Small Modular Reactors: A Realist Approach to the Future of Nuclear Power

Standard large nuclear reactors won’t achieve scale or cost competitiveness with alternative energy sources. DOE should focus its resources on small modular reactors, which are a more promising technology with the potential to achieve price and performance parity.

KEY TAKEAWAYS

Key Takeaways

Contents

Introduction: Why SMRs Could Be Important 7

Nuclear R&D in the United States 50

Conclusions: Defending and Expanding the Innovation Agenda for SMRs 54

Executive Summary

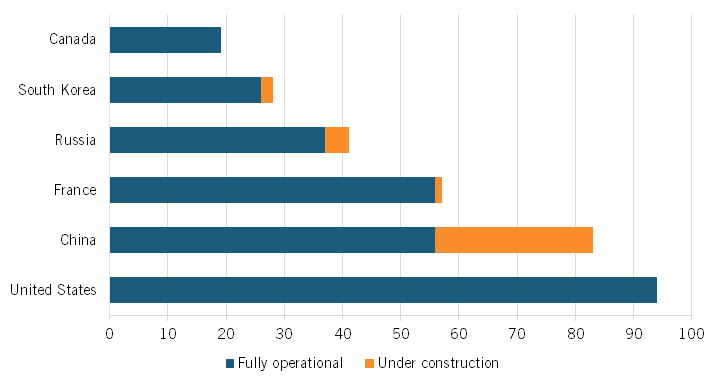

If nuclear power is the future, small modular reactors (SMRs) are the pathway, potentially offering a flexible, scalable, always-available, potentially cost-effective means of generating clean energy. U.S. companies are currently at the cutting edge of SMR development and deployment, but competition from China, Russia, South Korea, and certain European companies is intensifying. For SMRs to achieve widespread adoption, they must eventually reach price and performance parity (P3) with conventional energy sources, especially fossil fuels. And to do that, they need to scale.

Unlike large reactors, initially high SMR costs may fall because they are designed to be built—partly or completely—in a factory, rather than constructed on-site. Large-scale factory production can exploit economies of scale and can also lead to faster production, another key advantage. That is the endgame for SMRs. The question is how to get there, and the role the U.S. government should play along the way.

It’s useful to think of technology development as following a four-phase pathway, although, of course, all the boundaries are fuzzy, and not all technologies go through all four phases:

▪ Initial basic and applied research eventually leads to a prototype or the equivalent.

▪ Testing and further development leads to a fully complete design whose components have been successfully tested.

▪ First-of-a-kind deployment demonstrates that the protype and related components can be scaled up to commercial size, and the first reactor of its kind can be built.

▪ During the scale-up phase, multiple copies are produced and sold, allowing costs to fall and eventually the technology to become competitive with existing energy sources. Scale-up requires finally settling on a design, developing a fully functioning factory, and building an order book deep enough to support production at scale.

Today, large reactors have reached the scale-up phase but have largely stalled there, and show no sign yet of successfully reaching P3. There are simply not enough orders in the United States to generate sufficient scale economies. Proponents hope that a coalescence of orders around the Westinghouse AP1000 design (which is now a standard model for large reactors) will get large reactors to scale, but that seems unlikely. SMRs are at a much earlier stage, only now reaching the end of the testing and further development phase, with leading-edge designs preparing for first-of-a-kind deployment in the United States and elsewhere.

As a result, we don’t yet know whether SMRs will crack the scale-up problem; that question cannot be answered for at least a decade. But we can say that unlike large reactors, there is a greater possibility that SMRs will indeed scale, costs will fall, and P3 will be achieved. This is in part because SMRs have significant advantages, including that they may be able to expand the market for reactors very substantially. Because they can be sized from 1 megawatt (MW) to 300 MW or more, they can meet very different needs in different markets. Because some designs at least are well suited to the production of thermal energy, they can play a role in industrial decarbonization, and could also align well with desalination. Also, because they are modular, they can be aggregated to meet the specific amount of energy required. Some designs, for example those using molten salt and thorium promise cheaper fuel, lower refueling downtime requirements and have enhanced passive safety features that further reduce costs. In some cases, they use different fuels that are less expensive and easier to produce. And in contrast to wind and solar, they generate energy 24/7. That, combined with being clean, has attracted significant attention from Big Tech firms looking for power for their rapidly growing data centers.

Of course, first-of-a-kind SMRs are going to be expensive. They will likely cost more per megawatt hour (MWh) than existing large reactors, and certainly more than competing fuels (solar, wind, and natural gas). Expensive new technologies that will take a decade or more to reach scale (if they ever do) are very high risk, and SMRs face four distinct kinds of risk:

▪ Technology risks. Until the reactors are up and running, we won’t know whether in practice they meet the anticipated specs. Because we don’t have operational experience yet, SMR technology could fail to translate from the drawing board on pilot projects to full commercial operation in multiple ways—they could generate less power, use more fuel, require more downtime; there is a long list of things that could go wrong.

▪ Market risks. SMRs as a business face risks on both the supply side and the demand side. Aside from the technical risks, SMR companies may find that the competition is more intense or effective than anticipated; that some assumptions about their supply chain are wrong; or even that key patents don’t hold up. And of course—as with large reactors—companies may simply find that producing and siting SMRs is much more expensive than expected, or takes much longer, or that interest rates shift sharply upward, or indeed that inflation suddenly hits key inputs. On the demand side, it may be that expected markets simply don’t materialize, or that there is no market for SMR energy at the price it needs to charge. It’s hard to predict energy markets a decade out.

▪ Regulatory risks. SMRs must navigate multiple layers of regulation. They need to get their designs certified for safety (in the United States, by the Nuclear Regulatory Commission (NRC)). They need to get NRC safety approval for their operating plan for a specific site. They then need to get site approval via the National Environmental Protection Act (NEPA) process to ensure that environmental issues have been addressed. That may well also involve a defense against NIMBY (“not in my backyard”) lawsuits. And as SMRs will need to scale globally, they will also need to address regulators in other countries.

▪ Political risks. The reality is most nuclear reactor purchases involve national governments in some way (the United States is perhaps an outlier here, although the U.S. Department of Energy’s (DOE’s) Office of Nuclear Energy (ONE), Office of Clean Energy Demonstrations (OCED), Loan Program Office (LPO), and other programs will still be key enablers for nuclear). Government commitments to nuclear power have been subject to intense political conflict in some countries, leading to reversals, as in Germany, and to a double reversal and then reapproval in Japan. Government support will likely be critical, but governments can also be fickle. And in the United States, while there now appears to be a growing bipartisan consensus at the federal level in support of nuclear power, that is not the case at the state level, where environmental concerns, NIMBY issues, and waste management continue to generate opposition.

It is therefore not surprising that derisking has been at the heart of policy discussions. How can governments mitigate or perhaps even eliminate these risks in ways that don’t simply shift them entirely onto the backs of taxpayers?

It’s helpful to consider risk mitigation in terms of financial and nonfinancial risks, as the related policies are quite different.

Financial risk mitigation means finding ways to share risks between different stakeholders, including vendors (that sell reactors), constructors (that build plants), utilities (that usually own them), lenders, ratepayers, large end users, state and local governments, and national governments (and their taxpayers). Just listing the stakeholders indicates the complexity of possible risk-sharing models.

These stakeholders can also support nuclear construction through a wide variety of mechanisms. In the United States, funding comes from three primary sources: government grants for research and development (R&D) and eventually deployment; tax credits for either investment or production (Investment Tax Credits (ITC)/Production Tax Credits (PTC), with the latter currently set at $30/MWh; and—potentially though not yet in reality for SMRs—loan guarantees from LPO.

Other countries are using or exploring quite different approaches. The U.K. government has effectively been forced to become the owner of a plant being built at Hinkley Point, so taxpayers are largely on the hook there. The United Kingdom is also exploring rate-asset-based support, where ratepayers are required to pay a contribution during the construction period rather than just paying for electricity. In Finland, cooperative structures link vendors, construction companies, utilities, and large end users. In several European countries, Contracts for Difference (CfD) provide flexible operating subsidies that are tied tightly to market conditions, offering government subsidies where operating costs are higher than market prices. Many government have provided loans at below-market rates, while in Asia in particular, China has offered very attractive funding packages for new nuclear plants. The United States could clearly benefit from reviewing these options in a systematic way and aligning them with a much stronger emphasis on P3 assessment.

On the demand side, risk mitigation usually involves a long-term power purchase agreement (PPA), wherein a utility or large end user will agree to buy power at a more or less fixed price for a fixed number of years (often as long as 20 years). PPAs are effectively mandatory for large reactors; lenders will not take the risk of simply funding a huge speculative project. They will likely be mandatory for large SMRs, for the same reason. Microreactors—20 MW or less—may however be different; the amounts at stake are smaller and some microreactor companies aim to build and operate reactors themselves, simply delivering energy to clients.

The U.S. model for financial risk mitigation emerged largely because it was the approach that could get through Congress at the time, not because it was clearly the best approach. Indeed, it has many weaknesses especially over the long run, if only because it is exceptionally vulnerable to political risk.

Mitigating nonfinancial risks is also important. Technological risk is being mitigated by the close alignment between SMR companies and the National Labs, which provide critical expertise and capabilities in the form of facilities that can be shared by different SMR companies. Simulation, modeling, and physical test sites are all important, and can play especially helpful roles both at earlier stages of R&D and later in preparing designs for NRC certification. While this work is not glamorous or particularly visible, it is an important building block for the U.S. nuclear sector, and it would be devastating over the medium term if this work were not fully supported. Indeed, as SMR opportunities expand, it is likely that more SMR companies and designs will emerge, and they too will need access to and support from Idaho National Laboratory (INL), Oak Ridge National Laboratory (ORNL), Pacific Northwest National Lab (PNNL), and Argonne National Laboratory (ANL).

