Senate Reconciliation Legislation Fails to Reconcile the Interests of Biomedical Innovation and Drug Price Affordability

The drug price control reforms included in the Senate’s reconciliation package, the Inflation Reduction Act of 2022, are both misconstrued and misguided for numerous reasons and, if implemented, would threaten serious harm to America’s successful life-sciences innovation system. In particular, the legislation fails to recognize three critical realities: 1) that drug prices are, in fact, not a significant driver of raging inflation; 2) that there exist better mechanisms to reform Medicare Part D drug pricing practices; 3) that mandated government price controls do inflict serious harm on nations’ life-sciences innovation systems. Before examining their deleterious effects, this post first explains the mechanics of the drug price controls envisioned in the legislation.

Mechanically, the legislation would empower the Secretary of Health and Human Services (HHS), beginning in 2026, to “negotiate” the prices of 10 “negotiation-eligible” Medicare Part D drugs, with that number growing over subsequent years. Specifically, the legislation states the HHS secretary would publish a list of drugs subject to “negotiation,” starting with 10 drugs or therapies in 2026, then 15 in 2027, and 20 in 2029. While the legislation’s proponents frame the Secretary’s powers as “negotiation,” they have conveniently also added to the legislation a substantial excise tax specifically on sales of drugs the Secretary has targeted for negotiation but for which the manufacturer does not agree to the Secretary’s target price. The excise tax, of as much as 95 percent of a medicine’s sales, would be applied for any period in which the drug manufacturer is in “non-compliance.” (Moreover, as the Tax Foundation’s Erica York explains, while the excise tax penalty is referred to as a “95 percent tax rate,” it can actually amount to as much as an effective 1,900 percent tax rate because of how the proposal defines the tax base.) As the American Action Forum’s Doug-Holtz Eakin explains, “Given the 95 percent excise tax the secretary would be free to wield against noncompliant innovators, ‘price extortion’ would be a more honest label for the provision than ‘price negotiation.’”

Moreover, while the extent of drugs—just 10—affected by the legislation may seem small in the beginning, the legislation’s certain intent is to get “the camel’s nose under the tent” to establish drug price control mechanisms within the federal government, and then to expand them to an ever-growing set of drugs, and eventually beyond. As one assessment concluded, the number of medicines swept in by the far-reaching plan could account for nearly half of total Medicare Part B and Part D spending by 2031. Eakin elaborates on how the legislation truly represents a stalking horse to cap drug prices throughout the entire U.S. health care system, explaining in early Spring 2022 concerning the mechanics of the proposed Build Back Better Act (BBBA) (which supplies the basis for the drug price reforms now in the reconciliation package):

While the BBBA would not apply Medicare’s negotiated prices for drugs to non-federal programs, the most significant implication of the BBBA’s dollar-for-dollar penalties on price increases that exceed the rate of inflation is that, for the first time, the federal government would be unilaterally capping drug prices nationwide, both in federal programs and in the private market. This shift in the federal government’s posture toward private markets, negotiations, and competition cannot be overstated. [Thus]…Significantly under the BBBA, the federal government would cap the price of all drugs throughout the entire health care system by penalizing any manufacturer who increases a drug’s price faster than the rate of inflation.

Drug Prices Are Not Driving Raging U.S. Inflation

Moreover, the reality is that such drug price control proposals have absolutely no place whatsoever in a putative “Inflation Reduction Act,” for drug prices are simply not a contributor to the raging inflation America has experienced over the past year. Of course, Senate Democrats have been driving this fallacious narrative for some time as justification for their desire for the U.S. government to take much greater (if not complete) control over setting the prices Americans pay for drugs. Still, the contention that prescription drug prices are driving up U.S. inflation is a wholesale canard.

