Abandoning Growth and Increasing Inequality: A Critical Look at Oxfam’s Recommendations for Corporate Regulations

In a recently published report linking monopoly power to inequality, Oxfam, the noted global aid organization, proposed a series of changes governments should implement to rein in corporate power and reduce inequality. However, most of recommendations would harm economic growth, while Oxfam’s general message can increase inequality rather than decrease it.

Development advocacy for the global South—like economic policy in the North—used to be about promoting growth. Now, most development-oriented NGOs have abandoned growth, seeking instead to simply transfer income from the North to the South. This is bad economic policy and it will harm, not help, developing nations and their lower-income citizens.

Oxfam’s new report is the latest example of this approach. Rather than argue their case with careful analysis and reference to objective studies, Oxfam makes ungrounded assertions and ties them to their agenda of breaking up companies and weakening intellectual property protections. Given the long and important tradition of Oxfam’s work to help the poorest of the poor address challenges such as famines and help improve people’s lives with simple tools and innovations, it is troubling that it, like so many NGOs, has become an antibusiness, anti-North advocacy organization. That might satisfy Oxfam’s supporters, but it will end up hurting the very people Oxfam has helped for so long.

Indeed, the entire premise of the Oxfam report would have a detrimental impact on the groups Oxfam is trying to help, because the report’s anti-big business sentiments can increase inequality rather than reduce it. A study of 53 nations by Davis and Cobb found that, “societies in which more of the workforce is employed in the largest firms are more equal overall.” The study found that Denmark, the most equal society in Davis and Cobb’s sample, had 25 percent of its workforce employed by its 10 largest domestic corporations. Meanwhile, Colombia, the most unequal society in the research sample, had less than one-quarter of 1 percent of its workforce employed by its largest firms. As such, the study found that the correlation between income inequality and employment concentration was -0.47. Further corroborating this finding, a study of 48 contiguous U.S. states by Cobb and Stevens found that “as the number of workers in a state employed by large firms declines, income inequality in that state increases.” Moreover, their analysis suggested that employment in large firms reduced state-level income inequality as much as a $2.40 increase in the real minimum wage would. In other words, if Oxfam wants to reduce inequality, it should encourage governments to support large companies and stop subsidizing small, low-wage, mom-and-pop companies. But it does just the opposite.

More concerning, certain recommendations in the report would have the unintended consequence of harming innovation, which is closely tied to economic growth. That in turn would hurt the very people Oxfam is trying to help—those with the lowest incomes.

Among the proposals in this vein, Oxfam recommends:

1. Breaking up private monopolies and curbing extreme corporate concentration;

2. Breaking up the monopoly over knowledge, and democratizing trade and patent rules; and

3. Moving towards more effective taxation of large corporations, especially on their cross-border corporations.

Oxfam refers to large companies as “monopolies” just as neo-Brandeisians do. But encouraging governments to break them up to curb corporate concentration is problematic because temporary market power is an incentive for firms to innovate. Indeed, a study by Crouzet and Eberly concluded that “the increase in concentration is correlated with the rise in intangibles across industries,” meaning that firms with a greater share of the market spend more on research and development, which increases the likelihood of novel innovations. Similarly, the Obama administration’s Council of Economic Advisors argued that allowing firms to exercise legitimately acquired market power incentivizes firms to conduct more R&D and introduce more new products. Subsequently, the innovations that result from market power can drive productivity growth and promote long-term economic growth, raising living standards for those with the lowest income. As such, governments should not employ aggressive antibusiness antitrust policies if their goal is to help those at the bottom.

Oxfam’s second proposal—encouraging governments to permanently waive patents in critical areas of international trade, such as the pharmaceutical sector—is problematic because it will discourage inventors and innovators by preventing them from earning returns on their investments of time, effort, and money. As the World Intellectual Property Organization notes, “patents recognize and reward inventors for their commercially successful inventions.”

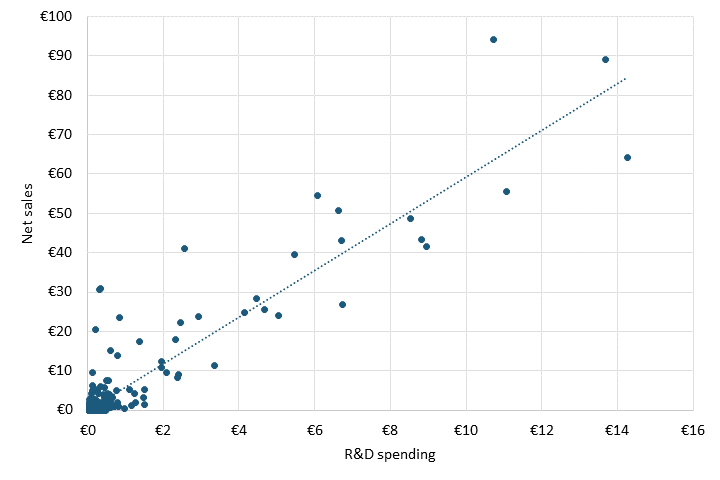

Having patents to recoup development costs is especially important in critical sectors such as the pharmaceuticals sector. Moreover, patents give pharmaceutical firms the cash flow necessary to invest in R&D for the next generation of new drugs. This is why the OECD found that “there is a high degree of correlation between sales revenues and R&D expenditure.” In 2022, the correlation between R&D spending and net sales for pharmaceutical companies around the globe was 0.92. (See figure 1.) As such, governments should not waive patent rights. It would only disincentivize investments in innovation, leading to fewer innovation outcomes and less economic growth, hurting those with the lowest incomes and lowering standards of living for future generations.

Figure 1: Net sales and R&D expenditures for pharmaceutical companies (billions)

The third proposal—encouraging governments to implement a minimum level of taxation of at least 25 percent—is problematic because it would reduce the incentive for companies to invest in R&D and new equipment, which are the building blocks of innovation. Indeed, a paper by Lichter et al. studied varying forms of profit taxation in Germany and found that “a one percentage point increase in the local business tax leads to a decrease in R&D spending of 6-7 percent after eight years.” As a result of the lower R&D activities, the researchers also found lower innovation output, as measured by patents. Further corroborating this finding, Mukherjee et al. studied corporate income tax changes at the U.S. state level and found that an increase in corporate taxes reduced R&D expenditure by 4.3 percent and innovation output by 5.1 percent. As such, implementing a high minimum tax rate will only reduce innovation and economic growth, hurting the living standard growth for those with the lowest incomes.

Oxfam’s proposals may or may not reduce inequality, but they will certainly reduce the growth of living standards. Governments should ignore the message that large firms are harmful and instead allow them to acquire market power legitimately (not through anticompetitive means), keep IP rights strong, and reduce corporate tax rates. Doing so will increase innovation, which is key to expanding the economic pie for everyone, including those with low incomes.