Why Policymakers Should Support Robotic Automation to Solve the Productivity Crunch in Logistics Facilities

As consumers continue to buy more goods online, logistics facilities will face greater demand to deliver goods across the country in a timely manner. Policymakers should promote robotic adoption and innovation to improve labor productivity, worker safety, delivery times, and supply chain resiliency.

KEY TAKEAWAYS

Key Takeaways

Contents

Retail E-commerce in the United States. 4

Logistics Facilities in the E-commerce Industry. 7

The Benefits of Robotics Automation Within Logistics Facilities. 12

Trends in the Warehouse Robotics Market. 13

The Case for Government Policy. 15

Introduction

The warehousing and storage industry needs to improve its productivity through automation, or it will risk delaying growth in the broader wholesale and retail trade sectors to the detriment of producers, consumers, and its own workers.

The warehousing and storage industry itself accounts for just 0.4 percent of the U.S. economy.[1] But with e-commerce expanding, it has an outsized impact on the fortunes of many other industries across the economy, serving as the logistical nerve center for millions of packages per day shuttling between firms and to and from consumers.[2] Since 2015, it has strained to meet growing demand for its services.[3] At the same time, the industry’s output has surged 39 percent. Meanwhile, its labor productivity has decreased by 35 percent.[4] To make up the difference, workers’ hours have ballooned 170 percent, increasing safety risks and decreasing job quality.

The obvious solution to the productivity crunch in warehousing and storage is to increase robotic automation: Firms need to adopt technologies to help workers accomplish more per hour. Increasing the use of robots would improve worker safety and job quality, lower shipping errors, speed order time, increase supply chain resiliency, boost productivity, and lower prices.

Yet, despite the advances in robotics, adoption has been slow, largely because of their cost and the difficulty of retrofitting existing warehouses with new and modern technologies. It is clearly in the national interest for the United States to lead in robotic adoption of logistics facilities. As such, Congress and the Biden administration should take the following steps:

1. Enact tax policies that encourage investment in automation and robotics. Rational companies invest in new equipment if its after-tax net present value is greater than the cost of the investment. As such, tax policy plays a big role in investment decisions. At minimum, Congress should restore legislation allowing companies to expense first-year capital equipment investments. Doing so would enable more robotic investments to meet the hurdle rate for capital investments. The 2017 Tax Cuts and Jobs Act contained a provision permitting companies to fully expense qualified equipment the year it was placed into service. Unfortunately, that provision is phasing out this year. Congress should permanently extend it. And of course, Congress should resist neo-Luddite calls to tax robots, as such taxes would lower ROI and discourage firms from investing in robotic tools that could improve productivity. Rather, Congress should restore the investment tax credit for new machinery and equipment that was eliminated in 1986.

2. Prioritize robotic automation in government warehouses. Agencies such as the United States Postal Service (USPS), Department of Defense (DOD), and Federal Bureau of Investigation (FBI) utilize warehouses in pursuit of their missions. Agency officials should prioritize warehouse automation to demonstrate the benefits of adoption and enable further development of robotic systems. And Congress should provide funding for both agencies to implement state-of-the art programs to automate their facilities.

3. Increase funding for the National Science Foundation (NSF) for robotics research. The new NSF Directorate for Technology, Innovation and Partnerships (TIP) was charged by Congress to focus on 10 critical technologies, including robotics. As they implement this legislation, NSF should prioritize robotics research. To that end, Congress should increase funding for the NSF by at least $500 million for robotics research.

4. Target funding to robotics research. Congress should increase funding for the National Institute of Standards and Technology’s (NIST) Hollings Manufacturing Extension Partnership (MEP). The agency should then use this funding to support projects that advance research in automation and autonomous robots. In addition, Congress should broaden the MEP mandate to include assisting small logistics and warehousing companies.

5. Modernize safety standards for machinery in industrial settings. The National Institute for Occupational Safety and Health (NIOSH) should work with researchers, private companies, and government agencies responsible for setting workplace standards to modernize standards for machinery in warehouses and other industrial settings. Current Occupational Safety and Health Administration (OSHA) standards limit facility managers and robotics companies from developing new robotic systems and integrating them into industrial settings. NIOSH should develop new performance-based standards that enable companies to safely experiment with robotic systems.

6. Support small logistics and warehousing companies. The Small Business Administration (SBA) should expand its Manufacturing Office to include support for logistics and warehousing companies. Allowing small logistics and warehousing companies to take advantage of the same resources as manufacturing companies would promote innovation and resiliency in each industry and the broader supply chain.

7. Create a national robotics awards program. The Department of Commerce (DOC) should add a complement to the Malcolm Baldridge Quality Award, a presidential award to recognize companies for performance excellence, by creating a robotics automation award to recognize outstanding achievements in the use of robotics to boost productivity. Improved recognition could encourage additional research and development in robotics and boost adoption, including by the warehouse industry.

8. Raise the minimum wage. Congress should raise the federal minimum wage to at least $12 an hour and index it to inflation to encourage the warehousing and storage industry to invest in automation. As the e-commerce industry continues to grow, raising the minimum wage will incentivize firms to invest in automation to improve labor productivity.

9. Support workers displaced by automation. Automation in warehouses will replace some tasks and may cause warehouse workers to lose their jobs, although much of this could be through attrition. Policymakers should improve job training and unemployment compensation programs. By partnering with local organizations to offer job training to displaced workers and permitting program attendees to receive unemployment compensation during training, policymakers can mitigate the effects of economic displacement.

10. Launch an advisory committee for robotics innovation and adoption. Congress should pass legislation directing DOC to create an advisory committee to develop a strategy supporting robotics innovation and adoption. In devising a strategy, the committee should create recommendations that advance robotics research, promote adoption by both the public and private sectors, support the workforce, and more.

Retail E-commerce in the United States

The retail industry has experienced significant changes in recent years as e-commerce platforms enabled consumers to purchase a wide variety of goods online. There have been four primary changes.

First, consumers increasingly purchase goods online instead of visiting a brick-and-mortar location. Between 2002 and 2022, e-commerce retail sales grew from 1.4 percent of total sales in the United States to 14.7 percent.[5] Similarly, according to Pitney Bowes, a U.S.-based shipping and mailing company, 11.8 billion parcels were shipped in the United States in 2015 while 21.2 billion parcels were shipped in 2022.[6] This increase in demand has resulted in facilities processing more orders than ever before.

Second, retailers give consumers opportunities to purchase a wider variety of products.[7] By shopping online, customers can purchase more products than would be available in a brick-and-mortar store. As a result, logistics facility workers must handle many distinct goods, which creates more complexity to account for all orders flowing through a facility.

Third, consumers who shop online have become accustomed to receiving their purchases within a few days or less because many online retailers commit to shipping and delivering orders in a timely manner. For example, Amazon Prime offers free one-day or same-day delivery in the United States for more than 20 million select goods.[8] To meet customers’ expectations for quick deliveries, companies have had to adapt to consumers’ expectations and process orders faster than in the past.

Fourth, many retailers operate an omnichannel distribution model, enabling consumers to purchase goods online, in-store, or in a hybrid of the two.[9] Under such a model, logistics facility workers may ship orders to stores, special pick-up points, or a customers’ home. This variety of destinations makes it more difficult for workers to pack and transport online orders, as they cannot necessarily be grouped together during the picking and shipping process.

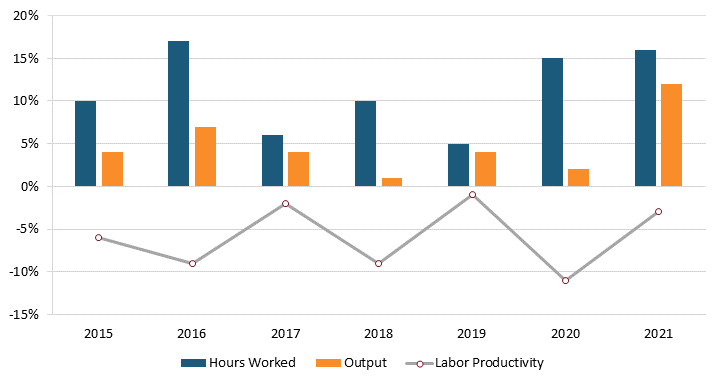

As a result of these dynamics, logistics facilities needed to sort higher quantities of smaller goods at quicker rates.[10] As a result, labor productivity—the ratio of output to hours worked—in the logistics facilities used to store and distribute goods has declined.[11] As shown in figure 1, the annual percentage increase in hours worked has exceeded the annual percentage increase in output since 2015 and, as a result, labor productivity in logistics facilities has declined.[12]

Figure 1: Annual percentage changes in labor productivity, output, and hours worked in warehousing and storage from 2015 to 2021

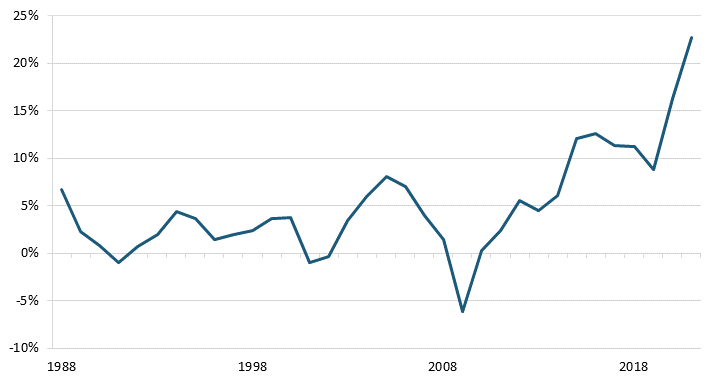

This development is likely due to the pace at which the e-commerce industry has grown, the challenges warehouse employees face when picking orders, and the COVID-19 pandemic. To address more demand from e-commerce, logistics facilities have hired more workers.[13] In 2021, the general warehousing and storage industry in the United States employed 1,578,300 workers, up from 651,300 in 2014.[14] Moreover, as seen in figure 2, the yearly percentage changes in employment from 2014 to 2021 generally outpaced yearly percent changes in employment before that time period, indicating that the rate of hiring has increased within the sector.

