How Innovative Is China in the Electric Vehicle and Battery Industries?

China is at the global forefront of the electric vehicle (EV) and EV battery industries. Its firms produce nearly two-thirds of the world’s EVs and more than three-quarters of EV batteries. They also have produced notable innovations in EV products, processes, and customer experiences.

KEY TAKEAWAYS

Key Takeaways

Contents

Importance of EVs and EV Batteries and the U.S. Role. 5

China’s Electric Vehicle Industry 6

How Innovative Are China’s EV and EV Batteries Industries? 12

Market- and Customer-Experience-Driven Innovation. 20

Innovation Inputs to China’s EV Sector 21

China’s Government Policies Supporting the EV Sector 30

JVs and Technology Transfer Requirements 32

Favoring Domestic Enterprises 33

Analysis of Chinese Policies Supporting the EV Sector 34

Introduction

In 1985, Chinese enterprises manufactured a grand total of 5,200 passenger vehicles.[1] In 2024, they will manufacture a total of 26.8 million—21 percent of global production—a share automotive analysts expect will reach one-third by 2030.[2] The now more than 200 EV manufacturers operating in China will produce an estimated 10 million EV units in 2024, up from 8.9 million vehicles in 2023. In 2022, China accounted for 62 percent of global EV production (though this figure also counts Western manufacturers operating in China, such as Tesla) and 59 percent of global EV sales.[3] Similarly, China’s battery manufacturing capacity in 2022 stood at 0.9 terawatt hours, roughly 77 percent of the global share.[4] China’s two largest EV battery producers—CATL and FDB—alone account for over one-half of global EV battery production and in total, Chinese manufacturers produce 75 percent of the world’s lithium-ion batteries.

As The Wall Street Journal’s Greg Ip wrote, China’s global lead in EVs stems from “a unique combination of industrial policy, protectionism, and homegrown competitive dynamism.”[5] Indeed, there’s no doubt China’s EV industry has benefited greatly from aggressive industrial policy, spearheaded in particular by China’s lavish expenditure of over $230 billion in subsidies to the sector from 2009 to 2023, principally in the form of buyers’ rebates and sales tax exemptions.[6] China’s EV and EV battery companies have also benefitted from other “innovation mercantilist” policies including local content requirements, forced technology transfer, and state-blessed IP theft. Yet, they have also benefitted from less injurious (to foreign competitors) forms of government support, including world-leading levels of public research and development (R&D) investment in EVs, proactive government procurement policies, aggressive deployment of electric charging infrastructure, and consumer incentives to purchase EVs (such as free vehicle licenses or exemptions from roadway restrictions).

The Chinese government—at both the federal and provincial levels—has made EV competitiveness a national priority. It’s important to note that China’s drive toward EVs stems from a recognition made in the mid-2000s that Chinese enterprises were unlikely to become globally competitive in the dominant technological paradigm of internal combustion engines (ICE) at the time (despite aggressive technology transfer requirements) and so China’s leaders identified EVs as a breakthrough, or “leapfrog,” technology that could at once enable China to develop a globally competitive domestic industry while breaking the country’s dependence on foreign automotive technologies—and, crucially, the imports of ICE automobiles (and their oil) that this entailed. As one industry observer explained, “The primary motivation for China to push for EVs was energy security. Second was industrial competitiveness, and a far distant third was sustainability.”[7] Today, China’s push toward leadership in EVs—just as for artificial intelligence (AI), aerospace, biotechnology, nuclear power, semiconductors, high-speed rail, or any another advanced technology—should be construed as an effort to accumulate and extend its national power.

But while China’s EV industry has certainly benefitted from intense government support, Chinese EV and EV battery enterprises have become increasingly innovative in their own right across a number of dimensions of product innovation, process innovation, business model innovation, and even customer experience innovation. In EV batteries, Chinese enterprises have made important breakthroughs in battery chemistry, with some Chinese EV battery start-ups now working to develop EV batteries they assert will have a 2,000 kilometer (km) (1,300 miles) range. With the battery accounting for as much as 40 percent of the value of an EV, the country’s dominance in EV battery production gives its EV manufacturers an important first-mover advantage.

Moreover, Chinese enterprises are leading in other aspects of vehicle technology, from innovative vehicle suspension systems to the incorporation of a range of novel digital features; from autonomous driving, interactive voice control to multiple touch screens that enable everything from watching movies to singing karaoke. Chinese firms are also aggressively innovating vehicle production processes, from robotic automation to digital production systems (i.e., digitalized manufacturing execution systems) to innovative aluminum diecasting processes. Chinese EV manufacturers are also accelerating the pace of product innovation. One assessment finds that Chinese EV companies are 30 percent faster in developing and releasing a new car model than “legacy” American, European, and Japanese carmakers are. In short, the quality and innovativeness of EVs from leading Chinese manufacturers such as BYD, Li Auto, Xiaomi, and others increasingly rival or exceed offerings from Tesla or BMW.

Chinese EV enterprises are backed by an increasingly capable support ecosystem, including everything from the quality of the R&D conducted at Chinese universities and research institutions to a deep local supplier base. In particular, the number and quality of Chinese scientific publications pertaining to EVs and EV batteries has increased markedly in recent years. For instance, the Australian Strategic Policy Institute (ASPI) found that Chinese institutions account for 65.4 percent of the high-impact publications for electric batteries, substantially outpacing the United States’ 11.9 percent. And, as ASPI wrote, “The Chinese Academy of Sciences is a stand-out performer in the Critical Technology Tracker datasets. It leads in six of the eight energy and environment technologies [and is] no. 1 globally for electric batteries.”[8] Meanwhile, Chinese entities’ global share of patents in the field of electric propulsion increased 11-fold from 2.4 percent in 2010 to 26.9 percent in 2020.

The quality and innovativeness of EVs from leading Chinese manufacturers such as BYD, Li Auto, Xiaomi, and others increasingly rival or exceed offerings from Tesla or BMW.

China’s EV makers have undeniably become critical global players in the sector, and certainly a long-term threat to once-dominant Organization for Economic Cooperation and Development (OECD) nation auto manufacturers. In response to this threat (in no small part a result of China’s industrial subsidies), the United States has introduced tariffs of 100 percent on Chinese EVs and the European Union has established tariffs of up to 38 percent. While that’s a stopgap to prevent what the Alliance for Automotive Manufacturing referred to as a potential “extinction-level event” (should Chinese EV companies come to significantly penetrate the U.S. vehicle market), market limitations alone will not be fully effective.[9] Rather, the leading OECD nations will need to double down on genuine technological innovation. Here, policymakers should support the sector with robust R&D funding, R&D programs such as a “BatteryShot” initiative that could help produce EV batteries with longer range and better price performance, and supportive policies to stimulate consumer adoption, such as the deployment of a nationwide EV charging infrastructure. Moreover, policymakers must recognize that green technologies such as EVs will only become attractive to American buyers once they reach price/performance parity (P3) with existing technologies, meaning that for a given level of performance, a green technology has reached price parity with an existing dirty technology without subsidies or taxes on the latter.

Background and Methodology

The common narrative is that China is a copier and the United States is an innovator. That narrative often supports a lackadaisical attitude toward U.S. technology and industrial policy. After all, America leads in innovation, so there is nothing to worry about. First, this assumption is misguided because innovators can lose leadership to copiers with lower cost structures, as has been the case in many U.S. industries, including consumer electronics, semiconductors, solar panels, telecom equipment, and machine tools.[10] Second, it’s not clear that China is a sluggish copier and always destined to be a follower.

To assess how innovative Chinese enterprises and industries are, the Smith Richardson Foundation provided support to the Information Technology and Innovation Foundation (ITIF) to research the question. As part of this research, ITIF is focusing on particular sectors, including EVs and their batteries.

To be sure, it is difficult to assess the innovation capabilities of any country’s industries, but it is especially difficult for Chinese industries. In part, this is because, under President Xi Jinping, China discloses much less information to the world than it used to, especially about its industrial and technological capabilities. Notwithstanding this, ITIF relied on three methods to assess Chinese innovation in EVs and EV batteries. First, we conducted in-depth case study evaluations of two Chinese EV companies randomly selected from EV companies listed on the “2023 EU Industrial R&D Investment Scoreboard.” Second, we conducted interviews and held a focus group roundtable with global experts (to whom we offered anonymous participation) on the Chinese EV industry. And third, we assessed global data on EV innovation, including scientific articles and patents.

Importance of EVs and EV Batteries and the U.S. Role

Concerns over climate change have prompted governments to start focusing on finding alternative sources of energy. As such, EVs, and the battery technologies associated with them, have gained an increasing importance in recent years. In an effort to reduce greenhouse gas (GHG) emissions, governments have adopted various strategies to spur investment in and adoption of EVs. For instance, between the 2021 Infrastructure Investment and Jobs Act and the subsequent Inflation Reduction Act, the U.S. Congress has allocated over $245 billion in public expenditures toward supporting EV development and adoption.[11]

Despite their increasing popularity, EVs have existed longer than most appreciate. U.S. inventor William Morrison invented the first operational EV in 1890.[12] More current interest arguably started in the 1970s, when the rise in oil prices and attendant gas shortages sparked an interest in alternative energy sources. This motivated Congress to pass the Electric and Hybrid Vehicle Research, Development, and Demonstration Act of 1976.[13]

Lithium iron phosphate (LFP) battery technology originated in the United States (particularly important breakthroughs were made at the University of Texas in 1996), but, as one observer argued, “U.S. companies abandoned it for lack of a near-term payback.”[14] Instead, the technology was initially commercialized in Japan in the 1990s and was long dominated by Japanese and South Korean manufacturers.[15] However, LFP battery technology has been refined and improved over the past two decades by several Chinese companies, notably CATL, FDB, and BYD.

Tesla has become an important American innovator of EV and EV battery technology, while others such as Rivian and Lucid Technology have stepped into the game, along with traditional manufacturers such as Ford and General Motors (GM). GM, which in 2010 introduced the Volt EV as a response to Toyota’s Prius, promised in 2021 to produce only EVs by 2035, although GM CEO Mary Barra backtracked on this in January 2024 by saying GM’s product introductions henceforth “will be guided by customer demand,” and that it would reintroduce a gasoline-electric car with a plug.[16] From 2018 to 2023, 4.1 million EVs were manufactured in the United States, making America the world’s third-largest EV manufacturer (after China and Germany) and giving the United States a 16 percent global share (among the top-six EV-producing nations) of EV production over that timeframe.[17] While the United States has fallen off the global lead in EV battery production, several innovative start-ups including QuantumScape, Factorial Energy, and Solid Power are now trying to develop a next generation of so-called “all-solid-state batteries” (ASSBs) that would reestablish an American foothold in the field (while foreign firms such as Korea’s LG and SK have recently expanded their EV battery manufacturing operations in the United States).

