The Bayh-Dole Act’s Role in Stimulating University-Led Regional Economic Growth

Universities play a pivotal role in America’s technology economy, serving as a crucial source of research, inventions, patents, start-up technology companies, and regional economic and employment growth. The Bayh-Dole Act has played an instrumental role in spurring academic technology transfer activities that serve as vital drivers of American innovation.

KEY TAKEAWAYS

Key Takeaways

Contents

The Bayh-Dole Act’s Foundational Role in America’s Tech Economy 3

Universities’ Roles in Regional and National Life Sciences Leadership. 7

U.S. State Competitiveness in Pharmaceuticals and Biotechnology Manufacturing 8

Best University Practices Stimulating Technology Commercialization. 34

Introduction

Universities play a pivotal role in America’s technology economy, serving as a crucial source of research, inventions, patents, start-up technology companies, and regional economic and employment growth. In fact, the impact of academic technology transfer from U.S. universities has been so extensive that, from 1996 to 2020, it resulted in 554,000 inventions disclosed, 141,000 U.S. patents granted, and 18,000 start-ups formed.[1] Moreover, academic technology transfer has bolstered U.S. gross domestic product (GDP) by up to $1 trillion, contributed to $1.9 trillion in gross U.S. industrial output, and supported 6.5 million jobs over that time.[2]

But it wasn’t always that way. That American universities have been transformed into engines of innovation and powerful catalysts of regional economic growth has been in no small part the result of seminal bipartisan legislation introduced in 1980 called the Patent and Trademark Law Amendments Act, better known as the “Bayh-Dole Act.” The legislation both created a uniform patent policy among the many federal agencies funding research and allowed universities to retain ownership of the intellectual property (IP) and inventions made as a result of federally funded research.[3]

In the years that followed, the Bayh-Dole Act would spawn robust academic technology transfer and commercialization capabilities and activities at hundreds of universities across the United States. That in turn would lead to the formation of thousands of advanced-technology start-up companies, especially in the life sciences sector, that would give rise to university-anchored, technology-based clusters and catalyze regions’ and states’ economic growth.

This report begins by recounting the history of the Bayh-Dole Act and documenting its role in transforming American universities into globally envied engines of innovation. It then examines how university tech transfer has given rise to regional technology clusters, especially in life sciences industries. It next examines U.S. states’ overall competitiveness in the pharmaceutical and biotechnology sectors before exploring how, in six states—Colorado, Delaware, Georgia, Indiana, Kansas, and North Carolina—universities have played a transformative role in driving forward regions’ and states’ technology-based economies.

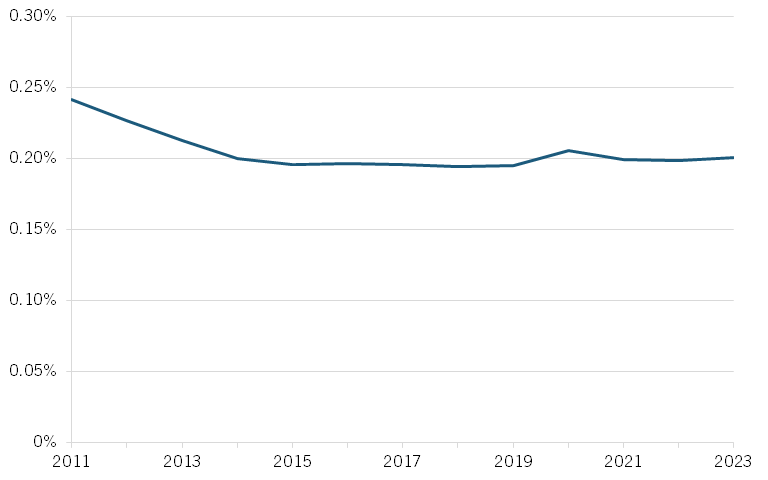

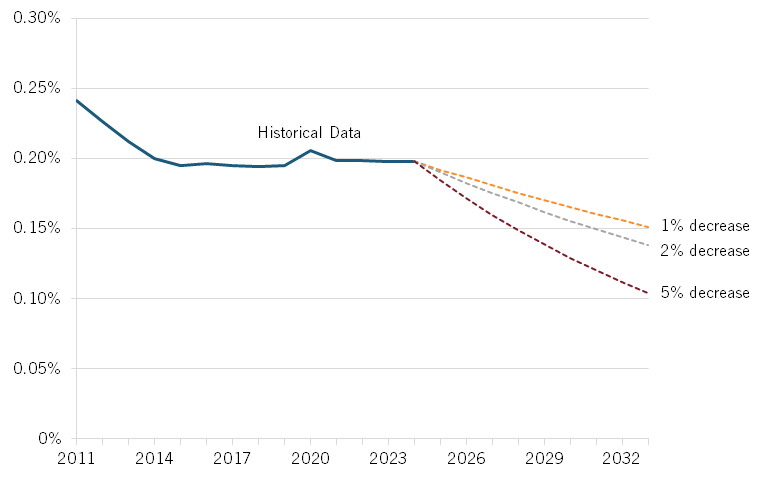

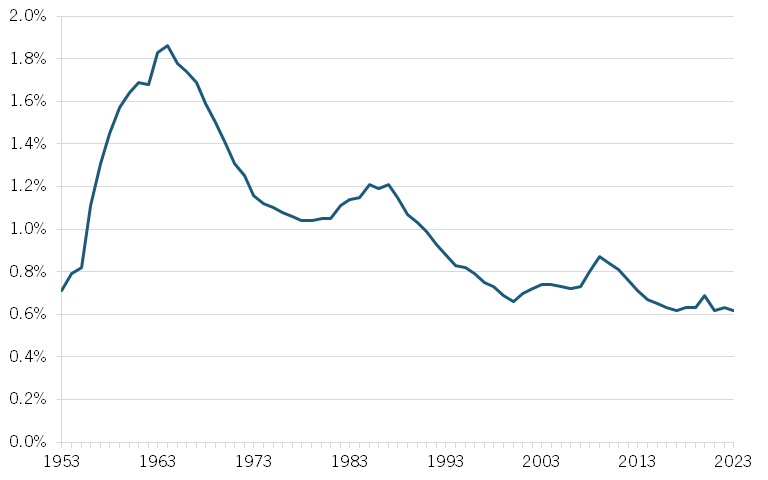

The report concludes with proposals for university leaders to better stimulate innovation and also policy recommendations for federal and state policymakers to maximize the potential of America’s innovation economy, particularly regarding the roles played by universities. Here, it emphasizes that the federal government has already been underinvesting in university R&D funding both relative to peer nations and in America’s own historical terms—and that’s even well before recently announced Trump administration cuts to scientific research that threaten to considerably hamstring America’s research-driven innovation economy going forward.

The Bayh-Dole Act’s Foundational Role in America’s Tech Economy

The United States has made tremendous contributions to the global innovation economy over the past 45 years, notably spearheading both the information technology (IT) and biotechnology revolutions. In fact, in recent decades, U.S. companies have accounted for nearly half the global new drug pipeline.[4] But it wasn’t always that way; indeed, for many decades after World War II, the United States was a global also-ran in drug innovation.[5] In the latter half of the 1970s, European-headquartered enterprises introduced more than twice as many new drugs to the world as did those in the United States.[6] In fact, as recently as 1990, the global research-based pharmaceutical industry invested 50 percent more in Europe than in the United States.[7] That the United States has come to lead the world in biopharmaceutical innovation has been the result of many public and private factors—patent rights, world-leading R&D investment, tax policy that incentivizes innovation, a drug pricing system historically allowing companies to earn sufficient revenues to sustain R&D investment, etc.—but the Bayh-Dole Act’s role in turning federally funded research into meaningfully impactful life sciences (and other technological) innovations for society has been as important as any of these.[8]

Before the passage of Bayh-Dole, only a handful of U.S. universities even had technology transfer or patent offices.

Before Bayh-Dole (i.e., pre-1980), the federal government had a very weak track record in commercializing the IP it owned as a result of publicly funded research conducted at universities (or federal laboratories). As late as 1978, the federal government had licensed less than 5 percent of the as many as 30,000 patents it owned.[9] Likewise, throughout the 1960s and 1970s, many American universities shied away from direct involvement in the commercialization of research.[10] Indeed, before the passage of Bayh-Dole, only a handful of U.S. universities even had technology transfer or patent offices.[11]

Aware as early as the mid-1960s that the billions of dollars the federal government was investing in R&D were not paying the expected dividends, President Johnson in 1968 asked Elmer Staats, then America’s comptroller general, to analyze how many drugs had been developed from National Institutes of Health (NIH)-funded research. Johnson was stunned when Staats’s investigation revealed that “not a single drug had been developed when patents were taken from universities [by the federal government].”[12] As his report to Congress elaborated:

At that time we reported that HEW [the Department of Health, Education, and Welfare, predecessor of the Department of Health and Human Services] was taking title for the Government to inventions resulting from research in medicinal chemistry. This was blocking development of these inventions and impeding cooperative efforts between universities and the commercial sector. We found that hundreds of new compounds developed at university laboratories had not been tested and screened by [the] pharmaceutical industry because the manufacturers were unwilling to undertake the expense without some possibility of obtaining exclusive rights to further development of a promising product.[13]

Policymakers were also aware that the commercialization of discoveries stemming from federally funded research was languishing. As Joseph P. Allen wrote, “Congress was rightly concerned that potential benefits from billions of dollars of federally funded research were lying dormant on the shelves of government.”[14] Congressmembers were also cognizant that rules about ownership of IP stemming from federal research funding needed to be aligned and streamlined across federal agencies. The stagflation, economic malaise, and heightened foreign competition America confronted in the 1970s amplified pressure on policymakers to generate solutions to revitalize America’s faltering economy.[15]

Senators Birch Bayh (D-IN) and Bob Dole (R-KS) responded by collaborating to introduce legislation that would allow universities, small businesses, and nonprofit institutions to take ownership of IP rights stemming from discoveries made from federally funded research. As John Rabitschek and Norman Latker noted as the legislation was being debated in Congress, “A broad political consensus ultimately developed around the notion that market forces would do a better job of commercializing government-funded technology than federal agencies could.”[16] By enacting Bayh-Dole, Congress decentralized patent management from the federal bureaucracy into the hands of the inventing organizations. As the first words of the Bayh-Dole Act explicitly noted, “It is the policy and objective of the Congress to use the patent system to promote the utilization of inventions arising from federally supported research and development.”[17]

In the first two decades after the enactment of Bayh-Dole, American universities experienced a tenfold increase in their patents and created more than 2,200 companies to exploit their technology.

The impact was immediate and lasting. The Bayh-Dole Act has been widely praised as a significant factor contributing to the United States’ “competitive revival” in the 1990s.[18] In 2002, The Economist called Bayh-Dole:

Possibly the most inspired piece of legislation to be enacted in America over the past half-century. Together with amendments in 1984 and augmentation in 1986, this unlocked all the inventions and discoveries that had been made in laboratories throughout the United States with the help of taxpayers’ money. More than anything, this single policy measure helped to reverse America’s precipitous slide into industrial irrelevance.[19]

Moreover, allowing U.S. institutions to earn royalties through the licensing of their research provided a powerful incentive for universities and other institutions to pursue commercialization opportunities.[20] The Bayh-Dole Act almost immediately led to a considerable increase in academic patenting activity. For instance, whereas only 55 U.S. universities had been granted a patent in 1976, 240 universities had been issued at least one patent by 2006.[21] Similarly, while only 390 patents were awarded to universities in 1980, by 2009, that number had increased to 3,088—and by 2015, to 6,680. Another analysis finds that in the first two decades after the enactment of Bayh-Dole (i.e., 1980 to 2002), American universities experienced a tenfold increase in their patents and created more than 2,200 companies to exploit their technology.[22]

In total, from 1996 to 2020, academic technology transfer resulted in 554,000 inventions disclosed, 141,000 U.S. patents granted, and 18,000 start-ups formed.[23] In fact, on average, three new start-up companies and two new products are launched in the United States every day as a result of university inventions brought to market, in part thanks to the Bayh-Dole Act.[24] This activity has bolstered U.S. GDP by up to $1 trillion and contributed to $1.9 trillion in gross U.S. industrial output. Further, more than 200 drugs and vaccines have been developed through public-private partnerships since the Bayh-Dole Act entered force in 1980.[25] Seventy-three percent of university IP licenses go to start-ups or small companies. Notably, start-ups spun out of research universities have higher success rates and file more patent applications than do other firms.[26]

As Harvard University’s Naomi Hausman has definitively written, “The sort of large-scale technology transfer from universities that exists today would have been very difficult and likely impossible to achieve without the strengthened property rights, standardized across granting agencies, that were set into law in 1980.”[27] Hausman has also analyzed Bay-Dole’s impact in shaping university relations with local economies and found that the increase in university connectedness to industry under the IP regime has created by Bayh-Dole produced important local economic benefits. In particular, Hausman has found that long-run employment, payroll, payroll per worker, and average establishment size has grown differentially more after the 1980 Bayh-Dole Act in industries more closely related to innovations produced by a local university or hospital.[28] There is also evidence that the Bayh-Dole Act has contributed to university faculty responding to royalty incentives by producing higher-quality innovations.[29] Evidence further suggests that patenting has increased most after Bayh-Dole in lines of business that most value technology transfer via patenting and licensing.[30]