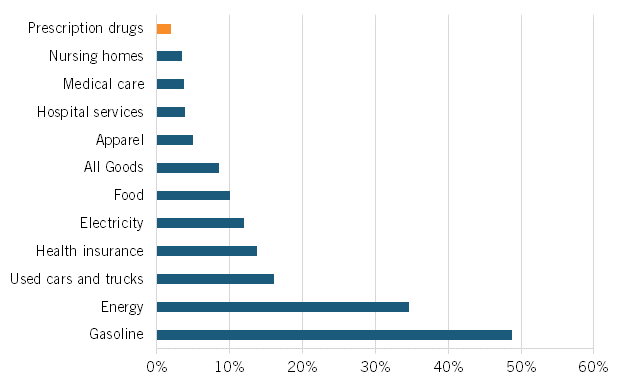

At a March 2022 Senate Finance Committee hearing, proponents of drug price controls attempted to suggest that substantially increasing drug prices were a key contributing factor to U.S. inflation that’s now raging at the highest level in 40 years, to wit the hearing’s title: “Prescription Drug Price Inflation: An Urgent Need to Lower Drug Prices in Medicare.” But increasing prescription drug prices aren’t a significant contributing factor driving U.S. inflation. In fact, over the past 12 months (from May 2021 to May 2022), U.S. prescription drug prices increased only 1.9 percent (which was even lower than their minimal 2.4 percent increase from February 2021 to February 2022). (See figure 1.) And between 2020 and 2021, the U.S. Bureau of Labor Statistics (BLS) recorded zero inflation on prescription drugs and only a 0.8 percent price increase on non-prescription drugs.

Figure 1: Consumer price index by sector, 12-month change ending in May 2022

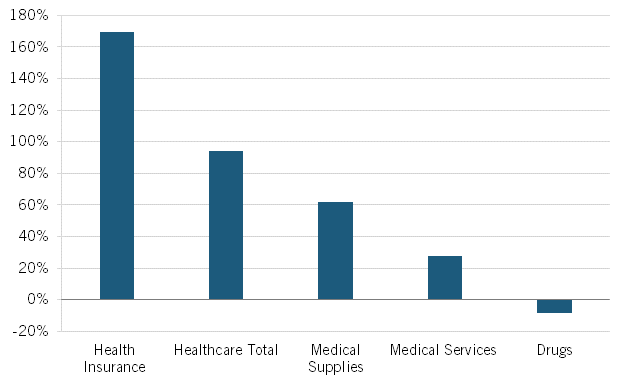

Nor is this recent trend unique. As calculated by BLS, from 2005 to 2020, Americans’ reported expenditures on health insurance increased by over 160 percent while their total health care expenditures increased 94 percent, but consumer expenditures on drugs fell by almost 9 percent. (See figure 2.) Of course, this does not necessarily mean overall drug expenditures fell because health insurance and hospitals also purchase drugs, but it does address consumers’ out-of-pocket costs.

Figure 2: Percent change in consumers’ reported healthcare expenditures, 2005–2020

Moreover, the percentage of total U.S. health care spending on retail prescription drugs was consistent from 2000 to 2017, at mostly under 10 percent, and even dipped slightly to 8 percent in 2020. Further, Altarum finds that the prescription drug share of national health expenditures should remain stable in the 14 percent range (with 9 percent going to retail prescriptions) through the remainder of this decade.

Data such as these reveal that, overall, the United States has done an admirable job of designing a system that supports the world’s highest levels of biomedical R&D and innovation, which brings (certainly more costly) innovative drugs to market but balancing this with mechanisms that, over time, introduce generic or biosimilar competition (not to mention competition from other innovators) which broadly enables sustainably affordable drug prices.

Medicare Part D Reform—Not Drug Price Controls—Are What’s Needed

Now, to be sure, there are cases where seniors are unnecessarily paying too much for drugs at the pharmacy counter, but the solution isn’t government price controls; it’s sensible Medicare Part D reforms, as ITIF has called for. Most concerningly, The Inflation Reduction Act of 2022 significantly delays the most obvious and potentially effective Medicare Part D reform—implementation of the rebate rule—both because some Senators seek their greater goal of drug price controls (and because they seek to apply the savings from the far-more-stringent drug price controls toward other objectives, such as financing subsidies for ACA plans).

