Korea Enters the Global Top Four in Innovation—Now It Must Turn Knowledge Into Scaled Firms

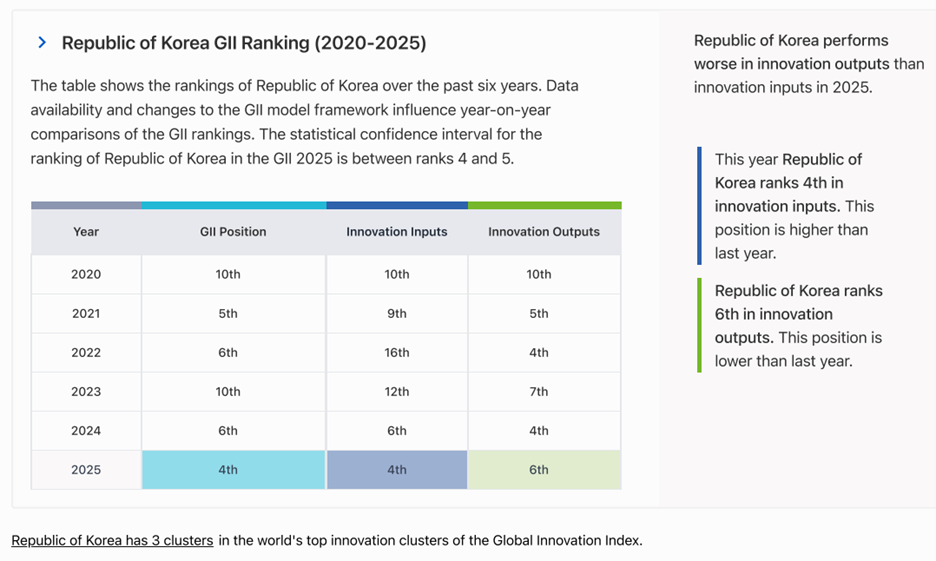

The Global Innovation Index (GII), published annually by the World Intellectual Property Organization (WIPO) and its partners, ranks economies on their ability to generate and commercialize innovation. It has become the world’s most widely used yardstick for benchmarking innovation policy. In the 2025 edition, Korea entered the global top four, rising from sixth place in 2024. That achievement reflects long-standing strengths in research intensity and corporate R&D, but it also raises tough questions about how to turn knowledge into scaled firms.

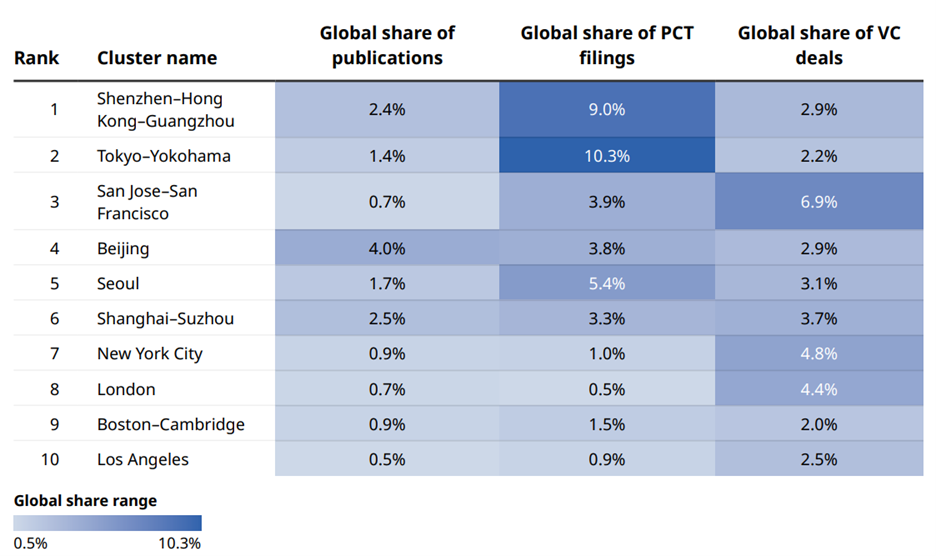

At the metro level, Seoul ranks fifth in WIPO’s Top 100 Innovation Clusters for 2025, trailing only Shenzhen–Hong Kong–Guangzhou, Tokyo–Yokohama, San Jose–San Francisco, and Beijing. Seoul accounts for more than 5 percent of global PCT filings, about 3 percent of global venture capital deals, and nearly 2 percent of global scientific publications—a rare combination of IP strength and growing venture activity in a single metro area.

