The Inflation Reduction Act Is Negotiating the United States Out of Drug Innovation

The Inflation Reduction Act (IRA) undermines innovation in small-molecule drugs by subjecting them to price controls after 9 years, whereas large-molecule drugs (biologics) are allowed 13 years of market pricing. Congress should pass the bipartisan EPIC Act to remedy this issue.

KEY TAKEAWAYS

Key Takeaways

Why the 9- vs. 13-Year Distinction? 4

The Economics of Biopharmaceutical Innovation. 5

Large Molecules (Biologics) 10

Implications of the IRA’s 9- vs. 13-Year Distinction. 11

Reduced R&D Leading to Fewer Treatment Options 11

Decreased Funding for Small Pharmaceutical Companies 14

Introduction

In August 2022, the Biden administration signed into law the Inflation Reduction Act (IRA), which purportedly intended to combat inflation—even though it directed $400 billion in federal funding toward clean energy investments—by offsetting these expenditures through drug price controls and increased revenues from corporate taxes.[1] In particular, Congress sought to realize $281 billion in health care savings through “prescription drug pricing reform,” which included an estimated $122 billion through the repeal of the drug rebate rule, $96 billion through drug price “negotiations”—properly understood, a euphemism for “government drug price controls”—and $63 billion through drug price inflation caps.[2] The Congressional Budget Office (CBO) estimated that the IRA’s drug price control provisions would lower the federal deficit by $237 billion in the first 10 years, while having no effect on inflation.[3]

The IRA became the first law in American history to grant the Centers for Medicare & Medicaid Services (CMS) the authority to control the prices of drugs. Specifically, it allows CMS to “negotiate”—but, in reality, this means to set—prices for specified drugs covered under Medicare Part B, outpatient care, and Medicare Part D prescription drug coverage. It also requires drug companies to discount medications if prices rise faster than inflation.[4]

There are two main classes of drugs: small-molecule drugs, which are derived chemically, and biologics, which are derived from, and generally manufactured within, living tissues.[5] The IRA applies different timelines for when these two classes of drugs can become eligible for “negotiation.” The legislation specifies that after 9 and 13 years, respectively, small- and large-molecule drugs become eligible for IRA price setting.[6] The IRA makes this distinction by using two drug approval processes: the New Drug Application (NDA), commonly used for small molecules, and the Biologics License Application (BLA) for large molecules. [7]

In August 2023, Medicare released a list of the first 10 drugs to become subject to price setting, of which 7 were small-molecule drugs. The drugs target a wide range of diseases, including diabetes, heart disease, and cancer, and are used by 8 million people on Medicare.[8] Gross spending on these drugs during the one-year negotiation period totaled over $50 billion, or around 20 percent of gross prescription drug costs under Part D benefits.[9] In January 2025, CMS released a list of the next 15 drugs selected for price setting, and all of them are small molecules.

The IRA’s distinction could have drastic consequences for small-molecule innovation, as drug developers and investors are incentivized to shift their resources toward the more-profitable production of biologics.

The IRA is poised to harm drug innovation both today and well into the future. While a 2022 CBO report concludes that the United States would lose 15 potential drugs over the next 30 years due to lost revenues from drug price controls, other assessments have found much larger effects.[10] A 2021 study finds that the impact of price controls, as proposed under HR 5376, would result in a nearly 45 percent decline in pharmaceutical research and development (R&D) investments and 135 fewer new drugs developed between 2021 and 2039. The study also estimates that the loss of life from the price controls over the next decade would be 20 times larger than the loss from COVID-19 in the United States between March 2020 and September 2021.[11]

Since releasing its estimates, CBO has acknowledged the need for better data and more rigorous studies to inform evidence-based policymaking and has called for new research to assess the impact of such policies on drug development.[12] A recent Information Technology and Innovation Foundation (ITIF) report “The Relationship Between Biopharma R&D Investment and Expected Returns: Improving Evidence to Inform Policy” outlines several limitations in CBO’s modeling and calls for new studies that could provide better evidence on how such policies affect Americans’ health and overall health care costs, beyond just drugs.[13]

Price controls such as those in the IRA harm pharmaceutical companies’ and venture investors’ incentives to undertake new drug R&D because there is a causal link between companies’ ability to earn revenue and their ability to invest in future drug R&D. Post-market R&D may suffer because this is where additional uses for a drug are often discovered. Indeed, a recent National Bureau of Economic Research study suggests that price controls are likely to reduce companies’ investment in highly welfare-improving R&D.[14] Moreover, since the United States constitutes the world’s largest biopharmaceutical market, policies that limit U.S. biopharmaceutical industry growth will have lasting effects that reverberate throughout the world, with downstream consequences to U.S. and global health that may be unanticipated by policymakers today.[15]

The IRA’s unnecessary and counterproductive distinction between small- and large-molecule drugs disproportionately discourages small-molecule drug innovation, as drug developers and investors become incentivized to shift resources toward potentially more-profitable biologics. Ultimately, this will come at a cost—not just for Medicare patients, but all citizens—in the form of fewer drug choices and reduced health care outcomes.[16] Access to both large- and small-molecule medicines is what makes treatments for a plethora of conditions so effective, as diseases including cancer and neurodegenerative disorders can be targeted based on the most-recent scientific findings. Maintaining access to the most-innovative treatments is essential to ensuring that patients are given the best chance at combating their illnesses.

Why the 9- vs. 13-Year Distinction?

Arbitrary size regulations that distinguish between small and large molecules started around 30 years ago when scientist Christopher Lipinski worked with a team to produce guidelines on making pills orally bioavailable.[17] Lipinski measured the size of drugs using Daltons (Da), also known as “unified atomic mass units”, in which a unit of mass is defined as 1/12th the mass of an unbound neutral atom of carbon-12 in its nuclear and electronic ground state and at rest.

Lipinski’s “rule of 5” suggested that, for optimal solubility and oral bioavailability, drug candidates should generally have a molecular mass of 500 Da or less, no more than 5 hydrogen-bond donors, no more than 10 hydrogen-bond acceptors, and a lipophilicity (measured as logP) of less than 5.[18] What began as a set of guidelines to help ensure efficient drug production evolved into a decades-long debate over how to appropriately size, evaluate, and regulate small- versus large-molecule drugs.[19]

While there is little gray area between the sizes of small and large molecules—with the average small molecule weighing 900 Da and below and the average large molecule weighing above 3,000 Da—the distinction that was made between the two has created problems for drug developers and policymakers alike, as seen in the lack of equitable regulation under the IRA.[20]

It is not exactly clear why the IRA features the 9 vs. 13 distinction, but some believe it was because policymakers wished to promote more cutting-edge biologic therapies. An alternative hypothesis is that policymakers worked from existing U.S. Food & Drug Administration (FDA) exclusivity laws, which grant biologics 12 years and small molecules only 5 years.[21] Exclusivity allows drug manufacturers a specific amount of time before generic versions can be produced using the innovator’s original clinical trial data. The initial difference in exclusivity timelines stemmed from the FDA’s desire to promote innovation in biologics and make up for the potential time lost during their longer discovery and development periods.[22]

Neither category (small- vs. large-molecule drugs) is more important than the other, and both are necessary to continue improving human health. Scientists should follow the science to decide what solutions work best to treat a particular medical condition.

