How Innovative Is China in Nuclear Power?

Though China built upon a foreign base of technology, it has become the world’s leading proponent of nuclear energy. Chinese firms are well ahead of their Western peers, supported by a whole-of-government strategy that provides extensive financing and systemic coordination.

KEY TAKEAWAYS

Key Takeaways

Contents

Importance of Nuclear Power and the U.S. Role. 5

China’s Nuclear Power Industry 6

How Innovative Is China’s Nuclear Industry? 8

Innovation Inputs to China’s Nuclear Sector 12

China’s Government Policies Supporting the Nuclear Sector 20

Executive Summary

As Jacopo Buongiorno, a professor of nuclear science and engineering at the Massachusetts Institute of Technology (MIT), observed, “China is the de facto world leader in nuclear technology.”[1] Indeed, China likely stands 10 to 15 years ahead of where the United States is in nuclear power (referring especially to the ability to field fourth-generation nuclear reactors). China’s government has assigned considerable priority to domestic nuclear reactor construction as part of Beijing’s broader energy strategy. Looking ahead, China appears likely to use this established domestic capacity as a foundation for competitive reactor exports, much as its “dual-circulation” strategy has accomplished in other areas, such as electric vehicles and batteries.

Indeed, China has embarked on a rapid buildout of its nuclear industry, with 27 nuclear reactors under construction (more than two and a half times more than any other country) complementing the existing fleet of 56. The country expects to build 6 to 8 new nuclear power plants each year for the foreseeable future, with the country surpassing the United States in nuclear-generated electricity by 2030. In total, China intends to build a total of 150 new nuclear reactors between 2020 and 2035. Moreover, in December 2023, China commenced operation of the world’s first fourth-generation nuclear power plant, the 200 megawatt (MW)-producing, gas-cooled Shidaowan-1, in China’s northern Shandong province. China’s Nuclear Energy Administration has asserted that “90 percent of the technology in the new plant was developed within China.”[2] China is also leading development and deployment of a new fleet of cost-competitive small modular reactors.

China likely stands 10 to 15 years ahead of the United States in nuclear power.

However, this does not necessarily mean that China’s largest nuclear power companies—notably the state-owned enterprises (SOEs) China General Nuclear Power Corporation (CGN) and the China National Nuclear Power (CNNP)—are exceptionally innovative technologically. Indeed, the bulk of China’s current fleet of nuclear reactors consists of “third-generation” nuclear reactors that were initially designed by the U.S. company Westinghouse Electric (its AP1000) in the late-1990s and whose technology and designs Westinghouse transferred to China in 2008 as part of a contract to build four Chinese reactors based on the AP1000’s 2005 design. And while China is certainly to be credited for deploying the world’s first operational fourth-generation reactor, as one expert commentator noted at an ITIF roundtable, “That technology has actually been known to the world for decades; it’s just that China took the actions required to build and deploy it.”[3] It’s also of note that China’s second-largest nuclear power operator, CNNP, notes on its website that “innovation and research and development (R&D) are not the primary emphases of the company … Instead, the company primarily focuses on safety, stability, optimization, and sustainability.”[4]

Where China has thrived, however, regarding nuclear power innovation more pertains to systemic and organizational innovation. This especially refers to the country’s coherent national strategy toward nuclear power—at both federal and provincial levels—which entails a range of supportive policies from low-interest financing, feed-in tariffs, and other subsidies that make nuclear power generation cost competitive to streamlined permitting and regulatory approval (i.e., of safety and environmental impact assessments), to coordinating supply chains in an effective fashion. Indeed, as industry analyst Kenneth Luongo commented, “They don’t have any secret sauce other than state financing, state supported supply chain, and a state commitment to build the technology.”[5] That said, China’s rapid deployment of ever-more modern nuclear power plants over time produces significant scale economies and learning-by-doing effects, and this suggests that Chinese enterprises will gain an advantage at incremental innovation in this sector going forward.

Nuclear fusion—the process by which two light atomic nuclei combine to form a single heavier one while releasing massive amounts of energy—represents a potentially transformative, disruptive nuclear energy innovation.[6] In January 2024, the Chinese government launched a new national industrial consortium, led by the China National Nuclear Corporation (CNNC), and composed of 25 organizations, to promote the development and advancement of nuclear fusion technology.[7] However, industry analysts observed that nuclear fusion technology remains very nascent, and commented that China and the United States are probably on par with regard to development of the technology. Those analysts also observed that China would be likely to adopt a fast-follower approach with regard to nuclear fusion and probably seek advantage when it comes to rapidly scaling deployment of nuclear fusion reactors, once they become technically viable.

The United States, with 94 operational nuclear reactors, remains the world’s leader in nuclear energy output, accounting for one-third of nuclear power generated globally. However, the country has only launched two new nuclear reactors in the past decade, with the newest, the Vogtle Unit 4 plant in Georgia, coming online this year (with its construction originally begun by Westinghouse but completed by Bechtel).[8] If the United States is to again become a leader in the nuclear reactor industry, it will need to likewise adopt a coherent national strategy and a “whole-of-government” approach. Among other steps, this would entail sufficient staffing at federal R&D and regulatory agencies to support the innovation, down-selection, regulatory approval, and deployment of new reactor types; incentives, tax credits, or attractive financing that facilitate the production of cost-competitive nuclear energy; and policies such as streamlined export credit programs that facilitate exports from U.S. nuclear reactor producers. Civilian nuclear energy represents yet another industry the United States and its enterprises pioneered, but which has experienced a significant (and potentially permanent) loss of U.S. capabilities.[9]

Background and Methodology

The common narrative is that China is a copier and the United States the innovator. That narrative often supports a lackadaisical attitude toward technology and industrial policy. After all, the United States leads in innovation, so there is nothing to worry about. First, this assumption is misguided because it is possible for innovators to lose leadership to copiers with lower cost structures, as we have seen in many U.S. industries, including consumer electronics, semiconductors, solar panels, telecom equipment, machine tools, and, as noted here, quite possibly, nuclear power. Second, it’s not clear that China is a sluggish copier and always destined to be a follower.

To assess how innovative Chinese industries are, the Smith Richardson Foundation provided support to the Information Technology and Innovation Foundation (ITIF) to research the question. As part of this research, ITIF is focusing on particular sectors, including commercial nuclear energy.

To be sure, it’s difficult to assess the innovation capabilities of any country’s industries, but it is especially difficult for Chinese industries. In part, this is because, under President Xi Jinping, China discloses much less information to the world than it used to, especially about its industrial and technological capabilities. Notwithstanding this, ITIF relied on three methods to assess Chinese innovation in nuclear power. First, we conducted in-depth case study evaluations of two Chinese nuclear power companies selected from nuclear power companies listed on the “2023 EU Industrial R&D Investment Scoreboard.” Second, ITIF conducted interviews and held a focus group roundtable with global experts on the Chinese nuclear power industry. And third, ITIF assessed global data on nuclear power innovation, including scientific articles and patents.

Importance of Nuclear Power and the U.S. Role

Enrico Fermi and his team at the University of Chicago constructed the world’s first artificial nuclear reactor, known as Chicago Pile-1, under the school’s football stadium in November 1942.[10] In 1946, Congress passed the Atomic Energy Act, which established the U.S. Atomic Energy Commission.[11] The commission subsequently designated Argonne National Laboratory as the first and primary national laboratory for nuclear research.[12] The United States commissioned the first commercial electricity-generating plant powered by nuclear energy, located in Shippingport, Pennsylvania, in 1957.[13] The majority of America’s nuclear power plants were built in the 1970s and early 1980s, although construction of new facilities plummeted after the Chernobyl nuclear disaster, and almost all were launched by 1990.[14]

By the 1990s, Westinghouse Electric Company LLC and General Electric became America’s leading suppliers of commercial nuclear power plants. Driven by the interest in designing safer nuclear reactors in the post-Chernobyl era, in 1999, Westinghouse introduced designs for the AP1000, which became the first Generation III+ reactor to receive final design approval from the Nuclear Regulatory Commission, in 2004.[15] In 2007, Westinghouse (acquired by Japan’s Toshiba in 2006) won a CNNC bid for four AP1000 reactors, although this also included a major technology transfer agreement that significantly accelerated the advancement of China’s commercial nuclear power industry.[16] This would become the main basis for China’s move to Generation III technology. For its part, the slowing pace of nuclear power plant approvals over the past-quarter century (and notably, the inability to find a robust domestic market for the AP1000) led to Westinghouse declaring bankruptcy in 2017, with its assets now possessed by Brookfield Renewable Partners and Cameco.[17] Today, Bechtel is an important player in the industry, alongside a range of start-ups including NuScale, TerraPower, X-energy, and others that are attempting to design and build innovative fourth-generation nuclear reactors.

