were rudimentary or unnecessary. One outcome was that an online application form to bring FDI into the country was reduced from 15 to 6.5 pages.[134]

The effort culminated in July 2023, when India’s Parliament passed the Jan Vishwas (Amendment of Provisions) bill, which removed (or decriminalized) 183 provisions in 42 pieces of legislation to make doing business easier in the country.[135] Prior to these changes, even inadvertent offenses, such as failing to file a business registration form, were punishable by fines and imprisonment as long as one year. India’s Commerce and Industry Minister Piyush Goyal noted that the outdated laws “have contributed to a trust deficit” (between Indian citizens and businesses and their government) and that repealing them was part of the government’s efforts to improve “ease of living as well as ease of doing business” in India.[136]

Separately, India’s Ministry of Commerce is currently undertaking a “Cost of Regulations” exercise that seeks to implement regulatory impact assessment (RIA)-based policies.[137] The effort seeks to ease Indian processes for tasks such as starting (or closing) a business, obtaining consent to operate a factory, obtaining electricity or water connections, getting a land registration, etc. India’s Ministry of Commerce expects to implement changes suggested from its “Cost of Regulations” initiative in the 2026–2027 timeframe.[138]

Indian government and state officials were keen to express the view that India’s approach to industry has evolved from “red tape” to “red carpet.”

One area where India’s central government and states have already made considerable progress is in introducing single-window systems. India’s Department for Promotion of Industry and Internal Trade (DPIIT) has created a National Single Window System (NSWS) whose goal is to provide a single platform to enable the identification and obtaining of approvals and clearances needed by investors, entrepreneurs, and businesses in India. The NSWS, which enables the identification, application, and subsequent tracking of approvals for all integrated states and central departments, is envisioned to reduce duplicity of information submission to different ministries, reduce compliance burdens, promote sector-specific reforms and schemes, reduce gestation period of projects, and promote ease of starting and doing business.[139] Launched in September 2021, by January 2023 the NSWS had made over 75,000 approvals out of 1,230,000 applications received.[140] (While that does represent progress, it only represents an aggregate 6 percent approval rate, suggesting a potential area for improvement.) The online NSWS portal hosts applications for approvals from 31 central departments and 22 (of India’s 28) state governments.[141]

Mirroring the central government, many Indian states have established their own single-window clearance initiatives. For instance, Tamil Nadu’s Single Window Portal represents a one-stop portal for investors to electronically secure all business-related approvals, licenses, and clearances, covering over 200 services and encompassing over 40 government departments/ agencies.[142] It provides a single point of acceptance and electronic distribution of applications to the respective authorities. As of July 31, 2023, Tamil Nadu had approved 21,380 of the 23,548 applications received through the portal, enabling investments supporting over 360,000 jobs.[143] Tamil Nadu officials have promised to make all investment project proposal decisions within 30 days.[144] Likewise, Karnataka offers a single-window clearance system.[145]

Taxation

Likewise, India has made strides in reforming its tax environment. In July 2017, India significantly simplified and streamlined its tax system with the introduction of the goods and services tax (GST).[146] The nationwide GST, essentially a destination-/consumption-based tax, replaced what was one of the world’s most complicated origin-based indirect tax system—a patchwork of value-added, sales, and excise taxes levied by India’s 28 states and the central government.[147] This reform has brought myriad benefits to the Indian economy, including increased revenues, uniformity in taxation, elimination of cascading taxes, reduced compliance burdens, and on online system of taxation.[148] India’s National Council of Applied Economic Research (NCAER) has estimated that the GST has led to an increase in the size of India’s economy of 1.0 to 3.0 percent.[149]

India has also made strides in lowering its corporate tax rates. As the EIU noted, “In 2019, the government reduced the standard corporate tax rate from 30% to 25%, while also offering a lower 22% opt-in tax, down from the standard rate of 30%, to eligible firms that choose not to avail themselves of certain deductions.”[150] The Indian government also reduced the tax rate to 15 percent for any new domestic company incorporated after 2019 that will make new manufacturing investments and intends to commence production before March 2024.[151] (However, companies that elect to partake in this lower corporate tax are not eligible to participate in other investment promotion schemes, such as SPECS or the PLI.) India’s top corporate tax rate of 25 percent in 2021 was lower than in the Philippines (30 percent), and was just slightly above Malaysia’s 24 percent, Indonesia’s 22 percent, and Thailand and Vietnam’s 20 percent.[152]