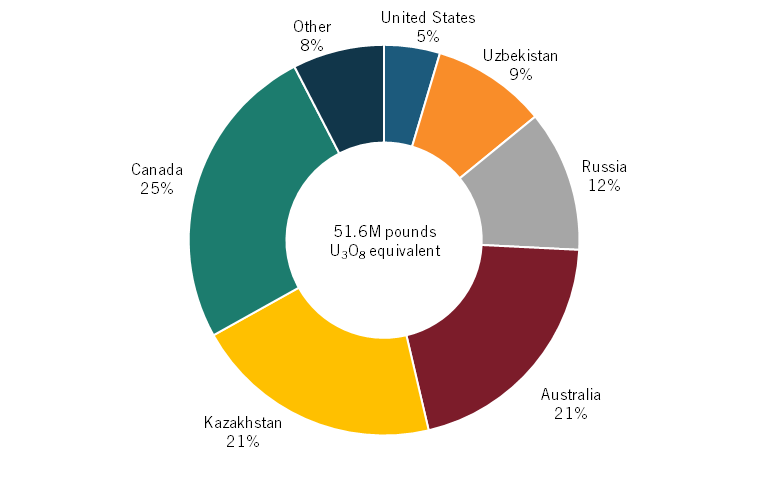

There are nonfinancial production risks to consider also. For example, many SMR designs require enriched uranium fuel (High-Assay Low-Enriched Uranium (HALEU)), and that supply chain is both global and insufficient. DOE is working on this, but other companies will likely have to follow TerraPower and cut their own deals with foreign entities and governments.

Regulatory risk is still substantial, despite recent efforts at NRC, where a new rulemaking aims to provide an optional alternative path for safety and operational certification for advanced reactors, replacing the existing model designed for existing GenIII large reactors. This pathway will however not be operational until at least 2027, although the current exemption-based process seems to be working better than SMR companies initially expected. More worrying, there has been no public discussion of a pathway for iteration: innovative products do not usually reach the market without substantial iteration and tweaking, or even full-scale pivots, and we simply have no idea how NRC will address a world that is so different from the “design once, build often” world that it is encouraging for large nuclear reactors. And regulatory risk is not limited to NRC: NEPA plays a significant role in delaying infrastructure projects (including SMRs), although fairly radical amendment is increasingly likely. State policy too impacts deployment, although antinuclear feeling is reversing, and this is being reflected in changes in state regulations for nuclear.

There are plenty of other regulatory concerns as well. SMR transportation and siting will be regulated and will likely need different approaches than those used for large reactors, and so will waste streams, all of which are in some state of flux.

Based on this analysis, the U.S. government has plenty still to do to support SMR development. Key recommendations cover the following areas:

▪ Expanded funding for basic and applied research. The Advanced Reactor Demonstration Program (ARDP), which spans several phases of development, has clearly been successful in supporting SMRs. Early funding—through this program or others—is critical, especially for a newly emerging sector such as SMRs; the discovery phase for this technology will require significant help in the form of grant funding and access to National Labs expertise and capabilities.

▪ Testing, certification, and further development. At this stage of development, new nuclear technologies are a decade or more from deployment at scale. They are therefore high-risk technologies, and federal funding in the form of matching grants will be crucial, as will access to testing and validating facilities at the National Labs and support for beginning the regulatory pathway.

▪ First-of-a-kind commercial deployment. This critical step marks the conclusion of the research and testing phase and the beginning of commercialization. Despite the missteps of OCED under the Biden administration, OCED funding will be absolutely critical for SMR deployment at this stage. We strongly recommend that OCED be reset to focus only on technologies that have reasonable prospects of reaching P3, but that support should be renewed and possibly expanded. DOE must also fully accept the need for much improved transparency across contracts, milestones, and both technical and economic outcomes from supported projects. Public funding should generate publicly available results.

▪ Scale-up. Here too existing mechanisms will play a key role. LPO should also be reoriented, mandated to focus explicitly on scaling up promising new technologies that are within reach of P3. It should avoid funding projects on either the supply or demand side that have no pathway to sustainability, and subsidies should be explicitly designed to support projects in reaching scale and hence P3. Subsidized loans and tax credits are, however, not the only mechanisms available; the administration should explore multiple alternatives including, for example, risk tiering, the use of CfD, and vertically organized consortia.

▪ Regulation is key to SMR success. NRC must both find ways to reduce the time lag before designs are certified and—especially critical for SMRs—develop ways to support design iteration, a key feature of innovation. Distinguishing between iteration that has safety impacts and those that don’t will be central, and NRC will also have to make significant strides in certifying factory-built reactors (and components) and addressing the need for new approaches to waste management and the transportation of SMR reactors, components, and fuel. SMRs will also need resolution of the current problems with interconnection, but it seems likely that these may be addressed before SMRs reach scale-up. Finally, international regulation matters; SMRs must work within global markets to achieve scale, so DOE should work to align certifications and safety regulations with other regulators.

SMRs are a promising technology with the potential to reach P3, in contrast to standard large nuclear reactors, which will not achieve scale or cost competitiveness with alternative energy sources. DOE should therefore focus its nuclear resources primarily on SMRs.

Box 1: Price/Performance Parity: “P3”

Climate change is global, so solutions must be global. In particular, they must meet the needs of low-income countries where demand for energy is rising fastest, and where ability and willingness to pay a green premium is low to nonexistent.

There is no evidence that forcing change with regulation, subsidies, or exhortation will work. Low-income countries will not adopt clean energy at the expense of growth. Neither will richer countries.

The market is the only lever powerful enough to drive the transition at the scale needed—and it will only work when clean energy technologies can outcompete dirty ones without subsidies or regulations. They must reach P3.[1]

Renewable energy is inherently variable. To succeed, especially in lower-income countries, Variable Renewable Energy (VRE) must deliver with reliability and costs that are broadly similar to fossil-generated energy. The United Kingdom recently announced that it is the first Organization for Economic Cooperation and Development (OECD) country to halve its emissions by effectively replacing coal-fired power generation with wind and solar. Nuclear and gas have remained largely constant over the past decade, but gas has now become the backup to VRE.

Introduction: Why SMRs Could Be Important

SMRs are clearly having a moment. Publicly traded companies such as Oklo and NuScale have seen both recent stock booms and several major investment announcements, and Big Data companies are buying into or supporting a range of SMRs as a partial solution to their energy needs. The new secretary of Energy, Chris Wright, is an investor in and board member of Oklo, and is clearly a fan of growing nuclear, having written when he was CEO of Liberty Energy, “Nuclear appears to be the most viable option to add sizable new energy resources in the coming decades.”[2]

DOE’s liftoff report is remarkably optimistic, and more generally, nuclear proponents have argued that using a standardized design (e.g., Westinghouse’s AP1000) and building a series of reactors using that design will reduce costs, as a trained construction workforce can be employed for multiple projects, and projects benefit from learning by doing across an increasing number of projects.[3] DOE’s report also notes other potential cost drivers such as reduced capital costs and of course clean energy subsidies from Biden administration programs.

These arguments, however, fly in the face of experience with the construction of large reactors. Between 2002 and 2017, 11,833 MW of U.S. nuclear generating capacity closed or announced retirement (11.9 percent of U.S. nuclear capacity), mostly because of unfavorable market conditions.[4] There are no major new reactors under construction or in review by regulators in the United States today, and the most recent completed plant, at Vogtle in Georgia, came in years late and massively over budget.[5] More generally, the cost of constructing large nuclear reactors has increased significantly in recent decades, partly because components have become much more expensive (notably steel and concrete), partly because no settled design has emerged, and partly because safety regimes and regulatory burdens expanded sharply after Three Mile Island and Chernobyl.[6] But the fact is recent construction of large nuclear plants in the United States and elsewhere has suffered from dramatic cost overruns and delays. As a result, no large nuclear plants are planned or under construction in the United States. Planned nuclear plants in Europe, meanwhile, are a response to the need for energy security in the face of Russian aggression, plus a stronger commitment to clean energy even if it costs more.

Initially, SMRs will likely cost as much per kilowatt as large reactors do, or perhaps even more. But SMR companies have developed to the point that they are close to commercial deployment in the United States (and elsewhere). Investment is pouring into the sector, and innovative new SMR companies are popping up like mushrooms after a rainstorm. Why?

SMRs do have plenty of potential ancillary advantages—site flexibility, size flexibility, modularity, possible new markets—and of course, like big reactors, they offer reliable baseload energy 24/7. But most important of all, SMRs could generate clean reliable power much more cheaply than large reactors if major components or the entire reactor (for smaller SMRs) can be manufactured in a factory, not on-site, which could open the door to economies of scale and declining costs. That promise is driving interest in SMRs, and Deloitte has identified more than 150 SMRs in development around the world.[7]

However, right now, there are only two commercially operating SMRs, one in Russia and one in China. Only three designs have been approved for construction by NRC. Investments and hype are fueled by the promise of SMRs, not the current reality. However, innovative new designs are emerging very rapidly, ranging in size from 1 MW to more than 300 MW, including new technologies, new configurations, new fuels, and new production systems.

This report explores the case for and against SMRs, and offers policy pathways that would give SMRs their best shot at making it to scale in the United States, becoming relevant in reality and not just in theory. Even though public views on nuclear are getting steadily more popular, they have a long way to go, and they will need a lot of help along the way, but it is potentially a very important technology.

What Are SMRs?

SMRs generate power just like other reactors—by using a nuclear reaction to heat a liquid that then generates steam, which in turn powers a turbine that creates electricity (see box 2). Today, SMRs are being developed with different technologies that offer variations on this theme, using different fuels, different coolants, and new safety features.

All SMRs have three key characteristics that differentiate them from standard large reactors: they generate lower levels of energy (usually defined as 20–300 MW, compared with large reactors that typically generate 1,000 MW or more) (reactors generating 20 MW or less are “microreactors”); they are modular in that multiple SMRs can be hooked together to provide the necessary level of power for a particular application; and they are designed to be made at least partly in a factory, rather than completely built on-site like large reactors.

Smaller scale and modularity make SMRs more flexible and hence a potential option for different applications, while factory production offers the tantalizing prospect of mass production and the potentially radical decline in cost that might bring.

