Why America Needs a National Competitiveness Council

Congress is poised to expand funding for U.S. competitiveness. But a one-time infusion of resources is not enough: The federal government needs to formulate and implement a coherent advanced-industry competitiveness strategy.

KEY TAKEAWAYS

Key Takeaways

Contents

U.S. Economic Competitiveness Is Faltering. 2

Past U.S. Competitiveness Bodies 5

Location and Composition of a New U.S. Competitiveness Commission. 6

Scope of the New Commission’s Work. 8

Introduction

The issue of faltering U.S. international economic competitiveness, especially in advanced industries and vis-à-vis China, is finally gaining attention in Washington, D.C. The Senate passed the U.S. Innovation and Competitiveness Act (USICA); and after passing a multitrillion-dollar infrastructure bill and the Build Back Better Act, House leadership has indicated a willingness to also move on USICA. Hopefully, going into 2022, the federal government will have more competitiveness tools at its disposal than it does now. But a one-time infusion of resources is not enough: The federal government needs to formulate and implement a coherent U.S. advanced industry competitiveness strategy.

Mustering the political will and ensuring administrative capabilities to generate and implement a robust and broad-based national advanced technology competitiveness strategy are not easy. One way to facilitate both is for the federal government to create a national competitiveness council composed of leaders and experts to provide not only advice to the government but advocacy for a discrete set of high-priority policies. But unless crafted and operated carefully, the risk is that such a body would simply repeat what so many other commissions and groups have done in the past: operating in the realm of generalities, failing to identify the most critical policy interventions and not using their influence to get those interventions fully funded and over the “finish line.” This report first briefly discusses the state of U.S. “competitiveness” and what the term means, and then how such a council could be formed and subsequently operate to be successful.

U.S. Economic Competitiveness Is Faltering

Before discussing the council, it’s worth noting that the United States faces an advanced industry-competitiveness challenge. Real manufacturing value added declined 13 percent from 2007 to 2019 (from 13.2 percent of gross domestic product (GDP) to 11.5 percent).[1] When controlling for the statistical overstatement of output growth in the computer industry, it fell even more (from 12.1 percent to 9.7 percent).[2] This is one reason Harvard Business School’s Gary Pisano and Willy Shih noted, “Decades of outsourcing manufacturing have left U.S. industry without the means to invent the next generation of high-tech products that are crucial to rebuilding its economy.”[3] Moreover, the United States ran an all-time-high trade deficit of $192 billion in advanced technology products in 2020, down from a $4.5 billion trade surplus in 2001.[4]

Defining Competitiveness

It seems obvious, but one key to the success of a competitiveness council is for it to focus on the actual issue of competitiveness. This can be difficult, as the term is normally used with little intellectual rigor.

Many define “competitiveness” as synonymous with “productivity.” For example, the World Economic Forum’s Global Competitiveness Report defines it as “the set of institutions, policies, and factors that determine the level of productivity of a country.”[5] But this is wrong. To see why, it’s important to understand the difference between traded and nontraded sectors. A traded industry is one in which firms sell a significant share of their output outside a particular geographical area. For example, a company in Michigan that sells printed materials to customers across the United States would be a traded firm from the perspective of the Michigan economy, but a nontraded firm from the perspective of the U.S. economy. In contrast, a software firm in California that sells software throughout the world would be a traded firm from both the state and national perspectives. A local barbershop in Texas would be a nontraded sector from both perspectives.

Competitiveness, therefore, relates to the ability of a nation’s traded sectors to thrive. But how do we define “thrive”? One definition could be the number of jobs. However, if one nation’s traded sector is more productive than another nation’s, it might have fewer jobs but still be more competitive. Another definition could be value added produced by traded sector firms as a share of GDP. This gets closer to the right definition but is not fully accurate because it fails to control for the size of a nation’s economy. The larger an economy, the smaller the share of the economy that is traded, because more is produced and consumed nationally.

