Climate-Tech to Watch: Clean Steel

Lower carbon steel is vital to the energy transition. It’s a long journey to decarbonize steel, and with competition being fierce, supportive RD&D and trade policies will be vital to success.

KEY TAKEAWAYS

Key Takeaways

Contents

What Is Net-Zero Steel and Why Is It Important?. 2

Clean Steel’s Role in the Energy Transition. 2

Pathways for Steel Production. 3

Progress in the United States. 5

What Is Net-Zero Steel and Why Is It Important?

Steel is an indispensable material of modern life that is essential to many industries including transportation, construction, and energy. Net-zero steel serves all the same functions as conventional steel but with no net greenhouse gas (GHG) emissions.

Due to the complexity of the steel industry, there is unlikely to be a single global decarbonization technology pathway; however, a combination of energy efficiency investments; electrification; carbon capture and storage (CCS); and low-emissions steelmaking technologies offer promising pathways toward decarbonizing the industry. To accelerate innovation, bring down costs, and reduce GHG emissions, governments need to implement federal and private innovation policies along with supportive regulatory and trade policies.

Clean Steel’s Role in the Energy Transition

Steel is critically important to achieving the broad decarbonization of global energy systems, buildings, manufacturing, and transportation. Steel production by itself is also responsible for a rising share of global carbon dioxide (CO2) emissions. Every tonne of steel produced creates an average of 1.9 tonnes of CO2 emissions, and the industry as a whole is responsible for between 7 and 9 percent of global CO2 emissions.[1] If the global steel industry were a country, it would rank third in the world for CO2 emissions.[2]

Demand for steel is expected to rise, driven in part by increased demand for wind turbines, solar arrays, electric vehicles, and other clean energy solutions. Global steel demand today is 1,985 million tonnes, with China producing almost 55 percent followed by India, Japan, and the United States. Over the past 50 years, production has tripled.[3] The International Energy Agency (IEA) projects that global demand for steel will grow by more than a third through 2050.[4] Industries will need global net-zero solutions to meet this increase in demand while simultaneously reducing emissions.

Pathways for Steel Production

There are three primary methods for steel production:

