How Japan Squandered Its Biopharmaceutical Competitiveness: A Cautionary Tale

Stringent drug price controls have significantly hampered the competitive and innovative capacity of Japan’s biopharmaceutical industry in recent decades, serving as a warning for U.S. policymakers considering introducing Medicare Part D drug price controls in 2022.

KEY TAKEAWAYS

Key Takeaways

Contents

The Evolution of Japan’s (Bio)Pharmaceutical Industry 3

Recovery to Peak: Japan’s Pharmaceutical Industry, 1945–1990. 3

Falling Off the Lead: Japan’s (Bio)Pharmaceutical Industry, 1990–Today 5

Scientific Publications and Patents 6

Extent and Share of Global Pharmaceutical Industry Value Added. 9

Factors and Policies That Cost Japan Its (Bio)Pharmaceutical Industry Competitiveness 12

Excessive Drug Price Controls: Starting in the 1980s 12

Adjusting Drug Price Controls: Experiences in the 2010s 16

Faltering Government R&D Investment and Incentive Support 20

Challenges With Internationalization and Achieving Scale. 22

Weak Industry-University Linkages 23

Stagnant Entrepreneurship and Partnering in Japan’s Bioeconomy 27

Japan’s Biopharmaceuticals Policy Today 31

Introduction

Possessing a world-leading biopharmaceutical industry constitutes a national treasure. Biopharmaceuticals represent a high-value-added industry that supports good-paying jobs, robust economic output, tax revenues, and often high levels of exports—not to mention one that produces life-saving drugs. But a nation’s continued leadership in life sciences, as with any advanced-technology industry, is never guaranteed or assured. It requires constant curation and tends to ensure a sustained supportive policy environment wherein the industry can continue to flourish in a hypercompetitive global environment.

This report examines how Japan once possessed a nearly world-leading (bio)pharmaceutical industry, only to lose that position. That’s not to say Japan doesn’t still harbor world-class biopharmaceutical companies—it does—but it is to argue that at the broader industry level the locus of leadership has moved elsewhere in the world. Notably, the United States wrested leadership of the industry from the European Union and Japan over the past four decades, the result of both a strong public policy and private enterprise environment in the United States combined with suboptimal policy choices made in both those competing regions. This report shows how excessive drug price controls have played a pivotal role in hamstringing the Japanese pharmaceutical industry, though the industry’s weakening over time was exacerbated by other policy weaknesses such as faltering government investments in basic scientific research, more-slowly evolving regulatory systems, and weak industry-university relations that impeded the Japanese industry’s ability to transition from leadership in chemistry to biology as biopharmaceutical innovation increasingly shifted from small to large molecules, particularly over the past several decades.

This report contains lessons for American and Japanese policymakers alike. For Japanese policymakers, it suggests policy explanations for biopharmaceutical industry decline and proposes opportunities for renewal. For U.S. policymakers, it should present a warning to those who are currently contemplating making significant changes to America’s drug pricing system through legislation such as H.R.3 or the broader Build Back Better agenda (drug price control elements of which several senators sought to push forward in early July 2022).[1] The situation is especially concerning in light of China’s continuing efforts to become a world leader in the life sciences, as it has in numerous other sectors from 5G and artificial intelligence (AI) to clean energy and high-speed rail—all with deleterious effects on the U.S. economy.[2] In fact, this report presents data showing that China’s biopharmaceutical industry is increasingly outpacing Japan’s in the development of early-stage innovative new drugs. If the United States wishes to retain its life-sciences innovation leadership, it needs to heed the lessons of loss not just in other U.S. industries such as semiconductors, but also what’s transpired in other nations’ life-sciences industries.[3] The same lessons go for Japanese policymakers who would like to restore the Japanese biopharmaceutical industry to the world’s leading edge.

The Evolution of Japan’s (Bio)Pharmaceutical Industry

This section provides an overview of Japan’s (bio)pharmaceutical industry across several timeframes—beginning with the period from 1945 to 1990 and then examining the period from 1990 to the present, with a particular focus on the period from roughly 2005 to today—examining the success of the sector in the initial period before turning to interpret and explain its gradual decline during the latter. (Note that the term “(bio)pharmaceutical” is used in this discussion to reflect the fact that the biotechnology industry came later, starting in the 1980s.)

Recovery to Peak: Japan’s Pharmaceutical Industry, 1945–1990

Japan’s pharmaceutical industry was devastated by World War II, but like other sectors, including automobiles and consumer electronics, the industry roared back, recovering rapidly during the post-War era. In fact, it recovered so much so that, by 1963, Japan had become the world’s second-largest producer of pharmaceuticals after the United States; and by the mid-1970s, “most Japanese firms were catching up with foreign firms in terms of [drug] discovery capacity, if not size or sales.”[4] By 1982, Japan had become the world’s second-largest investor in pharmaceutical research and development (R&D), behind only the United States.[5]

If the United States wishes to retain its life-sciences innovation leadership, it needs to heed the lessons of loss not just in other U.S. industries such as semiconductors, but also what’s transpired in other nations’ life-sciences industries

University of California at Berkeley Professor Michael Reich has argued that the post-War success of Japan’s pharmaceutical industry wasn’t driven—as in other sectors such as automotives, consumer electronics, or machine tool industries—by elite bureaucrats at the Ministry of International Trade and Industry (MITI) who excelled in developing internationally competitive industries through long-range strategic planning and a strong export orientation.[6] Rather, Reich has taken a political economy interpretation, contending that Japan’s pharmaceutical industry was “nurtured and promoted through a highly regulated market, where health policy served as implicit industrial policy.”[7] Reich has argued that five key policies largely in place until the 1980s—drug approval policy, health insurance policy, physician dispensing policy, fee-for-service reimbursement policy, and pharmaceutical price policy—“combined to produce a golden age for pharmaceuticals in Japan.”[8] Indeed, Japan’s introduction of a universal health care system in 1961, with a promise to provide world-class health care to its citizens, generally “provided manufacturers with a somewhat predictable pricing and access environment.”[9]

To provide a brief overview of these five factors, drug approval policy refers to the fact that until the late 1960s, Japan’s policy kept foreign firms out of the Japanese market (limiting competition for Japanese firms) while also making it easy for Japanese companies to license foreign products, get them approved without clinical trials, and sell them domestically at handsome profits. Changes in Japanese health insurance policy throughout the 1970s progressively reduced restrictions on access to medical care, thus promoting expansion of the domestic pharmaceutical market. The physician-dispensing policy refers to Japan’s post-War policy of allowing physicians to both prescribe and dispense medicine. The fee-for-service reimbursement policy for physicians meant prescriptions dispensed by physicians would be reimbursed with little challenge (thus helping to increase the consumption of pharmaceuticals). Lastly, Japan’s pharmaceutical price policy, “created incentives for physicians to dispense pharmaceuticals liberally and to select products with relatively higher product [i.e., profit] margins.”[10] In essence, the generous reimbursement rates in Japan’s “price policy provided a powerful mechanism to expand the Japanese pharmaceutical market for the financial benefit of physicians as well as producers.”[11]

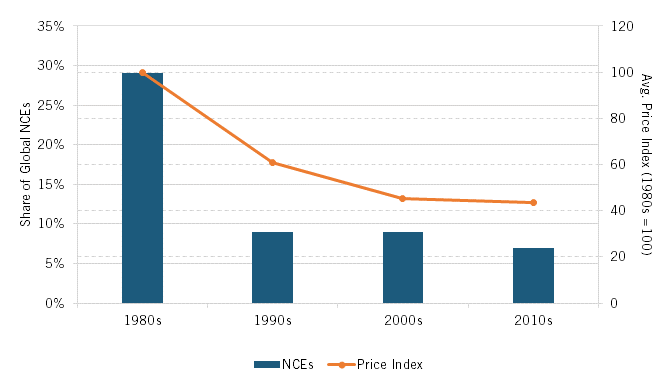

The post-War revival of Japan’s pharmaceutical industry was apparent not only in pharmaceutical R&D investment and overall pharmaceutical production, but also in pharmaceutical innovation. Indeed, the acid test of a nation’s pharmaceutical prowess is whether it’s creating innovative new drugs. By this measure, Japan’s pharmaceuticals industry would reach its zenith during the 1980s. In terms of innovation, in the early 1980s, Japanese-headquartered pharmaceutical companies began to equal or surpass European competitors, originating 16 percent of major new drugs introduced internationally during the period from 1980 to 1984, a share that exceeded Germany’s 15 percent and Switzerland’s 13 percent. For the decade of the 1980s overall, Japanese-headquartered companies would introduce 130 new chemical entities (NCEs)—essentially, new drugs—which accounted for 29 percent of all NCEs introduced in the world during that decade, nearly double the share the country accounted for in the 1970s. (See table 1.) In the 1980s, Japan stood virtually toe-to-toe with global peers in pharmaceutical innovation and, when considering NCEs as a share of gross domestic product (GDP), Japan led the United States.

Table 1: New chemical entities (NCEs), by country headquarters of inventing enterprise[12]

|

1971–1980 |

1981–1990 |

1991–2000 |

2001–2010 |

2011–2020 |

||||||

|

NCEs (#) |

Share (%) |

NCEs (#) |

Share (%) |

NCEs (#) |

Share (%) |

NCEs (#) |

Share (%) |

NCEs (#) |

Share (%) |

|

|

United States |

157 |

31% |

145 |

32% |

75 |

42% |

111 |

57% |

260 |

64% |

|

France |

98 |

19% |

37 |

8% |

10 |

6% |

11 |

6% |

5 |

1% |

|

Germany |

96 |

20% |

67 |

15% |

24 |

13% |

12 |

6% |

24 |

6% |

|

Japan |

75 |

15% |

130 |

29% |

16 |

9% |

18 |

9% |

27 |

7% |

|

Switzerland |

53 |

10% |

48 |

11% |

26 |

14% |

26 |

13% |

11 |

3% |

|

United Kingdom |

29 |

6% |

29 |

6% |

29 |

16% |

16 |

8% |

27 |

7% |

Japanese-headquartered enterprises introduced 29 percent of the world’s new chemical entities in the 1980s, but this share would fall to just 9 percent in each of the ensuing two decades.

