How Innovative Is China in the Display Industry?

Chinese companies have become leading innovators in display technologies, in addition to becoming the largest global producers. China’s display industry has grown as a result of extensive subsidies, rampant intellectual property theft, and economies of scale.

KEY TAKEAWAYS

Key Takeaways

Contents

Importance of Display Innovation and U.S. Role. 5

How Innovative Is China in Display? 12

Innovation Inputs to China’s Display Industry 16

China’s Government Policies Supporting the Display Industry 23

Introduction

Electronic displays have become an integral part of the economy, representing the key visual and tactile (via touchscreens) human interface for a wide variety of consumer electronics from televisions, computers, mobile phones, tablets, and vehicles to a range of other applications, from medical devices to refrigerators. Displays also play vital roles in national defense capabilities, from the heads-up displays in fighter jet cockpits to the combat information centers on navy ships. Thus, leadership in electronic displays has become critical not just for a nation’s ability to field competitive enterprises in consumer electronics and information and communications technology (ICT) industries, but also to their national defense capabilities.

Indeed, innovation in displays has been an indispensable driver of the global information technology revolution. Cathode ray tubes (CRTs) were first commercialized in the 1920s, with color CRT being developed in the 1950s and the CRT era persisting well into the 1980s. In the 1990s, the advent of liquid crystal displays (LCDs)—which leverage the light-modulating properties of liquid crystals combined with polarizers—enabled the creation of the first portable laptop computers; and in the 2000s, LCDs advanced further to enable manufacture of flat-screen televisions. Into the 2010s, display technology evolved again, with the advent of organic light-emitting diode (OLED) technology—think smartphone screens—becoming the current leading technology. While OLED display largely started with mobile phones, OLEDs have become increasingly prevalent in the flat-panel display (FPD) market (i.e., large flat-screen TVs). (While OLED offers superior display quality, its higher cost and shorter lifespan compared with LCDs mean both technologies will likely continue to coexist.)[1]

Innovation in displays has been an indispensable driver of the global information technology revolution.

Within LED technology, going forward, MiniLED technology, which uses LEDs that are much smaller, about 1/40 the size of regular LED backlights, comes next, and itself will be followed by MicroLED technology, which uses three nonorganic LEDs (red, green, and blue) per pixel and may offer an optimal combination of clarity, durability, and energy consumption.[2] Elsewhere, innovative micro-display technologies will advance visual interfaces for automated reality/virtual reality (AR/VR) goggles and help enable the metaverse economy.

Moreover, display has become one of the most significant inputs, by value, into ICT hardware. In fact, displays account for an estimated 64 percent of the value of a nominal 55” LCD ultra-high definition (UHD) TV (with the processor accounting for 13 percent and other components 23 percent). Likewise, displays account for about 20 percent of the value of an Apple MacBook Pro computer or iPhone and as much as half of the value of Apple’s Vision Pro VR goggles. Overall, analysts estimate that the display unit accounts for about 22 to 37 percent of a modern smartphone’s material cost (compared with the 50 to 70 different types of legacy chips in a smartphone, which together account for about 8 to 15 percent of the material cost).

Analysts estimate that the global display market will generate $182 billion in sales in 2024 and more than double in size over the next decade to become a $372 billion market by 2034.[3] (Analysts expect the interactive display market to grow from an $11.3 billion market in 2023 to $18.5 billion by 2031.)[4] And while Chinese enterprises used to be bit players in an industry once dominated largely by South Korean firms, China’s share of the combined glass display market—LCDs and OLEDs—now exceeds 70 percent.[5] Breaking that down, China’s share of global LCD production has now reached 72 percent, while its share of OLED production has exceeded 50 percent. For the first time, in Q1 2024, Chinese players surpassed South Korean ones as the leading producers of OLED panels.[6] Moreover, China’s prowess in displays is increasingly driving the competitiveness of its TV manufacturers.

China’s rapid ascent in the display industry has largely been the result of concerted Chinese government strategies—at national and provincial levels—designed precisely to make it so. The Chinese government has showered the sector with subsidies in an effort to foster national champions such as BOE and TCL. In fact, China display maker BOE alone received an estimated $3.9 billion in subsidies from Chinese national and provincial governments from 2010 to 2021, and in 2022, the company was the third-largest recipient of Chinese government subsidies (and in 2023, the seventh-largest recipient). In addition to cash (i.e., loans or grants), these subsidies have taken the form of tax breaks, discounted capital, free or discounted land and utilities, and state-provided financing for hiring foreign talent. Chinese display makers have also benefitted from extensive foreign IP theft.

China’s global share of LCD production has grown from 0 percent in 2004 to 72 percent in 2024, while its share of OLED production has grown from 1 percent in 2014 to over 50 percent today.

China’s aggressive subsidization of the display industry has driven down prices and led to overcapacity, thus depressing profitability for foreign competitors that have to earn market-based rates of return in order to persist in the industry. In the LCD sector, this approach has succeeded in driving most foreign competitors out of the industry—Japanese companies stopped investing in the sector wholesale around 2010, and the Japanese national champion, JOLED, recently filed for bankruptcy—or precluded other would-be competitors from entering the industry. As a U.S. Department of Commerce report concludes in diagnosing the failure of a proposed Foxconn LCD production facility to get off the ground in the United States, “Despite significant tax breaks, subsidies, and environmental exemptions from the State of Wisconsin, the project did not materialize as originally envisioned due to a lack of critical materials suppliers (e.g., glass-makers) in the geographic vicinity, a global glut in LCD production, and local labor costs making production unprofitable.”[7]

While Chinese display makers such as BOE, TCL, Tianma, and Visionox certainly started behind leading peers (notably Japan’s Sharp and South Korea’s LG and Samsing Display), they are increasingly developing innovative products in their own right, as reflected by BOE and TCL increasingly winning prestigious awards in the field, such as at the Consumer Electronics Show (CES). For instance, at the 2023 CES, TCL-CSOT (China Star Optoelectronics Technology Co., Ltd., which is TCL’s display subsidiary) won the “Innovation Award for MiniLED Display of the Year.” BOE has developed innovative flexible OLED screens and what it claimed to be the world’s largest 95-inch 8K OLED screen when the company launched it. BOE’s display manufacturing facilities are among the world’s most sophisticated and are extensively automated.[8] BOE has also worked assiduously to develop its patent portfolio, being a top 10 global patent filer over each of the past six years (and the fifth-leading patent filer globally in 2023).

In summary, China has clearly wrested leadership in the global LCD industry away from other players: In 2004, China accounted for 0 percent of global LCD production, but by 2024, this share had reached 72 percent (as strong a case of “comparative advantage” being effectively artificially manufactured through industrial policy as there ever could be). Likewise, China’s market share in OLEDs has increased from less than 1 percent in 2014 to over half today; and if current trends continue, competitors in that segment of the market will be hard-pressed to persist as well. (Indeed, the only route for South Korean or Japanese players will be to out-innovate on the front end to develop the next generation of MiniLED and MicroLED solutions.)

China has clearly wrested leadership in the global LCD industry away from other players.

Moreover, it turns out that the manufacturing process similarities between fabricating displays and semiconductors are close to 70 percent, meaning that as Chinese firms develop capabilities in display technologies, these may increasingly spill over into semiconductor capabilities, furthering powering the competitiveness of China’s semiconductor firms.[9] Ultimately, China’s increasing capabilities in display manufacturing are thus likely to spill over to adjacent and downstream sectors.

Background and Methodology

The common narrative is that China is a copier and the United States is an innovator. That narrative often supports a lackadaisical attitude toward U.S. technology and industrial policy. After all, America leads in innovation, so there is nothing to worry about. First, this assumption is misguided because innovators can lose leadership to copiers with lower cost structures, as has been the case in many U.S. industries, including consumer electronics, semiconductors, solar panels, telecom equipment, and machine tools.[10] Second, it’s not clear that China is a sluggish copier and always destined to be a follower.

To assess how innovative Chinese enterprises and industries are, the Smith Richardson Foundation provided support to the Information Technology and Innovation Foundation (ITIF) to research the question. As part of this research, ITIF is focusing on particular sectors, including display innovation.

To be sure, it’s difficult to assess the innovation capabilities of any country’s industries, but it is especially difficult for Chinese industries. In part, this is because, under President Xi Jinping, China discloses much less information to the world than it used to, especially about its industrial and technological capabilities. Notwithstanding this, ITIF relied on several methods to assess Chinese innovation in displays. First, we conducted in-depth case study evaluations of two Chinese consumer electronics/display innovation companies randomly selected from companies listed on the “2023 EU Industrial R&D Investment Scoreboard.” Second, we conducted interviews with global experts on the Chinese display innovation industry. And third, we assessed global data on display innovation, including scientific articles and patents.

