How Reducing Federal R&D Reduces GDP Growth

Cutting federal investments in R&D may appear to save billions in the budget, but it could cost the economy trillions. In fact, ITIF estimates that cutting federal R&D by 20 percent would cost the U.S. economy up to almost $1.5 trillion compared with China’s growth pace.

KEY TAKEAWAYS

Key Takeaways

Contents

Cuts to Federally Funded Research. 6

How Federal R&D Grows the Economy 9

Introduction

In an effort to cut federal spending, the Trump administration’s budget proposal for 2026 recommends slashing public investments in research and development (R&D) by as much as half for certain agencies—and in some areas, drastic reductions have already begun.[1] But federal R&D plays a crucial role in driving U.S. innovation, productivity, and economic growth. While cutting research funding may save taxpayers’ money in the short term, it incurs greater costs in the long term.

In this report, ITIF models the impact of cutting federal R&D investments by 20 percent starting in fiscal year 2026. (This would be $40.7 billion less than was budgeted for R&D in 2025.) The model projects this scenario over 10 years and compares it with three alternative scenarios: maintaining the 2025 R&D budget amount, maintaining the 2025 R&D level as a share of U.S. gross domestic product (GDP), or keeping pace with China’s level of R&D investment as a share of its GDP.

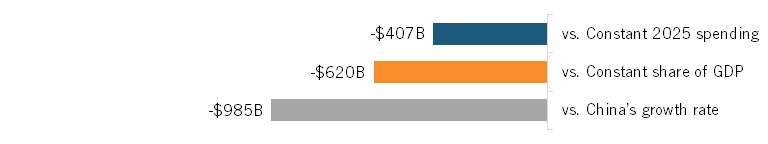

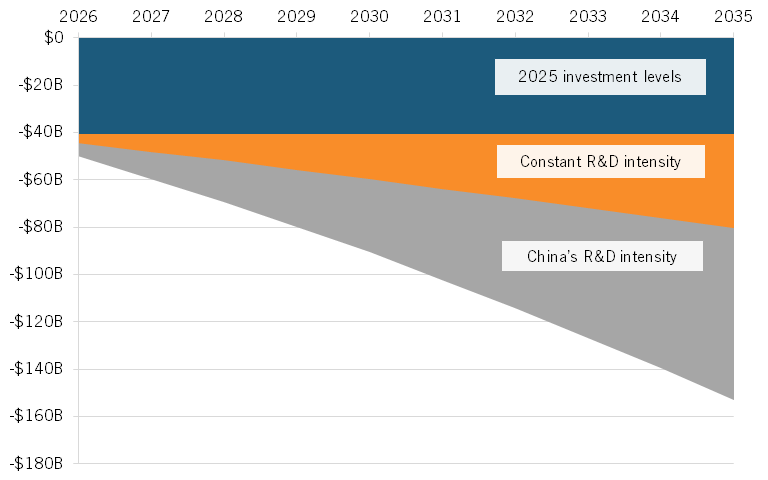

As shown in figure 1, a 20 percent cut would reduce federal R&D spending by a cumulative $407 billion over 10 years compared with maintaining the same amount of spending that was budgeted for 2025. It would reduce spending by a cumulative $620 billion compared with maintaining the 2025 R&D budget level as a share of GDP. And it would save $985 billion compared with keeping pace with China’s R&D intensity.

