The Census Bureau Confirms US Manufacturing Has Declined

The latest data from the United States Census Bureau (Census Bureau) demonstrates that manufacturing in America is steadily declining. Once the world leader in manufacturing, the U.S. relinquished that title in 2010, now producing $2.4 trillion less than China in manufacturing. Yet, pundits and Washington insiders continue to deny the facts, claiming that all is well in a concerted effort to avoid any blame for globalization.

The comparison of the Census Bureau’s quinquennial manufacturing data from 2002 to 2022 reveals a stark and depressing reality: in just two decades, the number of manufacturing firms fell, jobs diminished, payroll failed to keep pace with national growth, and productivity stalled.

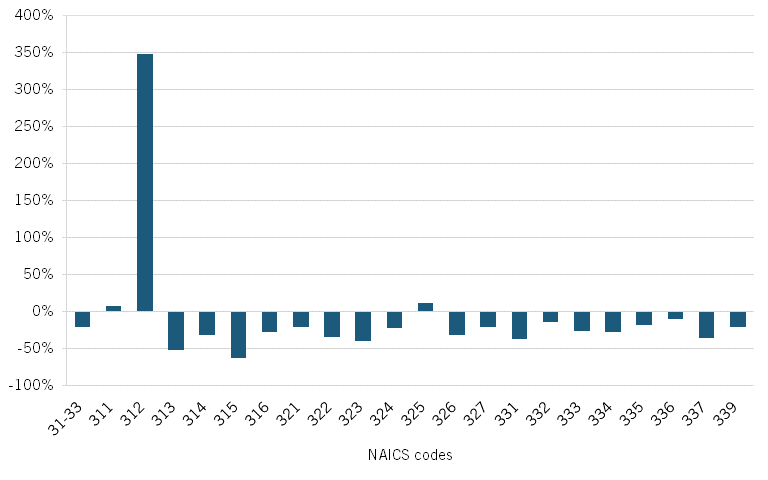

Manufacturing Firms

Let’s start with the number of manufacturing firms in the U.S., which declined by 21 percent in 20 years (figure 1). This drop accounts for a decrease in firms in every manufacturing sector, labeled according to the North American Industry Classification System (NAICS; see table 1), barring the production of food (311), beverages and tobacco (312), and chemicals (325). The clear outlier among the industries displayed in Figure 1 is beverages and tobacco, which has experienced an extraordinary 348 percent growth rate over the past two decades. This growth can be attributed to the spike in popularity of boutique sodas, kombuchas, seltzer waters, and ready-to-drink cocktails.

Figure 1: Change in the number of U.S. manufacturing firms, 2002–2022

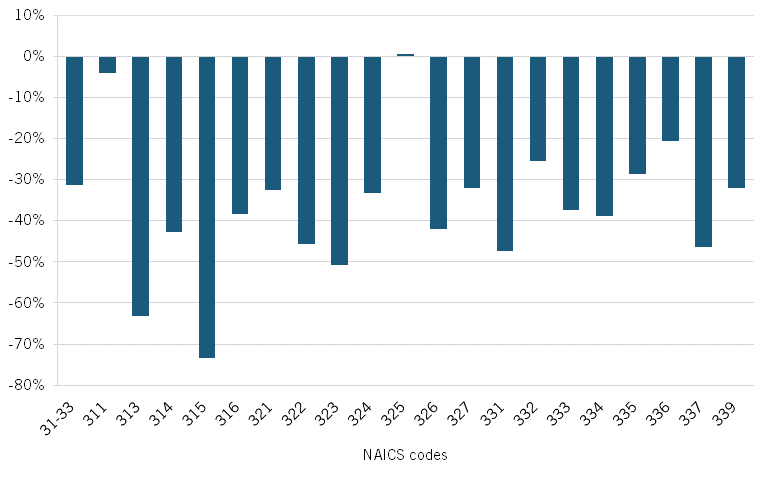

The fall in manufacturing firms is even more dramatic when considering the overall growth of the United States economy. Since 2002, the economy has grown substantially, with the number of American companies increasing by almost 600,000 or 10 percent. Not only has manufacturing not kept up with national growth, but it has decreased substantially. Figure 2 demonstrates this trend, displaying the difference in the percent change of manufacturing firms and the percent change in the total number of firms in the United States. Only chemical manufacturing had firm totals increase at a rate exceeding the national economy. Industries below zero were unable to match the national economy’s growth. The sectors that have seen the most significant decline in the past 20 years include textile mills (313) and apparel manufacturing (315), which shrunk by more than 50 percent.

Figure 2: Percent change in manufacturing firms less change in national firms (excluding 312)

