Venture Capital and Advanced Technologies Drive US Employment

It’s no surprise that technology adoption and venture capital (VC) investment have positive effects on firm performance, but a recent report by the U.S. Census Bureau illustrates just how large these effects can be. The report finds that VC investment and the adoption of advanced technology products, including artificial intelligence, robotics, and 3D printing, are strongly associated with higher employment.

VC-backed firms outperform non-VC-backed companies, employing a disproportionately large share of workers relative to their small share of total firms. Between 2018 and 2022, VC-funded firms accounted for just 0.2 percent of U.S. firms but employed 12.5 percent of the workforce. These firms were also four times more likely to adopt advanced technologies, which have been shown to increase employment, revenue, and labor productivity. When combined, the positive effects of VC support and advanced technology adoption are amplified, contributing to these firms’ outsized economic performance.

An odds ratio, which measures a group’s share of total employment relative to its share of total firms, further illustrates this disparity. Firms that are both backed by venture funding and adopt advanced technology have an odds ratio of 12,677, meaning their share of total employment in the economy (8.6 percent) is more than 12,000 times greater than their share of firms in the economy (0.07 percent). By contrast, an odds ratio below 100 indicates underperformance in employment. Non-VC-financed firms that do not adopt advanced technologies account for 45.7 percent of total firms but employ just 42.1 percent of workers, yielding an odds ratio of 92 (see Figure 1).

Figure 1: Odds ratio (share of total employees relative to share of total firms, 2018-2022)

The report also finds that the absence of VC financing or advanced technology adoption would impose substantial costs on firms and the broader economy. Modeling a scenario in which VC becomes prohibitively expensive and investment disappears, the report finds that gross domestic product (GDP) would decline by more than 4 percent, employment by 3 percent, and productivity by 2 percent. Similarly, making advanced technologies prohibitively expensive results in a 13 percent decline in GDP, an 8 percent drop in employment, and a 6 percent reduction in productivity.

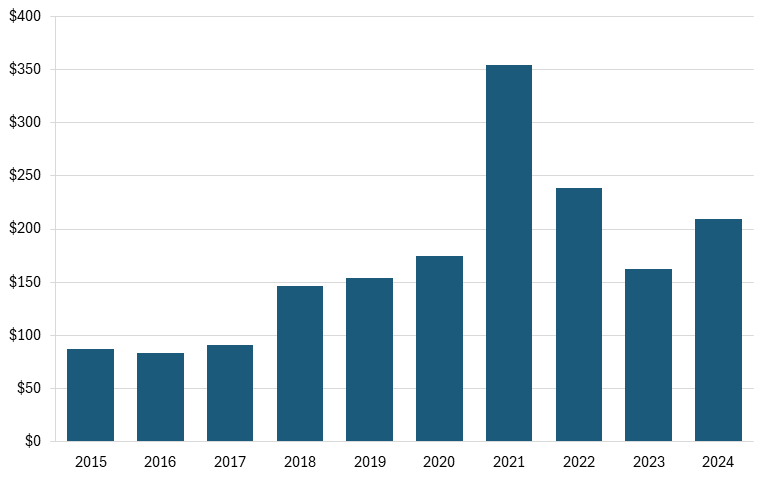

Taken together, these findings underscore just how central VC and advanced technology adoption are to U.S. economic performance. This makes the recent slowdown in U.S. VC investment all the more concerning. Since its peak in 2021, VC investment has fallen by 41 percent, to $209 billion in 2024 (see Figure 2). A prolonged decline in venture funding risks weakening one of the economy’s most effective engines of growth, innovation, and job creation.

Figure 2: VC investment in the United States (billions of dollars)

Policymakers should view this decline as a warning, not an inevitability. Reinvigorating venture investment and broadening access to advanced technologies should be core pillars of future U.S. innovation and competitiveness policy.

Related

November 15, 2024