Falling Off the Lead: Japan’s (Bio)Pharmaceutical Industry, 1990–Today

Yet, from its peak in the 1980s, Japan’s pharmaceutical industry would begin a gradual slide in subsequent decades, as reflected across a number of measures and indicators, including the share of innovative new drugs produced, levels of R&D invested, output of pharmaceutical publications and patents, amount and share of global industry value-added, and extent of exports.

Innovative Drugs

As noted, Japanese-headquartered companies’ share of NCEs reached 29 percent during the 1980s, but Japan’s share of global NCEs would decrease to just 9 percent over each of the following two decades, as the number of NCEs introduced by Japanese-headquartered companies fell to but a fraction of their level in the 1980s.[13] From 2009 to 2018, Japanese-headquartered pharmaceutical companies would introduce 11 percent (50 of 436), of the NCEs introduced globally.[14] From 2011 to 2020, they produced only 7 percent of NCEs approved by the U.S. Food and Drug Administration (FDA). Clearly, the extent of new drug innovation by Japanese-headquartered companies fell considerably after the 1980s, both in terms of the absolute number and global share of new drugs.

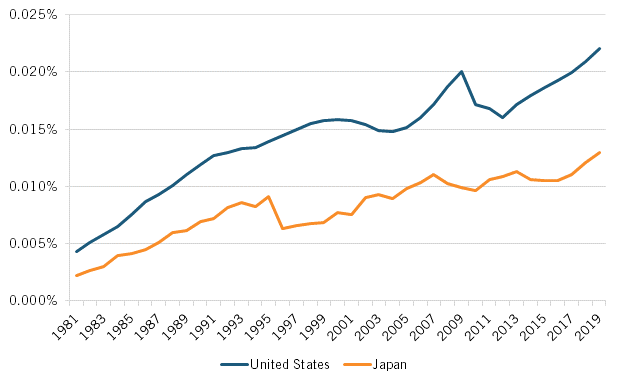

Research and Development

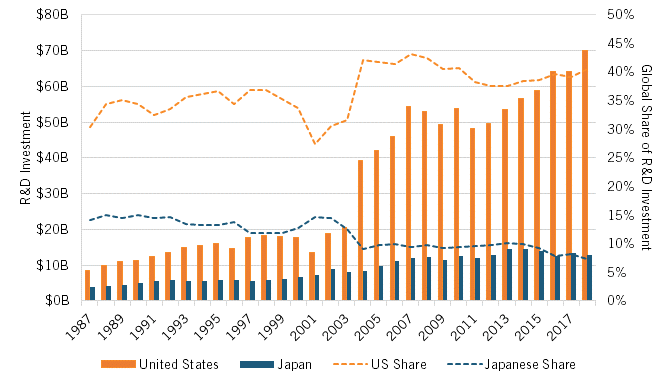

The relative decline of Japan’s pharmaceutical industry after the 1980s can be witnessed across numerous additional indicators. Consider investment in pharmaceuticals R&D. In 1987, firms in the United States invested slightly more than double the amount Japan did ($4.1 billion versus $1.9 billion, in current purchasing power parity [PPP] dollars) in pharmaceuticals R&D. As a share of GDP, R&D investment in Japan was at that time higher than it was in the United States (0.055 percent versus 0.046 percent). However, over the ensuing two decades, the pharmaceutical R&D investment gap would widen considerably, such that by 2018, U.S. pharmaceutical companies were investing 5.5 times more in pharmaceutical R&D than were Japanese ones ($74.5 billion compared with $13.5 billion), and about 33 percent more as a share of GDP. Moreover, considering countries’ share of total global pharmaceutical R&D investment, Japan’s fell by half (from 14.1 to 7.3 percent) from 1987 to 2018, while the United States’ share increased by one-quarter, from 30 to 40 percent. (See figure 1.)

Figure 1: Business expenditures on R&D in the pharmaceuticals industry, current PPP (1987–2018)[15]

Scientific Publications and Patents

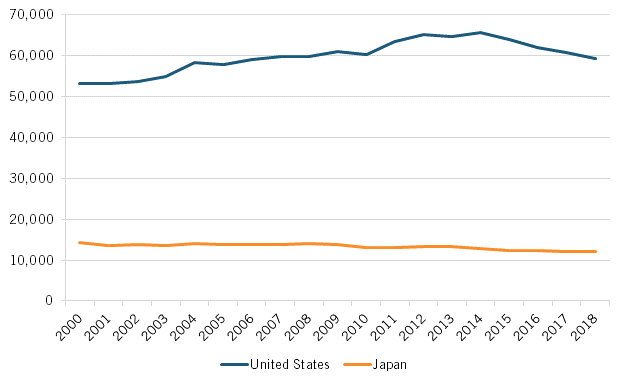

The decline in Japanese pharmaceutical R&D investment in part contributed to declines in Japan’s output of biology and biomedicine scientific publications and biotechnology and biopharmaceutical patent applications, which itself has prefigured Japan’s declining share of global NCE introductions over the past three decades. To wit, from 2000 to 2018, the number of biology and biomedicine scientific publications produced by Japanese researchers fell 16.5 percent, declining from 14,379 to 12,001 publications. In contrast, the extent of such publications from U.S. authors increased by about 10 percent over that period. (See figure 2.)

Figure 2: Number of biology and biomedicine scientific publications, the United States and Japan (2000–2018)[16]

From 2000 to 2018, the number of biology and biomedicine scientific publications produced by Japanese researchers fell 16.5 percent, declining from 14,379 to 12,001 publications.

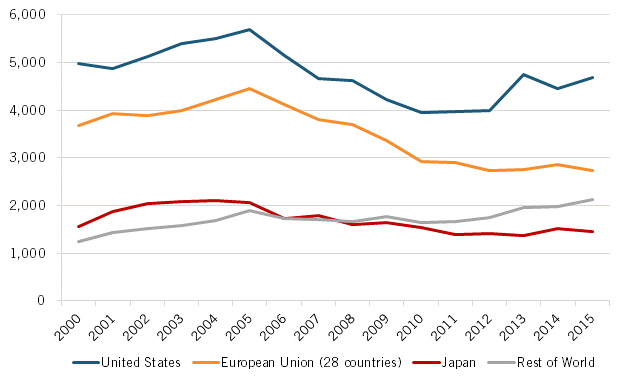

Not surprisingly, Japan’s declining share of biology and biomedicine scientific publications—the starting point for biomedical discovery—translated into fewer patent applications. In fact, from 2000 to 2015, the number of Japanese triadic biotechnology and pharmaceuticals patent applications filed under the Patent Cooperation Treaty (PCT) declined by 7 percent, from 1,565 to 1,460 applications. (See figure 3.)

Figure 3: Number of triadic biotechnology and pharmaceuticals patent applications by priority date, select regions (2000–2015)[17]

From 2000 to 2015, the number of Japanese triadic biotechnology and pharmaceuticals patent applications filed under the Patent Cooperation Treaty (PCT) declined by 7 percent.

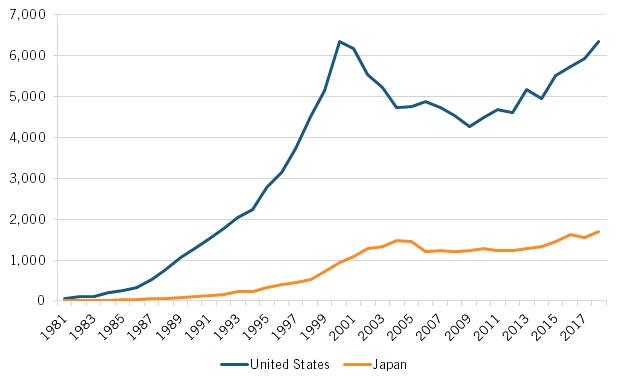

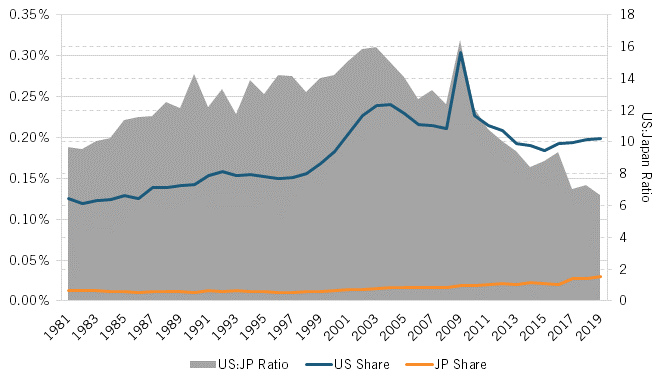

As the basis for life-sciences innovation would increasingly shift from chemistry-based pharmaceuticals to biology-informed biotechnology starting especially in the early 1980s, a wide gap opened between the United States and Japan in their number of biotechnology patents filed under the PCT. While biotechnology patent filings counted under 200 for both nations through 1984, by 1999, American filers were producing 10 times more such applications than were Japanese ones (5,514 versus 521). For the period 1981 to 2018, U.S. applicants filed 4.5 times more total biotechnology patent applications than Japanese applicants did (130,100 versus 28,770). (See figure 4.)

