Assessing the Dominican Republic’s Readiness to Play a Greater Role in Global Semiconductor and PCB Value Chains

The Dominican Republic is one of the world’s fastest-growing economies, offers perhaps the most attractive business environment in Latin America, and is a leading candidate for nearshored investments in advanced manufacturing activity—particularly for electronics such as printed circuit boards (PCBs) and the assembly, test, and packaging (ATP) of semiconductors.

KEY TAKEAWAYS

Key Takeaways

Contents

Why Should the Dominican Republic Seek to Establish a Presence in Semiconductor Value Chains?. 9

The Economy of the Dominican Republic. 11

The Reorganization of Global Advanced-Industry Value Chains. 32

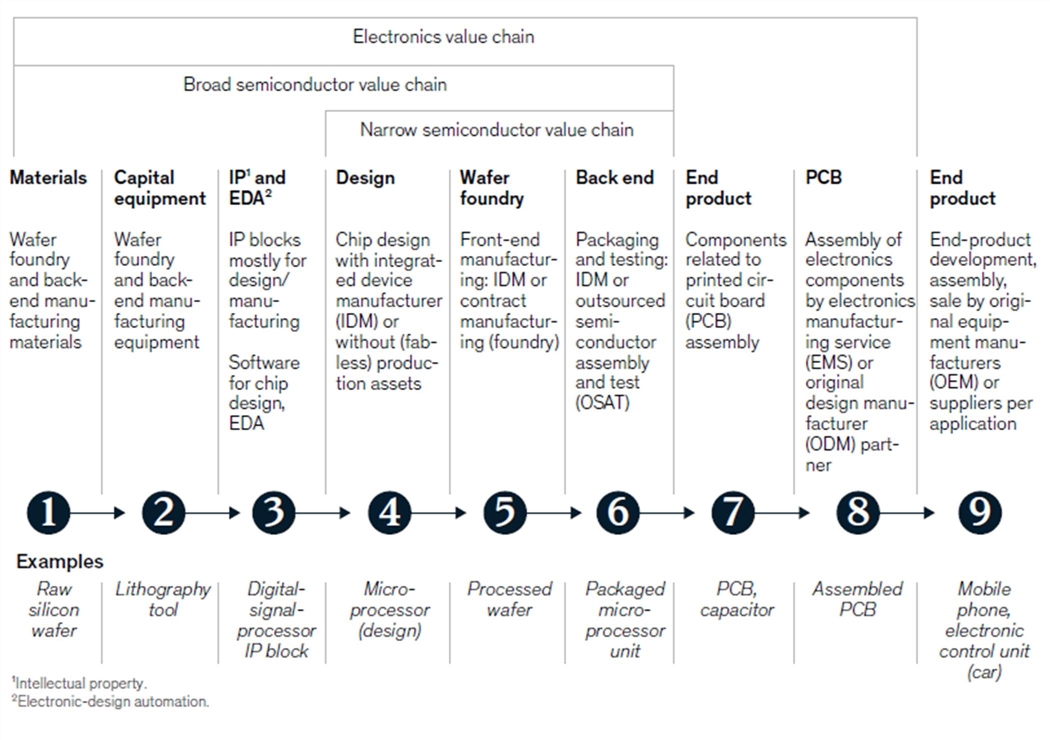

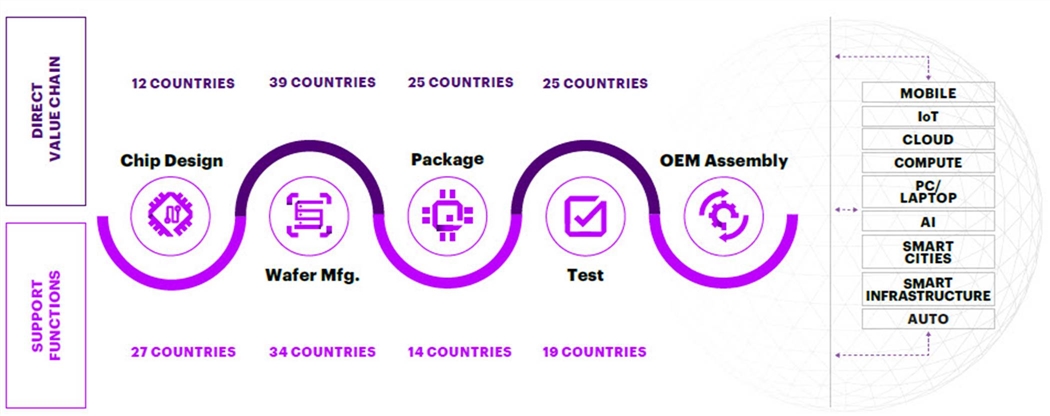

The Global Semiconductor Industry. 36

Executive Summary

The global economy is currently undergoing a dramatic reordering, driven by a multitude of factors including COVID-19 pandemic-induced supply chain disruptions; the emergence of breakthrough digital technologies such as artificial intelligence (AI); and geopolitical tensions, not least between the United States and China. In a quest to enhance the stability, resilience, and cost-competitiveness of their supply chains, advanced electronics manufacturers are considering alternative production locations worldwide, presenting nations with a unique opportunity to present their distinctive value propositions to attract globally mobile investment in an international economy that’s reorganizing in real time.