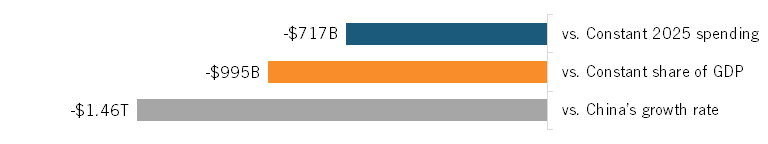

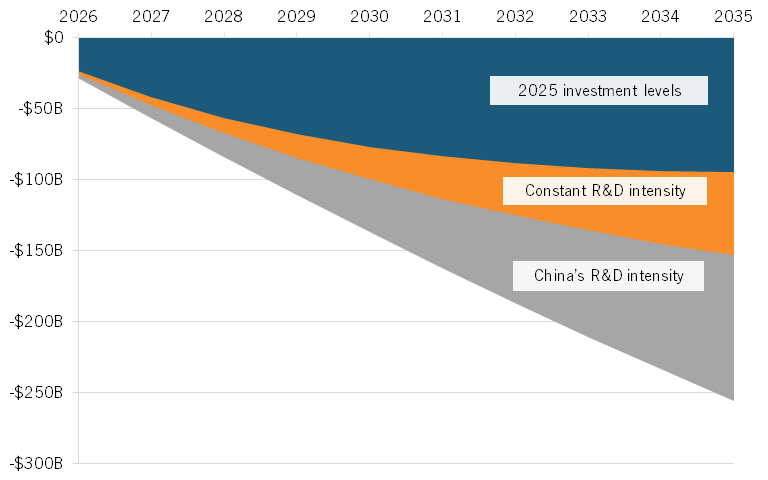

But as shown in figure 2, those spending reductions would come at a steep cost to the U.S. economy. Cutting federal R&D spending by 20 percent would reduce U.S. GDP by more than $700 billion cumulatively over 10 years versus maintaining the same amount of R&D spending that was budgeted in 2025. It would shrink the economy by $1 trillion compared with maintaining the 2025 level of R&D intensity as a share of GDP. And it would put the U.S. economy nearly $1.5 trillion behind China’s pace.

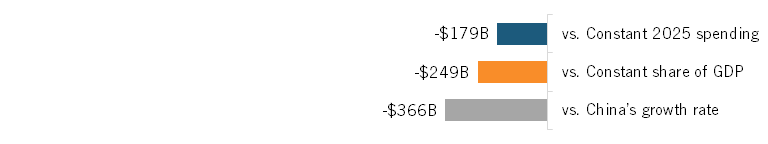

Moreover, as shown in figure 3, shrinking the economy also would reduce federal tax revenue, thereby wiping out a substantial share of the budget savings from figure 1.

Figure 1: Cumulative reduction in federal R&D spending 10 years after a 20 percent cut (2024 dollars)

Figure 2: Cumulative reduction in U.S. GDP 10 years after a 20 percent R&D spending cut (2024 dollars)

Figure 3: Cumulative reduction in tax revenue 10 years after a 20 percent R&D spending cut (2024 dollars)

R&D is a key factor in increasing productivity and, therefore, increasing GDP. However, the academic literature is inconclusive in terms of the social rate of return to R&D, with estimates ranging from 30 to 100 percent.[2] The Information Technology and Innovation Foundation (ITIF) used academic estimates of the impact of R&D on productivity to build an economic model that estimates the impact of R&D cuts on GDP. The estimates generated by this model do not stem from short-run reductions in government expenditures (Keynesian effects), but rather from the estimated effects of the decrease in R&D and its impact on productivity, the underlying mechanism of growth.

We estimate that a 20 percent cut to federal government R&D spending will reduce GDP by at least $717 billion and up to nearly $1.5 trillion over the 10-year period from 2026 to 2035

R&D is an indispensable input for businesses to generate innovation, which in turn leads to the development of new products, improvements to existing ones, and ultimately, business growth and expansion. Additionally, many for-profit businesses benefit from federal R&D assistance in the form of grants and public-private research partnerships. These awards incentivize greater R&D investment and increase U.S. competitiveness. In the current state of the techno-economic war with China, the United States cannot afford to stop investing in this critical ingredient for competitiveness. Our model shows that doing so would be self-defeating.

Importance of R&D

As of 2024, the federal government funded approximately 19 percent of R&D conducted in the United States and 6 percent of global R&D, more than any other nation.[3] Research has long been shown to enable innovation; however, translating that research into economic growth requires academic entrepreneurship, such as filing patent applications and launching start-ups.[4]

For one, investment in R&D has a direct and positive impact on the number of patent applications a firm files. When left to their own devices, firms underinvest in R&D relative to the socially optimal rate for economic growth.[5] For that reason, federal agencies have become some of the largest funders of R&D, providing grants and conducting collaborative research with universities and firms. For example, the National Institutes of Health (NIH) is the largest public health funder in biomedical research in the world, contributing to numerous innovations and patents.[6] For example, in 2018, for every $10 million in biopharma funding from NIH, 2.3 patents were filed, with each patent worth approximately $16.6 million.[7]

Beyond patents, R&D has a strong, positive effect on the establishment and growth rate of start-ups, particularly among new high-tech firms. Specifically, investment in R&D is essential for both the development of new products and the absorption of external knowledge by a start-up, enabling new product innovations and increased competitiveness.[8]

R&D has a positive effect on patent applications, start-up growth, and exporting.