Figure 4: Number of biotechnology patents filed under the PCT (1981–2018)[18]

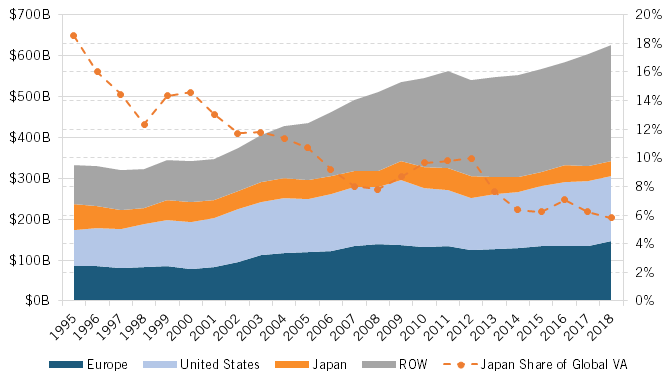

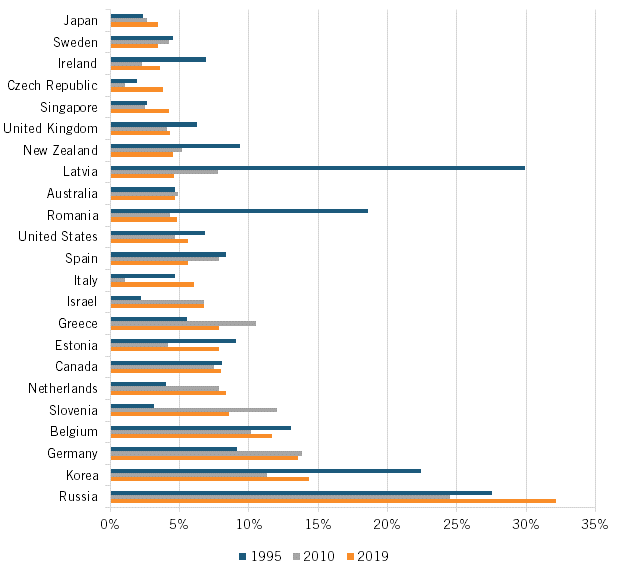

Extent and Share of Global Pharmaceutical Industry Value Added

Bringing all these factors together, it’s unsurprising that Japan’s share of global value added in the pharmaceutical industry declined by 70 percent overall, from 18.5 percent to just 5.5 percent, from 1995 to 2018. (See figure 5.) In fact, in 2015 U.S. dollars, Japan’s global value added in the pharmaceutical industry fell from $61.6 billion in 1995 to $36.5 billion in 2018, a near-41 percent decline over that 23-year period.

Figure 5: Value added in global pharmaceutical industry, in 2015 (1995–2018)[19]

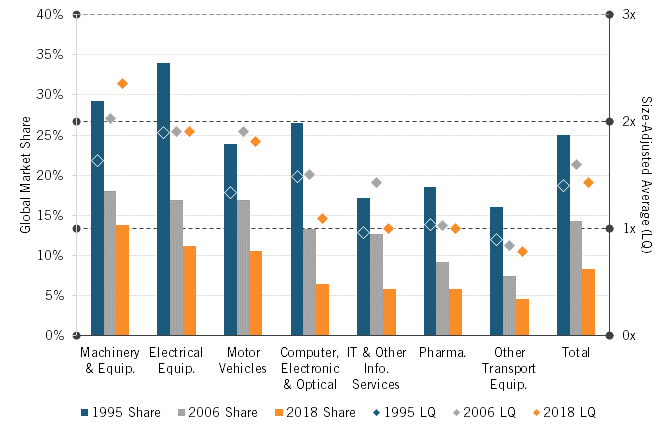

Japan’s global market share in pharmaceuticals has plummeted over the past 25 years, just as it has for most other advanced-technology industries, where Japan has gone from having a quarter of the global market to just 8 percent, an average yearly loss of almost 0.75 percentage points.[20] (See figure 6.) However, it should be noted that this decline appears much more muted when considered relative to the size-adjusted global average (a ratio known as a location quotient). In other words, when controlling for Japan’s dramatically shrinking share of the global economy, the performance of Japan’s pharmaceutical sector looks considerably better. However, the motor vehicle and machinery and equipment sectors both saw growth in their location quotient, whereas the location quotient for Japan’s pharmaceutical industrial fell slightly.

Figure 6: Japan’s market share in advanced-technology industries[21]

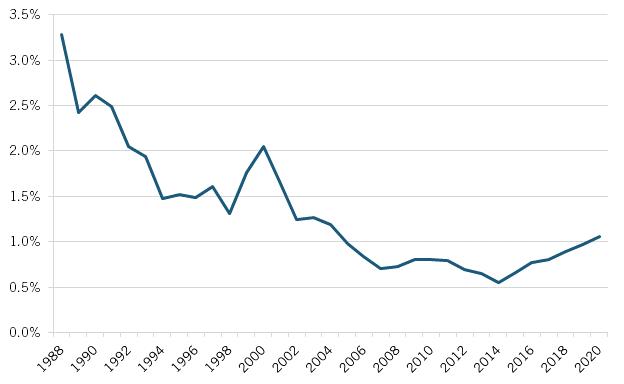

Exports

Nevertheless, while Japan’s biopharmaceutical industry was historically never very export-intensive,—unlike its automotive, consumer electronics, machine tools, and shipbuilding sectors—the country’s trade balances in the sector have considerably worsened over the past two decades, with Japan’s trade deficit in pharmaceuticals growing from $2 billion in 2000 to $21.3 billion by 2019. Moreover, Japan’s share of global exports of pharmaceuticals in 2020 was just one-third its level in the late 1990s. (See figure 7.)

Figure 7: Japan’s share of global exports of pharmaceuticals[22]

Factors and Policies That Cost Japan Its (Bio)Pharmaceutical Industry Competitiveness

A number of policy (and business) factors have contributed to Japan’s loss of (bio)pharmaceuticals industry leadership over the past four decades, but foremost among them was Japan’s introduction of stringent drug price controls starting in the 1980s and continuing into the 1990s and beyond. Other contributing factors included faltering Japanese government investment in biomedical R&D; challenges in achieving internationalization and scale; weak linkages between industry and academia that particularly inhibited Japan’s ability to pivot as the industry shifted more from chemistry to biology as the basis for drug innovation; a weak environment for entrepreneurship, risk taking, and new talent development; and a sclerotic regulatory approval system.

Japan’s share of global value added in the pharmaceutical industry declined by 70 percent, from 18.5 to 5.5 percent, from 1995 to 2018.

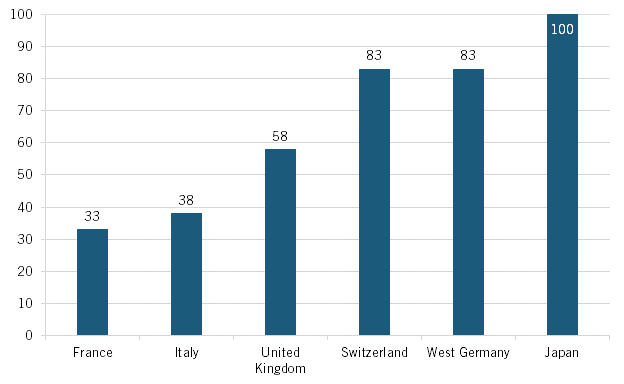

Excessive Drug Price Controls: Starting in the 1980s

For years, limited Japanese drug price controls were actually a key driver for the growth of Japan’s pharmaceutical industry. As Michael Reich wrote, “Price policy for pharmaceuticals has created major incentives for the expansion of the Japanese domestic market.”[23] He elaborated, “Until the 1980s, price cuts in the official tariffs for pharmaceuticals remained rare and minimal. Price policy provided a powerful mechanism to expand the Japanese market for the financial benefit of physicians as well as producers.”[24] For instance, a 1982 study by the UK Office of Health Economics found that Japanese pharmaceutical prices (for a comparative basket of products) were significantly higher than those in Switzerland, West Germany, the United Kingdom, Italy, and France.[25] That study pegged drug prices in Japan in the early 1980s as 17 percent higher than in Switzerland and West Germany, over 40 percent higher than in the United Kingdom, and over 60 percent higher than in France or Italy. (See figure 8.) As Robert Chew, then a health analyst with the UK Office of Health Economics, explained, “The level of [drug] prices in Japan reflects both the strength of the yen and the fact that Japan has consistently supported its home-based industry in order to strengthen its worldwide development.”[26] Reich concluded that “prior to the 1980s generous reimbursement rates in Japan served as an indirect support mechanism for the industry.”[27] This was indeed a strategy Japan applied to a number of advanced industries, where firms could make enough profits to consistently invest more back into R&D and advanced production technologies. It might have been a “tax” on Japanese citizens, but it nevertheless helped Japan’s advanced industries prosper and gain global market share.

Figure 8: Index comparison of pharmaceutical prices in six countries, 1982 (Japan = 100)[28]

But all that started to change in the 1980s as Japan began to introduce pharmaceutical price controls; specifically, Japan introduced biennial price reductions starting in 1981, beginning with a steep, across-the-board reduction of 18.6 percent, followed by biennial price cuts thereafter.[29] In 1982, Japan also ended free health care coverage for elderly citizens, with the two policies combining to reduce growth of production volumes of Japanese pharmaceuticals from a 5.2 percent average year on year in the 1970s to 3.8 percent in the 1980s. Moreover, as Maki Umemura (now a Cardiff University business professor) wrote, “The biennial price reductions had a particularly severe impact on Japanese pharmaceutical firms’ incentives to invest in R&D.”[30] That’s because Japan’s severe price controls not only limited the potential profits from biopharmaceutical innovation (thus decreasing the incentive to invest), but they also limited drug company revenues (thus decreasing the ability to invest). In fact, Umemura found that drug prices in Japan decreased by 67.9 percent in the decade from 1981 to 1991 alone.[31] And when one overlays these drug price reductions with Japan’s decreasing share of global new drug introductions, the general trend is unmistakable. (See figure 9.)

As Umemura elaborated:

Drug prices were revised uniformly on a regular basis—regardless of innovative value—throughout the patent protection period. These reductions incentivized Japanese firms to launch a stream of new drugs with short product life and little innovative value that could recoup the costs of R&D, rather than invest in more substantial innovation. While the industry did intensify its R&D orientation, most firms invested less than many American and European firms. This hindered the industry’s prospects of launching breakthrough drugs that would have been more competitive overseas.[32]

Figure 9: Impact of Japanese drug price reductions, 1980s–2010s[33]

Heather O’Neill and Lena Crain discussed these dynamics in their 2005 report, “The Effects of Price Regulation on Pharmaceutical R&D and Innovation,” writing:

Japan’s government sets prices of new drugs based on older comparator drugs. Recently, price premiums have been permitted on truly innovative drugs, but even with the premiums in place the introductory price is not higher than that of older drugs. Following a drug launch, the government decreases the price as the product matures; the highest price ever received is the first one. Prices fall by as much as two-thirds from the original price within ten years. The low introductory prices, coupled with no inflationary price increases, discourage new product development.[34]

O’Neill and Crain developed an econometric model to assess the impact of Japanese drug price regulations on Japanese pharmaceutical innovation. The authors concluded that “the regulations [here meaning regulatory price controls] in Japan create an environment that is not conducive to innovation.”[35] Their model finds that, controlling for R&D employment and time, Japan approved 7.5 fewer NCEs than the United States did on average in a given year during the years from 1980 to 2002.[36]

Japan’s severe profit controls not only limited the potential profits from biopharmaceutical innovation (thus decreasing the incentive to invest), but they further limited drug company revenues (thus decreasing the ability to invest).