While excitement about the potential of biologics to unlock groundbreaking life-sciences innovation is well warranted—about 30 percent of new drugs under development today are biologics—policymakers should not lose sight of the importance of small molecules as well. Neither category (small- vs. large-molecule drugs) is more important than the other, and both are necessary to continue improving human health. Scientists should follow the science to decide what solutions work best to treat a particular medical condition.

Benefits of small molecules include the ability to perform chemistry inside cells, which has only become feasible within the past 15 years, and which allows researchers to create targeted drug interactions within the natural environment of a cell, improving precision, efficacy, and safety. Recent developments in cancer treatments using small molecules have enabled the targeted tagging of specific proteins associated with cancer cells for apoptosis (programmed cell death), which allows for the precise identification and destruction of malignant cells.[23] Small-molecule drugs have also been used to treat polyneuropathy in people with hereditary amyloidosis, a fatal disease. Findings show that through this RNA interference technology, quality of life and measures of disability have shown positive (if modest) change.[24] However, IRA provisions reduce incentives for cutting-edge small-molecule R&D by shortening the market exclusivity period before CMS price setting begins. This can also discourage post-approval trials, with potentially significant consequences for oncology and other therapeutic areas where pursuing additional indications or patient populations after initial approval is crucial to address unmet medical needs. Overall, the IRA is likely to decrease incentives for such post-approval trials by setting a limited timeframe before a drug becomes eligible for price setting.[25]

The Economics of Biopharmaceutical Innovation

The IRA also reduces incentives for biopharmaceutical innovation by interfering with existing market competition and with generic entry, mechanisms already effective in reducing drug prices naturally.

Drug development constitutes a long, costly, and risky process: it can take up to 15 years and cost up to $4 billion to develop a new drug, with few drug candidates ever reaching the market.[26] Intellectual property (IP) rights and protections are foundational to biopharmaceutical innovation, as they help protect novel ideas while allowing for market competition after patent expiry. Without IP, a biotech or pharmaceutical company developing a new drug would bear the full costs of R&D but fail to capture the benefits of that investment, as other firms could simply enter the market copying the same compound shortly upon the drug’s launch. It is also important to note that IP does not prevent any competitor from coming in with a similar product. It has been a bedrock of innovation policy that incentives need to be created for companies to invest in R&D to develop new drugs in the first place. Patent protection represents a common policy tool to encourage socially desirable levels of R&D because it provides biotech and pharmaceutical companies with an opportunity to recover their R&D investments and generate revenues that are needed to sustain future R&D efforts.[27] A study using data from the Carnegie Mellon Survey on Industrial R&D confirms that patent protection leads to higher private returns on R&D, which in turn stimulates drug R&D investments.[28]

Existing U.S. law allows for 20 years of patent protection before IP enters the public domain. However, in the case of pharmaceutical patents, 6 to 8 years are usually spent on clinical research and trials, leaving only 12 to 14 years for companies to earn revenues that can be reinvested in future drug R&D. A study in the American Economic Review finds that the inability to bring new drugs to market may quickly lead pharmaceutical companies to shift their R&D efforts away from drugs for early-stage cancers. As it takes longer for early-stage cancer drugs to reach the market, their effective patent terms are shorter than those of late-stage drugs, so the combination of clinical trial length, disease complexity, and the patent system can under-incentivize such research.[29] Early-stage cancer treatments are particularly susceptible because the FDA dictates that the length of a clinical trial is dependent on how long it takes for a treated patient to show improvement. In early-stage cancers, it takes longer to document changes compared with later-stage cancer treatments.[30]

Strong IP plays a pivotal role in fostering market competition and driving product innovation. While patents are designed to prevent direct replication of an original innovation, importantly, they do not hinder the development of competing products within the same indication or therapeutic class. Competitors frequently introduce alternatives that offer differentiated treatment options, whether that be through administrative methods or formulations, enabling physicians to tailor treatment options while creating economic competition for value and price well before patents expire. This dynamic ultimately leads to the introduction of generic or biosimilar copies of original compounds after patent expiration, usually priced at the marginal cost of their production. However, the role of IP as a catalyst for such innovation and market competition is an often-misunderstood feature of pharmaceutical market design, with many overlooking its function in incentivizing the funding of innovative R&D and securing protection for product differentiation that results from it.

A compelling example of this competitive market dynamic was the launch of Gilead’s Sovaldi, the first curative treatment for hepatitis C, in 2013. Initially priced at $84,000 (list price for a 12-week course of treatment) with an estimated net price of $45,000 after rebates and concessions, Sovaldi faced widespread public scrutiny. However, economists calculated that the drug offered significant value for the money. Using extensive health-economic data, developers demonstrated that Sovaldi was clinically superior and cost effective for over 80 percent of patients, based on commonly accepted willingness-to-pay thresholds. The conclusion on its value-based price was further supported by payer-funded studies and research from the National Institutes of Health, which evaluated factors such as unmet medical needs, lifetime treatment costs, disease progression, and non-health expenditures such as productivity and caregiver time.[31]

However, competition in the hepatitis C market quickly followed. AbbVie’s expanding hepatitis C franchise drove net prices in the class much lower in subsequent years, while innovative pricing agreements, particularly with U.S. state Medicaid programs, further shaped the market. By 2018, Medicaid best prices had dropped to approximately $24,000, with states such as Louisiana and Washington negotiating population-level “Netflix” payment models for additional substantial discounts. By 2022, Gilead’s Epclusa, a successor to Sovaldi, offered a list price of $24,000, while the entire market will fully transition to generics in the coming years. This case demonstrates how IP is not a barrier to market competition, even in the context of curative therapies priced well below thresholds at which they are cost effective. On the contrary, IP serves as a critical enabler of competition, driving the development of alternative therapies that vie for market share and ultimately deliver value to patients, payers, and the healthcare system.

As the IRA currently stands, the timeframe for earning revenue on novel drugs approved through the NDA pathway becomes even shorter, leaving companies with fewer incentives and resources to invest in future projects.[32] This also interferes with current systems that naturally reduce drug prices through innovative pharmaceutical companies’ market competition and the entry of generics once a patent expires.[33]

Small Molecules

How They Work

Small-molecule drugs have been used to treat diseases for hundreds of years. Weighing around or below 900 Da, a loose guideline set by the FDA, small molecules are usually chemically synthesized or derived.[34] Due to their small size, they are effective inhibitors and allosteric modifiers, meaning they allow for the modification of signal transduction pathways and the regulation of hormone production.

Composed of around 20 to 100 atoms, small molecules can experience many different levels of stability and permeability depending on their chemical composition, and can be ingested in a variety of ways, especially orally, which is an advantage compared with large molecules that are typically administered by injection or intravenously.[35] Due to the simplicity of their design, small-molecule drugs have well defined structures that make it easier to predict interactions.[36] Historically, small molecules have struggled with achieving the same specificity in their targets as large-molecule drugs can, but this issue continues to be studied and resolved.[37] Small-molecule innovation is becoming increasingly cutting edge and specific.[38]

Diseases They Treat

In part due to their size, small-molecule drugs, including over-the-counter drugs such as antihistamines and prescription drugs such as antidepressants and blood pressure medications can target a vast range of treatments.[39] While they are representative of some of the most common ailments treated by small-molecule drugs, these drugs can also treat more complex conditions such as cancers. One example is Imbruvica, a small-molecule drug for blood cancer, which is 1 of the 10 medications initially subjected to price setting by CMS.[40] While cancer treatments normally focus on cell and gene therapy treatments—many of which are biologics—such drugs also often employ and rely on small molecules to help improve drug “safety, efficacy, and manufacturing.”[41]

Small molecules can also treat neurological disorders, as they can penetrate both the cell membrane and the blood-brain barrier. The crossing of the blood-brain barrier allows for the treatment of neurodegenerative diseases that impact the central nervous system, such as Parkinson’s and Alzheimer’s.[42] As drug technology continues to improve, the possibilities for small drug therapies continue to expand, and many experts believe that small-molecule drugs remain in a time of rapid growth.[43] Small molecules have also been involved in diagnostics, such as PET (positron emission tomography) scans and MRIs (magnetic resonance imaging), as well as in immunosuppressive drugs following organ transplants. The breadth of current applications for small molecules highlights their future potential for innovative uses.[44]

Small molecules can also treat neurological disorders, as they can penetrate both the cell membrane and the blood-brain barrier, allowing for the treatment of diseases that impact the central nervous system, such as Parkinson’s and Alzheimer’s.

