Wheezing Toward Glasgow: The Parlous Health of the Global Clean Energy Innovation System

The impacts of climate change are already devastating—from wildfires in California to floods in Germany—and will become increasingly severe unless greenhouse gas emissions drop dramatically and are ultimately eliminated. At the UN’s upcoming Glasgow climate conference, many national governments will up their emissions reductions commitments. Even oil-rich Saudi Arabia has recently pledged to reach net-zero by 2060. But such promises will ring hollow unless these nations take urgent action to accelerate innovation that will make climate solutions feasible, affordable, and reliable in the coming decades.

Unfortunately, such action has been lacking since the Paris agreement was signed in 2015. Drawing from the findings in ITIF’s 2021 Global Energy Innovation Index (GEII), this post assesses the health of the global clean energy innovation system across five indicators that track many of the system’s key functions:

- Public investment in clean energy research, development, and demonstration (RD&D);

- High-value patents for clean energy technologies;

- Early-stage venture capital investments;

- Successful clean energy company exits; and

- Clean energy technology exports.

The assessment reveals a system that is not thriving. At best, it is wheezing toward Glasgow in need of a serious infusion of public resources and attention.

There Has Been Some Progress, But With Severe Gaps

There’s no doubt that the world has made progress on some key climate solutions. The costs of wind and solar power have fallen dramatically, as have those of electric vehicle batteries. Some observers have declared victory, arguing the world has the technology it needs and lacks only political will to reduce emissions. Such declarations are wildly premature. As the International Energy Agency (IEA) has shown, many of the technologies needed to get to net-zero are still in the prototype or demonstration phase, and most are off track to be ready by 2050.

This complacency seems to have seeped into national clean energy and climate innovation policies. Public investments in low-carbon energy RD&D have barely increased as a share of the economy over the past five years. Most of these investments went to established technologies. Clean energy patents, not surprisingly, have gone sideways in this period, while clean energy technology exports increased at a slower pace than the global economy.

Entrepreneurial experimentation and early market formation are the only robust elements of the global clean energy innovation system in 2021. Yet, because the innovation system is deeply interconnected, the components that are degrading will ultimately weaken those that are thriving. There is no reason to cheer.

Indicator 1: Public Investment in Low-Carbon Energy RD&D

Public investment in low-carbon energy RD&D creates knowledge that inventors, entrepreneurs, and technology developers can draw upon to create climate solutions. In 2015, 24 leading nations adopted a goal of doubling their investments in five years in the Mission Innovation initiative. As a group, they fell far short of the goal. Only 4 of the 34 countries we cover in the 2021 GEII achieved it (Chile, New Zealand, the Slovak Republic, and the UK).

On the other hand, 10 countries had lower RD&D investments in real terms in the most recent year for which data is available than in 2015. They include Denmark and Finland, which took the top two spots in the 2021 GEII overall ranking. And relative to GDP, almost half of the countries on the list (15 out of 34) invested a lower share into public low-carbon energy RD&D investments than in 2015.

