A Realist Approach to Hydrogen

Clean hydrogen is expensive to produce, difficult to transport, and a second- or third-best clean energy solution in almost all proposed markets. To help drive the global green transition, a realist approach to hydrogen policy must address all these practical challenges.

KEY TAKEAWAYS

Key Takeaways

Contents

Policy Recommendations for the United States. 5

Transporting and Storing Hydrogen. 18

Transportation by Pipeline. 19

Solving for Hydrogen: A Different Approach to Transportation and Storage. 22

Existing Markets for Hydrogen. 23

The Swiss Army Knife of Decarbonization. 39

A Research Agenda for Hydrogen. 40

Transportation and Storage. 41

The Realist Case For Hydrogen. 42

Avoiding Hydrogen Pitfalls. 42

Potential Pathways to Sustainable Hydrogen. 44

A US Policy Agenda For Hydrogen. 46

Appendix: Levelized Cost of Energy. 48

Executive Summary

The world is high on hydrogen. The United States and Europe are racing to deploy subsidies,

the Department of Energy (DOE) recently announced seven new hydrogen hubs backed by

$8 billion from the Infrastructure Investment and Jobs Act (IIJA), while the Inflation Reduction Act offers unlimited production subsidies for “clean hydrogen.” Europe is gearing up, offering similar subsidies. China is mobilizing to claim the rapidly growing electrolyzer sector. Low-income countries are also jumping on the hydrogen train: Indonesia, India, the Philippines, Namibia, and many other countries have announced plans to build hydrogen production into

the renewables mix.

Unfortunately, much—but not all—of the hydrogen story is just hot air.

As ITIF described in a previous paper, “Beyond Force: A Realist Pathway through the Green Transition,” the critical need is for green technologies that can be adopted by low-income countries; that’s where all the growth in emissions is occurring, and low-income countries will only adopt technologies that are competitive with existing fossil-based technologies on price AND performance.[1] Price/performance parity (P3), without long-term subsidies, is the key benchmark to meet for addressing the global climate crisis, and rich country programs need to be directed to that end. Just solving emissions in the rich countries is not nearly enough.

Price/Performance Parity

As the West forces down global greenhouse gas (GHG) emissions, they are growing rapidly in low-income countries, where urbanization, population growth, and economic growth all require more energy. These countries cannot afford sufficient subsidies to go green today; that’s why they are overwhelmingly still using—and expanding—energy production from fossil fuels. They cannot pay a significant green premium for clean energy.

Global adoption of green technologies must therefore be driven by market forces, which will transform the world’s energy mix only when clean energy reaches price and performance parity with dirty energy. That is P3—price/performance parity.

Of course it’s true that fossil-driven products mostly do not pay for the externalities they create. And fossil energy has benefitted from subsidies in many countries, including the United States. In an ideal world, these advantages would be removed, but there is very limited political appetite even in the rich countries for high carbon taxes or similar policies. And we must live in the world we have, not the one we want.

The challenge for the hydrogen economy is that clean hydrogen is expensive to produce, difficult to transport, and a second- or third-best solution in almost all proposed markets.

“Clean” hydrogen is three to six times as expensive to produce as gray hydrogen (which accounts for ~98 percent of all hydrogen production today). Gray hydrogen is made using fossil fuels,

and generates 8–10 kilograms (kg) of carbon dioxide (CO2) for every kilogram of hydrogen produced.[2]

Hydrogen Colors Explained

There are today two main flavors of clean hydrogen: “blue hydrogen,” which is produced using fossil fuels plus the additional step of carbon capture, utilization, and storage (CCUS), and “green hydrogen,” made by applying green electricity to water to create hydrogen and oxygen. Along with other low-carbon- methods of making hydrogen, these are collectively called “clean hydrogen.”

Other colors:

§ Gray hydrogen uses natural gas or gasified coal as feedstock.

§ Brown hydrogen is produced from coal gasification, and generates the most GHG.

§ Pink hydrogen is produced via electrolysis using energy from nuclear power.

§ White hydrogen is extracted directly from underground deposits.

§ Turquoise hydrogen uses methane pyrolysis, and produces solid carbon instead of CO2.

§ Yellow hydrogen uses fossil-based electricity from the grid via electrolysis.

Blue hydrogen is made using the gray production process plus carbon capture and either utilization (often for enhanced oil recovery (EOR) in oil fields) or long-term storage (CCUS). This in theory captures the CO2 produced during gray hydrogen production, making the output “clean hydrogen.” CCUS for hydrogen has not been proven at scale, from either a cost or an emissions perspective: Currently, the world’s largest blue hydrogen facility captures only about 70 percent of GHG emissions, far below the level needed to qualify as “clean” hydrogen for U.S. or EU subsidies. Disposing of captured CO2 will be a growing challenge.

Green hydrogen is made by applying electricity to water (H2O), separating out hydrogen and oxygen through electrolysis. Proponents argue that economies of scale will drive down costs,

as they have done for wind and solar, and that green hydrogen will be cheaper than blue hydrogen by the early 2030s and will be fully price/performance competitive with fossil fuels

by 2050.[3]

Unfortunately, the economies of scale that drove down wind and solar costs will not apply to green hydrogen. According to DOE’s hydrogen production model, more than 85 percent of the cost of green hydrogen production comes directly from the cost of electricity as an input.[4] So even if the cost of electrolyzers declines dramatically as scale grows, that makes little difference to hydrogen prices. For green hydrogen to reach P3, the cost of renewable electricity inputs must fall very close to zero.[5]

In short, both green and blue hydrogen are much more expensive to produce than gray hydrogen, and are likely to remain so. Subsidies can make the math work, but they will be large, will be needed long term, and do not point to a useful energy pathway in low-income countries, or in other countries without the political will or fiscal headroom for ongoing subsidies.

Turning to delivery, hydrogen infrastructure is very limited today. Hydrogen can be transported

as gas though pipelines or in liquified form (at -253oC), but old gas pipelines are hard to repurpose and can carry only limited amounts of hydrogen, while new pipelines are expensive and require large quantities moving to tightly specified locations (e.g., between North Africa

and Europe). Both would need careful monitoring, as escaped hydrogen has highly negative climate impacts (worse than natural gas). Delivering hydrogen by truck is extremely expensive. High transport costs strongly encourage uses where hydrogen production is colocated with end uses—as it is in many oil refineries and ammonia plants today.

Markets for hydrogen constitute the third set of challenges. Proponents assume that the main existing markets for gray hydrogen (oil refining and ammonia) will switch quickly to clean hydrogen. They are wrong. Gray hydrogen is deeply embedded in these markets; gray hydrogen plants exist, they produce hydrogen at prices clean hydrogen cannot match, and production is often located on-site. In what world do large corporations abandon productive and efficient existing assets in order to adopt untested solutions that will rely on subsidies for the foreseeable future? Not this one.

Beyond existing uses, proponents have identified an extraordinary profusion of new use cases ripe for clean hydrogen. For every sector that is “hard to decarbonize,” hydrogen is seen as the right solution. It is the Swiss Army Knife of next-generation energy. Perhaps that’s why herds of VCs have already tumbled off the hydrogen cliff, with VC investments up more than 50 percent in 2022.[6]

A Swiss Army Knife makes a great holiday gift and it’s very useful if you are lost in the woods, but my own Swiss Army Knife is gathering dust in a drawer somewhere. Yes, it has many uses, but it offers only a second-best solution for every problem. Need to set a screw? Use a screwdriver! Open a bottle? Use a corkscrew! Hydrogen is indeed the Swiss Army Knife of energy: a second- or third-best solution for every use.

Often, hydrogen is fighting on two fronts: In road transportation, for example, it must compete against both internal combustion engine vehicles (ICEs) and also against battery electric vehicles (BEVs). Regulations and subsidies may eventually force ICEs off the roads in some rich countries, but they will very likely be replaced by BEVs, not by hydrogen fuel cell vehicles (HFCVs). In other sectors—such as aviation or cement—there is not even a plausible case that hydrogen can eventually become competitive without ongoing subsidies. Aside possibly from long-duration energy, there is no compelling use case for which hydrogen is undeniably the best.

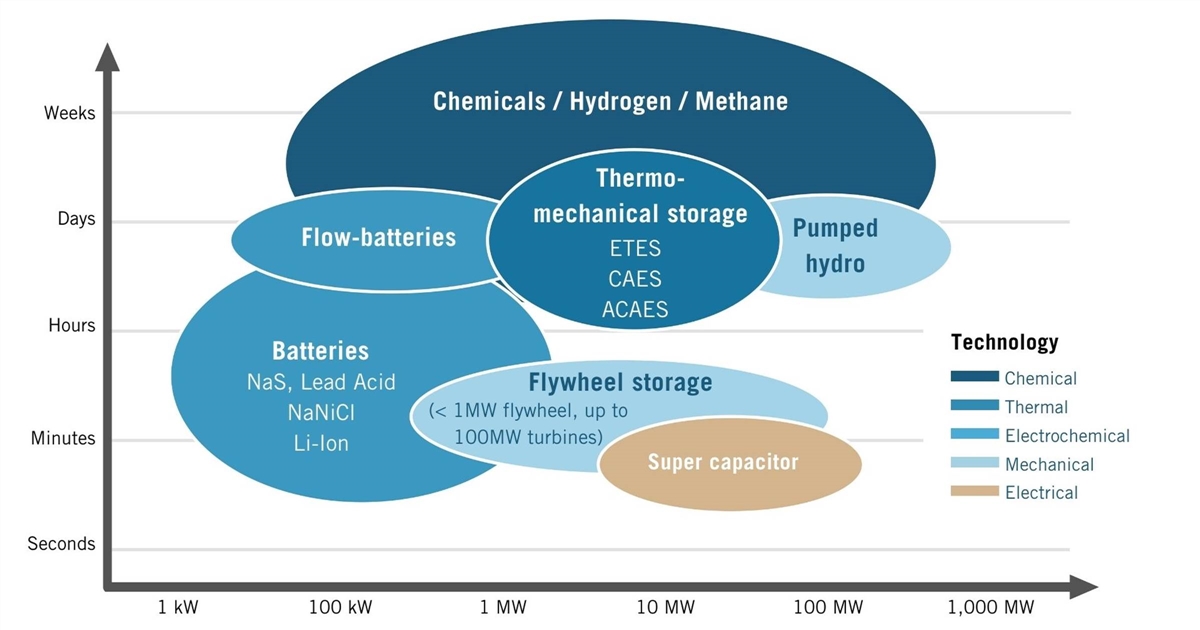

Hydrogen could however be needed to address one real and unique problem at scale: very long-duration energy storage (LDES). Demand for LDES will grow as renewables spread. It is possible that solutions can be found that don’t require hydrogen (e.g. gas peaker plants, bigger and better-connected energy grids, compressed air storage, demand side management), but there is no similar existing LDES technology with which hydrogen must compete. Hydrogen storage has been proven at scale and at long duration, and while burning hydrogen for power is not in itself competitive, it could be an important insurance policy. Renewables do experience substantial seasonal and annual variation, and as renewables come to dominate the energy mix, insurance against low production will become increasingly important. Hydrogen could perhaps fill that role.