Lastly, it’s imperative to note that a healthy automotive sector is critical to the U.S. economy. The sector has historically contributed from 3 to 3.5 percent of overall U.S. gross domestic product (GDP).[18] The industry supports a total of 9.7 million American jobs, or about 5 percent of private sector employment. Each job for an auto manufacturer in the United States creates nearly 10.5 other positions in industries across the economy.[19] In 2022, U.S. entities invested $48.4 billion on automotive R&D, which represented about 39 percent of global automotive R&D spending.[20] The industry represents the core of U.S. metal working and related production capabilities, which also entail very important dual-use applications (such as the key role GM played in building tanks, vehicles, and even aircraft during World War II). In short, the U.S. automotive industry is simply too big to fail if the United States is to have a robust manufacturing sector and vibrant advanced-technology economy.

China’s Electric Vehicle Industry

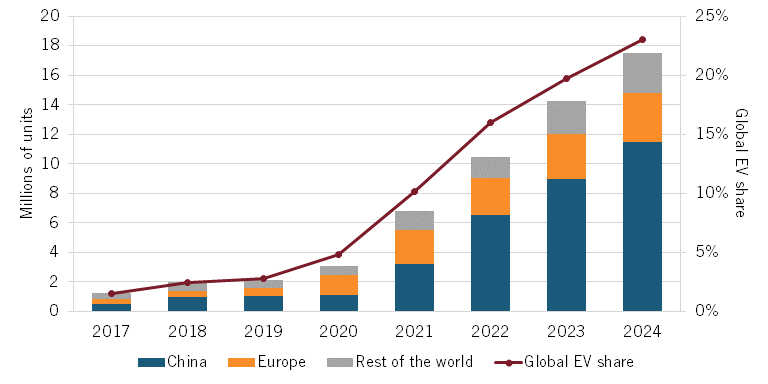

There exist several types of new energy vehicles (NEVs), with the most significant being fully battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid-electric vehicles (HEVs).[21] By year-end 2024, analysts expect that BEVs and PHEVs will account for 21.8 percent of all new vehicles sold globally, an increase of 2 percentage points from the 19.2 percent they accounted for in 2023.[22] (See figure 1.)

China has become the dominant market for both EV production and EV sales. Analysts expect that 11.5 million new EVs will be sold in China in 2024 (compared with 3.3 million in Europe and 2.7 million across the rest of the world), which they expect will account for 44 percent of new vehicles sold in the country this year. (See figure 1.) In 2023, sales of EVs in China increased by 37 percent from the year prior. In December 2023, China accounted for 69 percent of the world’s EV sales for that month, while for 2023, China accounted for 60 percent of global EV sales.[23] By 2030, analysts expect EVs to account for over 70 percent of annual vehicle sales in China.[24]

Figure 1: EV sales by country and EVs as a share of all car sales[25]

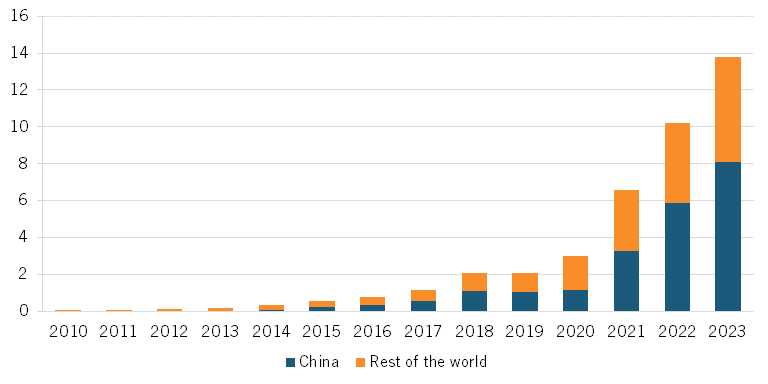

Overall, Chinese enterprises have come to be the leading players in the global EV industry. As of 2022, Chinese manufacturers accounted for 62 percent of all EVs produced in the world, a tremendous increase from the 0.1 percent of global EV sales Chinese enterprises accounted for in 2012.[26] (See figure 2.) In 2023, China’s total NEV production reached 8.91 million units, up 34.2 percent over the previous year, and analysts expect China’s total NEV production will exceed 10 million units in 2024.[27] For 2023, China produced 6.11 million BEVs (accounting for 68.6 percent of its NEV production) and an additional 2.8 million PHEVs.[28]

Figure 2: Global EV sales in millions of units[29]

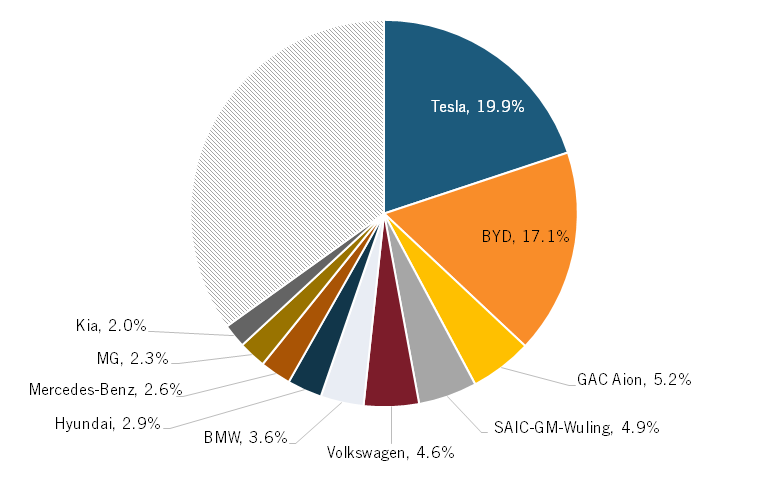

According to market research firm TrendForce, as of year-end 2023, Tesla commanded 19.9 percent of the global BEV market, followed by the Chinese firms BYD with 17 percent, GAC Aion with 5.2 percent, SAIC-GM-Wuling with 4.9 percent, and Volkswagen with 4.6 percent.[30] (See figure 3.) (All other manufacturers outside the top 10 accounted for 34.9 percent of sales.) However, based on Q1 and Q2 2024 production (and remainder of year forecasts), analysts expect that BYD will surpass Tesla as the top producer of BEVs by year-end 2024.[31]

Figure 3: Global market shares of top 10 BEV manufacturers, year-end 2023[32]

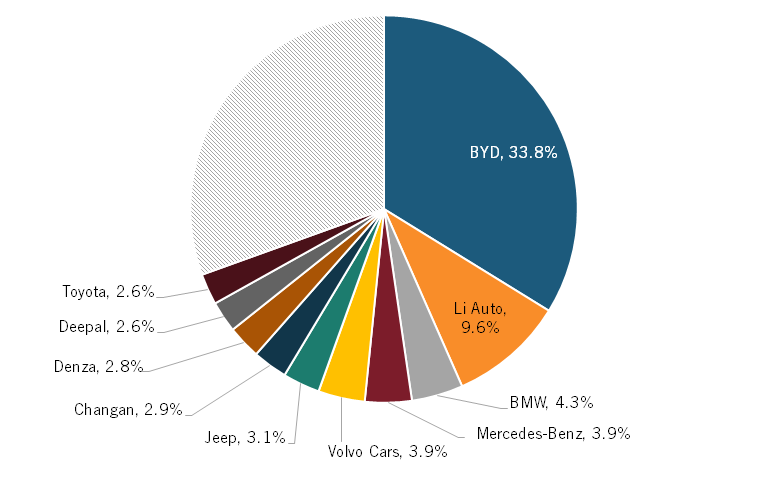

Considering PHEVs only, BYD dominates the global industry, with a 33.8 percent market share, followed at the top by Chinese firm Li Auto with 9.6 percent, BMW with 4.3 percent, and Mercedes-Benz and Volvo with 3.9 percent each. (See figure 4.) Li Auto’s share of the global PHEV market grew 182 percent from 2022 to 2023.

Figure 4: Global market shares of top 10 PHEV manufacturers, year-end 2023[33]

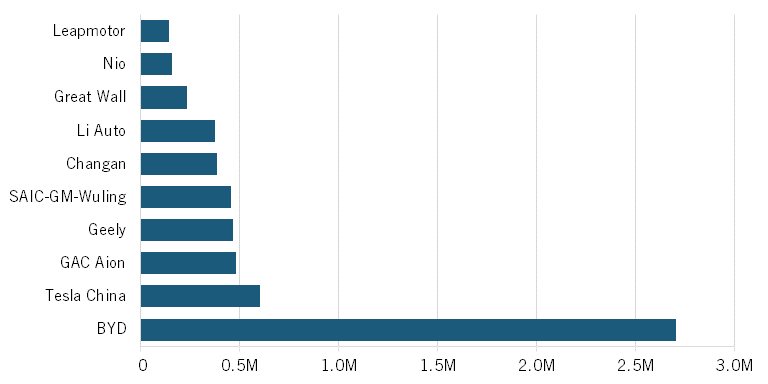

In terms of the Chinese NEV retail sales market specifically, BYD sold 2.76 million vehicles in 2023, followed by Tesla China with 603,664 vehicles sold and GAC Aion with 483,632. (See figure 5.) Overall, BYD accounted for 35 percent of Chinese NEV sales in 2023 and was the only manufacturer with a market share of more than 10 percent.[34]

Figure 5: Top 10 manufacturers’ NEV retail sales in China, 2023[35]

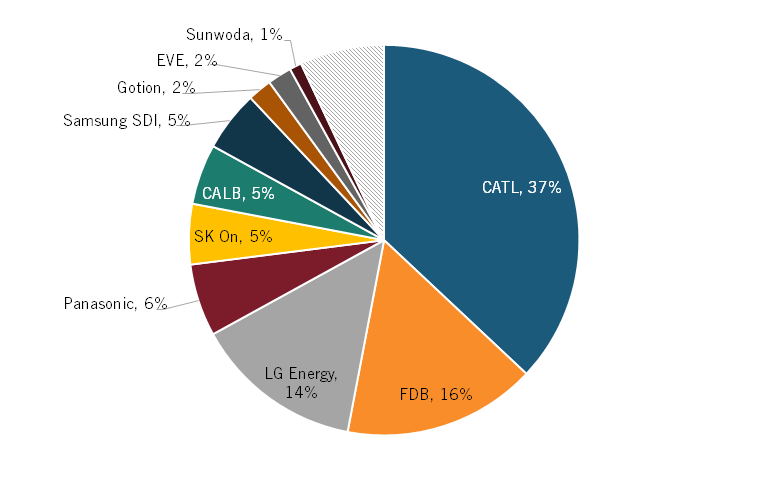

Likewise, Chinese enterprises dominate in the global share of EV battery manufacturing. CATL accounts for 37 percent of the global EV battery market followed by FDB with 16 percent, giving China’s top two competitors alone over half the global market. (See figure 6.) The twain are followed by LG Energy and Panasonic, with 14 percent and 6 percent of the market, respectively.[36] In total, Chinese EV battery manufacturers hold about 75 percent of the global market.[37] Morgan Stanley analysts predict that, by 2030, CATL alone will account for 35 percent of batteries sold in the European market.[38]

Figure 6: Leading EV battery manufacturers’ global market shares, 2023[39]

As of 2022, China accounted for 62 percent of all EVs sold in the world, a tremendous increase from the 0.1 percent of global EV sales Chinese enterprises accounted for in 2012.

