How Innovative Is China in AI?

China’s relentless drive and strategic investments in AI suggest it is only a matter of time before it catches up—if not surpasses—the United States’ early lead.

KEY TAKEAWAYS

Key Takeaways

Contents

China’s AI Industry and Market 4

How China Supports Its AI Innovation Ecosystem. 5

The Chinese Government Provides Financial Support to Domestic AI Firms 5

Top Chinese Start-Ups Are Pushing the Boundaries of AI 6

China’s Frontier AI Models Are Closing the Performance Gap With the United States 8

Assessing Chinese Innovation Inputs for AI 11

China’s Government Policies Supporting the AI Sector 22

China’s Strategy for AI Innovation. 22

China’s Industrial AI Strategy 24

China’s Strategy for AI Resources 24

Introduction

Artificial intelligence (AI) refers to the simulation of human intelligence in machines, enabling them to perform tasks such as visual perception, speech recognition, decision-making, and language translation. The field has advanced significantly in the past decade, and researchers have pushed the boundaries of AI technology with large language models (LLMs) that perform a number of tasks as well as humans.[1]

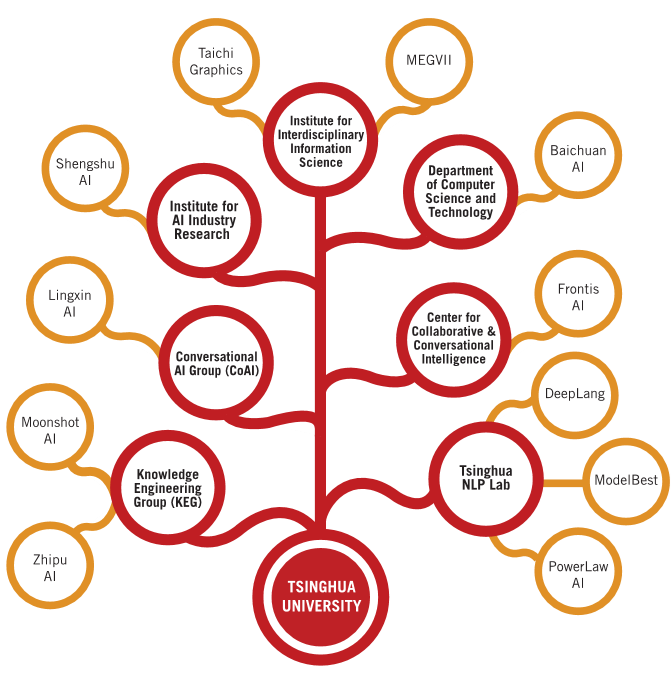

The United States has been at the forefront of AI innovation, benefiting from leading research universities, a robust technology sector and, until now, a supportive regulatory environment. However, China has emerged as a formidable competitor over the past decade.[2] And the narrative that China is merely a copier is false and outdated. China’s strong academic institutions and innovative research, particularly from Tsinghua University, has produced the majority of China’s top AI start-ups, including the current top four generative AI start-ups—Zhipu AI, Baichuan AI, Moonshot AI, and MiniMax—all founded by its faculty and alumni. China now produces more AI research than the United States, and it is rapidly closing the performance gap with U.S. LLMs, especially in bilingual benchmarks.

While China leads in research volume, the United States excels in translating cutting-edge research into real-world products, driven by its private-sector firms. This is evidenced by the United States producing more notable machine learning and foundation models, with 61 notable machine learning models compared with China’s 15 in 2023, and 109 U.S. foundation models compared with 20 from China.

China’s financial landscape further underscores its rapid catch-up. Although the United States dwarfs China in private AI investment, foreign investment is beginning to trickle into China’s generative AI sector. The venture capital arm of Saudi Arabia’s Aramco recently backed Zhipu AI in a $400 million deal, highlighting confidence in China’s AI capabilities. The Chinese government is also stepping in to fill funding gaps, supporting domestic AI companies with state-directed capital and financial aids, proving particularly effective in supporting domestic AI companies in regions typically overlooked by the private sector.

Despite extensive U.S. efforts to restrict China’s access to advanced technology through export controls, these measures have had limited success. In fact, these measures have helped spur China to advance its homegrown ecosystem. Chinese companies are circumventing restrictions by training in public clouds wherever they can and innovating with developing on-premises private clouds such as Huawei’s “AI-in-a-box” products wherever they can’t.

The reality is the United States’ efforts to hold back China’s AI progress are unlikely to succeed. China is advancing rapidly in AI research and application, challenging the United States’ dominance in this critical field. Despite hurdles, China’s robust academic foundations, innovative methodologies, and increasing foreign investment are propelling it toward becoming a leading AI powerhouse. The question is not whether the United States can contain China in AI, but whether it can keep ahead.

To implement the goal of increasing AI development, U.S. policymakers should do the following:

1. Stimulate private investment in AI R&D.

2. Revitalize the federal funding process for AI.

3. Avoid policies that undermine U.S. AI leadership and bolster Chinese competitors.

4. Develop a national data strategy to dramatically expand the availability of data for training AI models.

To implement the goal of increasing AI adoption, U.S. policymakers should do the following:

5. Create a national AI roadmap for adoption.

6. Prioritize the rapid adoption of AI in the federal government.

7. Support digital transformation.

8. Incentivize AI workforce training investment.

Background and Methodology

The Smith Richardson Foundation provided support to the Information Technology and Innovation Foundation (ITIF) to assess how innovative Chinese industries are. As part of this research, ITIF is focusing on particular sectors, including AI. To be sure, it’s difficult to assess the innovation capabilities of any country’s industries, but it is especially difficult for Chinese industries. In part, this is because, under President Xi Jinping, China discloses much less information to the world than it used to, especially about its industrial and technological capabilities.

Notwithstanding this, ITIF relied on three methods to assess Chinese innovation in AI. First, we conducted an in-depth case study evaluation of two leading AI companies. Second, we conducted interviews and held a focus group roundtable with global experts on the Chinese AI industry, allowing participants to speak anonymously unless they asked to be named in the report. And third, we assessed global data on AI innovation, including scientific articles, patents, talent, and access to infrastructure.

China’s AI Industry and Market

Nations must have healthy AI ecosystems in order to develop innovative AI technologies and firms. For example, nations must have sufficient venture capital and private equity funding to connect inventors with the money, expertise, and contacts necessary to develop and sell their products or services. Looking at venture capital and private equity funding can therefore be an indicator of innovation capacity. In addition, the number of firms indicates the health of a nation’s ecosystem.

Table 1: Overview of AI companies, investments, and investment value 2014–2024[3]

|

Metrics (Absolute Number or Value) |

China (Mainland) |

United States |

|

Number of companies |

1,944 |

9,500 |

|

Number of incoming investments |

8,194 |

59,534 |

|

Estimated total value of incoming investments (millions) |

$85,650 |

$605,416 |

When comparing the investment scene between China and the United States, the scale and scope in the United States is considerably larger (see table 1). With 9,500 AI companies, the United States hosts nearly five times as many companies as China in absolute numbers. It is important to clarify that in this report, we use data from the Emerging Technology Observatory, a database which relies on proprietary data about the number of firms in the AI category group on Crunchbase. Different reports may use varying definitions of what constitutes an AI firm, leading to discrepancies in existing literature. The Crunchbase AI category includes many different types of AI firms, including those conducting AI research, those developing AI-related products, and those applying AI to significant societal needs. Some studies use broader definitions of AI firms which results in counting more businesses as AI firms.

It also seems to have far more funding flowing into these businesses. AI venture capital (VC) and private equity funding can be concentrated in a few large deals, which is why it is important not only to measure the level of funding in dollar amounts, but to also track the overall number of funding deals. In the United States, there have been almost 60,000 incoming investments in the past decade, dwarfing the almost 8,200 in China. And in terms of value, the difference is significant. Estimated investment values in the United States amount to around $605 billion, far outpacing China’s $86 billion.

Data on VC investments in AI by country from the Organization for Economic Cooperation and Development (OECD) support the finding that Chinese firms have less access to private capital. In 2023, the sum of VC investments in China was just shy of $20 billion, whereas in the United States it was approximately $55 billion.[4] The Chinese government is trying to fill the gap with state-backed financial support.

How China Supports Its AI Innovation Ecosystem

There were three key insights about how China supports original innovation capabilities from the experts we interviewed. First, the Chinese government provides financial support to nurture high-potential firms, especially in regions that might otherwise be overlooked, fostering a broader base for innovation. Second, there is an emerging set of Chinese AI start-ups, supported by the prestigious Tsinghua University, that are not replicating existing technologies but pushing the boundaries of AI innovation, particularly in generative AI. And finally, China is able to produce competitive, and sometimes superior, AI models compared with those from the United States, highlighting its capacity for high-level, original innovation.

