An Allied Approach to Semiconductor Leadership

Many countries rightly seek to maximize their value added in the global semiconductor industry. But like-minded allied nations can also advance their leadership collectively by collaborating on technology and ecosystem development, intellectual property, and trade liberalization.

KEY TAKEAWAYS

Key Takeaways

Contents

The Global Semiconductor Industry 5

Global Semiconductor Value Chains 12

Countries’ Semiconductor Competitiveness Strategies 19

Collaborating to Collectively Enhance Semiconductor Competitiveness 23

Coordinated Technology Development 25

Coordinated Semiconductor Ecosystem Development 31

Coordinated Technology Protection. 33

Advance Supportive Trade Rules, Regimes, and Practices 40

Executive Summary

Semiconductors represent one of the world’s most important industries, the core technology that powers the modern digital world and empowers innovation and productivity growth across every industry. In turn, the evolution of global value chains has enabled the industry to sustain its relentless, multi-decades drive to produce ever-more powerful integrated circuits at ever-lower costs—a dynamic captured in Moore’s Law: the notion that the number of transistors on a microchip doubles about every two years, effectively meaning a semiconductor’s capability in terms of speed and processing is doubled, even though its cost is halved. However, recognizing semiconductors’ foundational role in the modern global economy, and their importance to national security, an increasing number of nations are seeking to capture as much value as possible from the industry, whether from semiconductor research and development (R&D); design; fabrication; or assembly, test, and packaging (ATP).

While national, including U.S., policies to spur semiconductor R&D and production are important, it’s also important to recognize that self-sufficiency cannot and should not be the goal. The increasing expense, complexity, and scale required to innovate and manufacture semiconductors means that no single nation can afford to go it alone. However, there exists an opportunity and a need for a like-minded set of nations committed to open trade and fair economic competition to collaborate in ways that collectively empower the competitiveness of their semiconductor industries.

This report begins by examining the global semiconductor industry, including the rise of semiconductor global value chains, and by examining nations’ semiconductor competitiveness strategies. It then examines how a community of allied nations can work together across four areas—by working collaboratively on semiconductor technology development, ecosystem support, and technology protection, as well as by developing supportive trade rules and regimes—to collectively enhance the competitiveness and innovation potential of their respective semiconductor industries and the industry globally.

The report makes the following policy recommendations:

Coordinated Technology Development

▪ Establish Manufacturing USA Institute(s) supporting semiconductor industry innovation—in activities including R&D, manufacturing, and packaging—and invite participation by semiconductor enterprises headquartered in like-minded nations.

▪ Expand international cooperation in semiconductor sector public-private partnerships.

▪ The United States and like-minded nations should increase funding for collaborative, pre-competitive R&D efforts, and ensure that there is reciprocal opportunity for semiconductor enterprises from like-minded nations to participate in such consortia.

▪ The U.S. government should work to more effectively coordinate the semiconductor R&D programs being conducted across various government agencies.

▪ The U.S. government should explore authorizing more-flexible federal contracting guidelines, such as a relaxation of Federal Acquisition Regulations, or allowing greater use of other transactional authority vehicles, in order to increase the commercialization potential of federally funded semiconductor R&D research programs.

▪ The U.S. government should invite other allied nations to co-invest in semiconductor moonshots, with resulting intellectual property (IP) and technical discoveries shared at levels proportionate to national mutual investment.

▪ The United States should explore additional opportunities to enroll peers from allied nations in the trusted foundries programs, with allied nations acting reciprocally for their related programs.

▪ Like-minded nations should amend their procurement guidelines by adding a fourth key pillar—security—in addition to the traditional standards of price, cost, and quality.

Coordinated Semiconductor Ecosystem Development

▪ Like-minded nations should continue to advocate for open standards-development processes, both as they relate to semiconductors specifically and to the vast panoply of downstream digital technologies fundamentally predicated on semiconductors, such as 5G, artificial intelligence (AI), the Internet of Things, and autonomous vehicles.

▪ Like-minded nations and enterprises therein should collaborate to develop a fundamentally more-secure computing infrastructure.

Coordinated Technology Protection

Export Controls

▪ U.S. export controls must be regularly updated to reflect the global state of play in semiconductor industries, such that controls do not preclude U.S. enterprises’ ability to sell goods that are on a technical par with commercially available goods and services from foreign competitors.

▪ Any emerging technologies that are ultimately deemed to meet the statutory standards for export controls should be designated as such only in cases of exclusive development and availability within the U.S. market—and the controls should be removed if and when that exclusivity no longer exists.

▪ The United States should eschew the application of unilateral export controls and seek to develop a more ambitious and effective plurilateral approach to promulgate export controls among like-minded nations that have indigenous semiconductor

production capacity.

▪ Congress should expand the remit and funding for the Export Control and Related Border Security (EXBS) Program at the U.S. Department of State.

▪ At the 2020 Multilateral Action on Sensitive Technologies (MAST) conference, scheduled for September 2020, the United States should consider introducing a plurilateral approach to advanced-technology export controls.

Foreign Investment Screening

▪ The United States should work with like-minded nations to align foreign investment screening practices and to exchange information when it appears other nations are trying to use unfair practices in making foreign investments, such as heavily state-subsidized, state-owned enterprises (SOEs) attempting to purchase foreign enterprises in advanced-technology industries.

▪ The United States should continue to work with like-minded nations to coordinate investment screening procedures, and it should consider expanding its list of “excepted foreign states” to include countries such as France, Germany, the Netherlands, Italy, Japan, and South Korea (among others).

Cataloging and Combatting Foreign Technology and Intellectual Property Theft

▪ Like-minded nations should develop a comprehensive list of enterprises and individuals who have attempted or affected IP theft, and develop mechanisms to restrict such firms and individuals from competing in like-minded nations’ markets.

▪ Like-minded nations should enhance information-sharing efforts to combat foreign economic espionage and IP/technology/trade secret theft.

▪ The United States should lead like-minded nations in developing stronger information-sharing mechanisms focused on combatting state-sponsored economic espionage in advanced-technology industries.

▪ The United States should continue to work with like-minded nations to strengthen their trade secret protection regimes.

▪ The United States and other like-minded nations should continue to include robust trade secret protections, and penalties for willful large-scale commercial trade secret theft, in trade agreements they pursue.

Supportive Trade Policies, Regimes, and Practices

▪ Elevate the imprimatur and stature of the World Semiconductor Council (WSC).

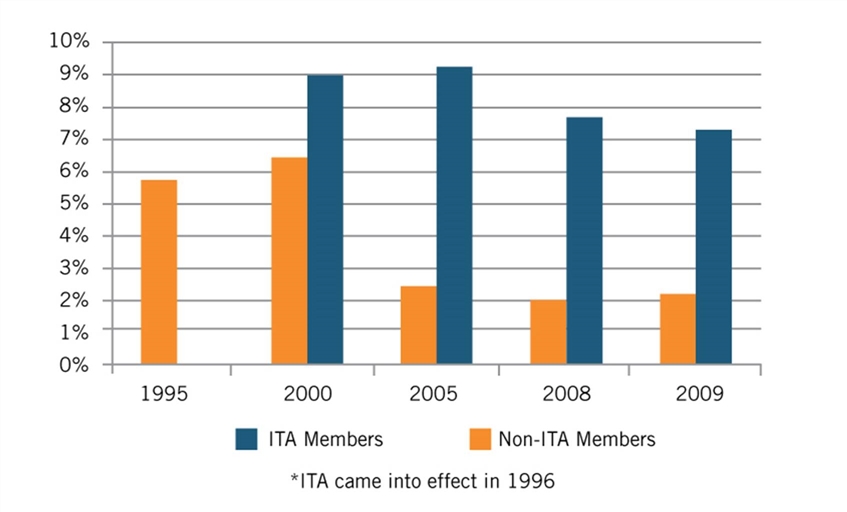

▪ Expand the Information Technology Agreement (ITA).

▪ Maintain the World Trade Organization (WTO) e-commerce customs duty moratorium.

▪ With like-minded nations, join and expand the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP) Agreement.

▪ Expand subsidies disciplines at the WTO.

▪ Insist on market access reciprocity in digital government procurement activity.

▪ Consider forming a Global Strategic Supply Chain Alliance (GSSCA).

▪ Develop an allied approach to expand market-based trade approaches in the

Indo-Pacific region.

Read the full report. (PDF)

The Global Semiconductor Industry

The term “semiconductor” actually refers to a solid substance—such as silicon or geranium—which has electrical conductivity properties allowing it to be used either as a conductor or an insulator. In 1956, Bell Labs’ John Bardeen, Walter Brattain, and William Shockley won a Nobel Prize for their 1947 invention of the transistor, a semiconductor device used to amplify or switch electronic signals and electrical power. In the mid-1950s, Jack Kilby at Texas Instruments and Robert Noyce and a team of researchers at Fairchild Semiconductor pioneered the integrated circuit, placing multiple transistors on a single flat piece of semiconductor material, giving rise to the modern visage of a “semiconductor chip.” But modern semiconductors are a far cry from those invented by the early pioneers; today, they contain billions of transistors on a chip the size of a square centimeter, circuits are measured at the nanoscale (“nm,” a unit of length equal to one millionth of a meter), and the very newest semiconductor fabrication facilities are producing semiconductors at 5nm and 3nm scales.[1] Leading-edge semiconductors contain transistors that are 10,000 times thinner than a human hair.

The increasing miniaturization of semiconductors alongside performance enhancements in both processing capacity and speeds as well as power efficiency lie at the core of every single information and communications technology (ICT) product. It’s principally the evolution of semiconductors that explains the ever-increasing capability at an ever-decreasing relative price of digital products—everything from cells phone costing $4,000 in 1983 to just a few hundred dollars today to the cost of personal genome sequencing dropping from $2.7 billion to $300 over the past 20 years to the emergence of new “G’s” in wireless communications about every decade.[2]

Semiconductors represent one of the world’s most important industries, the core technology that powers the modern digital world and empowers innovation and productivity growth across every sector of every economy.