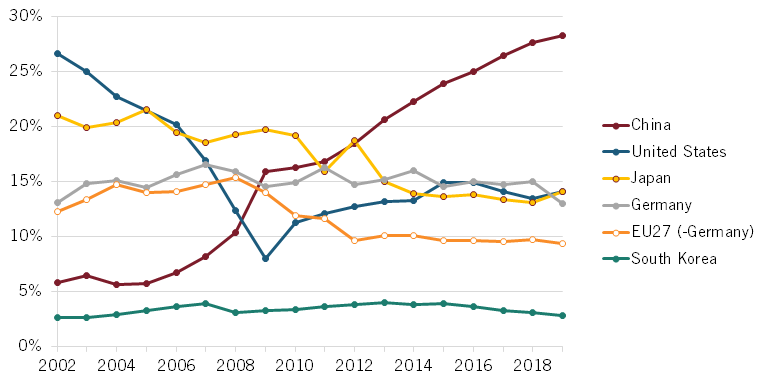

The U.S. National Science Foundation (NSF) provides data on countries’ shares of total value added in the motor vehicle, trailer, and semi-trailer industries (unfortunately, it does not break out EVs separately) and it finds that China’s share of value added in the automotive industry increased nearly fivefold from 6 percent in 2002 to roughly 28 percent by 2019. By contrast, the United States’ global share fell significantly over the 2000s and has never meaningfully recovered since the end of the 2008 recession, while the European Union’s share declined about one-third from its 2008 peak (31.2 percent) to 2019 (22.3 percent). (See figure 7.)

Figure 7: Global shares of value added in the motor vehicles, trailers, and semi-trailers industry[40]

China has become the leading global exporter of vehicles (including cars, sport utility vehicles (SUVs), pickups, and vans) with its nearly six million (5.6 million) vehicle exports in 2023 far surpassing those of Germany and Japan.[41] Chinese BEV exports rose 70 percent in 2023, reaching $34.1 billion in value.[42] Chinese producers accounted for approximately 35 percent of global EV exports as of year-end 2022.[43] From 2000 to 2023, Chinese EV exports increased over 850 percent.[44] Forty percent of Chinese BEV exports are destined for European markets, explaining how China’s share of the European EV market grew from just 0.5 percent in 2019 to 9.3 percent in 2023, with that share expected to reach 25 percent by year-end 2024.[45]

Analysts predict that Chinese carmakers will capture one-third of the global auto vehicle market by the end of this decade.

Perhaps surprisingly, it is a lack of specialized ships that has been the biggest obstacle holding China back from exporting even more vehicles. As Michael Dunne, a former president of GM Indonesia, explained, “They (China) are building cars a lot faster than they are building ships.”[46] As The Economist wrote, the biggest “constraint on their (Chinese EV) export today is the scarcity of vessels for shipping them.”[47] For this reason, the Jinling shipyard (near Nanjing) is “busy around the clock, there are night shifts every day.”[48] Chinese carmaker BYD itself has commissioned construction of a fleet of eight car carriers to underpin its global EV expansion; its BYD Explorer 1 can ship 7,000 vehicles at a time.[49] BYD exported 242,765 NEVs in 2023, which translates to a year-on-year growth of 334 percent.[50] In total, Chinese automakers (and shipping company agents) are responsible “for almost all of the orders now pending worldwide for 170 car-carrying vessels.”[51]

It should be noted, however, that Western auto manufacturers operating in China still account for a significant share of EV exports from China. For instance, in 2022, Tesla alone accounted for 40 percent of China’s total EV exports.[52]

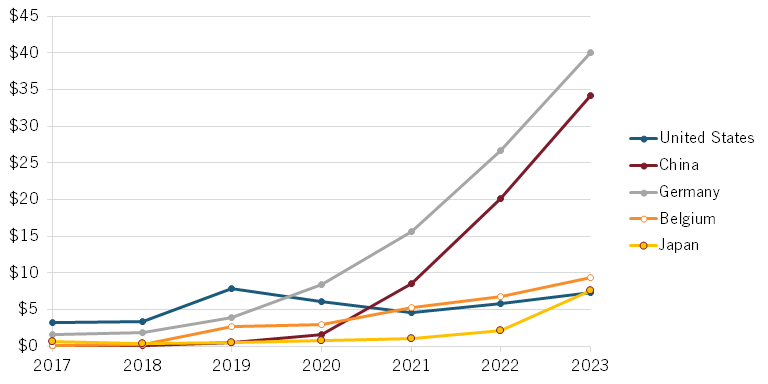

By value of EV exports, according to United Nations (UN) Comtrade data, Germany retains a slight edge over China. (See figure 8.) As of 2022, Germany remained the leading exporter of EVs, by value, with a 28.5 percent share, but China placed second at 18.6 percent.[53] This of course is likely explained by Germany’s greater levels of production of luxury vehicles (although Chinese EV makers such as Xiaomi and Li Auto are rapidly closing that gap).

Figure 8: Exports, by value, of top five EV-exporting nations ($ billions)[54]

How Innovative Are China’s EV and EV Batteries Industries?

Chinese enterprises have become highly competitive and innovative players in the global EV and battery industries. As one report observes, many contend that “China is the epicenter of EV innovation.”[55] Indeed, as commentators at an ITIF roundtable of experts on China’s EV industry observed, “Chinese enterprises are very innovative, especially in EVs” and “China is doing really remarkable, innovative work in the vehicle electrification space.”[56]

It’s a long cry from the year 2011, when Tesla CEO Elon Musk, being interviewed by Bloomberg and asked about rival BYD’s prospects, commented, “Have you seen their car? … I don’t believe they offer a superior product.”[57] As Musk continued in the interview, “I think their focus should be on making sure they don’t die in China.”[58] Asked the same question during a June 2024 analyst call, Musk sang a different tune, responding, “Our observation is, generally, that the Chinese car companies are the most competitive car companies in the world.”[59]

Enterprises can pursue a multitude of different types of innovation, including with regard to product innovation, process innovation, business model innovation, and even customer-experience-driven innovation.[60] The following section analyzes how innovative Chinese EV and battery makers are along these different innovation trajectories.

Product Innovation

This section examines Chinese enterprises’ innovations with regard to both the batteries powering the EVs and product innovations across the rest of the vehicle.

EV Battery Innovation

Batteries account for approximately 40 percent of the value of an EV—and thus essentially constitute the essence of what an EV represents.[61] While a wide variety of EV batteries exist, the two most prominent types have historically been LFP or nickel and cobalt-based batteries, which can come in nickel cobalt aluminum (NCA) or nickel manganese cobalt (NMC) varieties. Nickel/cobalt batteries have tended to be more popular in American- and European-produced EVs. Tesla, for instance, uses NCA batteries, in part because they have high energy density, meaning the batteries are smaller and lighter than others that can store the same amount of energy.[62] In contrast, LFP batteries represent an older battery chemistry, which tends to cost less, have a longer life cycle, and be safer when it comes to the possibility of catching fire. LFP batteries historically were more popular in markets such as China, where city drivers drove shorter, more frequent trips (than long hauls across U.S. highways) and so drivers favored the lower cost and longer life cycle of the battery (more recharging opportunities) while drivers in the U.S. and Europe tended to prefer larger vehicles with longer range.

Batteries account for approximately 40 percent of the value of an EV—and thus essentially constitute the essence of what an EV represents.

However, as Zeyi Yang wrote in MIT Technology Review, “Just a few years ago, LFP batteries were considered an obsolete technology that would never rival NMC batteries in energy density.”[63] Indeed, from 2016 to 2018, LFP batteries accounted for just 10 percent of the global EV battery market.[64] But today, LFP batteries account for about 40 percent of the global market for EVs, and as Yang wrote, “It was Chinese companies, particularly CATL, that changed this consensus through advanced research.”[65]

As Max Reid, a senior research analyst for EVs and batteries at research firm Wood Mackenzie, explained, “That’s purely down to the innovation within Chinese cell makers. And that has brought Chinese EV battery [companies] to the front line, the tier one companies.”[66] By February 2023, Ford announced it would invest $3.5 billion to build an LFP plant, licensing “battery cell knowledge and services provided by CATL.”[67] In March 2023, news broke that GM was in discussions with CATL “about establishing a North American battery production facility that would duplicate the licensing agreement Ford arranged with CATL.”[68] That America’s largest auto manufacturers are seeking to license Chinese EV battery technology would certainly seem to validate the innovativeness of that company’s products. The same applies to German carmakers: BMW has produced and exported its iX3 battery EV through a China-based joint venture with Brilliance since 2020.[69]

In April 2024, CATL announced that it had developed its fast-charging “Shenxing Plus” LFP battery, which is capable of a driving range of more than 1,000 km (621 miles) off a single charge.[70] CATL asserts that the battery can achieve a range of 400 km off just a 10-minute charge.[71] A notable innovation in CATL’s “Shenxing” battery is its elimination of dead space within the battery, allowing it to nearly double its energy density. In June 2023, another Chinese EV battery maker, Shenzhen-based Gotion High-Tech. Co. (whose largest publicly listed shareholder is Volkswagen), announced it had designed a lithium-iron-manganese phosphate (LFMP) battery also capable of a 1,000 km range off a single charge. The company asserts its LFMP costs 5 percent less than conventional LFP batteries in terms of dollars per kilowatt hour (kWh), and 20 to 25 percent less than nickel-cobalt units.[72] The company, now China’s fourth-largest EV battery maker, envisions large-scale delivery of the battery to EV assemblers in early 2025.[73]