The rebate rule would ensure that the rebates insurers and pharmacy benefit managers (PBMs) negotiate for Medicare Part D drugs are passed through to seniors at the pharmacy counter. The rebates (averaging nearly 30 percent for Medicare Part D drugs) are usually paid to PBMs in consideration of preferred placement on the insurance plan’s formulary, but the PBMs tend not to share the rebates directly with beneficiaries. Implementing this rule could save older Americans as much as $83 billion at the pharmacy counter over 10 years.

Moreover, if policymakers seriously wish to address the prices seniors pay for drugs, they’ll need to much more seriously examine the role PBMs play in setting drug prices, for the reality is that a significant amount of the money Americans pay for drugs goes not to the companies that innovate and manufacture them, but to other intermediaries in the pharmaceutical supply chain. In fact, since 2013, the share of drug expenditures going to manufacturers has decreased by 13 percent. Thus, while total expenditures on brand drugs grew by $268 billion between 2013 and 2020, only 31 percent of the increase accrued to the manufacturers, while 69 percent accrued to other stakeholders. By 2020—for the first time ever—over half of America’s expenditures on drugs accrued to non-manufacturers.

America’s three largest PBMs—CVS Caremark, Express Scripts, and OptumRx—commanded 79 percent of all prescription drug claims in 2020. Talk about a concentrated market. Moreover, it’s an enormously profitable one. In their paper, “Do companies in the pharmaceutical supply chain earn excess returns?” Sood, Mulligan, and Zhong find that other players in the pharmaceutical supply chain realize higher returns than U.S. pharmaceutical companies. Specifically, from 2003 to 2018, they found that wholesalers earned excess returns of 8.1 percent and that insurers, PBMs, and retailers collectively earned excess returns of 5.9 percent. By comparison, they found that the rate of return on investments of large firms in the pharmaceutical industry over that period was just 1.7 percent once adjusted for the risk premium paid for capital and the more logical treatment of R&D expenditures as long-term investments rather than current costs. (The authors did find the cohort of biotechnology firms in their study earned the highest return of companies examined, at 9.6 percent, though they note this was in part driven by several blockbuster drugs introduced from 2013-2015, notably new Hepatitis C drugs, and that by 2018 the sector’s excess rate of return had fallen to under 9 percent.) More importantly, the authors note, “In contrast with middlemen, monopoly power in the pharmaceutical and biotech sectors—derived through the U.S. patent system—provides [an] incentive for innovation that might not happen otherwise.”

In other words, America’s life-sciences companies invest over one-quarter of their revenues (25.7 percent in 2019) back into R&D each year (a level higher than any other U.S. industry), employ roughly one-quarter (23 percent) of America’s R&D workforce, and from 2009 to 2018 introduced 43 percent of all new drugs innovated in the world. In other words, American (and global) society receives tremendously more bang for the buck for the revenues America’s pharmaceutical and biotechnology companies earn compared to PBMs and other intermediaries. Most assuredly, those companies aren’t investing one-quarter of their revenues back into R&D each year, employing one-quarter of America’s R&D workforce, or inventing nearly half of the world’s new drugs. Instead of going after “Big Pharma,” policymakers should target “Big PBM.”

This matters particularly because, contrary to popular conception, when patients go to the pharmacy counter, they are not paying a drug price set by a drug’s manufacturer, but by one of the three leading PBMs. The rebate rule would ensure that discounts the PBMs receive on list prices (i.e., the difference between the list and lower net price) would be passed through to seniors at the counter, rather than used to subsidize the premiums of healthy beneficiaries.

