Which Nations Really Lead in Industrial Robot Adoption?

Southeast Asian nations significantly outperform the rest of the world in wage-controlled robot adoption, while Europe and the United States lag significantly behind.

KEY TAKEAWAYS

Key Takeaways

Contents

Introduction

Robots are key tools for boosting productivity and living standards. To date, most robot adoption has occurred in manufacturing, where there are robots designed to perform a wide variety of manual tasks more efficiently and consistently than humans. But with continued innovation, robot use is spreading to many other sectors, too, from agriculture to logistics to hospitality. As this trend continues—making robots increasingly important to productivity and competitiveness economy-wide—robot adoption will be a vital economic indicator for policymakers to monitor as a sign of growth and progress. The question is how best to measure it? The most commonly used method is to calculate the number of industrial robots as a share of manufacturing workers. But it is important to consider that there is a stronger economic case for adopting robots in higher-wage economies than there is in lower-wage economies. So, the more germane question is: Where do nations stand in robot adoption when we take wage levels into account?

This report examines robot adoption—controlling for wages—in 27 nations. It finds that Southeast Asian nations significantly outperform the rest of the world, and Europe and the United States lag significantly behind. If these gaps persist or continue to widen, it will bode ill for the future economy-wide productivity and competitiveness of Europe and America, and both regions will need to identify and adopt policies to dramatically increase their rates of robot adoption.

Trends in Robot Adoption

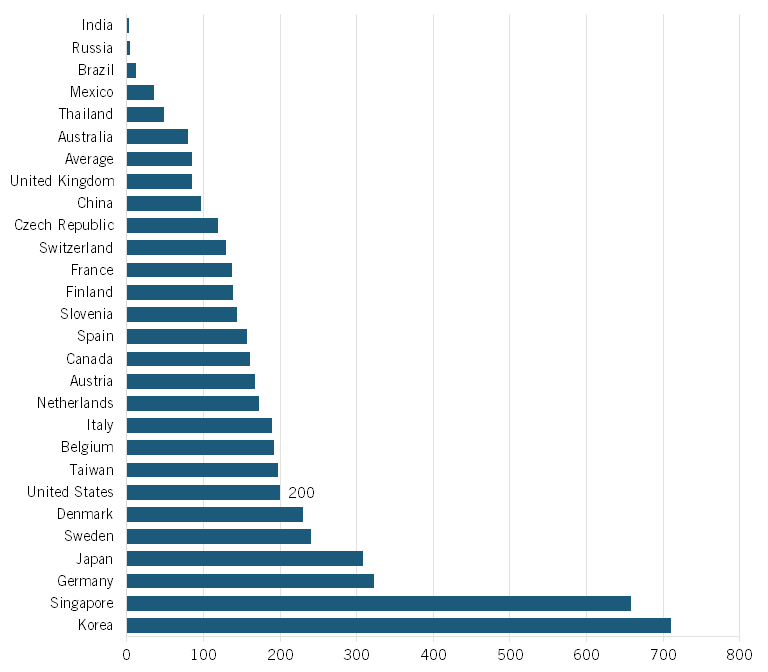

Companies around the world are adopting robots. According to the International Federation of Robotics (IFR), the global average for industrial robots per 10,000 manufacturing workers grew from 66 robots in 2015 to 74 robots in 2016, to 85 in 2017, a 15 percent increase in the last year.[1] This marked an acceleration from the 5 percent growth rate from 2014 to 2015. Korea was the world’s largest adopter of industrial robots in 2017, with 710 robots per 10,000 workers, while Singapore was second with 658 robots per 10,000 workers, Germany was third with 322 robots, Japan was fourth with 308, and Sweden was fifth with 240. The United States ranked seventh with 200 industrial robots per 10,000 workers. Among the countries surveyed, Russia and India ranked last with just 4 and 3 robots per 10,000 workers, respectively. (See figure 1.)

But the decision to install and run a robot is often based on the cost savings that can be achieved when a robot can perform a task instead of a human worker—and those cost savings are directly related to the compensation levels of manufacturing workers. It should therefore come as no surprise that high-wage Germany has a higher penetration rate of robots than low-wage India. But the interesting question is how do national economies perform in robot adoption when controlling for wage levels?