EV battery technology continues to evolve, and the next generation of EV batteries is expected to be ASSBs. Unlike lithium-ion batteries, which use liquid electrolytes between their electrodes, solid-state batteries employ a solid electrolyte, which can provide a higher energy density, enabling lighter and more efficient EVs with longer driving ranges.[74] As market research firm TrendForce wrote, “ASSB has emerged as the high ground in the competition for next-generation battery technology” and “in the future competition for ASSB, companies from Japan, South Korea, Europe and the US have the opportunity to surpass China and reshape the competitive landscape of [the] future EV battery industry.”[75] BMW intends to launch its first prototype vehicle based on U.S.-based Solid Power’s ASSB technology by 2025, while, “Japanese companies like Toyota and Nissan have stated their intention to achieve mass production of ASSB around 2028.”[76]

But China’s EV battery makers may already be beating competitors to the punch—or will at the very least be well in the mix. In December 2023, Chinese EV maker Nio unveiled its ET7 sedan with a semi-solid state, 150 kWh battery made by Chinese battery company WeLion, which can travel 650 miles on a single charge and which the company’s CEO, William Li, asserted currently represents the “battery pack with the highest energy density in mass production in the world.”[77] In April 2024, Chinese automaker GAC group (also an LFP battery maker) asserted it had developed an ASSB capable of 620 miles per charge that would be production ready at scale for its Hyper vehicles by 2026.[78] The Chinese government has provided 6 billion yuan (nearly $830 million) to Chinese companies including CATL and BYD to research and develop the next generation of solid-state batteries in China.[79]

Perhaps most intriguing is a new entrant, Tailan New Energy, a Chongqing-based start-up formed in 2018 that in April 2024 had developed the first automotive-grade, all solid-state lithium-metal prototype that has a single-cell capacity of 120 amperes (Ah) and a real-world energy density of 720 watt hours per kilogram (wh/kg).[80] If the technology can be mass produced, the battery could in theory support a range of 2,000 km (over almost 1,300 miles) on a single charge.[81] According to Tailan, the company “has achieved several technological breakthroughs in all-solid-state lithium batteries.”[82] Those breakthroughs pertain specifically “to ultra-thin and dense composite oxide solid electrolytes, high-capacity advanced positive and negative electrode materials, and an integrated molding process that culminates into a 120 Ah solid-state lithium metal cell.”[83] While the company asserts its batteries are vehicle grade, it has yet to announce specific plans for passenger vehicle integration. Regardless, companies such as CATL, GAC, Tailan, WeLion, and others certainly seem likely to keep Chinese firms at the forefront of global EV battery innovation in the years ahead.

It should be noted that, broadly, one reason China’s EV battery makers (and thus EV car makers) have been able to innovate so rapidly and cost-effectively in this space pertains largely to the country’s dominance over the middle and lower segments of the EV battery supply chain. For instance, regarding raw materials, China mines over two-thirds of the world’s graphite and 18 percent of its lithium.[84] Overall, China extracts 60 percent of all rare earths mined annually in the world, and Chinese companies own almost half the world’s cobalt mines and one-quarter of lithium ones.

Chinese dominance is even stronger in raw materials processing and refining, where China in 2023 refined 95 percent of the world’s manganese, 70 percent of cobalt and graphite, 67 percent of lithium, and over 60 percent of nickel.[85] Translating these raw materials into EV components, China accounts for nearly 90 percent of cathode active material capacity globally and more than 97 percent for anodes, according to the International Energy Agency (IEA).[86] China also accounts for 78 percent of separator and 82 percent of electrolyte processing.[87] Moreover, IEA research expects China’s dominance to only grow further in coming years, with a new report asserting that “over 90% of battery-grade graphite and 77% of refined rare earths will originate from China by 2030.”[88] Chinese dominance of these supply chains gives its battery makers access to key chemical inputs at lower price points and affords them a first-mover advantage in experimenting with new combinations of materials (not to mention the potential capacity to block competitors’ ability to access these inputs). As Alicia García-Herrero, chief economist for Asia Pacific at Natixis, explained, China’s control of critical chemical materials represents “the ultimate control of the sector, which China has clearly pursued for years well before others even figured that this was something important.”[89]

EV Innovation

As Andrew Bergbaum, global co-leader of the automotive and industrial practice at AlixPartners commented, “The revolution taking place in the global auto industry is driven by the incredible and once unthinkable maturation of Chinese automakers that do a number of things differently.”[90] An important point here is that, as The New York Times’ Keith Bradsher noted, “Beyond the battery itself, China also dominates electric motor production, and in designing high-efficiency systems that tie together batteries and motors.”[91]

Moreover, as with Tesla, Chinese EV makers have intensely focused on innovating beyond the battery itself, particularly in incorporating digital features into the vehicle, such as autonomous driving, driver-assistance features, navigational aids, virtual reality, and even “multiple high-res dashboard screens pimped with generative AI and streaming video.”[92] As Paul Gong, UBS head of China auto research, explained, “New EVs are more like computers with batteries on wheels. Chinese carmakers are now ahead of almost everyone else along the entire EV supply chain.”[93] As the hardware has become simpler, the focus for what makes an appealing product has shifted decisively to software and new features.[94] Ade Thomas, who founded World EV Day, coined the phrase “digital bling” cars to describe the tech-laden EVs now being manufactured in China.[95]

Indeed, as The Wall Street Journal’s Ip wrote, “Chinese EVs feature at least two, often three, display screens, one suitable for watching movies from the back seat, multiple lidars (laser-based sensors) for driver assistance, and even a microphone for karaoke.”[96] Elsewhere, at Auto China 2024, Chinese automaker JiYue (a joint venture between Geely and Baidu) showcased a “stylish saloon that can be entirely controlled by voice commands and a touch screen.” Nio offers $350 augmented reality glasses for each seat in its cars, and has introduced a smartphone that interacts with the car’s self-driving system.[97] Chinese EV makers are also working to develop interactive control systems that can perform functions such as analyzing drivers’ health data and stress levels to provide driving suggestions and allowing drivers and passengers to control car systems by voice and gestures.[98]

However, it’s not just that modern vehicles represent “digital bling,” for in reality, the digital components of modern vehicles—everything from electric steering and power brakes to navigational systems and autonomous driving—are increasingly powered by digital technology. In fact, the contribution of electronics and digital technologies to a vehicle’s cost has increased from just 18 percent in 2000 to over 40 percent today and an estimated 45 percent by 2030.[99]

In May 2024, XPeng Motors said it intends to introduce its AI-powered in-car operating system (the XOS 5.1.0), with the aim of delivering full autonomous driving (Level 4) in China by 2025.[100] The Society of Automotive Engineers (SAE) has defined six levels of driving automation ranging from 0 (fully manual) to 5 (fully autonomous).)[101] In 2023, Mercedes-Benz became the first automaker to offer an SAE Level 3 conditionally automated driving vehicle with its DrivePilot technology.[102] JiYue’s Point-to-Point Autopilot (PPA) offers Level 2 autonomous driving, in which computers take over multiple functions from the driver—and are intelligent enough to weave speed and steering systems together using multiple data sources.[103]

In April 2024, Xiaomi, historically a maker of smartphones and home appliances such as vacuums and rice cookers, which only entered the auto industry in 2021, became China’s eighth-largest EV manufacturer after selling more than 7,000 units of its first model, the Xiaomi SU7.[104] As The Wall Street Journal wrote, Xiaomi “has pulled off what Apple, its longtime rival, couldn’t: Make an electric car and bring it to market. And it did it in three years.”[105] The company has invested over one billion dollars in becoming an EV manufacturer.[106]

Auto industry analysts view Xiaomi’s SU7 as a serious competitor to Tesla’s Model 3, priced about $4,000 cheaper, with an EV battery that has a distance about 200 miles greater and roughly comparable Level 2 autonomy features. For instance, Xiaomi’s Pilot autonomous driving system intelligently adjusts driving paths for seamless navigation and offers object perception with a grid that detects objects from 5 cm to 250 meters away.[107]

Xiaomi’s rapid pace of innovation owes both to fast-follower techniques and genuine and novel innovation efforts. As Sha Hua and Yoko Kubota elaborated in The Wall Street Journal:

To save on time and costs, the company adopted practices from Tesla and other automakers, mined its own product-development know-how and plugged into China’s fast-moving car supply chain. Years of honing laptops, blenders and petcams helped it develop features tailored to a fickle consumer base, including a detachable panel of physical buttons that magnetically clips on below the 16.1-inch center screen for those who don’t like to control their volume or seat via touch screen.[108]

It was Tesla that pioneered the “gigacasting” process for manufacturing vehicle chassis, a metal die-casting process characterized by forcing molten metal under high pressure into a mold cavity. By combining hundreds of manufacturing steps into one, thus saving on components, weight, cost, and time, the technique helped Tesla reduce production costs for the underbody of its Model Y by some 40 percent.[109] As Hua and Kubota wrote, Xiaomi adopted Tesla’s gigacasting process, but “Xiaomi also had to innovate.”[110] Specifically:

The liquid aluminum that gets injected into the die-casting machine has to be a certain variety that can withstand an extraordinary amount of pressure. Xiaomi had to come up with its own material, building an artificial-intelligence program that used a method known as deep learning to simulate how different materials would behave when placed inside the die-cast machine.[111]

Other Chinese EV makers are aggressively adopting die-casting practices. Nio and XPeng supplier Guangdong Hongtu Technology (GHT) have already produced a 6,800-ton die-casting machine. Now GHT has announced it will start developing a 12,000-ton casting machine in partnership with Tesla supplier LK Technology.[112] It’s worth noting that one of the world-leading pioneers of the die-casting process was Brescia, Italy-based Idra srl. A leading manufacturing of aluminum and magnesium die-casting machines, over the last 68 years it has designed, produced, customized, and serviced more than 13,000 machines around the world.[113] However, in 2008, Hong Kong-based LK Technology purchased Idra, another example of Europe allowing the crown jewels of its manufacturing sector, such as the German industrial robot manufacturer, Kuka, to fall into Chinese hands.

