New NSF Data Shows Venture Capital Flowing Away From the United States

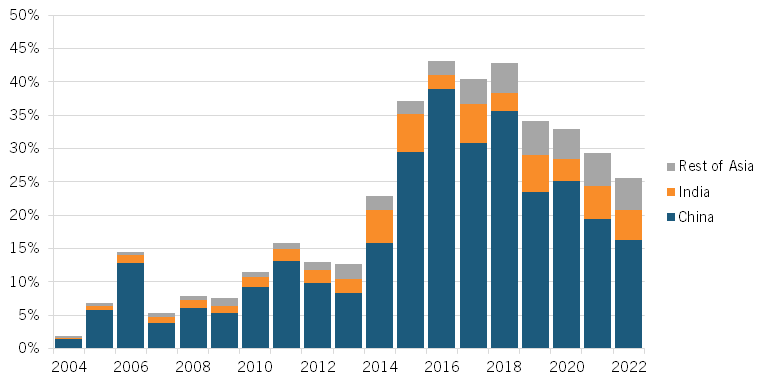

Twenty years ago, nearly 80 percent of the world’s venture capital (VC) was being invested in firms headquartered in the United States. But those days are now long gone. As of 2022, just under 46 percent of global VC investments went to firms headquartered in America, according to the latest data available from the National Science Foundation (NSF). The U.S. share was down about three-quarters of a point from 46.6 percent the previous year.

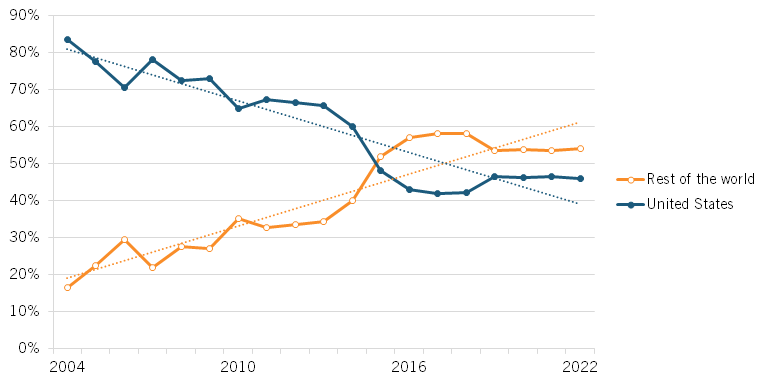

So, where have the VC investments been flowing? As shown in figure 1, a substantial share has gone to China—particularly in the period from 2015 through 2020—and even though China’s share in recent years has dropped off from its high-water mark, the overall U.S. share has continued to trend downward.

Figure 1: Global shares of VC invested in firms headquartered in selected regions, countries, or economies

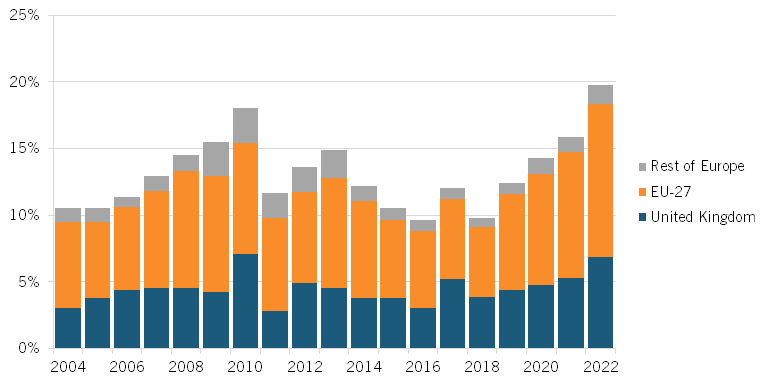

Interestingly, Chinese venture capital as a share of global VC peaked in 2016 at close to 39 percent and then declined steadily in subsequent years to 16 percent in 2022. It’s not clear if this has been due to cyclical or structural phenomena. It could reflect recent Chinese financial difficulties. Or, it could be that China invested massively in the 2000s to launch a large number of tech firms, which now have reached the public capital market stage and hence VC has declined to more stable numbers. Only time will tell.

Meanwhile, India’s share of global VC investment increased about 4 percentage points over the last 20 years to 4.4 percent in 2022, and the rest of Asia saw its share grow from next to nothing to 4.9 percent.

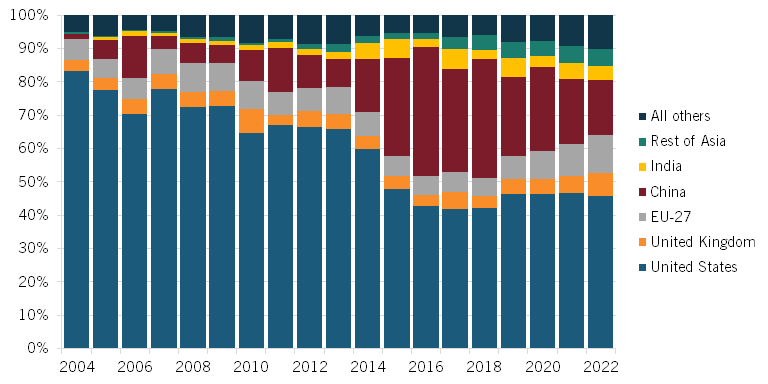

One of the reasons that the non-U.S. share of global VC investment has continued to trend upward even though China’s share has declined substantially in recent years is that VC investments have been increasing in the European Union and in the United Kingdom. As a result, Europe as a bloc accounted for close to one-fifth of VC investments in 2022 while Asia as a bloc accounted for more than one-quarter. (See figure 2 and figure 3.)

Figure 2: Global shares of VC invested in firms headquartered in Europe

Figure 3: Global shares of VC invested in firms headquartered in Asia

There are several resons for these trends. First, the VC investment opportunities are growing in many nations around the world as more and more nations focused on tech-led growth. Indeed, many nations have made expanding high-tech entrepreneurship a major national goal. Many have more generaous R&D tax credits, for example. Second, China has poured tens of billions of government funds into subsizing its venture firms.

While the United States can still boast the single largest global share of VC investments, the fact remains that it faces serious competition from ambitious rivals. The trends in global venture capital shares suggest that complacency is not an option for the United States. It would be putting hope over experience to believe that the U.S. share will not decline even more over the next decade. (See figure 4.) The trends in VC investments serve as yet another reminder of why the U.S. government needs to develop and implement its own comprehensive national innovation and competitiveness strategy.

Figure 4: Global shares of VC invested in firms headquartered in the United States and the rest of the world