False Promises II: The Continuing Gap Between China’s WTO Commitments and Its Practices

Nearly 20 years after joining the World Trade Organization, China remains woefully short of meeting a broad range of commitments and responsibilities, to the detriment of both its trading partners and the international economic system.

KEY TAKEAWAYS

Key Takeaways

Contents

Two Decades of False Promises 5

Discriminatory Standards and Practices 23

Unfair Trade Practices Harm Competitors 28

Introduction

As China nears its 20th year of World Trade Organization (WTO) membership, originally acceding to the organization on December 11, 2001, it has never been further away from faithfully committing to the foundational principles and tenets of the organization and its fundamental obligations and commitments. WTO membership comes with rights to enjoy preferential access to other nations’ markets, but also responsibilities. In particular, it commits nations to support and pursue “open, market-oriented policies” in accordance with the foundational principles of “non-discrimination, market access, reciprocity, and fairness.”[1]

China has taken full advantage of its WTO rights. It has also largely ignored the responsibilities and commitments through its embrace of state-directed capitalism predicated upon an aggressive innovation mercantilism. This mercantilism denies foreign enterprises access to Chinese markets on reciprocal terms; distorts global markets, including for advanced-technology goods; and deprives nations of the benefits they believed they would receive when granting China accession into the community of trading nations.

In this report, China’s accession to the WTO is recounted along with the trade rules with which it fails to comply. The report also describes the economic benefits China has accrued in part by not complying with its WTO commitments. Lastly, it offers policy recommendations for policymakers from the United States and like-minded nations to address the continuing China trade challenge.

Our initial 2015 Information Technology and Innovation Foundation (ITIF) report on this topic, on which this report is based, is premised on China’s false promises to the WTO. Even with a full-scale Section 301 investigation initiated by the Trump administration, China has made little progress in fulfilling a wide range of its WTO commitments over the past two decades.[2]

As such, the report’s policy recommendations reflect China’s failings and present a path forward to rectify the false promises. These recommendations include the following measures:

▪ Develop a comprehensive “Bill of Particulars” against China

▪ Revoke China’s Permanent Normal Trade Relations (PNTR) and renegotiate WTO market access schedules for Chinese goods and services

▪ Pursue a nonviolation nullification and impairment case against China at the WTO

▪ Insist that China extend to other nations provisions from the U.S.-China Phase One agreement

▪ Strengthen subsidies disciplines at the WTO

▪ Create a Democracies’ Alliance Treaty Organization (DATO) for trade

▪ Form a Global Strategic Supply Chain Alliance (GSSCA)

▪ The United States should join the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP) and pursue free trade agreements (FTAs) with like-minded nations

▪ The United States Trade Representative’s Office (USTR) should self-initiate more cases against China before the WTO.

▪ Elevate the focus on technology, innovation, and intellectual property (IP) in U.S. trade policymaking

High Expectations

Negotiations toward China’s accession to the General Agreement on Tariffs and Trade (GATT) and its successor organization, the WTO, began in 1986 and took 15 years to complete. China ultimately entered the WTO on December 11, 2001, with the WTO’s then-142 members voting in favor.[3] Policymakers believed that giving China a stake in global institutions such as the WTO would bind it into the rules-based system set up after World War II. As the Economist wrote, they hoped “that economic integration would encourage China to evolve into a market economy and that, as they grew wealthier, its people would come to yearn for democratic freedoms, rights and the rule of law.”[4]

At the time, pundits hailed China’s accession as a pivotal moment that heralded the country’s shift toward a market-based economy that would adhere to the rules of international trade. WTO Director General Dr. Supachai Panitchpakdi, who led the organization from 2002 to 2005, and Mark Clifford, then a regional editor for BusinessWeek, heralded the move in their book China and the WTO: Changing China, Changing World Trade. “It is virtually impossible to overstate the importance of bringing the world’s most populous nation into a system that establishes internationally accepted rules for economic behavior,” they wrote.[5] Furthermore, “The WTO will set out the rules for a market-based economy … The agreement signals China’s willingness to play by international trade rules and to bring its often opaque and cumbersome governmental apparatus into harmony with a world order that demands clarity and fairness.”[6]

Now, nearly 20 years on, a serious evaluation of China’s time in the WTO shows that on balance the country has not moved significantly toward the WTO trading order, and by and large has not lived up to its commitments.

Panitchpakdi and Clifford were not alone. Then-WTO Director General Mike Moore gushed in 2001 about China’s decision to join the WTO, describing it as “momentous,” and asserting that “China’s opaque and arbitrary trade and investment rules will become transparent, stable, and more predictable.”[7] Moore assuaged those concerned China might not live up to its commitments, intoning, “If it doesn’t, the U.S. or any other WTO member government can use the organization’s dispute-settlement procedures to ensure it does.”[8]

The WTO itself stated, “China has agreed to undertake a series of important commitments to open and liberalize its regime in order to better integrate into the world economy and offer a more predictable environment for trade and foreign investment in accordance with WTO rules.”[9]

Pascal Lamy, the European Union (EU) trade commissioner who negotiated Chinese WTO entry on behalf of the EU and later became WTO director-general, deemed China’s accession a “win-win agreement” that would “serve to boost the rule of law in China” while giving countries (including China itself) “predictable, rules-based access to other markets.”[10]

Global major powers rejoiced. “China’s accession can only lock in and deepen market reforms, empowering those in leadership who support further and faster moves toward economic freedom,” wrote the European Commission.

President Clinton called China’s accession “a hundred-to-nothing deal for America when it comes to the economic consequences,” and one that would “have a profound impact on human rights and liberty” in China.[11] Then-president George W. Bush promised that granting permanent normal trade relations to the Middle Kingdom would “narrow our trade deficit with China.”[12]

If China had been a “normal” country, such expectations might very well have been warranted. But it was not. Its massive economic size and growth rates impeded foreign business from a “capital strike” to punish China for its mercantilist behavior. China could and does punish any company that has the temerity to encourage countries to bring a case to the WTO.

Consider the case of one high-level official of a U.S. Fortune 100 company. He met with the head of a major Chinese Ministry to complain about an egregious violation of WTO rules that was hurting his business to the benefit of a Chinese competitor, and threatened a WTO case. The response: If the company advocated for a WTO case to be brought forward, they would be foreclosed in the future from selling in China.[13] Needless to say, the company did nothing, as it was better to have a shrinking share of the market than nothing at all.

In essence, many companies have no choice but to tolerate China’s actions because they must have access either to the market or the low-priced labor, whose low price was subsidized even more by currency manipulation.

In addition, the WTO has lacked tools to discipline many of China’s most-effective mercantilist practices, including currency manipulation, IP theft, and the forced technology transfer carried out by administrative guidance rather than formal rules. Neither the WTO itself nor its member countries have ever had the political courage to take on China’s misdeeds in a serious and sustained way.

As a result, many early supporters of China’s WTO accession soon realized a problem was brewing. In 2010, former U.S. trade representative Charlene Barshefsky, who led China’s WTO accession negotiations for the United States, observed that China’s embrace of trade-distorting industrial policies, “raises a significant and profound—almost theological—question about the rules as they exist.”[14]

In 2018, two former Obama administration officials—Kurt M. Campbell, who now leads the Biden administration’s Asia policy team at the National Security Council, and Ely Ratner (now at the Office of the Secretary of Defense)—admitted that both Democratic and Republican administrations “had been guilty of fundamental policy missteps on China.”[15] That same year, even the Economist magazine wrote that the West’s gamble on China had failed and “the illusion has been shattered” that China will integrate into the liberal international order.[16]

China may have evinced some degree of economic liberalization and market opening in the first decade after WTO accession, particularly in initially shrinking its large state-owned enterprise (SOE) sector. However, since President Xi Jinping’s ascent to leadership in 2013, these reforms have reversed and reformers who were sympathetic to a more market-driven model shunted to the sidelines.