Overall, research firm Bernstein estimates that Chinese EVs can cost half as much to make as European ones, even while they can boast of better tech.[114] And while certainly the Chinese government’s efforts to drive the industry have been a key factor in its growth, considerable innovation is now being driven among the automotive firms themselves. As one analyst noted, “The competition is so fierce that it pushes every automaker to develop new technologies.”[115]

Chinese carmakers are innovating many other vehicle features aside from electrification and digital features. For instance, in 2023, Yangwang (BYD’s luxury electric sub-brand) introduced its DiSus-X suspension technology, which enables its quad-motor EV, the U9, to drive on only three wheels and hop up and rotate in the air on all four wheels.[116]

Another affirmation that Chinese EV makers are indeed innovative comes from Western companies’ investments in the firms. For instance, in July 2023, Volkswagen paid $700 million for a 4.99 percent stake in XPeng.[117] In April 2024, the companies agreed to “expand their platform and software partnership” including “[j]oint development of the China Electrical Architecture, [and] a zonal Electrical/Electronic architecture, to make China-specific electric vehicle models fit for the next leap in innovation.”[118] Elsewhere, in May 2024, South Korea’s Hyundai Motor and Kia unveiled plans to work with Chinese Internet giant Baidu on mapping and AI technologies for auto-driving and vehicle software systems in China, while Nissan announced a partnership with Baidu on AI, and Toyota entered an agreement with Tencent to collaborate on AI models, cloud services, and big data.[119] And in October 2023, Stellantis cut a deal with China’s Leapmotor with the latter sharing EV technology and Stellantis launching a European venture to sell and make Leapmotor’s products outside China.[120]

To be sure, there are numerous market-based reasons driving these tie-ups: Tech talent tends to be more available and less expensive in China (certainly than it is in Europe) and foreign players get an opportunity to be closer to local markets, local tastes, and technologies being locally developed. However, another key factor is that the Chinese government is effectively requiring such tie-ups if a foreign company is to be permitted access to information such as mapping data to support vehicle autonomy and navigational aids. For instance, for years, Beijing withheld approvals for data transfers Tesla needed for development of autonomous vehicles for the Chinese market, a factor multiple analysts have noted gave Chinese players crucial time to catch up to Tesla in vehicle autonomy.[121] In fact, only in April 2024 did Tesla receive approval to sell autonomous driving services in China, though Beijing stipulates that they must be based on mapping and navigation functions provided by Chinese technology giant Baidu.[122]

Other Vehicle Innovations

China’s carmakers aren’t innovating only EVs. For instance, in June 2022, a team of researchers from 42 companies and three universities unveiled the Tianjin solar car, which its developers touted as “the country’s first smart vehicle to be powered solely by the sun.”[123] Developed in just five months, the car uses 87 square feet of solar panels, which deliver 7.6 kWh of power per day. Elsewhere, Chinese start-up AutoFlight has developed a proof-of-concept electrical-vertical-takeoff-and-landing air taxi.[124] The vehicle has 10 lift rotors on wing booms for vertical flight and three pusher propellors for cruise flight. The company plans to initially develop an uncrewed cargo version and later an interior cabin accommodating one pilot and four passengers.

Process Innovation

Process innovation refers to the process of development and implementation of new or improved processes, methods, or systems within an organization to enhance efficiency, effectiveness, and value creation.[125] Product and process innovation are often inherently interlinked—biologic drugs, which are derived from and manufactured within living cells, represent a good example of fundamentally intertwined process and product innovation—but they do represent separate steps in the innovation process.

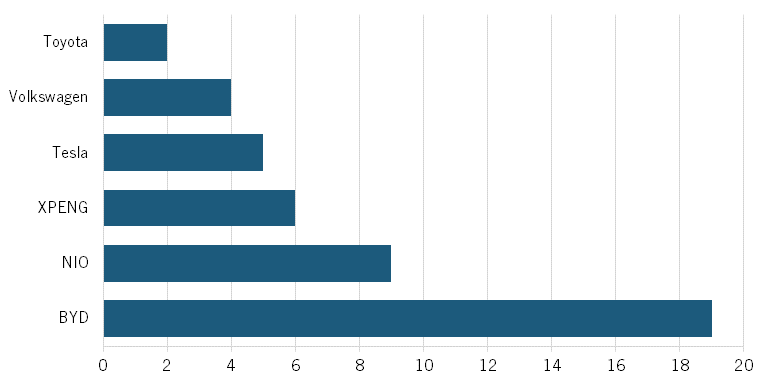

Chinese EV makers do seem distinctively strong at process innovation, and particularly at accelerating speed to market with their products. As Selina Cheng and Yoko Kubota of The Wall Street Journal wrote, “Many Chinese EV makers operate more like startups than legacy automakers.”[126] As they noted, “Chinese automakers are around 30% quicker in development than legacy manufacturers, largely because they have upended global practices built around decades of making complex combustion-engine cars.”[127] In fact, Chinese EV makers offer models for sale for an average of 1.3 years before they are updated or refreshed, compared with 4.2 years for foreign brands.[128] For instance, Nio takes less than 36 months from the start of a project to delivery to customers, compared with roughly four years for many traditional carmakers. For this reason, Chinese EV manufacturers were able to introduce substantially more new and updated EV releases from 2017 to 2023 than did their foreign counterparts. Over that time frame, BYD introduced 19 new vehicles, Nio 9, and XPeng 6, compared with Tesla’s 5, Volkswagen’s 4, and Toyota’s 2. (See figure 9.) Chinese EV makers’ rapid pace of innovation recalls then-Nokia CEO Stephen Elop’s “Burning Platform” memo, in which he famously observed that “Chinese mobile phone makers are bringing out new versions faster than it takes Nokia to polish off a power point presentation.”[129] Chinese EV companies will put at least 71 new models on the market in 2024.[130]

Figure 9: New and updated EV releases in China, 2017–2023[131]

Several factors explain Chinese EV makers’ rapid pace of process innovation, with digital automation of design practices being a key factor. And, in fact, the use of digital tools and other process innovations has facilitated the pathway for new entrants into the industry. As one article explains, “Chinese EV companies heavily use simulation software to create virtual prototypes and run tests in more iterations and in faster time. Virtual parts and mock-ups can be worked on between teams and 3D printed prototypes allow engineers to go through loops of trial and error much quicker.”[132] As an industry analyst commented at ITIF’s roundtable, “For China’s EV manufacturers, it’s more digital modeling and simulation in the design phase and fewer crash-test dummies.”[133] JiYue asserts it can complete its vehicle product designs in six months.

In 2023, Chinese enterprises deployed more industrial robots than did firms across the rest of the world combined.

Another example of innovative use of digital production systems comes from XPeng, which in 2023 introduced “a new platform architecture for making vehicles” with its Smart Electric Platform Architecture (SEPA) 2.0. It provides a modular, interchangeable vehicle platform that can support a range of vehicle types, such as XPeng’s upcoming G6 coupe SUV. XPeng asserts that SEPA 2.0 will help it shorten the R&D cycle for its future models by 20 percent and cut costs on adaptations for advanced driver assistance systems and smart infotainment systems by 70 percent and 85 percent, respectively.[134]

Chinese EV manufacturers are also devout adopters of a process pioneered by Tesla: leveraging software to update vehicle features. For instance, Nio releases cars with latent technology such as a spare chip that allows it to frequently add new features through software updates.[135] Managing the vehicles’ features more dynamically through software enables another process innovation. As Cheng and Kubota explained, “China’s carmakers are increasingly standardizing their models to cut time. Beyond traditional mechanical platforms, they standardize everything from important software to the digital vehicle operating systems that executives liken to the nerve center of smartcars.”[136] The technique recalls how John Deere can manufacture a single tractor but control the horsepower of its engines through the use of software.

Another factor contributing to Chinese EV makers’ rapid time to market is the depth of the supplier ecosystem within China. As one observer commented, “If customer feedback suggests a display screen in a Chinese EV should be a couple inches bigger, for instance, they can just go down the road to their supplier and have that change made in a couple months. The same process would have to go into a design cycle and might take three or even four years at a Western vehicle manufacturer.”[137] But it’s not just that, as Chinese EV manufacturers “are willing to substitute traditional suppliers for smaller, faster ones.”[138] Certainly the depth of the auto parts supplier ecosystem in China creates agglomeration effects and a time-to-market advantage for China’s EV makers.

Lastly, it’s important to note that Chinese EV makers are using automation processes to the maximum extent possible. As one expert told ITIF, “China’s firms are strong on the hardware side of robots, especially for automotive.”[139] As ITIF has noted, in 2023, Chinese enterprises deployed more industrial robots than did firms across the rest of the world combined. Indeed, Chinese firms are now using industrial robots at 12 times the U.S. rate when controlling for wages.[140] As The New York Times’ Bradsher explained, “[Nio] has invested so extensively in robots that one of its factories employs just 30 technicians to make 300,000 electric car motors a year.”[141]

Market- and Customer-Experience-Driven Innovation

Chinese EV industry analysts have also spotlighted the industry’s use of several additional innovation strategies worth mentioning. Writing in Harvard Business Review, Chengyi Lin noted that Chinese EV makers initially cut their teeth on EV battery technology as early as 15 years ago by experimenting with EV battery technologies in adjacent industries, before transitioning to the consumer vehicle market. As she explained, BYD and Geely “kickstarted their EV development by focusing on adjacent industries—namely, electric buses and motor cycles.… What they learned by tackling these challenges ultimately contributed to their EV manufacturing strategy.”[142] As she continued:

For instance, buses are heavier and carry more passengers than commercial sedans. Additionally, most buses are operational about 18 hours each day. They therefore have greater battery and power storage requirements. And more powerful batteries take longer to charge. By targeting an adjacent industry, BYD began pushing the boundaries of battery technology as early as 2009. BYD featured electric buses as its entry product into North American markets [and they] are now also prevalent in South American markets.[143]

A later section of this report, which examines China’s government policies supporting the EV sector, explores the critical role the Chinese government played in driving the rollout of the EV charging infrastructure that built Chinese consumer confidence in the EV market. But Lin notes that Chinese EV makers have also worked closely with different customer bases to drive adoption. They recognized that taxi operators would essentially need to deploy two fleets of cars daily, a morning and evening rush shift, so they “designed jointly” a schedule that enables the morning fleet to be charged after 8:00 p.m. and the evening shift to be charged overnight. Co-designing the schedule helped overcome initial resistance to EVs from taxi drivers because it “not only addresses the battery constraints of EVs but also helps to flatten the consumption curve of a city’s power grid.”[144] It’s a nice example of the systemic coordination needed to manage the transition to vehicle electrification.

