Moore’s Law Under Attack: The Impact of China’s Policies on Global Semiconductor Innovation

China’s mercantilist strategy to grab market share in the global semiconductor industry is fueling the rise of inferior innovators at the expense of superior firms in the United States and other market-led economies. That siphons away resources that would otherwise be invested in the virtuous cycle of cutting-edge R&D that has driven semiconductor innovation for decades.

KEY TAKEAWAYS

Key Takeaways

Contents

A Brief Overview of the Global Semiconductor Industry 3

Innovation Dynamics in the Global Semiconductor Industry 9

China’s Innovation Mercantilism in Semiconductors 20

Impacts on Semiconductor Industry Production and Competition. 36

Impacts on Semiconductor Industry Innovation. 46

Introduction

Semiconductors represent perhaps the world’s most-important industry, as they are the foundation of a wide array of products and services.[1] Moreover, they play a key enabling role in emerging technologies such as artificial intelligence (AI), high-performance computing (HPC), 5G, the Internet of Things, and autonomous systems, among others.

Unlike industries in which China has already gained significant global market share—including high-speed rail, solar panels, and telecom equipment—China’s global market share and competitiveness in semiconductors, especially with regard to Chinese-headquartered firms, is still quite modest, with the global leaders largely based in Europe, Japan, South Korea, Taiwan, and the United States.

It is because of this that China has targeted the industry for global competitive advantage, as detailed in a number of government plans, including “Made in China 2025.” China has taken a wide range of steps to propel itself into becoming a major global semiconductor competitor. However, while some of these policy actions are fair and legitimate, most are not and are “innovation mercantilist” in nature, seeking to unfairly benefit Chinse firms at the expense of more-innovative foreign firms.

Competition can drive innovation, but only if it is market-based. When Apple came out with the iPhone and helped drive Blackberry from the market, this spurred innovation, because it was based on consumer demand for a better product, with innovation driving the change. In contrast, Chinese semiconductor firms lag significantly behind the global leaders, usually by two generations of chip development, and Chinese firms patent less than the global leaders. As such, Chinese chip sales largely depend on unfair support from the Chinese government; and each sale reduces the pace of global semiconductor innovation by taking market share and revenue away from more-innovative non-Chinese firms. In fact, this report estimates that without Chinese innovation mercantilist policies in the semiconductor industry, there would be more than 5,000 additional U.S. patents in the industry annually than there are now.

This report provides an overview of the semiconductor industry and the innovation dynamics driving it, including an explication of why innovation mercantilist policies harm innovation. It then describes Chinese innovation mercantilism in the sector and examines the deleterious effect of China’s policies on global innovation in the sector. Finally, it provides policy recommendations for how policymakers can address these challenges.

A Brief Overview of the Global Semiconductor Industry

The term “semiconductor” refers to a solid substance—such as silicon or geranium—which has electrical conductivity properties allowing it to be used either as a conductor or an insulator. Semiconductors, also referred to as integrated circuits (ICs), constitute the brains powering electronic equipment, providing the computational and storage capacity underpinning digital computing. Semiconductors pack as many as 30 billion transistors onto a chip as small as the size of a square centimeter, with circuits measured at the nanoscale (“nm,” a unit of length equal to one-millionth of a meter) level, with the very-newest semiconductor fabrication facilities producing semiconductors at 5nm and 3nm scales.[2] Leading-edge semiconductors contain transistors that are 10,000 times thinner than a human hair, operating at tolerances smaller even than the size of the coronavirus. In 2019, the global semiconductor industry generated $412 billion in revenues and shipped over 1 trillion semiconductors.[3] Analysts expect the industry to grow to $730 billion by 2026.[4]

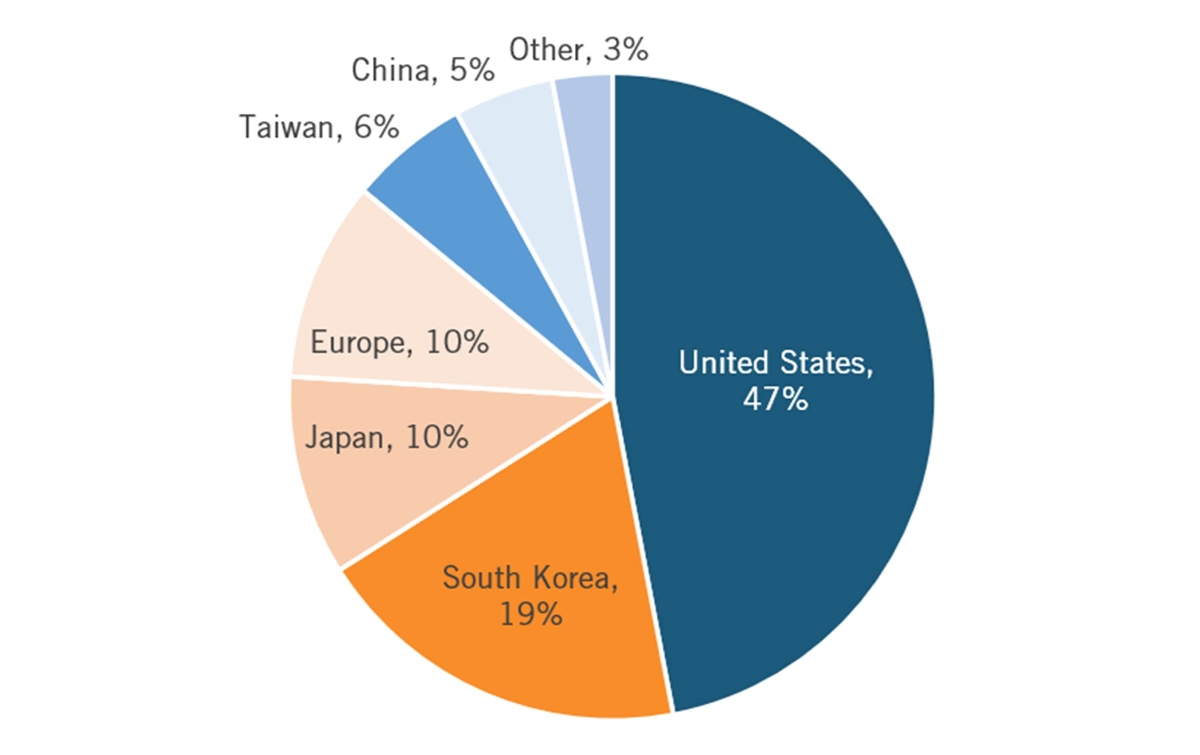

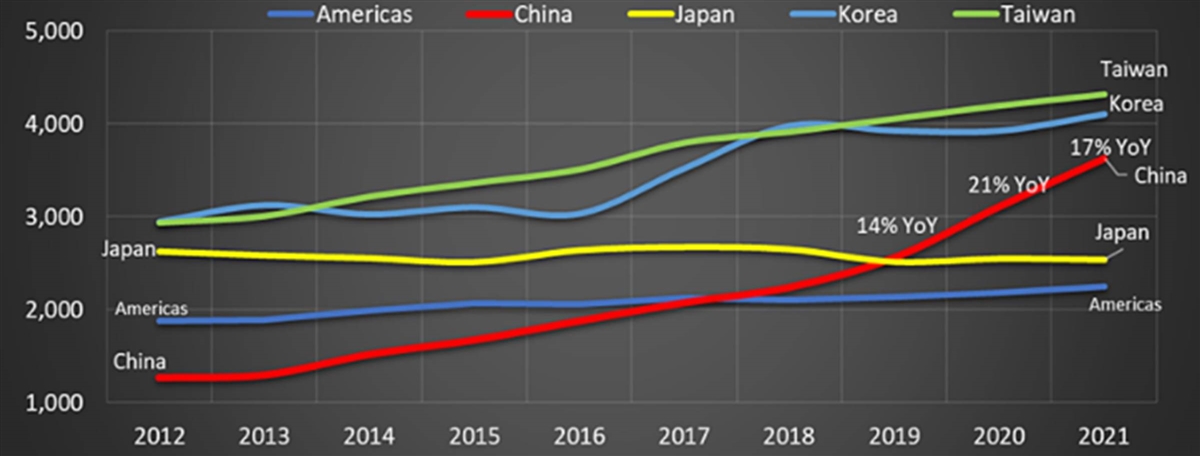

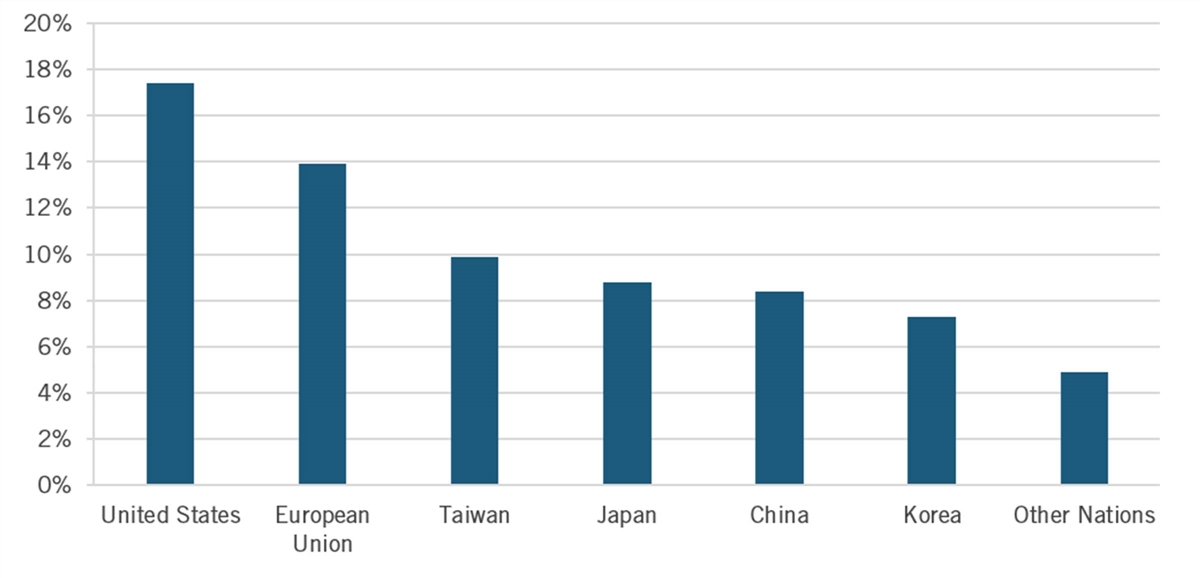

In 2019, U.S.-headquartered semiconductor enterprises held a 47 percent market share of global semiconductor industry sales (down about 5 percent from the 51.8 percent share they held in 2012), followed by South Korean firms with 19 percent, Japanese and European firms with 10 percent each, Taiwanese firms with 6 percent, and Chinese enterprises with 5 percent. (See figure 1.)