Importance of Display Innovation and U.S. Role

German physicist Ferdinand Braun is credited with inventing the first CRT in 1897, though it was John Bertrand Johnson and Harry Weiner Weinhart of Western Electric who were the first to invent a hot cathode and turn CRT into a commercial product in 1922.[11] Scottish engineer John Baird, Russian engineer Vladimir Zworykin, and American Philo Farnsworth are credited with pioneering television technology (Farnsworth won the U.S. patent, despite a lengthy dispute with RCA), but it was RCA under the leadership of David Sarnoff (who had hired Zworykin) that took the lead in commercializing the technology and establishing U.S. leadership in the industry.[12]

By World War II, RCA had become America’s leading manufacturer of displays for critical radar, sonar, and electronic navigation systems. By 1946, enhanced by innovations developed during WWII, televisions emerged significantly improved.[13] While in 1948 about 800,000 television receivers were sold, by 1950, this figure had surged to 7.5 million. (As noted, although displays and televisions are separate—displays being a TV’s key input—they do go hand-in-hand.) The postwar years were a time of remarkable growth for U.S. television manufacturing and programming, and RCA generated substantial revenue from its patents and manufacturing.[14]

Despite RCA becoming the leading American color TV producer of the 1950s, the U.S. Department of Justice (DOJ) began aggressive antitrust actions against RCA. DOJ required RCA to share its patents freely with domestic competitors and to only charge royalties from foreign competitors. RCA, reliant on licensing revenue, was forced to license its technologies to foreign companies, primarily ones from Japan. The effect was devastating. As Economist Steven Klepper argued in his book Experimental Capitalism: The Nanoeconomics of American High-Tech Industries, the action was one of the triggers that led to the eventual demise of the American color TV industry.[15] Or as historian John Steele Gordon wrote, “To protect an American industry from the dominance of one company, antitrust had killed off the entire industry. That’s a bit like using a guillotine to cure a headache.”[16]

There are no major U.S. companies involved in LCD production, nor is there significant LCD manufacturing in the United States.

By the 1960s, Japanese televisions were flooding the American market, sold at cheaper prices than their American counterparts. This was made possible by lower labor costs and technology transfer, as well as the practice of “dumping,” which involved pricing below cost in the United States but pricing high in Japan, where the industry was protected from foreign competition.[17] Unfortunately, when Zenith filed suit against Japanese players on antidumping grounds, the U.S. Supreme Court ruled against it, in large part because the court did not take the time to understand the Japanese industrial policy system and the role of “administrative guidance” provided by Japan’s Ministry of International Trade and Industry (MITI), which coordinated foreign markets, including pricing policies, of major Japanese companies in particular industries.[18] Such a decision would be akin to not recognizing the foundational role the Chinese government has played in turbocharging China’s display industry today, including though massive industrial subsidization.

By the late 1990s, Zenith, the last well-known U.S. television manufacturer, had been acquired by South Korea’s LG Electronics, ringing the death knell for the U.S. industry and providing a crystal clear case study of how poor antitrust and trade policy can conspire to decimate a U.S. industry.

Today, only two U.S. television manufacturers remain: VIZIO, which was founded in 2002 to provide high-quality, low-cost flat-panel televisions but produces primarily in countries such as China, Mexico, and Taiwan, and South Carolina-based Element Electronics, founded in 2006 to manufacture budget-friendly LCD and LED TVs.[19] However, there are no major U.S. companies involved in LCD production, nor is there significant LCD or OLED manufacturing at commercial-product scale in the United States.[20]

As China captures ever-greater market share in the display industry, the United States risks increased vulnerability to dependence on Chinese suppliers for critical display inputs, which is concerning at a time when the United States has taken steps to increase its resilience and self-reliance in supply chains for critical ICTs. Moreover, with displays vital to numerous weapons system platforms, the United States needs to ensure it maintains capabilities in display for defense purposes alone.

China’s Display Industry

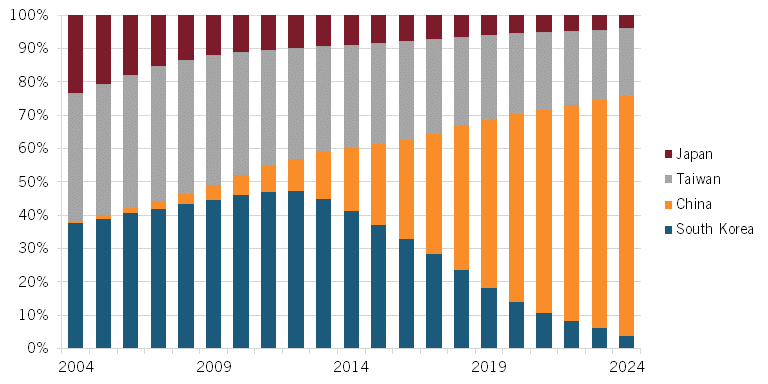

As noted, over the past two decades, China’s share of the LCD market has grown from virtually nil in 2004 to 72 percent today. (See figure 1.) Meanwhile, South Korean companies’ share of the LCD market cratered from 36 percent to just 4 percent, while Japanese companies’ share fell from 22 to 4 percent as well, and Taiwanese companies’ share fell by almost half, from 38 to 22 percent. The scale of China’s overall display industry continues to grow, with it experiencing a compound growth rate of 21.6 percent from 2012 to 2022.[21]

Figure 1: Global LCD industry market shares, by country[22]

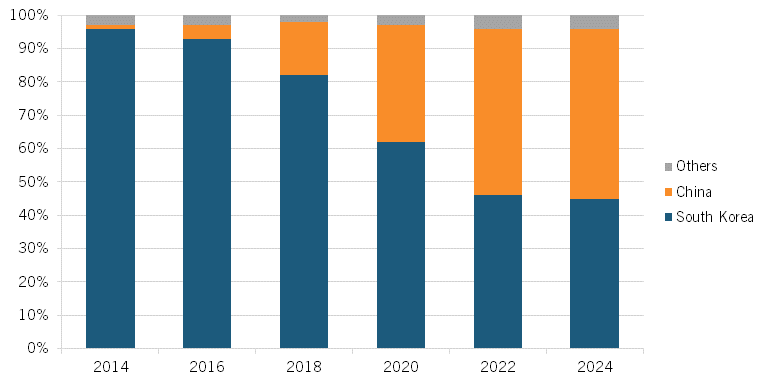

Similarly, China’s share of the global OLED market has grown from virtually nothing, just 1 percent, in 2004 to over half today, while South Korea’s share of the market has fallen from 96 to 45 percent over that timeframe. (See figure 2.)

Figure 2: Global OLED industry market shares, by country[23]

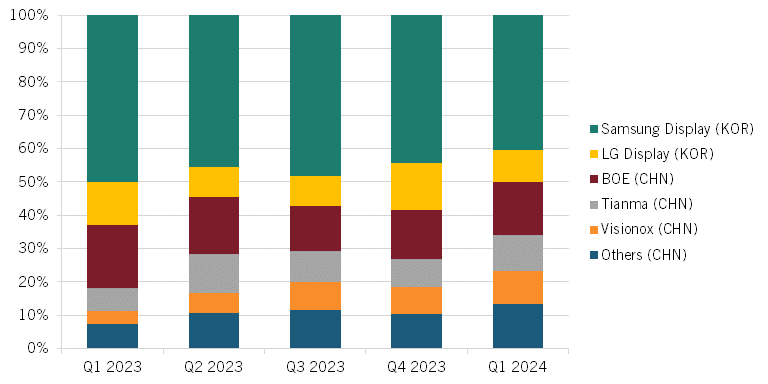

Within the OLED market, Samsung Display remains the leading player, with a 49 percent market share as of Q1 2024, but BOE has moved into second place, with a 16 percent market share, followed now by China’s Tianma and Visionox (with 10.8 percent and 10.1 percent market shares, respectively), and LG Display now in fifth place with a 9.5 percent market share. (See figure 3.) In the small and medium-sized OLED market (think of like vehicle display screens), South Korean companies held a 62.3 market share in 2023 compared with Chinese firms’ 36.6 percent; but by Q1 2024, Chinese firms had taken a 50.5 percent market share compared with South Korean firms’ 48.2 percent share, meaning that in this sector, China closed a gap of over 20 percentage points in just one year alone. In total, between 2015 and 2022, Chinese manufacturers grew their capacity from 1.0 million glass sheets per month (measured on a Gen 8.5 converted scale) to 4.0 million glass sheets per month.[24]

Figure 3: Overall OLED shipment market shares[25]

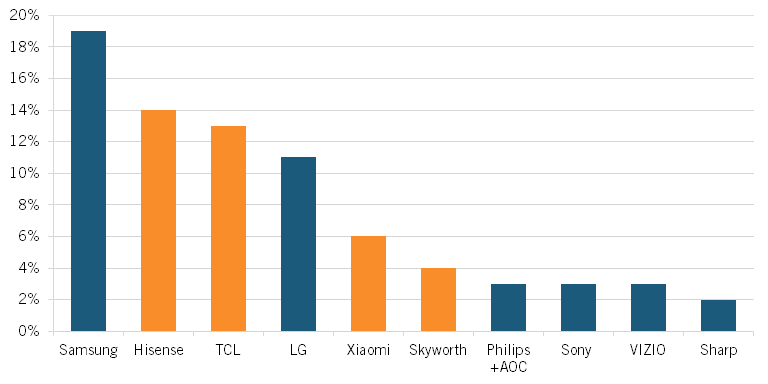

As noted, Chinese dominance in display innovation is in turn powering Chinese enterprises’ downstream competitiveness in the TV industry. Chinese companies including BOE, China Star (i.e., TCL-CSOT), and HKC Display account for 70 to 85 percent of the 65-/75-/85-inch LCD panel market and nearly 100 percent of ultra-large-sized LCD TVs (90–115 inches).[26] As market research firm Omdia wrote, Chinese TV makers TCL’s and Hisense’s “early adoption and sourcing of ultra-large-sized panels (98-inch and 100-inch) from Chinese panel makers have been particularly notable. This strategy not only helps panel makers efficiently utilize their display production capacity but also supports Chinese TV brands in their quest to become global leaders in the ultra-large-sized LCD TV market.”[27] As of year-end 2023, China’s Hisense had claimed a 14 percent share of the global television industry and TCL 13 percent, though Samsung still led with a 19 percent market share. (See figure 4.)