Policy Recommendations for the United States

To some extent, the die is cast in the United States for the next few years. Potentially huge production subsidies will be available through the IRA (notably sections 45C and 45V), DOE will spend $8 billion to stand up seven new “hydrogen hubs,” and more money will be poured into infrastructure, the manufacturing supply chain, and research and development (R&D). We hope that at least some of the hubs are successful, and the increase in production driven by these subsidies (and expanded R&D budgets) makes clean hydrogen more competitive. We also hope that lessons learned from each of the hubs will be widely publicized, leading to better design and improved economic models for their successors.

The key question, though, is whether this massive injection of funding will put hydrogen—either green or blue—on the path to P3, where it can expect widespread adoption and where these technologies can spread into the low-income countries that are the future focus of climate change. According to the evidence so far, and the policies adopted to date, that seems unlikely.

Our recommendations are therefore aimed at future policy, and at policies in other countries that are only now rolling out their hydrogen strategies. Our analysis leads to the following policy conclusions:

1. View hydrogen policy through the P3 lens. If there is no pathway to P3, piles of expensive subsidies in the rich countries will not turn hydrogen into a global decarbonization solution. Ensure that the solutions we fund are those that can in fact be adopted in low-income countries.

2. Economies of scale won’t transform the economics of green hydrogen. It is currently not close to P3, and production costs are overwhelmingly driven by the input cost of green energy, so even sharp declines in electrolyzer costs won’t make much difference. Green hydrogen projects that rely mainly on scale for anticipated cost reductions should be avoided.

3. Minimize investments in blue hydrogen. This technology will by definition always cost more than gray hydrogen, and hence has no long-term future in the global energy mix; indeed, any successes will mainly block the path for green hydrogen.

4. Don’t invest in second-best solutions. For most proposed markets, green hydrogen is and will be a second- or third-best solution. Governments should use the P3 framework to help identify target markets that make sense, and to avoid wasting enormous resources on markets that will never reach P3, including both existing markets and many proposed new ones.

5. We do not have all the technology we need! Of course we can produce green hydrogen, but not at P3, not at the price and performance needed for global adoption. A targeted research program is therefore the most pressing need, especially to improve the electrical efficiency of green hydrogen, improve net water use, and to reduce life cycle capital costs, particularly for applications around long-duration storage. And additional R&D aimed at further reducing the cost of renewable energy will also help improve the competitiveness of green hydrogen.

6. Location matters. “Additionality” is not theoretical; it is intensely practical: Green energy provided via the grid is heavily impacted by grid fees and taxes, which make green hydrogen uncompetitive (without substantial subsidies) even if the electricity itself is priced at close to zero.[7] We should therefore favor projects where green energy sources are colocated with green hydrogen production, and avoid those where electricity comes from the grid, especially where grid electricity is expensive. Green grid energy may also have uses with more emissions impacts than making green hydrogen.

7. Avoid projects that require expensive transportation infrastructure. Transporting hydrogen is difficult and expensive. Fantasies about a “network” of regional hydrogen facilities are just that. Policy should favor projects that are colocated with end users.

8. Invest in hydrogen as LDES. Focus on the best case for green hydrogen by investing in hydrogen for LDES, as it may be a key step toward a fully sustainable grid. This also offers the best opportunity to bring green hydrogen to scale. Upstream of production, provide more funding for research across all technology readiness levels (TRLs) focused on increasing the efficiency of electrolysis and reducing the use of other key inputs such as water. Downstream, fund technologies that improve natural underground storage, compression, and the eventual reconversion of hydrogen to energy.

We are not climate deniers. We believe fossil fuels are transforming the climate globally, and that we need a pathway through the green transition. Industrial policy in the form of subsidies, regulation, and public procurement has been an important driver for key technologies in the past, and can help generate market traction for green energy. But we also believe that simply subsidizing or regulating our way forward will not work: The backlash in rich countries is already strong and getting stronger; and fossil fuels are booming in low-income countries to meet their undeniable and rapidly growing needs for more energy. The only way to square that circle is to develop green technologies that are cheap enough for everyone. Green hydrogen could be one of them.

Hydrogen Production

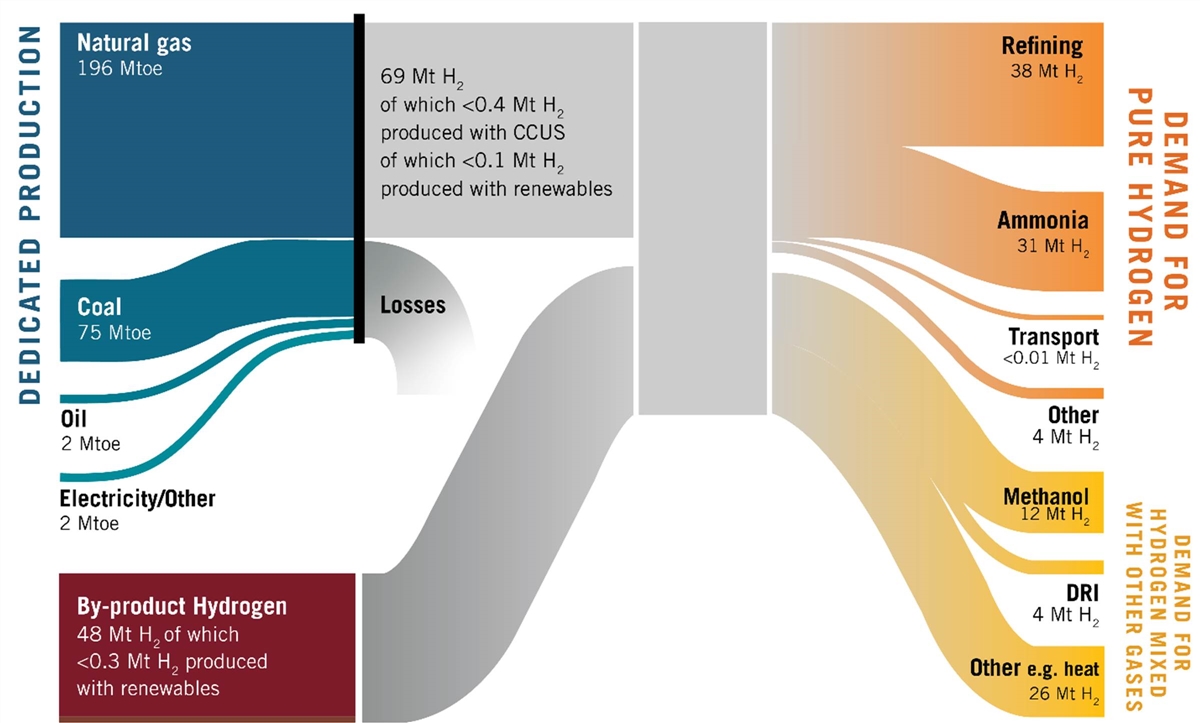

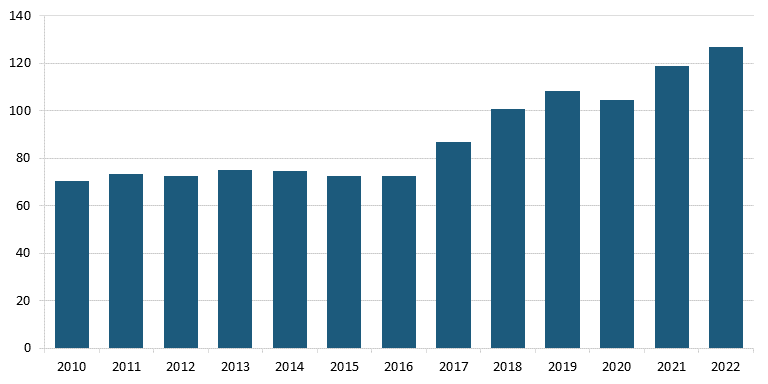

Around 70 million metric tons (MMT) of dedicated hydrogen is produced annually (additional hydrogen is produced as an industrial byproduct).

Figure 1: Value chain for hydrogen, 2019

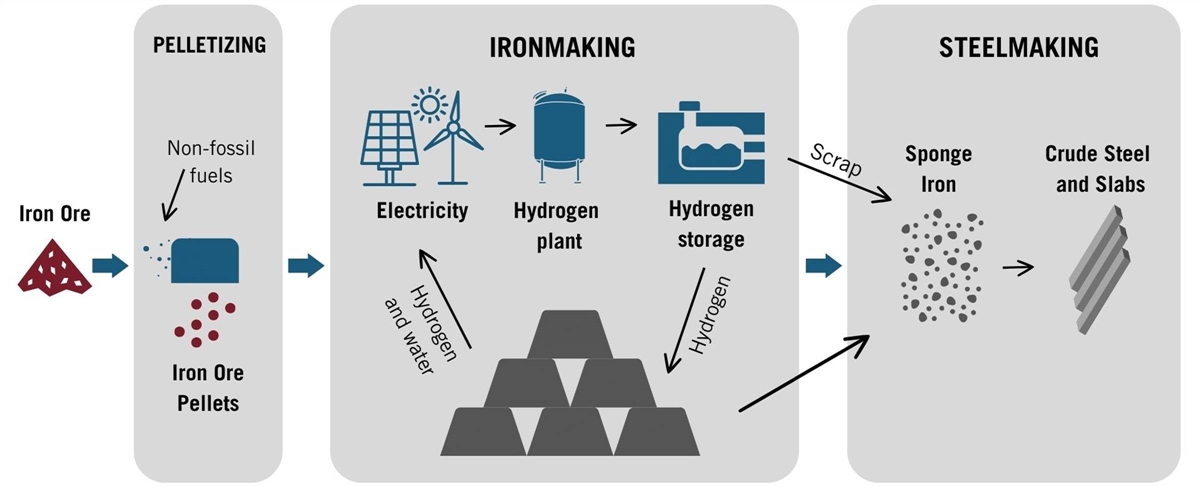

Less than 1 percent is produced by electrolysis, with the remainder overwhelmingly from natural gas (76 percent) and coal gasification (23 percent).[8] Aside from hydrogen used for heating in other industrial processes, and for methanol production, almost all the demand comes from oil refining and ammonia production; somewhat less than 4 percent is used in steel plants using direct iron reduction (DRI) technology. Overall, hydrogen demand is up about 50 percent in the past decade.[9]

Hydrogen made from fossil fuels is known as “gray hydrogen” (see the earlier box on “Hydrogen Colors Explained”) and is predominantly made through high-temperature steam methane reforming (SMR) or coal gasification.[10] It generates 8–10 kg of CO2 for every kilogram of hydrogen that is produced. Gray hydrogen accounts for 830 MMT of CO2 annually, or about 2.2 percent of GHG emissions.[11] It is therefore a significant target for net-zero emissions.

In contrast, “clean hydrogen” produces far less GHG emissions and has been touted as the pathway for decarbonizing a number of hard-to-decarbonize sectors, including steel, cement, aviation, heavy trucking, trains, shipping, industrial heat, and heat for buildings. Adoption in these markets would drive much-expanded use of clean hydrogen, and could also replace gray hydrogen for existing uses such as oil refining and ammonia production. Clean hydrogen can be produced either by electrolysis using renewable energy as an input (“green hydrogen”) or by applying CCUS to the standard gray hydrogen production process, thus removing the CO2 emissions at source (“blue hydrogen”).