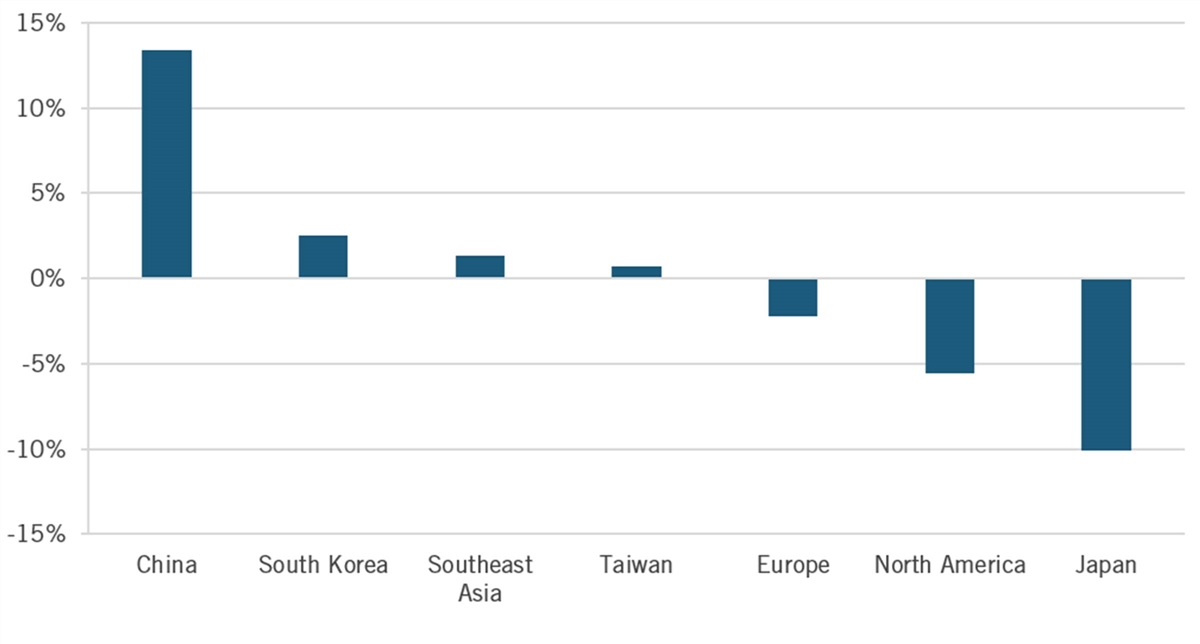

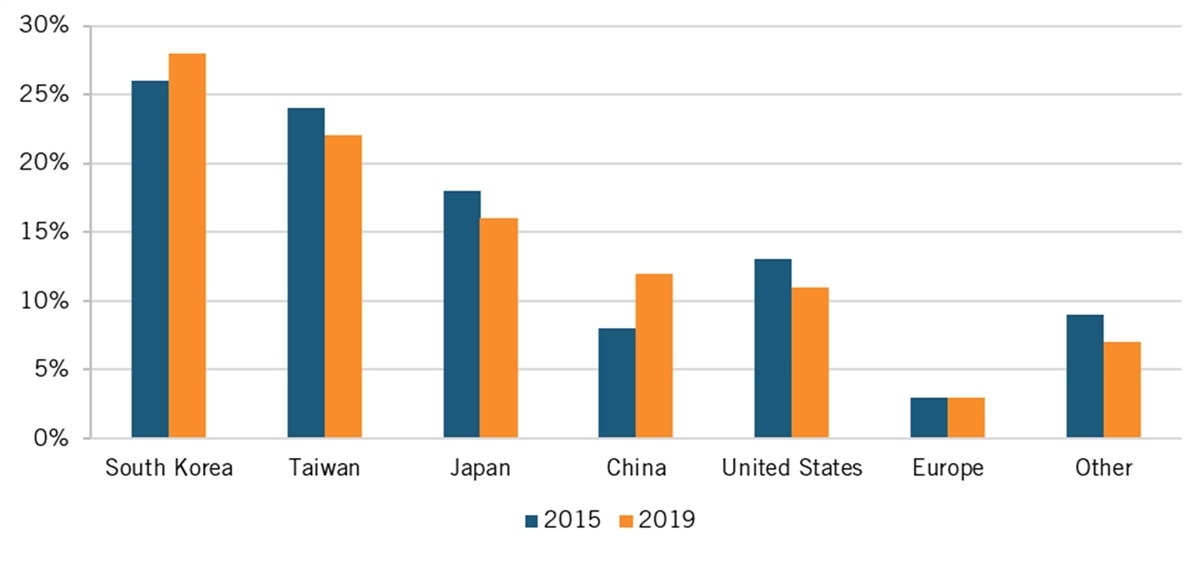

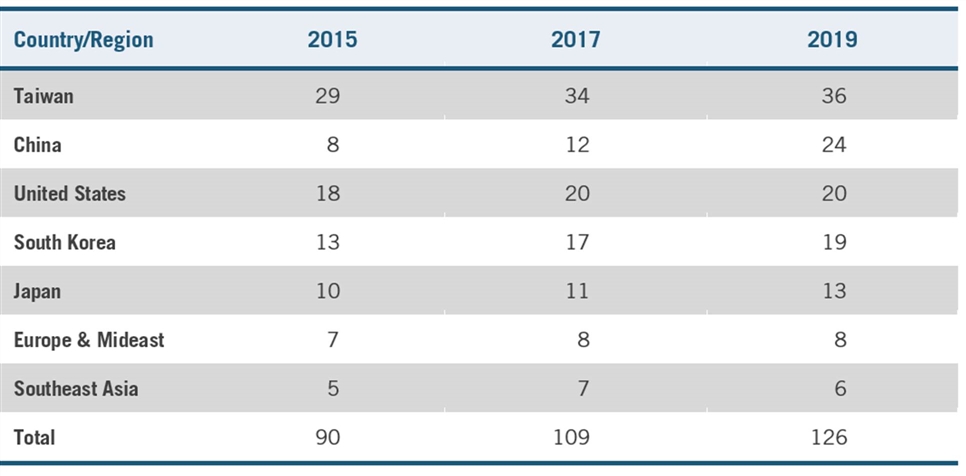

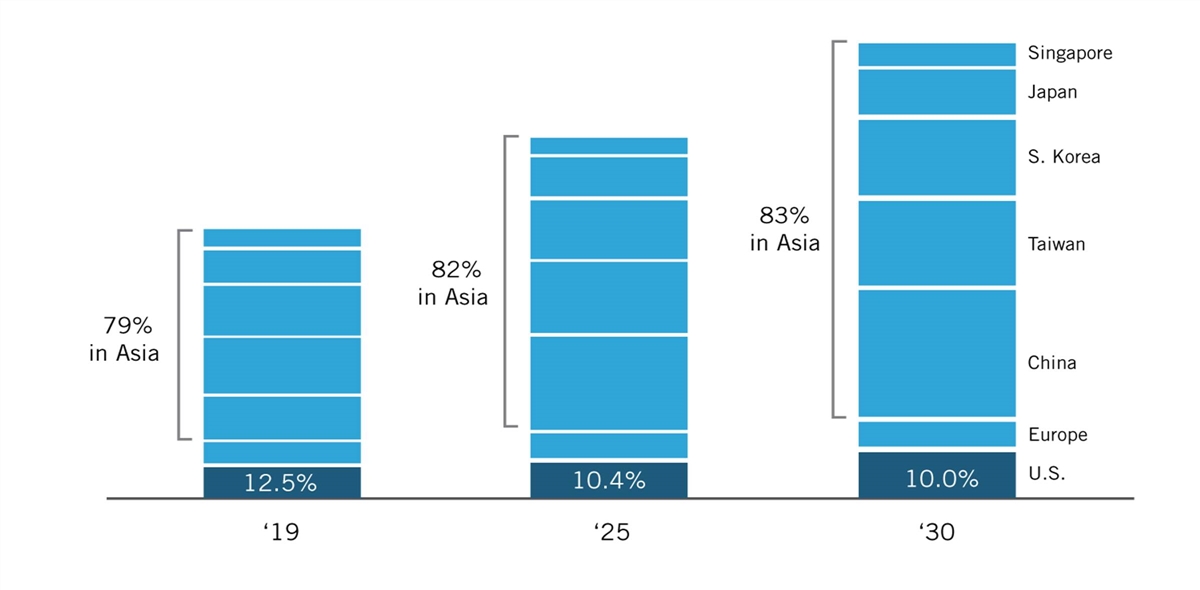

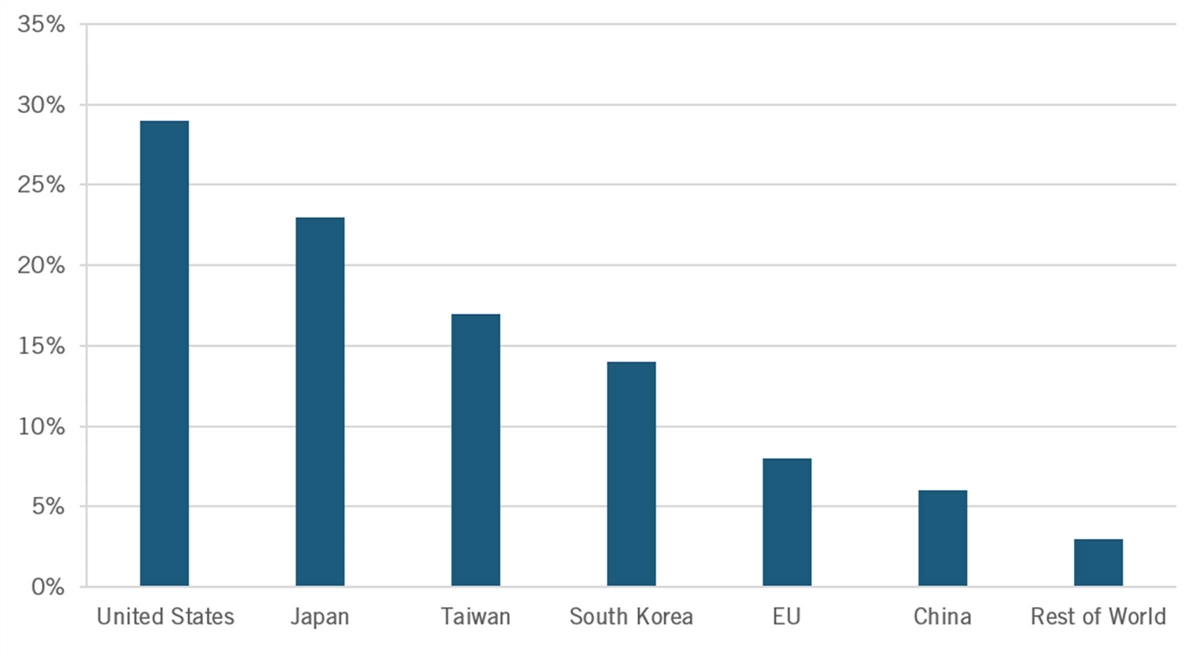

However, production shares are different, as many U.S. semiconductors are produced in places such as Taiwan and China. In fact, as of 2019, the United States possessed just 11 percent of global semiconductor fabrication capacity, whereas South Korea held 28 percent, Taiwan 22 percent, Japan 16 percent, China 12 percent, and Europe 3 percent. (See figure 2.) China’s share of global semiconductor fabrication capacity doubled from 2015 to 2019. As of year-end 2020, there were just 20 semiconductor fabrication facilities (“fabs”) operating in the United States.[5]

Figure 1: 2019 Global semiconductor industry sales market share by nationally headquartered company[6]

Figure 2: Global semiconductor fabrication capacity by country[7]

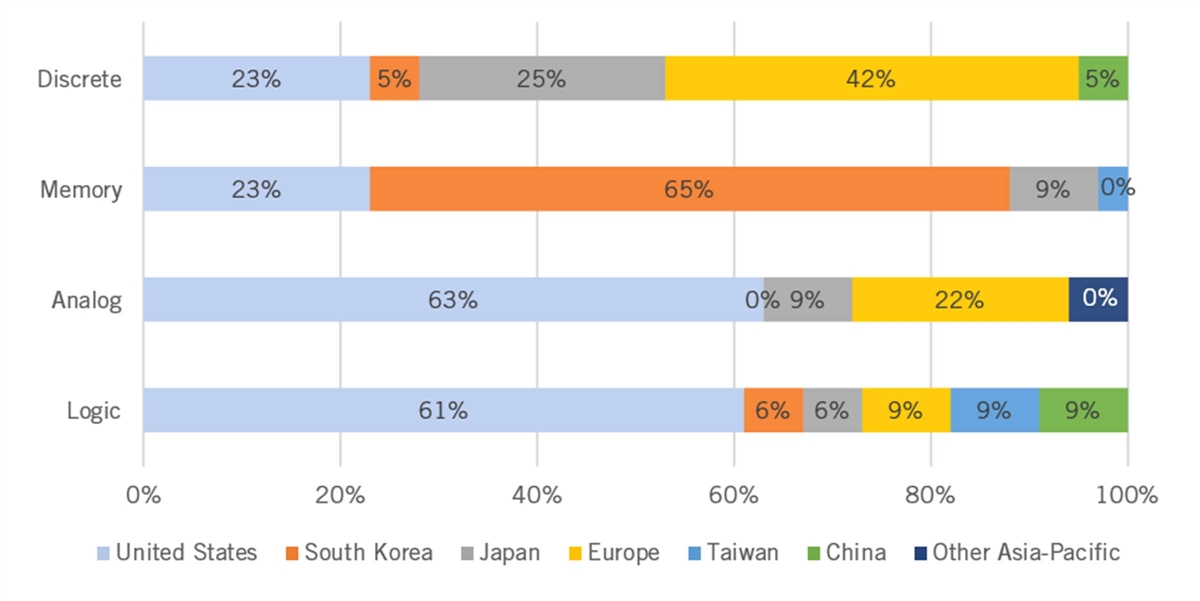

The four main types of semiconductor are logic chips, memory (usually dynamic random-access memory (DRAM) or NAND) chips, analog chips (those which generate a signal or transform signal characteristics, and which are especially prevalent in automotive and audio applications), and discrete chips (ones designed to perform specific electronic functions). In terms of market share by location of company headquarters for each major segment of the global semiconductor industry, in 2019, the United States led clearly in logic and analog, South Korea led in memory, (followed by the United States), and European firms led in discrete semiconductors. Chinese-headquartered companies registered but a 9 percent share of the logic market sector and a 5 percent share of the discrete sector. Moreover, as this report shows, if not for massive Chinese government interventions to stand up a domestic industry, Chinese-headquartered companies likely wouldn’t even have had these shares. (See figure 3.)

Figure 3: Semiconductor industry market share, by segment, by nationally headquartered company, 2019[8]

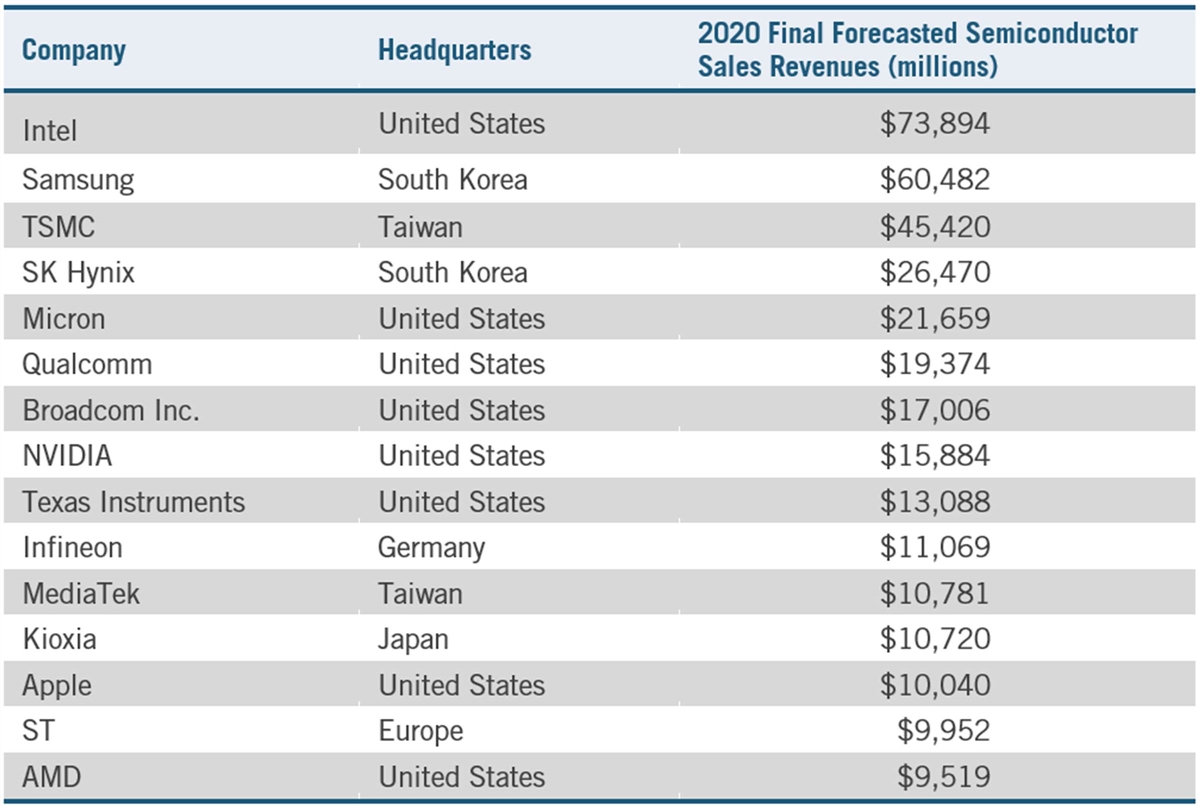

In 2019, the logic segment accounted for $107 billion in global sales, memory for $106 billion, and analog for $54 billion.[9] Intel is the world’s leader in logic chip market share. Texas Instruments, Analog Devices, and Infineon account for the market leaders in the analog chip market, with market shares of 19, 10, and 7 percent, respectively, as of Q1 2020.[10] Samsung and SK Hynix (both headquartered in South Korea) followed by Micron (United States) lead the world in DRAM production, accounting respectively for 44 percent, 29 percent, and 21 percent of global market share as of Q1 2020.[11] Intel, Samsung, TSMC, SK Hynix, and Micron led competitors in final forecasted 2020 semiconductor sales. (See Table 1.) This table also shows the strength of the U.S. fabless sector: U.S.-domiciled semiconductor design companies accounted for 65 percent of fabless global sales in 2019, with leaders including Qualcomm. Broadcom, NVIDIA, Apple, and AMD.[12]

Table 1: Top 15 2020 forecast semiconductor global sales leaders[13]

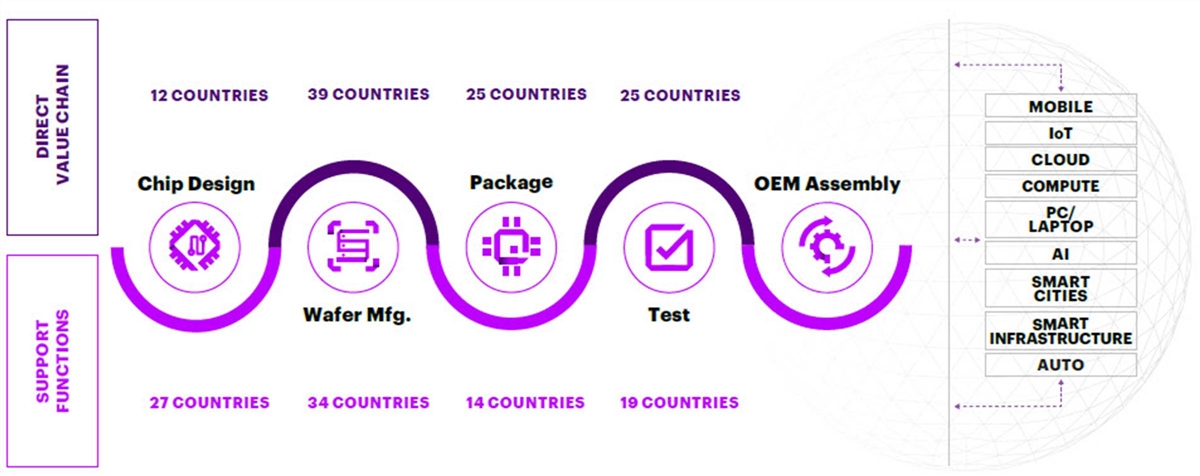

As Table 1 illustrates, the industry is highly globalized, with a large number of countries fielding enterprises competing across multiple facets of semiconductor production, from semiconductor design, to manufacturing, to ATP (assembly, test, and packaging) activities. In fact, each segment of the semiconductor value chain has, on average, firms from 25 countries involved in the direct supply chain and firms from 23 countries involved in support functions. Over 12 countries have enterprises directly engaged in semiconductor chip design and 39 countries have at least 1 semiconductor fabrication facility, while over 25 countries have enterprises engaging in ATP activities.[14] (See figure 4.) A considerable amount of value gets created along each segment of the semiconductor production process, with the U.S International Trade Commission (U.S. ITC) estimating that 90 percent of the value of a semiconductor chip is split evenly between the design and manufacturing phases, with the final 10 percent of value production accounted for through ATP activities.[15]

Figure 4: Number of countries with enterprises participating in various phases of semiconductor production activity[16]

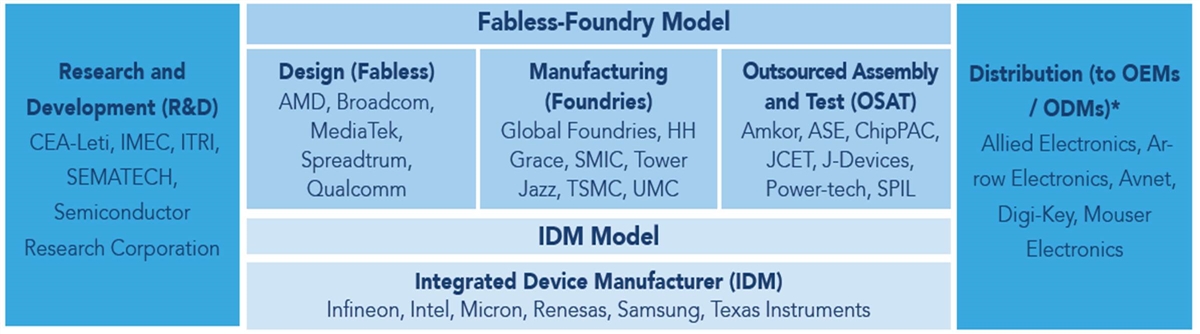

The global breadth and scale of the value chains needed to produce some of the world’s most sophisticated technological devices have given rise to a number of business/operating models in the industry. (See figure 5.) Historically (dating back to the 1950s and 1960s), the semiconductor industry consisted primarily of integrated device manufacturers (IDMs)—that is, firms which conduct all key facets of semiconductor manufacturing, especially design and fabrication, internally. Firms such as Infineon, Intel, Micron, Renesas, Samsung, SK Hynix, and Texas Instruments remain leading IDM players to this day.

Figure 5: Operating models in the semiconductor industry[17]

In 1987, Morris Chang founded the Taiwanese firm TSMC (Taiwan Semiconductor Manufacturing Company), which pioneered the foundry business model, concentrating on contract manufacturing for other semiconductor companies, often ones focused on designing semiconductors for application-specific purposes such as AI, wireless communications, or HPC uses. This essentially represents outsourced manufacturing, or “manufacturing as a service”—and it revolutionized the industry, giving rise to a host of new players beyond TSMC, including America’s Global Foundries, China’s Semiconductor Manufacturing International Corporation (SMIC), and Taiwan’s United Microelectronics Corporation (UMC).

The advent of foundries in turn supported the rise of the fabless industry; that is, companies which focus on semiconductor chip design, such as (now-fabless) Advanced Micro Devices (AMD) (chips for AI, HPC, and graphics), NVIDIA (graphics chips), and Qualcomm (5G and other wireless chips). Collectively, this is referred to as the “fabless-foundry” model.

Outsourced ATP (which may also be referred to as outsourced assembly and test, or OSAT) is performed by a number of global players, including Amkor (United States), ASE Technology (Malaysia), J-Devices (Japan), Power-Tech (China), and Siliconware Precision Industries (Taiwan). On the front end of the process are companies and consortia that focus on semiconductor research and development (R&D) activity, such as CEA-Leti (France), Imec (Belgium), ITRI (Taiwan), SEMATECH (United States), and the Semiconductor Research Corporation (United States).

Whereas almost 30 companies manufactured integrated circuits at the leading-edge of technology 20 years ago, only 5 do so today (Intel, Samsung, TSMC, Micron, and SK Hynix).

Also of high import are another set of companies—notably Applied Materials (United States), ASML (the Netherlands), KLA Tencor (United States), and Lam Research (United States)—which manufacture the machines and tooling equipment that run semiconductor fabs. The global semiconductor manufacturing equipment industry generated $62 billion in revenues itself in 2020, with revenues expected to rise at a 9 percent compound annual growth rate (CAGR) to $96 billion by 2025.[18] Finally, a number of enterprises, especially ones from Japan, South Korea, and Taiwan, manufacture chemicals and components essential to the semiconductor manufacturing process. For instance, fluorinated polyimides, a group of specialty polymers that provide physical strength and heat resistance, are produced by Daikin Chemical (Japan), DuPont (United States), Kaneka Asahi Kasei (Japan), and Taimide Technology (Taiwan).[19]

In other words, a key driver of the global semiconductor industry has been specialization, as enterprises—and indeed entire industrial ecosystem clusters within nations—have elected to concentrate their competitive energies on mastering key facets of the semiconductor production process (for instance, Dutch strength in extreme ultraviolet (EUV) lithography, Japanese strength in chemicals and production equipment, Korean strength in memory chips, Taiwanese strength in foundries, or Malaysian and Vietnamese strength in ATP activities).