As Nicholas Lardy of the Peterson Institute of International Economics explained, “Xi came into office endorsing wide-ranging market-oriented economic reform but quickly abandoned this design in favor of a more-statist approach.” Lardy continued that, since 2012, market-driven growth has made way for “a resurgence of the role of the state in resource allocation and a shrinking role for the market and private firms.”[17]

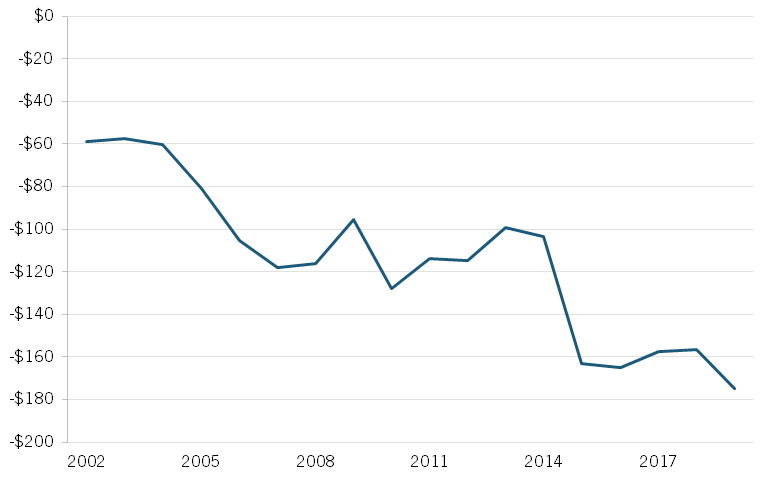

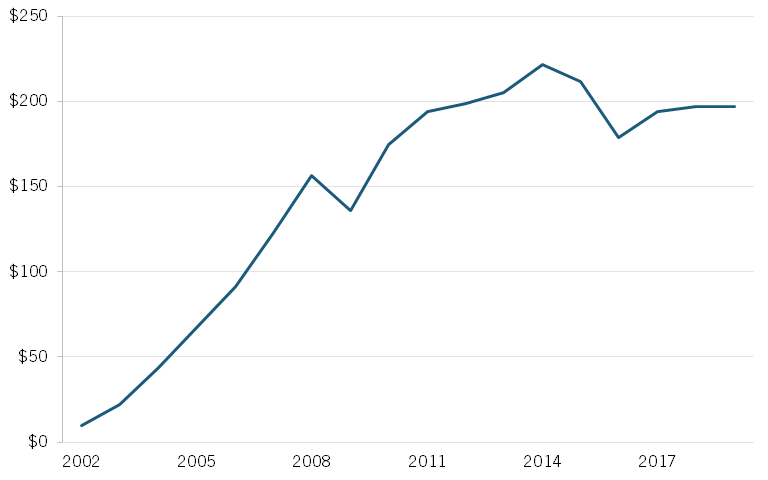

Nearly 20 years on, a serious evaluation of China’s time in the WTO shows that the country has not moved significantly toward the WTO trading order. By and large, China has not lived up to its commitments. Nor has it led to a reduced trade deficit for the United States (or for many other nations). The WTO’s dispute settlement system also fails to constrain China’s actions.

Whereas the United States had the wherewithal to “sue” China for not living up to many of the commitments and standards it should have already been adhering to as a WTO member, most nations don’t have that ability, and so continue to suffer from China’s refusal to play by WTO rules.

In short, China knew what it had to promise to gain access to the WTO. It made these promises. Its subsequent actions, however, have demonstrated its lack of intention to keep them. Getting into the WTO enabled China to gain largely carte blanche protection against trade enforcement measures that other nations might take. Accession was not about driving internal reform and moving toward a market-based economy.[18] China ramped up its innovation mercantilist policies and practices after joining the WTO. Its actions also revealed WTO enforcement against informal and subtle, yet effective, mercantilist practices to be no more than a paper tiger.

Two Decades of False Promises

China continues to fail to meet a wide range of its WTO commitments. According to USTR’s 2020 USTR Report to Congress on China’s WTO Compliance:

China’s record of compliance with the terms of its WTO membership has been poor. China has continued to embrace a state-led, non-market and mercantilist approach to the economy and trade, despite WTO members’ expectations—and China’s own representations—that China would transform its economy and pursue the open, market-oriented policies endorsed by the WTO. China’s non-market approach has imposed, and continues to impose, substantial costs on WTO members.[19]

Such was the extent of China’s failure to meet its commitments to the United States that in 2018, the Trump administration opened a Special 301 investigation into China’s trade and economic practices. The effort culminated in the imposition of tariffs on approximately $350 billion worth of Chinese exports to the United States—that’s about 66 percent of Chinese exports to America, at an average tariff rate of 19 percent. A Phase One “China-US Economic and Trade Agreement” ensued, which mandated structural reforms and other changes to China’s economic and trade regime in the areas of IP, technology transfer, agriculture, financial services, and currency and foreign exchange.[20] The Biden administration has left most of those tariffs in place.[21]

The United States had the wherewithal to “sue” China for not living up to many of the commitments and standards it should have been adhering to as a WTO member. Most nations do not have that ability. They continue to suffer from China’s refusal to play by the rules it signed up for in joining the WTO.

In its “2019 Global Mercantilist Index” report, ITIF ranked 60 nations on 18 mercantilist-oriented variables, including market access restrictions, forced localization of production, currency manipulation, IP theft, digital protectionism, and benefits for domestically owned enterprises, among others. The report found that China is in a class of its own when it comes to innovation mercantilism—it is the only country to score in the “High” category. Of the 60 nations assessed, China tied (with Brazil, India, and Russia) for the highest score in both the Preferences for Domestic Production and NTE (National Trade Estimate) Report Ranking (with Brazil and Russia) categories. China also had the highest Digital Trade Barriers score outright and scores above 1 in every category except Currency Manipulation and Tariffs and Import Discrimination.[22]

To enumerate every Chinese failure to live up to its WTO commitments over the past two decades would represent an exhaustive undertaking. Hence, this report examines the 12 highest-level, most-important examples of China’s continuing failure to meet its WTO commitments, though primarily oriented toward the U.S.-China trade relationship. (See table 1.) They are

▪ Fundamentally rejecting the WTO’s market orientation;

▪ State-led industrial planning that defies WTO norms;

▪ Continuing prevalence of and preferences for SOEs;

▪ Massive industrial subsidization often leading to overcapacity;

▪ Failure to make timely and transparent notifications of subsidies;

▪ Forced technology transfer and joint venture requirements;

▪ Failure to respect foreign IP rights;

▪ Abuse of antitrust rules;

▪ Discriminatory technology standards;

▪ Failure to reciprocally open government procurement;

▪ Continuing use of service-market access restrictions; and

▪ Retaliatory use of trade remedies.

This report represents an effort to place China’s WTO-contravening economic and trade practices within these 12 discrete buckets. However, the essential point is that the policies collectively represent the Chinese Communist Party’s (CCP) concerted effort to effectuate its brand of state-led capitalism with a heavy dollop of innovation mercantilism.

To be clear, China is not expected to be a free-market, libertarian haven. A nation such as China will want to have industrial policies to spur growth. That is not what is in dispute. What is in dispute is the overall extent of these policies and, importantly, whether they violate the spirit and letter of the WTO.

Table 1: WTO commitments China has failed to fully meet

|

Chinese WTO Commitment |

Has China Lived up to the Commitment? |

|

Embracing open, market-oriented policies |

No |

|

Embracing national treatment—treating foreign firms the same as domestic ones |

No |

|

SOEs shrinking as a share of the economy, especially in technology industries |

No |

|

SOEs making purchases based on commercial considerations |

No |

|

Curtailing extensive industrial subsidization |

No |

|

Providing timely and transparent notification of subsidies |

No |

|

Curtailing forced technology transfer, including through coerced joint ventures |

No |

|

IP theft and violations being significantly reduced |

No |

|

Technology standards developed transparently according to WTO Technical Barriers to Trade principles |

No |

|

Competition and antimonopoly policies applied on non-discriminatory terms |

No |

|

Joining the Government Procurement Agreement |

No |

|

Information and Communications Technology and telecommunications market opening to foreign producers |

No |

|

Foreign film distribution being liberalized |

No |

|

Foreign banks enjoying genuine national treatment and market access |

No |

|

Responsible and nonretaliatory use of trade remedies |

No |

Rejection of the WTO’s Market Orientation

There are myriad specific areas where China has failed to meet its WTO commitments. Fundamentally, China rejects the most foundational principle of the WTO: a market-based orientation.

Launched in 1995, the WTO grew out of the GATT set up after World War II. The GATT is fundamentally based on a market-economy view of world trade.[23] In 1994, the Marrakesh Declaration, signed by 123 nations, brought eight years of Uruguay Round negotiations to a conclusion. The WTO launched the following year. The declaration affirmed that WTO members participate “based upon open, market-oriented policies.”[24] As USTR noted, “It clearly was not contemplated that any WTO member would reject market-based policies in favor of a state-led trade regime.”[25]

Similarly, WTO Deputy Director-General Alan Wolff recently stated:

[T]he fundamental underlying assumption of the WTO is that market forces will dictate competitive outcomes. Few if any of the rules would have their intended positive effect if commercial considerations—price, quality, delivery, and the like—were overcome by political considerations, such as the implementation of buy national policies due to government influence.[26]

The distinction matters because market-oriented economies simply cannot interact fairly with nonmarket economies (NMEs) in “unconditional” market-based trade agreements such as the GATT/WTO. Mutually beneficial market access cannot be guaranteed when governments, not market forces, dictate competitive outcomes.[27]

While this report places China’s WTO incompliant polices into 12 discrete buckets, it’s essential to recognize their inherent “interwoven, overlapping, and reinforcing” nature, constituting the core of China’s innovation-mercantilism-driven brand of state-led capitalism.

Such a situation means none of the following three outcomes can be guaranteed to governments with market-oriented economies: 1) their own companies and workers will enjoy equal opportunities for market access or legal protections in NME systems; 2) imports from NMEs will compete against market-oriented producers on fair market conditions; and 3) trade-related employment gains and losses will reflect a fair and efficient allocation of resources.[28] USTR summed up the quandary well when it noted, “Companies in economies disciplined by the market cannot effectively compete with both Chinese companies and the Chinese state.”[29]

Yet, during WTO entry negotiations, Chinese representatives averred that China would hew to a market orientation and that its government would not influence trade and business operations.