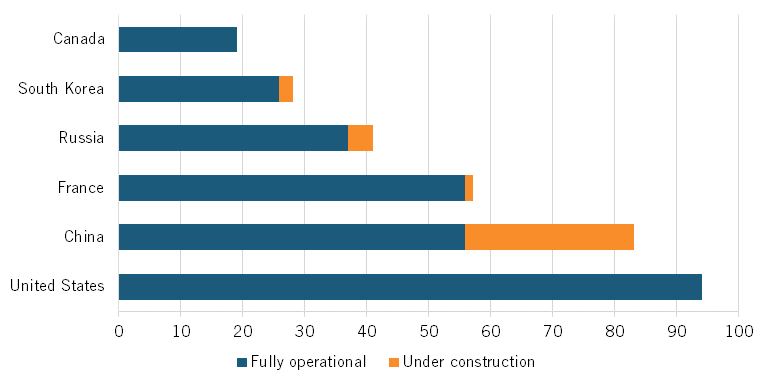

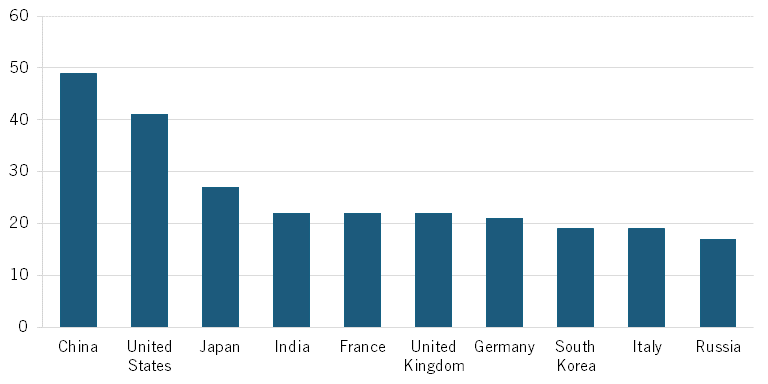

As of May 2024, the United States remains the global leader in nuclear energy production. America’s 94 plants in operation account for 31 percent of global nuclear power production, and in the United States, one-fifth of its energy production and one-half of its clean energy production. (See figure 1.) However, this represents almost entirely the effect of a previously fielded install base, as the United States has completed only two nuclear power plants in the last decade. In contrast, as this report illustrates, China’s commitment to commercial nuclear power is growing rapidly, with the country fielding 56 operational nuclear reactors, with 27 under construction, and the country on pace to overtake the United States as the nation with the largest nuclear-generating power capacity by 2030. Overall, China has nearly tripled its nuclear capacity over the past 10 years; it took the United States nearly 40 years to add the same nuclear power capacity as China added in the last decade.[18]

Figure 1: Nuclear power plants in operation or under construction as of May 2024[19]

China’s Nuclear Power Industry

As the Breakthrough Institute’s Seaver Wang explained, China’s “[n]ational policy has long prioritized both conventional and advanced reactor technology as a strategically important domestic capability and as a promising growth sector with export potential.”[20] In December 2011, China’s National Energy Administration committed to making nuclear energy the foundation of China’s power-generation system over the next “10 to 20 years,” promising to add as much as 300GWe (GWe means one billion watts of electric capacity) of nuclear energy over that period.[21] However, by 2022, nuclear energy still accounted for only 3.8 percent of Chinese power generation, in part because the Chinese government slowed approval and deployment of new reactors in the wake of the Fukushima nuclear plant incident.

However, China’s commitment to nuclear power increased significantly with the 14th Five-Year Plan (2021–2025), released in March 2021, which called for a buildout of some 150 new nuclear reactors over the ensuing 15 years to reach a production goal of 200 GW of nuclear energy by 2035 (enough to power more than a dozen cities the size of Beijing). Analysts estimated that adding an additional 147 GW (to the 53 GW of nuclear energy China produced at the time) would entail an investment of $370 billion to $440 billion over that 15-year timeframe.[22] By 2050, China wants nuclear to provide at least 15 percent of its electricity generation (which China envisions as its third overall source of energy by that year, behind wind and solar).[23]

Some analysts have observed that “climate policies have [had] the most significant impact on accelerating [China’s] nuclear policy development.”[24] They note that nuclear energy will be crucial to meeting Chinese president Xi Jinping’s goal of making China’s economy carbon neutral by mid century. However, certainly economic and national security considerations also represent key drivers in China’s push toward nuclear, especially with regard to the country’s historic dependence on oil imports (which the United States would certainly seek to impede in case of a conflict). China’s plans to produce 200 GW of nuclear energy by 2025 “could prevent about 1.5 billion tons of annual carbon emissions, more than what’s generated by the U.K., Spain, France, and Germany combined.”[25] The country seeks to replace all 2,990 of its coal-fired generators with clean energy solutions by 2060.

As noted, China is moving forward rapidly with its nuclear buildout, with 27 nuclear reactors now under construction, and the country aiming to install between 6 and 8 new nuclear reactors each year going forward.[26] (See figure 2.) That represents an additional 5,000–8,000 MW of new nuclear generating capacity per year.[27] Moreover, nearly every Chinese nuclear project that has entered service since 2010 has achieved construction in seven years or less.[28] Since the start of 2022, China has completed an additional five domestic reactor builds, with their completion times ranging from just under five years to just over seven years.

Figure 2: Locations of China’s nuclear power plants[29]

China’s main nuclear operators are CGN and CNNP, with SPIC (via its nuclear power business, State Nuclear Power Technology Corporation (SNPTC)) being the third largest. As of mid-2023, CGN operated 27 nuclear power units (accounting for 53 percent of the country’s nuclear power generation) and was constructing 7 more. CNNC’s 25 nuclear reactors account for 42 percent of China’s nuclear energy generation, with 9 more facilities under construction. China’s 56 existing nuclear plants (mainly located in coastal regions) produce 53.1 GW of electricity, while the 24 nuclear plants now under construction have the capability of generating over 23.7 GW of electricity.[30]

How Innovative Is China’s Nuclear Industry?

China approved the construction of its first nuclear power station only in 1981, 18 years after France (the last of the first four nuclear-armed states) had begun producing nuclear electricity.[31] But it wasn’t until 2005 that “China dramatically magnified its nuclear construction program.”[32] And a key catalyst in the Chinese industry’s growth was the 2008 agreement for Westinghouse to license its AP1000 technology to China’s SNPTC, which became the basis for China’s CAP1400 reactor. This was followed in 2014 (and again in 2018) with further SNPTC/Westinghouse agreements to deepen cooperation in relation to AP1000 and CAP1400 technology globally and “establish a mutually beneficial and complementary partnership.”[33] As a condition of the agreement, Westinghouse handed over thousands of documents on nuclear power plant design. But it wasn’t only voluntary tech transfer, as Robert Lighthizer writes in No Trade Is Free: Changing Course, Taking on China, and Helping America’s Workers, “What China could not get from Westinghouse through this deal, it simply stole.”[34] In 2010, hackers working with the Chinese military penetrated Westinghouse’s computer systems and stole confidential and proprietary technical and design specifications for Westinghouse’s AP1000.[35]

And although “The Westinghouse AP1000 was to be the main basis of China’s move to Generation III technology,” important nuclear “technology has [also] been drawn from France, Canada and Russia.”[36] In fact, only in 2020 did CNNP and CGN collaborate to bring online the Hualong One, which was the first Chinese third-generation reactor developed with homegrown technology and materials (though still based on Western designs).[37] However, China’s progress with nuclear technologies has advanced rapidly since then.

Indeed, from these austere beginnings, China and its nuclear power enterprises have rapidly developed their capabilities, to the point where MIT’s Buongiorno observed that, “China is the de facto world leader in nuclear technology at the moment.”[38] That sentiment is echoed by David Fishman, a Shanghai-based senior manager at the energy consulting firm Lantau Group, who has contended that, “China is arguably peerless in actually building and commercializing next generation nuclear power technology.”[39] Francois Morin, China director of the World Nuclear Association, concurs, observing that China’s new reactors put it “ahead of other countries in terms of nuclear technology research and development.”[40]

As noted, the flagship of China’s nuclear fleet has since become the CNNP-constructed Shidaowan-1 power plant, the world’s first fourth-generation nuclear reactor to come online. The facility features two high-temperature, helium gas-cooled modular pebble bed (HTR-PM) reactors that can produce 250 MW each, alongside a steam generator with an installed capacity of 200 MW.[41] CNNC asserts that 93.4 percent of the materials used in the $16 billion facility (which began construction in 2012) were domestically sourced.[42] Fourth-generation reactors such as the Shidaowan feature passive systems (meaning they don’t need to rely on electricity or pumps to shutdown in case of failure); use coolants other than water (such as helium); can operate at higher temperatures than most other reactors (permitting them to generate both electricity and hydrogen (via electrolyzers), the latter useful toward a number of industrial applications); and generate less waste.[43]

China has also led construction of the world’s first multipurpose SMR demonstration project, known as the Linglong One. SMRs represent advanced nuclear reactors that have a power capacity of up to 300 MW(e) per unit (compared with typical third-generation reactors, which have generating capacity above 1000 MW(e)) and are marked by the modular nature of their assembly, making it possible for systems and components to be factory-assembled and transported as a unit to a location for installation.[44] Linglong One constitutes a multipurpose pressurized water reactor (the ACP100) whose design was “developed by CNNC following more than 10 years of independent research and development.”[45] CNNC contends that “the design and construction of Linglong One are revolutionary and groundbreaking” and notes that “through standardized design, single module production, and mass production, the construction period is shortened and costs reduced.”[46] The Linglong One was the first SMR to receive approval from the International Atomic Energy Agency (IAEA). When it enters service (scheduled for year-end 2025), engineers expect the Linglong One to generate 1 billion kilowatt-hours of electricity annually, enough to service over 525,000 homes.[47]

Elsewhere, later in 2024, the Shanghai Institute of Applied Physics is slated to launch the world’s first molten salt and thorium nuclear reactor, the TMSR-LF1, in China’s Gansu province. While thorium-based reactors are not entirely novel, what differentiates this reactor is its utilization of thorium as a fuel source within a molten salt reactor.[48]

In December 2021 China became the third country to develop a floating nuclear reactor, the ACPR50S, which has been designed to endure a once-in-10,000-years weather catastrophe.[49] The 60 MW floating reactor is being built to power oil rigs and islands off the east coast of China in the Bohai Sea.[50]

China is in the process of deploying each of the six types of fourth-generation nuclear reactors identified by the Generation IV International forum.