Innovation Dynamics in the Global Semiconductor Industry

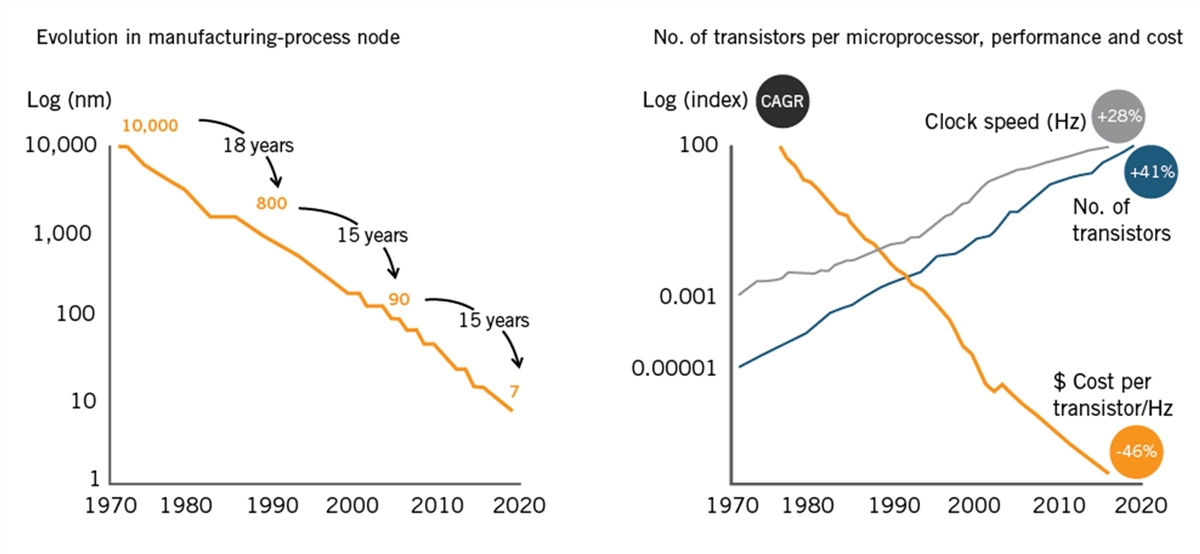

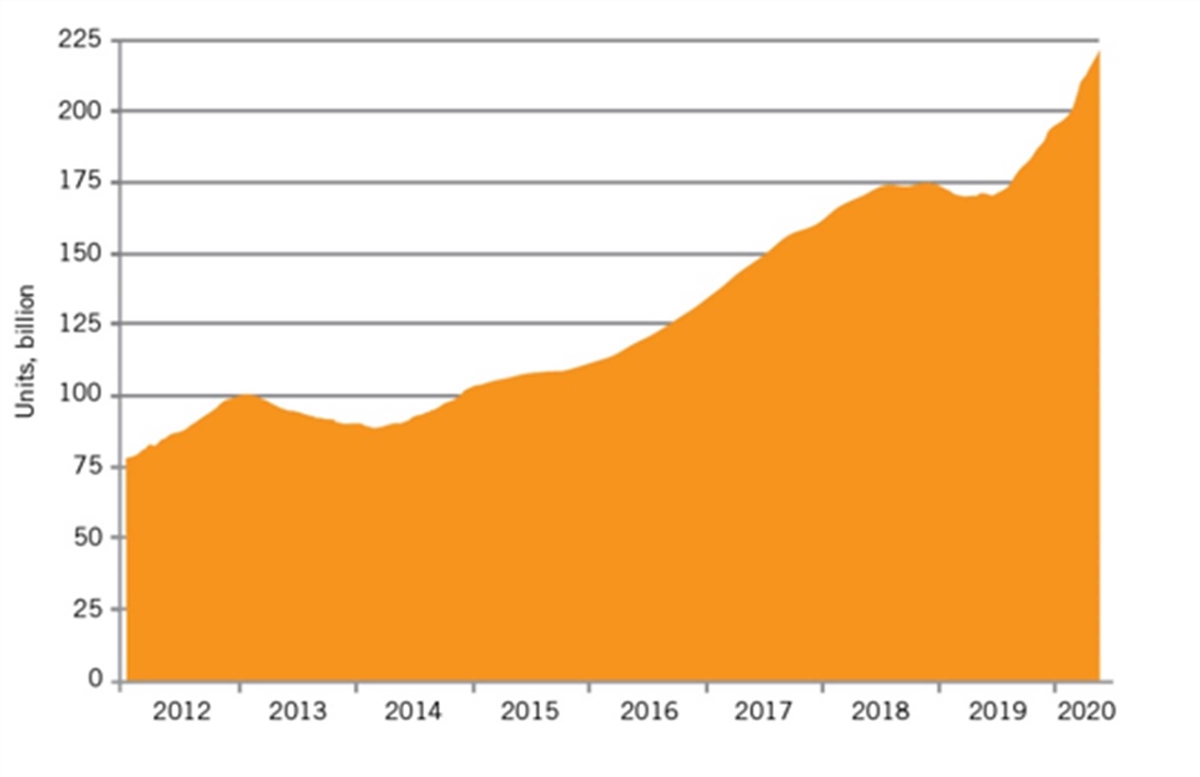

There’s been no industry with an innovation dynamic so clearly and effectively codified as the semiconductor industry’s Moore’s Law. Coined by Intel co-founder Gordon Moore, the “law” (which technologically speaking refers to “process-node scaling”) represents the notion that the number of transistors on a microchip doubles about every two years, effectively meaning a semiconductor’s capability in terms of speed and processing is doubled, even though its cost is halved. Moore’s prediction has proven remarkably prescient—and up to the present day at least, highly reliable. The innovation process captured by Moore’s Law has delivered tremendous improvements in semiconductor performance and cost: The number of transistors per wafer has increased by a factor of almost 10 million (since Moore articulated the law in 1975), yielding a 100,000-fold gain in processor speed and a cost reduction of more than 45 percent per year for comparable performance.[20] (See figure 6.) Moore’s Law has also offered somewhat of a guiding innovation pathway for the industry, providing an orientation for the efforts of pre-competitive research consortia and their development of long-term industry roadmaps. However, while some have come to take Moore’s Law for granted, one study found that the number of researchers required to achieve Moore’s Law today is more than 18 times larger than the number required in the early 1970s.[21]

Figure 6: Increasing performance, decreasing relative costs of semiconductors over the past half-century[22]

This speaks to an essential point: Innovation in the global semiconductor industry does not arrive like “manna from heaven,” but rather is the result of quite significant investment, starting with the R&D process itself but also extending into the costs required to build, and to operate, modern semiconductor fabs. Intel’s July 2020 announcement that it had fallen at least one year behind schedule in developing its next major advance in chip-manufacturing technology, that is, in moving from 10nm to 7nm technology (and that it might even have to rely on a competitor’s manufacturing facilities for some production), served as a stark reminder that innovation in semiconductors is not easy, inexpensive, or assured.[23] Indeed, keeping Moore’s Law on track has been no sure thing; rather, it’s been the result of hundreds of billions of dollars of investment by industry players from many nations (complemented by government investment in basic and applied research) over the preceding decades.

Industry R&D and CapEx Expenditures

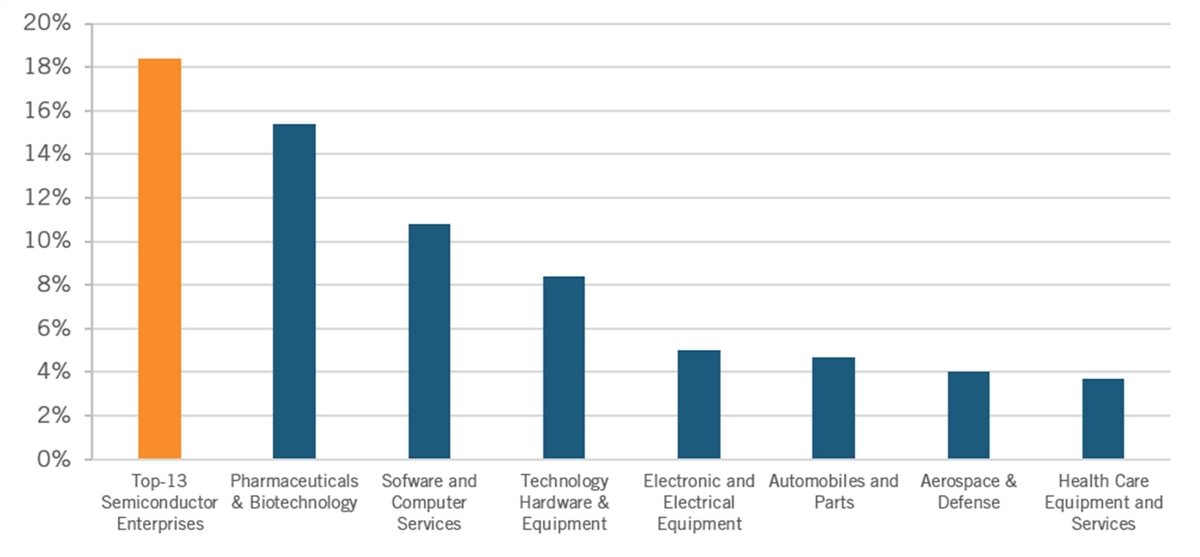

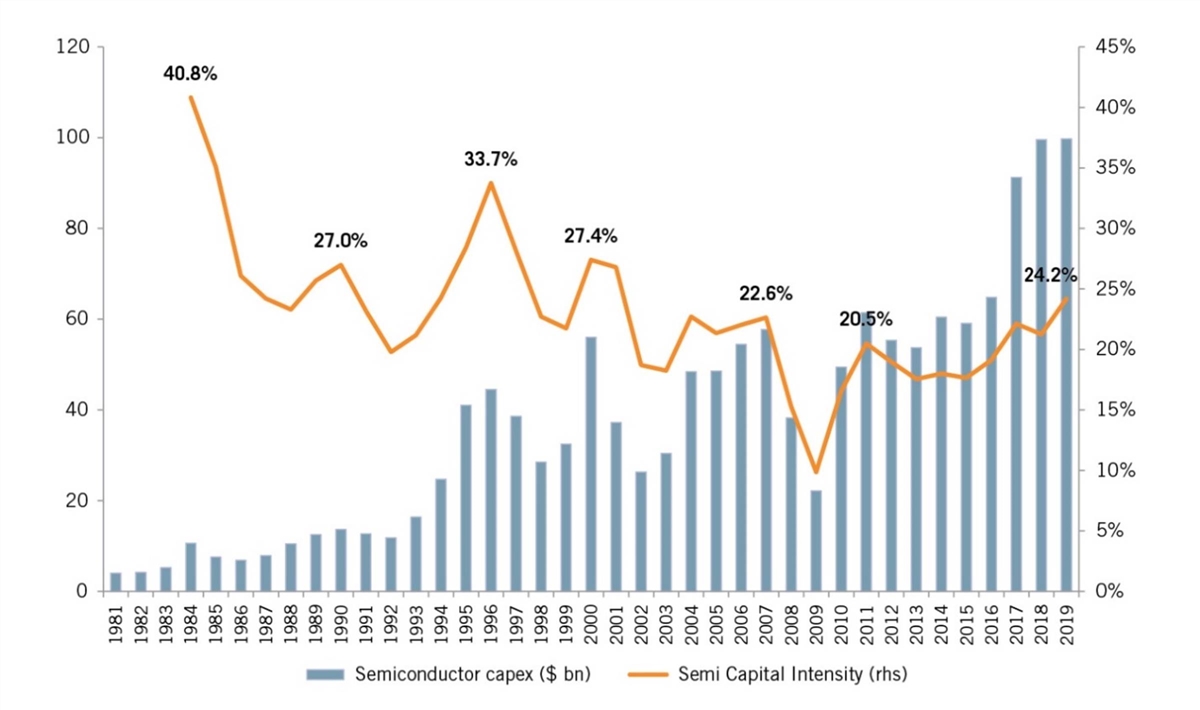

In fact, the global semiconductor industry vies with biopharmaceuticals to be the world’s most R&D-intensive industry. For instance, the top-13 semiconductor firms in the “2019 EU Industrial R&D Investment Scoreboard” invested 18.4 percent of sales in R&D, more than the biopharma industry. (See figure 7.)

Figure 7: Sector R&D intensity in the “2019 EU Industrial R&D Investment Scoreboard”[24]

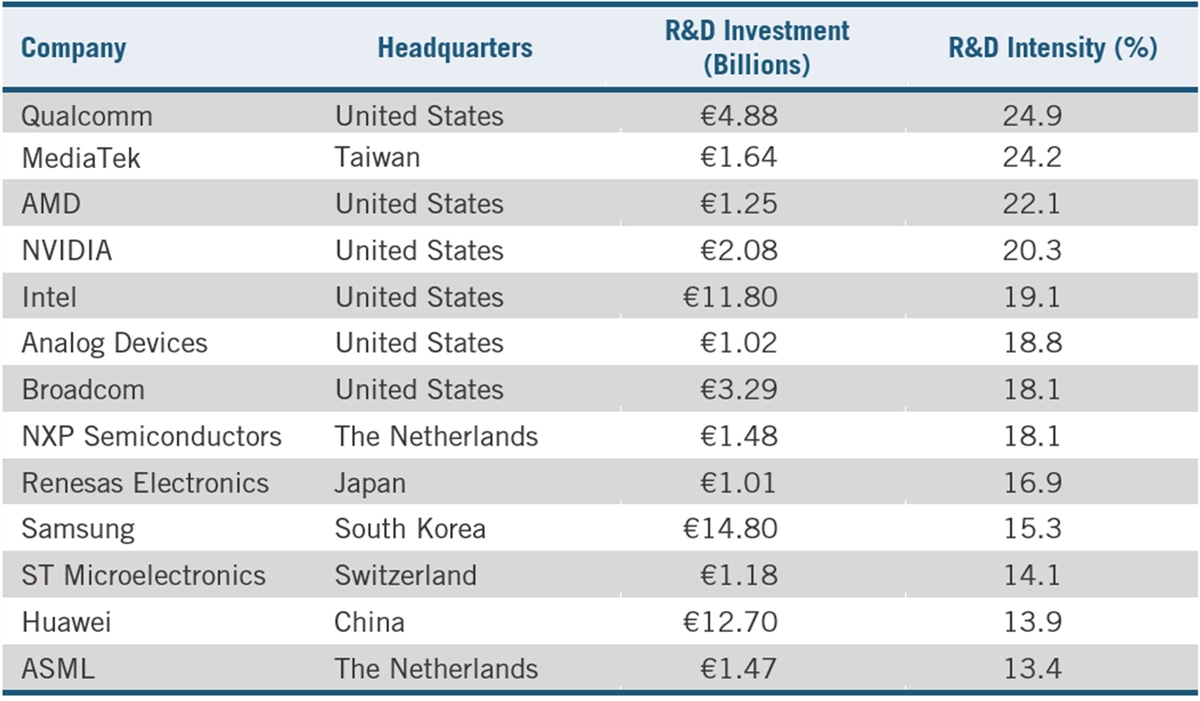

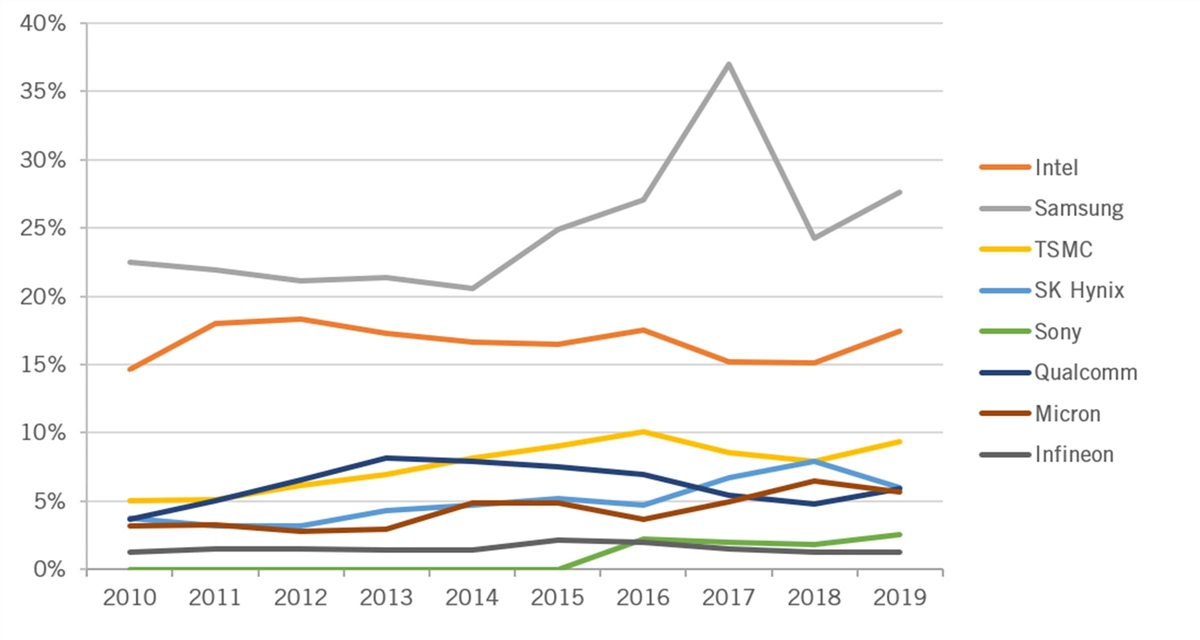

Of the top 13 semiconductor companies in the 2019 “EU Industrial R&D Investment Scoreboard,” six hail from the United States, and the top three most R&D-intensive companies are Qualcomm, Taiwan’s MediaTek, and America’s AMD. (See Table 2.) In terms of actual investment, Samsung led with €14.8 billion (approximately $17.6 billion), followed by Huawei with €12.7 billion ($15 billion), followed by Intel with €11.8 billion ($13.7 billion), although it should be noted that, of these three companies, Intel is the only one whose business is purely semiconductor related.[25] The 2020 version of the report contains less-extensive firm-level data, but it finds that Huawei has become the world’s third-largest R&D investor—its level of R&D having increased by 225 percent over the past five years alone (and by 31.2 percent over the past year)—while Samsung ranks fourth and Intel eighth among the top 10 global R&D investors.[26]

Table 2: Leading semiconductor investors on the “2019 EU Industrial R&D Investment Scoreboard”[27]

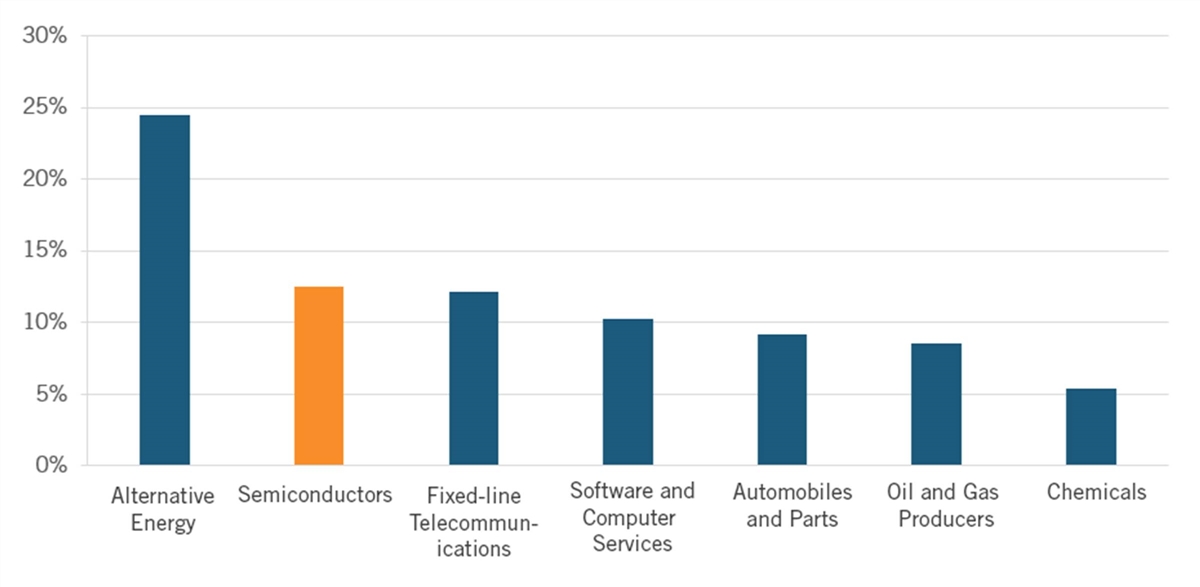

The industry is also highly capital intensive; with the U.S. semiconductor industry’s global gross capital expenditures (CapEx) totaling $31.9 billion in 2019, making the industry’s capital expenditures as a percentage of sales, at 12.5 percent, second only to America’s alternative-energy sector (although that is likely because they counted installed end use customer equipment).[28] (See figure 8.)