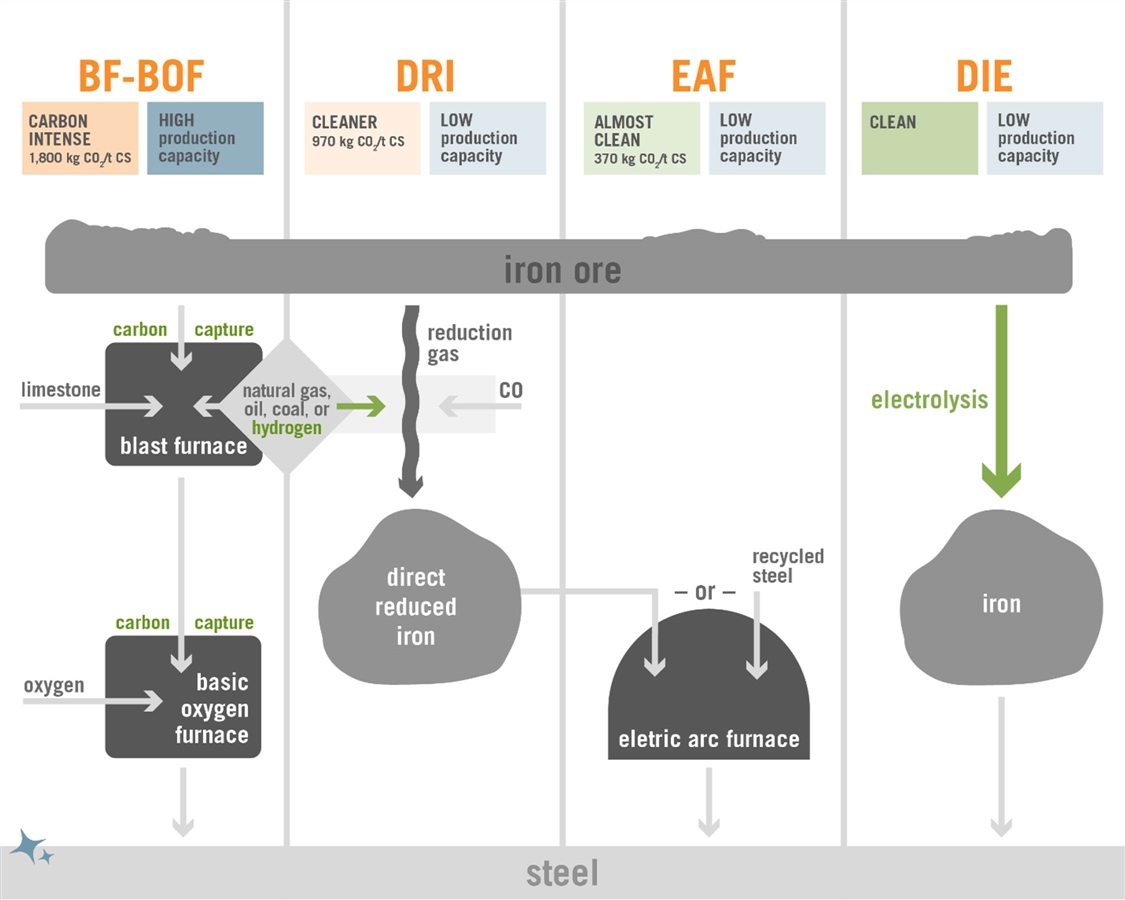

1. Blast furnace-blast oxygen furnace (BF-BOF) steel production is a process by which raw iron ore alongside a carbon source (primarily coal or natural gas), limestone, and a small percentage of steel scraps are converted into primary steel using large amounts of energy. Iron is smelted in a high-temperature blast furnace and limestone is fed into the BF to remove impurities. The molten iron, or pig iron, is then fed into a BOF along with steel scrap metal, where it is blasted with oxygen to further remove impurities.

2. Electric arc furnaces (EAFs) melt scrap steel using an electric current alongside added alloys. The liquid steel can then be cast into secondary shapes and formed into final steel products.[5]

3. Direct reduced iron (DRI) can substitute for the primary liquid steel in an EAF. It is produced by the reduction of iron ore using a reduction gas. The reduction gas—called “syngas,” which is a mixture of hydrogen (H2) and carbon monoxide (CO)—is typically made from natural gas or coal but can be replaced with low carbon hydrogen.

After both the BF-BOF and EAF process are complete, the hot steel can be shaped and finished into long products such as rebar, flat products such as steel sheets and slabs, or specialized steel products through the addition of alloys, including stainless steel and high-grade aviation and automotive steel. Finally, these products are finished and shipped, either via barge, shipping container, rail, or truck to construction worksites, factories that use steel as an input, or some other post-manufacturing processing.

Steel produced using the EAF pathway is less carbon intensive due to lower energy requirements. However, globally, the BF-BOF pathway is much more prevalent, accounting for over 70 percent of global production capacity.[6]

Decarbonization Pathways

There are several commercially proven technologies that can contribute to reducing the carbon footprint of U.S. steel production such as increased renewable energy for EAF production and energy efficiency measures. As the electric grid becomes less carbon intensive due to the increased use of renewable energy, the emissions associated with EAF steel products will continue to decline. There are also remaining energy efficiency improvements at the plant level that remain untapped. Steel plants could also continue to invest in improved onsite energy management systems that rely on integrated sensors, 5G telecommunications, machine learning, predictive maintenance, and smart manufacturing principles to further improve energy efficiency.

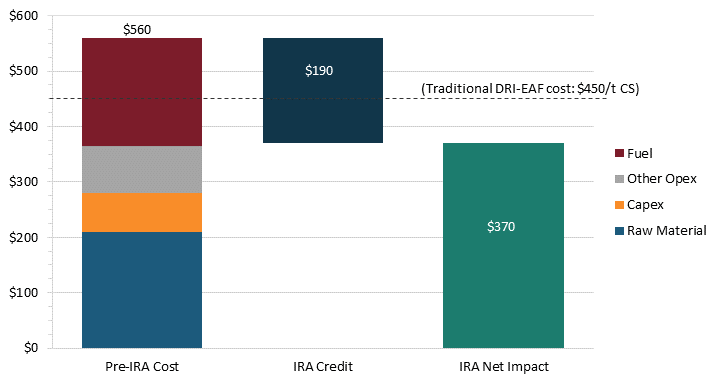

Technologies that currently exist at bench and pilot-scale demonstration sizes may provide promising pathways toward further decarbonizing existing steel production. The most promising full decarbonization pathway is the use of low-carbon hydrogen as a reductant alongside the DRI-EAF process (DRI-H2). This pathway combines the already commercially established DRI process, using low-carbon hydrogen, rather than natural gas, and the EAF process.