A 2004 Organization for Economic Cooperation and Development (OECD) report on Japan’s biotechnology innovation system concurs with this analysis, explaining:

It is also important to note that drug prices under the current health care insurance scheme are determined not by competition, but by the drug price standard [DPS], impeding fair market competition, and to note that the historical absence of incentives for clinical organizations—users of pharmaceuticals—to make daring applications of innovative drugs, weakening the drug makers’ motivation to seek innovative drugs in the first place.[37]

As Umemura concluded, “As Japanese pharmaceutical firms were not able to profit from free market prices for pharmaceutical innovation, many firms preferred to minimize their investments in R&D ... [Moreover] the capping of drug prices not only resulted in smaller profits, but also limited the ability of firms to pursue riskier, costly, or sophisticated investments in R&D.”[38]

Put simply, she wrote, “The government’s policy of containing drug prices undermined the ability and willingness of firms to make substantial investments in R&D. The potential profits of developing a new drug in Japan were much smaller than in the United States, for example, where there were no price restrictions of drugs.”[39]

In summary, it certainly appears that Japan’s introduction of stringent drug price controls in the 1980s and then continuing through subsequent decades played a significant role in depriving the industry of profits needed to invest in R&D toward future generations of innovative drugs—and this began to resonate as the number of NCEs introduced by Japanese-headquartered enterprises faltered in subsequent decades. That Japan’s pharmaceutical industry reached its zenith in the 1980s (in terms of new NCEs and global share thereof, at least), even as price controls started to take effect in the early 1980s, likely shows the pipeline effect. As drugs can take a decade or more to develop, many of the drugs introduced in the 1980s likely trace their provenance to years earlier, thereby explaining this apparent discrepancy. Indeed, the effect of price controls on drug innovation becomes more visible over time and apparent in downstream years.

Adjusting Drug Price Controls: Experiences in the 2010s

Recognizing that its pharmaceutical sector was faltering, in 2010, Japan introduced a pilot program called the Price Maintenance Premium (PMP) system with the goal of creating a stable and reliable pricing environment for life-sciences innovators.[40] Known in Japan as the “Reward Premiums for the Promotion of Innovative Drug Discovery and the Resolution of Off-Label Use Issues, Etc.,” its intent was “to encourage the research and development of innovative drugs in Japan” by “enabling pharmaceutical companies to recover the development cost before the launch of generics and reinvest that in new research and development.”[41] The PMP was initially viewed “as a critical factor in promoting innovation in Japan, eliminating the drug lag, ensuring that Japanese patients had access to timely medicines, and ensuring that U.S. and other innovative [biopharmaceutical] products were appropriately valued.”[42]

The PMP, which was introduced as a two-year pilot project in 2010 (and was renewed in 2012, 2014, and 2016), helped to promote life-sciences innovation, reduce Japan’s drug approval lag, and helped ensure that innovative life-sciences products were appropriately valued.[43] Analyzing the reward system in a 2016 study, Shibata et al. found that it was especially impactful in supporting innovative drugs treating nervous system disease and “antineoplastic and immunomodulating agents” and that overall “the reward system works well and should be continued in order to encourage pharmaceutical companies in Japan to conduct more clinical trials, thereby delivering more innovative drugs.”[44]

However, over the course of the 2010s, the scope and power of the PMP to support innovation began to wane considerably. In particular, in December 2017, Japan’s Ministry of Health, Labor, and Welfare introduced reforms that dramatically reduced the number of patented medicines that were recognized as “innovative” for the purpose of qualifying for the PMP.[45] Beyond making it more difficult to qualify for the PMP, in 2018, Japan’s government cut prices for several leading innovative medicines that were subject to an ongoing health technology assessment (HTA) cost-effectiveness pilot program, reducing the price premium granted at launch for innovativeness and clinical benefit (based on a cost-effectiveness threshold of 5 million yen per quality-adjusted life year [approximately $36,500 per year]).[46] Japan’s efforts to control drug prices took another step in April 2021, when the government announced that annual price cuts would be applied to all medicines with more than a 5 percent difference (yakkasa) between the government reimbursement price and the surveyed wholesaler price to purchasers (e.g., hospitals, clinics, and retail pharmacies). It’s estimated that for 2020 such price cuts would have been applicable to 69 percent of all medicines (and 59 percent of patented medicines), and for 2021, the reduction in biopharmaceutical expenditures generated by these price cuts equaled 430 billion yen ($3.1 billion).[47] In total, over the past several years, Japan has implemented more than 50 drug price-cutting mechanisms.[48]

In other words, whereas the drug pricing environment in Japan appeared to improve in the early part of the prior decade, it has significantly deteriorated since. In fact, according to data provided by the Pharmaceutical Research & Manufacturers of America, it’s estimated that Japan’s drug price revisions since 2017 may have already cut drug prices by nearly 20 percent.[49]

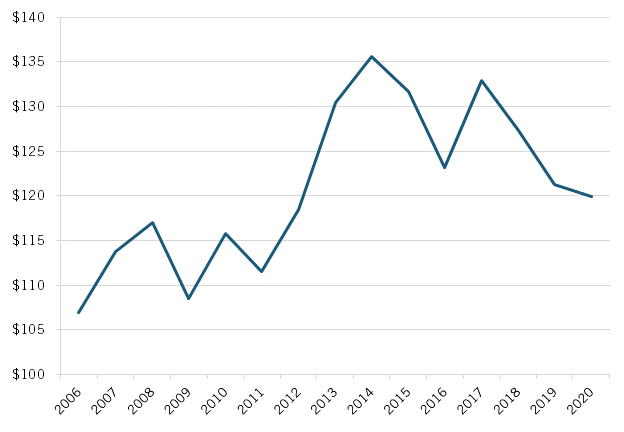

Moreover, there appears to be some evidence that Japan’s shifting drug pricing policies over the past decade may have had a positive—and then deleterious—impact on the sector’s competitiveness. For instance, from 2010 to 2017, Japan’s biopharmaceutical industry grew 14.7 percent, from $115 billion to $132 billion, but since 2017, it contracted by 10 percent. (See figure 10.) Further, from 2009 to 2015, Japan’s 22 percent growth in biopharmaceutical industry actually exceeded the global average of 16 percent.

Figure 10: Sales of Japan’s biopharmaceutical industry, $USD billions, 2006–2020[50]

![]()

![]()

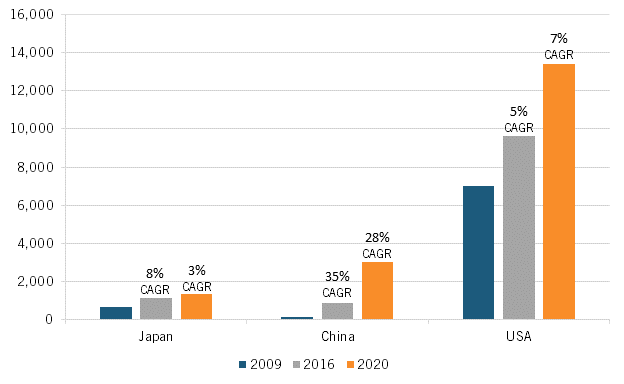

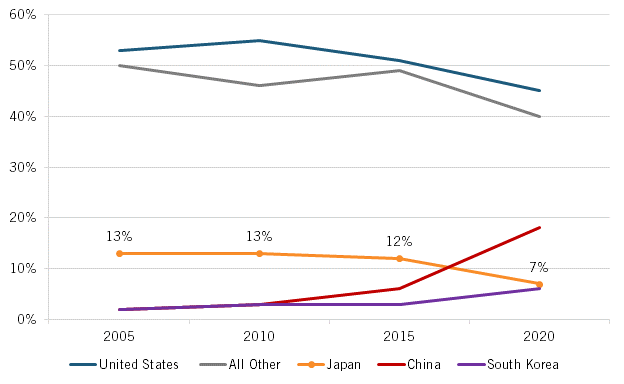

Similarly, Japan experienced a notable uptick in clinical trial activity and new drugs under development from 2009 to 2016, specifically an 8 percent compound annual growth rate (CAGR) over this time (which actually surpassed America’s 5 percent CAGR during this period), although this growth rate slowed to just 3 percent after 2016, less than half America’s growth rate, with both countries being far outpaced by faster growth rates in China. (See figure 11.) Moreover, while Japan’s share of global new oncology drugs under development remained roughly consistent at 12 to 13 percent from 2005 to 2015, this share cratered to 7 percent by 2020. (See figure 12.)

Figure 11: Number of medicines in development across all clinical trial phases in Japan, China, and the United States[51]

Figure 12: Country share of new oncology drugs under development, 2005–2020[52]

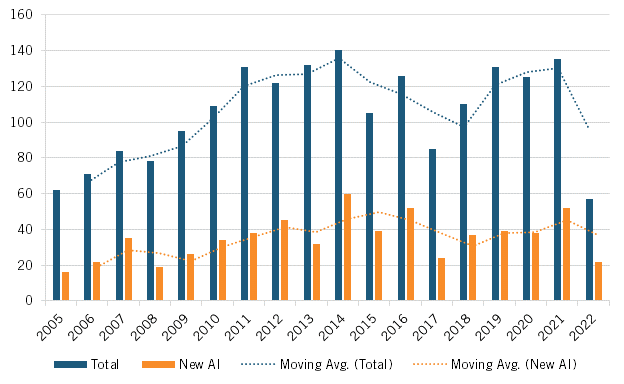

The number of new drugs approved in Japan during the first half of the 2010s involving a novel active ingredient also increased, suggesting companies were introducing more innovative drugs during that time. From 2005 to 2009, Japan approved on average 23.6 new drugs per year involving an active ingredient. From 2010 to 2016, this level increased to 40.5 new drugs per year involving active ingredients (meaning they were more-innovative drugs, as they involved a new or novel molecular compound), before falling back to 37.6 such new drugs from 2017 through 2022, suggesting that the PMP did have some effect in stimulating the development of more innovative drugs in Japan while its provisions were largely in effect. (See figure 13.)

