How Some Chinese Companies Obscure Ties to China and What Policymakers Should Do About It

Certain Chinese companies obscure their ownership and strategic intent in the U.S. economy, gaining access to markets, talent, intellectual property, and subsidies. These practices advance China’s industrial and military goals and necessitate stronger oversight measures.

KEY TAKEAWAYS

Key Takeaways

Contents

Understanding Patterns of Chinese Economic Obfuscation. 17

Introduction

Since the 1990s, China’s government has pushed its companies to “go out”: to compete internationally, capture market share, and leverage the benefits of globalization in talent and supply chains.[1] The Belt and Road Initiative, launched in 2013, has intensified this push.[2] An understudied part of this campaign is how China’s government has recommended Chinese companies to “adhere to cultural integration [and] actively adapt to host country culture” when operating abroad.[3] In its 2017 “Report on Development of China’s Outward Investment and Economic Cooperation,” China’s Ministry of Commerce (MOFCOM) instructed all Chinese multinationals that “internationalization must be accompanied by localization.”[4]

What MOFCOM frames as “localization” goes far beyond business school teachings on adapting products and management practices to foreign markets. In the same report, MOFCOM explained that in order to localize, a firm should “downplay the company’s home-country identity.”[5] This definition of localization has become widely adopted in Chinese academia, industry associations, and the private sector.[6] For example, the Chinese modular building company Shihang Holdings states on its English-facing website that it deliberately “dilute[s] the company’s home country color” as part of its localization business strategy.[7]

In practice, this obfuscation has become nefarious: Certain Chinese companies operating in the United States mask their national origin, presenting themselves as American corporate citizens—sometimes complete with patriotic branding—even while Beijing retains ultimate control over their ownership and strategic direction. The result is favorable to the Chinese Communist Party (CCP): these obscured companies benefit from their obfuscation by gaining privileged access to the U.S. market, intellectual property (IP), talent, and even generous U.S. government funding to support China’s strategic industrial and military priorities.

Certain Chinese companies operating in the United States mask their national origin, presenting themselves as American corporate citizens—sometimes complete with patriotic branding—even while Beijing retains ultimate control over their ownership and strategic direction.

This report features three case studies of U.S.-based Chinese companies operating in the strategic sectors of aerospace, construction machinery, and advanced batteries that obscure their ties to China. Together, they reveal a larger pattern: The People’s Republic of China’s (PRC’s) industrial strategy encourages embedded footholds within the U.S. economy through a deliberate, state-directed strategy of obfuscation. The case studies bring to mind the famous line attributed to Lenin that “the capitalists will sell us the rope with which we will hang them.”[8] The fact that the U.S. government would subsidize these obscured companies is alarming.

Meanwhile, U.S. companies operating in China face limits on market share, restricted access to government procurement, constraints on talent recruitment, and mandatory technology transfers.[9] China would never allow a U.S. military supplier to acquire a strategically critical Chinese company, rebrand it to appear Chinese, and receive extensive subsidies from China’s government—the reverse of a case study detailed in this report. While the openness of the U.S. economy is a strength, it also creates vulnerabilities that the PRC is deliberately exploiting, just as it has exploited the U.S. open scientific system.[10]

To mitigate risks from obfuscated Chinese companies, the United States should recalibrate its approach through the following policy changes. The stakes are no lower than safeguarding U.S. innovation, competitiveness, and national security.

1. Congress should strengthen Committee on Foreign Investment in the United States (CFIUS) screening and oversight.

2. Congress should expand Chinese ownership disclosure requirements.

3. The National Defense Authorization Act (NDAA) and CFIUS should block Chinese companies in the United States from advancing PRC military capabilities.

4. Federal agencies, in coordination with CFIUS, should block U.S. subsidies to PRC-financed companies.

5. The Federal Trade Commission (FTC) should clarify brand obfuscation practices.

6. Federal agencies, overseen by Congress’s intelligence committees, should create a centralized due diligence database and CFIUS should integrate trade enforcement intelligence into their screens.

False Flag Company Examples

The following case studies illustrate what this report terms a “false flag company”: a firm that presents itself as American but is ultimately owned by a Chinese company that itself is either state owned or has significant ties to the PLA.

Continental Aerospace Technologies (CAT)

CAT’s website presents itself as an all-American company, proudly displaying a red, white, and blue eagle logo, as seen in figure 1.[11]

Indeed, the aviation engine company has a patriotic history. Parent company Continental Motors Company spun it out as a subsidiary named Continental Aircraft Engine Company in 1927.[12] During World War II, Continental companies built engines for U.S. aircraft, tanks, and other combat vehicles.[13] Today, CAT’s website still highlights its contributions to the Navy’s storied Grasshopper Fleet in the 1940s.[14]

Figure 1: Continental Aerospace Technologies’ logo, 2025[15]

Yet, by the early 21st century, CAT faced significant challenges. In the 1960s, Teledyne Technologies had acquired Continental Motors Company, including its subsidiaries, renaming the consolidated company Teledyne Continental Motors (TCM).[16] After the 2008 recession, TCM cut costs due to “reduced demand,” and in 2010, Teledyne Technologies sold TCM to Technify Motor (USA) for $186 million.[17] The deal transferred TCM’s Alabama and New York plants and approximately 400 employees to the new owner.[18]

Despite the “USA” in its name, Technify Motor (USA) was a Chinese company.[19] Its parent, the state-owned aerospace and defense company Aviation Industry Corporation of China (AVIC), had registered the subsidiary to acquire TCM.[20] Because the buyer was foreign, the transaction required a CFIUS review.[21] CFIUS approved the transaction, leading to a 2013 academic conclusion from Amrietha Nellan that “the CFIUS review is not politically hostile against all Chinese investors.”[22] Teledyne Technologies framed the sale as an opportunity that “allows Teledyne to focus on its core businesses” and “will allow Continental Motors to continue to be a global leader in the general aviation piston engine industry.”[23] CAT’s website explained AVIC’s acquisition as “strengthening the company’s market access” (as seen in figure 2), but did not explicitly highlight AVIC’s Chinese ownership.[24]

Figure 2: Continental Aerospace Technologies’ website detailing AVIC’s 2011 acquisition[25]

Commentary from Robert Goyer of FLYING Magazine in a 2010 article titled “A Sad Day? Continental Motors Sold to Chinese Firm” offered a sharper perspective, warning, “It’s hard to imagine Chinese owners keep all manufacturing in Alabama to support an emerging aviation movement on their home turf.”[26] Yet, nearly 15 years later, CAT continues to manufacture piston aircraft engines in Alabama.[27] And under AVIC’s control, CAT launched its current logo in 2019, saying that it was “signaling a new chapter of excellence.”[28] By highlighting CAT’s long-standing contributions to U.S. aviation, AVIC has used marketing to emphasize CAT’s storied American legacy while obscuring its Chinese ownership.

Yet, according to limited access to WireScreen’s China-focused business intelligence platform, China’s State-owned Assets Supervision and Administration Commission of the State Council (SASAC), which governs its state-owned enterprises, owns 100 percent of AVIC and 46.4 percent of CAT.[29]

With CAT in hand, China—largely through AVIC—is now on track to achieve three goals within the piston aircraft engine sector. The first goal is achieving supply chain independence in piston engine development. China’s “Made in China 2025” plan directs local governments and agencies to “establish an independent industrial system for engine development.”[30] Following its 2011 acquisition of CAT, AVIC successfully produced China’s first domestically developed horizontally opposed piston engine in 2013, “filling a gap in [China’s] general aviation power sector.”[31] As one Chinese aerospace company noted in 2016, AVIC’s purchase of CAT directly launched “China’s domestic development strategy for aviation piston engines.”[32] MOFCOM’s China Aviation Industry Development Research Center wrote contemporaneously that AVIC’s acquisition of CAT “represents a major step by AVIC International in implementing [its] strategy to ‘integrate into the global aviation supply chain.’”[33]

Building on that, China’s second goal is to increase its global market share in the piston aircraft engine industry. It accounted for approximately 14.8 percent of global production capacity as of 2023, according to an industry estimate, though China’s government likely has aspirations to further expand.[34]

The third goal extends beyond market access and commercial competition. The Department of Defense (DOD) has identified AVIC as a dual-use company that “designs and produces PRC’s military aircraft,” while the Air Force’s China Aerospace Studies Institute has described AVIC “as if Lockheed Martin, Northrup Grumman, Sikorsky, at least parts of Boeing and Raytheon, and essentially all other domestic aviation companies were all subsidiaries of a single corporation.”[35]

CAT is key to AVIC’s dual-use ambitions in the current era of modern warfare that relies heavily upon unmanned aerial vehicles (UAVs).[36] In a 2016 article titled “Development Status and Trends of Advanced Power Systems for High-end Combat UAVs at Home and Abroad,” Chengdu Aerospace Superalloy Technology, which according to WireScreen is a defense supplier, wrote that “in the next few years, domestic high-end unmanned combat aircraft will be able to use domestically developed power systems,” and attributed that accomplishment in part to AVIC’s acquisition of CAT.[37]