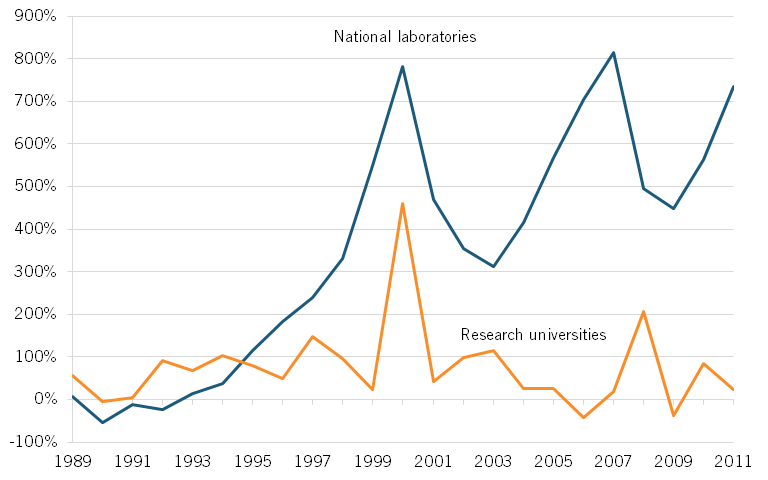

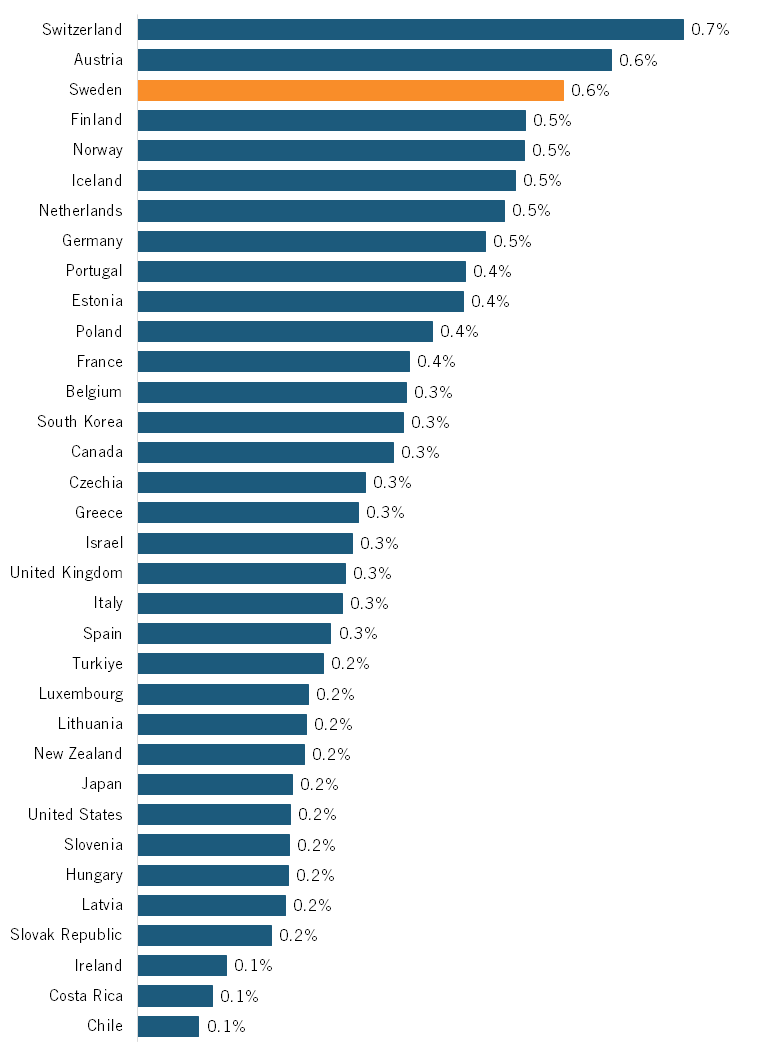

Related research by Tatari and Stern finds that the quality of local entrepreneurship and start-ups increases in the presence of a university or a federally funded research institution, such as a national laboratory.[31] They examined the percentage change in the quality-adjusted number of start-ups associated with the presence of a research university or a national laboratory, and found that changes in federal research commitments to universities are uniquely linked to positively correlated changes in the quality-adjusted quantity of entrepreneurship. (See figure 1.)

Figure 1: Percentage change in the quality-adjusted number of start-ups associated with the presence of a research university or a national laboratory[32]

Essentially, what the authors concluded is that “research funding to universities seems to play a unique role in promoting the acceleration of local entrepreneurial ecosystems.”[33] As they elaborated, “[W]e find that a positive shock in the allocation of Federal resources (both research and non-research, to universities or national laboratories) is associated with a meaningful increase in the quantity of entrepreneurship. This is in line with the idea that, as large local economic institutions, universities induce local demand for entrepreneurship of all types.”[34] Moreover, they continued, “[W]hen we turn to an analysis of the Federal resources on the quality-adjusted quantity of entrepreneurship (i.e., accounting for the potential for growth and spillovers from these start-ups), we find a very sizeable positive impact of Federal research expenditures towards universities.”[35]

Universities’ Roles in Regional and National Life Sciences Leadership

U.S. universities have played a key role in underpinning America’s life sciences leadership. Indeed, as Maryann Feldman wrote in a foundational 2000 paper, “Where Science Comes to Life: University Bioscience, Commercial Spin-offs, and Regional Economic Development,” “Increasingly, it is recognized that the engines of national economic performance are subnational technology districts that are characterized by strong ties between regional actors.”[36] As she continued, “The pattern of commercialization in bioscience favors the spin-off of new firms from university departments.”[37] Feldman also observed that “the importance of new scientific information”—often emerging from U.S. universities—“to the development of a technologically intensive industry leads to geographic clustering in that industry.”[38]

In a comprehensive February 2020 article in Nature Biotechnology, “The biotech living and the walking dead,” Godfrey, Allen, and Benson made an assessment of U.S. universities’ licensing of life sciences IP to start-up companies over the preceding decades. Especially notable, the authors documented a tenfold increase in university licenses to entrepreneurial life sciences firms between 1990 and 2005.[39] The researchers found that the top 50 patent-producing U.S. universities (between 1969 and 2008) accounted for 69.7 percent of all university patents over those four decades; by comparison, the next 50 universities generated only one-quarter as many patents (18 percent), and the remaining 472 schools produced the final 12 percent.[40]

The researchers also found a significant skew in the distribution of life sciences firms founded at the top 50 universities. Specifically, they found that the top five universities produced one-third of new life sciences start-ups, the top ten universities accounted for half (49 percent) of the start-ups, and the bottom seven universities produced only 3 percent of the start-ups.[41]

Of 498 university-licensed start-up life-science companies studied from 1990 to 2011, 68 percent stayed located within 60 miles of the founding university.

The authors then accrued locational data for 498 university-licensed life sciences start-ups for the years 1990 to 2011. They found that 68 percent of those companies remained located within 60 miles of the founding university (while the rest migrated away). The authors found that 23 percent of the companies were founded in the “well-established biotech clusters” around Boston/Cambridge, the San Francisco Bay Area, and San Diego. As they noted, “The advantages of locating in an economic cluster come, in large measure, from the close physical proximity of firms and others in the ecosystem to each other. This proximity facilitates deep and rich human interactions that help solve technical problems and strengthen commercial activities.”[42] In explaining the life sciences start-ups’ locational decisions, the authors found them best explained by a process of “assortive matching” or the idea that firms succeed because they locate in communities that provide an optimal “resource match” (whether with regard to talent, infrastructure, access to risk capital, etc.).

The authors’ research reconfirms previous findings that indeed life sciences companies often stay in the vicinity of the university that helped found them. For instance, in 1993 research, Delaney found that biotech start-ups “tend to be formed in the same geographical region as the parent firm or incubator” and that they used local information sources (within a 50-mile radius of the firm).”[43] Feldman also emphasized this tendency of bioscience companies to stay local. As she writes:

In interviews, we ask scientists where they would like to set up shop if they could locate anywhere in the world. The response is that even though they are part of global networks, have international opportunities, and easily could locate anywhere and still stay connected with new telecommunications technologies, they typically want to stay where they are.[44]

Godfrey, Allen, and Benson noted that one lesson for policymakers and university administrators from their research is that, “[c]ommunities should not focus on being good in the ‘life sciences’; they should create and develop resources around some narrow slice of the sector and become best-in-class in that area.”[45] As they wrote, “Universities should focus less on building strong colleges (for example, life science or medicine), and specialize more on outstanding departments (for example, genetics or ophthalmology).”[46] They pointed, for instance, to Orange County becoming a hotbed for ophthalmology innovation, though certainly there are other examples of this, such as Minneapolis being a hotbed of bioelectronics, Maine specializing in clinical human diagnostics, or Maryland and Virginia having specialties in immunological products.[47]

U.S. State Competitiveness in Pharmaceuticals and Biotechnology Manufacturing

Economists use an analytical statistic known as a location quotient (LQ) to measure a region’s level of industrial specialization relative to that of a larger geographic unit (such as a state or a nation). So, for instance, if a state has an LQ of 1 for the pharmaceutical industry, this would mean that the industry contributes exactly as much to that state’s economy as it contributes to the U.S. economy. Thus, states can be analyzed by whether they are more or less relatively concentrated (or “specialized”) in the industry compared to peer states. The Information Technology and Innovation Foundation (ITIF) has run this analysis for the pharmaceutical and medicine manufacturing and biotechnology R&D sectors.

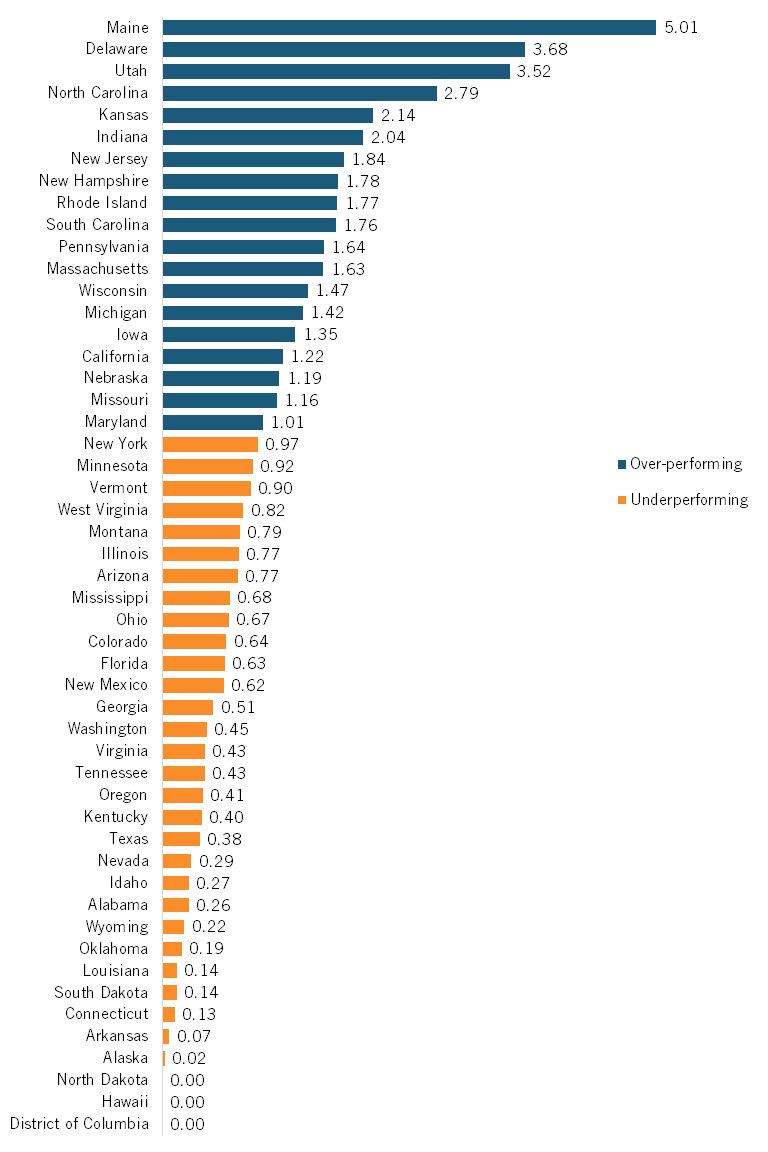

Pharmaceutical and Medicine Manufacturing

The pharmaceutical and medicine manufacturing industry includes the research, development, and production of drugs, medications, and other medical products. Maine leads the nation with an LQ of 5.01, indicating a concentration of pharmaceutical manufacturing five times greater than the national average. (See figure 2.) Delaware (3.68) and Utah (3.52) are relatively large pharmaceutical hubs, in large part thanks to their business-friendly environments and established research infrastructure. North Carolina (2.79), Kansas (2.14), and Indiana (2.04) round out the top six states, with a strong pharmaceutical manufacturing presence supported by research universities and specialized industrial hubs. California, while over-performing, has a lower LQ of 1.22.

