Short-Circuited: How Semiconductor Tariffs Would Harm the U.S. Economy and Digital Industry Leadership

Imposing blanket tariffs on U.S. semiconductor imports would imperil U.S. leadership across a broad range of digital and nondigital industries while significantly decreasing U.S. economic growth, raising prices, and jeopardizing broader U.S. manufacturing competitiveness.

KEY TAKEAWAYS

Key Takeaways

Contents

Modeling the Economic Impact of Possible U.S. Semiconductor Tariffs 3

The Implications of Tariffs on Data Centers 10

Importance of Semiconductors in Data Centers 12

Impact of Data Centers on the U.S. Economy 15

Case Study: Northern Virginia. 15

Downstream Effects on U.S. Manufacturing Industries 16

Case Study: U.S. Automobile Industry 16

U.S. Semiconductor Manufacturing 18

Introduction

Semiconductors represent the heartbeat of the modern global digital economy, a $627 billion industry in 2024 (that’s expected to grow to a $1 trillion industry by the end of this decade) that stimulates another $7 trillion in global economic activity annually by underpinning a range of downstream applications such as artificial intelligence (AI) and big data.[1] Semiconductors power—both literally, through power management, and figuratively, through their computational and information processing capacity—virtually every modern device, from IT products such as computers and smartphones to manufactured goods such as autos, appliances, and medical devices. Semiconductors constitute a “capital good” that is foundational to the ability of enterprises and nations alike to innovate and compete in the modern global digital economy. Moreover, semiconductors underpin American leadership across a wide range of digital industries from AI and data centers to quantum computing to Internet search and e-commerce.

Revitalizing U.S. semiconductor manufacturing is undoubtedly a vitally important goal. The bipartisan 2022 CHIPS Act stimulated investments in U.S. semiconductor research and development (R&D) and manufacturing that are poised to see the U.S. manufacture nearly 30 percent of the world’s leading-edge semiconductor chips by the end of this decade, up from virtually nil in 2022.[2] Since that year, private enterprises have announced $540 billion in semiconductor and electronics industry investment through over 100 projects across 28 states, including plans to launch 17 new semiconductor fabs in the United States.[3] This points to how effective innovation, R&D, and tax policy alongside regulatory reform, skills development, and collaborative investments can and have already led America down the path to significantly revitalized U.S. semiconductor manufacturing.[4]

To be sure, high tariffs on foreign semiconductor imports could in theory induce some shift in semiconductor production to the United States over time (although the costs from higher prices resulting from the tariffs would be realized immediately); but the reality is the United States can achieve its goals of increasing domestic semiconductor production without having to resort to imposing high tariffs and incurring the economic losses this would inevitably produce.[5]

This report proceeds by modeling the economic impact of blanket tariffs on U.S. (finished-good) semiconductor imports. It finds that tariffs at 25 percent would decrease U.S. GDP growth by 0.18 percent in the initial year, and if sustained, would lead to 0.76 percent less GDP growth in the 10th year post-implementation than would otherwise be the case. Tariffs set at 10 percent would lead to 0.06 percent of GDP growth foregone in the initial year and 0.20 percent lost in the 10th year. Meanwhile, a 50 percent tariff would result in 0.38 percent of U.S. GDP growth foregone in the initial year and 2.56 percent in year 10. A 25 percent tariff would reduce U.S. household incomes by $122 in the first year and by a cumulative total of $4,208 by the 10th year if sustained for that duration. The slower economic growth would also mean billions more tax revenues forgone than tariffs collected. The report concludes by considering the effects such tariffs would have on U.S. AI, data center, and broader manufacturing leadership.

Modeling the Economic Impact of Possible U.S. Semiconductor Tariffs

The Information Technology and Innovation Foundation (ITIF) has developed a model to estimate the impact a 10 percent or 25 percent tariff imposed on U.S. semiconductor imports would have on the American economy. Since semiconductors constitute the heart of virtually all ICT products, an increase in tariffs would effectively act as a price hike on the majority of ICT goods. As such, domestic entities—businesses and consumers alike—that rely on ICT products and services, such as computers, smartphones, and AI tools to function in their everyday lives would face higher prices and be less likely to consume these products. Consumption of ICT goods is highly price elastic. For instance, a study by Cette et al. finds that ICT goods have a price elasticity of 1.3, suggesting that a 1 percent increase in ICT prices induces a 1.3 percent decline in ICT consumption.[6] (However, for this report, ITIF uses a more conservative elasticity of 1.15, since ICT inputs for businesses tend to be slightly less price elastic than for consumer consumption.) Nevertheless, the elasticity of demand consumption for ICT products allows one to first estimate an annual decline in semiconductor imports due to lower consumption of ICT products if tariffs on semiconductors were raised to 25 (or other) percent.

Over time, the United States’ ICT capital stock would also decline as consumption of ICT products declines due to higher prices on semiconductors. That would mean, for instance, that U.S. manufacturers might purchase fewer productivity-enhancing ICT goods such as robots (China already deploys 12 times as many robots as does the United States on a wage-adjusted basis), or perhaps that they revert from using digital to manual processes.[7] (For example, a logistics manager that relies on a barcode scanner to manage product inventory may choose to return to logging inventory by hand as the scanner technology becomes more expensive.) As a result, the U.S. economy would suffer as productivity and economic growth stagnates. Using a study by Cardona et al., ITIF applied a growth factor suggesting that a 1 percent decrease in a nation’s net ICT capital stock generates a 0.06 percent decrease in a nation’s real GDP.[8] Multiplying the United States’ estimated annual net decline in ICT capital stock (as a result of the tariffs) by this growth factor provides an estimate of the potential negative impact a 25 percent tariff on semiconductors would have on the nation’s GDP. Finally, stagnation in America’s economic growth would take a toll on consumption and income tax revenue raised, despite the increase in tariff revenue.

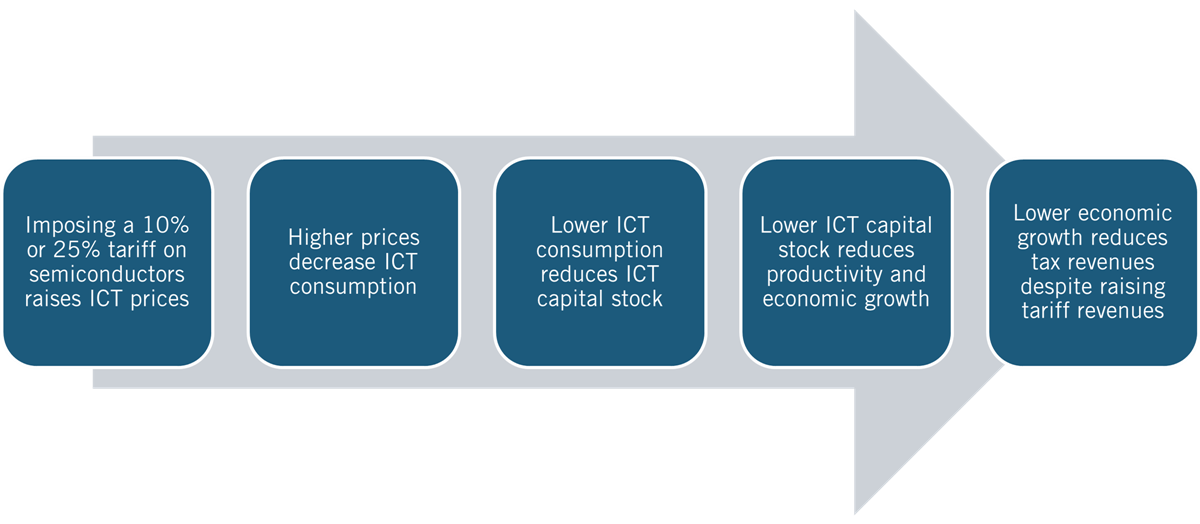

The following chart shows the analytical framework ITIF’s model deploys to estimate the economic impact of both a 10 percent and a 25 percent semiconductor tariff on the U.S. economy. (See figure 1.)