Harvard economist Jon Samuels estimated that total factor productivity in the U.S. semiconductor sector grew at close to 9 percent over the period from 1960 to 2007 (25 times the rate for the overall economy) and to have accounted for nearly 30 percent of the United States’ aggregate economic innovation over this period.[3] In terms of industry-specific contributions, from 1960 to 2007, semiconductors accounted for about 37 percent of the growth in the U.S. communications equipment manufacturing industry, 14 percent of the expansion of the electrical equipment and appliances sector, and 24 percent of the growth in output among other electronic products.[4] Oxford Economics estimated that the semiconductor industry helps create $7 trillion in global economic activity and is directly responsible for $2.7 trillion in total annual global gross domestic product (GDP).[5] And with the digital economy now accounting for nearly one-quarter of global GDP, semiconductors power the future of digitalization, underpinning everything from AI, cloud computing, and the Internet of Things to advanced wireless networks, smart grids, smart buildings, and smart cities, and even the next generation of quantum computing.[6]

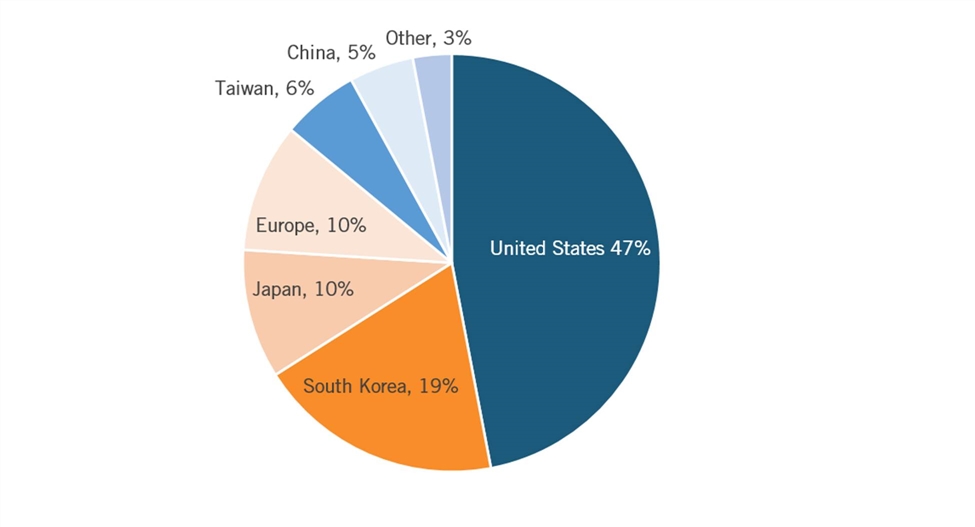

The semiconductor industry itself represents a $470 billion highly globalized industry (expected to become a $730 billion industry by 2026) that shipped over 1 trillion semiconductors for the first time ever in 2019, with some of these processors containing over 30 billion transistors.[7] In 2019, U.S.-headquartered semiconductor enterprises held a 47 percent market share of global semiconductor industry sales, followed by South Korean firms with 19 percent, Japanese and European firms each with 10 percent, Taiwanese firms with 6 percent, and Chinese enterprises with 5 percent. (See figure 1.)

Figure 1: 2019 Global semiconductor industry sales market share[8]

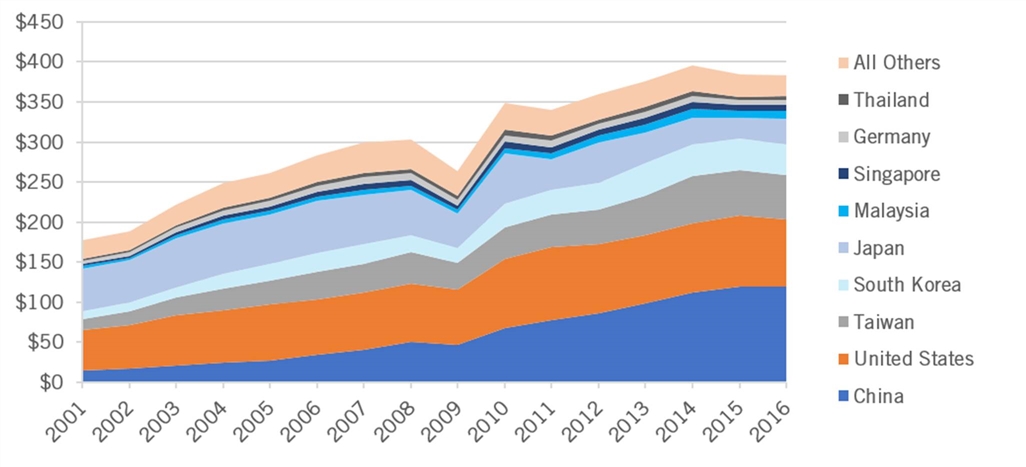

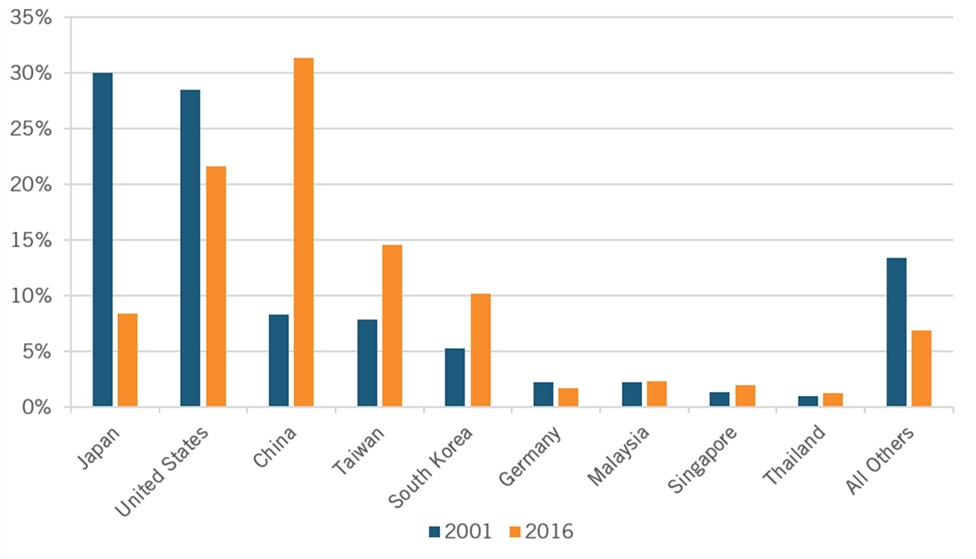

However, the picture is very different when it comes to value added (the value of actual production in a nation). In 2016 (the most-recent year for which data is available), China produced $120 billion in value added, compared with $83 billion for the United States, $55.6 billion for Taiwan, and $39 billion for South Korea. (See figure 2.) U.S. value added in the sector peaked at $91.3 billion in 2011 (values in nominal dollars). China’s value added in the sector increased three-fold from 2007 to 2016. In terms of share of global value added in the semiconductor industry, from 2001 to 2016, China’s grew almost four-fold, from 8 to 31 percent, while the United States’ share fell from 28 to 22 percent, and Japan’s share fell by over two-thirds, from 30 to 8 percent. Taiwan and South Korea both saw their shares double or almost so, with Taiwan’s share growing from 8 to 15 percent and South Korea’s growing from 5 to 10 percent. Germany and Malaysia maintained shares of 2 percent each. (See figure 3.)

Figure 2: Value added ($ billions) of semiconductor industry by economy, 2001–2016[9]

Figure 3: Country share of value added in global semiconductor industry, 2001 and 2016[10]

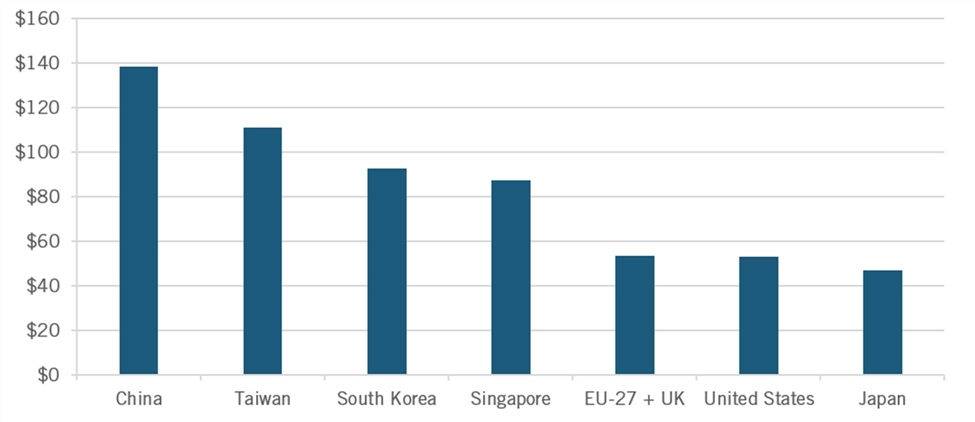

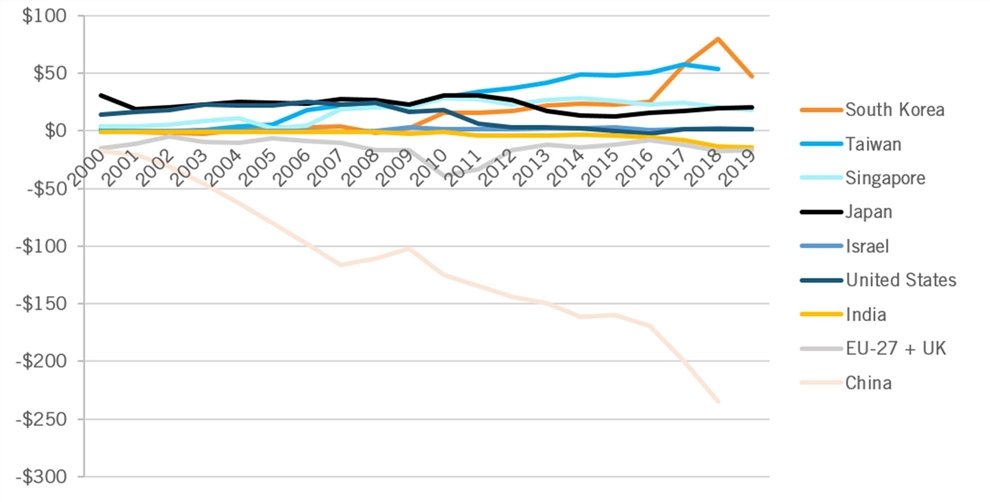

According to Organization for Economic Cooperation and Development (OECD) data, in 2018, China exported $138 billion in semiconductors, Taiwan $111 billion, South Korea $92 billion, Singapore $87 billion, the United States $53 billion, the EU-27 and United Kingdom combined $53 billion, and Japan $48 billion. (See figure 4.) In terms of trade balances, in 2019 (or the most recent year in which data is available for that country), Taiwan recorded a trade surplus of $54 billion, South Korea $47 billion, Japan $21 billion, Singapore $18 billion, and the United States $2 billion.[11] Conversely, in 2018, India recorded a $14 billion semiconductors trade deficit, the EU-27 countries and the United Kingdom an $18 billion one, and China a $235 billion deficit. (See figure 5.) However, it’s important to note that while China’s semiconductor trade deficit might appear quite substantial, the reality is that about half of these semiconductor imports were re-exported—with value added during assembly and manufacturing—from China as part of global production networks for cell phones, tablets, and other electronic products (one reason why China’s semiconductors trade balance is no justification for it seeking autarky in semiconductor production).[12] China’s trade deficit in semiconductors grew significantly during a time when its trade surplus in electronics goods (e.g., computers, cell phones, etc.) also grew significantly, accounting for 58 percent of the value of total exports.[13]