The vignette also amplifies the point that Chinese EV makers tend to be much more attuned to customer desires in the Chinese marketplace. As one observer of Germany’s auto industry commented, “From the German carmaker’s perspective [the approach to the Chinese market was] let’s bring them either a second-tier vehicle that isn’t top of class, or let’s sell them a high-end vehicle that’s been designed with the European market in mind, like a vehicle with a lot of horsepower. Chinese NEV companies have been much better at tapping into local markets and desires.”[145] For instance, Xiaomi was “intimately familiar with [Chinese] customers’ lifestyle preferences” and “could rely on its in-house expertise of household products and gadgets” as it started to develop EVs.[146] Elsewhere, Nio introduced an innovative subscription service for replaceable batteries.[147] Another observer commented that Chinese EV brands have benefited greatly from the “China chic” or “guochao” phenomenon, a consumer preference for domestic products and services.[148]

Lastly, from a “brand innovation” perspective, it’s worth noting that China’s companies have been shrewdly acquiring European vehicle brands as a back door to sell China-produced EVs under European brand names (in Europe and in third-party markets). For instance, the Chinese state-owned enterprise (SOE) Shanghai Automotive Industry Corporation (SAIC) acquired Britain’s fabled MG brand in 2007 and is now exporting inexpensive cars from China under the MG name not just to Britain but also to Australia.[149]

Innovation Inputs to China’s EV Sector

This section examines indicators assessing China’s EV competitiveness at the industry level, considering such factors as R&D intensity, scientific publications, and patenting levels.

R&D Intensity

In terms of automotive companies’ levels of R&D investments (as reported in the “2023 EU Industrial R&D Investment Scoreboard”), China places 8 of the top 15 in the study. U.S.-headquartered Fisker and Lordstown ranked first and second, although these are largely pre-revenue start-ups, which significantly skews their R&D intensity. Nio and XPeng were the leading Chinese companies, with an R&D intensity of about 21.3 percent of its revenue. That is ahead of well-known automotive manufacturers including Ferrari and Aston Martin. (BYD was not listed in the 2023 EU report, though ITIF research finds its R&D intensity to be roughly 6.7 percent.)

Table 1: Leading automotive R&D investors in the 2023 EU Industrial R&D Investment Scoreboard[150]

|

Company |

Headquarters |

R&D Investment (Millions) |

R&D Intensity |

|

Fisker |

United States |

€397.4 |

123949.0% |

|

Lordstown |

United States |

€101.1 |

55575.0% |

|

Nikola |

United States |

€256.7 |

538.7% |

|

Lucid |

United States |

€770.2 |

135.0% |

|

Rivian Automotive |

United States |

€1,733.6 |

111.5% |

|

Nio |

China |

€1,409.6 |

21.3% |

|

XPeng |

China |

€699.9 |

19.4% |

|

Ferrari |

Italy |

€934.2 |

18.3% |

|

Aston Martin |

UK |

€278.5 |

17.8% |

|

Zhejiang Century Huatong |

China |

€233.7 |

15.6% |

|

Li Auto |

China |

€897.3 |

14.8% |

|

Zhejiang Leapmotor |

China |

€180.0 |

10.8% |

|

Seres |

China |

€413.2 |

9.6% |

|

Great Wall Motor |

China |

€1,634.7 |

9.4% |

|

Dongfeng Motor |

China |

€978.0 |

7.9% |

Scientific Publications

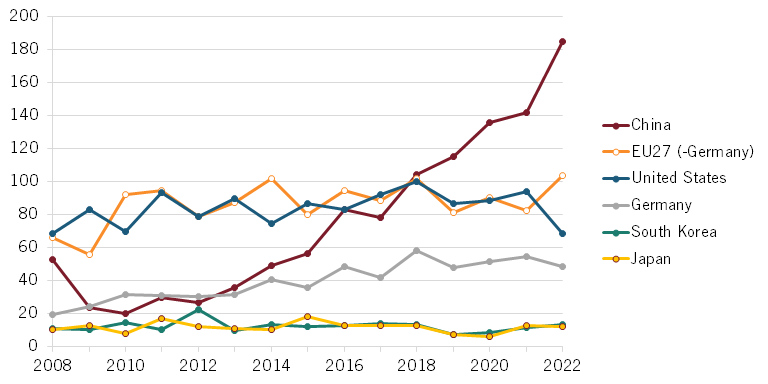

In 2021, Chinese institutions surpassed European ones in producing the most top-10 percent-cited publications in automotive engineering. In 2012, Chinese institutions only published about 26 such papers in automotive engineering; by 2022, that number had increased sevenfold, as Chinese institutions published about 184 top-cited papers. (See figure 10.)

Figure 10: Number of automotive engineering publications in top 10 percent of most-cited publications[151]

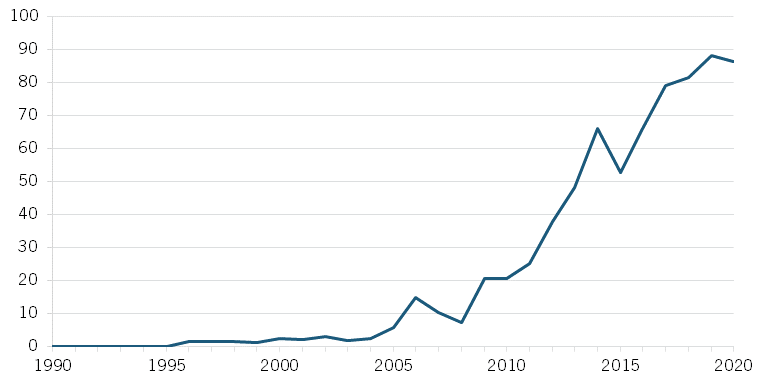

The number of Chinese scientific publications regarding EV research (relative to trillions of GDP) began to significantly accelerate around 2011, increasing from 25 papers then to 86 by 2020. (See figure 11.)

Figure 11: Number of EV scientific publications in China (per trillion $ GDP)[152]

The Australian Strategic Policy Institute does not track publications on automobiles or EVs in its Technology Tracker, per se. However, it does track publications for electric batteries, which serve as the critical input for EVs. In 2023, Chinese institutions held a 20 percent share of all scientific publications in the EV battery field. And as ASPI noted, “The Chinese Academy of Sciences is a stand-out performer in the Critical Technology Tracker datasets. It leads in six of the eight energy and environment technologies [and is] no. 1 globally for electric batteries.”[153]

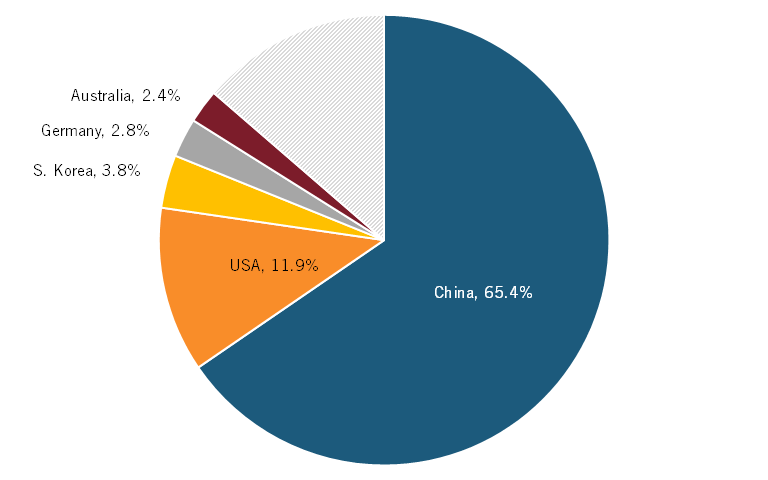

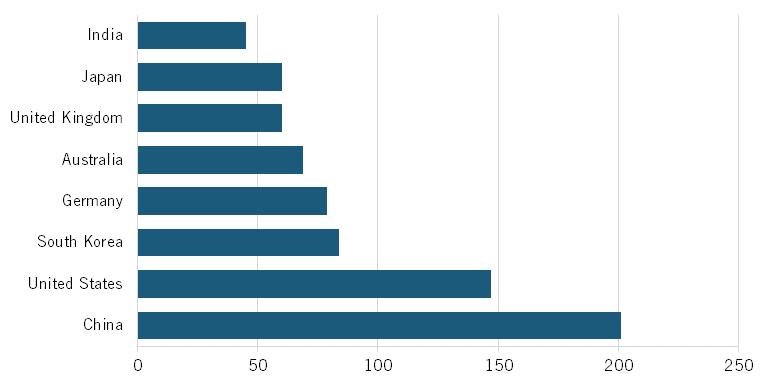

ASPI finds that Chinese institutions account for 65.4 percent of the high-impact publications for electric batteries, substantially outpacing the United States’ 11.9 percent, South Korea’s 3.8 percent, Germany’s 2.8 percent, and Australia’s 2.4 percent. (See figure 12.) And as ASPI wrote, “For electric batteries, China has a 5.5 times lead over the US in its share of high-impact research, and eight of the top 10 institutions are based in China.”[154]

Figure 12: Top five countries for high-impact publications about electric batteries in the ASPI Critical Technology Tracker dataset[155]

Similarly, the H-index represents a quantitative metric that estimates the impact of a scientist’s or scholar’s research contributions; effectively, it signals the extent to which other scholars are referencing the original scholar’s work. China’s score on the H-index for scientific publications in electric barriers is the highest in the world, one-quarter greater than the United States’. (See figure 13.) In sum, China is a leader not only in the quantity of publications, but also in “high-quality” publications.

Figure 13: H-Index for scientific publications in electric batteries, 2023[156]

Patents

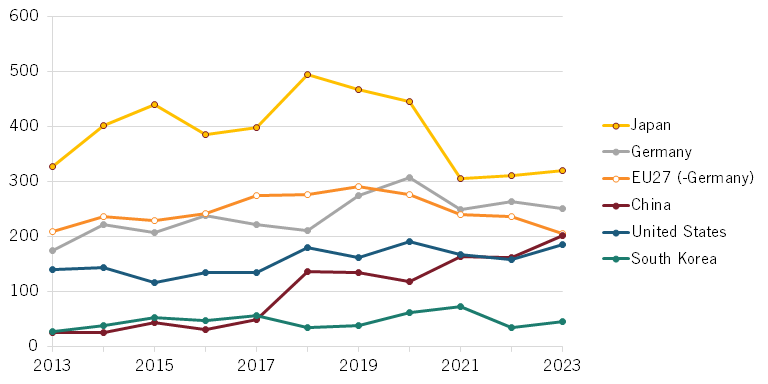

China’s number of Patent Cooperation Treaty (PCT) patent publications in motor vehicle technologies increased from 25 in 2013 to 201 in 2023. (See figure 14.) That represents about a 700 percent increase over that period (albeit from a low base). By contrast, the United States and EU only increased these patents by about 32 percent and 19 percent, respectively.