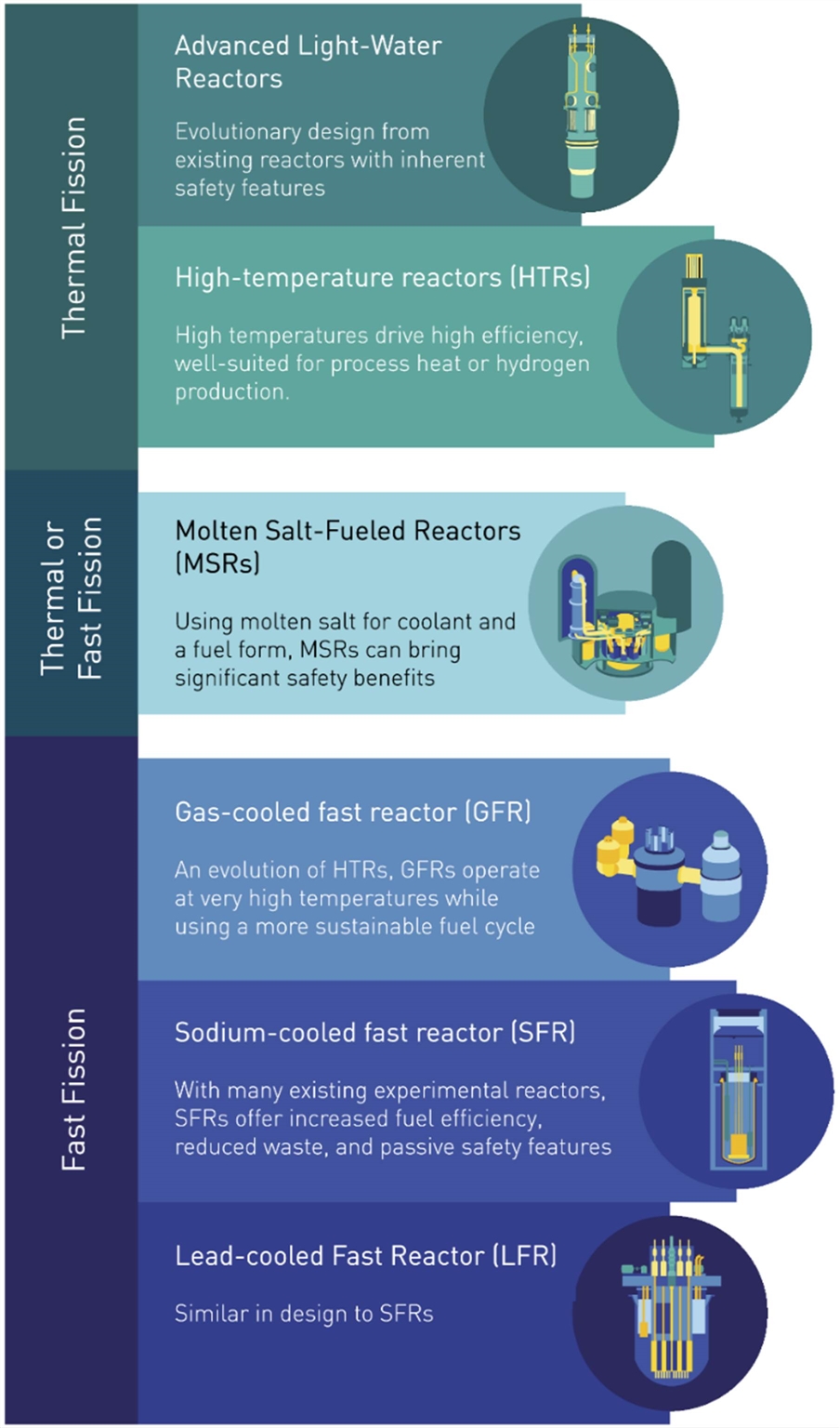

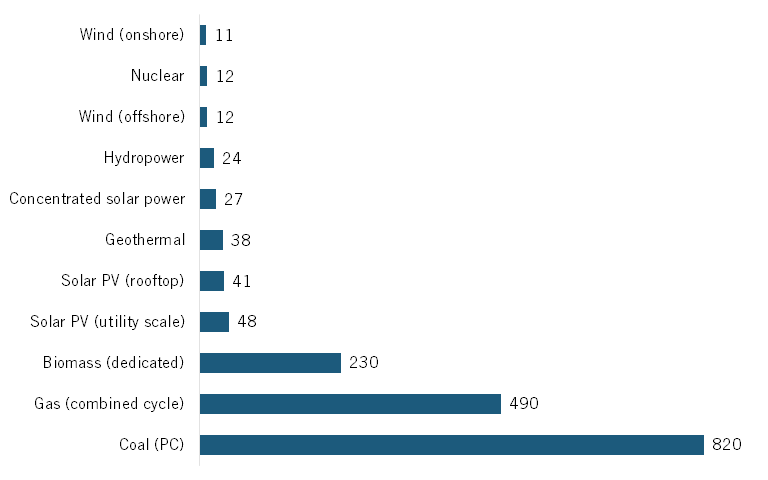

Although there are around 150 SMR companies worldwide, most offer no more than designs on paper. To become relevant globally, the SMR sector must go through the discovery phase to figure out which technologies and business models are winners and which are not, and both are still in flux. For example, at least six quite different designs are being developed (figure 1).

SMRs have plenty of promise, which is why Google, Meta, and Amazon are all exploring their use to power data centers. To become fully relevant in the green transition, SMRs will need to traverse the discovery phase of technology development quite quickly, settling on only a few dominant designs and companies. That’s necessary if SMRs are to exploit the promise of factory production, and perhaps then generate true economies of scale. But as shown later in this paper, getting to scale will take time, lots of investment, and plenty of government help.

Box 2: Generating Nuclear Power Using Pressurized Water Reactors

Pressurized Water Reactors (PWRs) operate on two isolated coolant loops. In the primary loop, water under intense pressure (15–17 megapascals (MPa)) flows through the reactor core, heating from 290°C to 325°C while remaining liquid. Main coolant pumps circulate this water through steam generators, where heat is transferred via tube walls to a separate secondary coolant loop. In this secondary loop, the water boils into steam at 6 MPa, then expands through the turbine to near vacuum (0.008 MPa). This pressure drop drives the movement of steam through the turbine-generator assembly, producing electricity.

Figure 1: SMR Reactor Types[8]

The Potential for SMRs

SMRs are a powerful energy source that generate no carbon emissions from operations; they are energy dense; they can be constructed flexibly; and—like wind and solar—costs could decline significantly as they gain scale. But that’s just the start. This section describes in more detail some of the advantages that SMRs might develop over both large reactors and competing energy sources.

New Markets for Nuclear

Because they are smaller and modular, SMRs may be able to expand into or develop new markets, across several dimensions:

▪ Geography. SMRs can go where large nuclear cannot. They could be used for off-grid and remote applications, for sites close to population centers, for locations where other clean power sources would require a lot of expensive transmission infrastructure. Atomic Energy of Canada Limited, for example, is developing a very low-powered SMR that can run for 15 years without refueling.[9]

▪ Industries. SMRs could support industrial decarbonization applications across many industries, as they can be located closer to existing industry clusters or—for microreactors at least—actually on-site. Entire new industry segments with distinct energy needs could open up: data centers, for example. And new approaches to existing needs are also potentially significant: SMRs could, for example, provide district heating, and could also power container ships.[10]

▪ Scale. SMRs can operate at scales from 1 MW to 1,000 MW or more because they are modular and hence stackable. Therefore, SMRs could work for applications that require 300 MW, for example, while standard large nuclear plants are usually around 1,000 MW.

▪ Existing infrastructure. SMRs don’t need a strong existing grid to distribute power, so they have applications in regions with weak or nonexistent grids, or where demand is growing faster than the grid can manage (especially in fast-growing low-income countries).

▪ Load following power. TerraPower emphasizes that, unlike large PWR reactors, which provide baseload power, its Natrium reactor uses molten salt energy storage; that could open the door to use as variable power, especially as a complement to wind power. That is in part the motivation for its first plant in Wyoming.

Some of the relevant potential markets are shown in table 1, although all of these are just “potential” markets right now, and SMRs will need to avoid the “Swiss Army Knife” problem: being the second- or third-best solution everywhere. But there are significant opportunities.

Table 1: Potential markets for SMRs

|

Potential Markets |

Examples |

|

Developing economies with growing energy needs |

▪ India, Indonesia, Philippines, and South Africa are attracted to SMRs’ lower up-front capital costs, limited infrastructure demands, smaller physical footprint, and potential for incremental expansion. |

|

Maritime and transportation applications |

▪Floating nuclear power plants, maritime propulsion systems ▪E.g., Russia’s floating nuclear power plant and emerging designs for maritime nuclear propulsion. ▪Nuclear submarines have demonstrated some options. |

|

Countries seeking energy security |

▪ Countries around Russia seeking to avoid dependence on Russian gas and oil |

|

Countries needing to diversify energy sources |

▪Countries such as Japan and the United Arab Emirates |

|

Big data |

▪ SMRs are a potentially important option for owners of data centers that require large amounts of very reliable energy, clean if possible. |

|

Industrial process heating |

▪SMRs generate heat as well as power and can be located close to end users or on-site. ▪E.g., desalination, synthetic and unconventional oil production, oil refining (for use in >700°C) |

|

Remote communities and off-grid applications |

▪ Remote mining operations ▪ Military bases and installations ▪ Off-grid communities ▪ Island nations |

|

Developed economies seeking green transition |

▪U.S. utilities may see SMRs especially as a way to replace coal with low emissions while maintaining grid stability. ▪E.g., the Tennessee Valley Authority and NuScale Power. |

A 2014 study in the United Kingdom estimated that the global market for SMRs could be 65–85 gigawatts (GW) annually by 2035 (assuming that they are economically competitive).[11] And TerraPower’s vision is explicitly focused on bringing competitive SMR power to developing countries: “This century, we would expect to see hundreds of Natrium reactors deployed around the world in nations that don’t even have nuclear today: nations in sub-Saharan Africa, where there’s tremendous population growth, or in Indonesia where we think Gen IV technology will be ideal.”[12]

SMRs for Data Centers

Much of the recent excitement around SMRs is built on the rapidly growing demand for firm, reliable energy for data centers. Even before the explosion of demand for artificial intelligence (AI), data centers were growing rapidly in the United States (and elsewhere), helping to transform electricity trends from decades of flat demand to significant projected growth. Demand from data centers is now expected to turbocharge that growth, and major data center owners are scrambling to find the substantial new electricity supply that will be needed.