Figure 2: Percentage change in employment (thousands) in the general warehousing and storage industry

However, many workers are employed at older warehouses that do not have modern robotic technologies in place to automate processes. In 2022, CBRE, a U.S.-based commercial real estate services and investment firm, reported that the average warehouse in the United States was 43 years old and that 28 percent of existing warehouses were over 50 years old.[15] Only 6 percent of warehouses were less than 10 years old.[16]

The average age of warehouses suggests that many do not have the layout or infrastructure to support modern systems that can enable workers to produce more output in the face of growing e-commerce demand. Installing robotic technologies is a time-consuming, expensive, and disruptive process that often requires logistics facilities to adjust or temporarily suspend full operations. Logistics facilities generally experience high levels of cost-based competition that result in low profit margins and volatility and risks in the supply chain. As a result, many may be risk averse to cost exposures.[17]

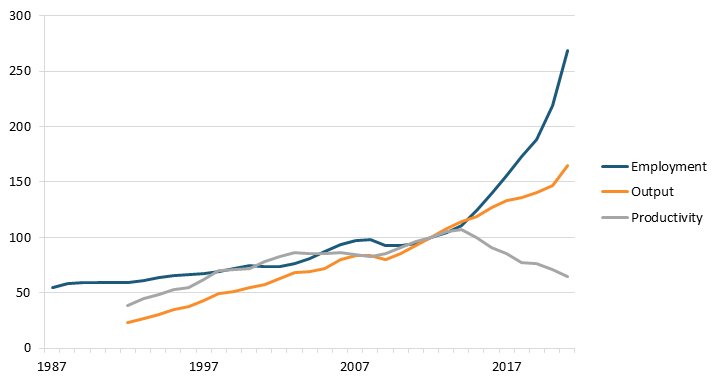

Together, the average age of warehouses and the challenges facility managers face in installing robotic systems likely have led managers to hire more workers to meet demand as e-commerce has grown. However, output has not increased as much as employment. As a result, as seen in figure 3, labor productivity (which is the ratio of output to hours worked) within the general warehousing and storage industry has declined compared with employment levels and real sectoral output. The response to the COVID-19 pandemic likely exacerbated this trend, as workers implemented social distancing measures that disrupted operations.[18] To increase labor productivity, warehouses would need to pursue more automation instead of only hiring more workers.

Figure 3: Labor productivity, employment, and real sectoral output in the general warehousing and storage industry (NAICS 493110) (2012=100)

Logistics Facilities in the E-commerce Industry

Goods sold by online retailers pass through many different types of logistics facilities as they travel from suppliers to customers. These facilities receive, store, and ship products to customers. Online retailers customize their distribution network to efficiently transport the goods they sell, and may partner with other entities, such as USPS or a third-party logistics company, to complete the process.[19]

Types of Logistics Facilities

Retailers use distribution centers to transport goods to local stores where customers shop in-person and transport their purchases home. In contrast, online retailers, which deliver directly to their customers, must accommodate for many more destinations.[20] Larger volumes of home deliveries, coupled with consumers’ expectations to receive their purchases quickly, have caused online retailers and other parties in the e-commerce industry to extend their logistics networks to distribute more goods to more endpoints than before.[21] Logistics facilities generally fall into six major categories: inbound cross-dock facilities, e-fulfillment centers, sortation centers, delivery stations, local freight stations, and fast-delivery hubs. As such, online retailers and external logistics providers may employ varying combinations of facilities to transport goods.[22]

Inbound Cross-Dock Facilities

The starting point for many e-commerce fulfillment services is inbound cross-dock facilities. These facilities receive containers from domestic or international suppliers and then send them to regional fulfillment centers for further processing.[23] They typically exist near major transportation hubs, such as ports or rail yards. During the process of receiving goods, workers pick up goods from a carrier at receiving docks on one side of the facility.[24] In order to receive goods efficiently, logistics facility workers need detailed information about arriving shipments, including their arrival time, the products being shipped, and the expected shipping time for each eventual order.[25] If facility managers know who will receive the goods next, workers immediately load goods onto trucks or railcars on the other side of the facility to transport them to their next destination.[26] If the recipient of the goods is not yet known or workers must sort the goods before transportation, facility managers may store those goods for a short time while ascertaining their destination and sort them at the facility.[27]

E-fulfillment Centers

The next destination for many e-commerce orders is e-fulfillment centers. These facilities receive truckloads of goods from distribution centers or inbound cross-docking—which refers to receiving products on an inbound dock (i.e., a point of entry designed to accept shipments of goods) and then transferring them to an outbound dock with minimal storage and handling—store high levels of inventory, and assemble online orders from individual consumers. Online retailers may build these facilities to handle different types of goods, such as apparel or furniture.[28] Moreover, given that unloading, sorting, and picking orders require significant amounts of labor, online retailers may elect to automate several functions within these facilities. Some facilities also require carriers to make an appointment to deliver goods to an e-fulfillment center.[29]

Sortation Centers

Sortation centers receive packages from e-fulfillment centers and sort them according to their final destination.[30] Similar to inbound cross-dock facilities, workers typically receive parcels at one side of the facility, sort them by destination, and load them for transportation to post offices, delivery stations, or subcontracted delivery companies to reach customers. Sortation centers may also serve as e-fulfillment centers for goods in high demand.

Delivery Stations

Delivery stations receive goods from sortation centers and load them onto delivery vehicles for last-mile delivery.[31] The facilities resemble inbound cross-docking facilities in that their primary purpose is to arrange goods for transportation.[32]

Local Freight Stations

Local freight stations function as hubs for customers to pick up their online orders. These stations may exist within stores or as lockers from which a customer can enter a QR code or other information to receive their package.[33]

Fast Delivery Hubs

Online customers have come to expect expedient deliveries of their orders. In order to meet these expectations, some online retailers use fast delivery hubs to deliver goods within a shorter timeframe, which can range from the same day to within 48 hours. Workers in these facilities store high-demand items in a way they can be quickly retrieved and shipped to the customer.[34]

Logistics Facility Functions

Logistics facilities distribute goods as they move along the supply chain. To that end, there are three primary functions of a logistics facility: receive goods from retailers, suppliers, or customers; store, sort, and order pick (i.e., sort goods or parcels into specialized shipments); and facilitate their transport to retailers, consumers, or another stop in the supply chain.

Receiving Goods

Workers first receive small-parcel, less-than-a-truckload, or full-truckload shipments from carriers at receiving docks before transporting the goods to either shipping docks, storage facilities, or a sortation station.[35] At the point of receipt, workers may direct and ship whole pallets without substantially changing their contents or break both mixed and whole pallets into smaller loads.[36] Smaller loads can contain multiple unique products. Loads may also contain returned orders customers are shipping back to retailers.