Figure 13: New drugs approved in Japan, with new active ingredients and total, 2005–2022[53]

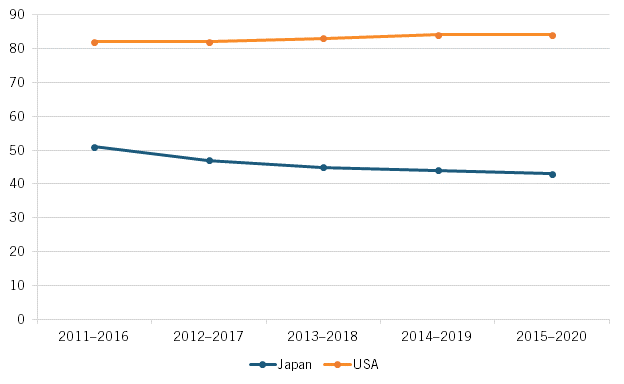

Lastly, the more-stringent drug pricing policies after 2017 may have contributed to a reaccelerating drug introduction lag between Japan and the United States, with the share of the percentage of prior five years’ worth of global new drugs available in Japan falling from 51 to 43 percent in the latter half of the previous decade. (See figure 14).

Figure 14: Percentage of prior five years of global new medicines available in Japan vs. the United States, 2011–2020[54]

As Shibata et al., concluded in their report, “Evaluating the Effectiveness of Repricing for Market Expansion in the Japanese Drug Pricing System”:

Compared with other developed nations, pharmaceutical companies in Japan have a lower incentive to launch drugs, mainly due to unique regulatory requirements for additional clinal trials, reduced prices for new drugs, and regular price reductions.… From this perspective, for Japan to become more competitive internationally in regard to the continuous development of innovative drugs that meet patient needs, a pricing system that enables pharmaceutical companies to adequately invest in clinical trials and deliver new drugs to the Japanese market needs to be established.… Unfortunately, our analysis suggests that the contradictions in the repricing and rewards systems in Japan have resulted in drug prices that do not reflect the true value of innovative drugs.[55]

However, as the following sections show, drug price controls aren’t the only factors that have contributed to a relative weakening of Japan’s (bio)pharmaceutical industry over the past four decades.

Faltering Government R&D Investment and Incentive Support

Japan’s government has long provided funding for biotechnology research; however, over time, these levels stagnated and, moreover, were never at the level of competitors such as the United States (whether considered as a share of GDP or in absolute dollars). As Umemura wrote, in the 1980s, “government agencies such as the Science and Technology Agency (STA), MITI, and the Ministry of Agriculture, Forest, and Fisheries provided funding for biotechnology research projects … but such funding [in absolute dollars] only amounted to one-tenth of U.S. levels.”[56]

OECD provides data on countries’ investments in health R&D as a share of total government-funded R&D. On this measure, Japan has consistently trailed peers since the 1980s, with the gap only continuing to widen over time. Japan’s share of health R&D as a percentage of all government-funded R&D increased, at best, modestly from 2.6 percent in 1998 to 4 percent in 2020, whereas in America it more than doubled from 12 to 27 percent. (See figure 15.)

Figure 15: Government R&D investment in health, as a share of GDP[57]

Indeed, as Umemura wrote (citing a Nature article by Leland Gershell and Joshua Atkins), between parsimonious federal R&D and constrained company R&D budgets, “The limited ability to invest in research technologies such as genomics, combinatorial chemistry, and high-throughput screening placed firms in Japan at further [competitive] disadvantage.”[58] As the Economist Intelligence Unit affirmed the link between stagnating Japanese R&D investment and reduced innovation, “The declining volume of Japanese life-sciences output is consistent with commonly perceived stagnation over the last 10 years in the wake of lower government investment in basic research.”[59]

In large part due to drug price controls, Japan approved 7.5 fewer NCEs than the United States did on average in a given year from 1980 to 2002.

And those trends have generally continued: While Japan did increase its R&D tax incentive generosity in the late 1990s, Japan’s R&D tax incentives have long been, at best, middling by OECD standards. To wit, a 2020 Information Technology and Innovation Foundation (ITIF) study ranks Japan 17th out of 34 comparable OECD and BRICS (Brazil, Russia, India, China and South Africa) countries in terms of tax-incentive generosity.[60]

Challenges With Internationalization and Achieving Scale

Japan’s pharmaceutical industry presents an interesting case because, while Japanese firms in many tech-based industries from automobiles and consumer electronics to information technology (IT) were able to successfully internationalize, export, and scale globally, those dynamics never came easily to Japan’s pharmaceutical industry. As Umemura observed, “Adopting an international orientation did not occur naturally to Japanese firms.” She traced this to the “historical origins” of Japan’s pharmaceutical business which “lay in the import business” and which “has always been domestically oriented, with relatively low levels of exports” as opposed to, for instance, “German pharmaceutical firms that were export oriented from a very early stage.”[61]

Relatively low levels of Japanese pharmaceutical exports have historically been a consistent feature of its industry. As Reich wrote in his 1990 report, “An International comparison shows Japan’s ratio of pharmaceutical exports to total production as significantly below that of other industrialized countries … [Moreover, Japan’s pharmaceutical] industry’s ratio of exports to production remains low, compared to the ratio for other Japanese industrial sectors.”[62] In fact, Japan’s ratio of exports to production of pharmaceuticals was virtually unchanged from 1955 to 1985, at about 3 percent. While this level would increase somewhat over the ensuing two decades, even by 2019 Japan exported just 11 percent of its pharmaceutical production, worth $6.7 billion, with the country the year prior accounting for only 0.93 percent of global pharmaceutical exports, ranking it 18th internationally.[63]

In addition to the historical origins of Japan’s industry cited by Umemura, Reich cited four additional factors for Japan’s low levels of drug exports. First, he noted that Japan’s health policy “created powerful incentives for a rapid expansion of the domestic pharmaceutical market in the 1960s and 1970s, thereby reducing the incentive for firms to look overseas for sales.” Second, this was complemented by post-War Japanese industrial policies that shielded domestic companies from foreign competitors across a range of industries, from autos and film to drugs and semiconductors. Indeed, until 1975, foreign pharmaceutical firms were explicitly prohibited from establishing wholly owned subsidiaries in Japan. Third, “Japanese firms had a lack of ethical drugs [i.e., drugs only available legally with a doctor’s prescription or consent] that were internationally competitive, due to a combination of government policy and corporate strategy.” Finally, idiosyncratic regulatory policies such as permitting impeded Japanese exports.[64]

Astute readers will note that Reich here effectively described the “Galapagos Island” syndrome that would especially harm Japanese telecommunications and mobile phone players in the 2000s: when products, services, or technologies develop with a focus on a single market or culture.[65] In other words, policies such as unique technical standards or market-entry limitations shielding domestic companies from international competition, or removing enticements to participate in international markets, can yield the development of firms that thrive domestically but aren’t internationally competitive. Such entities can only continue to thrive so long as domestic markets can wholly sustain them, especially as the industry evolves into one in which much more capital and research is required for new drug development.

And as Umemura noted, that dynamic began to negatively impact Japanese pharmaceutical players, particularly with regard to the need to achieve scale through access to global markets that could provide needed revenues as the cost of drug discovery soared throughout the 1990s and into the 2000s. In fact, of the 1,123 Japanese pharmaceutical firms in 2000, only 245 had expanded abroad.[66] This aggravated an already-existing industry dynamic in Japan, where “Japanese firms had historically been much smaller than European or America ones.”[67] For instance, in 1995, the United Kingdom had 7 leading pharmaceutical companies, while the Japanese industry had 20.[68] Toward the end of the 1980s, U.S. pressure on Japan to open its market combined with the harmonization of pharmaceutical regulations to significantly increase foreign entry into the Japanese market. But Japanese firms weren’t able to internationalize as effectively to achieve needed scale. For instance, in 1999, only one-eighth of NCEs launched by Japanese firms became international, compared with about one-third among European and U.S. firms.[69] As Umemura concluded, at the turn of the millennium, “Japan’s pharmaceutical industry had [become] a highly successful domestic industry” but “Japan did not make the transition into a globally competitive pharmaceutical industry.”[70]

As McKinsey & Company wrote in a 2018 report, some Japanese pharmaceutical enterprises’ challenges regarding internationalization persist to this day. As the article explains, “Japanese affiliates have historically been less modern and profitable than their more-developed global peers, especially those in Europe. Japanese companies, which have not developed similar capabilities in overseas markets, are struggling even more—having to develop new capabilities and overcome significant internal resistance to change.”[71]

The lesson here for other nations is that internationalization, especially drug exports, is critical to maintaining domestic competitiveness. This is one reason the push by most “drug populists” for compulsory licensing in developing countries is so harmful.

Weak Industry-University Linkages

One recurrent theme over the past several decades has been the weak state of Japan’s industry-university linkages, which have inhibited biomedical innovation. As Sean Connell wrote for a 2018 National Bureau of Asian Research report on Japan’s innovation system, “Collaboration between universities, research institutions, and the private sector in Japan is limited.”[72] Toshio Fujimoto of Takeda Pharmaceutical further explained that “the opportunity to change careers between sectors (academia-industry-public-venture capital) is very limited in Japan.��[73] Weak government funding for biomedical research, inadequate translational research capacity, and weak linkages between universities and risk-capital communities have all contributed to this dynamic.