Figure 4: Semiconductor exports by country ($ billions), 2019 or most recent year available[14]

Figure 5: Semiconductor trade balances by nation, 2000–2019 ($ billions)[15]

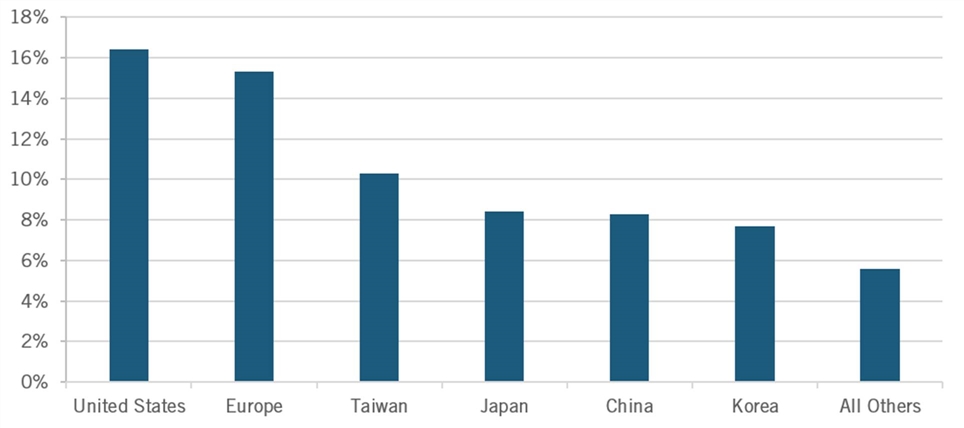

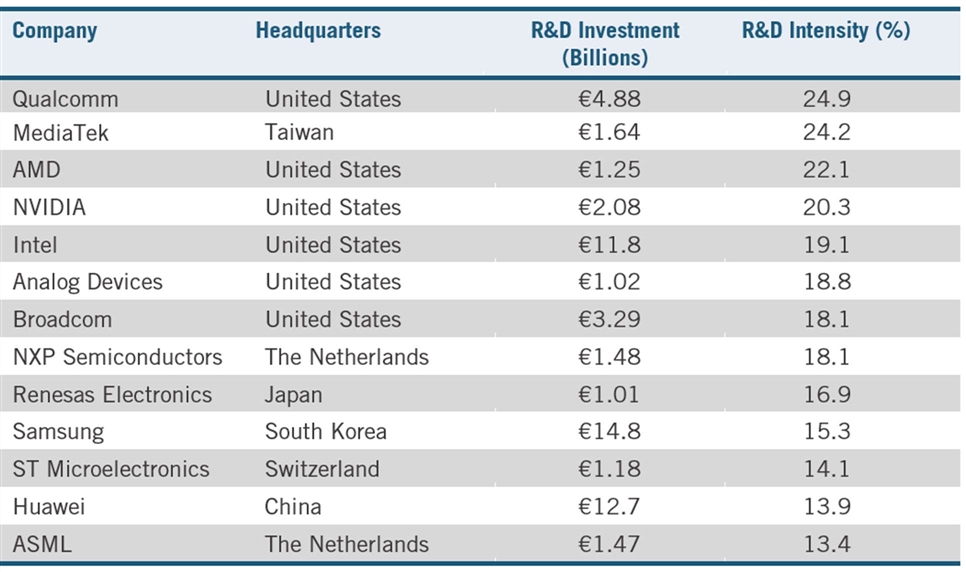

Semiconductors represent the world’s second-most R&D-intensive industry, after biopharmaceuticals. In 2018, U.S.-headquartered semiconductor companies invested 16.4 percent of their sales in R&D, compared with 15.3 percent on average for European-headquartered companies, 10.3 percent for Taiwanese firms, 8.4 percent for Japanese firms, 8.3 percent for Chinese companies, 7.7 percent for Korean firms, and 5.6 percent on average for semiconductor companies from all other nations.[16] (See figure 6.) Of the 12 most R&D-intensive semiconductor companies in the “2019 EU Industrial R&D Investment Scoreboard” report, half hail from the United States, and the top three most R&D-intensive companies are Qualcomm, which invests one-quarter of its revenues back into R&D annually, followed by Taiwan’s MediaTek with 24.2 percent, and America’s Advanced Micro Devices (AMD) with 22.1 percent. (See table 1.) In terms of actual investment, Samsung leads with €14.8 billion (approximately $17.6 billion) invested in R&D in 2019, followed by Intel with €11.8 billion ($13.7 billion).[17]

Figure 6: National semiconductor industry R&D intensity, 2019[18]

Table 1: Leading semiconductor investors on the 2019 EU Industrial R&D Investment Scoreboard[19]

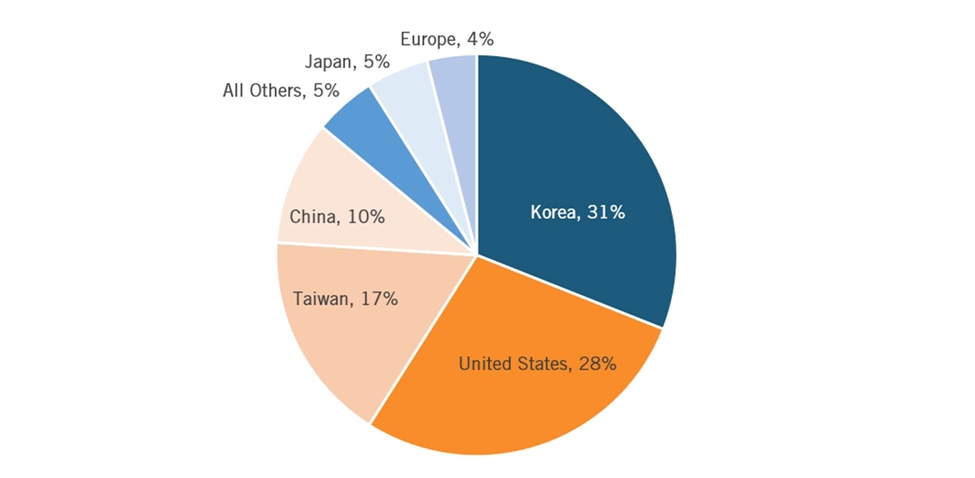

The industry is also highly capital intensive; in fact, the U.S. semiconductor industry’s global gross capital expenditures (CapEx) reached $31.9 billion in 2019, making the industry’s capital expenditures as a percentage of sales, at 12.5 percent, second only to America’s alternative-energy sector.[20] In 2019, Korean-headquartered enterprises invested 31 percent of global CapEx in the sector, followed by U.S. companies with 28 percent, Taiwanese firms with 17 percent, Chinese firms with 10 percent, Japanese firms with 5 percent, and European firms with 4 percent. (See figure 7.)

Figure 7: Countries’ headquartered-enterprise’s percent share of global semiconductor industry capital expenditures, 2019[21]

The industry must be so R&D- and capital-intensive because innovating in the semiconductor industry requires increasingly complex chip designs at ever-smaller scales, especially if the industry is to keep up with the vaunted Moore’s Law. And while some believed at the start of the last decade that the 28nm threshold would herald the limit of Moore’s Law, materials-engineering breakthroughs over the past decade in extreme ultraviolet lithography (EUV), etching, and thin-film deposition have brought the current industry frontier to 5 nm, with fairly clear visibility into the processes needed to get to 3 nm, 2 nm, and even 1 nm sizes.[22] As Dan Hutcheson, CEO and Chairman of VLSI Logic explains, even at the 7 nm level, today’s semiconductors pack over 20 billion transistors on a single chip, working at tolerances that are 1/10th or smaller the size of the coronavirus.[23] Contributions from enterprises and researchers from a wide range of nations—including China, Germany, France, Japan, Taiwan, the Netherlands, South Korea, the United States, and the United Kingdom, among others—have been responsible for advances in improving device performance, lowering power consumption, and shrinking size, reflecting the truly global nature of the industry.

However, whereas innovation in the sector historically was largely about doubling the processing power of chips while reducing or maintaining costs, the locus of innovation today is shifting and expanding, moving beyond mere processing speed to include energy consumption, “systems on a chip” functionality, and entirely new forms of technology and computing architectures. For instance, Silicon Valley-based Tachyum is working on a new “universal processor” microchip that would consolidate three types of microprocessors—the central processing unit (CPU), graphics processing using (GPU), and a tensor processing unit (TPU)—into a single chip, potentially delivering significant processing speed and power-consumption benefits.[24]

Yet the expertise, capital, and scale needed to develop a new semiconductor design, or build a new semiconductor fab, is extremely high, and increasing. For instance, an April 2020 study finds that the number of researchers required to achieve Moore’s Law (i.e., doubling of computer chip density) today is more than 18 times larger than the number required in the early 1970s.[25] This is one reason costs are increasing. In 2019, Taiwanese-manufacturer TSMC announced it would build a 5nm fab in Arizona at a cost of $12 billion; in 2017, it had announced it was making plans to build a 3nm fab in Taiwan at an anticipated cost of $20 billion.[26] As of 2020, it’s estimated that building a new 14–16nm fabs costs, on average, $13 billion; a 10nm fab $15 billion; a 7nm fab $18 billion; and a 5nm fab $20 billion.[27] Reflective of the increasing cost of competing in the sector, whereas almost 30 companies manufactured integrated circuits at the leading-edge of technology 20 years ago, only 5 do so today (Intel, Samsung, TSMC, Micron, and SK Hynix).[28]

The number of researchers required to achieve Moore’s Law (i.e., doubling of computer chip density) today is more than 18 times larger than the number required in the early 1970s.

