A Closer Look at US Private Sector R&D Spending in a Global Context

Private sector research and development spending is key to higher U.S. productivity, economic growth, and global competitiveness. This is because the private sector is more likely to use its R&D investment to conduct applied research, resulting in novel products and processes that solve practical problems. As a result, these innovations can encourage greater productivity, leading to greater economic growth for the nation and a competitive advantage for U.S. firms competing in the global economy.

An analysis of the EU Industrial R&D Investment Scoreboard, which includes the top 2,500 firms that makeup over 75 percent of the globe’s private business R&D spending, shows that U.S. firms’ cumulative R&D spending from 2018 to 2022 is generally growing. (Note: this data only measures the firms’ R&D, not where the R&D is actually performed.) Although U.S. firms’ spending still falls behind nations with firms that are the top R&D spenders when controlling for GDP, U.S. firms’ size-adjusted spending is catching up. More importantly, advanced sectors also follow similar trends. As a result, Congress policymakers should pass the Tax Relief for American Families and Workers Act (Families and Workers Act) to restore full R&D expensing so that firms are encouraged to continue increasing their R&D investments.

Of the 10 nations with firms that spent the most on R&D in 2022, U.S. firms ranked first with spending at $655 billion, a rise from $399 billion in 2018. Over 90 percent of the increase in U.S. firms’ R&D spending during this period came from four sectors: automobiles and parts (7 percent), pharmaceuticals and biotechnology (22 percent), software and computer services (44 percent), and technology hardware equipment (18 percent). This is partly because more firms in these sectors made it into the top 2,500 R&D spenders and/or the average firm spent more on R&D. However, it should be noted that a large portion of this increase comes from a spike in spending in 2021 and 2022, partly due to a return to in-person activity post-Covid. In other words, these four sectors were the main drivers of U.S. firms’ high spending and ranking in 2022.

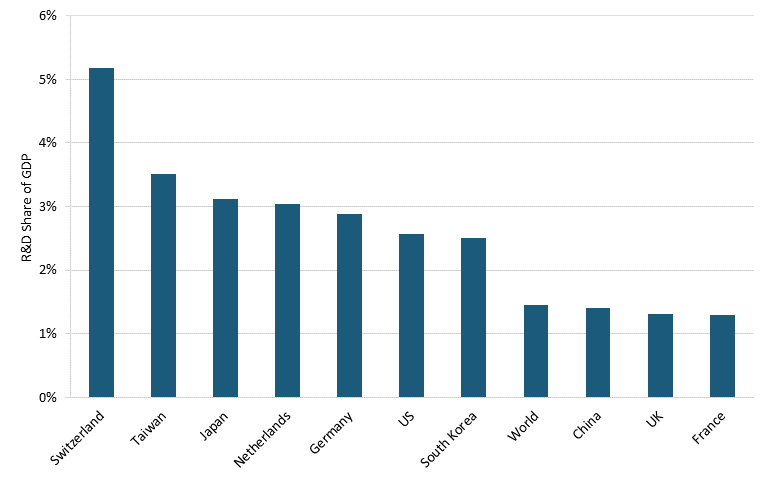

When controlling for the size of the economy, U.S. firms’ R&D spending ranked lower. In 2022, U.S. firms’ R&D spending ranked sixth at 2.57 percent of GDP, behind firms in Switzerland (4.75 percent), Taiwan (3.51 percent), Japan (3.12 percent), the Netherlands (3.03 percent), and Germany (2.88 percent). (See figure 1.) As a result, U.S. firms’ size-adjusted spending compared to the average globally, also known as location quotient (LQ), was only 77 percent higher. This is compared to Switzerland and Taiwan—the two countries with the highest LQ in the top 10 list—at 256 percent and 141 percent above the global average, respectively.

However, despite coming in sixth, U.S. firms did increase their size-adjusted R&D spending the most during this period, rising 0.63 percentage points to 2.57 percent from 2018 to 2022. In comparison, the other nine nations’ firms only saw an average increase of 0.34 percentage points. In other words, U.S. firms are catching up. As such, if U.S. policymakers want the nation’s size-adjusted R&D spending to continue growing—leading to economic growth and boosting U.S. firms’ global competitiveness—they should pass the Families and Workers Act to restore R&D expensing so that firms have an incentive to increase their investments in R&D.