The Chinese Government Provides Financial Support to Domestic AI Firms

Several experts we interviewed noted that the Chinese government financially supports the development of domestic AI companies. According to experts, two of the most important mechanisms government uses are government guidance funds and subsidies.

Government guidance funds are essentially state-directed capital funds. These funds are raised from both the public and private sectors and for projects that align with government objectives.[5] According to 2024 research published in the National Bureau of Economic Research, between 2000 to 2023, Chinese government VC funds invested in 9,623 unique firms in the AI space through more than 20,000 transactions, totaling $184 billion.[6] The definition this research uses for AI firms includes firms working on big data, image processing, facial recognition, natural language processing, machine learning, deep learning, neural networks, robotics, automation, computer vision, data science, and cognitive computing.[7]

Government guidance funds are used across a wide variety of strategic industries and business activities, but their impact has been found to be underwhelming. These funds have tended to raise less money than anticipated and have failed to deploy investments in many cases, and there have been too many with overlapping priorities leading to inefficiencies.[8]

But evaluating the funds created specifically for AI firms surfaces three important advantages: First, government VC funds are more spatially distributed than private funds, which are mainly based in China’s wealthy coastal regions.[9] Because Chinese government VC funds are spread more evenly across the country, including less-developed inland areas, the government is helping support high-potential firms in regions private VCs might overlook due to mobility restrictions and information gaps. Second, government VC funds invest in firms that initially show weaker performance indicators, but these firms end up growing faster than those funded by private VCs. Finally, government VC funds often invest in AI firms before private VC funds, and these government investments attract subsequent private VC investments. This pattern is especially strong when the government directly invests in firms with initially weaker performance indicators, suggesting that government choices are seen as valuable signals by private investors.

The Chinese government also supports its AI sector through subsidies. For example, Beijing city authorities have introduced subsidies for firms buying domestically produced AI chips to boost China’s semiconductor industry and lessen dependency on foreign technology.[10] The initiative will provide financial support to companies based on a percentage of their investment in domestically controlled graphics processing unit (GPU) chips. In addition, at least 16 local governments, including the largest, Shanghai, are providing companies with vouchers to access subsidized processing power from large state-operated data centers that consolidate limited supplies of advanced chips.[11]

Top Chinese Start-Ups Are Pushing the Boundaries of AI

Five generative AI start-ups—Zhipu AI, Baichuan AI, Moonshot AI, Minimax, and 01.AI—are among China’s AI “unicorns,” meaning they are valued at over $1 billion and are at the heart of the generative AI ecosystem in the country. The press has dubbed them the “new AI Tigers of China,” as they represent a new wave of AI companies focused on LLMs, like their Western counterparts such as OpenAI and Anthropic.[12] This is also to contrast them with what they call the older technology “dragons,” such as SenseTime, Megvii, CloudWalk Technology, and Yitu Technology that focused mostly on facial and image recognition technologies.[13]

One expert we interviewed said that while many of the new Chinese generative AI companies are trying to replicate OpenAI’s success with ChatGPT, there is no clear leader or breakthrough application that has emerged as the most popular or most widely used in China—and some analysts report that customers struggle to determine which company’s AI solutions are the best for their particular needs. Others, however, argue that Zhipu AI, whose models perform consistently, is the Chinese frontrunner in the race to challenge OpenAI (see more on Zhipu AI in the company case studies section).

Interestingly, the influence of these Chinese start-ups is so significant that even top Western institutions are starting to follow their lead. A recent controversy involving Stanford University revealed that its AI model, Llama 3-V, was suspiciously similar to MiniCPM-Llama3-V 2.5, a model developed by Tsinghua University’s Natural Language Processing Lab and the Chinese start-up ModelBest. Liu Zhiyuan, cofounder of ModelBest, highlighted this shift, acknowledging the “significant” gap between China’s generative AI models and top-tier Western projects such as GPT-4, but also noting that China has rapidly gone “from a nobody more than a decade ago to a key driver of AI technology innovation.”[14]

Tsinghua University in Beijing is at the root of much of China’s entrepreneurship in AI. The elite university has been a critical breeding ground for many of China’s most successful AI start-ups (see figure 1), supporting them with talent, research resources, and funding through the university’s investment vehicles. Zhipu AI was directly incubated within its research labs, while Baichuan AI, Moonshot AI, and MiniMax were all founded by Tsinghua faculty or alumni. Zhipu has also invested in several other start-ups connected to Tsinghua, including ModelBest, Shengshu, and Lingxin AI, indicating a continuous cycle of innovation and growth within Tsinghua’s own AI ecosystem.

Figure 1: The AI start-up scene connected to Tsinghua University[15]

China’s Frontier AI Models Are Closing the Performance Gap With the United States

In the past two years, China has seen a rapid increase in large-scale AI models from leading industry and academic labs. Companies must seek government approval before introducing AI chatbots built on LLMs into the market, and as of March 2024, China’s Cyberspace Administration had approved at least 117 generative AI products.[16] According to data provider IT Juzi, at least 262 start-ups are competing to bring out generative AI products in China.[17]

China’s large-scale AI models fall into two broad categories. In the first category are general-purpose AI platforms used across various sectors, including both closed-source and open-source models. In the second category are industry-specific models tailored to vertical sectors, such as finance, biopharmaceuticals, and remote sensing. An example in the latter group is MathGPT from the TAL Education Group, a smart-learning solutions provider in China. The model is trained on extensive data on mathematics learning and can power different EdTech applications by providing dialogue-based problem-solving.[18]

While China has many companies developing powerful AI models, U.S. models currently outperform them. One expert pointed to performance of U.S. and Chinese models on a comprehensive Chinese LLM benchmark called SuperCLUE. SuperCLUE was developed by a team of researchers, from both Chinese and international labs, to assess model capabilities on Chinese-language understanding, including semantic understanding and extraction, generating code, logic and reasoning, calculations, roleplaying, and safety.[19] From the latest results in 2024, three findings emerge:

1. The gap between the leading models from U.S. industry leaders and those developed by China’s foremost tech giants and start-ups is quickly closing. Figure 2 shows the overall scores for U.S. and Chinese models on the SuperCLUE benchmark in April 2024 and June 2024. In April, the top three models were all different generations of OpenAI’s GPT model series, while the fourth model was Claude, which was developed by U.S.-based start-up Anthropic. Then came several Chinese LLMs. The gap between the best Chinese model (Baichuan’s Baichuan3) and best U.S. model (OpenAI’s GPT-4 Turbo) in April was considered significant, but it was smaller than it was last year.[20] However, just two months later in June, Chinese companies had risen up the leaderboard and dethroned several U.S. models from their top spots. OpenAI’s GPT-4 still leads the pack, but Alibaba’s LLM series Qwen 1.5 ties for second with Claude while Chinese AI start-up DeepSeek newly enters the leaderboard and ties for third with Chinese start-up Zhipu AI’s GLM-4 model and Chinese AI company SenseTime’s Sensechat model.

2. The makeup of players developing China’s top models are a mix of start-ups and tech giants. Models from large tech giants include Baidu’s Erniebot, Alibaba’s Tongyi Qianwen, and Tencent’s Hunyuan, while models from the start-up scene are being led by Zhipu AI, Baichuan AI, Moonshot AI, and MiniMax.

