Why Is the EU So Reticent About Challenging Beijing?

In May 2024, the United States passed 13 sweeping tariffs on imported high-tech goods from China. In June 2024, the European Union passed a narrow, variable tariffon Chinese electric vehicles. The U.S. passed a tough overall adjustment of its Foreign Direct Investment Review Act, but the EU made only modest changes. Time and time again, the United States has been willing to stand up to China and fight back. Considering the EU's greatest ally is the U.S., why has it been slow to respond and stand alongside America in taking stern action?

For years, China has been bolstering its most strategically important sectors to distort the global economy through intellectual property (IP) theft, protectionist policies, and massive subsidies, which encourage overcapacity and artificially low prices. These practices go directly against World Trade Organization (WTO) policies and its primary goal of open and fair trade. While the United States has imposed export controls on China to limit its military and commercial advantage, the EU has largely stood by and watched.

For example, following an investigation by the European Commission into Chinese nonmarket practices, the EU passed limited, weak tariffs against China in an attempt to show parity with U.S. policy while avoiding anything close to legitimate parity. The EU applied tariffs between 17 and 38 percent to Chinese automakers, far less than that of the United States, with the tariff value depending on the level of cooperation automakers contributed during the EU’s preliminary investigation. Additionally, these tariffs apply not just to Chinese firms, but also to American and European automakers operating in China, such as Tesla, BMW, and Volkswagen.

Unlike the United States, the European Union has made it clear that these measures are not being instituted to remove Chinese products from the European market, but rather for the sake of leveling the playing field. The question few are asking is why the EU isn’t adopting policies more similar to the United States. Why isn’t the European Union aligning its trade policies with one of its closest allies? Why do EU nation presidents still lead business delegations to China, begging for more sales?

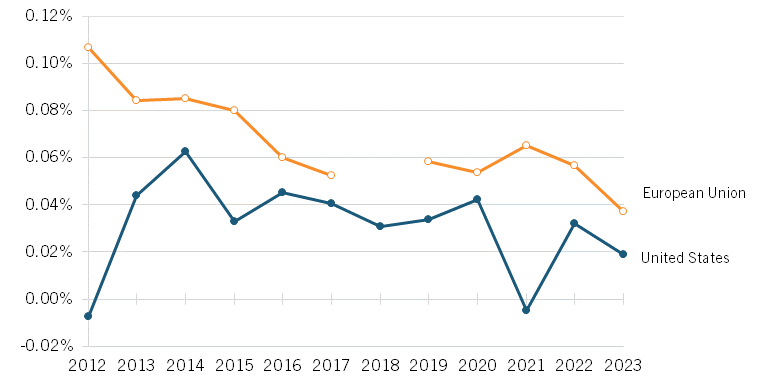

Clearly, part of the answer is euros. European companies invest more in China than U.S. companies. Both U.S. and EU companies have invested billions of dollars in China through foreign direct investment (FDI). However, the United States has consistently invested less than the EU for over a decade. The EU’s outward FDI to China as a share of its GDP is twice as much as that from the United States, 0.04 percent to 0.02 percent.

Figure 1: Outward FDI flows to China as a share of U.S. and EU GDP

Though it has decreased in recent years, FDI data shows that EU firms are still tightly intertwined with China, and it is in the interest of the EU to keep it that way, even if that means undercutting its core ally, America, and enabling Chinese technological advancement. The sad reality is that as China has shown over and over again, it lets in and even encourages FDI only to extract what it can from foreign companies before finally booting them out altogether. Just ask Siemens for high-speed rail or Ericsson and Nokia for telecom. It’s amazing the Volkswagen, BMW, and Daimler CEOs still think they can thrive in China’s market.

Outward FDI from China to the EU further corroborates this theory. Despite overall FDI flows from China falling over the past few years, greenfield investment (e.g., new or expanded plants) in Europe exploded. In 2022 and 2023, greenfield investment shot up by 51 percent and 78 percent, respectively. The electric vehicle sector comprised over two-thirds of the outward FDI from China to the EU. Neither the EU nor EU nations want to alienate Beijing.

While the United States continues to fight China as it distorts global markets for its gain, Europe complains; not about China, but about how the U.S. is distorting trade. If Western nations are to hold China accountable for its actions in IP theft, dumping, and over-subsidizing, the European Union needs to pay the short-term price for long-term gain and stand alongside the United States in taking tough action.