Figure 8: U.S. industries’ capital expenditures as a percent of sales[29]

Figure 9: Countries’ headquartered-enterprise’s percent share of global semiconductor industry capital expenditures, 2019[30]

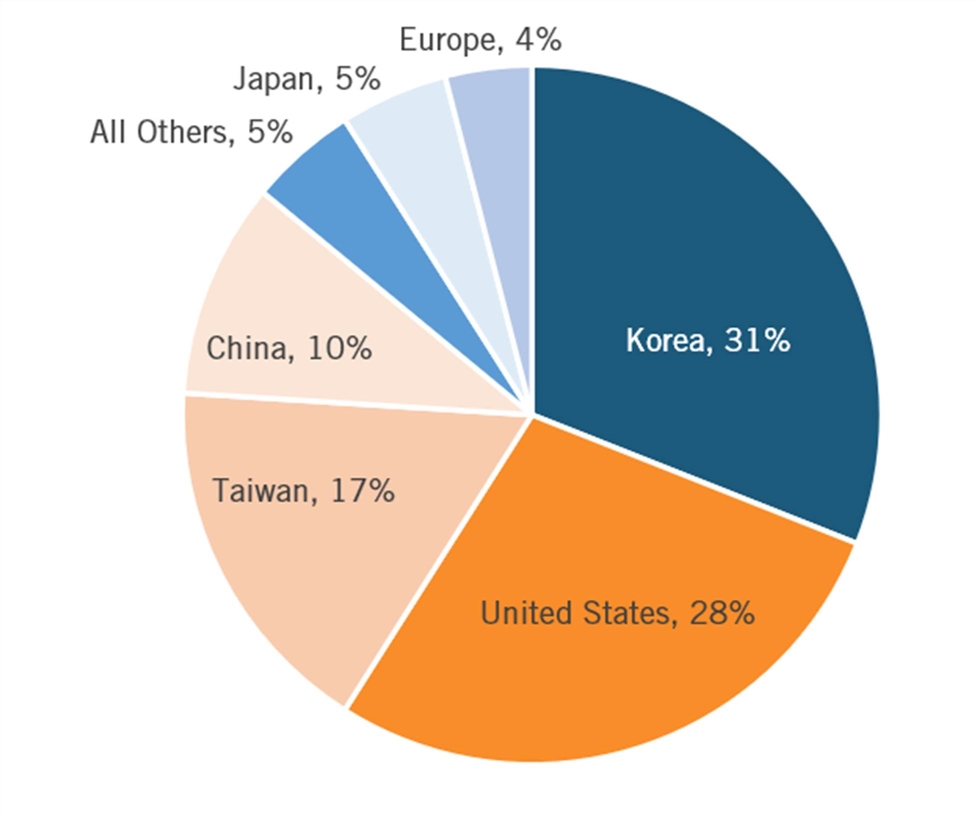

In terms of global capital investment, in 2019, Korean-headquartered enterprises invested 31 percent of global CapEx in the sector, followed by U.S. companies with 28 percent, Taiwanese firms with 17 percent, Chinese firms with 10 percent, Japanese firms with 5 percent, and European firms with 4 percent. (See figure 9.) Again there is concentration among leading nations, and firms: For instance, in 2014, only three firms (Samsung, Intel, and TSMC) accounted for 60 percent of all expenditures at global semiconductor factories.[31]

The global semiconductor industry must be so R&D- and capital-intensive because innovating in the semiconductor industry requires increasingly complex chip designs at ever-smaller scales, especially if the industry is to maintain Moore’s Law. And while some believed at the start of the last decade that the 28 nm threshold would herald the limit of Moore’s Law, materials-engineering breakthroughs over the past decade in EUV lithography, etching, and thin-film deposition have brought the current industry frontier to 5 nm, with fairly clear visibility into the processes needed to get to 3 nm, 2 nm, and even 1 nm-sized integrated circuits.[32]

The number of researchers required to achieve Moore’s Law (i.e., doubling of computer chip density) today is more than 18 times larger than the number required in the early 1970s.

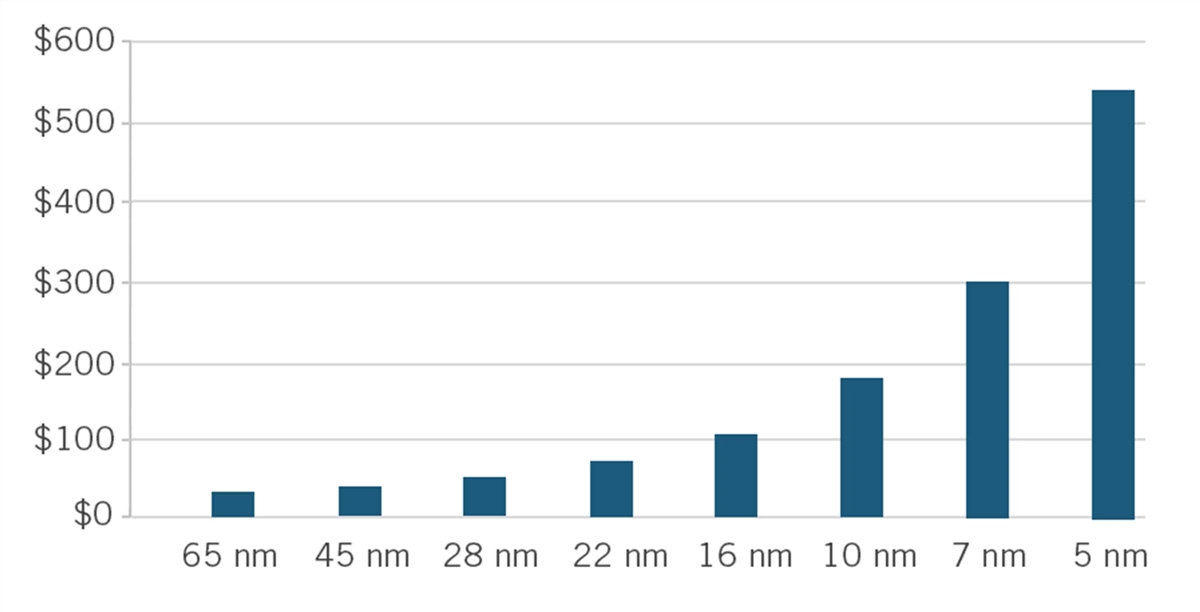

Yet the expertise, capital, and scale needed to develop a new semiconductor design—or to build a new semiconductor fab—is extremely high, and ever-increasing. For instance, the cost of advancing chip design from the 10 nm to the 7nm level increased by over $100 million, and the cost of moving from the 7 nm to the 5 nm level will likely nearly double again, increasing from a cost of $300 million to almost $550 million. (See figure 10.)

Figure 10: Cost to advance to next level of chip development (US$, millions)[33]

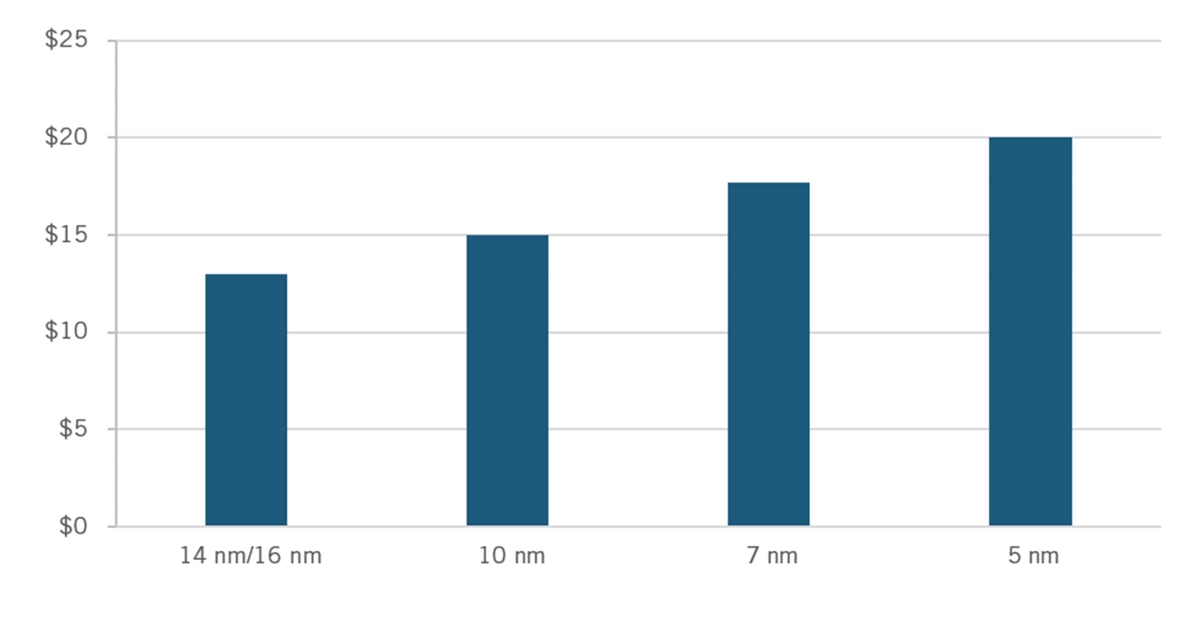

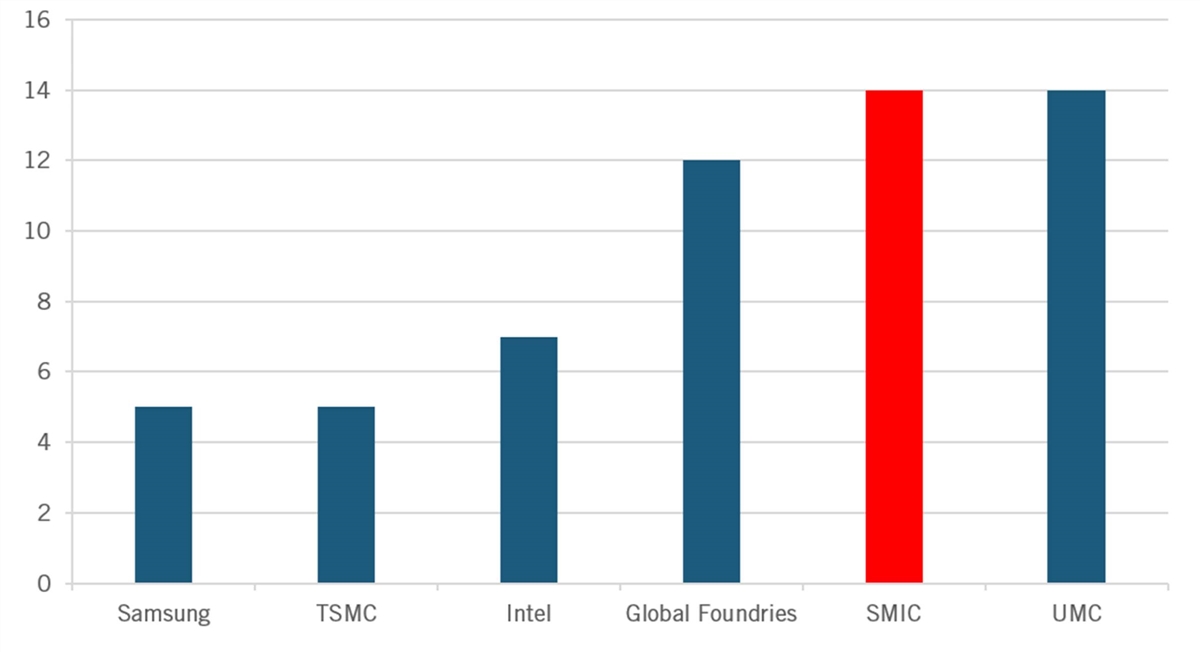

And that’s just the cost to design the chip; actually building the fabs to manufacture these ever-smaller chips only continues to increase as well. In 2019, TSMC announced it would build a 5 nm fab in Arizona at a cost of $12 billion; in 2017, it had announced it was making plans to build a 3 nm fab in Taiwan at an anticipated cost of $20 billion.[34] Overall, as of 2020, it’s estimated that building a new 14–16 nm fab costs, on average, $13 billion; a 10 nm fab $15 billion; a 7 nm fab $18 billion; and a 5 nm fab $20 billion.[35] (See figure 11.)

Figure 11: Average cost to build a new foundry/logic fab (US$, billions)[36]

Reflective of the increasing cost of competing in the sector, whereas almost 30 companies manufactured integrated circuits at the leading edge of technology 20 years ago, only 5 do so today (Intel, Samsung, TSMC, Micron, and SK Hynix).[37] Beyond the cost of building the fabs, it’s also worth noting the expense of maintaining their ongoing operations. The 10-year cost of a state-of-the-art fab, including both initial investment and annual operating costs, can reach up to $40 billion.[38]

Evidence of the need for companies in the global semiconductor industry to achieve scale to effectively compete arrives almost daily. For example, in November 2019, AMD acquired Xilinx in a $35 billion deal. Moreover, the three-largest mergers and acquisitions (M&A) deals of 2020 (involving U.S. companies) were also in semiconductors, including NVIDIA’s $40 billion proposed acquisition of Arm Holdings (a British chip design firm that had been backed by Japan’s SoftBank) and Analog Devices’ $20 billion deal to acquire Maxim Integrated Products.[39]

Factors Enabling Continued Innovation

The semiconductor industry is an innovation-based industry characterized by extremely high fixed upfront costs of R&D, design, and production equipment, yet incremental costs of production (i.e., an individual chip comes off the production line at marginal cost).[40] Moreover, the industry fundamentally depends on one generation of innovation to finance investment in the next, so profits from the 10 nm fab beget the revenues to invest in the 7nm fab, which make possible the 5 nm and 3 nm fabs of the future. In fact, there is a strong positive correlation (0.93) between revenue and R&D spending the next year for major semiconductor firms.[41] This means that if more-innovative semiconductor enterprises lose sales to less-innovative Chinese firms, they will on average reduce R&D spending. This dynamic matters greatly because each generation of leading-edge semiconductor technology has a lifespan of only two to four years before it is overtaken by newer technology.[42]

As such, the ability of the global industry to sustain itself depends on three critical factors: fair access to global markets, market-based competition to reduce artificial overcapacity and significant price declines, and minimal intellectual property (IP) theft. To the extent these factors don’t exist—and as discussed subsequently, they do not because of Chinese government action—global innovation will be hindered.

First, semiconductor companies need access to large global markets so they can amortize and recoup their costs across a single large global marketplace. In other words, access to larger markets better enables them to cover those fixed costs, so that unit costs can be lower (driving more consumption) and revenues for reinvestment, especially in R&D, higher. This is why firms in most innovation industries are global. If they can sell in 20 countries rather than 5, expanding their sales by a factor of four, their costs increase by much less than a factor of four. The more sales, the more can be plowed back into generating more innovations. This explains why a study of European firms found that, for high-tech firms, “their capacity for increasing the level of technological knowledge over time is dependent on their size: the larger the R&D investor, the higher its rate of technical progress.”[43]

A thriving global semiconductor industry depends upon three critical conditions: fair access to global markets, market-based competition to reduce artificial overcapacity and significant price declines, and minimal intellectual property theft.

And given the significant growth in fixed costs of R&D and capital equipment, the ability to access global markets is more important than it has ever been for the semiconductor industry. This means that policies to lower trade barriers are particularly important for semiconductor innovation. Lack of integrated global markets may cause relatively little harm to more-conventional industries with low fixed-to-marginal cost ratios, such as toys, shoes, and steel. But market barriers cause serious harm to global innovation in such innovation-based industries as semiconductors. Access to global markets is also essential to production at large scales, which matters greatly when learning effects are so significant to the industry. For instance, one study found an average “learning rate” of roughly 20 percent, meaning that per-unit semiconductor production costs fell 20 percent every time cumulative output doubled.[44]

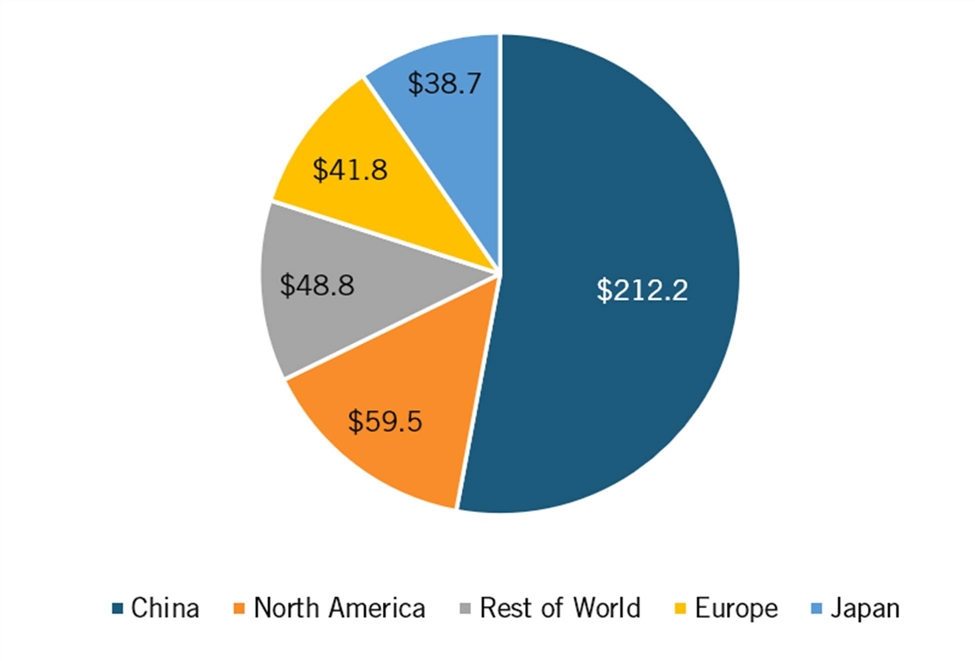

In this sense, Chinese actions regarding access to its market will play a key role in innovation in the industry. According to one study, China now accounts for 60 percent of global semiconductor consumption. According to International Business Strategies, in 2019, China accounted for $212.2 billion of semiconductor industry sales, followed by North America with $59.5 billion, rest of world with $48.8 billion, Europe with $41.8 billion, and Japan with $38.7 billion. (See figure 12.)