Figure 2: Pharmaceutical and medicine manufacturing LQ, 2022[48]

Most U.S. states underperform in pharmaceutical and medicine manufacturing, with 29 states posting LQs below 1. Surprisingly, some states with large populations and significant research institutions show relatively low concentrations, such as Florida (0.63), Washington (0.45), and Texas (0.38). The lowest-performing states include Arkansas (0.07), Alaska (0.02), and several states with no significant pharmaceutical manufacturing presence (0.00), such as the District of Columbia, Hawaii, and North Dakota.

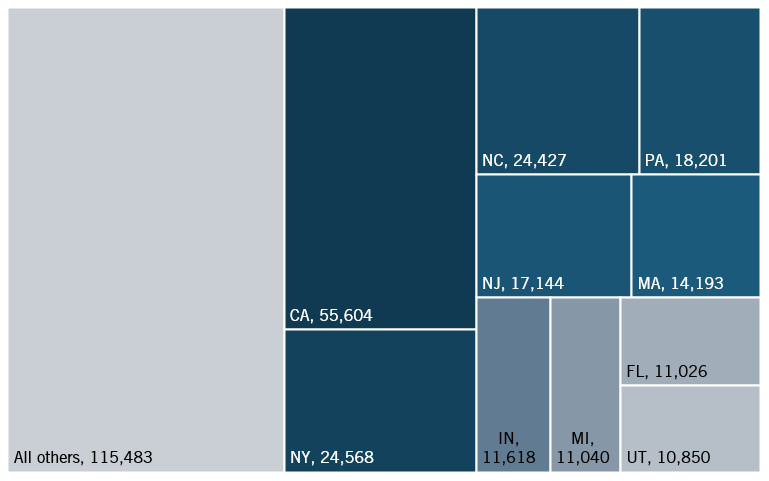

California leads the pharmaceutical and medicine manufacturing industry with 55,604 employees, making it the top state in this sector in absolute employment despite its modest LQ. New York and North Carolina follow with 24,568 and 24,427 employees, respectively. (See figure 3.) Pennsylvania, New Jersey, and Massachusetts, with large metropolitan areas and developed health-care infrastructure, are also leaders in this industry with over 14,000 employees each. Utah has 10,850 employees, while Delaware employs just 1 percent of the nationwide workforce (3,986).

Figure 3: Number of employees in pharmaceutical and medicine manufacturing (top 10 states, and all others)[49]

Biotechnology R&D

The biotechnology R&D industry focuses on harnessing biological processes for medical, agricultural, industrial, and environmental applications. Firms in this industry range from small start-ups developing novel therapies to large multinational corporations with expansive research pipelines. The industry is critical for technological advancement, medical breakthroughs, and maintaining the United States’ global innovation and scientific discovery leadership.

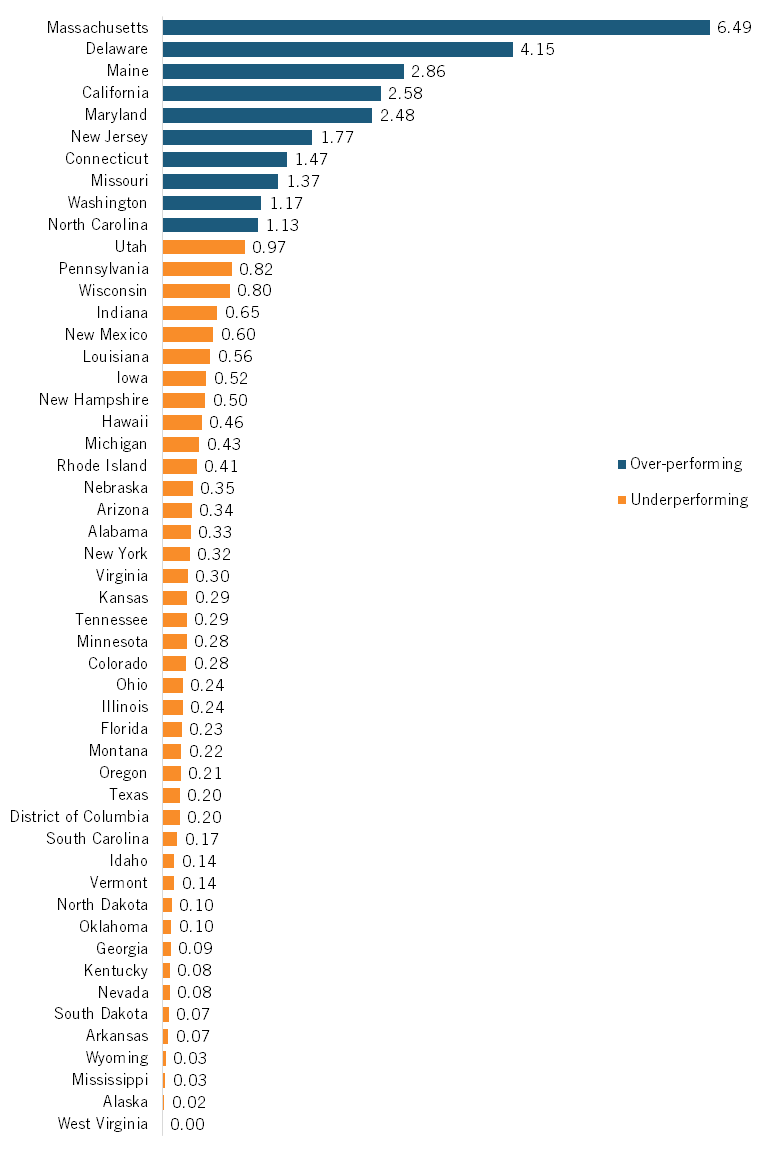

Massachusetts dominates the biotech R&D landscape with an impressive LQ of 6.49, reflecting its dense concentration of research universities, biotechnology firms, and research hospitals. (See figure 4.) Delaware follows with an LQ of 4.15, while Maine (2.86), California (2.58), and Maryland (2.48) round out the top five performers. These states benefit from robust academic-industry partnerships, substantial research funding, and established innovation ecosystems attracting top scientific talent and investment.

Figure 4: Biotechnology R&D LQ, 2022[50]

Most states show a relatively low concentration in biotechnology R&D, with 39 states having LQs below 1.00. Notably, several states with large economies underperform significantly, including New York (0.32), Florida (0.23), and Texas (0.20). The lowest-performing states include Wyoming (0.03), Mississippi (0.03), and Alaska (0.02), with West Virginia showing no significant biotechnology R&D activity (0.00). This distribution highlights the industry’s tendency to cluster around major research institutions and established innovation hubs, leaving many regions with limited biotechnology R&D activity despite their economic size.

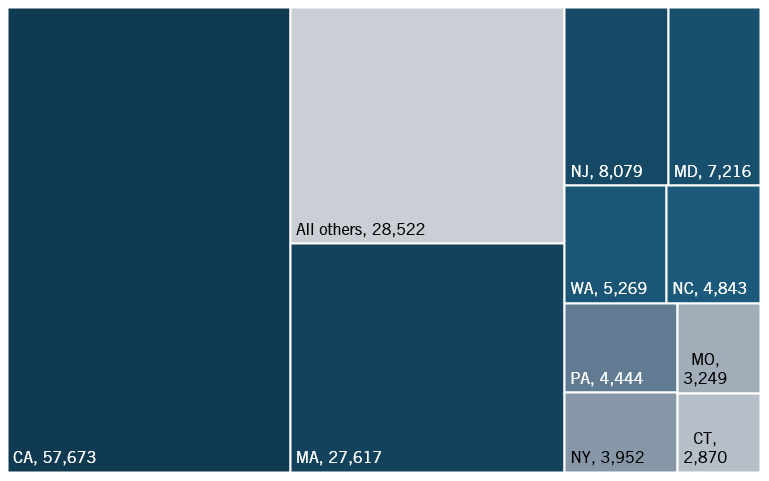

California leads the biotechnology industry with 57,673 employees, far outpacing other states. (See figure 5.) Massachusetts follows with 27,617 employees. Both states are significant biotechnology hubs, with areas such as Cambridge, Massachusetts, and San Diego, California, acting as magnets for high-caliber biotechnology companies such as Thermo Fisher Scientific and Bristol Meyers Squibb. New Jersey, Maryland, and Washington also play key roles, employing over 5,000 individuals each. The remaining states outside the top 10 collectively account for 28,522 employees. Among these states are Delaware and Maine, which employ 2,199 and 1,457 employees, respectively—modest amounts considering their large LQs in the industry.

Figure 5: Number of employees in biotechnology R&D (top 10 states, and all others)[51]

State-Level Analysis

This section provides a state-level analysis of the university-driven technology economies of six states: Colorado, Delaware, Georgia, Indiana, Kansas, and North Carolina. Of course, the stories of the university-driven regional innovation economies of states such as California and Massachusetts have been well documented.[52] These six states were chosen both because they have key research universities contributing to the innovation economies of their state and because they provide a diversity of geographical and industrial perspectives. (Note: data for the following states pertaining to their universities’ attraction of federal and private sector R&D investment, invention disclosures (IDs), patenting, IP licensing, and start-up activity is derived from the Association of University Technology Manager’s (AUTM’s) STATT database, which AUTM kindly provided ITIF access to for this research.)[53]

Colorado

Colorado’s Tech Economy

As of 2023, Colorado’s technology industry encompassed over 32,700 establishments and employed more than 302,000 individuals. The sector accounts for 10 percent of the state’s employment and contributes over $106 billion to Colorado’s gross state product (GSP), representing 20 percent of the state’s total economic output—a 2 percent increase from 2021. Notably, Colorado ranks third nationally in tech industry concentration, trailing only Massachusetts and New Mexico.[54]

Colorado’s fast-growing tech sector added 47,440 net new jobs between 2018 and 2023, the highest among major industries in the state. Coloradoans’ average earnings per worker in the tech sector stand at $165,500, positioning Colorado sixth nationally for tech wages. Further, the industry exhibits a significant multiplier effect; for every new tech job created, an additional 2.67 jobs emerge in other sectors.[55]

Colorado’s life sciences ecosystem is equally robust, comprising over 720 companies and organizations spanning biotechnology, medical devices, diagnostics, digital health, and pharmaceuticals. This sector directly employs more than 38,000 individuals, marking an 11 percent increase since 2018.[56]

Colorado has become a budding location for venture capital (VC) investment over the last several decades. From 1997 to 2023, Colorado received over $61 billion in VC investment, equivalent to 0.8 percent of Colorado’s GSP. Colorado ranks fifth nationally in relative VC investment, behind only Massachusetts, California, Washington, D.C., and New York. In 2023, VC in Colorado totaled $3.8 billion, or 0.7 percent of GSP.[57] In 2024, Colorado’s life sciences sector raised a record $2.15 billion in VC, a 46 percent increase compared with 2023.[58]

Jobs in science, technology, engineering, and mathematics (STEM) fields account for 19 percent of Colorado’s workforce, with 750,000 individuals working in these fields. These jobs are highly concentrated in urban areas, with more than half of Colorado’s STEM employees working in the Denver metro area (395,200), while Boulder and Colorado Springs employ 95,000 and 92,700 STEM workers, respectively. On a more granular level, Colorado employs 251,900 workers in science and engineering positions.[59]

Universities Anchoring Colorado’s Tech Economy

Colorado’s universities anchor the state’s technology economy and make significant contributions to the broader state economy. The University of Colorado system alone has estimated that it contributes nearly $20 billion to the state economy annually.[60] The University of Denver has estimated that it makes a $2.3 billion annual impact on Colorado’s economy.[61]