To remove goods from trucks, logistics facility workers can manually handle the pallets or goods, use a forklift, or use an automatic truck loading and unloading system. These systems use a combination of extendable forks, hydraulic skids, a roller or chain system, or other mechanisms to remove deliveries from a truck.[37] In a fully automated facility, the automatic truck loading and unloading system can place deliveries onto lifting platforms, hydraulic tables, or a conveyor system to transport them to the next stage of the facility.[38] For example, Boston Dynamics offers a robotic arm, known as Stretch, that can autonomously unload up to 800 cases per hour from trucks and place them on a conveyor belt.[39] Stretch uses an advanced vision system to recognize cases and a gripper handle to lift and maneuver packages of up to 50 pounds.[40] As a result, workers do not have to unload packages from trucks by hand. Boston Dynamics first announced a prototype of Stretch in 2021, before making the robot commercially available in March 2022.[41] DHL Supply Chain became the first company to purchase Stretch in a $15 million, multiyear agreement with Boston Dynamics to automate the former’s warehouses.[42] Two retailers, Gap and H&M, and two U.S.-based logistics companies, Performance Team and NFI, have since announced their own purchases of Stretch.[43]

During the unloading process, workers can remove loads from pallets by hand or employ depalletizer robots to remove loads from pallets if necessary.[44] Depalletizer robots can handle a variety of objects and use either mechanical arms, suction cups, or magnets to remove loads from pallets and place them onto a feeding conveyor belt to transport them to the next step of the facility.[45]

After reviewing goods for errors or damage, logistics facility workers can either manually record their arrival or use a variety of tools to check goods into a facility and track them throughout the receiving, storing, order-picking, and shipping processes. Workers can manually scan goods’ bar codes, shipping labels, or radio-frequency identification (RFID) tags to record their entry, or install automatic scanners or vision models on machines used during the receiving process to capture the data.[46] RFID tags do not require line-of-sight access, can store more data, and have a large range—and workers can read multiple tags at once.[47] Moreover, companies can place RFID tags in a variety of shipments, from individual containers to whole pallets.[48]

Using technology to automate checking in goods improves workers’ productivity, better traces goods throughout the supply chain, and reduces the number of errors in processing orders.[49] For example, UPS recently announced plans to expand the use of RFID tags in its U.S. network as part of its smart package initiative.[50] Through this initiative, the company will add RFID tags to packages that workers will scan with wearable devices. According to the company, implementing this tracking system will eliminate the need for 20 million daily scans and help managers reduce the number of packages loaded onto the wrong delivery vehicle by half. By reducing errors and improving traceability, companies save money that would have otherwise been spent rectifying such issues. In a 2021 study, researchers at McKinsey found that implementing an RFID system enables retailers to achieve 5 percent top-line growth through improved inventory control and reduce inventory-related labor hours by 10 to 15 percent.[51] Artificial intelligence (AI) systems similarly further automate the process of checking shipments into the system; however, the technology is not yet ready for widespread use, as it is still in development.[52]

Storing and Order Picking

After goods arrive at the facility and the receiving process has been completed, workers can immediately prepare goods for shipment during cross-docking or store them. The process of storing goods starts with sending them to a dedicated part of the facility.[53] After the goods have reached the next stage, workers zone the goods or assign them a specific storage location.[54]

Logistics facility workers who deal with whole pallets store goods in pallet reserve areas without breaking apart their contents, while those who work with goods in cases or item quantities may store them in case-pick areas or item-pick areas.[55] These storage locations hold items in areas where workers or machines can retrieve them for order picking; however, their exact location depends on each facility’s storage location assignment problem (SLAP) policy.[56] For example, if workers know the arrival and departure times of goods, they may store two goods in the same location at different times. However, if workers know only the product information of a good, they may store goods in dedicated storage areas, random storage areas, or class-based storage areas that hold goods with reasonable similarities in characteristics.[57] When workers know only the product information of a good, they can assign its storage location according to a number of factors, such as the popularity of the product, the amount of space available, or a combination of the two.[58]

Workers can automate the storing process through the use of carousels, rotary racks, or an automated storage/retrieval system (AS/RS). AS/RSs are computer-controlled inventory management systems that can help workers densely store goods or pallets in vertical or horizontal systems to maximize available facility space.[59] Common AS/RSs use horizontal or vertical carousels, vertical lift modules, cranes, or robotic shuttles to store goods in remote or inaccessible areas.[60] AS/RSs first originated in the 1960s as a means to transport pallets; however, the technology has since evolved to carry and store loads of varying sizes.[61]

Companies can likewise use carousels, rotary racks, or AS/RSs to retrieve goods from storage to prepare them for further processing in an operation known as order picking. Order picking primarily consists of retrieving goods from storage areas, sorting them, and preparing them for shipment.[62] Logistics facility managers can employ several different order picking systems to process goods, including single-order picking, batching and sorting while picking, batching with downstream sorting, or any combination thereof with varying degrees of prior zoning.[63] Sorting consists of separating multiple picked goods into different orders, either during the picking process or afterward. In the latter, workers typically sort through goods in a dedicated area of the facility known as the sorting area. The ideal system for each facility will depend on its variety of material flow, expected turnover rates, opportunities for workers to revisit storage locations, and the location of various processing sites.[64]

Order picking is the most time-consuming activity within a logistics facility.[65] In larger facilities, companies may dedicate entire floors to picking operations.[66] As such, it represents a significant opportunity for automation, with some companies employing thousands of robots to pick orders.[67] Logistics facility managers can use a variety of robotic technologies to automate the order picking process. First, in picker-to-product systems, or systems in which workers travel to stored goods, facility workers can employ collaborative robots, or cobots, to carry loads to sorting areas. For example, “meet-me bots” travel within predetermined areas to help workers pick an order while “follow-me bots” follow workers as they pick orders until the bots are fully loaded.[68]

Second, in a products-to-picker system, autonomous mobile robots (AMRs) or automated guided vehicles (AGVs) transport different types of loads without the need for humans present to move goods throughout facilities.[69] These two types of machines may carry racks, containers of goods, or individual products to workers for further picking; however, AMRs can move more freely and flexibly than AGVs, which typically travel on guided routes.[70] This capability is due to AMRs’ onboard intelligence systems and computer vision technology, both of which enable the robots to navigate their surrounding environments.[71] While AGVs have been in use since the 1950s, AMRs did not emerge as a commercially viable option for warehouse automation until the start of the 21st century.[72]

Third, robotic arms can sort goods for further processing, using gripping technology and an AI system to identify goods and place them into appropriate bins or redirect packages after picking an order.[73] Unimation, the world’s first robotics company, installed the first industrial robot, a robotic arm known as Unimate, at a General Motors plant in 1961.[74] General Motors had bought the robot for $18,000 to remove finished castings from a die casting machine.[75] The technology has since evolved to incorporate AI systems to recognize, sort, and transport goods according to various parameters. For example, Amazon has built a robotic arm, known as Sparrow, that can select goods out of a larger group, pick them up with a hydraulic-based suction system, and place them into designated bins.[76] Another one of the company’s robots still in development uses a pinch-grabbing system to retrieve goods from a pile and move them.[77] In tests, the system picked 1,000 units per hour and caused 10 times less damage to certain items than did robotic arms that used suction to pick up goods.[78]

Finally, workers may use autonomous humanoid robots to transport goods around facilities. In March 2023, U.S.-based robotics company Agility Robotics unveiled a humanoid robot known as Digit that can lift containers from warehouse stations and transport them to their next destination.[79] According to the company, Digit is the first commercially available humanoid robot designed for warehouse tasks.[80]

Shipping Goods

The process of shipping goods mirrors that of receiving them. Workers consolidate orders in unitizing, accumulation, sorting, or packing areas before transporting them to shipping docks. They can then use the same robots to prepare orders for transportation and loading as they do during the receiving process. For other orders, a palletizer robot loads them onto pallets before a stretch wrap or shrink wrap machine bundles the pallets.[81] Facility workers handling smaller parcels can similarly take advantage of automated solutions. For example, 3M manufactures a case sealer that can fold box flaps and seal cases of similar or varying sizes.[82] An automated truck loading and unloading system or conveyor system can then place pallets or parcels into a carrier for further transport.

The Benefits of Robotics Automation Within Logistics Facilities

Automating processes provides numerous benefits to logistics facility employees, online retailers, and consumers alike.

Improving Worker Safety

Many tasks for logistics facilities workers require extensive labor and repetitive movement patterns that invite opportunities for injuries, fatigue, low morale, and other sources of employee dissatisfaction. In the United States, the general warehousing and storage industry experienced an incidence rate of 5.5 nonfatal occupational injuries and illnesses per 100 workers in 2021, double the average for the entire private sector.[83] Common causes of injuries include falls, overexertion, and repetitive motion.[84] These incidents cost U.S. companies nearly $4.7 billion in 2022.[85] Automating processes, such as order picking or loading trucks, could prevent many such injuries.[86]

Using robots to automate physical processes, such as retrieving goods from remote storage areas or bending into bins to reach orders, can alleviate many of the causes of injuries and fatigue in workers. For example, the process of manual order picking often requires workers to handle heavy materials in awkward body positions—a task that frequently leads to the development of a musculoskeletal disorder—and walk significant lengths to retrieve goods.[87] Amazon’s work to solve the latter problem consists of integrating robots into its facilities so workers involved with picking or stowing goods can work at stations rather than walking through the warehouse facility to pick up items.[88] Researchers with Accenture surveyed warehouse workers regarding their thoughts about automation and found that the top factor prompting optimism around automation is its potential to improve safety.[89] In one response, a worker noted that he no longer has to take sick leave for his back pain because he’s now able to use an automated forklift truck.[90]