Figure 1: ITIF's analytical framework for modeling the deleterious effects of semiconductor tariffs

Economic Analysis

Using data from USA Trade, the International Trade Center, and the Organization for Economic Cooperation and Development (OECD), ITIF calculated that, in 2024, the United States imposed an average tariff rate of 2.88 percent on semiconductor imports.[9] However, this low tariff level appears to be poised to increase. Indeed, in February 2025, president Trump suggested plans to impose tariffs on semiconductors at 25 percent or higher, with possible increases over the course of the year.[10] Moreover, he has also imposed a 10 percent baseline tariff on products from all nations.[11]

The United States imported $46.3 billion of semiconductors in 2024, representing about 1 percent of all U.S. imports that year.[12] Assuming the Trump administration implements blanket 25 percent tariffs, ITIF calculated the impact an effective 22 percent increase in tariff levels on semiconductors would have on ICT consumption in the United States, given that semiconductors are the key components enabling functional ICT products. In other words, an increase in tariffs on semiconductors effectively acts as a price increase on ICT products that require chips to function. Using the price elasticity of 1.15 for ICT goods demanded, ITIF found that a 25 percent tariff on semiconductors would reduce ICT consumption by 25.4 percent, equating to a $11.8 billion decline in the consumption of ICT products. The decline in ICT consumption would also mean, in turn, a decline in the nation’s ICT capital stock.

By year 10, semiconductor tariffs set at 25 percent would translate into a cumulative $1.4 trillion loss in total GDP, or 4.8 percent of U.S. GDP.

Since semiconductors represent a crucial ICT component, investing in or importing them would also mean investing in ICT goods. As such, ITIF estimated that the initial U.S. ICT capital stock was 22 percent of U.S. manufacturing net stock for equipment in 2022.[13] ITIF estimated the initial ICT capital stock to be $396 billion. Thus, the initial loss in ICT capital stock from a 25 percent tariff on semiconductors would account for 3 percent of the total ICT capital stock.

The loss of ICT capital stock would, in turn, negatively impact productivity, harming overall U.S. economic growth. Indeed, with an ICT investment elasticity of 0.06, the 3 percent loss in ICT capital stock would translate into a 0.18 percent loss in economic growth in the initial year such tariffs were imposed. (See table 1.)

Table 1: Economic impact on the United States from imposing a 25 percent tariff on semiconductor imports[14]

|

Indicator |

Economic Impact |

|

ICT price increase |

22% |

|

Initial change in ICT consumption and capital stock |

-$11.8 billion |

|

Initial change in GDP growth |

-0.18% |

|

10-year change in GDP growth |

-0.76% |

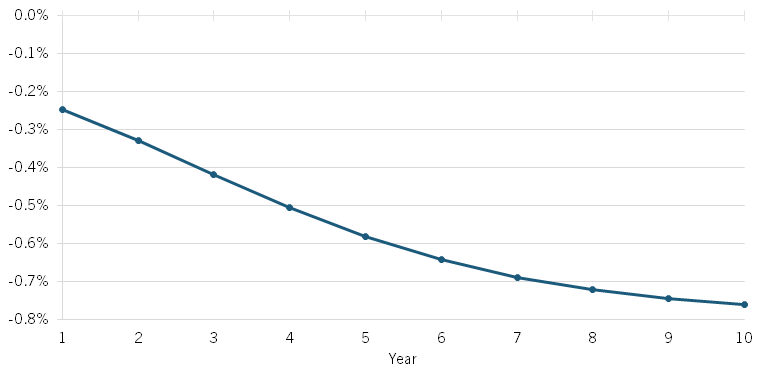

If sustained over a 10-year timespan, the United States would forego 0.76 percent GDP growth in the 10th year post implementation of tariffs. Although this number seems modest, the losses every year would translate into a cumulative $1.4 trillion loss in GDP over 10 years, which would represent 4.8 percent of the otherwise-anticipated 10th year’s GDP.

Figure 2: GDP growth foregone from a 25 percent tariff imposed on semiconductors[15]

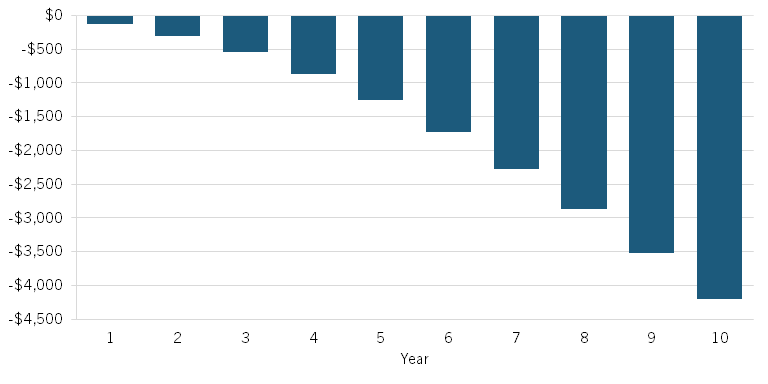

This foregone growth would mean a lower living standard for Americans. Using the estimated 2024 U.S. population from the U.S. Census Bureau, showing just over 340 million American citizens, the average American would forego a living standard growth of $122 the first year after a 25 percent tariff were imposed on semiconductors.[16] By the 10th year, the average American would forego a cumulative loss of $4,208 in living standard growth due to the tariffs. (See figure 3.)

Figure 3: Lost GDP per capita from a 25 percent tariff on semiconductor imports[17]

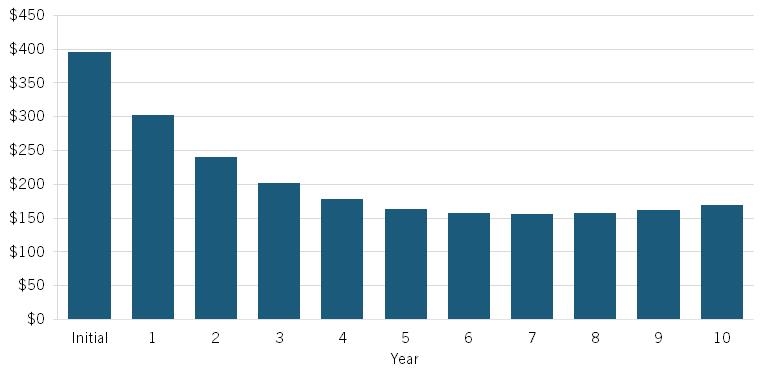

In addition to the GDP loss, the United States would also experience ICT capital decline during the first seven years. Using an unweighted average derived from depreciation rates from the Conference Board, ITIF estimated an average depreciation rate of ICT capital of 32.4 percent.[18] Factoring in the depreciation rate of ICT capital and the decline in semiconductor imports, ITIF concludes that the United States would experience a 24 percent decline in ICT capital in the first year after 25 percent tariffs were imposed on semiconductors. The U.S. ICT capital stock would continue declining another 20 and 16 percent in years 2 and 3, respectively, and continue declining until year 8. By year 8, ICT capital would only be $158 billion compared with the initial ICT capital stock of $396 billion. America’s ICT capital stock would not return to this initial level for many years after the 25 percent tariffs were imposed. (See figure 4.)

Figure 4: U.S. ICT capital stock after imposing a 25 percent tariff on semiconductor imports (billions) [19]

Given the Trump administration’s 10 percent baseline tariffs on all nations, ITIF also estimated the impact of a 10 percent tariff on semiconductors. This would effectively act as a 7 percent price hike on ICT products. This would translate into an initial $3.8 billion decline in ICT consumption and a 0.06 percent growth in GDP growth foregone. In year 10, the United States would forego 0.20 percent of GDP growth. (See table 2.) This would translate to a cumulative loss of $408 billion, or 1.38 percent of the 10th-year’s GDP had tariffs not been implemented. For the average American citizen, this would mean that they would forego a $39 increase in living standards in the first year and a cumulative loss of $1,198 by the 10th year.