Moreover, some of the most cutting-edge research being performed in small molecules has focused on RNA targeting, which as of 10 years ago was considered impossible.[45] Currently, there are 34 approved RNA-based therapies, and while most of them are large-molecule treatments, small-molecule RNA therapies were only first pioneered in 2020. RNA is the first step the body takes to transcribe genetic code, or DNA, into a functional protein. Having the capacity to prevent transcription of mutated RNA before it can be translated into mutated proteins would allow disease prevention in completely novel ways.[46] RNA therapies can modulate gene expression by silencing deleterious genes, correcting splicing errors, or degrading malignant RNA.[47] Due to their versatile capabilities, RNA therapies can be used to treat diseases such as muscular atrophy, cancers, and viral infections such as COVID-19.[48]

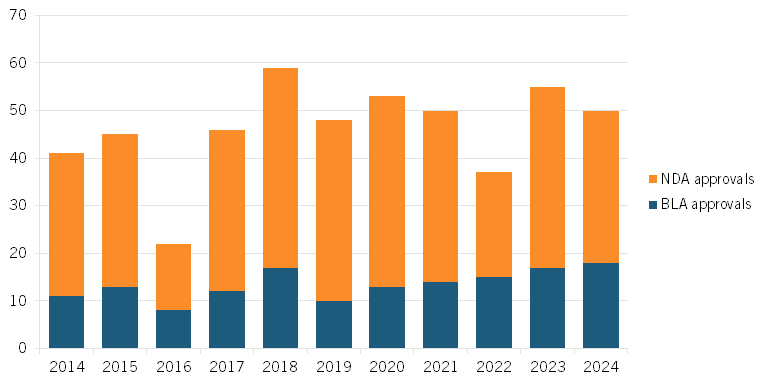

Over the past decade, about 75 percent of novel drugs (new molecular entities or NMEs) approved by the FDA have been small molecules approved through the NDA pathway, and 25 percent have been biologics approved through the BLA pathway. (See figure 1.) This makes the implementation of the IRA that much more problematic, especially since small-molecule drugs are at the forefront of new biopharmaceutical research. In 2021, small-molecule therapies accounted for 4 of the top 10 drugs sold worldwide.[49]

In 2024, 50 novel drugs were approved by the FDA, 32 of which were small-molecule drugs. Among these was the highly anticipated treatment for schizophrenia developed by Karuna and Bristol Myers Squibb. This medication, with a developmental history spanning over 30 years, uses the novel mechanism of targeting (instead of blocking) protein receptors to help ease symptoms such as hallucinations.[50]

Figure 1: Number of NMEs approved by the FDA, 2014–2024[51]

In 2023, 55 novel drugs were approved by the FDA, 38 of which were small-molecule drugs. Eight were for oncology treatments and nine were for rare diseases, and both groups had a first-in-class (FIC) approval. For example, the small-molecule drug Capivasertib is an FIC oncology therapy that binds to and inhibits phosphorylation, preventing the cell from undergoing cell division or apoptosis, both regulatory processes disrupted by cancer.[52] Another example is the rare disease FIC small-molecule drug trofinetide that treats Rett syndrome, a genetic disorder that affects a child’s brain development. It does so by decreasing inflammation and thus enhancing the function of brain cells.[53] Rett syndrome is almost exclusively seen in girls and disrupts neurons in the brain, potentially causing “varying degrees of cognitive, motor, behavior, and speech problems.”[54] While both drugs have earned FIC status—a designation that historically indicated that they would have a longer market exclusivity period—the new IRA provisions would decrease their earning potential.[55]

Most drugs (except for vaccines) used to combat infectious diseases are small molecules. Post-pandemic, development of such infectious disease treatments has been down 34 percent, and any further disincentivizing of small-molecule development could leave the United States susceptible to another pandemic.[56] Elsewhere, antibiotics represent a very common form of small-molecule therapy, and with increasing antibiotic resistance, there is an even greater need for new options for patients.

Overall, the importance of small molecules and their continued R&D cannot be overstated, as they account for about 86 percent of all U.S. prescriptions.[57] And that prevalence should persist going forward. For instance, in a study comparing the focus of new biopharmaceutical companies considering initial public offerings (IPOs) between 2010 and 2014, 64 out of 113 IPOs focused on small-molecule production, while only 17 focused strictly on biologics, showing the continued prevalence of small-molecule drug innovation.[58]

Production Cost

Mostly administered orally, small-molecule therapies are more easily accessible and most often lead to lower medical costs, since patients do not have to go to a medical office or hospital to have the treatments administered. A study conducted by the Boston Consulting Group finds that the average production cost for one small molecule therapy is just $5, compared with an average cost of $60 for a biologic.[59]

Large Molecules (Biologics)

How They Work

Large-molecule therapies have only become possible in the last four decades as advances in biotechnology have made molecule synthesis more accessible. Biologics are produced through the reproduction of living cells. This process begins with cultures being grown in controlled environments, where the cells then make the proteins that will be used and transformed into drugs. This is a long and laborious process, as cell maturation can take weeks, and even once a protein is ready, it must be purified (i.e., separated into the correct parts) before it can be used in drug form. Biologics, unlike small molecules, contain complex structures and can be composed of up to 25,000 atoms.[60] In other words, biologics can be more than 1,000 times larger than small-molecule drugs.

Diseases They Treat

Biologics are especially used to treat diseases of the immune system such as rheumatoid arthritis, psoriasis, and lupus. Biologics can interfere with the chemical signaling that increases inflammation, therefore preventing joints from swelling, helping to mitigate the painful side effects of diseases such as rheumatoid arthritis.[61] Other biologic treatments for autoimmune disorders include cell therapies—such as stem cells—or recombinant proteins, which increase protein production.[62]

Many biologics can integrate into patients’ immune systems and help teach those immune systems which cells to target. The best example of this is monoclonal antibodies, which attach markers to toxic cells, indicating to the immune system to destroy those cells.[63] Kisunla (donanemab-azbt), the second-ever approved treatment for Alzheimer’s, is an example of this kind of treatment.[64]

Biologics can also enhance cell function and the proliferation of healthy cells. An example of this type of biologic is colony-stimulating factors, which increase bone marrow cell growth, usually amid a patient’s treatment with chemotherapy, enhancing the patient’s immune system and reducing the risk of infections to allow for continued treatment and better patient outcomes. Another example of a common and vital biologic is insulin, a hormone released in response to elevated glucose (sugar) levels in the blood. It helps cells absorb glucose, allowing the body to use it for energy. Individuals with diabetes either do not produce enough insulin or cannot use it effectively. Biologic medicines can help regulate blood sugar by improving insulin function or increasing insulin levels, allowing the body to better manage glucose.