The International Energy Agency’s (IEA’s) net-zero projections anticipate that demand for hydrogen will grow to more than 600 MMT by 2050, and that almost all of it will be clean hydrogen. However, many snares, delusions, and pitfalls stand between us and the promised land of a hydrogen-fueled net zero.

Blue Hydrogen

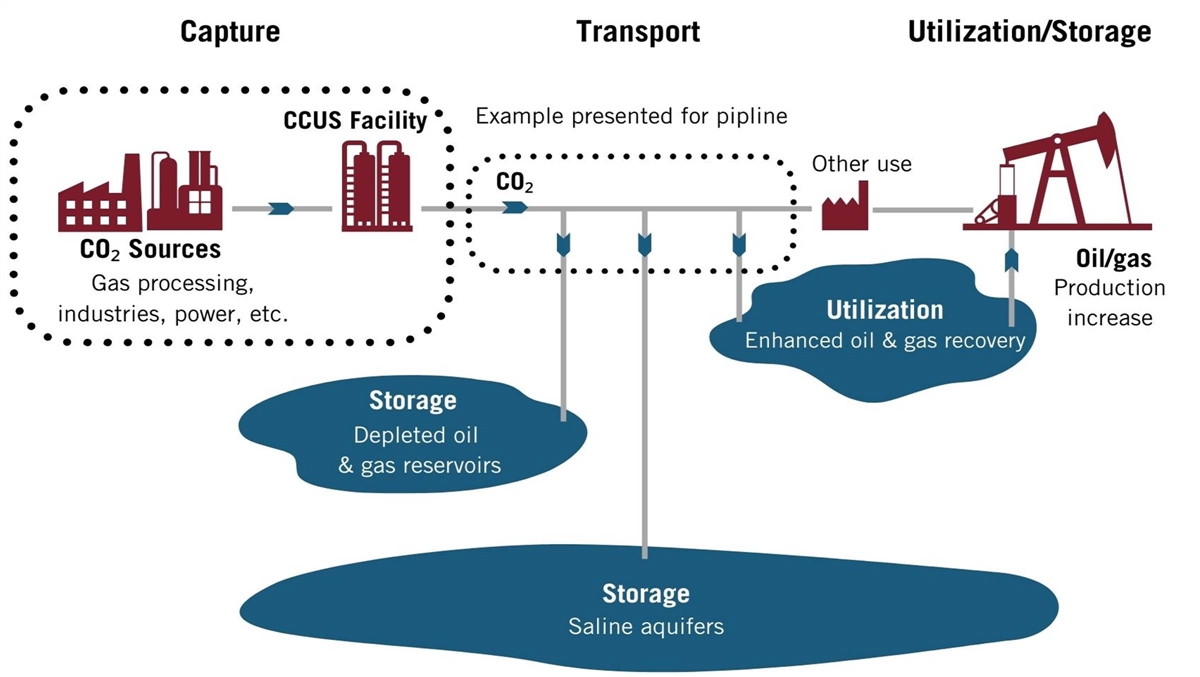

Blue hydrogen utilizes the same technology that produces gray hydrogen, plus additional steps to capture and store or utilize the CO2.

About three quarters of the very limited amount of blue hydrogen today is used for EOR, where CO2 adds pressure to oil fields to help increase production.[12] EOR is a widely used technology, and marketable natural gas also requires the removal of CO2 that is found in raw natural gas, so carbon capture has been an integral part of gas production. More recent non-EOR projects (e.g., the Sleipner project in Norway) simply capture and sequester the CO2 without seeking to find a use for it.

The energy required to run the capture system can typically be recovered from the hydrogen production process, so little additional energy is needed for capture.[13]

Proponents argue that blue hydrogen could be an important bridging technology, reducing GHG emissions (especially in certain sectors) until cleaner technologies such as green hydrogen are fully competitive sometime in the 2030s.[14] ExxonMobil recently announced a large blue hydrogen project in Baytown, Texas, which it claims will reduce emissions by 30 percent for olefins production.[15] Some of these proponents also argue that blue hydrogen technology is well understood, and that green hydrogen may not be competitive for decades.

Blue hydrogen is however the wrong pathway.

Figure 2: Blue hydrogen schematic[16]

Will CCUS effectively capture GHG at the levels (and costs) required? IEA projections assume that capture rates will be 90–95 percent.[17] The proposed ExxonMobil Baytown plant is anticipating capture rates of 98 percent.

Still, none of the 13 most significant carbon capture projects around the globe have aimed to capture more than 80 percent of emitted CO2, and only two have successfully reached the levels of capture that they targeted.[18] Shute Creek (the biggest) targeted around 75 percent capture, but overall fell far short of that. (See the box below on “Carbon Capture at Shutes Creek, WY.”) The enormous Gorgon project in Pilbara, Australia, missed its targets completely for the first 3.5 years of operation. Of the 300 megatons (MT) of CCUS anticipated in IEA’s 2009 roadmap, only 40 MT (13 percent) had been built by 2020.[19]

Carbon capture itself takes energy for absorbance, dehydration, compression, transport, and injection. For blue hydrogen plants, that energy comes from fossil-based electricity, and that offsets some of the capture. At the Quest project in Canada, for example, carbon capture and sequestration generated 1.16 MT of CO2 in 2016–2020, equivalent to more than 20 percent of the CO2 that was captured.[20]

Then there is the challenge of utilization or sequestration. EOR is the primary use for captured CO2, but raises multiple concerns. As Shute Creek demonstrates, EOR can put CCUS projects at the mercy of oil prices and local demand for its services. As renewables begin to dominate, demand for EOR is also likely to fall more generally. Some critics have argued that EOR itself generates enough Scope 2 emissions to cut the overall benefits of carbon capture by a third.[21]

Carbon Capture at Shutes Creek, WY[22]

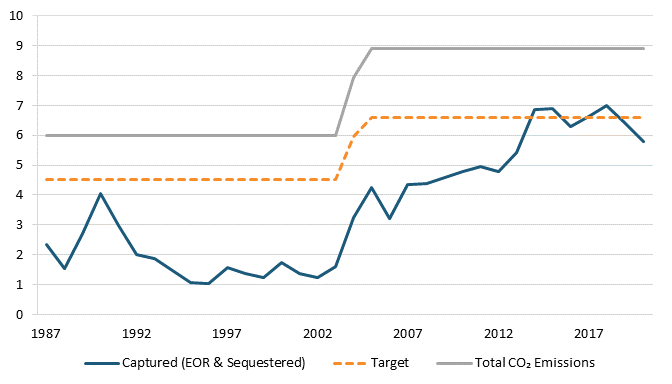

Commissioned in 1986, ExxonMobil’s, Shutes Creek plant uses raw gas from its La Barge, Wyoming gas field. That gas is only 21 percent methane (the marketable gas) and 65 percent CO2. Original and additional investment totaled $256 million, which built a plant capturing 7 MMT of CO2 annually (the largest carbon capture and sequestration plant in the world). A new addition will add 1.2 MMT/CO2, at a cost of $400 million. Figure 3 summarizes the results:

Figure 3: Carbon capture at Shutes Creek, WY[23]

Two points stand out. The share of emissions targeted for capture was for every year about 25 percent lower than actual emissions. And in all years except two, the project did not meet its targets, in many cases missing them by substantial margins largely because low oil prices from the early 1990s until the mid-2000s made EOR activities uneconomic in the La Barge area, eliminating the key market.

Sequestering CO2 in oil fields also risks GHG emissions from leaks—many big oil fields have hundreds of abandoned boreholes. Finding and capping those wells is a significant (and expensive) challenge, but unless it is done rigorously, those boreholes may become pathways back to the surface for the CO2.

Blue hydrogen production for power will also increase natural gas usage. Air Products’ proposed new 800 MW blue hydrogen project in Humberside, United Kingdom, will replace 1 million cubic feet (cf) of natural gas for power production with hydrogen. However, that requires production of 3.33 million cf of hydrogen. But hydrogen production (using efficient SMR technology) requires about 4.5 cf of natural gas to make 1 cf of hydrogen. So, to replace 1 million cubic feet of natural gas with hydrogen, Air Products will use about 15 million cf of natural gas! Its CEO recently observed that this will raise prices and increase the use of natural gas, but argued that it will have social benefits (i.e., CO2 reduction).[24]

Blue hydrogen—much like gray hydrogen—is also powerfully affected by variations in the price of natural gas (or coal). Crises such as the Russia-driven spike in gas prices could therefore be devastating; costs jumped 36 percent as a result.[25] Price spikes don’t affect the competitiveness of blue hydrogen against gray hydrogen, but competing fuels not reliant on gas could become much more competitive.

In the end, though, it is the economics that makes blue hydrogen a diversion, not a solution. Because it is simply gray hydrogen plus additional steps, blue hydrogen will never be P3 competitive with gray hydrogen. It will therefore always depend on subsidies to make it competitive, and that makes it a technology for rich countries only. It works, for example, in Norway, where a 1991 CO2 law taxed carbon released into the atmosphere at $49/tonne, while the cost of sequestration was only $17/per tonne. Subsequent regulations have made the cost of carbon even higher.

Estimated costs for CCUS in the United States vary wildly. This is not surprising, as few practical examples exist. One paper concludes that CCUS for concentrated gas projects such as SMR hydrogen in the Northeastern and Midwest United States would cost $80–$90 per ton of CO2 (tCO2).[26] A different study estimates costs at $30–$45/tCO2.[27] Combined with variations in the amount of CO2 emitted in the course of production, we get a wide range of estimates for the additional costs for CCUS: $0.24–$1.08 per kilogram of hydrogen, or ~24–100 percent of existing production costs for gray hydrogen. That gap can only be closed by ongoing subsidies or the imposition of carbon taxes or other forcing regulations. And because blue hydrogen will be so dependent on sustained subsidies, there is a significant risk that expensive assets could be stranded if the political climate changes.[28]

In short, blue hydrogen has not been widely and successfully demonstrated at scale or at sufficient levels of carbon capture, CCUS technology is untested or has failed on multiple dimensions, and the additional cost of CCUS means that blue hydrogen will never reach P3. Blue hydrogen is therefore of minimal relevance to global decarbonization.