Figure 12: Global semiconductor consumption, by region (billions), in 2019[45]

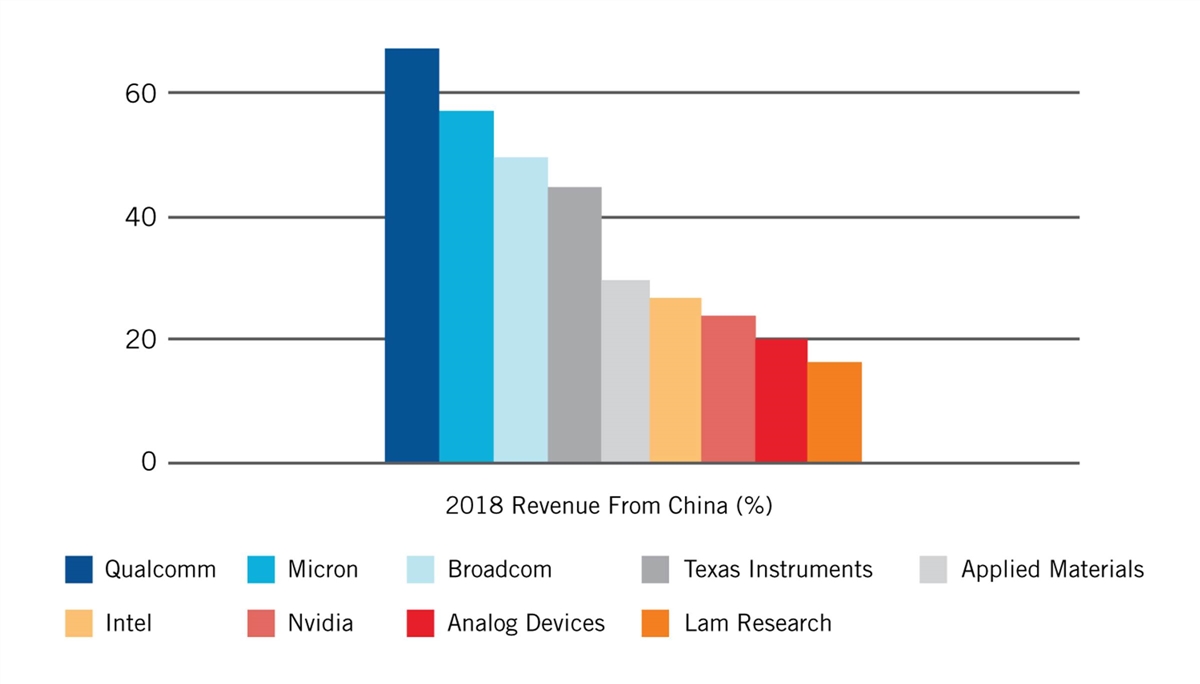

Clearly, the Chinese market is quite significant, accounting for a considerable proportion of revenues for many U.S. semiconductor companies. For instance, in the first four months of 2018, the Chinese market accounted for over 60 percent of Qualcomm’s revenues, over 50 percent of Micron’s, about 45 percent of Broadcom’s, and over 40 percent of Texas Instruments’.[46] (See figure 13.) In 2018, about 36 percent of U.S. semiconductor company revenues, or $75 billion, resulted from sales to China.[47] Having fair and non-discriminatory access to the Chinese market provides the opportunity for firms to earn revenues that can then be reinvested into future generations of innovation.

Figure 13: U.S. semiconductor companies' revenues from China (first four months 2018)[48]

Second, innovation is reduced when companies face excess, non-market-based competition. This can occur when governments pump in hundreds of billions of dollars in subsidies, which unfairly disadvantages enterprises that are attempting to compete on genuinely market-based terms. In other words, if leading-edge companies cannot be assured that they can earn a reasonable, risk-adjusted rate of return on their investments—which is put in doubt by some governments, such as China investing massive amounts of money to create a domestic semiconductor industry—then the leading companies will have to cut their R&D and capital expenditures. As James Lewis of the Center for International and Strategic Studies (CSIS) wrote, it’s easy to see this dynamic in the global semiconductor industry by considering the following hypothetical:

Let’s say there is a global demand for $1 billion semiconductors a year, and that 10 companies supply these, each with 10 percent of the market. China then uses subsidies to create 2 more companies. Now there are 12 companies and the market share of each falls to roughly 8 percent. This puts pressure on the existing companies, and some will go out of business. Others will look to cut costs to survive and one likely cut will be in research and development. This means that the overall rate of spending on R&D will fall and innovation will slow, unless you assume that the new Chinese companies will conduct R&D at the same level, which China does not yet have the R&D capability to do.[49]

Third, because the industry fundamentally depends on knowledge, technology, and know-how, an international system with robust IP rights—including patents, trade secrets, and trademarks—is critical to providing adequate incentives for investing significant amounts of R&D.[50] There are over 1,000 steps involved in making a DRAM chip, for example. If companies cannot retain and protect that expensive IP, and it goes to competitors illegally and illicitly, their revenue will go down, thereby reducing investment.

Finally, as noted, the industry relies on open and smoothly flowing global semiconductor value chains, enabling contributions to semiconductor R&D, innovation, and production from a wide variety of players around the world. However, because of this, as the Organization for Economic Cooperation and Development (OECD) noted in its report, “Measuring Distortions in International Markets: The Semiconductor Value Chain,” this extensive internationalization of the industry “implies that any trade distortion will be magnified and transmitted across many companies and markets.”[51] In other words, innovation mercantilism is even worse in this industry than others because the effects of one nation’s malevolent practices instantaneously propagate to negatively affect other firms throughout the world.

China’s Innovation Mercantilism in Semiconductors

China regards leadership in semiconductors as pivotal to the nation’s future economic growth and national security prospects. As one report summarizes the importance China places on the industry: “The Chinese government has prioritized the development of a domestically competitive and commercially viable semiconductor industry for decades because it considers semiconductors to be a strategic technology and finds that control over semiconductor production confers both economic and national security benefits.”[52] Indeed, China “has publicly exerted its desire to build a semiconductor industry that is far more advanced than today and less reliant on the rest of the world.”[53] And as the U.S. Congressional Research Service noted, “China’s state-led efforts to develop an indigenous, vertically integrated semiconductor industry are unprecedented in scope and scale.”[54]

Chinese Semiconductor Industrial Policies

China has a history of developing strategic industrial plans for its semiconductor sector dating back to 1956, when semiconductors were identified as a key strategic industry in the “Outline for Science and Technology Development, 1956–1967.” This has carried through to the country’s 2014 articulation of its “Guidelines to Promote [the] National Integrated Circuit Industry,”—the so-called China “National IC Plan”—and to its “Made In China 2025” strategy, announced in 2015.[55] In fact, over the last decade alone, China has issued over 100 science, technology, and sectoral development plans singling out domestic semiconductor industry development as a central objective.[56]

China has every right to compete intensely in the global semiconductor industry, but it should do so through innovation, not innovation mercantilism.

The U.S. International Trade Commission’s John VerWey comprehensively described the evolution of Chinese semiconductor industrial policy from 1956 to today in his report, “Chinese Semiconductor Industrial Policy: Past and Present.” VerWey noted that the period from 1956 to 1990 was characterized by (mostly ineffectual) state-led planning that emphasized indigenous innovation. From 1990 to 2002, China pivoted, “pursuing a hybrid model of industrial development, endowing a few large firms with the majority of available funds so that they could pursue partnerships with foreign companies in an effort to accelerate progress.” Project 908 (part of China’s Eighth Five-Year Plan from 1991 to 1995), sought to turn the firm Huajing into a global-leading IDM by “endowing it with 2 billion RMB [$300 million at the time, about $0.5 billion in current dollars] and negotiating a [forced] joint-venture (JV) relationship with Lucent Technologies to facilitate technology transfer.”[57] But as Yin Li explained, it took “eight years to take the idea from plan to reality, resulting in a JV that used old manufacturing equipment and process technologies to produce chips that lagged behind the industry’s leaders by the time they were brought to market.”[58]

After the failure of Project 908, China’s Ninth Five-Year Plan (covering 1996 to 2000) launched Project 909, which targeted the memory chip market and “called for the development of domestic chips made by an internationally competitive firm using Chinese IP and engineers.”[59] A Chinese government-designated champion firm, Hua Hong, leveraged a JV with Japan’s NEC to copy the design of a Japanese fab and replicate it in China with the Chinese facility staffed primarily with Japanese engineers and some Chinese scientists. The effort was modestly successful, until the global DRAM market cratered from oversupply in 2002, leading Hua Hong to incur losses of over 700 million RMB in one year.[60]

The failure of Projects 908 and 909, along with China’s accession to the World Trade Organization (WTO) in December 2001, ushered in a new approach, roughly from 2002 to 2014: broadly an “attraction strategy” in the semiconductor industry that sought to make China an attractive location for international firms. Taiwan’s TSMC launched a wholly foreign-owned foundry in Shanghai and a Taiwanese citizen founded China’s Semiconductor Manufacturing Company (SMIC). SMIC, which is among the world’s top five foundries, adopted a fast-follower strategy that was tremendously abetted by extensive central and provincial Chinese government support, including “a five-year tax holiday (and another five-year tax break at 50 percent of standard rates), tariff exemptions, reduced VATs, and loans from state-owned banks.”[61] In 2005, China’s National Medium- and Long-Term Science and Technology Development Plan Outline for 2006–2020 (the so-called “MLP”) highlighted semiconductors as a “core technology” enabling future hardware advances and called for companies to adopt an “IDAR” strategy: Introducing, Digesting, Absorbing, and Re-innovating IP and technologies as a means of industrial catch-up. China did have relatively more success during this period, becoming more globally competitive in the assembly and test segment of the semiconductor market.

China has a history of developing strategic industrial plans for its semiconductor sector dating back to 1956.

While China had some success in this period attracting inbound semiconductor foreign direct investment (FDI), firms investing in China were producing chips several generations behind the global state of the art, and Chinese semiconductor firms themselves remained relative laggards producing older generations of technology. As China became more of a global hub for electronics manufacturing and final assembly over this period (i.e., the iPhone), it became the world’s leading importer of semiconductors. Chinese imports of semiconductors grew from $41 billion in 2002 to $279 billion in 2014.[62] To be sure, as the Information Technology and Innovation Foundation (ITIF) has noted, while the Chinese trade deficit in semiconductors did grow over this period, the reality is that about half of those semiconductor imports were re-exported—with value added during assembly and manufacturing—from China as part of global production networks for cell phones, tablets, computers, and other electronic products.[63] Nevertheless, with the ascendence of the technology-focused Xi Jinping as Chinese president in 2013, these dynamics set the stage for a re-evaluation of China’s semiconductor development strategies, laying the groundwork for the introduction of the National IC Plan in 2014.

The National IC Plan and the Made In China 2025 Strategy

The National IC Plan became the centerpiece of China’s semiconductor strategy in 2014, with China’s State Council setting a goal of China becoming a global leader in all segments of the semiconductor industry by 2030.[64] The Plan called for at least $150 billion in government subsidies—from central, provincial, and municipal Chinese governments as well as a variety of state-owned enterprises (SOEs, from the technology sector and beyond)—to enable China to become self-sufficient in every facet of the industry.[65] The Chinese government established the China Integrated Circuit Investment Industry Fund (CICIIF, also known as the “National IC Fund”) to channel that $150 billion in state funding in support of domestic industry, overseas acquisitions, and the purchase of foreign semiconductor equipment.[66] The Semiconductor Industry Association (SIA) estimated that by 2017 China had raised $80 billion of its initial $150 billion investment goal.[67] In October 2019, China supplemented these investments by announcing a new national semiconductor fund of 204.2 billion yuan ($28.9 billion) financed by central- and local-government-supported enterprises including the State Tobacco Monopoly Administration and the China Development Bank Corp.[68] In order to avoid charges of government subsidization, China channeled funds through these types of state-owned businesses to make it look like they were akin to private-sector investments. As part of the National IC Plan, China called for 70 percent of the semiconductor chips used by companies operating in China to be domestically produced by 2025 (and ideally 100 percent by 2030).[69] Specifically, China’s government announced plans to expand the domestic supply of semiconductors with the aim of reaching targets by 2030 of $305 billion of domestic production of chips (from $65 billion in 2016), and 80 percent of domestic market served (from 33 percent in 2016).[70]

China’s National IC Plan calls for $150 billion of government subsidies to produce domestically at least 70 percent of the semiconductors it consumes, and for China to become a global leader in all segments of the semiconductor industry by 2030.

The tens of billions of dollars in funds made available as part of the National IC Fund have gone to purposes including: standing up from whole cloth entirely new Chinese companies competing in various facets of the semiconductor ecosystem, acquiring foreign semiconductor technology companies, and subsidizing China’s existing companies. As VerWey elaborated:

Endowed with $150 billion in funds from the central and provincial governments, the National IC Fund was tasked with acquiring companies throughout the semiconductor supply chain. The Fund has engaged in a two-pronged strategy. On the one hand, it funds outbound FDI to acquire foreign companies. On the other, it provides funds to facilitate inbound FDI such as greenfield investment and joint ventures with non-Chinese companies to help realize the vision of the National IC Plan.[71]

Beyond the National IC Plan, in 2015, the Chinese government released its “Made in China 2025” strategy, a 10-year, $300 billion, comprehensive blueprint aimed at transforming China into an advanced manufacturing leader, and which specifically targeted 10 strategic industries, including semiconductors.[72] Across these 10 industries, China has developed a series of national and provincial funds to progress Chinese firms toward three key strategic goals: 1) “localize and indigenize,” meaning “to indigenize R&D and control segments of global supply chains”; 2) “substitute,” meaning to replace foreign suppliers with domestic sourcing wherever possible in value chains toward the production of final products; and 3) “capture global market share,” meaning to “go out into the world” and compete.[73]

While certainly there are some elements of the National IC Plan and the “Made in China 2025” strategy that are well within the bounds of fair international competition—such as funding basic scientific research; supporting research consortia; supporting science, technology, engineering, and mathematics (STEM) education; providing tax incentives (so long as they are equally available to enterprises from all nations); and supporting digital infrastructure deployment—a great many of their elements, and related Chinese activities and policies, are steeped in the tenets of innovation mercantilism. As the United States Trade Representative’s Office (USTR) wrote, “Since 2014, when the government issued the [National IC] Guidelines, Chinese companies and investors—often backed by state capital—have undertaken a series of acquisitions to achieve technology breakthrough, shrink the technology gap between China and advanced countries, cultivate domestic innovation clusters, and reduce China’s reliance on

IC imports.”[74]

As the following section shows, China’s innovation mercantilist practices in the semiconductor sector have included excessive ownership and subsidization of state-owned or state-supported enterprises; direct provision of equity or provision of financing at below-market terms; state-directed or state-enabled acquisition (or attempted acquisition) of foreign semiconductor companies; IP theft; forced or compelled technology transfer, especially through mandated joint ventures; and manipulation of technology standards, alongside a variety of other market-access restrictions or impediments that seek to advantage Chinese players in this sector to the detriment of foreign competitors.

Chinese Government Ownership of Chinese Semiconductor Enterprises

Chinese innovation mercantilism in the semiconductor sector starts with the fact that the Chinese government exercises a considerable degree of influence over domestic enterprises by possessing a significant degree of ownership of them. As OECD wrote in its report, “Measuring Distortions in International Markets: The Semiconductor Value Chain”:

Ownership or investment by the state in semiconductor firms is very largely a Chinese phenomenon, with central and local authorities possessing stakes in nearly all domestic value-chain participants, be they fabless, foundries, or OSAT firms. Government stakes range from indirect participations below 20% to majority direct ownership.[75]

In effect, the Chinese government has become a minority or majority shareholder in most medium- and large-sized semiconductor enterprises in China. For example:

▪ Semiconductor Manufacturing International Corporation (SMIC): Total state participation in the company increased from 15 percent in 2014 to 45 percent as of 2018, led by stakes held by the National IC Fund (19 percent), state-owned Datang Telecom (19 percent), and Tsinghua Unigroup (7 percent).

▪ China Electronics Corporation (CEC): A state-owned firm that presides over two of China’s large semiconductor groups: Hua Hong Semiconductor and Huada Semiconductor. The National IC Fund owns 10 percent of Hua Hong Semiconductor and 29 percent of Hua Hong Wuxi, a semiconductor fab structured as a joint venture.

▪ Tsinghua Unigroup: Although it initially focused on chip design, the firm has made recent forays into the foundry business, receiving support from local governments and the National IC Fund to invest in the construction of new memory fabs in Chengdu (Sichuan), Chongqing, Nanjing (Jiangsu), and Wuhan (Hubei). Once completed, those investments could eventually reach approximately $100 billion.[76]

▪ Jiangsu Changjiang Electronics Technology (JCET): JCET originally started as a private firm that specialized in outsourced package assembly and testing, and with its acquisition of Singapore-based STATS-ChipPAC in 2015, it became the world’s largest OSAT firm. With that acquisition partly funded by the National IC Plan, and considering follow-on investments, the Chinese state now controls 25 to 30 percent of JCET.

▪ Yangtze Memory Technologies Co. (YMTC): YMTC is a Chinese state-controlled joint venture launched by the National IC Industry Investment Fund, the state university-controlled fabless semiconductor firm Tsinghua Unigroup, and the Hubei Science and Technology Investment Group, supported by $24 billion in initial government funding allocated for its initial Wuhan factory alone.[77] In effect, YMTC is China’s state-owned national champion for memory chips, especially those used in solid-state hard drives and USB flash drives.