However, perhaps the most significant contribution of R&D to growth stems from its ability to propel firms into foreign markets. Investing in research activities has a “learn to export” effect on firms. Through R&D, firms acquire knowledge and production capabilities that enable them to enter foreign markets through exportation.[9] For firms already active in foreign markets, the productivity returns to R&D are higher than those of pure domestic firms, meaning the expected long-run payoff to R&D is significantly greater for an exporting firm than for a nonexporter. Considering that some of the greatest beneficiaries of federal R&D investment include large technology and biopharmaceutical firms—both of which are active in and require access to foreign markets—a reduction in federal R&D spending will have the most significant impact on their growth and competitiveness.[10]

Consequently, trade restrictions such as tariffs lower the expected returns from R&D, with the greatest impact seen in high-tech industries. Implementing trade restrictions would only amplify the adverse economic effects resulting from the loss of federal R&D investment.[11]

Opponents of government research investment have claimed that federal funding for research crowds out private investment, suggesting that business investment will fill the gaps created through federal research cuts. However, there is ample evidence to suggest that not only will that not happen, as federal investment has a “crowding-in” effect on private investment, but private firms often do not invest in the same research as the federal government does. Most R&D investment by the private sector focuses on later-stage investment, thus overlooking investment in basic research. Basic research is often viewed as riskier from a business standpoint, as it takes longer and has fewer assured results. However, it is essential to increasing the pool of knowledge and can lead to breakthroughs in established and new technology areas. In 2022, the U.S. government funded 40 percent of basic research in the United States.[12]

Perhaps the most significant contribution of R&D to growth stems from its ability to propel firms into foreign markets. Investing in research activities has a “learn to export” effect on firms.

Many of the products we rely on for everyday activities are developed with the support of U.S. federal research dollars. For example, the National Science Foundation’s (NSF’s) Experimental Program to Stimulate Competitive Research (EPSCoR) funded the development of early multi-touch displays.[13] In 1998, Wayne Westerman, a doctoral student at the University of Delaware, launched his start-up FingerWorks, developing the first line of tablets capable of recognizing two or more points of contact with the screen.[14] FingerWorks was later sold in 2005 to Apple, and its technology was used to develop the modern touchscreen.[15]

In the health industry, the National Cancer Institute (NCI) under NIH has been a key supporter of life-saving research conducted by private companies. A clear example of this is the development of Gleevec, a treatment for chronic myelogenous leukemia (CML), a deadly blood cancer.[16] In the 1970s, researchers at the University of Pennsylvania, supported by NCI, first discovered the cause of the cancer, a genetic mutation called BCR-ABL.[17] Decades later, researchers working in an NIH-funded lab at the Oregon Health and Science University worked with Novartis to develop a drug that blocks the activity of BCR-ABL proteins, thus treating CML. NIH funding was essential in the discovery, development, and clinical trials for Gleevec, which now successfully treats 200,000 cancer patients annually.[18]

Cuts to Federally Funded Research

The agencies that account for most federal R&D funding and performance are the Departments of Defense (DOD), Health and Human Services (HHS) (which houses NIH), and Energy (DOE), the National Aeronautics and Space Administration (NASA), and NSF. These agencies, aside from DOD, are subject to high potential cuts by Trump’s proposed budget request. (See table 1.)

Table 1: Proposed 2026 R&D budgets for research-intensive agencies[19]

|

Agency |

FY 2025 Budget |

Proposed FY 2026 Budget |

Change |

|

NSF |

$8.6B |

$2.9B |

-66% |

|

HHS |

$11.5B |

$5.8B |

-50% |

|

NASA |

$9.5B |

$5.1B |

-47% |

|

NIH |

$46.0B |

$27.9B |

-39% |

|

DOE |

$18.7B |

$14.7B |

-21% |

|

DOD |

$91.2B |

$110.0B |

21% |

|

Total |

$185.4B |

$166.4B |

-10% |

Broad and sweeping cuts of this level to federal R&D funding will undoubtedly reduce research in vital STEM (science, technology, engineering, and math) and health fields. As of 2021, the most recent available data for most countries in the Organization for Economic Cooperation and Development (OECD), the U.S. investment in research was already below that of comparable nations. The United States ranked 11 out of 33 countries in federal R&D intensity at 0.6 percent. Austria and Germany invested nearly 50 percent more. A 20 percent cut to R&D investment would place the United States in 21st, behind Japan, Canada, and the United Kingdom.[20]

While the United States is threatening cuts to R&D, China is rapidly catching up and may have surpassed it in total research investment. As of 2023, U.S. gross expenditure on R&D (GERD) totaled $823 billion, more than China’s $781 billion. However, the average annual growth rate of China’s R&D investment between 2019 and 2023 was nearly double that of the United States. Assuming China continues to increase its investment at a constant rate while U.S. investment stagnates, 2024 data (which is not yet available) will show that China has already surpassed the United States in R&D investment.[21]

While the United States is threatening cuts to R&D, China is rapidly catching up and may have surpassed it in total research investment.