Green Hydrogen

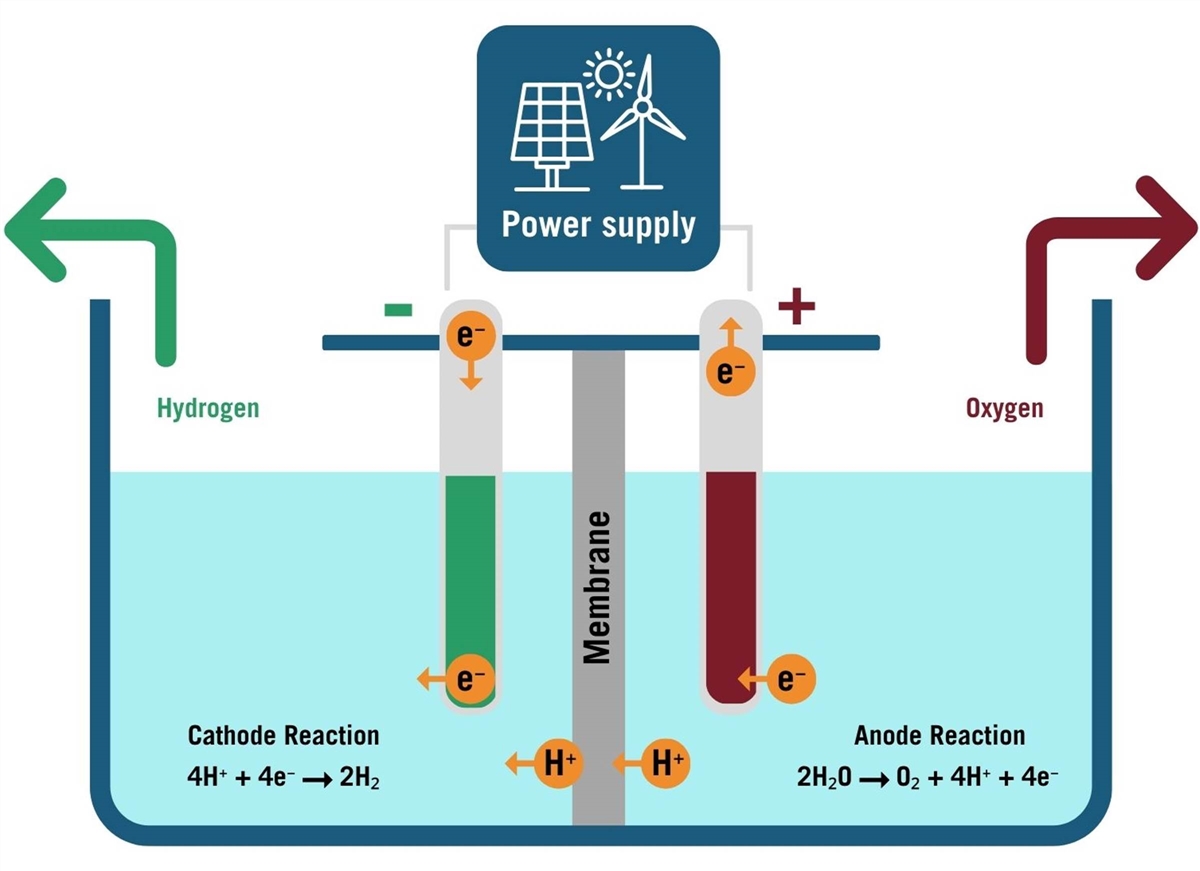

Green hydrogen might be different. It is made by applying electricity to water that contains the salts and minerals needed to conduct electricity. Two electrodes are immersed in water and connected to a power source and a direct current is applied. Water then breaks down into hydrogen and oxygen when the electrodes attract ions with an opposite charge (these electrodes often include substantial amounts of expensive or hard-to-source materials such as platinum).

A membrane then separates the oxygen and hydrogen. Production is “green” only when renewable power is used: The same process powered by energy from fossil fuels does not produce green hydrogen. Overall, green hydrogen accounts for less than 1 percent of total hydrogen production today.[29]

Figure 4: Green hydrogen production[30]

Two technologies dominate green hydrogen production: alkaline electrolysis (ALK) and proton exchange membranes (PEMs).[31] Solid oxide electrolysis cells (SOECs) have potential cost advantages because they use a different chemistry and less-expensive materials, but are only just reaching commercialization, while other technologies (e.g., high-temperature electrolysis) are at an even earlier stage of development.[32]

Key advantages for PEMs include operating below the 15 percent minimum capacity utilization that ALK requires, avoiding the use of an electrolyte (and accompanying maintenance costs), production at pressure, and a faster ramp-up and ramp-down time. However, ALK technology

is more efficient, has longer stack lifetimes, has a lower CAPEX, and is well suited to very large-scale production for local use. PEMs are a much newer technology, and hence are likely to see faster cost declines and further increased efficiency. Still, PEMs’ electrical efficiency, the critical variable, won’t change quickly: The International Renewable Energy Agency’s (IRENA’s) 2025 projections for green hydrogen production still require more than 50 kilowatt hours (kWh) of electricity per kilogram, somewhat improved from 2017. (See table 1.)

Table 1: Green hydrogen technologies compared[33]

|

Technology |

ALK |

PEM |

|||

|

Unit |

2017 |

2025 |

2017 |

2025 |

|

|

Efficiency |

kWh of electricity/kg of H2 |

51 |

49 |

58 |

52 |

|

Efficiency (LHV) |

percentage |

65 |

68 |

57 |

64 |

|

Lifetime Stack |

operating hours |

80,000 |

90,000 |

40,000 |

50,000 |

|

CAPEX—total system cost (incl. power supply and installation costs) |

EUR/kW |

750 |

480 |

1,200 |

700 |

|

OPEX |

percentage of initial |

2% |

2% |

2% |

2% |

|

CAPEX—stack replacement |

EUR/kW |

340 |

215 |

420 |

210 |

|

Typical output pressure |

bar |

Atmospheric |

15 |

30 |

60 |

|

System lifetime |

years |

20 |

30 |

||

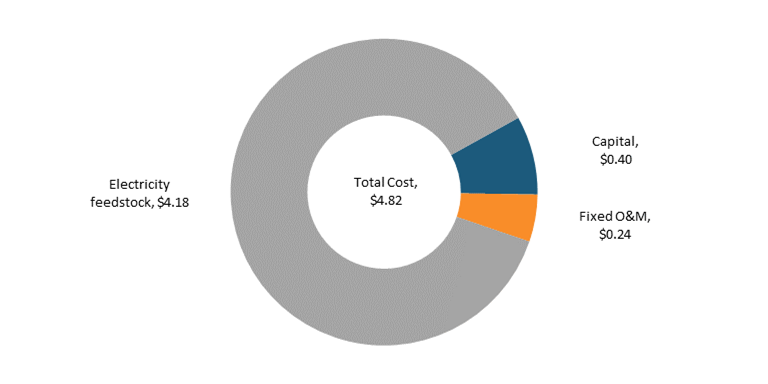

Whatever the technology used, green hydrogen economics are overwhelmingly driven by a single input cost: electricity. According to DOE’s models, for a large hydrogen plant producing 50,000 kg/day, input electricity accounts for just over 85 percent of the cost of production for PEM plants.[34]

Production costs are therefore highly sensitive to changes in electricity costs. DOE’s models show that if electricity costs fall from the baseline price of 7.3 cents/kWh to 1.5 cents/kWh, the cost of production falls from almost $5/kg to $1.70/kg, much closer to P3. As DOE itself has stated, “Low-cost clean hydrogen via electrolysis will also depend on ample availability of low-cost clean electricity (<$20/megawatt-hour (MWh)) that will need to scale in parallel with market demand for clean hydrogen.”[35] How much less than $20/MWh remains to be determined.

In simplified form, the distribution of costs between operating expenses, capital, and electricity inputs is abundantly clear: electricity inputs dominate (see figure 5).

Figure 5: Example of cost shares for 1 kilogram of hydrogen using PEM electrolysis (2019)[36]

If input electricity costs drive the price of green hydrogen, then the rest of the cost stack is of more limited significance. While DOE’s models imply very substantial cost declines for electrolyzers as production ramps up, even a 30 percent decline in electrolyzer costs would result in only a 2 percent decline in overall production costs. Other estimates of projected price declines are even more fanciful.[37]

Scaling up electrolyzer production may also be difficult, as Chinese firms loom between U.S./European electrolyzer companies and global markets. China accounts for about 40 percent of the global electrolyzer market, and Bloomberg New Energy Finance (BNEF) has estimated that Chinese electrolyzers cost about 70 percent less than European or U.S. production.[38] China’s industrial policy may be creating an electrolyzer glut, making scale-up even more difficult for U.S. and European producers.[39]

Green Hydrogen’s Additional H20 Challenge

Green hydrogen is made from electricity and water—a lot of water:

De Levie et al. argue that “thermoelectricpower generation for electrolysis will on average withdraw approximately 1,100 gallons of cooling water and will consume 27 gallons of water as a feedstock and coolant for every kilogram of hydrogen that is produced using an electrolyzer that has an efficiency of 75 percent.”[40]

In the United States, geography exacerbates this problem, as renewable energy is mostly concentrated in the West, Midwest and Plains states, Mountain West, and Texas—precisely where water resources are becoming scarce and expensive. Water issues will become important globally as green hydrogen production expands.

Regardless of where the electrolyzers come from or how much they cost, the dominance of input electricity in the cost matrix means that economies of scale won’t matter much anyway. The cost of electrolyzers may fall substantially, we may get better at building and operating hydrogen plants, CAPEX requirements may be reduced, and certain components may fall in price as scale increase—but all of that affects only the ~15 percent of costs that are NOT input electricity.

Can green hydrogen get to P3? Can electricity costs be cut substantially? Perhaps by an order of magnitude?

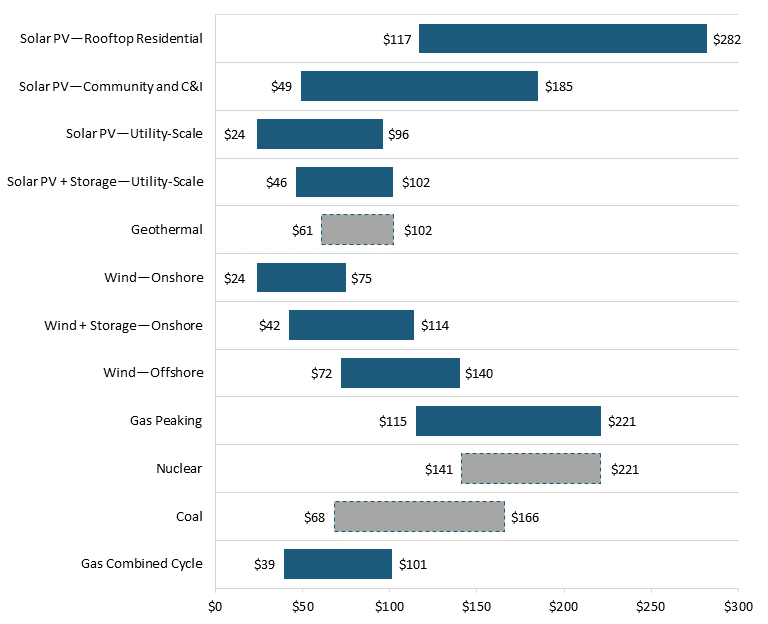

Green energy is not always intrinsically expensive. In some locations, and at some times, wind and solar are highly competitive with or even cheaper than other energy sources, including natural gas and coal.[41]

The levelized cost of energy for wind and solar will most likely continue to decline, though probably not at the pace of the last two decades. And perhaps new green sources will become competitive, such as widespread geothermal energy at scale. That’s possible. New technologies such as perovskites offer potentially important opportunities. Still, we are at the flatter part of the cost-reduction curve now.

However, levelized cost is not everything. The cost of green energy—like all energy on the grid—is not static. There are periods when renewable energy is in surplus. Production occurs when it occurs, and sometimes the grid has no use for the energy produced. This energy is “curtailed” (i.e., wasted). If green hydrogen could access green energy only at times when it is in surplus, input costs could be close to zero and the math start to work.

