OECD Nations Face Steeper FDI Decline Than Emerging Economies

Global foreign direct investment (FDI) has declined by nearly 3 percent per year over the past decade. Countries in the Organization for Economic Co-operation and Development (OECD) have accounted for a larger share of the decline than major non-OECD nations.

Since 2015, FDI flows to OECD nations have declined by about 3.8 percent annually. Over the same period, non-OECD G20 countries, including Argentina, Brazil, China, India, Indonesia, Russia, Saudi Arabia, and South Africa, have experienced a more modest decline of 2.5 percent. Looking only at the past two years, the differences are even greater: FDI inflows to the OECD decreased by 31 percent, while non-OECD G20 countries saw inward FDI decline by 14 percent. (See figure 1.) Notably, investment in China and the United States declined by 24 percent and 17 percent, respectively, while FDI to India increased by 45 percent.

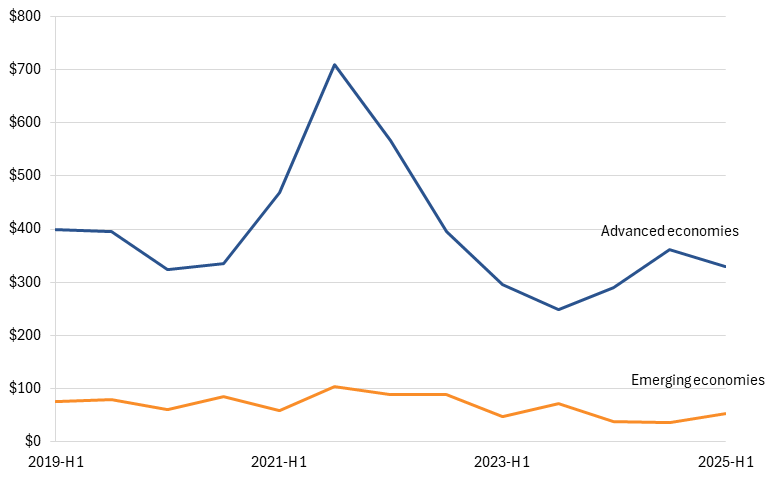

Figure 1: Inward FDI flows (billions USD)

FDI is divided into two main categories: mergers and acquisitions and greenfield investment. Mergers and acquisitions, which involve the combination or purchase of firms by foreign enterprises, declined by 4 percent globally in the first half of 2025. However, advanced economies, including the United States, Germany, and Japan, experienced a sharper 9 percent decline. In contrast, activity in emerging economies such as China, India, and Brazil increased by more than 30 percent. (See figure 2.) The OECD does not provide this data at the individual-country level.

Figure 2: Value of mergers and acquisitions (billion USD)

Greenfield investment—the establishment or expansion of foreign business operations within another country—tells a different story. Unlike mergers and acquisitions, greenfield investment in advanced economies increased sharply in 2025, while the opposite occurred in emerging economies. (See figure 3.) Although greenfield investment has declined in emerging economies, it still represents 80 percent of total FDI in these nations, compared with just 43 percent in advanced economies. In the United States, greenfield investment accounts for just 5 percent of total FDI.

Figure 3: Value of greenfield investment (billion USD)

Given the strategic importance of FDI to the competitiveness of advanced industries, these trends are troubling. Without a renewed focus on attracting FDI, specifically greenfield FDI, the United States risks losing its attractiveness as an investment location and eroding its long-term competitiveness.

Related

August 11, 2025

Fact of the Week: FDI to Developing Nations Has Dropped to Its Lowest Level Since 2005

August 19, 2025