Thus, the semiconductor industry represents a classic innovation-based industry characterized by extremely high fixed upfront costs of R&D and design, yet incremental costs of production (i.e., an individual chip comes off the production line at marginal cost). Moreover, the industry depends on one generation of innovation to finance investment in the next, so profits from the 10nm fab beget the revenues to invest in the 7nm fab, which make possible the 5nm and 3nm fabs of the future. As such, the ability of the global industry to sustain itself depends on several conditions attaining across the global economy. First, semiconductor companies need access to large global markets so they can amortize and recoup their costs across a single large global marketplace. Given the significant growth in fixed costs of R&D and capital equipment, the ability to access global markets is more important than it has ever been.

Second, semiconductor companies cannot face excess, non-market-based competition, such as governments pumping in hundreds of billions of dollars in subsidies, which unfairly disadvantages enterprises that are attempting to compete on genuinely market-based terms. In other words, if leading-edge companies cannot be assured that they can earn a reasonable, risk-adjusted rate of return on their investments—which is put in doubt by some governments such as China investing massive amounts of money to create a domestic semiconductor industry—then the leading companies will cut R&D and capital expenditures.

Third, because the industry fundamentally depends on knowledge, technology, and know-how, the international system must feature robust IP rights—including patents, trade secrets, and trademarks—for an extraordinary amount of the value is knowledge-based.[29] Again, if companies cannot retain that expensive IP, and it goes to competitors illegally and illicitly, their margins will go down, thereby reducing investment.

Finally, the industry relies on open and smoothly flowing global semiconductor value chains, as the following section elaborates.

Global Semiconductor Value Chains

The semiconductor industry has perhaps the most complex and geographically dispersed value chain of any industry in the world. In one stylized example, provided in the report “Beyond Borders: The Global Semiconductor Industry Value Chain,” large silicon ingots might be produced and cut into silicon wafers (the material used for producing semiconductors) in Japan; those bare wafers shipped to the United States to be transformed into fab wafers and cut into dies, on which the functional integrated circuit is etched to make a semiconductor; those semiconductor chips then being shipped to a country, such as Malaysia or Vietnam, where the semiconductor chips go through the ATP process; those chips then being exported to a country, such as China, South Korea, or the United States, to be integrated into end products such as tablets, mobile phones, or servers; and then those final consumer end products exported to the world.[30] (See figure 8.) In fact, the typical production process toward a final electronics product can see the underlying semiconductors within it cross international borders 70 or more times in a process that takes over 100 days and includes 3 full trips around the world.[31] One reason for this globalized supply chain is that unlike some industries such as cement, or even automobiles, with a high weight (and volume) to value ratio, semiconductors are small and light—and the costs of moving them around the globe is minimal compared with their actual value.

Figure 8: Stylized example of semiconductor value chain[32]

Individual semiconductor companies have very complex supply chains. For instance, Intel has 15 wafer fabs in production worldwide at 10 locations, including 4 in the United States, and its supply chain comprises more than 11,000 suppliers in over 90 countries.[33] South Korea’s Samsung identifies over 2,500 global suppliers, and SK Hynix has approximately 1,200 global suppliers.[34] Taiwan’s TSMC operates 2 dozen fabs across multiple continents, producing 12 million wafers annually using 270 different silicon technologies that support 10,700 different customer products. Taiwan’s TSMC is supported by more than 3,000 suppliers globally.

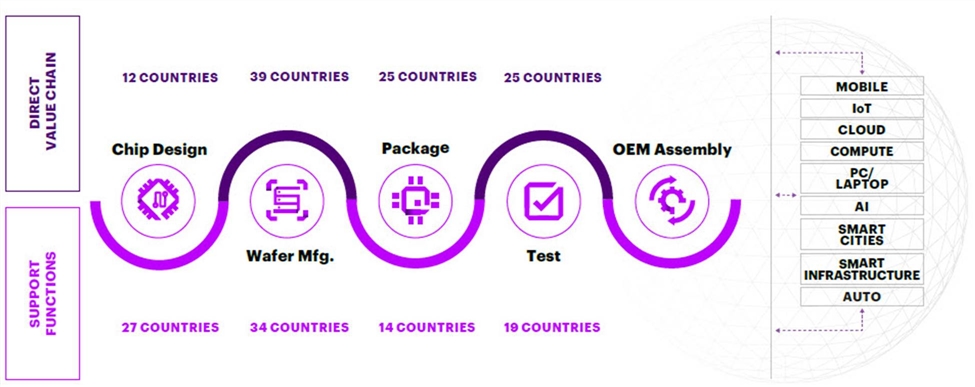

Figure 9: Number of countries participating in various phases of semiconductor manufacturing activity[35]

As noted, semiconductor R&D and chip design; semiconductor fabrication; and semiconductor ATP constitute the highest-level facets of the semiconductor production process. An estimated 90 percent of the value of a semiconductor chip is split evenly between the design and manufacturing phases, with the final 10 percent of the value provided through ATP activities.[36] A large number of countries field enterprises competing across multiple facets of semiconductor production. In fact, each segment of the semiconductor value chain has, on average, 25 countries involved in the direct supply chain and 23 countries involved in support functions. Over 12 countries have enterprises directly engaged in semiconductor chip design, 39 countries have at least 1 semiconductor fabrication facility, while over 25 countries have enterprises engaging in ATP activities.[37] (See figure 9.)

An estimated 90 percent of the value of a semiconductor chip is split evenly between the design and manufacturing phases, with the final 10 percent of the value provided through ATP activities.

Various countries and regions have carved out specific niches in global semiconductor supply chains. As the “Beyond Borders” report explains:

Canada, European countries, and the United States tend to specialize in semiconductor design, along with high-end manufacturing. Japan, the United States, and some European countries specialize in supplying equipment and raw materials. China, Taiwan, Malaysia, and other Asian countries tend to specialize in manufacturing, assembling, testing, and packaging. Canada, China, Germany, India, Israel, Singapore, South Korea, the United Kingdom, and the United States are all major hubs for semiconductor R&D. Major semiconductor companies have located facilities in countries as far flung as Costa Rica, Latvia, Mexico, South Africa, and Vietnam.[38]

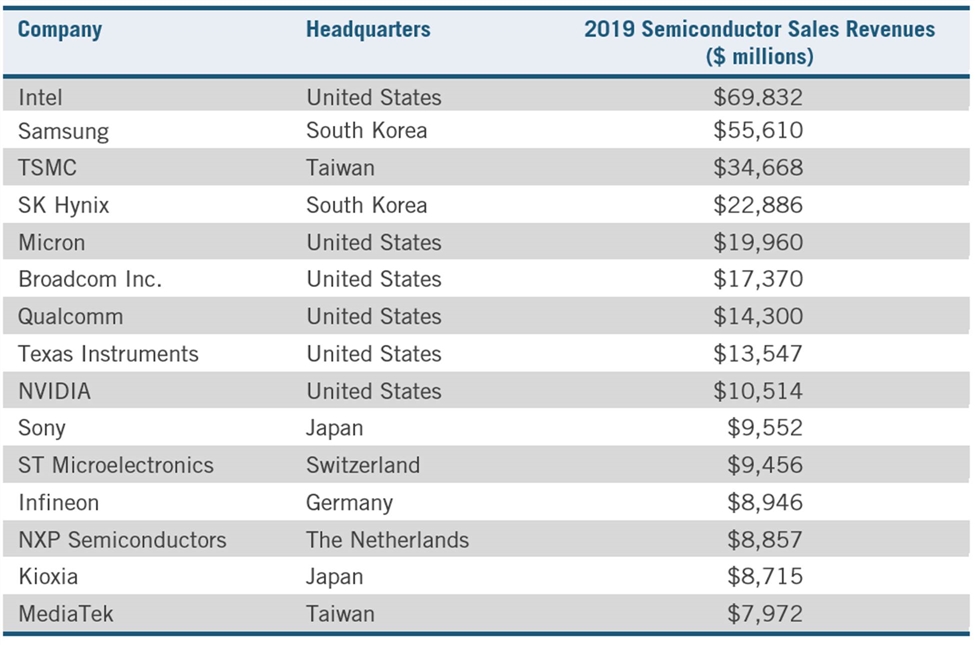

The internationalization of the semiconductor industry is also reflected by its leading players, with the 2019 top 4 global semiconductor sales leaders hailing from 3 different nations, led by America’s Intel ($69.8 billion in sales), South Korea’s Samsung ($55.6 billion), Taiwan’s TSMC ($34.7 billion), and South Korea’s SK Hynix ($22 billion). (See table 2.) No Chinese company makes the top 15, and only 1, HiSilicon at 16, ranks in the top 25 (as of year-end 2019).

The three most-prevalent types of semiconductors are logic chips, memory (usually dynamic random-access memory (DRAM)) chips, and analog chips (those which generate a signal or transform signal characteristics, and are especially prevalent in automotive and audio applications). In 2019, the logic segment accounted for $107 billion in global sales, memory for $106 billion, and analog for $54 billion.[39] Intel is the world’s leader in logic chip market share. Texas Instruments, Analog Devices, and Infineon account for the market leaders in the analog chip market, with market shares of 19, 10, and 7 percent, respectively.[40] Samsung, SK Hynix (both headquartered in South Korea), and Micron (United States) lead the world in DRAM production, accounting respectively for 44 percent, 29 percent, and 21 percent of global market share as of Q1 2020.[41]

Table 2: Top 15 2019 semiconductor global sales leaders[42]

The globalization of semiconductor value chains has been driven by multiple factors, and produces manifold benefits. As Macher and Mowery elucidated in their report “Vertical Specialization and Industry Structure in High Technology Industries”:

The growth in vertical specialization in semiconductors since 1985 reflects the influence of both market-related and technological factors. Scale economies lowered production costs, expanding the range of potential end-user applications for semiconductors and creating additional opportunities for entry by vertically specialized firms. The increasing capital requirements of semiconductor manufacturing provided another impetus to vertical specialization, since these higher fixed costs made it necessary to produce large volumes of a limited array of semiconductor components in order to achieve lower unit costs. The design cycle for new semiconductor products also has become shorter and product lifecycles more uncertain, making it more difficult to determine whether demand for a single product will fully utilize the capacity of a fabrication facility that is devoted exclusively to a particular product and increasing the risks of investing in such “dedicated” capacity.[43]

As the “Beyond Borders” report expounds, for enterprises to compete successfully in various facets of the semiconductor supply chain thus “requires great specialization and offers a chance to add significant value. The supply chain thus becomes a value chain, with each activity contributing to the overall competitive edge of the final product.”[44]

This is very different from “conventional” manufacturing industries wherein capital costs are nowhere near as high, and markets can support many producers in a particular industry, meaning that the odds of being able to have a significant share of suppliers located in a particular country, especially one with a large economy such as the United States, is much higher.