Another potential technology pathway is carbon capture, utilization, and storage (CCUS) technology, which can be retrofitted onto existing or new BF-BOF and DRI plants. CCUS works by capturing CO2 from smokestacks, sequestering it, and transporting it either to long-term storage or to be reused. The result is a low-emissions steel product.[7]

Direct iron electrolysis is still in the early stages of development but has the potential to fully decarbonize the steelmaking process if carbon-free electricity is used. Several routes have been tested at lab scales, including high-temperature molten oxide electrolysis and low-temperature aqueous electrowinning.[8] Both processes involve using electrolysis to extract iron from ore.

Figure 1: Pathways for lower carbon steel production

Steel is an inherently carbon-based product, so stripping out carbon entirely is either highly cost inefficient or not technically feasible depending on the technology pathway. Even if industry can effectively implement the decarbonization pathways described above, the sector will likely have residual emissions that will require offsets or carbon-negative technologies such as direct air capture, ecosystem preservation, or other ecological approaches.

Global Progress

Most pathways for reducing the carbon intensity of steel production are not yet widely commercially deployed. The Hydrogen Breakthrough Ironmaking Technology (HYBRIT) facility in Luleå, Sweden, a joint-venture partnership between Swedish steel produced SSAB, Swedish iron ore producer LKAB, and Swedish electric power producer Vattenfall, is the first large-scale demonstration facility to use the DRI-H2 process. Several other global steel firms have announced plans to pilot and deploy commercial scale DRI-H2 facilities, with a combined total production capacity of approximately 20 million tonnes and at least $50 billion in committed capital.[9]

The first and only fully operational CCS-DRI steel plant is the 3.2-million-tonne Al Reyadah facility in Abu Dhabi, capable of capturing 800,000 tonnes of CO2 annually from natural gas. The captured CO2 is then used in a nearby enhanced oil recovery gas field.[10] Two integrated global steel producers, US Steel and ArcelorMittal, have announced CCS steel projects, located in France, Norway, Belgium, and the Ohio River Valley in the United States. Yet, scale, scope, and projected completion date data remains sketchy, with few details beyond the initial project announcement.[11]

The more nascent direct iron electrolysis pathway has several research and development (R&D) projects globally. Siderwin, an EU-funded project, is working on a low-temperature aqueous solution with commercial scalability by mid-decade.[12] If successful, the technology has the potential to dramatically reduce total emissions from virgin steel production—on the order of 95 percent or more.

Progress in the United States

Steel production in the United States is already less carbon intensive than for its global competitors, with between 75 and 320 percent fewer carbon emissions than the global average, depending on the production pathway.[13] The United States has taken several steps with recent legislation to invest in low-emitting steel production pathways and spur uptake and private sector investment in new technologies. The 2022 Inflation Reduction Act (IRA) includes $5.8 billion for the Advanced Industrial Facilities deployment Program, which funds innovative industrial carbon reduction technologies particularly in hard-to-abate sectors such as steel. The IRA and the Infrastructure Investment and Jobs Act provide further incentives for related technologies such as CCS and low-carbon hydrogen.

The United States is just beginning to implement newer, more-transformative decarbonization technologies in the steel sector. The Department of Energy’s (DOE’s) Office of Fossil Energy and Carbon Management announced a $1.5 million grant for Cleveland Cliffs to design an industrial-scale CCS system for a BF-BOF steelmaking process.[14] And Boston Metals, which has developed a molten iron electrolysis platform for replacing fossil fuels used in the steelmaking process with renewable electricity, has plans to scale its early-stage technology by mid-decade.[15]

Key Policy Issues

Emerging technology pathways for producing clean steel face significant challenges and require additional federal and private research, development, and demonstration (RD&D) spending, alongside broader regulatory and infrastructure support to facilitate growth in renewables, hydrogen, and CO2 pipelines.

