The Flawed Analysis Underlying Calls for Antitrust Reform: Revisiting Lina Khan’s “Amazon’s Antitrust Paradox”

In the 2017 law journal article that established her reputation, now FTC Chair Lina Khan ignored or misapplied the economics of two-sided markets, mischaracterized competitive conditions, and did not consider the pro-competitive effects of Amazon’s conduct.

KEY TAKEAWAYS

Key Takeaways

Contents

The Economics of Two-Sided Markets 5

Characteristics of Two-Sided Markets 6

Antitrust Market Definition With Two-Sided Platforms 6

Identifying Platform Market Power 7

Assessment of Amazon’s Conduct 7

Predatory Pricing of E-Books 8

Amazon’s E-book Pricing Strategy 8

Khan’s Analysis of Amazon’s E-Book Conduct 8

Amazon’s Pricing Strategy Was Not Predatory or Exclusionary 10

Amazon’s Persistence as an Important E-book Retailer 12

An Outbreak of Competition in Online Diaper Retailing. 14

Khan’s Analysis of Amazon’s Acquisition of Quidsi 14

Amazon’s Pricing Strategy Was Not Predatory and Benefitted Consumers 18

Leveraging Retail Dominance Into Logistics 18

Amazon’s Expansion Into Logistics 18

Discrimination Against Marketplace Sellers 19

Entry Barriers for Retail Platforms 21

Vertical Integration Benefits Consumers and Sellers 22

Competition With Marketplace Sellers 24

Amazon’s Private Label Business 26

Amazon’s Use of Data Benefits Consumers 27

Khan’s Reform Proposals Are Unnecessary and Harmful 27

Introduction

In 2017, Lina Khan burst onto the antirust scene with her Yale Law Journal note “Amazon’s Antitrust Paradox.”[1] In the ensuing four years, she went from Yale law student to the youngest chair in the history of the Federal Trade Commission (FTC). Along the way, she worked as a legal fellow for former FTC Commissioner Rohit Chopra, advised the House Judiciary Committee’s investigation into digital markets, and was appointed as an associate professor at Columbia Law School. As a result of her placement in these influential positions, the ideas she expressed in her note have become central to the call for antitrust reform.

Using Amazon as an example, Khan argued that current antitrust doctrine cannot identify certain types of anticompetitive conduct in platform and data-driven markets. In her view, it fails to recognize that the platform business model, wherein the importance of scale leads platforms to pursue growth at the expense of profit, makes predatory pricing a rational business strategy and that vertical integration and concentrated control over data by platforms may enable new forms of anticompetitive conduct. She argued that the failure to recognize Amazon’s conduct as anticompetitive has allowed Amazon to attain a dominant position across multiple lines of commerce. In her view, reforming antitrust is necessary to correct these deficiencies.

Unfortunately, a careful assessment of Amazon’s conduct does not support Khan’s conclusion. The analysis she undertook and the conclusions she drew from it are flawed because she ignored or misapplied the economics of two-sided markets, mischaracterized competitive conditions in the markets in which Amazon operates, and did not consider the pro-competitive effects of Amazon’s conduct, which largely benefits consumers.

In this article, we first review the economics of two-sided markets—including how optimal pricing strategies, the definition of relevant markets, and the measurement of market power differ from one-sided markets. Two-sided markets or platforms are characterized by cross-platform, or indirect, network effects. This means that users on at least one side of the platform care about how many users are on the other side of the platform. These network effects are the key feature that distinguishes two-sided markets from one-sided markets. Despite the increased value from having many users on both sides of them, platforms often face a “chicken and egg” problem in attracting users to both sides simultaneously, which they often resolve by setting lower prices, sometimes below cost, to one side of the platform. This means that the prices charged to each side are unlikely to reflect the explicit costs of serving that side and traditional markup measures are unlikely to accurately reflect market power. Therefore, both sides of the platform should be considered when defining a relevant market or assessing firm conduct in two-sided markets.

With this overview of two-sided markets in mind, we next assess Khan’s analysis of Amazon’s conduct. Many aspects of Amazon’s conduct have been criticized in the popular press, policy circles, and academic writing. However, we restrict our focus to the specific issues Khan raised in her note. In particular, we assess her analysis of alleged predation in e-books and in the online sale of diapers, as well as the alleged anticompetitive implications of Amazon’s vertical integration into logistics and its use of data.

In the case of e-books, we demonstrate that Khan’s failure to appreciate that e-book retailing has characteristics of a two-sided market led her to mischaracterize a common pricing strategy in this type of market as predation. Khan’s analysis focused on Amazon’s alleged predation in the period before Apple’s entry and collusion with publishers. She argued that the Department of Justice (DOJ) failed to find evidence of predation because it defined the relevant market too broadly and failed to consider that Amazon could recoup its losses outside the relevant market—in particular, through higher fees to publishers. Khan’s analysis does not support a narrower market definition, while her recoupment argument is consistent with typical pricing in two-sided markets. Despite Amazon’s position as the largest seller of e-books, the relevant period is characterized by significant entry and very little exit, which is inconsistent with predation. Amazon’s conduct is also inconsistent with welfare-reducing exclusionary pricing in two-sided markets.

Khan ignored or misapplied the economics of two-sided markets, mischaracterized competitive conditions in the markets in which Amazon operates, and did not consider the pro-competitive effects of Amazon’s conduct, which largely benefits consumers.

With regard to the online retailing of diapers, we show that Khan misunderstood key features of online retailing. In particular, she failed to appreciate the extent to which consumers substitute between online and offline channels and the ease of entry into online retailing. Khan’s analysis focused on the aggressive price competition between Amazon and Diapers.com and Amazon’s acquisition of Quidsi, Diapers.com’s parent company. Khan characterized this outbreak of competition as predation and used it to argue that contemporary antitrust doctrine was not able to capture this merger to monopoly. Her implicit assumption that the online retailing of diapers constitutes a relevant antitrust market ignored the importance of brick-and-mortar diaper retailers during this period. But even if her conclusion about the relevant market was correct, Khan’s analysis ignored the full breadth of market participants and their competitive significance. Khan concluded that Amazon’s dominance has yet to be challenged due to the high entry costs and significant investment needed to establish a platform. However, the entry of brick-and-mortar retailers and Diapers.com into online diaper retailing demonstrates that entry costs are not prohibitive.

In the case of Amazon’s vertical integration into logistics, we demonstrate that Khan misrepresented key facts about Amazon’s logistics business, misunderstood Amazon’s relationship with independent sellers on its platform, and overstated the competitive impact of Amazon’s vertical integration on its rivals. Khan incorrectly argued that Amazon’s low, volume-based shipping rates with independent delivery companies led those companies to raise shipping rates to sellers on Marketplace, Amazon’s third-party seller platform. Khan claimed Amazon induced Marketplace sellers to adopt Fulfillment by Amazon (FBA), Amazon’s fulfillment and shipping program, to compensate for the shipping differential, thereby causing these sellers to become dependent on their biggest competitor. She argued that the current antitrust framework fails to account for how Amazon’s retail dominance allowed Amazon to discriminate against Marketplace sellers on shipping speeds and create entry barriers for rival retail platforms. This argument fails to appreciate that, because Marketplace is a two-sided platform, if consumers leave Amazon due to poor service, Amazon will be less attractive for Marketplace sellers, leading to a vicious cycle whereby Amazon continues to lose both consumers and sellers. Furthermore, her argument that Amazon’s conduct created entry barriers is contradicted by the expansion of fulfillment and logistics offerings by Amazon’s platform, direct-to-consumer, and logistics competitors.