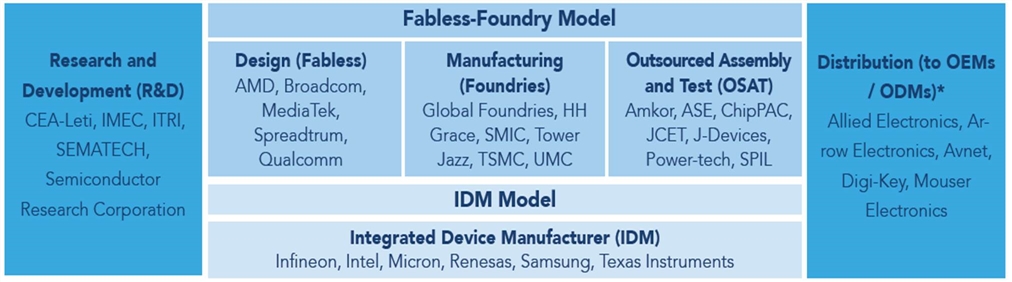

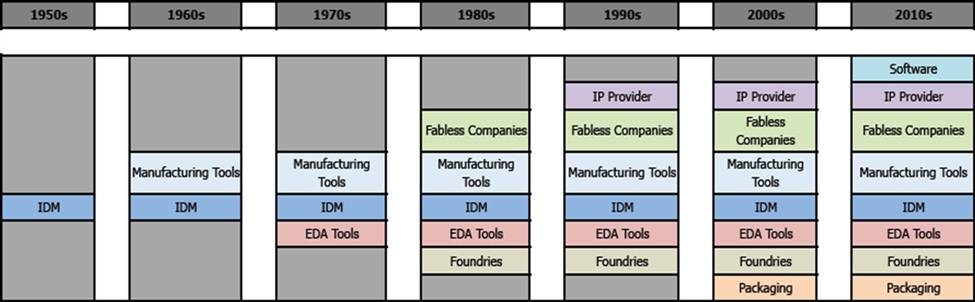

Perhaps most significantly, the globalization of supply chains has given rise to a wide variety of business models in the semiconductor industry. Historically (dating back to the 1950s and 1960s), the semiconductor industry consisted primarily of integrated device manufacturers (IDMs)—that is, firms which conducted all key facets of semiconductor manufacturing, especially design and fabrication, internally. Infineon, Intel, Micron, Renesas, Samsung, SK Hynix, and Texas Instruments remain leading IDM players today.

In 1987, Morris Chang founded TSMC, which pioneered the foundry business model, concentrating on contract manufacturing for fabless players that focus on designing semiconductors, often for application-specific purposes such as AI, wireless communications, or high-performance computing (HPC) uses. This essentially represents outsourced manufacturing, or “manufacturing as a service”—and it revolutionized the industry, giving rise to a host of new players including America’s Global Foundries, China’s Semiconductor Manufacturing International Corporation (SMIC), and Taiwan’s United Microelectronics Corporation (UMC).

The advent of foundries in turn supported the rise of the fabless industry; that is, companies which focus on semiconductor chip design, such as (now fabless) AMD (chips for AI, HPC, and graphics), NVIDIA (graphics chips), and Qualcomm (5G and other wireless chips). Collectively, this is referred to as the “fabless-foundry” model.

Finally, outsourced ATP is performed by a number of global players, including Amkor (United States), ASE Technology (Malaysia), J-Devices (Japan), Power-Tech (China), and Siliconware Precision Industries (Taiwan). On the front end of the process are companies and consortia that focus on semiconductor R&D activity, such as CEA-Leti (France), Imec (Belgium), ITRI (Taiwan), SEMATECH (United States), and the Semiconductor Research Corporation (United States). (See figure 10.)

Figure 10: Operating models in the semiconductor industry[45]

Another set of companies, including Applied Materials (United States), ASML (the Netherlands), KLA Tencor (United States), and Lam Research (United States), manufacture the machines and tooling equipment that run semiconductor fabs. Finally, a number of enterprises, especially ones from Japan, South Korea, and Taiwan, manufacture chemicals and components essential to the semiconductor manufacturing process. For instance, fluorinated polyimides, a group of specialty polymers that provide physical strength and heat resistance, are produced by Daikin Chemical (Japan), DuPont (United States), Kaneka Asahi Kasei (Japan), and Taimide Technology (Taiwan). Photoresists are critical components that provide the patterns used to build micro-circuitry into semiconductors. The Japanese firms JSR Corporation, Shin-Etsu Chemical Company, Sumitomo Chemical, and Tokyo Ohka Kogyo Company manufacture photoresists, as do the Korean players Dongjin Semiconductor Company and Dongwoo Fine Chemicals. Portland, Oregon-based Inpria is the only U.S.-headquartered photoresists manufacturer, while European players have abandoned the field altogether.[46]

In short, the semiconductor ecosystem has evolved from fully integrated firms in the 1950s to a global set of firms that by the 2010s specialized in discrete activities such as R&D, design, machine tooling, components, foundries, assembly, test, and packaging. (See figure 11.)

Figure 11: Functional evolution of the semiconductor ecosystem (1950s–2010s)[47]

And there are supply chains within semiconductor supply chains. Consider the supply chain for extreme ultraviolet lithography, centered on Dutch-based firm ASML, the world’s leading manufacturer of high-end photolithographic machines, which uses light to etch integrated circuits into silicon wafers. ASML’s global market share of photolithographic machines has doubled since 2005 to 62 percent (its competitors Canon and Nikon split the remainder).[48] But the EUV supply chain itself is global: German-based Carl Zeiss makes the lenses; VDL, a Dutch company, makes the robotic arms that feed wafers into the machine; and the light source comes from Cymer, a San Diego, California-based operation.[49] The technology underpinning photolithography today is the result of 15 years of research and some $20 billion in cumulative R&D investment made by multiple companies, including even Intel, Samsung, and TSMC, which have all co-financed some of ASML’s R&D activities. Put simply, without the existence of global supply chains and the specialization they provide, the rapid evolution of EUV lithography technology would never have happened.

The ability to effectively leverage international supply chains can in part explain national leadership in semiconductor industries. Consider Japan and the United States. The fabless-foundry model has been key for the global—and especially the U.S.—semiconductor industry because it has enabled the industry to spread out the risks of its capital investments so that fabless design companies don’t have to incur the risk of significant capital expenditures, or investing in the R&D for manufacturing process technologies. Back in the 1990s, the U.S. and Japanese semiconductor industries were at parity, with an equivalent level of global market share. Since then, the United States (i.e., U.S.-headquartered enterprises) has retained about half the global semiconductor market, while Japan’s share has fallen to less than 10 percent. A key reason for this has been that Japanese companies never truly took advantage of global value chains, preferring to keep most of their front-end fabrication in Japan. In contrast, the U.S. semiconductor industry leveraged global value chains, allowing enterprises in other nations, and especially in Taiwan, to specialize in manufacturing, assembly, test, and packaging, while U.S.-headquartered companies largely specialized in the higher-value-added activities of branding, R&D, chip design, and understanding how to leverage the chip sets into a wide range of high-value-added goods from smartphones to autonomous vehicles to Internet of Things applications. This empowered a key difference between the U.S. and Japanese semiconductor sectors over the past three decades, with the American firms being able to keep production costs low, making them more cost competitive, in part through leveraging specialized value-chain partners.[50] This does not mean U.S. policy should not seek to incentivize greater domestic production (and R&D) in the industry here; but rather that global supply chains have been a key to U.S. leadership in this sector.

The ability to effectively leverage international supply chains can in part explain national leadership in semiconductor industries.

Another advantage of the dispersion of global semiconductor supply chains and the multiplicity of suppliers has been resiliency and redundancy in overcoming supply chain disruptions. This has been proven through a number of situations, including the 2011 Tohoku earthquake and tsunami in Japan, major Indonesian earthquakes and tsunamis in both 2004 and 2018, and even the recent coronavirus crisis.

While some countries (or policymakers therein) have called for fully nationalized, closed-loop semiconductor supply chains, a globalized supply chain offers significant benefits from a resiliency perspective, in addition to an economic cost perspective.

Countries’ Semiconductor Competitiveness Strategies

A number of countries have articulated comprehensive national competitiveness strategies in the semiconductor sector. This section highlights several of these countries’ strategies.

China

In June 2014, the Chinese government published “Guidelines to Promote [the] National Integrated Circuit Industry” (the China “National IC Plan”) which called for $150 billion in investment from central, provincial, and municipal governments to facilitate development of a fully closed-loop semiconductor ecosystem in China, with China ideally to become self-sufficient in every facet of semiconductor manufacturing—from R&D and design to fabrication and ATP.[51] As part of this plan, China wants 70 percent of the semiconductor chips used by companies operating in China to be domestically produced by the year 2025.[52] As of 2017, the Semiconductor Industry Association (SIA) estimated that China had raised $80 billion of the $150 billion goal.[53] In October 2019, China supplemented these investments by announcing a new national semiconductor fund of 204.2 billion yuan ($28.9 billion) financed by central- and local-government-supported enterprises including the State Tobacco Monopoly Administration (STMA) and the China Development Bank Corp.[54] And, early in 2020, China’s Ministry of Industry and Information Technology announced a “New Infrastructure” campaign seeking to make at least $1.4 trillion in investments over the next five years in AI, data centers, mobile communications, and other projects.[55] This matters to China’s semiconductor sector because the investments made through the fund would ideally go to digital technologies using Chinese-manufactured semiconductors.