Table 2: U.S. economic losses from a 10, 25, and 50 percent tariff on semiconductor imports[20]

|

Indicator |

10 Percent Tariff |

25 Percent Tariff |

50 Percent Tariff |

|

ICT price increase |

7% |

22% |

47% |

|

Initial change in ICT consumption and capital stock |

-$3.8 billion |

-$11.8 billion |

-$25.1 billion |

|

Initial change in GDP growth |

-0.06% |

-0.18% |

-0.38% |

|

10-year change in GDP growth |

-0.20% |

-0.76% |

-2.56% |

Given the impact of a 25 percent tariff on semiconductors, a higher tariff rate would be even more damaging to the U.S. economy. Indeed, modeling the impact of a 50 percent tariff rate, ITIF found that the United States would initially forego 0.38 percent growth in GDP and 2.56 percent growth in the 10th year (table 2).

Revenue Analysis

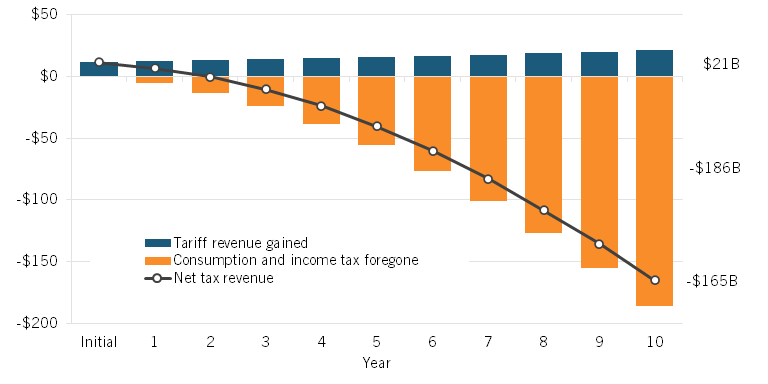

Although tariff revenue would certainly begin to accumulate immediately once tariffs were imposed, over time, the growth-retarding effects of the tariffs would also accrue and accelerate to the point that lost tax revenues from slower economic growth would outstrip the tariff revenues collected. In the initial year of imposing a 25 percent tariff, the United States would gain $11.6 billion in tariff revenue and forego $253 million in consumption tax. However, in the fifth year, the United States would gain $15.6 billion in tariff revenue but forego $56 billion in consumption and income tax revenue as fewer American businesses and consumers purchase ICT products, U.S. capital stock declines, and U.S. economic growth slows compared with the alternative scenario of these tariffs never being imposed in the first place.

In the 10th year, the United States would lose a total of $186 billion in consumption and income tax revenue, amounting to a net loss of $165 billion in tax revenue from a 25 percent tariff.

As shown in figure 5, by year 10 America’s consumption and income taxes foregone would be more than eight times the tariff revenue gains. At that point, America would have gained $21 billion in tariff revenue but forego $186 billion in income and consumption tax revenue, netting a loss of more than $165 billion.

Figure 5: Net tax revenue after imposing a 25 percent tariff on semiconductors (billions)[21]

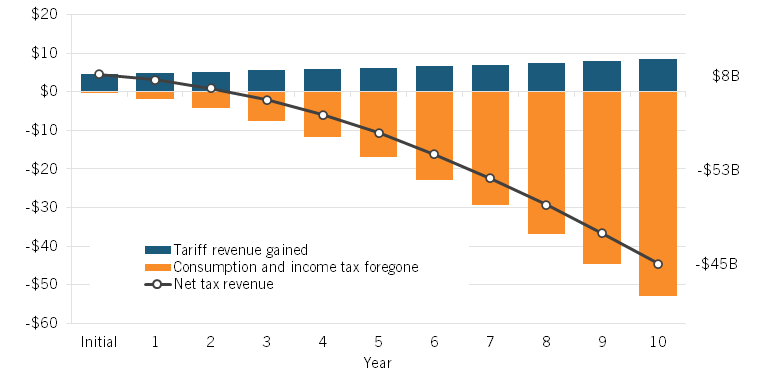

Figure 6: Net tax revenue after imposing a 10 percent tariff on semiconductors (billions)[22]

Meanwhile, a 10 percent tariff on semiconductors would translate into an initial gain of $4.6 billion in tariff revenue and a loss of $81 million in consumption tax revenue. As shown in figure 6, the United States would continue to gain from tariff revenues until year 3. In year 3, the loss in income and consumption tax revenue would be $7.6 billion while total tariff revenue gains would be only $5.5 billion, leading to a net loss $2 billion. In year 10, the United States would gain a total of $8.4 billion in tariff revenues but lose $53 billion in consumption and income tax revenue, netting a $45 billion loss.

In sum, the United States stands to lose much more than it will gain from imposing a 25 percent (or 10 percent) tariff on semiconductor imports. Acting as a price hike, the higher tariff rate would cause America’s businesses and citizens to consume fewer ICT goods, reducing the overall ICT capital stock in the United States. As a result of reduced ICT capital, U.S. GDP growth would also decline, harming the potential growth in living standards for Americans. Moreover, the U.S. government would also forego more in tax revenues than it would gain in tariff collections.

It should be noted that, in order to simplify the analysis, this report assumes that a semiconductor tariff is applied to just semiconductor imports (classified as goods within the Harmonized Tariff Schedule codes 8541 (without solar components) and 8542). However, this only paints a fraction of the picture. Should the Trump administration decide to place tariffs on imported goods that contain semiconductors or goods that are used as components or inputs into semiconductors, the costs to American businesses and families would only grow.

A 1 percent increase in duty rates for semiconductor manufacturing inputs leads to a 0.64 percent increase in the overall cost of constructing a fab.

The Implications of Tariffs on Data Centers

Data centers have become an irreplaceable component of digital infrastructure in the modern digital economy. The large, sometimes multi-mile-long facilities represent the bedrock of America’s advanced-industry economy, housing thousands of servers responsible for remote data storage, computing, and processing. Businesses require access to data centers in order to maintain their digital applications, including the e-commerce platforms and web services millions of American businesses and citizens use daily. But if data centers are the bedrock of our digital lives, then semiconductors are the bedrock of data centers, responsible for virtually every function undertaken.

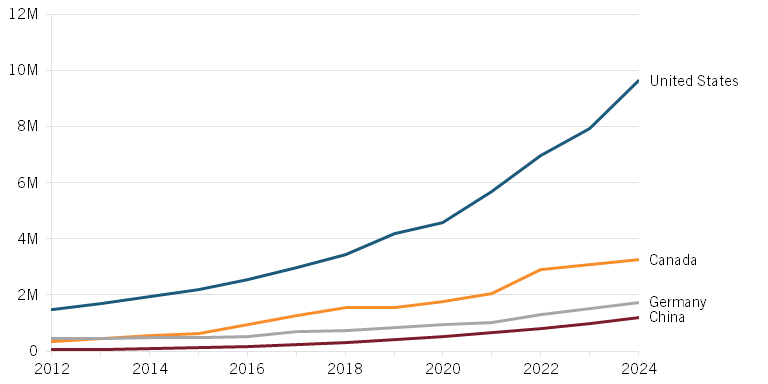

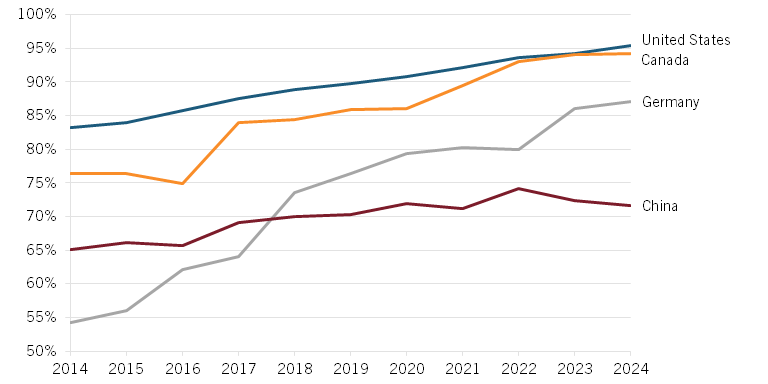

Data centers have become increasingly essential for nations to keep at the forefront of AI innovation, especially as the advent of generative AI has necessitated the construction of ever-more-sophisticated large-language models (LLMs). Training generative AI models requires substantial amounts of data, and the demand for AI has exacerbated the existing supply shortage of data centers.[23] The United States leads the world in compute power in data centers. For instance, from 2012 to 2024, the total power capacity of data centers in terms of kilowatts (kw) grew substantially more than in peer nations. (See figure 7.)