As Kazuyuki Motohashi wrote in an OECD report exploring Japan’s national biopharmaceutical innovation system, “The Japanese innovation system is seemingly characterized by the ‘in-house development principle’ mainly adopted for innovations in larger companies, and differs distinctly from the network-type innovation system found in the United States, which tends to involve venture companies and universities as well.”[74] Challenges Motohashi cited here include “the low mobility of researchers in companies and universities, the short supply of venture capital for start-up companies, the tendency of universities to focus on basic research and to be unenthusiastic about industry-university cooperation, and a corporate climate in which in-house development is highly valued and strategies of alliances disregarded.”[75]

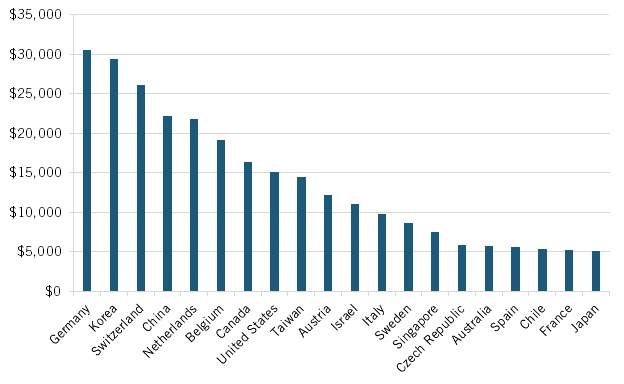

Indeed, weak industry-university linkages have long been a challenge for Japan’s broader innovation system. For instance, Japan significantly lags behind international peers in average industry funding per academic worker, with an average level of just $5,125, about one-sixth the approximately $30,000 amount it is for leaders Germany and South Korea. (See figure 16.) This dynamic is also visible in Japan’s very weak university share of corporate R&D funding, which stood at only 2.8 percent in 2019, well below the 14.3 and 13.6 percent levels of peers in South Korea and Germany, respectively. (See figure 17.) Indeed, Japan has long trailed the United States in industry-university R&D investment levels as a share of GDP, with the United States on average investing 1.75 times Japan’s amount over the period from 1981 to 2019. (See figure 18.)

Figure 16: Average industry funding per academic researcher (2019, or latest year available)[76]

Japan significantly lags behind international peers in average industry funding per academic worker, with an average level of just $5,125, about one-sixth the approximately $30,000 amount it is for leaders Germany and South Korea.

Figure 17: University R&D funded by business enterprises, as share of total university R&D, 1995–2019[77]

Japan’s university share of corporate R&D funding stood at only 2.8 percent in 2019, well below the 14.3 and 13.6 percent levels of peers in South Korea and Germany, respectively.

Figure 18: Industry-university R&D investment, as a share of GDP, 1981–2019[78]

This lack of industry-academic interconnectedness has posed a challenge not only for Japan’s innovation economy broadly, but also its life-sciences innovation ecosystem specifically, and especially as innovation in the sector became increasingly biotechnology-based in the 2000s. As Motohashi noted in his 2004 OECD report, “Japanese drug makers … are attempting to keep pace with changes in pharmaceutical R&D processes associated with progress in biotechnology. However, this move is believed to lag significantly behind those of pharmaceutical companies in the U.S., U.K., and Switzerland.”[79] And as Umemura noted, “Because R&D in Japan was conducted [largely] by academic laboratories, the research was not as responsive to industry conditions.”[80]

Cantwell and Edris expanded on this dynamic in their report “Evolution of the Location of Innovation in the International Pharmaceutical Industry,” writing that “locational technological specification evolves with location specific expertise in the life sciences, university commitment to these fields, and the openness and quality of scientific systems … we contend that the locations with greater industry-university interactions will become more attractive.”[81] The authors developed a revealed technological advantage (RTA) index, which is a proxy for technological specialization, defined as a country’s share of patents in the pharmaceutical technology field divided by the country’s share in all patent fields. The index’s intent is to provide an indication of 19 countries’ relative position as sources of pharmaceutical innovation over time, specifically from 1976 to 2015.[82] The authors found that “Japan has been losing specialization in this field” and that “the decline in Japan’s RTA in the pharmaceutical field may reflect its comparative weakness in the life sciences.”[83] The authors noted that “the ability to exploit university science, and make use of boundary-spanning relations, was correlated with [biopharmaceutical] technological productivity.”[84] Overall, the paper suggests that, as the source of life-sciences innovation has moved more from chemistry to molecular biology, weaker industry-university linkages left countries such as Japan and Germany less prepared than the United States for this shift.

In reality, Japan has long recognized this challenge. To its credit, in 1998, the country introduced the Law for Promotion of University-Industry Technology Transfer, which supports the launch of technology-licensing offices at universities and other public research institutions.[85] Moreover, the following year, Japan introduced its version of the United States’ critically instrumental Bayh-Dole Act, which permits universities ownership of intellectual property stemming from federally funded research.[86] In 2000, Japan’s Industrial Technology Enhancement Act made further refinements, including allowing university faculty members to also become corporate officers. And in 2004, Japan’s national universities acquired the status of national university corporations, which afforded them increased autonomy and encouraged revenue generation through industry cooperation and entrepreneurship.[87] As was America’s experience with the Bayh-Dole Act, which turbocharged American universities as engines of innovation, Japan’s legislation spurred the development of technology transfer capacities at Japanese universities. A survey by the University Network for Innovation and Technology Transfer (UNITT) finds that, by 2016, Japanese universities, research institutes, and technology licensing offices had hired about 1,000 specialists in tech transfer, joint research, and venture support. That year alone saw more than 6,000 patent filings and close to 3,000 licensing agreements, while over the previous decade, Japanese university income from royalties had tripled.[88]

As the source of life-sciences innovation has moved more from chemistry to molecular biology, weaker industry-university linkages left countries such as Japan and Germany less prepared than the United States for this shift.

To further empower Japan’s universities to become greater contributors to the country’s innovation system, in November 2021, Japan announced the establishment of an $88 billion “University Fund” that will provide public money to major research universities to accelerate and enhance R&D and increase technology transfer to the commercial sector.[89]

But while Japan has certainly improved its policy environment supporting industry-university collaborations, more significant institutional, organizational, and cultural challenges continue to impede such exchanges. Indeed, Hiroaki Suga, a chemist at the University of Tokyo who co-founded the $5 billion biotech start-up PeptiDream, explained that “a large part of the problem is the old-fashioned view among professors that commercialization efforts will taint the quality of their academic work … Researchers engaged in industrial applications are less respected than those involved in basic science.”[90]

Stagnant Entrepreneurship and Partnering in Japan’s Bioeconomy

Closely related to, yet slightly distinct from, the issue of anemic industry-university linkages stands Japan’s weak environment for entrepreneurship, start-up formation, and risk taking, again both across the broader economy and with regard to the life-sciences sector in particular. For instance, innovative start-ups are a critical part of America’s biotechnology ecosystem, representing a key source of technologies, novel molecules, and expertise. In fact, start-ups account for 66 percent of U.S. biopharmaceutical enterprises.[91] Moreover, these start-ups, 90 percent of which are prerevenue, account for 70 percent of drugs currently in Phase III clinical trials in the United States.[92] Innnovative start-ups represent a critical contributor of dynamism to a country’s life-sciences industry. This has become more so as the industry has evolved to large-molucule biotech-based drugs, where a signifiant share of innovation comes from university spin-offs and entrepreneurial start-ups. In other words, in the chemical (i.e., pharmaceutical) era, larger firms could produce most of the innovation. But Japan’s life-sciences innovation system hasn’t proven to be as well suited for the biotech era, when nimbler start-ups have produced much of the innovation (though certainly several of Japan’s larger life-sciences firms have indeed adapted ably to the modern biopharmaceutical era).

However, as the National Bureau of Asian Research wrote, “Japan is largely perceived as a challenging place for entrepreneurs to launch successful businesses.”[93] Of course, these issues are connected, with just 3.9 percent of new university-developed technologies in Japan being licensed to start-ups each year, well below the 17.1 percent rate of the United States.[94] This means Japan’s universities aren’t producing the feedstock to support biopharmaceutical innovation.

Japan’s weak entrepreneurial environment means virtually all life-sciences innovations come from established players, depriving of the nation a pipeline of disruptive innovators, especially in biotech-based drugs. This stands in stark contrast to the United States, where, as noted, start-up biopharmaceutical companies represent a vitally important part of the ecosystem. Indeed, ITIF research finds that start-ups account for 66 percent of U.S. biopharmaceutical enterprises, contribute 12 percent of employment, have an average R&D intensity rate of 62 percent, and have a 60 percent five-year survival rate.[95]

Just 3.9 percent of new university-developed technologies in Japan get licensed to start-ups each year, well below the 17.1 percent rate of the United States.

Consider that across 2018 and 2019, U.S.-headquartered companies produced 60 of the 109 new drugs approved by FDA, six times as many as the 10 drugs Japanese companies produced. Moreover, while about two-thirds of those were produced by biotech innovators, all of Japan’s came from large, established firms. As the Economist Intelligence Unit noted, “Insofar as start-ups can be a driver of innovation, this does not appear to be occurring to any great degree in Japan’s pharmaceutical industry.”[96] As the authors elaborated, the average deal value (early stage to exit) for U.S. life-sciences companies is $30 million (and for South Korean ones, $10 million), while it’s just $917,000 for Japanese ones, which “may well reflect Japan’s traditionally risk averse business environment [which is] likely compounded by challenges around co-location of academia and industry and technology transfer.”[97]

Japanese biopharmaceutical entrepreneurship is also hamstrung by the relative lack of venture capital. In 2020, venture capitalists invested $543 million of biotech/pharma in Japan (although this was a 67 percent increase from the $324 million available in 2016), with 31 new biotech start-ups founded in 2018.[98] Still, those levels pale in comparison to the $36.6 billion invested in biopharma venture capital in the United States in 2020 or the $32.9 billion invested in 2021.[99] Beyond this, per the OECD, “In Japan, venture capital tends to flow to more mature firms, in part reflecting limited merger and acquisition activity as an exit strategy for companies.”[100] In other words, not enough venture capital is flowing to potentially innovative Japanese biotech start-ups.

In his 2004 OECD report, Motohashi observed the afore-mentioned Japanese “in-house development principle” for pharmaceuticals. Another manifestation of that dynamic isn’t just limited entrepreneurship, but limited partnership. As a McKinsey & Company study finds, “Organizations that partner with external players in the development of new drugs have more than twice the success rate of those that go it alone.”[101] The McKinsey authors noted that European and U.S. pharmaceutical companies have been more actively engaging with outside partners in cultivating their innovation ecosystems, but Japanese firms have lagged in this regard: “Compared to overseas rivals, Japanese pharma companies have out-licensed fewer assets to biotech companies, with only three such deals recorded between 2009 and 2018, in contrast to more than 30 in Europe and more than 100 in the U.S.”[102]

Regulatory Delays

Another consistent challenge facing the global pharmaceutical industry, and Japan’s in particular, is regulatory delays. Japan’s regulatory system for the approval of new drugs has long lagged behind that of America and Europe. The challenge traces to a 1990s scandal pertaining to Japanese hemophiliacs who contracted HIV from the circulation of improperly treated blood products at a firm, Green Cross Corporation, well-staffed with retired bureaucrats from Japan’s Ministry of Health and Welfare (MHW, now called the Ministry of Health, Labor, and Welfare).[103] Legal filings suggested the then-MHW delayed the introduction of properly designed, heat-treated blood products from foreign rivals to allow Green Cross to catch up with its international competitors.