A 20 percent cut to R&D was chosen based on the overall cuts in Trump’s 2026 proposed budget, which implements a 22.6 percent cut to nondefense discretionary spending. It is worth noting that if cuts of this magnitude are implemented, R&D may be cut at even greater amounts. This is because, for many federal agencies, R&D is much more discretionary than are other core activities, meaning it is easier to make steeper cuts to R&D than to other costs, such as building leases, to meet budget requirements. Nevertheless, for this analysis, we assume proportional cuts to R&D.

R&D Expenditure Shortfall

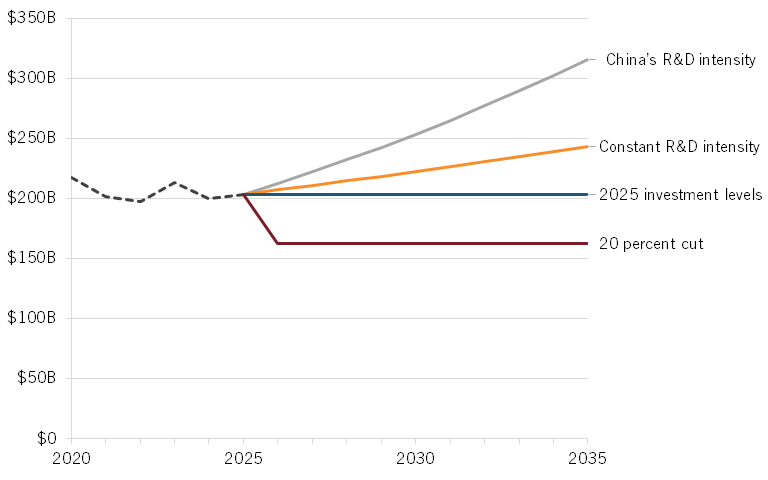

This assessment compares a 20 percent R&D spending cut with three different benchmarks. (See figure 4.) The first benchmark assumes that R&D expenditures are maintained at 2025 levels. This estimate predicts that the cumulative loss in R&D expenditures from 2026 to 2035 will amount to $407 billion. Using this benchmark, the annual R&D shortfall is constant across all years (figure 5).

Figure 4: 20 percent cut to federal R&D vs. three benchmarks of federal R&D (2024 dollars)

Though this first benchmark is a good baseline, it doesn’t account for global economic trends, GDP growth, or the current state of techno-economic competition. In reality, federal investment in R&D as a percentage of GDP has remained relatively stable for the past decade, hovering around 0.2 percent of GDP. A more accurate benchmark would take GDP growth into account.

For this reason, we consider a benchmark wherein R&D intensity remains constant. A constant R&D intensity would indicate that within the United States economy, the relative size of R&D investment is neither growing nor declining, presenting a neutral benchmark. This benchmark uses the Congressional Budget Office’s (CBO’s) projection of GDP through 2035. When comparing a 20 percent cut to R&D investment with this benchmark, there is a cumulative R&D shortfall of $620 billion through 2035. (The combined blue and orange areas in figure 5.)

However, it’s not enough for the United States to keep R&D intensity the same; it must be increased. The third and final benchmark represents the amount of R&D investment that the United States should strive to meet: increasing R&D investment at the same rate as China did between 2014 and 2023. China has been increasing R&D investment by 2.6 percent annually over the last decade, compared with just 2.4 percent in the United States. While matching Chinese R&D growth is a lofty, and perhaps unrealistic, goal, it still presents a relevant benchmark of where the United States needs to be in terms of R&D investment to maintain technological leadership. When comparing a 20 percent R&D cut with this benchmark, the United States would experience a cumulative R&D shortfall of nearly $1 trillion from 2026 to 2035. (All areas combined in figure 5.)

Figure 5: Projected annual R&D investment shortfalls (2024 dollars)

It’s not enough for the United States to keep R&D intensity the same; it must be increased.

How Federal R&D Grows the Economy

Effects on GDP and Tax Revenue

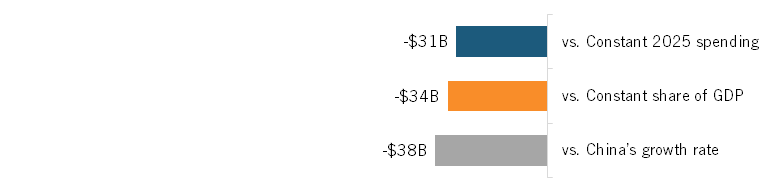

Every annual cut to R&D reduces R&D stock for several years in the future, thus producing long-term reductions in GDP and tax revenues. For example, compared with the first benchmark, a 20 percent cut to R&D in 2026 will result in the government saving approximately $41 billion in budgeted spending. However, over the next decade, the effect will be to reduce GDP by $135 billion versus maintaining the same R&D intensity that was budgeted in 2025. (See figure 6.) And, assuming tax revenue is equivalent to 25 percent of GDP, tax revenues will be reduced by $34 billion.[22] (See figure 7.)