A 2022 article by a frequent commenter on China’s military highlights AVIC’s acquisition of CAT in conjunction with “years of digestion and absorption” that has successfully led to China’s successful development of a heavy fuel oil piston aircraft engine industry, which allows Chinese drones “to fly at higher altitudes, have a longer flight time, and carry a heavier payload.”[38] China’s domestically-produced SAIC LE-500 Xiaoying light aircraft, which has an armed military variant, allegedly uses CAT piston diesel engines.[39]

The U.S. government has taken steps to limit risk exposure to AVIC’s status as a PLA supplier. A 2020 executive order prohibits U.S. persons from investing in securities of companies tied to the Chinese military, which the Department of the Treasury’s (USDT’s) Office of Foreign Assets Control (OFAC) enforces through its Non-SDN Chinese Military-Industrial Complex Companies (NS-CMIC) list, to which it added AVIC—and therefore its subsidiary CAT—in 2021.[40] Additionally, DOD included AVIC on its Section 1260H list in the NDAA for Fiscal Year (FY) 2021, which identifies Chinese military companies operating in the United States and works in conjunction with other laws that limit or prohibit government procurement and other engagements with listed companies.[41]

Yet, the U.S. government imposes few restrictions on CAT itself. Following its acquisition by AVIC, the company operates under Federal Aviation Administration regulations and can acquire other U.S. aerospace companies.[42] In 2013, CAT acquired Germany’s bankrupt Thielert Aircraft Engines, which supplied engines for the Gray Eagle Unmanned Aircraft System—a key component of the U.S. Army’s Aviation Modernization Plan.[43] Notably, Thielert Aircraft Engines’ lead engineer has ties to Beihang University, one of China’s “Seven Sons of National Defense.”[44]

Research companies including Datenna and BluePath Labs have flagged risks that AVIC’s acquisition of CAT present, but they only scratch the surface.[45] For example, although CAT cannot undertake U.S. defense work due to DOD listing AVIC on its Section 1260H list, the company likely faces no barriers in hiring personnel with security clearances or defense experience. An August 2025 job posting for a senior engineer III sought a candidate who “approaches all engineering work with a security lens” and could “actively look for security vulnerabilities including protection of intellectual property, import and export compliance.”[46]

In 2020, the Small Business Administration awarded CAT with a $7.43 million Paycheck Protection Program loan, which was later fully forgiven.

CAT’s Mobile, Alabama location gives the company access to a hub of aerospace talent.[47] Mobile’s University of South Alabama, Coastal Alabama Community College’s Alabama Aviation Center (AAC), and Embry-Riddle Aeronautical University’s Mobile sites offer aerospace programs and Reserve Officers’ Training Corps opportunities.[48] While many of the United States’ future aerospace engineers receive their education in Mobile, that talent does not all go to U.S. aerospace companies, U.S. allies’ companies, or the U.S. military.[49]

Instead, some of that talent goes to CAT, which actively engages with Mobile’s aerospace-focused education institutions by offering free planes to AAC, hiring students as interns, organizing its own Aviation Technician Advanced Training Program, and lobbying in its interests, for example publicly calling on the University of South Alabama to design a new supply chain major in part because it “would greatly improve the skill sets of Continental.”[50] CAT has also engaged with other U.S. aerospace hubs not necessarily near Mobile, such as donating to a state government-backed aviation program in Tennessee.[51] In return, CAT ensures a pipeline of skilled employees: For example, AAC lists CAT as one of many “leaders in the aviation industry” in the area that needs “trained, reliable employees to keep their operations moving.”[52]

CAT shares Mobile Aeroplex at Brookley—which was previously a U.S. Air Force base—with U.S. defense suppliers such as Airbus, Safran, and MAAS Aviation, as well as military users including the National Guard, Army Reserves, Marine Corps Reserves, and Coast Guard.[53] Given China’s history of targeting U.S. aviation companies for IP and military secrets, this location provides AVIC with potential access to sensitive industrial and human resources.[54] Cybersecurity company CrowdStrike has suggested that AVIC has “benefited significantly from the cyber efforts of the MSS [Ministry of State Security].”[55]

CAT also potentially provides China’s intelligence apparatus with an opportunity to collect intelligence on U.S. aerospace talent. China’s 2017 National Intelligence Law obligates organizations and citizens to support national intelligence work, which could require CAT to provide information on current or former employees of interest.[56] For example, one former CAT engineer who worked at the company both before and following its AVIC acquisition later assumed senior roles at U.S. defense contractors including SpaceX and Raytheon.[57]

AVIC can also access U.S. government funding and support through CAT’s continued presence in the United States. The Alabama Department of Commerceassisted CAT in building a new $75 million facility to produce piston and turbine engines and parts for light aircraft in 2018, and selected CAT as a recipient for a Governor’s Trade Excellence Award in 2022.[58] The Illinois state comptroller approved in 2021 a $78,000 contract of educational funding to go to CAT.[59] In 2020, the Small Business Administration (SBA) awarded CAT with a $7.43 million Paycheck Protection Program loan, which was later fully forgiven.[60]

Post-AVIC acquisition, CAT employs U.S. workers, pays taxes, manufactures goods for U.S. export, and engages with local institutions.[61] But its operational structure and branding obscure its Chinese ownership, granting AVIC—and, by extension, China’s government and military—substantial strategic and competitive advantages in the aerospace sector.

California Manufacturing & Engineering Company (CMEC)

|

Figure 3: Early Swedish hydraulic lift, 1929[62]

|

In 1920s Sweden, cities installed hydraulic lifts on vehicles so workers could safely change streetlights, as seen in figure 3.[63] Over the decades, this technology evolved into boom and scissor lifts, forming today’s aerial work platforms (AWPs) industry—machines that provide safe access to elevated work areas for construction, industrial, and military applications.[64] By the 1970s, U.S. companies were building larger, taller, and more innovative AWPs, setting global standards.[65]

Today, one of the United States’ leading AWP manufacturers calls itself “MEC Aerial Work Platforms.”[66] It traces its roots back to Mayville Engineering Company (MEC), a legacy American brand supplying components for commercial vehicles, data centers, and military platforms.[67] MEC has long supplied the U.S. defense sector with assemblies for tactical wheeled and military vehicles.[68] In 1976, MEC began producing AWPs, and by 2004, another company acquired MEC’s AWP arm and renamed it California Manufacturing & Engineering Company (CMEC).[69]

Between 2016 and 2024, Chinese AWP manufacturer Zhejiang Dingli Machinery Co., Ltd. (Dingli) took control of CMEC. Dingli, whose AWP product lineup is pictured in figure 4, became a supplier to CMEC in 2016, then bought a 25 percent stake in 2018.[70] At the time, Dingli described its rationale: “America is the originator and headstream of aerial working platform, which has the world-class access equipment manufacturers. Therefore, the door is shut upon the face of foreign products of the same kind which want to enter the American market in most cases.”[71] Dingli raised its ownership to 49.8 percent in 2023 and ultimately acquired the remaining 50.2 percent in 2024.[72] Reporting of Dingli’s acquisition of CMEC suggests that the transactions were private-share sales instead of open market purchases.[73] The Chinese law firm working with Dingli, Dacheng Law Offices, stated in a 2024 news release that the acquisition was “approved by CFIUS within a relatively short period of time.”[74]

Figure 4: Dingli’s AWP product lineup[75]

Following the acquisition, Dingli chose to rebrand CMEC into MEC Aerial Work Platforms, although the company’s official trade name remains CMEC.[76] Dingli explained to a journalist at the time that it chose to use the MEC branding “because it is popular and has historical significance in the region.”[77] Today, CMEC maintains strong visual and branding ties to MEC. Visitors to the CMEC website encounter historical narratives that reinforce continuity with the original MEC brand and see a logo that looks nearly identical to MEC’s, as seen in figure 5 and figure 6.[78]

|

Figure 5: MEC’s logo as of 2025[79]

|

Figure 6: CMEC’s logo as of 2025[80]

|

Furthermore, CMEC’s “Our History” page mentions neither the Dingli acquisition nor any ties to China.[81] CMEC executives simply refer to the company as “MEC.”[82] The only differences are subtle, such as using a red “®” instead of MEC’s black and white “®.”[83] To be clear, this is not trademark infringement—especially since CMEC owns an “MEC” trademark—but it appears to be using MEC’s branding to portray itself as something it no longer is.[84]

MEC and CMEC could not be more different. While MEC is a longstanding U.S. defense supplier, CMEC’s new parent company, Dingli, is a defense supplier to the PLA.

In 2013, Dingli obtained PLA clearances allowing it to conduct defense research and manufacture national defense equipment.[85] The year before, it had sold ¥14.62 million (approximately $2.3 million) in equipment to “a certain PLA unit”—its third-largest customer in 2012.[86] In 2016, Dingli signed a framework agreement for Military-Civilian Fusion strategic cooperation with “a unit of the PLA.”[87] The agreement gave some details into the PLA unit, saying it is “a professional underground engineering construction unit with rich experience in underground engineering excavation [and] complex structural recovery.”[88] Dingli operates “a research, testing, and training base” for the unnamed PLA unit.[89]

In 2018, an article described Dingli as having “continuously supplied a wide range of national defense and military equipment to the army,” and had specifically supplied bridge-type AWPs that “fully meet the military’s requirements for modern aerial work equipment.”[90] Dingli also operates its own Iron Army training camp for employees, as seen in figure 7, emphasizing PLA-style discipline and team-building.[91]

Figure 7: Dingli’s Iron Army training camp[92]

A 2015 Dingli document described China’s AWP sector: “A shortage of high-end domestic production has allowed imported products to dominate areas such as military engineering.”[93] Dingli’s journey to becoming a PLA defense supplier has likely helped China shore up its defense supply chains by localizing dual-use AWP production.