The structure of electricity markets in the United States makes nuclear an attractive proposition, for two main reasons. First, it seems unlikely that huge new demand from data centers can be accommodated by existing sources of electricity supply. Amazon’s efforts to acquire priority access to the Susquehanna nuclear plant has been rejected by the Federal Energy Regulatory Commission (FERC), and while lawsuits are ongoing, it appears that Big Tech companies and other data center owners have accepted that they will likely have to bring their own power sources rather than simply using electricity from the grid, as regulators will likely not allow utilities to disadvantage existing customers in favor of this new demand, so new generation must be built. In tight electricity markets, the sudden withdrawal of a significant part of electricity supply for data center use would cause substantial and persistent spikes in the price of grid electricity, and that will likely not be permitted.

Second, grid interconnection is a problem on two fronts. It currently takes on the order of five years for FERC approval for interconnection to the grid. And grid connections carry a substantial per-MWh cost in terms of fees and taxes. So avoiding interconnection where possible is attractive—and SMRs or nuclear more generally offers a good solution if nuclear can provide electricity at a reasonable price and within a reasonable timeframe. Evidence so far suggests that data center operators are willing to pay a substantial but not exorbitant premium for new nuclear energy, whether it is SMRs that will enter service in the next decade or refurbished existing large reactors that can be reactivated for use more quickly.

All the Big Tech companies have signed nuclear power agreements of some kind. Amazon is investing $700 million in X-energy and SMR deployment in the Northwest United States; Google is funding Kairos; Microsoft has agreed to a 20-year PPA that will pay for the restart of a reactor at Three Mile Island. Meta has released a Request for Proposal seeking 1–4 GW of nuclear power. Google, Microsoft, and Nucor are working with Duke Energy to build a data center next to Duke’s Surry nuclear plant. Oklo is partnering with RPower to provide a hybrid solution that offers gas generation until Oklo’s SMRs can be deployed.

Moreover, data center buyers seem especially likely to fund innovative new ideas. They may offer a uniquely helpful combination of very deep pockets, need for reliable 24/7 clean power, long timeframes, and a willingness to accept risks. Endeavor Energy, for example, has signed a deal with Deep Fission to power its expanding fleet of data centers with energy from 2 GW of SMRs located one mile underground.[13]

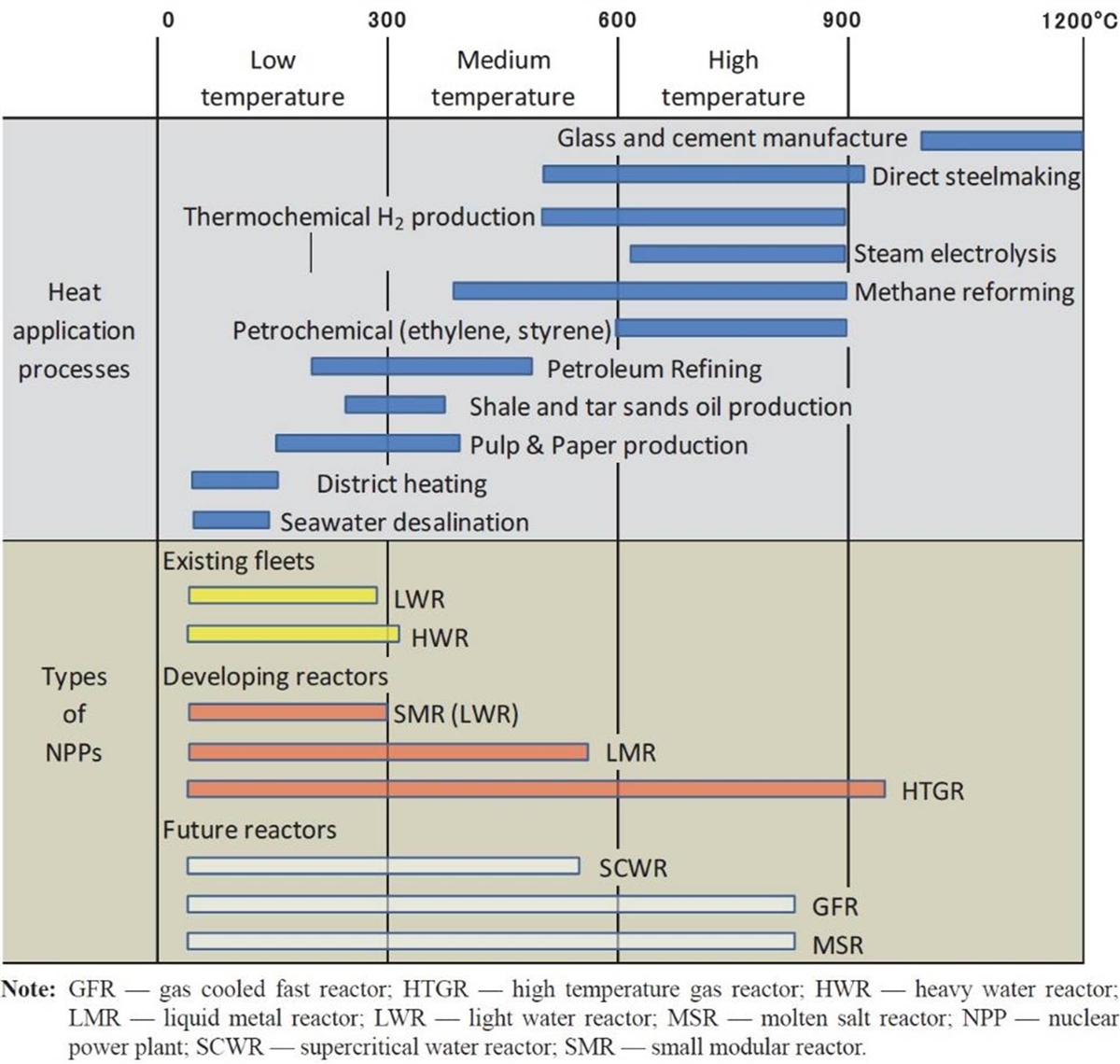

Markets for Thermal Power

Unlike wind and photovoltaic (PV) solar, nuclear power generates heat as well as electricity. That heat can be used directly in various industrial processes, or perhaps for district heating, and is especially relevant to SMRs, which could be sited near industrial end users, opening up potential new markets. Figure 2 shows both the range of potential heat industrial processes that could use nuclear power and the temperature range of existing and emerging nuclear technologies.

Some high-temperature applications will probably not be served by nuclear energy (e.g., glass and cement manufacturing), but others are potentially accessible targets, especially for high-temperature gas reactors (HTGRs), which generate very high levels of heat. Emerging new technologies—gas-cooled fast reactors (GFRs) and molten salt reactors (MSRs) in particular—may operate at high enough temperatures to be useful for the chemicals sector, petroleum refining, and pulp and paper production. Both GFR and MSR technologies have been proposed for SMRs.

Figure 2: Temperature ranges of heat application processes and types of nuclear power plant[14]

Desalination

Given the obvious need for clean water in many parts of the world and the growing pressure on water resources, desalinization will be a critically important technology. SMRs and desalination could be a very good fit.

Most analysis of SMRs is based on the assumption that they will provide firm baseload energy. That is a natural consequence of SMR economics: because reactors are so capital intensive and so reliable, it makes sense to run them at the highest possible capacity factor. That’s why nuclear power plants usually run at well over 90 percent capacity today. But SMRs could work differently: They could be linked both to a grid and to a desalinization plant, supplying energy to the grid when demand (and hence prices) is high, and redirecting energy to the desalinization plant when demand (and grid prices) is low. The desalinization plant could also be the offtaker for energy when the grid has no use for it at all (i.e., when the grid curtails the flow of energy from the plant to the grid). This alignment would put a floor under the price for reactor energy (the price at which desalination makes sense) and guarantee high capacity utilization even if grid demand fluctuates.

In effect, the desalinization plant would be an economic battery attached to the SMR, storing excess energy in the form of clean water when grid prices are low. Of course, the same strategy could be applied to other energy technologies such as solar or wind, and the growing curtailment of clean energy in California may provide a real-world test of this opportunity. However, the siting advantages and other flexibility features of SMRs mean that if this model works out economically, it could be applied in areas where excess solar, wind, or both are not so easily found, and especially where water is a scarce resource. For example, a Texas consortium is exploring nuclear for desalination at the Texas Tech SMR cluster.[15]

Several new technologies are also emerging for desalinization, some of which use heat-based desalination (evaporating water to lose contaminants such as salt). It seems quite plausible that nuclear plants—especially those using high-temperature technologies—could be well suited for this approach.[16]

Manufacturing and Economies of Scale: Getting to P3

Factory manufacturing and scale are critical SMRs: Without reaching scale and driving down costs, they have no future. Getting there involves settling on a technology, finding enough customers initially willing to pay a premium, and then successfully exploiting factory production, which does not necessarily require millions of units annually. Boeing builds approximately 500 planes per year on its production lines, and can build them vastly cheaper than if it built them one at a time.

Because SMRs have not yet been produced in a factory, we have only educated guesses about cost savings. And because many variables play a significant role in eventual costs—including the technology adopted, the size of the plant, and financing methods and costs—estimates are unlikely to be accurate.