Figure 6: Cumulative reduction of GDP after one-time 20 percent R&D cut to federal R&D in 2026 (2024 dollars)

Figure 7: Cumulative reduction of tax revenue after one-time 20 percent R&D cut in 2026 (2024 dollars)

Sustained disinvestment in R&D over the next decade will result in even greater economic losses for the United States. When comparing a 20 percent cut in R&D investment with the first benchmark, which provides the smallest estimated loss to GDP, cumulative GDP from 2026 to 2035 is reduced by $717 billion, almost double the amount saved in R&D cuts. (See figure 2 and figure 8.) Tax revenues decline by $179 billion. (See figure 3.)

Figure 8: Cumulative reduction in GDP due to a 20 percent cut to federal R&D (2024 dollars)

However, this first benchmark is still below what the United States should strive for and likely provides a low estimate of the foregone R&D and GDP. Realistically, the United States should aim to increase R&D spending at the rate of GDP growth and maintain R&D intensity. When a 20 percent cut to R&D is compared with this benchmark, the cumulative loss to GDP totals about $1 trillion. In comparison, the R&D cuts will total just $620 billion in savings for the U.S. government. Foregone tax revenues will total approximately $249 billion.

When comparing a 20 percent cut with the third benchmark, there is a cumulative GDP shortfall of nearly $1.5 trillion. However, this benchmark is not necessarily a reasonable goal for the United States, considering political sentiment regarding R&D investment; rather, it is a good predictor of where the United States will stand in relation to China. If the United States cuts R&D investment by 20 percent over the next 10 years while China continues to increase its R&D intensity at its current rate, China will make great steps in closing the gap to becoming the largest economy in the world, reducing the gap by close to $1.5 trillion from 2026 to 2035. Using this benchmark, the U.S. government will forego $366 billion in tax revenue.

A 20 percent cut to federal R&D investment would reduce potential tax revenue by between $179 billion and $366 billion over 10 years.

The impact of R&D cuts will not only be seen in the economy but also in the knowledge base. Because existing research is built upon to develop new knowledge and products, the rate at which new ideas and innovations are produced will be reduced when less R&D is undertaken. When R&D investment is cut, the United States can expect to see the number of patents, publications, start-ups, and licenses fall, which will have adverse downstream effects on U.S. competitiveness.

Implications on U.S. Competitiveness

Despite bipartisan consensus on the need to counter China’s unfair trade practices and technological market distortions, cutting federal R&D funding will represent a strategic misstep. Federal R&D investment is the bedrock of the U.S. innovation ecosystem, catalyzing private sector R&D activity that has propelled U.S. tech firms to leadership in critical sectors, including semiconductors, artificial intelligence (AI), and biotechnology. And while the United States discusses scaling back this vital input, China continues to execute a long-term, state-backed industrial strategy focused on research, development, and technological self-sufficiency.

China’s sustained investment in R&D is intended not only to accelerate domestic innovation but also to position China as the global leader in strategic technologies. In contrast, a reduction in U.S. federal R&D will weaken the crowding-in effect that public investment has historically exerted on private sector R&D, therefore diminishing overall R&D intensity and stifling innovation across the broader economy.

These consequences will extend into the workforce. Roughly 70 percent of federal R&D funding flows to universities and labs that train talent in STEM fields and attract top international researchers. Cutting this support would narrow the Ph.D. pipeline and push many foreign-born scientists to seek opportunities abroad, thereby weakening the U.S. R&D workforce.[23]

If the United States disinvests in its research capabilities while China continues to do the opposite, the future outlook of U.S. technological competitiveness vis-à-vis China is grim. Strategic competition with China requires sustained, predictable public R&D investment paired with private sector support.

Conclusion

Over the past decade, U.S. federal investment in R&D as a percentage of GDP has been stagnant, while other countries, including China, have increased investment, recognizing the economic and innovation benefits that can be gained from research. And now the Trump administration has taken steps to drastically cut research funding across multiple agencies.

However, decreasing federal investment in R&D is not going to save Americans’ money, but rather, it will cost. R&D has a direct and positive impact on productivity, and higher productivity increases GDP. Cutting federal R&D funding by 20 percent will shrink GDP growth over time, resulting in $717 billion to nearly $1.5 trillion in foregone economic growth over a decade.