With respect to data, we show that Amazon’s use of data to compete with Marketplace sellers is aimed at reducing prices for consumers rather than appropriating seller investments and is consistent with the ways in which Amazon’s brick-and-mortar retail competitors use data. Khan argued that the current antitrust doctrine fails to appreciate how concentrated control over data can allow a digital platform to tilt a market in its favor. She claimed that Amazon uses its “dominance” as a platform, its dual role as both a retailer and platform operator, and its ability to gather large amounts of data to gain an advantage over Marketplace sellers. While Amazon competes with Marketplace sellers for some products, concern about the overall success of its platform, which relies on attracting both consumers and sellers, should dissuade Amazon from generally making the platform unattractive to sellers. While Khan recognized that Amazon’s brick-and-mortar retail competitors also use data to decide what to offer in their stores, Khan claimed that Amazon is different because of the kind of data it can collect. However, this claim ignores the available technology routinely used by Amazon’s brick-and-mortar retail competitors to monitor consumers’ purchase intentions. Amazon’s use of Marketplace sales data has largely benefitted consumers through lower prices, lower search costs, and higher-quality products without systematically harming Marketplace sellers.

Khan has not demonstrated that antitrust reform is necessary because she has not demonstrated that Amazon’s conduct is anticompetitive.

Finally, after assessing Khan’s analysis of Amazon’s conduct, we review her proposals for antitrust reform and conclude that the antitrust reforms she proposed are unnecessary, are unlikely to capture the conduct about which she is concerned, and risk the consumer benefits arising from innovative digital platforms. Khan has not demonstrated that antitrust reform is necessary because she has not demonstrated that Amazon’s conduct is anticompetitive.

The Economics of Two-Sided Markets

Khan appears to recognize that the economics of two-sided markets is different from one-sided markets. In particular, she pointed out that “analysis applicable to firms in single-sided markets may break down when applied to two-sided markets, given the distinct pricing structures and network externalities.”[2] However, instead of acknowledging that an economic analysis of two-sided markets might have some relevance for analyzing Amazon’s conduct, she mischaracterized the rigorous analysis economists have undertaken in this area by noting that “[e]conomists tend to conclude that … antitrust should be forgiving of conduct that might otherwise be characterized as anticompetitive.”[3] More correctly, economists acknowledge that because the pricing structure in two-sided markets differs from one-sided markets, conduct that may be anticompetitive in a one-sided market (i.e., conduct that results in higher prices, less output, lower quality, or all three) may not be anticompetitive in a two-sided market. This is similar to the acknowledgment that the antitrust implications of certain types of firm conduct differ when that conduct is undertaken by a monopolist than when it is undertaken by a firm in a competitive market. In this section, to better appreciate how the two-sidedness of the markets in which Amazon competes might affect the competitive implications of Amazon’s conduct, we give an overview of the characteristics of two-sided markets and what distinguishes them from one-sided markets. This is followed by a discussion of how the antitrust exercise of defining a relevant market and measuring market power is impacted when markets are two-sided.

Characteristics of Two-Sided Markets

Two-sided markets or platforms are characterized by cross-platform network effects. This means that users on at least one side of the platform care about how many users are on the other side of the platform. Ride-hailing companies such as Uber and Lyft exhibit cross-platform network effects. Drivers prefer to drive for platforms with many passengers, and passengers prefer platforms with many drivers. Drivers do not want to wait too long for their next fare, and passengers do not want to wait too long for a ride. Having many users on both sides of the platform limits these wait times and increases the platform’s value to all users.

These network effects are the key feature that distinguishes two-sided markets from one-sided markets. In a one-sided market, the success of a seller does not depend on the ability of an intermediary or retailer to attract customers. When Microsoft sells Xboxes at Best Buy, Microsoft receives a wholesale price for each unit it sells to Best Buy and, all else equal, is largely indifferent to the success of Best Buy in attracting consumers to its store to buy those units. However, the Xbox itself can be thought of as a two-sided platform. When a video game developer designs a game for the Xbox platform, the developer’s sales depend on Microsoft’s ability to attract users to the Xbox platform through the purchase of a console.[4]

Despite the increased value from having many users on both sides of a platform, platforms often face a “chicken and egg” problem.[5] Drivers do not want to join a ride-hailing platform with no passengers, and passengers do not want to join a ride-hailing platform with no drivers. Platforms must be able to attract both sides to the platform simultaneously. A common way to overcome this problem is to use a “divide and conquer” strategy that involves setting a low, potentially below cost, price on one side of the platform while setting a higher price on the other. For example, Uber passengers do not pay any fees to use Uber’s platform outside the fare for the ride, but drivers pay fees to Uber to use the platform. The access fee to passengers is zero, but the net fee to bring both sides on board is positive. Absent the use of this pricing structure, the platform’s services may not be available at all. But even once the platform is established, it may still be beneficial for the platform to charge lower prices to passengers than to drivers if drivers value additional passengers more than passengers value additional drivers. Pricing in this way generates greater benefits from platform participation by attracting more high-value participants to the platform than would be generated from uniform pricing.[6]

Antitrust Market Definition With Two-Sided Platforms

In antitrust analysis, the market definition exercise requires identifying demand substitutes. That is, it requires identifying the set of products consumers would reasonably turn to in response to an increase in the price of the products at issue. In the case of two-sided markets, identifying demand substitutes is complicated by the presence of cross-platform network effects. This complication is at the heart of the Supreme Court’s decision in Ohio v. American Express Co. In that case, the majority concluded that the relevant market was a two-sided market for credit card transactions, but the dissent objected to including both cardholder services and merchant services in the same relevant market because these services clearly are not substitutes.[7] This conflict is resolved by more clearly identifying the product or service a two-sided platform offers.

When a two-sided platform facilitates transactions between the two sides, as in AmEx, the relevant antitrust market should consider both sides of the platform. For these platforms, “the product offered is the possibility to transact through the platform” as opposed to the individual services offered to each side.[8] This necessarily requires consideration of both sides of the platform when defining the relevant market. The ability to hail a ride through Uber exists only if Uber is in the relevant market on both sides. Uber is in a relevant market that takes into account both sides, or it is not in the relevant market at all. Therefore, it is necessary to consider how substitutes to platform-facilitated transactions constrain the platform on both sides when defining relevant markets for antitrust purposes.[9]

Consider a hypothetical merger between Uber and Lyft. A merger analysis that defines the relevant market around drivers might conclude that the merger is anticompetitive based on expected higher fees to drivers. However, a market definition that considers both sides of ride-hailing platforms recognizes that anything that affects one side of the platform will also affect the other due to the cross-platform network effects. Higher driver fees will reduce the number of drivers and may lead to longer wait times for passengers. Consequently, passengers may turn to alternatives such as hailing cabs directly on the street. This substitution may constrain the merged firm’s ability to raise prices to drivers, potentially leading to the conclusion that the merger is not anticompetitive. Of course, taxis may not provide an adequate competitive constraint. The critical point is that competitive constraints on both sides of the market need to be considered. Similarly, to understand the likely competitive effects of unilateral, or single-firm, conduct, it is necessary to assess the extent to which other methods for facilitating transactions exert competitive pressure on both sides of the platform. This assessment requires a relevant market definition that considers both sides.

Identifying Platform Market Power

To engage in unilateral anticompetitive conduct, a firm must have market power. As with market definition, the identification of market power for two-sided platforms requires consideration of both sides of the platform. As noted, a platform will charge a higher price to the side that values the platform more. In addition to intra-platform network effects, a platform’s pricing decisions also affect network effects on competing platforms. When a platform attracts users from a competing platform, that competing platform becomes less valuable to its remaining users due to reduced cross-platform network effects. The value generated from greater network effects relative to competing platforms is passed on to users through lower prices.[10] In general, the price to one side is increasing in the cost of serving that side, decreasing in the value created on the other side, and decreasing in the competitor value destroyed.[11] As a consequence, the prices charged to each side are unlikely to reflect the explicit costs of serving each side and traditional markup measures (i.e., the extent to which prices exceed marginal cost) are unlikely to accurately reflect market power. Conversely, for the same reason, below-cost pricing on one side is not necessarily indicative of predation.[12]

Assessment of Amazon’s Conduct

Khan’s call for antitrust reform relies on her conclusion that the current antitrust regime has failed to recognize Amazon’s conduct as anticompetitive. However, the analysis Khan undertook does not support that conclusion. As this section demonstrates, her analysis is flawed because she ignored or misapplied the economics of two-sided markets, mischaracterized competitive conditions in the markets in which Amazon operates, and did not consider the pro-competitive effects of Amazon’s conduct.