Figure 1: Firms in all sectors’ R&D spending as a share of GDP in 2022

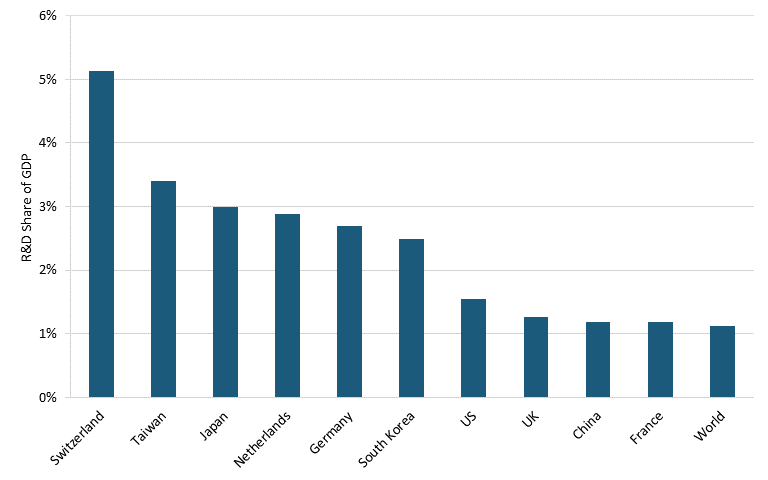

Moreover, without firms in the software and computer services industry, U.S. firms’ size-adjusted R&D spending would rank even lower compared to the previously mentioned top 10 nations’ firms. In 2022, without the software industry, U.S. firms’ size-adjusted R&D spending ranked seventh, behind Switzerland (5.13 percent), Taiwan (3.41 percent), Japan (2.99 percent), the Netherland (2.88 percent), Germany (2.69 percent), and South Korea (2.50 percent). (See figure 2.) Moreover, without this sector, U.S. firms’ size-adjusted R&D spending growth only rose 0.21 percentage points from 2018 to 2021. This is compared to the other nine nations’ growth of 0.32 percentage points. In other words, U.S. firms in the software and computer services sector are key drivers of the nation’s size-adjusted private sector R&D spending and its large growth.

Figure 2: Firms in all sectors’ (except software and computer services) R&D spending as a share of GDP in 2022

Although R&D spending is important in all sectors, they are especially critical in advanced traded sectors because these sectors compete globally. As a result, they need to consistently innovate to ensure that they do not lose market shares to their global competitors. This is because once market shares are lost in these sectors, it becomes challenging to gain them back. As such, it is important that U.S. firms’ R&D spending continue rising.