Figure 7: Total data center power capacity (kw) per 100,000 population[24]

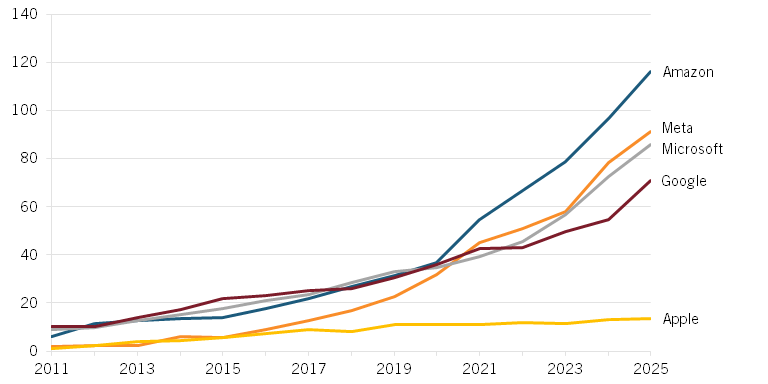

Similarly, growth in the number of hyperscale data centers in the United States has been considerable over that timeframe, with Amazon, Apple, Google, and Meta leading the way. For those companies, their growth of hyperscale data centers in the United States has been about tenfold over that 2012 to 2024 timeframe. (See figure 8.)

Figure 8: Number of hyperscale data centers in United States[25]

Overall, global demand for data center capacity is expected to increase at an annual rate of 22 percent between 2023 and 2030.[26] With North American data centers are already close to full capacity, with at least 95 percent of capacity currently being utilized, new construction is needed to keep up with demand. (See figure 9.) Worldwide data center capex is projected to surpass $1 trillion by 2029.[27] In 2024, large technology companies invested $180 billion in data centers, with Amazon, Google and Microsoft accounted for more than three-quarters of infrastructure capital expenditures in Q3 2024.[28]

Figure 9: Utilization of total data center power capacity[29]

But suppose a 25 percent tariff is applied to all U.S. semiconductor imports. In that case, the cost to develop data centers will rise substantially, and the cost to all industries that depend on this resource will increase in response, damaging everything from the healthcare industry to Anthropic AI and OpenAI.

If data centers are the bedrock of our digital lives, then semiconductors are the bedrock of data centers, responsible for virtually every function they undertake.

Importance of Semiconductors in Data Centers

Semiconductors constitute the core technology of a data center. In fact, semiconductor content can account for up to 60 percent of a given data center’s cost.[30] Due to the burgeoning need for data centers—and, by extension, chips—the data center chip market is expected to almost quadruple over the next decade, from $11.7 billion to $45.3 billion by 2032.[31] Still, due to the differing sizes of data centers, it’s impossible to peg precisely how many of the paper-thin chips can be found in each center, a statistic necessary to roughly estimate the risk a semiconductor tariff poses to U.S. data centers and AI developers. For instance, the largest AI computing cluster currently operating in the world is xAI’s Colossus supercomputer in Memphis, Tennessee, which uses over 200,000 (NVIDIA H100) chips alone.[32] Additionally, data centers are employed for various functions, including telecommunications, cloud computing, and powering LLMs and require different hardware as a result, further complicating the question. So while it’s impossible to calculate exactly how many semiconductors are necessary for the day-to-day functions of a data center, one can estimate.

For the purpose of this analysis, consider a hyperscale data center deploying 5,000 servers. Hyperscalers represent the largest data storage facilities in the world and account for 41 percent of worldwide data storage, a figure expected to grow as data centers expand.[33] The firms operating these monstrous data centers, such as Google and Amazon Web Services (AWS), represent the “big tech” firms driving innovation and growth in America. Hyperscalers are investing heavily in R&D and enabling America to keep up with China’s state-sponsored AI and data center investments.[34]

If one were to walk into a data center, one would see thousands of servers relying on semiconductors for every function they undertake, from computing to memory and storage, directing information requests and utilizing power efficiently throughout the machine. Indeed, there are multiple different types of semiconductors operating within data centers. (See table 3.)

Table 3: Types of and estimated count of semiconductors used in a nominal data center

|

Chip Type |

Usage |

Estimated Number of Chips |

|

CPU/GPU |

Core computational chips |

20,000 |

|

DRAM |

Volatile memory storage |

300,000 |

|

NAND |

Nonvolatile memory storage |

10,000 |

|

NIC |

Directing traffic in a server |

5,000 |

|

PMIC |

Efficiently managing power |

5,000 |

|

Total |

|

340,000 |

Depending on the size, there are typically between one and four central processing units (CPUs) and graphics processing units (GPUs) per server.[35] CPUs are designed to handle a wide range of computing tasks in the server, whereas GPUs handle more specialized, complex computations.[36] Taking a conservative estimate, one can assume four CPUs and GPUs are in each of the 5,000 servers—or 20,000 total. Some advanced servers may also contain data processing units (DPUs), the newest chip type, responsible for networking, storage, and security operations.[37]

When CPUs and GPUs aren’t using data for computations, the strings of zeros and ones must be stored somewhere. Dynamic random-access memory (DRAM) chips and NAND flash memory are used for this. Between 8 and 16 DRAM chips are arranged in a dual in-line memory module (DIMM), of which there are between two and eight in a server.[38] On average, about 300,000 DRAM chips can be identified in a single data center.

Flash memory chips, such as NAND, are arranged in a solid-state drive (SSD), an electronic storage device that relies on flash memory to write and read information. NAND chips are non-volatile, meaning they retain data even without power, as opposed to DRAM chips, which lose all memory when powered off.[39] There are about two SSDs per server, with multiple NAND chips per SSD.[40] Assuming at least two NAND chips per SSD, one can estimate about 10,000 flash memory chips in a nominal data center.

Then there are networking chips, such as network interface cards (NIC). These semiconductors are responsible for receiving network traffic in the form of packets, assessing the packet data, and, broadly, directing the traffic to the proper destinations within the server.[41] In other words, NICs are akin to technological mail sorters, ensuring that all mail is placed in the correct boxes within the server. There is typically one NIC per server, although dual NIC setups are common.[42] Assuming one NIC per server, there are at least 5,000 NICs in a center.

Finally, there are power management integrated circuits (PMICs), which manage the power on an electronic device. They help to control and distribute power efficiently so that different parts of a server receive the appropriate amount of power.[43] The number of PMICs in each server can differ based on design, so, conservatively estimating that there is at least one PMIC per server, we can add another 5,000 chips to our total.

In this crude and conservative estimation, one can infer that, at minimum, 340,000 semiconductors can be found in a hyperscale data center of 5,000 servers. Predictably, the number of chips is far larger in data centers of greater size. With hundreds of thousands of semiconductors imported to construct these data centers, their exposure to Trump’s potential semiconductor tariffs is considerable. A tariff could either curtail the construction of future data centers or drastically increase construction and operation costs as companies struggle to replace imported semiconductors with ones fabricated domestically. These costs would be passed down to downstream users of data centers, including firms and individuals.