As in other facets of their operations, investors seek a predictable tax environment. To increase predictability, India scrapped retrospective taxes, which charged for transactions in the long past. As one analyst observed, this reform “could encourage the flow of foreign investment in India and create a transparent and reliable tax regime for global investors.”[153] As the EIU noted, in a positive step, “The government has moved to settle disputes over retrospective taxation with foreign companies, which had acted to unnerve investors.”[154]

India has also moved to offer R&D tax credits, another important instrument to encourage business investment. In a study of 34 countries, ITIF found that India ranked 26th in terms of R&D tax subsidies, with an R&D subsidy rate of 8.2 percent, which is slightly lower than the U.S. rate of 9.5 percent rate and considerably below the 16.6 percent in the comparison group (excluding the United States).[155] Further improvements in this area could boost India’s attractiveness as a semiconductor investment destination.

Considering tax issues, it should also be noted that in the special economic zones (SEZs) spread across India’s states, state taxes on goods and services—along with some national taxes—are exempted or discounted for a certain period (usually 5–10 years). Some states have also eased labor laws within the SEZs.[156] For instance, Gujarat has offered an amendment to industrial dispute legislation to allow flexible employment in SEZs.

Labor Policy

India has made considerable strides in reforming its labor market policies to encourage investment. As ITIF wrote in a 2013 report on the Indian economy, “India’s 51 central and 170 state labor statutes—some of which pre-date independence—make it hard for firms to fire underperforming workers.”[157] It cited Indian businessman Jaithirth “Jerry” Rao as observing, “There are no clear rules for lay-offs. In order to lay off workers, an employer needs the ‘approval’ of the government in power.”[158] Approval of the government needs to be sought to shut down any factory, as well.

Fortunately, times have changed considerably over the past decade with regard to Indian labor market policies. In particular, major reforms undertaken from 2019–2020 amalgamated 29 pieces of labor legislation into four comprehensive labor codes.[159] As the EIU noted, “The codes simplify compliance by ensuring a single licensing mechanism for industries and provide operational flexibility for small and medium-sized enterprises” and “provide faster dispute-settlement mechanisms.”[160]

Analysts view the benefits of the labor market reforms as enabling companies to adjust their labor requirements in line with changes in market demand, facilitating the ability of gig and platform workers to attain benefits, ensuring better compliance of labor laws through online tools, and shifting labor inspection regimes from a negative regulatory regime based on “do’s” and “don’ts” to a more positive inspector and facilitator approach.[161] Streamlining labor laws (including with regard to minimum wages) across Indian states remains a challenge, but overall, India’s labor market reforms have succeeded in making the country a more competitive location for manufacturing activity.[162]

Tariffs and Import Policies

The nature of a country’s tariff and import policy regime plays an important role in informing multinational enterprises’ investment decisions in high-tech industries, which includes semiconductors. The World Trade Organization’s (WTO’s) Information Technology Agreement (ITA1)—implemented in 1996 and to which India is an original signatory—has played a catalytic role in this regard, eliminating tariffs on trade in hundreds of ICT products.[163] As noted by the WTO, the “zero-in/zero-out” tariff environment for the parts, inputs, and components that flow through semiconductor value chains created by the ITA1 “influence investment and entry decisions taken by multinational firms, including through firm location, in favor of ITA1 participants, thereby increasing their competitiveness and capacity to innovate.”[164] It is observed that from 2005 to 2015, ITA1-member nations enjoyed nearly one-third greater participation in ICT global value chains than did non-ITA1-member nations.[165]

India is a member of the ITA1, but refrained from participating in the 2015 expansion of the agreement (ITA2). Participants in the ITA2 eliminated import tariffs on myriad additional semiconductor-related products, materials, and equipment. By contrast, in April 2023, a WTO dispute settlement panel found that India was charging import tariffs on a range of technology products in violation of its commitments under the ITA1.[166]

More recently, in August 2023, the Indian government announced a licensing requirement for imports of laptops, tablets, and personal computers, with the requirement taking immediate effect.[167]The promulgation of new regulations without consultation or the ability to submit comment and feedback raised concerns for foreign investors about the extent to which they can operate in a predictable and transparent regulatory environment in the country. The Indian government ultimately modified the measure, shifting to an “import management system” that requires companies to register the quantity and value of imports but does not require an import license.[168] This new system took effect on November 1, 2023.