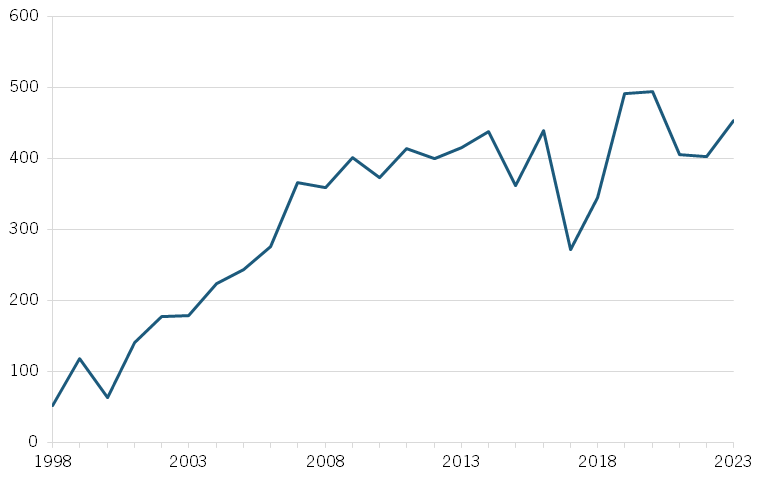

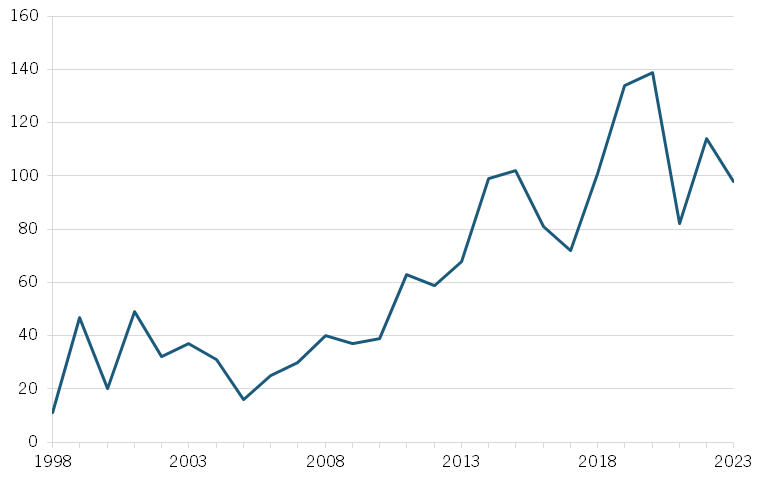

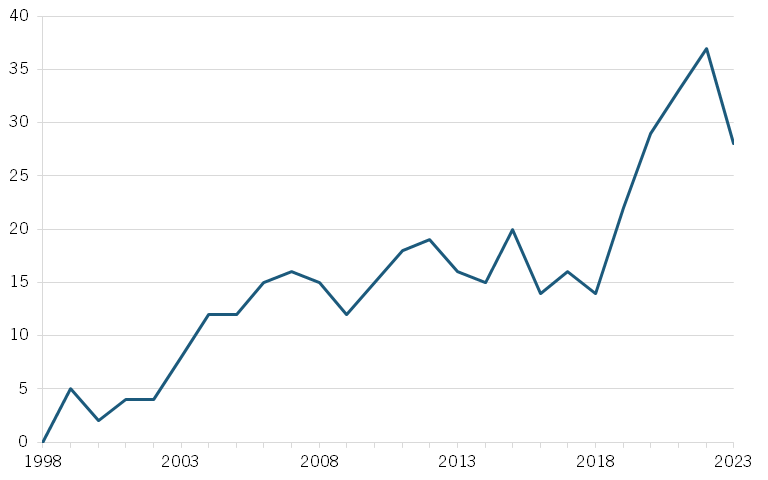

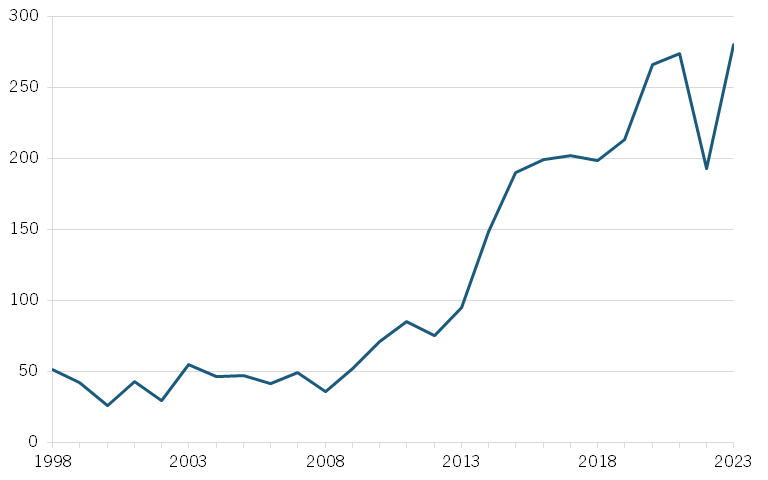

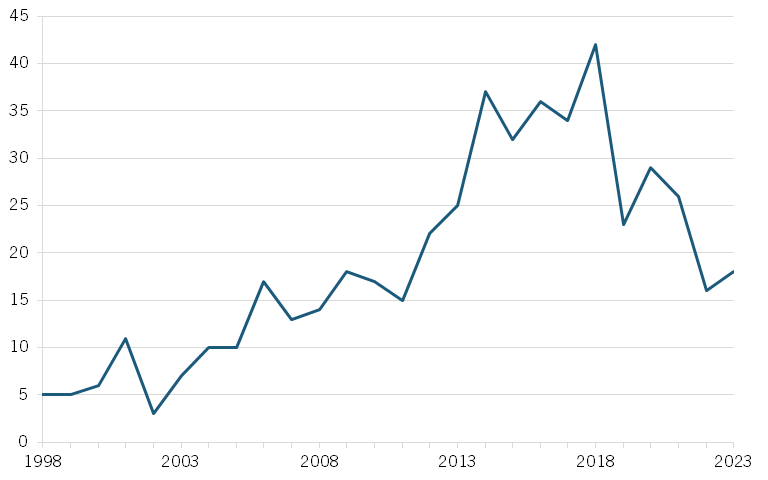

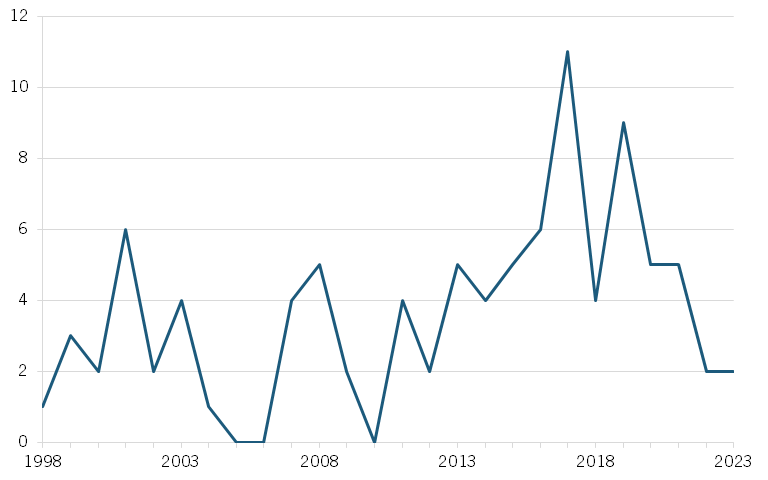

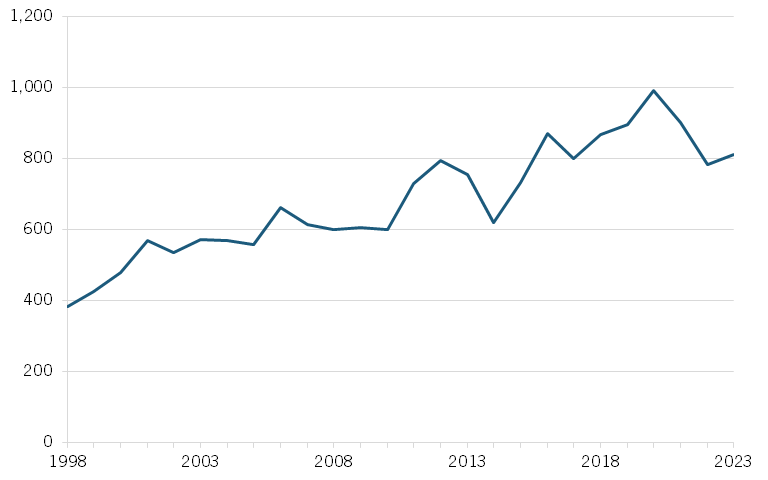

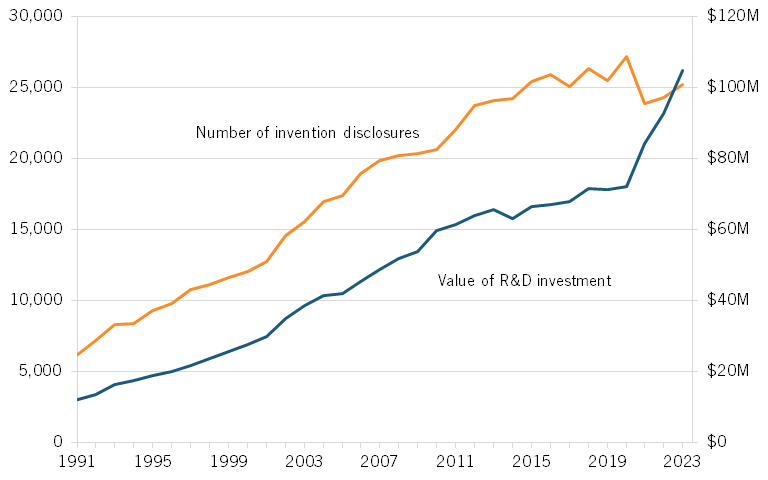

In the 25 years from 1998 to 2023, Colorado universities received $20.3 billion in federal R&D funding, led by $12 billion to the Boulder-based University of Colorado (CU) and $5.6 billion to Fort Collins-based Colorado State University (CSU). Research funding at Colorado’s universities grew tenfold over that period, with most of the investment supported by the federal government. Over those years, Colorado universities received $2.8 billion of business R&D investment, again led by CU ($1.9 billion) and CSU ($351.3 million). Colorado universities issued 8,295 IDs over those years, marked by a ninefold annual increase in IDs over that timeframe. (See figure 6.) Innovators have generated 1,626 patents from the U.S. Patent and Trademark Office (USPTO) based on research initially conducted at Colorado universities. (See figure 7.) Additionally, Colorado universities issued 1,687 IP licenses over that time period. In 2024 alone, the CSU system had 99 invention disclosures and 144 patent applications.[62]

Figure 6: IDs from Colorado universities,1998–2023[63]

Colorado universities contributed to the launch of 401 start-up companies from 1998 to 2023; however, that number has significantly increased since 2019, as over one-third of Colorado university start-ups have been launched in that time.

Figure 7: Issued USPTO patents from Colorado universities, 1998–2023[64]

Colorado universities contributed to the launch of 401 start-up companies from 1998 to 2023 (see figure 8); however, that number has significantly increased since 2019, as over one-third of Colorado university start-ups have been launched in that time. CU leads the state with 237 new start-ups since 1998, followed by CSU with 101 and the Colorado School of Mines with 29.

Figure 8: Start-ups launched out of Colorado universities, 1998–2023[65]

According to USPTO data on patenting by U.S. regions, from 2000 to 2015 (the most recent available data), Colorado produced 34,121 technology patents. The Denver-Aurora-Broomfield metropolitan statistical region led with 11,439 patents, followed by Boulder with 9,140, Fort Collins-Loveland with 5,867, Colorado Springs with 3,750, and Greeley with 3,125. Over that timeframe, patenting activity in the Denver metro area increased by 92 percent, in Boulder by 81 percent, and in the Fort Collins area by 30 percent.[66]

Showing the strength of universities in anchoring Colorado’s bioeconomy, Boulder and the Fort Collins region stand behind only Denver in leading the state in patents for drug treatments and immunological testing technologies. As a whole, Colorado filers were issued 874 patents for drug treatments and 113 for immunological test technologies between 2000 and 2015.[67]

Innovation Vignette: CSU Enables Groundbreaking Genomic Variation Research

CSU has been home to groundbreaking research into genomic analysis.[68] The NASA Twins Study, featuring astronaut Scott Kelly’s year-long mission aboard the International Space Station and his identical twin Mark Kelly on Earth, marked a milestone in space medicine. The twin brothers provided a perfect test case to compare the effects of space on the body’s genome. Among its many findings, the study identifies changes in gene expression and genomic structural variations due to space radiation. A breakthrough tool in the study was Directional Genomic Hybridization (dGH)™—a technology invented in 2007 by CSU researchers and the University of Texas Medical Branch. DGH revealed persistent genomic changes, such as increased inversions, even after astronauts returned to Earth, which signaled possible long-term health risks such as cancer.

This progress was made possible through strong public sector support, highlighting the critical role of government-funded research in innovation. NASA’s backing enabled the implementation of dGH in astronaut health monitoring, while the National Human Genome Research Institute and CSU Ventures—the university’s tech transfer office (TTO)—provided key funding and commercialization support. With CSU Ventures’ assistance, the dGH technology evolved from a university invention into KromaTiD, a start-up now offering cutting-edge genomic analysis tools, particularly in gene therapy safety.

Innovation Vignette: CSU Advancing Personalized Cancer Treatment

PhotonPharma, a biotechnology company based in Fort Collins, Colorado, developed InnoCell. This personalized cancer vaccine uses a photochemical process involving riboflavin and ultraviolet (UV) light to inactivate a patient’s tumor cells. These inactivated cells are then reinfused to stimulate the immune system to recognize and attack cancer, providing an individualized approach to immunotherapy. The treatment has shown promise in preclinical models for breast and ovarian cancer.