Higher expenses for hyperscalers such as Google and AWS would raise costs for AI competitors such as OpenAI and Microsoft, slowing model training and discouraging further investment in AI infrastructure.

The wide assortment of chips used adds another vulnerability to data centers. During the COVID-19 chip shortage, while CPUs and GPUs were prioritized as profit makers, networking and power management chips were hardest hit. Networking chip producers such as Arista Networks experienced supply chain bottlenecks for necessary components, causing increased wait times and higher costs for downstream consumers.[44] Future shortages caused by possible semiconductor tariffs may leave some chips unaffected, especially those already produced in large quantities in the United States, while others, specifically the most advanced sub-5 nanometer (nm) chips, would cause the most difficulty for data centers.

Slowing the construction of data centers and the subsequent rise in costs would hinder U.S. competitiveness in AI, ceding ground to China at a pivotal moment in the global technology race. AI development depends on high-performance computing in data centers. Higher expenses for hyperscalers such as Google and AWS would raise costs for AI competitors such as OpenAI and Microsoft, slowing model training and discouraging further investment in U.S. AI infrastructure. Meanwhile, China will continue aggressively subsidizing its AI and semiconductor industries, allowing its firms to expand AI capabilities without the same cost constraints.[45] By misguidedly trying to incentivize investment in U.S. semiconductor manufacturing (through tariffs), the Trump administration would be opening a door to Chinese dominance in these key industries.

Impact of Data Centers on the U.S. Economy

Along with their impact on America’s competitiveness in advanced industries, data centers have acted as economic catalysts for the areas in which they’re located, creating jobs in data centers themselves and related industries and bringing in millions of dollars in tax revenue for local and state governments. In terms of jobs, data centers themselves are relatively small employers. In 2024, the U.S. data center industry, which also includes jobs in Internet hosting and data processing, employed 452,000 individuals, less than half a percent of all U.S. private sector jobs.[46] However, the economic benefits of data centers extend beyond the buildings themselves. Data centers often usher in a “halo effect” for regions, whereby their presence attracts other high-tech industries and investments in existing firms.[47] As foundational structures underpinning the digital economy, they increase the attractiveness of a city or county as an investment location, inviting investment from data center-related firms, such as those in e-commerce, fintech, and, of course, AI. These impacts can be explicitly seen in Arizona, Ohio, and Virginia, where the construction of data centers has completely changed the makeup of regional economies.

Additionally, data centers have brought substantial tax revenue to new areas. The purchase of expensive tech equipment for the construction of data centers is coupled with high sales taxes in most states. Corporate taxes from high-revenue-generating data centers and high-value-added-related industries have also generated millions of dollars for regions to spend on public services, education, and infrastructure.

Case Study: Northern Virginia

Northern Virginia, situated just west of Washington, D.C., has become the global hot bed for data centers, with approximately 500 facilities in operation with hundreds more under development, giving it the highest concentration of data centers in the world.[48] In what has been nicknamed “Data Center Alley,” data centers stretching from Ashburn to Arlington, Virginia, have literally and figuratively changed the region’s landscape, bringing in billions of tax dollars and creating thousands of jobs.

Data centers in the region have changed the job market, employing 12,140 individuals and creating over 14,000 construction jobs. There hasn’t been a day in 14 years when a data center wasn’t being built in Northern Virginia.[49] In addition, data centers have exerted an outsized impact on the Northern Virginia economy, creating an additional 3.5 jobs per data center job, leading to over 78,000 supported jobs in 2023.[50] And data centers have not only created jobs, but high-paying ones at that. The mean annual income of employees in data centers in 2023 was $128,000, twice as much as the U.S. average.[51]

There hasn’t been a day in 14 years when a data center wasn’t being built in Northern Virginia.

Data centers have contributed billions in tax revenue to Virginia local and state governments, even with the significant tax breaks many of these centers have received. In 2022, they paid $640 million in taxes to the state of Virginia and $1 billion to local governments.[52] Moreover, tax revenue from purchases, such as those for necessary computer equipment, has surged over the last decade, increasing to $582 million in 2023.[53] This revenue has gone on to improve the lives of American families in these counties. Over the last 15 years, tax revenue in Loudoun County has financed the rebuilding of 15 schools and the investment of $1 billion into road maintenance.[54]

Data centers represent the backbone of the Northern Virginia economy, and imposing a 25 percent semiconductor tariff would significantly alter the region. Increased construction prices may drive firms to pause or slow construction. (And those prices are already increasing due to separate tariffs imposed on imported steel.) Moreover, the fear of escalating tariffs over the next four years, as the Trump administration has promised, could entirely halt construction plans as costs exceed what investors planned. With fewer data centers in the region and heightened costs for the centers currently in operation, firms may conduct layoffs or run at a shrunken capacity, hurting employees and workers in supported firms.

Downstream Effects on U.S. Manufacturing Industries

Thus far, this report has analyzed the impact of a 25 (or 10) percent semiconductor tariff on ICT goods and data centers, two sectors immediately and obviously impacted by price hikes in the semiconductor supply chain. However, the effects of a semiconductor tariff would be felt across all U.S. manufacturing industries, from automobiles and aerospace to medical devices and machinery. Traditionally, analog activities have become digital with the emergence and widespread usage of semiconductors, meaning that no manufacturing industry will be safe from the oncoming price hike caused by semiconductor tariffs.

Indeed, the Semiconductor Industry Association estimates that a 1 percent increase in duty rates for semiconductor manufacturing inputs leads to a 0.64 percent increase in the overall cost of constructing a fab. For every $1 that a semiconductor chip increases in price, products with embedded semiconductors will have to raise their sales price by $3 to maintain their previous margins.[55]

For every $1 that a semiconductor chip increases in price, products with embedded semiconductors will have to raise their sales price by $3 to maintain their previous margins.

In increasing the cost of semiconductors, the downstream costs for all industries would increase, potentially leading to layoffs or closures for businesses and reduced affordability for consumers, meaning both production and consumption would decrease. Tax revenue from the sales of cars, trucks, and MRI machines would decrease, adding to the already-calculated $165 billion in lost tax revenues. Reduced consumption would also have implications on economic growth, meaning, realistically, GDP growth would decline by even more than the aforementioned potentially $1.4 trillion. Semiconductor tariffs would hit America’s vehicle manufacturing sector particularly hard, as the following case study elaborates.

Case Study: U.S. Automobile Industry

Semiconductor tariffs threaten to hamstring the U.S. automobile industry by driving up costs and exacerbating supply shortages, much like the COVID-19 chip crisis did. During the crisis in 2020 and 2021, heightened demand for chips created bottlenecks in the supply chain, with chip-making capacity unable to keep up with demand.[56] In response, lead times, or wait times to receive a chip, reached an all-time high of a year or longer.[57]

This supply crunch hit all downstream industries; however, the auto industry was extremely vulnerable. On average, modern vehicles contain somewhere from 1,000 to 3,000 semiconductor chips.[58] When car manufacturers began to feel the pain of the chip shortage, they shut down American operations. This included Toyota, which halted all U.S. production, and GM and Ford, which suspended production in North America.[59] By April 2020, American auto sales had dropped by 200,000 units.[60] In 2021, more than 7.7 million fewer cars were produced, amounting to billions in lost revenue, while prices for new cars rose over 17 percent, hurting consumers.[61] Production disruptions caused by chip shortages finally slowed by 2023, and auto production slowly returned to normal.[62]

During the chip shortage, the auto industry in every country was impacted, meaning all firms experienced lost revenue, not just American firms such as Ford and GM. One can expect the same result if Trump’s 25 percent tariff on semiconductors goes into effect. With heightened semiconductor prices, automakers would face a choice: either continue buying semiconductors at the rate they always have and pass the cost on to consumers or do what Trump intends: shift their supply chain and attempt to find a domestic producer.