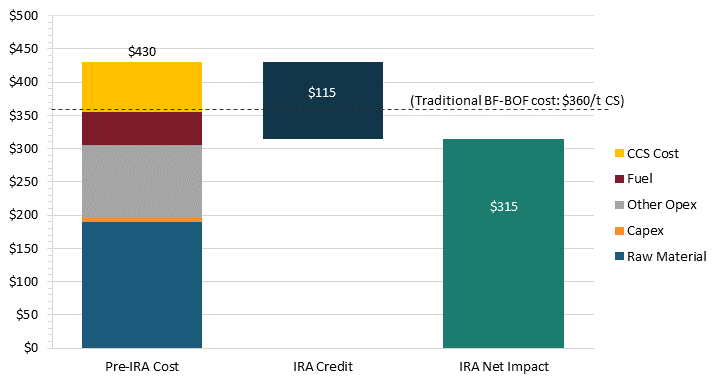

One of the most significant barriers is the high additional cost associated with net-zero carbon steel. Current average virgin steel prices produced via BF-BOF facilities range from $450 to $600 per tonne, depending on the location and product. IEA reports that all current technology pathways that are likely to significantly reduce sectoral emissions are between 10 to 50 percent more expensive than current production processes—a significant cost premium for a globally traded commodity product.[16] Federal policy should focus on continued RD&D that results in deployable innovations that bring costs down and provide price parity with traditional steel technologies. The DRI-H2 pathway requires cheap and accessible access to low-emitting hydrogen, which is currently two to three times more expensive than traditional carbon-intensive hydrogen.

Recent federal legislation such as incentives for CCUS and green hydrogen included in the IRA will help drive the deployment of these technologies with benefits to net zero. Breakthrough Energy found that the tax incentives authorized in the IRA could, in some cases, make net-zero steel cost competitive with incumbent technologies.[17] Also, the Steel Upgrading Partnerships and Emissions Reduction (SUPER) Act, which was included in the CHIPS and Science Act of 2022, authorizes DOE to establish its first R&D program for advanced, low-emission steel technology.[18] Assuming the program gets funded, it could help accelerate the commercialization of technologies that are crucial to decarbonizing the steel industry.

Figure 2: Retrofitting BF-BOF plants with CCUS (45Q sequestration credit: $50–$85/t CO2e)[19]

Figure 3: Using green H2 as fuel for DRI-EAF (45V green hydrogen production credit: $31/kg H2)[20]

Finally, nations are becoming increasingly aware of the need for supportive regulatory and trade policies to address competitiveness in emission-intensive, globally traded industries. Countries pursuing costly domestic efforts to reduce emissions fear that other nations will take advantage of industries such as steel that face a carbon cost by exporting lower cost, higher carbon steel into that country, or that manufacturers will move to countries without such carbon emissions penalties. One proposed solution is the European Union’s carbon border adjustment mechanism (CBAM), which would impose a carbon price on industrial imports comparable to the carbon price faced by domestic producers.[21] The United States is considering an alternative policy based on the relatively low-carbon intensity of domestically produced steel that would impose a tariff on imported products that emit more than the equivalent U.S.-made product.[22]

Looking Forward

In order to achieve net-zero emissions by 2050, technology pathways that dramatically reduce emissions from the steel sector must be implemented at scale. These technologies will need to become cost competitive with traditional steel production methods. Recent federal and private policies and investments and supportive trade proposals aim to spur innovation and deployment of these lower-carbon technologies at scale. It’s a long journey to decarbonize steel, and with competition being fierce, supportive RD&D and trade policies will be vital to success.

Acknowledgments

The author would like to thank Ed Rightor and Robin Gaster for their help on this report.

About the Author

Hannah Boyles is a research assistant with ITIF’s Center for Clean Energy Innovation. Previously, Boyles was a research assistant at the Weldon Cooper Center and the ROMAC Lab in Charlottesville, Virginia, and has interned with the American Energy Society. Boyles holds a bachelor of science degree in aerospace engineering from the University of Virginia.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent 501(c)(3) nonprofit, nonpartisan research and educational institute that has been recognized repeatedly as the world’s leading think tank for science and technology policy. Its mission is to formulate, evaluate, and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit itif.org/about.