▪ ChangXin Memory Technologies (CXMT): Launched in May 2016, CMXT is another Chinese-government-created semiconductor manufacturer that also focuses on memory technologies. ChangXin was established as a project co-led by the local state-owned Hefei Industrial Investment Fund (HIIF) and GigaDevice Semiconductor Beijing (a Chinese designer of flash memory chips), with HIIF kicking in $8 billion to launch the effort.[78] CXMT was created as a “pilot demonstration” of the “Made in China 2025” initiative and as such enjoys tremendous support from a variety of Chinese government programs.[79]

An OECD study of 21 international semiconductor companies from 2014 to 2018 found that Chinese companies received 86 percent of the below-market equity provided by their nations’ governments.

Overall, out of China’s top-10 semiconductor companies by revenue, China’s National IC Fund and Chinese SOEs together hold more than 25 percent of at least 5 of those firms.[80] (State ownership increases further when state investments at the subsidiary level of these semiconductor companies, or where local governments and provincial funds often partner with other state actors, are included.) As the OECD’s report further elaborates, Chinese government investment, through a multitude of investment vehicles, has “profoundly reshaped China’s semiconductor industry, combining to give the state a stronger influence over domestic companies.… Growing direct participation by the state in China’s semiconductor industry proceeds from a broader policy push to turn the country into a leading producer of semiconductors over the medium-term.”[81] The OECD further noted that “the distinction between SOEs and other companies in China is made harder” by the “blurring of boundaries between the state and private interests” through “critical avenues of state influence.”[82] Moreover, state ownership is not passive; rather, the state provides direction to companies to achieve state development goals.

Government Subsidies

Closely related to the issue of ownership is the issue of subsidization of Chinese semiconductor firms by central, provincial, and local governments. As the U.S. ITC explained, “Essential to China’s semiconductor industrial plans are subsidies, which can take the form of regional, provincial, and national funds (such as the National IC Fund); investment vehicles; and policies that incentivize industry investment, such as tax breaks.”[83] In fact, “out of the 11 funds the U.S. Chamber of Commerce identified as targeting Made in China 2025 industries, the National IC Fund is the second largest, behind only a more-general Special Constructive Fund.”[84] It should also be noted that the national fund has since been flanked by a series of sister funds at provincial and city levels, such as the Beijing IC Industry Equity Investment Fund, and funds from other local governments including Shanghai (Pudong), Shenzhen, and Wuxi. Indeed, subsidizing the activities of domestic semiconductor firms, or subsidizing the ability of those firms, or other investment vehicles, such as thinly veiled private equity or venture capital firms to acquire foreign semiconductor players, has been a central feature of Chinese semiconductor mercantilism.

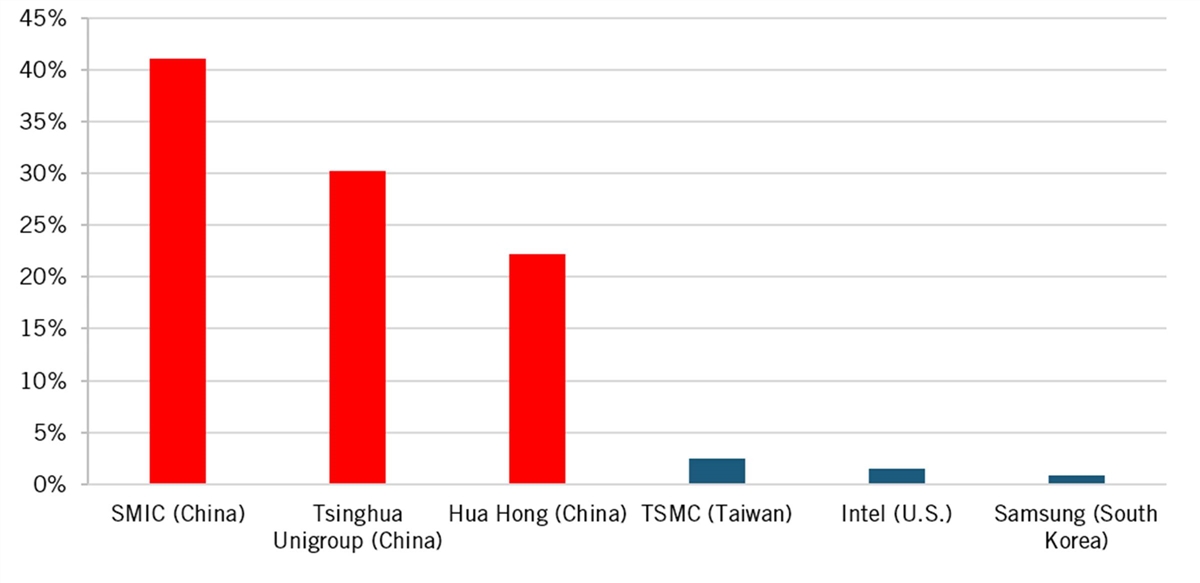

As the OECD found, “Government support through below-market equity appears to be particularly large in the semiconductor industry and concentrated in one jurisdiction.”[85] The OECD’s study of 21 international semiconductor firms over the years 2014 to 2018 found that government support provided through “below-market equity” (i.e., effectively a subsidy) “amounted to $5-15 billion for just six semiconductor firms, four of which are from China” (these being Hua Hong, JCET, SMIC, and Tsinghua Unigroup). The report continued to note that, for SMIC and Tsinghua Unigroup, “total government support exceeded 30 percent of their annual consolidated revenue.”[86] In total, the OECD found that Chinese firms together received 86 percent of below-market equity injections identified in its study. The organization concluded that, “For the four Chinese firms covered by this study, government funds have committed equity funding of about $22 billion in total to date, with the largest share benefitting SMIC and Tsinghua Unigroup, and their subsidiaries. These four firms received about $10 billion of the initial $23 billion tranche of National IC Plan funding.”[87] With regard to SMIC, the OECD report found that state subsidies accounted for slightly over 40 percent of the company’s revenues from 2014 to 2018.[88] Of particular import, the OECD study found that there “notably appears to be a direct connection between equity injections by China’s government funds and the construction of new semiconductor fabs in the country.”[89]

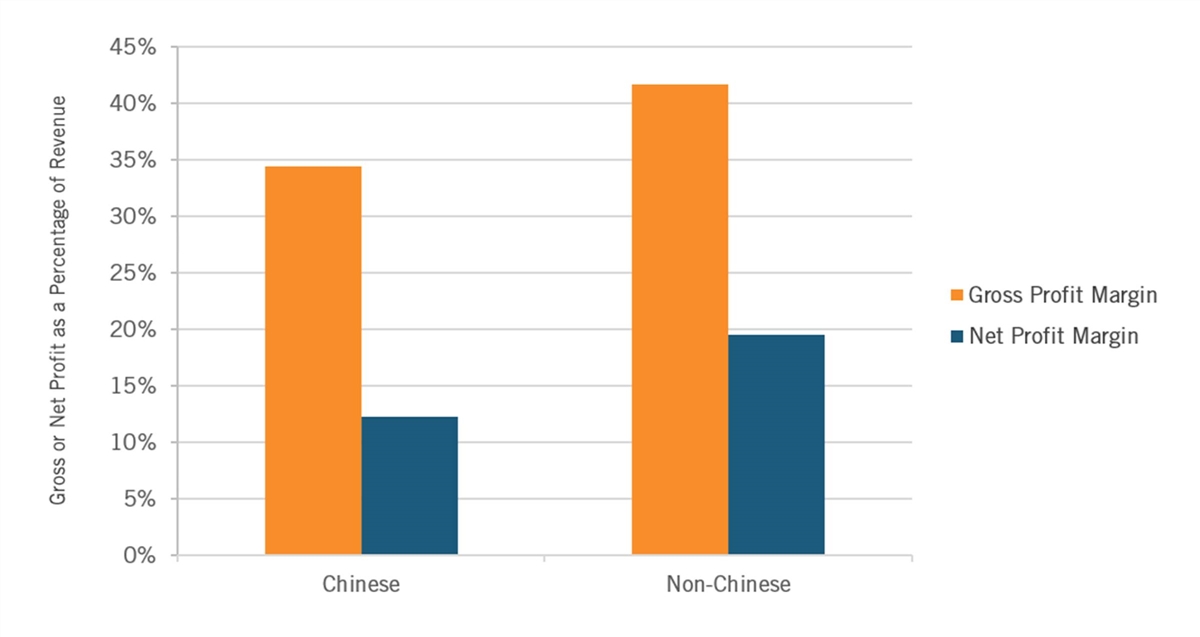

When it comes to state subsidies at the firm level—that is, as a percentage of revenue for semiconductor manufacturers (from 2014 to 2018)—Chinese enterprises clearly led their foreign competitors, by an order of magnitude. (See figure 14.) As noted, state subsidies accounted for slightly over 40 percent of SMIC’s revenues over this period, 30 percent for Tsinghua Unigroup, and 22 percent for Hua Hong. In contrast, this figure was minimal for TSMC, Intel, and Samsung, each, for whom revenues identifiable as state subsidies accounted for, at most, 3 percent or less of their revenues over this period.

Figure 14: State subsidies as a percentage of revenue for chip fabs, 2014–2018[90]

Another example came in 2017, when a semiconductor investment vehicle that was set up using funds from the National IC plan provided monetary support to Chinese smartphone maker Xiaomi to develop the company’s first smartphone processor.[91] While Xiaomi did not disclose how much financial support the government provided in developing that chip—which in total was estimated to be at least RMB 1 billion ($141 million)—it underscored that the Chinese government’s “warmth,” in addition to funding, was important.[92]

Chinese government-directed ownership or subsidization of Chinese semiconductor enterprises enables them to vastly expand production relative to the speed and extent possible if they were primarily reliant on private capital markets. As such, just like Chinese-subsidized capacity in many other industries, such as solar panels and steel, China is also artificially creating capacity in semiconductors. These types of efforts are also critical to China’s efforts to develop a fully indigenous “closed-loop” semiconductor manufacturing ecosystem by 2030. One other facet of this is that the Chinese government provides insurance to Chinese companies to protect against faulty equipment or materials from Chinese suppliers, in addition to making many of these aforementioned manufacturing subsidies contingent on a commitment to use local suppliers.[93]

OECD researchers have identified a direct connection between equity injections by China’s government semiconductor funds and the ensuing construction of new semiconductor fabs in the country.

The subsidies also enable Chinese firms to sustain below-market rates of return. Indeed, the OECD report explains that “the four Chinese companies in the sample (Hua Hong, JCET, SMIC, and Tsinghua Unigroup) all had sustained below-market equity returns continuously from 2014–2018.” Losses at Yangtze Memory Technologies were reported to be $460 million in the first half of 2018, yet the state-backed company continues to operate normally, has not defaulted on its debts, and still receives large amounts of cash.[94] While their global competitors have to earn market-based rates of return to survive, let alone to realize funds that can be reinvested in future generations of R&D and innovation, Chinese firms can endure long periods of below-market rates of return, giving them a competitive leg up on more-innovative market-based firms.[95] The OECD observed that “the lower returns put these firms at competitive advantage by exempting them from having to meet their full cost of capital, thus relaxing market discipline that otherwise constrains their competitors.”[96]

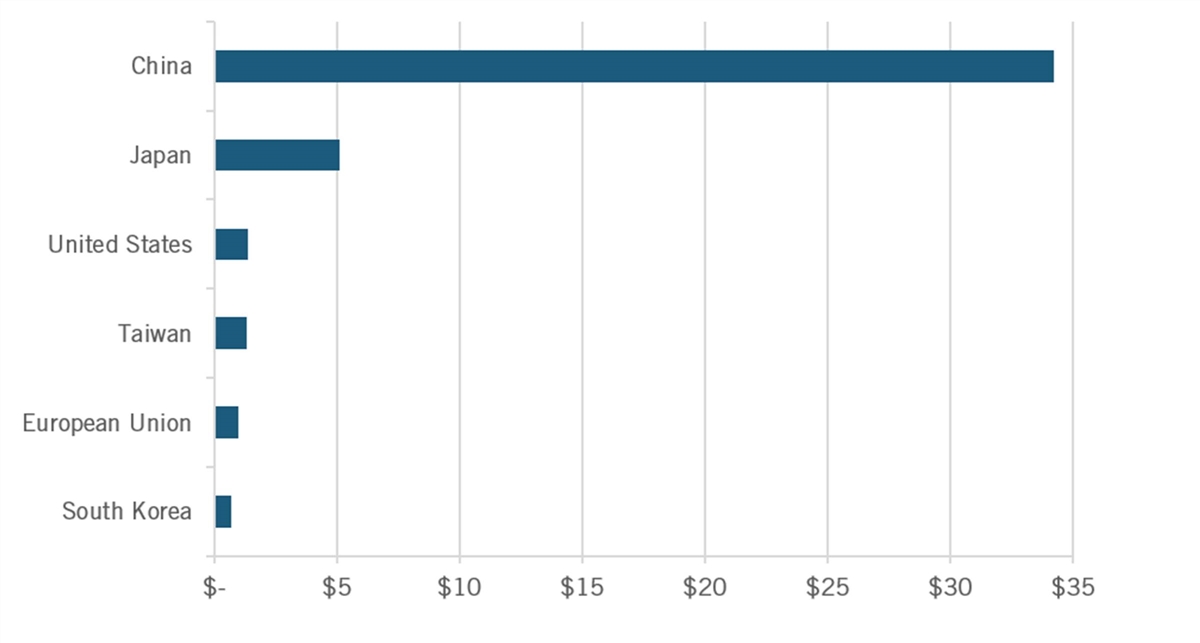

For the year 2019, Peter Cowhey, Dean of the School of Global Policy and Strategy at the University of California, San Diego, has estimated nations’ “total funding assistance” to their semiconductor industries, with his definition of total funding assistance including “the addition of known semiconductor programs, including provision of equity, grants/tax concessions, capital investment, R&D grants, and workforce development activities.” Cowhey estimated China’s total government funding for 2019 at $34.2 billion, Japan’s at $5.1 billion, America’s at $1.4 billion, Taiwan’s at $1.3 billion, the European Union’s at $1 billion, and Korea’s at $700 million.[97] (See figure 15.)

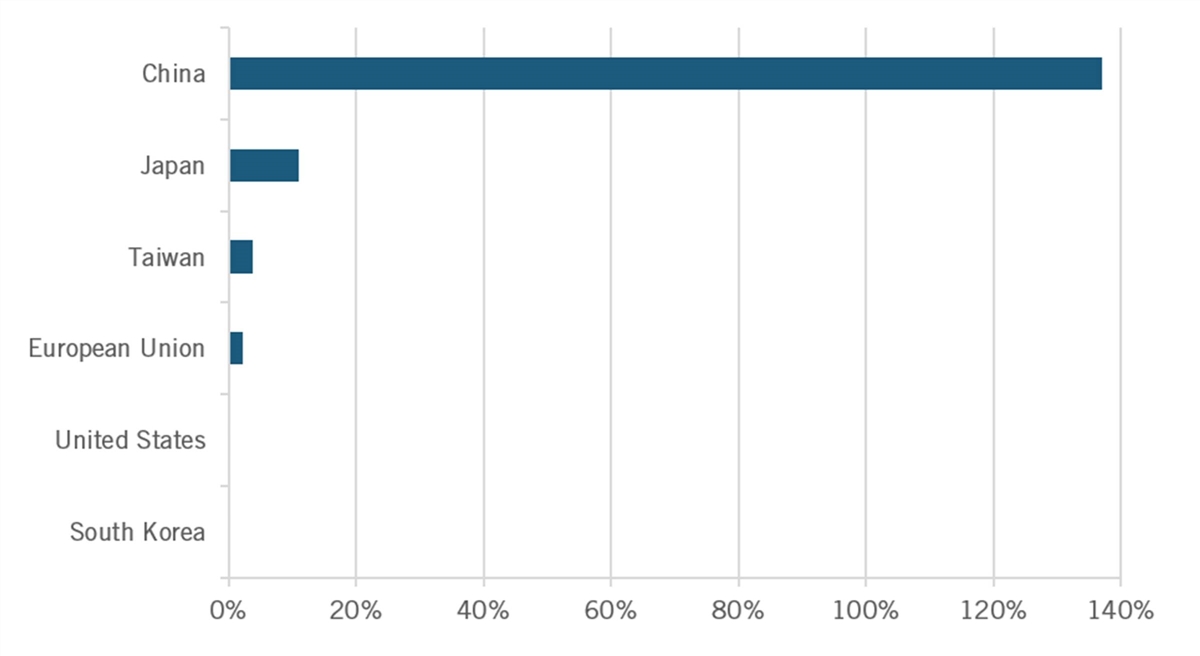

For China, most of these amounts are industrial subsidies. In contrast, the amounts for the other nations are mostly legitimate investments, such as in pre-competitive research. For instance, the U.S. figure mostly reflects the amount of federal R&D research funding related to the sector. However, the outsized Chinese government support for its semiconductor industry becomes even more starkly apparent when comparing the value of total funding assistance as a percentage of the nations’/regions’ value of global semiconductor sales. By this measure, China’s government assistance to its semiconductor industry is equivalent to 137 percent of the Chinese semiconductor industry’s global sales, compared with just 11 percent for Japan, 3.8 percent for Taiwan, 2.3 percent for the European Union, and a miniscule 0.01 percent each for South Korea and the United States. (See figure 16.)

Figure 15: Estimated value of total semiconductor sector funding assistance by nation/region (US$, billions) in 2019[98]

Figure 16: Estimated value of total semiconductor sector funding assistance as a percentage of global sales[99]

Below-Market Financing

In addition to below-market equity, Chinese firms have benefited considerably from below-market borrowing. As the OECD observed, “The empirical record shows unambiguously that in countries where the state plays a strong role in the economy, SOEs obtain on average more subsidies and more loans at cheaper interest rates than their private counterparts.”[100] And, indeed, the OECD report also found that, “The overwhelming majority of all below-market borrowings … identified over the period 2014-28 originate from the Chinese financial system.”[101]

This is consistent with China’s 2014 IC Guidelines, which instructed “domestic development banks and commercial banks to continually provide financial support to the integrated circuit industry.”[102] Over the period from 2014 to 2018, the three-largest Chinese semiconductor industry recipients of below-market financing were Tsinghua Unigroup ($3.4 billion), SMIC ($695 million), and JCET ($688 million), notably from loans they received from Chinese state banks such as the Bank of China, the China Development Bank, and the China Construction Bank.[103] Hua Hong obtained an estimated $71 million in below-market financing from Chinese banks over this period. The provision of below-market financing is another way Chinese firms are able to remain in competition despite earning below-market returns.