China is also building fast neutron reactors (FNRs), another type of fourth-generation reactor, whose design more deliberately uses the uranium-238 as well as the fissile U-235 isotope used in most reactors.[51] If FNRs are designed to produce more plutonium than the uranium and plutonium they consume, they are called fast breeder reactors (FBRs).[52] CNNC connected a 600 MW FBR to the grid in 2023 and expects to launch a second by 2026. China is also considering whether to build a commercial 1,000 MW FBR in the coming years.[53] (Of note is that FBRs represent a dual-use technology: Analysts expect that each FBR reactor China builds could yield up to 200 kilograms of weapons-grade plutonium annually, enough for 50 nuclear warheads.) It should also be noted that China has received considerable assistance from Russia in designing and building these two FBRs, and also that the world’s first FBR was launched in 1969, so the design for such facilities has been known for some time.[54]

Ultimately, the Generation IV International forum—a cooperative international endeavor among 13 countries seeking to develop the research necessary to test the feasibility and performance of fourth-generation nuclear systems and to make them available for industrial deployment by 2030—has identified six different reactor types as “Gen IV.” These are: the gas-cooled fast reactor (GFR), the lead-cooled fast reactor (LFR), the molten salt reactor (MSR), the sodium-cooled fast reactor (SFR), the supercritical-water-cooled reactor (SCWR), and the very high-temperature reactor (VHTR).[55] Notably, across various projects, China is trying to build reactors of each of these types.[56]

Beyond nuclear reactors themselves, China has long been dependent on other nations, notably Kazakhstan and Russia, for the uranium that fuels nuclear reactors. Overall, “China has stated it intends to become self-sufficient not just in nuclear power plant capacity, but also in the production of fuel for those plants.”[57] This requires sourcing uranium, enriching it, and manufacturing fuel.

Part of China’s strategy for building different types of fourth-generation reactors is to build new designs that do not rely on uranium in order to reduce this dependency. At present, analysts have noted that, “China aims to produce one-third of its uranium domestically, obtain one-third through equity in mines and joint ventures overseas, and to purchase one-third on the open market.”[58]

China is also looking to become self-sufficient in its ability to enrich uranium and manufacture nuclear fuel. Accordingly, CNNC’s Shaanxi Uranium Enrichment Co. Ltd. subsidiary introduced in March 2018 a next-generation uranium enrichment centrifuge for large-scale commercial application.[59]

Nuclear Fusion

Nuclear fusion, which seeks to replicate the nuclear fusion reaction at the core of a star, refers to the energy released from fusing two hydrogen nuclei, with the process requiring a reactor that can withstand extreme temperatures, in excess of 100 million degrees Celsius, and one that can allow the nuclei to collide with each other.[60] In theory, nuclear fusion technology would be able to generate energy equivalent to that produced by eight tons of oil from just one gram of fuel (tritium or deuterium, which are isotypes of hydrogen and which in theory could be attained readily from seawater).[61]

The Chinese government has set a goal of building the first industrial prototype fusion reactor, which it has dubbed an “artificial sun,” by 2035, with officials hoping to begin large-scale commercial production of fusion energy by 2050.

Nuclear fusion has become a national priority for China. Indeed, China’s State Council made it clear in a recent meeting that “controlled nuclear fusion is the only direction for future energy.”[62] On January 9, 2024, the Chinese government launched a new national industrial consortium, led by CNNC, to promote the development and advancement of nuclear fusion technology.[63] The consortium will include 25 primarily government-owned companies, four universities, and one private company, with much of the technological know-how for the project derived from research conducted at the CNNC-affiliated Southwestern Institute of Physics and the Chinese Academy of Sciences-affiliated Institute of Plasma Physics.[64] The Chinese government also announced that it would create a new enterprise, the China Fusion Corporation, in an attempt to lead the industry’s development.[65] China also participates as a member of the 35-nation $25 billion nuclear fusion power research project, the International Thermonuclear Experimental Reactor.

Heretofore, the main locus of China’s government-funded fusion research has been based at the Institute of Plasma Physics at the Hefei Institute of Physical Science, where scientists operate the $900 million Experimental Advanced Superconducting Tokamak (EAST).[66] In 2021, EAST attained several world records, including maintaining a plasma temperature of 120 million degrees Celsius for 101 seconds and 160 million degrees Celsius for 20 seconds.[67] Following on EAST, in 2017 China commenced engineering design on the China Fusion Engineering Test Reactor (CFETR), a magnetic confinement fusion device, construction of which is planned for the late 2020s as a demonstration of the feasibility of large-scale fusion power generation.[68] The Chinese government has also launched new fusion education programs in China, with a goal of training 1,000 new plasma physicists to support these initiatives.[69]

Ultimately, the Chinese government has set a goal of building the first industrial prototype fusion reactor, which it has dubbed an “artificial sun,” by 2035, with officials hoping to begin large-scale commercial production of fusion energy by 2050.[70] Industry analysts ITIF interviewed for this report observed that China appears to be roughly on par today with U.S. (and other foreign) efforts to develop nuclear fusion technologies. They noted, however, that China is likely to adopt a fast follower approach in this sector (once commercially viable nuclear fusion technologies are realized) and differentiate themselves by rapidly scaling production and deployment of fusion reactors.

Other Chinese Nuclear Power Innovations

The start-up Beijing Betavolt New Energy Technology Company Ltd., established in April 2021, claims to have developed a miniature atomic energy battery that can generate electricity stably and autonomously for 50 years without the need for charging or maintenance.[71] Such atomic energy batteries, which are also known as nuclear batteries or radioisotope batteries, utilize energy released by the decay of nuclear isotopes and converts it into electrical energy through semiconductor converters.[72] Betavolt has asserted that its battery “combines nickel-63 nuclear isotope decay technology and China’s first diamond semiconductor (4th generation semiconductor) module to successfully realize the miniaturization of atomic energy batteries.”[73] Such batteries can provide long-lasting power supply in multiple scenarios such as aerospace, AI equipment, medical equipment, micro-electromechanical systems, advanced sensors, small drones and micro-robots.

Innovation Inputs to China’s Nuclear Sector

This section examines indicators assessing China’s nuclear competitiveness at the industry level, considering such factors as R&D intensity, scientific publications, and patenting levels.

R&D Intensity

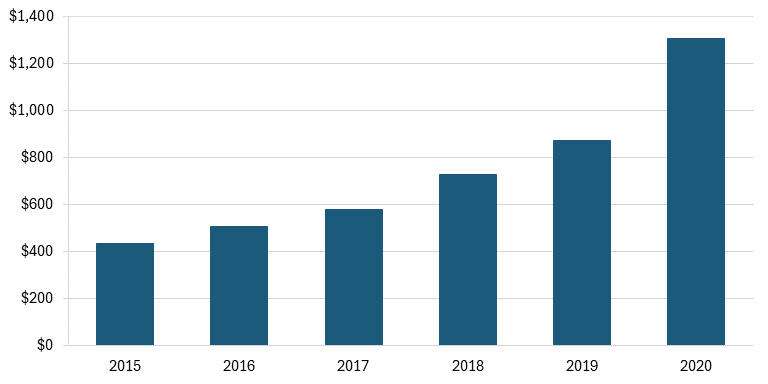

A study by the IAEA estimates that private R&D in China’s nuclear industry is steadily increasing, at least among globally listed companies. Estimated private R&D reached about $1.3 billion in 2020, compared with only about $436 million in 2015. (See figure 3.)

Figure 3: Nuclear R&D investment by globally listed companies headquartered in China, 2015–2020 (millions) [74]

In terms of nuclear power companies’ levels of R&D investments (as reported in the “2023 EU Industrial R&D Investment Scoreboard”), China placed 7 of the top 22 enterprises in the study. CGN Power was the leading Chinese company, with an R&D intensity of about 4.5 percent of its revenue. That is an even higher R&D intensity than Orano, one of the leading nuclear power companies in the European Union. (See table 1.) (Note: NuScale’s R&D intensity is so high because it’s a (mostly) pre-revenue startup enterprise.)

