How Innovative Is China in Biotechnology?

China used to be considered a laggard in biotech. But with a comprehensive national strategy and extensive resources now supporting the industry, it is becoming more innovative. In fact, several indicators suggest it is narrowing the innovation gap with global leaders in the West.

KEY TAKEAWAYS

Key Takeaways

Contents

Importance of Biotechnology and the U.S. Role. 4

China’s Biotechnology Industry 5

How Innovative Is China’s Biotech Industry? 6

Innovation Inputs to China’s Biotech Sector 13

China’s Government Policies Supporting the Biotech Sector 26

Executive Summary

Austrian-Czech scientist Gregor Mendel laid the mathematical foundation of the science of genetics when he identified genes as the fundamental unit of inheritance in 1865.[1] Nearly 90 years later, in 1953, the work of scientists James D. Watson, Francis H.C. Crick, Maurice Wilkins, and Rosalind Franklin led to the discovery of the structure of DNA, the molecule containing human genes.[2] Their discovery marked the beginning of modern biotechnology, which has a wide range of applications, including in human health, the primary focus of this report.

The biotechnology industry uses living organisms and biological processes to develop drugs, drawing on areas including molecular biology, synthetic biology, genetic engineering, bioinformatics, and -omics technologies, among others, for drug discovery and development. Biotech is one branch of the broader biopharmaceutical sector, which encompasses biotech and pharmaceutical companies. Both produce medicines, but from different sources and through different modalities. While biotech focuses on the development of biologics, which are large, complex molecules derived from living organisms, such as monoclonal antibodies, vaccines, and gene therapies, pharma focuses on medicines with a chemical basis, synthesized from chemical compounds, such as small molecule drugs.[3]

The United States remains the world’s biotechnology leader with the highest level of new drug development. A sophisticated U.S. ecosystem, composed of national research funding sources, venture capital and private equity (VC/PE) start-up funding, large pharmaceutical firms that support life-sciences research and development (R&D), robust intellectual property (IP) protections, and strong commercialization ability have produced a globally unique environment that powerfully supports domestic biotechnology innovation. But this leadership position is at risk without a continually supportive domestic policy environment amidst robust foreign competition, particularly from China. Until recently, China’s playbook was to imitate the advances of industrialized countries, but since the 12th Five-Year Plan (2011–2015), the Chinese government has shifted its strategy toward incentivizing innovation, naming biotech as a strategic emerging industry and providing substantial support.[4] In 2016, China committed itself to improving health outcomes for the Chinese population through its “Healthy China 2030” strategy, which focuses on medical innovation and improving access to drugs.[5]

More specifically, China has developed a comprehensive national strategy to enhance the innovation capabilities of its domestic biotech industry. The strategy includes subsidies; financial incentives; the initiation of national reimbursement for innovative therapies; the establishment of high-tech science parks, start-up incubators, and public-private partnerships; talent recruitment initiatives; reforms to expedite drug review, especially for domestic products; and efforts to enhance IP protection to foster innovation. China has set several milestones and goals for the industry, such as enhancing the originality of biotech through new technologies and products, creating a biotech innovation platform, and strengthening the industrialization of biotech.

Several recent indicators suggest that China’s domestic biotech industry is indeed becoming more innovative. These include an uptick in the volume and quality of biotech-related scientific publications, a growing number of novel Chinese drugs approved by the U.S. Food and Drug Administration (FDA) and China’s National Medical Products Administration (NMPA), an increase in out-licensing deals from small Chinese biotech companies, particularly in oncology, and a rise in clinical trials occurring in China.

Despite recent progress, China still faces challenges in commercializing scientific discoveries into market-ready products, such as novel therapeutics. Doing so requires a different skill set from producing scientific innovations. The United States continues to lead in this area, leveraging its sophisticated ecosystem comprising national funding sources, VC start-up funding, pharmaceutical R&D investment, robust IP protections, and strong commercialization abilities. For China to realize its ambition of becoming a global biotech superpower, it will be important for it to develop a comprehensive biotech ecosystem and enhance its commercialization capabilities through approaches such as technology transfer from research to industry.

Background and Methodology

The common narrative is that China is a copier and the United States is the innovator. That narrative often supports a lackadaisical attitude toward technology and industrial policy. After all, the United States leads in innovation, so there is little to worry about, with the exception of perhaps making sure the country deepens its science, technology, engineering, and mathematics (STEM) skill base. First, this assumption is misguided because innovators can lose leadership to copiers with lower cost structures, as we have seen in many U.S. industries, including consumer electronics, semiconductors, solar panels, telecom equipment, and machine tools.[6] As Clayton Christensen has shown, followers often attack at the lower end of the market through copying and significant cost advantages and work their way up toward higher value-added and more-innovative segments.[7] Second, it is not clear that China is a sluggish copier and always destined to be a follower.

To assess how innovative Chinese industries are, the Smith Richardson Foundation provided support to the Information Technology and Innovation Foundation (ITIF) to research the question. As part of this research, ITIF is focusing on particular sectors, including the biotechnology industry.

To be sure, it is difficult to assess the innovation capabilities of any country’s industries, but it is especially difficult for Chinese industries. In part, this is because, under President Xi Jinping, China discloses much less information to the world than it used to, especially about its industrial and technological capabilities. Notwithstanding this, ITIF relied on three methods to assess Chinese innovation in biotechnology. First, we conducted an in-depth case study evaluation of two biotechnology companies that originated in China listed on the “2023 EU Industrial R&D Investment Scoreboard.” Second, ITIF conducted interviews and held a focus group roundtable with global experts on the Chinese biotechnology industry, allowing participants to speak anonymously, unless they expressed they wished to be named in the report.[8] And third, we assessed global data on biotechnology innovation, including scientific articles, patents, and novel drug applications.

Importance of Biotechnology and the U.S. Role

The biotechnology industry uses materials derived from living organisms to produce innovations that help improve human lives. The sector’s numerous applications range from the development of therapeutics and diagnostics to improve human health to energy production, waste treatment, and genetically modified crops for agriculture, among others.[9] This report focuses primarily on the healthcare applications of biotechnology.

Biotechnology can help advance human health in different ways. It can support precision medicine by tailoring therapeutics to individual patients, making them more effective and reducing side effects. Methods such as genetic sequencing and molecular diagnostics help identify specific genetic mutations associated with disease to determine the most suitable therapies based on individuals’ unique genetic profiles.[10]

The biotech industry also enables the production of biologics, drugs derived from living organisms or their components, such as therapeutic proteins, monoclonal antibodies, and vaccines. Biologics provide targeted treatments for serious diseases such as cancer and autoimmune disorders, inflammation-related conditions, hemophilia, and diabetes, among others.[11]

Biotech also has applications in gene therapies. Gene editing technologies such as CRISPR-Cas9 enable scientists to modify cells’ DNA, which could help treat genetic disorders by correcting disease-causing gene mutations. These examples illustrate the range of applications of biotech in healthcare, and the ways in which its outputs are critical to improving human lives.[12]

The United States remains the global leader in biotech, with the highest level of new drug development in the world. From 2014 to 2018, U.S.-headquartered enterprises produced almost twice as many new chemical or biological entities (NCEs and NBEs) as European ones, and nearly four times as many as Japan.[13] But this leadership position is at risk without a more supportive domestic policy environment amidst robust foreign competition, particularly from China.

The United States owes its biotechnology leadership to several factors, including strong research universities and institutions such as the National Institutes of Health (NIH) and the Advanced Research Projects Agency for Health (ARPA-H) that fund basic research; supportive science policies such as the Orphan Drug Act of 1983 and the Prescription Drug User Fee Act (PDUFA) of 1992 that aim to incentivize innovation; a robust IP protection regime, including strong patent rights and enforcement that encourage innovation; and the existence of supportive innovation clusters of collocated universities, companies, and incubators. These clusters facilitate knowledge and resource sharing, playing a critical role in transforming scientific ideas from the laboratory into commercial products such as novel therapeutics.

According to a McKinsey Biocentury report, China has seen the recent emergence of four leading biotechnology clusters: the Bohai Rim Cluster, located in Beijing, Tianjin, and Jianin; the Yangtze River Cluster, located in Shanghai, Suzhou, and Hangzhou; the Mid-West Cluster, in Wuhan and Chengdu; and the South China Cluster, located in Shenzhen, Guangzhou, and Xiamen. Over 8,500 biotech and biopharma companies are found in these leading biohubs.[14]

China’s Biotechnology Industry

Traditional forms of biotechnology have existed in China since its earliest days. During the Sui Dynasty in the 6th and 7th centuries, a smallpox vaccine was developed, which became widely available in China by the Ming Dynasty, in the 14th century.[15] More recently, the 1980s was a period of growth for China’s modern biotech industry. In 1987, China launched the 863 Program, providing support to 15 science and technology sectors, one being biotech, to stimulate the development of advanced technologies, particularly in genetic engineering, vaccination, and gene therapy.[16] This was both to prepare for public health crises and to respond to international competition, as other countries had established their own science and technology strategies. China has seen significant growth in its life sciences industries since the start of the current century.

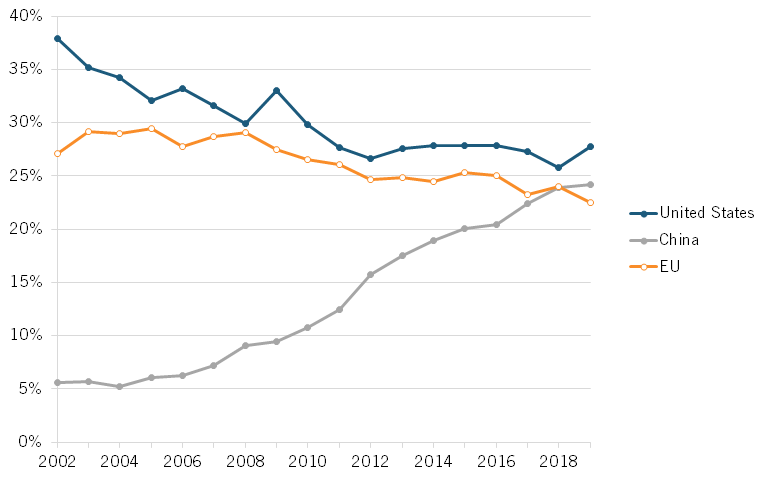

According to data from the National Science Foundation (NSF), value added output of China’s pharmaceuticals industry increased its global share from roughly 5.6 percent in 2002 to 24.2 percent in 2019. At the same time, the global share for the United States and the European Union have steadily declined. (See figure 1.)

Figure 1: Global shares of value added in pharmaceuticals[17]

Until recent years, China’s playbook was to imitate the advances of industrialized countries, but since the 12th Five-Year Plan (2011–2015), the Chinese government has shifted its strategy toward incentivizing innovation, naming biotech as a strategic emerging industry, and setting development priorities for drugs, biomedical engineering, agriculture, and biomanufacturing.[18]

According to the National Science Foundation (NSF), value added output of China’s pharmaceuticals industry increased its global share from roughly 5.6 percent in 2002 to 24.2 percent in 2019.

How Innovative Is China’s Biotech Industry?

Several indicators suggest that Chinese biotech is indeed has become more innovative in recent years, following its government’s strategic shift to support innovation in the sector. These indicators include a growing number of novel Chinese drugs, a rise in R&D companies, an increase in out-licensing deals from small Chinese biotech companies, particularly in oncology, and a surge in clinical trials taking place in China.

Chinese biotech companies are increasingly establishing global footprints. Out of the top 10 Chinese biotechnology companies, 9 have established overseas operations in more than 15 countries, including overseas R&D centers, offices, and manufacturing sites.[19]

The building blocks of biomedical innovation have been changing to facilitate research into complex conditions such as cancer and the development of new types of drugs. Notably, genetic databases are becoming the holy grail of drug discovery and development, and the Chinese government has supported the creation of gene and cell banks. Yet, Scott M. Moore, practice professor of political science, University of Pennsylvania, explains that while China’s large databases can help spur innovation in areas such as cancer therapeutics and CAR-T cell therapy, there are also logistical issues, including inconsistent hospital recordkeeping, and challenges surrounding how data is structured and coded, that China still needs to overcome.[20]

Chinese biotech companies are increasingly establishing global footprints.