If automakers take the first option, consumers would feel the effects immediately. Four years ago, semiconductors were an integral part of America’s auto supply chain; today, the auto industry is even more dependent. The value of semiconductors installed in cars is expected to grow to as much as $4,000 by 2030, an 800 percent increase from 2020.[63] A 22 percent increase in the cost of semiconductors could directly increase the cost of cars by up to $800, with the indirect costs stemming from these tariffs unknown as of this time. Even greater impacts would be experienced in electric vehicles (EVs), an industry essential to American technological competitiveness, which require up to 20 times more semiconductors than does a traditional car. Heightened costs may discourage investment in EVs and push U.S. automakers further behind in a market that China already dominates.[64]

A 25 percent increase in the cost of semiconductors could directly increase the cost of cars by up to $1,000 each.

The second option, replacing foreign-made chips with domestic ones, also has drawbacks. American chip manufacturing is still in its infancy in many ways. Just 12 percent of global semiconductors are produced in America, meaning the auto industry could be facing another supply crunch if it, and every other impacted industry, decides to shift to American suppliers.[65] Even if foreign firms were to shift their operations to the United States, getting those fabs to operational status would take years. Additionally, chips used in the production of automobiles are often not easily substitutable, as they are often specially designed for each vehicle and their specific function within the vehicle.

Unfortunately, changing suppliers would not be as easy as calling Intel or Texas Instruments and placing an order. American automakers struggled to endure a chip supply shock once before, showing just how vulnerable the industry is. A 25 percent tariff on semiconductors would rattle the industry, disproportionately hurting American manufacturers and American competitiveness in an industry policymakers should be bolstering, while European and Asian automakers benefit from American losses.

U.S. Semiconductor Manufacturing

Lastly, even as semiconductor tariffs reduce economic growth, increase inflation, and harm American businesses, semiconductor firms may not migrate in mass to the United States. Semiconductor fabs are some of the most complex and sophisticated structures constructed, planned years in advance, taking years to complete, and costing billions to construct. Where a fab is constructed is decided based on up to 500 variables—including tariffs—but also including skilled workers, favorable tax and trade policies, and regulatory and environmental conditions.[66] The notion that a semiconductor firm will move to the United States (where costs will be greater) purely based on tariffs is unrealistic. And even if a firm were to shift production to the United States, it would be years before the fab is completed. Indeed, a greenfield fab can take over five years to construct in the United States and an expansion at a brownfield can take up to three years.[67]

Conclusion

Imposing a 25 percent tariff on semiconductor imports would be a counterproductive move that would threaten to undermine U.S. economic growth, inflate costs for business and consumers, and erode American competitiveness in critical industries. Such tariffs would lead to immediate and sustained GDP losses, amounting to $1.4 trillion over 10 years (if 25 percent tariffs were maintained over that timeframe). The impact on American households would be equally damaging, with an income loss of $122 in the first year alone. The reduced affordability of semiconductors would ripple across the economy, affecting the cost and availability of productivity-enhancing ICT products and thereby stifling innovation and productivity growth across every American industry.

Semiconductor tariffs would jeopardize key technological advancements in AI, data centers, and manufacturing. Increased semiconductor costs would raise the price of AI model training, slow data center expansion, and diminish the ability of American firms to compete with heavily subsidized Chinese competitors. Moreover, semiconductors are used in the production of almost all advanced goods, including cars, medical devices, and aerospace products, further raising costs for businesses and consumers. While boosting U.S. semiconductor manufacturing is undoubtedly something to strive for during this administration, placing a blanket 25 percent tariff on semiconductors is not the solution; rather, it would only serve to harm the U.S. economy while eschewing far more effective and less-costly approaches to revitalize U.S. semiconductor manufacturing.

About the Authors

Stephen Ezell is vice president for global innovation policy at ITIF and director of ITIF’s Center for Life Sciences Innovation. He also leads the Global Trade and Innovation Policy Alliance. His areas of expertise include science and technology policy, international competitiveness, trade, and manufacturing.

Trelysa Long is a policy analyst at ITIF. She was previously an economic policy intern with the U.S. Chamber of Commerce. She earned her bachelor’s degree in economics and political science from the University of California, Irvine.

Meghan Ostertag is a research assistant for economic policy at ITIF. She was previously an intern with the Federal Deposit Insurance Corporation. She holds a bachelor’s degree in economics from American University.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent 501(c)(3) nonprofit, nonpartisan research and educational institute that has been recognized repeatedly as the world’s leading think tank for science and technology policy. Its mission is to formulate, evaluate, and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit itif.org/about.

Endnotes

[1]. Semiconductor Industry Association, “Global Semiconductor Sales Increase 19.1% in 2024; Double-Digit Growth Projected in 2025,” news release, February 7, 2025, https://www.semiconductors.org/global-semiconductor-sales-increase-19-1-in-2024-double-digit-growth-projected-in-2025/; Oxford Economics, “Enabling the Hyperconnected Age: The role of semiconductors” (Oxford Economics, 2013), 20, http://www.semismatter.com/enabling-the-hyperconnected-age-the-role-of-semiconductors/.

[2]. Raj Varadarajan et al. “Emerging Resilience in the Semiconductor Supply Chain” (Boston Consulting Group, May 2024), https://www.bcg.com/publications/2024/emerging-resilience-in-semiconductor-supply-chain.

[3]. Semiconductor Industry Association, “Semiconductor Supply Chain Investments,” March 7, 2025, https://www.semiconductors.org/chip-supply-chain-investments/.

[4]. Stephen Ezell, “Chipping Away at Competitiveness: Why Tariffs Won’t Save U.S. Semiconductor Manufacturing,” Innovation Files, December 10, 2024, https://itif.org/publications/2024/12/10/chipping-away-at-competitiveness-why-tariffs-won-t-save-u-s-semiconductor-manufacturing/.

[5]. Stephen Ezell, “Comments to the Bureau of Industry and Security Regarding Its Section 232 Investigation of Semiconductor Imports” (ITIF, May 2025), https://itif.org/publications/2025/05/07/comments-regarding-section-232-investigation-of-semiconductor-imports/.

[6]. Gilbert Cette and Jimmy Lopez, “ICT Demand Behavior: An International Comparison” Economics of Innovation and New Technology Volume 21, Issue 4 (September 2011), https://www.tandfonline.com/doi/abs/10.1080/10438599.2011.595921. Cette and Lopez calculated the elasticity for ICT demand for the United States over a 20-year period, showing that the price demand for ICT changes over time. The trend follows an inverted-U shape, increasing in elasticity for a peak in the 1990s before falling. To simplify our estimates, we chose a static elasticity of 1.3—which is about the middle of the elasticity range shown in the paper. This is to partially account for the difference in technological levels between the United States and developing nations, as well as the difference in technological levels between developing nations.

[7]. Robert D. Atkinson, “Chinese Manufacturers Use 12 Times More Robots Than U.S. Manufacturers When Controlling for Wages” The Innovation Files, September 5, 2023, https://itif.org/publications/2023/09/05/chinese-manufacturers-use-12-times-more-robots-than-us-manufacturers-when-controlling-for-wages/.

[8]. M. Cardona, T. Kretschmer, and T. Strobel, “ICT and Productivity: Conclusions From the Empirical Literature” Information Economics and Policy Vol. 25 (2013): 109–125, https://www.sciencedirect.com/science/article/abs/pii/S0167624513000036.