Table 1: Leading nuclear power generation investors on the “2023 EU Industrial R&D Investment Scoreboard”[75]

|

Company |

Headquarters |

R&D Investment (Billions ) |

R&D Intensity |

|

NuScale Power |

United States |

€ 0.12 |

1045% |

|

CGN Power |

China |

€ 0.49 |

4.49% |

|

Orano |

France |

€ 0.13 |

3.02% |

|

China Energy Engineering |

China |

€ 1.38 |

2.83% |

|

China National Nuclear Power |

China |

€ 0.24 |

2.60% |

|

Elia |

Belgium |

€ 0.09 |

2.48% |

|

Guangdong Electric Power Development |

China |

€ 0.15 |

2.08% |

|

China Nuclear Energy |

China |

€ 0.21 |

1.63% |

|

Korea Electric Power |

South Korea |

€ 0.56 |

1.07% |

|

GD Power Development |

China |

€ 0.20 |

0.78% |

|

Taiwan Power |

Taiwan |

€ 0.14 |

0.73% |

|

Iberdrola |

Spain |

€ 0.36 |

0.67% |

|

Huaneng Power |

China |

€ 0.22 |

0.66% |

|

Electric Power Development |

Japan |

€ 0.07 |

0.56% |

|

Electricite De France |

France |

€ 0.79 |

0.55% |

|

Chugoku Electric Power |

Japan |

€ 0.06 |

0.51% |

|

Kansai Electric Power |

Japan |

€ 0.07 |

0.27% |

|

Vattenfall |

Sweden |

€ 0.06 |

0.26% |

|

Tokyo Electric Power |

Japan |

€ 0.14 |

0.25% |

|

Chubu Electric Power |

Japan |

€ 0.06 |

0.22% |

|

Engie |

France |

€ 0.14 |

0.13% |

|

Fortum |

Finland |

€ 0.06 |

0.04% |

Scientific Publications

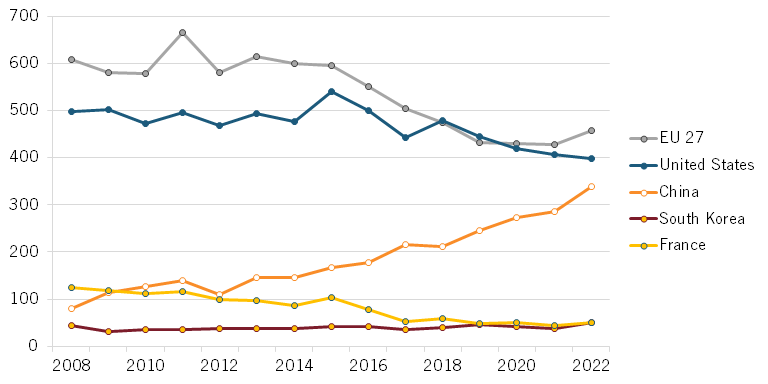

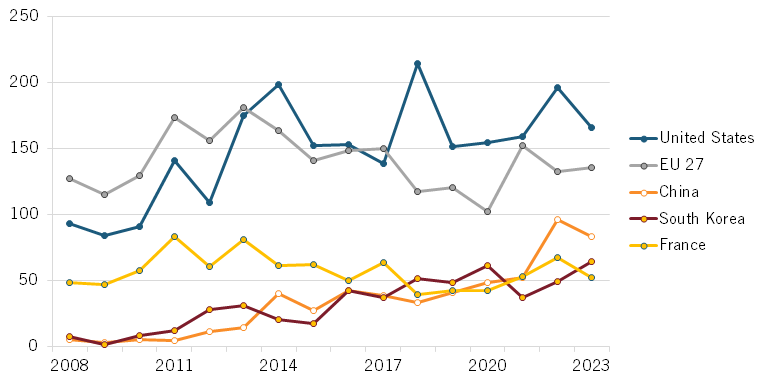

As of 2022, China ranked third in terms of nations with citations among the top 10 percent of highly cited publications in nuclear science and engineering, with 339 such publications, compared with EU-27 nations with 457 such publications and American ones with 399. China’s number of such publications increased four-fold between 2008 and 2021, while European publications declined by nearly one-quarter and the number of American ones declined by one-fifth. (See figure 4.)

Figure 4: Number of top 10 percent most-cited publications in nuclear science and engineering, 2008-2022[76]

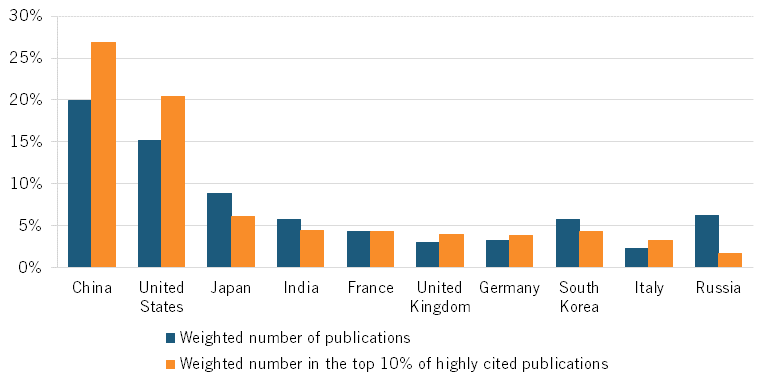

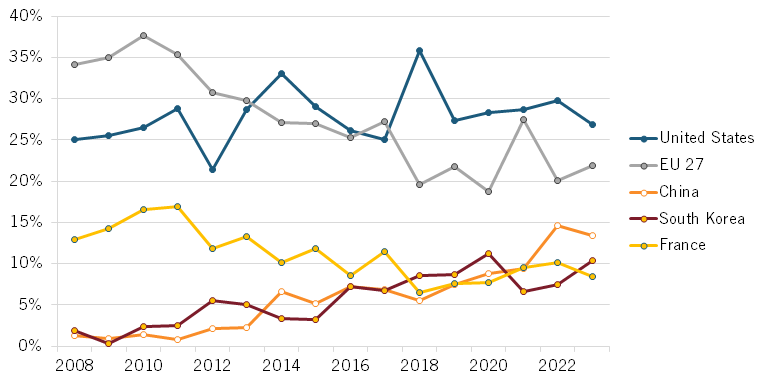

Research from the Australian Strategic Policy Institute (ASPI) confirms that China has become a world leader in scientific publications on nuclear energy. In 2023, Chinese publications had a weighted share of 20 percent of all scientific publications in the field. Similarly, Chinese publications had a weighted share of about 27 percent of all publications in the top-cited journals. (See figure 5.) Similarly, China ranks first in the H-index, a commonly used metric for measuring the scholarly impact of journal publications, for nuclear energy. (See figure 6.) In sum, China is a leader not only in the quantity of nuclear energy publications, but also in “high-quality” publications.

Figure 5: Weighted shares of scientific publications in nuclear energy by country, 2023[77]

Figure 6: H-Index for scientific publications in nuclear energy, 2023[78]

Patents

The Patent Cooperation Treaty (PCT) framework allows for innovators to seek protection for an invention simultaneously in each of a large number of countries by filing an “international” patent application.[79] From 2008 to 2023, Chinese entities increased their levels of PCT nuclear patents awarded from 5 to 83, exceeding France’s and South Korea’s counts by 2023. While China’s increase from 5 to 83 over that period represents an astonishing 1,560 percent increase (albeit from a low starting point), the number of patents being awarded to U.S. filers increased by only 78 percent. (See figure 7.)

Between 2008 and 2023, China’s share of all nuclear patents increased from about 1.3 percent to about 13.4 percent. That constitutes a 12.1 percentage point increase, in contrast to an increase of only about 1.9 percentage points for the U.S. global share. By contrast, the EU’s global share fell by about 12.3 percentage points over that same period. (See figure 8.)

Figure 7: Number of PCT patents granted in nuclear science and engineering, 2008–2023[80]

Figure 8: Global shares of PCT patents granted in nuclear science and engineering, 2008–2023[81]

Patent applications can be a problematic metric, especially because countries such as China have been known to provide generous incentives for patent filers, which can incentivize the number, though not the quality, of patents filed. Nevertheless, patent applications can be an indicative metric, and on this score, between 2011 and 2022, China filed more patents in fusion technology than any other country.[82]

The Tokyo-based research company Astamuse has examined the strength and quality of countries’ nuclear fusion patent application portfolios by considering the 1,133 nuclear fusion patent applications filed by entities from 30 countries from 2011 to 2022 and scoring them based on measures including the number of patents filed, the feasibility of each innovation, and the remaining period of exclusivity.[83] Astamuse ranked China first in its national nuclear fusion patent portfolio ranking, followed by the United States, United Kingdom, and Japan. In terms of the strength of organizations’ patent filings, Astamuse ranked the Chinese Academy of Sciences second followed by the Southwestern Institute of Physics, an affiliate of China National Nuclear Corp., third.[84] (British startup Tokamak Energy ranked first). To be sure, Astamuse considered patent filings, not grants, but still it noted several impressive Chinese fillings, such as one by the Chinese Academy of Sciences for a ceramic composite material that can be used in the wall of a nuclear fusion reactor, which outside experts indicated appears to represent a significant technological breakthrough.[85] It’s also worth noting that China’s significant increase in nuclear energy patent application filings over the past decade does correspond well with the significant increase in patent grants in the field to Chinese entities over that timespan.

Company Case Studies

This section provides case study analyses of several Chinese nuclear power companies; as there are a very small number of leading nuclear power entities in China, these two were intentionally selected from Chinese nuclear power companies included on the “2023 EU Industrial R&D Investment Scoreboard” report.

CGN Power

CGN Power is an SOE that represents one of the two main participants in China’s nuclear power industry, operating 27 nuclear power units (generating 30.6 MW) and constructing 7 more (to generate a total of 8.4 MW) as of mid-2023, accounting for about 54 percent of the total nuclear power installed capacity in China. The company operates five types of reactor units, including the independently developed, third-generation, 1,200 MW Hualong One reactor. The company’s operations span the entire nuclear power industry value chain, with nuclear power generation and electricity sales contributing over 72 percent to its total revenue, and nuclear engineering design and construction services accounting for 28 percent.

The company was initially founded as Guangdong Nuclear Power Joint Venture Company in Guangzhou in 1985, and it achieved a significant milestone with the successful operation of the Daya Bay nuclear power station in 1994, marking the start of large-scale commercial nuclear power stations in China. CGN benefitted greatly from French technology transfer and guidance. In the first four years after its establishment, the nuclear power station’s operational management personnel were all from EDF France. In 2007, CGN Power imported third-generation pressurized water reactor EPR (European Pressurised Reactor) technology from France and Germany, began construction in 2009, and completed it in 2015, making it the first globally operated reactor using EPR technology. As the company matured (notably into the 2000s), it began focusing on R&D activities toward developing proprietary third-generation nuclear power technology.