A major catalyst in the development of InnoCell was the support provided by CSU. PhotonPharma was incubated within CSU’s Research Innovation Center (RIC), a facility that provides access to critical lab space, research infrastructure, and a collaborative scientific environment. CSU’s partnership not only helped lower the barriers to early-stage development but also accelerated the company’s ability to achieve regulatory milestones. This university-industry collaboration was instrumental in guiding PhotonPharma from concept to clinical readiness.

Delaware

Delaware’s Tech Economy

Technology-based industries represent a core driver of Delaware’s economy. The state’s life sciences sector employs 11,000 individuals and directly contributes $2 billion to Delaware’s GSP annually. The sector represents about 2.5 percent of both total state employment and GSP. The industry encompasses a range of sub-sectors, including R&D, medical laboratories, pharmaceuticals, and agricultural biosciences.[69]

The state’s IT sector generates approximately $1.13 billion annually and encompasses various industries, including advanced manufacturing, architectural and engineering services, IT and software publishing, scientific R&D, and telecommunications. As of 2023, Delaware employed 22,687 individuals in high-tech jobs, with projections estimating 25,511 by 2028.[70]

Delaware ranks seventh nationally for life sciences VC funding per capita, highlighting its competitive position in attracting investment. Because of Delaware’s growth as a biotechnology and pharmaceutical hub, VC investment is growing in the state. In 2000, VC amounted to just 0.06 percent of GSP. In 2021, it reached a high of 3.04 percent. Delaware ranks sixth in the country in overall VC investment as a share of GSP, and in absolute terms, the state has received $10.7 billion since 1997.[71]

STEM employees account for 18 percent of the working population in Delaware, with 110,200 people employed in these fields. As it is the largest metropolitan area in the state, Wilmington employs the most individuals in STEM fields (68,400), followed by the Salisbury metro area (23,800), and Dover (18,000). Less than one-fourth of all STEM employees in Delaware work in science and engineering fields (26,900), suggesting that the majority are employed in tech industries.[72]

Universities Anchoring Delaware’s Tech Economy

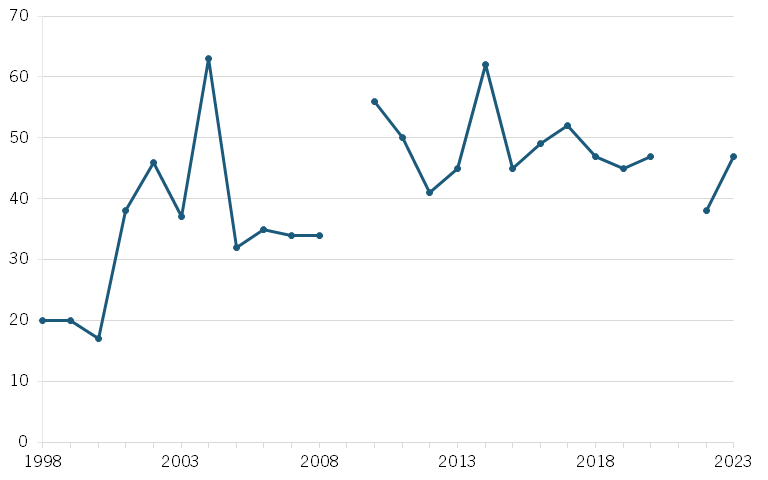

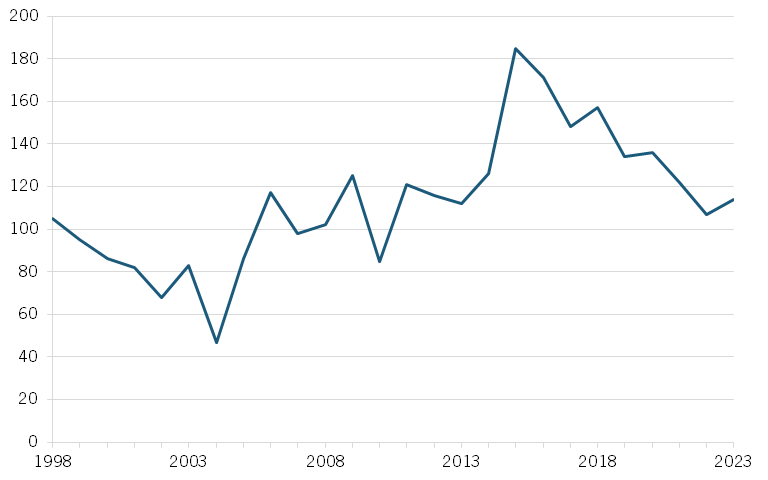

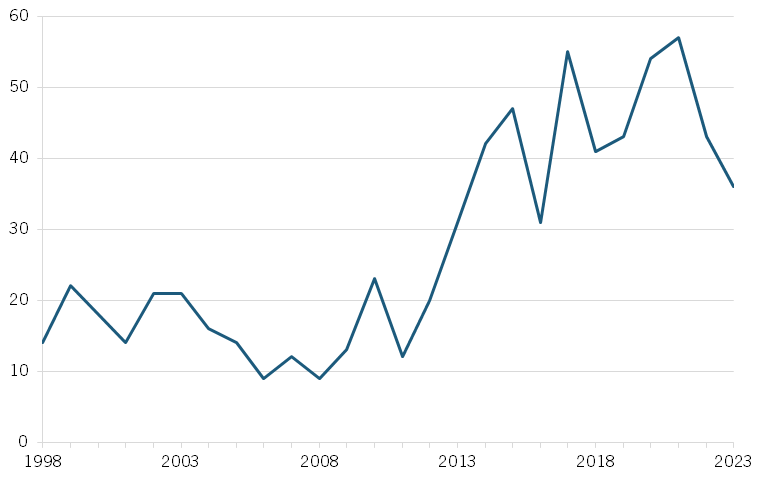

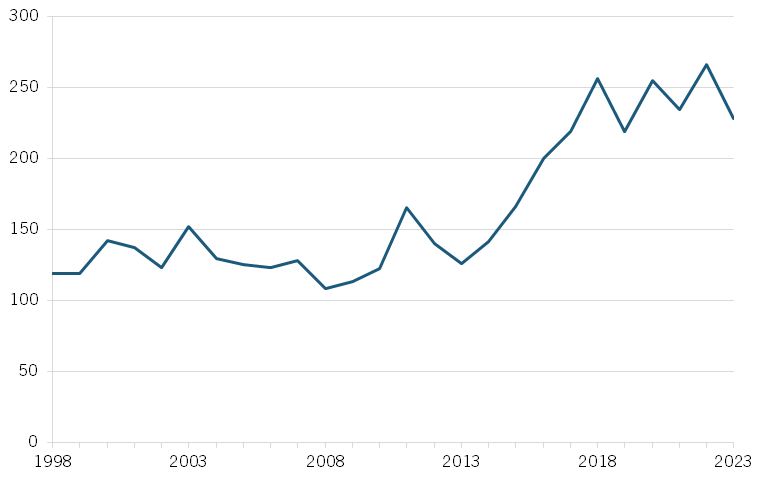

Delaware universities received $3.2 billion in R&D funding between 1998 and 2023, driven principally by the state’s flagship university: the University of Delaware. Over those 25 years, research investment at the university more than tripled. The majority of this investment came from the federal government ($2.1 billion), while just $179 million came from private businesses. During this 25-year period, the University of Delaware disclosed 1,000 inventions. (See figure 9). Patent applicants leveraging research conducted at Delaware universities received 198 patents from USPTO over that timeframe. (See figure 10). (Note: years without data reported are left blank in the following charts.) Delaware universities also issued 99 IP licenses over that timeframe.

Figure 9: IDs from Delaware universities,1998–2023[73]

Figure 10: Issued USPTO patents from Delaware universities,1998–2023[74]

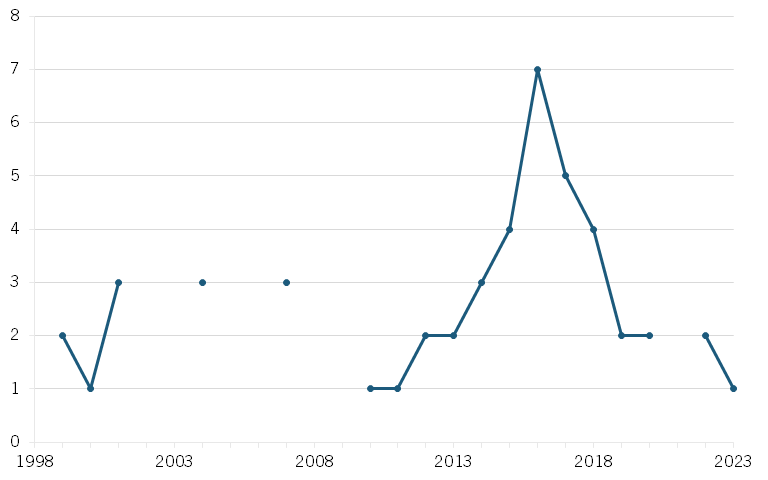

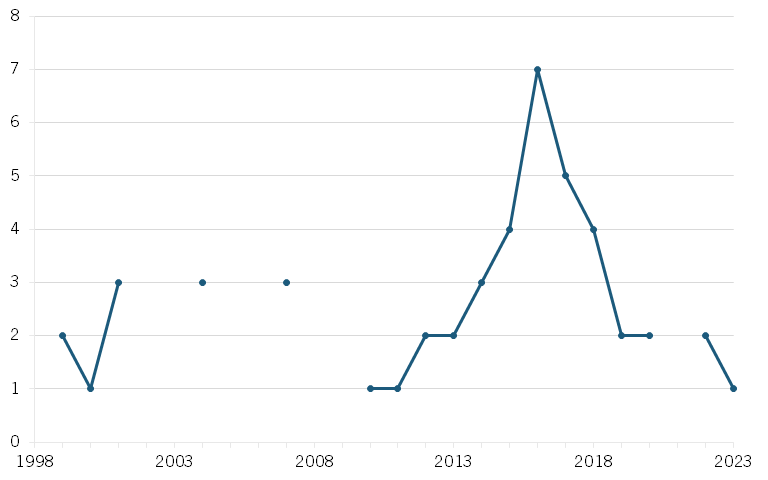

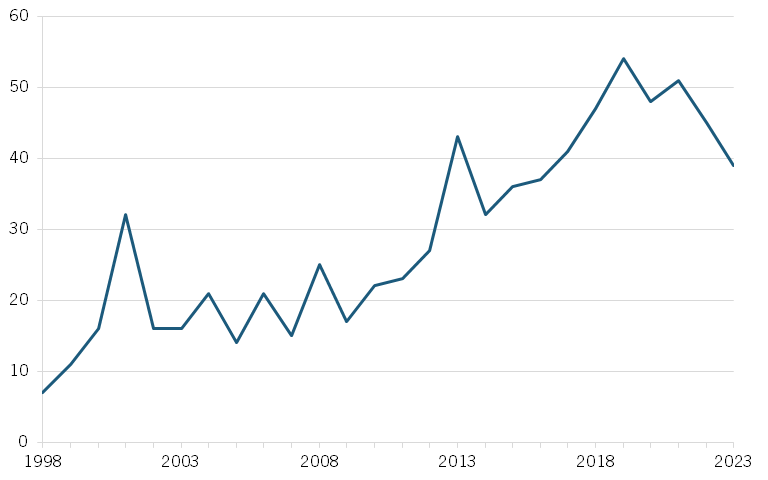

The University of Delaware is responsible for having launched 48 start-ups between 1998 and 2023, although the number of annual start-ups launched declined since reaching a high in 2017. (See figure 11). That year alone, seven start-ups were launched from the university, while in 2023, just one start-up was reported.

From 2000 to 2015, Delaware as a whole produced an estimated 3,544 technology patents.[75] Notably, 512 of the patents filed in Delaware were for drug treatments, meaning approximately one out of every seven Delaware patents were issued for drug-related discoveries.[76]

Figure 11: Start-ups launched out of Delaware universities,1998–2023[77]

Innovation Vignette: University of Delaware Expanding Access to Safe Drinking Water

Two billion people globally lack access to safe drinking water, and twice as many suffer from poor sanitation, leading to 3.4 million annual deaths—primarily among children—from waterborne diseases. In response to this urgent challenge, researchers Pei Chiu and Yan Jin at the University of Delaware developed a groundbreaking, nonchlorine-based water purification technology that removes 99.999 percent of bacteria and viruses. Unlike traditional methods, this approach uses elemental iron to chemically inactivate or bind viruses and pathogens that are typically resistant to chlorination and filtration. The method is also cost effective, leveraging iron byproducts from steel production, making it viable for both industrial and low-resource settings.