3. China’s open-source LLM ecosystem is gaining significant traction. Alibaba’s LLM series Qwen 1.5 showed impressive capabilities across various sizes, but particularly its largest model with 72 billion parameters. Some iterations of China’s open-source models also beat their U.S. counterpart’s, such as Zhipu AI’s ChatGLM3 and Baichuan’s Baichuan2, which outperformed Google’s Gemma and Meta’s Llama 2 series.[21] Additionally, Hugging Face, which evaluates open-source models, ranks several iterations of Chinese AI start-up 01.AI’s open-source model (called the Yi series) highly for common sense reasoning, math, coding, and reading ability.[22]

Figure 2: Scores of Chinese and U.S. LLMs on Chinese-language understanding based on SuperCLUE benchmark[23]

|

April 2024 |

June 2024 |

||||

|

Model |

Score |

Model |

Score |

||

|

|

GPT-4-Turbo-0125 |

79 |

|

GPT-4o |

81 |

|

|

GPT-4-Turbo-0409 |

77 |

|

Claude-3.5-Sonnet-200K |

77 |

|

|

GPT-4 |

75 |

|

Qwen2-72B-Instruct |

77 |

|

|

Claude3-Opus |

74 |

|

DeepSeek-V2 |

76 |

|

|

Baichuan3 |

73 |

|

GLM-4-0520 |

76 |

|

|

GLM-4 |

73 |

|

SenseChat5.0 |

76 |

|

|

通义千问2.1 |

72 |

|

AndesGPT |

75 |

|

|

腾讯Hunyuan-pro |

72 |

|

GPT-4-Turbo-0409 |

75 |

|

|

文心一言4.0 |

72 |

|

GPT-4 |

73 |

|

|

Moonshot(Kimi) |

70 |

|

Baichuan4 |

72 |

|

|

从容大模型V1.5 |

70 |

|

Doubao-pro-32K-0615 |

72 |

|

|

MiniMax-abab6.1 |

70 |

|

Moonshot(Kimi) |

72 |

|

|

山海大模型 |

70 |

|

山海大模型4.0 |

72 |

|

|

讯飞星火V3.5 |

69 |

|

360gpt2-pro |

72 |

|

|

Llama-3-70B-Instruct |

69 |

|

MiniMax-abab6.5 |

71 |

|

|

阶跃星辰step-1-32K |

69 |

|

通义千问2.5 |

71 |

|

|

qwen-1.5-72B-chat |

68 |

|

文心一言4.0 |

69 |

|

|

云雀大模型 |

67 |

|

Llama-3-70B-Instruct |

69 |

|

|

360gpt-pro |

67 |

|

Gemini-1.5-Pro |

68 |

|

|

GPT3.5-Turbo-0125 |

67 |

|

阶跃星辰step-1-32K |

68 |

|

|

Gemini-Pro |

64 |

|

讯飞星火V4.0 |

67 |

|

|

qwen-1.5-14B-chat |

64 |

|

GPT-3.5-Turbo-0125 |

64 |

|

|

Llama-3-8B-Instruct |

57 |

|

Yi-1.5-34B-Chat-16K |

63 |

|

|

XVERSE-13B-L |

56 |

|

qwen2-7B-instruct |

62 |

|

|

qwen-1.5-7B-Chat |

55 |

|

XVERSE-65B-2-32K |

60 |

|

|

Llama-3-70B-Instruct |

54 |

|

qwen1.5-32B-chat |

57 |

|

|

Baichuan2-13B-Chat-v2 |

53 |

|

Llama-3-8B-Instruct |

54 |

|

|

ChatGLM3-6B |

51 |

|

Baichuan2-13B-Chat-v2 |

53 |

|

|

Gemma-7B |

44 |

|

Yi-1.5-6B-Chat |

53 |

|

|

Chinese-Alpaca2-13B |

44 |

|

Phi-3-mini-128K-Instruct |

40 |

|

|

Llama2-13B-Chat |

41 |

|

Gemma-7B |

38 |

|

|

Llama2-7B-Chat |

40 |

|

qwen2-1.5B-instruct |

38 |

|

|

|

|

Llama-2-13B-chat |

35 |

|

Assessing Chinese Innovation Inputs for AI

Several metrics reveal important insights about the current state of Chinese innovation capabilities. In this report, we examine four categories of metrics—research, patents, talent, and infrastructure—to gauge the overall health and potential of the AI ecosystem in China.

AI Research

For years, the dominant narrative in AI research has been that while Chinese institutions generated the greatest quantity of AI papers, the quality of those papers lagged behind, and much of China’s research involved applying fundamental advances made by researchers in the United States, Europe, and elsewhere. Indeed, China has long pulled ahead in the sheer volume of AI research, with the five largest global producers of AI research articles being Chinese institutions.[24] Despite this quantity, the quality, often measured by citations, has traditionally been higher in the United States, where both academic institutions and private-sector firms are producing cutting-edge research that translates more effectively into practical applications.[25]

The dynamic for the emerging field of generative AI is different. Currently, China and the United States both publish at similar levels, with China having around 12,450 generative AI publications as of 2023 and the United States having 12,030.[26] China has a smaller group of prolific institutions at its publication helm, as shown by the fact that half of the top 10 publishers in the world are Chinese organizations (see figure 3).

However, despite being comparable in terms of the number of publications, China and the United States differ significantly in terms of citations. On the top 10 list of top-cited generative AI research, China only claims one spot. The United States, by comparison, claims half of the leaderboard, including four of the top five (alongside Canada).

Figure 3: Leading organizations in AI generative research in 2023[27]

|

All Research |

Top-cited Research |

|

|

1 |

|

|

|

2 |

|

|

|

3 |

|

|

|

4 |

|

|

|

5 |

|

|

|

6 |

|

|

|

7 |

|

|

|

8 |

|

|

|

9 |

|

|

|

10 |

|

|

Interestingly, all the top 10 institutions in AI research from China are academic institutions, whereas the institutions producing top-tier AI research from the United States are a mix of academic organizations and private-sector firms. In fact, the wider top 20 leaderboard given in a 2024 report from the World Intellectual Property Organization (WIPO) shows that all the companies that feature on the top 20 leaderboard are U.S.-owned (Alphabet, Meta, DeepMind, NVIDIA, OpenAI, Microsoft, Twitter, and Indico Research).[28] All other entrants on the publications and citations lists from all countries, including China, are universities or research institutions.

This distinction is significant because it shows that the active involvement of U.S. private-sector firms in AI research is a major factor in maintaining the United States’ leadership. This strong presence of industry-driven research ensures that the United States remains at the forefront of AI innovation, not only producing high-quality research but also rapidly converting it into impactful technologies and applications. Indeed, the United States produces more notable machine learning models and foundation models than does China. In 2023, the United States had 61 notable machine learning models while China had only 15.[29] Most of the world’s foundation models have originated from the United States (109), compared with those from China (20).[30]

AI Patents

Intellectual property rights have long been recognized as fostering innovation. The idea is that those who combine the spark of imagination with the grit and determination to see their vision become reality in books, technology, medicines, designs, sculpture, services, and more deserve the opportunity to reap the benefits of their innovation—and that those rewards incentivize more creative output. Patents can therefore indicate the ability of a firm or nation to innovate. China has a higher number of AI patents, but the United States surpasses in patent quality.

The number of global AI patents has increased sharply in recent years. From 2021 to 2022, AI patent grants worldwide increased by almost 63 percent, and since 2010, the number of granted AI patents has grown more than 30-fold. The United States and China dominate the filings for AI patents, followed by Japan. These three offices account for 78 percent of total patent filings according to a 2019 report from WIPO.[31]

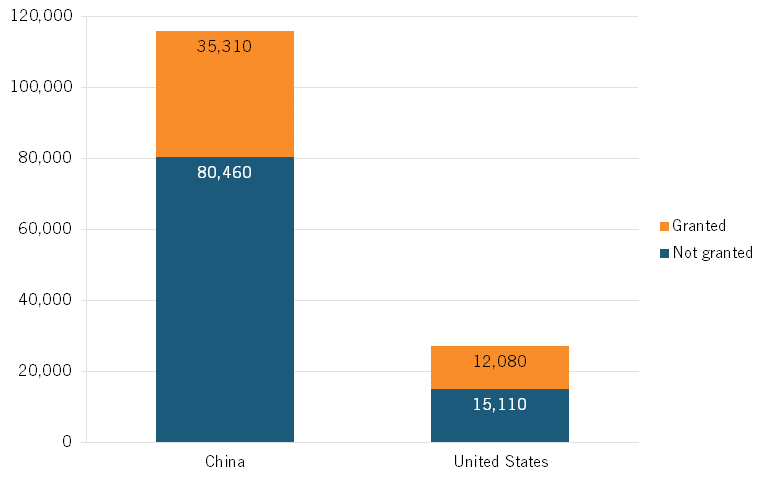

That said, China is far and away the leader in number of AI patents (though it lags behind in patent quality, as discussed later); China has been the largest originator of granted AI patents since 2013, and in 2022, Chinese organizations filed approximately four times as many AI patents as their U.S. counterparts and the Chinese patent office granted almost three times more than the U.S. patent office did. (See figure 4.) In fact, a 2024 report from WIPO on generative AI finds that since 2017, China has published more patents in the field each year than all other countries combined.[32]

Figure 4: Number of AI patents in 2022[33]

This is important because the sheer volume of patent applications from China, irrespective of their quality, poses a challenge for U.S. innovators. This influx creates an extensive pool of “prior art,” which refers to the global repository of existing scientific and technical knowledge patent examiners use to assess whether an invention is novel.[34] American inventors have to demonstrate that their innovations are not already covered in any prior publications, including those from Chinese-language patents filed both domestically and internationally, which gets increasingly hard to do as the pool of prior art increases.