CGN’s R&D motto is “Introduce, Digest, Absorb, Innovate.” The company’s R&D efforts are concentrated in mainland China, where it has a national-level engineering technology center, a national key laboratory, five national technology R&D centers, and three major R&D bases located in Shenzhen, Yangjiang, and Zhongshan. As of year-end 2022, the company employed approximately 19,000 people, 91 percent of whom are technical personnel, including over 4,700 full-time R&D staff, which comprised one-quarter of the company’s workforce.

In 2022, the company’s R&D expenditures were 3.85 billion RMB (approximately $539 million), representing an R&D expense rate of 4.65 percent, an increase of 26.5 percent from 2021. (Its R&D intensity in 2023 was about 4.5 percent.) CGN Power’s R&D expense rate has consistently been within the range of 3.5 to 5 percent for several years, benefiting from stable and rapid revenue growth, allowing the company to maintain a steadily increasing R&D budget.[86]

In terms of patents, CGN Power Group has applied for 15,467 patents, of which 10,058 have been granted (mostly in China). Of these 15,467 patents, over 80 percent are active. Since 2003, the number of patents applied for by CGN Power Group has been on an upward trend, with 2,126 patents applied for in 2021 alone. Out of these 15,467 patents, 15,003 are in China, 40 in the United Kingdom, 18 in Germany, and 61 in other European countries. According to the U.S. Patent and Trademark Office, CGN Power has made five patent applications in the United States, four of which have been granted.[87] The company has received some international recognition, including the 2020 Inno ESG Prize from Hong Kong and the 2019 Sino-French Corporate Social Responsibility Award, though most of its awards have been won from within China.

China National Nuclear Power

CNNP is a subsidiary of the state-owned CNNC. As of year-end 2023, CNNP operated 25 nuclear reactors with an installed capacity of 23.8 GW and 9 reactors (10.1GW) under construction. The company holds a 42 percent share of China’s nuclear energy market and contributes 2.04 percent of the country’s annual electricity production. Nuclear power generation accounts for 90 percent of the company’s $9.8 billion annual revenues (the remainder from other renewables).

Like CGN, CNNP’s development history has also involved extensively replicating existing technologies from abroad while transitioning toward applying more advanced and technologically complex innovative systems in the future. Indeed, CNNP has extensively absorbed and replicated existing foreign technologies. This has included introducing second- and third-generation reactor designs from French nuclear companies (shared with CGN), importing the AP1000 reactor from Westinghouse and optimizing it to develop the CAP1400, and adopting heavy water reactor technology from Canada’s CANDU reactors. It was not until the end of 2014 that CNNP and CGN jointly introduced the Hualong One, China’s first third-generation nuclear reactor.

Key areas of R&D investment include the indigenization of critical equipment, enhancing equipment reliability, intelligent operation of nuclear power stations, and maintenance and overhauls of units. Currently, the company has three R&D centers located in Shanghai, Qinshan, and Liaoning, with no overseas R&D branches or cooperative projects.[88]

In 2022, CNNP invested $196 million in R&D, a 5 percent increase in expenditures over the previous year, giving the company a 2.7 percent level of R&D intensity. That year, CNNP reported having 3,984 R&D personnel, which constituted about 23.3 percent of its total workforce. Among them, 3,200 held undergraduate degrees, while the remaining staff had master’s degrees or higher.[89]

It appears that a significant proportion of patents have been applied for in the name of CNNC or one of its subsidiaries, the China Nuclear Energy Research Institute, suggesting that there may be collaborative aspects to the R&D projects, although no reports specifically mention this. Considering only the patents under the name CNNP, the company applied for 96 new patents in 2022. As of 2023, according to data from China’s official patent platform, the company holds a total of 308 valid patents and has applied for 490 additional ones. According to data from the World Intellectual Property Organization (WIPO), the company has applied for 322 patents and holds 266 valid patents. All of these patents were applied for and are registered within mainland China.[90]

Overall, CNNP lags behind global peers such as Électricité de France (EDF) in terms of R&D centers, R&D funding, and the number of patents, but surpasses them in R&D intensity and the proportion of R&D personnel.

China’s Government Policies Supporting the Nuclear Sector

From framing the economics of the sector, to coordinating ecosystem actors, to streamlining regulatory and permitting procedures to supporting R&D investments in the sector, China’s state guidance has been critical in driving China’s nuclear sector; and that’s setting aside the reality that China’s nuclear companies are themselves SOEs. Indeed, China has benefited greatly from a coherent national strategy and whole-of-government approach to promoting nuclear energy. As Luongo observed, China doesn’t “have any secret sauce other than state financing, state supported supply chain, and a state commitment to build the technology.”[91]

About 70 percent of the cost of Chinese reactors are covered by loans from state-backed banks at rates as low as 1.4 percent, far below rates nuclear power companies can receive in other nations.

The role of China’s government has been particularly important in framing the economics of the industry. In particular, China’s government has supported the sector with inexpensive financing as well as subsidies, known as feed-in tariffs, that decrease the cost of consumption. These factors have driven down the price of nuclear power in China to about $70 per MW-hour, compared with $105 in America and $160 in the European Union.[92] About 70 percent of the cost of Chinese reactors is covered by loans from state-backed banks, at rates as low as 1.4 percent, far lower rates than companies in other nations (outside Russia) can secure.[93] According to analysts at BloombergNEF and the World Nuclear Association, in part thanks to these low financing costs, China can build plants for about $2,500 to $3,000 per kilowatt, about one-third of the cost of recent projects in the United States and France.[94] Chinese provincial governments often also provide free or discounted land, further lowering operating costs in China.

China’s nuclear operators also benefit considerably from value added tax (VAT) rebates. The policy involves initially collecting VAT and then refunding it, with the refund rate decreasing over three phases: 75 percent refund during the first 5 years of official commercial operation, 70 percent during the 6th to the 10th year, and 55 percent from the 11th to the 15th year, with no VAT refund after 15 years. For example, for CGN, in most provinces where CGN Power’s nuclear power stations operate, the original VAT rate is 13 percent. Conservatively estimated, under the VAT refund policy for nuclear power projects, CGN Power reduces its operational costs by over 6 percent annually. Based on cost estimates for 2022, this equates to a government subsidy of about $532 million, nearly 40 percent of the net profit, significantly enhancing CGN’s profitability and competitiveness.[95] Similarly, VAT rebates reduce CNNP’s operational costs by over 5 percent annually, equating to a subsidy of over $360 million in 2022.

Beyond finance, China’s nuclear power companies also benefit from coordinated ecosystem development. Indeed, Beijing has worked hard to foster localized supply chains for reactor components. As Breakthrough’s Wang explained:

The large-scale growth of industrial and civil infrastructure countrywide in past decades has cultivated considerable megaproject management experience and construction capacity. In particular, private and public-sector projects have learned to target construction economies of scale by planning and co-locating multiple identical units or manufacturing lines at the same site, organized in successive phases of site development and expansion.[96]

The Chinese government envisions nuclear as a key future export sector for the country, particularly to countries participating in China’s Belt and Road Initiative (although China remains well behind Russia, which is still the world’s leader in the export of nuclear products and services). Nevertheless, Chinese officials have set a goal of selling 30 overseas nuclear reactors to Belt and Road partners by 2030.[97] Chinese officials anticipate that “Belt and Road” nuclear projects could earn Chinese firms as much as 1 trillion yuan ($145.5 billion) by 2030. Indeed, the director of China’s National Energy Administration has stated that the sale abroad of one nuclear power plant is worth “the export of one million Volkswagen Santana cars.”[98] China has placed a bid to build Saudi Arabia’s first civilian nuclear power plant at a price 30 percent lower than competing French and South Korean tenders.[99] Notably, China (like Russia) is not bound by Organization for Economic Cooperation and Development (OECD) guidelines on minimum interest rates and loan repayment terms, which is already enabling it to offer more attractive export financing packages (affording it a distinct advantage) in competing for overseas business in nuclear markets.[100]

There’s no question the development of China’s capabilities in nuclear energy were in part a significant result of U.S. technology transfer and knowledge sharing.

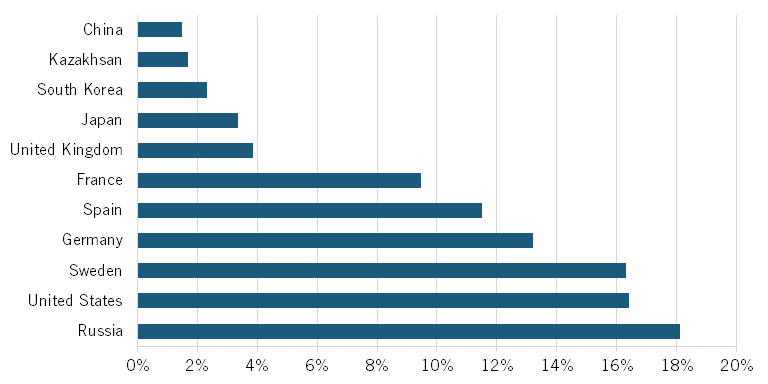

But China still has a long way to go here, as it trails the leading exporters of nuclear reactors, notably Russia, which as of 2022 held an 18.1 percent share ($545 million) of nuclear reactor exports, followed by the United States with a 16.4 percent share ($492 million) and Sweden with a 16.3 percent share ($488 million). (See figure 9.) That’s followed by Germany, Spain, and France, while Japan’s share has fallen to just 3.34 percent and China’s is still getting off the ground at 1.5 percent.