Crucially, the innovation was supported by government-funded research, including a National Science Foundation (NSF) Small Business Innovation Research (SBIR) grant. Public investment enabled the initial discovery and refinement of the technology, and the zero-valent iron process has since been licensed for humanitarian use by the Center for Affordable Water and Sanitation Technology. Beyond drinking water, the researchers envision its use in agricultural settings, such as to produce wash systems to prevent foodborne illness outbreaks such as the 2006 E. coli outbreak event in the United States.

Innovation Vignette: University of Delaware Pioneers Reusable Carbon Fuel

Founded in 2018 by Dr. Basudeb Saha, RiKarbon is a start-up dedicated to transforming waste biomass and plant-based oils into renewable, high-performance products.[78] The company focuses on creating sustainable alternatives to petroleum-based ingredients used in cosmetics, lubricants, and other specialty chemicals. By utilizing nonconventional and typically unused carbon feedstocks, RiKarbon aims to reduce environmental impact and promote a circular economy. RiKarbon’s innovations include bio-based oils for emollients in personal care products and bio-poly-alpha-olefin base oils for performance lubricants.

RiKarbon’s origins are deeply rooted in research conducted at the University of Delaware. The company’s technology was developed in collaboration with the university’s Center for Catalytic Science and Technology, highlighting the institution’s role in fostering innovation. The 1980 Bayh-Dole Act has played a pivotal role in this process by allowing universities to retain ownership of inventions developed through federally funded research, thereby facilitating the commercialization of academic innovations. The legislative framework has enabled RiKarbon to license its technology and attract investment, exemplifying how supportive policies and university partnerships can drive the growth of sustainable enterprises.

Georgia

Georgia’s Tech Economy

Georgia’s life sciences industry represents a dynamic and rapidly growing sector. According to a 2021 economic impact study, life sciences companies in Georgia generate $27.2 billion in direct economic impact and employ over 78,000 individuals. The state’s biosciences ecosystem comprises more than 4,000 organizations, with significant hubs in cities including Atlanta, Athens, and Augusta. These organizations span various subsectors, including biotechnology, pharmaceuticals, medical devices, ag biotech, and research institutions.[79]

The Georgia life sciences industry’s growth is further evidenced by a 14.7 percent increase in employment over the past decade. When accounting for multiplier effects, the life sciences sector supports approximately 194,000 jobs and contributes $21.8 billion to Georgia’s GSP. This expansive impact underscores the sector’s significance to the state’s overall economic health and its potential for future growth.[80]

Georgia’s IT industry exerts a substantial economic footprint as well, with an estimated impact of $113.1 billion. The state is recognized as a national leader in health IT, housing 8 of the top 100 health IT firms, which collectively generate $5 billion in revenue. Major companies such as McKesson Technologies, MedAssets, and Greenway Health have established operations in Georgia, reinforcing its status as a hub for technological innovation. Furthermore, Georgia ranks fifth nationally in IT employment concentration, underscoring the sector’s importance to the state’s workforce and economy.[81]

Since 2020, 114 start-ups have been launched out of Georgia’s universities.

Georgia’s workforce consists of 1.1 million employees in STEM positions, or 17 percent of all employees. The largest number of STEM employees are found in the Atlanta metro area (756,000), followed by the Augusta metro area (71,600), the city of Savannah (47,300), and Albany (36,400).[82]

Despite its strong start-up and innovation ecosystem, VC investment in Georgia has been lackluster. From 1997 to 2023, VC investment in the state equaled just 0.25 percent of GDP, placing it 30th in the nation compared with other states. VC investment growth has also been relatively anemic, as investment grew just 20 percent over the past decade, from 0.17 percent of GSP in 2013 to 0.21 percent in 2023.[83]

Universities Driving Georgia’s Tech Economy

The Athens-based University of Georgia (UGA) contributed $8.4 billion to the state’s economy in fiscal year 2024.[84] In 2023, Georgia Tech contributed $5.3 billion to the state’s economy, a year in which Georgia’s public universities in total contributed $21.9 billion to the state’s economy.[85]

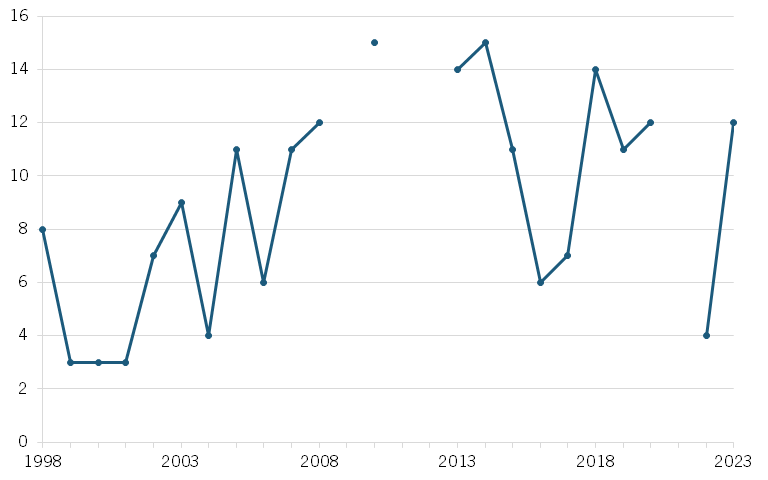

Georgia universities received $22.7 billion in federal research funding between 1998 and 2023. Georgia Tech was allocated nearly half of this total ($10.1 billion), while Emory University ($8.2 billion) and the UGA ($3.2 billion) also received considerable investment. Since 1998, total investment in research at Georgia universities has grown by 7 percent annually, reaching over $3.2 billion by 2023. Investment in research from private businesses in Georgia amounted to $2.8 billion in that same period, with half again going to Georgia Tech ($1.5 billion). Emory University and the UGA received $839 million and $301 million, respectively. From 1998 to 2023, Georgia’s universities issued nearly 16,000 IDs. (See figure 12.) In addition, 3,299 patents were issued on technologies stemming from research conducted at Georgia’s universities over that timeframe. (See figure 13.) Additionally, Georgia’s universities issued 3,378 IP licenses.

Figure 12: IDs from Georgia universities,1998–2023[86]

Figure 13: Issued USPTO patents from Georgia universities,1998–2023[87]

Universities in Georgia contributed to the launch of 492 start-up companies from 1998 to 2023, although that number has shot up in recent years. (See figure 14.) Since 2020, 114 start-ups have been launched out of Georgia’s universities. Georgia Tech leads universities in the state with 236 start-ups since 1998, followed by Emory University (122) and UGA (116).

Figure 14: Start-ups launched from Georgia universities,1998–2023[88]

From 2000 to 2015, Georgia produced 26,641 technology patents, led overwhelmingly by the Atlanta region (home to Georgia Tech and Emory universities) with 22,970 patents, followed by Augusta with 617 patents and Athens with 616. Over that timeframe, Atlanta’s annual output of patents more than doubled, with 1,023 grants in 2000 and 2,143 in 2015, an increase of 109 percent.[89] Georgia also produced 931 patents for drug treatments, again with the majority coming from the Atlanta metro area.[90]

Innovation Vignette: Emory University Pioneers Innovative Cancer Treatment

In the 1990s, government-funded research at Emory University, supported in part by corporate backing from Nihon Mediphysics, led to the development of fluciclovine F-18, an imaging compound designed to detect cancer recurrence, particularly in lymph nodes and bones. The Office of Technology Transfer at Emory licensed the patents to Nihon Mediphysics in 2003, and in 2008 GE Healthcare acquired rights to the compound. However, GE deprioritized it in favor of other research, leaving Emory researchers and some GE employees, including David Gauden, frustrated by the lack of progress on a product they believed filled a critical unmet medical need.

Recognizing its potential, Gauden and colleagues left GE to found Blue Earth Diagnostics in 2014, with funding from Syncona (backed by the Wellcome Trust and Cancer Research UK). They licensed fluciclovine F-18 from GE, and with continued support from Emory’s TTO, strengthened the compound’s patent portfolio and brought it to market under the name Axumin. It received U.S. Food and Drug Administration (FDA) approval in 2016 and European approval the following year. Today, Axumin is used globally to guide prostate cancer treatment, benefiting thousands of patients. The journey of this innovation, spanning three continents and multiple institutions, underscores the crucial role of federally and institutionally funded research, TTOs, and collaborative public-private partnerships in translating scientific discoveries into lifesaving tools.

Innovation Vignette: University of Georgia Researcher Treats Dry Eyes

Restasis® is a groundbreaking prescription eye drop developed to treat chronic dry eye disease by addressing its underlying cause—inflammation—rather than merely alleviating symptoms. The drug’s origins trace back to 1994, when Dr. Renee Kaswan, a professor at UGA, formulated a topical cyclosporine treatment for dry eye in dogs, later marketed as Optimmune. Recognizing its potential for human application, Dr. Kaswan’s research, supported by federal funding, led to the development of Restasis, which received FDA approval in 2002. This approval marked Restasis as the first FDA-approved prescription treatment for chronic dry eye disease, a condition that affects millions worldwide.[91]

The impact of Restasis has been significant in the field of ophthalmology. By reducing ocular inflammation, Restasis enhances the eye’s natural ability to produce tears, providing relief for patients suffering from dry eye symptoms such as burning, itching, and blurred vision. Clinical studies have demonstrated its effectiveness, with most participants reporting improvement in symptoms. The development of Restasis has not only offered a novel therapeutic option for patients but also highlighted the importance of academic research and federal support in bringing innovative treatments to market.[92]

Innovation Vignette: University of Georgia Revolutionizes Protein Expression to Treat Rare Diseases

Synageva BioPharma Corp., originally founded as Avigenics in 1996 by UGA professor Dr. Robert Ivarie, began as a biotechnology company focused on producing therapeutic proteins using a transgenic chicken egg white expression system. In 2008, under the leadership of CEO Sanj K. Patel, the company rebranded as Synageva BioPharma and shifted its focus to developing treatments for rare diseases. Synageva’s lead product, Kanuma® (sebelipase alfa), is an enzyme replacement therapy for lysosomal acid lipase deficiency (LAL-D), a rare and life-threatening genetic disorder. Kanuma received orphan drug designation and fast-track status from the FDA.[93]

Recognizing the potential of Synageva’s pipeline and proprietary manufacturing platform, Alexion Pharmaceuticals announced in May 2015 its acquisition of Synageva for approximately $8.4 billion, one of the largest premiums paid in the biotech sector at that time. This acquisition not only expanded Alexion’s portfolio in rare disease therapeutics but also highlighted the significant impact of university-originated research on the biotechnology industry.[94]

Innovation Vignette: Georgia Tech’s Innovative Solar Cell Manufacturer

Suniva, a manufacturer of high-efficiency crystalline silicon solar cells and modules, was founded in 2007 as a spinout from the Georgia Institute of Technology’s University Center of Excellence for Photovoltaics (UCEP).[95] The company originated from the pioneering research of Dr. Ajeet Rohatgi, a renowned photovoltaic scientist and professor of electrical engineering at Georgia Tech. Suniva’s core technology focuses on advanced silicon solar cell architectures, including the development of high-efficiency monocrystalline cells using proprietary screen-printed metallization and optimized passivated emitter rear contact (PERC) designs.[96] These innovations significantly reduce recombination losses and improve light absorption, resulting in commercially competitive solar cells with conversion efficiencies exceeding 20 percent. With Georgia Tech’s support in technology transfer and prototyping, Suniva was able to bring cutting-edge lab-scale photovoltaic innovations to scalable industrial manufacturing.

The legislative framework embodied in the Bayh-Dole Act empowered Georgia Tech to license its photovoltaic technologies directly to Suniva, facilitating the company’s commercialization efforts. Moreover, Suniva benefited from sustained public investment in solar energy R&D through agencies such as the U.S. Department of Energy (DOE) and the National Renewable Energy Laboratory (NREL). The combination of advanced scientific research in crystalline silicon photovoltaics, strategic university support, and favorable federal innovation policy enabled Suniva to emerge as a domestic leader in solar manufacturing. Today, the company continues to drive forward the U.S. solar industry by producing high-performance solar technologies that support grid-scale renewable energy adoption and promote national energy independence.

Indiana

Indiana’s Tech Economy

Indiana’s IT sector represents a significant economic driver, contributing $51 billion to Indiana’s GSP. The sector encompasses various industries, including software development, IT services, and advanced manufacturing. The state’s commitment to fostering a robust tech ecosystem is evident through initiatives such as the designation of three federal tech hubs in microelectronics, hydrogen energy, and biotechnology, positioning Indiana for substantial federal investment and job creation.[97]

Indiana’s life sciences industry represents a cornerstone of its economy, contributing $95 billion to Indiana’s GSP in 2023. A strong manufacturing base underpins the sector, with pharmaceutical and medical device production being particularly prominent. The state’s life sciences sector also leads in exports, with Indiana becoming the top state exporter of life sciences products in the United States in 2024, tallying $27 billion. This achievement reflects the global competitiveness of Indiana’s life sciences industry and its capacity to meet international demand.[98]

Indiana has rapidly expanded its presence in the life sciences by leveraging its strong pharmaceutical and medical device industries, advanced manufacturing capabilities, and academic research institutions. At the center of Indiana’s strategy lies BioCrossroads, a public-private partnership that coordinates strategy across the sector. The state’s life sciences cluster includes major companies such as Eli Lilly, Cook Medical, and Roche Diagnostics, while research powerhouses such as Purdue and Indiana University contribute cutting-edge innovations. Indiana places strong emphasis on workforce development, with STEM education initiatives, industry-aligned training, and internship programs that help build a robust talent pipeline. The state also supports life sciences entrepreneurship through funding mechanisms such as the Indiana Seed Fund and partnerships that help start-ups navigate commercialization. In recent years, Indiana has focused on becoming a leader in medical diagnostics and health data analytics, bolstering its capabilities in digital health and precision medicine.