Figure 1: Robots per 10,000 manufacturing workers, 2017[2]

To assess this, ITIF first looked at industrial robot adoption rates in 27 nations, using the IFR data. It included all the nations whose robot adoption rate exceeded the global average and a sample of the nations that were below average. ITIF then identified total compensation averages for manufacturing workers in each country.[3] On the basis of the annual compensation data, we calculated the estimated time of payback (in months) from installing a robot. For this, we used the payback calculator from RobotWorx.[4] The calculator assumed the average robotic system cost of $250,000 running two shifts a day, five days a week, 50 weeks a year. We also assumed two operators per shift were no longer needed, and 10 percent of the labor force was retained to operate the system during each shift. Higher wages lead to faster payback, making more robots economical to invest in. This is why the Boston Consulting Group (BCG) estimated that the projected labor cost savings from robotics are considerably lower for developing nations than for

developed ones.[5]

ITIF calculated the share of robots to workers in each nation as a ratio of the global average share (85 per 10,000 manufacturing workers). We then calculated the average payback period for each country as a share of the average payback period for all the nations in the sample. Next, we divided the relative share of robots by the payback ratio to come up with the adjustment factor. Finally, we multiplied the share of robots in each nation by the adjustment factor to calculate the share of robots that would be expected based on countries’ compensation levels. For example, in Korea, annual compensation in the most recent year was $45,960, and the payback period for installing a robot was 15 months, which was 0.41 percent of the global average payback time. Korea’s installed robots as a share of 10,000 workers was 710, which was 7.35 times higher than the global average. Its expected rate of robot adoption was 29 percent of its actual rate. So, its actual rate of robot adoption was 239 percent higher than its expected adoption rate.

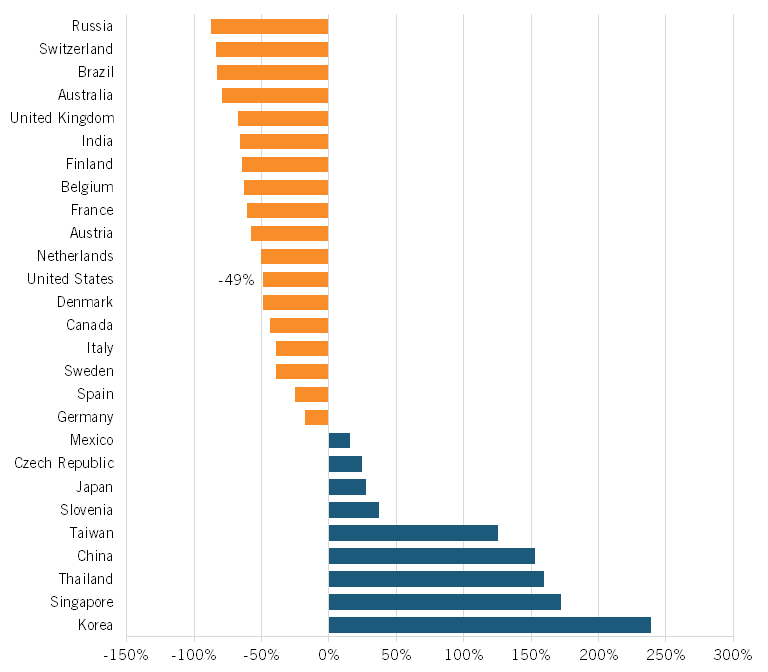

Comparing the ranking of expected robot adoption rates to actual rates, several patterns emerge. The first is that, on a wage-adjusted basis, Southeast Asian nations lead the world in robot adoption, occupying six of the top seven positions in the ranking: Korea leads the world with 2.4 times more robots adopted than expected, followed in order by Singapore, Thailand, China, and Taiwan. Japan ranks seventh with 27 percent higher adoption rates than expected. In contrast, Commonwealth nations lag behind significantly, with Canada ranking 14th (44 percent below expected adoption rates), the United Kingdom 23rd (68 percent below), and Australia 24th (80 percent below). (See figure 2.)

Figure 2: Actual robot adoption rate as a share of expected robot adoption rate[6]

Overall, Europe is a laggard, with only two countries adopting more than expected given wage levels: Slovenia (ranking sixth, 37 percent above the expected adopted rate) and the Czech Republic (ranking eighth, 25 percent above the expected rate). All other EU nations had lower-than-expected adoption rates, including Germany (18 percent below par), Spain (25 percent below), Sweden (39 percent below), Italy (40 percent below), Denmark (49 percent below), the Netherlands (51 percent below), Austria (58 percent below), France (61 percent below), Belgium (63 percent below), Finland (65 percent below), and Switzerland (a massive 84 percent below par).