Figure 9: Leading exporters of nuclear reactors, country share of global market (2022)[101]

Thus, with regard to the eight S’s ITIF has framed as part of its “Is China Innovative?” research series—Science and engineering talent, a head Start, Scale, Speed, local Suppliers, Subsidies, Size, and Specialization—China’s nuclear energy policy and strategy hits upon most of these. As noted, China is rapidly approving and building nuclear facilities (six to eight new approvals a year and building them within about seven years or so each), seeking to build some 150 (so as to achieve scale and decrease cost), leveraging local suppliers, and massively subsidizing the sector. It’s also now getting a head start on deploying the newest fourth-generation nuclear reactors, and, as noted, it has launched training programs to educate at least another 1,000 scientists and engineers in nuclear fusion alone. The eight S’s provide a nice synthesis for how China is seeking to compete in nuclear fission and fusion.

Going forward, the United States will need to determine how much it wishes to collaborate with China with regard to nuclear technologies. There’s no question the development of China’s capabilities in nuclear energy were in part a significant result of U.S. technology transfer and knowledge sharing. As one industry analyst told ITIF, “For a six- to eight-year time period from 2007 to 2015 or so, Chinese researchers formed the largest category of international visitors at Oak Ridge National Laboratory. They were making a very systematic effort to vacuum up all the {nuclear] knowledge and research they could possibly get.”[102] This reflected incredible naïveté by U.S. officials, who argued that transferring to the Chinese, for free, incredibly valuable U.S. technology made sense because it would help mitigate global warming. One almost cannot make this up.

What Should America Do?

Unfortunately, as industry analyst Luongo observed, “It is generally agreed the U.S. has lost its global dominance in nuclear energy.”[103] Therefore, the United States needs to develop a coherent national strategy and whole-of-government approach to reanimating the deployment of modern nuclear reactor technology. This should be predicated on the recognition that America’s current nuclear installed base is aging rapidly, and, more importantly, that modern nuclear reactor technologies are substantially safer and more efficient (in producing energy from a given set of fuels) than previous designs. It should also be predicated on a recognition that if the United States is to contribute to global clean energy and decarbonization objectives, an embrace of nuclear energy must be part of an “all-of-the-above” energy strategy. A recent U.S. Department of Energy (DOE) report suggests that if the United States commits more to nuclear, it could triple its nuclear-power generation to 300 GW by 2050 (and make an important contribution toward meeting America’s net-zero emission goals).[104] This would also promote U.S. energy security and the resilience of America’s energy system.

Policymakers will need to both fund the future and provide necessary funding today to appropriately maintain America’s existing fleet of nuclear reactors, building upon Congress’s creation of a $6 billion relief fund in the 2021 Bipartisan Infrastructure Investment and Jobs Act (BIIJA), whose intent is to preserve America’s existing nuclear fleet and related jobs through 2031.[105] The 2022 Inflation Reduction Act also includes tax credits through 2032 for existing U.S. reactors. (The advanced nuclear tax credit under Section 45J of the Energy Policy Act of 2005, which offers a maximum 1.8 cent per kilowatt-hour credit, continues to be the only currently available federal generation credit for new nuclear electricity generation facilities not yet placed into service.)[106]

DOE’s Advanced Reactor Demonstration Program (ARDP), launched in 2020, seeks to speed the demonstration of advanced reactors through cost-shared partnerships with U.S. industry. Since its 2020 launch, Congress has appropriated $3.2 billion to the program, including $2.48 billion in funding through FY 2025 as part of the BIIJA. The agency is extending awards to applicants developing: 1) advanced reactor demonstrations, which are expected to result in a fully functional advanced nuclear reactor within seven years of the award; 2) advanced reactor concepts 2020 (ARC 20), which will support innovative and diverse designs with potential to commercialize in the mid-2030s; or 3) risk reduction for future demonstrations.[107] In total, DOE is supporting 10 U.S. advanced reactor designs to help mature and demonstrate its technologies.[108]

China is years ahead of the United States in even deploying our country’s own technologies.

There are many promising potential U.S. nuclear power innovators. For instance, Bellevue, Washington, and Bill Gates-backed TerraPower is developing a sodium fast reactor combined with a molten salt energy storage system and X-energy is developing a Gen-IV High-Temperature Gas-Cooled reactor. (Bechtel is the engineering, procurement, and construction provider for TerraPower in deploying its Natrium technology.)[109] In June 2024, TerraPower announced it was commencing construction in Wyoming on its advanced nuclear reactor, with an expected launch date of 2030.[110] Elsewhere, NuScale seeks to launch a scaled-down light water reactor (LWR) and Westinghouse is developing the AP300, its own scaled-down LWR.[111] Yet, none of these are expected to enter even the demonstration stage until 2030, at the earliest, which means China has opened a significant lead over the United States in the development of fourth-generation nuclear technology. And even considering the prior generation of reactors, notably the Westinghouse AP1000, China was deploying their versions of them as early as 2017, while as noted the Vogtle Unit 4 has just now come online, meaning that China is years ahead of the United States in even deploying our country’s own technologies.

Policymakers will also need to support the economics of new nuclear technologies. DOE estimates that nuclear reactors will need to cost about $3,600 per kilowatt to be built quickly and scaled around the country, but first-of-their-kind reactors are costing anywhere from $6,000 to $10,000 per kilowatt.[112] The United States will also need to work to develop domestic fuel enrichment capacity for these projects. For instance, DOE is currently trying to enable domestic high-assay low-enriched uranium (HALEU) production capabilities via the HALEU Availability Program, through which DOE will acquire HALEU through purchase agreements with domestic industry partners and produce limited initial amounts of material from DOE-owned assets.[113] Of course, production at scale can reduce per-unit costs, but this requires a sustained commitment to comprehensive buildout. Another challenge pertains to skills: DOE estimates that if the United States is to meet the aforementioned 2050 target of tripling nuclear energy production, America would need an additional 375,000 skilled engineers, technicians, and construction personnel in the sector to support such a buildout.[114]

As such, the United States needs to revamp its approach to supporting next-generation nuclear initiatives. Notably, both ARDP and the Nuclear Regulatory Commission (NRC) need more resources, in terms of funding and manpower, in part so they can pay market rates to the staff that will be needed to evaluate the wider variety of proposed nuclear designs to come. ARDP also needs a better down-selection process for the demonstration projects it’s currently funding. In particular, it appears that the current DOE approach envisions going from start-up to commercialization immediately; instead, DOE should have grant recipients produce a pilot-scale demo, such as in the 5–10 MW range, as part of the down-selection process, before going full commercial.

If nuclear energy is going to become a considerable export product for the United States again, then U.S. companies well need to be better supported in their efforts to sell into global markets. The United States should develop a “one-stop-shop” approach, including the U.S. Export-Import Bank (EXIM), U.S. State Department, and other relevant agencies so that foreign buyers of U.S. nuclear exports can deal with a single entity rather than multiple agencies to complete deals (as Russia’s Rosatom does). It should also be made clear that nuclear is a qualifying technology for the EXIM’s China and Transformational Exports Program (CTEP), whose intent is to assist U.S. exporters facing competition from China and which makes qualifying companies in the program eligible for reduced fees, extended repayment terms, exemptions to EXIM policy requirements, and other benefits.[115] To its credit, America’s State Department has established partnerships with more than a dozen countries to help them fund and develop nuclear-energy programs and, eventually, SMRs.[116]

Here, the United States could also expand theFoundational Infrastructure for Responsible Use of Small Modular Reactor Technology (FIRST) program, a multiagency U.S. government initiative that provides capacity building support to help partner countries safely and responsibly build an SMR or other advanced reactor program, to include more countries.[117] The United States also has to negotiate civil nuclear cooperation agreements with foreign governments (Section 123 agreements) and has been quite slow in doing this; enhanced staffing at DOE and the State Department could better support this, along with making a list of priority countries in the Global South with which to promote U.S. nuclear technology exports.

The United States has historically been a leader in nuclear fusion research, most notably with regard to the National Ignition Facility achieving the first net-energy gain nuclear fusion reaction in December 2022.[118] Still, the United States needs to build a comprehensive nuclear fusion strategy and strengthen investments therein: While the federal government will invest $790 million in fusion science programs in 2024, advocates had sought for at least $1 billion in investment.[119] Moreover, as one commentator observed, “The Biden administration has taken steps in the right direction with its development of a Bold Decadal Vision, recognizing the technology’s potential as a clean energy source, but has not translated this into a large-scale push.”[120] U.S. policy should work to more strongly coordinate government, academic, and private sector efforts in nuclear fusion and empower DOE with a mandate to achieve commercial fusion power as soon as possible.[121] A comprehensive strategy and sustained investment will be needed, for nuclear fusion represents yet one more arena where the technical, scientific, and commercial competition will be fierce between China and the United States in the years ahead.

For this reason, recent administrations have clamped down on the transfer or export of nuclear technologies to China. In January 2019, the Trump administration scuttled a 2015 agreement TerraPower had signed with CNNC to build a prototype 600 MW reactor at Xiapu in Fujian province.[122] Further, in August 2019, the United States placed China General Nuclear Power Group and three of its subsidiaries on its Entity List because they had “engaged in or enabled efforts to acquire advanced U.S. nuclear technology and material for diversion to military uses in China.”[123] And in August 2023, the Biden administration further tightened controls on the export of materials and components for nuclear power plants to China.[124] China has become America’s leading geostrategic competitor, and America needs to completely cease any sharing of its nuclear technologies with the country.