Production Cost

Biologics are generally more expensive to manufacture than are small-molecule drugs due to the complexity of production, supply chain, and storage challenges. Biologics also have stricter regulations to adhere to before they are considered market ready. Coupled with longer regulatory review times and consistent regulatory checkpoints, biologics often take considerably more time, money, and effort to produce than do small-molecule drugs. Once production is finished and the product is sold, additional costs ensue, as most biologics are temperature sensitive and must be stored and transported very carefully in controlled environments (e.g., refrigeration or freezing) in order to maintain their stability.

Moreover, because many biologics require health professionals to administer them either intravenously or through an injection, there are additional indirect costs, adding to the overall higher costs of biologics.

Between 2010 and 2014, 64 of 113 IPOs focused on small molecule production, while only 17 focused strictly on biologics.

The biologics market itself is also concentrated among a select few drugs, with the top 10 therapies accounting for 36 percent of all spending.[65] By comparison, the 10 largest small-molecule drugs only account for about 20 percent of the small-molecule market. The three largest therapeutic areas—autoimmune, diabetes, and oncology—are alone worth over $110 billion, and have contributed 70 percent to biologics’ growth since 2010.[66] However, the market share of biologics is on the rise, from 16 percent of the pharmaceutical market (by value) in 2006 to 46 percent in 2021.[67]

Implications of the IRA’s 9- vs. 13-Year Distinction

Reduced R&D Leading to Fewer Treatment Options

The IRA is poised to significantly reduce small-molecule treatment options over the next several decades. By limiting the expectation of revenue for these drugs, the law discourages further R&D, leaving patients and doctors with fewer treatment options.[68] Small-molecule drugs are critical in providing access to care for many individuals, particularly those unable to afford more expensive biologics.[69]

An important factor driving reduced R&D is the expected decrease in venture capital (VC) interest in small-molecule companies. An informal survey conducted by Steve Potts, CEO of SLAM Biotherapeutics, finds that out of 100 VC firms surveyed, over 75 percent are planning on divesting from small-molecule companies, as the return on investment in the wake of the IRA has become too unpredictable.[70] Potts noted that the shortened timeframe for small molecules indicates to VC firms that returns need to happen quicker in order for them to remain a good investment; but this trend has not been observed and is leaving investors wanting to turn away.[71] This is especially the case since, as estimated in a recent analysis by RA Capital Management, drug revenues from years 10 to 14 account for more than one-third of revenues and roughly 40 percent of the total net present value (NPV) of a cardiovascular drug in the United States. Cutting off this important part of the revenue curve can make early-stage cardiovascular drugs not worth the investment.[72]

As the IRA pushes pharmaceutical companies and venture investors away from small-molecule medicine, three-fourths of companies have said that they are reconsidering current strategies, shifting away from small-molecule drugs as they become economically unaffordable to pursue.[73] Fifty-seven percent of pharmaceutical companies interviewed by PhRMA said that they expect to reduce funding on projects that will take many years to develop.[74] As an example, in early 2024, Pfizer announced plans to alter its oncology treatment strategy toward more biologic drugs and to reduce small-molecule investment.[75] Elsewhere, Bristol Myers Squibb’s CEO publicly announced that the company was conducting a thorough review of its portfolio, expecting to cancel certain programs in its effort to make financially sound decisions.[76]

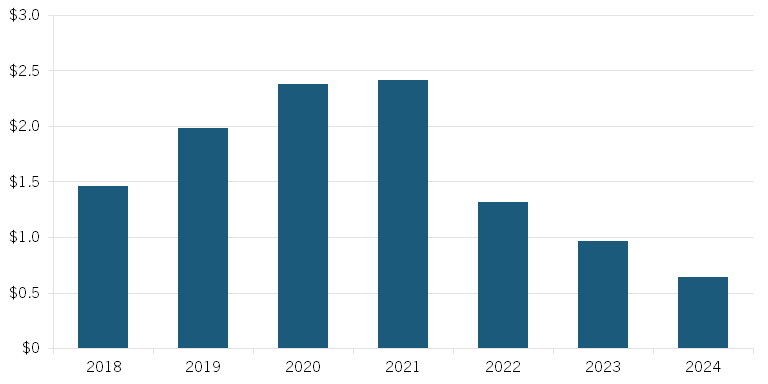

Early data gathered in a preprint study published by Vital Transformations shows evidence of the rapid decrease in small-molecule investment that coincided with the introduction of draft legislation that would become the IRA’s drug price-setting provisions. Since September 2021, small-molecule funding has dropped by 70 percent. (See figure 2.) The report also finds that in the first seven months of 2024, biologics received 10 times more funding than small molecules, despite the versatility and necessity of both types of drugs.[77]

Figure 2: Total investment in small-molecule lead assets ($billions)[78]

While the loss of future R&D is an issue that must be addressed, the IRA is causing currently ongoing projects to be halted as well. In the same previously mentioned PhRMA study, 78 percent reported that they expect to cancel early-stage small-molecule pipeline projects, preventing these drugs from even reaching the end of their research stages, as they are no longer economically viable. Novartis, for example, recently announced the discontinuation of research on several early-stage cancer drug candidates, as their development is no longer financially viable due to the IRA.[79] Other pharmaceutical companies, such as AstraZeneca, have also announced delayed releases of cancer drugs in response to the IRA, and have even reported further reprioritization of small drugs more generally.[80] Treatments are being taken off the market before they even have a chance to prove themselves.

Seventy-eight percent of companies reported that they expect to cancel early-stage pipeline projects, preventing small-molecule drugs from even reaching the end of their research stages, as they are no longer economically viable.

The IRA’s 9 vs. 13 distinction also impacts post-market research, which is conducted after a drug’s initial approval in order to explore additional indications for other conditions and patient populations. Post-market research is valuable, as it can build on an already-approved drug’s established safety profile. This process takes time, and the shortened window dictated by the IRA discourages post-market research for new small-molecule drugs. A study conducted by the Partnership for Health Analytic Research finds that “more than half of small molecule medicines received at least one additional indication,” and almost 50 percent of these happened after the seven-year mark.[81] Thirty-four percent of small-molecule approvals occur more than five years after their initial approval; shortening their timespan would disproportionately hurt rare disease treatments.[82] This seven-year mark falls only two years short of the time when small molecules become subject to price setting under the IRA, making it prohibitive for small-molecule drugs to conduct post-approval studies. These post-approval indications can help to combat diseases such as cancer and orphan diseases (i.e., those affecting 200,000 or fewer people), which are difficult to treat.[83]

Orphan drugs themselves accounted for 54 percent of novel drug approvals in 2022, and these treatments provide life-saving care to groups of often forgotten patients.[84] As it stands, the IRA includes conflicting policies regarding orphan drug exemptions from price setting. The IRA initially only allowed this exemption for orphan drugs that address only one disease, immediately discounting well over half of these treatments. A case in the U.S. Court of Appeals for the Eleventh Circuit states that orphan drug exclusivity should only apply to one drug per rare disease—a policy which, if adopted, could halt further development.[85] To address this, the ORPHAN Cures Act (introduced by John Joyce, M.D. (R-PA) and Don Davis (D-NC)) would amend the IRA to ensure that orphan drugs treating one or more rare diseases or conditions are excluded from Medicare price negotiations.[86]

With a reported 63 percent of PhRMA member companies reporting that they expect to shift R&D investment focus away from small-molecule medicines, treatments for many common life-threatening diseases, including cancer, hypertension, and allergies, will likely see less innovation.[87] As noted, small molecules are uniquely positioned to address these ailments, as they, uniquely, can cross the blood-brain barrier. If companies deprioritize small-molecule development, patients who rely on these accessible, lower-cost treatments could face fewer options, especially in cases where biologics are not suitable substitutes. Reducing treatment approaches would also stifle competition, resulting in higher health care costs and fewer affordable options for patients.