There are two basic problems with the “use wasted energy” model: capacity utilization and energy delivery costs.

Traditionally, hydrogen production has operated at close to maximum capacity. Every percentage drop in capacity utilization means an increase in the levelized cost of hydrogen that’s produced, because CAPEX and operating costs must be spread over a smaller amount of production. So typically, hydrogen production models assume that capacity utilization will be 90 percent or even higher. However, to substantially cut electricity costs, the plant would need to operate when green energy is in surplus. Existing green energy producers are not likely to be in surplus more than 40 percent of hours spread across a year. But reducing capacity utilization to 40 percent would increase the levelized cost of hydrogen (LCOE) substantially.

Still, under a 40 percent utilization scenario, electricity costs would become far less important, falling from 82 percent of production costs to only 24 percent. Conversely, CAPEX would grow to 46 percent, and would become the most important cost component. That opens the door to significant further cost reductions as well as bigger impacts from reductions in OPEX (e.g., via longer-lasting electrolyzers or more plant automation). In this case, economies of scale and other improvements in electrolyzer efficiency could again become important cost drivers. It’s true that LCOE would indeed increase, but near zero renewable energy could reduce costs so much that the increased costs from low-capacity utilization would be acceptable. It’s a balancing act, but there is potentially a pathway there.

But where will the necessary green energy come from?

Unfortunately, close to zero-cost green electricity isn’t zero cost at all if it is delivered via the grid. Even for large users, electricity costs include not just the cost of production but also the cost of delivery, plus the inevitable taxes and surcharges imposed by governments (most governments charge taxes and fees on energy). For example, large customers of Southern Cal Edison are charged approximately 3.75 cents per kWh for delivery, and there are varied local taxes and surcharges as well.[42] Similar additional costs apply widely across the United States.[43]

These delivery costs are potentially devastating. To be competitive, DOE believes green hydrogen needs green electricity at less than $20/MWh, or 2 cents per kWh. But delivery fees and taxes are in themselves much more than that. In addition, of course, most grid electricity is still not 100 percent green—far from it. So “green” hydrogen using grid energy would instead be some shade of yellow (see the earlier box on “Hydrogen Colors Explained”).

The conclusion is clear: Green hydrogen producers must avoid taking energy from the grid if at all possible. The current arguments about “additionality” in both Washington and Brussels are limited to highly subsidized production regimes. That’s why the EU has concluded that green hydrogen projects can access its subsidy regime (for projects coming online in 2028 or later) only if they use “additional” green energy (i.e., projects that bring their own new green energy supplies).[44] Some form of additionality will likely be imposed in the United States as well. These additionality rules are needed when there are generous subsidies, as those subsidies allow green hydrogen producers to overcome grid fees and taxes, and could therefore be positioned to soak up scarce green energy. However, the subsidies necessary to overcome grid fees and taxes won’t be available in low-income countries. More generally, even in rich countries, green hydrogen producers will have strong incentives to avoid grid delivery.

The simplest way to do that is by colocating hydrogen production with new green energy sources. Colocation also helps avoid high national or regional electricity prices (e.g., in the United Kingdom); local electricity production costs may be much lower. Colocation is therefore highly desirable.

Green hydrogen also uses a lot of water—~9 liters per kilogram (l/kg). While even large-scale green hydrogen adoption would not significantly impact U.S. national water usage, many green hydrogen plants will likely be located in the increasingly arid Mountain, Southwest, and upper Plains states, along with Texas and California. So local water issues may well become very important in the United States, especially in the Colorado River basin. But water is challenging in many areas of the world, and water conflicts are on the rise in many regions. Successful use of salt or brackish water at scale and at low cost would be helpful.

Leaving aside economies of scale, are there breakthrough technologies coming soon to green hydrogen? Not obviously. IRENA, a strong backer of hydrogen, sees only limited progress in electrical efficiency—a seven-year decline from 58 to 52 kWh per kilogram of hydrogen. Deloitte anticipates an increase in efficiency from 65 percent to 80 percent between 2030 and 2050.[45] Still, SOECs are reaching commercialization, and have potential cost advantages because they use different chemistry with potentially less-expensive materials. Other earlier-stage technologies also offer promise.

Some conclusions emerge about green hydrogen production:

1. Currently, unsubsidized green hydrogen is six to eight times the cost of its primary existing competitor: gray hydrogen. It is about twice the cost of blue hydrogen. This is the economic backdrop for all green hydrogen development.

2. Economies of scale won’t make the difference for green hydrogen production costs.Electrolyzers will likely become cheaper as economies of scale drive down production costs, but that doesn’t matter much because they account for only a small percentage of production costs. Electricity inputs drive price, so the only way to make green hydrogen competitive is to sharply reduce electricity costs.

3. One pathway to reduced costs is to avoid electricity delivered via the grid.That energy carries significant fees and taxes. In the United States, those additional costs add on the order of 100 percent to the basic cost of production, even at wholesale prices.[46] Subsidies may pay for these costs, but that is not a path forward for low-income countries. To avoid crushing grid delivery costs, green hydrogen plants will mostly need to be colocated with green energy sources.

4. Low-cost renewable energy sources colocated with green hydrogen production may reduce costs substantially. Some green energy sources could provide electricity at or below $20/MWh, although certainly not 24/7.

5. Production costs are sensitive to capacity utilization. Reducing utilization has a significant effect on costs: at 40 percent utilization, the cost of production increases by 24 percent based on the National Renewable Energy Laboratory (NREL) model.[47] This matters, because 24/7 use of green energy requires expensive storage. Still, these additional costs may be manageable.

6. Green hydrogen will become more competitive as the energy efficiency of electrolyzers increases. Scale makes little difference to final cost, but efficiency matters a lot. A 10 percent increase in electrical efficiency means an 8.5 percent reduction in production costs.

7. If electricity costs are cut substantially, economies of scale and other efficiencies and innovation will become important. That is crucial for the medium-term outlook, but reduced electricity costs come first.

8. Green hydrogen production will require expensive subsidies for the foreseeable future. Before green hydrogen gains global traction and significant adoption in low-income countries, it must be at or near P3 with competing fuels. Currently, green hydrogen is not close to P3.

9. Research, development, and demonstration will be critically important. We do NOT have all the technologies we need to underpin a hydrogen economy. Substantial investment is needed in technologies that increase the electrical efficiency of electrolyzers, address water usage issues, and reduce or eliminate the need for scarce and expensive minerals from the supply chain. Those are top research priorities for green hydrogen production.

If green hydrogen can use this framework and get to P3, it could eventually become an extraordinarily valuable offtaker for green electricity, creating demand at times when there is none. It could also become a solution for long-duration energy storage at scale, a critical component of a renewables dominated energy system.

We have not reviewed pink hydrogen, powered by nuclear energy, because the LCOE for that energy is far higher than for other green energy sources—and because slow deployment means there is limited nuclear power available now and for the coming years.

Transporting and Storing Hydrogen

Most analysis of hydrogen production stops at the plant gate. That’s understandable: The cost to end users varies with the distance that the hydrogen must travel, plus a range of other factors (e.g., the plant and end user may be in different countries, or even different continents). However, the cost of transportation is just as real and just as important as the cost of production, so elaborate calculations that focus only on production mean little. It is the delivered price that users must pay.

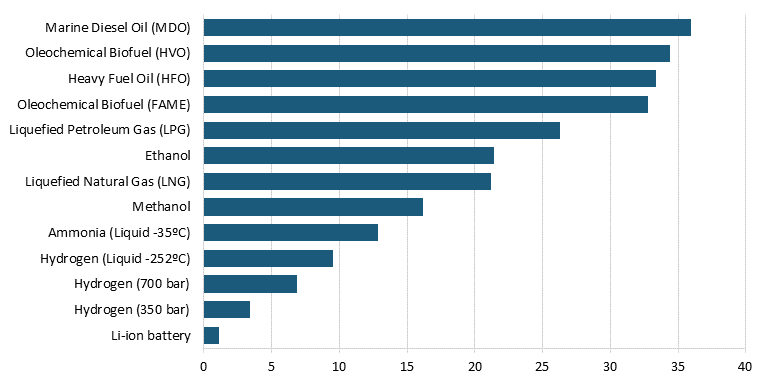

Figure 6: Volumetric energy density of different fuels (MI/L)[48]

Today, hydrogen transportation isn’t much of a problem. Gray hydrogen production is often colocated with end users in oil refining and ammonia. But that will change. A recent report from the Hydrogen Council (a hydrogen trade group) calls for total hydrogen production of 660 MMT (million metric tons) by 2050, of which 400 MMT will be transported long distances.[49] And some countries are planning to rely on imported hydrogen or ammonia to transform their energy backbones. For example, “Japan aims to commercialize an international hydrogen supply chain by producing hydrogen in bulk at low cost in countries blessed with bountiful renewable energy resources coupled with marine transport infrastructure.”[50] Similarly, Germany has struck a series of agreements with African countries, including a massive project to produce green ammonia in Namibia.[51] Most of these plans seem to assume that transportation of hydrogen will be simple and cost comparable to transporting liquified natural gas (LNG) or petroleum.

That’s not the case. Most critically, it is much less energy dense than competing forms of energy (see figure 6). Liquid hydrogen has less than half the energy density of LNG, a primary competitor. Compressed hydrogen has even lower energy density (the exact energy density depends on the degree of compression), which translates directly into higher transportation costs.

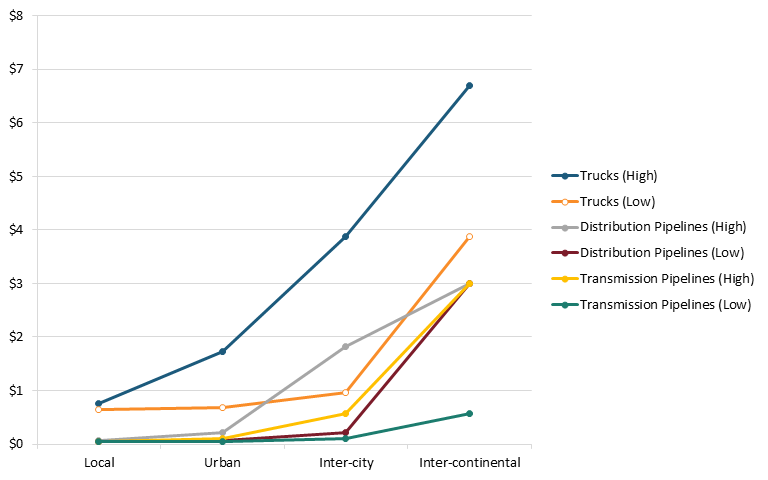

Costs vary by distance, scale, and technology. Figure 7 shows costs that range from 5 cents/kg for high volume over short distances to almost $7 per kg for intercontinental deliver by truck. While these estimates will likely change as more infrastructure is installed, they offer a useful framework for discussion.