As of 2019, China accounted for 17 percent of global semiconductor chip manufacturing, with that share expected to increase to 28 percent by 2030, in part thanks to the Chinese government currently funding the construction of more than 60 new semiconductor fabs.[56] Although China is unlikely to meet its goal of 70 percent self-sufficiency by 2035, analysts expect it will be able to meet 25 to 40 percent of its domestic demand with locally designed semiconductors by then.[57] China views the semiconductor sector as the lynchpin of its digital development and even broadest-scale economic growth plans, and has proven itself willing to utilize every tool at its disposal in its efforts to develop a world-class semiconductor industry.

European Union

In May 2013, the European Commission announced an EU-wide strategy for micro- and nano-electronic components and systems. An implementation plan for the strategy called for European companies and governments “to invest at least €35 billion ($41.4 billion) in the sector by 2025.” In support of the strategy, two new instruments were launched at the European level in 2014: the Electronic Components and Systems for European Leadership (ECSEL) Joint Undertaking, which funds research, development, and innovation projects in electronic components and systems, and the IPCEI (Important Project of Common European Interest) instrument. To date, €2.6 billion ($3.1 billion) has been invested in 51 ECSEL projects involving more than 1,600 research, development, and end-user organizations in collaborative research and innovation.

Despite this, some commentators, including Dr. Friedrich Dornbusch, have written that over the past half-decade there has been “insufficient alignment of the European member states on a common semiconductor strategy.”[58] To address that, in 2018, EU Commissioner for Digital Economy and Society Mariya Gabriel commissioned a study on “Boosting Electronics Value Chains in Europe.”[59] The resulting strategy document outlined an eight-step action plan to revitalize European competitiveness in electronics and microelectronics: 1) Extend Europe’s partnership success model; 2) Continue investment toward a strong microelectronics manufacturing industry; 3) Create a strategic sovereignty program; 4) Create a smooth innovation path from IP to products; 5) Pursue strategic design initiatives; 6) Create design tools for electronic value chains; 7) Create a task force for electronic education and skills; and 8) Create a pan-European research infrastructure for advanced-computing technologies.[60]

Each segment of the semiconductor value chain has, on average, 25 countries involved in the direct supply chain and 23 countries involved in support functions.

Perhaps most significantly, at year-end 2018, the European Commission approved the “Important Project of Common European Interest (IPCEI) on Microelectronics,” which will facilitate transnational cooperation projects in microelectronics across four European nations: France, Germany, Italy, and the United Kingdom. The program permits the use of state aid for microelectronics industrial competitiveness. Twenty-nine European companies are directly involved in the Microelectronics ICPEI, which includes over 40 sub-projects divided into 5 technology fields: energy efficient chips, power semiconductors, sensors, advanced optical equipment, and compound materials.[61] Funding for the IPCEI has come from the participating countries themselves, not the European Union.

Of note as well in the strategy is “a call for a specific 'sovereignty' programme to be put in place to support and develop essential assets for critical electronic components, leading to guaranteed access to and control over secure and trusted components for strategic European infrastructure and systems.” This would target “essential technologies, components and product lines for aerospace, defense, security, and critical infrastructures.”[62] While there’s understandably a need for trusted semiconductors in mission-critical national security systems and defense platforms, Europe should still work wherever possible with vendors from like-minded nations, and more broadly eschew the notion of “digital sovereignty,” which unfortunately has become increasingly prevalent in Europe.

Germany

In 2019, Germany’s Federal Ministry for Economic Affairs and Energy contributed €275 million ($312 million) to the European microelectronics programme to boost the competitiveness and innovation capacity of Europe’s semiconductor industry.[63] From 2019 to 2021, Germany is committing a total of €1 billion to the effort. In June 2020, Germany’s Federal Ministry of Education and Research (BMBF) unveiled 2 new funding programs with a combined value of €45 million ($50 million) with the aim of developing "trusted" electronics. Through the so-called “Zuse” program, Germany’s BMBF plans to support 3 processor development projects with €25 million (almost $30 million). In addition, starting in 2021, a further €20 million (almost $25 million) will be devoted for the development of a “trusted ecosystem” into which domestic hardware and software components are to be integrated.[64] Germany’s BMBF is still evaluating to what extent these programs will be enacted within Germany itself, or as part of broader European microelectronics initiatives.

Japan

Despite its decorated history of leadership in semiconductor innovation, and enduring technical ability and talent base, Japan’s semiconductor industry has languished in recent years. Part of this, as noted previously, is attributable to Japan’s slow embrace of the fabless-foundry model. Another facet was the 1986 U.S.-Japan Semiconductor Agreement, in which Japan agreed to limit its exports of semiconductors, particularly DRAM chips, to America, and increase the sales of American-made memory chips in Japan to 10 percent of their market.[65] Another challenge for Japan’s semiconductor and broader technology industry, for much of the 1990s and early 2000s, was that Japan’s ICT sector tended to isolate itself from global markets, suffering from a “Galapagos Island syndrome” of market and technology isolation that ultimately left many of the country’s firms uncompetitive in the global economy.[66]

In fact, whereas Japanese companies commanded 35 percent of the global semiconductor industry in 1982, the country’s share of global semiconductor industry value added has fallen to less than 10 percent, and Japan now only has 1 company ranking in the top 15 of global semiconductor sales.[67] Japan’s Ministry of Economy, Trade, and Industry acknowledged Japan’s industrial shortcomings (including in semiconductors) in a 2016 report entitled “Initiatives for Promoting Innovation,” which attributed today’s challenges to a delay in response to environmental changes, closed R&D investments, short-termism of private companies, low mobility of personnel and funds, and isolation from global networks.[68] Attempting to tackle some of these challenges, Japan passed an Industrial Competitiveness Act and has promulgated a Japan Revitalization Strategy, which collectively seek to “revitalize the Japanese economy and enhance the industrial competitiveness of enterprises doing business in Japan.”[69] More recently, Japan’s Society 5.0 vision articulates the country’s vision for future digitalization, which calls for Japan to become a leading manufacturer of semiconductors for “specialized for AI applications.”[70]

South Korea

In 2019, South Korea’s Ministry of Trade, Industry, and Energy (MTIE) launched a new semiconductor competitiveness strategy that seeks to make the country a leading competitor and invests 1 trillion won ($830 million) over the next 10 years toward developing next-generation semiconductor technologies and training 17,000 high-end professionals.[71] The strategy includes 100 billion won ($83 million) earmarked for the creation of a fabless business fund. The strategy also calls for developing a cooperative platform called “Alliance 2.0” that would involve 25 private and public organizations in areas where there is high demand for system semiconductors, or where South Korean companies can secure competitiveness within a short time frame, focusing on five major strategic areas: automobiles, biotechnology, energy, Internet of Things-based home appliances, machinery, and robots. The plan calls for South Korea to capture 10 percent of the market share in the fabless (i.e., chip design) sector by 2030, in addition to maintaining a leading position in manufacturing semiconductor memory chips. Further, in July 2020, MTIE announced that South Korea will invest over 5 trillion won ($4.1 billion) in the materials, parts, and equipment industries to ensure stable supplies for the nation’s key exporters. Of that amount, 2 trillion won ($1.6 billion) will be allocated for the nation’s 3

most-significant industries in 2021, including semiconductors, biotechnology, and future mobility sectors.[72]

United States

In 2017, the Obama administration’s President’s Council of Advisors on Science and Technology (PCAST) produced a report on “Ensuring Long-term U.S. Leadership in Semiconductors,” which set out a vision for U.S. semiconductor competitiveness predicated upon: 1) a competitive domestic sector supported by basic R&D funding, policies aimed at developing and attracting talent, reforming corporate tax laws, and reforming permitting practices; 2) combatting foreign innovation mercantilism; and 3) a series of moonshots aiming to drive transformative innovation in the sector.[73] While the agenda contained a number of useful recommendations, it lacked any real strategy for encouraging more construction of semiconductor fabs in the United States.

The Trump administration has not articulated a formal strategy for the sector, but picked up on several elements from the Obama strategy, including taking steps to contest China’s non-market-based strategies to grow its semiconductor sector. The Trump administration placed, among others, Chinese DRAM chip manufacturer Fujian Jinhua Integrated Circuit Company on the entity list (thus restricting the firm’s ability to import key sensitive technologies) for trying to steal U.S. IP, imposed export control restrictions on Huawei, and pressured Dutch EUV lithography manufacturer ASML not to sell critical semiconductor production to China’s SMIC.[74] The Trump administration has also encouraged U.S. and foreign firms to increase their semiconductor manufacturing activity in the United States, leading, in part, in 2020 to TSMC committing to open a new U.S. fab in Arizona.[75]

The administration has also partnered with key members of Congress to propose two new pieces of legislation (since combined) designed to bolster U.S. semiconductor competitiveness. First, Senators John Cornyn (R-TX) and Mark Warner (D-VA) introduced the bipartisan Creating Helpful Incentives to Produce Semiconductors (CHIPS) for America Act, which was followed by Senators Tom Cotton (R-AR) and Chuck Schumer’s (D-NY) introduction of the American Foundries Act (AFA) of 2020.[76] The two pieces of legislation have since been merged, and a consolidated version of the legislation was included in the 2020 National Defense Authorization Act (NDAA), which passed in the House and Senate in July 2020.[77] (Note: The NDAA legislation will now go to conference committee, where further negotiations will occur, including over budgeting, so the figures below reflect budget requests as included in the initial legislative proposal. Except for a $1.2 billion authorization for R&D in the House version of the legislation, the versions of the legislation in the NDAA do not contain specific authorization amounts). The legislation would expand federal investment in semiconductor research and technology development, introduce incentives to locate semiconductor manufacturing facilities in the United States, and provide expanded tax credits for investment in the sector. Among other elements, the legislation would:

▪ Provide $10 billion (CHIPS Act) to $15 billion (AFA) in matching grants for WTO-consistent state/local incentives to attract semiconductor manufacturing facilities, which would help level the playing field with other nations’ incentives;

▪ Invest $12 billion over five years (CHIPS Act, AFA calls for $5 billion) for semiconductor research at agencies such as the National Science Foundation (NSF), Department of Energy, and the Defense Advanced Research Projects Agency (DARPA);

▪ Introduce a $750 million multilateral security fund to support development and adoption of secure microelectronics and secure microelectronics supply chains;

▪ Create a Manufacturing USA Institute for Semiconductor Manufacturing as well as a National Semiconductor Technology Center to research and prototype advanced semiconductors;

▪ Introduce a refundable 40 percent investment tax credit for semiconductor equipment and facilities expenditures; and

▪ Launch initiatives to support the development and adoption of secure microelectronics and secure microelectronics supply chains.