The disincentive to invest in small-molecule therapies may disproportionately affect underserved and elderly populations, which are often most reliant on these more easily accessible treatment options. The previously mentioned Vital Transformations study also found evidence that treatments for the Medicare-aged population have been declining since the passage of the IRA.[88] This reduced availability of small-molecule drugs will limit care affordability and accessibility, preventing patients in need from receiving timely and effective treatment. Small-molecule drugs are also uniquely positioned to allow for medical treatment in remote areas, as they do not require trips to the doctor, hospital, or infusion center—with the associated cost and time burden and logistics—and are more easily distributed and used in areas of the world that do not support the handling needed for biologics, including areas of conflict. The burden of cost and time associated with large-molecule drugs can be an inhibiting factor for patients receiving life-saving treatment, but small molecules overcome these barriers, as they can be taken as pills at home. Both small and large molecules are vital to ensuring that patients receive the best care, and the IRA stands in the way of doing just that.

Decreased Funding for Small Pharmaceutical Companies

Small pharmaceutical companies, defined as those with $500 million or less in yearly revenue, are responsible for almost two-thirds of novel blockbuster therapies. They also represent the source of more than 7 in 10 drug candidates currently in Phase III (pivotal stage) clinical trials.[89] Moreover, start-ups, which account for nearly 66 percent of biopharmaceutical firms in the United States, have an average R&D intensity of 62 percent.[90]

Such small pharmaceutical companies may struggle to find funding for ongoing small-molecule projects because they rely on VC firms and large pharmaceutical companies to finance their work.[91] Production of small molecules in small pharmaceutical companies accounts for 55 percent of all first-in-class drugs, so such companies are one of the main driving forces of small molecule development.[92] Indeed, while over 64 percent of blockbuster therapies originate in small companies, the funding of these firms has suffered due to the IRA’s disincentives for small-molecule therapies.[93]

While large firms must toggle between innovation and efficiency, joint R&D with smaller companies benefits both parties and increases treatment options for patients. One of the first drugs selected for price setting, Imbruvica, was first developed by Celera Genomics, a small, specialized biopharmaceutical company, in 2006.[94] After discovery, Pharmacyclics and Johnson & Johnson agreed to jointly fund the drug through its FDA review process, and it is now used in over 100 countries.[95] The drug itself proves effective in slowing the growth of cancer cells, particularly in treating chronic lymphocytic leukemia and Waldenstrom’s macroglobulinemia.[96] The IRA creates tension between funders and small pharmaceutical companies. Projects that are viewed as high risk, such as those susceptible to price setting, represent a higher liability for investors and risk receiving less funding. This would decrease overall medical innovation and inhibit progress in breakthrough treatments. While the IRA aims to address this with exemptions for small manufacturer drugs from 2026 to 2028, these provisions are insufficient to prevent the damage to R&D that is likely to be wrought by the IRA.[97]

A recent paper in Sage Journals claims that the IRA will have no impact on small-molecule drug development, as small companies will continue to research and develop them even if the larger companies change their focus.[98] This analysis, however, fails to account for the fact that larger pharmaceutical companies support smaller ones, which is an integral part of the broader biopharmaceutical innovation ecosystem.

The EPIC Act

The bipartisan Ensuring Pathways to Innovative Cures (EPIC) Act was first introduced in February 2024 by Reps. Greg Murphy (R-NC), Don Davis (D-NC), and Brett Guthrie (R-KY).[99] It was then reintroduced in February 2025 by Reps. Murphy, Davis, and Richard Hudson (R-NC).[100] The legislation (H.R. 1492) seeks to fix the 9 vs. 13 “pill penalty” imposed on small-molecule drugs and support their continued R&D. The EPIC Act would give small-molecule drugs the same market time before price setting as biologics get, allowing both drugs 13 years of market exclusivity.

By helping to rebalance the incentive structure for pharmaceutical R&D, the EPIC Act ensures companies can choose delivery formulations of their novel drugs based on science, not economics. The sooner the EPIC Act is passed, the sooner pharmaceutical companies will be able to devote time and energy to appropriate resource allocation that prioritizes patient needs. It is imperative that Congress pass the EPIC Act to place small- and large-molecule drugs on the same playing field and avert compromising the next generation of small-molecule innovation.

Conclusion

The biopharmaceutical industry is crucial to the U.S. economy. America is the global leader in this sector thanks to its large domestic market, robust IP protections, historically limited government drug price setting, supportive science policies, and innovative regional biotech clusters. But recent policies, such as price setting through the IRA, are hamstringing the industry, as they reduce incentives for pharmaceutical companies to invest in future drug R&D to create life-improving, -extending, and -saving medicines.

Further, the IRA’s arbitrary distinction between small molecule and biologic drugs exerts a disproportionately negative effect on small-molecule drugs that account for nearly 90 percent of all drugs on the market. The IRA is likely to stifle innovation, particularly in small-molecule therapies, which may be faster to develop, more cost effective to manufacture, and cheaper to administer. It could also limit patient access to a variety of affordable drug options, as fewer small-molecule drugs would reach the market, decreasing accessibility for underserved and elderly populations.

Legislative efforts, such as the EPIC Act, seek to address this disparity by equalizing the time that both types of drugs are sold at market prices. Without such adjustments, the IRA may unintentionally bias drug development based on nonscientific rationales, leading to less innovation, decreased competition, and ultimately fewer life-saving small-molecule therapy options for patients in many disease areas with continued unmet needs.

Acknowledgments

The authors would like to thank Robert Atkinson for his feedback on this report. ITIF would like to thank We Work for Health for providing financial support to help make this research possible. ITIF maintains complete editorial independence in all its research. Any errors or omissions are the authors’ responsibility alone.

About the Authors

Stephen Ezell is vice president for global innovation policy at ITIF and director of ITIF’s Center for Life Sciences Innovation. He also leads the Global Trade and Innovation Policy Alliance. His areas of expertise include science and technology policy, international competitiveness, trade, and manufacturing.

Leah Kann is a fellow at ITIF’s Center for Life Science Innovation. She is a senior at the University of North Carolina at Chapel Hill, pursuing a Bachelor of Science in Biology and a Bachelor of Arts in Public Policy, with a minor in Spanish for Business.

Sandra Barbosu, Ph.D., is the senior policy manager for the economics of biopharmaceutical innovation at ITIF’s Center for Life Sciences Innovation. Sandra is also an adjunct professor at New York University’s Tandon School of Engineering. She holds a Ph.D. in Strategic Management from the Rotman School of Management at the University of Toronto, and an M.Sc. in Precision Cancer Medicine from the University of Oxford.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent 501(c)(3) nonprofit, nonpartisan research and educational institute that has been recognized repeatedly as the world’s leading think tank for science and technology policy. Its mission is to formulate, evaluate, and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit itif.org/about.

Endnotes

[1]. McKinsey and Company, “The Inflation Reduction Act: Here’s what’s in it,” October 24, 2022, https://www.mckinsey.com/industries/public-sector/our-insights/the-inflation-reduction-act-heres-whats-in-it.