Indeed, until the rebate system is fundamentally reformed, list prices will continue to increase at rates well above the actual cost of drugs, with insulin being a prime example. For instance, a bipartisan report by the Senate Finance Committee found that some PBMs have secured rebates on insulin as high as 70 percent in recent years. In fact, in 2019, PBMs paid $52 for an insulin product with a list price of more than $350. Manufacturers often sell insulin, an essential medicine, to insurers and PBMs at deep discounts. However, many patients are forced to make out-of-pocket payments based on insulin’s irrelevant list price. For instance, one study found that list prices for Sanofi’s insulins have grown by 140 percent over the past eight years, while net prices have declined by 41 percent.

Similarly, over the past five years, the list price of Eli Lilly’s Humalog insulin increased by 27 percent, while its net price declined by 10 percent. But as Drug Channel’s Adam Fein notes, [formulary plan] “benefit designs often mask these declining net prices.” As Fein explains, “Payers’ drug costs and manufacturers’ revenues have been dropping for the past four years. Despite this decline, patients’ out-of-pocket costs have been rising.” As Fein concludes, “Third-party payers’ benefit designs remain a significant barrier to addressing drug costs. Many continue to use the ever-growing rebate dollars of the gross-to-net bubble to offset overall plan costs rather than reducing a patient’s out-of-pocket spending. …Until the rebate system is reformed, list prices will continue to rise at rates above the actual cost of drugs.”

Further, policymakers must ensure PBMs list generic or biosimilar drugs on Medicare Part D formularies when such options become available. Consider the case of Tecfidera (dimethyl fumarate), a blockbuster multiple sclerosis treatment manufactured by Biogen which went generic in late 2020. Within months of Tecfidera going off-patent, more than 10 generic drug makers brought competing versions of dimethyl fumarate to market with “deeply discounted prices to Tecfidera.” Roughly one-year post-generic launch, aggressive competition from generics manufacturers drove prices for a 60-count bottle of the generic equivalent today down to “a 99%+ discount to the brand’s list price.” However, by Q3 2021, Medicare Part D plans covering the majority of U.S. seniors didn’t make the generic equivalent available to their members, instead only offering them brand-name Tecfidera. Moreover, when the generic was made available to seniors, it was largely done at “negotiated prices” far exceeding the lowest cost generic equivalent.

In other words, here’s a case where America’s life-sciences innovation system worked to support the creation of an innovative drug and then a subsequent pathway for entry of much-lower-priced generic drugs, but it was the middleman system that prevented the cheaper drugs from being made available to seniors. Policymakers need to take a closer look at the role of PBMs in America’s drug payments system. That’s why ITIF supports proposals calling for the imposition of greater fiduciary obligations on the activities of PBMs. ITIF also supports other recommendations to increase drug price transparency and require plan sponsors to provide patients with information about drug price increases and lower-cost options.

Lastly, to help seniors at the pharmacy counter, ITIF supports the proposal to cap at $2,000 out-of-pocket prescription drug costs on Part D beneficiaries that don’t already qualify for cost-sharing protections (i.e., through low-income subsidies). ITIF also supports provisions that would “smooth” beneficiaries’ out-of-pocket costs over a year so that a beneficiary wouldn’t potentially have to pay as much as $2,000 in a single month.