The pressing need for the CHIPS/American Foundries Act was brought home in stark relief with Intel’s July 2020 announcement that it had fallen at least 1 year behind schedule in developing its next major advance in chip-manufacturing technology, that is, in moving from 10-nm to 7-nm technology.[78] (Intel CEO Bob Swan even noted that the company might have to use a competitor’s manufacturing facilities if it is unable to resolve the delay quickly.) In a way, Intel is a victim of its own success in the sense that it was Intel co-founder Gordon Moore’s famous Moore’s Law which conditioned onlookers to assume the law would continue indefinitely as a simple matter of course. As such, what this fundamentally illustrates is not that Intel suddenly got poor at engineering, but rather the extreme difficulty and complexity of innovating in this industry, which requires significant investment to continue to advance. That’s why public-private partnerships, especially in R&D, have been so important to the evolution of the industry and continued U.S. competitiveness therein. As the Information Technology and Innovation Foundation (ITIF) has noted in other reports, if the United States is to have a healthy and robust economy, it must be competitive in manufacturing, especially in advanced-technology industries such as semiconductors, meaning that initiatives such as those contemplated in the CHIPS/American Foundries Act aren’t misguided industrial strategies or corporate handouts, but rather appropriate, WTO-consistent efforts to support the competitiveness and innovation capacity of the sector broadly.

Beyond this, there exist a number of semiconductor R&D programs being run out of various government agencies (as described subsequently). In short, the actions of the past two administrations, combined with heightened attention from Congress, suggests the United States is finally becoming serious about bolstering its semiconductor competitiveness, especially in light of peer nations’ attempts to do the same. Notwithstanding this, to date, America’s semiconductor policies and programs have been disjointed and inadequately funded. The nation would benefit from a regularly updated, comprehensive national semiconductor competitiveness strategy.

Collaborating to Collectively Enhance Semiconductor Competitiveness

It’s certainly appropriate, and indeed laudable, for countries (or supra-national regions such as the European Union) to articulate comprehensive strategies to advance the competitiveness of their nations’ semiconductor industries. Despite the contentions made be some that, “The notion that nations compete is incorrect … countries are not to any important degree in competition with each other,” the reality is that nations do compete with one another to achieve greater levels of economic growth.[79] As ITIF wrote in Innovation Economics: The Race for Global Advantage, this competition increasingly centers around nations’ efforts to incubate, scale, and grow (or attract) industries and enterprises competing in the highest value-added sectors of economic activity, such as advanced industrial manufacturing, aerospace, biotechnology, renewable energy, and semiconductors (and other digital and ICT sectors).[80] While it’s appropriate for nations to compete intensely for leadership in advanced-technology industries, the policies they implement to do so should always be positive sum in nature, investing in the global stock of knowledge and know-how, through policies such as investing in R&D, education, and infrastructure. When nations elect to compete by implementing certain policies such as restricting market access, tech transfer as a condition of market access, subsidizing industries, or influencing technology standards, they harm other nations and enterprises therefrom and damage the global economy.[81]

Yet, while nations compete, they also trade with each other for mutual gain. Moreover, there are opportunities for scientific, technical, and trade collaboration that can advance a base of knowledge upon which private-sector competition can unfold. A classic example is the Human Genome Project, a multi-billion-dollar global effort that unlocked the field of genomics and in turn unleashed a new era of biopharmaceutical innovation. Similarly, in semiconductors, especially given the extreme expense and complexity of innovating in the sector, there exist opportunities for collaboration that can collectively drive like-minded nations’ own semiconductor industries forward in a pro-competitive way. This becomes especially important when some nations elect to compete in the sector substantially through mercantilist and distortive economic trade practices that undermine market-based competitors in the industry, and as national security concerns increase.

Given the extreme expense and complexity of innovating in the sector, there exist opportunities for collaboration that can collectively drive like-minded nations’ own semiconductor industries forward in a pro-competitive way.

Like-minded, allied nations need to find more ways to work together on semiconductor policy and programs, recognizing that “open societies are stronger when they act in unison.”[82] The United States should lead such collaboration, for, as one report presciently notes, “Unless the United States builds this community—an ‘alliance innovation base’—it will steadily lose ground in the contest … to ascend the commanding technological heights of the 21st century.… The only way for the United States to tip the scale back in its favor is to deepen innovation linkages with its allies.”[83]

The opportunity is rich in semiconductors, wherein successful innovation depends upon the work of a complex tapestry of scientists, researchers, and engineers working across a multitude of international companies, universities, government agencies and research institutions, and public-private research consortia. Indeed, the semiconductor industry owes its foundation to, and indeed has been tremendously advanced over a course of decades by, breakthroughs in basic scientific research in fields such as particle physics, materials science, and nanoengineering that benefitted from tremendous levels of cross-national research and international scientific publications. If nations work together to co-fund R&D, build industry technology roadmaps, develop voluntary technology standards, and craft liberalized trade rules, they can collectively build a semiconductor ecosystem positioned to successfully compete against those of nations that pursue an autarkic path.

Unfortunately, the history of information and communications technology shows that nations can choose to isolate themselves. For much of the 1990s and early 2000s, Japan’s ICT sector isolated itself, suffering from a Galapagos Island syndrome of market and technology isolation that ultimately left many of the country’s firms uncompetitive in the global economy.[84] Today, it’s concerning that the European Union has elected to frame so much of its new industrial strategy around the goal of gaining “digital sovereignty.” These and other allied nations need to think bigger and broader and focus on “allied nation digital sovereignty,” or at least allied national semiconductor competitiveness. As such, the United States should work with European peers to reframe Europe’s objective to be about achieving advanced-industry leadership in a broad range of sectors and technologies, not just in the digital sphere, and to do so while maintaining a commitment to free trade and global innovation.[85] And it always does well for the United States to remember these lessons itself.

The following sections articulate how like-minded nations can collaborate across four areas: semiconductor technology development, technology protection, ecosystem development, and trade liberalization.

Coordinated Technology Development

As noted, the expense and scale required to successfully innovate in the semiconductor sector make it difficult for any one nation, let alone any one enterprise, to go it alone. There are several ways like-minded nations and enterprises therein can collaborate to collectively raise the competitiveness of their respective semiconductor sectors.

Establish Manufacturing USA Institutes(s) Supporting Semiconductor Manufacturing, Including in R&D, Manufacturing, and ATP. America’s Manufacturing USA network constitutes a public-private partnership consisting of 14 Institutes of Manufacturing Innovation dedicated to developing advanced manufacturing product and process technologies.[86] PowerAmerica, the second Institute established, focuses on accelerating adoption of wideband advanced semiconductor components made with silicon carbide and gallium nitride.[87] In 2018, Manufacturing USA leveraged $183 million in federal funds to attract $304 million in private-sector and state-government investment.[88] The CHIPS Act calls for creating an Advanced Packaging National Manufacturing Institute that would “establish U.S. leadership in advanced microelectronic packaging and … support [a] domestic advanced microelectronic packaging ecosystem.”[89]To be sure, there could be several possible facets of the semiconductor fabrication process meriting their own Manufacturing USA Institute, including ones focused on semiconductor design, advanced semiconductor fabrication processes, semiconductor tooling, or advanced microelectronic packaging. ITIF has called for Congress to give the Secretary of the Department of Commerce the ability to adopt an “affiliates model” that would permit the agency to designate as members of Manufacturing USA organizations that are substantially similar to existing institutes as a way to rapidly expand the Manufacturing USA network, including as a way to establish additional semiconductor-focused institutes.[90]

The Manufacturing USA program provides a proven model that should be central to the United States’ efforts to build a stronger and globally connected and competitive semiconductor sector. It has proven a useful vehicle for collaboration with international firms on advanced-technology innovation. For instance, PowerAmerica’s members include ABB, BAE Systems, Infineon, and Toshiba, while MxD, which focuses on digital manufacturing, counts as members international firms including Rolls Royce and Siemens.[91] As the U.S. Government Accountability Office explained, “Under some institutes’ agreements, foreign members are allowed if the sponsoring agency approves such members and certain conditions are met, such as having a significant manufacturing footprint in the United States.”[92] But if the United States looks to stand up more semiconductor-focused Manufacturing USA Institutes, it’s critical that foreign semiconductor enterprises (including ones from the manufacturing and fabless sectors) not only be allowed, but encouraged, to join them, given the global nature of the semiconductor sector. As long as these firms have a manufacturing, production, or R&D process in the United States, they can contribute to the overarching goal of growing the U.S. semiconductor sector. At the same time, such partnerships should be based on reciprocity as a touchstone principal: Foreign nations should allow U.S. semiconductor enterprises to participate in their similar initiatives on equivalent terms. Foreign nations that have similar pre-competitive research institutes show allow U.S.-headquartered firms to participate on reciprocal terms.

Expand International Cooperation in Semiconductor-Sector Public-Private Partnerships. Collaborative, pre-competitive research and the development of coordinated industry technology roadmaps have long been a hallmark of the semiconductor innovation process, especially given the expense and scale required to successfully innovate in the sector. The archetypal case is SEMATECH, a consortium of 14 U.S.-based companies which convened in 1988 to conduct pre-competitive (though applied) R&D to produce generic semiconductor manufacturing technology with a stated goal of achieving world leadership in manufacture of 0.35 micron devices.[93]The U.S. Department of Defense (DOD), via DARPA, supported SEMATECH with $500 million over a 5-year period, with industry and some states and universities providing additional contributions. SEMATECH’s R&D efforts focused on lithography processes (including steppers, photoresists, mask-making, and metrology), working with multilevel metals (etch, planarization, and deposition), and process technologies such as manufacturing systems and process integration.[94] SEMATECH yielded technological breakthroughs in semiconductor design and manufacturing processes that rallied an industry and infrastructure in near collapse, allowing U.S. semiconductor manufacturers to achieve technological parity with Japanese competitors and remain competitive in the decades hence.[95] In 1996, SEMATECH’s board voted to eliminate matching funds from the U.S. government, and the organization's focus shifted from the U.S. semiconductor industry to the larger international semiconductor industry. In part due to subsequent consolidation in the semiconductor industry, in 2015, SEMATECH merged with the SUNY Polytechnic Institute and moved beyond semiconductors to oversee research, development, and commercialization in other industries such as green energy, power electronics, and biotechnology.[96]

Successful semiconductor innovation depends upon the work of a complex tapestry of scientists, researchers, and engineers working across a multitude of international companies, universities, government agencies and research institutions, and public-private research consortia.