Endnotes

[1]. “Climate change and the production of iron and steel” (policy paper, World Steel Association, 2021), https://worldsteel.org/publications/policy-papers/climate-change-policy-paper.

[2]. Mark Peplow, “Can industry decarbonize steel?” Chemical & Engineering News, June 13, 2021, https://cen.acs.org/environment/green-chemistry/steel-hydrogen-low-co2-startups/99/i22.

[3]. “Trade and climate change, information brief no. 7,” World Trade Organization (WTO), December 21, 2022, https://www.wto.org/english/tratop_e/envir_e/trade-climate-change_info_brief_no7_e.pdf.

[4]. IEA, “Iron and Steel Technology Roadmap,” 2020, https://www.iea.org/reports/iron-and-steel-technology-roadmap.

[5]. Congressional Research Service, Domestic Steel Manufacturing: Overview and Prospects, May 17, 2022 https://crsreports.congress.gov/product/pdf/R/R47107.

[6]. IEA, “Iron and Steel,” 2022, https://www.iea.org/reports/iron-and-steel.

[7]. “CCS: a necessary technology for decarbonizing the steel sector” (Global CCS Institute, June 17, 2017), https://www.globalccsinstitute.com/news-media/insights/ccs-a-necessary-technology-for-decarbonising-the-steel-sector/.

[8]. “Industrial Decarbonization Roadmap,” Department of Energy, September 2022, https://www.energy.gov/eere/doe-industrial-decarbonization-roadmap.

[9]. “Green Steel Tracker,” Leadership Group for Industry Transition, accessed May 25, 2023, https://www.industrytransition.org/green-steel-tracker/.

[10]. The University of Edinburg, “SCCS Projects,” accessed May 25, 2023, https://www.geos.ed.ac.uk/sccs/project-info/622.

[11]. “Green Steel Tracker.”

[12]. Siderwin website, https://www.siderwin-spire.eu/.

[13]. “Leveraging a Carbon Advantage: Impacts of a Border Carbon Adjustment and Carbon Fee on the U.S. Steel Industry” (Carbon Leadership Council, May 5, 2021), https://clcouncil.org/reports/leveraging-a-carbon-advantage-key-findings.pdf.

[14]. “FOA 2187 and FOA 2188 Project Selections,” Department of Energy Office of Fossil Energy and Carbon Management, September 1, 2020, https://www.energy.gov/fecm/articles/foa-2187-and-foa-2188-project-selections.

[15]. “Boston metal Fact Sheet” (Boston Metal, January 2023), https://www.bostonmetal.com/wp-content/uploads/2023/01/Boston-Metal-FactSheet-20230126.pdf.

[16]. IEA, “Iron and Steel Technology Roadmap.”

[17]. “Impact of IRA, IIJA, CHIPS, and Energy Act of 2020 on Clean Technologies” (Breakthrough Energy and Boston Consulting Group, April 2023), https://breakthroughenergy.org/wp-content/uploads/2023/04/Steel-Cleantech-Policy-Impact-Assessment.pdf.

[18]. John Milko, “Clean Steel: Policies to Help America Lead” (ThirdWay, December 14, 2022) https://www.thirdway.org/memo/clean-steel-policies-to-help-america-lead.

[19]. “Impact of IRA, IIJA, CHIPS, and Energy Act of 2020 on Clean Technologies

[20]. Ibid.

[21]. Emily Benson et al., “Analyzing the European union’s Carbon Border Adjustment Mechanism” (Center for Strategic and International Studies (CSIS), February 17, 2023, https://www.csis.org/analysis/analyzing-european-unions-carbon-border-adjustment-mechanism.

[22]. Clean Competition Act of 2022, S.4355, 117th Cong.

Editors’ Recommendations

April 17, 2023

Climate-Tech to Watch: Green Ammonia

February 21, 2023

Climate-Tech to Watch: Hydrogen-Powered Aviation

October 17, 2022

Climate-Tech to Watch: Sustainable Aviation Fuel

Related

November 14, 2022