Another definition could be whether a nation runs a trade surplus or a deficit, and how well companies compete in domestic and global markets. But a narrow focus on trade deficits or global market share of exporting firms fails to control for whether a nation is subsidizing its exporters (e.g., by keeping the value of its currency low, keeping wage levels artificially low, giving producers money [as China does], etc.) or erecting barriers to imports (e.g., tariffs). If a nation runs a trade surplus through such mercantilist means, that would not be a reflection of its competitiveness. Such policies reduce its terms of trade by requiring its residents to forfeit some of their income to foreign consumers, pay higher prices for foreign goods and services, or both. We can see this by looking at past trends in the U.S. trade deficit. Many argue that the U.S. economy became more competitive toward the end of the 1980s as its large trade deficit shrank. But this reduced trade deficit was in part brought about through the lower value of the dollar in the last half of the 1980s, which lowered the prices of exports and raised the relative prices of imports. This just made the United States’ terms of trade worse, as the United States was able to buy fewer imports for the same quantity of exports. Therefore, true U.S. competitiveness was very likely unchanged even though its trade deficit fell.

Putting this together, we now get closer to the true definition of competitiveness: the ability of a nation to have a strong currency, run a trade surplus in manufactured goods and advanced services, or both. In international trade theory, all else being equal, nations should run neither sustained trade surpluses nor deficits, as currencies should adjust in order to bring trade into balance. So, in a textbook world, competitiveness would only be defined by the relative strength of a nation’s currency. But we don’t live in a textbook world, especially as the U.S. dollar is the global reserve currency and remains much higher in value than it should be. In this case, U.S. competitiveness relates more to running a trade surplus in advanced industries.

There is one important caveat to this definition of competitiveness, and it relates to the extent to which the trade balance relates to natural resource exploitation, including fuels, minerals, and crops. For a nation such as oil-rich Saudi Arabia, for example, running a trade surplus should be easy. Rather than having to import oil, it can export it as a fungible commodity. However, in reality, the Saudi economy is not very competitive, as it runs trade deficits in nonmineral industries (e.g., agriculture, manufacturing, and services). In fact, it is extremely difficult for nations with large amounts of mineral production to be truly competitive because of what’s known as the “Dutch disease”—which refers to the negative impact on an economy of anything that gives rise to a significantly inflow of foreign currency, such as the discovery of large oil reserves, that in turn raises the value of the currency, making produced, as opposed to mined, exports more expensive on global markets.

This gets to the full definition of competitiveness. Competitiveness relates to the ability of a nation’s non-resource-based traded sectors to effectively compete in global markets in the absence of subsidies and government protections, while at the same time receiving a price premium that enables strong terms of trade. To be sure, most conventional neoclassical economists will reject this definition, arguing that a nation’s trade balance is simply a mathematical function of its savings rate. But this is incorrect.

Competitiveness is the ability of a nation’s non-resource-based traded sectors to effectively compete in global markets in the absence of subsidies and government protections, while at the same time receiving a price premium that enables strong terms of trade.

Competitiveness is also sometimes conflated with innovation, with some arguing that levels of innovation determine competitiveness.[6] But while related, innovation is different. It involves developing an improved product (a good or service), production process, marketing method, or organizational method. Just as with productivity, if this innovation occurs in traded sectors, a nation’s economy will become more competitive. But innovation in nontraded sectors will have less impact on competitiveness because, by definition, their output is not sold outside local borders. Figure 1 illustrates the relationship between the three concepts. Any national competitiveness commission should be firmly focused on the competitiveness circle.

Figure 1: The relationship between competitiveness, innovation, and productivity

Past U.S. Competitiveness Bodies

It was not until the second half of the 1970s that the federal government began to focus explicitly on competitiveness. For much of the history of the Republic, the federal government’s efforts to be competitive revolved around tariff protection of infant industries. As the United States gained industrial strength, support for tariffs weakened, and the view was largely that the United States was so competitive that no specific policy was needed.

However, in 1971, the United States ran its first trade deficit since 1888. President Nixon responded by devaluing the dollar. But this was merely a band-aid solution. It wasn’t until the election of Jimmy Carter in 1977 that the federal government began to focus in a more serious way on competitiveness. Initially, the Carter administration tried to respond to the challenge with conventional macroeconomic economic policy tools, but policymakers gradually realized they needed to do more. One result was the initiation in 1979 of the Domestic Policy Review of Industrial Innovation, which attempted a comprehensive review of the problem and identified a number of solutions.

The competitiveness challenge only heightened in the next few years and, as a result, the Reagan administration established a Commission on Industrial Competitiveness. Chaired by John Young, CEO of Silicon Valley company Hewlett Packard, the commission highlighted how both the United States had lost its international competitive position and innovation was a key to regaining it.[7]

It wasn’t until the election of Jimmy Carter in 1977 that the federal government began to focus in a serious way on competitiveness.