One reason IP experts believe might explain China’s lead is its advantage in data quantity. Since AI-related innovations are enabled by data, it is believed that organizations that generate the most AI-related patents are often the ones that have access to more data.[35] As we explore later in this report, China does indeed have an advantage in data quantity, but having more data is not the only requirement for true innovation. Innovation also depends on the quality of data, advanced algorithms, robust infrastructure, and skilled talent. However, for the purpose of generating patents, a large volume of data might indeed be sufficient because patents often focus on novel approaches and applications, which can be derived from extensive datasets. The explanation of “more data, more patents” might be particularly true for generative AI, which tends to be particularly data heavy. Generative patents currently represent 6 percent of all AI patents globally, but this is an uptick from the 4.2 percent share they held in 2017.[36] China currently leads the field, far outpacing United States more than 6 to 1.[37]

Another reason some experts posit that China leads in AI patents is because China has a broader scope of what AI innovations are eligible to be patented. In 2017, China’s examination guidelines revised the definition of “patent eligible” in a way that some saw as a conscious effort to expand the scope of patent eligibility.[38] However, other legal experts find that China’s revisions align its approach to patenting AI more closely with Europe’s framework, which is more stringent and consistent than the United States’.[39] What is also clear from the data in figure 5is that patent offices in both countries accept only a fraction of the patent filings they receive. This is part of a widening discrepancy: Before 2015, more AI patents across the world were granted than were not granted, but since then, the opposite has been true, and the gap has been getting wider.[40]

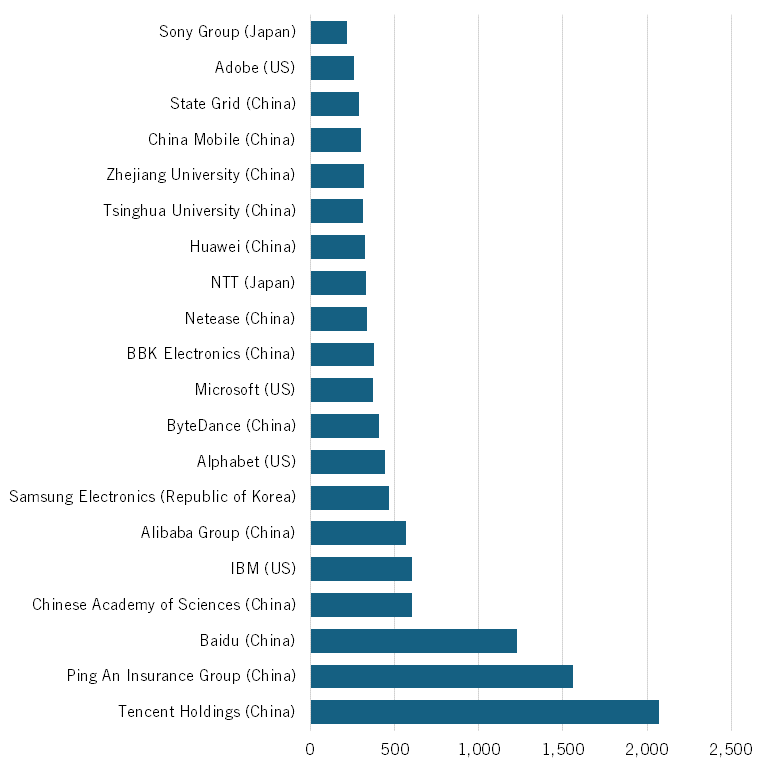

China also dominates the top 20 patent owners in generative AI, accounting for 13 of them (figure 5) and four of the top five (the fifth is IBM). Corporations dominate the entire list, but there are three research organizations in the top 20 and they are all Chinese (the Chinese Academy of Sciences, Tsinghua University, and Zhejiang University). The most prolific of these research universities, the Chinese Academy of Sciences, ranks fourth overall.

Figure 5: Top patent owners in generative AI, as of 2023[41]

The number of patent filings for a nation can be a problematic metric for innovation capability because patents vary greatly in quality. Many patents issued by the Chinese Patent Office are of relatively poor quality and therefore patent counts from China cannot be compared easily against patents issued by the U.S. Patent and Trademark Office (USPTO) or from European patent offices.[42] Indeed, just 4 percent of AI patents first filed in China were also filed in another jurisdiction, compared with 32 percent of patents first filed at USPTO—which is an indicator of the significantly higher quality of U.S. patents.[43]

As a result, it is useful to examine Patent Cooperation Treaty (PCT) patent applications and highly cited patent families, which are patents filed for the same invention in numerous jurisdictions. A 2019 report from the Center for Data Innovation finds that per one million workers, the United States (11 PCT applications) far outpaced China (1).[44] However, while patent quality may be lower in China, some evidence suggests China is addressing issues in this area.[45]

AI Talent

Talent is essential for a nation’s innovation capability because it provides the necessary expertise, creativity, and problem-solving skills to develop new technologies and drive economic growth. A nation that invests in attracting, nurturing, and retaining AI talent is better positioned to achieve long-term economic growth and maintain a competitive edge in the global economy. There is a robust debate over what type of talent is most important to enhancing national or institutional AI capabilities. While some argue that countries should prioritize cultivating a large workforce of relatively lower-skilled AI engineers, others contend that it’s more important to prioritize developing and attracting elite researchers. China is leading in the production of talent and retaining more of its own than it used to, but it lags behind in upskilling existing workers.

When it comes to producing top-tier AI researchers, China is a leading country. This can be seen in the percentage of Chinese researchers whose papers were published at the Conference on Neural Information Processing Systems, or NeurIPS, as it is known. NeurIPS focuses on advances in neural networks, which have anchored recent developments in generative AI, and it is considered one of the most selective and prestigious AI conferences, making the cohort it accepts a useful proxy for elite AI research talent. Analysis from MacroPolo, a think tank run by the Paulson Institute, shows that in 2022, China produced 47 percent of the world’s top-tier AI researchers (“top-tier” is defined as the top fifth of all AI researchers), compared with 29 percent in 2019.[46] For the most elite AI researchers (defined as the top 2 percent of all AI researchers), 26 percent come from China compared with 28 percent from the United States. This is a significant jump from 2019, when China was only producing 10 percent of elite AI researchers compared with the United States producing 35 percent.

More of China’s top AI talent ends up in the United States than anywhere else. The United States has long benefitted from large numbers of Chinese talent moving to U.S. universities to complete doctoral degrees, and most of them stay and help power competitiveness of the U.S. AI ecosystem. But while the United States remains the leading destination for elite Chinese talent, several countries including Australia, Canada, France, and the United Kingdom have introduced new visas in the last few years to entice foreign talent to create Silicon Valley-like tech hubs in their own countries—and they seem to be working. A recent report from Tsinghua University, China’s leading institution overall and second most-leading institution for AI research, shows the number of Tsinghua graduates who chose to study in the United States of America has dropped from 11 percent in 2018 to 3 percent in 2021.[47] Some attribute this decline to the COVID-19 pandemic; however, the proportion of Tsinghua graduates studying in the United Kingdom has not declined at all, and the number of those choosing to study in Singapore has risen. The United States’ outmoded visa laws, as well as recent concerns about Chinese researchers and international competition for AI talent from other countries, are contributing to international AI scientists and engineers looking outside the United States for education and employment.

While there is a prevailing impression that China is facing a brain drain, according to an October 2023 New York Times article, data suggests that a growing number of high-quality Chinese researchers are choosing to stay in China.[48] That is to say, while the sheer number of Chinese researchers emigrating might be growing, the percentage of the best and brightest who are leaving its shores might actually be declining. MacroPolo’s Global AI Tracker found that in 2022, 28 percent of top AI researchers were working in China, up from only 11 percent in 2019.[49] This trend could indicate that China is successfully creating attractive opportunities and environments for its top talent, counterbalancing the outward migration and fostering domestic innovation.

AI Infrastructure

Data

AI systems often rely on vast quantities of data for training. Large datasets help AI systems develop highly accurate models to perform tasks ranging from navigating without a map to identifying faces to answering Google search queries. Moreover, machine learning techniques allow AI systems to recognize subtle patterns in large datasets that are difficult or impossible for humans to perceive. This is one reason why many AI systems perform certain tasks better than human experts, such as identifying the signs of lung cancer in commutated tomography scans.

However, determining whether one country has a data edge in AI over another is not as simple as measuring total data output. The role of data in AI is much like the role of labor in the economy; China may have a large working population, but the structure, quality, and adaptability of that workforce are just as important to driving economic growth.[50] Similarly, data isn’t just a matter of having more of it; it’s about the quality of the data, how well it is curated, and how accessible it is.