Figure 14: Number of PCT patent publications in motor vehicles (B62D)[157]

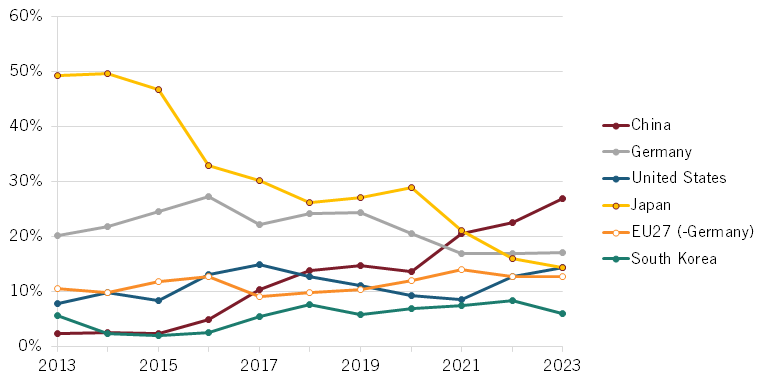

When considering global shares of PCT patent publications, China’s global share increased 11.9 percentage points between 2013 and 2023. (See figure 15). By contrast, the global shares of patent publications for the EU and Japan declined by about 4.8 percentage points and 9.2 percentage points, respectively.

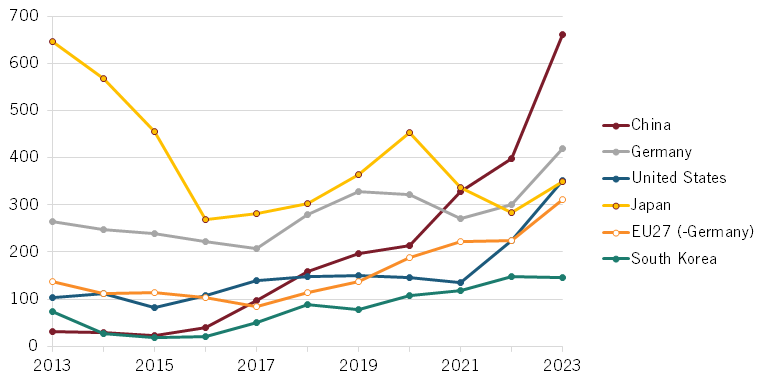

Figure 15: Global shares of PCT patent publications in motor vehicles (B62D)[158]

A related technology area is electric propulsion technology, which goes into the design of parts for EVs. In this area, China went from only 31 patent publications in 2013 to 660 patent publications in 2023. That’s an astonishing increase of over 2,000 percent. (See figure 16.) By comparison, the United States increased its number of patent publications in this field by about 242 percent over that timeframe. Japan produced about 46 percent fewer patent publications in this area in 2023 than in 2013.

Figure 16: Number of PCT patent publications in electric propulsion technology (B60L)[159]

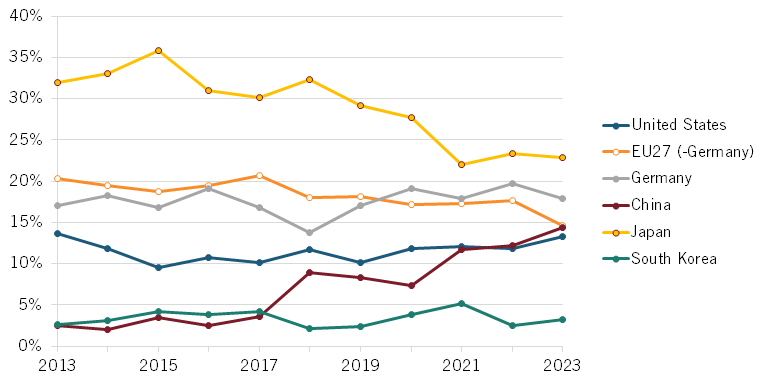

When considering global shares of PCT patent publications in this field, China’s share increased from 2.4 percent in 2010 to 26.9 percent in 2020. (See figure 17.) That represents a 24.5 percentage point increase over that period. The United States also experienced an increase in its global share by about 6.5 percentage points. By contrast, the global share in this field for Japan declined by about 34.9 percentage points.

Figure 17: Global shares of PCT patent publications in electric propulsion technology (B60L)[160]

Company Case Studies

This section provides case study analyses of two Chinese EV companies: BYD and Li Auto. They were intentionally selected as representative from Chinese EV companies included on the “2023 EU Industrial R&D Investment Scoreboard” report.

BYD

BYD, the pinyin initials of the company’s Chinese name, Biyadi, was founded in 1995 in Shenzhen, China. The company’s name has now been “back-formed” into the Western-friendly slogan "Build Your Dream.”[161] BYD entered the automotive sector through the acquisition of Qinchuan Automobile in 2003. BYD’s initial focus was manufacturing batteries for ICE vehicles, although the company manufactured its first PHEV in 2008. In 2023, BYD became the world’s largest manufacturer of EVs. It is also a significant manufacturer of EV batteries. Overall, BYD’s product range covers the entire industrial chain of NEVs, including passenger vehicles, commercial vehicles, batteries, and automotive electronics.

In FY 2023, BYD’s revenues reached 602 billion yuan ($82 billion), with EVs accounting for approximately 70 percent as the company accounted for 37 percent of EVs produced in China (a share analysts expect to reach 50 percent by 2026).[162] In 2022, BYD manufactured 4 of the top 10 EVs sold worldwide.[163] Overall, BYD is the world’s largest producer of rechargeable batteries, including NiMH batteries, lithium-ion batteries, and NCM batteries.[164] In 2023, BYD manufactured 117 gigawatt hours (GWh) worth of EV battery production, compared with CATL’s 243.3.[165] In 2020, BYD launched its then-revolutionary long-range Blade LFP battery, which is far less prone to spontaneous combustion than other EV batteries.[166] In April 2024, BYD introduced its second-generation blade battery pack, which the company asserted “will be lighter, smaller and more efficient than BYD’s first-generation LFP batteries” with “as much as 190 kWh density enabling up to 1000 km range.”[167] Beyond the Blade Battery, BYD’s other core technologies include the (cell-to-body) CTB-integrated battery technology and the e^4 drive system.

BYD has received much recognition for its innovation and leadership in the industry. In fact, from 2020 to 2023, BYD received over 191 international awards in regions outside China, highlighting its global recognition and leadership within its sector. These accolades include the Zayed Future Energy Prize, the Japan EV of the Year, the UN Energy Special Award, nominations among the top three for the World Car of the Year and World Urban Car at the Geneva Motor Show, and Automotive Innovation Awards in Germany.

As of year-end 2023, BYD’s R&D team comprised 69,700 personnel (significantly outnumbering Tesla’s estimated 10,000 to 13,000 employees). The number of BYD R&D personnel increased 66 percent from 2021 to 2022, with BYD’s R&D team representing 12.2 percent of the company’s workforce. At year-end 2023, the team included 36,018 individuals with bachelor’s degrees, 7,827 with master’s degrees, and 590 with doctorates.[168] By July 2024, BYD reported employing 102,000 R&D personnel. In 2023, BYD hired some 30,000 university graduates (under- and post-graduate) with research personnel accounting for 80 percent of the total intake.[169] In 2023, BYD allocated 39.92 billion yuan ($5.5 billion) to R&D, which gave the company an R&D intensity of approximately 6.7 percent.

By year-end 2023, BYD held 29,201 patents globally, with 18,968 active. Annually, since 2016, BYD has consistently filed between 2,000 and 3,000 new patents. Within this portfolio, 23,346 patents were filed in mainland China, while 1,300 were registered in the European region, and 1,009 in the United States. Notably, of the U.S. filings, 893 patents originated from BYD’s automobile business, with close to 570 receiving formal approval.[170]

BYD is a “privately-owned” company, although, of course, under Article 19 of China’s Company Law, all SOEs or private Chinese companies have a Chinese Communist Party (CCP) cell that management must listen to, if not necessarily obey.[171] Article 19 in essence codifies CCP influence over corporate governance and business decisions in China.[172] From 2017 to 2022, BYD received government subsidies amounting to approximately $4.175 billion for NEV purchases and $0.92 billion in direct subsidies, reflecting significant government support for the NEV industry.

Li Auto

Founded in 2015 and headquartered in Beijing, Li Auto is an NEV company specializing in the design, development, manufacturing, and sale of EVs, particularly PHEVs. The company’s current products include Li MEGA, a high-voltage BEV; Li L9, a six-seat flagship family SUV; Li L8, a six-seat family SUV; and Li L7, a five-seat flagship family SUV. In 2023, Li Auto sold 376,030 vehicles, an increase of over 180 percent from the year prior; this placed Li Auto as China’s seventh-largest EV maker, with a 4.9 percent market share.[173] For the 12 months ending March 31, 2024, Li Auto earned $10.2 billion in revenues, a 182 percent increase year over year.

Li Auto has been developing technologies such as EREV4 Powertrain (combining battery power with range extension), BEV technologies, and autonomous driving. The company’s intelligent system technology for EVs in the context of digital transformation made it the winner of the 2023 IDC China Future Enterprise Awards Excellence Award. Li Auto was also the first Chinese automaker to receive the world’s highest MSCI ESG global “AAA” rating, which acknowledges its development and use of clean technology for environmental sustainability. Li Auto introduced its advanced integrated drive module (iDM220) to the company’s EVs in 2023.

Li Auto took different development and innovation strategies compared with its domestic and global peers. Li Auto is backed by some of China’s largest tech giants, such as Meituan and ByteDance. Having been in the Internet sector for two decades before starting the company, Li, the founder, took a different route from other Chinese EV start-ups by focusing on plug-in hybrids rather than pure EVs. Unlike BYD’s more mass-market models, Li Auto’s offerings are more niche, such as SUVs or larger multi-purpose vehicles targeting wealthier Chinese consumers with bigger families. The company has only recently entered the full BEV space with its Li MEGA.