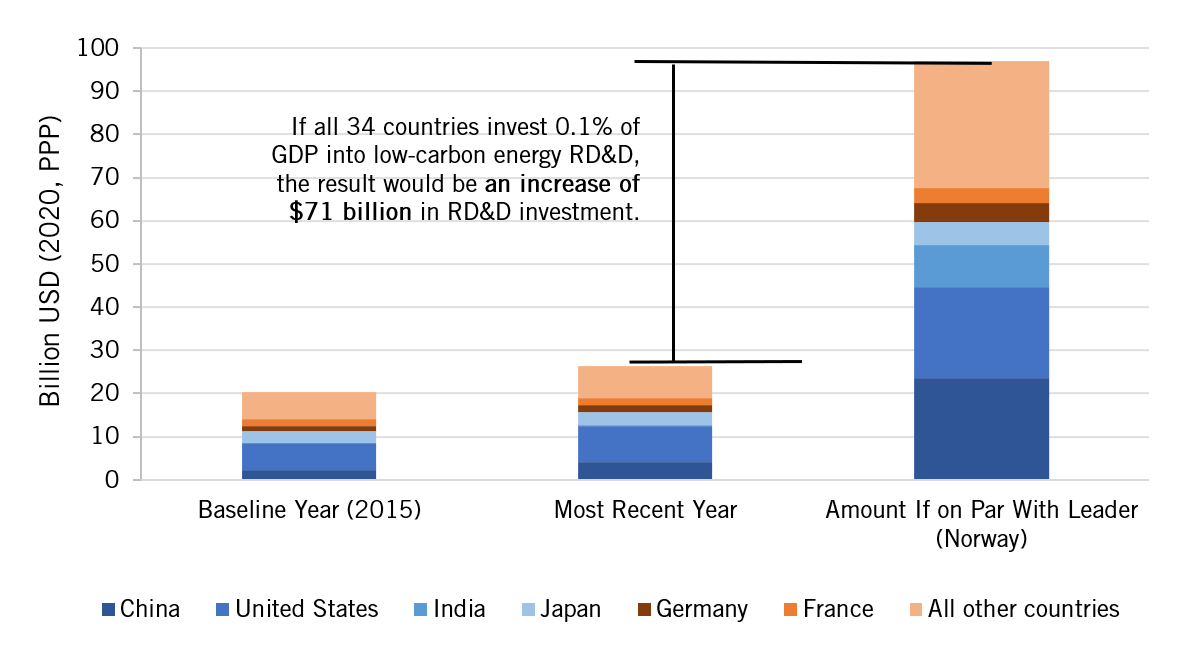

On average, the nations in the GEII invested just 0.03 percent of their GDP in this extremely important field. Norway is the only country in which low-carbon energy RD&D investments exceeded 0.1 percent of its GDP. As figure 1 shows, if all of the countries in the GEII had followed its example, the global energy innovation system would have received $71 billion more per year than it did.

Figure 1: Worldwide public investment in low-carbon energy RD&D if every country in the GEII followed Norway’s lead