Figure 4: Company market shares of global television industry, 2023 (Chinese firms in orange)[28]

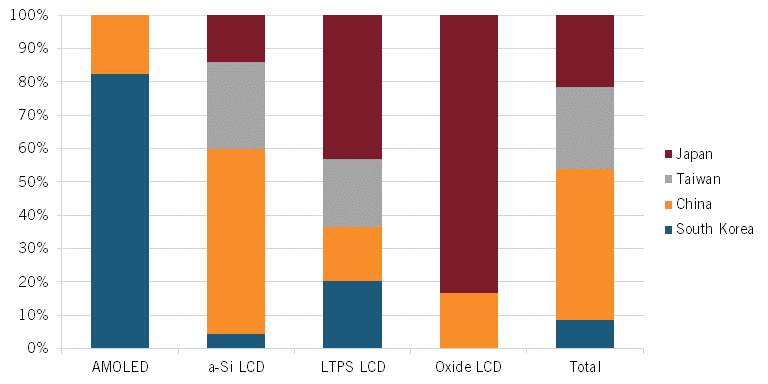

Chinese companies have also become significant players in the automotive display industry, with their total market share increasing from just 12.9 percent in 2016 to 45.3 percent today. (See figure 5, last bar.) (Note: Shown in figure 5 are various types of automotive displays, AMOLED referring to active-matrix OLEDs.) China’s two largest players in the automotive sector, BOE and Tianma, together now account for 30.7 percent of the global market.[29]

Figure 5: Automobile unit shipment share, by region, first half of 2023[30]

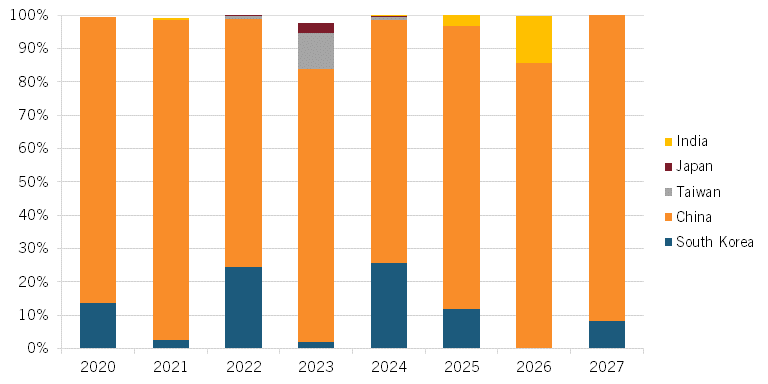

Finally, a key reason Chinese companies have become so strong in the display industry is that they are leading investment in it. And these are capital-intensive projects: A new display fab can cost as much as $7 billion and take three to four years to complete.[31] From 2015 to 2022, China had already increased its number of multibillion-dollar display fabs from 7 to 16.[32] From 2020 to 2027, analysts expect China’s global share of capital expenditure (CapEx) investments in display technologies to average about 85 percent, with Chinese companies expected to account for over 90 percent of the sector’s CapEx by 2027. (See figure 6.)

Figure 6: Global shares of display equipment CapEx by country, 2020–2027 (forecast)[33]

How Innovative Is China in Display?

Chinese companies are making strides in display innovation, with regard to both manufacturing process innovation and product innovation itself. Importantly, innovation in display manufacturing processes is critical for enabling display product innovation. Indeed, display fabs are some of the most expensive and complex in the world—rivaling at least the cost and complexity of 7 to 10 nanometer (nm) semi fabs (if not the most-sophisticated 2 to 3 nm semi fabs, which can cost over $30 billion to construct.) When BOE launched its Gen 10.5 LCD fab in Heifi, China, in 2018 called “Fab 9” at a cost of $6.95 billion, it was regarded at the time as “the most advanced [display fab] in the world.”[34] (See Box A for a description of the LCD manufacturing process.) Notably, since most display manufacturing must be performed in a cleanroom, and handling the glass requires extraordinary precision, display factories are heavily automated and robotized, with few engineers on the factory floor.

More recently, in April 2022, BOE confirmed it would build an $8.8 billion 8.5-Gen IT AMOLED line in Chengdu, China—the facility to be known as B16—to target the laptop and tablet market.[35] BOE’s equipment costs for the B16 facility are expected to be about 18 percent higher than Samsung’s A6 factory (which is manufacturing competing IT AMOLED products). However, as one analyst explained, “B16 will adopt a more equipment intense low-temperature poly oxide (LTPO) array process than Samsung’s planned oxide thin film transistor (TFT) approach.”[36] The equipment BOE is using at B16, though more costly, will give it the capability to produce fully flexible displays (and presumably also include more module process equipment). BOE asserts that factory B16 will enable it to boost OLED production by more than 50 percent over the ensuing three years.[37]

Box A: How an LCD Screen Is Manufactured

Writing in Forbes, Harvard professor Willy Shih has provided a comprehseive description of the complex process of maufacturing LCD display panels.[38] The following is excerpted from his article with permission:

Liquid crystal display screens are manufactured by assembling a sandwich of two thin sheets of glass. On one of the sheets are transistor “cells” formed by first depositing a layer of indium tin oxide (ITO), an unusual metal alloy that is transparent. That conveys electrical signals to the middle of a screen. Then a layer of silicon is deposited, followed by a process that builds millions of precisely shaped transistor parts. This patterning step is repeated to build up tiny little cells, one for each dot (known as a pixel) on the screen. Each step has to be precisely aligned to the previous one within a few microns.

On the other sheet of glass, the process entails making an array of millions of red, green, and blue dots in a black matrix, called a color filter array (CFA). This is how colors are produced when light is shined through it. Then tiny amounts of liquid crystal material are dropped into the cells on the first sheet and the two sheets are glued together. The manufacturing process align the two sheets so the colored dots sit right on top of the cells; they can’t be off by more than a few microns in any direction anywhere on the sheet. The sandwich is next covered with special sheets of polarizing film, and the sheets are cut into individual “panels”—a term that is used to describe the subassembly that actually goes into a TV.

Flat-screen television being manufactured along a Chinese assembly line[39]

In terms of product innovation, Chinese display products have made great strides in recent years, despite, on net, continuing to lag behind leading South Korean products by some degree—although that gap temporally is likely at most 18 months behind. Notably, in 2021, Apple approved China’s BOE as an iPhone display supplier, and BOE is reportedly supplying OLED panels for the newest iPhone 15 series base model.[40] However, as one analyst noted, Chinese OLEDs feature predominantly in domestic products or in Apple’s budget models due to their lower quality and yield compared with South Korean OLEDs. As the analyst elaborated, “Chinese companies have not yet matched Korean technology in power consumption, weight, and image quality, which is why they have not supplied premium products like Apple’s iPads.”[41] The analyst noted, however, that “Chinese companies aim to quickly close the technology gap by investing heavily with profits from their domestic market.”[42]

That said, China’s display and TV products are demonstrating increasing innovation and starting to win prestigious awards. At the January 2024 CES in Las Vegas, TCL introduced what it billed as “the world’s largest MiniLED TV,” measuring 115 inches. There, TCL also highlighted its ink-jet (IJP) OLED technology, saying it had achieved “significant breakthroughs” in image quality, power consumption, and product lifespan.[43] At the show, TCL chairperson Tomson Li noted that when TCL first appeared at CES, “we had only a small booth covering 9 square meters.” In 2024, the TCL booth covered a space of 1,700 square meters.[44] TCL’s portfolio at the January 2024 CES built upon its showing at the May 2023 Display Week expo in Los Angeles, at which the company “unveiled over 30 of its latest products and advanced technologies” including more than 10 firsts in the world, the company claimed.[45] At that conference, Louis Lazar, a senior consultant at Newry Corp, an innovation and growth strategy consulting firm, commented that “China has been pushing innovations in the display industry, and has been leading the way, which was really impressive.”[46]

In terms of product innovation, Chinese display products have made great strides in recent years, despite, on net, continuing to lag behind leading South Korean products by some degree—although that gap temporally is likely at most 18 months behind.

For its part, at the 2024 CES, BOE “rolled out a slew of new products such as a flexible organic light-emitting diode or OLED display, a transparent display panel, a 4K mini LED curved display, and a 45-inch 8K borderless cockpit screen equipped in automaker Geely’s new electric vehicle, the Galaxy E8.”[47] At the 2023 LA Display Week expo, BOE presented more than 50 new products, one of them being a 110-inch 16K glasses-free 3D display, the first of its kind in the world.[48] (This is its α-MLED, a new glass-based active LED display system.) At that expo, BOE also introduced its f-OLED, a high-end flexible OLED technology solution, which can not only present a variety of new forms such as full screen, folding, and curling, but also realize multi-functional intelligent integration such as fingerprint recognition, under-screen camera, and biometrics.