Predatory Pricing of E-Books

Amazon’s E-book Pricing Strategy

In late 2007, when Amazon introduced the Kindle e-reader, its policy was to sell new releases and New York Times bestsellers for $9.99. This price was well below hardcover prices for these same books “which were often priced at thirty dollars or more.”[13] At the time, publishers sold e-books to Amazon at a 20 percent discount off the print book wholesale price to reflect the lower costs associated with the sale and distribution of e-books. Amazon’s $9.99 retail price roughly matched the e-book wholesale price set by publishers.[14] In early 2009, without any change to the distribution and sales costs for e-books, publishers eliminated the wholesale price discount for e-books. This change was driven by a concern that Amazon’s low prices for e-books would cannibalize print book sales. Despite the change in the wholesale price for e-books, Amazon continued to charge $9.99 for new releases and bestsellers.[15] Consequently, as a result of the exercise of market power by the largest publishers at the time, then collectively known as the Big Six, Amazon’s maintenance of its e-book pricing strategy led Amazon to sell new releases and bestsellers at a loss.

Khan’s call for antitrust reform relies on her conclusion that the current antitrust regime has failed to recognize Amazon’s conduct as anticompetitive. However, the analysis Khan undertook does not support that conclusion.

Khan’s Analysis of Amazon’s E-Book Conduct

In 2012, DOJ sued Apple and five of the Big Six publishers for colluding to raise e-book prices.[16] Khan framed the collusion between Apple and the publishers as necessary to counter Amazon’s predatory conduct. In connection with the case, DOJ investigated claims that Amazon had engaged in predatory pricing of e-books and concluded that, overall, Amazon’s e-book business was consistently profitable. It found that Amazon’s below-cost pricing of some e-books was consistent with a loss-leader strategy and was not intended to create monopoly power. Because DOJ found that Amazon’s e-book business was profitable, it never reached the issue of recoupment. In Khan’s view, DOJ defined the market too broadly to find evidence of predatory pricing. She also argued that the current predatory pricing doctrine does not sufficiently appreciate the unique ways in which losses can be recouped. For these reasons, Khan believes DOJ failed to recognize Amazon’s e-book pricing strategy as anticompetitive.

According to Khan, DOJ defined the market as it would in the nonplatform context by incorporating all e-books into the definition of the relevant market as opposed to specific lines of books such as bestsellers. However, not only did DOJ not define the relevant market too broadly, recent research suggests that it may not have defined the market broadly enough. The market definition exercise in any antitrust analysis focuses on “demand substitution factors, i.e., on customers’ ability and willingness to substitute away from one product to another in response to a price increase or a corresponding non-price change such as a reduction in product quality or service.”[17] To properly evaluate Khan’s criticism of DOJ’s market definition, there are two main demand substitution factors to consider: (1) substitution between bestsellers and non-bestsellers regardless of book format; and (2) substitution between e-books and print books regardless of book type.[18]

While we do not have evidence on how consumers substitute between bestsellers and nonbestsellers, or whether they even view these book types as substitutes, Li (2021) addressed the second factor by estimating the demand for books across sales channels and formats.[19] She estimated that about 70 percent of e-books sales are due to the cannibalization of print book sales and found relatively large cross-elasticities of demand between e-books and print books—especially for the casual genre, which she defined to include fiction, science fiction, humor, and biographies. Across all genres, she estimated a cross-elasticity of demand of around 2 (i.e., a 10 percent increase in e-book prices increases print book sales by 20 percent) while for the casual genre she estimated a cross-elasticity of demand of around 3 (i.e., a 10 percent increase in e-book prices increases print book sales by 30 percent). This high degree of substitutability between e-books and print books suggests that a relevant market for bestselling books may include both e-books and print books and thus is even broader than the market analyzed by DOJ.

According to Khan, the current predatory pricing doctrine fails to appreciate that Amazon could recoup its losses from below-cost pricing of e-books on other products and through higher fees on publishers. This view fundamentally misunderstands the economics of two-sided platforms and mischaracterizes a common pricing strategy as predatory pricing.

Khan’s criticism that DOJ defined the relevant market as it would in the nonplatform context rings hollow both because empirical evidence does not suggest such a narrow definition and because she herself failed to incorporate a critical feature of platforms into her analysis. In particular, she ignored the publisher side of Amazon’s e-reading platform. This failure has important implications for the arguments she made with respect to recoupment.

According to Khan, the current predatory pricing doctrine fails to appreciate that Amazon could recoup its losses from below-cost pricing of e-books on other products and through higher fees on publishers. This view fundamentally misunderstands the economics of two-sided platforms and mischaracterizes a common pricing strategy as predatory pricing. Amazon’s Kindle e-reading system has many characteristics of a two-sided platform. Initially only through physical Kindle devices but now also through device-agnostic apps, Amazon facilitates transactions between readers and e-book publishers. Cross-platform network effects are present, as readers obtain more value from an e-reading platform with many titles and publishers obtain more value from an e-reading platform with many readers.

Even though publishers sold e-books using a wholesale model during the period of Amazon’s alleged predation, the digital nature of e-books means that the publishers’ success depended on the number of readers Amazon could attract. That is, regardless of the final price Amazon set for a title, the publisher would not receive the wholesale price for that title unless Amazon made a sale to a reader. In this way, regardless of whether Amazon sells e-books under a wholesale pricing model or an agency, or commission-based, model, cross-platform network effects are present, as the success of the publishers depends on Amazon’s success in attracting readers to its platform. This is not meant to suggest that publishers supported Amazon’s pricing strategy because they were still concerned about the cannibalization of print book sales, but merely to highlight that the existence of cross-platform network effects does not depend on the use of an agency model.

What Khan characterized as predatory pricing is the very essence of how two-sided platforms overcome the “chicken and egg” problem. In two-sided markets, charging prices below cost is no more evidence of predation than above-cost pricing is evidence of market power.[20] A two-sided platform charges a lower price, sometimes below cost, to the side of the platform with the relatively more elastic demand for the platform services (i.e., relatively more price sensitive) and a higher price to the side of the platform with the relatively less elastic demand for the platform services. In the case of Amazon’s e-reading platform, readers are likely more price sensitive than are publishers due to their willingness to substitute between e-books and print books. Consequently, Amazon subsidized readers through low-cost devices and e-books and charged higher prices to publishers through promotional fees, known in the publishing industry as “co-ops,” which were tied to a publisher’s Amazon sales.[21] While these co-op payments were originally only designated for print book promotions, Amazon eventually sought co-op payments for e-books as well.[22] Therefore, while Amazon did “recoup” losses on the reader side of the platform with higher fees on the publisher side, this was merely a way to attract both readers and publishers to the platform and should not be viewed as predatory conduct.[23] Appropriately defining the relevant market to consider readers and publishers avoids incorrectly identifying procompetitive conduct as anticompetitive, as Khan has done.

Amazon’s Pricing Strategy Was Not Predatory or Exclusionary

Amazon Was Not Dominant in an Appropriately Defined Market

While Kindle was the dominant e-reading platform at the time of Amazon’s alleged predatory conduct, Amazon was not the first e-reading platform in the United States. In early 2006, Sony introduced its e-reading platform to the U.S. market but, with only 10,000 titles at launch, it was not able to attract enough readers and titles to its platform to overcome the “chicken and egg” problem.[24] Sony managed to increase the number of titles to 57,000 by late 2008 whereas Amazon’s Kindle already had 90,000 titles when it launched in late 2007.[25] In late 2009, Amazon’s entry was followed by Barnes and Noble with its Nook e-reader while Apple entered with its iBooks platform in early 2010.