Increasing Labor Productivity

Using robotics to automate logistics facilities can increase labor productivity. For example, the use of an AGV to send a good to a picker eliminates the need for a human worker to bring that good to the picker.[91] In one warehouse owned by Gilt, a U.S.-based online retailer, robots helped workers process orders up to three times faster.[92] The use of robotic shuttle put walls, or robotic shelving units that enable quicker sorting, similarly improve upstream picking productivity by 30 percent.[93]

In its warehouses, Amazon has deployed robots that can automate the order packing process.[94] Two machines, known as SmartPac and CartonWrap, can scan products on conveyor belts and package them in boxes or envelopes according to their size.[95] By automating the order packing process, the machines enable workers to increase their productivity by four to five times.[96] Walmart, U.S.-based photography company Shutterfly, and Chinese online retailer JD.com have installed the machines as well in their own facilities.[97]

In a 2012 study, researchers at MWPVL, a Canadian supply chain consulting company, reviewed robotics firm Kiva Systems before the company’s acquisition by Amazon.[98] The team reported that workers in Kiva-run distribution centers achieved two to three times the productivity of warehouses with pick-to-conveyor operations and five times the productivity of manual pick-to-cart or pick-to-pallet operations.[99] Further, they determined that Kiva-run distribution centers required less than half the number of pickers that traditional warehouses required, thus saving warehouse managers the equivalent of at least three pickers’ salaries.[100]

In another example, Walmart recently announced plans to automate its regional distribution centers using robotics.[101] The company expects that within three years, the majority—55 percent—of the products moving through its fulfillment centers will be processed in automated facilities. These changes will not only increase worker productivity, but the company expects that its shift to robotics will result in roles that require less physical labor, but higher pay.[102] And because of intense competition in the wholesale and retail trade sector, improvements in productivity translate into relatively lower prices for consumers.

Using Space More Efficiently

Robotic technologies enable managers to utilize facility space more efficiently. For example, by automating the storage and retrieval process, workers can store goods in hard-to-reach or remote areas of their facility. In a 2020 study, U.S.-based real estate investment firm Prologis found that logistics facilities that installed fully fixed automation systems, such as AS/RSs, could realize space efficiencies up to 50 percent, depending on the type of system.[103] While such tools could help logistics facilities in all locations better manage their space, facilities in more dense or expensive areas would benefit from reduced real estate costs.[104] In reducing the amount of land required to operate, automation also helps facilities minimize their impact on the environment.[105]

Trends in the Warehouse Robotics Market

The adoption of warehouse robots varies by establishment, with no two companies constructing the same setup within their facilities. Companies can choose from a wide range of robotic systems for their warehouses—from robotic arms to depalletizing robots—and may automate certain processes within their facilities while employing human workers to manually handle other tasks.

According to the logistics market intelligence firm LogisticsIQ, the global market for warehouse automation will reach $41 billion by 2027, with a compound annual growth rate (CAGR) of 15 percent between 2022 and 2027.[106] The company based this prediction on the growth of 700 companies responsible for material handling solutions or equipment designed to aid handling products, warehouse management systems, micro-fulfillment, AGVs, AMRs, piece picking robots, robotic components, energy and power automation, battery and charging infrastructure, AS/RSs, autonomy solutions, warehouse drones, automatic truck loading systems, machine vision, imaging, wireless technology, third-party logistics, last-mile delivery, and warehouse real estate.[107] Another market research firm, ABI Research, expects the global warehouse automation market to reach $51 billion by 2030, with a CAGR of 23 percent between 2021 and 2030 as the sector contends with growth in the e-commerce industry and labor challenges.[108]

Some of the biggest robotics companies expected to play a role in this growth are Daifuku, Dematic, and Honeywell Intelligrated.[109] Daifuku is a Japanese materials handling systems manufacturer that builds a variety of warehouse robotics technologies.[110] Dematic and Honeywell Intelligrated are U.S.-based materials handling systems manufacturers that similarly build many of the systems in place in warehouses today.[111] According to Interact Analysis, a U.K.-based market intelligence firm, Amazon invested the most in automation in the United States in 2021, accounting for 38 percent of warehouse automation spend.[112] The company acquired the robotics firm Kiva in 2012 and has since become the world’s largest manufacturer of industrial robots and has deployed over 750,000 robots in its fulfillment centers.[113]

However, despite expected growth in the warehouse robotics market and continued installation, most facilities have not adopted the robotic technologies mentioned in this report. Peerless Media, a U.S.-based media company that publishes magazines centered around the logistics, freight, and transportation industries, conducted a survey in 2022 of its readers who run warehouse and distribution centers. The company found that utilization of certain types of materials handling systems has declined.[114] For example, from 2021 to 2022, the percentage of respondents who reported using a palletizer dropped from 19 percent to 13 percent, the percentage of respondents who reported using a robotic or articulating arm dropped from 12 percent to 10 percent, and the percentage of respondents who reported using an AGV dropped from 9 percent to 7 percent.[115] However, sorter and push cart utilization both increased, with 13 percent of respondents reporting using a sorter and 59 percent a push cart in 2022.[116] In an NSF survey conducted by the National Center for Science and Engineering Statistics, 85 percent of transportation and warehousing companies reported that they did not use or test robotics technology in 2020 and 83 percent of companies reported that they do not use an AGV.[117] Further, these results are similar to global rates of warehouse automation. According to M14 Intelligence, a market intelligence company based in India, more than 80 percent of warehouses worldwide have no automation, while only 5 percent of warehouses use sophisticated automated tools.[118]

Warehouses’ lack of adoption of robotic technologies is likely due in part to the age of the warehouses and the cost of robotic equipment. A third of warehouses are over 50 years old and were not built to accommodate modern robotics technologies.[119] Given that warehousing and storage is a traditionally low-margin industry, many facility owners likely cannot afford to purchase robotic technologies and substantially remodel their buildings to integrate them.[120]

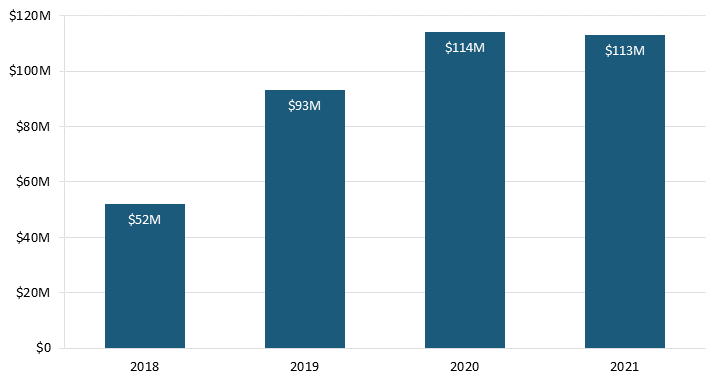

Investment in robotic equipment in the United States has increased in the warehousing and storage industry. As shown in figure 4, capital expenditures on robotic equipment more than doubled from $52 million in 2018 to $113 million in 2021.[121] However, these numbers are imprecise because they miss investments in robotics in logistics facilities made by online retailers. The retail sector, which includes online retailers as well as brick-and-mortar stores, is the second-largest investor in robotics in the United States, accounting for 11.4 percent of all robotics expenditures.[122]

Figure 4: Capital expenditures for robotic equipment in the warehousing and storage industry

The Case for Government Policy

Policymakers should facilitate robot adoption and innovation for four reasons.[123]

First, warehouse automation boosts supply chain resiliency. By supporting automation, policymakers help firms increase productivity and accelerate the distribution of goods across the country. These effects, combined with other benefits of robot innovation and adoption, strengthen U.S. supply chains and help insulate them from future shocks.[124]

Second, many firms focus on short-term profitability rather than the more rational goal of maximizing net present value profits. Firms focused exclusively on short-term profits may underinvest in robotics equipment, even if it decreases their long-term value and profits. As such, government incentives can better align firms’ time horizons with societally optimal time horizons.

Third, many firms avoid adopting new technology because they are risk averse and lack information. Smaller firms in particular may not have the resources to make appropriate investment decisions. One study shows that “being in a region with a large pool of existing robot users and robot-related skilled labor positively affects establishments’ decisions on robot adoption.”[125] As such, firms do not capture all the societal benefits of their investments in robotics—and absent government policies, will underinvest.

Fourth, there are other positive spillovers.[126] Firms are not able to capture all the benefits from their investments in capital equipment for a number of reasons. One is that investments in new machinery give workers knowledge about these new investments and in turn transmit this information to their next employer, leading them to also invest in new machinery. Indeed, users of new equipment learn what modifications need to be made and then transfer this experience to other firms in a host of ways, including interfirm labor movement, trade shows, and professional association meetings. In addition, some equipment, especially information technology, has network effects wherein the benefits to other firms from a firm adopting the technology are significant. One study notes that “firm-level investments in communications technologies can create benefits for business partners. Alternatively, investments in information technologies can produce knowledge that can spill over between firms.”[127] This is not to say that all corporate capital investments have these characteristics. When a firm buys office furniture, a vehicle, or a new building, the suppliers (the makers of the furniture, vehicle, or building) benefit, but the purchase does not create spillovers because the equivalent number of jobs would have been created elsewhere in the economy had the firm spent those same funds elsewhere. But when a firm buys new equipment or software technology, there is a spillover effect because other firms are able to boost their own productivity because of it.