BOE has won several notable innovation awards. For instance, the project of R&D and industrialization of high-refresh-rate display technology based on super-dimensional field technology won the First Prize of Beijing Science and Technology Progress in 2021.[49] The company’s Industrial Design Centre has won 13 design awards including two Red Dot Awards, and was qualified as a leading design institution in Beijing and a design innovation center in Beijing. And BOE was listed as one of MIT Technology Review’s “50 Smartest Companies in the World” in 2019 for its self-developed light and shadow devices.[50]

Elsewhere, Chines OLED-maker Visionox has been regarded for its innovative self-aligned pixelization technology, portable and rollable laptops, and transparent car displays.[51] And Hisense turned heads at the 2024 CES with an automobile laser display that provides higher color performance than LEDs do, is 80 percent smaller than traditional products, and for which Hisense won a CES innovation award. Hisense also earned a CES 2024 Innovation Award for the 110UX MiniLED TV it introduced there.[52] Lastly, Xiaomi, one of China’s leading electric vehicle producers, has started incorporating high-tech display technology into its newest car models, which includes a 16.1-inch 3K resolution mini-LED center display.

An Honor Magic v2 phone with a flexible screen that folds[53]

Innovation Inputs to China’s Display Industry

This section examines indicators assessing China’s display industry innovativeness, considering factors such as research and development (R&D) intensity, scientific publications, and patenting levels.

R&D Intensity

The R&D intensity of Chinese firms competing in the display sector is mixed. According to the “2023 EU Industrial R&D Investment Scoreboard” (which actually reports companies’ R&D investments from the year 2021), BOE and TCL Electronics posted R&D intensities of 4.9 and 4.0 percent, respectively, for that year; this was less than Samsung’s 8.1 percent R&D intensity, but more than Sharp’s 3.5 percent. (See table 1.) U.S. OLED maker Universal Display posted an R&D intensity of 18 percent.

Table 1: Leading display company R&D investors on the “2023 EU Industrial R&D Investment Scoreboard”[54]

|

Company |

Headquarters |

R&D Investment (Billions) |

R&D Intensity |

|

Universal Display |

United States |

$0.1 |

18.0% |

|

Samsung |

South Korea |

$20.7 |

8.1% |

|

BOE |

China |

$1.8 |

4.9% |

|

TE Connectivity |

Switzerland |

$0.7 |

4.1% |

|

TCL Electronics |

China |

$0.4 |

4.0% |

|

Xiaomi |

China |

$2.0 |

3.6% |

|

Sharp |

Japan |

$0.8 |

3.5% |

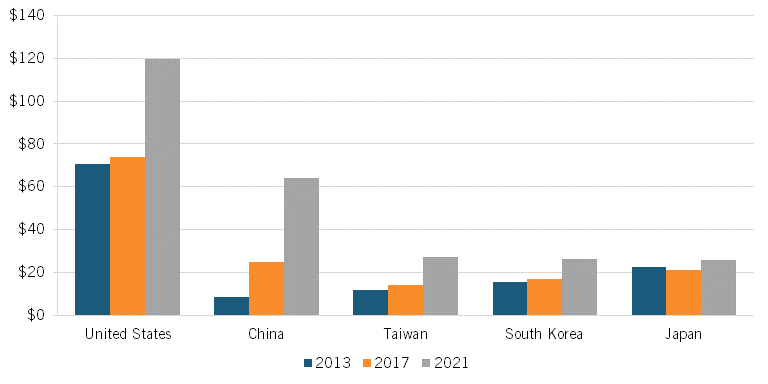

While, unfortunately, displays are not a subcategory within the “EU Industrial R&D Investment Scoreboard,” the study places companies (including display ones) into the broader category of “technology and electrical hardware and equipment” (although this would include other tech hardware companies, from computers to semiconductors). Nevertheless, considering this, both the United States and China experienced the greatest growth in R&D expenditures by their technology and electrical hardware firms, compared with other nations. Here, U.S. firms posted a 70 percent increase in their R&D investments from 2013 and 2021, whereas Chinese enterprises in the sector increased their aggregated level of investment by 646 percent. (See figure 7.)

Figure 7: R&D investment by leading firms in technology and electrical hardware and equipment (billions)[55]

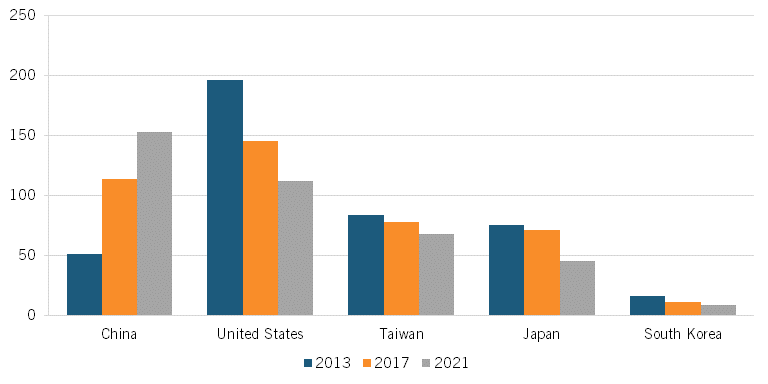

Considering a count of companies in the “technology and electrical hardware and equipment” category in the “EU Industrial R&D Investment Scoreboard” (which provides data for the top 2,500 R&D-investing companies globally), the number of Chinese companies on this list tripled from 2013 to 2021 (from 51 to 153), while the number of U.S. companies fell by 40 percent and other competitor nations including Taiwan, Japan, Germany, and South Korea all also experienced declines (though smaller). (See figure 8.)

Figure 8: Number of top-R&D investing firms in technology and electrical hardware and equipment, by country[56]

Scientific Publications

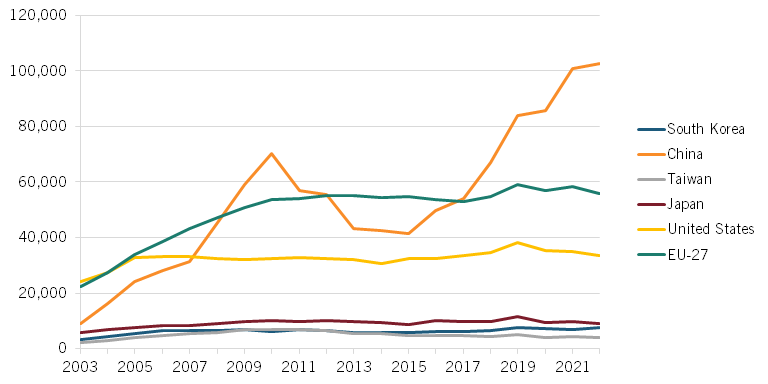

Unfortunately, scientific publications data is unavailable for companies competing in the display industry specifically. However, in the closest industry for which comparable data is available, computers and information science, scientific publications in the field by Chinese publishers increased from 9,200 to roughly 102,500 between 2003 and 2022, while U.S. publications increased by only 38 percent. (See figure 9.)

Figure 9: Scientific publications in computers and information science[57]

Patents

While, to be sure, patent applications can be a problematic metric (they don’t necessarily reflect quality, and their number can be artificially inflated through incentives to file), Chinese companies have been trying to dramatically ramp up their patent holdings in the display field. Emblematic of this is that BOE was the fifth-largest filer of patents to the Patent Cooperation Treaty (PCT) system in 2023, filing for nearly 2,000 patents. (See table 2.) BOE has been among the top 10 PCT filers for the past six consecutive years. BOE’s cumulative independent patent applications exceeded 80,000 by the end of 2022.

Table 2: Leading global corporate PCT patent filers, 2023[58]

|

Firm |

Number of patents filed to PCT |

|

Huawei Technologies |

6,494 |

|

Samsung Electronics |

3,924 |

|

Qualcomm |

3,410 |

|

Mitsubishi Electric |

2,152 |

|

BOE Technology Group |

1,988 |

|

LG Electronics |

1,887 |

|

Telefonaktiebolaget LM Ericsson |

1,863 |

|

Contemporary Amperex Technology |

1,799 |

|

Oppo Mobile Telecommunications |

1,766 |

|

Nippon Telegraph and Telephone |

1,760 |

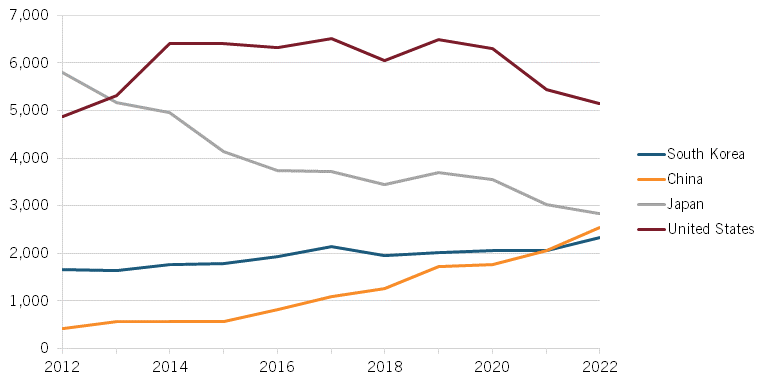

Patent grant applications are unfortunately unavailable for display technology specifically. The closest categorically related field is for audio-visual technology patents. Here, Chinese entities had seen a sixfold increase in audio-visual technology patents awarded from 2012 to 2022 (from 412 to 2,542), although here U.S. entities were awarded about double that number of patents in 2022. (See figure 10.)