Beyond the macroeconomic effects, reduced R&D, particularly in critical technologies and advanced industries, will weaken U.S. competitiveness, opening the door for foreign competitors, including Chinese firms, to gain global market share. Instead of cutting research in industries such as AI, quantum computing, and biotechnology, the U.S. government must increase R&D funding and engage in industrial policy that encourages private sector R&D investment.

Cutting these programs will only harm long-term economic growth. President Trump and Congress should weigh the long-run growth effects alongside the near-term budget considerations when considering federal R&D investment and resist the urge to cut these critical programs.

Appendix: Methodology

The estimates of the economic effects of a 20 percent cut to discretionary R&D are based on aggregated forecasts of defense and nondefense R&D expenditures. A 20 percent cut to R&D is forecast by reducing 2025 discretionary spending, which is derived from existing data from the American Association for the Advancement of Science, while maintaining defense and nondefense R&D intensity at 2025 levels.

In forecasting the rates of total discretionary R&D spending in the three benchmark scenarios, we hold total defense and nondefense discretionary spending constant at 2025 levels, allowing us to manipulate R&D investment in each benchmark. We also utilize CBO’s forecasts of real GDP in 2024 dollars through 2035.

In the first benchmark, the R&D intensity of discretionary spending is held constant at 2025 levels. In the second benchmark, R&D expenditures are increased at the same rate as GDP growth, which is calculated using CBO’s forecasts. In the third benchmark, national R&D intensity data from OECD is used to calculate the average annual growth of R&D intensity in China from 2014 to 2023. R&D investment is then forecasted to increase at this growth rate. After forecasting R&D expenditures according to these three different benchmarks, the difference in R&D spending between each benchmark and the 20 percent cut scenario is calculated, giving the cumulative R&D shortfall. (See table 2.)

Using these forecasts of R&D shortfalls, we calculate the change in the R&D capital stock for each year from 2026 to 2035. The GDP to R&D elasticity from Coe and Helpman (1994) of 0.23 is then applied to calculate the impact of a decrease in R&D stock on GDP.[24] Finally, we sum the immediate and residual effects from the expenditure shortfalls after properly accounting for depreciation. All values are in constant 2024 dollars.

For example, when compared with the first benchmark wherein R&D expenditures are held at 2025 levels, a 20 percent cut to R&D results in a $40.7 billion shortfall in 2026. R&D capital stock after the cut is then projected to be $12.5 trillion, 0.33 percent lower than the benchmark amount.[25] This percentage change is then multiplied by the elasticity of GDP with respect to R&D capital stock. This indicates that in 2026, GDP will decrease by $23.1 billion due to the productivity losses that would have been created from the foregone investment in R&D. However, the reduction continues to affect GDP throughout the 2026 to 2035 period. We use the R&D depreciation rate of 15 percent found by Mead (2007) to calculate the residual effects on GDP due to the loss of R&D in 2026.[26] In 2027, the related decrease in GDP due to the 2026 shortfall is $19.6 billion. At the same time, because of a continued lack of investment in R&D, the United States experiences an additional R&D expenditure shortfall of $40.1 billion, resulting in a loss of $22.0 billion in GDP. Therefore, the net loss in 2027 is the sum of the two ($19.6 billion and $22.0 billion), which is $41.7 billion. This process continues throughout the 2026 to 2035 period, where each year the residual and immediate impacts of R&D cuts are combined to find the cumulative economic effect of R&D expenditure shortfalls. The economic impact of R&D cuts increases with every passing year.

Table 2: Annual R&D investment by benchmark (2024 dollars)

|

Year |

20% Cut to R&D |

Constant 2025 Spending |

Constant GERD/GDP |

R&D Share of GDP Increasing at China’s Ratio |

|

2025 |

$204B |

$204B |

$204B |

$204B |

|

2026 |

$163B |

$204B |

$207B |

$213B |

|

2027 |

$163B |

$204B |

$211B |

$222B |

|

2028 |

$163B |

$204B |

$215B |

$232B |

|

2029 |

$163B |

$204B |

$219B |

$243B |

|

2030 |

$163B |

$204B |

$223B |

$254B |

|

2031 |

$163B |

$204B |

$227B |

$265B |

|

2032 |

$163B |

$204B |

$231B |

$277B |

|

2033 |

$163B |

$204B |

$235B |

$290B |

|

2034 |

$163B |

$204B |

$239B |

$303B |

|

2035 |

$163B |

$204B |

$243B |

$316B |

Acknowledgements

The author would like to thank Robert Atkinson for his helpful feedback and Randolph Court for his editorial assistance. Any errors or omissions are the author’s own.