Beyond military goals, Dingli has also helped China achieve economic goals. Dingli stated in a 2024 document that it plans to “steadily expand its presence in North America” through CMEC, carrying out a strategy that a 2018 profile of Dingli’s founder and chairman, Xu Shugen, described as “to break the long-standing monopoly of European and American companies in the AWP sector.”[94] The following year, China’s government inducted Xu into its Ten Thousand Talents Science and Technology Entrepreneurship Leading Talents Program, which bestows support upon individuals “whose entrepreneurial projects are in line with the development direction of [China’s] strategic emerging industries and are in a leading position.”[95]

Following Dingli’s acquisition of CMEC, which cost approximately $90 million, Dingli shifted much of its manufacturing to its China-based factories and expanded its U.S. operations to focus more on servicing the U.S. market and increasing research and development (R&D) investment.[96] With CMEC as a subsidiary, Dingli now has a trusted brand and existing operations base with which to access the U.S. market with prices that undercut U.S. AWP companies. The U.S. Department of Commerce (DOC) determined in 2025 that Dingli had sold AWPs in the United States at prices below normal value between April 2023 and March 2024 at a weighted-average dumping margin of 9.75 percent, having initially investigated Dingli’s trade practices following a petition filed by two of the largest U.S. AWP companies: JLG Industries and Terex Corporation.[97]

Two factors drive Dingli’s U.S. dumping: endogenous market forces—such as lower labor costs, especially following CMEC’s outsourcing of manufacturing to China—and exogenous, market-distorting factors such as PRC subsidies. DOC preliminarily found a subsidy rate of 79.3 percent for Dingli and its subsidiaries between January and December 2022.[98] For example, in 2016, a Chinese provincial government exempted Dingli from corporate income tax of ¥19.75 million (approximately $2.77 million) in preferential policies.[99] Those subsidies align with Dingli’s ownership structure: According to WireScreen, after Xu—who owns nearly half the company—the next-largest shareholders are a cluster of Chinese state-owned financial institutions, including CITIC Securities Company Limited and the investment arms of Agricultural Bank of China, China Merchants Bank, and Bank of Communications.[100]

Dingli’s founder and chairman, Xu Shugen, described the company’s goal: “To break the long-standing monopoly of European and American companies in the aerial work platform sector.”

As of 2022, CMEC indirectly participated in U.S. federal procurement via H&E Equipment Services, a federal contractor later acquired by United Rentals that has supplied equipment to Department of Homeland Security (DHS) and DOD in the past.[101] Dingli integrates its AWPs with remote monitoring and motion sensor technologies, and since Dingli increasingly manufactures CMEC’s machinery in China, it stands to reason that it might also integrate CMEC’s AWPs with these technologies.[102]

If CMEC’s machines are ever used in sensitive U.S. locations, they could present a potential vector for national security concerns, especially following a 2024 congressional investigation that found potential espionage risks on Chinese-built cranes deployed at U.S. ports.[103] To be clear, there is no evidence that CMEC’s products present this type of risk, but it is the kind of cybersecurity and supply chain questions regulators should be asking of any U.S.-based company owned, in part or in full, by China’s government or companies that contract with the PLA.

CMEC is a U.S.-based company that underwent a U.S. government-approved foreign acquisition, and its logo’s resemblance to MEC’s logo does not constitute trademark infringement. Yet, beneath its familiar U.S. facade and affordable AWP products is a Chinese company whose expansion into the United States aims to secure China’s long-term economic advantage in the AWP sector and ultimately profit a PLA supplier.

Farasis Energy

In March 2025, the Chinese company Farasis Energy unveiled an electric vehicle (EV) battery capable of charging from 10 to 80 percent in just eight and a half minutes—a full-cycle performance that outpaces Tesla’s and other EV companies’ fastest chargers.[104] Farasis Energy grew from an American startup into one of China’s top companies in its cutthroat battery industry. But behind its technological breakthroughs lies a story of strategic government guidance, IP transfer, and obfuscation.

An American, Keith Kepler, and a Canadian, Yu Wang, founded Farasis Energy in Silicon Valley in 2002.[105] Both men brought with them valuable experience in energy storage technology. Kepler worked at the Battery Development Group at Argonne National Laboratory in the late 1990s.[106] At the time, Argonne was spearheading energy storage research for the Partnership for a New Generation Vehicle, a U.S. Department of Energy (DOE) program collaborating with the U.S. auto industry.[107] During the same time, Wang worked for NEC Moli Energy, a Canadian research company that in 1984 commercialized the world’s first rechargeable lithium battery.[108]

Between its founding in 2002 and 2009, Farasis Energy secured over $6 million in Small Business Innovation Research (SBIR) awards for novel energy storage technologies, including a contract with the U.S. Navy.[109] The company also received funding for a separate project supported by the Defense Advanced Research Projects Agency (DARPA).[110] Then, in 2009, Farasis Energy moved to China.[111] Farasis Energy’s website today explains the move that “at the time, it was simply too cost-prohibitive to manufacture li-ion batteries in the US, and so operations were moved to Ganzhou, Jiangxi, China.”[112]

Chinese language documents tell a different story. As early as 2006—during which it was receiving U.S. government funding and began work on the DARPA-funded project—Farasis Energy had signed a letter of intent to form a joint venture in Jiangxi Province, China, to manufacture products based on the company’s technology.[113] In 2009, the company established a joint venture with the Chinese state-owned company Manyuan Construction, contributing ¥175 million (approximately $25.6 million) worth of patents and proprietary technology related to lithium manganese oxide materials and lithium-ion batteries as its capital stake, while Manyuan Construction contributed ¥75 million (approximately $11 million) in cash.[114] Articles described Farasis Energy’s relocation to China as CEO Wang having “brought with him the technology and patents he had amassed over the years” and how Wang was “bringing with him cutting-edge lithium battery technology from Silicon Valley.”[115]

China’s government additionally used talent plans to seal the deal. Around the time of Farasis Energy’s relocation, China’s government inducted Wang into the Thousand Talents Plan (TTP) as an “Entrepreneurial Talent,” a program that specifically targets overseas scientists and entrepreneurs who “possess independent intellectual property rights or master core technologies, [or] have overseas entrepreneurial experience.”[116] One news article describing Wang’s accolades retroactively redacted Wang’s induction into the TTP, as seen in figure 8, which aligns with China’s government’s 2018 instruction that “the phrase ‘Thousand Talents Plan’ should not appear in written circulars/notices.”[117]

Figure 8: Redacted mention of Wang’s TTP induction[118]

In 2011, a Jiangxi Province municipal government inducted Wang, Kepler, and Weigong Zheng—then Farasis Energy’s vice president of production of China operations—into the Jiangxi Ganpo Talent 555 Project.[119] The talent plan had been created in 2010 to “bring in 500 urgently needed high-level talents from home and abroad to innovate and start businesses in Jiangxi.”[120] As part of the talent plan, Jiangxi’s provincial government supported inductees by paying them between ¥100,000 and ¥3 million (approximately $15,000 to $460,000) and supplying benefits such as subsidized housing.[121]

According to the Federal Bureau of Investigation, China’s talent plans “incentivize its members to steal foreign technologies needed to advance China’s national, military, and economic goals.”[122] This is not to say that Farasis Energy did this, but that some if not many in PRC talent plans engage in these activities. Another Farasis Energy executive, Jiang Junwei, was also a TTP inductee, having worked at Farasis Energy between 2015 and 2019 following managerial positions at 3M and Johnson Controls, Inc. between 2005 and 2010.[123]

Articles described Farasis Energy’s relocation to China as CEO Wang having “brought with him the technology and patents he had amassed over the years.”