The commission was not the only group shining a spotlight on the issue of competitiveness. As Kent Hughes documented in Building the Next American Century, a number of reports and task forces sounded the alarm and proposed solutions. Congress created the Competitiveness Policy Council in 1988, which existed until Republicans in Congress eliminated it in1997. New York Governor Mario Cuomo launched his own competitiveness task force. And during the George H.W. Bush administration, the president created an interagency White House Competitiveness Council, chaired by Vice President Dan Quayle.[8]

Neither the Clinton nor Bush II administrations established a competitiveness council, although President Bush’s Domestic Policy Council and Office of Science and Technology released the American Competitiveness Initiative report in 2006.

During the Obama administration, the president established the President’s Council on Jobs and Competitiveness (originally the President’s Economic Recovery Advisory Board), which was populated mostly by CEOs. Engaging in little formal analysis, it instead served as a source of input providing the administration with the political bona fides that it was talking to industry and being attentive to competitiveness and growth issues. In addition, the 2010 COMPETES Act called on the Obama administration to conduct a study on the competitive and innovative capacity of the United States. The Economic and Statistics Administration in the Department of Commerce completed the report, advised by an innovation advisory board.[9]

Location and Composition of a New U.S. Competitiveness Commission

There are three possible organizational locations for a national competitiveness commission. One is to have it be freestanding, similar to the recent National Security Commission on artificial intelligence.[10] But this separation would mean that it would be more isolated from Biden administration officials. A second would be to locate it in the White House, overseen by a body such as the National Economic Council (NEC). While there are advantages to this (e.g., receiving high-level, White House attention), the risk is that it would “get lost” in the shuffle of the time-critical matters the NEC is engaged in. The third, and preferred, solution would be to have the Department of Commerce (DOC) host it. Secretary Raimondo has made U.S. competitiveness a top focus, and DOC already operates a number of competitiveness-related programs.

Determining the composition of the commission is trickier. Usually, when governments launch commissions focused on industry competitiveness, they naturally look to bring in CEOs, with the assumption that they are best positioned to opine and advise on competitiveness matters. After all, since CEOs lead companies in globally traded industries, they must be focused on the international competitiveness of their businesses on a daily basis.

While certainly any commission should include CEOs, it would be a mistake to populate it only or even predominantly with them and other senior business representatives. The reason is twofold: Like the tale of the blind man and the elephant, CEOs often see only one part of the “elephant.” They clearly understand business, but often do not fully grasp competitiveness dynamics or policy. Moreover, CEOs often ascribe competitiveness problems to forces outside their companies, such as not enough skilled workers or too little basic science funding. While not to discount this skilled-worker shortage, it is not the sole, or even the main, issue in declining U.S. advanced technology competitiveness. And much of U.S. basic research funding spills over to competitors in other nations. Other issues, such as the operation of trade policy, federal funding of applied research, technology commercialization, advanced manufacturing, and investment incentives, usually are overlooked. On top of that, CEOs seldom look inward to investigate whether perhaps some of the United States’ problems are self-inflicted, such as from focusing on short-term equity market performance or being unwilling to invest enough in truly disruptive innovations.

While certainly any commission should include CEOs, it would be a mistake to populate it only or even predominantly with them and other senior business representatives.

Years ago, when I had the good fortune to be the executive director of the Rhode Island Economic Policy Council—a public-private body co-chaired by the governor and a top Rhode Island CEO—the Council conducted an in-depth assessment of the state’s competitive position, including by analyzing eight key sectors. In addition to analyzing industry data, we formed working groups of CEOs in each industry to help identify challenges and opportunities, especially opportunities for changes in state policy. Invariably, each group opened with the CEOs complaining about and blaming most of their woes on state policy or other external factors they had no control over. For example, several CEOs from the jewelry industry (at the time, Rhode Island had more jewelry jobs per capita than any other state had) blamed states’ industry problems on the fact that the TV show Dynasty (a popular series that featured a wealthy business family the women of which wore extremely expensive jewelry) had been taken off the air. When I explained that this could not have been the reason, as U.S. jewelry consumption had actually increased since the show had been cancelled—and despite Rhode Island’s market share having declined—the conversation shifted to other factors. As time went on, the CEOs did identify some real issues around Rhode Island economic policy, such as an unemployment system that was uncompetitive and the need for a tax code that was more favorable to capital investment. But they also acknowledged that firms themselves needed to change, including investing more in modern equipment, engaging in partnerships with local universities (including the Rhode Island School of Design), and partnering with community colleges for training industry technicians.