About the Author

Meghan Ostertag is a research assistant for economic policy at ITIF. She previously interned with the Federal Deposit Insurance Corporation. She holds a bachelor’s degree in economics from American University.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent 501(c)(3) nonprofit, nonpartisan research and educational institute that has been recognized repeatedly as the world’s leading think tank for science and technology policy. Its mission is to formulate, evaluate, and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit itif.org/about.

Endnotes

[1]. Paul Bierman, “Unprecedented Cuts to the National Science Foundation Endanger Research That Improves Economic Growth, National Security and Your Life,” The Conversation, May 15, 2025, https://theconversation.com/unprecedented-cuts-to-the-national-science-foundation-endanger-research-that-improves-economic-growth-national-security-and-your-life-256556.

[2]. Charles I. Jones and John C. Williams, “Measuring the Social Return to R&D,” Federal Reserve Board, February 1997, https://www.federalreserve.gov/pubs/feds/1997/199712/199712pap.pdf.

[3]. Organization for Economic Cooperation and Development, Gross domestic expenditure on R&D by sector of performance and source of funds; accessed June 20, https://data-explorer.oecd.org/vis?lc=en&df%5bds%5d=dsDisseminateFinalDMZ&df%5bid%5d=DSD_RDS_GERD%40DF_GERD_SOF&df%5bag%5d=OECD.STI.STP&df%5bvs%5d=1.0&dq=USA.A.._T.GOV%2B_T.....USD_PPP.Q&pd=2013%2C2024&to%5bTIME_PERIOD%5d=false&vw=tb; Alessandra Zimmermann, “U.S. R&D and Innovation in a Global Context: The 2024 Data Update,” American Association for the Advancement of Science, April 23, 2024, https://www.aaas.org/news/us-rd-and-innovation-global-context-2024-data-update.

[4]. Esther de Wit-de Vries et al., “Knowledge Transfer in University-Industry Research Partnerships: A Review,” The Journal of Technology Transfer, vol. 44 (2019): 1236–1255, https://link.springer.com/article/10.1007/s10961-018-9660-x.

[5]. James R. Brown et al., “What Promotes R&D? Comparative Evidence From Around the World,” Research Policy, vol. 46, no. 2 (2017): 447–462, https://www.sciencedirect.com/science/article/pii/S0048733316302001.

[6]. Amy Baxter, “Is Federal Funding Frozen? Has it Already Thawed? Flip-flop Leaves Biopharma on Edge,” PharmaVoice, January 31, 2025, https://www.pharmavoice.com/news/federal-funding-freeze-biopharma-trump-nih/738818/.

[7]. Figure adjusted by author to account for inflation; Pierre Azoulay et al., “Public R&D Investments and Private-Sector Patenting: Evidence from NIH Funding Rules,” National Library of Medicine, vol. 86, no. 1 (2018): 117–152, https://pmc.ncbi.nlm.nih.gov/articles/PMC6818650/; Miethy Zaman and George Tanewski, “R&D Investment, Innovation, and Export Performance: An Analysis of SME and Large Firms,” Journal of Small Business Management, vol. 62 (2024): 3053–3086, https://www.tandfonline.com/doi/full/10.1080/00472778.2023.2291363#d1e137.

[8]. Erik Stam and Karl Wennberg, “The Roles of R&D in New Firm Growth,” Small Business Economics, vol. 33 (2009): 77–89, https://link.springer.com/article/10.1007/s11187-009-9183-9#Sec1.

[9]. Zaman and Tanewski, “R&D Investment, Innovation, and Export Performance: An Analysis of SME and Large Firms.”

[10]. Florin G. Maican et al., “The Dynamic Impact of Exporting on Firm R&D Investment” working paper, National Bureau of Economic Research, Cambridge, Massachusetts, October 2020, https://www.nber.org/system/files/working_papers/w27986/w27986.pdf.

[11]. Ibid.

[12]. Peter L. Singer, “Federally Supported Innovations: 22 Examples of Major Technology Advances That Stem From Federal Research Support” (ITIF, February 2014), https://www2.itif.org/2014-federally-supported-innovations.pdf.

[13]. Ibid.

[14]. ”Federally Funded Research Drives American Innovation,” Association of American Universities, accessed August 4, 2025, https://www.aau.edu/sites/default/files/%40%20Files/Research%20and%20Scholarship/Why%20University%20Research%20Matters/Infographics/BASIC_RESEARCH_IPAD.pdf.

[15]. Singer, “Federally Supported Innovations: 22 Examples of Major Technology Advances That Stem From Federal Research Support.”