While SEMATECH has moved on, today the Semiconductor Research Corporation (SRC), a technology research consortium that seeks “to assemble the best university researchers while educating an elite workforce of talented graduate students—in science, engineering, and technology,” plays a key role.[97] SRC represents an effective platform for engagement with like-minded nations interested in collaboratively advancing semiconductor technology development, as it already works with many of the world’s leading semiconductor firms (both U.S. and foreign). As SRC CEO Ken Hansen explains, “SRC launched in 1982 with a mission to fund university research in the pre-competitive stage to leapfrog the technology disadvantage we felt at the time and to develop a workforce pipeline of well-educated Ph.D. students working on industry-relevant topics.”[98] SRC runs the Joint University Microelectronics Program (JUMP), which focuses on high-performance, energy-efficient microelectronics in partnership with DARPA and also the nano-electronic Computing Research (nCORE) program in partnership with NSF and the National Institute of Standards and Technology (NIST).[99] In 2018, SRC initiated an effort to bring together companies, academics and students, government agencies, and other stakeholders to create a “Decadal Plan for Semiconductors” that would chart the R&D needs of the sector over the coming decade as a guide for both academic researchers and students looking to earn advanced degrees in the field.

The Decadal Plan for Semiconductors seeks to transform the future of the global semiconductor industry by: 1) informing and supporting the strategic visions of semiconductor companies and government agencies; 2) guiding a (r)evolution of cooperative academic, industry, and government research programs; and 3) placing a “stake in the ground” to challenge the best and brightest university faculty students.[100] The Decadal Plan seeks to develop effective approaches to deal with looming challenges confronting the semiconductor (and broader ICT industries), including: 1) continuing to achieve exponential decreases in compute energy required to execute computations, lest energy expenditures limit the growth of computational capacity; 2) addressing the analog data deluge (i.e., rapidly processing massive amounts of data); 3) meeting the dramatic increase in global data storage requirements; 4) advancing communication technologies to transmit data rapidly and seamlessly; and 5) addressing emerging security challenges, from hardware to AI to the cloud.[101]

To be sure, collaborative R&D efforts on close-to-market applied R&D activities, in the semiconductor or any other technology sector, are challenging, even when such collaborations involve only domestic players, let alone international ones. However, at the five-to-ten-year, and even three-to-five-year, timescales, when nations have pulled their semiconductor technologists, they’ve often identified research opportunities that, while perhaps not appealing for any one country to undertake, can still generate immense significant scientific value in high-risk, high-reward areas of research. Research at those timescales, for instance, could include new approaches to computing architectures, such as in-memory compute, special-purpose compute engines, brain-inspired/neuromorphic computation, and quantum computing. Players from like-minded nations should pull together their chief technology officers (and other technologists), academic researchers, and policymakers to create a roadmap for areas of priority research that no one country wishes to pursue alone (and that does not veer into the commercial space) and identify opportunities to collectively advance the long-term development of their semiconductor industries. If the United States takes a leading role in this effort, it should consider establishing a “green list” of countries whose stakeholders would be invited into such collaborations. The $750 million multilateral security fund envisioned by the CHIPS Act to support development and adoption of secure microelectronics and secure microelectronics supply chains would be an excellent first step in this regard, and Congress should be sure to appropriate such funding as it reviews the NDAA this fall.

However, such collaboration will have a limited impact unless the United States and like-minded nations increase funding for these types of collaborative, pre-competitive R&D efforts, and ensure that there is reciprocal opportunity for semiconductor enterprises from like-minded nations to participate in such consortia. In 2019, the U.S. federal government invested just $1.7 billion in core, semiconductor-specific R&D (along with an additional $4.3 billion in research in semiconductor-related fields). And whereas 40 years ago federal funding for semiconductor R&D was more than double the level of private-sector funding, in 2019, U.S. private sector investment of about $40 billion in semiconductor R&D was 23 times greater than the federal government’s level of investment.[102] However, even with regard to the $1.7 billion in annual federal R&D investment in semiconductor-industry R&D, much of this is agency program manager-led, and America’s semiconductor R&D investments could achieve much greater impact if programs and initiatives were more effectively coordinated across the federal government. Beyond increasing R&D funding, the impact and commercialization potential of these types of consortia could be increased with more-flexible federal contracting guidelines, such as a relaxation of Federal Acquisition Regulations or the ability to make greater use of other transactional authority vehicles (as SRC and DARPA have used for over 20 years, but which could be used more broadly).[103]

DOD also operates several important collaborative research initiatives advancing semiconductor innovation. For instance, in 2013, DARPA launched the Semiconductor Technology Advanced Research Network (STARnet), which engaged 8 companies and 46 universities to identify paths around the fundamental physical limits threatening the long-term growth of the microelectronics industry.[104] In 2017, DARPA launched a larger program, the Electronics Resurgence Initiative (ERI), which aims to forge forward-looking collaborations among the commercial electronics community, defense industrial base, university researchers, and DOD to address related challenges.[105] ERI will be a 5-year effort receiving $1.5 billion in federal funding and encompassing over 20 different DARPA programs. ERI’s specific areas of R&D focus include: 1) 3D heterogeneous integration; 2) new materials and devices; 3) specialized functions; and 4) design and security. ERI partners must ensure that program benefits differentially accrue to the U.S. commercial and defense base.[106] However, ERI does host annual summits about its various research programs, which present opportunities for international exchange and collaboration.

Collaboration will have a limited impact unless the United States and other like-minded nations increase government funding for collaborative, pre-competitive R&D efforts.

Europe also features several important research consortia focused on semiconductor and microelectronics pre-competitive R&D. Dutch-headquartered Imec seeks “to be the world-leading R&D and innovation hub in nano-electronics and digital technologies.”[107] With over 4,000 researchers spread through several European facilities, 5 in the United States, and 4 in Asia, Imec aims to be a leader in applying semiconductor-driven digital innovation to many economic sectors, including automotive, health, transportation, energy, and sustainability. A core focus at Imec is driving microchip miniaturization and advancing application-specific microchip technology. In Grenoble, France, CEA-Leti helps companies performing micro- and nano-technology research bridge the gap between basic research and manufacturing.[108] Thirty-seven companies have been formed out of Leti as spin-offs, resulting in the creation of more than 2,500 jobs.

Collectively, these research consortia and initiatives across the United States, Europe, and Asia play vital roles in driving semiconductor-sector innovation, engaging both domestic and international partners in activities such as pre-competitive R&D, technology roadmapping, integrating key small to medium sized enterprises into industrial supply chains, and workforce training and credentialing. In particular, observers note that the role of common industry technology roadmaps have played a crucial role in establishing a multi-decade industry vision and keeping Moore’s Law on-track. However, several observers noted that as the 3 nm threshold arrives, semiconductor innovation is becoming increasingly application-specific—with customized microchips for AI, driverless vehicles, 5G, graphics-intense applications, smart grids, etc.—and so industry-wide technology roadmaps may be less impactful in the future as innovation pathways in the sector bifurcate. Nevertheless, the United States and governments of like-minded nations should increase R&D investments in these types of consortium-based pre-competitive research programs, and explore opportunities for greater international participation and collaboration.

Enrolling Allied Partners in Semiconductor Moonshots

Like-minded partners not only need closer collaboration, but specifically targeted cooperation. The 2017 PCAST report on “Ensuring Long-term U.S. Leadership in Semiconductors” called for identifying “carefully selected ambitious challenges or ‘moonshots,’ as focal points for industry, government, and academic efforts to drive computing and semiconductor innovation forward together.”[109] As the report notes:

Our recommended approach to designing the moonshots is driven by the fact that the future of semiconductors and computing lies in innovating along multiple dimensions: new ways of performing calculations (such as non-von Neumann and approximate computing), utilization of materials other than silicon (such as carbon nanotubes and DNA for computation and storage), and novel approaches to integrating semiconductors into the devices we use (such as embedding into fabrics and the Internet of Things).[110]

Possible semiconductor-sector moonshots PCAST identified include:

▪ Developing affordable desktop semiconductor fabrication capabilities that could take the place of a billion-dollar fabrication facility and allow the production of small batches of structures;

▪ Using 3D printing at the nanoscale to connect “hard” electronic materials with “soft” biological materials, which could be the foundation of a zero-day bio-threat detection network; and

▪ A commercial, gate-based quantum computer to work on large-scale problems.

The first moonshot objective, in particular, around increasing semiconductor R&D efficiency, in both design and manufacturing processes, could be ripe for coordinated co-investment among like-minded nations. For instance, a representative of one semiconductor company noted that today it can take as many as 2,000 people up to 2 years to develop a new-to-the-world semiconductor design, and that industry should endeavor to collectively cut both components by a factor of at least 10.

The PCAST report suggests that semiconductor-sector moonshots should be designed with a 10-year time horizon, focus on reducing design costs, take an applications-driven approach, and compensate for areas of weak industry investment, “Government will also almost certainly need to back these efforts with significant, catalytic funding to overcome the risks associated with radical innovation.”[111] The PCAST report also suggests several “best-practice models” that could advance progress toward achieving the moonshots, including the use of incentive prizes, creating an industry-led venture capital consortium, establishing a Manufacturing USA Institute for semiconductor moonshots, and expanding U.S. government-sponsored industry-academic research fellowships in the field.[112] While all these are positive proposals and should be pursued, given the significant investments required to pursue these worthy moonshots, the U.S. government should invite other allied nations to co-invest in the moonshots, with resulting IP and technical discoveries shared at levels proportionate to mutual investment (as appropriately adjusted for nations’ economic size).