Beyond the Numbers: The Truth About US Business R&D Growth

Advanced Manufacturing Industries 6

Introduction

Business research and development (R&D) spending is key to the innovation economy. As such, the fact that domestic business R&D expenditures increased 15 percent from 2021 to 2022 should be good news. But not so fast. The growth of business R&D spending from 2018 to 2022 was quite uneven, with nonmanufacturing industries’ growth rate far exceeding that of manufacturing industries. This means that manufacturing industries are growing their R&D much more slowly, including advanced industries that the United States relies on for global competitiveness. For the United States to successfully compete with China, most industries need to be strong in innovation, which requires robust R&D increases. As such, Congress should pass pro-innovation tax reforms, including restoring the full expensing of R&D expenditures and doubling the R&D credit.

R&D Spending Trends

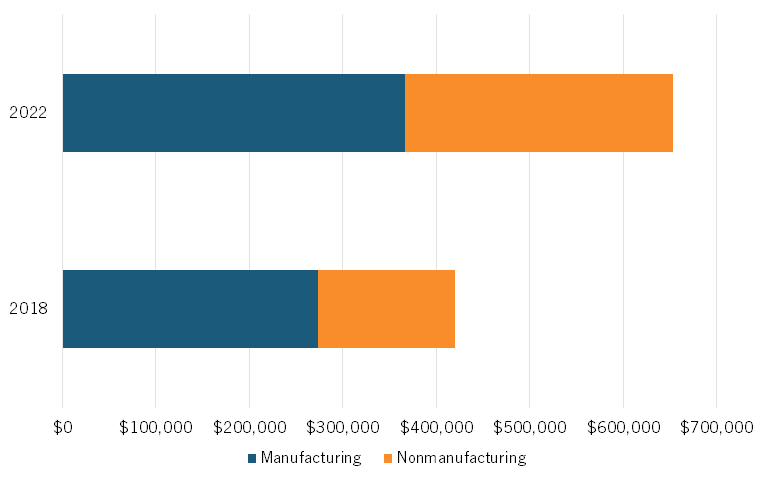

The National Science Foundation (NSF) recently released its 2022 Business Enterprise Research and Development Survey, which shows that U.S. businesses spent $653.5 billion on R&D in 2022, a 55 percent increase (in nominal dollars) from 2018’s spending of $420.5 billion. (See figure 1.) However, when controlling for GDP growth, business R&D spending only grew 30 percent faster than GDP.

Figure 1: Domestic R&D spending ($ millions) for manufacturing and nonmanufacturing industries

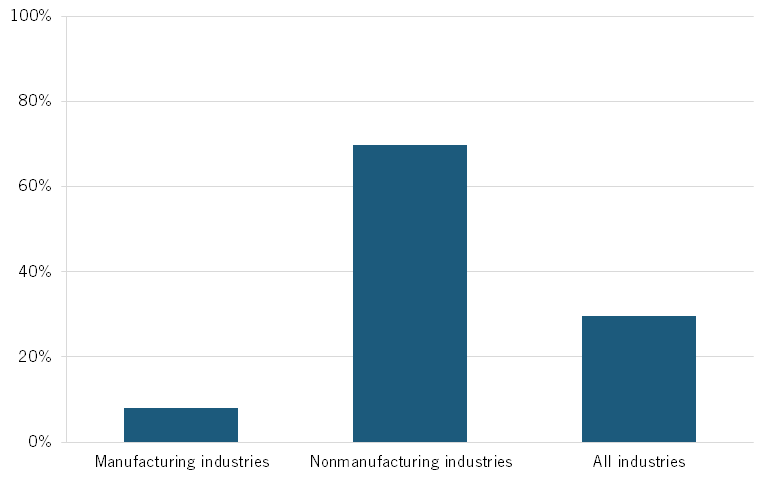

This overall growth masks significant differences between manufacturing and nonmanufacturing R&D growth. Manufacturing R&D only grew 8 percent from 2018 to 2022 when controlling for nominal GDP growth. In contrast, nonmanufacturing R&D grew nine times faster (70 percent). (See figure 2.)