[2]. Ibid.

[3]. The White House, “Fact Sheet: One Year In, Presidents Biden’s Inflation Reduction Act is Driving Historic Climate Action and Investing in America to Create Good Paying Jobs and Reduce Costs” (August 16, 2023), https://www.whitehouse.gov/briefing-room/statements-releases/2023/08/16/fact-sheet-one-year-in-president-bidens-inflation-reduction-act-is-driving-historic-climate-action-and-investing-in-america-to-create-good-paying-jobs-and-reduce-costs/; Juliette Cubanski, Tricia Neuman, and Meredith Freed, “Explaining the Prescription Drug Provisions in the Inflation Reduction Act” (Kaiser Family Foundation, January 24, 2023), https://www.kff.org/medicare/issue-brief/explaining-the-prescription-drug-provisions-in-the-inflation-reduction-act/.

[4]. Cubanski, Neuman, and Freedman, “Explaining the Prescription Drug Provisions.”

[5]. Huy X. Ngo and Sylvie Garneau-Tsodikova, “What are the drugs of the future?” MedChemComm, Vol. 9, No. 5 (2018): 757–758, https://pubs.rsc.org/en/content/articlelanding/2018/md/c8md90019a.

[6]. Cubanski, Neuman, and Freedman, “Explaining the Prescription Drug Provisions.”

[7]. Meena Seshamani, “Medicare drug price negotiation program: Revised guidance, implementation of sections 1191-1198 of the social security act for initial price applicability year 2026” (memorandum, Center for Medicare & Medicaid Services, June 30, 2023), https://www.cms.gov/files/document/revised-medicare-drug-price-negotiation-program-guidance-june-2023.pdf.

[8]. Centers for Medicare & Medicaid Services, “Medicare Drug Price Negotiation Program: Selected Drugs for Initial Price Applicability Year 2026” (Medicare Drug Price Negotiation Program, August 2023), https://www.cms.gov/files/document/fact-sheet-medicare-selected-drug-negotiation-list-ipay-2026.pdf; PhRMA, “Access to Medicine,” https://phrma.org/access-to-medicines.

[9]. Ned Pagliarulo, “Medicare names first 10 drugs for price negotiations,” Industry Dive, August 29, 2023, https://www.biopharmadive.com/news/medicare-10-drugs-price-negotiation-ira/692044/.

[10]. Congressional Budget Office, “Estimated Budgetary Effects of Public Law 117-169, to Provide for Reconciliation Pursuant to Title II of S. Con. Res. 14,” https://www.cbo.gov/publication/58455.

[11]. Tomas J. Philipson and Troy Durie, “The Evidence Base on the Impact of Price Controls on Medical Innovation” (working paper, Becker Friedman Institute, University of Chicago, 2021), https://bfi.uchicago.edu/working-paper/the-evidence-base-on-the-impact-of-price-controls-on-medical-innovation/.

[12]. This includes both studies on how changes in the expected financial returns for different drug modalities (e.g., small- vs. large-molecule drugs) affect R&D investment decisions and studies on the trade-offs between current cost savings from price setting and the future health benefits from new drug development.

[13]. Kirsten Axelsen and Sandra Barbosu, “The Relationship Between Biopharma R&D Investment and Expected Returns: Improving Evidence to Inform Policy” (ITIF, May 2024), https://www2.itif.org/2024-biopharma-rd-returns.pdf; Phil Swagel, “A Call for New Research in the Area of New Drug Development,” Congressional Budget Office, December 20, 2023, https://www.cbo.gov/publication/59818.

[14]. Kate Ho and Ariel Pakes, “Policy Options for the Drug Pricing Conundrum” (NBER Working Paper 32606, June 2024), https://www.nber.org/papers/w32606.

[15]. IQVIA, “Top 10 Pharmaceutical Markets Worldwide, 2023,” https://www.iqvia.com/-/media/iqvia/pdfs/canada/2023-trends/english/top10worldwidesales_23.pdf.

[16]. Steven Potts, “Measuring the damage: IRA’s impact on small molecule drug development,” No Patient Left Behind, March 21 2024, https://www.nopatientleftbehind.org/media-collection/95r1kiynt79tpamvn2z3b7ms54v6nq?rq=Measuring%20the%20damage.

[17]. Omathanu Pillai, Ananda Babu Dhanikula, and Ramesh Panchagnula, “Drug delivery: an odyssey of 100 years,” Current Opinion in Chemical Biology Vol. 4, No. 4 (2001): 439–446, https://www.sciencedirect.com/science/article/abs/pii/S136759310000226X.

[18]. Lipophilicity refers to a drug’s ability to dissolve in fats, oils, or lipids and affects how a drug is absorbed, is distributed, and interacts with the body.

[19]. Bethany Halford, “Wrestling with Lipinski’s rule of 5,” C&EN Vol. 101, No. 8 (2023), https://cen.acs.org/pharmaceuticals/drug-discovery/Wrestling-Lipinski-rule-5/101/i8.

[20]. Allucent, “Points to Consider in Drug Development of Biologics and Small Molecules,” https://www.allucent.com/resources/blog/points-consider-drug-development-biologics-and-small-molecules.

[21]. Pew Trust, “Policy Proposal: Reducing the Exclusivity for Biological Products,” September 8, 2017, https://www.pewtrusts.org/en/research-and-analysis/fact-sheets/2017/09/policy-proposal-reducing-the-exclusivity-period-for-biological-products.

[22]. Allucent, “Types of Marketing Exclusivity in Drug Development,” https://www.allucent.com/resources/blog/types-marketing-exclusivity-drug-development.

[23]. Laura Howes, “Why small-molecule drug discovery is having a moment,” Chemical & Engineering News, October 30, 2023, https://cen.acs.org/pharmaceuticals/drug-discovery/small-molecule-drug-discovery-having/101/i36.

[24]. David Adams et al., “Five-Year Results With Patisiran for Hereditary Transthyretin Amyloidosis With Polyneuropathy: A Randomized Clinical Trial with Open-Label Extension,” Jama Network, January 13, 2025, https://jamanetwork.com/journals/jamaneurology/fullarticle/2828606.

[25]. Stacie B. Dusetzina and Frank S. David, “Cancer Drug Access and Innovation Under the Inflation Reduction Act—A Balancing Act,” JAMA Oncology, October 24, 2024, https://doi.org/10.1001/jamaoncol.2024.4745.

[26]. David Proudman et al., “Public sector replacement of privately funded pharmaceutical R&D: cost and efficiency considerations,” Journal of Medical Economics, vol. 27, no. 1 (2024): 1253–1266, https://doi.org/10.1080/13696998.2024.2405407; Joseph A. DiMasi, Henry G. Grabowski, and Ronald W. Hansen, “Innovation in the pharmaceutical industry: New estimates of R&D costs,” Journal of Health Economics Vol. 47 (2016): 20–33, https://pubmed.ncbi.nlm.nih.gov/26928437/.

[27]. Heidi L. Williams, “How Do Patents Affect Research Investments?” Annual Review of Economics Vol. 9 (2017): 441–469, https://www.annualreviews.org/doi/10.1146/annurev-economics-110216-100959.

[28]. Ashish Arora, Marco Ceccagnoli, and Wesley M. Cohen, “R&D and the patent premium” International Journal of Industrial Organization Vol. 26, No. 5 (2008): 1153–1179, https://www.sciencedirect.com/science/article/abs/pii/S01677187001373.