Many metrics find that China leads in sheer quantity of data but lags behind in quality and diversity. High-quality data refers to both correct and consistent data and also data that is appropriately formatted for its intended use.[51] China has introduced policies to promote data standards in certain sectors, but significant amounts of data remain unreadable by computers, lowering the quality and usability of data for analysis. According to the findings of the National Data Resources Survey Report 2023, which was the first nationwide data resource survey by Chinese authorities, while Chinese companies produced 22 percent more data than the previous year, they digitized and stored only about 3 percent more.[52]

Where China leapfrogs its competitors is in providing its firms and researchers with access to data. This is particularly true for data from public spaces, which the Chinese government collects primarily through an extensive network of surveillance, security, and traffic cameras. A common way in which private Chinese AI firms gain access to this valuable government data is by providing services to the state, such as optimizing traffic management through smart-city projects. These services not only improve the efficiency and effectiveness of government operations but also provide Chinese AI firms with valuable, large datasets. A 2023 paper study published in The Review of Economic Studies examined nearly 1,900 government contracts for facial recognition technology (FRT) in China and finds that companies with access to high-quality government data through these contracts produced significantly more commercial AI software products than those without such access, indicating that government data access has materially contributed to the rise of China’s facial recognition AI firms.[53] And in FRT, Chinese firms are certainly leaders. According to the Face Recognition Vendor Test (FRVT) by the U.S. National Institute of Technology, which evaluates the performance of facial recognition algorithms from various vendors, Chinese firms produce a quarter of the top 25 algorithms, 3 of which crack the top 10 list.[54]

Compute

Access to advanced chips is critical in researching and developing advanced AI systems, which often demand extensive computing power. Unfortunately for China, it depends entirely on the United States and U.S. allies for access to these chips. A recent study of 20 Chinese LLMs finds 17 models were built using chips produced by the U.S-based firm NVIDIA and only 3 models built with Chinese-made chips.[55] Since October 2022, the United States has imposed a series of export control measures to limit China’s access to its chips, but there is disagreement on how effective these policies are. While some experts we spoke to noted that the controls seem to be undercutting Chinese AI developments in the short term, others noted that these measures are unlikely to hold back China’s progress in AI. China already has an existing stock of chips and is quickly pivoting to develop its own supply that is not reliant on U.S. companies.[56] An article published in Caijing, an independent magazine based in Beijing that covers societal, political, and economic issues, reported that in the wake of the United States export ban, demand for these chips spiked, and tens of thousands of resellers are active in the Pearl River Delta.[57] According to some resellers, the market price of certain NVIDIA chips doubled within a week.[58] Moreover, Chinese AI companies are circumventing U.S. export controls by accessing high-end U.S. chips through cloud providers. Indeed, despite sanctions, companies such as state-backed voice recognition company iFlytek allegedly rent access to NVIDIA’s A100 chips, highlighting loopholes in enforcement.[59]

Even if the U.S. government closes gaps in export control enforcement, China is working on being self-sufficient in compute capacity and reducing reliance on the United States. For one, China has prioritized creating a domestic semiconductor industry. The expertise, capital, and scale needed to develop a new semiconductor design, or build a new semiconductor fab, is extremely high and increasing—and Chinese firms have weaknesses in almost all the subsectors needed for chip design and manufacture, especially photolithography, metrology, and inspection.[60] Still, one of China’s major microchip foundries, the Semiconductor Manufacturing International Corporation (SMIC) is working to produce microprocessors using less-advanced equipment, demonstrating China’s commitment to advancing its semiconductor capabilities despite challenges; however, experts are doubtful this process can ever be commercially competitive.[61] And Huawei’s Ascend 910B offers a competitive and cost-effective alternative for AI applications, but it is not as efficient as NVIDIA’s A100.

For a country with China’s resources and political will, it could still gain market share in AI-related semiconductors by focusing on developing better chips for certain tasks or application areas. Outside the market for the types of chips that are needed to best train AI models, there is also a newer, smaller, and dynamic market for the types of chips that are best at applying AI models. For instance, while NVIDIA leads the markets for GPUs, which are specialized chips designed to train and run AI models, there are field programmable gate arrays (FPGAs), which are mostly used to apply trained AI algorithms to new data inputs. FPGAs are different from other AI chips because their architecture can be modified by programmers after fabrication. There is also a group of AI chips called “application-specific integrated circuits” (ASICs), which can be used for either training or inference tasks. ASICs have hardware that is customized for a specific algorithm and typically provide more efficiency than do FPGAs, but because they are so narrow in their application, they grow obsolete more quickly as new AI algorithms are created. In the long term, there are many areas of AI chip development for competitors to thrive, especially those that make more energy-efficient chips, as the use of electricity is proving to be a huge cost for companies training and running AI models.[62] As table 2 shows, there are Chinese firms in the market for all these chip architectures.

Table 2: Notable supplier companies for different AI logic chips

|

AI Chip Architecture |

U.S. Companies |

Chinese Companies |

|

GPUs |

NVIDIA, AMD |

Hygon Information Technology, Jingjia Micro, Enflame Technology |

|

FPGAs |

Achronix, Intel, Xlininx, Lattice |

Baidu, DeePhi |

|

ASICs |

Amazon, Google, Cerebras, Tesla |

HiSilicon, Cambricon, Horizon Robotics, Intellifusion |

That said, Chinese firms currently have a negligible market share in AI chip design, except for ASICs, which can be easier to design than other types of chips because they are designed for specific applications rather than are more general-purpose chips, making them more feasible for many companies to produce. However, they are not widely commercialized due to small market sizes and high development costs.

More promising is Huawei’s innovation with “AI-in-a-box” solutions, which combine its AI chips with industry-specific software and pre-trained models, making it easier and cheaper for businesses to use AI without needing advanced chips such as NVIDIA’s.[63] This allows companies to implement AI solutions quickly and securely on their own premises.

Company Case Studies

This section provides case study analyses of two leading Chinese generative AI companies.

Zhipu AI

Zhipu AI is China’s most prominent generative AI start-up, the country’s biggest AI start-up by number of employees with 800 staff, and one of its highest valued AI start-ups, with a valuation of $3 billion as of May 2024.[64] The company was founded by professors Tang Jie and Li Juanzi at Tsinghua University’s Department of Computer Science and Technology. Jie and Juanzi were participants in the university’s Knowledge Engineering Group (KEG), a research lab that focuses on knowledge engineering theory, methods, and applications in network environments.

Zhipu AI began investing in and developing LLMs in 2020, ahead of many other companies. In a paper its researchers published in April 2022 titled “GLM: General Language Model Pretraining with Autoregressive Blank Infilling,” Zhipu AI introduced its language model GLM, and made it clear the company was trying to solve a different challenge than existing language models were at the time, such as Google’s BERT and OpenAI’s GPT. BERT, GPT, and Zhipu AI’s GLM are all based on the transformer model architecture, which was introduced in a seminal 2017 paper “Attention is All You Need” by Google scientists, but Zhipu AI integrates innovative features into GLM to make a unique model that is highly accurate for both Chinese and English tasks. To see what makes GLM unique, consider the following comparison:

▪ BERT (Bidirectional Encoder Representations from Transformers) uses a method known as masked language modeling, which essentially hides certain words in the input text and trains the model to guess these hidden words using the context from both directions (before and after the hidden words). This helps BERT understand the meaning of words in context.

▪ GPT (Generative Pre-trained Transformer) uses an autoregressive model in which each token is predicted based on the tokens that preceded it. This is a unidirectional approach because the model is trained to predict the next word in a sentence by looking only at the words that come before it. GPT’s strength is in generating coherent and contextually appropriate text over longer passages, leveraging its training to predict the next word given all the previous words.

▪ GLM (General Language Model) combines features of both of these approaches by hiding parts of the text and then predicting the missing parts in sequence. This method helps the model understand the context from both directions, like BERT, and generate text like GPT. GLM also uses advanced techniques to handle both Chinese and English languages effectively, making it very versatile and powerful for a range of language tasks.

Much like OpenAI created ChatGPT as a specialized application of the GPT model, Zhipu AI has created ChatGLM as an application based on its GLM architecture, designed to excel in bilingual tasks in Chinese and English. But ChatGLM is not Zhipu AI’s only offering; the company has a whole host of products including WebGLM, designed for web search and retrieval capabilities; VisualGLM, designed to understand and generate both text and images; CogVLM, a multimodal understanding model that was designed to be effective for tasks that require interpreting visual data; and code generation model CodeGeeX2-6B.