Wright’s Law

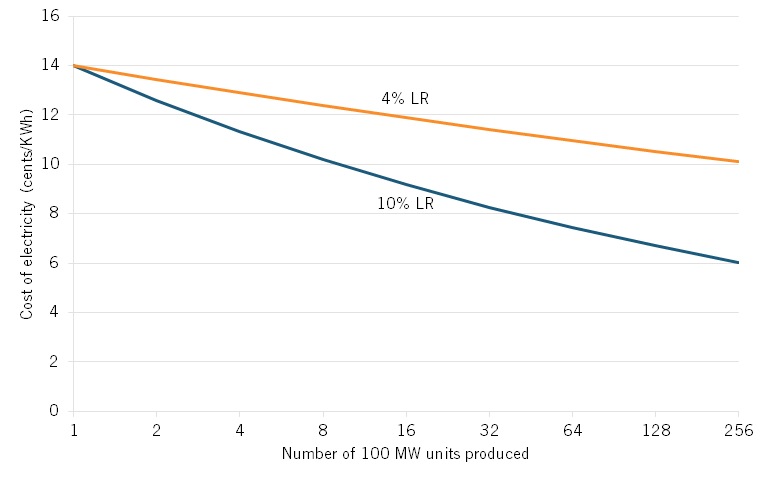

Still, in the context of SMRs, the literature provides useful estimates of potential learning effects from scale. In the 1930s, Theodore Wright found that the cost of aircraft production at Boeing fell 10–15 percent each time production volume doubled.[17] This is known as Wright’s Law. It has held up fairly well (to different degrees) across other industries (e.g., solar and batteries) and seems a reasonable rule of thumb for scaling nuclear as well; the United Kingdom’s National Nuclear Lab used it in a report for the U.K. Parliament in 2014, for example.[18] Other studies, however, offer more pessimistic conclusions, as Wright’s Law is not a fixed constant, and doubling the installed base for a technology does not inevitably reduce costs by a fixed percentage.[19]

The potential impact of Wright’s Law on the cost of SMR electricity is shown in figure 3, which shows two hypothetical learning rates (LRs)—at 10 percent and 4 percent—for an SMR starting at $0.14/kilowatt (KW), with one initial unit deployed. The chart shows hypothetically that a 10 percent learning curve reduces the cost of electricity by around two-thirds as deployment reaches 256 units, at which point SMRs would be a competitive energy source. These curves show just how important the learning rate will turn out to be—something we won’t know for at least two decades. They also underscore the critical role of scale in cost reduction.

Figure 3: Hypothetical scale economy curves for SMRs

How Quickly Can Demand Scale?

We are really talking about two distinct markets at least, one for quite large SMRs (perhaps 100 MW+), where costs and deployment limitations suggest that it will take several decades before 256 units are deployed, and smaller SMRS and microreactors, where take-up could be much faster and where companies are planning to roll out large numbers of units annually (Copenhagen Atomics, for example, anticipates that it will be building plants in multiple countries; each plant is expected to produce more than 300 units annually, and the company aims to eventually deliver reactors at a levelized cost of energy of $20/MWh—well below the cost of competing technologies for new build plants, including gas).[20]

Even if we hypothetically begin rollout with three SMRs deployed in their first year of operation, 30 years of 10 percent compounded growth in deployment will generate a total of only 53 deployed units; growth rates would have to reach more than 15 percent annually to 256 units within 30 years. Of course, early-stage growth could be much faster—the current excitement suggests that it will be. So, while sufficient scale is possible, it could take considerably longer than a decade of rapid growth for SMRs to reach P3 with competing fuels, especially for larger SMRs.

What Will the Rate of Cost Decline Turn Out to Be?

Looking directly at the process improvements available, several detailed studies show how different components of SMRs can be modularized for factory production. One study, for example, estimates that full modularization alone can reduce overnight capital costs by more than 40 percent—and also that the opportunities are greater for smaller reactors.[21]

Another detailed analysis suggests that 60–80 percent of SMR production by value could be accomplished with a factory.[22] That in turn could allow for the application of advanced manufacturing techniques such as electron beam welding and diode laser cladding.[23] It has also been claimed that because SMRs are smaller, they can become more standardized in that there is less need to adapt to local conditions. But this remains unproven.

It’s worth noting that larger SMRs likely will to be completely built in a single factory. TerraPower’s 345MW Natrium reactor will have all its large components built by fabricators in its factories, and those components will then be assembled on-site and lowered into the ground to their final position. TerraPower still expects to build hundreds of reactors, so component-level economies can become substantial if they succeed.[24]

A high rate of production has other advantages. Workers (both white collar and blue collar) remain employed, and their experience will help drive learning rates. And SMRs can design in features that could reduce the cost of production in other ways. Passive safety features enabled by SMRs (which have a higher surface-to-volume ratio than large reactors do and consequently a lower need for additional features such as large cooling towers) could cut containment costs substantially, while fuels can be designed to be lower costs (e.g., molten salt using thorium).

It’s also worth noting that because SMRs are still in the discovery phase, we don’t even know what factory production will look like. For example, both Core Power in the United Kingdom and Blue Energy in the United States are looking at converting shipyards to SMR production, aiming to build reactors for sea-based deployment.[25]

To summarize, we do not yet know how all the excitement about declining cost curve and factory production will translate to the real world. But low-cost nuclear power via SMRs has a foundation both in the history of technology and in the specifics of SMR production, and is a tantalizing possibility.

Shorter and Potentially More Predictable Construction Timelines

If SMR production can become standardized to include a substantial factory-built component, that should shorten construction timelines significantly. Optimistic SMR companies claim to expect deliveries and operations in 2–4 years, not the 7–10 years or more that’s now standard (at best).

Lower Up-Front Capital Costs

While SMRs have not yet proven that they can generate energy at a lower levelized cost (per MWh) than large nuclear plants (or other competing energy sources), they will definitely require less capital expenditure up front. First-of-a-kind construction is expensive, but even so, a 300 MW SMR facility will require much less up-front capital than a standard 1,000 MW nuclear plant will. Even if overnight costs for first-of-a-kind construction are $10,000/KW (similar to the cost of recent large plants in the United States and Europe), a 100 MW SMR would require on the order of $1 billion in overnight costs, rather than the $10 billion potentially needed for a 1,000 MW plant.[26] Lower capital investments mean lower risks, and create opportunities for projects financed from a wider range of partners.

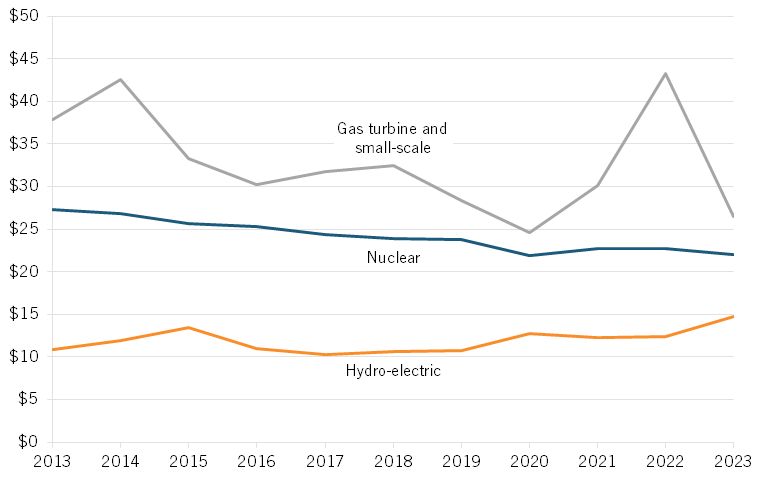

Low Operational Costs

A survey from the Nuclear Energy Institute indicates that both operational and fuel costs for nuclear reactors have been falling fairly steadily in the United States, and amounted to about $24/MWh in 2022.[27] That’s similar to data from the U.S. Energy Information Administration (EIA), which compares operating costs for nuclear, gas, and hydroelectric power (see figure 4). Fuel and operating costs for combined cycle gas turbines (CCGTs) (the most widely used and cheapest gas technology) vary based on factors such as the price of gas, the turbine technology being used, the maintenance schedule, and even the ambient temperature. Typically, fuel accounts of 60–70 percent of CCGT operating costs, and fuel costs—perhaps especially gas—can spike unexpectedly, as they did in Europe after the Russian invasion of Ukraine. Operating costs for gas have historically been at least $4/MWh more expensive than nuclear (and are currently just over 20 percent more expensive). However, it is also possible that new kinds of fuel for SMRs will be more expensive, at least initially, especially ais most currently propose to use HALEU, which requires more-expensive processing.

Figure 4: Operating costs per MWh for selected technologies in the United States[28]

Low Life-Cycle Emissions

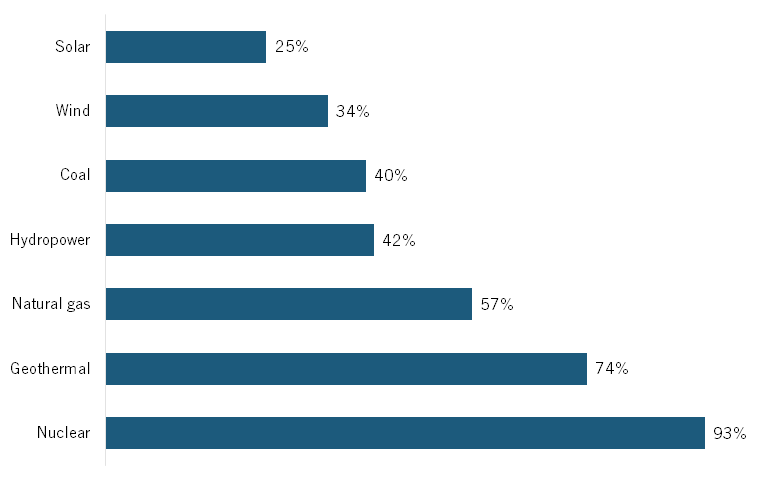

SMRs produce zero greenhouse gases from operations, so their life cycle emissions come from mining and enriching uranium and also the construction of SMRs. Emissions from large nuclear reactors are far lower than those for fossil fuels, and are around one quarter those of solar. It’s reasonable to expect that life cycle emissions for SMRs will be roughly similar. Critically, therefore, SMRs offer clean power—much cleaner than fossil fuels do (see figure 5). If they didn’t, there would be little reason to pursue them.