As the WTO Report of the Working Party on the Accession of China notes, “The Government of China would not influence, directly or indirectly, commercial decisions on the part of state-owned or state-invested enterprises, including on the quantity, value, or country of origin of any goods purchased or sold, except in a manner consistent with the WTO Agreement.”[30]

China’s representative reiterated these points in an introductory statement to the report:

A nation-wide unified and open market system had been developed. An improved macroeconomic regulatory system used indirect means and market forces to play a central role in economic management and the allocation of resource. …Further liberalization of pricing policy had resulted in the majority of consumer and producer products being subject to market prices.[31]

China has backtracked from (or simply ignored) this essential requirement of WTO membership through its embrace of, in Chinese President Xi Jinping’s framing, a “socialist market economy with Chinese characteristics.” The Chinese government—that is, the CCP—exercises effective control over all domestic firms (SOE or private) operating in its economy.

In 2001, China promised WTO members that the government would not influence, directly or indirectly, the commercial decisions of SOEs. That has not been the case. Under Article 19 of the Company Law, all SOEs or private Chinese companies have a Chinese CCP cell that management must listen to, if not necessarily obey.[32] Article 19 in essence codifies CCP influence over corporate governance and business decisions in China.

While Chinese leaders attempt to obfuscate and prevaricate about the true nature of their economic system with epithets such as “a socialist market economy with Chinese characteristics,” the essential point is China’s fundamental rejection of a market-based system.

China’s “state capitalism,” or “China Inc.,” as described by Mark Wu, is not found anywhere else in the world and differs significantly from the economic models that influenced the Uruguay Round agreements. Wu outlines six elements that make China Inc. unique:

▪ The state (i.e., the State-owned Assets Supervision and Administration Commission of the State Council (SASAC)) as a corporate holding entity

▪ State control of financial institutions

▪ State control over planning and inputs (i.e., the National Development and Reform Commission (NDRC))

▪ Chinese-style corporate groups and affiliated networks

▪ Communist Party involvement and control

▪ The intertwined nature of private enterprises and the party-state[33]

This gives rise to an economy wherein the party-state—a form of government in which a political party, rather than citizens or individual politicians, are the primary basis of rule—remains all powerful, though with a veneer of economic activity putatively driven by private enterprises. It is difficult to apply labels such as “market vs. nonmarket” and “private-led vs. state-led” to the Chinese context.[34] Chinese leaders may attempt to obfuscate and prevaricate about the true nature of their economic system with epithets. Essentially, China fundamentally rejects a market-based system.

China also rejects the fundamental WTO principle of comparative advantage. Countries all have an advantage in production relative to others and should specialize in the production and export of those products or services—and subsequently use those gains to trade for products and services for which they have less comparative advantage.[35] China increasingly rejects this view and seeks absolute advantage across virtually all advanced-technology industries (as the following section will elaborate).

To be sure, this does not mean that only one version of capitalism fits within the WTO. In his classic 1967 book Modern Capitalism: The Changing Balance of Public and Private Power, Andrew Shonfield outlined the distinctly different flavors of capitalism that evolved in the post-war era. In the German model, large banks play a key role in allocating investment. The Italian model espouses public–private ownership of key industries, the French model touts indicative planning, and the Japanese model favors state-led industrial policy. Meanwhile, the American and British models offer largely free-market, laissez-faire capitalism, albeit leavened with a growing social-welfare state.[36]

Notwithstanding their differences, Shonfield concluded that advanced capitalist economies share basic convictions. Private capital should be at the center of economic activity, market-based transactions are the key to prosperity, and private property should be protected. In short, any differences between capitalist nations are of degree, not of kind.

Against this understanding, China tries to portray itself as a market economy.

Indeed, many simply assume China has become capitalist. For instance, Wall Street financier Steven Rattner argued that China “understands the benefits of incorporating a robust free-enterprise element.” Nobel laureate Ronald Coase and his coauthor Ning Wang have proclaimed that China has “embraced capitalism,” citing, in part, the reference to Adam Smith’s book The Theory of Moral Sentiments having more than a dozen Chinese translations.

China does have many “private” companies, which allowed Communist Party member Jack Ma to become a billionaire as head of Alibaba Group, which, among other things, translates capitalist classics into Mandarin. This does not mean it is capitalist. Few describe the Chinese economic system without putting a modifier in front of the terms “capitalism,” “authoritarian,” “state,” “predatory,” or “Communist.” This tells us something—as should the CCP’s calls for a socialist market economy. The differences between the Chinese and Western variants of capitalism are more of kind than of degree.[37]

China is a hybrid economy in which the state uses an array of tools for Communist-Party ends. To start with, China has more than 150,000 SOEs. However, Chinese state capitalism is not just, or even principally, about the number and size of such enterprises. It is about the CCP’s central role in virtually all aspects of economic life. In fact, CCP officials are part of many Chinese companies in order to make sure the company follows the “direction” of the state.

Indeed, the party takes great effort to make its central planning sound like a jubilant, bottom-up exercise developed by cherubic-faced workers and wise intelligentsia. At its heart, however, Chinese state capitalism is a system in which the purpose of private and public firms is to fulfill the goals of the CCP—which itself uses an array of tools to obtain that alignment: hard and soft power; carrots and sticks. As Mavroidis and Sapir wrote in China and the WTO: Why Multilateralism Still Matters, “In China, the market economy is subservient to the needs of

the state.”[38]

Confusion about the Chinese economic system may stem from the view of capitalism as a system built on private ownership of property. Capitalism is more than that. It is a system in which those property owners have considerable, albeit not unlimited, freedom to pursue their goals without undue influence from the state. By this standard, China is far from a capitalist economy.

Indigenous Innovation: Industrial Planning Defying WTO Norms

A good prism to view China’s state-led capitalism through is its Made in China 2025 strategy: a 10-year, $500 billion blueprint aimed at transforming China into an advanced technology leader. The strategy specifically targets 10 strategic industries, including advanced information and communications technology (ICT); robotics and automated machine tools; aircraft and aircraft components; maritime vessels and marine engineering equipment; advanced rail equipment; new energy vehicles; electrical generation and transmission equipment; agricultural machinery; new materials; and pharmaceuticals and medical devices.[39]

China is well within its rights to develop competitiveness and innovation strategies. In fact, ITIF would counsel all nations to do so.[40] However, predicated in a drive for absolute as opposed to comparative advantage, China’s Made in China 2025 approach is palpably different in many ways from the approaches of other nations. Key differences include its government-directed, government-funded approach and mechanisms to increase Chinese global market share in these industries, as well as its overt attempts to decrease the market share of foreign enterprises in China.

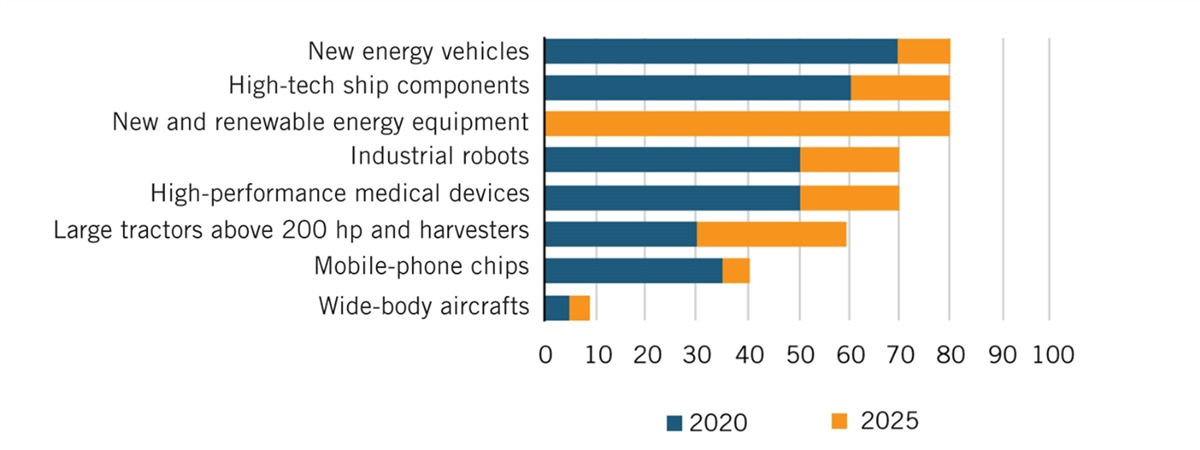

Figure 1: Semi-official targets for domestic market share of Chinese products in Made in China 2025 (%)[41]

Across these 10 industries, China has developed a series of national and provincial funds to progress Chinese firms toward three key strategic goals. The first goal is to “localize and indigenize,” which means “to indigenize research and development (R&D) and control segments of global supply chains.” The second goal is to “substitute.” This refers to the replacement of foreign suppliers with domestic sourcing wherever possible in value chains toward the production of final products. Third is to “capture global market share.”[42]

The aim is to supplant foreign market share with domestic market share in these industries. This is tantamount to a strategy of indigenous innovation. To these ends, the Chinese government established semi-official targets to achieve the desired domestic share of Chinese products identified in the Made in China strategy by 2020 and 2025. This translates to 80 percent domestic sourcing of new energy vehicles, high-tech ship components, and new and renewable energy equipment by 2030; 70 percent for industrial robots and high-performance medical devices by 2030; and 35 percent domestic sourcing of mobile-phone chips by 2025 and 40 percent by 2030.[43] (See figure 1.)