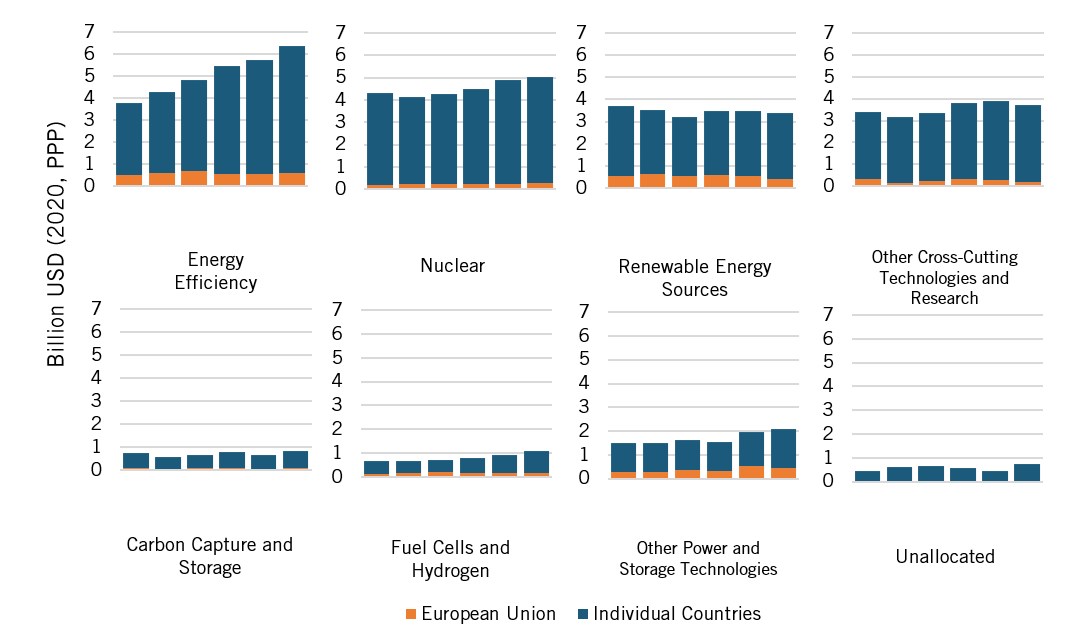

Energy efficiency, renewable energy sources, and nuclear power—all of which are relatively mature technological fields—are the top categories, accounting for 64 percent of total investment in 2020. On the other hand, hydrogen and fuel cell technologies, and carbon capture and storage—which are relatively nascent—have the lowest levels of investment, accounting for just eight percent of the 2020 total (see figure 2, which includes data from 21 countries plus the European Union, covering about 80 percent of global energy RD&D).

Figure 2. Public investment in RD&D by technology, 2015 to 2020

There is no doubt that the world needs to continue innovating in mature technological fields (such as offshore wind and advanced nuclear power). But to bring the nascent technologies highlighted by the IEA to maturity, nations will have to adopt targeted policies, including substantial increases in RD&D investments.

Indicator 2: High-Value Patents in Clean Energy Technologies

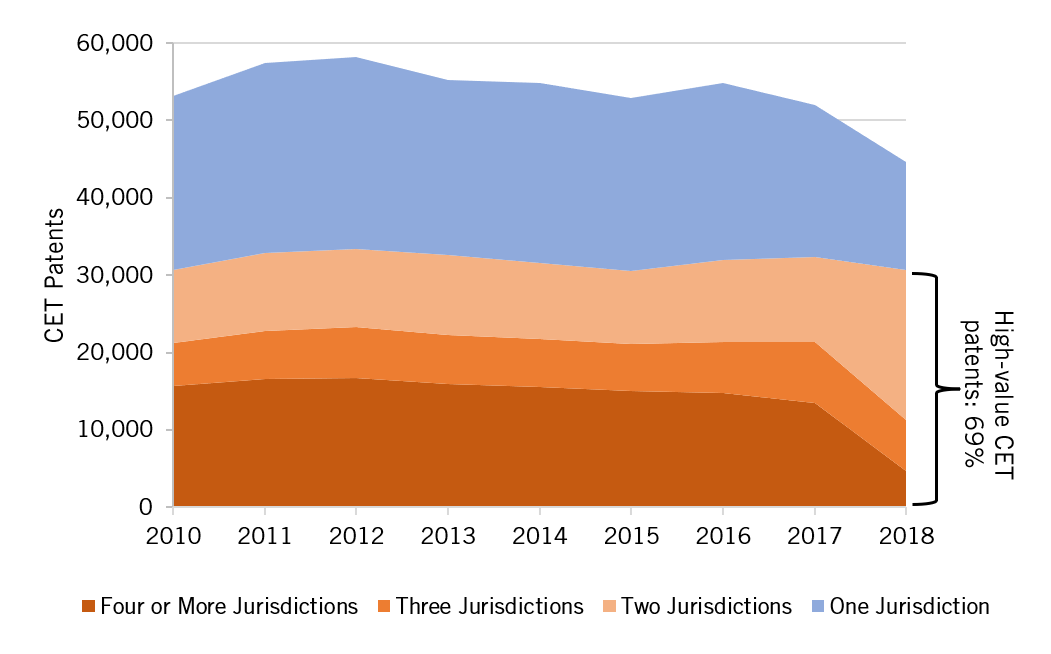

Patents provide inventors with exclusive rights to make, use, or sell the patented product or process. These exclusive rights are important in attracting investors to fuel further development, leading eventually to new and improved products and processes entering the market. The 2021 GEII uses high-value patents to assess how inventors around the world who want to advance in clean energy technologies are doing.