Figure 5: Average life cycle of carbon dioxide (CO2) emissions (grams of CO2 equivalent per KWh)[29]

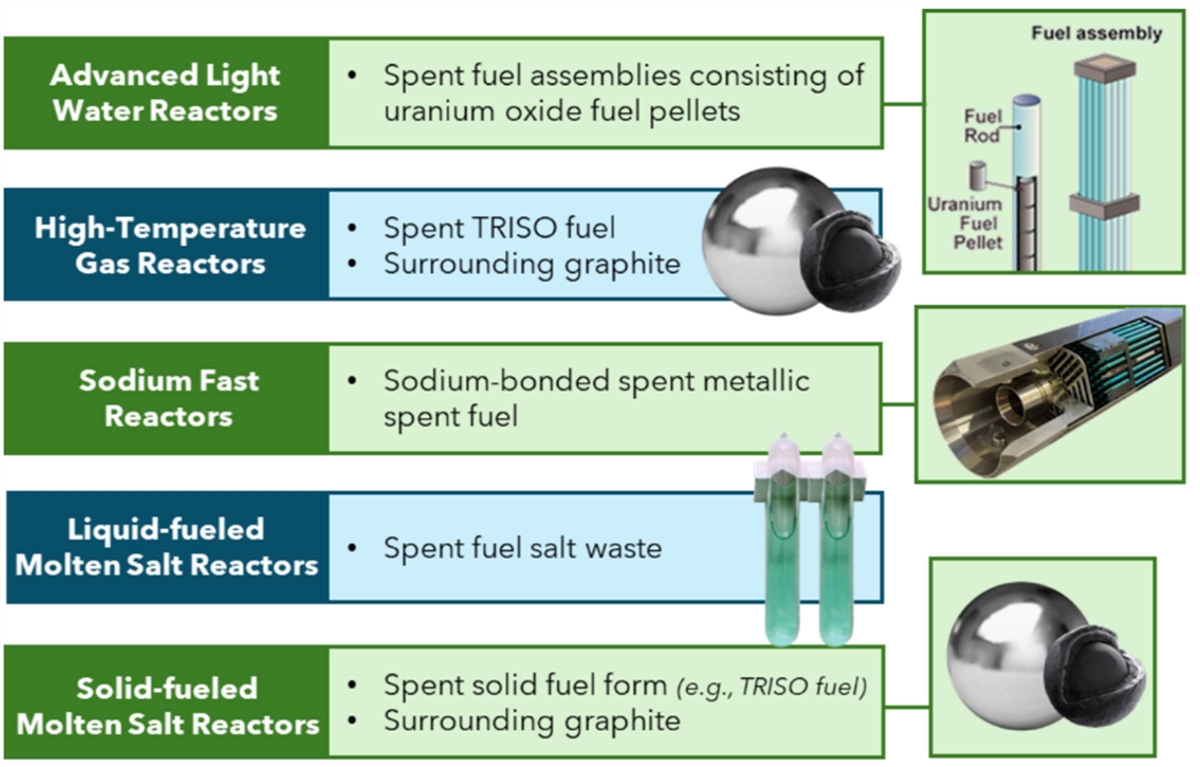

Firm Power, Reliability, High Capacity Factors, and Low Systems Costs

In sharp contrast to wind and solar, nuclear plants are extremely reliable—they provide firm power that’s available almost all the time: their capacity factor averages 92.5 percent in the United States, far higher than other energy sources (see figure 6).[30] That offers certainty about electricity supply, which is especially important for certain users. Data centers offer their customers contracts that guarantee more than 99.9 percent uptime; they will need correspondingly reliable energy sources to meet that level of performance.

Figure 6: Capacity factor by U.S. energy source[31]

Downtime for reactors is almost entirely predictable. (Almost! France recently suffered unexpected problems with some of its reactors, as did TVA in the United States.) Downtime is usually caused by scheduled maintenance or refueling time (about every 18 months for large reactors, lasting about a month). SMRs are designed to require less-frequent refueling (or swap out): mostly every three to seven years, depending on the design. Refueling outages should therefore be less frequent, and capacity utilization correspondingly higher.

Further, unlike wind and solar, power output from nuclear is highly predictable. Adopting nuclear—either large reactors or SMRs—can reduce the need for balancing capabilities such as banks of lithium-ion batteries for short-term storage, or the use of natural gas to address long-term variation.[32] The additional system costs for nuclear are much lower than those of wind and solar as well, especially as transmission costs may be lower because of siting flexibility.

Footprint and Siting Flexibility

Both wind and solar require a large land footprint. Of course, the United States has a lot of land, but a PV solar plant generating 1,000 megawatt electrical (MWe) would require 5–10,000 acres, depending on location, according to the National Renewable Energy Laboratory (NREL).[33] A similar-scale nuclear plant would require only about 640 acres. And SMRs have a much smaller footprint than large reactors; for example, a proposed NuScale 920 MW plant would require about 35 acres.[34] A radically smaller footprint also opens the door to a much wider array of potential sites.

Longevity

Nuclear plants last far longer than any other source of energy except possibly hydro. We are seeing plants lasting beyond 60 years now, and it seems likely that, for some at least, the operating lifetime is 80 years or more, based on research on nuclear plant sustainability conducted by DOE. In December 2019, NRC staff approved a renewal application for Turkey Point Nuclear Units 3 and 4 in Florida, allowing operations until 2052 and 2053, respectively—the first time NRC extended a plant lifetime to 80 years.[35] This could transform the financing of nuclear plants; longer lifespans reduce the average lifetime cost of energy by spreading the heavy capital costs of nuclear plants over a much longer period of operation. In contrast, CCGT gas plants have a nominal lifetime of 25–30 years.[36] However, it remains to be seen whether SMRs last as long, especially as there may be trade-offs between longevity and higher temperatures.

Avoiding Costly New Transmission Lines

The need for new transmission lines has become a major concern in the United States as well as other countries such as the United Kingdom, where curtailment caused by lack of transmission has become a real problem. The United Kingdom generates most of its wind energy—which is quickly becoming the dominant source of power for the grid—in Scotland and the north of England, while most demand is in the south. As a result, Scottish wind farms were paid £1.4 billion in 2023 to not produce electricity because there was no room on transmission lines to the south. The new state-owned U.K. grid operator estimates the cost of grid expansion to fix this at £40 billion pounds annually through 2030 (the gross domestic product (GDP) equivalent of about $360 billion annually in the United States).

New transmission lines are needed for many reasons: they make the grid more reliable and resilient by interconnecting regional grids, and that could also help to balance the variability of wind and solar, and to provide markets for variable power that may be produced hundreds of miles away from eventual users (as in the United Kingdom). But the United States currently builds only a fraction of the transmission lines it already needs for these purposes. The interconnection queue waiting for approval at FERC is currently five years long, while the UK example shows how expensive building out sufficient transmission might be.[37]

SMRs could avoid both the cost of transmission, by collocating them with end users such as data centers, and by avoiding the FERC interconnection queue by locating them “behind the meter” (i.e., entirely off the public grid). Those avoided costs are major benefits not captured in simple formulations focused on the immediate levelized cost of energy production.[38] Hence, the interest from data centers.

Nuclear Power and National Security

Civilian nuclear power plays a minimal role in U.S. national energy security; domestic fossil fuel reserves are enormous, and the United States has substantial (and by global standards, reasonably efficient) wind and solar resources as well. Civilian nuclear power plays a much more prominent role in national security for other countries, as it offers the promise of independence from energy sources that can become too expensive or unreliable. The Russian gas crisis after the invasion of Ukraine underlines the fragile state of energy security in much of Europe. Unsurprisingly, countries around the periphery of Russia—Romania, Poland, Hungary, Czech Republic, Finland, Slovakia—are exploring or building new nuclear reactors. Slovakia, Czechia, and Hungary already depend on nuclear for at least one-third of their energy supply.

▪ Poland is buying three reactors from Westinghouse (at $16 billion), and three more from South Korea’s KHNP. It aims for a 30 percent nuclear share in the energy supply mix.

▪ Hungary is building on nuclear links to Russia, expanding the Russian-built Paks site with two new 1,200 MW reactors (estimated cost: €12 billion, but now years behind schedule). This is partly a like-for-like replacement for existing capacity.

▪ Czechia aims to phase out coal by 2033, replacing it in large part with nuclear by adding one or possibly two reactors to the existing Dukanovy plant, plus two more reactors at Temelin. The first contract has been let to KHNP.

▪ Slovakia recently completed a new 471 MW reactor at Mochavce (under construction since 2008), and another unit is planned this decade.

▪ Romania is adding two 700 MW units at Cernavoda (estimate cost $8 billion), for completion in 2031. The engineering contract has been signed with Canyu. The Romanian state is providing a full guarantee of costs, as well as operating subsidies via a contract for difference. A joint venture with NuScale is exploring an SMR at Doicesti.

In this context, it is perhaps not surprising to hear that “Romania is taking firm steps towards energy independence and becoming a net energy exporter,” according to then-PM Nicolae Ciuca.[39] More generally, provided that the nuclear supply chain can be globalized away from dependence on Russia, nuclear power offers significant national security benefits: the energy effects of Russia’s invasion demonstrate to these countries the need for more energy autonomy very clearly. Those benefits could apply to SMRs once they are price competitive with large nuclear reactors.

Risks for SMRs

The dramatic cost overruns and delays on recent large nuclear projects in the United States, United Kingdom, France, and Finland explain why building nuclear is regarded as a high-risk operation. A lot can go wrong, and capital costs are huge to begin with. Risk therefore provides a useful lens through which to explore the challenges facing SMRs.