[29]. Eric Budish, Benjamin N. Roin, and Heidi Williams, “Do Firms Underinvest in Long-Term Research? Evidence from Cancer Clinical Trials,” American Economic Review, Vol. 105, No. 7 (2015): 204–2085, https://www.aeaweb.org/articles?id=10.1257/aer.20131176.

[30]. Ibid.

[31]. Jagpreet Chhatwal et al., “Cost-Effectiveness and Budget Impact of Hepatitis C Virus Treatment With Sofosbuvir and Ledipasvir in the United States,” Ann Intern Med. Vol 162. No. 6 (2015): 39–406: 10.7326/M14-1336; Mehdi Najafzadeh et al., “Cost-Effectiveness of Novel Regimens for the Treatment of Hepatitis C Virus,” Ann Intern Med. Vol. 162, No. 6 (2015): 407–419, 10.7326/M14-1152.

[32]. Tomas J. Philipson, Yier Ling, and Ruiquan Change, “The Impact of Price Setting at 9 Years on Small Molecule Innovation Under the Inflation Reduction Act” (The University of Chicago, October 5, 2023), https://bpb-us-w2.wpmucdn.com/voices.uchicago.edu/dist/d/3128/files/2023/10/Small-Molecule-Paper-Final-Oct-5-2023.pdf.

[33]. Nicholas Florko, “Prisons say they can’t afford to cure everyone with hepatitis C. But some are figuring out a way,” STATNews, December 15, 2022, https://www.statnews.com/2022/12/15/prisons-cant-afford-hep-c-drugs-but-some-figured-out-a-way/.

[34]. NIH Seed, “Regulatory Knowledge Guide for Small Molecules,” NIHI, November 2023, https://seed.nih.gov/sites/default/files/2024-03/Regulatory-Knowledge-Guide-for-Small-Molecules.pdf.

[35]. Ibid.

[36]. Favour Danladi Makurvet, “Biologics vs. small molecules: Drug costs and patient access,” Medicine in Drug Discovery Vol. 9 (2020), https://doi.org/10.1016/j.medidd.2020.100075.

[37]. Tristan S. Maurer et al., “Designing small molecules for therapeutic success: A contemporary perspective,” Vol 27. No. 2 (2022): 538-546, https://doi.org/10.1016/j.drudis.2021.09.017.

[38]. Hartmut Beck et al., “Small molecules and their impact in drug discovery: A perspective on the occasion of the 125th anniversary of the Bayer Chemical Research Laboratory,” Vol. 28, No.6 (2022) 1560–1574, https://doi.org/10.1016/j.drudis.2022.02.015.

[39]. Allucent, “Points to Consider in Drug Development of Biologics and Small Molecules.”

[40]. Hartmut Beck “Small molecules and their impact.”

[41]. Ibid.

[42]. Lindsey Seidlitz, “New resource underscores the importance of small molecule medicines,” PhRMA (May, 2023), https://phrma.org/blog/new-resource-underscores-the-importance-of-small-molecule-medicines.

[43]. Howes, “Why small-molecule drug discovery is having a moment.”

[44]. Ibid.

[45]. Ibid.

[46]. Kathi Zarnack and Eduardo Eyras, “Artificial intelligence and machine learning in RNA biology” Briefings in Bioinformatics Volume 24, Issue 6 (November 2023), https://doi.org/10.1093/bib/bbad415.

[47]. Young Kook Kim, “RNA therapy: rich history, various applications and unlimited future prospects,” Experimental & Molecular Medicine, Vol. 54 No. 2 (2022), 10.1038/s12276-022-00757-5.

[48]. Yiran Zhu et al., “RNA-based therapeutics: an overview and prospectus,” Cell Death & Disease (July 23, 2022), https://doi.org/10.1038/s41419-022-05075-2.

[49]. Manufacturing Chemist, “Small molecules: big market opportunities,” https://manufacturingchemist.com/small-molecules-big-market-opportunities-210051.

[50]. Asher Mullard, “2023 FDA approvals,” Nature Vol 24 (2025): 75–82, https://doi.org/10.1038/d41573-025-00001-5.

[51]. U.S. Food & Drug Administration (FDA), “Compilation of CDER New Molecular Entity (NME) Drug and New Biologic Approvals,” April 22, 2024, https://www.fda.gov/drugs/drug-approvals-and-databases/compilation-cder-new-molecular-entity-nme-drug-and-new-biologic-approvals; U.S. Food & Drug Administration (FDA), “2024 Biological License Application Approvals,” December 18, 2024, https://www.fda.gov/vaccines-blood-biologics/development-approval-process-cber/2024-biological-license-application-approvals.

[52]. National Cancer Institute, “Capivasertib,” National Institute of Health, https://www.cancer.gov/publications/dictionaries/cancer-drug/def/capivasertib#.

[53]. Jeffrey L. Neul et al., “Trofinetide for the treatment of Rett syndrome: a randomized phase 3 study” Nature Medicine Vol. 29 (2023): 1468–1475, https://doi.org/10.1038/s41591-023-02398-1.

[54]. International Rett Syndrome Foundation, “What is Rett syndrome?” https://www.rettsyndrome.org/about-rett-syndrome/what-is-rett-syndrome/.

[55]. Drug Hunter Team, “2023 Novel Small Molecule FDA Drug Approvals,” January 10, 2024, Drug Hunter, https://drughunter.com/articles/2023-novel-small-molecule-fda-drug-approvals; Leeza Osipenko, et al., “The Origin of First-in-Class Drugs: Innovation Versus Clinical Benefits” Clinical Pharmacology & Therapeutics Vol. 115, No.2 (2023): 342-348, https://doi.org/10.1002/cpt.3110.

[56]. Institute for Human Data Science, “Global Trends in R&D 2024” (IQVIA, February 2024), https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/global-trends-in-r-and-d-2024-activity-productivity-and-enablers.

[57]. Favour Danladi Makurvet, “Biologics vs. small molecules: Drug costs and patient access.”

[58]. Percy H. Carter et al., “Investigating investment in biopharmaceutical R&D” Nature Reviews Drug Discovery Vol. 15 (2016): 637-674, https://doi.org/10.1038/nrd.2016.104.

[59]. John Gooch et al., “What Does – and Does Not – Drive Biopharma Cost Performance” (Boston Consulting Group, July 7, 2017), https://www.bcg.com/publications/2017/biopharmaceuticals-operations-what-does-and-does-not-drive-biopharma-cost-performance.

[60]. American Cancer Society, “Understanding Biologic and Biosimilar Drugs” (American Cancer Society Cancer Action Network, July 27, 2018), https://www.fightcancer.org/policy-resources/understanding-biologic-and-biosimilar-drugs.

[61]. National Rheumatoid Arthritis Society, “Biologics,” https://nras.org.uk/resource/biologics.

[62]. Meng-Jun Tao et al., “The safety and efficacy of biologic agents in treatment of systemic lupus erythematosus: A network meta-analysis” Pakistan Journal of Medical Sciences Vol. 35, No. 6 (2019): 1680-1686, https://pubmed.ncbi.nlm.nih.gov/31777515/.

[63]. American Cancer Society, “Understanding Biologic and Biosimilar Drugs.”

[64]. U.S. Food & Drug Administration, “FDA approves treatment for adults with Alzheimer’s disease,” July 2, 2024, https://www.fda.gov/drugs/news-events-human-drugs/fda-approves-treatment-adults-alzheimers-disease.