The answer is not so well. The number of patents that inventors have filed for in at least two major jurisdictions ([RC1] >=2), which is how the 2021 GEII defines “high-value,” has been flat for the past 10 years. (See figure 3.) Worse, the number of extremely high-value patents (4 or more jurisdictions) decreased dramatically in 2018. Perhaps the only good news is that the count of low-value clean energy technology patents (1 jurisdiction), which were the most abundant from 2010 to 2018, has dropped precipitously since 2016.

Figure 3: Patents by number of jurisdictions

Indicator 3: Early-Stage Venture Capital Investments

Early-stage venture capital investments measure the degree to which financial resources are being mobilized to fund clean energy startups. They contribute to the resource mobilization, entrepreneurial experimentation, and market formation functions of the global energy innovation system.

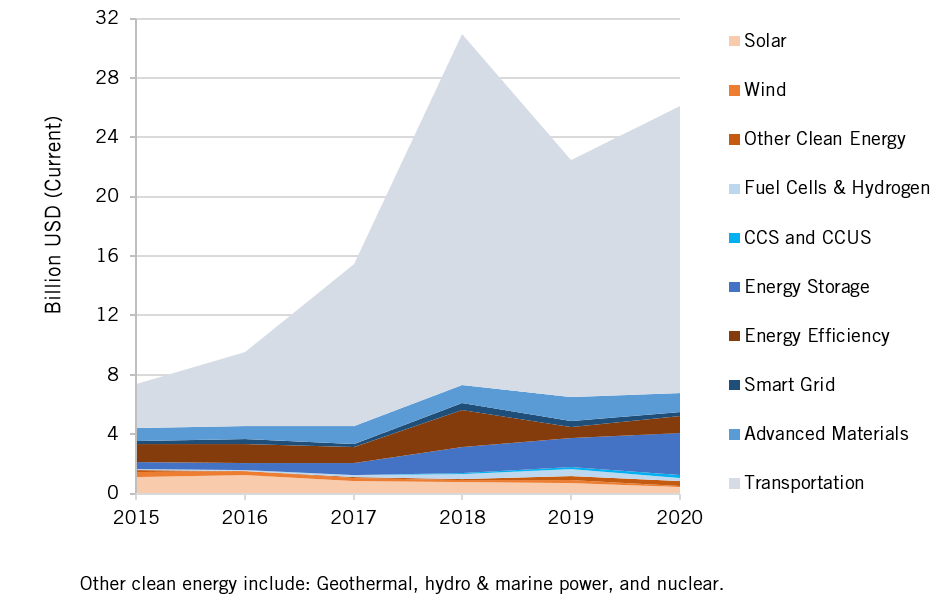

After years of falling VC investments, during the so-called Cleantech 1.0 phase, money has been flowing back into cleantech startups in recent years. Early-stage VC investments in clean energy startups is the healthiest indicator in ITIF’s assessment of the global energy innovation system, increasing almost four-fold in current dollars from $7.4 billion in 2015 to $26.1 billion in 2020. (See figure 4.)

Figure 4: Early venture capital investments in select clean energy technologies

But like public RD&D investments, VC investments are becoming increasingly concentrated in already-large industry sectors. Transportation and logistics and enabling technologies (which include robotics, AI and machine learning, internet of things, big data and analytics, and other digital technologies) accounted for almost 75 percent of the total amount invested in 2020, up from 43 percent in 2015, while clean energy sectors (geothermal, hydro and marine power, nuclear, solar, and wind) accounted for just 3 percent of investments in 2020.

VC investments in CCUS and related technologies, energy storage, and fuel cell and hydrogen technologies accounted for only 13 percent of investments collectively in 2020. While it is vital to accelerate transportation and complete the transition to electric vehicles, neglecting these three categories could jeopardize the pace of innovations that are key to reducing emissions in hard-to-decarbonize sectors. Still, more investors are paying attention. VC investments in these three technologies above jumped over 500 percent from 2015 to 2020.