Lastly, the United States needs to be working more closely with its own allies, including France, Germany, Japan, South Korea, and Sweden (among others), to collaborate on R&D for advanced nuclear technologies and to help promote nuclear exports from techno-democracies to third-party markets. Indeed, considerable collaboration could be achieved in the regulatory, procurement, and contracting spaces. For instance, the United States could allow foreign companies in allied countries to own reactor licenses in the United States in order to promote foreign investment and accelerate domestic deployment. Further, the United States could lean into international efforts to standardize and harmonize design and testing standards, such as those embodied in IAEA’s SMR Platform and Nuclear Harmonization and Standardization Initiative.[125]

NRC should provide limited endorsement of internationally recognized quality assurance standards, testing standards, design methodologies, and safety analysis methodologies for advanced reactors. That would allow U.S. suppliers to learn and assess what allied countries are doing without reinventing the wheel in the United States and open the door for more international collaboration while limiting redundant qualification work.

Nuclear fusion represents yet one more arena where the technical, scientific, and commercial competition will be fierce between China and the United States in the years ahead.

The United States could also further relax import or export control of non-fuel or non-nuclear safety-related components (e.g., vessels, piping, testing services, etc.) to and from allied nations. This could include limited authorizations to be exempt from domestic sourcing on the procurement of systems, subsystems, and components related to advanced reactors from specific allied countries. Further, DOE could forge more bilateral agreements with allied R&D centers (e.g., the French Alternative Energies and Atomic Energy Commission (CEA), the UK Atomic Energy Authority (UKAEA), and the Korea Atomic Energy Research Institute (KAERI)) to provide funding to advance joint small R&D projects and data sharing. The United States could also explore joint financing of projects among allies; for instance, a foreign firm might be the prime contractor on a project, but firms from other countries could be involved too.

That matters, for, ultimately, every nuclear project America, France, Germany, Japan, South Korea, or Sweden (or other allied countries) completes instead of China and Russia in developing countries or other third-party markets represents a win for democratic, free-market economies.

Acknowledgments

ITIF wishes to thank the Smith Richardson Foundation for supporting research on the question, “Can China Innovate?” Other reports in this series will cover artificial intelligence, autos/electric vehicles, biopharmaceuticals, chemicals, consumer electronics, and quantum computing. (Search #ChinaInnovationSeries on itif.org.)

The author wishes to thank Paul Saunders of the Center for the National Interest; Harry Andreades, Christina Leggett, and Cheng Xu of Booz Allen Hamilton; and Ian Tufts and Robert Atkinson for their assistane with this report. Any errors or omissions are the author’s alone.

About the Author

Stephen Ezell is vice president for global innovation policy at the Information Technology and Innovation Foundation (ITIF) and director of ITIF’s Center for Life Sciences Innovation. He also leads the Global Trade and Innovation Policy Alliance. His areas of expertise include science and technology policy, international competitiveness, trade, and manufacturing.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent 501(c)(3) nonprofit, nonpartisan research and educational institute that has been recognized repeatedly as the world’s leading think tank for science and technology policy. Its mission is to formulate, evaluate, and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit itif.org/about.

Endnotes

[1]. Catherine Clifford, “How China became the king of nuclear power, and how the U.S. is trying to stage a comeback,” CNBC, August 30, 2023, https://www.cnbc.com/2023/08/30/how-china-became-king-of-new-nuclear-power-how-us-could-catch-up.html.

[2]. Sha Hua, “Atomic Power Is In Again—and China Has the Edge,” The Wall Street Journal, December 7, 2023, https://www.wsj.com/world/china/atomic-power-is-in-againand-china-has-the-edge-5f8a8b84.

[3]. Remark of participant at ITIF roundtable on China’s nuclear power industry, April 4, 2024.

[4]. ITIF translation of CNNP corporate website, April 24, 2024.

[5]. Clifford, “How China became the king of nuclear power.”

[6]. International Atomic Energy Agency, “What Is Nuclear Fusion?” https://www.iaea.org/newscenter/news/what-is-nuclear-fusion.

[7]. China launches fusion consortium to build “artificial sun,” Nuclear Newswire, January 9, 2024, https://www.ans.org/news/article-5668/china-launches-fusion-consortium-to-build-artificial-sun/.

[8]. Jennifer Hiller, “A Massive U.S. Nuclear Plant Is Finally Complete. It Might Be the Last of Its Kind,” The Wall Street Journal, April 29, 2024, https://www.wsj.com/business/energy-oil/a-massive-u-s-nuclear-plant-is-finally-complete-it-might-be-the-last-of-its-kind-0c0f6e44; Bechtel, “Plant Vogtle Units 3 & 4,” https://www.bechtel.com/projects/plant-vogtle-unit-3-4/.

[9]. Sandra Barbosu, “Not Again: Why the United States Can’t Afford to Lose Its Biopharma Industry” (ITIF, February 2024), https://itif.org/publications/2024/02/29/not-again-why-united-states-cant-afford-to-lose-biopharma-industry/.

[10]. U.S. Department of Energy, “The History of Nuclear Energy,” https://www.energy.gov/ne/articles/history-nuclear-energy.

[11]. U.S. Department of Energy, “The Atomic Energy Commission” (July 1983), https://www.energy.gov/management/articles/history-atomic-energy-commission.

[12]. Encyclopedia of Chicago, “Argonne National Laboratory,” http://www.encyclopedia.chicagohistory.org/pages/66.html.

[13]. U.S. Department of Energy, “The History of Nuclear Energy.”

[14]. Cutler Cleveland, “Watch the history of nuclear power in the U.S.,” Boston University Institute for Global Sustainable Energy, October 23, 2023, https://visualizingenergy.org/watch-the-history-of-nuclear-power-in-the-u-s/.

[15]. Westinghouse, “AP1000 Public Safety and Licensing,” https://web.archive.org/web/20070807115318/http://www.westinghousenuclear.com/AP1000/public_safety_licensing.shtm.

[16]. World Nuclear Association, “Nuclear Power in China,” https://world-nuclear.org/information-library/country-profiles/countries-a-f/china-nuclear-power.aspx.

[17]. Diane Cardwell, “The Murky Future of Nuclear Power in the United States,” The New York Times, February 18, 2017, http://www.nytimes.com/2017/02/18/business/energy-environment/nuclear-power-westinghouse-toshiba.html?partner=Bloomberg.

[18]. Sean Wolfe, “China has nearly tripled its nuclear capacity in 10 years,” Power Engineering, May 6, 2024, https://www.power-eng.com/nuclear/china-has-nearly-tripled-its-nuclear-capacity-in-10-years/#gref.

[19]. Data compiled from the International Atomic Energy Agency, country profiles.

[20]. Seaver Wang, “China’s Impressive Rate of Nuclear Construction” (The Breakthrough institute, March 19, 2024), https://thebreakthrough.org/issues/energy/chinas-impressive-rate-of-nuclear-construction.

[21]. World Nuclear Association, “Nuclear Power in China.”

[22]. Dan Murtaugh and Krystal Chia, “China’s Climate Goals Hinge on a $440 Billion Nuclear Buildout,” Bloomberg, November 2, 2021, https://www.bloomberg.com/news/features/2021-11-02/china-climate-goals-hinge-on-440-billion-nuclear-power-plan-to-rival-u-s.

[23]. World Nuclear Association, “Nuclear Power in China.”

[24]. Sha Ya et al., “The role of nuclear in China’s energy future: Insights from integrated assessment,” Energy Policy Vol. 139 (2020), https://www.sciencedirect.com/science/article/abs/pii/S0301421520301014.

[25]. Murtaugh and China, “China’s Climate Goals Hinge on a $440 Billion Nuclear Buildout.”

[26]. “China is building nuclear reactors faster than any other country,” The Economist, November 30, 2023, https://www.economist.com/china/2023/11/30/china-is-building-nuclear-reactors-faster-than-any-other-country.

[27]. Wang, “China’s Impressive Rate of Nuclear Construction,”

[28]. Ibid.

[29]. World Nuclear Association, “Nuclear Power in China.”

[30]. Clifford, “How China became the king of nuclear power.”

[31]. Mark Hibbs, “The Future of Nuclear Power in China” (Carnegie Endowment for International Peace, 2018), 25, https://carnegieendowment.org/files/Hibbs_ChinaNuclear_Final.pdf.

[32]. Ibid.

[33]. World Nuclear Association, “Nuclear Power in China.”

[34]. Robert Lighthizer, No Trade Is Free: Changing Course, Taking on China, and Helping America’s Workers (Northampton, Massachusetts: Broadside Books, 2023).

[35]. Jose Pagliery, “What were China’s hacker spies after?” CNN, May 19, 2014, https://money.cnn.com/2014/05/19/technology/security/china-hackers.

[36]. World Nuclear Association, “Nuclear Power in China.”

[37]. Shunsuke Tabeta, “China’s first homegrown reactor ready to take on Western players,” Nikkei Asia, November 28, 2020, https://asia.nikkei.com/Business/Energy/China-s-first-homegrown-reactor-ready-to-take-on-Western-players.

[38]. Clifford, “How China became the king of nuclear power.”

[39]. Ibid.

[40]. Hua, “Atomic Power Is In Again—and China Has the Edge.”

[41]. Victoria Bela, “Shidaowan: world’s first fourth-generation nuclear reactor begins commercial operation on China’s east coast,” South China Morning Post, December 6, 2023, https://www.scmp.com/print/news/china/science/article/3244102/shidaowan-worlds-first-4th-generation-nuclear-reactor-begins-commercial-operation-chinas-east-coast.