In terms of its R&D and patent activity, Li Auto’s R&D investments reached 1.3 billion yuan ($193 million), 742 million yuan ($103 million), and 61 million yuan ($8.5 million) in 2022, 2021, and 2020, respectively.[174] In 2022, Li Auto’s R&D investment increased 87 percent over the prior year, although its R&D intensity for the year only reached about 3 percent (about half that of BYD’s). Li Auto employed 4,318 R&D personnel at year-end 2022, accounting for 22.3 percent of its employees. The company states that it had 2,028 granted patents and 5,887 pending patent applications in China as of the end of 2022. Most of Li Auto’s patents have been filed and granted in China.[175]

China’s Government Policies Supporting the EV Sector

While Chinese EV enterprises have become increasingly innovative in their own right, there’s little doubt that China’s current leadership in EVs and EV batteries stems from a conscientious strategy and set of industrial policies designed to make it so. Indeed, as Gregor Sebastain, an analyst with the Rhodium Group, explained, “Without government-led industrial policy, the EV sector wouldn’t be nearly what it is today in China.”[176]

Or, as Erica Downs, an expert in Chinese energy markets at Columbia University’s Center on Global Energy Policy explained, “The government in China went all in on EVs.”[177]

The Chinese government began investing in EV-related technologies as early as 2001, when EV technology was introduced as a priority science research project in China’s 10th Five-Year Plan.[178] However, observers credit much of China’s EV vision to Wan Gang (a Chinese citizen employed as a Germany-based fuel-cell engineer at Volkswagen-Audi early in his career) who became China’s minister of science and technology in 2007. Gang convinced Chinese leaders that China was unlikely to catch up to global leaders in ICE technologies but could potentially develop NEVs as a leapfrog technology.[179] One of China’s earliest EV policy promulgations, from 2009, pledged 10 billion yuan ($1.375 billion) to support the industry over the ensuing three years and extended one-off purchase subsidies for NEVs to public sector companies in 13 cities.[180]

The support of China’s government (at both the federal and provincial levels) has been instrumental at every stage in advancing China’s EV industry.

While initially China wished to expand domestic vehicle production as a source of economic and employment growth, as former Chrysler executive (and current China auto industry analyst) Bill Russo explained, “The primary motivation for China to push for EVs was energy security,” notably to reduce China’s need for imports of oil (and autos). “Second was industrial competitiveness, and a far distant third was sustainability.”[181] That said, Chinese leaders today bill sustainability—notably meeting the country’s 2060 carbon-neutral climate goal—as a key rationale for EV deployment, and one study finds that EVs could help reduce China’s GHG emissions from the transportation sector by up to 6.2 percent by 2030 with a 20 percent EV penetration rate (of the total Chinese vehicle fleet).[182]

Indeed, the support of China’s government (at both the federal and provincial levels) has been instrumental at every stage in advancing China’s EV industry, from setting strategic direction to financing R&D to providing the industry with tens of billions of dollars of subsidies to deploying charging infrastructure to incentivizing EV adoption through a range of policies from government procurement to consumer tax credits to readily providing licenses for electric (but not gas-powered) vehicles.

Subsidies

While all these factors have moved China’s EV market forward, subsidies have far and away been the most substantial. Scott Kennedy and colleagues at the Center for Strategic and International Studies (CSIS) estimated that, from 2009 to 2023 alone, China channeled $230.9 billion in subsidies and other support to its domestic EV sector.[183] (Note: $25 billion of this amount was R&D investment, which ITIF would generally not characterize as a market-distorting subsidy, so long as a country makes enterprises from all nations eligible for R&D tax credits or the ability to win R&D grants.) CSIS found that Chinese EV subsidies have only increased in recent years, with an estimated $120.9 billion in subsidies over just the previous three years ($30.1 billion in 2021, $45.8 billion in 2022, and $45.3 billion in 2023), compared with a total of $49 billion in subsidies the three years prior, and $60.7 billion in subsidies from 2009 to 2017 (then at a $6.74 billion annual rate).[184] In 2023, the Chinese government extended $809 million in subsidies to EV battery maker CATL (more than double the $401 million it provided in 2022) and $208.9 million to EVE Energy (China’s fourth-largest EV battery producer).[185] From 2018 to 2023, the Chinese government extended a total of $1.8 billion in subsidies to CATL alone.

CSIS’s estimates calculate five forms of subsidy support for China’s EV sector: nationally approved buyer rebates, exemption from the 10 percent sales tax, government funding for infrastructure (primarily charging infrastructure), R&D programs for EV makers, and government procurement of EVs.[186] CSIS found that from 2009 to 2017, buyer’s rebates accounted for 62 percent of the Chinese government’s support for the sector, but with the Chinese government reducing the buyer’s rebate in 2022 and eliminating it as of 2023, the largest form of support (87.4 percent of the total, or $39.6 billion) in 2023 came from sales tax exemptions.[187]

From 2009 to 2023 alone, China channeled $230.9 billion in subsidies and other support to its domestic EV sector.

A key reason why Chinese subsidies to the EV sector (just like any other advanced-technology sector) are so pernicious is that they enable Chinese companies to both sustain themselves in industries where they wouldn’t be able to subsist if they had to earn market-based rates of return and, similarly, sell products below cost and sustain losses while still being able to build economies of scale. As The New York Times’ Bradsher explained, China automaker Nio lost $835 million from April through June 2023, equivalent to a loss of $35,000 for each car it sold.[188] (A separate study finds that China BYD’s profitability per vehicle in Q3 2023 was just $1,460, compared with $5,330 for Tesla, noting that BYD was underpricing its vehicles to build market scale.)[189] Moreover, if this aggressive strategy of selling vehicles below costs fails, China steps in to rescue the automaker. As Bradsher observed, “When Nio nearly ran out of cash in 2020, a local government immediately injected $1 billion for a 24 percent stake, and a state-controlled bank led a group of other lenders to pump in another $1.6 billion.”[190]

Thus, an important point is that it’s both the Chinese government and provincial governments that are providing financing and subsidies for Chinese EV players. As the U.S.-China Economic and Security Review Commission explained, “Local governments, rather than central ministries, [have] played the leading role in deploying consumer subsidies for EV purchases.”[191] This matters because it means Chinese provincial governments have played a key role in propping up uncompetitive firms and contributing to overcapacity (and also inefficiency) in the sector. Local governments in China have given auto manufacturers nearly free land, loans at near-zero interest, and other subsidies.[192] (A World Bank report found that, in 2022, China’s automotive sector as a whole received loans with interest rates of roughly 2 percent, half the weighted average for all commercial and industrial loans.)[193] As CSIS’s Ilaria Mazzocco elaborated, “Local governments denied subsidies for EVs made in other provinces, and public officials supported local firms by procuring solely from manufacturers located in the same city. This created a highly fragmented market with hundreds of EV manufacturers, many of which failed to bring a car into production.”[194] The essential point is that subsidies at all levels of Chinese government have contributed considerably to industrial overcapacity in EVs and explain why there are over 200 EV car manufacturers currently operating in China.[195]

JVs and Technology Transfer Requirements

As The Economist wrote, Chinese EV subsidies “come on top of the ransacking of technology from joint ventures with Western carmakers and South Korean battery-makers.”[196] Indeed, China has long employed a practice called “trading technology for market,” conditioning foreign companies’ access to Chinese markets on the transfer of technology and IP (and/or opening research or production facilities in China). In fact, China introduced its inaugural “Law on Joint Venture Using Chinese and Foreign Investment” in July 1979, and it yielded some important deals, including Volkswagen in 1994 signing a 25-year contract to build vehicles and engines in Shanghai.[197] However, over time, China’s approach to attracting foreign direct investment, and thus technology transfer, evolved from attraction to compulsion, especially as its growing market gave it an increasing ability to dictate detailed terms. For instance, as ITIF wrote in its 2011 book Innovation Economics: The Race for Global Advantage, “Ford Motor Company has opened several automobile plants in China, but as a condition of access had to do so as part of a joint venture with a Chinese auto firm. Moreover, the Chinese government required Ford to open an R&D laboratory employing at least 150 Chinese engineers.”[198]

However, as several analysts noted, “While certainly boosting production, the intention to also transfer critical internal combustion engine (ICE) capability to Chinese partners largely failed.”[199] Indeed, it was this recognition that, despite tech transfer requirements and industrial upgrading efforts, Chinese firms simply weren’t going to catch up in ICE vehicles that precipitated China’s embrace of EVs as a potential alternative leapfrog technology. Nevertheless, Chinese tech transfer requirements forced Western automakers to divulge key clean energy technologies, especially in the early years.

For instance, as The New York Times wrote in 2011, “The Chinese government is refusing to let the Volt qualify for subsidies totaling up to $19,300 a car unless G.M. agrees to transfer the engineering secrets for one of the Volt’s three main technologies to a joint venture in China with a Chinese automaker.”[200] That said, as one observer noted, if anything, the reality in the EV industry today is the concept of “reverse joint ventures,” where Chinese firms are sharing EV technology with Western companies (in exchange for market access or financing).[201]

IP Theft

Nevertheless, whatever EV IP or technologies Chinese entities can’t acquire by enticing foreign enterprises to barter away, China seeks to acquire through state-sanctioned IP theft. As Nicholas Eftimiades, author of the book Chinese Intelligence Operations and who has extensively documented Chinese industrial espionage activities over his four-decade career, wrote, “Out of 724 cases of Chinese espionage, we find about 500 are directed toward main technologies, [including] aerospace technologies, IT technologies, clean energy technologies, and automotive, electric vehicle technology.”[202]

In fact, in 2020, Federal Bureau of Investigation director Christopher Wray warned explicitly that “China is placing a priority on stealing electric car technology,” as the Chinese government is “fighting a generational fight to surpass our country in economic and technological leadership.”[203] As Wray elaborated, “We see Chinese companies stealing American intellectual property to avoid the hard slog of innovation, and then using it to compete against the very American companies they victimized—in effect, cheating twice over.”[204] In February 2020, William Evania, director of the National Counterintelligence and Security Center, singled out two fields where China is putting a priority on technology theft: EVs and aircraft.[205]

Whatever IP or technologies can’t acquire by enticing foreign enterprises to trade away, China seeks to acquire through state-sanctioned IP theft.

Indeed, U.S. EV companies are feeling the brunt of coordinated Chinese efforts to pilfer their technology. In September 2023, Tesla sued Chinese chip designer and auto parts maker Bingling for infringing its IP and stealing its trade secrets, both related to the integrated circuits (i.e., semiconductors) Tesla uses in its vehicles.[206] In June 2024, Klaus Pflugbell (a Canadian and German national living in China) pleaded guilty to conspiring to sell trade secrets (about EV batteries) that belonged to a leading U.S.-based EV company to Chinese entities.[207]

Favoring Domestic Enterprises