At the time of Apple’s entry, Amazon’s share of U.S. e-book sales was around 90 percent.[26] If sales of print books are included, Amazon was still an important book retailer, but it was far less dominant than its share of e-book sales would suggest. In 2008, the first full year Amazon’s Kindle was available, e-book sales made up less than 1 percent of total book sales.[27] In that year, the dominant retailer of books was Barnes & Noble—not Amazon. As seen in table 1, Barnes & Noble was responsible for nearly a quarter of all sales by book retailers. And these shares likely overstate the importance of both Barnes & Noble and Amazon, as the table does not include sales of books by important mass merchandise retailers such as Walmart and Target.[28] While, like Barnes & Noble, Amazon likely had market power in book retailing, one could hardly conclude, at the time of the alleged conduct, that Amazon was the dominant retailer of books—even if e-books are included. Amazon’s position as one of several important book retailers during this time mitigates against the conclusion that Amazon was engaged in predation.

Amazon Lacked Predatory Intent

Khan claimed that selling e-books below cost was part of Amazon’s strategy to become the dominant e-book retailer.[29] However, Amazon’s conduct was consistent throughout the alleged predation period despite changes in publishers’ e-book wholesale pricing strategy. When Amazon launched the Kindle, it was not selling new releases and bestsellers below cost. It was only when the Big Six publishers exercised their market power to increase wholesale prices that Amazon’s prices were below cost. If Amazon’s pricing strategy at the launch of its e-reading platform was not intended to be predatory, it seems unlikely that the exercise of market power by publishers caused that pricing strategy to become predatory in and of itself. Furthermore, given the optimal pricing strategy in two-sided markets, a cost increase to serve one side of the market may not be fully passed through due to the cross-platform network effects. Therefore, Khan’s inference of predatory intent is tenuous at best.

Table 1: 2008 U.S. book retailer sales and market shares[30]

|

Retailer |

Sales ($Billion) |

Share |

|

Amazon |

$4.1 |

18% |

|

Barnes & Noble |

$5.1 |

23% |

|

Borders |

$3.1 |

14% |

|

Others |

$10.3 |

46% |

|

Total |

$22.6 |

100% |

The period during which Amazon’s alleged predation occurred is one that is characterized by significant entry and very little exit. This pattern of entry and exit is inconsistent with conduct aimed at driving competitors from the market or deterring entry.

Amazon’s Conduct Did Not Exclude Competitors

The period during which Amazon’s alleged predation occurred is one that is characterized by significant entry and very little exit. This pattern of entry and exit is inconsistent with conduct aimed at driving competitors from the market or deterring entry. Barnes and Noble entered the market with the Nook after the Big Six publishers had eliminated the wholesale discount for e-books and were selling e-books at the same wholesale prices as print books. Despite this, Barnes & Noble matched Amazon’s pricing and priced new releases and bestsellers at $9.99, providing support for this pricing strategy to attract readers to a new e-reading platform.[31] Kobo introduced a device-agnostic e-reading platform in 2009 and its own e-reader in early 2010. The Kobo platform was available in the United States through a partnership with Borders.[32] Both the Barnes & Noble and the Kobo e-reading platforms are available today, although Kobo is now partnered with Walmart.[33] Sony was the only significant e-reading player to exit the market and did not do so until 2014—well after the alleged period of predation by Amazon.[34]

Amazon’s Conduct Benefitted Consumers

Amazon’s conduct is not consistent with welfare-reducing exclusionary pricing in two-sided markets. The use of a narrow judicial standard for predatory pricing (i.e., both evidence of below-cost pricing and a high likelihood of recoupment of losses) is to prevent characterizing competition on the merits, which appropriate enforcement of the antitrust laws is intended to preserve, as predatory conduct. Fierce competition benefits consumers through lower prices. Therefore, aggressive price cutting by firms should only be discouraged when it can be shown to harm consumers (e.g., through higher future prices), not simply because it puts competitive pressure on rivals.[35] Amelio et al. (2020) consider the incentives of a monopoly incumbent platform to engage in entry-deterring limit pricing (i.e., setting prices just low enough to deter entry) when consumers single-home (i.e., only use one platform) and when the potential entrant must incur a fixed cost to enter. They find that profitable exclusionary pricing by two-sided platforms only harms consumers when network effects are low and entry costs are high.[36] These conditions do not apply to e-books. Entry costs are not high and network effects are quite important.

The use of digital rights management systems makes it difficult to read e-books purchased from one e-book retailer on other e-reading platforms. Therefore, readers are more likely to single-home( i.e., use only one e-reading platform) due to the difficulty in transferring titles across platforms. As a consequence, readers care a lot about the number of titles available on an e-reading platform. That is, cross-platform network effects are likely to be large. Furthermore, entry costs for developing an e-reading platform, particularly during the time of Amazon’s alleged predation, are likely to be low. The most significant cost is likely to be the cost to develop an e-reader. E-readers are similar to tablet computers but with reduced functionality and a screen more suitable for reading.[37] In 2011, more than 80 new tablets came onto the market.[38] The sheer number of tablets coming onto the market at that time strongly suggests that entry costs are not significant for tablets and hence are also unlikely to be significant for e-readers. Confirming the ease of developing an e-reader, Kobo’s chief technical officer said that “if we had known so many e-book readers were going to launch, we probably wouldn’t have launched our own.”[39] The combination of large network effects and low entry costs means that even if Amazon had been engaged in exclusionary pricing, this conduct likely benefited consumers.

Amazon’s Persistence as an Important E-book Retailer

As part of their collusive scheme with Apple, five of the Big Six publishers moved e-book retailers to an agency model for pricing. Under the agency model, the publishers set the prices at which e-books are sold to final consumers and the retailer receives a commission on each sale. These publishers, now the Big Five following Penguin's merger with Random House, still use the agency model for e-book pricing and, with the exception of a two-year period following their consent decrees with DOJ, fully control the pricing of their e-book titles. The original agency agreements, at Apple’s insistence, included most-favored-nation (MFN) terms, which ensured uniform pricing across all e-book retailers. Amazon’s current agency agreements with publishers reportedly also include MFN terms or terms with substantively the same effect as MFNs.[40]

The MFNs in the agreements between Amazon and the publishers are referred to as platform MFNs and differ in their execution and competitive implications from traditional MFNs. A traditional MFN is a contract between a seller and buyer that the buyer will receive the lowest price the seller offers to any other buyer. While efficiency justifications for traditional MFNs exist, for example, preventing hold-up in the presence of sunk investments, they also have been shown to facilitate collusion.[41] A platform MFN is a contract between the platform owner and a seller that the seller will not sell at a lower price on its own website or on a competing platform. In the context of e-books, this means publishers cannot offer e-books on competing platforms at a price that is lower than their price on Amazon.

Like traditional MFNs, efficiency justifications exist for platform MFNs. For example, platform MFNs may encourage investments that make the platform more attractive to the platform’s users. Such investments might include the development of search or recommendation algorithms that return results that are a better match for a consumer’s search. In the absence of a platform MFN, sellers could free ride on the platform’s investment by offering a lower price when the consumer buys from the seller directly or through a competing platform, thereby reducing the platform’s incentive to make these investments.[42] However, like traditional MFNs, under certain conditions, platform MFNs have been shown to lead to higher prices and less aggressive price competition between platforms.[43] Two-sided platforms compete for sellers by offering more attractive fees for selling on the platform than do their competitors. A platform with lower selling fees is also likely to have lower prices for the goods and services transacted on the platform, as sellers will pass on part of the savings to final consumers. As a result, the platform is more attractive for final consumers and, due to the cross-platform network effects, even more attractive for sellers. The use of a platform MFN reduces the incentive for platforms to compete for sellers. With an MFN in place, a reduction in seller fees cannot be passed onto final consumers. Because the reduction in seller fees does not generate any additional final sales, competition for sellers is reduced. As a result, seller fees and prices to final consumers may be higher with platform MFNs.

Like traditional MFNs, efficiency justifications exist for platform MFNs. For example, platform MFNs may encourage investments that make the platform more attractive to the platform’s users.