USTR describes the Made in China 2025 strategy thusly:

While ostensibly intended simply to raise industrial productivity through more advanced and flexible manufacturing techniques, Made in China 2025 is emblematic of China’s evolving and increasingly sophisticated approach to “indigenous innovation,” which is evident in numerous supporting and related industrial plans. Their common, overriding aim is to replace foreign technologies, products, and services with Chinese technologies, products, and services in the China market through any means possible to enable Chinese companies to dominate international markets.[44]

The semiconductor sector provides a representative case study of the Made in China 2025 plan. The implementing strategy, referred to as the “National IC Plan,” calls for $150-$170 billion in government subsidies—from central, provincial, and municipal Chinese governments as well as a variety of SOEs, from the technology sector and beyond. The goal is to enable China to become self-sufficient or autarkic in every facet of the industry. These subsidies were not designed to merely prop up domestic competitors, however. They are also to be deployed in international markets to acquire the companies and technologies needed to help strengthen China’s position in the industry.[45]

The Organization for Economic Cooperation and Development (OECD), in describing the strategy, noted, “Chinese authorities have indicated that ‘they intend to use the national [semiconductor] funds selectively’ in order to acquire foreign technology.”[46] From 2015 to 2017 alone, Chinese investors and firms offered more than $30 billion in bids for U.S. and European semiconductor companies.[47] From 2014 to 2019, China’s Tsinghua Unigroup Ltd.—the technology investment arm of one of China’s top state-led universities—attempted to invest an estimated $47 billion to acquire Western companies.[48]

By December 2020, government-guided technology funds controlled more than RMB 4 trillion ($610 billion) in capital.[49] This represents Chinese government-directed manipulation, not market-based competition, in one of the world’s most-important industries. It is perfectly symbolic and representative of the centralized industrial planning system that is inconsistent with WTO principles.

The Prominence of State-Owned Enterprises

According to China, as of 2016, there were 150,000 state-owned or state-controlled enterprises at the central and local government levels (excluding financial institutions) with total assets worth $15.2 trillion. The SOEs employed 30 million workers and accounted for 40 percent of industrial assets.[50] Joining the WTO was supposed to lead to a decline in the prevalence of and preferences for Chinese SOEs. That has not been the reality.

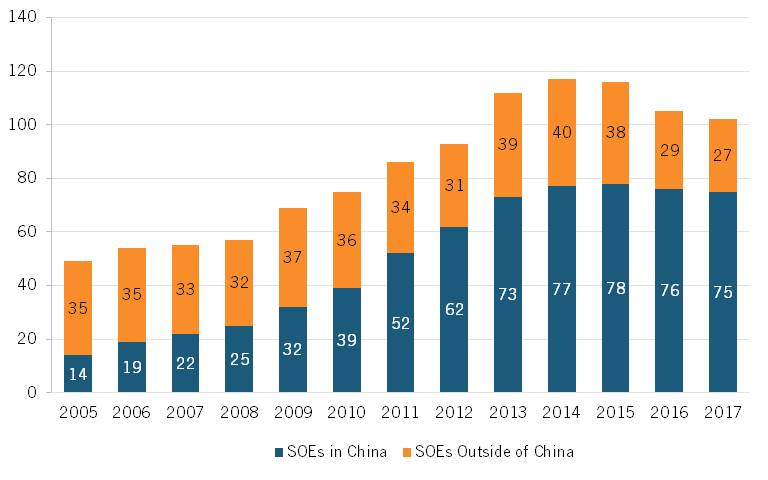

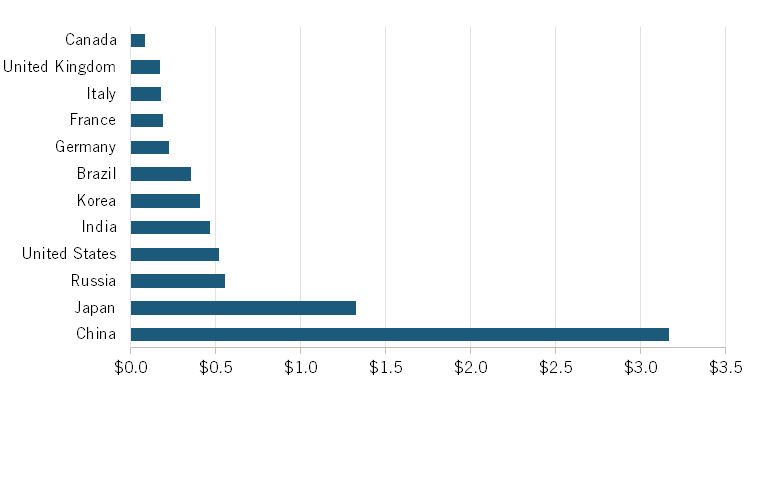

Rather, China’s SOE sector has grown significantly over the last four decades, both in total numbers and market capitalization.[51] In fact, the number of Chinese SOEs in the Fortune Global 500 has grown considerably since 2005. China’s share of such firms has also increased substantially over that time, to where Chinese SOEs account for about three-quarters of such firms today. (See figure 2.) As of 2019, 109 Chinese corporations were listed on the Fortune Global 500. Only 15 percent of those were privately owned, and 93 were SOEs.[52]

Figure 2: Number of SOEs in Fortune Global 500, 2005–2017[53]

China’s SOEs have only gotten stronger under the leadership of President Xi Jinping. According to a 2019 OECD report, “Somewhat surprisingly, over the past decade state assets doubled relative to GDP in competitive industry SOEs.”[54]

China’s SOEs play an outsized role in its economy, particularly in strategic sectors.[55] For instance, China’s banking system is largely dominated by state-owned or state-controlled banks. According to the U.S. Congressional Research Service, China has identified the industries in which the state should have full control. These industries include autos, aviation, banking, coal, construction, environmental technology, information technology, insurance, media, metals (such as steel), oil and gas, power, railways, shipping, telecommunications, and tobacco.”[56]

Moreover, SOEs’ share in many key strategic industries is rising. Again, the semiconductor industry provides a good example. Out of China’s top-10 semiconductor companies by revenue, China’s National IC Plan Fund and Chinese SOEs together hold more than 25 percent of at least 5 of those firms.[57] An OECD report on government-induced distortions in the global semiconductor industry finds that Chinese government investment has “profoundly reshaped China’s semiconductor industry, combining to give the state a stronger influence over domestic companies.”[58] Distinguishing between SOEs and other companies in China, the report explains, is complicated by the “blurring of boundaries between the state and private interests” through critical avenues of state influence.[59]

Chinese SOEs enjoy considerable advantages unavailable to private enterprises, domestic or foreign. SOEs receive preferred access to bank capital, below-market interest rates on loans from state-owned banks, and favorable tax treatment. They also operate under regulatory policies that create a favorable competitive environment relative to non-SOE firms and receive capital injections when needed.[60] They further benefit by being the preferred suppliers to China’s government, at all levels. Thanks to government subsidies and support, they survive without having to earn the market-based returns that are required of companies competing in

open markets.

In 2020, despite one of history’s worst global economic downturns, nearly 80 percent of centrally administered Chinese SOEs reported year-on-year profit growth, with net profits up 2.1 percent to 1.4 trillion yuan ($215.9 billion) for the year.[61] A 2015 study finds that the pretax profits of China’s SOE sector were roughly one half of the pretax profits in the US nonfinancial corporate sector.[62]

Yet, global competitors have to earn market-based rates of return to survive, let alone to realize funds that can be reinvested in future generations of R&D and innovation. Chinese firms can endure long periods of below-market rates of return, giving them a competitive advantage over more innovative firms.[63]

“China claims that its SOEs make business decisions of the state based on market principles,” a USTR report summarizes. “However, the government and the Party continue to exercise control over SOEs.”[64]

Again, this stands in direct contravention to China’s promises to WTO members that it “would not influence, directly or indirectly, commercial decisions on the part of state-owned or state-invested enterprises.”

Subsidies Leading to Overcapacity

Observers suggested that levels of state subsidies to enterprises would fall dramatically with China’s entry into the WTO. Yet, across a wide range of industries—from semiconductors and solar panels to steel, aluminum, glass, and auto parts—massive Chinese government subsidies continue apace. For instance, an estimated 95 percent of Chinese firms in technology industries received R&D subsidies in 2015, which accounted for 22 percent of those firms’ R&D investments.[65]

Since China joined the WTO in 2001, subsidies have financed approximately 20 percent of China’s manufacturing capacity every year.[66] The subsidies help economically inefficient firms to be more competitive. Markets are distorted and firms trying to compete on market-based terms are disadvantaged, in part by being deprived the revenues needed to reinvest in R&D and innovation.[67]

According to the U.S. International Trade Commission, subsidies are essential to China’s semiconductor industrial plans and can take the form of regional, provincial, and national funds (such as the National IC Plan Fund); investment vehicles; and policies that incentivize industry investment, such as tax breaks.[68] As noted, China’s “Guidelines to Promote the National Integrated Circuit Industry”—the National IC Plan—has sought to contribute as much as $170 billion in funding from Chinese central, provincial, and municipal governments to establish a closed-loop semiconductor ecosystem in China.