Between 2009 and 2025, China’s government subsidized and slowly took control of Farasis Energy. Local governments in Jiangxi Province provided land and financing for its first factories, smoothed the path for fundraising, and helped the company recruit talent.[124] National-level investors, including China Reform Holdings Corporation and China State-Owned Capital Venture Investment Fund, poured billions of renminbi in equity into Farasis Energy, framing it as a strategic asset in the country’s push for developing EVs.[125] The investors also lent support that went beyond capital, with officials personally leading site inspections, securing Farasis Energy’s headquarters facilities, and forming business partnerships with Chinese automakers on the company’s behalf.[126] In 2016, China’s former premier, Li Keqiang, inspected Farasis Energy’s facilities, as seen in figure 9, and praised the company.[127]

Figure 9: China’s former premier, Li Keqiang, inspecting Farasis Energy’s facilities, 2016[128]

That trajectory culminated in 2025, when Guangzhou Industrial Investment Holding Group (GIIHG)—a municipal state-owned enterprise—became Farasis Energy’s controlling shareholder, with GIIHG and its affiliated parties holding 16.1 percent ownership.[129] GIIHG, which had attempted to increase its ownership in the company since 2022, also installed its deputy general manager, Xie Yong, as chairman.[130] Because GIIHG is owned by the Guangzhou municipal government, China’s government effectively gained state control of Farasis Energy through this transaction. In addition, the acquisition covered all international subsidiaries, meaning Farasis Energy’s original headquarters in Silicon Valley became Farasis Energy USA, a wholly-owned subsidiary of Farasis Energy.[131]

With GIIHG’s takeover, the setup was complete. China’s government controls Farasis Energy through a number of investments, as seen in table 1, which uses WireScreen data to show China’s beneficial direct and indirect ownership of the company, which includes GIIHG’s stake.[132] China’s government has the company positioned exactly where it wants it: anchored in China with generous industrial policy support and access to world-class manufacturing capacity, while still maintaining access to R&D, talent pipelines, IP, and funding streams in Silicon Valley.

Table 1: Farasis Energy, Chinese government beneficial ownership[133]

|

Beneficial Owners |

Ownership Share |

|

Department of Finance of Guangdong Province |

7.9% |

|

State Council |

4.0% |

|

State-Owned Assets Supervision and Administration Commission of Guangdong Province Government |

2.5% |

|

China Construction Bank Corporation (CCB) |

2.4% |

|

China Pacific Insurance (Group) Co., Ltd. |

2.3% |

|

State-Owned Assets Supervision and Management Commission of Shenzhen Municipal People’s Government |

1.8% |

|

Guangzhou Automobile Group Co., Ltd. |

0.7% |

|

Hefei Municipal State-Owned Assets Management Committee |

0.3% |

|

State-Owned Assets Supervision and Administration Commission of the State Council (SASAC) |

0.1% |

Between 2002 and 2023, the U.S. government and USCAR funded Farasis with $13.49 million, with $9.21 million of that coming after its relocation to China in 2009.

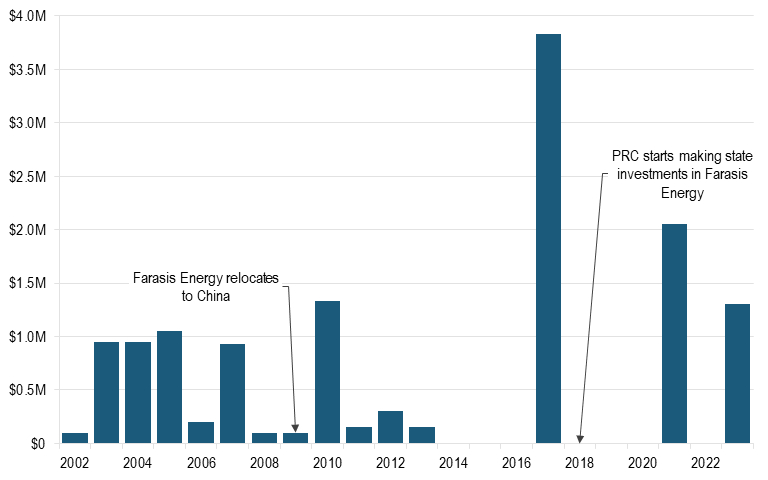

Even following its relocation to China, Farasis Energy USA has had no problems accessing U.S. government funding. Between 2009 and 2013, Farasis won a total of $2.03 million in SBIR grants, including awards from both the U.S. Navy and Air Force.[134] Between 2017 and 2023, the United States Advanced Battery Consortium LLC (USABC) awarded Farasis Energy USA with four cost share contracts totaling $14.36 million, of which DOE funded half of at least one of the contracts.[135] USABC is a subsidiary of the United States Advanced Battery Consortium (USCAR), which is funded by DOE as well as Ford Motor Company, General Motors, and Stellantis.[136] In total, between 2002 and 2023, USCAR and the U.S. government funded Farasis with $13.49 million, with $9.21 million of that coming after its relocation to China in 2009, as seen in figure 10.[137] A Chinese article from 2021 about Farasis Energy described its funding from USCAR as a “stepping stone” to “open up the North American market.”[138]

Figure 10: U.S. government and USCAR funding awarded to Farasis Energy, 2002–2023[139]

A 2024 report from the Carnegie Endowment for International Peace concludes that the United States’ only chance to compete with China in the future battery market is to quickly commercialize emerging battery technologies such as lithium iron phosphate and solid state. The report laments the fact that “of the $24 billion in U.S. federal grants and loan guarantees through the Department of Energy over the last two years … more than 90 percent of the funding has supported lithium-ion batteries.”[140]

Farasis Energy USA’s most recent U.S. government subsidization, which funded the company with $2.6 million between 2023 and 2025, was “to develop beyond lithium-ion battery technologies,” making it part of the 10 percent exception to focus on next-generation batteries.[141] This direction was the right one: R&D investments in advanced batteries can help the United States compete with China in the global battery market, and, as the Information Technology and Innovation Foundation (ITIF) has noted, enable clean energy technologies to challenge fossil fuels on price and performance.[142] Yet, in this case, that taxpayer-funded innovation flowed to a Chinese state-owned company.

Unlike CAT or CMEC, Farasis Energy does not fully obscure its ties to China; its U.S. subsidiary openly acknowledges its relocation to China.[143] Yet, the company obscures the full story of its Chinese-government-directed ownership, IP transfer, and talent integration. While Farasis Energy USA contributes to the U.S. economy through employment and innovation, China’s economy ultimately gains much more, since Farasis Energy USA’s U.S.-government-subsidized R&D helped its parent company improve its R&D. By relocating its supply chains and manufacturing to China and benefiting from PRC subsidies, Farasis Energy is well-positioned to compete for global market share in batteries, with profits primarily benefitting Chinese shareholders, including state-owned entities. Speaking about Farasis Energy’s state-sponsored ownership, Wang said, “[W]e hold distinct advantages over foreign competitors.”[144]

Understanding Patterns of Chinese Economic Obfuscation

As this report’s case studies illustrate, Chinese companies use a range of tactics to obscure the PRC’s government influence in the U.S. economy. Understanding these patterns is key to accurately assessing the risks and designing effective policy responses.

Defining Nefarious Economic Obfuscation

Not all branding choices, foreign investment, or U.S.-based Chinese operations present risks to national security or to competitiveness in key industries, including dual-use industries.

Branding vs. Obfuscation

The concern behind this report’s three case studies is not merely about branding. Companies such as Farasis Energy openly acknowledge their Chinese ownership, and CMEC’s logo resemblance to MEC’s is legal. Branding alone does not constitute a national security issue. The core problem identified in this report is obfuscation of ownership, governance, and strategic intent—and the U.S. government’s failure to detect and address that obfuscation.

China vs. Other Countries

Most foreign investment in the U.S. economy does not pose a problem. Allied company investment, especially new greenfield investment, can add valuable production and capabilities to the U.S. economy. In contrast, China’s investments into the U.S. economy highlighted in this report are different. They represent successful execution of China’s coordinated strategy to gain economic and technological leverage over the United States by hollowing out U.S. competitors.[145] The distinction is between benign foreign investment and state-supported efforts to undercut critical industries.

Noncritical vs. Strategic Sectors

The United States should not close itself off to all Chinese investment, especially greenfield investment. The issue is not whether Chinese companies operate in the U.S. market, but where and how they do so. Some degree of branding obfuscation—such as the Chinese retailer MINISO, which is expanding in the United States and has previously styled itself as Japanese—poses little risk, especially if the company operates in noncritical consumer sectors.[146] These industries have minimal bearing on U.S. national power, and market forces can readily replace lost supply.[147]

The calculus changes when Chinese investment targets defense, dual-use, or enabling industries.[148] In these sectors, ownership transparency matters because the technologies and supply chains involved directly or indirectly support key U.S. industrial and defense capabilities.[149] CAT, CMEC, and Farasis Energy all operate in dual-use industries. Their products are not intrinsically defense-specific, but could—and in CMEC’s and possibly CAT’s cases, do—support defense operations. At the same time, some Chinese participation in dual-use industries, such as import-export logistics, critical minerals, or advanced components—as well as many enabling industries—remains integral to U.S. supply chains today. That reality underscores the need for the U.S. government to de-risk inbound greenfield investment from China, rather than outright decouple.

Shifting Tactics of Obfuscation

CAT is just one of numerous AVIC-controlled companies operating in the United States.[150] For example, AVIC also acquired the U.S. company Henniges Automotive in 2015.[151] Some of the same risks outlined in the CAT case study likely also apply to Henniges Automotive. While this report’s case studies represent individual examples of China’s obfuscation of ownership and intent, they also represent just the tip of the iceberg.

Additionally, while CAT, CMEC, and Farasis Energy all obscure their ties to China in different ways, they share a common pattern: each underwent acquisitions or investment from entities linked to China’s government. This illustrates one form of obfuscation—masking ownership through corporate acquisitions or partial stakes—but there are many other mechanisms.