New Drugs

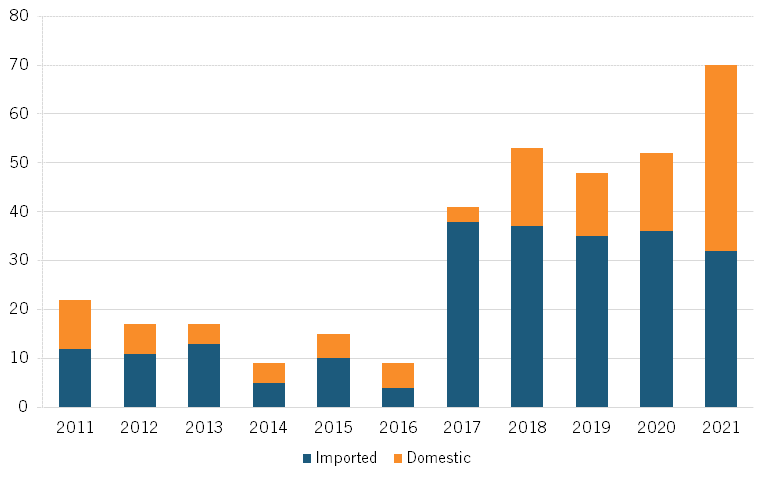

A 2023 study finds that the number of Chinese domestic medicine approvals increased between 2011 and 2021.[21] (See figure 2, recreated from the study.)[22]

Figure 2: Number of NMPA domestic and imported drug approvals in China[23]

In 2023, China had five first-in-class domestic drug approvals, a sign that domestic innovation is increasing. The five drugs approved were Glumetinib (Haihe Biopharma), Leritrelvir (Raynovent), Anaprazole (Xuanzhu Biopharma), Pegol-Sihematide (Hansoh Pharma), and Zuberitamab (BioRay Biopharmaceutical).[24] These drugs treat a range of conditions: mild or moderate COVID-19 symptoms, acid reflux, anemia in chronic kidney disease, and cancer. Also in 2023, the FDA approved three new Chinese drugs: Loqtorzi (toripalimab), the first FDA-approved drug for nasopharyngeal cancer, Fruzaqla (fruquintinib) for metastatic colorectal cancer, and Ryzneuta (efbemalenograstim) for the treatment of chemotherapy-associated neutropenia.[25]

An industry expert highlights that beyond the focus on truly novel, first-in-class drugs, two other kinds of innovation are important in the biotech industry: first, innovation using the resources of brute force, and second, innovation that improves current technologies. Focusing only on first-in-class innovation might obscure the other two, which are also critical for the development of the industry, and can also serve as building blocks for the first type of innovation.

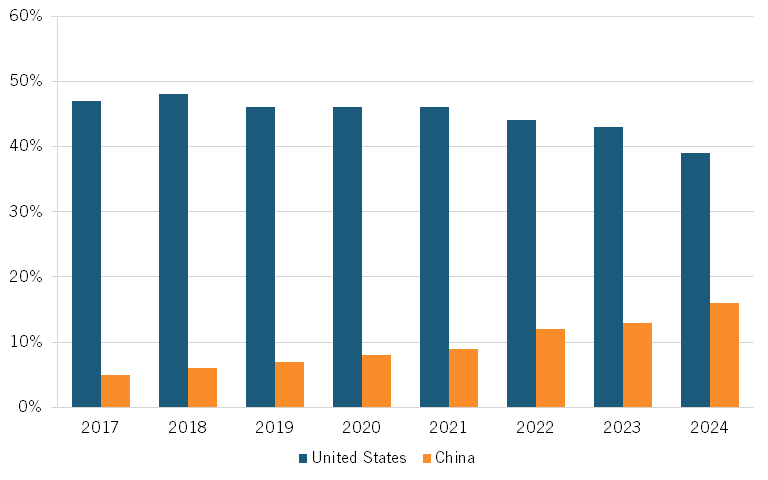

In recent years, China has focused on developing novel drug types, including monoclonal and CAR-T cell products, which show promise in cancer immunotherapy. An industry expert explains that Chinese biotech companies are conducting innovative work in cutting-edge modalities and small molecule drugs, and that the number of companies with innovative drug R&D pipelines is on the rise. Citeline finds that the share of companies involved in pharma R&D headquartered in China has increased from 5 percent in 2017 to 16 percent in 2024.[26] (See figure 3.)

Figure 3: Share of global companies involved in biopharmaceutical R&D[27]

While FDA approval is one valuable measure of new product innovation, George Baeder, a biotech executive with 30 years of experience in China, explains that an equally interesting innovation measure is the number of innovative Chinese drugs licensed by foreign multinational companies (MNCs).[28]

Out-Licensing Deals

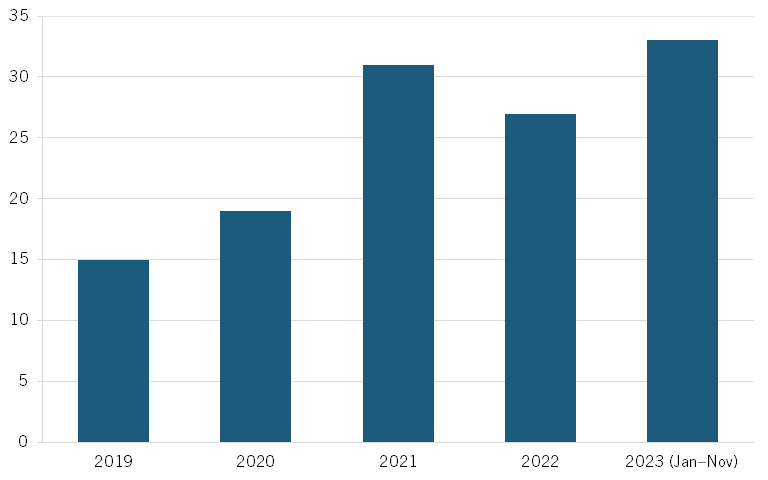

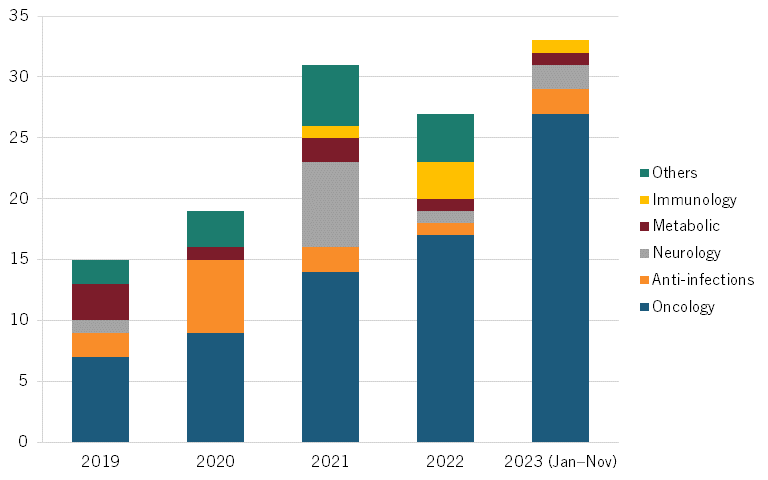

According to a November 2023 McKinsey BioCentury report, China evinces increasing numbers of out-licensing deals, suggesting growing confidence of MNCs in the quality of Chinese biotech products. This number more than doubled from 15 in 2019 to 33 in 2023. (See figure 4, recreated from the report.)[29] The largest rise has been in oncology, which experienced a nearly fourfold increase from seven out-licensing deals in 2019 to 27 in 2023, accounting for the greatest share of out-licensing deals. (See figure 5, recreated from the report.)[30]

Figure 4: Number of Chinese out-licensing deals[31]

Figure 5: Number of Chinese out-licensing deals by therapeutic area[32]

For example, in May 2023, Roche announced a partnership with Chinese biotech company Zion Pharma, through which it will pay Zion $70 million up front for a new orally delivered breast cancer drug. The drug, which targets the HER2 protein, is currently in Phase 1 clinical trials in the United States and China.[33] In January 2021, Novartis announced a collaboration and licensing agreement with BeiGene to develop and commercialize BeiGene’s anti-PD-1 antibody tisleziumab in the United States, European Union, and other countries.[34] In 2021, Eli Lilly entered a $1.5 billion deal with China’s Regor Therapeutics for a multi-year research collaboration and licensing agreement to develop new therapies for metabolic disorders, leveraging Regor’s Computer Accelerated Rational Discovery (CARD) platform.[35] And in December 2023, GSK entered into an exclusive license agreement with Chinese company Hansoh Pharma for an antibody-drug conjugate (ADC) targeting solid tumors.[36]

Beyond drugs, the industry is also making advances in multi-cancer early detection (MCED) tests, which involve the application of genome sequencing techniques to detect common cancer features in the blood. Through the Chinese government’s support, MCED developers can access state capital, academic biobanks, and other resources. This gives them an advantage over their American counterparts, which do not have access to the same resources and thus have to rely heavily on private sector investment to obtain them.

Important Chinese MCED players include BurningRock Dx, SeekIn, Berry Oncology, Singlera Genomics, and GeneSeeq. In 2023, SeekIn and Dutch OncoInv entered a partnership that enhanced China’s international collaboration and expanded the global accessibility of MCED tests.[37] Scientists in China have also recently created an AI-based test that can detect cancer, including pancreatic, gastric, and colorectal cancer, using a single spot of dried blood. This technique is cheap and easy to perform and transport, making it more accessible to underserved populations and less-developed countries.[38]

But as the mortality rates from infectious diseases fell, China’s focus shifted to chronic diseases, such as cardiovascular and metabolic disorders, and eventually, oncology. China seized the opportunity to develop treatments for these diseases at lower cost structures.

Baeder says that the Chinese biotech industry’s focus on cancer—as evidenced by its novel drugs, out-licensing deals, and diagnostic tests in this therapeutic area—is relatively new. and motivated in large part by China’s aging population and the rising incidence of cancer. This combination makes China one of the largest and fastest growing countries for new cancer diagnosis and treatment. Previously, its domestic biopharmaceutical industry focused on one health care priority: bringing down infectious disease. This led China to become the global leader in penicillin production, vaccines, and other antibiotics. But as the mortality rates from infectious diseases fell, China’s focus shifted to chronic diseases, such as cardiovascular and metabolic disorders, and eventually, oncology. China seized the opportunity to develop treatments for these diseases at lower cost structures. [39]

Clinical Trials

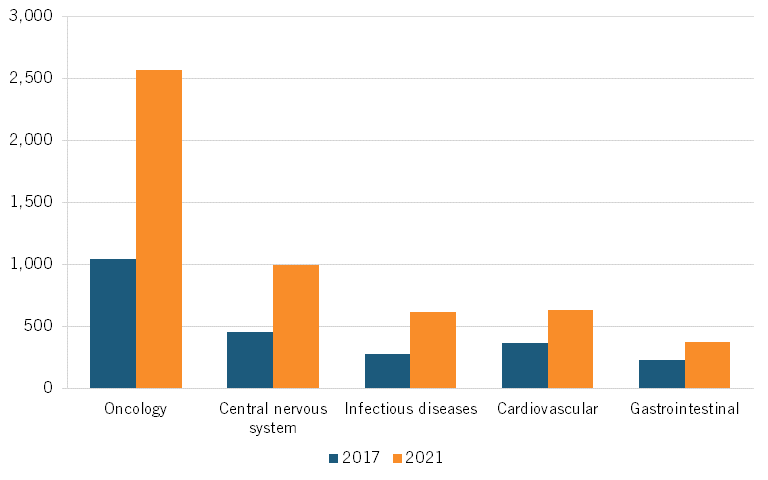

By several measures, China has already overtaken the United States as a site for clinical development. According to a 2022 report from GlobalData Healthcare Consulting, clinical trial activity between 2017 and 2021 more than doubled in China, from 2,979 trials in 2017 to 6,497 trials in 2021, while the United States saw only a 10 percent increase during this time, from 4,557 to 5,008 trials.[40]