An OECD study of subsidies in the semiconductor industry finds that government support “through below-market equity appears to be particularly large in the semiconductor industry and concentrated in one jurisdiction [China].”[69] State subsidies accounted for over 40 percent of the revenues of Semiconductor Manufacturing International Corporation (SMIC) and over 30 percent of Tsinghua Unigroup’s from 2014 to 2018. Moreover, the report concludes that there appears to be a direct connection between equity injections by China’s government funds and the construction of new semiconductor fabs in the country.[70]

China’s industrial subsidies significantly distort markets and disadvantage firms trying to compete on market-based terms, in part by depriving them of revenues needed to reinvest in R&D and innovation.

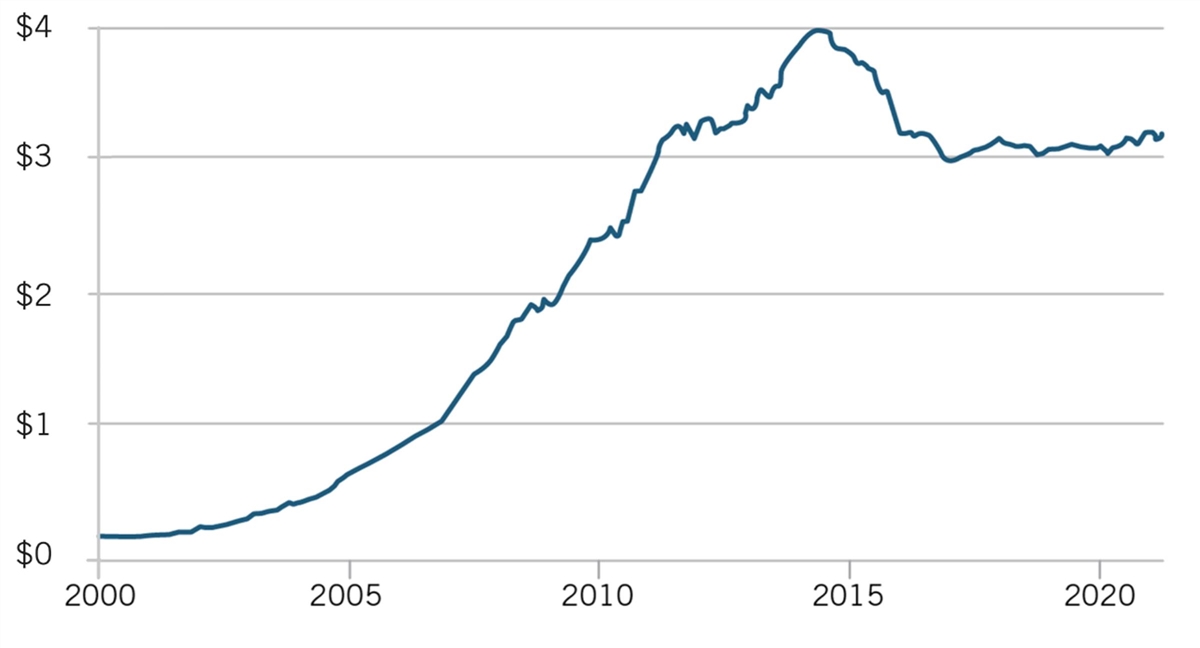

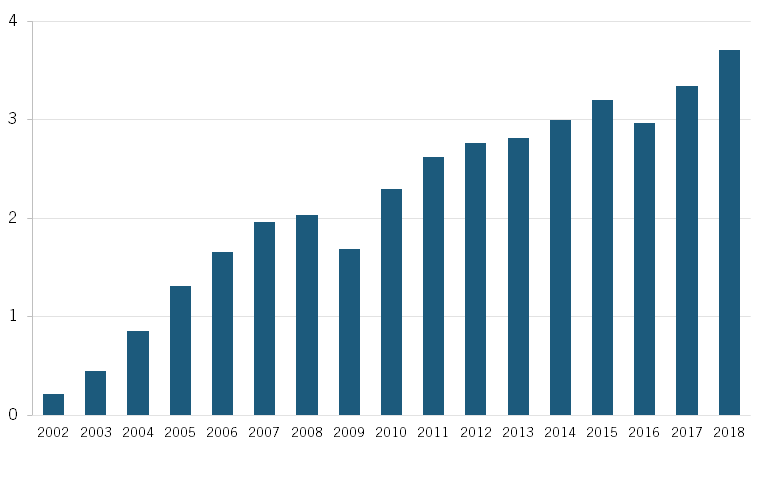

Massive industrial subsidies have been critical to China’s emergence in other industries as well. With its global market share growing from practically nothing in 2005 to over 60 percent by 2011, China became the dominant global player in solar photovoltaic (PV) manufacturing during the 2000s—with critical help from government subsidies.[71] Chinese solar output was turbocharged by at least $42 billion of subsidies from 2010 to 2012 alone, according to the GW Solar Institute at George Washington University. The subsidies allowed China’s major PV manufacturers to sustain enormous losses during their scale-up phase.[72]

The global glut that followed led to a crash in solar panel prices, by 80 percent from 2008 to 2013. Most of the more-innovative foreign competitors went bankrupt, thus setting up Chinese producers for a final coup de grace. They used their government-enabled profits to buy bankrupt Western solar firms in order to strip out their remaining technology and send it back to China.[73] As a spokesperson for SolarWorld, a German solar PV firm, explained in 2011, “Pervasive and all-encompassing Chinese subsidies are decimating our industry.”[74]

Similarly, in high-speed rail, CRRC Corporation Limited’s Chinese financial documents have reported more than 5.4 billion RMB (almost $800 million) in direct subsidies since 2015, with some 1.37 billion RMB (approximately $191 million) provided in 2018 alone.[75]

Extensive subsidization has also turbocharged the growth of Chinese telecommunication firms Huawei and ZTE. The Wall Street Journal reported that Huawei has received some $75 billion in state support over the past 25 years, including $1.6 billion in grants, $46.3 billion in credit facilities, $25 billion in tax breaks, and $2 billion in subsidized land purchases.[76] By comparison, since 2000, Cisco Systems has received $44.5 million in total state and federal subsidies, loans, guarantees, grants, and other assistance from the U.S. government.”[77]

China is the world’s largest telecommunications market, with approximately half of global 5G base stations found in the country. This market guarantee is the biggest “subsidy” provided to Huawei and ZTE, giving them billions of additional RMB annually in revenue. Furthermore, Huawei and ZTE have long benefited from a deeply undervalued Chinese currency, which provided it with a 25 to 35 percent price subsidy.[78]

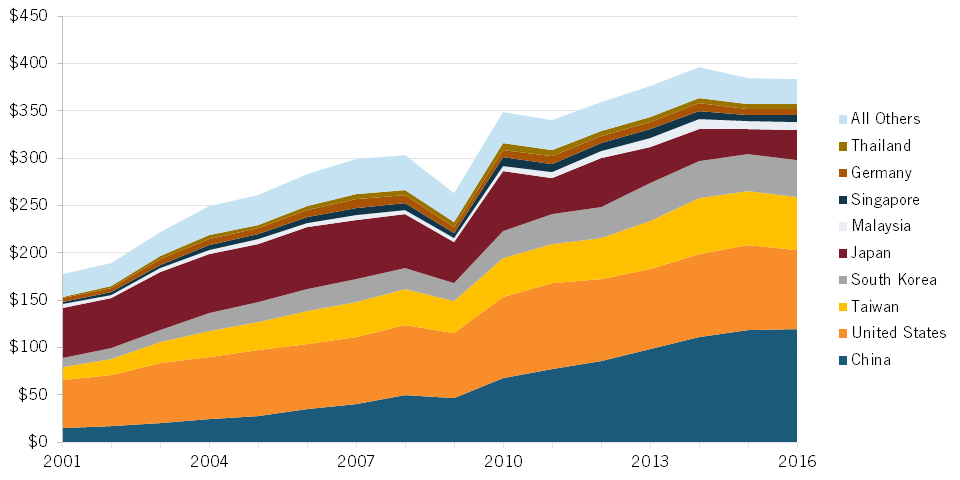

China’s subsidies in semiconductors, solar panels, high-speed rail, and telecommunications are certainly problematic. But they are equaled by Chinese subsidies in other sectors, particularly steel and aluminum. China’s share of world steel output grew from just 15 percent in 2000 to 50 percent by 2015. During the same period, America’s share fell by half (from about 12 to 6 percent), Japan’s by roughly equivalent amounts, and Europe’s cratered from 22 to 10 percent. By 2015, China’s steel output had doubled to 112 million tons annually—more than America’s total consumption of steel in a single year.[79] Today, two individual Chinese steel producers alone manufacture more steel than Japan’s annual output.