Recent research suggests that the use of platform MFNs has produced higher prices for e-books. De los Santos and Wildenbeest (2017) estimated that the elimination of the platform MFNs following publisher consent decrees with DOJ decreased Amazon's and Barnes & Noble's e-book prices by 18 percent and 8 percent, respectively.[44] The presence of MFNs in the Big Five publishers’ contracts with Amazon may reduce the incentive of publishers to offer higher commissions (i.e., lower seller fees) to other e-book retailers in exchange for lower e-book prices at those retailers because those lower e-book prices would also have to be made available to Amazon’s customers. That is, with agency pricing, the most direct way to increase competition in e-book retailing is unavailable to publishers due to the presence of MFNs. While publishers may be limited in their ability to increase competition in e-book retailing due to the MFNs, they may nonetheless agree to them as a condition of maintaining agency pricing. By controlling the price of e-books, publishers are able to limit the extent to which e-book sales cannibalize print book sales. Therefore, the longstanding use of an agency pricing model combined with MFNs is a more likely contributor to Amazon’s high share of e-book sales than is any alleged predation by Amazon.

Agency pricing combined with a platform MFN is similar in effect to wholesale pricing combined with minimum resale price maintenance (RPM), as in both cases the publisher sells a title for the same price at all e-book retailers.[45] The use of RPM may be justified on efficiency grounds in the offline retailing of print books where higher retail prices may incentivize retailers to hold larger inventories of slow-moving books.[46] This is unlikely to be a valid efficiency justification for RPM in the case of e-books where inventory costs are not present. However, there may be other complementary investments, such as the development of recommendation algorithms that could potentially justify the use of RPM for e-books.

Fortunately, no reform to antitrust is necessary to reach those platform MFNs that may be anticompetitive. That current antitrust jurisprudence can reach platforms MFNs is evident in the case at the heart of Khan’s complaint about Amazon’s e-book conduct: U.S. v. Apple. “Apple included the MFN, or price parity provision, in its Agreements [with publishers] both to protect itself against any retail price competition and to ensure that it had no retail price competition.”[47] Consequently, Apple’s conduct was found to violate Section 1 of the Sherman Act. Similarly, a class action antitrust suit against Amazon for using MFNs in its agreements with Amazon Marketplace sellers has recently survived a motion to dismiss. The plaintiffs argued that Amazon’s Marketplace Fair Pricing Policy, which all Marketplace sellers must abide by or risk losing access to the Marketplace, operates as an implicit platform MFN. In denying Amazon’s motion to dismiss, the judge found that the allegations in the complaint, if true, are sufficient to support a violation of both Sections 1 and 2 of the Sherman Act.[48]

However, even if platform MFNs for e-books were eliminated, it is not obvious that there would be increased competition in e-book retailing due to the threat of Robinson-Patman Act enforcement. There is a long history of Robinson-Patman Act cases brought by the American Booksellers Association, the trade association for independent book retailers, against Barnes & Noble and Borders for the more preferable terms they received from publishers—particularly wholesale prices and co-op payments.[49] In an environment where there is interest in reviving Robinson-Patman Act enforcement, publishers may be reluctant to offer special terms to specific e-book retailers to encourage more retail competition.[50]

Predation Against Quidsi

An Outbreak of Competition in Online Diaper Retailing

In 2005, Vinit Bharara and Marc Lore launched the e-commerce site Diapers.com. Initially, they just sold diapers and formula but they later expanded to also sell car seats, toys, and other baby products.[51] Eventually, they sold household products as well through affiliate sites such as Soap.com. Amazon began selling diapers a year later in 2006.[52] Both Quidsi, the parent company of Diapers.com, and Amazon were selling diapers at a loss—adopting a common loss-leader strategy deployed by offline retailers.[53] Amazon’s entry into diapers led to an outbreak of competition in online diaper retailing. In order to induce consumers to switch away from Quidsi—the incumbent online diaper retailer—Amazon charged lower prices than Quidsi and offered additional discounts through a subscription program. In 2010, in the face of meager profits due to increased competition, Quidsi, a venture capital-backed start-up, agreed to be acquired by Amazon—a common exit strategy for many start-ups.[54] Because Amazon’s discounts on baby products became less generous after the acquisition, Khan characterized this outbreak of competition as predation.

Khan’s Analysis of Amazon’s Acquisition of Quidsi

Khan used this alleged predation episode to attack two aspects of current antitrust jurisprudence concerning predatory pricing. First, she attacked the idea that acquiring the victim of predation is unlikely because antitrust law would forbid such a merger to monopoly. In her view, Amazon’s acquisition of Quidsi demonstrates how current antitrust jurisprudence does not adequately consider this possibility. Second, she indirectly attacked the recoupment prong of the predatory pricing test by suggesting that current antitrust analysis does not appreciate the extent to which barriers to entry exist for online retailing. In her view, significant investment is needed to establish an online retail platform that will attract traffic. In an attempt to lend credence to her view that current antitrust jurisprudence could not capture this episode of predatory pricing, Khan noted that Amazon’s dominance in the online retailing of baby products has yet to be challenged by new entrants into online retailing or by brick-and-mortar retailers selling online.

Merger to Monopoly

The main problem with Khan’s view that contemporary antitrust was unable to capture this merger to monopoly is her assumption that Amazon’s acquisition of Quidsi created a monopoly. This assumption reveals two analytical errors. The first is she did not correctly identify the relevant market in which Amazon and Quidsi were competitors. The second is she did not adequately consider what other competitors might participate in the relevant market—even as incorrectly defined.

The main problem with Khan’s view that contemporary antitrust was unable to capture this merger to monopoly is her assumption that Amazon’s acquisition of Quidsi created a monopoly. This assumption reveals two analytical errors.

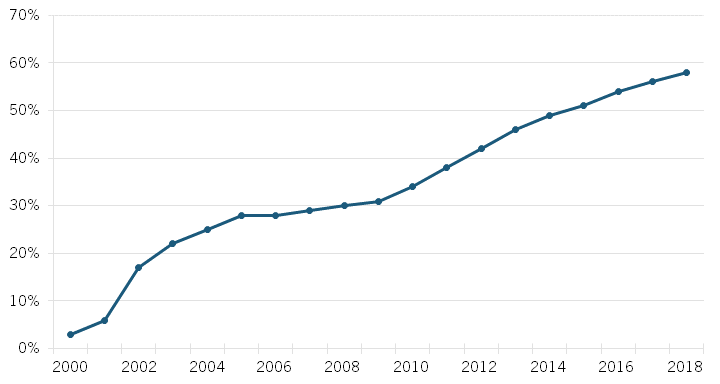

As noted previously, appropriately defining a relevant market requires examining how customers substitute other products in response to changes in both price and nonprice factors, such as quality. Khan implicitly defines the relevant market as online diaper retailing. With such a narrow market definition, it is unsurprising that Khan would conclude that the acquisition of Quidsi created a monopoly. However, this definition overlooks that consumers substitute between online and offline retailers. At the time of the acquisition, online diaper sales were a relatively small share of total diaper sales and by 2016 had only reached 20 percent of total sales.[55] Given the small share of online sales at the time, it seems unlikely that consumers would not switch to the offline channel in response to increases in online prices.

Numerous studies confirm that consumers view online and offline channels as substitutes. For example, Brynjolfsson et al. (2009) found that for popular women’s clothing, demand in the online channel is 4.2 percent lower for consumers who have access to seven brick-and-mortar stores (the median number in their data) relative to consumers who do not have access to any brick-and-mortar stores.[56] That is, at least some purchasers of women's clothing view the online and offline channels as substitutes. Similarly, Li (2021) provides evidence of high substitutability between online and offline sales of print books. She found a cross-elasticity of demand between online and offline sales of print books of 2.6 (i.e., a 10 percent increase in the online price of print books increases offline sales of print books by 26 percent).[57] With respect to baby products, a recent analysis of online and offline prices during 2018 and 2019 finds virtually no difference between online and offline prices. Furthermore, when offline prices for baby products were lower, online prices fell to match offline prices. This strongly suggests that offline prices constrain online prices for baby products.[58] In addition, the distinction between online and offline channels has become blurred because many brick-and-mortar retailers now allow for in-store pick-up or home delivery of orders made online.[59]

Even if Khan’s implied market definition is correct and the relevant market is restricted to just online retailing of diapers, Khan’s conclusion that the acquisition of Quidsi resulted in monopoly ignores the full breadth of market participants and their competitive significance. At the time of the acquisition, both Walmart and Target were selling diapers online and in their physical stores. While their online presence may have been small, their existing relationships with diaper manufacturers uniquely positioned these retailers to expand their online presence in response to any potential post-merger price increases. And, as can be seen in table 2, these companies have since expanded. Table 2 shows the share of total diaper transactions (i.e., both online and offline sales) by important online retailers from 2016 to 2018. Both Walmart and Target had modest increases in their share of online diaper sales between 2016 and 2018—Walmart’s share of online diaper sales implied from table 2 increased from 21 to 27 percent while Target’s share increased from 17 to 23 percent. Amazon’s implied share of online diaper sales fell over this period, decreasing from 50 percent in 2016 to just 30 percent by 2018.