Recommendations

Some of the logistics facilities that support e-commerce have adapted to meet new demands, but not all of them have had the capacity to invest in automation in order to boost productivity.[128] Given the benefits of automation in logistics facilities, policymakers should establish several measures to encourage the uptake of robotic systems in the sector.

Enact Proactive Tax Policies That Reward Investment in Automation and Robotics

President Trump signed the Tax Cuts and Jobs Act into law in 2017.[129] The law contained a provision permitting companies to fully expense in the first year capital equipment investments.[130] This provision effectively enabled companies to deduct a larger portion of equipment’s real value and encouraged investment in new equipment.[131] However, this provision is only temporary and starts phasing out in 2023. Congress should restore legislation making this provision permanent so companies can continue to fully expense qualified equipment during their first year of service. According to the U.S.-based tax policy nonprofit organization Tax Foundation, making the provision permanent would grow the economy by 0.9 percent, raise wages by 0.8 percent, and add 172,300 jobs.[132]

Congress should avoid any legislation that places a tax on robots. Senator Bernie Sanders (I-VT) has advocated for implementing a tax on robots to slow their adoption and generate revenue for job retraining programs.[133] However, new machinery and equipment help logistics facility workers increase productivity and avoid unnecessary strain.[134] Policymakers should avoid any tax that works against those two purposes in the name of delaying or slowing inevitable growth.[135] And ideally, Congress should restore the investment tax credit that was eliminated in 1986.

Prioritize Robotics Automation in Government Warehouses

Federal agencies, particularly those that use warehouses to store and transport goods both around the country and abroad, should make greater use of robotics automation. For example, DOD should partner with external contractors to adopt robotic automation in its warehouses. In October 2020, DOD announced that it would partner with external contractors to test 5G technologies at five military installations across the United States.[136] These efforts included building smart warehousing capabilities at Naval Base San Diego to improve the transportation of goods between base and naval units and building a smart warehouse for the storage and maintenance of Marine Corps vehicles at Marine Corps Logistics Base Albany.[137] These tests served both the public and private interests, as operating on military bases streamlined the permitting and experimentation processes for private industry partners.[138] As a result, the private sector could operate and test new technologies much quicker than in off-base locations. The tests have proven to be a success thus far.[139] DOD and other federal agencies should continue to incorporate robotic automation in their warehouses and partner with private industry organizations to support the development of robotic technologies and promote their further adoption.[140]

Likewise, USPS has several different types of facilities dedicated to the processing and distribution of mail.[141] In July 2022, Postmaster General DeJoy announced that USPS would construct 60 new regional processing centers to make delivery networks more efficient.[142] As part of this modernization effort, Congress should allocate funds to purchase robotic sorting machines and additional systems that could improve the mail sorting process. Increasing automation at post offices could enhance the development of robotic technology by encouraging adoption and usage in other sectors.

Automating government warehouses could also save taxpayers money and enable federal employees to transition to more fulfilling work. For example, the FBI has deployed robots to store and retrieve paper records at its new Central Records Complex in Virginia.[143] By automating the storage and retrieval process, the FBI can manage information requests and digitization more efficiently, transition staff to different jobs, and save on costs.[144]

Target Innovation Funding to Robotics

Policymakers should continue their support for NSF.[145] NSF produces important research that serves to advance U.S. technological capabilities. Due to spillover effects, their work often benefits the U.S. economy as a whole.[146] Congress should increase funding for the agency by at least $500 million to support more research that advances robotics. In certain past robotics funding initiatives, NSF has supported projects designed to complement rather than replace human workers.[147] Going forward, however, NSF should avoid any such restrictions on automation research that might replace human labor.

Increase Funding for the National Institute of Standards and Technology

Congress should similarly increase funding for robotics research at NIST. The agency should then launch a “Warehouse of the Future” initiative that funds projects designed to advance robot innovation and automation. In addition, Congress should broaden the Hollings MEP mandate to include assisting small logistics and warehousing companies, instead of only manufacturing companies.

Modernize Standards for Industrial Mobile Robots in Warehouse Settings

Robots in the workplace pose a slight risk to workers. From 1992 to 2017, there were 41 robot-related fatalities in U.S. workplaces.[148] While the number of robot-related fatalities falls well below the total number of fatal workplace injuries in the United States, policymakers should help companies eliminate all risks for fatal and nonfatal workplace injuries. In order to help workers avoid these potential sources of harm, policymakers should ensure that robotics firms have the resources they need to develop safe robots and create worker training or apprenticeship programs to teach about appropriate robot operation and safety protocols.

NIOSH should work with private organizations, academia, and other government agencies responsible for protecting workers’ safety and well-being to modernize standards that support the safe development and incorporation of industrial mobile robots in warehouse settings. NIOSH is a federal research agency responsible for researching workplace injuries and illnesses and recommending standards to promote safe workplaces to OSHA, which then implements standards to protect workers.

OSHA does not have specific standards for the robotics industry.[149] Instead, the agency relies on industry consensus standards that detail important safety considerations for robot manufacturers, integrators, and owners to assess workplace safety. For example, in early 2022, the agency released an update to the OSHA Technical Manual on Industrial Robot Systems and Industrial Robot System Safety, in partnership with NIOSH and the Association for Advancing Automation, to provide guidance for technical information, potential hazards, and appropriate safeguards for industrial robot systems.[150] By partnering with private industry organizations to protect worker safety instead of issuing its own standards, OSHA enables companies to innovate within the robotics industry without facing unduly burdensome safety requirements. The agency should continue to follow the private industry’s lead in devising appropriate guidance for industrial robots that supports workers’ safety and well-being and promotes innovation.

Moreover, NIOSH and OSHA should review and modernize current standards for rules that unnecessarily hamper innovation. For example, OSHA standards for the control of hazardous energy (lockout/tagout) and machine guarding prevent many companies from fully integrating newer robot systems into their workflows as companies must meet certain requirements designed for outdated technologies. In May 2019, OSHA issued a Request for Information in regard to updating lockout/tagout standards to better accommodate innovation in the robotics industry; however, the agency has not yet initiated a rulemaking process.[151] NIOSH and OSHA should work with private organizations that design industrial mobile robots, warehousing and logistics companies that could implement robotics systems, academia, and other government agencies to revise these standards and enable companies to better integrate robots into their workplaces. Further, in order to account for future innovation, the agencies should focus on performance-based standards instead of design standards. Performance-based standards that protect worker safety would enable companies to safely pursue innovation without requiring that new robots meet the same design requirements as their predecessors.

Support Small Logistics and Warehousing Businesses

SBA launched the Manufacturing Office in early 2022 to support small manufacturers and provide them with capital, counseling, and contracting resources.[152] Through this program, SBA helps more than 50,000 small manufacturers expand their businesses every year.[153]

While the Manufacturing Office serves as a good first step, SBA should extend the office to support more actors in the supply chain, such as logistics and warehousing companies. Many companies involved in the transportation of goods across the country, including 5,000 warehousing and storage companies and 4,900 couriers and express delivery companies, could take advantage of the same resources as small manufacturers and improve the supply chains’ resiliency.[154]

Offer a Robot Award

There is a lack of enthusiasm for robots in the United States, in part due to misguided fears over their potential to cause mass unemployment and hysteria about the “technopocalypse.”[155] This “robophobia” is unfortunate and unwarranted, and discourages research into technologies that could improve economic productivity and raise workers’ quality of life.[156]

In order to counteract this antirobot narrative, policymakers should support robotics research and encourage the adoption of robotic technologies in all industries. To that end, DOC should add a robotics automation award that recognizes outstanding organizations that use robots to improve productivity, as a complement to the he Malcolm Baldridge National Quality Award, which is a presidential honor designed to recognize organizations for performance excellence.[157] Improving recognition of breakthroughs in robotics research could draw more attention to potential applications in logistics facilities and encourage investment in robotic systems.