These three cases, additionally, represent an earlier wave of Chinese overseas investment activity. China’s current tactics to gain footholds in the U.S. economy have likely evolved to become more subtle than headline-grabbing acquisitions and instead feature quieter financial maneuvers. At this point, CAT, CMEC, and Farasis Energy are historical, “right of boom”—that is, post-incident—examples that nonetheless provide useful evidence of PRC obfuscation.

The current generation of obfuscation toward U.S. companies still “left of boom” will still feature obscured Chinese influence not only through rebranding or “doing business as” names that hide the ultimate parent company, but also through less-visible corporate structures such as debt holdings, layered venture funding, or private companies with opaque capitalization. For a more recent example, the autonomous trucking company TuSimple billed itself as a dual-headquartered startup in Silicon Valley and China and signed a national-security agreement with the U.S. government but ultimately siphoned money and trade secrets to China.[152]

Policy solutions should therefore not just focus on tactics seen in “right of boom” cases but also account for emerging obfuscation that evolves and adapts to regulatory and market conditions.

Gaps in U.S. Oversight

While CMEC is subject to duties for subsidization and dumping, and CAT faces restrictions due to its AVIC ownership, all three case studies show that the U.S. government has historically acted too late or not at all. CFIUS allowed CAT and CMEC’s acquisitions, and CAT and Farasis Energy received millions of dollars in U.S. subsidies long after their ties to China’s government had been made clear.

In other examples, the U.S. government has instituted checks on Chinese investments in the U.S. economy, but they are still flawed. For example, Zheng Weigong—one of three Farasis Energy employees that China’s government inducted into the Jiangxi Ganpo Talent 555 Project talent plan—later joined a different Chinese battery company, EVE Energy.[153] WireScreen identifies EVE Energy as a state security contractor with defense contractor involvement.[154]

The U.S. government listed EVE Energy in the 2024 NDAA as one of six Chinese battery companies that DOD cannot contract with after October 2027.[155] Why the six companies were given until that late date is not clear. A proposed bill in the current sessions of the House and the Senate—Decoupling from Foreign Adversarial Battery Dependence Act—would similarly prohibit DHS from contracting with EVE Energy and the other five Chinese battery companies named in the 2024 NDAA.[156] However, that bill has yet to pass in the Senate, where it also failed to pass the originally introduced bill in the 118th Congress.[157] And this whack-a-mole approach, while better than nothing, is fundamentally too limited.

Moreover, this example illustrates two issues with current legislation seeking to protect the U.S. economy from Chinese economic obfuscation:

1. Failure to defend a large attack surface. Neither the NDAA’s future cutoff of EVE Energy’s ability to become part of the U.S. defense industrial base nor the proposed bill focused on protecting DHS’s supply chain are the right solution. DOD and DHS are just two avenues through which a company such as EVE Energy can access the expansive amount of procurement the U.S. government offers.

For example, in 2022, EVE Energy was able to access U.S. government funding at the subnational level in Ohio, when the state’s private economic development corporation, JobsOhio, awarded a $1 million grant to EVE Energy North America to construct a lithium-ion battery research facility.[158] JobsOhio had faced scrutiny in the past for awarding funding to companies with concerning ties to China, but the deal went through anyway.[159] EVE Energy expects its new research facility to create a mere 12 new jobs.[160]

Twelve new jobs are not worth $1 million, nor does that number of new jobs offset R&D gains from the $1 million that EVE Energy will use to compete with U.S. battery companies in the future and feed into its defense work in China. On defending U.S. procurement power, a more whole-of-government approach is needed. And as the CAT case study shows, procurement is just one vector that can benefit Chinese companies operating obfuscated in the U.S. economy.

2. Struggles to identify risk. The U.S. government likely added EVE Energy and the other five Chinese battery companies to the NDAA due to their ties to China’s military.[161] Despite no identified open-source military ties for Farasis Energy, the company’s control by China’s government and long track record of using its operations in the U.S. economy to economically benefit China beg the question why Farasis Energy was not also on the NDAA’s list. The U.S. government is still deciding case by case which companies pose risk and which do not, rather than applying a consistent framework.

Policy Recommendations

This report’s case studies suggest the need for the U.S. government to more comprehensively approach transparency, ownership disclosure, and risk management of Chinese investment in the U.S. economy, especially within defense, dual-use, and enabling industries. The following recommendations explain how the U.S. government can strengthen its systems to reduce vulnerabilities to Chinese techno-industrial predation.

1. Strengthen CFIUS screening and oversight. As of 2020, CFIUS is implementing the Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA) in its screens.[162] FIRRMA states that CFIUS should also factor into its reviews “whether a covered transaction involves a country of special concern that has a demonstrated or declared strategic goal of acquiring a type of critical technology or critical infrastructure that would affect United States leadership in areas related to national security.”[163] Dingli’s acquisition of CMEC took place following this rule change. It is unclear if CFIUS cleared the transaction with mitigation measures imposed, but clearly chose not to block the transaction. One could argue that China acquiring a single U.S. AWP company may not, on its own, materially affect U.S. leadership in national security, but Dingli’s PLA connections put CFIUS’s decision into question.

Congress should expand FIRRMA to widen the definition of what would affect U.S. leadership. CFIUS’s mandate should encompass not only threats to U.S. leadership “in areas related to national security” but also industries critical to economic and strategic competitiveness, such as civilian aerospace engines, AWPs, and advanced batteries.[164]

CFIUS should also create a comprehensive registry of all Chinese-origin companies operating in the United States, including subsidiaries, joint ventures, firms with Chinese financing, and entities with partial Chinese government ownership. To ensure that the list is accurate and up to date, CFIUS should leverage private sector open source intelligence providers to both identify Chinese-controlled entities that may otherwise evade detection and ensure that the registry remains accurate and up to date.

2. Expand ownership disclosure. Congress should expand the Corporate Transparency Act to require Chinese-origin companies operating in U.S. power industries—industries that enable a strong military or give the United States leverage over other nations, especially China—to report beneficial ownership and operational control, including minority stakes, joint ventures, offshore subsidiaries, and IP transfer rights.[165] Using CFIUS’s registry, the Securities and Exchange Commission should collect detailed information on ownership and decision-making structures, while DOC should verify compliance and monitor access to dual-use technology and strategic assets. Companies that fail to provide full transparency should be barred from doing business in America, and CFIUS and DOC should have authority to enforce restrictions or divestment where necessary to protect U.S. national security.

3. Proactively use NDAA and CFIUS authority. Congress should direct NDAA authorities that the NDAA for FY26 mandate that agencies expand Section 1260H and related authorities to ensure that Chinese-origin companies in defense, dual-use, and enabling industries cannot indirectly advance military capabilities.[166] This should include explicit prohibitions on contracting, technology sharing, and participation in federally funded programs. The NDAA should also direct agencies to require ongoing reporting for Chinese companies, covering IP transfers, supplier relationships, and workforce development activities.

4. Block subsidies to PRC-financed companies. Federal agencies, led by the Office of Management and Budget, should bar companies with PRC financing from receiving U.S. government funding, tax incentives, or other financial support. The same should apply to companies with involvement in China’s military or dual-use programs. These checks should span both national and subnational levels, with CFIUS coordinating with state-level economic development offices. U.S. state policy has sped ahead on foreign adversary defensive regulation, but in many cases, these laws are flawed and could be better harmonized to national-level security priorities.[167]

Federal agencies such as DOE, DOD, National Science Foundation, and Department of Transportation, as well as federal agency-linked consortiums such as USCAR, should also implement pre-award due diligence to screen for Chinese ownership, operational control, or dual-use access before awarding grants or cooperative agreements. This would ensure that U.S. taxpayer funds support domestic innovation rather than foreign industrial strategy.

In addition, USDT, through CFIUS, working with funding agencies, should require companies that receive U.S. federal funding to obtain explicit U.S. government approval before relocating operations or substantial portions of their workforce or IP to China. This requirement would ideally be designed to not prevent legitimate global business activity but rather ensure that taxpayer-funded investments are not diverted to foreign jurisdictions in ways that could undermine U.S. strategic industrial capabilities.

5. Clarify brand obscuration practices. Companies such as CMEC maintain U.S. branding to obscure foreign ownership, misleading stakeholders and regulators. FTC, with congressional authority as needed, should issue guidance on truth-in-branding and ownership disclosure by requiring companies in defense, dual-use, or enabling industries to clearly disclose foreign state ownership or control in marketing, websites, and communications.

In addition, for Chinese companies operating in defense, dual-use, or enabling industries, Congress should consider legislation or FTC rulemaking to mandate disclosure of foreign state ownership or control in a standardized and visible manner.[168] This requirement would not apply to benign consumer sectors, where branding obfuscation poses minimal national security or economic risk, but would prevent companies in critical sectors from misleading U.S. consumers, investors, or regulators about their foreign affiliations.