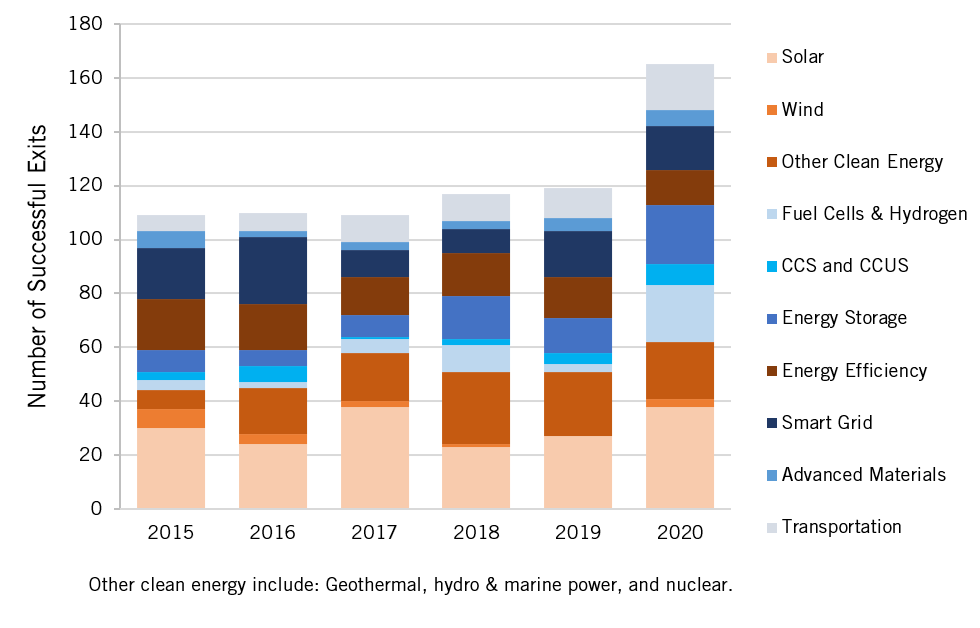

Indicator 4: Successful Clean Energy Company Exits

Successful company exits are an important part of the clean innovation entrepreneurial ecosystem. A successful exit signals a firm’s growth potential and its high-quality innovations.

The number of successful clean energy company exits through private equity deals, mergers and acquisitions (M&A), or initial public offerings (IPOs) has been steadily increasing. (See figure 5) M&A accounted for slightly over half of the successful exits between 2015 and 2020.

Figure 5: Successful clean energy technology company exits

Solar technology firms accounted for the highest share of exits globally (23 percent in 2020), but the number of exits by hydrogen and fuel cells, energy storage, and transportation firms have risen the fastest, which suggests these technologies could be widely deployed in the coming years.

Heightened VC investments and successful company exits signal that cleantech has renewed investor interest—a phase now dubbed Cleantech 2.0—which is welcome news. Nations must double down with supportive policies to make sure that Cleantech 2.0 does not repeat Cleantech 1.0’s fate.