Among developing nations, Thailand leads with adoption rates 159 percent higher than its wage levels would predict, while China’s adjusted rate is 153 percent higher, up from 104 percent higher in 2016. Mexico also outperforms, with adoption rates 16 percent higher than expected. But Brazil, India, and Russia, even with their low wages, are laggards. India’s adoption is 66 percent below the expected rate, Brazil’s is 83 percent below, and Russia’s 88 percent below.

Finally, the United States is significantly behind, ranking 16th, with adoption rates 49 percent below expected. Even before controlling for wage levels, the United States ranks only seventh, with an adoption rate less than 30 percent that of the global leader, South Korea. In part, this reflects an overall lag in capital expenditures by U.S. manufacturers and an almost complete lack of a national robotics strategy.[7] To the extent that the United States supports robot development—through the National Science Foundation’s national robotics initiative—it does so with miniscule funding levels, and it focuses only on robots that complement workers, not automate jobs, even though the latter are much more critical to driving productivity.[8]

To be sure, wage levels are not the only factor to weigh in assessing adoption rates. Robot adoption differs by industry, with the automobile industry generating the largest demand for industrial robots. Depending on the country, the industry accounts for 30 to 60 percent of total robot adoption. Yet many of the lagging nations have relatively robust automobile industries relative to the size of their manufacturing economies, including Brazil, Canada, France, Germany, Italy, Russia, Spain, Sweden, and the United States.[9] And China scores well in overall robot adoption despite having a relatively small auto sector compared with the rest of these nations (on a per-GDP basis).

Economists Acemoglu and Restrepo have found a modestly positive correlation between robot adoption and higher ratios of middle-aged workers, with the logic being that less robot adoption reflects a relative scarcity of middle-wage workers—who tend to have higher wages and often can be replaced by robots.[10] But the correlation is not strong enough to explain the large differences that ITIF’s analysis finds—and the wage factor is included in the analysis here.

Why Are the Leaders Ahead?

It is not clear why some economies, particularly those in Southeast Asia, are ahead, but there are likely many contributing factors. Some of the leading nations have established national goals and strategies to support robotics innovation and robot adoption. For example, in 2014, Japan established a goal to realize a “new industrial revolution driven by robots,” while Korea enacted its Intelligent Robot Development and Promotion Act.[11] Some of the leaders, particularly Korea, Taiwan, and Japan, also have robust public programs and institutes that help their manufacturers—particularly small and medium-sized enterprises—adopt advanced technologies, including robotics.[12] Culture may also play a role, as many of these nations have distinctly positive views of robots (e.g., Japan has an annual “Robot Award”); while many of the societies that are lagging in their relative rates of robot adoption appear to have significant portions of their populations, or at least significant shares of their elites, who view robots as unsafe job killers.[13]

Some nations have proactive tax policies to provide incentives for advanced technology adoption, including robotics. In Singapore, for example, firms can expense in the first year all computers and prescribed automation equipment, robots, and energy efficiency equipment.[14] In addition, companies in manufacturing and engineering services industries may receive investment allowances for projects in addition to depreciation allowances. Korea provides an investment tax credit for new equipment, while Japan and Slovenia provide accelerated depreciation on new equipment.[15] In contrast, some nations, such as the United States and United Kingdom, appear to have less generous tax treatment of capital expenditures, which depresses the spillover effect for robotics investment.[16]

China appears to be in a class of its own, with its national and provincial governments committing massive amounts of money to subsidize adoption of robots and other automation technology. China’s Robotics Industry Development Plan (2016–2020) set a goal of expanding robot use tenfold by 2025. As a result, many provincial governments are providing generous subsidies for firms to buy robots—although the accuracy of reported figures is perhaps dubious, as their size defies comprehension. For example, Guangdong province supposedly will invest 943 billion yuan (approximately $135 billion) to help firms carry out “machine substitution.”[17] Likewise, the provincial government of Anhui has stated it will be investing 600 billion yuan (approximately $86 billion) to subsidize industrial upgrading of manufacturers in its province, including through robotics.[18] To put this in perspective, it is the equivalent on a per-GDP basis of the United States investing $4 trillion. These numbers maybe inflated—the Boston Consulting Group reports around $6 billion in subsidies.[19] Either way, China appears to provide greater subsidies for robot adoption than any other nation, both in absolute terms and per-robot. As a result, if China and South Korea’s respective growth rates continue at the same pace they achieved from 2016 and 2017, then by 2026 China will overtake Korea as the nation with the highest number of industrial robots as a share of its industrial workers, when controlling for compensation levels.