Drug Price Controls Harm Life Sciences Innovation

For all the flaws with the reconciliation package’s drug price control proposals, perhaps the most concerning is their architects’ failure to recognize that drug price controls do impede life-sciences innovation. Indeed, academic studies consistently find that a reduction in current drug revenues leads to a decrease in future research and the number of new drug discoveries. For instance, one study found that a real 10 percent decrease in the growth of drug prices would be associated with an approximately 6 percent decrease in pharmaceutical R&D spending as a share of net revenues. Similarly, Lichtenberg found that a 10 percent decrease in cancer drug prices would likely cause a 5 to 6 percent decline in cancer regimens and research articles. Likewise, Golec and Vernon show that if the United States had used an EU-like drug pricing system from 1986-2004, this would have resulted in a decline in firms’ R&D expenditures of up to 33 percent and the development of 117 fewer new medicines. Maloney and Civan found that a 50 percent drop in U.S. drug prices would decrease the number of drugs in the development pipeline by up to 24 percent. Similarly, Abbot and Vernon estimate that a price cut of 40 to 45 percent in real terms would reduce the number of new development projects by 50 to 60 percent. Most recently, 2021 research by Tomas Philipson and Troy Durie at the University of Chicago leveraged existing literatre to estimate that a 1 percent reduction in pharmaceutical industry revenue leads on average to a 1.54 percent decrease in R&D investment.

Applying their research to the Build Back Better Act, Philipson and Durie find the legislation would reduce revenues by 12.0 percent through 2039, with the reduced revenues meaning R&D spending would fall by about 18.5 percent, or $663 billion. They find that this cut in R&D activity would lead to 135 fewer new drugs, with this drop in new drugs is predicted to generate a loss of 331.5 million life years in the United States. The authors further conclude that therapies that treat endocrine, cardiovascular, and respiratory diseases, along with treatments for cancer and neurological diseases, would be most impacted by the BBBA’s policies because they make up a high share of Medicare spending.

Analyses such as these explain why a February 2018 report by the President’s Council of Economic Advisors found that while lowering reimbursement prices in the United States would reduce the prices Americans pay now for biopharmaceutical products, it would “make better health costlier in the future by curtailing innovation,” thus failing to meet the goal of reducing the price of health care by reducing the incentives for innovative products in the future.

Stringent drug price controls don’t only impede R&D and innovation, they preclude access to innovative medicines. For instance, the Department of Health and Human Services’ October 2018 report, “Comparison of U.S. and International Prices for Top Medicare Part B Drugs by Total Expenditures,” analyzed the price and availability of 27 drugs across 16 comparator countries. It found that only 11 of the 27 drugs examined were widely available in all the comparator countries, indicating that patients in these countries were experiencing delays in access to innovative treatments. For instance, 95 percent of new cancer drugs are available to patients in the United States, compared to just an average of 55 percent of new drugs available among the 16 reference countries. Further, for the cancer drugs available in the reference countries, there appears to be a 17-month average lag between the time they are available in the United States and their availability elsewhere.

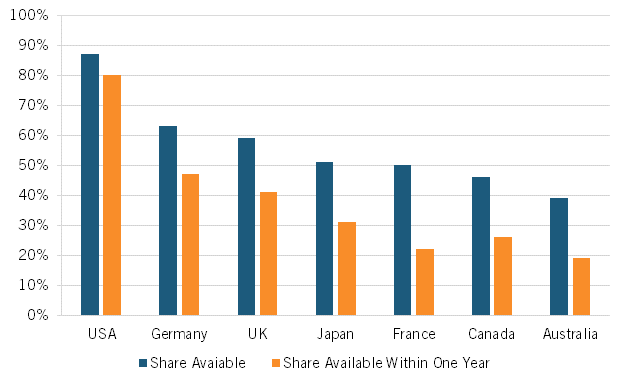

Indeed, a broad range of research suggests that Americans enjoy access to innovative medicines earlier than citizens in other nations. For instance, considering the availability of new medicines first launched globally from 2011 through year-end 2019, 87 percent were available first in the United States, a wide gap over Germany and the United Kingdom, at 63 and 59 percent respectively, with percentages declining to as low as 46 percent in Canada and 39 percent in Australia. Considering the percentage of drugs available within one year of the first global launch, again, U.S. citizens enjoyed the greatest access, with 80 percent of drugs available to Americans first, followed by Germany and the United Kingdom at 47 and 41 percent, respectively, and again Canada and Australia trailing at 26 percent and 19 percent, respectively. (See figure 3.)