Separately, a broad range of Chinese manufacturers, including of semiconductors, have benefited from the aggressive export credit initiatives of the China Export-Import (Ex-Im) Bank. For instance, Huawei (which mainly produces phones and networking equipment, but which does own HiSilicon, a Shenzhen-based fabless semiconductor company) benefits from a $100 billion line of credit that Chinese state-owned banks have made available to Huawei customers.[104] Moreover, the U.S. Export-Import Bank has concluded that “most of the terms and conditions of their [China Exim Bank’s] financing did not and do not fit within the OECD guidelines.”[105]

Government-Directed Acquisition of Foreign Firms

Chinese entities have used National IC Strategy and related funds to acquire or attempt to acquire a variety of foreign enterprises operating along virtually every segment of the semiconductor production process. As the OECD noted plainly, “Chinese authorities have indicated that ‘they intend to use the national [semiconductor] funds selectively’ in order to acquire foreign technology.”[106] As it continued, “Cross-border acquisitions appear in particular to have gathered pace following the creation in 2014 of China’s state-backed national semiconductor fund and related sister funds at the local level.”[107] From 2015 to 2017 alone, Chinese investors and firms offered more than $30 billion in bids for U.S. and European semiconductor companies.[108] And over a five-year period starting in 2014, it’s estimated that China’s Tsinghua Unigroup Ltd., (the technology investment arm of one of China’s top state-led universities) alone tried to invest $47 billion to acquire Western companies.[109] One consultancy estimated that, by December 2020, Chinese-government-guided strategic technology investment funds controlled more than RMB 4 trillion ($610 billion) in capital.[110]

Chinese entities have used National IC Strategy and related funds to acquire or attempt to acquire a variety of foreign enterprises operating along virtually every segment of the semiconductor

production process.

Examples are manifold. In 2011, California-based microchip designer Atop Tech, which commanded a $1 billion market share in electronic-design automation (specialized software) and integrated circuits markets, was forced into bankruptcy and acquired by a Hong Kong-listed company Avatar Integrated Systems, which had a sole director listed in its incorporation papers: a Chinese steel magnate.[111] In 2015, Hua Capital Management—a Beijing-based private-equity fund co-founded by Tsinghua Unigroup and tasked with managing Beijing’s semiconductor funds—acquired the U.S. semiconductor company OmniVision.[112] In October 2015, Jiangsu Changjiang Electronics Technology Co. used $300 million from the National IC Fund to help pay for the $780 million acquisition of Singapore’s STATs ChipPac. That same year, Beijing E-Town Capital, a CICIIF shareholder, acquired U.S.-headquartered Mattson Technology, gaining specialized capabilities in etchers and rapid thermal processing equipment and strip tools used in semiconductor production.[113] Also in 2015, a CICIIF consortium acquired Integrated Silicon Solutions, Inc., gaining specialized chip expertise.[114] In 2016, the Chinese firm Navtech (Beijing Navgnss Integration Co., Ltd.) acquired Swedish foundry Silex Microsystems after having received funding from China’s National IC Fund and a Beijing sister semiconductor fund.[115] Also in that year, China’s National Silicon Industry Group (NSIG)—an investment fund backed by Sino IC Capital, the manager of the country’s national semiconductor fund—acquired Finnish wafer producer Okmetic as well as a 14.5 percent stake of French wafer producer Soitec.[116] One particularly active entity has been Digital Horizon Capital, a Chinese technology fund used extensively by the Chinese government to invest in strategic overseas targets. The fund has invested in 113 U.S. companies which the Chinese Communist Party has identified as strategic priorities.[117] And it should also be noted that the National IC Fund has supported Chinese purchases of foreign firms in other segments of the information and communications technology (ICT) ecosystem. For instance, in 2014, Chinese firm Apex Microelectronics bought the U.S. printer company Lexmark at a 17 percent premium over its listed stock price, in part because it received funding from the Chinese National IC fund.[118] Indeed, the company is now 5 percent owned by the IC fund.[119]

And those are just examples of acquisitions that succeeded; many other attempts were launched. In 2015, Tsinghua Unigroup launched a $23 billion bid to purchase America’s Micron.[120] Spurned with that purchase blocked by the U.S. government, in 2016, the National IC Fund backed a buyout firm seeking to buy U.S.-based Lattice Semiconductor Corp.[121] Also in 2016, the Fujian Grand Chip Investment Fund, with support from the National IC Fund, was behind a $723 million gambit to acquire Germany’s Aixtron.[122] That same year, Unisplendour, a Hong Kong-based subsidiary of Tsinghua Unigroup, attempted to purchase a 15 percent stake in U.S. data storage company Western Digital.[123] As Western leaders began to wise up to the nature of these transactions, with Chinese government-subsidized entities trying to acquire the crown jewels of Western technology (Germany having regrettably allowed robotics manufacturer Kuka to be acquired by the Chinese household appliance manufacturer Midea in 2016), such transactions were increasingly blocked, and the United States enhanced its FDI screening procedures with reforms to its Committee on Foreign Investment in the United States (CFIUS) program in 2018.

It should be noted, however, that one other active avenue of Chinese efforts to acquire U.S. semiconductor firms or their technologies has been, and remains, venture capital. For instance, the proposed purchase of Lattice Semiconductor was actually made by Canyon Bridge Capital Partners, a Chinese-backed JV/private equity fund operating out of Silicon Valley.[124] As Alex Capri of the Hinrich Foundation elaborated in his report “Semiconductors at the Heart of the U.S.-China Trade War,” “China’s state-backed venture capital firms have been active in Silicon Valley in targeting start-ups working on innovations that can be incorporated into semiconductor niches along global value chains.”[125] As Capri noted, two such examples include Westlake Ventures, a Silicon Valley-based entity that receives funding from the Chinese City of Hangzhou, and ZGC Capital Connection, which lists itself as a subsidiary of a state-owned enterprise funded by the Chinese government.[126]

And though the introduction of America’s CFIUS legislation in 2018 has made it more difficult for Chinese entities to outright acquire U.S. semiconductor firms, China continues to make investments in many U.S. semiconductor-related enterprises. As recently as December 2020, China’s government-guided funds made investments in the U.S. semiconductor firms Pixelworks, Black Sesame Technologies, and LightIC Technologies.[127]

Intellectual Property Theft

As CSIS’s Jim Lewis noted, the Chinese government has sponsored “long-running state espionage programs targeting Western firms and research centers (and this) technological espionage has carried over into cyberspace.”[128] Indeed, the acquisition of foreign semiconductor technology through IP theft has been a key pillar of Chinese strategy. For instance, in November 2018, the U.S. Department of Justice charged China’s Fujian Jinhua Integrated Circuit Co. with working to steal trade secrets from U.S. chipmaker Micron Technologies.[129] The incident spurred the Justice Department to launch a new initiative to combat foreign economic espionage and trade secret theft. That effort yielded results when, in June 2020, the U.S. Department of Justice found Chinese national Hao Zhang guilty of economic espionage and theft of trade secrets from both Avago, a California-based developer of semiconductor design and processing for optoelectronics components and subsystems, and Skyworks, a Massachusetts-based innovator of high-performance analog semiconductors.[130] Taiwanese-based semiconductor manufacturers TSMC and Nanya Technology Corporation have both experienced attempted or effected thefts of trade secrets, including a 2016 incident in which TSMC engineer Hsu Chih-Pen stole TSMC trade secrets he intended to sell to Chinese state-owned Shanghai Huali Microelectronics Corp.[131] One assessment found that China’s SMIC alone has accounted for billions in semiconductor IP theft from Taiwan.[132] In fact, as early as 2003, TSMC had filed lawsuits in U.S. courts alleging that SMIC had infringed upon its patents and stolen its trade secrets.[133] The acquisition of foreign semiconductor technology through IP theft has been an essential pillar of Chinese strategy to develop its semiconductor industry.

Moreover, as Capri wrote, “Cybersecurity experts have noted that since imposition of export restrictions on Chinese tech firms such as Huawei, Hikvision, SenseTime and others, there has been an escalation of cyber security threats (attacks and attempted cyber-intrusions) at American technology companies.”[134] Indeed, China has regularly amped up its cybertheft after it has released new industrial development strategies, and cybersecurity firm Crowd Strike noted China did so again in 2018–2019 amidst the intensified U.S.-China trade conflict.[135] As Dan Lips wrote in “Answering the China Chip Challenge,” the Department of Defense’s 2020 China Military Power report found that Chinese hackers “repeatedly targeted tech groups developing machine learning, autonomous vehicle, medical imaging, semiconductors, processors, and enterprise cloud computing software.”[136] It cited a 2018 example in which a Chinese SOE “was implicated in a conspiracy to commit economic espionage through the theft, conveyance, and possession of stolen trade secrets from a U.S. semiconductor company,” [that] “specializes in dynamic random-access memory.”[137]

A 2019 CNBC Global CFO Council report found that one in five North American corporations had their IP stolen in China within the past year.[138] The Commission on the Theft of American Intellectual Property has estimated that China’s IP theft may cost the U.S. economy as much as $600 billion annually.[139]

Forced Joint Ventures/Forced Technology Transfer

As the OECD observed, “[T]here is also unease in the [semiconductor] industry regarding practices that may amount to forced technology transfers, whereby government interventions create the conditions where foreign firms may be required to transfer technology to local partners or to share information that can be accessed by competitors.”[140] Such unease should not be a surprise. The reality is that pressured technology transfer concessions are part and parcel of virtually every negotiation with the Chinese. A 2017 survey conducted within the semiconductor industry by the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) found that 25 U.S. companies—which accounted for more than $25 billion in annual sales—had been required to form JVs and transfer technology, or both, as a condition of market access.[141]

Chinse government-forced joint partnering or forced local production as a condition of market access has been one reason explaining increased U.S. multinational enterprise (MNE) semiconductor production in China over the past two decades. As a report from the U.S.-China Economic and Security Review Commission, “Trends in U.S. Multinational Enterprise (MNE) Activity in China, 2000-2017,” finds, “U.S. MNE capital expenditure in China for the production of semiconductors accounted for nearly one-third of all U.S. MNE global capital expenditure on semiconductor manufacturing assets in 2017” with “the U.S. MNE affiliate value added in China for semiconductors and other electronic components increasing over 250 percent from 2009 to 2017, from $1.6 billion to $5.6 billion.”[142] As that report notes, certainly some of the factors driving increased U.S. MNE ICT and semiconductor production in China pertain to being closer to local markets as well as to “relatively lower labor and overhead costs, flexible production and benefits from economies of scale, decreased transportation costs, and proximity to global supply chains.”[143] However, the report continues to note that another significant driving factor has been that “[t]he Chinese government’s industrial policies and related trade restrictions have also coerced foreign companies into expanding their manufacturing operations in China.”[144]

Chinse government-forced joint partnering or forced local production as a condition of market access has been one reason explaining increased U.S. multinational enterprise (MNE) semiconductor production in China over the past two decades.

Related has been China’s efforts to corner markets for rare earth metals. As the aforementioned report notes, “[B]etween 2005 and 2010 Beijing steadily reduced export quotas on rare earth elements, often used in the production of electronic components, making it necessary for many ICT equipment manufacturers to locate production in China. As a result, U.S. MNE ICT manufacturing assets in China grew 61.7 percent from $14.1 billion in 2005 to $22.8 billion in 2010.”[145]

Technology Standards

The development of voluntary, transparent, consensus-based, industry-led technology standards has played a catalytic role in fostering the development of interoperable and globalized supply chains for semiconductors and other ICT goods.[146] Developing and applying common global standards instead of differential country- or region-specific standards makes it far more efficient to integrate components across semiconductor and other ICT supply chains.[147] While technology standards work best when developed through a collaborative, voluntary, industry-led basis, China has made the development of indigenous technology standards, particularly for ICT products, a core component of its industrial development strategy. For instance, in 2018, China introduced a new standardization law that will likely favor local firms’ goods and services.[148] While, at this point, China’s attempts to set advantageous standards pertain more to the downstream applications or technologies that use semiconductors—such as 5G, AI, the Internet of Things, and autonomous vehicles—rather than the actual semiconductors themselves, there’s little doubt that “China Standards 2035,” a nationwide effort to develop industrial standards and eventually internationalize them, is meant to place Chinese firms in a superior position to their American and European competitors.[149] There’s also evidence that China is attempting to influence international standards development organizations (SDOs) to ensure their technology lies at the heart of (i.e., are considered essential to) the international standard.[150]

Preferential Tax Policies

In August 2020, the Chinese government announced preferential tax breaks for the sector, but made them only available to “homegrown semiconductor companies and software developers.”[151] For instance, a manufacturer that has been in operation for more than 15 years and that makes 28 nm or more-advanced chips is exempt from corporate income tax for up to 10 years, with the preferential treatment period starting from the company’s first profit-making year.[152]

China’s Integrated Circuit Market

Before moving on to assess the impact of China’s innovation mercantilism on the global semiconductor industry, it’s worth providing a brief overview of the current state of the Chinese integrated circuit marketplace. Semiconductor Digest estimated that the Chinese integrated circuit market was worth $124.6 billion in 2019, with $19.5 billion worth of those ICs manufactured in China, and with China-headquartered companies producing only $7.6 billion (38.7 percent) of that production, and thus accounting for only 6.1 percent of the total Chinese IC market (and 2.1 percent of the worldwide IC market).[153] The growth of China’s semiconductor market has outpaced that of the rest of the world for many years. For instance, from 2005 through 2015, China’s semiconductor industry grew at a 10-year compounded annual growth rate of 18.7 percent while its semiconductor consumption grew at a rate of 14.3 percent and the worldwide semiconductor market grew at a 4.0 percent CAGR.[154]

However, Chinese semiconductor strengths are growing rapidly, both from the chip design and chip manufacturing perspectives. For instance, between 2010 and 2015 alone, the number of Chinese IC design firms grew from 485 to 715, with the largest 20 percent of these firms producing revenues of between $2.3 billion and $16 billion.[155] About 20 percent of the world’s fabless chip design firms are now located in China.[156] As a Deloitte report notes, “In integrated circuit design, China's capability has surged over the past 5 years, and started to catch up with Taiwan's and South Korea's, joining them as the main players in Asia Pacific IC design.”[157] Also, a core focus of China’s strategy going forward will be trying to lead in the development of semiconductor chips for application-specific purposes, most noticeably chips for AI. As the MIT Technology Review’s Will Knight noted, China is leveraging “its existing strength in AI and its unparalleled access to the quantities of data required to train AI algorithms [which] could give it an edge in designing chips optimized to run them.”[158] Other noteworthy achievements of China’s semiconductor industry include optical devices, low-power embedded processors, sensors, and discrete devices.[159]

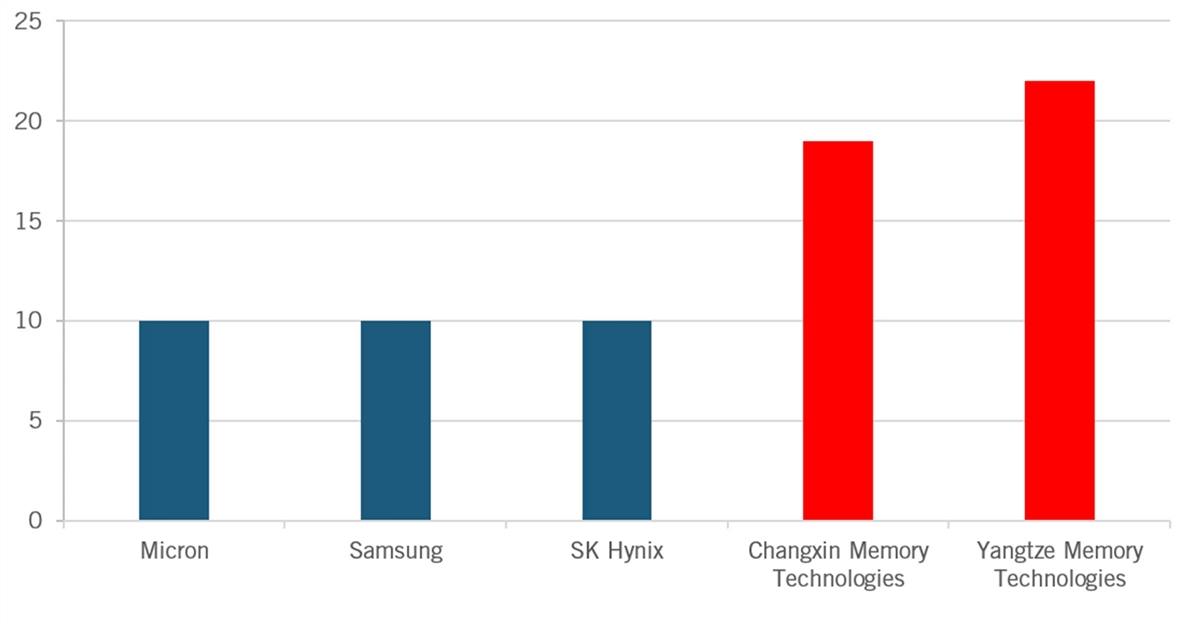

China has paid special attention to two specific market segments: foundries and memory chips. China’s pure-play foundry market increased by 41 percent in 2018, which resulted in China accounting for 19 percent of the global foundry market.[160] China has also been particularly targeting memory chips (even going back to Project 908), with the country continuing to make large investments in its memory chip manufacturing infrastructure. As Ernst noted, China has made a “massive push to develop from zero a domestic memory industry, with reported investments of more than $40 billion in flash memory production, and another $10 - $15 billion in DRAM memory production.”[161] Indeed, from 2019 to 2021, Chinese-owned companies ramped up the country’s indigenous memory capacity from basically 0 to 300,000 wafers per month (wpm).[162] And this all came at the expense of foreign market share. Over the course of 2020, China’s state-backed companies announced major production increases in both NAND and DRAM—both critical memory technologies.[163] For instance, Yangtze Memory Technologies (owned by the state-backed Tsinghua Unigroup) announced it would triple production to 60,000 wpm, equivalent to 5 percent of global output, by year-end 2020 at its new, $24 billion plant in Wuhan.[164] Similarly, ChangXin Memory Technologies, also a state-funded company, announced that in 2020 it would quadruple production of DRAM chips to 40,000 wpm (or 3 percent of world DRAM output) at its $8 billion facility in Hefei.[165]

As Capri wrote about these investments (and to lead into this report’s following section):

As China’s memory chip production is based on government output targets and other strategic, non-market driven goals, then the possibility of an over-supply of NAND and DRAM chips would seem likely, at some point, which would drive down global market prices. None of this bodes well for the world’s existing players in this space.[166]

As James Mulvenon similarly warned in a recent SOS International report on YMTC:

YMTC is currently aggressively expanding its capacity and fabrication facilities, raising serious concerns about its future plans in the global market. YMTC’s state-backing means it does not have to worry about profits and can expand capacity beyond supply demands. This will result in significant oversupply in the market. Unless the other chip suppliers reduce their capacity, which will result in ceding market share to YMTC, the industry will experience massive losses. The semiconductor industry will be forced to consolidate, which could lead existing companies—including U.S. and allied country companies—to exit the industry, as happened with solar panels, flat panel displays, and LEDs.[167]

In December 2020, China’s SMIC contended that it had achieved a major breakthrough in its ability to manufacture 7 nm chips. It asserted that its N+1 7 nm node marks a significant improvement over its current 14 nm production node, including a 20 percent increase in performance, a power consumption reduction of 57 percent, a reduced logic area of 63 percent, and SoC (System on a Chip) area reduction of 55 percent.[168] This aligns with a recent Goldman Sachs report predicting that China may be capable of producing 7 nm chips by 2023.[169] Also notable about this development is that the design architecture for the N+1 foundry node may enable SMIC to break its reliance on EUV lithography machines provided by foreign vendors. Reducing its dependence on foreign EUV-lithography-based semiconductor manufacturing equipment has long been a key objective for China, with the Suzhou Institute of Nano-tech and Nano-Bionics under the Chinese Academy of Sciences (Sinano), along with the National Center for Nanoscience and Technology, recently announcing breakthroughs in development of a new type of 5 nm laser lithography technology.[170]

China is also working to position itself for leadership in what are called third-generation, wide band-gap semiconductors, which are chipsets made of materials such as silicon carbide and gallium nitride. The main applications of the third generation of semiconductor materials are semiconductor lighting, power electronics, lasers and detectors, and other fields, each with different industry maturity.[171] U.S.-based CREE Inc. and Japan’s Sumitomo Electric Industries, Ltd. currently lead in development of these next-generation chipsets, but with no single country now dominating this fledgling technology, up-and-coming Chinese competitors such as San’an Optoelectronics Co., Ltd. and state-owned China Electronics Technology Group Corp. may be able to make a step change in the sector.[172]

Impacts on Semiconductor Industry Production and Competition

Enterprises from the United States (and other leading nations such as Germany, the Netherlands, South Korea, Taiwan, and the United Kingdom) remain ahead of China in semiconductor technology. Experts believe that China still “remains at least two generations behind in its ability to produce microchips for consumer electronics.”[173] However, as noted immediately above, China has demonstrated the ability to rapidly close such gaps, as shown nowhere more clearly than in solar photovoltaics, where the Chinese share of the global market was miniscule before 2005 but had exceeded 60 percent by 2011, and has only grown further since then.[174] A similar trajectory in semiconductors is not unthinkable, especially should other nations not heed lessons from their loss of global production and market share in other advanced-technology industries, especially in the face of unbridled, unimpeded Chinese innovation mercantilism. As President Obama’s Council of Advisors on Science and Technology warned, “Chinese policies are distorting [semiconductor] markets in ways that undermine innovation, subtract from U.S. market share, and put U.S. national security at risk.”[175] These trends have only grown over the last three to five years.

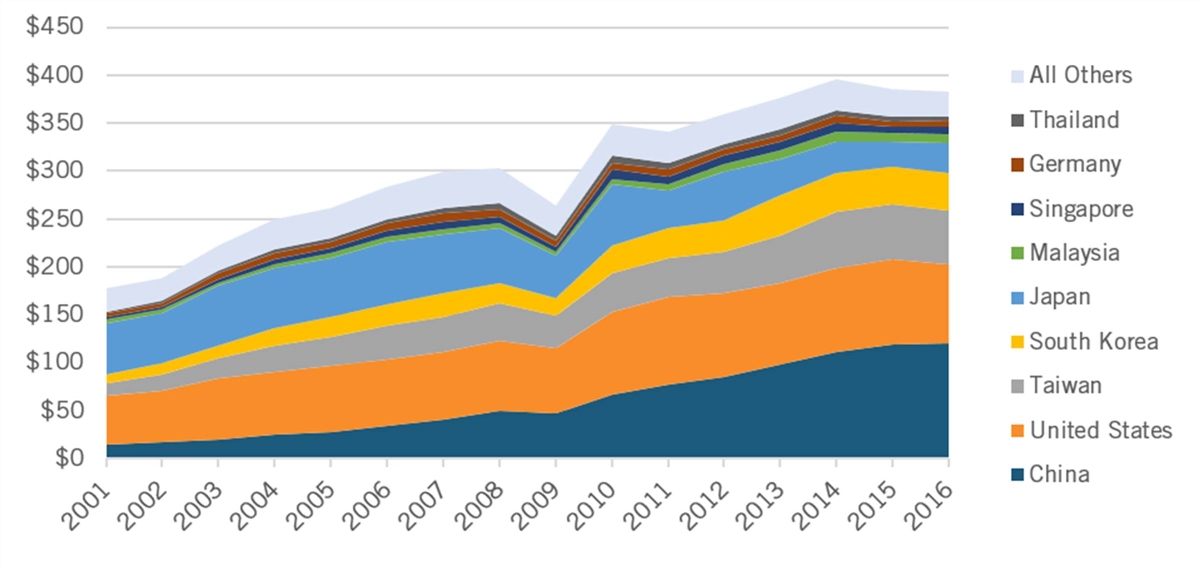

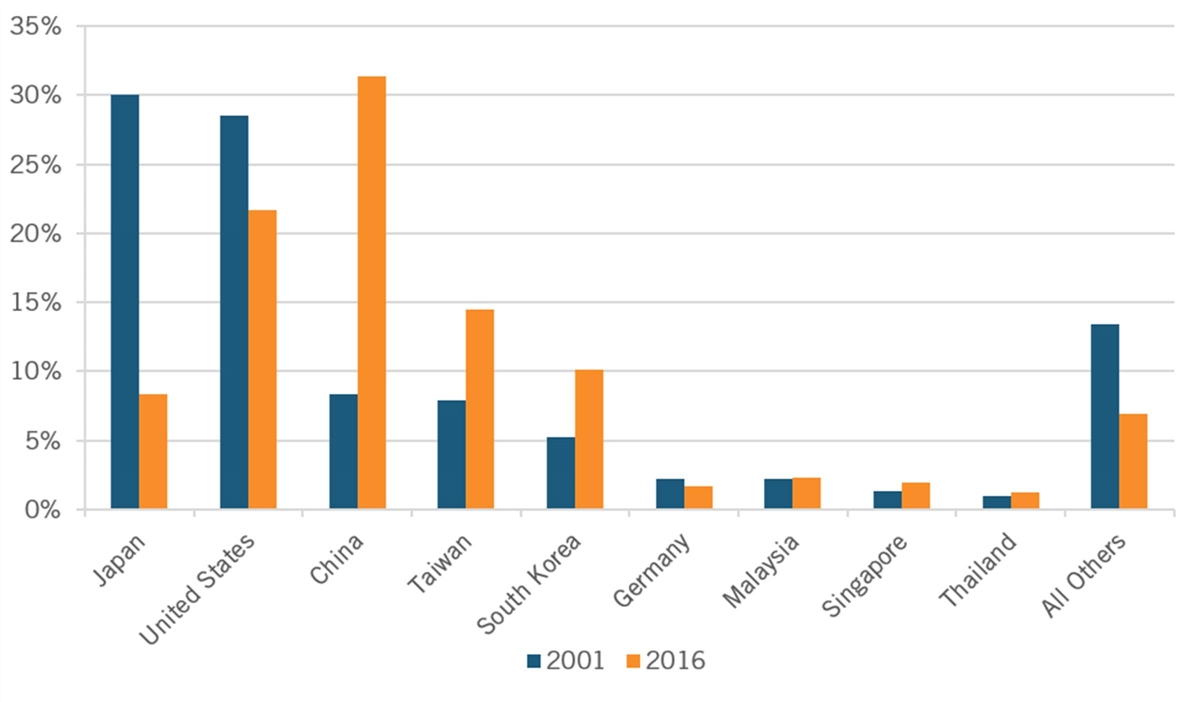

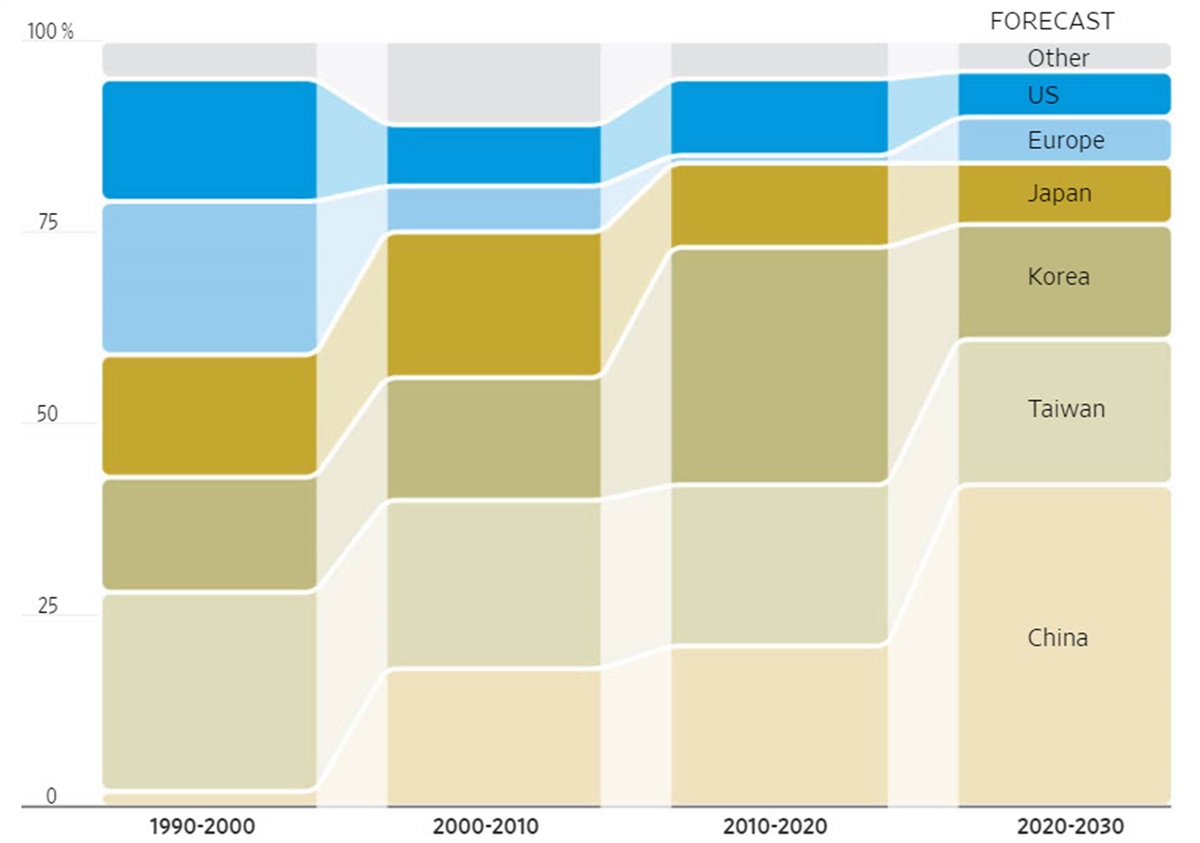

From 2001 to 2016, China’s share of global value added in the semiconductor industry grew almost fourfold, from 8 to 31 percent, while the United States’ share fell from 28 to 22 percent, and Japan’s share fell by over two-thirds, from 30 to 8 percent.

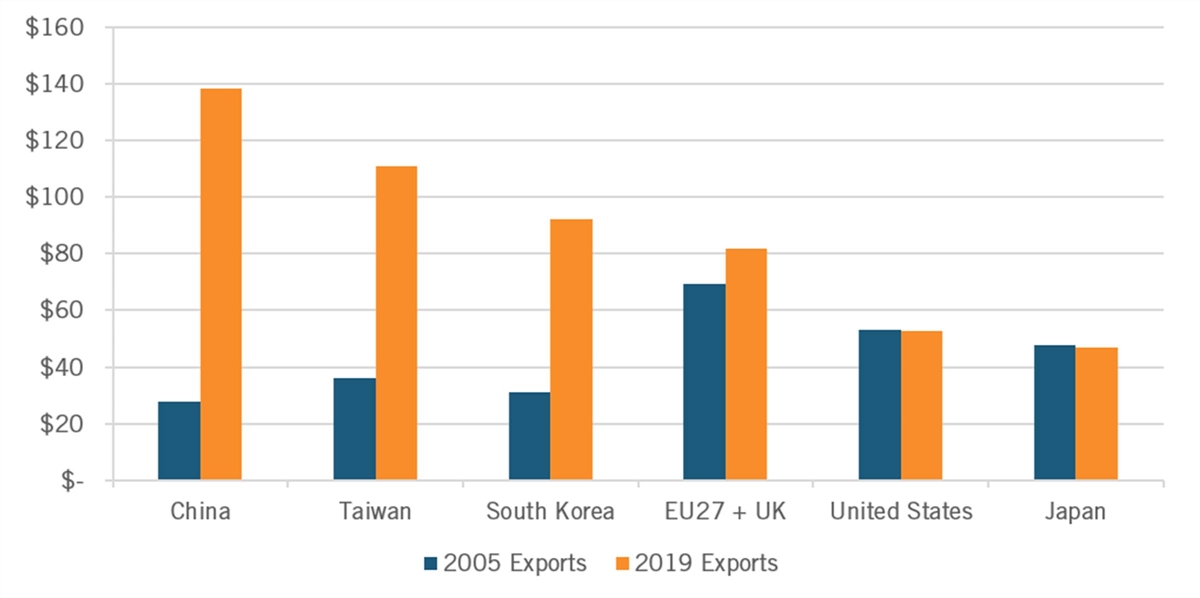

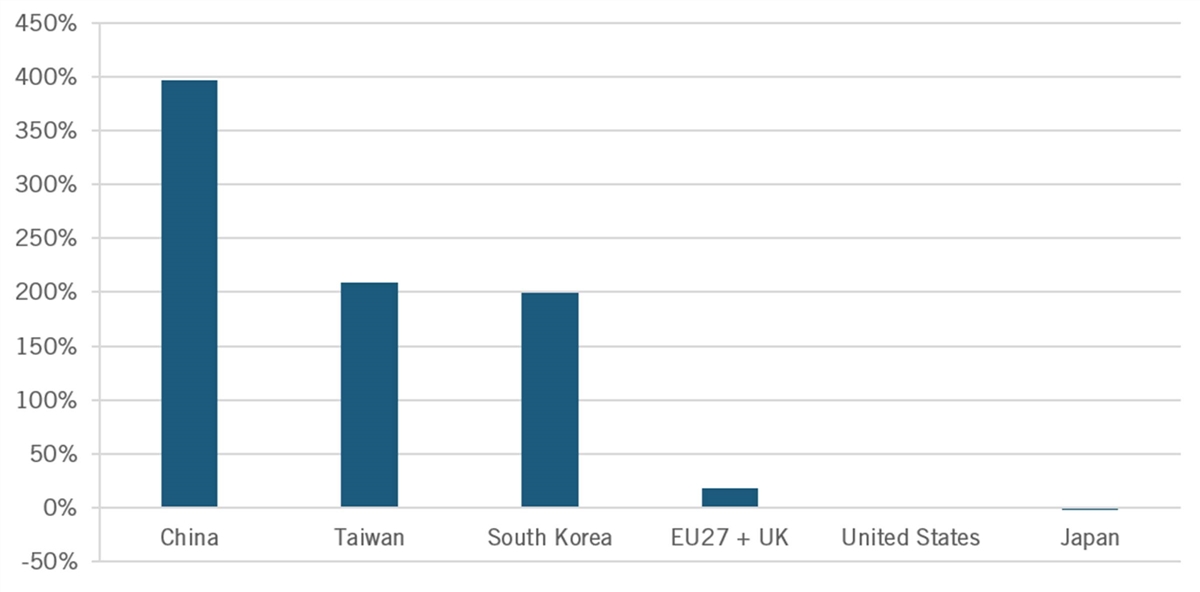

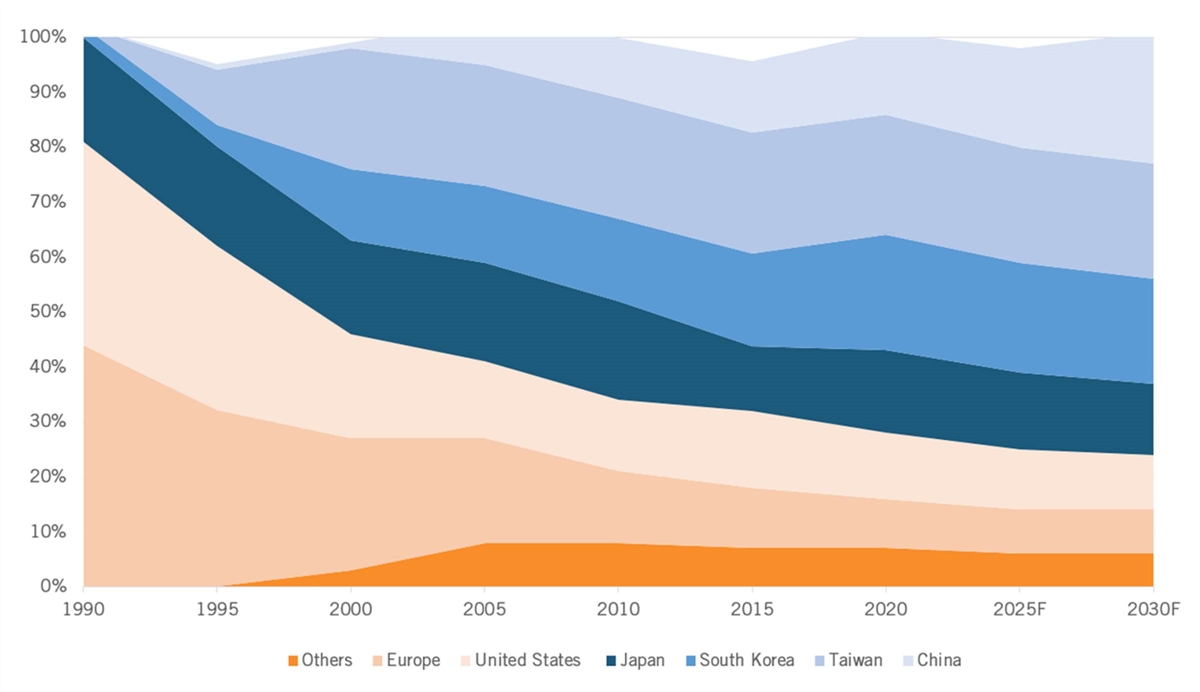

Share of Semiconductor Value Added, Exports, and Fabrication Capacity