6. Centralize interagency due diligence. USDT, along with DOC, DOD, and other relevant agencies, and with oversight from the House and Senate intelligence committees, should establish a single, interagency due-diligence database that integrates CFIUS, DOC, and federal grant-funding data to screen all potential recipients of federal awards, contracts, and research grants. As the Select Committee on the CCP’s Fox in the Henhouse 2025 report and a recent article, “Why Is the U.S. Defense Department Funding China’s Military Research?” underscore, a lack of data interoperability has enabled Chinese defense-linked institutions to receive U.S. funding through loopholes in agency coordination.[169] A unified system bringing together in-house capabilities and outsourced procured capabilities would automatically flag any entity on federal restriction lists (e.g., the Entity List, Section 1260H list, or the NS-CMIC list) before awards are approved.

Another area of improved intelligence sharing would be for CFIUS to integrate trade intelligence into its screens. DOC’s trade enforcement arm routinely collects detailed information on foreign corporate ownership, subsidy networks, and state involvement, producing rich data that overlaps with the national security risks CFIUS evaluates. In the CMEC case, DOC may have identified Dingli as a PLA supplier during its subsidization investigation, even though DOC’s investigations are not designed for national security screening. While DOC is part of CFIUS, it is unclear whether DOC would have shared this intelligence with CFIUS when the committee was conducting its own screen of Dingli.[170] There are no clear formal mechanisms for synthesizing such information, and the Government Accountability Office has documented interagency coordination gaps across U.S. efforts to mitigate national security risks from foreign investment in the U.S. economy.[171] CFIUS should establish a formal analytic mechanism—led by USDT in coordination with DOC’s International Trade Administration and Bureau of Industry and Security—to integrate dumping, subsidy, and export-control data into investment reviews.

Conclusion

This report’s case studies demonstrate a consistent pattern: Chinese companies use a variety of legal and financial structures, branding strategies, and investment pathways to obscure government influence and strategic intent in the U.S. economy. When these practices occur in defense, dual-use, or enabling industries, they can directly affect U.S. industrial, technological, and national security competitiveness. Current U.S. oversight mechanisms are narrow and reactive, allowing state-linked Chinese entities to access market trust and sensitive technologies. Implementation of the recommendations outlined in this report will help ensure the United States maintains an open economy while protecting critical sectors from strategic exploitation.

Acknowledgments

The author would like to thank Esther Serger for helping fact-check the report, and Stephen Ezell, Robert D. Atkinson, and Randolph Court for their reviews. Any errors are the author’s own.

About the Author

Eli Clemens is a policy analyst focusing on e-commerce and retail technology policy at ITIF’s Center for Data Innovation. Previously, he worked as an open source intelligence analyst and served as a Peace Corps Volunteer in China. He holds a Master of International Affairs degree from Columbia University’s School of International and Public Affairs and a B.A. from New York University.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent 501(c)(3) nonprofit, nonpartisan research and educational institute that has been recognized repeatedly as the world’s leading think tank for science and technology policy. Its mission is to formulate, evaluate, and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit itif.org/about.

Endnotes

[1]. Sheng Hetai, “Sheng Hetai: Improve Insurance Mechanisms, Support Chinese Companies ‘Going Global,’” Development Research Centre of the State Council, February 8, 2020, https://www.chinathinktanks.org.cn/content/detail/id/rjwzdg43; Chen Yangyong, “The Formation and Significance of Jiang Zemin’s ‘Going Global’ Strategy,” Party History and Literature Research Institute of the CPC Central Committee, July 12, 2012, https://www.dswxyjy.org.cn/n1/2019/0228/c425426-30909751.html.

[2]. Ministry of Commerce (MOFCOM), Report on Development of China’s Outward Investment and Economic Cooperation (Beijing: MOFCOM, February 2017), https://beadcn.com/fec/article/tzhzcj/tzhz/upload/zgdwtzhzfzbg2017.pdf.

[3]. Sheng Hetai, “Sheng Hetai: Improve Insurance Mechanisms, Support Chinese Companies ‘Going Global;’” “‘Going out’ requires ‘integration,’” Economic Daily, May 10, 2014, https://www.gov.cn/zhengce/2014-05/10/content_2676825.htm.

[4]. MOFCOM, Report on Development of China’s Outward Investment and Economic Cooperation.

[5]. Ibid.

[6]. Huang Manying, Wang Zhonghui, and Zheng Yijun, “Jointly Building the Belt and Road Initiative and Protecting Overseas Interests: Risk Insights and Countermeasures,” International Trade 6 (2025), https://www.caitec.org.cn/n9/sy_zkmt_gjmy/json/6868.html; Huang Manying, Wang Zhonghui, and Zheng Yijun, “Suggestions on strengthening the protection of China’s overseas interests in countries participating in the Belt and Road Initiative,” Academy of Ocean of China, October 13, 2025, https://aoc.ouc.edu.cn/2025/1012/c9824a508506/pagem.htm; “Who Are We,” Shihang Holdings Co., Ltd., accessed October 2025, https://www.shcontainer.com/about.html; Wukong, “Localization Construction of International Engineering Enterprises (I),” China Association of International Engineering Consultants, May 27, 2025, http://caiec.org.cn/detail.html?id=979757190074073088&name=%E4%B8%9A%E5%86%85%E4%BA%A4%E6%B5%81.

[7]. “Who Are We,” Shihang Holdings Co., Ltd.

[8]. Quoteresearch, “Quote Origin: The Capitalists Will Sell Us the Rope with Which We Will Hang Them,” Quoteresearch, February 22, 2018, https://quoteinvestigator.com/2018/02/22/rope/.

[9]. Department of State (DOS), “2025 Investment Climate Statements: China,” DOS, September 2025, https://www.state.gov/wp-content/uploads/2025/09/638719_2025-China-Investment-Climate-Statement.pdf.

[10]. Strider Technologies, “New Strider Report Reveals Scope and Scale of U.S. Academic Research Done in Collaboration with PLA-Affiliated Entities on STEM Technologies,” news release, October 14, 2025, https://www.prnewswire.com/news-releases/new-strider-report-reveals-scope-and-scale-of-us-academic-research-done-in-collaboration-with-pla-affiliated-entities-on-stem-technologies-302583110.html.

[11]. “Continental Aerospace Technologies,” Continental Aerospace Technologies, accessed October 2025, https://continental.aero/.

[12]. “The Legacy of Continental Motors: Powering America on Land and in the Air,” Automotive American, January 10, 2025, https://automotiveamerican.com/2025/01/10/the-legacy-of-continental-motors-powering-america-on-land-and-in-the-air/; Continental Aerospace Technologies, “Continental Motors® announces name change to Continental Aerospace Technologies™ and global rebranding,” news release, March 28, 2019, https://continentaldiesel.com/news-events/continental-motors-announces-name-change-to-continental-aerospace-technologies-and-global-rebranding/; Lakeshore Museum Center, “Teledyne Continental Motors Finding Aid” (archival collection, Lakeshore Museum Center, 2019), https://lakeshoremuseum.org/wp-content/uploads/2019/09/TCM-Finding-Aid.pdf.

[13]. Morgan Faust, “Continental Motors,” HistoricDetroit.org, March 8, 2019, https://historicdetroit.org/buildings/continental-motors; “Patton Tank engine V12 Continental AVI-1790-8M,” British American Infantry Vehicles BV, accessed October 2025, https://www.baiv.nl/patton-tank-engine-v12-continental-avi-1790-8m/.

[14]. “Our Heritage In The Skies,” Continental Aerospace Technologies, accessed October 2025, https://continental.aero/history/; Norman Polmar, “Historic Aircraft - The Grasshoppers, Part 1: The Planes,” Naval History Magazine, January 2014, https://www.usni.org/magazines/naval-history-magazine/2014/january/historic-aircraft-grasshoppers-part-1-planes.

[15]. “Continental Aerospace Technologies,” Continental Aerospace Technologies.

[16]. Lakeshore Museum Center, “Teledyne Continental Motors Finding Aid.”

[17]. Ibid.; Glenn Pew, “TCM Announces Temporary Plant Closures, More,” AVweb, October 3, 2009, https://avweb.com/avwebflash/news/tcm_closure_shutdown_continental_engine_employee_customer_201253-1.html (site discontinued); Mark Phelps, “Teledyne’s Continental Motors Unit Sold to Chinese Company,” FLYING, December 15, 2010, https://www.flyingmag.com/news-teledynes-continental-motors-unit-sold-chinese-company/.

[18]. Robert Goyer, “A Sad Day? Continental Motors Sold to Chinese Firm,” FLYING, December 14, 2010, https://www.flyingmag.com/blogs/going-direct/sad-day-continental-motors-sold-chinese-firm (site discontinued).

[19]. Teledyne Technologies Incorporated and AVIC International Holding Corporation, “Teledyne Technologies Agrees to Sell Teledyne Continental Motors to AVIC International,” news release, December 14, 2010, https://www.sec.gov/Archives/edgar/data/1094285/000095012310113274/v58132exv99w1.htm.

[20]. “Technify Motors (USA) Inc.,” Alabama Company Directory, accessed October 2025, https://al.ltddir.com/companies/technify-motors-usa-inc/.

[21]. Teledyne Technologies Incorporated and AVIC International Holding Corporation, “Teledyne Technologies Agrees to Sell Teledyne Continental Motors to AVIC International.”