Similarly, Chinese primary aluminum production capacity increased by more than 1,500 percent between 2000 and 2020. China accounted for more than 80 percent of global capacity growth during that period, and much of this capacity addition has been built with support by the Chinese government.[80] One study finds that the Chinese government provided $52 billion in subsidies to steel producers from 2001 to 2006 alone.[81] Again, these subsidies kept unprofitable Chinese firms alive. According to one report, subsidies accounted for four-fifths of the profits reported by Chinese steel companies in the first half of 2014.[82]

Elsewhere, a study by Harvard scholar Myrto Kalouptsidi finds that Chinese government subsidies decreased the cost of production in Chinese shipyards by 13 to 20 percent from 2006 and 2012.[83] That estimate does not include the government-directed undervaluation of China’s currency, which provided their shipbuilders with another 25 to 35 percent price subsidy. Without the subsidies, China’s estimated market share would be cut up to 50 percent, while Japan’s share would increase by 70 percent.[84]

Once firms accumulate the technology, competencies, and scale needed to go global, the Chinese government then often subsidizes their global market expansion, such as through the China Export-Import Bank and China’s Export and Credit Insurance Corporation (Sinosure).[85] As the Washington Post reported, Huawei’s customers in the developing world can take advantage of loans at below-market interest rates, drawing on a staggering $100 billion line of credit at state-owned banks.”[86]

According to the U.S. ExIm Bank, China’s official MLT [medium-long term] export credit activity from 2015 to 2019 alone was at least equal to 90 percent of that provided by all G7 countries combined. China’s aggressive provision of export credits were “fundamentally changing the nature of export credit competition,” the bank noted.[87] These subsidies not only help the recipients directly but are often tied to buying Chinese components. For example, in the high-end equipment manufacturing sector, China maintains a program that conditions the receipt of a subsidy on an enterprise’s use of at least 60 percent Chinese-made components when producing intelligent manufacturing equipment.[88] This represents a direct violation of WTO subsidies rules.

Lack of Notification and Transparency

Putting aside concerns regarding the propriety of China’s industrial subsidies under WTO rules is the separate issue that countries must notify their trading partners about their subsidies in a timely manner. China has failed to provide these notifications to the WTO in accordance with its WTO obligations. USTR describes China’s disregard of its WTO transparency obligations, which places its trading partners at a disadvantage, as a cloak for China to conceal unfair trade policies and practices from scrutiny.”[89] According to USTR:

Since joining the WTO, China has not yet submitted to the WTO a complete notification of subsidies maintained by the central government, and it did not notify a single sub-central government subsidy until July 2016, when it provided information largely only on sub-central government subsidies that the United States had challenged as prohibited subsidies in a WTO case.[90]

From 2011 to 2017 alone, the United States made formal requests (i.e., counter-notifications) for information from China regarding over 350 unreported Chinese subsidy measures.[91] China has consistently failed to provide a complete and comprehensive response.

Furthermore, China fails to provide a period for public comment for new trade-related laws and regulations—as it agreed to as part of its WTO accession and (again) at the U.S.-China Strategic and Economic Dialogue (S&ED) in 2011. Multiple USTR reports show that this is part of a consistent pattern by China to avoid scrutiny for discriminatory and trade-distorting rules, regulations, and subsidies.[92] China also regularly fails to publish measures in English, French, or Spanish before it implements them.

Forced Joint Ventures and Technology Transfer

In 2011, the Economist wrote erroneously, “Thanks to the WTO, foreign firms are no longer required to hand over technology in exchange for entry to China’s market.”[93]

Their comment is understandable, as China clearly committed, in one of the legally binding paragraphs of its Working Party report, that it would not condition investments on the transfer of technology. The report stated:

The allocation, permission or rights for importation and investment would not be conditional upon performance requirements set by national or sub-national authorities, or subject to secondary conditions covering, for example, the conduct of research, the provision of offsets or other forms of industrial compensation including specified types or volumes of business opportunities, the use of local inputs or the transfer of technology.[94]

In reality, Chinese technology transfer requirements are a continuing feature of Chinese policy. In 2012, 23 percent of the value of all foreign direct investment (FDI) projects were joint ventures.[95] In 2015, 6,000 new international joint ventures, amounting to $27.8 billion of FDI inflows, were established in China.[96] In their report China vs the World: Whose Technology Is It?, Harvard Business School professors Thomas Hout and Pankaj Ghemawat documented the technology transfer required in China as a condition of market access and impacted scores of companies in industries as diverse as aviation, automotive, chemicals, renewable energy, and high-speed rail.[97]

Not only do China’s forced joint venture and technology transfer practices continue to exist but they may actually be getting even worse.

ITIF’s recent report, “Heading Off Track: The Impact of China’s Mercantilist Policies on Global High-Speed Rail Innovation,” comprehensively documents how China forced foreign competitors to transfer rail technology to domestic competitors. After assimilating the technology with “stunning quickness,” the local companies then supplanted the foreign competitors in China’s domestic market and used the technology to compete with the original innovators in international markets.[98]

Because such conditions contravene China’s WTO commitments, officials are careful not to put such requirements in writing. Instead, they often resort to oral communications to pressure foreign firms to transfer technology, although recent decisions of the WTO Appellate Body have made it clear these unwritten measures can also be challenged.[99] USTR’s 2018 Special 301 report comprehensively documents how industrial plans such as Made in China 2025 apply foreign ownership restrictions, including formal and informal joint venture requirements, “to require or pressure technology transfer from U.S. companies to Chinese entities.”[100]

China has employed different tactics to the same end in the biopharmaceutical industry, wherein various policies enable Chinese firms to get access to U.S. technology. For example, the relatively short six-year term for data exclusivity, coupled with the lack of a formal definition of a “new chemical entity,” means the Chinese government can pressure U.S. firms to turn over important data to Chinese generic-drug firms.

Similarly, the Chinese government requires that all drugs sold in China go through Chinese clinical trials, even if they have already been approved in the United States. This extends the waiting time for a company to sell a drug by as much as eight years. In other words, the company has only 12 years left of patent-protected sales in China before a Chinese generic company can copy the drug. Moreover, unlike in the United States and Europe, there is no extension in China of marketing exclusivity at the back end to reflect long clinical trial delays. Finally, China pressures foreign biopharmaceutical companies to form joint ventures if they want their products included on the government list of drugs that qualify for reimbursement.[101]

Forced technology transfer is also prevalent in cloud computing.[102] China requires companies running cloud-computing operations to be locally controlled. This means that if a company such as Amazon Web Services or Microsoft wants to serve the rapidly growing Chinese market, it must partner with a Chinese company and sell their services under the Chinese company brand. The partnership includes the expectation for the foreign cloud provider to provide the Chinese firm with technology and know-how.[103] Chinese cloud providers such as Aliyun—the cloud services unit of Alibaba—can establish their own data centers in the United States without any similar requirements.

China’s forced joint venture and technology transfer practices not only continue but may be getting worse. In May 2019, the Wall Street Journal reported the increasing frequency of forced technology transfers between European firms in China to local firms.[104] That same year, the European Chamber of Commerce found that more than twice as many firms felt compelled to undertake technology transfer in China as they did in 2017.[105]

European companies in high-value, cutting-edge industries felt more pressure than usual, the Chamber reported. Some 30 percent of chemicals and petroleum companies, 28 percent of medical-device companies, 27 percent of pharmaceutical companies, and 21 percent of automotive companies reported such transfers.

Clearly, the practice has concerned foreign firms for a long time, and is not abating. According to a survey conducted by the U.S.-China Business Council in 2015, some 59 percent of firms were worried about transferring technology to China. Some 23 percent had been asked to transfer technology within the previous three years.[106]

Intellectual Property Theft and Discriminatory Treatment

In China and the WTO, Panitchpakdi and Clifford were sanguine about the strength of China’s commitments to protect foreign IP. China has promised “to make a number of long-term structural changes to limit IPR [intellectual property rights] violations,” they wrote.[107] Joining the WTO, they added, would require China to recognize the Trade-related Aspects of Intellectual Property Rights (TRIPS) agreement, which provides protections for patents, copyrights, trademarks, service marks, industrial designs, digital content, and other intangible property.

However, IP theft by China has grown, and much of it is directly sponsored or instigated by the Chinese government. Jim Lewis of the Center for International and Strategic Studies described the action as “long-running state espionage programs targeting Western firms and research centers” that has carried over into cyberspace.[108]

Scores of researchers have documented the economic espionage. Nicholas Eftimiades in the Brown Journal of World Affairs characterized the actions as “a massive, whole-of-society approach to economic espionage.”[109] Michael Pillsbury referred to the regular hacking into foreign commercial entities as “the world’s largest perpetrator of IP theft.”[110] USTR’s 2021National Trade Estimate Barriers (NTE) report laments that “actors affiliated with the Chinese Government and the Chinese military have infiltrated the computer systems of U.S. companies, stealing terabytes of data, including the companies’ proprietary information and IP, for the purpose of providing commercial advantages to Chinese enterprises.”[111]

Indeed, China remains on USTR’s Priority Watch List of countries committing the most-extensive IP rights infringements.[112]

The acquisition of foreign semiconductor technology through IP theft has been a key pillar of Chinese industrial strategy.