Customs and Trade Facilitation

India has worked diligently to improve its trade facilitation environment, which has resulted in substantive improvements in its performance in the Trading Across Borders indicator, from ranking 146th in 2017 to 68th in 2019.[169] In 2017, the WTO’s Trade Facilitation Agreement (TFA) entered force (India had ratified it in 2016). The TFA contains provisions for expediting the movement, release, and clearance of goods, including goods in transit. It also sets out measures for effective cooperation between customs and other appropriate authorities on trade facilitation and customs compliance issues and contains provisions for technical assistance and capacity building.[170] To facilitate domestic coordination and implementation of its TFA commitments, India established a National Committee on Trade Facilitation (NCTF) under the chairmanship of the cabinet secretary.[171]

India’s efforts to implement its TFA commitments have led to improvements and is a work in progress. For instance, average dwell time for containers between May and October 2022 was just 3 days for India, compared with 7 for the United States and 10 for Germany.[172] According to India’s Ministry of Commerce, India’s customs clearance time for goods entering ports improved 15–17 percent over the past year, helped by many reforms to the custom clearance system.[173]

India also introduced a risk-based management system, reduced the number of pieces of documentation (e.g., bills of entry and lading), made it possible to support out-of-port documentation online, and introduced a grievance-redress system to improve and expedite customs clearance. However, there is room for continued improvement, for example by reducing India’s “Import Release Time” at seaports, which is still significantly higher than the timeframe in many other countries competing for semiconductor investment.[174]

India’s position to allow the WTO moratorium on customs duties on electronic transmissions to expire could pose challenges for prospective investors, as well as semiconductor design firms with activities in India.[175] Under the moratorium, WTO members have agreed to refrain from charging import tariffs on cross-border transfers of data. A non-renewal of this agreement could open the door to India and other countries requiring companies to file customs declarations and comply with other customs administration requirements for the “import” of semiconductor design and manufacturing data, and ultimately pay import duties on such data transfers into India. This would increase both compliance burdens and capital costs for semiconductor company operations, which would be a significant consideration for prospective investors regarding location of future semiconductor design and manufacturing investments.

Business Environment

As with India’s regulatory environment, India has attempted to make strides toward improving its business environment. The World Bank’s Ease of Doing Business series has unfortunately been discontinued, but in the final 2020 report, India ranked 63rd, more than doubling in improvement from its 142nd rank in 2014.[176]