Figure 10: Global number of audio-visual technology patents[59]

Company Case Studies

This section examines the China display innovation companies BOE and TCL.

BOE

BOE Technology Group Co., Ltd. is a leading manufacturer of electronic displays and intelligent interface products. Displays account for 88 percent of BOE’s operating revenues. Since its inception in April 1993, the company has expanded its network across 20 countries and regions in Europe, the Americas, Asia, and Africa. Simultaneously, it has concentrated its ownership of manufacturing sites in domestic locations such as Beijing, Hefei, Chengdu, Chongqing, Fuzhou, Mianyang, Wuhan, Kunming, Suzhou, Ordos, and Gu’an.[60] This balanced “conducting overseas acquisitions and taking root in domestic markets” strategy has led to BOE becoming a leading enterprise in the global display industry.

In terms of BOE’s organizational structure, it employs a model called the “1+4+N Ecosystem.” The “1” accounts for the semiconductor display business, the primary capacity of BOE’s resources and assets; “4” symbolizes the pillars of their Internet-of-Things (IoT) operations, which are the IoT innovation business, the sensor business, the Mini LED business, and the smart medical and engineering business; “N” stands for the continuation of these IoT applications; and “ecosystem” is a testament to BOE’s collaborative partnerships and the company’s management of innovative resources.[61]

According to 2021 rankings published by the World Intellectual Property Organization (WIPO), BOE placed seventh with 1,980 international patent applications, landing it among the top 10 patent filers for six consecutive years. Among its newer applications, 90 percent were domestic inventions while over 35 percent were filed overseas with its neighbors Japan and South Korea, as well as throughout the United States and Europe. In recent years, BOE has also increased its R&D investments, expenses, and personnel. In 2022, BOE invested approximately $12.6 billion RMB ($1.8 billion) in R&D investments, a 1.28 percent increase from the previous year.[62] This amounted to 33 R&D projects, with an increased focus on OLED technologies. Specifically, BOE began its Taishan Project with the goal of producing LCDs “with an image quality comparable to that of OLEDs and a cost lower than that of OLEDs.”[63]

In addition to its success in the semiconductor industry, BOE has garnered numerous global and domestic partnerships with automobile corporations. One of its most notable achievements came to prominence in April 2023 at the 20th Shanghai International Automobile Industry Exhibition, which saw the launch of the Yang Wang U8, U9, Denza N7, as well as the newly released Dolphin and Seagull series models, all of which were equipped with BOE’s new in-vehicle display solutions.[64] Specifically, the 12.8-inch large-size flexible OLED curved surface display central control screen enhanced the immersive driving experience. Its 180° ultra-wide viewing angle was conducive to improving safety features and the interactive display, thus distinguishing itself from the traditional LCD instrument display.

BOE’s continued success in new display technology has garnered the company numerous awards. Moreover, its National Engineering Research Centre was honored for its achievements in the new-type display industry by China’s National Development and Reform Commission. Additionally, the project of R&D and industrialization of high refresh rate display technology based on super-dimensional field technology was awarded the First Prize of Beijing Science and Technology Progress in 2021.[65] The company has also gained substantial recognition in the world of academia. Moreover, BOE was granted the honor of MIT Technology Review’s “50 Smartest Companies in the World” in 2019 for its self-developed light and shadow devices.[66]

TCL

Headquartered in Huizhou, Guangdong Province, the Creative Life (TCL) Industrial Holdings Co., Ltd. began operations in April 2019 amid a split from its predecessor, TTK Home Appliances (Huizhou) Co., Ltd. Whereas the latter engaged in the production and manufacturing of audio tapes, telephones, TVs, mobile phones, and similar technologies, TCL focuses on the R&D, manufacturing, and sales of products including smart screens, mobile communication devices, and independently develops home Internet services. With 28 R&D Centers, over 10 joint laboratories, as well as 22 manufacturing facilities, TCL effectively operates businesses in 160 countries and regions across the globe.[67] This can be attributed to its innovation strategy known as “Value Led by Brand with Relative Cost Advantage.”[68]

In more recent years, TCL has established itself as a trailblazer in the MiniLED industry, thus maintaining market competitiveness through innovative contributions and award-winning products. In developing this smart-screen technology, TCL has aimed to improve the user’s viewing experience by offering convenient, high-quality products with competitive pricing. As a result, the market share of global TV shipments saw TCL with the second-highest amount by the end of 2022.[69] Among its numerous accolades in the past several years, TCL’s MiniLED 4K Smart Screen 65C835 won the “Best Product 2022-2023, Premium MiniLED TV” at the Expert Imaging and Sound Association (EISA) Awards.[70] Moreover, TCL MiniLED 4K Smart Screen 75C935 and 75C835 together won the CES 2023 Innovation Awards, thus displaying outstanding design and engineering in consumer technology products.[71]

TCL headquarters in Huizhou, China[72]

Over the past seven years, TCL has also made significant developments in OLED technology and panel manufacturing, with substantial contributions from the Japanese panel company JOLED. Although conventional LED TV sets are less expensive and display better brightness, OLED demonstrates advanced image quality and contrast with deep blacks. The key term to note is “light-emitting,” thus an LED never completely turns off, as it functions as a backlight to produce color and transmit images through the LCD screen. In contrast, OLED technology uses micro-pixels to emit light, thus images can be more legible to the average user and are able to quickly change color since the pixels are individually controlled.[73] Beyond television sets, TCL has implemented OLED technology in the form of a light tablet computer solution. In March 2023, TLC launched an upgraded tablet from its traditional medium-sized predecessor to an ultra-thin model with high-precision touch technology, a faster refresh rate, and enhanced image quality.[74]

According to Insights by GreyB, TCL currently has 7,963 patents globally, 60 percent of which are active.[75] Beyond R&D investment in other global corporations, TCL has implemented similar initiatives in academic institutions. In 2018, TCL began collaborating with the Warsaw University Technology in Poland on artificial intelligence (AI)-related research and innovation after launching the a large R&D center named TCL Research Europe.[76] In connection with its ongoing investment in AI and identifying its new applications, the company also partnered with the University of Hong Kong and Chinese University of Hong Kong.[77]

China’s Government Policies Supporting the Display Industry

The Chinese government has targeted the display sector since the early 2000s, although its first significant industrial policy toward the sector came in 2012 with the 12th Five-Year Plan for the Development of New Display Technology, which was followed with a 2014–2016 New Display Industry Innovation Development Action Plan and more recently the 2018–2020 New Display Industry Action Plan, which focused on accelerating Chinese R&D into OLED micro displays and printed micro display panels.[78] China’s “Made in China 2025” strategy also targeted the display industry, calling for the development of 100-inch-level, 8K, and 4K printed AMOLED displays by 2025 as well as the development of similar flexible displays by the same year. Notably, in 2019, China’s Ministry of Industry and Information Technology (MIIT) promulgated the “Implementation Opinions on Promoting the Quality of Manufacturing Products and Services,” which provided direction and funding to establish a flexible display innovation center and promote further development and commercialization of display technologies.[79]

From 2010 to 2021, BOE received a total of $3.9 billion in subsidies from the government; that’s an average of $325 million in subsidies annually.

It’s worth noting that Chinese provinces also have their own long-term economic development plans, of which displays, TVs, and consumer electronics are a common focus. For instance, the “Outline of the 13th Five-Year Plan for National Economic and Social Development of Guangdong Province” called for “the promotion of key flat panel display industrialization projects such as TFT-LCD panels, AMOLED panels among others.”[80] Sichuan province, where medium-sized OLED manufacturing is concentrated, likewise targeted the sector in its own 13th Five-Year plan, released in 2016. In 2017, the Wuhan Municipal People’s Government issued the 13th Five-Year Plan of Wuhan East Lake New Technology Development Zone, promoting the advancement of the optical communication, laser and integrated circuits industries, and the new display sector as well. (Wuhan is a major production location for BOE, TFT-LCD, and Tianma).[81] Elsewhere, in October 2019, Shanghai announced that it would build a new base for the display industry in Jinshan District to promote cluster-type development with upstream and downstream industries and establish the Shanghai New Display Process Research Center as one of Shanghai’s innovation platforms.

Government subsidies are omnipresent in China, and more than 99 percent of listed firms in the country received direct government subsidies in 2022. In fact, Chinese industrial subsidies added up to about $245 billion, or 1.73 percent of Chinese gross domestic product (GDP) in 2019.[82]

And the display industry has been one of China’s largest recipients of government subsidies: One author noted that “the scale of the Chinese government’s subsidies for the display industry is staggering.”[83] Indeed, China has supported the growth of its LCD and OLED industry through generous government subsidies and reduced taxes to domestic display manufacturers.[84] From 2010 to 2021, BOE received a total of $3.9 billion in subsidies from the government; that’s an average of $325 million in subsidies annually. In 2023, BOE received 3.8 billion yuan in subsidies ($532 million) which was more than the company’s 2.5 billion yuan ($350 million) in profits for the year.[85] BOE is regularly among the top 10 annual recipients of Chinese government subsidies, ranking seventh, for instance, in 2021.[86] Meanwhile, BOE’s top shareholder is a fund owned by the Beijing city government.