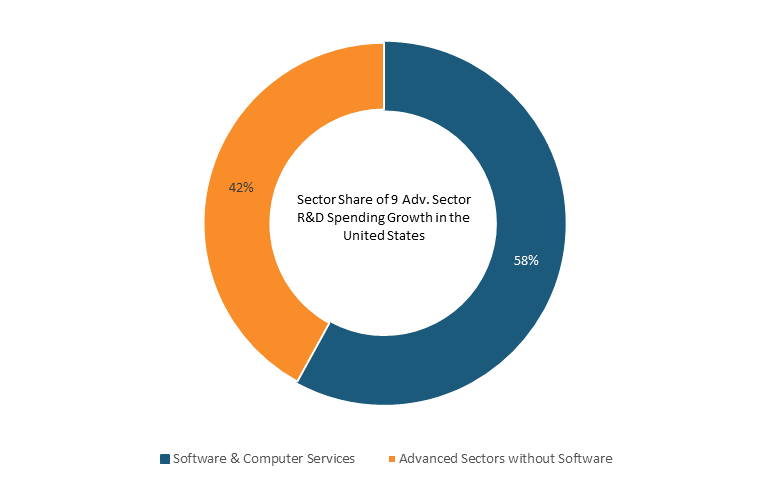

U.S. firms in advanced sectors’ R&D spending rose from 2018 to 2022. During this period, their R&D spending increased from $359 billion to $594 billion. This increase in spending made the United States the highest spender of the top 10 nations with firms that spent the most on R&D in advanced sectors in 2022. (See Figure 4 for a list of nations.) The majority of this increase can be traced back to firms in the software and computer services sector. Of the $235 billion increase, $136 billion came from firms in this sector while $99 billion came from the remaining eight advanced sectors. (See figure 3.) In other words, firms in the software and computer services sector are the main drivers of the nation’s high private sector R&D spending and ranking in advanced sectors.

Figure 3: Firms in advanced sector's share of total R&D spending growth from 2018 to 2022

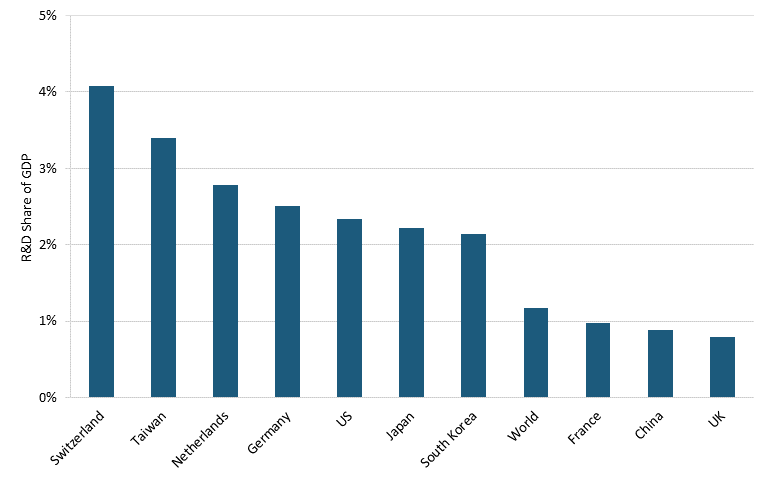

When controlling for GDP, U.S. firms’ R&D spending ranked fifth. In 2022, U.S. firms’ spending was 2.33 percent of the nation’s GDP, falling behind Switzerland (4.07 percent), Taiwan (3.39 percent), the Netherlands (2.78 percent), and Germany (2.51 percent). (See figure 4.) As a result, their size-adjusted spending was only 98 percent higher than the average globally. In comparison, Switzerland and Taiwan’s size-adjusted spending were 246 percent and 188 percent, respectively, higher than the average globally. However, despite coming in fifth, U.S. firms did increase their size-adjusted R&D spending the most, increasing 0.59 percentage points to 2.33 percent of GDP from 2018 to 2022. In comparison, the other nine nations only increased their size-adjusted spending by an average of 0.27 percentage points in this period.

Figure 4: Firms in advanced sectors' share of GDP in 2022

As a result of these findings, U.S. policymakers should pass the Tax Relief for American Families and Workers Act (Families and Workers Act) of 2024 to restore full R&D expensing. This is because firms will increase their investment in R&D when they are allowed to fully expense their R&D costs since they are better able to capture returns on R&D. Indeed, an ITIF report concluded that R&D “underinvestment is primarily due to firms being unable to capture the full returns of R&D…[As such] tax incentives can play a role in increasing R&D investments.” As a result of higher R&D investments from the restoration of full R&D expensing, the United States will benefit from greater economic growth and its firms will see a boost in their global competitiveness.

Moreover, when the full expensing of R&D is restored, the United States will also benefit from a boost in economic output, higher capital stock, and more jobs. Indeed, the Tax Foundation concluded that if full expensing is made permanent, the United States’ capital stock would increase by 0.7 percent, long-run economic output would increase by 0.4 percent, and jobs would increase by 73,000. Further corroborating this, an ITIF report also found that “restoring full [R&D] expensing would create 81,000 direct jobs nationally.” In other words, the United States only stands to benefit from higher R&D spending and economic growth, a boost in global competitiveness, and more jobs if they restore full R&D expensing.