Table 2: U.S. e-commerce share of all diaper transactions[60]

|

Outlet |

2016 |

2017 |

2018 |

|

Amazon.com |

7.5% |

7.0% |

6.6% |

|

Walmart.com |

4.4% |

5.3% |

5.9% |

|

Target.com |

3.5% |

4.5% |

5.1% |

|

BRU.com (Babies R Us) |

N/A |

2.0% |

4.4% |

|

Diapers.com |

2.9% |

3.3% |

0.0% |

|

Other Ecommerce |

2.6% |

0.3% |

-0.2% |

|

Total for Amazon (incl. Diapers.com) |

10.4% |

10.3% |

6.6% |

|

Total for All Outlets |

20.9% |

22.4% |

21.8% |

The most striking element of table 2 is not how Walmart and Target have grown but how customers reacted when Amazon shut down Diapers.com in 2018. If Khan’s theory that Amazon’s acquisition of Diapers.com created an online diaper retailing monopolist, then we would expect customers to switch to Amazon in response to Diapers.com becoming unavailable. What we see instead, using a broad, back-of-the-envelope examination of diversion based on market share changes, is that about a third of Diapers.com customers switched to either Walmart.com or Target.com and about two-thirds switched to BRU.com (Babies R Us). And Amazon’s lost customers exceeded those shopping at Diapers.com. This suggests that Amazon and Diapers.com were not close substitutes for online diaper customers and that customers viewed BRU.com as the next-best alternative. Therefore, even in a narrowly defined market of online diaper retailing, which is unlikely to correspond to a relevant antitrust market, Amazon’s acquisition of Diapers.com cannot be viewed as a merger to monopoly.

Barriers to Entry

Khan argued that online retailing has high entry costs, due to the significant investment needed to establish a platform that will attract traffic, which contemporary antitrust fails to consider. In her view, because “the vast majority of online commerce is conducted on platforms, central marketplaces that connect buyers and sellers … successful entry by a potential diaper retailer carries with it the cost of attempting to build a new online platform.”[61] While a new online retail platform must attract both buyers and sellers in order to be successful, Khan erred in her analysis of entry barriers first by assuming that entry into online diaper retailing requires the establishment of a platform and second by assuming that entry costs for platforms are high.

Some parts of Amazon’s retail business can be described as a two-sided platform. The Amazon Marketplace, wherein consumers can purchase products from third-party sellers on Amazon’s website, is a two-sided platform. Third-party sellers on Marketplace obtain greater value from listing their products with Amazon the more consumers there are visiting Amazon’s website. Similarly, consumers obtain more value from shopping on Amazon the more third-party sellers there are on Marketplace. To overcome the “chicken and egg” problem, Amazon subsidizes the consumer side of the platform by offering free, fast shipping through Prime membership and charges fees to third-party sellers to offer their products on Marketplace. The part of Amazon’s business where it acts as a first-party seller (i.e., the “sold by Amazon” part of Amazon.com), is not a two-sided platform. When Amazon purchases goods such as diapers from manufacturers and resells them on its website, Amazon is best characterized as a traditional retailer—albeit retailing products online.

While a new online retail platform must attract both buyers and sellers in order to be successful, Khan erred in her analysis of entry barriers first by assuming that entry into online diaper retailing requires the establishment of a platform and second by assuming that entry costs for platforms are high.

Khan’s own analysis demonstrates that it is not necessary to build a new online platform in order to successfully enter online diaper retailing. Quidsi did not operate a two-sided retail platform and yet it successfully entered. It was so successful that there were multiple bidders to acquire its business.[62] Furthermore, Khan’s complaint is that Amazon was selling diapers below cost and not that sellers on Amazon’s two-sided Marketplace were engaged in predation. Her complaint is about Amazon as a retailer and not as an operator of a two-sided platform. Looking beyond Quidsi and Amazon, both Walmart and Target successfully entered online diaper retailing without establishing a platform. Walmart announced its platform for third-party sellers just two months before it began retailing diapers online.[63] If Walmart’s goal in creating the platform was to sell diapers, that motive is absent from its press release announcing it.[64] Similarly, Target, which has been selling diapers online for years, only established a platform for third-party sellers in 2019.[65] Finally, some diaper manufacturers, such as Honest Co., bypassed online retailers altogether and successfully used their proprietary websites to sell to consumers directly.[66] The growth of Shopify, which saw the number of merchants using its services more than double between 2018 and 2020, demonstrates how sellers of any product, including diapers, can bypass platforms and sell directly to consumers.[67]

Even if one accepts Khan's assertion that entry into online diaper retailing requires the establishment of a platform, she overstates the difficulty in establishing a platform that will attract traffic. In the time since Quidsi began retailing diapers online, several online platforms have entered or expanded. Etsy, a platform for sellers of handmade and vintage items, launched in the same year as Diapers.com. Its revenue grew from just $1 million in its first year to $5 billion by 2019.[68] Similarly, eBay’s U.S. marketplace revenue increased from $1.8 billion in 2005 to just over $5 billion in 2021.[69] Other smaller platforms have entered in niche categories such as Newegg for electronics and Chairish for home furnishings. While Newegg has long existed as a first-party retailer, since adding a third-party seller platform to its retail operations in 2011, the number of customers shopping with Newegg has more than doubled. And Chairish reached nearly four million customers in just seven years.[70] Each of these platforms has used a divide-and-conquer strategy to attract traffic to its platform. That is, benefits to consumers such as free shipping are subsidized through fees to sellers on the platform. This is a common strategy two-sided platforms use to attract traffic. That many platform entrants have adopted the divide-and-conquer strategy demonstrates the extent to which Khan overstates the barriers to entry for new platforms.

Amazon’s Pricing Strategy Was Not Predatory and Benefitted Consumers

Khan concluded that Amazon’s dominance in the online retailing of baby products has yet to be challenged by new entrants into online retailing or by brick-and-mortar retailers selling online. Yet, this conclusion flies in the face of online diaper sales data. By 2018, Walmart’s share of online sales of diapers (27 percent) was nearly the same as Amazon’s 30 percent of sales. Therefore, if Amazon was engaged in predation, it was not successful, as it was unable to deter the entry and expansion of other competitors after acquiring Quidsi. Furthermore, Amazon’s deep discounting of diapers benefitted consumers, even if it was short-lived. Not only did Amazon reduce its own diaper prices by 30 percent, this discounting and the additional incentives offered by Amazon led Quidsi to reduce its prices and offer additional incentives as well.[71] Consequently, consumers gained from this outbreak of competition in online diaper retailing.