By 2000, the average drug approval time in Japan was nearly 60 percent longer than in the United States: 28.5 months versus 16.5 months.

Umemura explained that “the Japanese drug lag since the 1990s originates from this scandal, which left the MWH much more cautious and tentative in the drug approval process.”[104] This became “a major source of contention for firms seeking to introduce new drugs swiftly into the market” and “for many firms [made] R&D investment in Japan become less attractive.”[105] By 2000, the average drug approval time in Japan was nearly 60 percent longer than in the United States, 28.5 months compared with 16.5 months.[106] This gap has continued. In 2010, Tsuji and Tsutani examined 65 new biopharmaceutical drugs submitted for approval across Europe, Japan, and the United States from 1999 to 2006. They found first that more of these drugs were approved in the United States than in the other regions, with 59 (90.8 percent) approved in America, 52 (80 percent) approved in Europe, and just 22 (33.8 percent) approved in Japan. More importantly, they found that the mean approval lag was 3.7 months in the United States and 7.5 months in the European Union, but 52.6 months in Japan.[107] An October 2020 study of 400 new drugs approved in Japan from 2008 to 2019 finds that just 20 percent of those drugs were introduced first in Japan, with 50.5 percent and 20.5 percent introduced first in America and Europe, respectively. The report concluded that while Japan’s “drug lag has been greatly decreased, it still exists” with “substantial drug lag remain[ing] in neurology, psychiatry, and therapeutic areas where the number of new drug approvals was relatively small.”[108]

One reason for drug approval delays in Japan has historically been the higher cost and longer duration of clinical trials in the country as compared with the United States or Europe, which has been attributed to factors including the dispersion of clinical trials across multiple hospitals, more rigorous clinical trial standards, and the lack of qualified personnel to make safety and efficacy determinations.[109]

In this regard, the United States has certainly out-innovated Japan in the regulatory medicines space. In large part thanks to the ingenious series of Prescription Drug User Fee Acts (PDUFAs), which allow America’s FDA to collect user fees from industry, the median FDA review time for drug submissions decreased from 29 months in 1987 to under 10 months by 2015.[110] Moreover, the PDUFAs provide application-fee waivers and advanced reviews for medicines that can treat rare diseases, as well as prioritize the development of breakthrough medicines for patients with life-threatening diseases. Japan has failed to keep pace in innovating its regulatory system for the approval of new drugs.

Lack of Policy Coherence

Lastly, a continuing challenge for Japan has been its inability to articulate a consistent vision for supporting the competitiveness of its biopharmaceuticals industry. In particular, Japan’s Ministry of Finance has focused intensively on health system cost management against the backdrop of a rapidly aging society, especially through aggressive drug price controls. For instance, over 80 percent of the 440 billion yen ($3.2 billion) reduction Japan targeted for social security expenditures for the years 2016 to 2018 was to be raised by drug price reductions.[111]

Unfortunately, trying to address Social Security costs primarily through drug price reductions represents an unsustainable approach that fails to fully contemplate the value innovative drugs can provide to managing such costs. Indeed, drugs regulary produce health system value well above their cost. For instance, Columbia University professor Frank Lichtenberg found that, from 1997 to 2010 in the United States, “the value of reductions in work loss days and hospital admissions attributable to pharmaceutical innovation was three times larger than the cost of new drugs consumed.”[112] Elsewhere, he found that the mean number of lost workdays, lost school days, and hospital admissions declined more rapidly among medical conditions with larger increases in the mean number of new (post-1990) prescription drugs consumed.[113] He further discovered that “the use of newer prescription drugs also reduced the ratio of the number of workers receiving Social Security Disability Insurance benefits to the working-age population, and has had a positive effect on nursing home residents’ ability to perform activities of daily living.”[114] Updating this work in October 2021, Lichtenberg estimated the value in 2015 of the reductions in disability, Social Security recipiency, and use of medical care attributable to previous biopharmaceutical innovation. That value, estimated at $115 billion annually, stood fairly close to 2015 expenditures of $127 billion on drug classes that were first approved by FDA during the period of 1989 to 2006.[115]

Moreover, this approach has militated against efforts by other Japanese government agencies to support research, innovation, and the industry’s global competitiveness. As Umemura noted, Japan’s “lack of an explicit industrial policy for the pharmaceutical sector meant that government policies tended to be reactive, ad-hoc, and short-sighted.”[116] She concluded, with an admonition regarding the importance of countries developing comprehensive strategies to support the competitiveness of their biopharmaceutical industries, “An earlier implementation of comprehensive, long-term strategies and strong legislation to strengthen the industry would likely have facilitated the development of a more research-intensive and global pharmaceutical industry well before the 1990s.”[117]

But such contradictions persist to this day in Japan’s public health versus industrial competitiveness policies. As the Economist Intelligence Unit observed, Japan’s government “has sent mixed messages to the market about innovation over the last decade. The size of the pharmaceutical market is currently an asset for innovation [but] the Japanese government has continued to keep prices down via more frequent price reviews.”[118]

Japan’s Biopharmaceuticals Policy Today

As noted previously, recognizing that its pharmaceutical sector was faltering, in 2010, Japan introduced its PMP pricing system with the goal of creating a stable and reliable pricing environment for life-sciences innovators—and the approach initially delivering positive results. Japan’s government built on this effort in 2014 when it introduced the “Sakigake strategy,” which sought to accelerate drug and device approvals, cut review times, and stimulate innovation. (Sakigake translates to “charge ahead.”) Legislatively, these changes were enacted through the Pharmaceutical and Medical Devices Act.[119] The Sakigake strategy sought to increase Japan’s output of innovative medical products by supporting R&D; streamlining the pharmaceutical, medical device, and regenerative medicine approval processes; and expediting pricing and national health reimbursement decisions.[120]

In 2015, the country took another step by introducing its “Japan Vision: Health Care 2035: Leading the World Through Health,” a long-term policy vision from the health ministry.[121] The strategy focuses on three prongs: the first on increasing longevity and quality of life for Japan’s rapidly aging society; the second on improving the country’s biotech and IT ecosystem, in particular leveraging health care IT such as telemedicine and using AI for medical data analysis; and the third on advancing innovation in specific areas associated with aging, including regenerative medicine, diabetes, and dementia.[122] Other priorities in the strategy included developing a national platform to support clinical trials, further speeding up drug approval timelines, and introducing incentives that promote the development of orphan drugs. To advance this mission, also in 2015, the country established the Japan Agency for Medical Research and Development, which works to promote seamless medical R&D extending from basic research to practical application, and to apply the outcomes of such research in practice.[123]

However, as noted, starting in 2017, Japan began implementing changes to the PMP system that have significantly eroded its capacity to adequately appraise the value of innovative medicines. That’s in part because Japan’s current system fails to conduct a science-based evaluation of new medicines, with many best-selling global products now being deemed not innovative under the new criteria and thus consequently being stripped of their PMP eligibility. In fact, according to Japan’s Ministry of Health, Labor, and Welfare, approximately 30 percent of patented medicines no longer qualify for the PMP. Further PMP revisions announced in 2018 also “appear to be inherently biased toward domestic companies (e.g., based on the number of local clinical trials and whether the product was launched first in Japan).”[124] The PMP system continues to severely undervalue innovative medicines produced by American and life-sciences innovators of other nations, a violation of the spirit—if not the letter—of the World Trade Organization agreement,.

Beyond Japan’s PMP discriminating against foreign enterprises, Japan announced in 2020 that it would move from its current system of biennial price cuts to an annual system for doing so, clearly signaling its intent to accelerate price cuts going forward. For 2020, the move covered 69 percent of all medicines (more than 90 percent on a monetary basis) and 59 percent of patented medicines. In 2021, the average price cuts to those products was expected to be 5.2 percent (before application of the PMP) and is expected to be similar in future years.[125] Further in 2021, the Japanese government lowered prices for 70 percent of National Health Insurance-listed drugs.

Japan is also piloting an HTA system that seeks to assess the value of innovative medicines and technologies. While such an approach isn’t unreasonable, a particular concern is that it does not include the societal value of innovative medicines. Further, the HTA relies on incremental cost-effectiveness ratios alone, and not a broader definition of “value,” and is not aligned with good practices for HTA as recommended by the Professional Society for Health Economics and Outcomes Research (ISPOR).[126] As implemented, Japan’s HTA is inconsistent with international norms, solely focuses on cost-effectiveness thresholds, and ignores many aspects of a product’s value.

Recognizing the declining competitiveness of Japan’s pharmaceutical industry—and particularly struck by the sector’s inability to produce a timely and effective COVID-19 vaccine, leaving Japan dependent on other Western nations for it—on September 21, 2021, the Ministry of Health, Labor, and Welfare announced a new pharmaceutical industry vision, the so-called “Vision Plan.”[127] The Vision Plan lays out the government’s approach for the next decade to cope with challenges in drug discovery, generics, and drug distribution. If implemented, “it would enable the Japanese pharmaceutical industry to invest more in R&D through several initiatives, including a predictable and sensible reimbursement approach.”[128] As of July 2022, members of the now-ruling Liberal Democratic Party have indicated a desire to place greater focus on cultivating a more-innovative biopharmaceuticals industry and are holding active discussions with the Kishida government on how implementation of such a plan would impact drug pricing policies in Japan.

Yet, it appears that the Japanese government wants it both ways: It wants an innovative and competitive life-sciences industry, but it also wants to continue to artificially drive down drug prices. The Vision Plan attempts to address that inherent contradiction, but it is doubtful that it can. Japan can have either lower drug prices or a more competitive drug industry—it can’t have both.

Japan’s experience should provide a cautionary real-world warning for U.S. policymakers now contemplating similarly aggressive drug price controls and the perilous implications one would have for the innovative potential of America’s now world-leading life-sciences industry.