[22]. Amrietha Nellan, “AVIC International a Success: How Regulatory Changes to CFIUS Has Limited Political Interference and Empowered Chinese Investors to Obtain a Successful Review,” UC Law Business Journal 9, no. 3 (2013): 517-538, https://repository.uclawsf.edu/cgi/viewcontent.cgi?article=1056&context=hastings_business_law_journal.

[23]. Teledyne Technologies Incorporated and AVIC International Holding Corporation, “Teledyne Technologies Agrees to Sell Teledyne Continental Motors to AVIC International.”

[24]. Ibid.

[25]. Ibid.

[26]. Goyer, “A Sad Day? Continental Motors Sold to Chinese Firm.”

[27]. “About Continental Aerospace Technologies™,” Continental Aerospace Technologies, accessed October 2025, https://continental.aero/about-us/; “Our Heritage In The Skies,” Continental Aerospace Technologies.

[28]. “Our Heritage In The Skies,” Continental Aerospace Technologies.

[29]. WireScreen dataset, accessed October 2025; “About Us,” State-owned Assets Supervision and Administration Commission of the State Council, accessed October 2025, http://en.sasac.gov.cn/aboutus.html. CAT’s parent company, Continental Aerospace Technologies Holding Limited, which has full ownership of CAT, is a publicly listed company on Hong Kong’s stock exchange, according to WireScreen data, leading to limited insight into CAT’s remaining 53.6 percent ownership.

[30]. State Council, “Notice of the State Council on the Publication of Made in China 2025” (translation, Center for Security and Emerging Technology, Georgetown University, March 2022), https://cset.georgetown.edu/wp-content/uploads/t0432_made_in_china_2025_EN.pdf.

[31]. Yu Shuang and Yu Jinli, “AVIC’s new aviation piston engine obtains certification to fill the domestic gap,” China Aviation News, June 9, 2013, https://www.chinanews.com/mil/2013/06-09/4915043.shtml.

[32]. “Industry News,” The Internet Archive, accessed October 2025, https://web.archive.org/web/20210927075101/http:/www.sccast.com/Industry/201610/29.html.

[33]. MOFCOM, “Investment Promotion Report On Unmanned Aerial Vehicle Industry” (Beijing: MOFCOM, November 2016), https://fdi.mofcom.gov.cn/resource/pdf/2020/03/02/dea0b9914c1b4abda67f3572cb252330.pdf.

[34]. “2024 Piston Engine Aircraft Research Report - Market Share, Industry Size, and Major Companies’ Market Share,” Hunan Beijiesi Information Consulting Co., Ltd., accessed October 2025, https://www.gelonghui.com/p/884065.

[35]. J.J. Long, Thomas Corbett, and Dan Shats, “Organization and Structure of the Aviation Industry Corporation of China (AVIC)” (China Aerospace Studies Institute, January 2024),

https://www.airuniversity.af.edu/CASI/Display/Article/3643494/organization-of-the-aviation-industry-corporation-of-china-avic/; Department of Defense (DOD), “Military and Security Developments Involving the People’s Republic of China 2024,” DOD, December 2024, https://media.defense.gov/2024/Dec/18/2003615520/-1/-1/0/MILITARY-AND-SECURITY-DEVELOPMENTS-INVOLVING-THE-PEOPLES-REPUBLIC-OF-CHINA-2024.PDF.

[36]. Major Mark Sauser, “Unmanned Aircraft and the Revolution in Operational Warfare,” Army University Press, July-August (2025): 54-64, https://www.armyupress.army.mil/Portals/7/military-review/Archives/English/JA-25/Unmanned-Aircraft-Revolution/Unmanned-Aircraft-Revolution-ua.pdf.

[37]. “Industry News,” The Internet Archive; WireScreen dataset, accessed October 2025.

[38]. Zhang Mi, “After 11 years of hard work, the Rainbow-4 heavy-fuel UAV has successfully completed its maiden flight, making island and plateau operations easier than ever,” Zhang Mi Talks About the World, August 20, 2022, https://new.qq.com/rain/a/20220820A07O0I00; Zhang Mi, “Equipped with universal hypersonic missiles, the US ‘science fiction warship’ seeks ‘re-employment,’” China Business Network, June 21, 2022, https://www.huaxia.com/c/2022/06/21/1207897.shtml.

[39]. “SAIC LE-500 Xiaoying,” Airframer, accessed October 2025, https://www.airframer.com/aircraft_detail.html?model=500%20Xiaoying.

[40]. “Sanctions List Search,” Office of Foreign Assets Control (OFAC), accessed October 2025, https://sanctionssearch.ofac.treas.gov/Details.aspx?id=30925; “Chinese Military Companies Sanctions,” OFAC, accessed October 2025, https://ofac.treasury.gov/sanctions-programs-and-country-information/chinese-military-companies-sanctions; Executive Order 13959, “Addressing the Threat From Securities Investments That Finance Communist Chinese Military Companies,” Federal Register, November 17, 2020, https://www.federalregister.gov/documents/2020/11/17/2020-25459/addressing-the-threat-from-securities-investments-that-finance-communist-chinese-military-companies.

[41]. Servicemember Quality of Life Improvement and National Defense Authorization Act for Fiscal Year 2025, H.R. 5009, 118th Cong. (2024); “Countering Unwanted Influence in Department-Funded Research at Institutions of Higher Education” (memorandum, Department of Defense, June 2023), https://media.defense.gov/2023/Jun/29/2003251160/-1/-1/1/COUNTERING-UNWANTED-INFLUENCE-IN-DEPARTMENT-FUNDED-RESEARCH-AT-INSTITUTIONS-OF-HIGHER-EDUCATION.PDF; National Defense Authorization Act for Fiscal Year 2024, H.R. 2670; Adelicia Cliffe and Alexandra Barbee-Garrett, “New Year, Updated List: The U.S. Department of Defense Updates Its List of Chinese Military Companies with Ancillary Supply Chain and USG Contracting Impacts,” Crowell, January 14, 2025, https://www.governmentcontractslegalforum.com/2025/01/articles/supply-chain/new-year-updated-list-the-u-s-department-of-defense-updates-its-list-of-chinese-military-companies-with-ancillary-supply-chain-and-usg-contracting-impacts/; Department of the Treasury (USDT), Entities Identified as Chinese Military Companies Operating in the United States in Accordance with Section 1260H of the William M. (“Mac”) Thornberry National Defense Authorization Act for Fiscal Year 2021 (Public Law 116-283), USDT, January 2025, https://media.defense.gov/2025/Jan/07/2003625471/-1/-1/1/ENTITIES-IDENTIFIED-AS-CHINESE-MILITARY-COMPANIES-OPERATING-IN-THE-UNITED-STATES.PDF.

[42]. Federal Aviation Administration, “Global Alternative Method of Compliance (AMOC) to Airworthiness Directive (AD) 2023-09-09” (letter to Continental Aerospace Technologies, July 2025), https://continental.aero/wp-content/uploads/2025/07/AMOC_AD_2023-09-09.pdf; “Mattituck Services To Purchase Southern Avionics And Communications,” Plane & Pilot, June 26, 2014 https://planeandpilotmag.com/mattituck-services-to-purchase-southern-avionics-and-communications/.

[43]. Editorial Staff, “Continental Buys Thielert Aircraft Engines,” AVweb, July 22, 2013, https://avweb.com/news/continental-buys-thielert-aircraft-engines/; “Gray Eagle,” General Atomics Aeronautical, accessed October 2025, https://www.ga-asi.com/remotely-piloted-aircraft/gray-eagle.

[44]. Select Committee on the CCP, “New Investigative Report Uncovers Billions in Taxpayer Money Used to Fund Chinese Military Apparatus,” news release, September 5, 2025, https://selectcommitteeontheccp.house.gov/media/press-releases/new-investigative-report-uncovers-billions-in-taxpayer-money-used-to-fund-chinese-military-apparatus; “Beihang University,” Australian Strategic Policy Institute, accessed October 2025, https://unitracker.aspi.org.au/universities/beihang-university; “Berlin - Brandenburg Branch: The Genesis and Development of Europrop International and the TP400-D6 engine,” Royal Aeronautical Society, accessed October 2025, https://www.aerosociety.com/events-calendar/berlin-brandenburg-branch-the-genesis-and-development-of-europrop-international-and-the-tp400-d6-engine/; “Günter Kappler,” Technische Universität München, accessed October 2025, https://www.emeriti-of-excellence.tum.de/eoe/tum-emeriti-of-excellence-eoe-portraits/portraits-a-z/guenter-kappler/.

[45]. J.J. Long, Thomas Corbett, and Dan Shats, “Organization and Structure of the Aviation Industry Corporation of China (AVIC)”; “Blacklisted defense conglomerate AVIC retains influence in US aviation industry via Continental Aerospace Technologies,” Datenna, accessed October 2025, https://www.datenna.com/resources/the-acquisition-of-continental-aerospace-technologies/.