Indeed the acquisition of foreign semiconductor technology through IP theft has been a key pillar of Chinese industrial strategy.[113] In November 2018, the U.S. Department of Justice (DOJ) charged China’s Fujian Jinhua Integrated Circuit Co. with working to steal trade secrets from U.S. chipmaker Micron Technologies.[114] That charge was followed in June 2020 with the conviction of Chinese national Hao Zhang for economic espionage and theft of trade secrets. Zhang had stolen from Avago, a California-based developer of semiconductor design and processing for optoelectronics components and subsystems, and Skyworks, a Massachusetts-based innovator of high-performance analog semiconductors.[115]

Nor are U.S. firms alone in being targeted. One assessment found that China’s SMIC alone has been responsible for billions of dollars in semiconductor IP theft from Taiwan.[116]

China’s IP theft is also rampant in the life sciences sector.[117] Chinese actors have hacked into the ICT systems of numerous U.S. biopharmaceutical companies, including Abbott Laboratories and Wyeth (now part of Pfizer).[118] Similarly, a report to the U.S. China Economic and Security Review Commission notes that Ventria Bioscience, GlaxoSmithKline, Dow AgroSciences LLC, Cargill Inc, Roche Diagnostics, and Amgen have all experienced theft of trade secrets or biological materials perpetrated by current or former employees with the intent to sell to a Chinese competitor.

In the academic sector, researchers have stolen information or samples from their employers at Cornell University, Harvard University, and University of California at Davis.[119] China also issues compulsory licenses for the IP for particular drugs.[120] In the clean energy sector, Chinese IP theft may have contributed to the collapse of SolarWorld, which claimed that $60 million in R&D investment and $600 million overall was “undercut” by Peoples Liberation Army hackers who stole the firm’s technology and shared it with Chinese manufacturers in 2012.[121]

In 2013, the IP Commission Report on the Theft of U.S. Intellectual Property found that China accounted for nearly 80 percent of all IP thefts from U.S.-headquartered organizations, amounting to an estimated $300 billion in lost business.[122] Updating its assessment in 2017, the Commission on the Theft of American Intellectual Property estimated that China’s IP theft may cost the U.S. economy as much as $600 billion annually.[123] By 2019, a CNBC Global CFO Council report found that one in five North American corporations had their IP stolen in China within the past year.[124]

As Timothy Qiu of China’s Shenzhen College of International Education wrote in one scholarly article, “It’s also important to note that coerced joint ventures often represent a critical conduit of involuntary IP transfer. American companies seeking to enter the China market are required to partner with an existing Chinese firm. These joint ventures become the vehicles for the siphoning of technologies and trade secrets.”[125]

Again, the United States is not alone. In 2019, the European Union Intellectual Property Office issued a report that estimates foreign IP infringement costs for the EU to reach €60 billion ($73 billion) in annual sales through IP theft in goods and services. The report identifies China/Hong Kong as the “main offender.”[126]

China also deals with IP unfairly by treating IP owned or developed in other countries in the same manner as IP owned or developed in China. At an S&ED meeting in May 2012 and again at a U.S.-China Joint Commission on Commerce and Trade (JCCT) meeting in December 2014, China agreed to treat both IP owned by or developed in other countries and IP owned by or developed in China as the same. Once again, however, USTR noted in a 2021 report that China “continues to pursue myriad policies that require or favor the ownership or development of intellectual property in China.”[127]

Some claim that the United States and other like-minded nations have little ground to stand on in contesting Chinese IP theft or forced tech transfer. They argue that the United States did the very same to the United Kingdom and other nations as it developed. For instance, as Martin Wolf wrote in the Financial Times:

In the 18th and early 19th centuries, the UK was the leading country and the U.S. striving to catch up. In the late 18th century, England duly criminalized the export of textile machinery and the emigration of textile mechanics. But one Samuel Slater emigrated covertly in 1789, to start a modern textile industry in the U.S. (the “technology” industry of the era). Other British ideas crossed the Atlantic, notably railways, just as Chinese ideas had come to Europe centuries earlier.[128]

This argument collapses when we are reminded that the WTO did not exist in the 1700s. Nor was the United States committed to a certain set of trade obligations in return for a certain set of trade benefits. China is a sovereign actor, but it is bound to the international treaty commitments it has made and the trade agreements it has entered. This includes the covenants of the WTO TRIPS agreement.

If China wishes to pursue a strategy of unfettered economic espionage, IP theft, and forced tech and IP transfer, it has that option. However, it should then remove itself from the WTO. Such policies and behaviors are fundamentally inconsonant with the commitments China has made to other nations in order to receive the benefits of market access that come with WTO membership.

Abuse of Antitrust Laws

China’s use of antitrust law as an industrial policy weapon poses a significant threat to many U.S. firms operating in China. It provides the Chinese government with a large and flexible tool to target foreign firms for almost any reason. Indeed, China’s 2007 antimonopoly law was designed to treat legitimately acquired IP rights as a monopolistic abuse. Article 55 states, “This Law is not applicable to undertakings’ conduct in exercise of intellectual property rights pursuant to provisions of laws and administrative regulations relating to intellectual property rights; but this Law is applicable to undertakings’ conduct that eliminates or restricts competition by abusing their intellectual property rights.”[129]

For the Chinese government, abuse means charging market-based IP licensing fees to Chinese companies. This provision has been used to take legal action against companies whose only “crime” is to be innovative and hold patents. Indeed, Chinese law allows compulsory licensing of IP by a “dominant” company that refuses to license its IP if access to it is “essential for others to effectively compete and innovate.”[130]

With Chinese courts largely rubber-stamping CCP dictates, foreign companies have little choice but to comply. All too often, complying means changing their terms of business so that they sell to the Chinese for less, transfer even more IP and technology to Chinese-owned companies,

or both.

USTR wrote that:

Through the threat of steep fines and other punitive actions, China’s regulatory authorities have pressured foreign companies to “cooperate” in the face of unspecified allegations and have discouraged or prevented foreign companies from bringing counsel to meetings. In addition, U.S. companies continue to report that the Chinese authorities sometimes make “informal” suggestions regarding appropriate company behavior, including how a company is to behave outside China, strongly suggesting that a failure to comply may result in investigations and possible punishment.[131]

Yet, this stands in contravention of China’s commitments under the WTO. Specifically, it is in violation of TRIPS Article 40 Section 8, which addresses “control of anti-competitive practices in contractual licenses” covenants.[132] The section essentially covers antitrust concerns relating to IP licensing, such as were at play in the Qualcomm and InterDigital cases.

In 2015, China’s NDRC fined Qualcomm, the world’s largest producer of smartphone chips, $975 million for purportedly using its dominant market share to overcharge Chinese telecommunications firms for its patent royalties. The governments of the EU, Japan, and the United States had concluded the contrary. In addition, China forced Qualcomm to offer 3G and 4G licenses at a lower price in China than Qualcomm’s normal wholesale rate.[133]

The WTO offers few antitrust remedies other than what is afforded under the TRIPS agreement. The first clause of Section 8, Article 40 states, “Members agree that some licensing practices or conditions pertaining to intellectual property rights which restrain competition may have adverse effects on trade and may impede the transfer and dissemination of technology.”[134]

Hence, a country must conduct economic analysis to prove adverse effects if it is going to assert that a company has abused anticompetitive practices in IP or technology licensing.[135] Furthermore, paragraph 3 entitles WTO members to enter consultations on this issue. As such, countries can insist that that all related decisions be made publicly available.

Moreover, since Article 40 is governed by other standards in TRIPS, such as due process, members are obligated to additional standards, such as “making decisions on the merits,” “without undue delay,” “based only on evidence,” “with an opportunity for review,” “with the right to written notice,” and “the right to be represented by independent legal counsel.”[136] China fails to meet virtually all these standards with regard to the investigations it has opened into alleged anticompetitive practices in IP and technology licensing agreements.

The WTO’s national treatment requirement obliges nations to treat foreign enterprises no worse than domestic ones. Yet, USTR reports that many U.S. companies have cited selective enforcement of the Anti-monopoly Law against foreign companies seeking to do business in China as a “major concern” and highlighted the limited enforcement of this law against SOEs.[137]

Discriminatory Standards and Practices

China is perhaps the world’s most-aggressive nation in terms of trying to develop technology standards and influence the direction of international standards development organizations (SDOs). One Chinese official framed China’s prevailing view of technology standards as, “Third tier companies make products; second tier companies make technology; first tier companies make standards.”[138] China pursues indigenous (i.e., China-specific) technology standards because it believes China’s domestic producers will gain advantage over foreign competitors and the royalties Chinese firms pay for foreign technologies will be reduced.

In June 2020, China unveiled its “China Standards 2035” strategy. The culmination of two years of development work, the strategy lays out a blueprint for China’s government and leading technology companies to set global standards in emerging technologies such as artificial intelligence (AI), 5G, the Internet of Things, and advanced manufacturing systems. The strategy seeks to help turn China’s enterprises into “tier-one” standards-making ones.[139]

China is certainly within its right to develop a strategy to influence standards development in a way that is advantageous to its companies. It is also reasonable for China to try to gain as much influence as possible in SDOs—that’s just smart and tough competition. However, China is not within its right to develop discriminatory technology standards, to prevent foreign companies from equitably participating in domestic standards-setting processes, or to otherwise contravene principles for the development of international standards identified in the WTO’s Technical Barriers to Trade agreement.