In other words, the CEOs’ initial responses were to focus on outside factors, such as tax or regulation, and not dig down deeper into the full panoply of causes of diminished competitiveness, including ones they controlled.

As such, any national competitiveness commission should have a balanced set of representatives that includes CEOs or top officials from industries in traded, technologically-advanced sectors; individuals who study and are experts in business and competitiveness; academics who focus on firm and industry competitiveness (e.g., Willy Shih at Harvard Business School or Erica Fuchs at Carnegie Mellon); and individuals with business consulting firms that focus on both business strategy and economic policy. And it should include scholars at think tanks that focus on competitiveness issues. It is important for organized labor to have more than just a token slot on the commission, as there are a number of individuals in organized labor who have spent their careers at the intersection of industry and government policy—and besides this knowledge, they bring a critical perspective on what is in the best interests of U.S. workers. Finally, any effective national competitiveness policy should foster federal-state partnerships, so bringing in a governor who has made competitiveness a focus of their administration would be warranted.

Finally, what about civil society groups and economists? Generally, neither should be represented, as very few, if any, civil society groups care about or even consider competitiveness—and to the extent that they are engaged in policy advocacy, most of what they advocate for (e.g., breaking up U.S. companies, imposing onerous data regulations, etc.) would have deleterious consequences on U.S. competitiveness.

Economists should generally be excluded because they typically know next to nothing about industry or competitiveness, having instead studied in macro-economic performance or micro-economics of prices. On top of that, most subscribe to Paul Krugman’s view that competitiveness is a dangerous delusion and that the United States does not compete with other nations. Even if economists do recognize that competitiveness is real, all too often they either see competitiveness policy as an inappropriate intervention into the so-called “free market,” or they call for palliatives such as a “better business climate” and better factor inputs such as more skilled workers rather than on the nuts and bolts of competitiveness policy.

Scope of the New Commission’s Work

It’s important that any commission not have too broad of a focus, as doing so—throwing in “everything but the kitchen sink”—causes the analysis to become shallow and the recommendations too numerous and not specific enough to be acted on.

Another risk is a commission defaulting to well-tread ground simply because that is what most experts focus on. Case in point, in virtually any open-ended meeting on competitiveness, the discussion almost always very quickly defaults to the deficiencies in education, usually K-12. Everyone can relate, since everyone went to school and most have or had children in K-12. In addition, focusing on education takes companies and other actors off the hook (i.e., there is nothing wrong with corporate strategy and implementation, only a deficit of skills). And it avoids the more controversial issue of government policy focusing on particular sectors and technologies. As such, it is a narrative all sides of the political spectrum can coalesce around.

There are at least two other problems with this. First, significantly improving the K-12 system seems like an intractable problem given that ever since the publication in 1983 of “A Nation At Risk,” K-12 reform has always been a focus, yet little tangible progress has been made. Absent foundational change in the structure of schools and the nature of pedagogy, it’s highly unlikely that the United States will see significant progress in the future. Second, among the many challenges to U.S. advanced industry competitiveness, K-12 education, and even worker skills, are not among the most important five issues.

As such, a commission should spend time trying to go beyond conventional bromides and platitudes and really dig into the true nature of the U.S. competitiveness challenge—and to support the analysis based on the structure and performance of firms, industries, and technologies.