Indiana received nearly $9 billion in VC funding from 1997 to 2023, equivalent to 0.11 percent of its GSP over that period. Interestingly, compared with the rest of the country, Indiana ranks in the bottom one-fifth of states for VC. In 2023, the state received $514 million in VC, significantly down from its annual peak of $1.9 billion in 2021.[99]

One-fifth of Indiana’s workforce, or 811,500 individuals, work in STEM positions in the state, demonstrating the strength of Indiana’s STEM economy. The largest number of these workers are concentrated in the Indianapolis metro area (266,300), followed by the Indiana “Chicago” region (87,800), and Fort Wayne (62,500). About 4 percent of Indiana’s workforce specifically works in science and engineering.[100]

Universities Driving Indiana’s Tech Economy

Indiana University generates about $10 billion in economic impact to the state annually, while Purdue University generates over $2 billion.[101],

Out of the $27 billion Indiana universities received in research funding from 1998 to 2023, $12.1 billion came from the federal government. West Lafayette, Indiana-based Purdue University and the Bloomington-based Indiana University were the two largest beneficiaries of federal funding, receiving $5.4 billion and $5.2 billion, respectively, followed by Notre Dame University in South Bend with $1.4 billion. Private businesses also contributed $2.1 billion to university research, with Purdue University receiving the bulk of this investment ($1.2 billion). In fiscal year 2024, Purdue received $647 million in research awards from federal and industry sources, a 6 percent increase from the year prior and more than double the figure from 2013.[102] Research investment has led to a significant number of discoveries made in the state, with Indiana universities producing 11,886 IDs from 1998 to 2023. (See figure 15). Indiana universities have been the source of research leading to 3,006 patents issued by USPTO over that 25-year timeframe. In 1990, Indiana universities contributed to the generation of 50 patents, but by 2023, that count was just under 300, indicating a nearly sixfold increase in Indiana university patenting over that time. (See figure 16.) Indiana universities issued 2,362 IP licenses over that period.

Figure 15: IDs from Indiana universities,1998–2023[103]

Figure 16: Issued USPTO patents from Indiana universities,1998–2023[104]

In 1990, Indiana universities contributed to the generation of 50 patents, but by 2023, that count was just under 300, indicating a nearly sixfold increase in Indiana university patenting over that time.

In addition to patents and IDs, research performed at Indiana universities has led to a considerable number of start-ups. Between 1998 and 2023, 491 start-ups were launched out of Indiana universities. (See figure 17.) However, the number of start-ups launched annually from Indiana universities has been declining for several years. In 2018, 42 were launched, up from 5 in 1998. But since then, Indiana’s commercialization pipeline out of its universities appears to have faltered somewhat. Since 2018, the number of start-ups formed has fallen by 57 percent, with just 18 new start-ups launched in 2023.

Figure 17: Start-ups launched from Indiana universities,1998–2023[105]

From 2000 to 2015, Indiana produced 25,755 patents, led by the Indianapolis metro area with 8,161 patents, followed by the (Indiana parts of the) Chicago-Joliet-Naperville metro area. This region produced 46,991 patents; however, just 8 percent of the population of the region resides in Indiana, so just 3,947 were attributed to the state. Indianapolis’s annual rate of patenting increased by 35 percent from 544 patents in 2000 to 735 in 2015.[106] Regarding biotech, the state produced 1,525 patents in drug treatments specifically, with Indianapolis leading the state (1,013), followed by Lafayette (193), showing Purdue’s strength in this area.[107] Nationwide, Purdue ranks fourth in the country for the number of issued patents coming from a university.[108]

Innovation Vignette: Indiana University Research Leads to Rare Disease Cancer Breakthrough

A treatment for two rare pediatric bone diseases—X-linked hypophosphatemia (XLH) and tumor-induced osteomalacia—reached the market in 2018 thanks to decades of research led by Indiana University faculty and the efforts of its Innovation and Commercialization Office (ICO). The therapy, Crysvita (burosumab), is a monoclonal antibody that targets Fibroblast Growth Factor-23 (FGF23), a hormone that causes severe bone malformation. Researchers Michael Econs and Kenneth E. White at the Indiana University School of Medicine discovered the role of FGF23 in XLH, laying the scientific foundation for this transformative drug. Indiana University’s ICO managed the FGF23 IP and successfully licensed the technology to Kyowa Kirin Co., Ltd., which developed the drug in collaboration with Ultragenyx Pharmaceutical.

The development of Crysvita represents a testament to the power of federally funded basic research, particularly through grants from NIH. Beginning with early investigations in the 1980s, public investment has enabled the sustained research needed to understand the genetic and molecular mechanisms behind XLH. Without this long-term funding commitment, such rare disease therapies, termed “orphan diseases,” would likely never reach patients. The FDA’s approval of Crysvita for XLH in 2018, followed by a 2020 approval for tumor-induced osteomalacia, demonstrates how government-backed science can lead to life-changing clinical innovations for underserved populations.

Innovation Vignette: Purdue Revitalizes America’s Rare Earth Capabilities

ReElement Technologies is a pioneering company in the field of rare earth elements (REEs) and critical mineral refining, with its origins rooted in research conducted at Purdue University. Founded in 2016 as American Rare Earth, the company rebranded to ReElement Technologies and, in 2021, acquired exclusive rights to a suite of patented ligand-assisted displacement (LAD) chromatography technologies developed by Dr. Nien-Hwa “Linda” Wang, a professor in Purdue’s Davidson School of Chemical Engineering. Dr. Wang’s research, spanning over four decades, initially focused on medical applications but evolved to address the separation and purification of REEs and battery elements from various sources, including coal byproducts, recycled magnets, and lithium-ion batteries. This innovative technology offers a more environmentally friendly and efficient alternative to traditional refining methods, which are often associated with high energy consumption and pollution.[109]

Leveraging Purdue’s technology, ReElement has established itself as a key player in the domestic production of high-purity REEs and battery materials. The company operates a commercial qualification facility in Noblesville, Indiana, and is developing a larger production site in Marion, Indiana, aiming to produce over 1,000 tons per year of ultra-pure rare earth oxides. ReElement’s modular and scalable refining platform is capable of processing diverse feedstocks, including recycled materials and virgin ores, making it the only U.S.-based solution of its kind. This advancement is significant in reducing the nation’s reliance on foreign sources (particularly China) of critical minerals essential to technologies such as semiconductors, electric vehicles, and renewable energy systems.[110]

Kansas

Kansas’s Tech Economy

Kansas increasingly fields a tech-driven economy, with Kansas’s life sciences industry a significant contributor to the state’s economy. The state’s biopharmaceutical sector contributes $11.3 billion in annual economic impact and supports over 34,700 jobs (7,989 directly and the rest indirectly).[111] It is also home to the largest concentration of animal health companies globally, anchored by the Kansas City Animal Health Corridor.[112]

From 1998 to 2023, Kansas universities contributed to nearly 3,000 IDs, 700 USPTO patent awards, 708 IP licenses, and 94 new start-up companies.

In 2021, bioscience-related VC investment in Kansas companies increased significantly, reaching nearly $56 million. The state’s bioscience ecosystem includes more than 1,600 establishments, with a strong presence in research, testing, and medical laboratories, as well as bioscience-related distribution.[113] Kansas’s commitment to the life sciences is further demonstrated by its investment in facilities such as the National Bio and Agro-Defense Facility, which enhances the state’s capabilities in animal health research and biodefense.[114]

Kansas’s IT industry contributes over $8 billion to the state’s GSP and accounts for approximately 9 percent of the state’s workforce. The sector encompasses various industries, including software development, IT services, and advanced manufacturing. Notably, the Kansas City, MO-KS metro area ranks 14th nationally in the highest number of tech jobs per capita among large metropolitan areas.[115] Kansas also ranks second in the nation for the share of power produced by renewable energy technology, highlighting the state’s commitment to sustainable technological advancements.[116]

VC financing in Kansas is low relative to its GSP, with total VC investment from 1997 to 2023 amounting to 0.13 percent of GSP. Compared with other states, Kansas ranks 41st. In 2023, the state received $250 million in VC funding, a steep drop from years prior, with VC investment peaking in 2021 when the state received $836 million.[117]

Kansas’s workforce consists of 352,100 STEM employees, or 18 percent of all workers. The largest number of STEM employees is located in the Kansas side of the Kansas City metro area, with 131,700 employees, followed by Wichita with 87,500 employees, and Topeka with 22,500. Manhattan and Lawrence, home to the two largest universities in the state, Kansas State and the University of Kansas, employ about 16,000 and 13,000 STEM workers, respectively.[118]

Universities Driving Kansas’s Tech Economy

The University of Kansas contributed $1.34 billion to the Kansas (and broader U.S.) economy between 2011 and 2023.[119] The University of Kansas’s Innovation Park, which includes 71 companies, contributes to the state’s economy with 680 private sector jobs and $45.1 million in annual payroll.

Kansas universities received $6.2 billion in federal funding for R&D between 1998 and 2023, with most going to the two state university systems: the University of Kansas ($4 billion) and Kansas State University ($1.9 billion). Private industry also invested $565 million in university R&D, with the University of Kansas receiving the most ($337 million), followed by Kansas State University ($136 million) and Wichita State University ($74.3 million). Kansas universities produced nearly 3,000 IDs between 1998 and 2023. (See figure 18.) Research conducted at Kansas universities contributed to over 700 USPTO patent awards over that timeframe. (See figure 19). Additionally, Kansas universities issued 708 IP licenses.

Figure 18: IDs from Kansas universities,1998–2023[120]

Figure 19: Issued USPTO patents to Kansas universities,1998–2023[121]

From 1998 to 2023, 94 start-ups were launched from Kansas universities, with at most 11 start-ups being launched per year. (See figure 20.) The University of Kansas was responsible for most of these companies, with 63 started from the school since 1998. Kansas State University follows with 28 start-ups, then Wichita State University with 3.

Figure 20: Start-ups launched from Kansas universities,1998–2023[122]

From 2000 to 2015, Kansas residents produced 6,566 patents, led by the Kansas City metro area, which produced 7,952 patents. (As about 45 percent of the Kansas City population lives on the Kansas City side of the river, about 3,600 of these patents were counted for Kansas). The Kansas City area experienced a noticeable 273 percent increase in patenting activity between 2000 and 2015, from 219 to 816 patents. After Kansas City, Wichita reported 1,648 patents, Lawrence reported 424, and Manhattan 305.[123] In terms of patents for drug-specific technologies, Lawrence led the state, producing 83 patents, followed by Kansas City (68) and Manhattan (33), again showing the strength of these university-led life sciences tech ecosystems.[124]

Innovation Vignette: University of Kansas Leading Research Into Drug Metabolism

Andrew Parkinson, founder of XenoTech, LLC, in Lenexa, Kansas, has seen his company grow into a global leader in drug metabolism research. Originally a professor at the University of Kansas Medical Center (KUMC), Parkinson identified a growing need for research services focused on enzymes and drug interaction testing. He was encouraged by consistent requests from pharmaceutical companies and supported by KUMC’s incubator space, so he transitioned his research into a commercial enterprise. Over time, XenoTech expanded to more than 80 employees and developed specialized departments offering FDA-recommended in vitro research services, including drug metabolism, enzyme inhibition, and species comparison studies. XenoTech’s products and services are now used by global pharmaceutical companies, regulators, and academic institutions.

The company’s success highlights the vital role of government-supported academic research and tech transfer infrastructure in creating real-world impact. XenoTech was launched with resources provided through a university-affiliated biotech center and benefited from early research funded at a public institution. The company provides a prime example of how federally supported research and university innovation ecosystems—empowered by policies such as the Bayh-Dole Act—can be translated into private-sector ventures that advance public health, generate jobs, and strengthen the economy. As Richard Huston of KUMC has noted, XenoTech’s evolution serves as inspiration for other researchers, demonstrating how academic discoveries can be successfully transferred into the public domain for broad societal benefit.