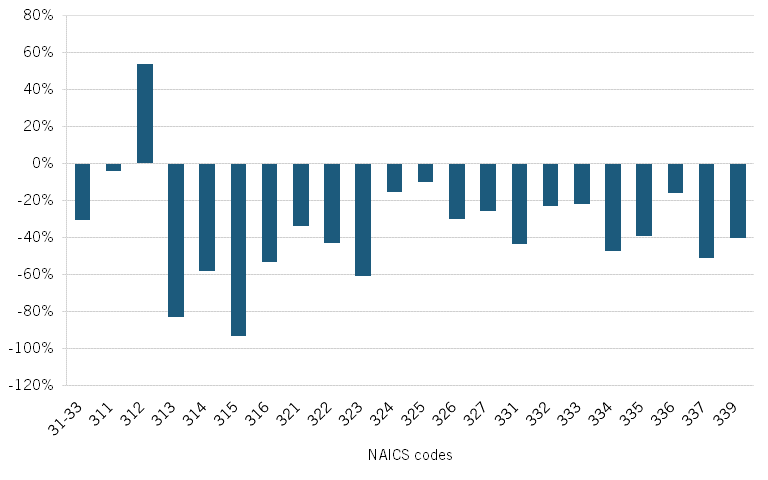

Manufacturing Employment

We see similar losses in manufacturing employment. Overall, the number of manufacturing jobs in the United States fell by 2.4 million. Again, when considering the growth of the U.S. economy over the past two decades, the fall in manufacturing jobs is even more significant, as shown in figure 3, while the number of jobs in America grew by over 14 percent from 2002 to 2022, the number in manufacturing fell by 17 percent. Only three sectors, food, beverage and tobacco, and chemical manufacturing, saw an increase in employment over the twenty-year period. Except for beverage and tobacco, every manufacturing sector in the United States experienced a drop in employment relative to the national average.

Figure 3: Change in manufacturing employees less the change in national employees

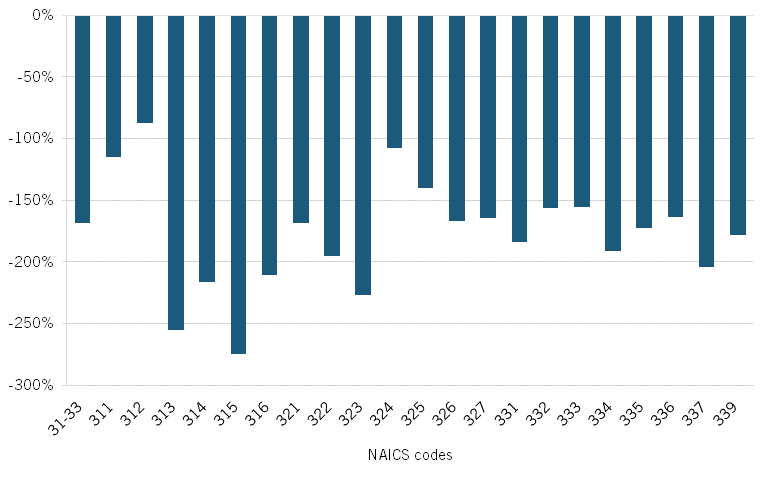

Manufacturing Payroll

Payroll, another indicator of economic growth, has more than doubled in the United States in the past twenty years, increasing from $3.9 trillion to $8.2 trillion. Comparatively, manufacturing payroll has stagnated, growing just 41 percent over the same time. Figure 4 displays the difference between the change in manufacturing payroll and the change in national payroll from 2002 to 2022. Across all sectors, manufacturing payroll has failed to keep pace with national payroll growth, even in sectors that experienced employment growth. Some industries, such as textile mills (314), apparel manufacturing (315), and printing (323), saw payroll decrease over the twenty years.

Figure 4: Change in manufacturing annual payroll less the change in national payroll

Manufacturing Productivity and Consolidation

Many proponents of the narrative that manufacturing is stronger than ever in the United States will argue that the decline in these indicators reflects industry consolidation and superior productivity. In their view, firms have not gone out of business due to global competition; they have merged (which is why there are fewer firms). Likewise, jobs and payroll are down because of superior manufacturing productivity. However, the data shows that both excuses are wrong.

Consolidation data on the market share of the four largest firms in an industry from the Census Bureau tells a different story. From 2002 to 2017 (the latest year of Census data), the average C4 ratio, which is the market share of the top 4 manufacturing firms in an industry, increased by less than one percent. That cannot explain the relative loss of 31 percent of manufacturing firms. Further, from 2002 to 2022, annual growth in manufacturing labor productivity averaged 1.3 percent per year compared to 1.8 percent for the overall non-farm business economy. This means productivity cannot explain the steep loss of jobs.

Conclusion

It's time for the manufacturing debate to be informed by data, not ideology. As such, U.S. policymakers should reject the Polaynas who deny the loss of manufacturing. Instead, they must support a strategy to grow manufacturing, particularly in advanced industries critical to global power and national security.

References

Table 1: Manufacturing NAICS Codes

|

NAICS Code |

Industry |

|

31-33 |

Manufacturing |

|

311 |

Food manufacturing |

|

312 |

Beverage and tobacco product manufacturing |

|

313 |

Textile mills |

|

314 |

Textile product mills |

|

315 |

Apparel manufacturing |

|

316 |

Leather and allied product manufacturing |

|

321 |

Wood product manufacturing |

|

322 |

Paper manufacturing |

|

323 |

Printing and related support activities |

|

324 |

Petroleum and coal products manufacturing |

|

325 |

Chemical manufacturing |

|

326 |

Plastics and rubber products manufacturing |

|

327 |

Nonmetallic mineral product manufacturing |

|

331 |

Primary metal manufacturing |

|

332 |

Fabricated metal product manufacturing |

|

333 |

Machinery manufacturing |

|

334 |

Computer and electronic product manufacturing |

|

335 |

Electrical equipment, appliance, and component manufacturing |

|

336 |

Transportation equipment manufacturing |

|

337 |

Furniture and related product manufacturing |

|

339 |

Miscellaneous manufacturing |