Raise the Minimum Wage

Certain firms do not adopt robots because wages are so low that the payback time for their investment would become prohibitive. One reason for the low labor costs is Congress has not raised the minimum wage since 2009.[158] As such, Congress should raise it to at least $12 an hour and index it to inflation. While the average wage for warehouse workers is well above the federal minimum wage—$23.71 in April 2023—compensation rates differ according to workers’ location, employer, seniority, and more.[159] Raising the minimum wage may also push wages higher for warehouse workers above the minimum wage due to spillover effects, especially for those in occupations with lower wages.[160] Increasing labor costs will improve the return on investment (ROI) in robotics and other automation technologies.[161] And despite what some economists say, it will not reduce total employment.[162]

Support Workers Displaced by Automation

Policymakers should enact measures to support workers displaced by automation to reduce financial hardships and help them successfully transition to new jobs.[163] For example, stronger state unemployment insurance programs and wage insurance programs for workers who lose their jobs through no fault of their own could better protect workers from financial hardship. Policymakers should also better support workers looking for new employment. Receiving unemployment benefits typically hinges on a worker’s ability to immediately return to the workforce upon finding employment.[164] However, many workers who choose to participate in a job training or further education program would have to prematurely leave the program to receive benefits. While states allow unemployed individuals to receive unemployment benefits while pursuing additional training, they should also partner with nonprofit organizations dedicated to reskilling or job retraining to help workers find and adapt to new jobs.

Establish a National Robotics Strategy Advisory Committee

Congress should enact legislation directing DOC to launch an advisory committee tasked with developing a strategy for supporting robotics adoption and innovation, similar to Australia’s National Robotics Strategy Advisory Committee.[165] The committee should create recommendations for promoting innovation in the robotics industry, lowering the costs of robots, revising education standards to prepare students for workplaces with robotics, supporting workers affected by automation, supporting advanced industries, and more. In developing the strategy, the committee should prioritize improving the United States’ productivity and competitiveness.

About the Author

Morgan Stevens is a research assistant at ITIF’s Center for Data Innovation. She holds a J.D. from the Sandra Day O’Connor College of Law at Arizona State University and a B.A. in economics and government from the University of Texas at Austin.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent 501(c)(3) nonprofit, nonpartisan research and educational institute that has been recognized repeatedly as the world’s leading think tank for science and technology policy. Its mission is to formulate, evaluate, and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit itif.org/about.

Endnotes

[1]. U.S. Bureau of Economic Analysis, “Value added by Industry as a Percentage of Gross Domestic Product,” accessed Thursday, June 1, 2023, https://apps.bea.gov/iTable/?reqid=150&step=2&isuri=1&categories=gdpxind#eyJhcHBpZCI6MTUwLCJzdGVwcyI6WzEsMiwzXSwiZGF0YSI6W1siY2F0ZWdvcmllcyIsIkdkcHhJbmQiXSxbIlRhYmxlX0xpc3QiLCI1Il1dfQ==.

[2]. Matthew Haag and Winnie Hu, “1.5 Million Packages a Day: The Internet Brings Chaos to N.Y. Streets,” The New York Times, October 27, 2019, https://www.nytimes.com/2019/10/27/nyregion/nyc-amazon-delivery.html.

[3]. “Labor Productivity for Selected Service-Providing Industries,” Bureau of Labor Statistics, accessed June 2, 2023, https://www.bls.gov/productivity/highlights/selected-services-industries-labor-productivity.htm.

[4]. Ibid.

[5]. U.S. Census Bureau, E-Commerce Retail Sales as a Percent of Total Sales (annual sales, 2002, 2022; accessed June 2, 2023; retrieved from the Federal Reserve Bank of St. Louis), https://fred.stlouisfed.org/series/ECOMPCTSA#0.

[6]. “Pitney Bowes Parcel Shipping Index forecasts 20 percent industry growth by 2018,” Pitney Bowes, accessed April 14, 2023, https://www.pitneybowes.com/us/shipping-and-mailing/case-studies/pitney-bowes-2017-parcel-shipping-index.html; “Pitney Bowes Parcel Shipping Index,” Pitney Bowes, accessed April 14, 2023, https://www.pitneybowes.com/content/dam/pitneybowes/us/en/shipping-index/pb-2023-parcelshippingIndexInfographic-v5.pdf.

[7]. Kris Goldhair, “Mass Customization is Coming for E-Commerce – Here’s How Manufacturers Can Get It Right,” retail TouchPoints, June 19, 2019, https://www.retailtouchpoints.com/features/executive-viewpoints/mass-customization-is-coming-for-e-commerce-here-s-how-manufacturers-can-get-it-right.

[8]. “Prime Delivery,” Amazon, accessed April 14, 2023, https://www.amazon.com/b?ie=UTF8&node=15247183011.

[9]. Manik Aryapadi et al., “Key principles of designing the omnichannel distribution network of the future” (McKinsey & Company, December 23, 2021), https://www.mckinsey.com/industries/retail/our-insights/key-principles-of-designing-the-omnichannel-distribution-network-of-the-future.

[10]. Larissa Custodio and Ricardo Machado, “Flexible automated warehouse: a literature review and an innovative framework,” The International Journal of Advanced Manufacturing Technology, no. 106 (2020): 533-558, https://link.springer.com/article/10.1007/s00170-019-04588-z.

[11]. “Productivity 101: What is Productivity? > Labor Productivity,” Bureau of Labor Statistics, accessed April 14, 2023, https://www.bls.gov/k12/productivity-101/content/what-is-productivity/what-is-labor-productivity.htm.

[12]. “Labor Productivity for Selected Service-Providing Industries,” Bureau of Labor Statistics, accessed April 14, 2023, https://www.bls.gov/productivity/highlights/selected-services-industries-labor-productivity.htm.

[13]. Custodio and Machado, “Flexible automated warehouse: a literature review and an innovative framework”; Arshia Mehta and Frank Levy, “Warehousing, Trucking, and Technology: The Future of Work in Logistics” (MIT Task Force on Work of the Future, September 2020), https://workofthefuture.mit.edu/wp-content/uploads/2020/09/2020-Research-Brief-Mehta-Levy-4.pdf; Dan Zhang, L.G. Pee, and Lili Cui, “Artificial intelligence in E-commerce fulfillment: A case study of resource orchestration at Alibaba’s Smart Warehouse,” International Journal of Information Management 57 (April 2021): https://www.sciencedirect.com/science/article/abs/pii/S0268401220315036.

[14]. U.S. Bureau of Labor Statistics, Industry Productivity Viewer (General warehousing and storage: employment (thousands), 2014, 2021; accessed June 2, 2023), https://data.bls.gov/apps/industry-productivity-viewer/home.htm.

[15]. “Aging Warehouse Inventory Justifies Record Development,” CBRE, September 14, 2022, https://www.cbre.com/insights/briefs/aging-warehouse-inventory-justifies-record-development.

[16]. Ibid.

[17]. Beth Gutelius and Nik Theodore, “The Future of Warehouse Work: Technological Change in the U.S. Logistics Industry” (U.C. Berkeley Center for Labor Research and Education and Working Partnerships USA, October 2019), https://laborcenter.berkeley.edu/pdf/2019/Future-of-Warehouse-Work.pdf.

[18]. Stephen T. Hopper, “Could the Pandemic’s Effect on Your Warehouse Have a Silver Lining?” Parcel, December 10, 2020, https://parcelindustry.com/article-5603-Could-the-Pandemic&rsquos-Effect-on-Your-Warehouse-Have-a-Silver-Lining.html.

[19]. “Amazon facilities,” Amazon, accessed April 3, 2023, https://www.aboutamazon.com/workplace/facilities.

[20]. Jean-Paul Rodrigue, “The distribution network of Amazon and the footprint of freight digitalization,” Journal of Transport Geography 88 (October 2020): https://www.sciencedirect.com/science/article/pii/S0966692320306074#bb0130.

[21]. Zuopeng Xiao et al., “New paradigm of logistics space reorganization: E-commerce, land use, and supply chain management,” Transportation Research Interdisciplinary Perspectives 9 (March 2021): https://www.sciencedirect.com/science/article/pii/S259019822100004X#b0115.

[22]. Jean-Paul Rodrigue, “The distribution network of Amazon and the footprint of freight digitalization”; Laetitia Dablanc and Catherine Ross, “Atlanta: a mega logistics center in the Piedmont Atlantic Megaregion (PAM),” Journal of Transport Geography 24 (September 2012): 432–442, https://www.sciencedirect.com/science/article/abs/pii/S0966692312001305.

[23]. Jean-Paul Rodrigue, “The distribution network of Amazon and the footprint of freight digitalization.”

[24]. Afonso Vaz de Oliveira et al., “Improvement of the Logistics Flows in the Receiving Process of a Warehouse,” Logistics 6, no. 1 (2022): 22, https://www.mdpi.com/2305-6290/6/1/22.

[25]. Nils Boysen and Malte Fliedner, “Cross dock scheduling: Classification, literature review and research agenda,” Omega 38, no. 6 (December 2010): 413-422, https://www.sciencedirect.com/science/article/abs/pii/S0305048309000772.

[26]. “The Basics: Cross-Docking,” CWI Logistics, last modified July 29, 2020, https://cwi-logistics.com/news/the-basics-cross-docking/; Hong Yan and Shao-long Tan, “Pre-distribution and post-distribution cross-docking operations,” Transportation Research Part E: Logistics and Transportation Review 45, no. 6 (November 2009): 843-859, https://www.sciencedirect.com/science/article/abs/pii/S1366554509000830.