In few sectors is this opportunity greater than in semiconductors, an industry that’s expected to grow 40 percent globally to a $1 trillion by 2030, and where the U.S. government is stimulating its growth across North America through the CHIPS and Science Act, which committed $52 billion in federal investment and has already attracted $220 billion in announced investments across some 70 projects. The Dominican Republic is a prime candidate to capture increased North American investment in printed circuit board (PCB) manufacturing and offers considerable attractiveness as a destination for near-shored semiconductor assembly, test, and packaging (ATP) activity, in which semiconductors are tested and assembled into sophisticated packages.

Indeed, the Dominican Republic presents one of the most attractive foreign direct investment (FDI) environments the Americas have to offer. The country’s political economy is marked by a business friendly environment that features political stability, a liberalized trade regime, and regulatory continuity that affords a stable and predictable operating environment for multinational corporations. These factors have contributed to the Dominican Republic becoming the seventh-largest Latin American economy and growing at a nearly 5 percent (4.9 percent) growth rate from 1972 to 2022, making it one of the world’s fastest-growing economies over the past half century. As the International Finance Corporation (IFC) has written, the Dominican Republic’s, “remarkable performance can be attributed to several factors, including implementation of sound policies, particularly by the central bank, improvements in policy framework, a more diversified export base, and the economy’s structural flexibility to changing global condition.” The IFC predicts the Dominican Republic’s over 5 percent annual growth rate will persist into the foreseeable future, with the country graduating from middle-income to advanced economy status potentially as soon as 2060.

The Dominican Republic presents one of the most attractive FDI environments the Americas have to offer.

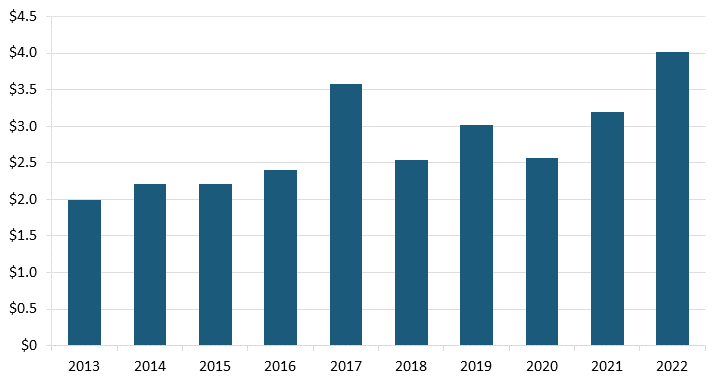

A key driver of the Dominican Republic’s economic growth has been FDI in the country’s 87 free zones (FZs) that underpin advanced manufactured goods production—notably of electronics products and medical devices/instruments—for export to regional (though principally North American) markets. In the decade from 2013 to 2022, the Dominican Republic attracted a total of $27.7 billion in inbound FDI, with annual investment levels more than doubling from $1.9 billion in 2013 to $4.01 billion in 2022. Just under 20 percent of the inbound investment goes toward industry/manufacturing (tourism and energy being the Dominican Republic’s other leading FDI sectors).

The Dominican Republic’s FZs are situated across 28 of the country’s 32 provinces, supporting 820 companies in operations that employ over 197,600 direct jobs, produce over $8.1 billion in exports annually, and have made cumulative investments of over $7.16 billion in the country. The flourishing of the Dominican Republic’s FZs has been made possible by Law 8-90, which exempts beneficiaries from paying 100 percent of income taxes; export or-reexport taxes; import taxes and customs duties on machinery, raw materials, equipment, and construction materials; taxes on the transfer of industrialized goods and services; taxes on patents, estates, or assets; and municipal taxes. Thus, the FZs present a very attractive environment for near-shored manufacturing, particularly of goods intended for export to North American markets.

Medical devices/instruments constitute the country’s leading export sector, accounting for $2.25 billon in annual exports, with 5 of the world’s top 10 medical device manufacturers operating in the Dominican Republic, and the sector enjoying an annual growth rate of 17.7 percent in 2022. But just behind medical devices comes electronics, the second-largest exporter from the country’s FZs and which accounted for $1.2 billion of exports in 2022, with this representing 15 percent of total FZ exports and a 3.8 percent growth rate from the prior year.