Conclusion

Japan provides a cautionary example of a country that once stood at (or, at least, very near) the global leading edge of a critical industry—pharmaceuticals—but that has allowed its lead to erode through a combination of poor policy choices and underinvestment in basic scientific research. In particular, Japan’s introduction of stringent drug price controls starting in the 1980s deprived the industry of crucial revenues needed to invest in future generations of drug innovation, triggering a spiraling decline in NCEs introduced as drug prices declined across the 1980s and 1990s. That cycle appears to have repeated itself in the 2010s. Atop the litany of academic studies that have already identified this dynamic, Japan’s experience should provide a cautionary real-world warning for U.S. policymakers now contemplating similarly aggressive drug price controls and the perilous implications that would have for the innovative potential of America’s now world-leading life-sciences industry.[129]

For Japan, regaining its capacity as a key biopharmaceutical innovator requires comprehensive policy reforms—particularly with regard to drug pricing and the willingness to pay for innovative medicines—if it’s going to keep pace in the future with the United States, European countries, and especially China.

Acknowledgments

The author would like to thank Robert Atkinson, Ian Clay, Luke Dascoli, and Jaci McDole for their assistance with this report.

About the Author

ITIF Vice President, Global Innovation Policy Stephen J. Ezell focuses on science, technology, and innovation policy as well as international competitiveness and trade policy issues. He is the coauthor of Innovating in a Service Driven Economy: Insights Application, and Practice (Palgrave McMillan, 2015) and Innovation Economics: The Race for Global Advantage (Yale 2012).

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent, nonprofit, nonpartisan research and educational institute focusing on the intersection of technological innovation and public policy. Recognized by its peers in the think tank community as the global center of excellence for science and technology policy, ITIF’s mission is to formulate and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress.

For more information, visit us at www.itif.org.

Endnotes

[1]. Robert D. Atkinson and Stephen Ezell, “Five Fatal Flaws in Rep. Katie Porter’s Indictment of the U.S. Drug Industry” (ITIF, May 2021), https://itif.org/publications/2021/05/20/five-fatal-flaws-rep-katie-porters-indictment-us-drug-industry; Natalie Andrews and Stephanie Armour, “Democrats Move Ahead on Drug-Pricing Piece of Broader Climate and Tax Agenda,” The Wall Street Journal, July 6, 2022, https://www.wsj.com/articles/democrats-move-ahead-on-drug-pricing-piece-of-broader-climate-and-tax-agenda-11657131934.

[2]. Robert D. Atkinson, “The Impact of China’s Policies on Global Biopharmaceutical Industry Innovation” (ITIF, September 2020), https://itif.org/publications/2020/09/08/impact-chinas-policies-global-biopharmaceutical-industry-innovation.

[3]. Stephen Ezell, “Going, Going, Gone? To Stay Competitive in Biopharmaceuticals, America Must Learn From Its Semiconductor Mistakes” (ITIF, November 2021), https://itif.org/publications/2021/11/22/going-going-gone-stay-competitive-biopharmaceuticals-america-must-learn-its.

[4]. Maki Umemura, “Unrealised Potential: Japan’s Post-war Pharmaceutical Industry, 1945-2005,” Thesis Submitted to the Department of Economic History, London School of Economics (August 2008), 3, 87, https://etheses.lse.ac.uk/2172/1/U613404.pdf.

[5]. Robert Chew, George Teeling Smith, and Nicholas Wells, Pharmaceuticals in Seven Nations (London, England: Office of Health Economics, May 1985): 53, https://www.ohe.org/system/files/private/publications/147%20-%20Pharmaceuticals_in_Seven_Nations_Chew_1985.pdf.

[6]. Michael R. Reich, “Why the Japanese Don’t Export More Pharmaceuticals: Health Policy as Industrial Policy,” California Management Review No. 32, Issue 2 (1990): 124–150, https://journals.sagepub.com/doi/abs/10.2307/41166609.

[7]. Ibid., 125.

[8]. Ibid., 129.

[9]. Patrick Branch, John Gill, and Ray Fujii, “New Realities of Drug Pricing and Access in Japan” (L.E.K. Consulting, 2017), 3, https://www.lek.com/sites/default/files/insights/pdf-attachments/Japan_Drug_Pricing_Special_Report.pdf.

[10]. Reich, “Why the Japanese Don’t Export More Pharmaceuticals,” 129–133.

[11]. Ibid., 132.

[12]. Data for 1971 to 2010 from Ross C. DeVol, Armen Bedroussian, and Benjamin Yeo, “The Global Biomedical Industry: Preserving U.S. Leadership” (Milken Institute, September 2011), 8, http://www.ncnano.org/CAMIExecSum.pdf. Data for 2011–2020 compiled by author from U.S. Food and Drug Administration, “Drugs@FDA: FDA-Approved Drugs” (accessed January 31, 2022), https://www.accessdata.fda.gov/scripts/cder/daf/index.cfm?event=reportsSearch.process&rptName=1&reportSelectMonth=1&reportSelectYear=2022&nav#navigation.

[13]. Ibid.; Umemura, “Unrealised Potential,” 112.

[14]. European Federation of Pharmaceutical Industries and Associations (EFPIA), “The Pharmaceutical Industry in Figures, Key Data 2019,” 8, https://www.efpia.eu/media/413006/the-pharmaceutical-industry-in-figures.pdf.

[15]. Author's calculations using OECD.Stat, “Main Science and Technology Indicators, BERD performed in the pharmaceutical industry (current PPP$),” https://stats.oecd.org/Index.aspx?DataSetCode=MSTI_PUB#.

[16]. National Science Foundation, “Science and Engineering Indicators 2020” (Supplemental Tables S5a-5, S5a-10), https://ncses.nsf.gov/indicators/data.

[17]. Organization for Economic Cooperation and Development, OECD.Stat, “Patents by technology: Triadic Patent Families,” accessed July 6, 2020. https://stats.oecd.org/viewhtml.aspx?datasetcode=PATS_IPC&lang=en.

[18]. Author's calculations using OECD.Stat, “Main Science and Technology Indicators, Number of patents in the biotechnology sector - applications filed under the PCT (priority year),” http://stats.oecd.org.

[19]. OECD.Stat, “TiVA: Trade in Value Added Database 2021,” accessed via https://stats.oecd.org/Index.aspx?DataSetCode=TIVA_2021_C1.

[20]. Robert D. Atkinson, “The Hamilton Index: Assessing National Performance in the Competition for Advanced Industries” (ITIF, June 2022), 47, https://itif.org/publications/2022/06/08/the-hamilton-index-assessing-national-performance-in-the-competition-for-advanced-industries/.

[21]. Organization for Economic Cooperation and Development (OECD), Trade in Value Added (TiVA) 2021 ed: Principal Indicators (accessed April 6, 2022), https://stats.oecd.org/Index.aspx?DataSetCode=TIVA_2021_C1.

[22]. OECD.Stat, Structural Analysis Database (Bilateral trade in goods by industry and end use), accessed July 5, 2020, https://stats.oecd.org/#.

[23]. Reich, “Why the Japanese Don’t Export More Pharmaceuticals: Health Policy as Industrial Policy,” 132.

[24]. Ibid.

[25]. HealthEcon, The European Community: Still a Competitor in the World Pharmaceutical Market of Tomorrow? (Basel, Switzerland: HealthEcon, Ltd., 1983).

[26]. Chew, Smith, and Wells, Pharmaceuticals in Seven Nations, 45.

[27]. Reich, “Why the Japanese Don’t Export More Pharmaceuticals: Health Policy as Industrial Policy,” 133.

[28]. Chew, Smith, and Wells, Pharmaceuticals in Seven Nations, 46.

[29]. Umemura, “Unrealised Potential,” 89.

[30]. Ibid., 90.

[31]. Ibid.

[32]. Ibid., 90–91.

[33]. Author’s calculations using data points (extracted via graphreader.com) on drug price index from figure 6 of Maki Umemura, “Unrealised Potential: Japan’s Post-war Pharmaceutical Industry, 1945-2005,” 91; DeVol, Bedroussian, and Yeo, The Global Biomedical Industry: Preserving U.S. Leadership, 8.

[34]. Heather M. O’Neill and Lena Crain, “The Effects of Price Regulation on Pharmaceutical R&D and Innovation” Business and Economic Faculty Publications, Ursinsus College Vol. 5 (2005), 62, https://digitalcommons.ursinus.edu/bus_econ_fac/5/.

[35]. Ibid., 68.

[36]. Ibid., 67–69.

[37]. Kazuyuki Motohashi, “OCED/TIP Project on Biopharmaceutical National Innovation Systems National Report: Japan” (OECD, March 2004), 37, https://www.oecd.org/innovation/inno/31663450.pdf.

[38]. Umemura, “Unrealised Potential,” 115, 117.

[39]. Ibid., 104.

[40]. Simon Wentworth, “Japan pharma market review,” ThePharmaLetter, June 28, 2019, https://www.thepharmaletter.com/article/japan-pharma-market-review.

[41]. Shoyo Shibata et al., “Evaluating the Effectiveness of Repricing for Market Expansion in the Japanese Drug Pricing System,” Therapeutic Innovation & Regulatory Science Vol 50, Issue 6 (December 2016): 753, https://link.springer.com/article/10.1177/2168479016652927.

[42]. Pharmaceutical Manufacturers of America (PhRMA), “2021 PhRMA Special 301 Submission,” (PhRMA, 2021), 59–60, https://phrma.org/-/media/Project/PhRMA/PhRMA-Org/PhRMA-Org/PDF/P-R/PhRMA_2021-Special-301_Review_Comment-1.pdf.

[43]. Pharmaceutical Manufacturers of America (PhRMA), “2022 PhRMA Special 301 Submission,” (PhRMA, 2022), 48, https://www.phrma.org/-/media/Project/PhRMA/PhRMA-Org/PhRMA-Org/PDF/P-R/PhRMA-2022-Special-301-Submission.pdf.

[44]. Shibata et al., “Evaluating the Effectiveness of Repricing for Market Expansion in the Japanese Drug Pricing System,” 755.

[45]. PhRMA, “2022 PhRMA Special 301 Submission,” 45.

[46]. Ibid., 46.

[47]. Ibid.

[48]. Ibid., 17, 45.

[49]. Data provided by the PhRMA to the Chuikyo Special Committee on Drug Prices (November 5, 2021); PhRMA, “Towards the Realization of a Drug Discovery Innovation Ecosystem” (Power Point Presentation, May 2022), 11.