[9]. United States Census Bureau, “USA Trade (US imports for 8541 and 8542 in 2024),” accessed May 12, 2025), https://usatrade.census.gov/index.php?do=login; International Trade Center, “List of importers for the selected products (imported value for total all products,” accessed May 2025), https://www.trademap.org/Country_SelProduct_TS.aspx?nvpm=1%7c%7c%7c%7c%7cTOTAL%7c%7c%7c2%7c1%7c1%7c1%7c2%7c1%7c2%7c1%7c1%7c1; OECD, “Global Revenue Statistics Database (tax revenue; taxes on income profits, and capital gains; general taxes on goods and services; and customs and import duties,” accessed February 2025), https://data-explorer.oecd.org/vis?fs[0]=Topic%2C1%7CTaxation%23TAX%23%7CGlobal%20tax%20revenues%23TAX_GTR%23&pg=0&fc=Topic&bp=true&snb=150&df[ds]=dsDisseminateFinalDMZ&df[id]=DSD_REV_COMP_GLOBAL%40DF_RSGLOBAL&df[ag]=OECD.CTP.TPS&dq=..S13._T..PT_B1GQ.A&lom=LASTNPERIODS&lo=10&to[TIME_PERIOD]=false.

[10]. Charlotte Trueman, “Trump says semiconductor tariffs will start at 25 percent, keep rising over the year,” Data Center Dynamics, February 19, 2025, https://www.datacenterdynamics.com/en/news/trump-says-semiconductor-tariffs-will-start-at-25-keep-rising-over-the-year/.

[11]. “Fact Sheet: President Donald J. Trump Declares National Emergency to Increase our Competitive Edge, Protect our Sovereignty, and Strengthen our National and Economic Security,” White House, April 2, 2025, https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-declares-national-emergency-to-increase-our-competitive-edge-protect-our-sovereignty-and-strengthen-our-national-and-economic-security/.

[12]. United States Census Bureau, USA Trade (US imports for 8541 and 8542 in 2024, accessed May 12, 2025).; U.S. International Trade in Goods and Services, December and Annual 2024, Bureau of Economic Analysis, February 5, 2025, https://www.bea.gov/news/2025/us-international-trade-goods-and-services-december-and-annual-2024#:~:text=For%202024%2C%20the%20goods%20and%20services%20deficit%20was%20%24918.4%20billion,up%20%24253.3%20billion%20from%202023.

[13]. National Institute for Science and Technology, “U.S. Manufacturing Economy,” https://www.nist.gov/el/applied-economics-office/manufacturing/manufacturing-economy/total-us-manufacturing#:~:text=In%202022%2C%20the%20U.S.%20manufacturing,%2C%20and%20%241.9%20trillion%2C%20respectively.

[14]. United States Census Bureau, USA Trade (US imports for 8541 and 8542 in 2024); OECD, “Global Revenue Statistics Database”; U.S. Bureau of Economic Analysis, National Income and Product Accounts (Table 1.1.6. Real Gross Domestic Product, Chained Dollars, accessed May 12, 2025), https://apps.bea.gov/iTable/?reqid=19&step=2&isuri=1&categories=survey&_gl=1*14am8sj*_ga*ODQ5MjY3MDUwLjE3NDA0MTI5NzA.*_ga_J4698JNNFT*czE3NDcwNTY3MDUkbzkkZzEkdDE3NDcwNTcwNTgkajYwJGwwJGgw#eyJhcHBpZCI6MTksInN0ZXBzIjpbMSwyLDMsM10sImRhdGEiOltbImNhdGVnb3JpZXMiLCJTdXJ2ZXkiXSxbIk5JUEFfVGFibGVfTGlzdCIsIjYiXSxbIkZpcnN0X1llYXIiLCIyMDEzIl0sWyJMYXN0X1llYXIiLCIyMDI1Il0sWyJTY2FsZSIsIi05Il0sWyJTZXJpZXMiLCJBIl1dfQ==.

[15]. Ibid.

[16]. U.S. Census Bureau, “U.S. Population Grows at Fastest Pace in More Than Two Decades,” December 19, 2024, https://www.census.gov/library/stories/2024/12/population-estimates.html.

[17]. United States Census Bureau, USA Trade (US imports for 8541 and 8542 in 2024); OECD, “Global Revenue Statistics Database”; U.S. Bureau of Economic Analysis, National Income and Product Accounts (real GDP for the United States).; U.S. Census Bureau, “U.S. Population Grows at Fastest Pace in More Than Two Decades.”

[18]. Conference Board, “Total Economy Database (key findings),” accessed October 1, 2016, https://www.conference-board.org/data/economydatabase/.

[19]. United States Census Bureau, USA Trade (US imports for 8541 and 8542 in 2024); OECD, “Global Revenue Statistics Database”; U.S. Bureau of Economic Analysis, National Income and Product Accounts (real GDP for the United States).

[20]. Ibid.

[21]. Ibid.

[22]. Ibid.

[23]. “The Impact of Artificial Intelligence on Data Centers: A Comprehensive Analysis,” Digital Realty, accessed February 25, 2025, https://www.digitalrealty.com/resources/articles/data-center-ai.

[24]. J.A. Otero, S. David, and Y. Tucker, “Data Protectionism: Lessons from China’s Data Localization Framework” (unpublished draft manuscript, April 2025).

[25]. Ibid.

[26]. Bhargs Srivathsan et al., “AI Power: Expanding Data Center Capacity to Meet Growing Demand” (McKinsey & Company, October 29, 2024), https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/ai-power-expanding-data-center-capacity-to-meet-growing-demand.

[27]. Dell’Oro Group, “Data Center Capex to Surpass $1 Trillion by 2029, According to Dell’Oro Group,” news release, February 5, 2025, https://www.delloro.com/news/data-center-capex-to-surpass-1-trillion-by-2029/.

[28]. Matt Ashare, “Big tech on track to pour more than $180B into data centers this year,” Construction Drive, December 4, 2024, https://www.constructiondive.com/news/cloud-data-center-q3-spend-aws-azure-microsoft/734579/.

[29]. Otero, David, and Tucker, “Data Protectionism: Lessons from China’s Data Localization Framework.”

[30]. Sarah Ravi, “SIA Comments on BIS Section 232 Investigation on Imports of Semiconductors and Semiconductor Manufacturing Equipment” (Semiconductor Industry Association, May 2025), 6, https://www.semiconductors.org/wp-content/uploads/2025/05/SIA-Comments-Section-232-Investigation.pdf.

[31]. “The Future of Data Centers and the Power of the Chip,” Green Revolution Cooling, Inc., August 30, 2023, https://www.grcooling.com/blog/the-future-of-data-centers-and-the-power-of-the-chip/.

[32]. Gregory C. Allen. “DeepSeek, Huawei, Export Controls, and the Future of the U.S.-China AI Race” (CSIS, March 2025), https://www.csis.org/analysis/deepseek-huawei-export-controls-and-future-us-china-ai-race.

[33]. Georgia Butler, “Hyperscalers Account for 41% of Worldwide Data Center Capacity – Synergy,” Data Center Dynamics, August 9, 2024, https://www.datacenterdynamics.com/en/news/hyperscalers-account-for-41-of-worldwide-data-center-capacity-synergy-research-group/.

[34]. Hilal Aka, “Why Big Tech Matters for National Security” (ITIF, January 24, 2025), https://itif.org/publications/2025/01/24/why-big-tech-matters-for-national-security/.

[35]. “What is a Server CPU?” FS, December 7, 2023, https://www.fs.com/blog/what-is-a-server-cpu-143.html; Aston Zhang et al., “23.5. Selecting Servers and GPUs,” in Dive Deep Into Learning (Cambridge University Press, 2023), https://d2l.ai/chapter_appendix-tools-for-deep-learning/selecting-servers-gpus.html.

[36]. AWS, “What’s the Difference Between GPUs and CPUs?” accessed February 27, 2025, https://aws.amazon.com/compare/the-difference-between-gpus-cpus/.

[37]. “Data Processing Units: What are DPUs and Why Do You Want Them?” Data Center Knowledge, May 1, 2023, https://www.datacenterknowledge.com/data-center-hardware/data-processing-units-what-are-dpus-and-why-do-you-want-them-.

[38]. ”Dual In-Line Memory Modules,” Lumenci, January 18, 2022, https://lumenci.com/blogs/dimm/#.; Vijay Kanade, “What is a Dual In-Line Memory Module (DIMM)? Meaning, Characteristics, and Types,” Spiceworks, May 3, 2023, https://www.spiceworks.com/tech/tech-general/articles/what-is-dimm/#.