All too often, these latter practices have unfortunately characterized China’s standards-development efforts. China is not only aggressively writing standards for emerging technologies to benefit its own firms. It is also reportedly “exporting its standards through its Belt and Road initiative.”[140]

ITIF documented in its report “The Middle Kingdom Galapagos Island Syndrome: The Cul-De-Sac of Chinese Technology Standards” China’s development of indigenous technology standards, particularly for ICTs, even when effective international standards already exist. This approach is a core part of China’s industrial strategy. China developed unique indigenous technology standards across six key ICTs: wireless telecommunications networks, wireless local area networking, encryption technology, audio/video encoding, optical storage media, and Internet of Things.[141]

China is also trying to dominate the development of global AI standards. In 2018, China created an AI roadmap that identifies 23 critical near-term standards and 200 additional standards to be developed.[142]

That same year, China also introduced a new standardization law that appeared to favor local firms, goods, and services. The legislation referenced “indigenous innovation” while failing to note either its WTO commitments (thereby raising questions about WTO compliance) or its acceptance of existing international standards, as approved by various global SDOs.[143] In its new standardization law, China could have made clear it is committed to global rules and best practices on technical standards by explicitly acknowledging WTO technical barriers to trade commitments and core principles. It chose not to do so.[144]

Early evidence shows that China is continuing this trade-restrictive approach for new and emerging technologies. A report by the German think tank Mercator Institute for China Studies (MERICS) shows that Chinese standards for basic smart manufacturing correlate with about 70 percent of relevant international standards. It falls to around 53 percent for key smart manufacturing technology standards, and to 0 percent for standards relating to cloud computing, industrial software, and big data.[145]

China has become perhaps the world’s most-aggressive nation in terms of trying to develop technology standards and to influence the direction of international SDOs.

The United States and most other nations have adopted a voluntary, transparent, market-led, and global approach to standards development. In comparison, China has adopted a government-directed system and made it difficult for foreign firms to equitably engage in Chinese standards-setting processes.

According to USTR, foreign companies are often unable to effectively influence China’s domestic standards-setting processes. For instance, the technical committee for cybersecurity standards (known as TC-260) allows foreign companies to participate in standards development and setting, but does not universally permit them to participate as voting members. They face difficulties getting included in drafting and remain prohibited from participating in certain TC-260 working groups, such as the working group on encryption standards.[146]

Moreover, the Chinese government often exerts leverage on Chinese firms to favor domestic technology standards. In 2016, the Third Generation Partnership Project—one of the largest international bodies that sets standards on mobile technologies—was developing standards for fifth-generation mobile telecommunications networks. The project worked to develop standards for how to encode information and correct for errors in data transmission in a new enhanced mobile broadband scheme.[147] Several mathematical techniques were proposed, including one by Qualcomm, known as a “low-density parity-check” (LDPC) and one by Huawei called “polar coding.”

However, the Chinese firm Lenovo, which had voted for [Qualcomm’s proposed] LDPC, returned home to an online outcry for its “unpatriotic vote.”[148] Several months later, when a second part of the standard was being adopted, Lenovo switched to support Huawei’s polar codes, with Lenovo founder Liu Chuanzhi commenting, “We all agree that Chinese companies should be united and cannot be played off one another by outsiders.”[149]

Government Procurement

In joining the WTO, China agreed to also join the Government Procurement Agreement (GPA), which prohibits restrictions on government purchases between member countries in accordance with the national treatment principle. The agreement also further commits member countries to “to full transparency and non-discrimination (i.e., most-favored nation ‘MFN’) in government purchases.”[150] China thus made a commitment to open its vast government procurement market to the United States and other GPA parties.

To date, however, USTR reports that GPA parties view China’s offers as “highly disappointing in scope and coverage” and “incommensurate with the coverage offered by other GPA parties.”[151]

Nearly 20 years after it joined the WTO, China has yet to make a credible offer for GPA coverage, despite its commitment to do so swiftly in 2001.

China submitted its sixth revised GPA offer in October 2019. The entry showed some progress, but fell short of U.S. expectations (and those of other WTO members) and remains “far from acceptable to the United States and other GPA parties as significant deficiencies remain in a number of critical areas, including thresholds, entity coverage, services coverage, and exclusions.”[152]

Following the Phase One agreement, China said that it would “speed up the process of joining” the GPA. However, it did not submit a new offer in 2020.[153] In other words, nearly 20 years after it joined the WTO, China has yet to make a credible offer for GPA coverage, despite its commitment to do so swiftly in 2001.

Another facet of discriminatory Chinese government procurement practices relates to “indigenous innovation,” or discriminatory preferences for indigenously made Chinese products in government procurement. According to USTR, China agreed to de-link indigenous innovation policies at all levels of the Chinese government from government procurement preferences, including through the issuance of a State Council measure mandating that provincial and local governments eliminate any remaining linkages by December 2011.[154]

A decade later, that promise remains unfulfilled. In 2020, China’s Ministry of Finance made amendments to its Government Procurement Law and Tendering and Bidding Laws. However, USTR has assessed that “China continues to implement policies favoring products, services, and technologies made or developed by Chinese-owned and Chinese-controlled companies through explicit and implicit requirements that hamper foreign companies from fairly competing

in China.”[155]

Restricting Access to Services Markets

Across a range of services markets, from financial services to telecommunications and information technology services to theatrical films and audiovisual services, China fails to honor many of its decades-old commitments.

Banking and Electronic Payment Services

In the early years following China’s accession to the WTO, optimism reigned. In their book China and the WTO, Panitchpakdi and Clifford contended that foreign banks would enjoy the same privileges as domestic banks. “Chinese banks,” they wrote, “will for the first time face real competition.”[156]

This has not been the reality. Instead, the United States brought a case before the WTO challenging China’s restrictions to banking market access, prevailing in 2013. By 2021, China had opened its banking sector to wholly foreign-owned banks. However, at the same time, it has maintained restrictions on market access in other ways. (For instance, discriminatory and non-transparent regulations have limited foreign banks’ ability to provide capital market-related activities in China.) Consequently, foreign banks have been unable to establish, expand, and obtain significant market share in China.[157] In fact, as of year-end 2020, foreign banks held only 1.4 percent of banking assets in the country.[158]

China has long placed restrictions on foreign companies operating in the electronic payment services sector, such as credit and debit card processing companies, despite promising to open the sector by 2006. In 2010, the United States launched a WTO dispute over these restrictions. A WTO panel sided with the United States in a 2012 decision, and China agreed to abide by the panel’s ruling in 2013. However, it did not take the needed steps to allow foreign enterprises to apply for such licenses until June 2017.[159]

By January 2020, no foreign supplier of electronic payment services had yet been able to secure the license needed to operate in China’s market due largely to delays caused by China’s regulator, the People’s Bank of China (PBoC). At times, the PBoC has simply refused to accept applications from U.S. suppliers to begin preparatory work, the first of two required steps in the licensing process. These actions have enabled China to build up domestic players in the sector, such as China Union Pay and Ant Financial. USTR noted that “China has been able to maintain market-distorting practices that benefit its own companies, even in the face of adverse rulings at the WTO.”[160]

Cloud and Telecommunications

In joining the WTO, China made a number of commitments in the telecommunications sector, including liberalizing foreign investment, agreeing to implement “pro-competitive regulatory principles, and agreeing to allow foreign suppliers to use any technology they choose to provide telecommunications services.”[161] USTR noted, however, that ”China’s restrictions on basic telecommunications services, such as informal bans on new entry, a requirement that foreign suppliers can only enter into joint ventures with state-owned enterprises, and exceedingly high capital requirements, have blocked foreign suppliers from accessing China’s basic [telecommunications] services market.”[162]

Since 2001, not one single foreign firm has successfully established a new joint venture in the telecommunications sector.[163]

China maintains extensive restrictions on foreign cloud service providers despite committing to provide nondiscriminatory treatment and broad market access to foreign firms in “computer and related services” as part of its WTO accession commitments.[164] This category of Internet-based computer services includes email, voicemail, online information and database retrieval, electronic data interchange, enhanced facsimile services, code and protocol conversion, and online information and data processing. China categorizes cloud and related services as valued-added telecommunication services (VATS) and not as computer and related services, as it has much greater freedom in its WTO commitments to enact barriers to foreign firms and services in this sector.[165]

China maintains extensive restrictions on foreign cloud service providers despite committing to provide nondiscriminatory treatment and broad market access to foreign firms in “computer and related services” as part of its WTO accession commitments.

China uses restrictive and discriminatory licensing and joint venture requirements to control foreign competition and to force foreign companies to help local competitors, including through forced technology transfers. Of the thousands of VATS licenses given out, only a small handful have gone to U.S. or other foreign firms.

Thus, for most U.S. cloud service firms, China’s market is essentially closed. Although not explicitly stated in rule or policy, China appears to apply an economic needs test to new entrants in this sector to avoid “unhealthy competition,” according to USTR.[166] Meanwhile, Chinese cloud firms take advantage of open markets in the United States and elsewhere around the world.

Distribution and Production of Theatrical Films

When China joined the WTO, it committed to allowing “20 films to be imported on a revenue-sharing basis in each of the three years after accession.” It also committed to permit U.S. firms to “form joint ventures to distribute videos, software entertainment, and sound recordings and to own and operate cinemas.”[167]

China’s continuing failure to meet this standard led the United States to initiate a WTO dispute in 2009. That action resulted in the WTO ruling that “many of China’s regulations on trading rights and distribution of films for theatrical release, DVDs, music, and books and journals were inconsistent with China’s WTO obligations.”[168]