[46]. “Senior Engineer III,” Continental Aerospace Technologies, accessed October 2025, https://recruiting.ultipro.com/TEL1004TELCM/JobBoard/c7c69624-8aeb-4dd3-946d-16700c5136fe/OpportunityDetail?opportunityId=e8fa5e48-0353-45a1-9f1d-26a7e6287bc2.

[47]. “Continental Aerospace Technologies,” Continental Aerospace Technologies.

[48]. “Alabama Aviation Center at Brookley Field,” Coastal Alabama Community College, accessed October 2025, https://www.coastalalabama.edu/about/locations/alabama-aviation-center/; “Mobile, AL,” Embry‑Riddle Aeronautical University, accessed October 2025, https://worldwide.erau.edu/locations/mobile; “University of South Alabama,” University of South Alabama, accessed October 2025, https://www.southalabama.edu/; “Aerospace Engineering (BS),” University of South Alabama, accessed October 2025, https://bulletin.southalabama.edu/programs-az/engineering/mechanical-aerospace-biomedical-engineering/mechanical-engineering-bs-aerospace-track/; “Aviation Training Center,” United States Coast Guard, accessed October 2025, https://www.forcecom.uscg.mil/Our-Organization/FORCECOM-UNITS/ATC/; “Air Force ROTC,” University of South Alabama, accessed October 2025, https://www.southalabama.edu/colleges/artsandsci/afrotc/.

[49]. “Investors,” Airbus, accessed October 2025, https://www.airbus.com/en/investors/share-price-and-information.

[50]. University of South Alabama, “Design, Build, Fly,” news release, March 10, 2022, https://www.southalabama.edu/departments/publicrelations/pressreleases/031022dbf.html; “Meeting Agenda and Minutes” (University of South Alabama board of trustees meeting agenda and minutes, December 2019), https://www.southalabama.edu/departments/trustees/agendas/2019/agenda12052019.pdf; “Continental Aerospace Technologies™ Academy,” Continental Aerospace Technologies, accessed October 2025, https://continental.aero/factory-technical-training/; Coastal Alabama Community College, “Continental Aerospace Technologies Donates Aircraft to CACC,” news release, October 13, 2022, https://www.coastalalabama.edu/news/news/continental-aerospace-technologies-donates-aircraft-to-cacc.

[51]. Pellissippi State Community College, “PSCC Aviation Technology Program gets off the ground with college’s first cohort of students,” news release, August 28, 2025, https://www.pstcc.edu/news/2025/082825aviation-program/.

[52]. “Alabama Aviation Center at Brookley Field,” Coastal Alabama Community College.

[53]. “Aeroplex Solutions,” Mobile Aeroplex at Brookley, accessed October 2025, https://www.mobileairportauthority.com/aeroplex/aeroplex/; Lawrence Specker, “Airbus expands military aircraft center in Alabama as workforce grows,” Stars and Stripes, March 6, 2024, https://www.stripes.com/theaters/us/2024-03-06/airbus-military-aircraft-alabama-workforce-13231083.html; Victoria Tozer-Pennington, “MAAS Aviation appoints new US leader of operations,” Airline Economics, March 10, 2017, https://aviationnews-online.com/public/article/maas-aviation-appoints-new-us-leader-of-operations; “MAAS Aviation,” MAAS Aviation, accessed October 2025, https://maasaviation.com/; “Aircraft Manufacturing Center at Brookley Aeroplex,” The Austin Company, accessed October 2025, https://theaustin.com/projects/aircraft-manufacturing-center-at-brookley-aeroplex/; Jerry Underwood, “Mobile Brookley Aeroplex preparing for Airbus’ touch down in Alabama,” Made in Alabama, February 24, 2013, https://www.madeinalabama.com/2013/02/brookley-preparin-for-airbus-alabama-facility/; https://airbusus.com/about-airbus-us; “United States,” Safran Group, accessed October 2025, https://www.safran-group.com/countries/united-states.

[54]. Mark Huber, “U.S. DOJ: Chinese Spy Targeted GE, Other Aviation Firms,” Aviation International News, October 11, 2018, https://www.ainonline.com/aviation-news/aerospace/2018-10-11/us-doj-chinese-spy-targeted-ge-other-aviation-firms.

[55]. Alex Scroxton, “Researchers reveal the cyber campaign that built China’s new airliner,” ComputerWeekly.com, October 14, 2019, https://www.computerweekly.com/news/252472244/Researchers-reveal-the-cyber-campaign-that-built-Chinas-new-airliner; “Turbine Panda,” CrowdStrike, accessed October 2025, https://www.crowdstrike.com/adversaries/turbine-panda/.

[56]. National Counterintelligence and Security Center, “Safeguarding Our Future,” July 1, 2023, https://www.dni.gov/files/NCSC/documents/SafeguardingOurFuture/FINAL_NCSC_SOF_Bulletin_PRC_Laws.pdf.

[57]. “Relativity engineer comes ‘full circle’ to Stennis” (NASA, August 2019), https://www.nasa.gov/wp-content/uploads/2015/05/august_lagniappe_1.pdf; “Who We Are,” Raytheon, accessed October 2025, https://www.rtx.com/raytheon/who-we-are; “Starshield,” SpaceX, accessed October 2025, https://www.spacex.com/starshield.

[58]. Jerry Underwood, “Continental Motors embarks on $75 million Alabama factory project,” Made in Alabama, August 24, 2018, https://www.madeinalabama.com/2018/08/continental-motors-embarks-on-75-million-alabama-factory-project/; Office of the Governor of Alabama, “Governor Ivey Honors Seven Alabama Companies for Their Exporting Success,” news release, February 23, 2022, https://governor.alabama.gov/newsroom/2022/02/governor-ivey-honors-seven-alabama-companies-for-their-exporting-success/.

[59]. “File-Only Contracts Report” (contract report, Susana A. Mendoza Illinois State Comptroller, 2021), https://illinoiscomptroller.gov/__media/sites/comptroller/assets/File/Quarterly%20File%20Only%20Contract%20Reports/664-C%20File%20Only%20Contract%20Quarterly%20Report%20-%207-1-21%20-%209-30-21.pdf.

[60]. “Guaranteed/Insured Loan FAIN 8636197105,” USAspending.gov, accessed October 2025, https://www.usaspending.gov/award/ASST_NON_8636197105_073; “Continental Aerospace Technologies, Inc.,” ProPublica, accessed October 2025, https://projects.propublica.org/coronavirus/bailouts/loans/continental-aerospace-technologies-inc-8636197105.

[61]. William S. Stimpson, Scott Collins, and Donna G. Bryars, “Annual Comprehensive Financial Report” (City of Mobile, AL, September 2024), https://www.cityofmobile.org/uploads/file_library/2024-final-acfr---stamped.pdf.

[62]. Wofford, “The History of Scissor Lifts”; “History and the pioneers of Access equipment,” Swift, https://www.swiftaccess.co.nz/single-post/2017/03/13/history-and-the-pioneers-of-access-equipment.

[63]. John Wofford, “The History of Scissor Lifts,” Lilly Forklifts, August 29, 2023, https://www.lillyforklifts.com/blog/the-history-of-the-scissor-lift.

[64]. “What is an Aerial Work Platform (AWP)?” Alpha Platforms, https://www.alphaplatforms.com/blog/what-is-an-aerial-work-platform-awp; “Aerial Work Platform (AWP),” Naval Safety Command, accessed October 2025, https://navalsafetycommand.navy.mil/Portals/100/Documents/Risk-Card-02-2025-Aerial-Work.pdf.

[65]. “Innovation History,” JLG, accessed October 2025, https://www.jlg.com/en/about-jlg/innovation-history; “Our Story,” Genie, accessed October 2025, https://www.genielift.com/en/about-genie/our-story; “The History of Elevated Work Platforms,” Ausdirect Hire, https://www.ausdirecthire.com.au/news/the-history-of-elevated-work-platforms/.

[66]. Shree Basu, “Top 12 Aerial Work Platform Companies in the World,” IMARC Group, https://www.imarcgroup.com/top-aerial-work-platform-companies.

[67]. “Critical Power & Data Center,” MEC, accessed October 2025, https://www.mecinc.com/markets/critical-power-and-data-center/; “Commercial Vehicles,” MEC, accessed October 2025, https://www.mecinc.com/markets/commercial-vehicles/; “Military,” MEC, accessed October 2025, https://www.mecinc.com/markets/military/.

[68]. “Military,” MEC; “Company Overview” (company report, MEC, June 2023), https://www.mecinc.com/wp-content/uploads/2023/06/MEC_Company-Overview-June-2023.pdf; “About Us,” MEC, accessed October 2025, https://www.mecinc.com/our-company/about-us/.

[69]. “Our History of Better Solutions,” CMEC, accessed October 2025, https://www.mecawp.com/about-mec/our-history/.

[70]. “Dingli Takes 25% Stake in MEC,” Lift & Access, https://www.liftandaccess.com/article/dingli-takes-25-stake-mec; CMEC, “MEC® Announces Elevated Strategic Partnership with Global Leader Zhejiang Dingli Machinery Co., Ltd.,” news release, November 2, 2023, https://www.mecawp.com/mec-announces-elevated-strategic-partnership-with-global-leader-zhejiang-dingli-machinery-co-ltd/.