Figure 2: R&D spending growth (controlled for GDP growth) from 2018 to 2022

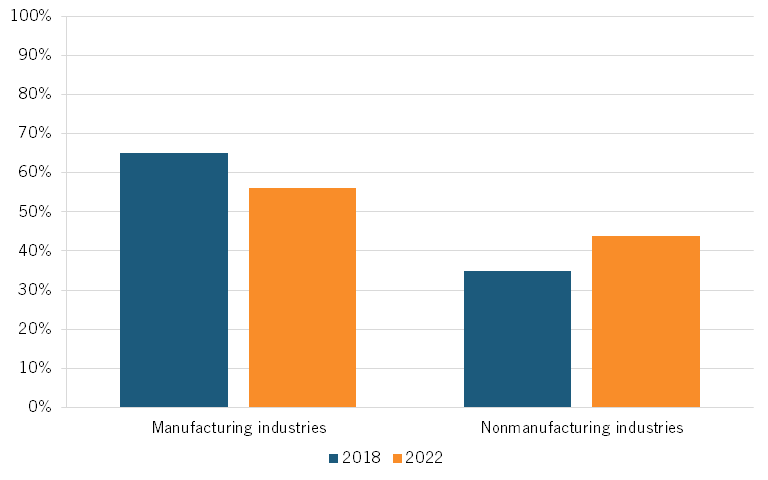

In 2018, manufacturing accounted for 65 percent of U.S. business R&D and nonmanufacturing industries accounted for 35 percent. Over the next four years, nonmanufacturing accounted for 60 percent of the growth in R&D, 73 percent more than their share would have predicted. In contrast, manufacturing accounted for 40 percent of the growth, 40 percent less than their share would have predicted. As a result, manufacturing industries’ share of R&D spending declined to 56 percent while nonmanufacturing industries’ share rose to 44 percent. (See figure 3.)

Figure 3: Manufacturing and nonmanufacturing industries' R&D share in 2018 and 2022

Manufacturing Industries

This discouraging outlook becomes even worse when removing the overcontribution to growth from the few industries that boosted the manufacturing industries’ overall R&D share in 2022. Indeed, only 4 of the 32 manufacturing industries (with available data) contributed a larger share to R&D growth than their 2018 share would have predicted, boosting the 2022 R&D share. (See table 1.) For example, the semiconductor and other electronic components industry accounted for 8 percent of the business R&D spending growth, 16 percent more than their share in 2018 would have predicted. Without this industry’s over contribution to growth, all manufacturing industries’ R&D spending would have been 0.4 percentage points lower in 2022.

Collectively, these 4 industries accounted for 1 percentage point growth in R&D spending. Alternatively, consider the medical equipment and supplies industry, which accounted for 2.6 percent of the growth, 29 percent lower than its 2018 share would have predicted. Without its under contribution to growth, manufacturing R&D spending would have been 0.4 percentage points higher. The 29 under contributing industries collectively led to a 9 percentage point decline in R&D share during this period.

Table 1: Manufacturing industries' R&D share in 2018 and contribution to R&D growth from 2018 to 2022

|

Industry (All NAICS) |

R&D Share in 2018 |

Share of Change in R&D |

|

Guided missile, space vehicle, and related parts |

0.1% |

1.8% |

|

Military armored vehicle, tank, and tank components |

0.0% |

0.0% |

|

Semiconductor and other electronic components |

6.9% |

8.0% |

|

Electrical equipment, appliances, and components |

1.0% |

1.0% |

|

Food |

1.1% |

1.0% |

|

Semiconductor machinery |

0.9% |

0.8% |

|

Fabricated metal products |

0.5% |

0.4% |

|

Medical equipment and supplies |

3.6% |

2.6% |

|

Pharmaceuticals and medicines |

22.8% |

15.9% |

|

Motor vehicles, bodies, trailers, and parts |

6.1% |

3.9% |

|

Other machinery |

1.5% |

0.8% |

|

Primary metals |

0.2% |

0.1% |

|

Wood products |

0.1% |

0.0% |

|

Electromedical, electrotherapeutic, and irradiation apparatus |

0.7% |

0.4% |

|

Plastics and rubber products |

0.7% |

0.2% |

|

Other transportation |

0.4% |

0.1% |

|

Basic chemicals |

0.6% |

0.2% |

|

Agricultural implement |

0.5% |

0.1% |

|

Engine, turbine, and power transmission equipment |

0.6% |

0.2% |

|

Other miscellaneous manufacturing |

0.6% |

0.1% |

|

Paper |

0.2% |

0.0% |

|

Nonmetallic mineral products |

0.3% |

0.0% |

|

Soap, cleaning compound, and toilet preparations |

0.7% |

0.1% |

|

Furniture and related products |

0.1% |

0.0% |

|

Communications equipment |

3.0% |

-0.2% |

|

Resin, synthetic rubber, and artificial synthetic fibers and filaments |

0.4% |

-0.1% |

|

Aircraft, aircraft engine, and aircraft parts |

2.7% |

-0.8% |

|

Petroleum and coal products |

0.4% |

-0.2% |

|

Printing and related support activities |

0.1% |

0.0% |

|

Beverage and tobacco products |

0.3% |

-0.2% |

|

Textile, apparel, and leather products |

0.2% |

-0.2% |

|

Search, detection, navigation, guidance, aeronautical, and nautical system and instruments |