Robots and Jobs

Finally, no discussion of robots and robot policy is complete without addressing the issue of employment. To be sure, the emergence of the next production revolution, which will include better and cheaper robots, will increase both productivity and labor market churning, as more workers are likely to lose their jobs due to technological displacement.[20] But claims of mass unemployment can be dismissed out of hand. Companies invest in process innovations to boost productivity and cut costs. When companies use technologies to cut costs, competition forces them to pass a significant share of those savings to consumers in the form of lower prices (the remainder going to workers in the form of higher wages, and to shareholders in the form of greater returns on investment). This added purchasing power is not buried; it is spent, and that spending demand creates new jobs. This job-creating dynamic is the same whether productivity grows at 1 percent a year or 10 percent. This is why the OECD has found that, “Historically, the income-generating effects of new technologies have proved more powerful than the labor-displacing effects: technological progress has been accompanied not only by higher output and productivity, but also by higher overall employment.”[21] Likewise, in its 2004 World Employment Report, the International Labor Organization (ILO) found strong support for simultaneous growth in productivity and employment in the medium term.[22] In a paper for that ILO report, Van Ark, Frankema, and Duteweerd also found strong support for simultaneous growth in per-capita income, productivity, and employment in the medium term.[23] There is simply no reason to believe this “law of economics” will somehow be repealed going forward, by robots or any other new technology.

Moreover, there is clear evidence that there is a positive correlation between robot density and manufacturing output.[24] In other words, more robots help economies’ manufacturing sectors gain global market share. Because of this gain in output, the correlation between robot use and manufacturing as a share of employment is negative, but only slightly.[25] Conversely, it is actually countries such as Canada, the United States, and the United Kingdom—those with low rates of manufacturing adoption and automation—that have seen the highest rates of manufacturing job loss over the past two decades.[26] Companies that fail to invest in the newest and most efficient production systems lose their competitiveness and risk going out of business. Entire industries can go into blight, and everyone can lose their jobs. Companies that leverage the latest automated production systems may displace some workers, but if they grow and remain competitive, they can often create new opportunities for those displaced workers in other sectors of the business.

In conclusion, if nations want to boost their productivity and competitiveness, one of the most important things they can do is implement policies that spur faster, deeper, and wider adoption of robots—not just in manufacturing, but, as robots get better, in many sectors of the economy.

Acknowledgments

The author wishes to thank Caleb Foote for providing research assistance on this report, and Randolph Court, Alex Key, and MacKenzie Wardwell for editorial assistance. Any errors or omissions are the author’s alone.

About the Author

Robert D. Atkinson is the founder and president of ITIF. Atkinson’s books include Big is Beautiful: Debunking the Myth of Small Business (MIT, 2018), Innovation Economics: The Race for Global Advantage (Yale, 2012), and The Past and Future of America’s Economy: Long Waves of Innovation That Power Cycles of Growth (Edward Elgar, 2005). Atkinson holds a Ph.D. in city and regional planning from the University of North Carolina, Chapel Hill, and a master’s degree in urban and regional planning from the University of Oregon.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent 501(c)(3) nonprofit, nonpartisan research and educational institute that has been recognized repeatedly as the world’s leading think tank for science and technology policy. Its mission is to formulate, evaluate, and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit itif.org/about.

Endnotes

[1]. International Federation of Robotics, “Robot Density Rises Globally,” news release, February 7, 2018, https://ifr.org/ifr-press-releases/news/robot-density-rises-globally.

[2]. Ibid.

[3]. This was from both the International Labor Organization and the Conference board; “Labour Costs,” International Labor Organization, accessed October 23, 2018, https://ilostat.ilo.org/?MBI_ID=443&_afrLoop=2316899372413622&_afrWindowMode=0&_afrWindowId=ovyeuluap_1; “International Comparisons of Hourly Compensation Costs in Manufacturing, 2016-Summary Tables,” The Conference Board, accessed October 23, 2018, https://www.conference-board.org/ilcprogram/index.cfm?id=38269#Table2.

[4]. “How Much Do Industrial Robots Cost?” RobotWorx, accessed October 23, 2018, https://www.robots.com/faq/how-much-do-industrial-robots-cost.

[5]. The Boston Consulting Group, “The shifting Economics of Global Manufacturing,” February 2015, Retrieved from https://www.slideshare.net/TheBostonConsultingGroup/robotics-in-manufacturing.

[6]. ITIF calculations, based on the methodology described herein.