Figure 7: Delivery costs of hydrogen by scale and distance (price per kg)[52]

Transportation by Pipeline

Pipelines are the least expensive and hence most attractive option for transporting hydrogen, which can be delivered either by blending it with natural gas and using existing pipelines or by building out new hydrogen-only pipelines. Using existing pipelines is obviously much cheaper, even if some refurbishment is necessary, but hydrogen can only be blended in at relatively low concentrations. NREL looked at the consequences of blending a 5–15 percent hydrogen mix to existing end users and concluded, “Any introduction of a hydrogen blend concentration would require extensive study, testing, and modifications to existing pipeline monitoring and maintenance practices (e.g., integrity management systems). Additional cost would be incurred as a result.”[53] It’s widely accepted that a 20 percent hydrogen mix is the maximum before steel embrittlement problems become severe.

Blending therefore doesn’t seem to be a good option for delivering large quantities of 99.99 percent pure hydrogen (needed for many industrial applications). New pipelines will be needed, but these face permitting challenges and scale limitations. While the Hydrogen Council predicts 40 new long distance pipelines by 2050, the distances make some of this impractical: Underwater pipeline links between Europe, North Africa, and the Gulf states may be feasible, but intercontinental pipelines between the United States and either Europe or Asia, and between Asia and Australia, seem out of reach.

New pipelines are also expensive. Onshore pipelines in the United States will require capital expenditures of $2.2 million to $4.5 million per kilometer. New offshore pipelines are much more expensive, at $4.5 million to $7.1 million per kilometer.[54] So a proposed pipeline from Rabat in Morocco to Seville in Spain (383 km) would cost $1.7 billion to $2.7 billion—before adding in the cost of pipelines to Rabat and also onward from Seville.

There are also substantial GHG risks to pipeline delivery. Hydrogen is a potent GHG, much more so than CO2, so any serious leaks could cut or eliminate any GHG benefits from the project. And pipelines do leak.

Trucking Hydrogen

Several proposed U.S. hubs anticipate using trucks to move hydrogen to end users, at least until sufficient scale emerges to justify building a pipeline. This avoids expensive (and initially underused) infrastructure. But shipping compressed hydrogen by truck is not cheap: A recent literature survey finds it would cost approximately $1 per kilogram per 100 km.[55] Trucking liquified hydrogen is much cheaper because it is denser, but it is still expensive, especially over longer distances, and requires more expensive facilities at either end.

Truck distribution makes the most sense when the end use is also distributed—for example, trucking hydrogen to refueling stations across a region—but that is very expensive. Hydrogen at the scale needed for industrial processes does not seem well suited to truck distribution.

Seaborne Transportation

Even liquified, hydrogen carries much less energy per unit of volume than does LNG: 60 percent less.[56] As a result, 2.5 times as much cargo space is needed for an equivalent amount of energy. Liquefied gas transporter ships cannot be made much bigger than they are today, as they need to fit through the Suez and Panama canals and into existing docking facilities. But a hydrogen carrier the size of the largest LNG carriers can carry only 40 percent of the energy, and would therefore require 2.5 times as many trips, which means 2.5 times the cost.

Hydrogen carriers will also be more expensive to operate per mile because liquid hydrogen is transported at -253oC while LNG travels at -162oC. Lower temperatures equal higher costs. Lower temperatures also mean a much higher rate of boil off during operations, which is both costly and presents GHG emission problems. Hydrogen carriers must also be built differently to resist the embrittlement that hydrogen causes to normal steel piping and valves.

Liquification and regasification are complex processes, and require additional steps to prevent re-evaporation of hydrogen (regardless of temperature). As a result, liquification consumes 30–40 percent of hydrogen’s energy content, compared with 10 percent for LNG.[57] Regasification adds a further energy tax (and cost). This all suggests that existing LNG terminals cannot easily be repurposed and therefore most existing infrastructure must be replaced.

Another approach is to avoid liquification altogether, transporting compressed hydrogen instead. Provirus Energy has designed such a ship, but at 250 bar, hydrogen provides about one-seventh the energy by volume of LNG, so shipping would require seven times the number of trips to deliver the same amount of energy.

Hydrogen can also be loaded into a chemical or metal container—such as a liquid organic hydrogen carrier (LOHC)—that allows transportation at ambient temperatures and pressures. But loading and unloading LOHCs requires the equivalent of about 30 percent of the hydrogen energy, and decades of research into metal hydrides (another alternative) have failed to generate a competitive solution.

In short, the low energy density of hydrogen in volumetric terms and its physical characteristics make transportation by sea much more expensive than shipping LNG. Micheal Liebreich has estimated that liquified hydrogen costs four to six times as much to ship as LNG, while alternative approaches do not seem promising.[58]

One final alternative is to ship hydrogen as ammonia. Countries in North Africa (Morocco) and sub-Saharan Africa (Namibia) have signed agreements with Germany to produce green hydrogen using new solar energy for transportation either by pipeline or in the form of ammonia.[59] These projects will likely come on stream well before any trans-Mediterranean pipeline is available.

Can shipping ammonia itself be cost effective? Critically, the volumetric energy density of LNG is 1.7 times that of ammonia, so more ships will be needed to ship the same amount of energy, and converting hydrogen to ammonia and then burning it as fuel imposes a heavy energy tax.

Storage

There are limited options for storing hydrogen at scale. Liquified hydrogen must be stored at very low temperatures (-253oC) or in a liquid organic hydrogen carrier. Both are expensive, as is the other nongaseous alternative: ammonia. Realistically, for LDES in particular, storage in salt caverns is the best solution; while depleted oil fields can be used and are cheaper than liquid storage, they are still far more expensive than salt caverns and risk substantial leakage through abandoned bore holes.

BNEF’s levelized cost of storage for hydrogen currently ranges from $0.23/kg for salt caverns to about $4.50/kg for liquid hydrogen and LCOH storage (see table 3 and table 4). BNEF expects these costs to fall substantially over time.

The cost of storage, and the reality that only salt caverns currently offer any scalable low-cost option, means that hydrogen production will likely be closely aligned with the availability of geologic storage; in fact, it has been a major selling point for several of the competing hydrogen hubs in the US.

Table 3: Storage options for hydrogen in a gaseous state[60]

|

Salt Caverns |

Depleted Gas Fields |

Rock Caverns |

Pressurized Containers |

|

|

Main Usage (volume and cycling) |

Large volumes, months-weeks |

Large volume, seasonal |

Medium volumes, months-weeks |

Small volumes, daily |

|

Benchmark LCOS ($/kg) |

$0.23 |

$1.90 |

$0.71 |

$0.19 |

|

Possible future LCOS |

$0.11 |

$1.07 |

$0.23 |

$0.17 |

|

Geographical availability |

Limited |

Limited |

Limited |

Not limited |

Table 4: Storage options for hydrogen in a liquid or solid state[61]

|

Liquid Nitrogen |

Ammonia |

LOHCs |

Metal Hydrides |

|

|

Main Usage (volume and cycling) |

Small—medium volumes, days-weeks |

Large volumes, months-weeks |

Large volumes, months-weeks |

Small volumes, days-weeks |

|

Benchmark LCOS ($/kg) |

$4.57 |

$2.83 |

$4.50 |

Not evaluated |

|

Possible future LCOS |

$0.95 |

$0.87 |

$1.86 |

Not evaluated |

|

Geographical availability |

Not limited |

Not limited |

Not limited |

Not limited |

While storage adds costs, these do seem manageable, provided that sufficient capacity is available locally and that large-scale commercial storage can be demonstrated quickly. A levelized cost of storage (LCOS) of 11–20 cents/kg is not a deal breaker, though above-ground storage at $1–$4/kg certainly is (future LCOS in table 3 is, of course, just an estimate).

Solving for Hydrogen: A Different Approach to Transportation and Storage

Transportation and storage impose substantial costs, and there are drawbacks to each of the main proposed methods of transporting hydrogen. We do know though that delivery by truck is always very expensive, and that pipelines must deliver large quantities of hydrogen gas in order to reach any kind of efficiency.

Avoiding transportation as much as possible is a key to reaching P3. The transportation burden is also one that competing technologies long ago amortized: LNG pipelines already exist and are largely paid for, gray hydrogen is very often produced on site by end users, and low-scale regional delivery networks are part of the existing hydrogen ecosystem.

Systems that require the widespread distribution of hydrogen (e.g., for fuel cell electric vehicles (FCEVs)) face enormous transportation and delivery costs; that’s largely why hydrogen fuel at the pump in California just hit $36/kg, even after substantial state investment, to subsidize the cost of refueling stations. California may be especially expensive, but the cost of delivery networks for hydrogen is substantial and inescapable.

Markets and End Users

Markets divide into existing markets currently served by high-emission gray hydrogen and prospective markets served today by nonhydrogen technologies.

Existing Markets for Hydrogen

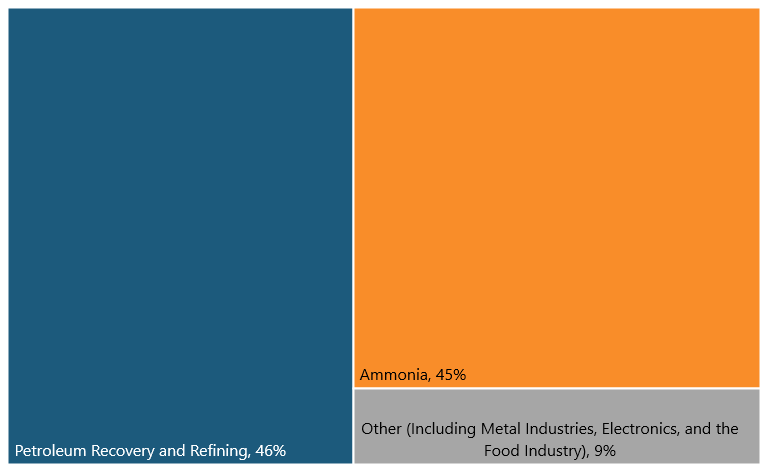

Oil refining and ammonia production, along with the smaller market for chemicals, use about 70 MMT of hydrogen production annually. Will these markets be the first to adopt clean hydrogen? At least these markets exist and there are buyers—and it seems natural to assume that, as clean hydrogen becomes competitive, these markets will be among the first to switch.[62]

However, clean hydrogen will find these markets very hard to crack. They are almost entirely supplied by gray hydrogen production facilities, which, in many cases are colocated with (and often share ownership with) the ammonia and refining plants. These gray hydrogen facilities thus avoid any transportation costs, and produce hydrogen at the lowest cost. They also represent existing sunk costs for refinery and ammonia plant owners.

Figure 8: Existing markets for hydrogen[63]

Hydrogen and Ammonia For Fertilizer

Globally, about 190 million tons of ammonia are produced annually, almost all using fossil fuels as feedstock for the standard Haber-Bosch process. Production accounts for about 1 percent of world energy use, and emits around 500 MT of CO2 annually. Around 80 percent is used for fertilizer, and about 50 percent of world food production relies on ammonia.[64] In contrast, less than 1 percent of production is used for power generation, mostly for pilots and demonstrations.[65]

So cleaning the ammonia production process is a distinct priority for decarbonization, and clean hydrogen could offer a pathway. The Heartland Hydrogen Hub, one of the winning hydrogen hub proposals to be funded by DOE, is focused on using clean hydrogen to reduce emissions from ammonia for fertilizer. The hub has not announced a fuel source, but it is expected to use blue hydrogen made using natural gas.[66]

However, as noted, gray hydrogen is deeply embedded and will remain cheaper than clean hydrogen. Subsidies might close the gap, and adding CCUS to existing gray hydrogen plants might not be a deal breaker. Once again, though, reliance on indefinite subsidies or carbon blocking regulation is a significant risk.