Investors in SMRs face four kinds of risk:

1. Technology risks are inevitable as companies introduce new technologies to the market. Sometimes technologies just don’t work as expected.

2. Market risks can be divided into supply-side risks (the possibility that a company will be outcompeted, or that critical supply chains will fail, for example) and demand-side risks (e.g., the possibility that expected markets will not materialize at the right price, or perhaps at all).

3. Political risks reflect the reality that—as Germany and Japan demonstrate—the political appetite for nuclear power can change, sometimes dramatically.

4. And because nuclear power is tightly regulated, there are substantial regulatory risks as well, especially as the regulatory pathway for SMRs is not yet well defined.

All these risks are real, as the main U.S. nuclear contractor (Westinghouse) can confirm (it went bankrupt in 2017).

Technology Risks for SMRs

SMRs have already divided into two broad technology pathways. Some companies, such as NuScale, have decided to use existing technology scaled to the needs of their smaller reactors; it uses existing PWR technology. That’s partly why NuScale has already had its design certified by NRC. Others (e.g., Copenhagen Atomics) have opted for more innovative non-PWR designs (Copenhagen is based on molten salt as a coolant). However, even reactors using PWR technology will need significant innovation such as helical coil steam generators, internal control rod drive mechanisms, new in-vessel instrumentation, and perhaps new fuel combinations and configurations.[40]

In contrast, alternative technologies offer a range of potentially significant performance benefits beyond possibly lower long-run costs:

▪ Higher operating temperatures potentially increase efficiency (reducing fuel costs and increasing output per reactor) and could allow for more uses for industrial heating and thermal applications more generally.

▪ Potential for improved fuel utilization that would reduce fuel consumption, which in turn reduces fuel costs and—perhaps more important—extends the period before refueling (and hence downtime) is needed. Innovative SMRs may use different fuels altogether: molten salt breeder reactors can for example use thorium instead of uranium, and can act as a breeder reactor using spent nuclear fuel (SNF) from other reactors.

▪ Lower operating pressures would potentially reduce containment requirements and hence both construction costs and perhaps regulation-related compliance costs.

▪ Some designs offer inherent proliferation resistance by using fuel formulated in ways that are resistant to easy extraction and would require considerable further processing before they could be used for weapons.

These new designs are likely to be higher risk. They do not have decades of use behind them, and the technology trade-offs pale in comparison to the primary risk: that the design will not work as expected, and will either fail or require substantial revision (and associated delays). That risk is lower for SMRs based on well-understood existing technology; advanced design SMR companies are betting that the benefits of new designs will outweigh the additional risks. We will find out who was right sometime in the mid-2030s.

Is Enough Iteration Possible?

Today, SMRs are at a stage of development roughly analogous to the U.S. auto industry in 1900—when there were more than a thousand companies making autos, using multiple technologies, in a frenzy of experimentation. By the early 1930s, internal combustion engines (ICE) had won out over electric and steam, the industry had consolidated into three dominant companies (Ford, GM, and Chrysler) plus a handful of others, and mass production led by Ford had opened the door to the cheap cars that drove the American Dream. To get there, the 1,000-plus auto companies operating in 1900 raced to iterate—new designs, new technologies, new ways of manufacturing, new marketing strategies.

In SMRs, not only are there no clear winning companies yet, but also the basic technology has not yet been defined. In 1900, steam-powered cars outsold ICE and electric vehicles, but we all know what happened after that.[41] Today, SMR designs include at least four different kinds of coolants, for example, and multiple different fuels among many other varying design choices. We still don’t know what the SMR equivalent of internal combustion will be.

Further, there are clear tensions between innovation and cost certainty. In order to find the best technologies, markets, and solutions, SMRs will need to innovate—probably many times. But innovation is the enemy of replication and hence scale: Building the first of a kind is both more expensive and riskier. The experience with nuclear more generally shows that the path to reduced cost is through focused exploitation of a selected technology which can be replicated and (for SMRs) manufactured rather than stick built.

Clients have clearly gotten the message, and nuclear power suppliers are now being forced to address this tension. EDF, the French national champion in nuclear energy, has now abandoned years of work on innovative SMR designs and will return to PWR technology to meet the demands of its customers who require certainty that energy will be produced at a levelized cost of €70–€100/MWh. To do that, it will use only proven technologies.[42]

Box 3: Early Auto Industry Technology Innovations in the United States

In the first three decades of the 20th century, the auto industry developed and then adopted scores of important innovations, including the following:

§ Electric ignition starters: Invented in 1911 and made standard by the late 1920s, these allowed drivers to start the engine with a button instead of a manual hand crank.

§ Drive-in service stations: The first drive-in opened in Pittsburgh in 1913, offering services such as lubrication, tire repairs, and washing.

§ Automatic transmission: The Sturtevant brothers of Boston developed an early automatic transmission in 1904.

§ Air-cooled engine: General Motors developed an air-cooled engine with copper fins to disperse heat for the 1923 Chevrolet.

§ All-steel body: This innovation was adopted by the Dodge Brothers in 1914.

§ Hydraulic brakes: These were invented in 1919 and first adopted by Duesenberg in 1921 to replace mechanically actuated drum brakes.

§ Synchromesh transmission: This easier-shifting device was invented in 1924.

§ New pyroxylin-based paints, eight-cylinder engines, four-wheel brakes, and balloon tires: These innovations were the biggest trends for 1925.[43]

Iteration is also difficult in a tightly regulated environment, as every significant design change will presumably need to be approved by the NRC, and could potentially reopen NEPA litigation pathways. This will tend to make SMR iteration slooooow. And because it takes many years to deliver even first-of-a-kind reactors, cross-pollination between companies is also drastically slowed. Hydraulic brakes were invented in 1918, and had become industry standard a decade later. It’s hard to believe anything similar will occur so quickly for SMRs.

Finally, it is not clear how the NRC will handle iteration. In general, reactor designs are tightly specified, and only those exact designs are approved when replicating. It is not obvious how the NRC would even begin to think about what is a “significant” design change and what is not, especially as regulation has moved toward a probabilistic model where cascades of small problems are seen as important. However, if all design changes are important, then any change could perhaps trigger the need for NRC review and potentially recertification. Of course, firms will need to do their own due diligence on safety, but we don’t know how much extra work will be demanded by the NRC. It’s also possible that AI will play an important role in the development of simulations to carry some of the regulatory burden.

Transporting SMRs

The point of SMRs is that they are at least in part built in a factory. Smaller microreactors could perhaps be built entirely in a factory and then loaded onto a large tractor-trailer for transport. Larger ones will be partly built on-site. Rolls Royce’s huge 470 MW SMR is in part built using Rolls’s turbine manufacturing skills and technologies in a factory. But it will require 2,000 container loads to deploy, and will then be assembled on-site. Microreactors, in contrast, can be designed around the limitations of a single large container-sized truckload.

Transportation for small nuclear reactors is not new. Eighty-three nuclear powered ships and submarines are currently operated by the United States, for example. Submarines seal radiation behind a heavyweight barrier at an aft bulkhead while allowing radiation to escape in other directions (into the sea—hence, divers cannot safely operate while the reactor is running). Nuclear powered aircraft carriers are essentially small floating cities, big enough to accommodate the enormous amount of shielding and the multiple layers of safety provisioning that are required.[44] There have been smaller experiments as well: The U.S. Army built truck-mounted reactors in the 1960s (the ML-1), but that project failed. It is now trying again with Project Pele.

Box 4: The U.S. Army’s Portable Nuke: The ML-1

The ML-1 was an experimental mobile nuclear reactor developed by the U.S. Army in the early 1960s, featuring a unique design: a nitrogen-cooled, water-moderated reactor with a nitrogen turbine energy conversion system.

It was engineered to be highly portable, transportable in six containers weighing approximately 38 tons total. It could be moved by C-130 aircraft, trucks, or rail. Its low weight, however, meant reduced protection, and it required humans to stay 500 feet away.

The ML-1 project faced significant technical challenges. The experimental heat engines generated only two-thirds of planned power output. There were other issues as well: poor compressor performance, cracked moderator water tubes, and failure of internal regenerator insulation. The project was ultimately abandoned due to increasing Vietnam War expenses, budget constraints, technical difficulties, and caution regarding premature field testing.[45]

SMRs face several transportation challenges, including:

▪ potential mechanical stress during transportation;

▪ radiation shielding during transit;

▪ securing nuclear materials against potential accidents or external threats; and

▪ maintaining reactor integrity during movement.

The physical challenge of transporting reactors. SMRs range from 20 to 300 MW—one third to 1/50th the size of large reactors.[46] But even the smallest are still large pieces for equipment. Trucks are the most flexible and cheapest form of transportation for reactors but face significant size constraints.[47] Trains and barges can handle much bigger equipment in one trip, but are far less flexible. Barges can work only where the infrastructure is available to offload heavy machinery. Trains work only where there are train tracks.[48] Both still require additional transportation after delivery, in most cases. Vessel size determines whether a reactor can be transported in one piece. The 77 MW NuScale VOYGR SMR modules are smaller than many SMR designs, but will still weigh 700 tons in total, and must be shipped in at least three different segments.[49]

DOE’s nuclear fuel management program has funded development of new railcars for transporting SNF to the consolidated interim storage facility. The railcar project took 10 years to complete and cost approximately $33 million before receiving regulatory approval.[50] It is also providing $16 million for R&D of containers specifically designed for transporting HALEU fuel. Presumably, this research will be completed in time to meet demand when HALEU SMRs become commercially available.[51]

Security in transit. The transportation of a nuclear reactor presents new security vulnerabilities. SMRs may be fuel loaded before transit, and there will (if successful) be many SMRs on the move, so there will be a lot more nuclear material in transit to protect.