Zhipu AI is aiming for breakthrough advancements rather than incremental improvements. The company’s CEO, Zhang Peng, has been reported to have said the company’s slogan is to strive for artificial general intelligence (AGI), which is also the mission of OpenAI and Google DeepMind.[65] However, Zhang has been clear that Zhipu is on the road to AGI in its own way, and not simply following its competitors. He said in an interview:

Today, I feel that Zhipu AI is undergoing a qualitative change from quantitative change, especially in terms of the emergence of large models. Standing at this juncture, whether looking forward or backward, I feel that our team is quite fortunate. The market has given us, hard workers, many opportunities and chances. Although the road of independent innovation and research and development will be difficult, we are still persevering. In addition, the development of artificial intelligence will focus more on our general artificial intelligence (AGI), achieving super cognitive intelligence beyond human level, realizing AI’s self-explanation, self-assessment, self-supervision. At the same time, to ensure that the model’s performance aligns with human values and safety standards, a super alignment technology is also under development with the goal of achieving machine automatic alignment with human intelligence and human values to enable model self-reflection and control. As a company specializing in large models.[66]

For many, Zhipu AI might become OpenAI’s rival, and foreign investors who do not want Silicon Valley to dominate in AI are throwing their weight and funding behind Zhipu AI in support. Saudi Arabia’s Prosperity7, which is part of the state-owned oil group Aramco’s venture capital arm, became the first foreign investor in Zhipu AI in 2024, participating in a roughly $400 million investment round.[67]

Moonshot AI

Moonshot AI was founded in March 2023. The company is focused on the development of LLMs but is unique in that it is working on long-text processing, a specialization that is crucial for enabling detailed and thorough interactions, such as LLMs that can address extensive customer service questions. This capability is becoming a significant competitive advantage in the LLM market, as the capacity to understand and maintain context over extended texts can substantially improve performance.[68]

Moonshot AI’s unique selling point is heavily influenced by the technical background of its three founders. One of the cofounders is Yang Zhilin, a former student of one of Zhipu AI’s founders at Tsinghua University. Zhilin completed his Ph.D. at Carnegie Mellon University in 2019 and did internships at Meta and Google Brain in 2017 and 2018, respectively, and it is during this period when he wrote and published two of his most widely cited papers titled “Transformer-XL: Attentive Language Models Beyond a Fixed-Length Context” and “XLNet: Generalized Autoregressive Pretraining for Language Understanding.” The first paper introduced a method to extend the context length in transformer models, which essentially enables models to remember more information from earlier in a given text, helping them to understand and generate longer, more coherent pieces of text. The second paper introduced a method to help models understand more complex relationships in data, and Zhilin was able to demonstrate better performance than models such as BERT on many language tasks by using this method. The other two cofounders are Xinyu Zhou and Yuxin Wu. Zhou had previously worked at Hulu, Tencent, and Megvii and conducted research in deploying deep neural networks on hardware with limited computational resources, while Wu worked at Google Brain on foundation models and at Meta AI Research on computer vision.

Together, Zhilin, Zhou, and Wu combined their expertise to create the concept at the core of Moonshot AI’s business: lossless long-context. “Lossless long-context” refers to techniques that allow these models to process long sequences of text without losing important information or context. Traditional transformer models, which are the backbone of many language models, typically have a fixed-length context window, meaning they can only consider a certain number of tokens (words or characters) at a time, which limits their ability to understand and generate coherent long-form text.

Moonshot AI’s chatbot Kimi, which was launched in October 2023, had a 200,000 context-window in Chinese, a capacity that allegedly far exceeded its nearest competitors. Other companies were hot on Moonshot’s heels, with Chinese start-up Baichuan announcing a model that could process up to 350,000 Chinese characters at once shortly after Kimi came out, but Moonshot continues to innovate. It claimed in March 2024 that its chatbot could handle up to 2 million Chinese characters in a single prompt, a tenfold increase in just six months.[69] By comparison, OpenAI’s GPT-4Turbo and Google’s Gemini 1.5 Pro support a 128,000 token context window, while Anthropic’s Claude 3 family offers a 200,000 context window, with only some select use cases allowing up to 1 million tokens.

China’s Government Policies Supporting the AI Sector

China’s Strategy for AI Innovation

The annual sessions of China’s top legislature and political advisory body—the National People’s Congress (NPC) and the Chinese People’s Political Consultative Conference (CPPCC)—took place in Beijing between March 4 and March 11, 2024. Known as the “Two Sessions,” these meetings gathered thousands of representatives from diverse sectors of society to participate in the deliberation of state affairs and the national agenda for the coming year.[70] One of the key events during the Two Sessions was the delivery of the Government Work Report, which highlights recent progress and sets new policy goals for the future.

The Government Work Report makes clear that one of China’s top priorities for the year ahead is to pursue digital transformation by integrating AI across all sectors of the economy as part of the newly announced “AI+” initiative.[71] The Government Work Report for 2024 outlines this priority as follows:

We will actively develop the digital industry, transform traditional industries with digital technologies, and fully integrate digital technology into the real economy.

We will step up R&D and application of big data and AI, launch an AI Plus initiative, and build digital industry clusters with international competitiveness.

Exactly what the AI+ initiative will entail is still an open question, as the government has not yet provided these specifics. However, during the Two Sessions, political advisors submitted proposals and offered suggestions. These proposals play a crucial role in contributing to the country’s development, as previous sessions show that submitted content will be taken into careful consideration by relevant authorities.[72] Thus, looking into representatives’ suggestions is helpful to understand future steps China might take in specific fields after the Two Sessions.

There were four main categories for AI proposals: model development, data sharing, skills development, and safety.

First, some participants called for China to focus on building cutting-edge AI models to catch up with foreign competitors such as OpenAI and replicate its success with ChatGPT. Zhou Hongyi, CEO of 360 Group, presented a two-pronged proposal for AI model development.[73] On the first track, Zhou encouraged collaborations between large tech companies and key research institutions, similar to the partnership between Microsoft and OpenAI, where those working on technological breakthroughs in AI pair up with a resource-rich company. On the second track, Zhou called for a long-term open-source AI project to establish multiple national-level, open-source AI models and an open innovation ecosystem. Echoing the desire to create national AI models, Liu Qingfeng, chairman of iFlytek, proposed during the Two Sessions that China should build a national AI development plan to build a domestic AI ecosystem of large AI models.[74]

Second, some representatives proposed improving data sharing. Liu also called for the open sharing of high-quality data, noting that China should open and share high-quality training data from various sectors at the national level to develop its AI industry. Cao Fei, CFO of Weibo, presented a proposal to promote the development of an AI data trading market to make it easier for Chinese firms to buy and sell the high-quality data necessary to develop leading AI models while protecting the rights of data subjects. She also called for accelerating and supporting the implementation of new rules governing cross-border data flows to promote cooperation on international projects.

Third, some participants proposed ideas for training AI talent. Lei Jun, CEO of Xiaomi, pointed out that the fast development of AI technologies creates massive needs for AI talent in all fields, and strengthening AI training would be a pivotal factor in facilitating continuous industrial advancement. Thus, Lei suggested including AI classes in the K-12 syllabus and opening more AI-relevant majors in universities. He also encouraged companies to collaborate with universities to help future workers adjust to the fast-changing AI landscape. Zhou Yuan, CEO of Zhihu, also offered suggestions for training AI talent, calling for better aligning vocational training options for skilled professionals with companies’ needs and suggesting colleges for technical workers collaborate with companies to set their courses accordingly. Zhang Yunquan, a researcher at the Chinese Academy of Sciences, recognized the resource gap in AI education, noting that high-quality courses, experienced professors, and advanced technologies are gathered in top universities and cities. He suggested building an educational platform for sharing resources and content about teaching AI that lead to more educational opportunities, including in rural areas. Like other representatives, he encouraged collaboration between companies and universities to develop AI knowledge for real-world scenarios.

Finally, some representatives focused on AI safety and oversight. Zhou Hongyi, CEO of 360 Group, pointed out that companies and local governments should pay attention to possible AI risks. Qi Xiangdong, CEO of QAX, suggested more focus on innovation around “AI+ Safety” and promoting “AI+ Safety” products in all industries. Zhang Yi, a partner at the law firm King & Wood Mallesons, advocated for moving forward with a new AI law as soon as possible that would classify AI algorithms by risk level and apply different regulatory measures for different levels. Zhou Yuan, CEO of Zhihu, proposed supervising and reviewing the data collection sources, processing methods, and compliance of large AI models, as well as conducting social impact and risk assessment to identify and address potential problems models in a timely manner.