Provincial-level (or local-level) subsidies play an important role and flow directly into Chinese display makers’ ability to construct new fabs. For instance, BOE’s aforementioned new B16 plant in Chengdu is to be operated by a joint venture that is 53 percent owned by BOE, with the remainder held by state-owned entities. The Chengdu regional government covered an estimated 30 percent of the funds to build the plant.[87] Overall, local government subsidies in China for building a display facility can be as high as 85 percent of the costs.[88] One reason financial subsidies (and the cheap financing provided by Chinese banks) matter is that depreciation can make up 30 to 40 percent of the cost of producing an LCD panel. As Shih explained:

For a 6.7 inch high definition OLED display like one that might be used on a smartphone, estimated production costs in Korea are $62 which include $28 for materials, and $34 for labor and overhead, which includes the depreciation. Chinese suppliers have been pricing this display at $20–$23, which would only be possible if you didn’t have to factor in capital costs.[89]

Overall, local government subsidies in China for building a display facility can be as high as 85 percent of the costs.

Broadly, China provides 50 to 70 percent of investment costs for Chinese display makers through equity investments, cash benefits, and discounts on loans, land, and infrastructure. China also provides a selling price subsidy of 5 to 15 percent (normally when a panel maker sells a product to the original equipment manufacturer (i.e., the TV maker)). China also provides talent recruitment subsidies of up to 100 percent and supports annual salaries when display manufacturers hire personnel with master’s/doctor’s degree from overseas. The Chinese government also ensures attractive financing to the sector, providing capital at zero or low interest rates. Companies in the sector are also eligible for reduced corporate tax rates of as low as 15 percent.[90] Display makers are further entitled to a one-time reward of $85.7 million if they reach a revenue of $857.2 million.[91]

China’s massive subsidization of the display industry has both led to overcapacity in the sector and driven down prices to an extent damaging for firms that don’t receive such massive subsidies and have to earn market-based rates of return. As the U.S. Department of Commerce explained:

In summary, Chinese companies hold a significant share of the global production of LCDs. Buttressed by Chinese government non-market policies and practices, Chinese firms dominate the industry while their competitors struggle to compete with their artificially low-priced products. Since displays are important in other sectors, lack of manufacturing diversity may increase supply chain risks in other product areas outside of ICT.[92]

Chinese overcapacity has driven competitors out of the business and/or precluded new competitors from entering. Japanese firms ceased all investments for LCD larger than 8Gen as of 2010. In March 2024, Sharp announced it would close its Gen 10 LCD factory, which one industry analyst noted “would hasten FPD display industry consolidation and further strengthen China’s TC panel suppliers.”[93]

Chinese theft of foreign IP in the display industry has been rampant. In July 2023, Korea’s Supreme Court found a dozen executives and employees of Toptec, a key input supplier to the display industry, guilty of leaking key technological assets to BOE. In July 2024, a former Samsung engineer was sentenced to six years in a South Korean prison for leaking 340 billion won ($24.5 million) worth of OLED technology secrets to China.[94] In October 2023, the U.S. International Trade Commission (USITC) announced it would begin an investigation into allegations that several Chinese electronics companies stole trade secrets related to OLED display technology from Samsung Display.[95] USITC identified eight Chinese respondents in the case so far, including major display maker BOE Technology Group as well as several BOE subsidiaries. In short, China’s display sector has benefitted greatly from innovation mercantilism.

What Should America Do?

As noted, the United States no longer has consumer electronics industry commercial-scale domestic LCD or OLED production capabilities. (It does have smaller players serving niche markets such as defense.) To recreate one, the United States would need to introduce an industrial policy on the scale of what China has implemented, which is unlikely to happen. Nevertheless, there are steps U.S. policy could take.

NetFlex is one of America’s 18 institutes of manufacturing innovation focused on advancing America’s hybrid electronics technology base.[96] While display is not one of its 11 manufacturing technology roadmaps continuously updated by its Technical Working Groups, it does provide technology platform demonstrators for sectors such as automotive. There is a niche OLED manufacturing community in the United States (e.g., for defense electronics), and NetFlex could be attuned to supporting the country’s innovation and technology development needs. Congress could also consider establishing a new Manufacturing USA Institute more specifically tailored to next-generation display electronics, such as microdisplays.

Chinese government policy has been foundational and indispensable to the growth of the Chinese display industry, and the experience shows that industrial policy can indeed artificially manufacture “comparative advantage” for nations’ advanced-technology industries.

U.S. government agencies could further assist allied nations’ companies combating Chinese IP theft in the sector. For instance, in 2023, Samsung filed suit against BOE in the Eastern District Court of Texas, citing infringement on its edge panel technology for smartphones. Further, as noted, Samsung sued BOE for trade secret misappropriation before USITC in November 2023.[97] Where appropriate, U.S. entities could file amicus briefs on Samsung’s behalf in these cases. Moreover, U.S. government agencies should be working with counterparts in allied nations to more effectively exchange information about Chinese industrial espionage activities and push back against them.[98]

As it’s clear that Chinese display companies such as BOE are benefitting from Chinese innovation mercantilist practices that include IP theft and subsidization, it’s appropriate USITC be investigating whether Chinese display products entering U.S. markets are benefitting from pilfered IP or unfair trade practices such as excessive government subsidies. To this end, it’s laudable that in November 2023 USITC initiated a “Section 337 Investigation of Certain Organic Light-Emitting Diode Display Modules and Components Thereof.”[99]

In 2023, the U.S. and South Korean governments launched the “U.S.-ROK Next Generation Critical and Emerging Technologies Dialogue,” which committed to collaborating, “in strategic technologies that will be of greatest consequence to bolstering economic prosperity; enhancing resilience against supply chain disruptions; and securing competitive advantages for our two nations and like-minded partners.”[100] Within this framework, a working group could be established whose agenda items could include information sharing on supply chain trends and non-market practices in the display industry, potential ways to protect the display industry from unfair competition, and the promotion of cooperation and investments in display technologies in the United States and South Korea. The vehicle for this could be a bilateral initiative such as the U.S.-Korea Supply Chain and Commercial Dialogue or perhaps a trilateral initiative such as the U.S.-Japan-ROK Business Dialogue.[101]

Conclusion

In summary, China has become a major player in the global display industry. It has clearly wrested leadership in the global LCD sector away from other nations, increasing its global share of LCD production from nothing in 2004 to 72 percent by 2024. Likewise, Chinese companies’ surpassed South Korean ones for the first time in 2024 as the leading OLED manufacturers, capturing more than half the market. While Korean companies maintain a lead at the cutting edge of LED technologies—notably in MiniLED and MicroLED technologies—Chinese competitors are increasingly innovative and catching up fast in that market segment as well.

Chinese government policy has been foundational and indispensable to the growth of the Chinese display industry, and the experience shows that industrial policy can indeed artificially manufacture “comparative advantage” for nations’ advanced-technology industries. China’s strategy of massive industrial subsidization, rampant IP theft, and helping its companies achieve scale production efficiencies through access to a large domestic market have certainly reshaped the dynamics of the global display industry. It’s yet another advanced-technology industry where China has transformed from being a bit player to on the cusp of being the global innovation leader.

Acknowledgments

ITIF wishes to thank the Smith Richardson Foundation for supporting research on the question, “Can China Innovate?” Other reports in this series cover artificial intelligence, biopharmaceuticals, chemicals, electric vehicles and batteries, nuclear power, quantum computing, robotics, and semiconductors. (Search #ChinaInnovationSeries on itif.org.)

The author wishes to thank Rob Atkinson, Leah Kann, Meghan Ostertag, and Victor Vernick for their assitance with this report. Any errors or omissions are the author’s responsibility alone.

About the Author

Stephen Ezell is vice president for global innovation policy at ITIF and director of ITIF’s Center for Life Sciences Innovation. He also leads the Global Trade and Innovation Policy Alliance. His areas of expertise include science and technology policy, international competitiveness, trade, and manufacturing.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent 501(c)(3) nonprofit, nonpartisan research and educational institute that has been recognized repeatedly as the world’s leading think tank for science and technology policy. Its mission is to formulate, evaluate, and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit itif.org/about.

Endnotes

[1]. Kin Eun-Jin, “China’s “Big 2” Expected to Dominate Global LCD Market with Combined 52% Share by 2027,” Business Korea, August 20, 2024, https://www.businesskorea.co.kr/news/articleView.html?idxno=223348.

[2]. Becky Roberts and Joe Svetlik, “Mini LED TV: everything you need to know about OLED TV’s premium rival,” What Hi*Fi, April 18, 2024, https://www.whathifi.com/advice/mini-led-tv-everything-you-need-to-know-about-the-oled-rival; Lewis Empson, “I’ve seen Samsung’s conventional-sized Micro LED TV and I’m convinced it could kill OLED,” What Hi*Fi, September 5, 2024, https://www.whathifi.com/features/ive-seen-samsungs-conventional-sized-micro-led-tv-and-im-convinced-it-could-kill-oled. To be sure, MicroLED technology is expensive: a 110-inch Micro LED TV currently costs about $190,000, but as with these other technologies, costs will come down over time as manufacturing processes are refined and the products are produced at scale.