[65]. Denis Kent, Sarah Rickwood, and Stegano Di Biase, “Disruption and maturity: The next phase of biologics," Quintile, 2017, https://www.iqvia.com/-/media/iqvia/pdfs/nemea/uk/disruption_and_maturity_the_next_phase_of_biologics.pdf.

[66]. Ibid.

[67]. Ibid; IQVIA, “Biosimilars in the United States 2023-2027” (January 2023), https://www.iqvia.com/-/media/iqvia/pdfs/institute-reports/biosimilars-in-the-united-states-2023-2027/iqvia-institute-biosimilars-in-the-united-states-2023-usl-orb3393.pdf.

[68]. PhRMA, “Health care policy should get us closer to health equity. The Inflation Reduction Act fails to do so.” (PhRMA, 2022), https://www.phrma.org/resources/health-care-policy-should-get-us-closer-to-health-equity-the-inflation-reduction-act-fails-to-do-so.

[69]. Ibid.

[70]. Steve Potts, “The Future of Biotech,” Vital Health, Podcast Audio, October 2024.

[71]. Ibid.

[72]. Tess Cameron, Peter Kolchinsky, and Richard Xie in a presentation to economists: “Beyond total revenues… How the IRA impacts investors’ early-stage R&D decision-making,” November 11, 2023, RA Capital Management.

[73]. PhRMA, “Inflation Reduction Act Already Impacting R&D,” https://cdn.aglty.io/phrma/global/resources/import/pdfs/Infographic%20%20Inflation%20Reduction%20Act%20Already%20Impacting%20RD%20%20010923%20FINAL.pdf.

[74]. Ibid.

[75]. Greg Slabodkin, “IRA Drives Pfizer’s Decision to Focus on Biologics, Not Small Molecules” (Biospace, March 4, 2024), https://www.biospace.com/ira-drives-pfizer-s-decision-to-focus-on-biologics-not-small-molecules.

[76]. James Waldron, “Bristol Meyers CEO already reassessing portfolio in wake of US pricing law: report,” Fierce Biotech, November 21, 2022, https://www.fiercebiotech.com/biotech/bristol-myers-already-reassessing-portfolio-wake-ira-ceo-tells-ft.

[77]. Duane G. Schulthess et al., “ The Inflation Reduction Act’s Impact upon Early-stage Venture Capital Investments” (preprint, MedRxiv, January 7, 2025), https://doi.org/10.1101/2025.01.07.25320113. Data for companies whose market valuations are less than or equal to $2 billion.

[78]. Ibid.

[79]. Josh Nathan-Kazis, “Novartis CEO: Some Cancer Drugs Dropped From Pipeline Because Medicare Price Negotiations,” Barron’s, May 19, 2023, https://www.barrons.com/articles/novartis-stock-price-ceo-cancer-drug-medicare-e9b0fcb7.

[80]. Steve Usdin, “AstraZeneca may defer U.S. cancer drug launches in response to IRA,” Biocentury, November 10, 2022, https://www.biocentury.com/article/645834/astrazeneca-may-defer-u-s-cancer-drug-launches-in-response-to-ira.

[81]. Andrew Powaleny, “New report shows how the Inflation Reduction Act stifles innovation for small molecule medicines” (PhRMA, June 22, 2023), https://phrma.org/blog/new-report-shows-how-the-inflation-reduction-act-stifles-innovation-for-small-molecule-medicines.

[82]. IQVIA, “Proliferation of Innovation Over Time,” February, 2025, https://www.iqvia.com/insights/the-iqvia-institute/reports-and-publications/reports/proliferation-of-innovation-over-time.

[83]. Ibid.

[84]. Food and Drug Administration, “New Drug Therapy Approvals 2022,” January 2023, https://www.fda.gov/drugs/novel-drug-approvals-fda/new-drug-therapy-approvals-2022.

[85]. Mark Von Eisenburg, “Orphan Drug Development Amid Regulatory Uncertainty,” Avalere, February 27, 2023, https://avalere.com/insights/orphan-drug-development-amid-regulatory-uncertainty.

[86]. Biotechnology Innovation Organization, “The ORPHAN Cures Act,” https://www.saveraretreatments.org/wp-content/uploads/2023/11/ORPHAN-Cures-Act-One-Pager.pdf.

[87]. PhRMA, “Inflation Reduction Act Already Impacting R&D.”

[88]. Duane G. Schulthess et al., “ The Inflation Reduction Act’s Impact upon Early-stage Venture Capital Investments.”

[89]. “Research and Development in the Pharmaceutical Industry,” CBO, April 2021, https://www.cbo.gov/system/files/2021-04/57025-Rx-RnD.pdf.

[90]. John Wu and Robert D. Atkinson, “How Technology-Based Start-Ups Support U.S. Economic Growth” (ITIF, November 2017), https://itif.org/publications/2017/11/28/how-technology-based-start-ups-support-us-economic-growth/.

[91]. Wendy Tsai and Stanford Erickson, “Early-Stage Biotech Companies: Strategies for Survival and Growth,” Biotechnology Healthcare Vol. 3, No. 3 (2006): 49-50, https://pmc.ncbi.nlm.nih.gov/articles/PMC3571061/.

[92]. Mingxiao Gu et al., “Forward or Backward: Lessons Learned from Small Molecule Drugs Approved by FDA from 2021 to 2022,” Molecules Vol.28, No.24 (2023), https://pmc.ncbi.nlm.nih.gov/articles/PMC10745639/.

[93]. Gwen O’Loughlin et al., “The US Ecosystem for Medicines: How new drug innovations get to patients” (PowerPoint Presentation, (December 5, 2023), https://vitaltransformation.com/wp-content/uploads/2022/12/Where-do-new-medicines-originate_FINAL2022_12_05.pdf.

[94]. U.S. Department of Health and Human Services, “HHS Selects the First Drugs for Medicare Drug Price Negotiation,” news release, August 29, 2023, https://www.hhs.gov/about/news/2023/08/29/hhs-selects-the-first-drugs-for-medicare-drug-price-negotiation.html.

[95]. WebMD, “How to use Imbruvica,” https://www.webmd.com/drugs/2/drug-165432-1576/imbruvica-oral/ibrutinib-oral/details.

[96]. Ibid.

[97]. Juliette Cubanski, “FAQs about the Inflation Reduction Act’s Medicare Drug Price Negotiation Program” (KFF, January 23, 2025), https://www.kff.org/medicare/issue-brief/faqs-about-the-inflation-reduction-acts-medicare-drug-price-negotiation-program/#small-biotech.

[98]. Gregory Vaughan et al., “Modeling impact of inflation reduction act price negotiations on new drug pipeline considering differential contributions of large and small biopharmaceutical companies,” Pub Med, https://pubmed.ncbi.nlm.nih.gov/39049558/.

[99]. Office of U.S. Congressman Gregory F. Murphy, “Murphy Introduces Legislation to Eliminate IRA ‘Pill Penalty’ and Support Small Molecule Drug Innovation” (February 1, 2024), https://murphy.house.gov/media/press-releases/murphy-introduces-legislation-eliminate-ira-pill-penalty-and-support-small.

[100]. Congress.gov, “H.R.1492 - To amend title XI of the Social Security Act to equalize the negotiation period between small-molecule and biologic candidates under the Drug Price Negotiation Program,” https://www.congress.gov/bill/119th-congress/house-bill/1492.

Editors’ Recommendations

Related

February 25, 2025