[27]. Dustin Smith and Sharan Srinivas, “A simulation-based evaluation of warehouse check-in strategies for improving inbound logistics operations,” Simulation Modelling Practice and Theory 94 (July 2019): 303-320, https://www.sciencedirect.com/science/article/abs/pii/S1569190X19300280.

[28]. Jean-Paul Rodrigue, “The distribution network of Amazon and the footprint of freight digitalization.”

[29]. “Onboarding Information,” Amazon Carrier Central, accessed April 14, 2023, https://carriercentral.amazon.com/onboarding.

[30]. Jean-Paul Rodrigue, “The distribution network of Amazon and the footprint of freight digitalization.”

[31]. “Our facilities,” Amazon, accessed April 14, 2023, https://www.aboutamazon.com/workplace/facilities.

[32]. Jean-Paul Rodrigue, “The distribution network of Amazon and the footprint of freight digitalization.”

[33]. Ibid.

[34]. Nayeon Kim et al., “Hyperconnected urban fulfillment and delivery,” Transportation Research Part E: Logistics and Transportation Review 145 (January 2021): https://www.sciencedirect.com/science/article/abs/pii/S1366554520307523.

[35]. “Shipping and Routing Requirements,” Amazon Seller Central, accessed April 14, 2023, https://sellercentral.amazon.com/help/hub/reference/external/G200141510.

[36]. Christian Serrano et al., “Cross-docking Operation Scheduling: Truck Arrivals, Shop-Floor Activities, and Truck Departures,” IFAC-PapersOnline 49, no. 12 (2016): 1353-1358, https://www.sciencedirect.com/science/article/pii/S2405896316310321.

[37]. “Automatic truck loading and unloading systems,” Interlake Metalux, last modified February 1, 2021, https://www.interlakemecalux.com/blog/automatic-truck-loading-unloading-systems.

[38]. Ibid.

[39]. “Solutions for Warehouse Automation,” Boston Dynamics, accessed April 14, 2023, https://www.bostondynamics.com/solutions/warehouse-automation.

[40]. Ibid.

[41]. Boston Dynamics, “Boston Dynamics’ Stretch Robot Now Available for Commercial Purchase,” news release, March 28, 2022, https://www.bostondynamics.com/stretch-robot-now-available-commercial-purchase.

[42]. Boston Dynamics, “DHL Supply Chain to Invest $15 Million to Further Automate Warehousing in North America Via Boston Dynamics Collaboration,” news release, January 26, 2022, https://www.bostondynamics.com/dhl-supply-chain-invest-15-million-boston-dynamics-collaboration.

[43]. Boston Dynamics, “Boston Dynamics’ Stretch Robot Now Available for Commercial Purchase”; Boston Dynamics, “NFI to Deploy Boston Dynamics’ Stretch Robot in $10 Million Deal,” news release, August 30, 2022, https://www.bostondynamics.com/nfi-deploy-boston-dynamics-stretch-robot-10-million-deal.

[44]. “Depalletizing,” Honeywell, accessed April 14, 2023, https://sps.honeywell.com/us/en/products/automation/solutions-by-technology/palletizing-depalletizing/depalletizing.

[45]. “Depalletizers,” Industrial Quick Search, accessed April 14, 2023, https://www.iqsdirectory.com/articles/palletizer/depalletizers.html.

[46]. Niak Wu Koh et al., “RFID for crossdocking: Is it worth the investment?” IEEE Xplore (August 18, 2009): https://ieeexplore.ieee.org/abstract/document/5203970.

[47]. Xingxin Gao et al., “An approach to security and privacy of RFID system for supply chain,” IEEE Xplore (February 7, 2005): https://ieeexplore.ieee.org/document/1388318.

[48]. “RFID in warehousing and distribution,” core rfid, accessed June 7, 2023, https://www.corerfid.com/rfid-%20applications/rfid-in-distribution/.

[49]. Abderahman Rejeb et al., “Internet of Things research in supply chain management and logistics: A bibliometric analysis,” Internet of Things 12 (December 2020): https://www.sciencedirect.com/science/article/pii/S2542660520301499#bib0083.

[50]. Max Garland, “UPS’ RFID initiative to expand to rest of US network in 2023,” Supply Chain Dive, February 10, 2023, https://www.supplychaindive.com/news/ups-rfid-tag-smart-package-initiative-expands-2023/642338/.

[51]. Praveen Adhi, Tyler Harris, and Gerry Hough, “RFID’s Renaissance in Retail,” McKinsey & Company, May 7, 2021, https://www.mckinsey.com/industries/retail/our-insights/rfids-renaissance-in-retail.

[52]. “How Amazon robotics is working on new ways to eliminate the need for barcodes,” Amazon, last modified on December 9, 2022, https://www.amazon.science/latest-news/how-amazon-robotics-is-working-on-new-ways-to-eliminate-the-need-for-barcodes.

[53]. B. Rouwenhorst et al., “Warehouse design and control: Framework and literature review,” European Journal of Operational Research 122, no. 3 (May 2000): 515–533, https://www.sciencedirect.com/science/article/abs/pii/S037722179900020X.

[54]. Ibid.

[55]. Ibid.

[56]. Marcele Elisa Fontana et al., “Multi-criteria assignment model to solve the storage location assignment problem,” Investigacion Operacional 41, no. 7 (November 2020): 1019–1029, https://www.researchgate.net/publication/348518501_MULTI-CRITERIA_ASSIGNMENT_MODEL_TO_SOLVE_THE_STORAGE_LOCATION_ASSIGNMENT_PROBLEM.

[57]. Ibid.

[58]. Charles J. Malmborg and Krishnakumar Bhaskaran, “A revised proof of optimality for the cube-per-order index rule for stored item location,” Applied Mathematical Modeling 14, no. 2 (February 1990): 87-95, https://www.sciencedirect.com/science/article/pii/0307904X9090076H.

[59]. “Six types of ASRS for warehouse automation: how to pick the right one,” Element Logic, accessed April 14, 2023, https://www.elementlogic.co.uk/six-types-of-asrs-for-warehouse-automation-how-to-pick-the-right-one/.

[60]. Ibid.

[61]. Lorie King Rogers, “Automated storage: shuttle technology is taking off,” Modern Materials Handling, June 1, 2012, https://www.mmh.com/article/automated_storage_shuttle_technology_is_taking_off.

[62]. Chang S. Yoon and Gunter P. Sharp, “A structured procedure for analysis and design of order pick systems,” IIE Transactions 28, no. 5 (1996): https://www.tandfonline.com/doi/abs/10.1080/07408179608966285.

[63]. Ibid.

[64]. Ibid.

[65]. Daria Battini et al., “Order picking system design: the storage assignment and travel distance estimation (SA&TDE) joint method,” International Journal of Production Research 53, no. 4 (2015): 1077-1093, https://www.tandfonline.com/doi/abs/10.1080/00207543.2014.944282.

[66]. Brendan Case, “Walmart Bets on Warehouse Robots, Dangles Profit Potential,” Bloomberg, April 4, 2023, https://www.bloomberg.com/news/articles/2023-04-04/walmart-wmt-bets-on-warehouse-robots-hints-at-speedier-profit-gain#xj4y7vzkg.

[67]. Joseph N. DiStefano, “Inside Amazon’s largest warehouse – where you’ll find more robots than people,” The Philadelphia Inquirer, October 17, 2021, https://www.inquirer.com/business/amazon-robots-delaware-largest-warehouse-fulfillment-20211017.html; Alejandra Salgado, “DHL Supply Chain, Locus Robotics plan to deploy 5k robots worldwide in deal expansion,” Supply Chain Dive, May 11, 2023, https://www.supplychaindive.com/news/DHL-Supply-Chain-Locus-Robotics-expand-agreement-5K-autonomous-mobile-robots/649965/.

[68]. “Seven Types of Warehouse Robots: Considerations for Leveraging Robots in the DC,” Fortna, accessed April 14, 2023, https://www.fortna.com/insights-resources/seven-types-of-warehouse-robots-considerations-for-leveraging-robots-in-the-dc/.

[69]. Ítalo Renan de Costa Barros and Tiago Pereira Nascimento, “Robotic Mobile Fulfillment Systems: A survey on recent developments and research opportunities,” Robotics and Autonomous Systems 137 (March 2021): https://www.sciencedirect.com/science/article/abs/pii/S0921889021000142.

[70]. Rich Reba, “Fulfillment automation: Where are 3PLs and shippers investing?” Ryder Ecommerce, May 9, 2022, https://whiplash.com/blog/fulfillment-automation/.