[39]. “How Do You Choose Between DRAM and NAND Flash for Your Memory and Storage Needs,” LinkedIn, accessed February 27, 2025, https://www.linkedin.com/advice/0/how-do-you-choose-between-dram-nand-flash.

[40]. Daniella Coleman, “SSDs for Server,” Server Space, June 1, 2023, https://serverspace.io/about/blog/ssds-for-server/; Robert Sheldon, “Storage 101: Understanding the NAND Flash Solid State Drive,” Redgate, March 11, 2020, https://www.red-gate.com/simple-talk/databases/sql-server/database-administration-sql-server/storage-101-understanding-the-nand-flash-solid-state-drive/.

[41]. Sharada Yeluri, “Networking Chips Versus GPUs/CPUs,” LinkedIn, April 21, 2022, https://www.linkedin.com/pulse/networking-chips-versus-gpuscpus-sharada-yeluri/.

[42]. “What is a Dual NIC?” FS, March 1, 2024, https://www.fs.com/blog/what-is-a-dual-nic-3841.html.

[43]. Kathik Srinivasan “Better PMIC Design Using Multi-Physics Simulation,” Semiconductor Engineering, July 14, 2016, https://semiengineering.com/knowledge_centers/integrated-circuit/ic-types/power-management-ic-pmic/.

[44]. Yevgeniy Sverdlik, “‘It’s Little Things’ – How the Chip Shortage Is Affecting the Data Center Industry,” Data Center Knowledge, May 17, 2021, https://www.datacenterknowledge.com/data-center-chips/-it-s-little-things-how-the-chip-shortage-is-affecting-the-data-center-industry.

[45]. Stephen Ezell, “How Innovative Is China in Semiconductors?” (ITIF, August 2024), https://itif.org/publications/2024/08/19/how-innovative-is-china-in-semiconductors/; Hodan Omaar, “How Innovative Is China in AI?” (ITIF, August 2024), https://itif.org/publications/2024/08/26/how-innovative-is-china-in-ai/.

[46]. Alex Fitzpatrick, “America’s Data Center Job Hot Spots,” Axios, January 24, 2025, https://www.axios.com/2025/01/24/data-center-jobs-map-states.

[47]. Byron Sarhangian et al., “Essential Infrastructure: Data Centers Powering Economic Growth,” Data Center Dynamics, November 19, 2024, https://www.datacenterdynamics.com/en/opinions/essential-infrastructure-data-centers-powering-economic-growth/.

[48]. “Northern Virginia Data Center Market,” Baxtel, accessed February 28, 2025, https://baxtel.com/data-center/northern-virginia.

[49]. “Data Centers,” Loudon Virginia Economic Development, accessed February 28, 2025, https://biz.loudoun.gov/key-business-sectors/data-centers/.

[50]. Tarin Horan, “Virginia Data Centers Supported 78,140 Jobs and $31.4 Billion in Economic Output in 2023,” Northern Virginia Technology Council, May 1, 2024, https://www.nvtc.org/press-releases/virginia-data-centers-supported-78140-jobs-and-31-4-billion-in-economic-output-in-2023/.

[51]. Bureau of Labor Statistics (Occupational Employment and Wages, May 2023), accessed March 4, 2025, https://www.bls.gov/oes/current/oes151299.htm.

[52]. Dan Swinhoe, “The Future of Virginia Post-Loudoun, Data Center Dynamics, November 4, 2024, https://www.datacenterdynamics.com/en/analysis/the-future-of-virginia-post-loudoun/.

[53]. “Data Center Growth Has Economic Ripple Effects,” CBRE, May 23, 2024, https://www.cbre.com/insights/briefs/data-center-growth-has-economic-ripple-effects.

[54]. Brooke Dudley, “Data Centers Increasing Tax Revenue: Northern Virginia Case Study,” Landgate, January 3, 2025, https://www.landgate.com/news/data-centers-increasing-tax-revenue-northern-virginia-case-study#.

[55]. Ravi, “SIA Comments on BIS Section 232 Investigation on Imports of Semiconductors and Semiconductor Manufacturing Equipment,” 12–13.

[56]. Ian King et al., “How a Chip Shortage Snarled Everything from Phones to Cars,” Bloomberg, March 29, 2021, https://www.bloomberg.com/graphics/2021-semiconductors-chips-shortage/.

[57]. Stephanie Brinley “The Semiconductor Shortage is – Mostly – Over for the Auto Industry,” S&P Global, July 12, 2023, https://www.spglobal.com/mobility/en/research-analysis/the-semiconductor-shortage-is-mostly-over-for-the-auto-industry.html.

[58]. Polar Semiconductor, “How Many Semiconductor Chips Are in a Car? [Infographic],” November 30, 2023, https://polarsemi.com/blog/blog-semiconductor-chips-in-a-car; Stephen Ezell, “Short-term Chip Shortages Don’t Merit Government Intervention; Long-term Competitiveness in the Semiconductor Industry Does” (ITIF, February 18, 2021), https://itif.org/publications/2021/02/18/short-term-chip-shortages-dont-merit-government-intervention-long-term/.

[59]. Colin Beresford, “Details of Increasing Plant Shutdowns Amid COVID-19 Pandemic,” Car and Driver, March 25, 2020, https://www.caranddriver.com/news/a31753194/ford-gm-honda-shutdown-us-plants/.

[60]. Ezell, “Short-term Chip Shortages Don’t Merit Government Intervention; Long-term Competitiveness in the Semiconductor Industry Does.”

[61]. “Analysis for CHIPS Act and BIA Briefing” (Washington, D.C.: U.S. Department of Commerce, April 2024), https://www.commerce.gov/news/press-releases/2022/04/analysis-chips-act-and-bia-briefing; Tom Krisher, “Chip Shortage Drives UP Vehicle Prices, Cuts Sales,” PBS News, July 1, 2022, https://www.pbs.org/newshour/economy/chip-shortage-drives-up-vehicle-prices-cuts-sales.

[62]. Stephanie Brinley “The Semiconductor Shortage is – Mostly – Over for the Auto Industry,” S&P Global, July 12, 2023, https://www.spglobal.com/mobility/en/research-analysis/the-semiconductor-shortage-is-mostly-over-for-the-auto-industry.html.

[63]. Sher Zhang, “EV and ADAS Trends Drive Carmakers in the Semiconductor Arena,” EV Design & Manufacturing, July 16, 2024, https://www.evdesignandmanufacturing.com/news/semiconductor-testing-pivotal-meeting-quality-cost-time-to-market-demands/#.

[64]. Stephen Ezell, “How Innovative Is China in the Electric Vehicle and Battery Industries?” (ITIF, July 2024), https://itif.org/publications/2024/07/29/how-innovative-is-china-in-the-electric-vehicle-and-battery-industries/; Christian Shepherd, “How China Pulled Ahead to Become the World Leader in Electric Vehicles,” The Washington Post, March 3, 2025, https://www.washingtonpost.com/world/2025/03/03/china-electric-vehicles-jinhua-leapmotor/.

[65]. Antonio Varas et al., “Government Incentives and US Competitiveness in Semiconductor Manufacturing,” Semiconductor Industry Association, September 2020, https://www.semiconductors.org/turning-the-tide-for-semiconductor-manufacturing-in-the-u-s/#.

[66]. Stephen Ezell, “Trump’s Proposed Tariffs on Taiwanese Semiconductors Would Backfire” (ITIF, January 28, 2025), https://itif.org/publications/2025/01/28/trump-s-proposed-tariffs-on-taiwanese-semiconductors-would-backfire/.

[67]. Gaurav Tembe et al., “Navigating the Costly Economics of Chip Making,” (Boston Consulting Group, September 28, 2023) https://www.bcg.com/publications/2023/navigating-the-semiconductor-manufacturing-costs.