The AI+ initiative is part of a history of prior efforts aimed at digital transformation of the Chinese economy. For example, the Government Work Report in 2015 proposed “Internet+,” and in 2019, proposed “Smart+.” The “AI+” initiated announced this year reflects the global interest in AI and China’s focus on diligently putting AI technologies into practice. China’s attention in the past was primarily on developing the technology, and while it still seeks to lead the industry, it has signaled that 2024 will be “The Year of AI Application.”

China’s Industrial AI Strategy

President Xi first introduced the term “new quality productive forces” in September 2023, and it has become a popular idea in China since then. The term describes China’s new industrial strategy of driving economic growth through innovation in frontier technologies. It is the next evolution of the “Made in China 2025” strategy that focuses on reorienting China’s economic growth by upgrading its domestic manufacturing capabilities to produce higher quality goods more efficiently. The Made in China 2025 initiative has seen some success, with China now producing many of the technologies it set out to produce back in 2015, such as electric vehicles, photovoltaics, and wind turbines. For example, more than 40 percent of the exhibitors at the 135th Canton Fair in April 2024—previously a place to source labor-intensive manufactured products—presented intelligent and green products (e.g., smart mobility, industrial automation, intelligent manufacturing), showcasing the nation’s progress.[75]

China’s Premier Li Qiang has stated that AI is an important engine for the new productive forces.[76] In order to cultivate AI and other emerging technologies as new quality productive forces, the National Development and Reform Commission, a government agency responsible for restructuring China’s economic systems and formulating policies for social development, is focusing on forming a new industrial ecosystem. First, to obtain a high-quality technical and skilled workforce for future development, the commission has called for collaboration between universities and companies, establishing open talent policies to recruit international professionals, and creating regional innovation hubs for technology-focused innovation and entrepreneurship. Second, it has urged all companies to work with universities on technological breakthroughs and to apply advanced technologies in production processes. Finally, the commission has suggested planning out the development of “future industries”—industries driven by cutting-edge technologies and currently in incubation. The goal is for China to gain market share in advanced industries to become a global innovation leader.

One expert we spoke to noted that China’s strategic approach prioritizes specialized, industrial AI applications over more broad-based, versatile uses like LLMs. This strategy focuses on embedding AI in sectors such as manufacturing and raw materials to enhance efficiency and profitability, rather than developing AI technologies for general, consumer-facing purposes, in a bid to more seriously drive economic efficiency and growth.

China’s Strategy for AI Resources

The Chinese government is increasing access to computing and data resources to support its domestic innovation ecosystem. For one, it plans “to create a nationally unified computing system” to ensure sufficient access to computing resources by continuing its “Eastern Data, Western Computing” project.[77] This initiative aims to optimize the distribution of data centers in China by connecting businesses in the east of the country that have high data processing demands with data centers in the west, where land and energy is much cheaper. These investments in digital infrastructure will ensure Chinese businesses can access the computing resources they need for AI adoption.

The Chinese government has also recognized the importance of data as a key element for using AI. One of its goals for 2024 is to “improve basic data systems and vigorously promote the development, openness, distribution, and utilization of data.”[78] Indeed, China has already shown significant progress in this area. Last year, the government established the National Data Administration, a new agency responsible for creating data infrastructure and promoting data utilization across the economy. In December 2023, the National Data Administration launched a three-year campaign to “promote the high-level application of data, ensure the quality of data supply, improve the environment of data circulation.”[79] In the coming year, China plans to pursue a “Data Multiply” (“Data ×”) initiative to “unleash the multiplier effect of data.”[80] This initiative will include conducting a national data resources survey, reforming management of public data resources, and establishing new mechanisms for using enterprise data.

China is also working on specific types of data that support sector-specific AI innovation; for instance, the state has several policies that promote the country’s biodata holdings. These include policies such as the 14th Five-Year Plan for National Informatization, which requires hospitals to digitize health records; the National Health Commission’s Healthy China 2030 initiative, which promotes the standardization of data between health services and institutions; and the Biosecurity Law, which emphasizes the state’s sovereignty over collecting, managing, and sharing certain biodata.[81] Chinese companies benefit significantly from these policies because they gain extensive access to biodata for developing AI technologies, while similar companies in other counties must partner with specific hospitals or research institutions to access certain types of biodata.

What Should America Do?

The United States is the global leader in developing AI, but it faces fierce and increasing competition from China. Focusing on stymying China’s growth will not impede China’s progress in the long run. Instead, the United States should be focusing on maintaining, if not expanding, its lead. It is critical for Congress and the White House to craft and fund a comprehensive national AI strategy that addresses the twin goals of increased AI development and increased AI adoption.[82]

To implement the goal of increasing AI development, U.S. policymakers should do the following:

1. Stimulate private investment in AI R&D. This is crucial to cementing U.S. leadership in AI because the private sector in the United States plays a uniquely important role in conducting AI R&D and keeping the country ahead, unlike in China, where the government plays a bigger direct role in conducting R&D. Congress should double the R&D tax credit and restore first-year expensing.[83]

2. Revitalize the federal funding process for AI. The current federal funding mechanisms are too slow and rigid to keep up with the rapid pace of AI advancements. Congress should introduce flexible funding models that release money as projects reach specific goals (milestone-based awards) and create flexible funds that can be quickly directed to the most promising AI research (program-agnostic funds).[84] This approach ensures that federal investments are agile and responsive to the rapidly evolving AI landscape.

3. Avoid policies that undermine U.S. AI leadership and bolster Chinese competitors. U.S. policymakers should evaluate the impact of policies that may unintentionally hurt U.S. competitiveness in AI. For instance, overly stringent export controls may undermine U.S. chip competitiveness and inadvertently bolster China’s chip industry.[85] Similarly, unwarranted antitrust actions could unduly weaken large U.S. tech companies, diminishing their capacity to fund and leverage AI advancements across multiple business lines, and neither the government nor startup ecosystem would be able to adequately fill the resulting gap.

4. Develop a national data strategy to dramatically expand the availability of data for training AI models. China recently announced the creation of a new regulatory body to improve its use of data as a strategic economic resource. As part of ongoing efforts to promote China’s digital economy, the National Data Administration will work toward building smart cities, digitizing government services, and facilitating data-driven development. Policymakers in the United States should learn from this example and strengthen their commitment to data-driven innovation and increase commercial access to data.[86]

To implement the goal of increasing AI adoption, U.S. policymakers should focus on the following:

5. Create a national AI roadmap for adoption. Widespread adoption of AI should be one of U.S. policymakers’ top priorities, especially in key sectors such as education, transportation, government, and healthcare where, because of existing regulations and government involvement, the public sector will need to work with the private sector to deploy the technology. The administration should develop a national AI roadmap that outlines sector-specific opportunities and barriers, as well as a detailed strategy for achieving widespread adoption in each of these sectors.

6. Prioritize the rapid adoption of AI in the federal government. One of the most important things the federal government can do to spur AI is to be a robust adopter of AI technologies, increasing its own productivity, reducing costs, and improving public services. The AI Center of Excellence within the Government Services Administration should identify the most important core processes in which AI can make a difference. Ideally, these would be ones where AI would either lead to significant improvements in customer service and quality or reductions in cost (to both the government and users of government services).

7. Support digital transformation. AI adoption among U.S. firms is low partly because it requires foundational technologies such as Internet of Things-enabled equipment in manufacturing. Successful AI applications depend on cumulative technological advancements. The federal government should invest in a broad array of digital infrastructure including broadband, cybersecurity, smart cities, and more.

8. Incentivize AI workforce training investment. Employers are currently underinvesting in AI workforce training, and without government intervention, the rate of employee training is unlikely to reach the optimal level for both societal and economic benefit.[87]Policymakers should introduce a tax credit covering at least 50 percent of training expenditures to strongly encourage businesses to expand their investment in workforce development and grow the pool of AI talent.

Acknowledgments

ITIF wishes to thank the Smith Richardson Foundation for supporting research on the question, “Can China Innovate?” Other reports in this series cover biopharmaceuticals, chemicals, consumer electronics, nuclear power, semiconductors, robotics, and quantum technologies. (Search #ChinaInnovationSeries on itif.org.) The author would also like to thank Robert Atkinson and Daniel Castro for their assistance with this report.

Any errors or omissions are the author’s responsibility alone.

About the Author

Hodan Omaar is a senior policy manager at the Center for Data Innovation. Previously, she worked as a senior consultant on technology and risk management in London and as an economist at a blockchain start-up in Berlin. She has an M.A. in Economics and Mathematics from the University of Edinburgh.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent 501(c)(3) nonprofit, nonpartisan research and educational institute that has been recognized repeatedly as the world’s leading think tank for science and technology policy. Its mission is to formulate, evaluate, and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit itif.org/about.

