China Is Dominating Advanced Industries as US, G7, and OECD Economies Founder, ITIF Finds in New Industrial Study

WASHINGTON—China has taken a commanding lead in technologically advanced and strategically important industries at the heart of the global economy by capturing market share from the United States and other advanced economies in the G7 and OECD, according to a new study and data visualization tools from the Information Technology and Innovation Foundation (ITIF), the leading think tank for science and technology policy. China now produces more in the 10 industries comprising ITIF’s Hamilton Index than any other nation—and more than all other nations outside the top 10 combined.

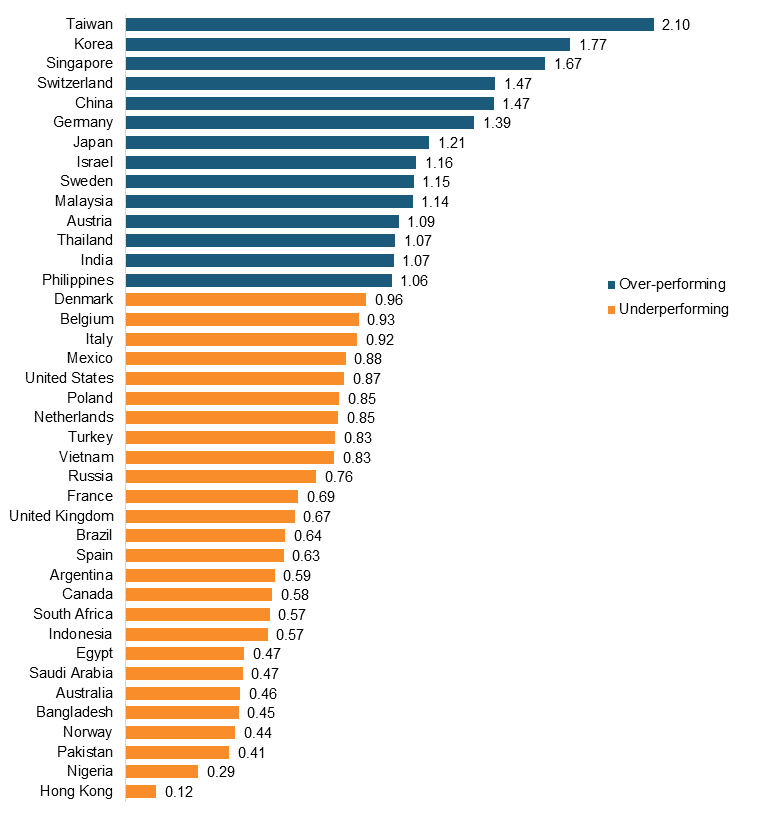

“China is running away with technologically advanced and strategically important industries,” said ITIF President Robert D. Atkinson, who led the study. “It would be one thing if China’s growth in these industries was proportional to its overall economy. But it hasn’t been. China has made a determined effort to outperform in these industries—and it has used mercantilist methods that subvert trade rules to achieve its goals. As a result, it has succeeded in relative terms, too. Its value-added production in advanced and strategically important industries was 47 percent higher than the size-adjusted global average in 2020, whereas U.S. production was 13 percent below average.”

The study draws from the OECD’s latest dataset on trade in value added, covering the period from 1995 through 2020. To assess nations’ industrial performance on a size-adjusted basis, ITIF uses an analytical statistic known as a “location quotient” (LQ), which measures any region’s level of industrial specialization relative to a larger geographic unit—in this case, a nation relative to the rest of the world.

Among the key findings:

▪ As of 2020, China was the world’s leading producer in 7 of the 10 industries covered: computers and electronics; chemicals; machinery and equipment; motor vehicles; basic metals; fabricated metals; and electrical equipment.

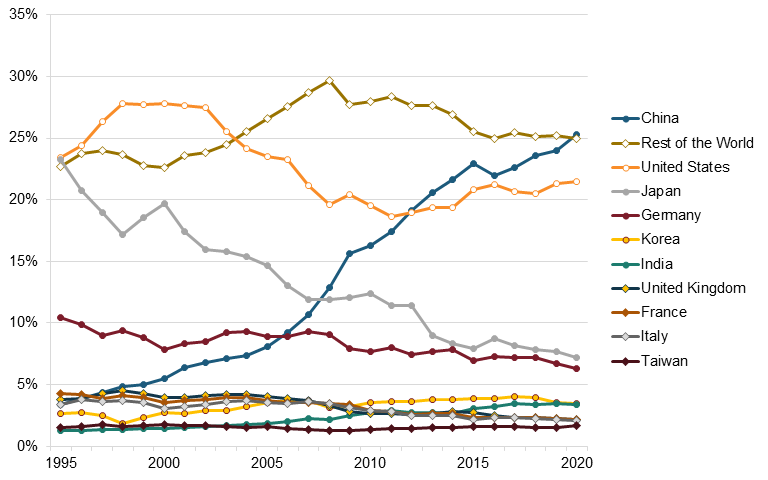

▪ China produced more than one-quarter of the world’s output across all 10 industries combined in 2020 (25.3 percent), up from 12.9 percent in 2008.

▪ On a relative basis, China’s overall LQ in the Hamilton Index was 1.47 in 2020, meaning its production in the 10 covered industries was 47 percent higher than the global average on a size-adjusted basis.

▪ The 10 industries’ collective production represented 11.8 percent of the global economy in 2020, about the same as 25 years prior, underscoring the zero-sum nature of the competition between nations for global market share. Indeed, China’s rapid growth in market share across the 10 industries in the Hamilton Index mirrored rapid declines for G7 and OECD nations as blocs.