[3]. “Display Market Size | Share and Trends 2024 to 2034,” Precedence Research, August 2024, https://www.precedenceresearch.com/displays-market.

[4]. “Interactive Display Market Worth $18.51 Billion, Globally, by 2031 - Exclusive Report by The Insight Partners,” The Insight Partners, September 3, 2024, https://www.globenewswire.com/news-release/2024/09/03/2939460/0/en/Interactive-Display-Market-Worth-18-51-Billion-Globally-by-2031-Exclusive-Report-by-The-Insight-Partners.html.

[5]. Dave Haynes, “Chinese Manufacturers Now Have Almost 3/4s Of Flat Panel Display Market: DSCC,” Sixteen:Nine, February 26, 2024, https://www.sixteen-nine.net/2024/02/26/chinese-manufacturers-now-have-almost-3-4s-of-flat-panel-display-market-dscc/.

[6]. Yoo Ji-han, Lee Hae-in, and Kim Seo-young, “China overtakes S. Korea in OLED market for 1st time,” The Chosun Daily, August 12, 2024, https://www.chosun.com/english/industry-en/2024/08/12/KRTDINCQIBCF3LZIYV7VP55QXI/.

[7]. U.S. Department of Commerce and U.S. Department of Homeland Security, “Assessment of the Critical Supply Chains Supporting the U.S. Information and Communications Technology Industry,” February 2022, https://www.dhs.gov/publication/assessment-critical-supply-chains-supporting-us-ict-industry.

[8]. Willy Shih, “How Did They Make My Big-Screen TV? A Peek Inside China’s Massive BOE Gen 10.5 Factory,” Forbes, May 15, 2018, https://www.forbes.com/sites/willyshih/2018/05/15/how-did-they-make-my-big-screen-tv/.

[9]. Stephen Ezell, “How Innovative Is China in Semiconductors?” (ITIF, August 2024), https://itif.org/publications/2024/08/19/how-innovative-is-china-in-semiconductors/.

[10]. Sandra Barbosu, “Not Again: Why the United States Can’t Afford to Lose Its Biopharma Industry” (ITIF, February 2024), https://itif.org/publications/2024/02/29/not-again-why-united-states-cant-afford-to-lose-biopharma-industry/.

[11]. J. B. Johnson, “A Low Voltage Cathode Ray Oscillograph” Journal of the Optical Society of America Vol. 6, Issue 7 (1922): 701–712, https://doi.org/10.1364/JOSA.6.000701.

[12]. Sarah Pruitt, “Who Invented Television?” History, March 12, 2024, https://www.history.com/news/who-invented-television.

[13]. Ibid., 18.

[14]. Gary Hoover, “Tech Wars: RCA and the Television Industry,” American Business History Center, February 5, 2021, https://americanbusinesshistory.org/tech-wars-rca-and-the-television-industry/.

[15]. Steven Klepper, Experimental Capitalism: The Nanoeconomics of American High-Tech Industries (Princeton University Press: 2015); Serguey Braguinsky et al., “Mega Firms and Recent Trends in the US Innovation: Empirical Evidence from the US Patent Data” (working paper, no. w31460, National Bureau of Economic Research, 2023), https://www.nber.org/papers/w31460.

[16]. Robert D. Atkinson and Michael Lind, Big Is Beautiful: Debunking The Myth Of Small Business (MIT Press, 2018).

[17]. Douglas Frantz and Catherine Collins, Selling Out: How We Are Letting Japan Buy Our Land, Our Industries, Our Financial Institutions, And Our Future (Contemporary Books, 1990), 90–91.

[18]. Barbosu, “Not Again: Why the United States Can’t Afford to Lose Its Biopharma Industry.”

[19]. “VIZIO: About Us,” https://www.vizio.com/en/about-vizio; “Element Electronics: Our Company,” https://elementelectronics.com/our-company.

[20]. U.S. Department of Commerce and U.S. Department of Homeland Security, “Assessment of the Critical Supply Chains Supporting the U.S. Information and Communications Technology Industry.”

[21]. “The output value of China’s new display industry exceeds 490 billion yuan,” Retop Led Display Co., Ltd., https://www.szretop.com/industry/outputvalue.html.

[22]. Data compiled from: Omdia, “OLED and LCD Supply Demand & Equipment Tracker,” July 22, 2024, https://omdia.tech.informa.com/collections/afccd062/oled-and-lcd-supply-demand--equipment-tracker.

[23]. Ibid.

[24]. Willy Shih, “Supply Chain Disruptions Should Remind Leaders to Keep Up With Allies,” Forbes, May 1, 2023, https://www.forbes.com/sites/willyshih/2023/05/01/friend-shoring-means-you-have-to-worry-about-the-health-of-your-friends/.

[25]. Ji-han, Hae-in, and Seo-young, “China overtakes S. Korea in OLED market for 1st time.”

[26]. Omdia, “Chinese panel makers dominate 98-/100-inch TVs panel market boosting China’s TV sector,” news release, July 9, 2024, https://omdia.tech.informa.com/pr/2024/jul/omdia-chinese-panel-makers-dominate-98-100-inch-tvs-panel-market-boosting-chinas-tv-sector.

[27]. Ibid.

[28]. Data provided by ADC. (Note: Total does not sum to 100 percent.)

[29]. Stacy Wu, “Chinese manufacturers have risen to dominate the auto display market, holding a 45% market share in 1H23,” Omdia, https://omdia.tech.informa.com/blogs/2023/oct/chinese-manufacturers-have-risen-to-dominate-the-auto-display-market-holding-a-45-market-share-in-1h23.

[30]. Ibid.

[31]. Shih, “How Did They Make My Big-Screen TV? A Peek Inside China’s Massive BOE Gen 10.5 Factory.”

[32]. Shih, “Supply Chain Disruptions Should Remind Leaders to Keep Up With Allies.”

[33]. DSCC, “DSCC Raises Capex Outlook as OLED Manufacturers Respond to Rising Demand with More Capacity,” news release, August 5, 2024, https://www.displaysupplychain.com/press-release/dscc-raises-capex-outlook-as-oled-manufacturers-respond-to-rising-demand-with-more-capacity.

[34]. Shih, “How Did They Make My Big-Screen TV? A Peek Inside China’s Massive BOE Gen 10.5 Factory.”

[35]. “BOE to build a $8.8 billion flexible IT AMOLED production line in Chengdu,” OLED-Info, November 29, 2023, https://www.oled-info.com/boe-announces-plan-build-88-billion-flexible-it-amoled-production-line-chengdu.

[36]. Omdia, “Gen 8.6 OLED factories for IT applications drive a flat panel display equipment recovery of 154% in 2024 and stabilize the market in future years,” February 5, 2024, https://omdia.tech.informa.com/pr/2024/feb/omdia-gen-86-oled-factories-for-it-applications-drive-a-flat-panel-display-equipment-recovery-of-154-in-2024-and-stabilize-the-market-in-future-years.

[37]. Shunsuke Tabeta, “China’s BOE chases South Korean rivals in OLEDs with new factory,” Nikkei Asia, May 28, 2024, https://asia.nikkei.com/Business/Technology/China-s-BOE-chases-South-Korean-rivals-in-OLEDs-with-new-factory.

[38]. Shih, “How Did They Make My Big-Screen TV? A Peek Inside China’s Massive BOE Gen 10.5 Factory.”

[39]. Stock photo licensed from iStock: “Line conveyor assembly televisions stock photo,” Stock photo ID:849897082, https://www.istockphoto.com/photo/line-conveyor-assembly-televisions-gm849897082-139541861.

[40]. Jin Eun-Soo, “Can Korea fend off China in display race?” KoreaJoongAng Daily, February 15, 2024, https://koreajoongangdaily.joins.com/news/2024-02-15/business/industry/Can-Korea-fend-off-China-in-display-race/1980411.

[41]. Ji-han, Hae-in, and Seo-young, “China overtakes S. Korea in OLED market for 1st time.”

[42]. Ibid.

[43]. “Chinese companies attend world’s leading display show in US,” Xinhua, May 15, 2024, https://www.chinadaily.com.cn/a/202405/15/WS6645663fa31082fc043c766a.html.

[44]. Li Yan, “Chinese innovation leads global display market,” China Daily, January 12, 2024, https://www.chinadaily.com.cn/a/202405/15/WS6645663fa31082fc043c766a.html.

[45]. Tian Shenyoujia, “Chinese innovations shine at world’s leading display show,” Belt and Portal News, May 25, 2023, https://eng.yidaiyilu.gov.cn/p/320246.html.

[46]. “Chinese innovations shine at world’s leading display show,” Xinhua News Agency, May 25, 2023, https://eng.yidaiyilu.gov.cn/p/320246.html.

[47]. Li Mingmei and Fan Feifei “China firms grab spotlight at CES,” China Daily, January 19, 2024, https://www.chinadailyhk.com/hk/article/372443.