Endnotes

[1] Helen Toner, “What Are Generative AI, Large Language Models, and Foundation Models?” Center for Security and Emerging Technology (CSET), Georgetown University, May 12, 2023, https://cset.georgetown.edu/article/what-are-generative-ai-large-language-models-and-foundation-models/.

[2] Daniel Castro and Michael McLaughlin, “Who Is Winning the AI Race: China, the EU, or the United States? — 2021 Update” (Center for Data Innovation, January 2021), https://datainnovation.org/2021/01/who-is-winning-the-ai-race-china-the-eu-or-the-united-states-2021-update.

[3] Investment metrics for China, United States within all AI Fields, “Country Activity Tracker: Artificial Intelligence,” Emerging Technology Observatory, Center for Security and Emerging Technology (CSET), Georgetown University, accessed August 2, 2024, https://cat.eto.tech/?expanded=Summary-metrics&countries=China+%28mainland%29%2CUnited+States&countryGroups=&dataset=Investment.

[4] “Investments in AI and Data,” OECD.AI Policy Observatory, accessed accessed July 24, 2024, https://oecd.ai/en/data?selectedArea=investments-in-ai-and-data&selectedVisualization=vc-investments-in-ai-by-country.

[5] Ngor Luong, Zachary Arnold, and Ben Murphy, “Understanding Chinese Government Guidance Funds,” Center for Security and Emerging Technology (CSET), Georgetown University, March 2021, https://cset.georgetown.edu/publication/understanding-chinese-government-guidance-funds/.

[6] Martin Beraja et al., “Government as Venture Capitalists in AI,” National Bureau of Economic Research, July 2024, https://www.nber.org/system/files/working_papers/w32701/w32701.pdf.

[7] Ibid.

[8] Emily Feng, “China’s state-owned venture capital funds battle to make an impact,” Financial Times, December 24, 2018, https://www.ft.com/content/4fa2caaa-f9f0-11e8-af46-2022a0b02a6c.

[9] Beraja et al., “Government as Venture Capitalists in AI.”

[10] “Beijing city to subsidise domestic AI chips, targets self-reliance by 2027,” Reuters, April 26, 2024, https://www.reuters.com/technology/beijing-city-subsidise-domestic-ai-chips-targets-self-reliance-by-2027-2024-04-26/.

[11] Raffaele Huang and Jiyoung Sohn, “For Apple’s AI Push, China Is a Missing Piece, The Wall Street Journal, June 20, 2024, https://www.wsj.com/tech/ai/for-apples-ai-push-china-is-a-missing-piece-7d2b0ec6.

[12] Ben Jiang, “China’s 4 new ‘AI Tigers’ – Baichuan, Zhipu AI, Moonshot AI and MiniMax – emerge as investor favourites,” South China Morning Post, April 19, 2024, https://www.scmp.com/tech/big-tech/article/3259499/chinas-four-new-ai-tigers-baichuan-zhipu-ai-moonshot-ai-and-minimax-emerge-investor-favourites.

[13] Ibid.

[14] Dannie Peng, “Stanford University team apologises over claims they copied Chinese project for AI model,” South China Morning Post, June 4 2024, https://www.scmp.com/news/china/science/article/3265377/stanford-university-team-apologises-over-claims-they-copied-chinese-project-ai-model.

[15] “Tsinghua camp: backbone of China’s AI start-up scene,” last modified May 1, 2024, https://table.media/en/china/sinolytics-radar/the-tsinghua-camp-the-backbone-of-chinas-ai-start-up-scene.

[16] Huang and Sohn, “For Apple’s AI Push, China Is a Missing Piece.”

[17] Eleanor Olcott, “Four start-ups lead China’s race to match OpenAI’s ChatGPT,” Financial Times, May 3, 2024, https://www.ft.com/content/4e6676c8-eaf9-4d4a-a3dc-71a09b220bf8.

[18] “TAL Pioneers AI in Math Tutoring,” GenAI Gazette, January 4, 2024, https://genaigazette.com/tal-pioneers-ai-in-math-tutoring/.

[19] Liang Xu et al., “SuperCLUE: A Comprehensive Chinese Large Language Model Benchmark,” July 23, 2023, https://arxiv.org/abs/2307.15020.

[20] Jeffrey Ding, “ChinAI #264: One Year of Ranking Chinese Large Language Models,” ChinAI Newsletter, https://chinai.substack.com/p/chinai-264-superclue-april-2024-report.

[21] Ibid.

[22] Olcott, “Four start-ups lead China’s race to match OpenAI’s ChatGPT.”

[23] SuperCLUE website filtered for April 2024 and June 2024, accessed July 20, 2024, https://www.superclueai.com.

Note: The scores in the left-hand column of the comparison table have been rounded to align with the presentation in the right-hand column, where scores are shown without decimal places. While this approach may not display the full nuance of the original data, the detailed figures were considered during our analysis and informed the findings presented in this report.

[24] Alison Snyder, “Exclusive: Inside the AI research boom,” Axios, May 3, 2024, https://www.axios.com/2024/05/03/ai-race-china-us-research.

[25] Daniel Castro and Michael McLaughlin, “Who Is Winning the AI Race: China, the EU, or the United States? — 2021 Update” (Center for Data Innovation, January 2021), https://datainnovation.org/2021/01/who-is-winning-the-ai-race-china-the-eu-or-the-united-states-2021-update.

[26] World Intellectual Property Organization (WIPO) Patent Landscape Report - Generative Artificial Intelligence (Geneva: WIPO, 2024), https://www.wipo.int/web-publications/patent-landscape-report-generative-artificial-intelligence-genai/en/index.html.

[27] “The state of global AI research,” Emerging Technology Observatory, Center for Security and Emerging Technology (CSET), Georgetown University, May 2, 2024, https://eto.tech/blog/state-of-global-ai-research.

[28] WIPO Patent Landscape Report - Generative Artificial Intelligence (Geneva: WIPO, 2024).

[29] “The state of global AI research,” Emerging Technology Observatory.

[30] Ibid

[31] WIPO Technology Trends 2019: Artificial Intelligence (Geneva: WIPO, 2019), https://www.wipo.int/edocs/pubdocs/en/wipo_pub_1055.pdf.

[32] WIPO Patent Landscape Report - Generative Artificial Intelligence.

[33] Nestor Maslej et al., The AI Index 2024 Annual Report (Institute for Human-Centered AI, Stanford University, April 2024), https://aiindex.stanford.edu/wp-content/uploads/2024/05/HAI_AI-Index-Report-2024.pdf.

[34] “Chapter 12: Intellectual Property,” Final Report (Washington, D.C.: National Security Commission on Artificial Intelligence, 2021), https://reports.nscai.gov/final-report/chapter-12.

[35] WIPO Technology Trends 2019: Artificial Intelligence.

[36] WIPO Patent Landscape Report - Generative Artificial Intelligence.

[37] “China-based investors lead on global GenAI patents: UN report,” UN News, July 3, 2024, https://news.un.org/en/story/2024/07/1151761.

[38] WIPO Technology Trends 2019: Artificial Intelligence.

[39] Ma Junhao, “Securing AI Patents in China: The Regulatory Framework,” King & Wood Mallesons, June 5, 2024, https://www.kwm.com/global/en/insights/latest-thinking/securing-ai-patents-in-china-the-regulatory-framework.html.

[40] Ibid

[41] WIPO Patent Landscape Report - Generative Artificial Intelligence.

[42] Robert D. Atkinson and Caleb Foote, “Is China Catching Up to the United States in Innovation?” (Information Technology and Innovation Foundation, April 2019), http://www2.itif.org/2019-china-catching-up-innovation.pdf.

[43] WIPO Technology Trends 2019: Artificial Intelligence .

[44] Daniel Castro, Michael McLaughlin, and Eline Chivot, “Who Is Winning the AI Race: China, the EU, or the United States?” (Center for Data Innovation, August 2019), https://datainnovation.org/2019/08/who-is-winning-the-ai-race-china-the-eu-or-the-united-states.

[45] Dewey Murdick and Patrick Thomas, “Patents and Artificial Intelligence: A Primer” (Georgetown CSET, September 2020), https://cset.georgetown.edu/publication/patents-and-artificial-intelligence/.

[46] “The Global AI Talent Tracker 2.0,” MacroPolo, Paulson Institute, accessed June 29, 2024, https://macropolo.org/digital-projects/the-global-ai-talent-tracker/.

[47] “China’s Gain,” The Statesman, August 13, 2024, https://www.thestatesman.com/opinion/chinas-gain-1503243271.html.