0.8% |

-0.6% |

Advanced Manufacturing Industries

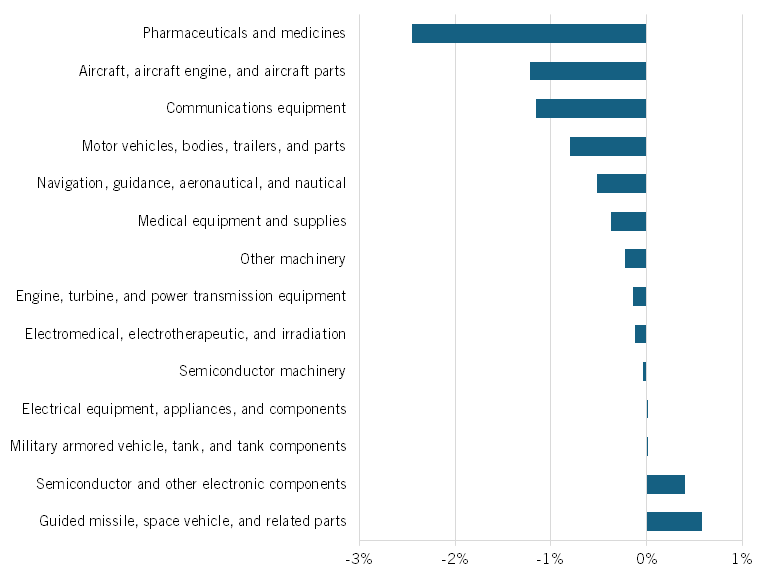

Due to the declining R&D share in manufacturing industries, many advanced industries’ R&D investments are not keeping up with the overall average growth rate (55 percent) and contributing their fair share. This is because many advanced industries tend to be manufacturing ones. Indeed, 13 ITIF-designated advanced industries fall under manufacturing in the NSF dataset. As such, their share of R&D spending in 2022 also declined. Of the 13 advanced manufacturing industries, only 4 contributed more than their 2018 share would have predicted. (See figure 4.) The other nine did not. For example, the motor vehicles, bodies, trailers, and parts industry’s growth rate was below average at 35 percent, while its contribution to growth was 37 percent less than its 2018 share predicted. As such, its R&D share declined from 6.1 percent in 2018 to 5.3 percent in 2022. This is especially problematic because innovation is crucial to these industries remaining competitive and keeping their global market share from being lost to another nation. As ITIF explains, “Once lost, a firm’s—or a nation’s—technology advantage is almost impossible to regain.”

Figure 4: Advanced manufacturing industries' change in R&D share from 2018 to 2022

Nonmanufacturing Industries

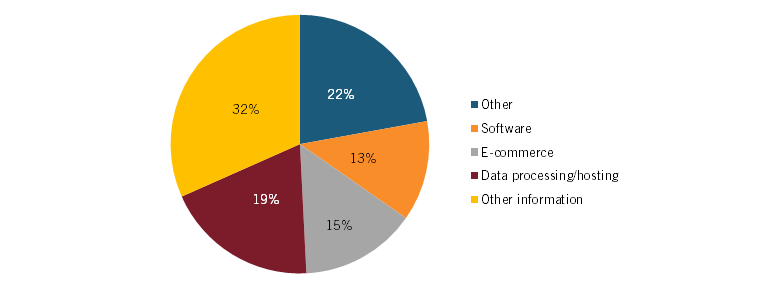

Moreover, the growth in nonmanufacturing is also quite concentrated, with approximately 78 percent coming from just 4 industries: electronic shipping and electronic auctions, data processing, hosting and related services (e.g., cloud providers), software publishers, and other information (e.g., Internet companies). (See figure 5.) This NSF data emphasizes the importance of “looking under the hood” and not just at top-line numbers. While the latter appears very impressive, 40 percent of the faster growth than overall R&D is due almost exclusively to the information technology sector.

Figure 5: Share of growth in nonmanufacturing R&D by industries

There should be two main conclusions from this data. The first is that nonmanufacturing IT industries are powering U.S. R&D growth. As such, current efforts to hamstring those sectors through antitrust regulations, for instance, amount to a national suicide pact. The second is that the positive top-line numbers hide real weaknesses in U.S. manufacturing innovation and, ultimately, competitiveness. Chinese industrial R&D is not standing still. In fact, it grew about 70 percent from 2018 to 2023.

Recommendations

Congress should pass pro-innovation tax reforms that will encourage firms in all industries, but particularly those in manufacturing, to increase their R&D investment. Policymakers should start by restoring full expensing of R&D expenditures, as this will reduce the after-tax cost of R&D investments and incentivize businesses to put more money toward research and development. Additionally, Congress should double the R&D tax credit from 20 to 40 percent for the regular credit and 14 to 28 percent for the Alternative Simplified Credit.