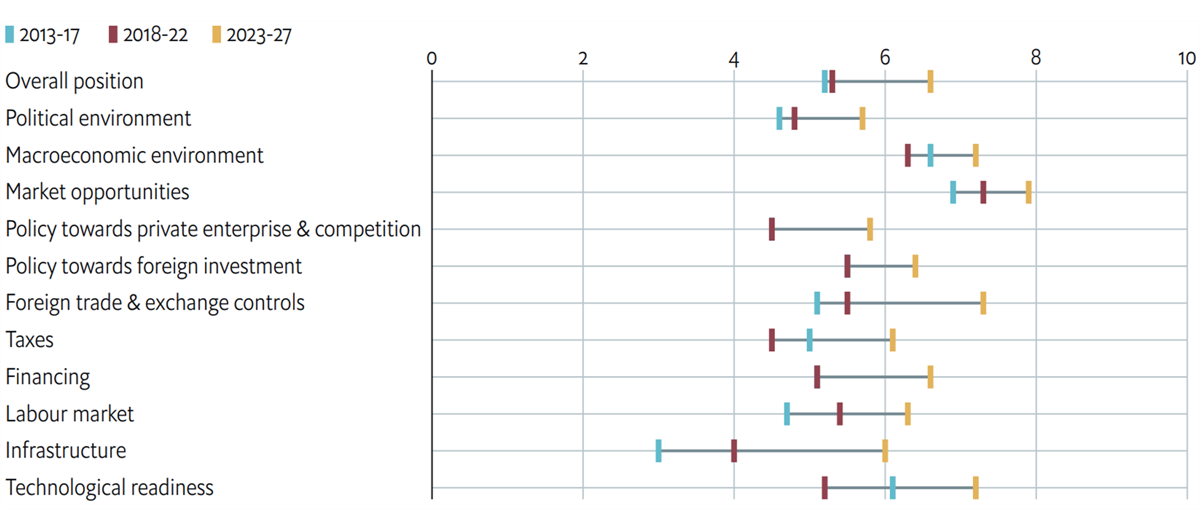

More recently, the Economist Intelligence Unit has created a Business Environment Readiness (BER) Index that ranks countries on 11 factors: 1) political environment; 2) macroeconomic environment; 3) market opportunities; 4) policy toward private enterprise & competition; 5) policy toward foreign investment; 6) foreign trade & exchange controls; 7) taxes; 8) financing; 9) labor market; 10) infrastructure; and 11) technological readiness. For its 2023–2027 forecast assessment, the EIU ranked India 10th among 17 assessed Asian nations (up from 14th place in their 2018–2022 period assessment), with India’s improvement mostly attributable to gains in its scores for infrastructure, technological readiness, and foreign trade and exchange controls.[177] India’s strongest score on the BER Index came for market opportunity, given the large and growing domestic market the country offers, while its lowest score came for infrastructure quality. (See figure 10.)

Figure 10: India’s scores on the Economist Intelligence Unit’s BER Index (10 is highest)[178]

The following sections delve deeper into some of the business environment-oriented factors the EIU assesses, especially labor/workforce and infrastructure considerations.

Labor/Workforce

As noted, India currently has about 125,000 engineers—with a bachelor’s, master’s, or Ph.D. degree—working in various aspects of chip design and development.[179] And employment in the category is growing, as semiconductor job openings in India increased 7 percent between March 2019 and 2023.[180] As Pranay Kotasthane, chair of the high-tech geopolitics program at the Takshashila Institution, explained, “India has semiconductor human power. Semiconductor design [or production] requires large numbers of skilled engineers and this is where India’s strength lies.”[181]

Deloitte estimates that the global semiconductor workforce will need to grow by more than a million additional skilled workers (from a base of 2 million in 2021) by 2030, and India is well poised to help address this need, roughly adding more than 100,000 workers annually.[182] Close to 2.5 million students enroll for undergraduate engineering degrees in India each year, with almost 600,000 students opting for the electronics stream.[183] The Indian Ministry of Education’s report “All India Survey on Higher Education 2021–2022” finds that India currently has 36.62 lakh (3.6 million) students enrolled in B.Tech and B.E courses, with about 8.25 lakh students (825,000) awarded such degrees in FY 2021.[184] However, that graduate pool could be deepened, as several interviewees observed that while only 1 percent (roughly 6,000 graduates) are “industry ready” upon graduation (i.e., capable of working on the factory floor within three months of graduation), it may take one to two years of on-the-job training before others are prepared.

Interviewees noted that one challenge for India’s semiconductor manufacturing ambitions is that most engineering students are focused on data science or AI and machine learning, and it’s been more difficult to interest students in electrical engineering, which is a key need for semiconductor talent. As the head of one foreign fabless chip design firm operating in India explained, for Indian engineering students, “the exposure to semiconductors is lesser than other technologies. Engineering students are choosing the easier path to employability compared to semiconductor-hardware engineering, which requires a master’s degree and years of experience.”[185]

Indeed, while India boasts a strong base of skilled talent supporting semiconductor design work, it will need to expand its base of skilled talent capable of supporting semiconductor chip manufacturing plants. As one MeitY representative explained, ““For semiconductor manufacturing … we do not have skilled manpower readily available in India.”[186] A MeitY report supports this, finding, “There will be a requirement of 10,000–13,000 human resources to meet industry [chip manufacturing] requirements, by 2027.”[187] India simply doesn’t produce enough M.Tech or Ph.D.’s in semiconductor-related fields (a mere 8 percent of graduates); indeed, remediating this is a key objective of the aforementioned C2S initiative.[188]

To boost employment, it’s essential that engineering institutes focus on facilitating programs that concentrate primarily on semiconductor equipment operation and manufacturing. These programs can offer practical experience and hands-on training that will help students to explore jobs in various fields such as process engineers, foundry engineers, etc.[189]

To that end, many of India’s premier engineering institutes are expanding their electrical and computer engineering course offerings. For instance, Indian Institute of Technology (IIT) Kanpur offers a course on IC fabrication, and various courses related to electronics device physics and modelling as well as integrated circuits, while its Material Science and Engineering (MSE) and Chemical Engineering departments offer courses related to semiconductor fabrication and packaging. Similarly, IIT Madras has launched a four-year online Bachelor of Science in Electronic Systems programme.[190] Elsewhere, the All India Council for Technical Education (AICTE) has also designed a curriculum for BTech in Electronics (VLSI Design and Technology) and a diploma in IC manufacturing.[191]