Hydrogen and Oil Refining

Hydrogen is used as both a catalyst in oil refining (to stimulate chemical reactions) and as a process byproduct that, in certain concentrations, can indicate that some critical action must be taken. For a typical oil refinery, real-time measurements of hydrogen can be critical at multiple physical locations.[67]

In recent years, while total demand for hydrogen in oil refineries has increased quite sharply as oil production has expanded, on-site production for oil refineries has changed very little, at least in the United States.[68] The U.S. Energy Information Administration has calculated that off-site production was up 135 percent between 2008 and 2014 and now accounts for more than half of the total.[69] So there is increasing room for third-party providers, although almost half of production is still on-site and is therefore tied to production owned by the oil refineries themselves.

Only blue hydrogen can replace gray hydrogen at colocated plants. Economically competitive sources of green hydrogen are unlikely to be available, and while adding CCUS to existing plants is challenging within the footprint of existing plants, it is not impossible. Gray hydrogen produced off-site also has certain competitive advantages over clean hydrogen, notably cost and existing distribution networks. Overall, clean hydrogen will struggle to break into the ammonia and oil refining markets.

New Markets for Hydrogen

Instead of competing in markets where incumbents are deeply entrenched and clean hydrogen will struggle to meet P3, perhaps new markets without the gray hydrogen incumbents will be easier. Their absence, however, does not mean there are no incumbents; every new market already has incumbents using nonhydrogen technologies.

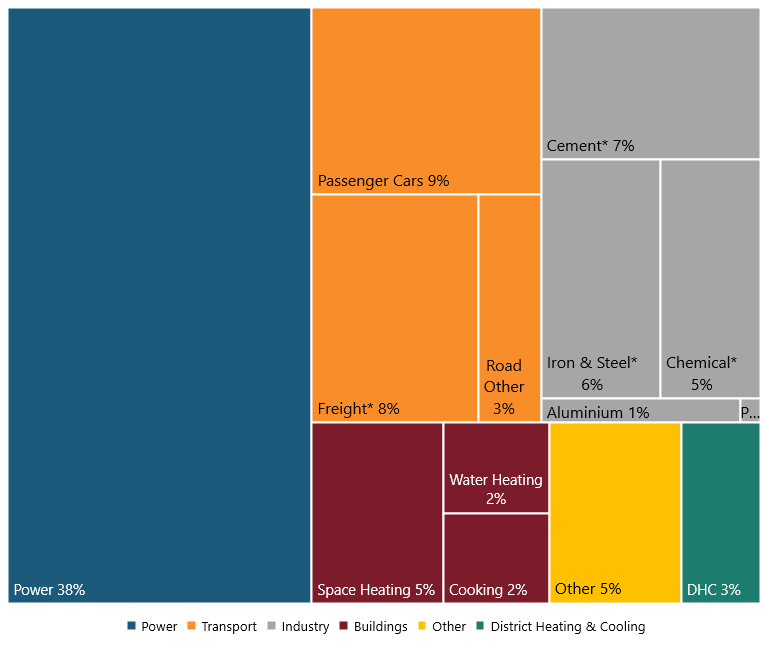

Figure 9 shows markets that have been identified both as significant sources of GHG emissions and as especially hard to decarbonize using existing technologies; in short, they are not good candidates for electrification. To them could be added aviation and shipping, neither of which will be electrified (batteries are simply too heavy).

These hard-to-decarbonize sectors—notably heavy transportation, chemicals, steel, and cement—are potential new markets for hydrogen. More speculative arguments have pushed hydrogen as solutions for light vehicles and building heating, aviation, and shipping. Hydrogen could also play various roles in decarbonizing the power sector itself.

Unfortunately, new markets turn out to be mostly a mirage, as the following analyses demonstrate.

Figure 9: Global GHG emissions by sector (* = no economically viable option for deep decarbonization)[70]

Road Transportation

Light-Weight Fuel Cell Electric Vehicles

Among the proposed future markets for hydrogen, FCEVs stand out. An FCEV world would generate enormous demand for hydrogen—and California is that world’s test case. The state is currently planning to expand its network of hydrogen refueling stations in line with its Zero Emission Vehicle (ZEV) program, which requires all vehicles sold in California to be zero emission by 2035.[71]

California has spent more than $100 million on FCEV infrastructure. And given the long distances driven by California drivers, it is also the state where the range limitations of EVs become more apparent. Yet, despite California’s plunge into hydrogen, FCEVs for light vehicles are simply not competitive now, and won’t be competitive in the future. Fighting on two fronts—against ICE engines and EVs—there is no competitive path forward for FCEVs, despite the heavy regulatory thumb on the scale in California. Battery EVs made up 22.6 percent of California’s new car sales in the second quarter of 2023, up 5 percentage points over Q2 2022. Fuel cells’ share fell to just 0.23 percent, and there are fewer than 12,000 FCEV vehicles on its roads today.[72]

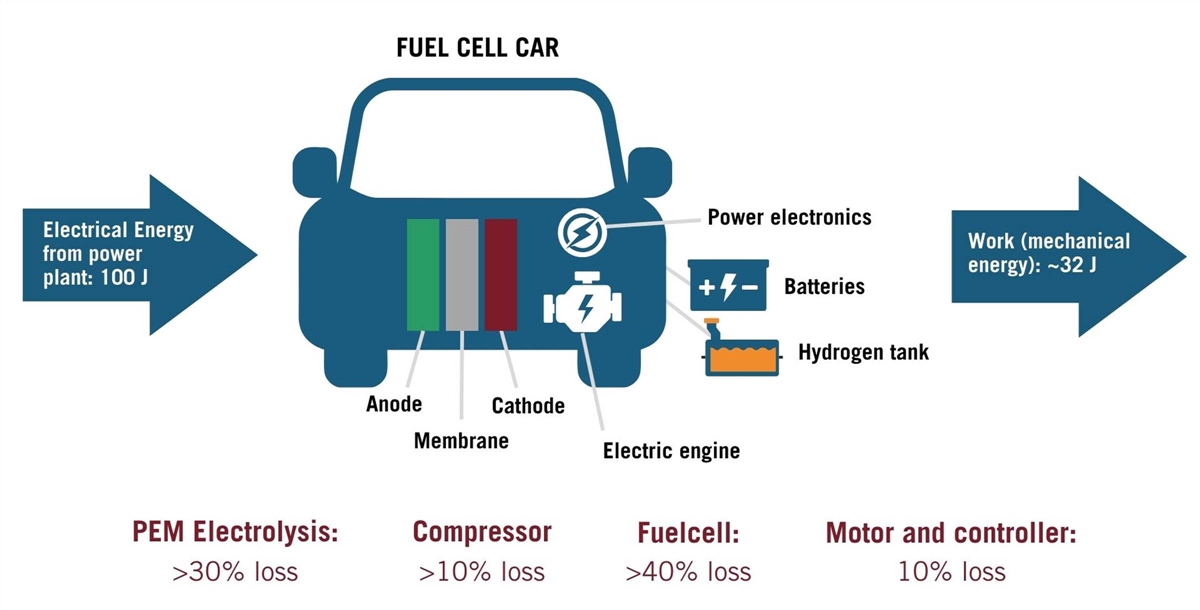

FCEV for light vehicles is failing for three basic reasons. First, the conversion of energy to hydrogen and then back again results in low efficiency and hence high costs. Second, there is no widespread charging infrastructure to support use of FCEVs, and building it would cost billions of dollars. Finally, producing and delivering the hydrogen needed is enormously expensive, resulting in running costs that are many times those for BEVs and ICE engines.

Figure 10: PEM FCEV efficiency[73]

FCEVs require multiple steps to shift power from the grid to the wheels, but at each step, energy is lost. Paul Martin’s deconstruction of the FCEV power flow demonstrates this quite clearly:[74]

▪ 6 percent loss from grid distribution leakages

▪ 30 percent loss from electrolysis, where 70 percent is already an ambitious level of electrical efficiency

▪ 10 percent loss from compressing the hydrogen for use in the fuel cell

▪ 40–50 percent loss from PEM fuel cell operations (the ultimate thermodynamic limit is about 83 percent)[75]

▪ 10 percent loss from drive train efficiency

In the end, the total grid-to-wheels efficiency is about 32 percent (see figure 10). BEVs avoid most of these steps and operate at about 77 percent efficiency, so BEVs are currently more than twice as efficient as FCEVs.[76]

FCEVs need substantial fueling infrastructure, as they cannot be charged at home or at the office like BEVs can. This is an enormous problem, which can be solved only by the deployment of fueling stations. But this is impossible, as doing so would cost an enormous amount—evidence from Europe suggests current costs of ~$8 million per station, with thousands of stations needed.[77] Land purchases and permitting would be extremely difficult at the scale that’s needed, as new hydrogen fueling stations cannot simply replace the 8,000 existing gas stations in California—they will be needed to fuel ICE vehicles for decades.[78] And FCEVs are green only if the electricity used for hydrogen production is green, and that is in relatively short supply. As Paul Martin observed, “If the source electricity isn’t green, FCEVs just become an elaborate (and expensive) way of emitting carbon from grid sources rather than vehicles.”[79]

As elsewhere, though, the final deal breaker is the cost of hydrogen. Toyota’s hydrogen-powered Mirae is comparable to a Tesla 3 in many respects, but in September 2023, California’s largest hydrogen fuel retailer increased the per-kilo price of hydrogen to $36 at the pump. Based on the 400-mile range announced by Toyota for the Mirae, it would cost more than $200 to fill the tank—and the Mirae would cost 14 times as much to operate (50 cents per mile, compared with 3 cents for the Tesla 3).[80]

FCEVs still have a few advantages. They can charge much more quickly than EVs, and they could have a significantly longer range (although Toyota’s recent announcement of a 700 mile-per-charge solid-state battery may eliminate that advantage). But those advantages are not nearly big enough to overcome the three core disadvantages described previously. FCEVs for light vehicles are therefore just a fantasy.

Heavy-Duty Trucks

In contrast to light vehicles, heavy fuel cell electric vehicles (HFCEVs) do have some potential advantages for long distance routes: Notably, they refuel rapidly and hence reduce costly wait time; BEV batteries are heavy so capacity must be limited.[81] DOE’s hydrogen roadmap assumes that hydrogen may be workable for long-range hauling at 750 miles/day or beyond, although around two-thirds of freight by weight travels less than 250 miles.[82]

California is again leading the way on regulations (see the box below on “California Truck Regulations: A Force-First Approach”), where a technology-neutral model is setting up a competition in trucking between BEVs and HFCEVs. Of course, any take-up of clean vehicles over existing ICE trucks would be driven by regulation and subsidies, as no hydrogen (or BEV) trucks are P3 competitive.[83]

California Truck Regulations: A Force-First Approach

Advanced Clean Fleet (ACF) regulations require fleet operators to adopt an increasing percentage of zero emission vehicles (ZEVs) (including BEVs, electric hybrids, and HFCVs). The ACF identified three key segments for action:High priority fleets (>50 trucks or >$50 million in annual revenue), drayage truck fleets (trucks that operate at California ports or intermodal rail yards), and public fleets (fleets owned by state and local governments).