And it is not only the capital. Daejeon, long recognized as a science city, ranks 25th worldwide and 15th in innovation intensity per capita. This shows how tightly concentrated research capacity can translate into global visibility when sustained by universities and public labs. Meanwhile, Busan remains within the top 100, ranking 95th worldwide and 86th in innovation intensity per capita.

The broader success rests on relentless business R&D: Korea ranks first globally for GERD performed by business (as a percentage of GDP) and continues to generate patents at a scale few economies can match. In terms of pure knowledge production, Korea has delivered exactly what policymakers hoped for when they set targets two decades ago.

However, while Korea’s inputs are world-class, the translation into market results still lags. In 2025, Korea ranks fourth on innovation inputs but only sixth on outputs—an explicit input–output gap that underscores the need to convert knowledge into scaled, globally competitive firms.

IPO activity was not the weak link in early 2025. According to EY, Korea recorded 38 IPOs in the first half of 2025, the second-highest first-half total in 22 years and nearly matching the 2021 peak of 40. That is a sign of resilience. Yet the startup M&A channel—crucial for recycling talent and capital—remains soft, with local reporting pointing to a continuing “startup M&A winter.” In short, listings remain strong, but trade sales are thin, narrowing the set of viable scale-up paths for venture-backed firms.

A second friction is foreign capital. Korea’s overall investment position looks like a net exporter of risk: Inward FDI fell 20 percent year over year to $15.2 billion in 2024, while outward FDI rose to $48.6 billion, according to the UN Trade and Development’s 2025 Country Fact Sheet. The GII 2025 country profile reinforces the point, ranking FDI net inflows (as a percentage of GDP) 108th—a stark outlier for a top-five innovation system. If late-stage domestic pools are not deep enough, and cross-border capital faces frictions, promising firms encounter a funding valley between Series A and scale.

On firm creation at the frontier, Korea is competitive but not yet dominant. The GII’s measure of “unicorn valuation as a percentage of GDP” ranks Korea 27th, reinforcing the finding that scaled outcomes lag behind the country’s scientific and patent strengths. That ranking mirrors the GII’s broader message: robust inputs, a solid pipeline, but fewer scaled outcomes than Korea’s science and patent position would predict.

So, what comes next? Korea should:

- Deepen growth-stage capital by empowering pension funds and other institutional investors with mandates and evaluation horizons that accommodate late-stage venture and growth equity in capital-intensive fields such as AI hardware, biotech platforms, and space technology.

- Stabilize the rules and widen exits, providing predictable, technology-neutral regulation and reducing frictions for cross-border M&A while courting foreign buyers.

- Make scale the key metric, tying national programs to revenue growth, export intensity, and private co-investment rather than firm counts or grant volumes. For the Ministry of SMEs and Startups, this means shifting from providing survival assistance to setting explicit targets for firm-size expansion.

- Pull in global capital by streamlining inbound FDI processes and actively marketing late-stage rounds to foreign institutions. Outward FDI shows global ambition; inward FDI needs to catch up if domestic scale-ups are to accelerate.

Breaking into the GII’s global top four is a milestone, not a finish line. The data shows that Korea has the necessary inputs—patents, researchers, corporate R&D—and that Seoul now pairs IP strength with real venture activity. The test for the next five years is whether Korea can convert knowledge into scaled firms that lift productivity and compete globally. Measure success by scale-up throughput and global reach, not inputs alone. That is how a patent-and-paper powerhouse becomes a market powerhouse.

Related

March 15, 2021

Korea’s Next Innovation Challenge

May 11, 2022