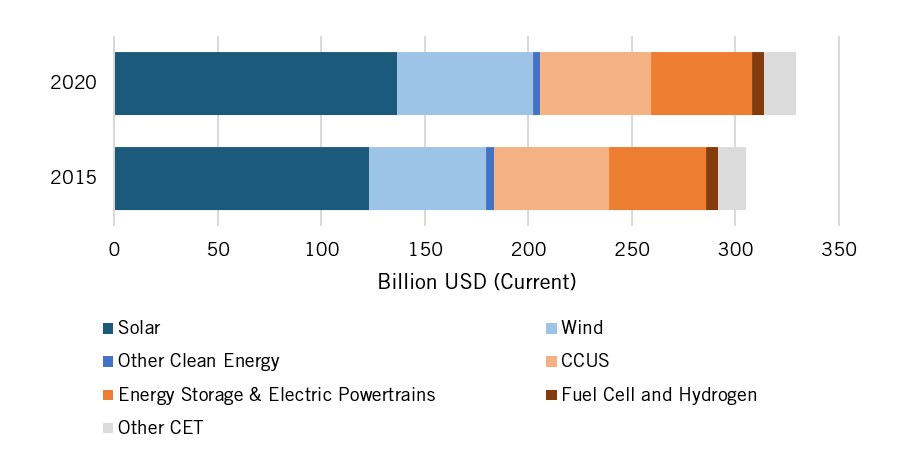

Indicator 5: Clean Energy Technology Exports

Incremental innovation in established products and services is a vital feature of a healthy innovation system, particularly for a sector as large and essential as energy. The ability of a nation’s enterprises to sell what they make in global markets indicates that these enterprises are continuing to improve their products in ways that customers value.

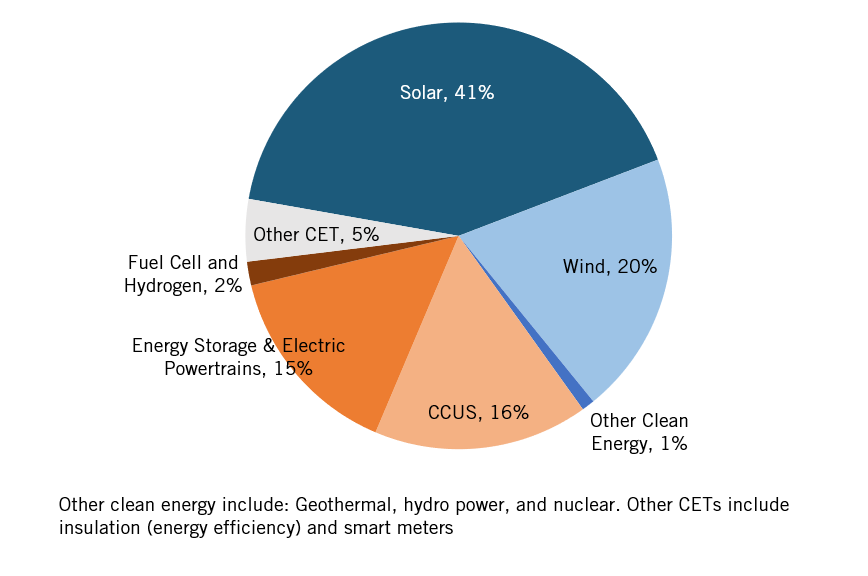

In clean energy, that doesn’t seem to be happening the way it used to. Clean energy technology exports globally grew 8 percent in 2020 compared to 2015 (figure 6), but global GDP grew 13 percent at the same time.

Figure 6: Global clean energy technology exports

Figure 7: Global clean energy technology exports percentage breakdown, 2020

Solar is the largest category of clean energy technology exports, accounting for 41 percent of the global total in 2020. (See figure 7.) Surprisingly, carbon capture, utilization and storage (16 percent) and energy storage and electric powertrain (15 percent) each had about $50 billion in exports, despite receiving relatively little public RD&D and VC investment. On the other hand, fuel cell and hydrogen totaled just shy of $6 billion in exports (2 percent). As clean hydrogen gains traction as a climate solution, exports may need to accelerate to meet emissions reduction goals.

Time Is Running Short

Technological innovation is essential for fighting climate change, but the global clean energy innovation system is not healthy enough to drive it as quickly as it is needed. While private VC investments in cleantech have made a roaring comeback, the rest of the system is in a precarious state. Public investments in low-carbon energy RD&D have increased only modestly over the past five years, and most of these investments went to established technologies. Clean energy patents have mostly stayed flat, while clean energy technology exports grew more slowly than GDP.

Climate change is a global challenge that requires global solutions. Without better, cheaper clean energy and decarbonization technologies across the board, the world will not meet its climate goals. So far, nations have fallen far short of their commitments to meet the goals of the Paris Agreement, resulting in an ever-growing emissions gap. This emissions gap is also the result of a clean energy innovation gap. Time is running short, and the world needs to act now by accelerating innovation that will make climate solutions feasible, affordable, and reliable.