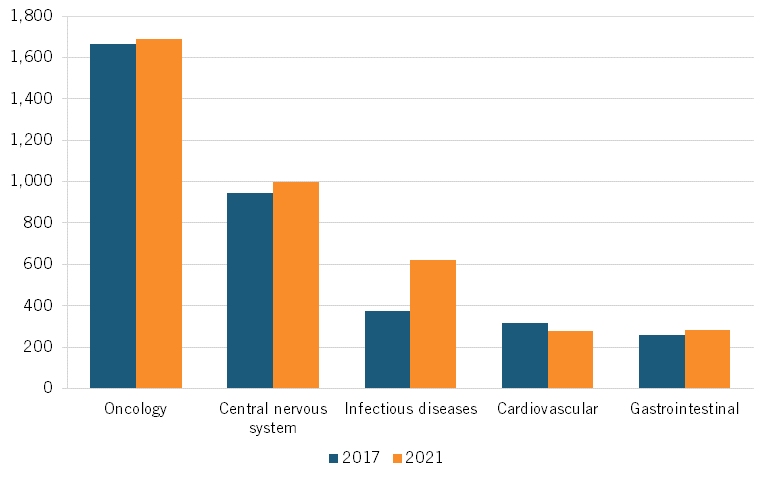

In oncology, the number of clinical trials grew from 1,040 in 2017 to 2,564 in 2021, a 146 percent increase. Meanwhile, in the United States, oncology clinical trials grew from 1,664 in 2017 to 1,690 in 2021, a 1.56 percent increase. (See figure 6 for U.S. clinical trials, and figure 7 for Chinese trials in the top five therapeutic areas.)[41]

Figure 6: Number of trials in top five therapeutic areas, United States[42]

Figure 7: Number of trials in top five therapeutic areas, China[43]

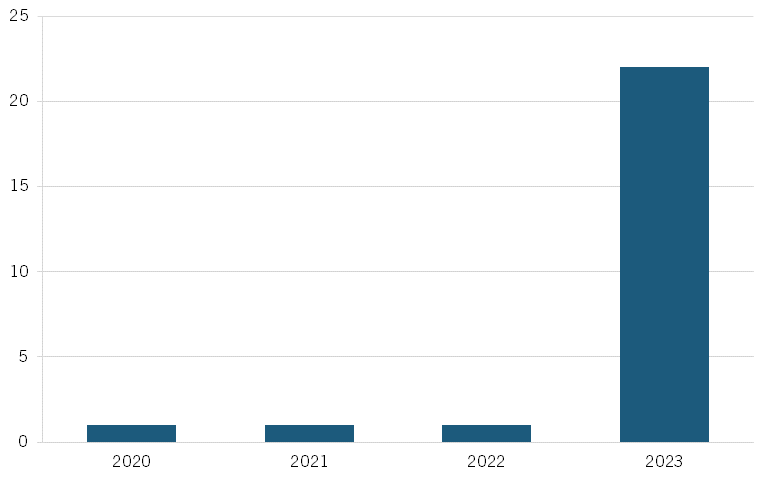

Analysis from Vital Transformation, a health care economics consultancy, also shows a surge in Chinese clinical trials for Alzheimer’s, from just one trial in each of 2020–2022, to 23 trials in 2023. (See figure 8.)[44]

Figure 8: Number of Alzheimer’s disease clinical trials originating from Chinese pharma companies[45]

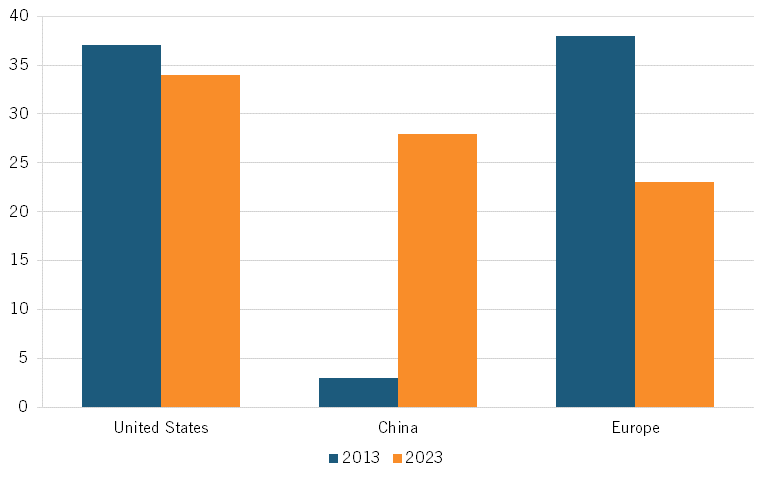

Further, a 2024 IQVIA report shows that the share of clinical trials launched by Chinese-headquartered biopharmaceutical companies rose from 3 percent in 2013 to 28 percent in 2023, suggesting a growing involvement of Chinese companies in early-phase drug development.[46] (See figure 9, drawing on data from the report.)

Figure 9: Share of clinical trial starts based on company headquarters location[47]

Baeder explains that as clinical development becomes more narrowly focused (e.g., based on biomarkers that target subsets of patients), the availability of patients and the speed at which they can be recruited have a significant impact on both speed to market and economics. While China’s process for approving trials still lags behind that of the United States, recruitment is much faster due to the comparatively large numbers of treatment patients in many disease areas. Baeder also states that Chinese clinical trial costs are generally 25 to 40 percent less than those in the United States, and taken together, these factors are turning China into a leading site for clinical development. For companies, this creates the opportunity to accelerate and lower the cost of the most expensive and time-consuming component of bringing a drug to market while at the same time helping firms gain access to the world’s largest market for many diseases.

Innovation Inputs to China’s Biotech Sector

This section of the report examines indicators assessing China’s biotechnology competitiveness at the industry level, considering such factors as scientific publications, patenting levels, and venture capital investment.

Scientific Publications

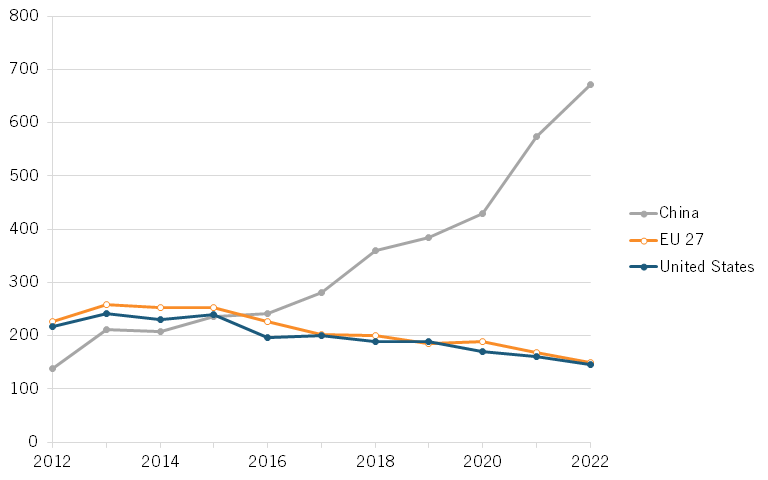

Chinese institutions are producing an increasing number of top-cited publications. In 2012, they published 139 biotech papers in the top 10 percent of most-cited publications. (See figure 10.) By 2022, that number had surged to 671 top-cited papers, an increase of more than 382 percent. Meanwhile, the number of publications from other countries has been relatively stable or slightly decreasing. In the United States, this number decreased from 218 in 2012 to 145 in 2022, a nearly 34 percent decrease.

Figure 10: Number of biotechnology publications in top 10 percent of most-cited publications[48]

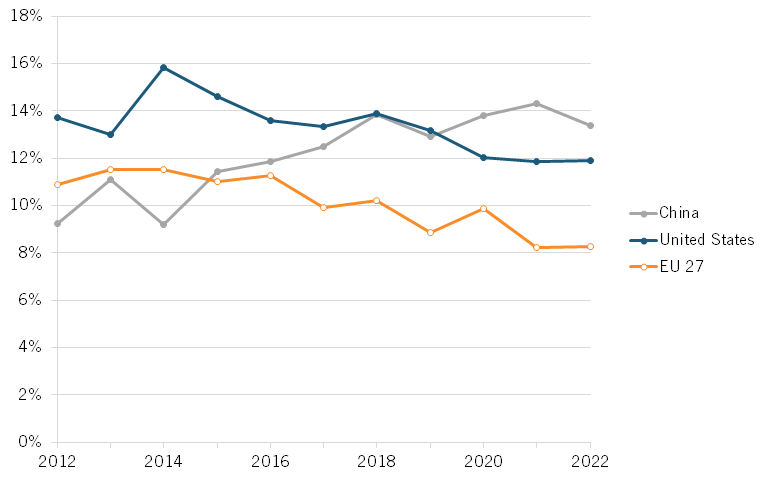

One can see a similar trend in global shares of publications. Between 2012 and 2022, the share of Chinese publications appearing in top-cited publications steadily grew from about 9.3 percent to about 13.4 percent. (See figure 11.)

Figure 11: Share of biotechnology publications in top 10 percent of most-cited publications[49]

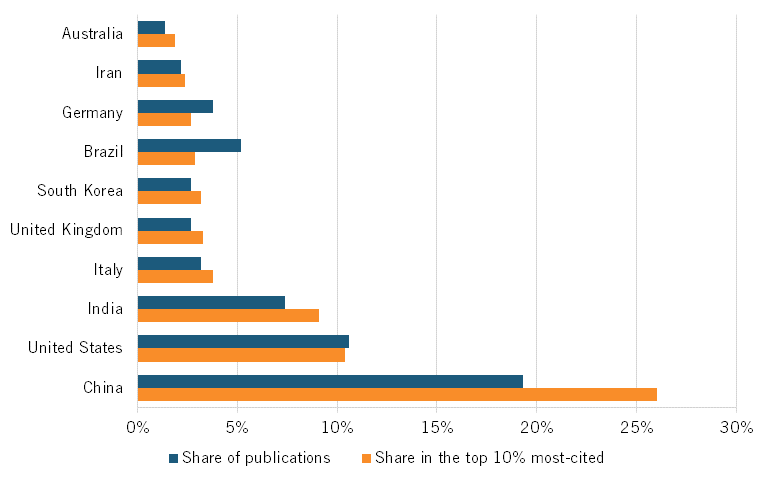

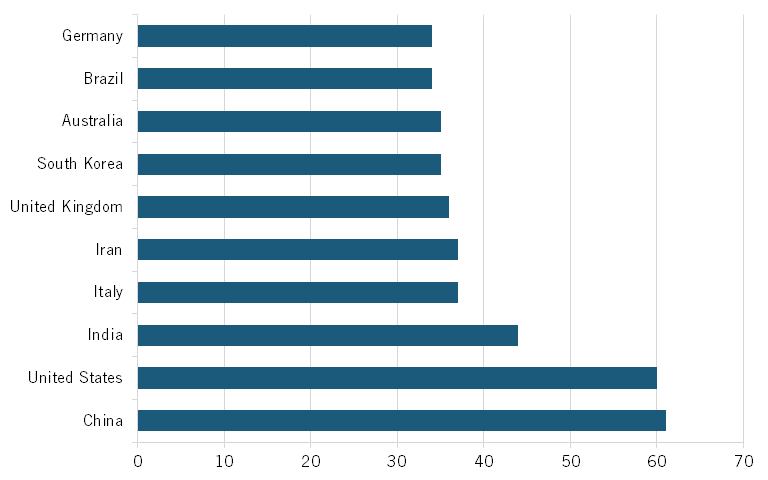

Biological Manufacturing

Data from the Australian Strategic Policy Institute, which tracks biotech in its Technology Tracker, shows that, in 2023, Chinese publications accounted for about 19 percent of all scientific publications in biological manufacturing. Similarly, Chinese publications accounted for 26 percent of all publications in top-cited journals, making China first in the world in terms of overall publications and high-impact publications in this field. (See figure 12). Moreover, China also ranks first in its H-index for biological manufacturing, just ahead of the United States. (See figure 13.) The H-index, an author-level metric that measures both the productivity and citation impact of publications, is another commonly used metric.