[48]. Lia Zhu, “Chinese display makers shine at global show,” May 16, 2024, China Daily, https://www.chinadaily.com.cn/a/202405/16/WS664570bfa31082fc043c76c7.html.

[49]. BOE, “BOE Annual Report 2022,” 15–17.

[50]. Argam Artashyan, “The 50 Smartest Companies In The World (2019): MIT,” BizChina, July 1, 2019, https://www.gizchina.com/2019/07/01/the-50-smartest-companies-in-the-world-2019-mit/.

[51]. Shenyoujia, “Chinese innovations shine at world’s leading display show.”

[52]. Yan, “Chinese innovation leads global display market.”

[53]. Image credit: Luke Baker, “Honor Magic V2 RSR Porsche Design Review,” Trusted Reviews, February 14, 2024, https://www.trustedreviews.com/reviews/honor-magic-v2-rsr-porsche-design.

[54]. European Commission (EC), “The 2023 EU Industrial R&D Investment Scoreboard” (EC, 2023), https://publications.jrc.ec.europa.eu/repository/handle/JRC135576.

[55]. Economics of Industrial Research and Innovation, “EU Industrial R&D Investment Scoreboard (World 2500),” European Union, https://iri.jrc.ec.europa.eu/data.

[56]. Ibid.

[57]. National Science Foundation, “Publications Output: U.S. Trends and International Comparisons,” October 2021, https://ncses.nsf.gov/pubs/nsb20214/technical-appendix.

[58]. World Intellectual Property Organization (WIPO), “IP Facts and Figures,” March 2024, https://www.wipo.int/en/ipfactsandfigures/patents.

[59]. World Intellectual Property Organization, “Intellectual Property Statistics,” 2022, https://www.wipo.int/web/ip-statistics.

[60]. BOE, “About Us,” https://boe.com/en/about/index.

[61]. BOE, “BOE Annual Report 2022,” March 31, 2023, 14–15, https://convergencemedia.boe.com.cn/pdf/3MguhlZeRmyDAS18EWPpsSB3FPfYJr/ANNUAL%20REPORT%202022.pdf.

[63]. Ibid., 17–18.

[64]. “BOE joins hands with its partners to make a big debut at the Shanghai Auto Show with “screen power” leading the smart cockpit vane,” DoNews, April 19, 2023.

[65]. BOE, “BOE Annual Report 2022,” 15–17.

[66]. Ibid.

[67]. TCL, “China’s power in the wave of globalization”, 2023, http://www.tcl.cn/group/companyInfo/slipPath?type=1.

[68]. TCL, “Annual Report 2021,” December 31, 2021, 3, https://doc.irasia.com/listco/hk/tclelectronics/annual/2021/ar2021.pdf.

[69]. TCL, “2022 Annual Results,” March 2023, https://doc.irasia.com/listco/hk/tclelectronics/cpresent/pre230310.pdf.

[70]. “TCL Wins Four Prestigious 2022-2023 EISA Awards Including Premium Mini LED TV Award,” TCL, news release, August 19, 2022, https://www.tcl.com/global/en/news/tcl-wins-four-eisa-awards.

[71]. Consumer Technology Association (CTA), “CES 2023 Innovation Awards,”(CTA, 2023), https://www.ces.tech/innovation-awards/honorees.aspx.

[72]. Photo licensed under the Creative Commons Attribution-Share Alike 4.0 International license, https://commons.wikimedia.org/wiki/File:TCL_2.jpg.

[73]. Joe Lindsey, “What’s the Difference Between OLED and QLED TVs?” Popular Mechanics,March, 3, 2020, https://www.popularmechanics.com/technology/gadgets/a27719487/oled-vs-qled/.

[74]. Wit OLED, “Ultra thin and light! TCL Huaxing launches the first tablet OLED,” March 2, 2023, https://mp.weixin.qq.com/s/w_DbORvLkAFJ9vGysqDNaw.

[75] Insights by GreyB, “TCL Patents – Key Insights and Stats,” March 22, 2024, https://insights.greyb.com/tcl-patents/.

[76]. TCL, “TCL Announces New Research & Development Center in Poland,” September 3, 2018, https://www.tcl.com/global/en/news/tcl-announces-news-research-development-center-in-poland.

[77]. Ibid.

[78]. Park Sohee, “Display Industry Promotion Policies in China,” Korea Institute for Industrial Economics and Trade Research Paper No. 21/IER/26/1-4, Vol. 26 No. 1 (2003), https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4190924.

[79]. Ibid.

[80]. Ibid.

[81]. Ibid.

[82]. Frank Bickenbach et al., “Foul Play? On the Scale and Scope of Industrial Subsidies in China” (KIEL Institute for the World Economy, April 2024), https://www.ifw-kiel.de/fileadmin/Dateiverwaltung/IfW-Publications/fis-import/bc6aff38-abfc-424a-b631-6d789e992cf9-KPB173_en.pdf.

[83]. Brian J. Cavanaugh, “What China’s Dominance in Electronics Manufacturing Means for U.S. National Security,” The National Interest, August 12, 2024, https://nationalinterest.org/feature/what-chinas-dominance-electronics-manufacturing-means-us-national-security-212290.

[84]. Shuhei Ochiai, “Subsidized Chinese Makers Squeeze Asia’s LCD Industry,” Nikkei Asia, April 21, 2019, https://asia.nikkei.com/Business/Business-trends/Subsidized-Chinese-makers-squeeze-Asia-s-LCD-industry

[85]. Shunsuke Tabeta, “China’s BOE chases South Korean rivals in OLEDs with new factory,” Nikkei Asia, May 28, 2024, https://asia.nikkei.com/Business/Technology/China-s-BOE-chases-South-Korean-rivals-in-OLEDs-with-new-factory.

[86]. Kenji Kawase, “‘Made in China 2025’ thrives with subsidies for tech, EV makers,” Nikkei Asia, July 22, 2022, https://asia.nikkei.com/Business/Business-Spotlight/Made-in-China-2025-thrives-with-subsidies-for-tech-EV-makers.

[87]. Eun-Soo, “Can Korea fend off China in display race?”

[88]. Shih, “Supply Chain Disruptions Should Remind Leaders to Keep Up With Allies.”

[89]. Ibid.

[90]. BOE, “Interim Annual Report 2024,” https://convergencemedia.boe.com.cn/pdf/53jDm6awOgm6xA8IuBHV0xG4yB0LdC/INTERIM%20REPORT%202024.pdf.

[91]. Eun-Soo, “Can Korea fend off China in display race?”

[92]. U.S. Department of Commerce and U.S. Department of Homeland Security, “Assessment of the Critical Supply Chains Supporting the U.S. Information and Communications Technology Industry.”

[93]. Linda Lin, “Display Dynamics – May 2024: Sharp will restructure its display fabs in Japan in September 2024,” Omdia, May 30, 2024, https://omdia.tech.informa.com/om122137/display-dynamics--may-2024-sharp-will-restructure-its-display-fabs-in-japan-in-september-2024.

[94]. Charlotte Trueman, “Former Samsung engineer receives six year prison sentence for leaking tech giant’s secrets to China,” Data Center Daily, July 22, 2024, https://www.datacenterdynamics.com/en/news/former-samsung-engineer-receives-six-year-prison-sentence-for-leaking-tech-giants-secrets-to-china/.

[95]. Emory Kale, “USITC Launches Investigation Into OLED Display Technology Theft,” Display Daily, December 1, 2023, https://displaydaily.com/usitc-launches-investigation-into-oled-display-technology-theft/.

[96]. NetFlex, “About Us,” https://www.nextflex.us/about/.

[97]. Eun-Soo, “Can Korea fend off China in display race?”

[98]. Stephen Ezell, “An Allied Approach to Semiconductor Leadership” (IITF, September 2020), https://itif.org/publications/2020/09/17/allied-approach-semiconductor-leadership/.

[99]. United States International Trade Commission, “Section 337 Investigation of Certain Organic Light-Emitting Diode Display Modules and Components Thereof,” news release, November 30, 2023, https://www.usitc.gov/press_room/news_release/2023/er1130_64620.htm.

[100]. The White House, “JOINT FACT SHEET: Launching the U.S.-ROK Next Generation Critical and Emerging Technologies Dialogue,” December 8, 2023, https://www.whitehouse.gov/briefing-room/statements-releases/2023/12/08/joint-fact-sheet-launching-the-u-s-rok-next-generation-critical-and-emerging-technologies-dialogue/.

[101]. U.S. Department of Commerce, “Joint Readout: United States-Korea Supply Chain and Commercial Dialogue Ministerial Meeting,” June 27, 2024, https://www.commerce.gov/news/press-releases/2024/06/joint-readout-united-states-korea-supply-chain-and-commercial-dialogue.

Editors’ Recommendations

September 16, 2024

China Is Rapidly Becoming a Leading Innovator in Advanced Industries

August 19, 2024

How Innovative Is China in Semiconductors?

August 26, 2024

How Innovative Is China in AI?

March 11, 2024

How Innovative Is China in the Robotics Industry?

September 9, 2024

How Innovative Is China in Quantum?

June 17, 2024

How Innovative Is China in Nuclear Power?

July 30, 2024

How Innovative Is China in Biotechnology?

April 15, 2024