Radiation leakage is the greatest risk from the transportation of SMRs. While most SMRs will be transported in pieces and fueled on-site, some will be fabricated and fueled in a factory.[52] Radiation exposure for those reactors must be limited to safe levels throughout transit, but the NRC and the International Atomic Energy Agency (IAEA) have yet to provide meaningful guidance, and DOE does not appear to have committed to following IAEA’s international standards on nuclear packaging covering its composition, material categorization, documentation, and labelling.[53]

The U.S. Environmental Protection Agency (EPA) is the regulator for nuclear transportation (once it meets a threshold of radioactivity). Highly radioactive packages must be encased in specially designed casks that are tested against extreme accident conditions (e.g., being dropped from 30 feet in the air, or onto a steel spike, or burned in a gasoline fire for 30 minutes, or submerged in water for eight hours).[54] However, EPA has not yet offered even draft regulations for SMRs, and it is not even clear whether a fully fueled reactor should be regulated as a reactor (and hence perhaps by NRC) or as a fuel package to be regulated by EPA. The former would be a new approach for regulators.

The transportation of SMR fuel is a source of additional concern. Because the HALEU fuel required by most new SMRs is more highly enriched than fuel used in large PWR reactors, new packaging for that fuel will likely be necessary.[55] It is not yet clear how IAEA—or U.S. agencies—plan to adjust existing transportation regulations for these new more radioactive technologies.[56]

Transportation issues have been largely avoided by SMR companies in their public statements, while regulatory agencies are just beginning to address SMR-specific issues in transportation. Radiation risks, size and mobility, security, cost implications, and regulatory peculiarities are just the tip of the iceberg, suggesting that there will be a lot of work to do, even though nuclear fuel and nuclear waste have been transported across the United States for many years, and the absence of nuclear incidents suggests that these regulations are effective.

How Will SMRs Handle Their Waste?

Nuclear waste will vary substantially depending on the nuclear technology used and a company’s design (see figure 7). Broadly, nuclear waste is divided into three categories: low-level nuclear waste (LLW or Class C); intermediate-level waste (known as “greater than class C waste” or GTCC); and high-level nuclear waste (HLW).[57] LLW can include protective clothing and equipment (e.g., gloves, coveralls, and shoe covers); filters used to clean air and water systems; tools and instruments used in reactor maintenance (e.g., wrenches, gauges, and monitors); and materials from decommissioning as plant systems, structures, and components are removed, including concrete, piping, wiring, and metal structures, all of which may become contaminated.

GTCC waste includes used fuel from commercial nuclear power plants, from radioactive medical waste, industrial and research activities, and from DOE itself (especially from nuclear armaments and the cleanup of legacy facilities).

Figure 7: SNF generated by different kinds of reactors[58]

As of 2024, there were four U.S. intermediate disposal sites that could take LLW that is not suitable for local disposal. LLW from advanced reactors (including SMRs) should be accommodated within these four sites. In May 2024, NRC issued a proposed rule that would authorize the near-surface disposal of some GTCC, but there has been strong political opposition to constructing a facility, particularly from the governors of Texas and New Mexico. Currently, DOE needs congressional action before it can move forward on GTCC disposal, under the Energy Policy Act of 2005.[59]

HLW includes both SNF and waste products from the reprocessing of that fuel. [60] The United States, under intense political pressure, has abandoned efforts to build an HLW facility at Yucca Mountain in Nevada. However, other countries are moving forward.

Finland’s Onkalo repository is the first HLW site to begin trial operations. Originally designed to accommodate 6,500 tons of SNF, it has since increased capacity to 9,000 tons, and new tunnels will be constructed in parallel with operations.[61] In France, the Cigéo project aims to store waste in a 500-meter-deep clay layer, and should be operational by the late 2030s.[62] Canada’s Nuclear Waste Management Organization is developing a repository expected to open by the 2040s, with site selection now completed in partnership with local communities. [63]

Sweden’s Forsmark repository will encapsulate waste in copper canisters and then store it in bedrock. It will have 500 tunnels at 500-meter depth, with the capacity to store 12,000 tons of SNF. It is designed to last 100,000 years. Construction has been approved, but will take approximately 70 years to complete. Other countries such as Slovakia are looking to Sweden’s approach as a model.[64]

Hungary, Bulgaria, and the Czech Republic are also making progress. Hungary is expanding its geological disposal plans, while Bulgaria is exploring deep borehole technology.[65] The Czech Republic is reviewing sites for a final repository, with a decision expected by 2030.[66]

In contrast, Germany and Belgium are struggling. Germany is looking for ways to store approximately 28,000 cubic meters of HLW. A search for a final repository began in 2013, but a location decision is not expected until at least 2074, with construction expected to take another 20 years.[67] Belgium has begun construction of a surface disposal facility in Dessel for LLW and GTCC but has not found permanent storage for more hazardous materials.[68]The Netherlands is not expected to commit to a final disposal site until around 2100, focusing instead on storing HLW from its Borssele nuclear power plant in solidified glass containers.[69]

China has 46 nuclear reactors currently operating, with 11 more under construction. It will store high-level waste in a stable geological formation 500–1,000 meters underground, and is expecting construction of a final repository around 2050.[70] Industrial-scale disposal of LLW and GTCC occurs at three sites, the first phase of five planned regional disposal facilities.[71]

China is also exploring a closed nuclear fuel cycle strategy wherein SNF is first stored and then reprocessed for use in fast reactors. It operates a pilot reprocessing plant in Gansu, and is partnering with France to build a new plant capable of producing mixed oxide fuel for PWRs. China is also exploring fast (breeder) reactors; construction of the first commercial unit (1,000–1,200 MWe) could start in December 2028, with operations expected in 2034.[72]

In the United States, NRC is still seeking a deep geological repository for permanent storage. But no such facility exists for commercial nuclear waste, and none is currently under development since the collapse of the Yucca Mountain project in 2010. The only operating deep geologic disposal site in the United States is the Waste Isolation Pilot Plant (WIPP) in New Mexico, created to store defense-related transuranic waste. WIPP experienced a major accident in 2014, leading to significant delays and repair costs. Estimated costs to fix the facility are up to $2 billion, and full operations cannot resume until a new ventilation system is completed—perhaps in 2026.[73]

In the absence of any permanent deep geologic sequestration site, SMR companies are developing plans to store SNF indefinitely in interim storage facilities that they will build on-site. TerraPower and X-energy have both submitted relevant plans to NRC for approval, which suggests that this could be a model at least for larger SMRs.[74] DOE has also announced plans to develop a federal consolidated interim storage facility for SNF, with an initial capacity of 15,000 metric tons (with expansion potential).[75] However, it is much less clear how SNF will be managed for much larger numbers of microreactors.

Overall, while significant progress has been made in certain countries, the safe, permanent disposal of nuclear waste remains a pressing challenge across Europe as facilities fill up and new solutions are developing slowly. The United States has essentially abandoned efforts to find a permanent deep geological storage facility for HLW, and is focusing instead on intermediate storage.

For SMRs in particular, there appears to have been minimal thinking about waste disposal, in part because locations have not yet been decided on. SMRs that use standard fuel will presumably fit within the basic schema currently being operated by DOE, with waste stored at interim facilities. Some more-innovative designs may generate substantially less waste, and in particular less HLW. MSRs, for example, could be designed as breeder reactors.

SMRs and Security

The cost of security for nuclear reactors is nonlinear. Protecting a 1,000 MW site is not 10x more expensive than protecting a 100 MW site, and that in turn is not 5x the cost of protecting a 20 MW site. Some critics have argued that these nonlinear costs will make SMRs relatively more expensive. While most site-level security costs are hidden behind corporate privacy, analysis suggests that for large nuclear sites, direct security costs account for roughly 5 percent of annual operating expenses.[76]

Aside from providing for physical security, SMRs can also be less-attractive targets for acquisition and capture—they can use lower levels of uranium enrichment and can also make fuel extraction very difficult (e.g., by integrating fuels into other materials). But they may still be targets for destruction, acting as a kind of radiation bomb for bad actors. Site-level security is therefore another area where regulators and companies will have to develop suitable programs and metrics specifically for SMRs.

Market Risks

SMEs face substantial risks on both the supply and the demand side of the market.

Supply Side

Supply-side risks encompass all the possibilities on the production side that could lead an SMR company to be outcompeted and eventually fail. In part, these risks are a story about the competition, to which we will return shortly. But they is also a story about construction.

Construction Risks

Bluntly, the construction of large nuclear plants has been a story of relentless overpromising and under-delivering, of construction that takes much longer and costs much more than expected. The time to construct a large reactor grew from around 5 years during the 1960s nuclear boom to more than 10 years. That led to a tripling of overnight CapEx in real terms.[77] It is now estimated that Sizewell C in the United Kingdom will cost £40 billion for 3.2 GW of power—up from £16 billion at inception. French, Finnish, and U.S. plants have suffered similar though not as extreme delays. Even in France, where nuclear is the largest source of power and where EDF has been building plants for decades, costs have ratcheted up significantly. More broadly, a 24-month delay in plant construction is associated with about a 10 percent increase in the levelized cost of energy.[78] Thus, SMRs operate in a world where the likelihood that nuclear construction will be delivered late and well over budget is a very present risk.

SMRs should avoid some of this construction risk, as they are partly or wholly built in a factory and then simply delivered and installed on-site. This process should be much shorter overall than large nuclear construction. Of course, SMRs still need containment and control structures, and connection to the grid, but the cost of the actual reactor might be cut substantially. However, that does not mean SMRs can entirely avoid construction risks: the failure of NuScale’s pilot project in Utah is explicitly tied to inflation in construction costs (see box 5).

Box 5: NuScale’s Failure in Utah

NuScale’s proposed flagship SMR project in Utah has closed because it became uneconomic, as the projected cost of construction increased by 75 percent (to $9.3 billion) between 2021 and 2024. As a result, the estimated cost of electricity per MWh increased from $58 to $89, even after including a $30/MWh subsidy under the Inflation Reduction Act (IRA).

NuScale is seen by industry critics as the canary in the SMR coal mine, arguing that the most advanced commercial deployment for SMRs in the United States has failed, and therefore SMRs are a failure. This seems premature at best.