Figure 12: Global share of scientific publications in biological manufacturing by country, 2023[50]

Chinese publications in 2023 accounted for about 19 percent of all scientific publications in biological manufacturing.

Figure 13: H-Index for scientific publications in biological manufacturing, 2023[51]

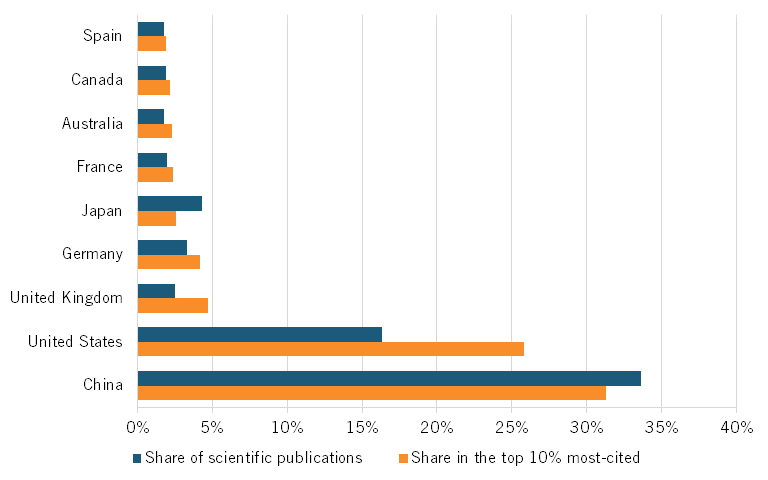

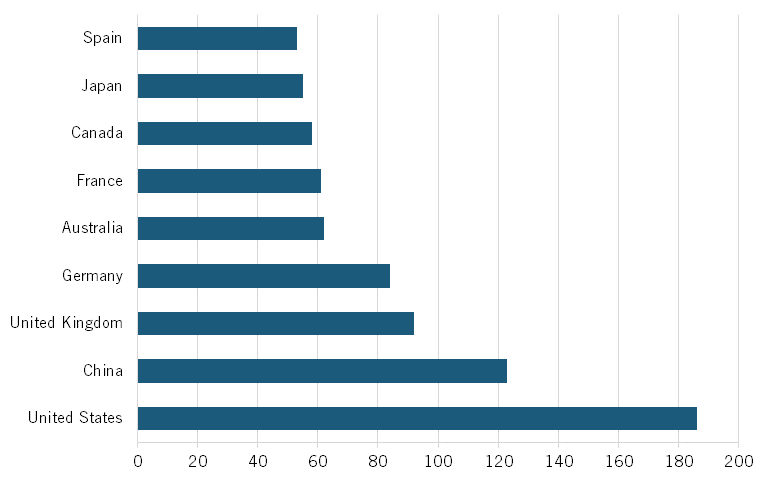

Genome and Genetic Sequencing and Analysis

In 2023, Chinese articles accounted for roughly 33 percent of all scientific publications in the field of genome and genetic sequencing and analysis. Similarly, Chinese publications accounted for 31 percent of all publications in the top-cited journals, making China first in the world in scientific publications in this field. (See figure 14.) China also ranks highly in its H-index for genetic sequencing, second behind the United States. (See figure 15.)

Figure 14: Global share of scientific publications in genome and genetic sequencing and analysis, 2023[52]

Figure 15: H-Index for scientific publications in genome and genetic sequencing and analysis, 2023[53]

Genetic Engineering

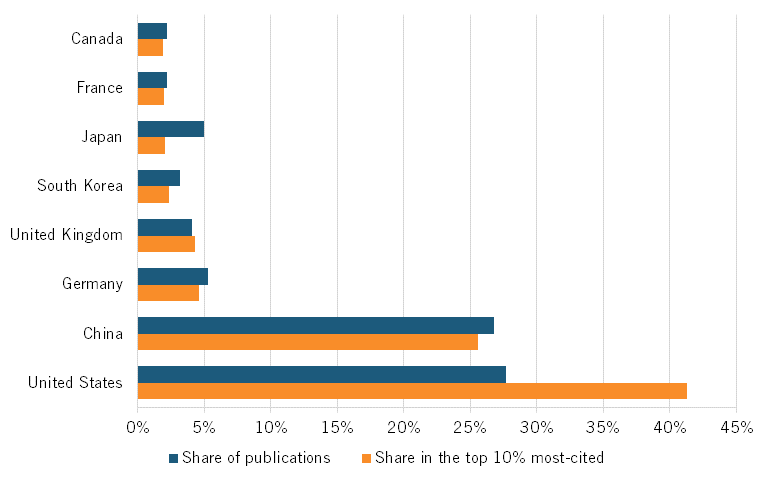

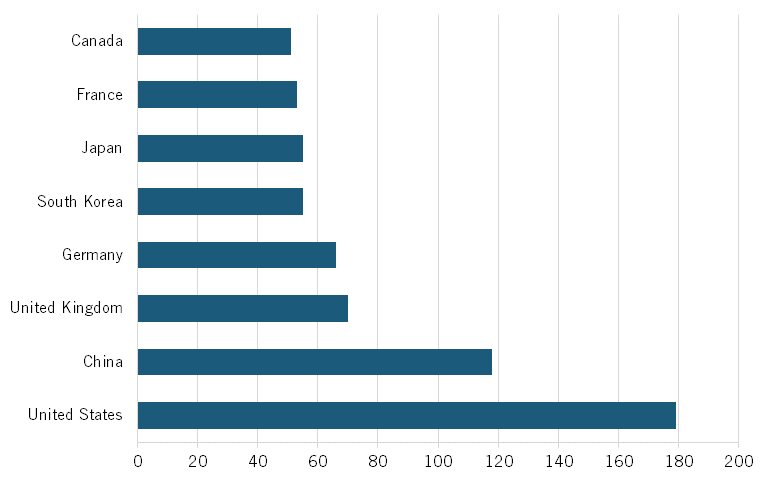

In 2023, Chinese publications constituted nearly 27 percent of all scientific publications in genetic engineering, second to the United States’ 28 percent, and roughly 26 percent of all publications in top-cited journals, second to the Unites States’ 41 percent. (See figure 16.) China also ranks second to the United States in its H-index for genetic engineering (figure 17).

Figure 16: Global share of scientific publications in genetic engineering, 2023[54]

Figure 17: H-Index for scientific publications in genetic engineering, 2023[55]

Novel Antibiotics and Antivirals

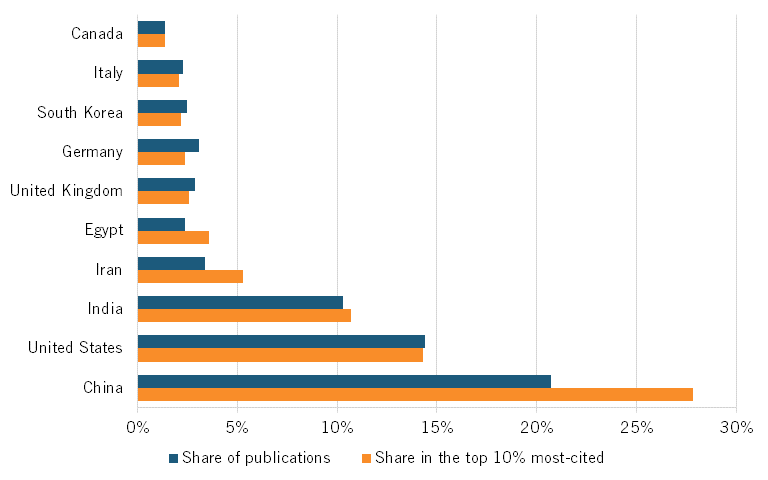

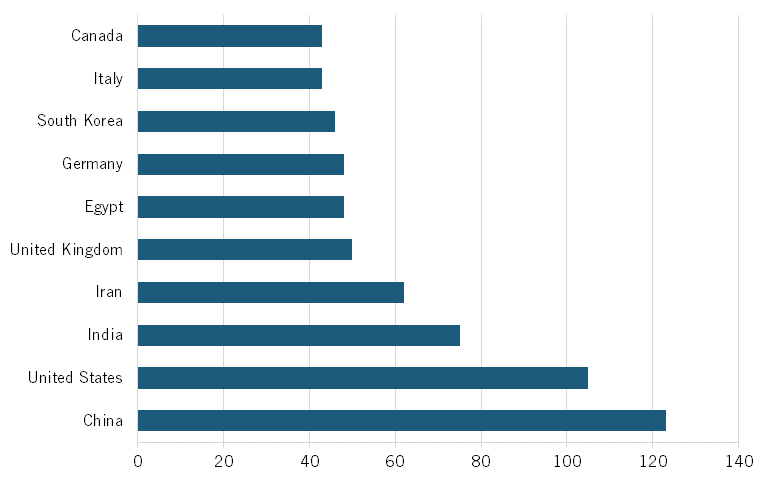

In 2023, Chinese publications held a share of about 21 percent of all scientific publications in novel antibiotics and antivirals. Similarly, Chinese publications had a share of about 28 percent of all publications in top-cited journals, placing the country ahead of the United States on both measures. (See figure 18.) China also ranks highly in its H-index for novel antibiotics and antivirals, ranking first in the world. (See figure 19.)

Overall, these findings suggest that China is a leader not only in the quantity, but also in the quality, of scientific publications in fields relevant to the biotech industry.

Figure 18: Global share of scientific publications in novel antibiotics and antivirals, 2023[56]

Figure 19: H-Index for scientific publications in novel antibiotics and antivirals, 2023[57]

Patents

China has also made significant strides in turning its scientific publications into biotechnology patents. The Patent Cooperation Treaty (PCT), which entered force in 1978, allows innovators to seek protection for an invention simultaneously in each of a large number of countries through an “international” patent application.[58] The PCT is not the only way of filing patents internationally; there are also other routes to protect IP across countries, including individual applications to the patent offices of each country, regional applications that cover multiple countries, and the Paris Convention Route, which is far older than PCTs, and is also less expensive, but lacks the coordination mechanism of the PCT. This section uses PCT filings to compare patent activity across countries because the PCT provides a standardized, comprehensive, and accessible dataset that reflects international innovation trends and patent strategies.

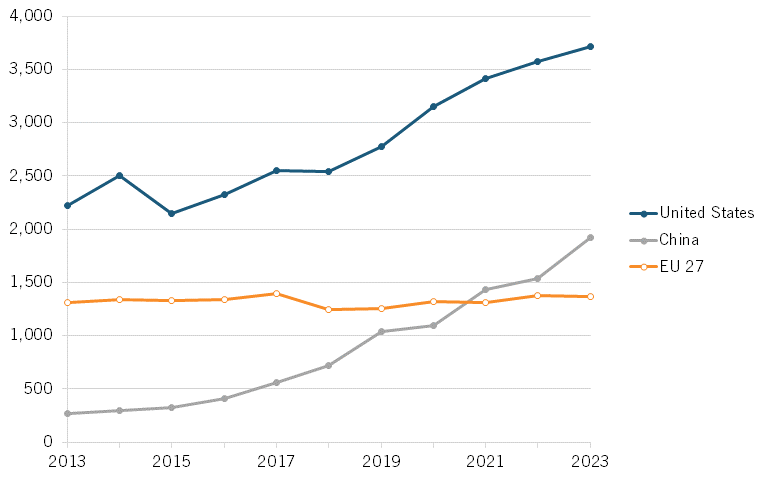

From 2013 to 2023, the number of biotech PCT patents awarded to Chinese entities increased by more than 720 percent, from 266 to 1,920, exceeding the European Union’s annual number starting in 2021. While this represents a 622 percent increase (albeit from a low starting point), the number of patents awarded to U.S. filers over the same period increased by 67 percent. (See figure 20.)