Leveraging Retail Dominance Into Logistics

Amazon’s Expansion Into Logistics

Amazon has grown tremendously both with respect to its retail sales and its shipping volume. By 2013, Amazon’s sales revenue was over $74 billion and it was shipping 608 million packages a year in the United States alone—primarily through third-party delivery companies such as FedEx and UPS—with shipping costs of over $6 billion.[72] Amazon’s shipping volume entitles it to steep discounts from third-party delivery companies on the order of 70 percent or more.[73] In order to reduce costs further and to improve the reliability of its package shipments, Amazon has invested significantly in its own logistics capacity.[74] “Amazon now has 400,000 drivers worldwide, 40,000 semi-trucks, 30,000 vans, and a fleet of more than 70 planes.” In addition to the investment in transportation vehicles, Amazon also recently opened a $1.5 billion air hub in Kentucky.[75]

Khan claimed, without evidence, that the more favorable shipping rates Amazon was able to obtain led third-party delivery companies to raise rates for Marketplace sellers. According to Khan, Amazon induced Marketplace sellers to join FBA to limit their disadvantage arising from the shipping rate differential. She also claimed that Amazon tied access to Prime customers to the use of FBA and thereby further induced Marketplace sellers to adopt Amazon’s fulfillment program. After inducing Marketplace sellers to adopt FBA, Amazon then discriminated against those sellers with respect to delivery services. Khan also claimed that by leveraging its retail dominance into logistics, Amazon created entry barriers for other retail platforms. She argued that Amazon’s retail platform competitors are not able to profitably provide both platform and logistics services due to the shipping rate differential caused by Amazon’s more favorable terms with third-party delivery companies. According to Khan, the current antitrust framework fails to account for how Amazon’s retail dominance allowed Amazon to discriminate against Marketplace sellers and to create entry barriers for rival retail platforms due to the framework’s focus on price and consumer welfare.

Many of Khan’s arguments relating to Amazon’s vertical integration into logistics rely on her claim that “[d]elivery companies sought to make up for the discounts they gave to Amazon by raising the prices they charged to independent sellers.”[76] However, she provides no causal evidence. In fact, the evidence she cited clearly contradicts her claim. It merely shows that low-volume shippers receive less-generous discounts than do high-volume shippers. It does not show that third-party delivery companies raised prices to compensate for discounts to Amazon. Furthermore, in 2016, “about 560 shippers … spent in the range of $100 million annually on shipping could qualify for discounts of more than 80% on overnight shipments, and up to 60% on residential delivery by ground.”[77] That is, more than 500 other shippers were able to obtain shipping discounts similar to those obtained by Amazon due to their high shipping volumes. This suggests that there is nothing unique about the discounts provided to Amazon.

Many of Khan’s arguments relating to Amazon’s vertical integration into logistics rely on her claim that “[d]elivery companies sought to make up for the discounts they gave to Amazon by raising the prices they charged to independent sellers.” However, she provides no causal evidence. In fact, the evidence she cited clearly contradicts her claim.

Given its shipping volume, Amazon is undoubtedly an important customer for both FedEx and UPS, but Khan overstated the materiality of the discounts provided to Amazon by these delivery companies. Over the last 10 years, the one customer FedEx mentions in its annual 10-K filings with the Securities and Exchange Commission (SEC) as being material to its business is not Amazon but the U.S. Postal Service (USPS).[78] And it was not until 2019 that UPS mentioned Amazon specifically as material to its business in its filings with SEC.[79] Moreover, the average price increase third-party delivery companies would have had to impose on other customers to “make up” for the discounts to Amazon is trivial. In 2006, the year Amazon launched FBA, the average price increase for UPS customers would have been no more than $0.11 per item shipped and at most $0.49 five years later.[80] This hardly constitutes a differential that would have put Marketplace sellers at a disadvantage relative to Amazon. However, if third-party delivery companies could profitably raise prices to non-Amazon customers, as Khan has suggested, why were they not doing it already? Under Khan’s misguided claim, these companies would have been leaving money on the table but for their discounts to Amazon.

Discrimination Against Marketplace Sellers

Khan argued that by luring Marketplace sellers to adopt FBA, “thousands of retailers and independent businesses … are increasingly dependent on their biggest competitor.”[81] She claimed that Amazon could take advantage of this dependence and its vast logistics infrastructure to deliver its own products more quickly than the products of Marketplace sellers. This claim implicitly assumes extensive competition between Amazon and its Marketplace sellers and that it is in Amazon’s interest to make more first-party sales than third-party sales. Neither of these assumptions is likely to be true.

For some portion of the products available in its store, Amazon certainly competes with Marketplace sellers. However, the extent of this competition is far less than anecdotal evidence might suggest. One motivation for opening Amazon’s retail store to third-party sellers was to increase product selection for customers.[82] If third-party products are intended to fill gaps in product selection, then we should expect limited competition between Amazon’s offerings and the offerings of third-party sellers. Analyzing data from Germany, Crawford et al. (2022) found that over 60 percent of sales on Amazon are of products for which Amazon does not have a first-party offering. And only about 8 percent of sales were of products where Amazon entered into competition with a Marketplace seller during the period of their study (i.e., Amazon was not the incumbent seller of the product).[83] This is consistent with an analysis of U.S. data by Zhu and Liu (2018), who found that Amazon entered into competition with Marketplace sellers for only 3 percent of products during the period of their study.[84]

Even if competition between Amazon and Marketplace sellers is more extensive than these recent analyses suggest, Amazon is unlikely to preference its products through more advantageous shipping speeds or other methods such as search rankings or Buy Box placement. Hagiu et al. (2022) showed that a monopoly hybrid platform (i.e., a platform on which there are both first-party and third-party sales) will only preference its first-party products when its expected margin from selling its own product exceeds the expected commission from allowing a third party to make the sale or when consumers showroom (i.e., discover the product on the platform but buy directly from the third-party seller).[85] If the platform expects to earn more by letting a third party make the sale, it will not preference its own products.

Table 3: Estimated 2021 profits from first-party and third-party retail sales ($billion)[86]

|

First Party |

Third Party |

Total |

|

|

Revenue |

$222.1 |

$103.4 |

$325.4 |

|

Cost of Sales |

$233.3 |

$39.1 |

$272.3 |

|

Fulfilment |

$30.0 |

$45.1 |

$75.1 |

|

Profit |

($41.3) |

$19.2 |

($22.0) |

As table 3 shows, Amazon earns much more from third-party sales than from first-party sales. The table estimates what portion of Amazon’s costs is attributable to third-party sales based on information from Amazon’s 2021 10-K filing with SEC, historical information about Amazon’s shipping costs, and estimates of the third-party share of Amazon’s gross merchandise sales. The profit estimates show that Amazon earned approximately $19.2 billion from third-party sales in 2021 while it lost money on its first-party sales. We should not be surprised that Amazon loses money on first-party sales, as a number of its first-party products are likely to be loss leaders. Loss leaders are products that consumers expect to find in any retail store and are priced below cost to bring consumers into the store. If Amazon does not carry these loss-leader products, for example, diapers or Tide detergent, consumers will shop elsewhere and both Amazon and Marketplace sellers will lose sales on higher-margin products. The use of these loss leaders is likely a contributing factor to the unprofitable state of Amazon’s first-party business. Given the higher profitability of third-party sales, we should not expect Amazon to preference its first-party products.

Despite Khan’s suggestions to the contrary, Amazon has e-commerce competitors, and those competitors are growing. In the three years prior to the pandemic, the average quarterly growth rate for Walmart’s e-commerce business was over 40 percent.

Amazon wants to ensure that the products it shows consumers and the speed at which they are delivered are a good match for consumer preferences. If Amazon’s offers are not a good match for a consumer’s search or are not a good value, consumers will look elsewhere. Despite Khan’s suggestions to the contrary, Amazon has e-commerce competitors, and those competitors are growing. In the three years prior to the pandemic, the average quarterly growth rate for Walmart’s e-commerce business was over 40 percent.[87] Walmart’s e-commerce business is growing more than five times faster than Amazon’s. At current e-commerce growth rates, Walmart is forecast to overtake Amazon in less than four years.[88] If Amazon does not show consumers products they want to buy or delivers them too slowly, it risks losing them to competitors such as Walmart.