[7]. Rob Atkinson et al., “Worse than the Great Depression: What the Experts Are Missing About American Manufacturing Decline” (Information Technology and Innovation Foundation, March 2012), https://itif.org/publications/2012/03/19/worse-great-depression-what-experts-are-missing-about-american-manufacturing.

[8]. “The Realization of Co-Robots acting in Direct Support of Individuals and Groups,” National Science Foundation, https://www.nsf.gov/pubs/2016/nsf16517/nsf16517.htm.

[9]. “International Organization of Motor Vehicle Manufacturers,” OICA, accessed October 23, 2018, http://www.oica.net/category/economic-contributions/auto-jobs.

[10]. Daron Acemoglu, Pascual Restrepo, “Demographics and Automation” (working paper, Department of Economics, Boston University, Massachusetts, 2018), https://economics.mit.edu/files/15056.

[11]. The Headquarters for Japan’s Economic Revitalization, New Robot Strategy: Japan’s Robot Strategy- Vision, Strategy, Action Plan (Tokyo, October 2015), https://www.kantei.go.jp/jp/singi/keizaisaisei/pdf/robot_honbun_150210EN.pdf; Kim Sang-mo, “Policy Directions for S. Korea’s Robot Industry,” Business Korea, August 17, 2018, http://www.businesskorea.co.kr/news/articleView.html?idxno=24394.

[12]. Stephen Ezell, “International Benchmarking of Countries’ Policies and Programs Supporting SME Manufacturers” (Information Technology and Innovation Foundations, September 2011), https://itif.org/publications/2011/09/14/international-benchmarking-countries%E2%80%99-policies-and-programs-supporting-sme.

[13]. The Headquarters for Japan’s Economic Revitalization, New Robot Strategy, October 2, 2015, http://www.meti.go.jp/english/press/2015/pdf/0123_01b.pdf.

[14]. “Taxation and Investment Guides and Country Highlights,” Deloitte, accessed October 3, 2011, https://dits.deloitte.com/#TaxGuides.

[15]. Ibid.

[16]. Benedict Dellot and Fabian Wallace-Stephens, “What’s Stopping UK Businesses From Adopting AI & Robotics?” Medium, September 18, 2017, https://medium.com/@thersa/whats-holding-back-uk-businesses-from-adopting-ai-robotics-e471b68c24fd.

[17]. “China’s Guangdong province invests billions in robot factories,” March 27, 2015 http://www.globaltimes.cn/content/914262.shtml.

[18]. People's Government of Anhui Province, “Policies and Measures—2016 Anhui Investment and Trade Expo,” October 26, 2016, http://english.ah.gov.cn/content/detail/581009cc8513f3e1bf1991df.html.

[19]. Justin Rose, et. al, “Advancing Robotics to Boost US Manufacturing Competitiveness,” Boston Consulting Group, October 25, 2018, https://www.bcg.com/en-us/publications/2018/advancing-robotics-boost-us-manufacturing-competitiveness.aspx.

[20]. Robert Atkinson, “False Alarmism: Technological Disruption and the U.S. Labor Market, 1850–2015” (Information Technology and Innovation Foundation, May 2017), https://itif.org/publications/2017/05/08/false-alarmism-technological-disruption-and-us-labor-market-1850-2015.

[21]. Organisation for Economic Co-operation and Development (OECD), Technology, Productivity and Job Creation: Best Policy Practices (OECD, July 1998), http://www.oecd.org/dataoecd/39/28/2759012.pdf.

[22]. International Labour Organization, “World Employment Report 2004-05: Employment, Productivity, and Poverty Reduction,” ILO, December 2004, http://www.ilo.org/global/publications/ilo-bookstore/order-online/books/WCMS_PUBL_9221148130_EN/lang--en/index.htm.

[23]. Bart van Ark, Ewout Frankema, Hedwig Duteweerd, “Productivity and Employment Growth: An Empirical Review of Long and Medium Run Evidence,” Groningen Growth and Development Centre, 20004, https://pdfs.semanticscholar.org/9792/8adb01f5e20c58b62a5fa4cb8ae7af767876.pdf.

[24]. Joerg Mayer, “Robots and Industrialization: What Policies for Inclusive Growth?” (working paper, Group 24 and Friedrich-Ebert-Stiftung, New York, 2018), https://www.g24.org/wp-content/uploads/2018/08/Mayer_-_Robots_and_industrialization.pdf.

[25]. Ibid.

[26]. George Graetz and Guy Michaels, “Robots at Work”; Muro and Andes, “Robots Seem to Be Improving Productivity, Not Costing Jobs.”