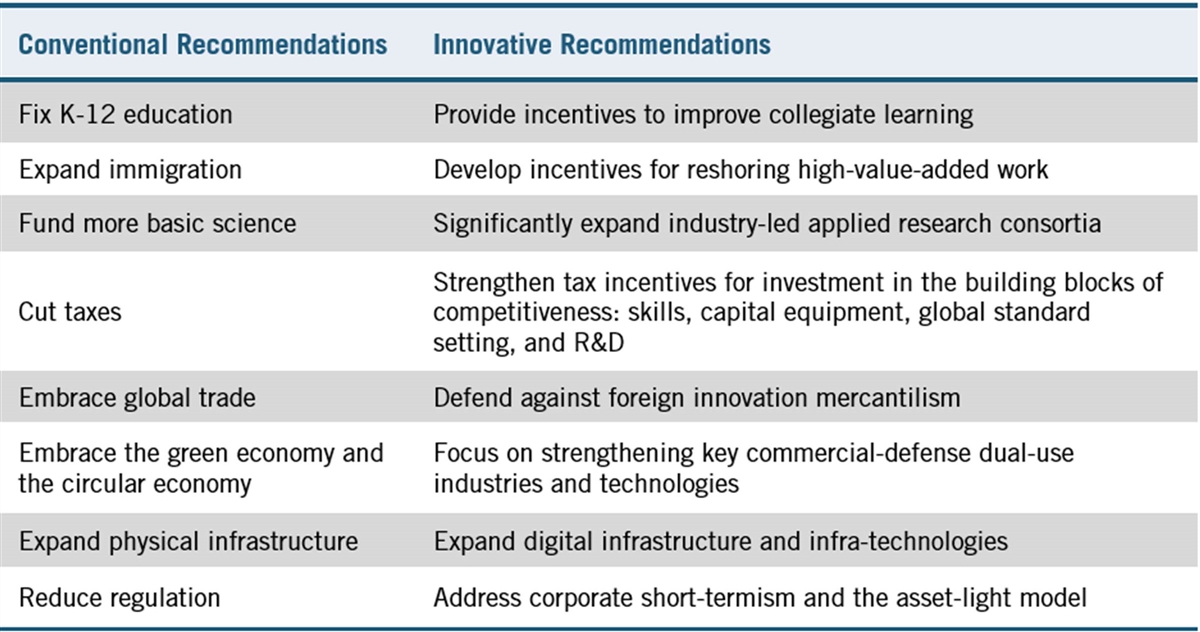

One way to think about this is to consider conventional and commonly offered recommendations to the U.S. competitiveness challenge and more “out of the box” alternatives. (See table 1.)

1. Instead of rehashing the need to improve K-12, consider the failures of higher education (too many students enrolled, too little learning, and not enough focus on STEM [science, technology, engineering, and math] degrees) and how to address them.[11]

2. Instead of repeating the need for more immigration (STEM immigration is needed, but because this issue remains tied to overall immigration expansion, little progress is likely to happen), consider how to develop incentives for reshoring high value-added work to American shores.[12]

3. Instead of proposing an increase in basic science funding—something universities support because it provides no-strings-attached money, but where much of the benefits “spill over” to U.S. competitors—focus on how to expand industry-led research consortia.[13]

4. Instead of focusing on cutting the corporate tax rate (something Republicans do when they are in power, and Democrats try to reverse when they are in power), instead focus on expanding key business tax incentives to invest in the key building blocks of competitiveness (global standards, machinery and equipment, research and development (R&D), and worker skills).[14]

5. Instead of focusing principally on opening up global markets, focus more on enforcing existing trade laws and using other tools to push back against foreign mercantilist practices.[15]

6. Instead of focusing on the green economy—climate tech, while needed, can never be a large enough industry to power U.S. competitiveness—focus on strengthening key commercial-defense dual-use industries and technologies.[16]

7. Instead of focusing on expanding physical infrastructure, focus on hybrid physical-digital infrastructures (physical infrastructures using digital technologies to become smart).[17]

8. Instead of focusing on reducing regulation, focus on how to reform financial and corporate government systems to enable U.S. companies to invest more in long-term factors driving competitive success, including more capital equipment in the United States and higher-risk R&D.[18]

Table 1: Eight commonplace approaches to U.S. competitiveness with more innovative alternatives

Conclusion

About the Author

Robert D. Atkinson (@RobAtkinsonITIF) is the founder and president of ITIF. Atkinson’s books include Big Is Beautiful: Debunking the Myth of Small Business (MIT, 2018), Innovation Economics: The Race for Global Advantage (Yale, 2012), Supply-Side Follies: Why Conservative Economics Fails, Liberal Economics Falters, and Innovation Economics Is the Answer (Rowman Littlefield, 2007), and The Past and Future of America’s Economy: Long Waves of Innovation That Power Cycles of Growth (Edward Elgar, 2005). Atkinson holds a Ph.D. in city and regional planning from the University of North Carolina, Chapel Hill.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent, nonprofit, nonpartisan research and educational institute focusing on the intersection of technological innovation and public policy. Recognized by its peers in the think tank community as the global center of excellence for science and technology policy, ITIF’s mission is to formulate and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress.

For more information, visit itif.org.

Endnotes

[1]. Bureau of Economic Analysis, “GDP by Industry,” last modified September 30, 2021, https://www.bea.gov/data/gdp/gdp-industry.