When considering the global shares of biotechnology PCT patents, China’s share increased by 15 percentage points from 4.8 percent in 2013 to 19.8 percent in 2023. (See figure 21.) By contrast, the U.S. global share declined slightly by 1.8 percentage points, while the EU saw a more significant decline of 9.5 percentage points.

Figure 20: Number of PCT publications in biotechnology[59]

Figure 21: Global shares of PCT patent publications in biotechnology[60]

Venture Capital

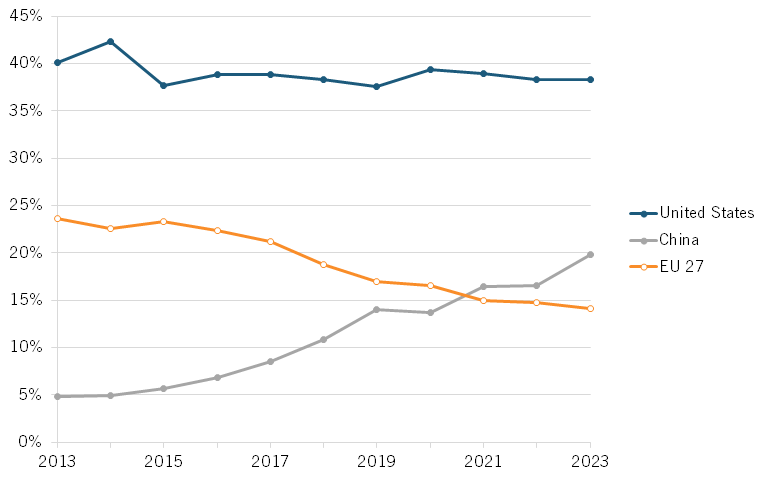

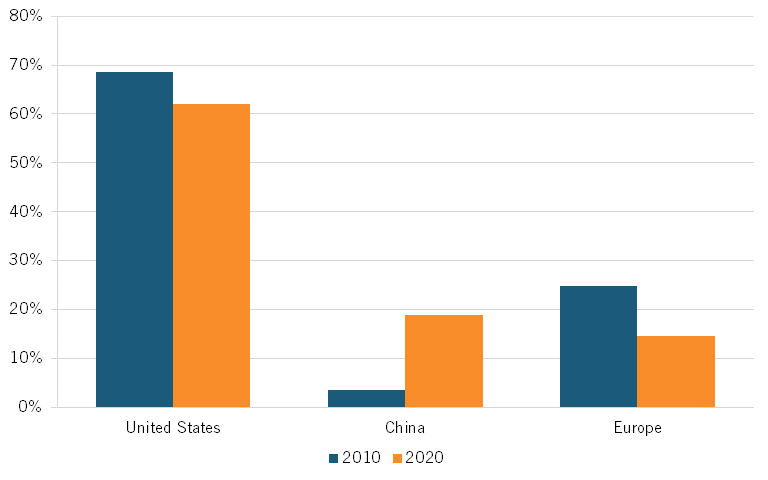

According to NSF, the total biotechnology VC raised by China—as determined by the VC financing raised by Chinese-headquartered firms—has surged. China’s share of global biotechnology VC raised grew from a mere 3.5 percent in 2010 to 18.9 percent in 2020. At the same time, the U.S. share declined from about 68.6 percent to 62.1 percent. Europe (including non-EU countries) saw an even greater decline over that same period from about 24.9 percent to 14.5 percent. (See figure 22.)[61]

Figure 22: Global shares of biotechnology venture capital raised[62]

Company Case Studies

This section provides case study analyses of two biotechnology companies that originated in China. They were intentionally selected from those companies included on the “2023 EU Industrial R&D Investment Scoreboard” report.

BeiGene

Founded in Beijing in 2010, BeiGene has grown into a global multinational oncology innovation company dedicated to developing both best-in-class and first-in-class clinical candidate drugs. The company operates on five continents and focuses on immuno-oncology, hematological oncology, and solid tumors and has built a diversified technology platform and product pipeline through in-house research and business development. BeiGene is a fully integrated company covering preclinical research, global clinical trial operations, large-scale drug manufacturing, and commercialization.

BeiGene employs more than 10,000 individuals worldwide, including over 3,000 global clinical research personnel. The company relies significantly on its in-house R&D team, which reduces its dependence on Contract Research Organizations (CROs). The founders, John V. Oyler, an American entrepreneur, and Xiaodong Wang, a Chinese-American biochemist, were driven by the belief that it was possible to run high-quality clinical trials in China that were global in nature and design, enabling them to enroll patients and run trials more quickly and cheaply, supporting innovation.[63] Today, BeiGene boasts a powerful in-house clinical development operation that leverages China’s faster recruitment and lower cost structure. The company has independently conducted over 130 clinical trials, enrolling more than 22,000 participants across 45 countries and regions.[64] BeiGene has also developed robust internal production capabilities. Its biopharmaceutical manufacturing facility and clinical R&D center in Hopewell, New Jersey, is nearing completion, and its newly completed small molecule innovation drug industrialization base in Suzhou, China, will expand solid-dosage-form production capacity to 1 billion tablets (or capsules) per year. Its biopharmaceutical production facility in Guangzhou, China, has reached a total capacity of 65,000 liters, with completed ADC production facilities and a new biopharmaceutical clinical production building.

Currently, BeiGene has three internally developed and approved drugs on the market: Brukinsa (zanubrutinib), a small molecule Bruton’s tyrosine kinase (BTK) inhibitor for treating various hematological malignancies; tislelizumab, an anti-PD-1 antibody immunotherapy for solid tumors and hematological malignancies; and pamiparib, a selective small molecule inhibitor of PARP1 and PARP2. Brukinsa has been approved in over 70 countries and regions, including Australia, Canada, China, the EU, the United Kingdom, and the United States.[65] Additionally, BeiGene has licensed the commercialization rights for 14 other approved drugs in the Chinese market, and established partnerships with leading biopharmaceutical companies such as Amgen and Beijing Novartis Pharma for the development and commercialization of innovative drugs.[66]

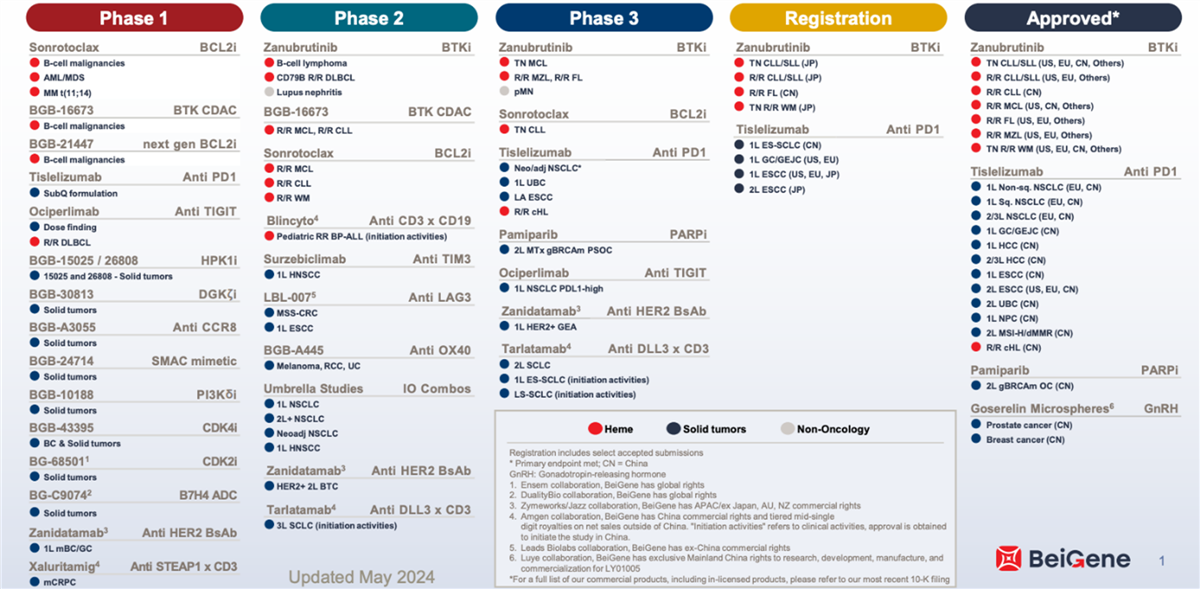

BeiGene boasts an extensive drug development pipeline, with approximately 50 drugs in clinical and commercialization stages: 16 approved drugs (including 3 internally developed products), 3 drugs in Phase 3 clinical trials, 13 drugs in Phase 2, and 18 drugs in Phase 1. The company also has over 60 preclinical projects, encompassing a variety of drug types such as small molecules, monoclonal antibodies, bispecific antibodies, and ADCs. Many of these drugs have the potential to be first-in-class with differentiated mechanisms of action. BeiGene’s rich and diverse R&D pipeline broadly covers 80 percent of global cancer types by incidence.[67] (See figure 23.)

Figure 23: BeiGene’s drug development pipeline[68]

BeiGene has established a comprehensive technical system that spans early discovery of anti-tumor drugs to commercialization. In the areas of small molecules, antibodies, cell therapies, and new drug production, the company has independently developed 15 core technology platforms.[69] In recent years, BeiGene has received nine international awards, nominations, and honors, including the 2023 Swiss Galen Award for “Most Innovative New Anti-Tumor Drug,” the Best Star Product Award for International Innovative Drugs and Medical Devices, and the Taiwan International Innovation Award, among others.[70]

In terms of R&D, BeiGene positions itself as an international company. It has 45 office locations, and of its over 3,000 clinical research employees, more than 500 are located in North America and Europe. In addition to its R&D centers in Beijing and in Guangzhou, BeiGene established a clinical R&D center at the Princeton West Innovation Campus in Hopewell, New Jersey. Beyond its extensive R&D team, the company also engages in numerous collaborations and commercial development activities, relying on overseas partnerships and technologies. In 2017, BeiGene entered a collaboration with Celgene (now part of Bristol Myers Squibb). In 2019, it signed a collaboration agreement with Amgen, and in 2021, it established collaborations with Novartis. BeiGene has introduced innovative products from companies such as Amgen, Mirati, Zymeworks, SpringWorks, Seagen, Leap Therapeutics, BioAtla, and Assembly, completing the commercialization of 13 drugs in China as third-party licensed medications.[71]

BeiGene has established regional hubs, which serve as “regional headquarters,” around the world: in Basel, Switzerland; Beijing, China; Cambridge, Massachusetts; and San Mateo, California. The company does not have a major shareholder with a government background. Its overseas-issued shares account for 91.5 percent of its total issued shares, while domestically issued shares account for 8.46 percent of the total issued shares. The four main shareholders are Amgen, Baker Brothers Life Sciences, L.P.; HHLR Fund, L.P.; and Capital Research and Management Company, holding 18.3 percent, 11.3 percent, 10.9 percent, and 7.9 percent of the shares, respectively. The largest shareholder, Amgen, is a global pharmaceutical giant, while the other three major shareholders are VC funds. Overall, the company’s equity is relatively dispersed, with no single shareholder holding more than 30 percent of the shares or voting rights.[72] In 2023, BeiGene received government subsidies amounting to CNY 220 million (approximately $30.8 million), which was less than 2 percent of its total annual revenue of CNY 17 billion (approximately $2.44 billion).[73]