Figure 3: National availability of new medicines first launched globally from 2011 to year-end 2019

Lastly, as ITIF demonstrated in its recent report, How Japan Squandered Its Biopharmaceutical Competitiveness: A Cautionary Tale, countries’ introduction of significant drug price controls can have significant deleterious effects on the competitiveness of their life-sciences industries. Japan’s severe price controls not only limited the potential profits from biopharmaceutical innovation, thus decreasing the incentive to invest, they further limited drug company revenues, thus decreasing the industry’s ability to invest. Japan’s drug price controls were a significant reason why Japan’s share of global value added in the pharmaceutical industry declined by 70 percent, from 18.5 to 5.5 percent, from 1995 to 2018 and why the country’s share of global introduction of new drugs has been on a steadily downward trajectory since the 1980s.

Similar scenes have played out in Europe, decimating that continent’s life-sciences innovation industry. By imposing such draconian drug price controls, European regulators have severely disrupted the economics of innovation in the European life-sciences industry. As the EFPIA explained in a 2000 report, “Many European countries have driven prices so low that many new drugs can no longer recoup their development costs before patents expire.” As the report continues, “These policies, most of which seek only short-run gains, seriously disrupt the functioning of the market and sap the industry’s ability to compete in the long-run.” As industry analyst Neil Turner wrote in 1999, those policies “set in motion a cycle of under-investment and loss of competitiveness that’s very difficult to break out of.” While Europe’s drug price controls undoubtedly lead to lower drug prices and charges that Europe “free rides” off U.S. biopharmaceutical innovation, one report notes, “Europe’s free ride is not free” and shows that Europe’s drug price controls actually lead to considerable “social and economic costs in Europe, in the form of delayed access to drugs, poorer health outcomes, decreased investment in research capabilities, and a drain placed on high-value pharmaceutical jobs.”

2021 research by Schulthess and Bowen confirms that these trends continue today, finding that a 10 percent drop in the price of medicines in price-controlled European Union markets was associated with a 14 percent decrease in total venture capital funding (10 percent early stage and 7 percent late); a 7 percent decrease in biotech patents; a 9 percent decrease in biotech start-up funding relative to the United States; and an 8 percent increase in the delay of access to medicines. As the report observes, “the continued downward pressures on prices in Europe have led to declines in biopharmaceutical industry investments in the European Union relative to the United States.” For example, from 2013 to 2019, biotech investments in the United States increased sixfold even as they remained static in the European Union, while by 2020, the U.S. share of total annual biotech start-ups was roughly three times greater than the European share.

In summary, stringent drug price controls have significantly hampered the innovation capacity and global competitiveness of the European and Japanese life-sciences industries; the last thing U.S. policymakers should do is offer a similar prescription for the United States.

Conclusion

In conclusion, the drug price control provisions in The Inflation Reduction Act of 2022 are unnecessary, unwarranted, damaging, and far fall short of any effective set of reforms to address drug price issues. It’s tremendously disappointing that, coming just one week after the passage of the CHIPS and Science Act of 2022, which makes significant and much-needed investments toward renewed U.S. industrial competitiveness, science and technology leadership, and greater levels of innovation in the life sciences and other advanced technology industries, Congress is now considering passing legislation that would imperil U.S. life-sciences innovation leadership and other Biden administration priorities, such as the Cancer Moonshot. At the very least, the Senate (and House) should strip the proposed prescription drug price reforms from the Inflation Reduction Act of 2022.

The United States enjoys a bountiful return on the roughly 14 percent of national health care expenditures it invests in prescription drugs each year. America’s market-based, private-enterprise-led, government-supported biomedical innovation system has tremendous strengths. It is both the envy of the world and the source of the majority of the world’s new drugs benefitting American and global citizens alike. To be sure, some reform is needed—notably to address the pinch seniors are experiencing in out-of-pocket costs at the pharmacy counter—but radical reconstructive surgery in the form of stringent drug price controls is not.