▪ The United States has been buoyed by its IT and information services industry, where it leads the world with 36 percent of global production, and to a lesser extent by its other transportation and pharmaceutical industries, where it leads with 35 percent and 28 percent of global production, respectively.

▪ Across all 10 covered industries, the United States produced about one-fifth of the world’s value-added output in 2020, holding a 21.5 percent global market share, up from 19.6 percent in 2008.

▪ On a relative basis, though, America’s overall LQ in the Hamilton Index was just 0.87 in 2020, meaning its production in the covered industries was 13 percent below the global average on a size-adjusted basis.

▪ If the IT and information services industry was removed from the picture for the United States, its LQ in the other nine covered industries would have dropped to 0.73 in 2020—17 percent below the global average—and its global market share would have dropped to 18 percent.

▪ Germany and Japan were the only G7 countries over-performing on a relative basis in the Hamilton Index as of 2020, with LQs of 1.39 and 1.21 respectively, although both had declined significantly from earlier peaks.

Commenting on the competitive challenge the United States now faces, Atkinson said: “The administration and Congress need to recognize that passing the CHIPS and Science Act was a good step, but it only scratched the surface. Regaining competitive advantage in advanced industries is critical to America’s economic and national security—and it will require a comprehensive advanced industry strategy.”

Further highlights in the new report:

▪ Taiwan was the top relative performer in the composite Hamilton Index in 2020 with an LQ of 2.10 (more than twice the size-adjusted global average), although that was down from a peak of 2.25 in 2014.

▪ Taiwan’s continued strength reflects its relative dominance of the global computer and electronics industry, which includes semiconductor fabrication. There, its LQ in 2020 was almost nine times the global average (8.79).

▪ In the IT and information services industry, Israel was the top performer in relative terms in 2020 with an LQ of 2.89, although that was down from a peak of 3.16 in 2016.

▪ In the motor vehicles industry, Mexico was the top performer in relative terms in 2020 with an LQ of 3.14. It overtook Germany on that measure in 2019, although the data shows over the longer term its increased performance has come mainly at the expense of Canada following the North American Free Trade Agreement.

▪ In machinery and equipment, Germany was the top performer in relative terms in 2020 with an LQ of 2.02, slightly better than Japan’s LQ of 1.96.

▪ In the pharmaceuticals industry, Switzerland was the top performer in relative terms in 2020 with an LQ of 7.26, far ahead of second-place Denmark, which had a pharmaceuticals LQ of 4.23.

▪ In electrical equipment, Vietnam was the top performer in relative terms in 2020 with an LQ of 2.36, ahead of Korea (2.12) and China (2.10)

▪ In chemicals, Saudi Arabia led in relative terms in 2020 with an LQ of 2.41, ahead of Singapore’s LQ of 2.02.

▪ In fabricated metals, Poland was the top performer in 2020 with an LQ of 2.12, followed by Italy, which had an LQ of 1.91.

▪ And in basic metals, China was the top performer in 2020 with an LQ of 2.64, ahead of Russia, which had an LQ of 2.41.

Summary of Hamilton Index industry leaders, 2020

|

Industry |

Global Output (Billions) |

Leading Producer |

Leader’s Market Share |

Relative Leader |

Leader’s LQ |

|

IT and Info. Services |

$1,900 |

USA |

36.4% |

Israel |

2.89 |

|

Computers & Electronics |

$1,317 |

China |

26.8% |

Taiwan |

8.79 |

|

Chemicals |

$1,146 |

China |

29.1% |

Saudi Arabia |

2.41 |

|

Machinery and Equip. |

$1,135 |

China |

32.0% |

Germany |

2.02 |

|

Motor Vehicles |

$1,093 |

China |

24.3% |

Mexico |

3.14 |

|

Basic Metals |

$976 |

China |

45.6% |

China |

2.64 |

|

Fabricated Metals |

$846 |

China |

25.6% |

Poland |

2.12 |

|

Pharmaceuticals |

$696 |

USA |

28.4% |

Switzerland |

7.26 |

|

Electrical Equipment |

$602 |

China |

36.1% |

Vietnam |

2.36 |

|

Other Transportation |

$386 |

USA |

34.5% |

Singapore |

3.52 |

|

Composite Hamilton Index |

$10,097 |

China |

25.3% |

Taiwan |

2.10 |

Along with the new edition of the Hamilton Index report, ITIF also created three interactive data visualization tools that are freely available for media, researchers, and the public to use. They include:

▪ An industry-focused visualization tool showing how the 40 covered nations compare in gross output, relative output (LQ), and global market shares in each of the 10 covered industries plus the composite Hamilton Index.

▪ A country-focused visualization tool that breaks down how each of the 40 covered nations and other multinational groupings perform.

▪ A momentum visualization that weighs how nations’ and multinational groupings’ output and relative performance has changed over time.

Read the report and explore the data visualizations.

Top 10 producers’ historical shares of global output in Hamilton industries

Relative national performance in the composite Hamilton Index (2020 LQ)

###

The Information Technology and Innovation Foundation (ITIF) is an independent, nonprofit, nonpartisan research and educational institute focusing on the intersection of technological innovation and public policy. Recognized by its peers in the think tank community as the global center of excellence for science and technology policy, ITIF’s mission is to formulate and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress.

Editors’ Recommendations

December 13, 2023

The Hamilton Index, 2023: Data Visualization for Industries

December 13, 2023

The Hamilton Index, 2023: Data Visualization for Countries

December 13, 2023