In terms of R&D investment, in 2022, BeiGene’s investments reached CNY 11.2 billion (approximately $1.6 billion), and increased further to CNY 12.8 billion ($1.8 billion) in 2023. Over the past five years, the company’s total R&D expenditure amounted to CNY 49.03 billion ($6.86 billion). During the same period, its operating revenues totaled CNY 39.66 billion ($5.55 billion). BeiGene’s R&D efforts are primarily supported by continuous financing. In 2023, the average R&D expenditure in the industry was CNY 1.57 billion (roughly $216 million), while BeiGene’s R&D investment was eight times this amount.[74] BeiGene and its subsidiaries hold a total of 103 patent assets, which include 41 Chinese invention patents, 58 U.S. invention patents, 1 Chinese utility model patent, and 3 Chinese design patents.[75]

Hengrui Pharmaceuticals

Jiangsu Hengrui Pharmaceuticals, known as Hengrui Pharmaceuticals, is a leading Chinese pharmaceutical company specializing in oncology, metabolic diseases, autoimmune diseases, respiratory diseases, and neurological disorders. Hengrui originated from the Lianyungang Pharmaceutical Factory established in 1970. It transitioned to a private company in 1997 and went public in 2000. The company shifted focus from generic to innovative drugs after 2008, and now has 14 self-developed and 2 co-developed novel drugs.[76]

Hengrui has an extensive R&D pipeline in oncology and has also made significant advances in autoimmune, metabolic, cardiovascular, infectious, respiratory, and hematological diseases, as well as pain management, neurological disorders, ophthalmology, and nephrology.[77] Hengrui’s pipeline includes 147 projects, a 38.7 percent increase from 2023, ranking it eighth globally (being preceded by Johnson & Johnson and followed by Merck).[78] Among these 147 projects, 138 are originated drugs, the highest number globally. Currently, Hengrui has 13 drugs in Phase III clinical trials, 10 drugs that have submitted New Drug Applications or Biologics License Applications, and 15 drugs that are either already commercialized or in the process of commercialization.[79]

The company has received numerous international awards. In 2023, Hengrui was listed in the Top 50 Global Pharmaceutical Companies by PharmExec magazine for the fifth consecutive year, and it ranked 13th on Informa Pharma Intelligence’s “Top 25 Global Pharmaceutical Companies by R&D Pipeline” list, the highest ranking ever of any Chinese pharmaceutical company.[80] It was also listed in the top 10 of the Global Pharmaceutical Innovation Index by IDEA Pharma, and named one of Forbes China’s 50 Most Innovative Companies in 2022.

In 2023, the company earned revenue of $3.15 billion, marking a 7.3 percent year-on-year increase, and a net profit of $592 million, a 10 percent year-on-year increase. Revenue from innovative drugs reached $1.46 billion, the second highest among Chinese pharmaceutical companies (the highest being BeiGene). Its total R&D investment in 2023 was $850 million, similar to the previous year, with an R&D expenditure ratio of approximately 27 percent, which had increased from $5.18 million and a R&D ratio of 4.2 percent in 2005.[81]

Hengrui employs over 5,000 R&D personnel and operates 14 global R&D centers, including in China, Europe, and the United States, and has conducted 60 clinical trials overseas.[82] In 2023, Hengrui published 119 research achievements in academic journals, with a total impact factor of 1,394.5.[83] Through independent research and external collaborations, the company has developed 16 technology platforms encompassing PROTAC, molecular glue, ADC, bispecific/multispecific antibodies, AI molecular design, γδT cells (i.e., a subset of T cells that bridge innate and adaptive immunity, playing a key role in the immune system and holding promise for treating cancer), drug resistance, in-vivo pharmacology, molecular dynamics, and bioinformatics. This allows Hengrui to manage the entire drug development process, from early-stage research and translational medicine to clinical development.[84] The company also maintains long-term R&D and commercialization partnerships with international pharmaceutical companies and distributors. In 2023, it secured five external transactions, with a total value exceeding $4 billion.[85] For example, in February 2023, Hengrui licensed its EZH2 inhibitor for lymphoma to Treeline Biosciences in a deal worth more than $700 million.[86] In August 2023, Hengrui inked a $1 billion out-licensing deal for its asthma drug with One Bio.[87] In October 2023, it partnered with Merck in a deal worth up to $1.48 billion for Hengrui’s PARP1 trapping inhibitor and its ADC drug.[88]

In 2023, Hengrui received approximately $59.3 million in government subsidies, compared with $33.1 million in 2022. These subsidies primarily consisted of direct support for products, projects, and taxes. Tax incentives amounted to $5.8 million, accounting for roughly 10 percent of the total subsidies. Product-related subsidies were $41.4 million, around 70 percent of the total. Project subsidies, including government research funding for innovation projects and grants for construction projects, totalled $13.8 million, representing 20 percent of total subsidies. Government subsidies accounted for roughly 10 percent of the company’s $592 million profit.[89]

According to the World Intellectual Property Organization, Hengrui owns 3,661 patent records. The company has filed 2,389 invention patents and 662 PCT patents. It holds 545 valid invention patents in China and 667 authorized patents in countries including the United States, EU nations, and Japan. Its patents cover new drug compounds, protein molecular structures, preparation processes, uses, and formulation compositions. [90] Hengrui’s robust R&D pipeline, increasing R&D investments, and research partnerships demonstrate the company’s commitment to biopharmaceutical innovation.

China’s Government Policies Supporting the Biotech Sector

Early Building Blocks

In the 1980s, the Chinese government undertook efforts to encourage biotechnology R&D activities, launching two novel types of biotechnology centers. The first were large biotechnology bases, notably in Jiangmen and Shanghai, which aimed to bring basic research to production. The Jiangmen Single Cell Protein Biotechnology Base near Guangzhou fermented molasses into single-cell feed protein, which had applications in the food and biotechnology industries. The Shanghai Center of Biotechnology focused on areas such as genetic engineering and cell, enzyme, and fermentation technologies, attempting to develop processing techniques for human insulin and epidermal growth factor, among others.[91]

The second new type of biotechnology centers was laboratories intended as national training centers for Chinese scientists. The government helped establish 11 laboratories at top biotechnology research institutions, including Peking University, Fudan University, and the Beijing Institute of Virology, among others. The technology and resources that accompanied the establishment of those labs also enabled the universities’ research centers to improve their facilities and equipment. For example, the building of the Laboratory of Genetic Engineering at Fudan University had positive spillovers for existing labs in the university’s Institute of Genetics, enabling collaborations between scientists and facilitating access to sophisticated laboratory instruments.[92]

National Biotechnology Strategy

While in the past China had developed a robust manufacturing capacity primarily for small molecule drugs and vaccines, it is now seeking to become a hub of biotechnology innovation and discovery. China views biotech as a key emerging industry critical to the country’s global competitiveness, and has developed a national biotechnology strategy to bolster its industry’s innovation capabilities.

Since the early 2000s, Chinese government policies have shifted toward emphasizing domestic biotech innovation.[93] In 2010, China launched the Strategic Emerging Industries Initiative, identifying seven industries—biotech being one of them—deemed crucial to China’s economic competitiveness. The Chinese government prioritized these industries, providing substantial support, and set specific milestones for them. For the biotech industry, the milestones included enhancing the originality of biotechnology by developing new technologies and products, creating a biotechnology innovation platform, and strengthening the industrialization of biotechnology through the construction of biotech high-tech parks.[94]

Government support has consisted of subsidies, financial incentives for innovative companies, and research grants for scientists conducting biotech-related research. Funding programs include the National High-tech R&D Program and the National Key R&D Program, which allocate resources for innovative projects.[95] An industry expert explains that government support provides Chinese biotechnology companies an advantage for projects with longer time horizons.

China views biotech as a key emerging industry critical to the country’s global competitiveness, and has developed a national biotechnology strategy to bolster its industry’s innovation capabilities.

As part of the 13th Five-Year Plan (2016–2020), China’s Ministry of Science and Technology (MOST) released a Biotechnology Development Plan outlining biotech priorities and goals. These include the widespread application of genomics, development of precision medicine, and creation of gene and cell banks to be used in research. The plan emphasizes biotech as key to China’s economic growth, supports the construction of research centers for innovative R&D and high-tech science parks, and urges industry players to enhance the originality of their drugs and devices.[96] China’s most recent Five-Year Plan (the 14th, covering 2021 to 2025), promotes the continued development and expansion of the industry, seeking to promote the integration of biotech and IT, accelerate the development of biotech and pharmaceuticals, and increase the size and strength of China’s bio-economy.[97]

While prior policy had focused on international exchange and capability development for more mature biotech sectors, China’s most recent policies have shifted toward developing globally competitive companies and advanced biotechnology, signaling a goal to move from incremental to more radical innovations.[98] MOST has played a key role in supporting Chinese biotech innovation. In 2018, it also began overseeing China’s National Natural Science Foundation (NSFC), China’s largest public science funding organization and a major funding source for basic research and frontier exploration, as part of a broader effort to streamline the management of domestic science and technology funding.[99] In 2022, NSFC increased its research funding to encourage exploration and innovation, awarding 51,600 grants for a total of CNY 32.699 billion (nearly $4.5 billion), up from CNY 31.2 billion ($4.2 billion) in 2021.[100]

The creation of a national biotechnology strategy, which provides support and incentives for government, academia, and industry to all work for the common goal of advancing biotech innovation, has been critical for China’s biotech advances, encouraging the industry to shift from “Made in China” to “Created in China.”

China’s government has also promoted public-private partnerships, particularly collaborations with academia and industry on biotech research projects and technology commercialization. One example is the Tianjin Institute of Industrial Biotechnology of the Chinese Academy of Sciences (CAS), a national research institute established by CAS and the Tianjin Municipal Government in 2012. The institute was equipped with sophisticated facilities for high-throughput screening, systems biotechnology, fermentation, and genome synthesis.[101] Another example is the government-funded China National GeneBank, established as a repository of genetic data to spur genomics research.[102] The creation of a national biotechnology strategy, which provides support and incentives for government, academia, and industry to all work for the common goal of advancing biotech innovation, has been critical for China’s biotech advances, encouraging the industry to shift from “Made in China” to “Created in China.”

High-Tech Parks

The Chinese government has also supported the construction of high-tech science parks to support biotech development. These parks provide biotech companies with infrastructure, lab space, resources, talent pools, and financial support, including access to VC funding. Examples include the Zhangjiang Hi-Tech Park in Shanghai, Zhongguancun Life Science Park in Beijing, and BioBay in Suzhou. Biobay, for example, provides nanotechnology platform services to 51 companies, and supports companies with regulatory filings and financing.[103]

Such parks are especially critical for resource-constrained start-ups that cannot build their own expensive R&D facilities due to the massive up-front investments required and the high risks associated with drug R&D. A subtle but important factor that has supported China’s fledgling biotech industry has been a shift in cultural attitudes toward entrepreneurship. Entrepreneurship was not previously viewed positively in China, and start-ups were not allowed during the country’s Mao era (1950s–1970s) due to being considered “sprouts of capitalism.”[104] But in recent years, entrepreneurship has increasingly been seen as an important force of economic growth. As such, the Chinese government has implemented a number of initiatives to foster entrepreneurship, including the creation of high-tech parks and start-up incubators to support them.[105]

The emergence of a new type of organization in the 1990s, known as the contract research organization, has also spurred the development of China’s biotech industry.[106] CROs provide a wide variety of research services to biotech companies. In recent years, these services have shifted from technology transfer and customized production to a more cooperative R&D model between companies and CROs.[107]

Baeder explains that while early Chinese CROs were not very sophisticated, recently, high-quality, innovative, local CROs have emerged, with a wide range of capabilities including running clinical trials. In fact, China has become an ideal locale for clinical trials, due to high speed and low costs, and trials that used to be conducted in Europe were already moving to China prior to the U.S. government’s efforts to discourage firms from using this avenue to accelerate development.[108]

A study of 66 CROs finds that many of them are located among biotech companies in high-tech parks, where they can leverage the parks’ infrastructure, incubators, R&D facilities, and government support. The agglomeration offered by high-tech parks, pooling scientific expertise, state-of-the-art technological facilities, biotech companies, incubators, and financial resources, supports the development of CROs, which in turn spurs biotech innovation.[109] Nowadays, CROs and contract development and manufacturing organizations provide services ranging from discovery biology and preclinical research through biologics manufacturing at both clinical and commercial volumes.