[42]. Aaron Larson, “Impressive Milestones Achieved on Chinese Advanced Nuclear Power Projects,” POWER Magazine, December 7, 2023, https://www.powermag.com/impressive-milestones-achieved-on-chinese-advanced-nuclear-power-projects/.

[43]. Bela, “Shidaowan: world’s first fourth-generation nuclear reactor begins commercial operation on China’s east coast.”

[44]. IAEA, “What are Small Modular Reactors (SMRs)?” https://www.iaea.org/newscenter/news/what-are-small-modular-reactors-smrs.

[45]. Larson, “Impressive Milestones Achieved on Chinese Advanced Nuclear Power Projects.”

[46]. Ibid.

[47]. “Digital control system installed at China’s Linglong One,” Nuclear Newswire, April 26, 2024, https://www.ans.org/news/article-5991/digital-control-system-installed-at-chinas-linglong-one/.

[48]. Mike L., “China’s Thorium Reactor: Pioneering the Future of Nuclear Energy,” September 28, 2023, https://www.linkedin.com/pulse/chinas-thorium-reactor-pioneering-future-nuclear-energy-mike-l/.

[49]. Sakshi Tiwari, “China Becomes Third Country To Develop Floating Nuclear Reactor; Claims It Can Withstand The ‘Rarest Of Rare’ Storms,” The EurAsian Times, December 15, 2021, https://www.eurasiantimes.com/china-becomes-third-country-to-develop-floating-nuclear-reactor/.

[50]. Stephen Chen, “China’s first floating nuclear reactor may withstand once-in-10,000-years weather event, engineers say,” South China Morning Post, December 14, 2021, https://www.scmp.com/news/china/science/article/3159566/chinas-first-floating-nuclear-reactor-may-withstand-once-10000.

[51]. World Nuclear Association, “Fast Neutron Reactors,” https://world-nuclear.org/information-library/current-and-future-generation/fast-neutron-reactors.

[52]. Ibid.

[53]. Prachi Patel, “China’s New Breeder Reactors May Product More Than Just Watts,” IEEE Spectrum, December 28, 2022, https://spectrum.ieee.org/china-breeder-reactor.

[54]. Bill Gertz, “With an assist from Russia, China’s plutonium reactors fuel strategic arms buildup,” The Washington Times, January 23, 2024, https://www.washingtontimes.com/news/2024/jan/23/with-assist-from-russia-chinas-plutonium-reactors-/.

[55]. Generation IV International Forum, “Welcome to Generation IV International Forum,” https://www.gen-4.org/gif/.

[56]. Hua, “Atomic Power Is In Again—and China Has the Edge.”

[57]. World Nuclear Association, “China’s Nuclear Fuel Cycle,” April 25, 2024, https://world-nuclear.org/information-library/country-profiles/countries-a-f/china-nuclear-fuel-cycle.

[58]. Ibid.

[59]. China Atomic Energy Authority, “The China’s new-generation uranium enrichment centrifuge for commercial use,” news release, March 20, 2018, https://www.caea.gov.cn/english/n6759361/n6759362/c6800629/content.html.

[60]. Rimi Inomata, “China tops nuclear fusion patent ranking, beating U.S.,” Nikkei Asia, February 22, 2023, https://asia.nikkei.com/Business/Science/China-tops-nuclear-fusion-patent-ranking-beating-U.S.

[61]. Ibid.

[62]. Dannie Peng, “China’s new Fusion Energy Inc to pool national resources in push to build ‘artificial sun,’” South China Morning Post, January 3, 2024, https://www.scmp.com/news/china/science/article/3247145/chinas-new-fusion-energy-inc-pool-national-resources-push-build-artificial-sun.

[63]. “China launches fusion consortium to build “artificial sun,” Nuclear Newswire, January 9, 2024, https://www.ans.org/news/article-5668/china-launches-fusion-consortium-to-build-artificial-sun/.

[64]. Ibid.

[65]. “China Seeks Nuclear Fusion Leap Through New R&D Company,” Bloomberg, January 2, 2024, https://www.bloomberg.com/news/articles/2024-01-02/china-seeks-nuclear-fusion-leap-through-new-r-d-company.

[66]. Fusion Industry Association, “Chinese Fusion Energy Programs Are A Growing Competitor in the Global Race to Fusion Power,” https://www.fusionindustryassociation.org/chinese-fusion-energy-programs-are-a-growing-competitor-in-the-global-race-to-fusion-power/.

[67]. Yang Kunyi and Shen Weiduo, “China maintains ‘artificial sun’ at 120 million Celsius for over 100 seconds, setting new world record,” Global Times, May 28, 2021, https://www.globaltimes.cn/page/202105/1224755.shtml.

[68]. Fusion Industry Association, “Chinese Fusion Energy Programs Are A Growing Competitor in the Global Race to Fusion Power.”

[69]. ITER, “Fusion Education Program in China,” https://www.iter.org/education/national/china.

[70]. “China launches fusion consortium to build ‘artificial sun,’” Nuclear Newswire.

[71]. “Nuclear battery: Chinese firm aiming for mass market production,” World Nuclear News, January 16, 2024, https://www.world-nuclear-news.org/Articles/Nuclear-battery-Chinese-firm-aiming-for-mass-mark.

[72]. Ibid.

[73]. Ibid.

[74]. Analyst’s calculations; International Energy Agency (IEA), Tracking Clean Energy Innovation: Focus on China (Paris: IEA, 2022), https://iea.blob.core.windows.net/assets/6a6f3da9-d436-4b5b-ae3b-2622425d2ae4/TrackingCleanEnergyInnovation-FocusonChina_FINAL.pdf.

[75]. European Commission (EC), “The 2023 EU Industrial R&D Investment Scoreboard” (EC, 2023), https://publications.jrc.ec.europa.eu/repository/handle/JRC135576.

[76]. OECD Data Explorer, Bibliometric indicators, by field (Fractional counts of scientific publications among the world’s 10% top-cited scientific publications, Nuclear Energy and Engineering, Nuclear and High Energy Physics, 2008, 2022), https://data-explorer.oecd.org/.

[77]. Australian Strategic Policy Institute, “Critical Technology Tracker: Nuclear energy” (accessed April 10, 2024), https://techtracker.aspi.org.au/tech/nuclear-energy/?c1=cn.

[78]. Ibid., 10.

[79]. WIPO, “Patent Cooperation Treaty (PCT),” https://www.wipo.int/treaties/en/registration/pct/.

[80]. World Intellectual Property Organization (WIPO), WIPO statistics database (6 – PCT publications by IPC class; G21B, G21C, G21D, G21F, G21G, G21H, G21J, G21K; 1995, 2023), accessed March 27, 2024, https://www3.wipo.int/ipstats/ips-search/patent.

[81]. Ibid., 14.

[82]. Peng, “China’s new Fusion Energy Inc to pool national resources in push to build ‘artificial sun.’”

[83]. Inomata, “China tops nuclear fusion patent ranking, beating U.S.”

[84]. Ibid.

[85]. Ibid.

[86]. GCN Power, “2022 Annual Report,” https://static.cninfo.com.cn/finalpage/2023-03-16/1216127809.PDF.

[87]. Insights by Greyb, “China General Nuclear Power Group Patents – Key Insights and Stats,” https://insights.greyb.com/china-general-nuclear-power-group-patents/. Author’s analysis of WIPO and USPTO data.

[88]. China National Nuclear Power, “About,” https://www.cnnp.com.cn/cnnp/index/index.html.

[89]. China National Nuclear Power, “2022 Annual Report,” https://static.cninfo.com.cn/finalpage/2023-04-27/1216626987.PDF.

[90]. Author’s analysis of WIPO data, https://patentscope.wipo.int/search/en/search.jsf; Search results from China National Intelligence Property Administration, https://www.cnipa.gov.cn/jact/front/mailpubdetail.do?transactId=438222&sysid=12.

[91]. Clifford, “How China became the king of nuclear power, and how the U.S. is trying to stage a comeback.”

[92]. “China is building nuclear reactors faster than any other country,” The Economist.

[93]. Murtaugh and China, ““China’s Climate Goals Hinge on a $440 Billion Nuclear Buildout.”

[94]. Ibid.

[95]. GCN Power, “2023 First half-year Report,” https://static.cninfo.com.cn/finalpage/2023-08-19/1216127802.PDF.

[96]. Wang, “China’s Impressive Rate of Nuclear Construction.”

[97]. “China could build 30 ‘Belt and Road’ nuclear reactors by 2030: official,” Reuters, June 20, 2019, https://www.reuters.com/article/idUSKCN1TL0HY/.

[98]. Hua, “Atomic Power Is In Again—and China Has the Edge.”

[99]. Ibid.

[100]. Alan Ahn, “Nuclear Export Financing Today and Tomorrow” (Third Way, October 2023), https://www.thirdway.org/report/nuclear-export-financing-today-and-tomorrow.

[101]. OEC, “Nuclear Reactors,” (accessed April 24, 2024), https://oec.world/en/profile/hs/nuclear-reactors. Note: The nuclear reactors category includes exports of “[n]uclear reactors; fuel elements (cartridges), non-irradiated, for nuclear reactors, machinery and apparatus for isotopic separation.”

[102]. Remark of participant at ITIF roundtable on China’s nuclear power industry, April 4, 2024.

[103]. Clifford, “How China became the king of nuclear power.”

[104]. “America aims for nuclear-power renaissance,” The Economist, June 25, 2023 https://www.economist.com/united-states/2023/06/25/america-aims-for-nuclear-power-renaissance.