And the fewer customers Amazon has, the less attractive Amazon will be for Marketplace sellers due to the presence of cross-platform network effects. And while Amazon may be a must-have for some independent merchants, this is not true as a general proposition, as only around a quarter of Marketplace sellers rely on Amazon as their sole source of income.[89] If Amazon limits the ability of its Marketplace sellers to grow by not surfacing their products to consumers or by taking too long to deliver their products, they will look for growth opportunities elsewhere. While Walmart’s third-party seller marketplace is still quite small, nearly 40 percent of Amazon sellers are considering selling on Walmart.[90] Sellers can also bypass platforms and sell directly to consumers through companies such as Shopify, which saw the number of merchants using its services increase by 64 percent between 2019 and 2020.[91]

Entry Barriers for Retail Platforms

Khan pointed to eBay’s exit from same-day shipping as evidence that Amazon’s rivals are not able to compete with the shipping benefits Amazon provides its Prime subscribers. While eBay may have exited same-day shipping, other rivals have been expanding the logistics services they offer to customers and sellers, suggesting that eBay’s decision may have been idiosyncratic and not reflective of overall market conditions.

Walmart has already developed an extensive network of distribution centers to supply its physical stores. Walmart has over 150 distribution centers in the United States compared with just 110 at Amazon.[92] In addition to these distribution centers, Walmart is also expanding a pilot program to add automated fulfillment centers to dozens of its stores.[93] In 2020, Walmart began offering Walmart Fulfillment Services (WFS), which provides logistics services to third-party sellers similar to Amazon’s FBA program.[94] Since 2017, Walmart has provided free two-day shipping to all online customers and in 2020 began offering free grocery delivery to subscribers of its Walmart Plus program.[95]

In 2019, Shopify launched the Shopify Fulfillment Network (SFN), which provides fulfillment and logistics services similar to those provided by FBA for Shopify’s independent merchants.[96] Following its acquisition of Deliverr in July 2022, Shopify began offering multichannel inventory management that provides its merchants (e.g., Amazon, Etsy, Instagram, etc.) with “a single place to view and ship their inventory for different sales channels” as well as offering two-day shipping for participating SFN merchants.[97]

FedEx also provides logistics and fulfillment services to independent merchants. Its Supply Chain service offers “inbound logistics, warehousing and distribution, fulfillment, contract packaging and product configuration, systems integration, returns process and disposition, test, repair, refurbishment, and product liquidation” through more than 30 fulfillment centers and over 130 warehouse and distribution centers, while its Fulfillment service “helps small and medium-sized businesses fulfill orders from multiple channels, including websites and online marketplaces, and manage inventory for their retail stores.”[98] Through its acquisition of ShopRunner in December 2020, FedEx now also provides a two-day shipping program similar to Prime.[99] UPS also has a logistics and fulfillment offering through its Supply Chain Solutions services.[100]

These examples provide evidence of entry and expansion in logistics, not exit, and demonstrate robust competition to provide third-party sellers with alternatives to Amazon. This runs counter to Khan’s “efficiencies offense” narrative that Amazon’s platform competitors are not able to profitably provide both platform and logistics services in the face of Amazon’s lower costs arising from vertical integration.[101]

Vertical Integration Benefits Consumers and Sellers

Cournot Complements

Amazon’s vertical integration into fulfillment and logistics helps resolve what economists refer to as a Cournot complements problem. When multiple complementary inputs are necessary to produce a final product, if each input is supplied by a separate firm, the total cost of all the inputs, and therefore the final product price, will be higher than if all the inputs are supplied by one firm. This is because each input supplier does not take into account the effect of its price on the demand for the other inputs. When one input supplier raises its price, this increases the price of the final product. A higher final product price lowers the demand for the final product and indirectly lowers the demand for all inputs. An input supplier considers the lower input demand for its own input but not the lower demand for the other inputs. That is, it does not consider the externality its pricing decisions impose on the other input suppliers. Vertical integration solves the Cournot complements problem by internalizing this externality.

In a gross simplification of the process of retailing, we can think of retailing as composed of three inputs: (1) product discovery (i.e., learning about the existence and/or characteristics of a product), (2) fulfillment (i.e., picking, packing, and preparing products for delivery), and (3) delivery. These three inputs are present in all forms of retailing including traditional retailing through physical stores, online retailing, and hybrid retailing (i.e., order online, pick-up in-store), although the provider of these inputs varies by the form of retailing. In traditional retailing, the retailer primarily provides product discovery through display in a physical store, while consumers generally self-supply fulfillment and delivery. In hybrid retailing, the retailer provides product discovery through online search results and fulfillment while consumers self-supply delivery. In online retailing, the retailer provides product discovery but fulfillment and delivery may be outsourced to other firms and are typically not self-supplied by consumers. Therefore, online retailing is especially susceptible to the Cournot complements problem.

When Marketplace sellers use FBA, Amazon internalizes the externality that would otherwise be created from obtaining fulfillment and delivery services separately from Amazon’s product discovery service, thereby reducing costs for Marketplace sellers. Khan herself noted that “it was cheaper for those [Marketplace] sellers to go through Amazon than to use UPS and FedEx directly.”[102] By relying on Amazon for fulfillment and delivery, Marketplace sellers are able to pass on their lower costs to consumers in the form of lower prices for the products they sell through Amazon.

Cross-Platform Network Effects

When an individual Marketplace seller provides poor service to consumers by not meeting promised delivery times, this may impact the seller's future sales to the extent that consumers recognize the Marketplace seller as distinct from Amazon. But to the extent that consumers associate the poor service with Amazon, the conduct of an individual Marketplace seller may impact future sales on Amazon’s website more generally. That is, an individual seller’s poor service imposes a negative externality on Amazon and all other Marketplace sellers.

Amazon has an interest in ensuring that Marketplace sellers meet certain performance metrics (e.g., two-day shipping). And, in this instance, consumers’ and sellers’ interests are aligned with Amazon’s interest.

The negative externality arising from an individual seller’s poor conduct is amplified due to the cross-platform network effects present in two-sided platforms. When consumers stop coming to Amazon due to perceived poor conduct by Amazon, Amazon’s Marketplace becomes less attractive to sellers, as there are fewer consumers on the platform. That is, poor conduct by some Marketplace sellers makes Amazon’s platform less valuable to both consumers and other sellers.

Therefore, Amazon has an interest in ensuring that Marketplace sellers meet certain performance metrics (e.g., two-day shipping). And, in this instance, consumers’ and sellers’ interests are aligned with Amazon’s interest. By vertically integrating into fulfillment and delivery, Amazon has a greater ability to ensure that delivery expectations are met.

Diffusion of Innovation

Amazon’s provision of low-cost, fast shipping, enabled by its vertical integration into fulfillment and logistics, has led to a change in consumer expectations regarding shipping cost and speed across all online retailers. In a recent consumer survey, the availability of free shipping was the most cited reason for a purchase from a specific e-commerce website.[103] In another consumer survey, over a third of consumers had ordered from online-only retailers for same-day delivery.[104] Recognizing these changes in consumer expectations, nearly three-quarters of the top 1,000 online retailers offer some form of free shipping.[105] And over a third of all retailers, including those selling online and through a physical store, offer same-day delivery, with nearly all retailers expected to offer same-day delivery in the next three years.[106]

The need to compete with Amazon to meet consumer expectations has spurred innovation across the logistics industry. “Several startups are emerging to solve the problem that legacy companies are ill-equipped to solve: enabling retailers to compete with Amazon, respond faster to market needs and contain rising costs.” Shipwell, Stord, and Shipbob have entered with inventory and warehouse management solutions that provide retailers with better inventory visibility to enable 24/7 tracking of inventory. Others, such as Deliverr (since acquired by Shopify), Shipmonk, and Darkstore have entered to provide fulfillment services that are competitive with Amazon in terms of cost and speed, while companies such as FLEXE, Flowspace, Convoy, and Ontruck have entered to reduce warehousing and logistics costs by better utilizing warehouse and trucking capacity.[107] The diffusion of innovation in logistics and fulfillment occurred more quickly than it otherwise might have due to the competitive pressures provided by Amazon. This is particularly salient in light of the increased reliance on e-commerce during the COVID-19 pandemic.

Exploitation of Data

Competition With Marketplace Sellers