For instance, BioBay Park, built in 2006 in Suzhou, has over 360 companies. Its CROs provide chemistry synthesis, reagent provisioning, and gene synthesis and sequencing services to these companies. The bioinformatics company Genewiz is one example of a CRO located in BioBay Park.

The agglomeration offered by high-tech parks, pooling scientific expertise, state-of-the-art technological facilities, biotech companies, incubators, and financial resources, supports the development of CROs, which in turn spurs biotech innovation.

Regulatory Environment

China has also been initiating regulatory reforms to streamline its drug and device review processes. The reforms are in response to challenges that have hindered access to innovative drugs, such as overly strict requirements for clinical trial approvals, long regulatory review times, and a shortage of reviewers.[110] In 2017, China’s NMPA, its equivalent of the FDA, joined the International Council for Harmonisation—whose role is to ensure that effective and safe medicines reach patients in the most resource-efficient way around the world—as a regulatory member, and began focusing on fast approval of innovative therapeutics.[111] NMPA introduced expedited pathways for the review of biotech products and has substantially increased its staff to speed up review processes.[112]

A recent study exploring the impact of these reforms on drug review times analyzed 344 NMPA approvals (for small molecule drugs, biologics, and vaccines) between 2011 and 2021. Overall, the median approval time for all drugs decreased from 22.1 months in the period 2011–2013 to 15.4 months in 2017–2021. For small molecule drugs, review time decreased from 20.4 to 15.7 months, while for biologics, it decreased even more, from 21.3 to 14.2 months. Between 2011–2013 and 2017–2021, drug review times decreased more for domestic than for imported drugs: from a median of 19.9 to 14.5 months for imported drugs, and from 32.5 to 16.7 months for domestic drugs, representing a 27 percent and a 49 percent decrease, respectively.[113]

Baeder notes that the difference in drug approvals between imported and domestic drugs owes mainly to the fact that imported drugs, which typically already had U.S. FDA approval, a track record of safety in other markets, and strong clinical data, were safer bets than domestic drugs for NMPA reviewers. As part of recent regulatory reforms, NMPA announced that any filing that falsified data would automatically be rejected and the entire filing process must be restarted from the beginning. Following the announcement, 86 percent of filings were voluntarily withdrawn before the NMPA deadline. This reform helped improve the quality and credibility of Chinese companies’ data, reducing reviewers’ workload and accelerating domestic approvals.

IP Protection

China has also been undertaking reforms to strengthen IP rights and enforcement to incentivize innovation. Compared with the United States, China has had a weaker IP environment for life sciences innovation, and historically shorter patent terms that enabled domestic companies to copy the drug discoveries of more innovative foreign companies. The United States provides a five-year data exclusivity period (a time during which regulatory authorities cannot rely on innovators’ clinical trial data to approve generic drugs) for new chemical entities (NCEs, small molecule drugs) and 12 years for biologics. These measures seek to incentivize innovation by granting exclusive use of clinical trial data submitted to the FDA by the innovator.

In China, the regulatory landscape has been evolving over the past few years. Existing regulations allow six years for NCEs, but do not include biologics. NMPA has published multiple versions of a draft guidance that proposes keeping the data exclusivity period of 6 years for NCEs and establishing a period of 12 years for biologics.[114] However, at the time of this writing, the draft guidance has not been enacted, and has been in a “draft for comment” status for the last two years, with a lack of practical guidelines in implementation, and only NCEs remain eligible for regulatory data protection.[115]

In June 2021, China further updated its patent laws, implementing several significant revisions designed to encourage pharmaceutical companies to develop and seek approval for novel drugs in China. Two notable revisions involve the introduction of a new patent linkage system and a patent term extension (PTE) mechanism for certain types of pharmaceutical patents. Patent linkage has been in operation for almost three years, but PTEs have not yet been fully implemented. [116] Such changes to China’s IP protection regime, and the country’s desire to harmonize its IP environment with other developed regimes, illustrate its efforts to achieve a more robust patent system supportive of biotechnology innovation.

IP Theft

There have been many reports of Chinese biomedical researchers working at U.S. universities, often on NIH grants, and taking the IP that their labs develop back to China.[117] For example, in 2020, the U.S. Department of Justice charged the chair of Harvard University’s Chemistry and Chemical Biology Department, Charles Lieber, with aiding China with “one count of making a materially false, fictitious and fraudulent statement” regarding his work with organizations tied to the Chinese government, while on NIH funding.[118] Also in 2020, Ohio citizen Yu Zhou was sentenced to prison for conspiring to steal trade secrets concerning the research and treatment of different medical conditions, including cancer, from Nationwide Children’s Hospital’s Research Institute to sell to China.[119]

Moreover, Chinese state-sponsored actors have targeted biopharma firms for IP theft, including through cybertheft and rogue employees.[120] That theft is sometimes through direct means whereby scientists working at U.S. biopharma companies engage in IP theft and then transfer it to China. In 2018, Yu Xue, a leading biochemist working at a GlaxoSmithKline research facility in Philadelphia, admitted to stealing company secrets and funneling them to a rival firm, Renopharma, a Chinese biotech company funded in part by the Chinese government.[121] In October 2023, intelligence chiefs from the Five Eyes countries—the United States, Britain, Canada, Australia, and New Zealand—accused China of IP theft in sectors including biotechnology.[122]

Scientific Talent

China has invested significant resources in STEM education, as well as talent development and recruitment efforts, to nurture a strong biotech workforce.

One effort was the Chinese Ministry of Education’s China-United States Biochemistry Examination and Application (CUSBEA) program, which ran between 1981 and 1989. Its goal was to train young Chinese scientists in biochemistry and molecular biology at U.S. universities, with the expectation that they would return home to advance their respective fields. More than 400 students attended Ph.D. programs at U.S. universities throughout the program.[123]

From 1985 to 2005, through CUSBEA and other means, Chinese scientists earned 12,000 Ph.D. degrees in life-sciences disciplines at American universities.[124] The Chinese government has implemented several talent recruitment efforts to attract them to return to China. One effort, the National Science Fund for Distinguished Young Scholars, has supported scientists to pursue basic research projects, given that they work in their home institutions in China for at least nine months a year.[125] Another effort, a program run through the China Scholarship Council, a subsidiary of the Ministry of Education, has provided funding to students from top Chinese universities to pursue Ph.D.’s at universities in the United States, Canada, the United Kingdom, and Australia, especially in the life sciences. Recipients must return to China after finishing their studies.[126] Such initiatives, while not limited to China, seek to enhance the country’s domestic research and innovation capacity.

According to the National Bureau of Statistics of China, the number of Chinese students returning from abroad steadily increased from 108,300 returnees in 2009 to 580,300 in 2019.[127] And, in total, according to the Ministry of Education of China, out of nearly 6.6 million young Chinese who studied abroad since 1978, over 4.23 million (86 percent) have chosen to return home and work in academia or industry in China.[128] This is creating a brain drain for the United States, and a brain gain for China, especially in certain therapeutic areas such as cancer and neurology.

In an interview published on Medium, Duane Schulthess, CEO of Vital Transformation, a health economics consulting firm, noted that “what you’re seeing is a transition to advanced therapies. In 2018, in China, there were 240 CAR-T developments, there were 140 in the United States, there were 40 in Europe … [China is] focusing on the advanced sciences … because all the Chinese students who used to come to the United States, and go to Stanford and Berkeley and Harvard and MIT … [now are] going back.”[129] Returnees are attracted to, among other factors, both the resources and capital available through the Chinese government’s support of the biotech industry and increasing amounts of VC funding.[130]

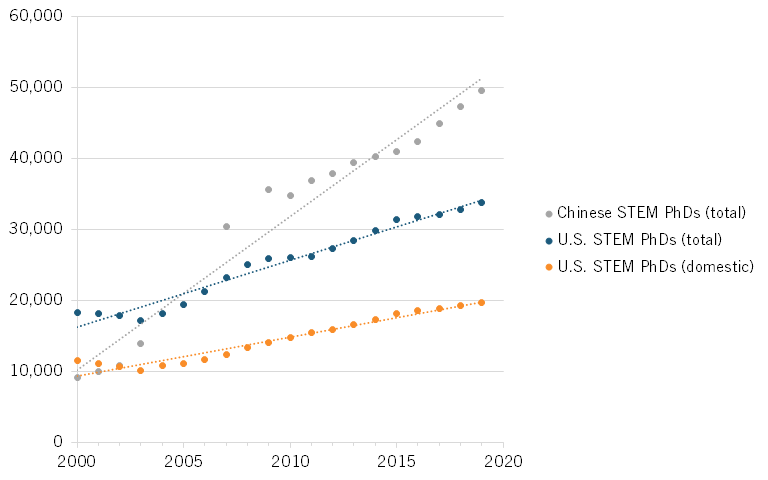

Moreover, the annual number of STEM Ph.D.’s who graduated from universities in China has surpassed those graduating in the United States. In 2000, U.S. universities awarded more than twice as many STEM doctoral degrees as Chinese universities. More than half of those U.S. degrees (62 percent) were awarded to domestic students. And Chinese students comprise the largest share of non-domestic U.S. STEM Ph.D.’s.[131] By 2007, the number of STEM doctorates awarded by Chinese universities exceeded that from American universities. In 2019, China awarded 49,498 STEM Ph.D. degrees, while the United States awarded 33,759.[132] (See figure 24).

Figure 24: STEM Ph.D. graduates, United States and China[133]

Price Controls

Drug reimbursement in China has become increasingly centralized through the establishment of the National Healthcare Security Administration and the implementation of the National Reimbursement Drug List (NRDL), where drug price negotiation takes place.[134] China has been imposing steep drug price controls and favoring Chinese firms in national drug selection, seeking to build up its domestic industry capabilities.[135]

For example, in 2022, as in 2021, Chinese domestic companies were the source of most new drugs added to the 2022 NRDL, with some MNCs continuing to struggle to make deals with NHSA for their drugs. In 2022, out of 147 drugs negotiated, 121 were added to the 2022 NRDL, with an average price cut of 60.1 percent. Seven orphan drugs were included in the 2022 NRDL, but the prices of those reimbursed drugs were far lower than their prices in other countries, with some reaching discounts of 94 percent during NRDL negotiation.[136] These price controls hurt foreign firms more than Chinese firms with lower cost structures, and reduce the revenues of the global drug discovery innovation system.[137]

China has been imposing steep drug price controls and favoring Chinese firms in national drug selection, seeking to build up its domestic industry capabilities.

What Should America Do?

The United States has developed a sophisticated ecosystem supporting biotechnology innovation. This ecosystem is composed of national funding sources, VC/PE start-up funding, large pharmaceutical firms supporting and conducting life sciences R&D, strong IP protection, and robust commercialization ability. A scientist quoted in the 2021 book Demystifying China’s Innovation Machine commented, “Commercial transformation ability is completely different from scientific research ability … ‘No place in the world can be compared with Cambridge, where a complete ecosystem supports R&D and commercialization of biotechnology.’”[138] An industry expert explains that this ecosystem is crucial to the success of the industry, and that it will take time before we see an industry in China on par with the one in the United States. Yet, the emergence of Chinese biohubs, such as the Bohai Rim Cluster, the Yangtze River Cluster, the Mid-West Cluster, and the South China Cluster, mentioned previously, suggests that China is actively establishing the infrastructure necessary to develop such ecosystems.