[71]. “The Latest Technological Innovations in Autonomous Mobile Robots,” A3 blog, May 5, 2018, https://www.automate.org/blogs/the-latest-technological-innovations-in-autonomous-mobile-robots

[72]. International Federation of Robotics, “Robot mobility is booming,” news release August 6, 2021, https://ifr.org/news/mobile-robots-revolutionize-industry/; Christine Lagorio-Chafkin, “Automated Guided Vehicles: Behind the Swift Business of a Heavy Industry,” Inc, March 25, 2014, https://www.inc.com/christine-lagorio/best-industries/automated-guided-vehicles.html; Patrick Sisson, “Robots Aren’t Done Reshaping Warehouses,” The New York Times, July 12, 2022, https://www.nytimes.com/2022/07/12/business/warehouse-technology-robotics.html.

[73]. Jennifer Smith, “Robotic Arms Are Using Machine Learning to Reach Deeper Into Distribution,” The Wall Street Journal, January 10, 2022, https://www.wsj.com/articles/robotic-arms-are-using-machine-learning-to-reach-deeper-into-distribution-11641852537.

[74]. Allison Marsh, “In 1961, the First Robot Arm Punched In” (IEEE, August 30, 2022), https://spectrum.ieee.org/unimation-robot.

[75]. Ibid.

[76]. Liz Young, “Amazon Looks to Sparrow to Carry its Robotics Ambitions,” The Wall Street Journal, November 18, 2022, https://www.wsj.com/articles/amazon-looks-to-sparrow-to-carry-its-robotics-ambitions-11668797969.

[77]. John Roach, “Pinch-grasping robot handles items with precision,” Amazon, September 7, 2022, https://www.amazon.science/latest-news/pinch-grasping-robot-handles-items-with-precision.

[78]. Ibid.

[79]. Jennifer A. Kingston, “Humanoid robots are coming to a warehouse near you,” Axios, March 29, 2023, https://www.axios.com/2023/03/29/robots-workers-humanoid-warehouse-amazon.

[80]. Ibid.

[81]. “Distribution – Logistics – Warehouse – 3PL Packaging Equipment,” Robopac USA, accessed April 14, 2023, https://robopacusa.com/distribution-industry/.

[82]. “3M-Matic™ Case Sealers,” 3M, accessed April 14, 2023, https://www.3m.com/3M/en_US/packaging-shipping-fulfillment-us/products/packaging-equipment/3m-matic-case-sealers/.

[83]. Bureau of Labor Statistics, Injuries, Illnesses, and Fatalities (Incidence rates of nonfatal occupational injuries and illnesses by industry and case type, 2021; accessed May 19, 2023), https://www.bls.gov/iif/nonfatal-injuries-and-illnesses-tables/table-1-injury-and-illness-rates-by-industry-2021-national.htm#soii_n17_as_t1.f.5.

[84]. “Workplace Safety Index: Transportation and warehousing,” Liberty Mutual, accessed April 14, 2023, https://business.libertymutual.com/wp-content/uploads/2022/06/WSI-1008_2022.pdf.

[85]. Ibid.

[86]. Dominic Loske et al., “Logistics Work, Ergonomics and Social Sustainability: Empirical Musculoskeletal System Strain Assessment in Retail Intralogistics,” Logistics 5, no. 4 (2021): https://www.mdpi.com/2305-6290/5/4/89#sec5-logistics-05-00089.

[87]. Eric Grosse, Christoph Glock, and W. Patrick Neumann, “Human factors in order picking: A content analysis of the literature,” International Journal of Production Research 55, no. 5 (May 2016): https://www.researchgate.net/publication/302458871_Human_factors_in_order_picking_A_content_analysis_of_the_literature.

[88]. Jason Del Rey, “Amazon’s robots are getting closer to replacing human hands,” Vox, September 27, 2022, https://www.vox.com/recode/2022/9/27/23373588/amazon-warehouse-robots-manipulation-picker-stower.

[89]. Joe Lui et al., “Research: How Do Warehouse Workers Feel About Automation?” Harvard Business Review, February 11, 2022, https://hbr.org/2022/02/research-how-do-warehouse-workers-feel-about-automation.

[90]. Ibid.

[91]. Custodio and Machado, “Flexible automated warehouse: a literature review and an innovative framework.”

[92]. Verne Kopytoff, “In Warehouses, Kiva’s Robots Do the Heavy Lifting,” MIT Technology Review, July 20, 2012, https://www.technologyreview.com/2012/07/20/184844/in-warehouses-kivas-robots-do-the-heavy-lifting/.

[93]. Peter Van Alstine, “Four Reasons to Rethink Your Ecommerce Fulfillment Operations Using a Robotic Shuttle Put Wall,” Supply Chain 247, March 8, 2022, https://www.supplychain247.com/article/four_reasons_to_rethink_your_ecommerce_fulfillment_operations/berkshire_grey.

[94]. Jeffrey Dastin, “Exclusive: Amazon rolls out machines that pack orders and replace jobs,” Reuters, May 13, 2019, https://www.reuters.com/article/us-amazon-com-automation-exclusive/exclusive-amazon-rolls-out-machines-that-pack-orders-and-replace-jobs-idUSKCN1SJ0X1.

[95] Ibid.

[96] Ibid.

[97] Ibid.

[98]. Marc Wulfraat, “A Supply Chain Consultant Evaluation of Kiva Systems (Amazonrobotics)” (white paper, MWPVL International, 2012): https://www.mwpvl.com/html/kiva_systems.html.

[99]. Ibid.

[100]. Ibid.

[101]. Melissa Repko, “Walmart chases higher profits powered by warehouse robots and automated claws,” CNBC, last modified April 12, 2023, https://www.cnbc.com/2023/04/11/walmart-warehouse-automation-powers-higher-profits.html.

[102]. “Walmart Outlines Growth Strategy, Unveils Next Generation Supply Chain at 2023 Investment Community Meeting,” SEC.gov, April 4, 2023, https://www.sec.gov/Archives/edgar/data/104169/000010416923000026/exhibit991-8xk442023.htm.

[103]. “Automation and Logistics Real Estate #2: How Automation Can Help Navigate Urgent Supply Chain Challenges,” Prologis, last modified on December 9, 2020, https://www.prologis.com/news-research/global-insights/automation-and-logistics-real-estate-2-how-automation-can-help.

[104]. Matt Leonard, “E-commerce warehouse productivity could improve up to 20% with greater automation: Prologis,” Supply Chain Dive, February 9, 2021, https://www.supplychaindive.com/news/ecommerce-warehouse-productivity-prologis-robot-automation-prologis/594728/.

[105]. Laura Worker, “Greening the Supply Chain Through Warehouse Automation,” Inbound Logistics, June 2010, https://www.inboundlogistics.com/articles/greening-the-supply-chain-through-warehouse-automation.

[106]. “Warehouse Automation Market,” Logistics IQ, accessed April 14, 2023, https://www.thelogisticsiq.com/research/warehouse-automation-market/.

[107]. Ibid.

[108]. John Barbee et al., “Automation has reached its tipping point for omnichannel warehouses” (McKinsey & Company, December 27, 2021), https://www.mckinsey.com/industries/retail/our-insights/automation-has-reached-its-tipping-point-for-omnichannel-warehouses; David Edwards, “Revenues from robotics in warehouses to exceed $51 billion by 2030,” Robotics and Automation News, August 19, 2021, https://roboticsandautomationnews.com/2021/08/19/revenues-from-robotics-in-warehouses-to-exceed-51-billion-by-2030/45636/.

[109]. “Warehouse Automation Market,” Logistics IQ.

[110]. “About Daifuku,” Daifuku, accessed April 14, 2023, https://www.daifuku.com/company/summary/.

[111]. “Automation Solutions for Third-Party Logistics,” Dematic, accessed April 14, 2023, https://www.dematic.com/en-us/industries/third-party-logistics/; “Automation,” Honeywell, accessed April 14, 2023, https://sps.honeywell.com/us/en/products/automation.

[112]. Rowan Stott, “How Will Amazon’s U-turn in Fulfillment Center Expansion Affect the Warehouse Automation Market?” Interact Analysis, June 1, 2022, https://interactanalysis.com/insight/how-will-amazons-u-turn-in-fulfillment-center-expansion-affect-the-warehouse-automation-market/.

[113]. “How Amazon deploys collaborative robots in its operations to benefit employees and customers,” Amazon, last modified on June 26, 2023, https://www.aboutamazon.com/news/operations/how-amazon-deploys-robots-in-its-operations-facilities.

[114]. Roberto Michel, “2022 Warehouse/DC Operations Survey: Recalibrating operations and spending,” Modern Materials Handling, November 7, 2022, https://www.mmh.com/article/2022_warehouse_dc_operations_survey_recalibrating_operations_and_spending.

[115]. Ibid.

[116]. Ibid.

[117]. National Center for Science and Engineering Statistics, Annual Business Survey: 2021 (Technologies and digital activities, use of robotics technology, by industry: 2020, use of automated guided vehicles (AGV) or AGV systems technology, by industry: 2020; accessed May 24, 2023) https://ncses.nsf.gov/pubs/nsf23313.