1. High-priority fleet operators must either purchase only new ZEVs starting in January 2024 (!) and must retire all ICEs in use for the lesser of 13 years or 800,000 miles, or match fleet composition to specific percentage targets based on vehicle year and model.

2. All drayage fleet vehicles must be ZEV by 2035; after 2024, only ZEVs can be purchased and all ICEs must be retired once they reach 800,000 miles or 18 years.

3. Public fleet compliance requires that 50 percent of new vehicle purchases from now until 2026 be ZEVs; from 2027 onwards, 100 percent of purchases must be ZEVs.

It’s true that charging times for HCFEVs are much shorter than for BEVs, but, even though HCFEVs take only a few minutes to fill up and BEVs require at least an hour to recharge (using one of the very few extremely fast chargers now available), charging time matters much less than it might seem.

In Europe, drivers may drive for nine hours, after which they must take at least a nine-hour break. They also must take a 30-minute break after 4.5 hours. In the United States, they must take an 11-hour break after 11 hours on the road, with a 30-minute break after 8 hours.[84] Those breaks are opportunities to refuel. Assuming that trucks are driven at an average of 60 mph, they can travel 660 miles in a day in the United States and 540 miles in the EU, and must take one 30-minute break.

Those breaks are critical. HFCEV vehicles can charge in only a few minutes, so charging time for them is not a concern. For BEVs, very high-speed chargers such as Tesla’s can completely charge a BEVS 900 kWh battery in about an hour and a quarter, and Tesla’s batteries seem capable of providing 450 miles per charge, according to Pepsi, which is piloting their use.[85], During a 30-minute break a truck can add perhaps 350 kWh of energy (using a Supercharger), enough to drive least 175 additional miles. So, in principle, that’s close to meeting the daily drive of 660 miles. BEV battery technology is also improving quite quickly (e.g., Toyota’s recently announced solid-state batteries). So mandatory rest stops at least in principle provide enough time to charge heavy BEVs—if there are enough chargers.

Currently, of course, there is no network of either HFCEV or super-fast BEV chargers, and the cost and difficulty of deploying one will be substantial. That’s why both BEVs and HFCEVs will start by working on specific long-distance routes. Charging stations are already being built for light BEVs across the country, so extending that to truck charging stations is not a substantial stretch. And every truck stop already has electricity—BEV chargers won’t need elaborate energy delivery networks.

In France, estimated CAPEX per charging station is $360,000 for BEVs and $5.6 million for HFCEVs (as of 2030). However, the same study concludes that a longer refueling time means that a single refueling station could handle 110 HFCEVs daily, but only 20 BEVs. So despite lower costs per station, the annual cost of infrastructure per vehicle is 45 percent higher for BEVs. Longer refueling times also mean that many more chargers will need to be built, which adds further difficulties, especially in more urban areas.[86] That could be a deal breaker for BEV trucks.

The initial strategy for both BEVs and HFCEVs is to focus on specific routes (also referenced in several of the U.S. hydrogen hub proposals). There are now three long distance HFCEV routes at the planning stage in the United States: GTI energy H2LA (Houston to Los Angeles; the I-10 Hydrogen Corridor Project); Calstart East Coast Commercial ZEV Corridor (I-95 corridor spanning Georgia to New Jersey); and the Cummins MD-HD ZEV project (the I-80 Midwest Corridor).[87] This is also the strategy being adopted by Tesla, which is seeking $97 million in federal funds (plus $24 million of its own) to build a 1,800-mile BEV Megacharger corridor between its factory in Fremont, California, and Laredo, Texas.[88] Tesla seems to be further advanced in its planning, and has signed up a number of vehicle manufacturers to use its technology, which is quickly emerging as the industry standard. It would be no surprise if the first leg of the Tesla Megacharger network gets built long before the HFCEV corridors are off the ground.

What does this tell us about markets for hydrogen? To begin with, we should remember that all ZEV markets for heavy trucks are entirely dependent on regulations that force their adoption. And while ambitious regulations can be put in place, they may not survive contact with reality. American Trucking Association president and CEO Chris Spear noted that “the decision to force motor carriers to purchase zero emission vehicles ignores the fact that these trucks are early-stage technologies and the infrastructure to support them does not exist.”[89]

Still, heavy trucks are mentioned in almost every laundry list of sectors that are hard to decarbonize, and hence are also listed as likely candidates for a shift to hydrogen. But despite some advantages over BEVs, HCFEVs are in a race to reach and dominate the market that for many reasons they are not likely to win. Data from France suggests that the total cost of ownership for HFCEVs will be significantly higher than that for BEVs well into the future, even for long distance trucking, although NREL found that the total cost of ownership for HFCEVs was lower than for heavy BEVs and competitive with diesel on long distance routes (albeit using some fairly favorable assumptions).[90]

Rolling out the charging infrastructure for both technologies will be immensely challenging, but the mountains of obstacles facing HFCEVs seem considerably higher. Certain specific corridors could find ways to support sustainable HCFEV routes, but everywhere else, HCFEVs will be second or third best (depending on the degree to which regulation forces ICE vehicles off the roads).

Even if the corridors pan out, HFCEVs will likely not provide the massive demand that the clean hydrogen economy requires to get off the ground. There may well be some corridors, especially given the massive subsidies available in the United States, but even with these subsidies, HFCEVs won’t be dominating the heavy truck market. And that’s the best case for hydrogen: In low-income countries, HFCEVs will not be close to P3 against either ICE or BEV alternatives. That helps to explain why Cummins, a major player, noted (in the course of a very optimistic presentation) that only 2.5 percent of Class 8 heavy duty trucks will be HFCEVs by 2030 in the United States.[91]

California Subsidies and Supports

California provides an extraordinary array of subsidies and supports for ZEVs. They include: the California Air Resources Board (CARB) Bus Replacement Grant (replacing shuttle, transit, and school buses); the Heavy Duty Low Emission Vehicle Replacement Grant (replacing class 7 and 8 trucks); Low Emission Truck and Bus Purchase Vouchers (reducing the incremental cost of qualified electric, hybrid, and natural gas buses); Plug-In Hybrid and Zero Emission Light-Duty Vehicle Rebates (rebates for the purchase or lease of qualified vehicles by the CARB below a maximum income threshold); the Bay Area Vehicle Replacement Program (cash incentive to turn in operable and registered vehicles made before 1998 for scrapping); the California Electric Vehicle Infrastructure Project (CALeVIP) (provides guidance and funding for property owners to develop and implement EV charging station incentive programs); the Clean Vehicle Rebate Project; the Clean Transportation Program (invests up to $100 million annually in a broad portfolio of transportation and fuel transportation projects throughout the state); and other programs offerring high-occupance vehicle (HOV) exemptions, weight limit exemptions, tax exemptions, charging station rebates, and many more.

Drayage, Buses, and Other Clusters

California’s Advanced Clean Fleets Rule will directly affect the Port of Los Angeles, as drayage trucks will need to be zero emissions by 2035.[92] That implies major expenditures, as clean energy trucks will cost $800,000 or more, compared with $150,000–$175,000 for diesel, although California subsidies offer up to $520,000 for qualifying vehicles traveling at least 52,000 miles annually.[93]

Essentially, the California model is to regulate first and then soften the blow with subsidies. This of course is far from a P3-style policy, but it also leaves hydrogen-powered vehicles facing direct competition with BEVs. As there is no existing hydrogen supply chain, and fuel costs account for about 70 percent of total ownership cost over the vehicle’s lifespan, relying on HFCEVs is very risky for fleet operators. The recent explosive price increase in hydrogen refueling costs will not have been encouraging.

Real limits on time in use for BEVs could offer certain competitive advantages for HFCEVs—BEV drayage vehicles in one port could only handle seven to eight hours of heavy work between charges, which implies the purchase of additional vehicles.[94] HFCEVs don’t face that recharging problem, and the geographically concentrated use (in a port) means there is no need to build out a widely distributed hydrogen refueling network. That’s an important factor.

The port transition has barely begun, and most bus fleets are not yet transitioning to ZEV, so it’s unclear whether BEVs or HFCEVs will dominate in these niche markets. We do, however, know that the capital cost of HFCEV vehicles is likely to be substantially more than for BEVs, even after California subsidies. This seems to apply across all heavy vehicle classes (including close-to-shore maritime tugs, for example).[95]

As with other niche markets, outcomes for the BEV/HFCEV race in drayage and buses will likely be determined by the extent to which BEVs resolve limitations imposed by recharging needs, and consequently by the capacity of leading BEV producers to reach scale quickly, while meeting domestic production requirements for the rich subsidies available in the United States and EU. While outcomes are uncertain, it is abundantly clear that these markets are not in any sense focused on P3. On the contrary, policymakers are focused on forcing the transition through regulation and matching subsidies.

Local Delivery

While there has been little interest in the United States in converting local delivery vehicles to FCEVs, one useful practical study was completed in Berlin, Germany, looking at food distribution. Berlin has 1,057 food markets placing 1,928 orders daily, fulfilled by 15 suppliers (carriers) with 17 distribution centers. Fresh, dry, and frozen are handled separately. The study assumes a delivered hydrogen price of €7.13/kg, and compares BEV and HFCEV alternatives to existing diesel delivery vehicles. It finds that BEVs would cost 17–23 percent more than diesels, but FECVs are even more expensive—22–57 percent more. The study concludes that, for urban delivery, BEVs offer a decisively better alternative to ICEs, unless the cost of hydrogen falls dramatically.[96]

Aviation

Aviation accounts for about 2.5 percent of global CO2 emissions and 3.5 percent of global warming when non-CO2 climate impacts are considered (the remainder comes from contrails, a different problem with different solutions).[97] Passenger air travel has now almost entirely recovered from the collapse during the COVID-19 pandemic, is booming in Asia in particular, and Boeing anticipates that, by 2025, it will have reached 120 percent of its pre-pandemic peak.[98]

To date, the EU has taken the lead in pressing for more sustainable fuels. As with California’s approach to ZEVs, the EU is imposing tight requirements that would force the adoption of sustainable aviation fuels (SAFs). The EU’s ReFuelEU Aviation regulations require that SAF fuels account for 2 percent of all fuel at EU airports by 2025, rising to 70 percent by 2050.[99]

Low-income countries might not be enthusiastic, but if flights ending in the EU (and perhaps eventually the United States) are forced to meet SAF requirements, their airlines might not have much choice. Fuel costs account for only around one-third of ticket prices, so a significant jump there might not translate into unsustainably high overall ticket prices. And of course, airline passengers are as a whole much wealthier than non-flyers, so the capacity to meet higher prices is greater, and airline tickets are in any event only a small percentage of their overall annual budgets.

So where does hydrogen fit into the sustainable aviation revolution? There are efforts to go directly to hydrogen-powered flight.Rolls-Royce and EasyJet recently tested a turboprop engine on pure hydrogen.[100] Airbus hopes to bring to market a 100-seat, 1,150-mile (1,850 km) range hydrogen-powered airplane by 2035.[101] Smaller hydrogen-powered aircraft will come earlier, perhaps even by 2025, from start-ups such as ZeroAvia and H2FLY.