[16]. “How Imatinib Transformed Leukemia Treatment and Cancer Research,” National Cancer Institute, April 11, 2018, https://www.cancer.gov/research/progress/discovery/gleevec.

[17]. Ibid.

[18]. James Love, “Novartis, Dana Farber, Oregon Health & Science University Wait 18 Years to Disclose NIH Funding in Key Gleevec Patent,” The Petrie-Flom Center, October 11, 2019, https://petrieflom.law.harvard.edu/2019/10/11/novartis-dana-farber-oregon-health-science-university-wait-18-years-to-disclose-nih-funding-in-key-gleevec-patent/#:~:text=In%202002%2C%20Michael%20Palmedo%20asked,partly%20funded%20by%20the%20NIH.

[19]. Alessandra Zimmermann, “FY 2026 R&D Appropriations Dashboard,” American Association for the Advancement of Science (AAAS), accessed August 18, 2025, https://www.aaas.org/news/fy-2026-rd-appropriations-dashboard.

[20]. OECD, Gross domestic expenditure on R&D by sector of performance and source of funds (Constant prices, US 2020 dollars, PPP converted, millions); accessed April 21, 2025, https://data-explorer.oecd.org/vis?lc=en&df[ds]=dsDisseminateFinalDMZ&df[id]=DSD_RDS_GERD%40DF_GERD_SOF&df[ag]=OECD.STI.STP&df[vs]=1.0&dq=AUS%2BAUT%2BBEL%2BCAN%2BCHL%2BCOL%2BCRI%2BCZE%2BDNK%2BEST%2BFIN%2BFRA%2BDEU%2BGRC%2BHUN%2BIRL%2BISL%2BISR%2BITA%2BJPN%2BKOR%2BLVA%2BLTU%2BLUX%2BNLD%2BNZL%2BNOR%2BPOL%2BPRT%2BSVK%2BSVN%2BESP%2BSWE%2BCHE%2BTUR%2BGBR%2BUSA.A..HES%2B_T.HES%2BBES%2BGOV%2B_T.....USD_PPP.Q&pd=2019%2C2024&to[TIME_PERIOD]=false&vw=tb.

[21]. Trelysa Long, “China is Catching Up in R&D-and May Have Already Pulled Ahead” (ITIF, April 9, 2025), https://itif.org/publications/2025/04/09/china-catching-up-rd-may-have-already-pulled-ahead/.

[22]. Organization for Economic Cooperation and Development (OECD), A comparative table of countries in the global database (Total tax revenue as a percentage of GDP), accessed August 8, 2025, https://data-explorer.oecd.org/vis?fs[0]=Topic%2C1%7CTaxation%23TAX%23%7CGlobal%20tax%20revenues%23TAX_GTR%23&pg=0&fc=Topic&bp=true&snb=150&df[ds]=dsDisseminateFinalDMZ&df[id]=DSD_REV_COMP_GLOBAL%40DF_RSGLOBAL&df[ag]=OECD.CTP.TPS&dq=..S13._T..PT_B1GQ.A&to[TIME_PERIOD]=false&pd=2010%2C&vw=tb.

[23]. “Federal R&D Funding” (Emerging Tech Policy Careers, Horizon Institute for Public Service; July 3, 2025), https://emergingtechpolicy.org/federal-rd-funding/; Marcelo Jauregui-Volpe, “New Data Show U.S. Retains Significant Share of Foreign Science and Engineering Talent Upon Graduation,” Association of American Universities; April 18, 2025, https://www.aau.edu/newsroom/leading-research-universities-report/new-data-show-us-retains-significant-share-foreign#:~:text=Further%2C%20according%20to%20a%202024,engineers%E2%80%9D%20in%20the%20United%20States.

[24]. David T. Coe and Elhanan Helpman, “International R&D Spillovers,” European Economic Review, vol. 39, no. 5 (1995): 859-887, https://www.sciencedirect.com/science/article/pii/001429219400100E.

[25]. Bureau of Economic Analysis, Intellectual Property Archive (Research and Development Satellite Account), accessed July 20, 2025, https://www.bea.gov/data/special-topics/intellectual-property/archive; Author’s calculation.

[26]. Charles Ian Mead, “R&D Depreciation Rates in the 2007 R&D Satellite Account,” Bureau of Economic Analysis, November 2007, https://www.bea.gov/sites/default/files/papers/P2007-8.pdf.

Editors’ Recommendations

Related

September 15, 2025

Twenty Percent Cut to Federal R&D Would Cost the US Economy $1 Trillion Over Next 10 Years, New Report Finds

February 26, 2013