ITIF has previously laid out a comprehensive set of policies to stimulate U.S. biopharmaceutical innovation through reports such as “Ensuring U.S. Biopharmaceutical Competitiveness.”[139] While this report doesn’t recount all those policy recommendations, it does highlight several measures that would help the United States nurture its robust and unique ecosystem to maintain its global biotechnology leadership. These include restoring a more supportive policy environment, expanding efforts to strengthen domestic supply chains for essential medical ingredients, improving the IP system to incentivize long-term medical research, providing federal R&D investments, and limiting government drug price control schemes. A June 2024 study shows that proposed U.S. policies to reduce pharmaceutical prices, while beneficial at present for low-income populations, would cause a roughly 20 percent decrease in pharmaceutical firms’ net profits, which in turn would reduce their future drug R&D investments.[140] The stark reality is that if the United States continues down the path of strict drug price controls, its lead over China will continue to shrink, if not evaporate.

The United States should also expand policies that spur greater domestic innovation, such as boosting R&D funding through bodies such as NIH and ARPA-H, expanding investment incentives for biopharmaceutical companies, and supporting data-driven drug development through greater data availability and secure data sharing among global biopharmaceutical stakeholders.

Two factors that could help achieve this are good data-sharing policies and the use of privacy-enhancing technologies (PETs), which help improve privacy protection and promote secure collaborative research. Several steps have been taken in this direction. In October 2023, the White House issued an executive order, “Advancing a Vision for Privacy-Enhancing Technologies,” which called for the design, development, and deployment of PETs. And in April 2024, a new bill, the “Privacy Enhancing Technology Research Act,” which would require NSF to support R&D of PETs and direct federal agencies to accelerate their development, deployment, and adoption, passed the House. It currently stands for consideration in the Senate. Implementing such policies could help support data-driven drug development.

Further, when examining investment incentives for U.S. domestic innovation, it is also crucial to consider policies that ensure beneficiary access. For example, in the landscape of genomic innovations for early cancer detection, the lack of meaningful coverage pathways significantly inhibits U.S. innovation and competition.[141] Congress should pass the MCED Screening Coverage Act, which seeks to address these gaps in access and support the development and deployment of such innovations.[142]

The United States should also support policies to spur increased domestic production, including supporting R&D for biopharmaceutical process innovation, increasing funding for biomedical manufacturing centers, providing financial support for the establishment of new domestic biomedical production facilities, and expanding incentives for domestic manufacturing to mitigate vulnerabilities in biopharmaceutical supply chains and enhance national security.[143]

The National Institute for Pharmaceutical Technology and Education, a research- and education-based academic organization, stresses that the critical elements of a comprehensive strategy for reshoring pharmaceutical manufacturing include innovation in advanced manufacturing, pharmaceutical “new prior” knowledge (i.e., a synthesis of the existing prior knowledge from the time the original drug was approved with the new, state-of-the-art technologies), and training and education of pharmaceutical scientists, engineers, and manufacturing workforce. In particular, to facilitate reshoring the supply chain employing new technologies, it is essential to support the design and development of materials and products and continuous manufacturing processes.[144]

Moreover, while differences exist between the biotechnology and semiconductor industries, the United States should support the passage of legislation similar to the CHIPS Act for the biopharmaceutical industry, including allocating at least $5 billion to states to provide incentives for the establishment of new biomedical production facilities in the United States, and supporting the launch of a joint industry-university-government R&D partnership to reduce the cost of drug development and production. New technologies, such as AI and quantum computing, have the potential to lower the cost of drug discovery and production, and funding for an R&D program to support the development of such technologies, such as the R&D program established under the CHIPS legislation, could support biopharmaceutical advances.[145]

On the last point, proposed legislation known as the BIOSECURE Act aims to protect U.S. national security by limiting the involvement of certain foreign biotechnology companies in U.S. government contracts and research collaborations. The act would prohibit federal agencies from contracting with or extending loans or grants to any company engaging with a “biotechnology company of concern”—those connected to foreign adversaries deemed to pose a security risk to U.S. national security due to their ties with such governments. The bill specifically names several Chinese biotechnology companies, including BGI, MGI, Complete Genomics, and WuXi Apptec, as companies of concern.[146] It will take time for U.S. entities to move away from working with Chinese contract biomanufacturing organizations to find new partners and build up their own capabilities, but the bill does mean that the United States is beginning to decouple America’s dependence on China in order to advance national security and public health interests.

Conclusion

The Chinese government has devised a comprehensive national strategy to advance the innovativeness of its biotechnology industry, which it views as crucial for economic growth and national competitiveness. The plan aims to turn China into a world leader in the industry. The strategy includes subsidies; financial incentives; the initiation of national reimbursement for innovative therapies; the establishment of high-tech science parks, start-up incubators, and public-private partnerships; talent recruitment initiatives; reforms to expedite drug review, especially for domestic products; and efforts to enhance IP protection to foster innovation.

China’s biopharmaceutical industry is starting to show signs of innovation, including a surge in the volume and quality of biotech-related scientific publications, a rise in the number of novel Chinese drugs and out-licensing deals from Chinese biotech companies, and an increase in clinical trials taking place in China.

But despite China’s biotechnology advances, the country still faces several challenges. Many Chinese start-ups are founded by scientists, which presents difficulties for commercialization, as scientific research ability is very different from commercial transformation ability. Reflecting on the state of technology entrepreneurship in China, Marina Tue Zhang, Mark Dodgson, and David M. Gann wrote in their 2021 book, Demystifying China’s Innovation Machine, “There is a long distance from lab to hospital and pharmacy. Supportive policy, capital, and experienced managers are needed to make it, which also depend on mature ecosystems that China does not possess. The United States, on the other hand, has a sophisticated biopharmaceutical ecosystem, not only in life science R&D but also in the commercialization of biotechnology and bioengineering breakthroughs, and in strong IP protection.”[147] For China to become a global biotech leader, it will be critical for it to build comprehensive ecosystems, which include greater enforcement of IP rights, ethical use of technologies such as gene editing, and technology transfer from research to industry to enhance commercialization capabilities.[148]

Acknowledgments

ITIF wishes to thank the Smith Richardson Foundation for supporting research on the question, “Can China Innovate?” Other reports in this series will cover artificial intelligence, electric vehicles and batteries, chemicals, nuclear power, quantum computing, robotics, and semiconductors (Search #ChinaInnovationSeries on itif.org.).

The author would like to thank Robert Atkinson, Stephen Ezell, Ian Tufts, and Chongyi Zhang for their assistance with this report. Any errors or omissions are the author’s responsibility alone.

About the Author

Sandra Barbosu, Ph.D., is senior policy manager in the Economics of Biopharmaceutical Innovation at ITIF’s Center for Life Sciences Innovation. Her research focuses on the economics of innovation, particularly the role of emerging technologies in health care. Sandra is also adjunct professor at New York University’s Tandon School of Engineering. She holds a Ph.D. in Strategic Management from the Rotman School of management at the University of Toronto, and an M.Sc. in Precision Cancer Medicine from the University of Oxford.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent 501(c)(3) nonprofit, nonpartisan research and educational institute that has been recognized repeatedly as the world’s leading think tank for science and technology policy. Its mission is to formulate, evaluate, and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit itif.org/about.

Endnotes

[1]. “Gregor Mendel,” Britannica, accessed May 30, 2024, https://www.britannica.com/biography/Gregor-Mendel

[2]. Susan Borowski, “The other discoverers of DNA,” American Association for the Advancement of Science (AAAS), April 25, 2013, https://www.aaas.org/other-discoverers-dna.

[3]. Troy Segal, “Biotechnology vs. Pharmaceuticals: What’s the Difference?” Investopedia, April 19, 2023, https://www.investopedia.com/ask/answers/033115/what-difference-between-biotechnology-company-and-pharmaceutical-company.asp.

[4]. Aifang Ma. “Biotechnologies in China: A state of play,” Fondation pour L’Innovation Politique, February 2020, https://www.fondapol.org/app/uploads/2020/06/etude-ma-aifang-fondapol-biotech-chine-va-2020-02-25-3.pdf.

[5]. Xiaodang Tan, Xiangxiang Liu, and Haiyan Shao, “Health China 2030: A Vision for Health Care,” Values in Health Regional Issues (2017) 12C: 112–114, https://www.ispor.org/docs/default-source/publications/newsletter/commentary_health-care_china_2030.pdf.

[6]. Sandra Barbosu, “Not Again: Why the United States Can’t Afford to Lose Its Biopharma Industry” (ITIF, February 2024), https://itif.org/publications/2024/02/29/not-again-why-united-states-cant-afford-to-lose-biopharma-industry/.

[7]. Clayton M. Christensen, Michael E. Raynor, and Rory McDonald, “What is Disruptive Innovation?” Harvard Business Review, December 2015, https://hbr.org/2015/12/what-is-disruptive-innovation.

[8]. Scott M. Moore, Practice Professor of Political Science, University of Pennsylvania, and George Baeder, a biotech executive with 30 years of experience in China, gave us permission to be named in the report.

[9]. “What is Biotechnology?” Biotechnology Innovation Organization (2024), https://www.bio.org/what-biotechnology

[10]. Praveen Sharma and Shailendra Dwivedi, “Prospects of Molecular Biotechnology in Diagnostics: Step Towards Precision Medicine,” Indian Journal of Clinical Biochemistry, vol. 32 (2017): 121–123, https://doi.org/10.1007/s12291-017-0650-9.

[11]. Gary Walsh, “Biopharmaceutical benchmarks 2018,” Nature Biotechnology, vol. 36 (2018), 1136–1145, https://www.nature.com/articles/nbt.4305.

[12]. Jennifer A. Doudna and Emmanuelle Charpentier, “The new frontier of genome engineering with CRISPR-Cas9,” Science, vol. 346, no. 6213 (2014), https://doi.org/10.1126/science.1258096.

[13]. David Ricks, “Building an Innovation Ecosystem for a Healthier and More Secure Future” (PhRMA, January 28, 2022), 10, http://www.phrma-jp.org/wordpress/wp-content/uploads/2022/01/220128_PhRMA_Press_Conference_Presentation_ENG.pdf. Citing: IQVIA Institute for Human Data Science, “Global Trends in R&D: Overview Through 2020” (IQVIA, May 2021), https://www.iqvia.com/insights/the-iqvia-institute/reports/global-trends-in-r-and-d; Sandra Barbosu, “Not Again: Why the United States Can’t Afford to Lose Its Biopharma Industry” (ITIF, March 2024), https://www2.itif.org/2024-losing-biopharma-leadership.pdf.

[14]. “China biopharma – Charting a path to value creation,” McKinsey & Company, November 2023, accessed May 10, 2024, https://media.biocentury.com/m/68e31b4dc8238342/original/2023-BioCentury-China-Summit-McKinsey-Biopharma-Report.pdf.

[15]. National Academy of Sciences (US) Committee on Scholarly Communication with the People's Republic of China, Hamer DH, Kung S, editors, Washington (DC): National Academies Press (US) (1989), Ch. 2, China’s Long History of Biotechnology, https://www.ncbi.nlm.nih.gov/books/NBK236111/.

[16]. “Biotechnologies in China: A state of play.”

[17]. National Science Foundation, Science & Engineering Indicators, Production and Trade of Knowledge- and Technology-Intensive Industries, Table SKTI-9: Value added of pharmaceuticals industry, by region, country, or economy: 2002–19; accessed May 5, 2024, https://ncses.nsf.gov/pubs/nsb20226/data.

[18]. “Biotechnologies in China: A state of play.”

[19]. “China biopharma – Charting a path to value creation,” McKinsey & Company.

[20]. Phone conversation with Scott M. Moore, Practice Professor of Political Science, University of Pennsylvania, April 2, 2024.

[21]. Ling Su et al., “Trends and Characteristics of New Drug Approvals in China, 2011–2021,” Therapeutic Innovation & Regulatory Science, vol. 57 (2023): 343–351, https://doi.org/10.1007/s43441-022-00472-3.

[22]. Ibid.

[23]. Ibid.

[24]. Lang Zheng, Wenjing Wang, and Qiu Sun. “Targeted drug approvals in 2023: breakthroughs by the FDA and NMPA,” Signal Transduction and Targeted Therapy, vol. 9, no. 46 (2024), https://doi.org/10.1038/s41392-024-01770-y.