North Carolina

North Carolina’s Tech Economy

North Carolina exhibits a heavily technology-based economy. In 2023, North Carolina’s technology industry contributed over $92 billion to the state’s GDP, accounting for more than 12 percent of North Carolina’s GSP. The sector employed approximately 323,000 individuals, representing nearly 7 percent of the state’s workforce. Between 2018 and 2023, tech employment in North Carolina grew by nearly 19 percent, placing the state eighth nationally in tech job growth during that period.[125] North Carolina’s modern tech-driven economy has come a long way from the tobacco, textile, and furniture industries that initially made the state prosperous, and indeed this transformation has been “one of the economic success stories in the country.”[126] As the following shows, North Carolina’s universities have played a pivotal role in transforming the state into a tech-driven economy.

From 1998 to 2023, 756 start-ups were launched from North Carolina universities. In 2023, 39 were launched, over four times more than in 1998.

North Carolina’s life sciences industry represents a significant economic driver, generating $51.6 billion in direct corporate revenues. When accounting for multiplier effects, the industry’s total revenue impact reaches $82.1 billion, with a contribution of $41 billion to the state’s GDP. The sector supports over 213,000 jobs, with an employment multiplier of 2.84, meaning each life sciences job supports an additional 1.84 jobs in the state economy.[127]

The North Carolina Biotechnology Center (NCBiotech) plays a central role in nurturing this ecosystem, providing grants, loans, and support for workforce development. In 2023, the state attracted significant investments from life sciences companies, including a $450 million expansion by Eli Lilly and a $485 million investment by ProKidney, collectively creating hundreds of high-paying jobs.[128]

North Carolina has established itself as a national leader in the life sciences through a long-standing, coordinated strategy centered around NCBiotech, the first state-sponsored life sciences initiative in the United States. Founded in 1984, NCBiotech plays a central role in aligning government, academia, and private industry in support of innovation and economic growth. The state’s Research Triangle Park (RTP) acts as a cornerstone of North Carolina’s biotech ecosystem, offering world-class research facilities and proximity to leading universities such as Duke, UNC-Chapel Hill, NC State, and Wake Forest, among others. North Carolina has become a hub for biomanufacturing, attracting pharmaceutical giants such as Eli Lilly and Pfizer with its highly trained workforce and business-friendly environment. Workforce development represents a top priority, with programs such as NCBioImpact uniting universities and community colleges to provide specialized bioscience training. In addition to infrastructure and talent development, NCBiotech supports early-stage companies through grants, loans, and commercialization assistance, helping to translate research into real-world products.

As North Carolina has gained acclaim for its success as a biotech and pharmaceutical hub, VC investment to the state has increased substantially. Since 1997, the state has received over $37 billion in VC investment, equivalent to 0.3 percent of GSP. This places North Carolina 18th in the country in terms of VC investment relative to GSP. Over that same period, annual investment has grown by a factor of nine, from 0.03 percent of GDP to 0.25 percent.[129]

Nearly 1.2 million individuals work in STEM-related positions in North Carolina, representing 19 percent of the state’s workforce. The highest percentage of these employees are located in the Charlotte metro area, with 284,100 employees, followed by Raleigh (222,400), the Durham-Chapel-Hill area (101,200), and the Greensboro-High Point region (89,300).[130]

Universities Driving North Carolina’s Tech Economy

Universities have played a catalytic role in the growth of North Carolina’s tech economy. The University of North Carolina (UNC) reports spawning 786 university-affiliated start-ups since 1958 and notes that there are 443 UNC-spawned start-ups currently headquartered in North Carolina. These UNC-spawned start-ups contribute $14.4 billion in annual revenues to the state and employ over 13,500 North Carolinians.[131]

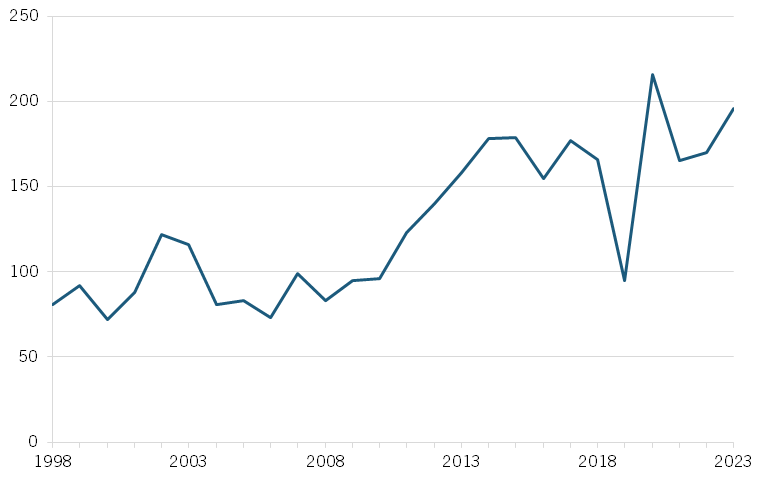

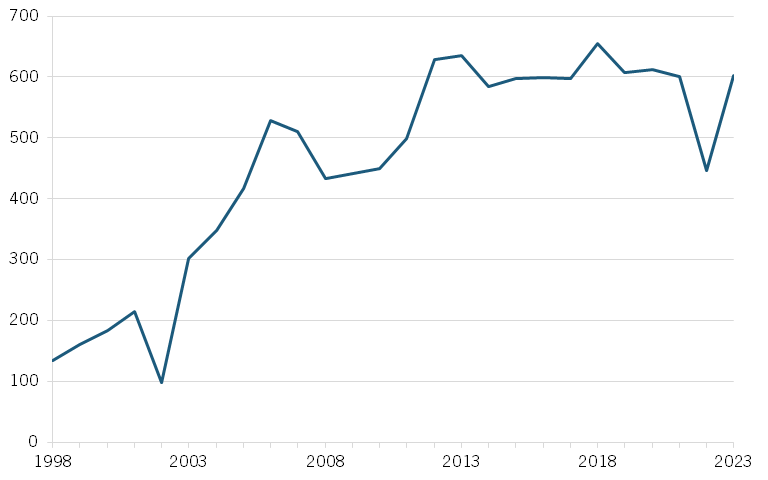

Over $33 billion has been invested in research conducted at North Carolina universities by the federal government since 1998. UNC Chapel Hill leads the state in federal funding, receiving $13.2 billion, followed by Duke University ($12.8 billion), and North Carolina State University ($4.3 billion). Universities in North Carolina have also received $7.8 billion in research funding from private businesses. Duke University has been the greatest recipient of private funding, receiving $4.7 billion, followed by North Carolina State ($1.3 billion), and UNC Chapel Hill ($732 million). North Carolina universities generated 17,699 IDs from 1998 to 2023. (See figure 21).

Figure 21: IDs from North Carolina universities,1998–2023[132]

Research conducted at North Carolina universities contributed to 4,255 U.S. patents over that timeframe. (See figure 22.) Additionally, North Carolina universities issued 4,802 IP licenses. UNC Charlotte saw 21 new company introductions for patent licenses in the most recent 12 months, compared to 11 in the prior year, a 90 percent increase. The university also recorded 53 new inventions in FY25, a jump from 36 in the previous year, while its patens filed increased to 71 from 56 in the previous year.

Figure 22: Issued USPTO patents to North Carolina universities,1998–2023[133]

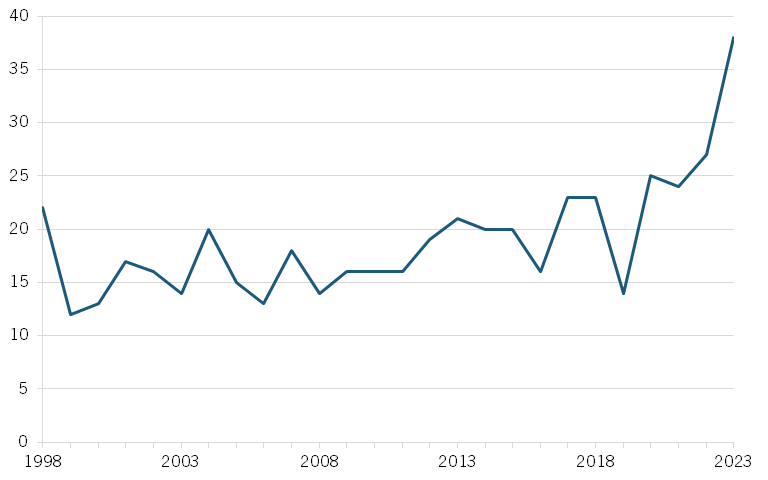

From 1998 to 2023, 756 start-ups were established from North Carolina universities. In 2023, 39 were launched, over four times more than in 1998. (See figure 23.) Over that timeframe, North Carolina State University was responsible for the most start-up launches (243), followed by Duke University (196), and UNC Chapel Hill (153).

Figure 23: Start-ups launched by North Carolina universities,1998–2023[134]

From 2000 to 2015, North Carolina filers produced over 35,000 patents, led by the Raleigh-Cary metro area with 15,950, followed by Durham-Chapel Hill with 6,861 and the Charlotte-Gastonia-Rock Hill region with 3,425. (Considering that about 75 percent of the population of this region resides in North Carolina, only 75 percent of the region’s 4,527 patents were attributed to the state.) North Carolina’s patent production more than doubled over this period, growing from 672 in 2000 to 1,535 in 2015.[135]

Innovation Vignette: North Carolina University Develops Innovative Wound Therapies

Severe blood loss is a major cause of death in trauma cases, particularly in military settings where wounds are difficult to treat with conventional gauze. Recognizing this unmet need, researchers from the University of North Carolina at Chapel Hill and East Carolina University developed a novel hemostatic textile made from a blend of natural and synthetic fibers such as glass, silk, bamboo, and zeolite. The fabric can also incorporate clotting agents such as thrombin and fibrin, enhancing the body’s ability to stop bleeding. This material—soft, absorbent, and easy to use in a variety of conditions—offers a significant improvement over traditional gauze dressings by accelerating clot formation and reducing overall blood loss.

With support from government-funded academic research and the technology transfer infrastructure enabled by the Bayh-Dole Act, this innovation was licensed to the University of North Carolina start-up Entegrion, as in 2007, the company received FDA approval for the textile under the brand name Stasilon™, and it launched AlphaBandage™ for battlefield use. The U.S. military played a key role in early pilot testing and distribution, underscoring the importance of public investment in lifesaving technologies.

Innovation Vignette: UNC Charlotte Research Enhances Access to Safe Drinking Water

Safe drinking water is still not accessible across much of the world. Addressing this global crisis, AquiSense Technologies has pioneered a compact, chemical-free method for water disinfection using ultraviolet (UV) light-emitting diode (LED) technology. Founded in 2015 as a spinout from the University of North Carolina at Charlotte (UNCC), AquiSense was among the first companies to commercialize UV-C LEDs for water purification. The company’s flagship product, the PearlAqua, delivers mercury-free disinfection by emitting germicidal light that neutralizes bacteria, viruses, and protozoa at the DNA level, offering a solution for applications ranging from household drinking systems to medical equipment sterilization.[136]

This breakthrough was made possible through the strong foundation of academic research and public support. Research at UNCC laid the groundwork for the development of advanced photonics and optical systems. At the same time, the Bayh-Dole Act enabled the university to retain and license its IP to AquiSense, thereby accelerating commercialization. Federal innovation programs such as the SBIR program provided early-stage funding to validate and expand the technology’s reach.

Best University Practices Stimulating Technology Commercialization

Based on conversations with representatives from several universities referenced in this report, the following themes emerged regarding best university practices to stimulate technology commercialization.

Build a supportive ecosystem. A successful tech transfer process requires more than just IP licensing; it must include incubation, start-up services, mentoring, and access to funding. UGA’s Innovation Gateway and Purdue’s Purdue Innovates are prime examples. Both offices provide structured start-up support and facilitate industry engagement, investor connections, and mentoring. Purdue’s launch of its Discovery Park in West Lafayette—a 400-acre innovation district—demonstrates how infrastructure can support start-ups and attract public-private partnerships.

Focus on talent and team building. Across interviews and institutional reports, the shortage of experienced entrepreneurial management talent has consistently been cited as a major hurdle for university-based start-ups, especially in nonmetropolitan regions. UGA, for example, addresses this by creatively sourcing management and leveraging programs to bring experienced entrepreneurs to campus. Duke and UNC run bootcamps and mentorship initiatives to develop entrepreneurial skills among students and faculty. These programs help founders build well-rounded teams capable of raising capital and supporting start-up companies’ growth.

Cultivate a culture of innovation. Purdue attributes much of its tech transfer success to a deliberate “pro-innovation culture shift” across the university, led from the top down and supported by data-driven storytelling. Its consistent growth in IDs and patent filings reflects a strong internal buy-in to innovation as a core university mission. Similarly, Duke’s transformation from minimal support to a comprehensive start-up ecosystem shows how sustained investment in infrastructure and outreach can make a difference. In 2023, 64 percent of new Duke start-ups were headquartered in North Carolina.[137] Mirroring a similar strategy, the University of Delaware has integrated innovation and entrepreneurship (I&E) as core pillars of the university, and this top-down approach has allowed for a culture shift toward innovation.