[2]. Robert D. Atkinson, et al., “Worse Than the Great Depression: What the Experts Are Missing About American Manufacturing Decline” (ITIF, March 2012), https://itif.org/publications/2012/03/19/worse-great-depression-what-experts-are-missing-about-american-manufacturing.

[3]. Gary Pisano and Willy Shih, “Restoring American Competitiveness,” Harvard Business Review, July/August 2009, http://hbr.org/2009/07/restoring-american-competitiveness/ar/1/.

[4]. U.S. Census Bureau, “Trade in Goods with Advanced Technology Products,” last modified October 12, 2021, https://www.census.gov/foreign-trade/balance/c0007.html#2020.

[5]. Klaus Schwab, “Global Competitiveness Report 2012-2013,” World Economic Forum (September 2012), https://www3.weforum.org/docs/WEF_GlobalCompetitivenessReport_2012-13.pdf.

[6]. Robert D. Atkinson, “Competitiveness, Innovation and Productivity: Clearing Up The Confusion” (ITIF, August 2013), https://www2.itif.org/2013-competitiveness-innovation-productivity-clearing-up-confusion.pdf.

[7]. The White House, “Executive Order 12428 -- President’s Commission on Industrial Competitiveness,” Ronald Reagan Presidential Library and Museum, June 28, 1983, https://www.reaganlibrary.gov/archives/speech/executive-order-12428-presidents-commission-industrial-competitiveness.

[8]. Philip J. Hilts, “At Heart of Debate on Quayle Council: Who Controls Federal Regulations?” New York Times, December 16, 1991, https://www.nytimes.com/1991/12/16/us/at-heart-of-debate-on-quayle-council-who-controls-federal-regulations.html.

[9]. The author had the pleasure and honor of serving as a member of this advisory board.

[10]. The National Security Commission on Artificial Intelligence homepage, accessed November 23, 2021, https://www.nscai.gov/.

[11]. Joe Kennedy, Daniel Castro, and Robert D. Atkinson, “Why It’s Time to Disrupt Higher Education by Separating Learning From Credentialing” (ITIF, August 2016), https://itif.org/publications/2016/08/01/why-its-time-disrupt-higher-education-separating-learning-credentialing.

[12]. Robert D. Atkinson, “Killing Two Birds With One Stone: Why Congress Should Establish a Tax Incentive For Companies Reshoring Production from China to U.S. Labor Surplus Areas,” ITIF Innovation Files, March 7, 2021, https://itif.org/publications/2021/03/07/killing-two-birds-one-stone-why-congress-should-establish-tax-incentive.

[13]. David Adler, et al., “Next Steps for Ensuring America’s Advanced Technology Preeminence” (ITIF, April 2021), https://itif.org/publications/2021/04/12/next-steps-ensuring-americas-advanced-technology-preeminence.

[14]. John Lester and Jacek Warda, “Enhanced Tax Incentives for R&D Would Make Americans Richer” (ITIF, September 2020), https://itif.org/publications/2020/09/08/enhanced-tax-incentives-rd-would-make-americans-richer.

[15]. Robert D. Atkinson, Nigel Cory, and Stephen Ezell, “Stopping China’s Mercantilism: A Doctrine of Constructive, Alliance-Backed Confrontation” (ITIF, March 2017), https://itif.org/publications/2017/03/16/stopping-chinas-mercantilism-doctrine-constructive-alliance-backed.

[16]. Robert D. Atkinson, “Time for a New National Innovation System for Security and Prosperity,” PRISM Vol. 9, No. 2, March 2021, https://ndupress.ndu.edu/Media/News/News-Article-View/Article/2541901/time-for-a-new-national-innovation-system-for-security-and-prosperity/.

[17]. Robert D. Atkinson, et al., “A Policymaker’s Guide to Digital Infrastructure” (ITIF, May 2016), https://itif.org/publications/2016/05/16/policymakers-guide-digital-infrastructure.

[18]. Robert D. Atkinson, “Restoring Investment in America’s Economy” (ITIF, June 2016), https://itif.org/publications/2016/06/13/restoring-investment-americas-economy; Robert D. Atkinson, “Think Like an Enterprise: Why Nations Need Comprehensive Productivity Strategies” (ITIF, May 2016), https://itif.org/publications/2016/05/04/think-enterprise-why-nations-need-comprehensive-productivity-strategies.