Twenty-five leading electronics companies are active in the Dominican Republic’s FZs, led by enterprises such as Eaton, Rockwell Automation, Jabil, Fenix Manufacturing Solutions, and Cutler Hammer Industries; 16 of these 25 electronics companies are headquartered in North America, with 22 of the 25 the subsidiary of a foreign parent. Collectively, electronics companies operating in Dominican Republic FZs generate 11,120 jobs, 6 percent of all employment in Dominican Republic FZs. Dominican Republic electronics exports from FZs flow overwhelmingly to North America, with 98.8 percent going to the United States. By product exports to the United States, circuit breakers lead with 62.5 percent of such exports, followed by cellular phones and wireless network equipment at 9.1 percent, and other devices, such as junction boxes, with a 5.3 percent share.

The Dominican Republic offers a cost-competitive manufacturing environment.

Two of the most notable electronics manufacturers in the Dominican Republic are Eaton Corporation and Rockwell Automation. Eaton operates three manufacturing plants in the PIISA FZ in Haina, which together cover 460,000 square feet and employ over 5,000 individuals manufacturing a variety of electrical products, though most notably molded-case circuit breakers, electronics/commercial smart breakers, and miniature and residential circuit breakers. Eaton’s Dominican Republic team also won a global competition to site a Santo Domingo R&D and Design Center that will attract some $3 billion in research and development (R&D) investment through 2030. For its part, Rockwell Automation, a global developer of industrial automation and digital transformation technologies, employs over 300 individuals who produce 12 million electronic units (again, largely circuit breakers, PCB assemblies, cabling, etc.) and $53 million in total cost of goods sold annually.

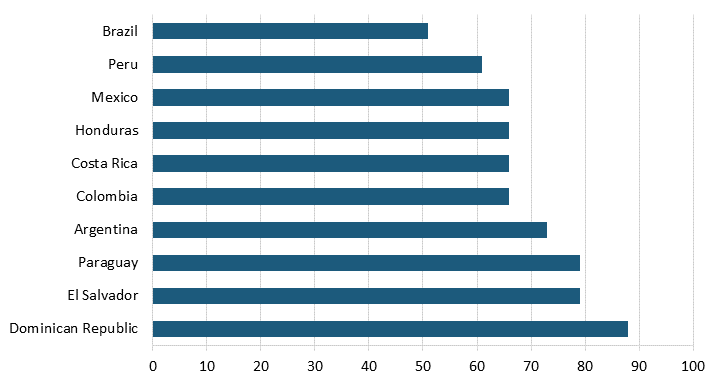

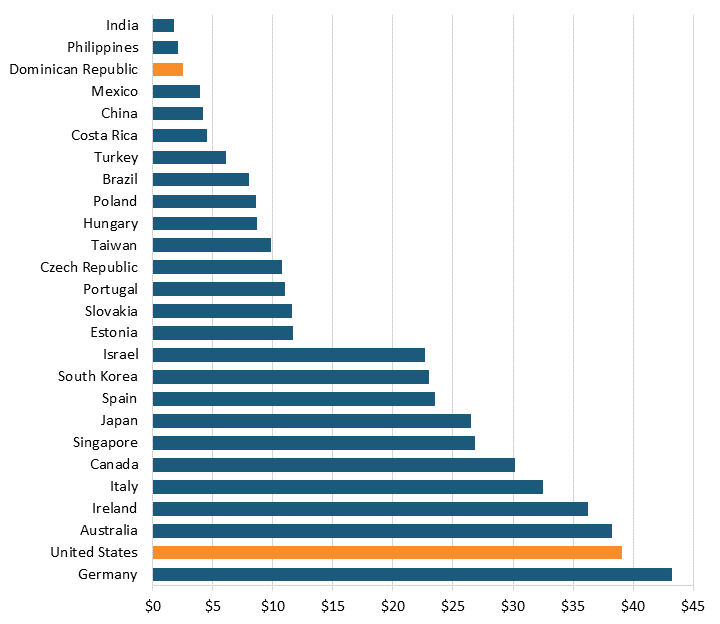

The Dominican Republic offers a cost-competitive manufacturing environment. In fact, the World Bank found that the hourly manufacturing labor cost in the Dominican Republic is $2.50, 6 percent the rate in the United States, approximately half that of Costa Rica or Mexico, and even less than in China.

But another key reason why the Dominican Republic attracts multinationals is that its liberalized trade regime permits exporters duty-free access to more than 900 million consumers across 49 countries. Most importantly, the Dominican Republic-Central America-United States Free Trade Agreement (CAFTA-DR) liberalizes trade in goods and services between the United States and six Central American countries: Costa Rica, the Dominican Republic, El Salvador, Guatemala, Honduras, and Nicaragua. The country entered into an Economic Association Agreement with the European Union (EU) in 2008, since when its trade with the EU has increased 231 percent. As the EU has written, “The Dominican Republic has stood out for its punctual implementation of the assumed commitments in the EPA, including the tariff reduction schedule.” Critically for electronics manufacturers, the Dominican Republic is also a member of he seminal World Trade Organization (WTO) Information Technology Agreement (ITA), through which 82 nations have collaborated to eliminate tariffs on trade in hundreds of information and communications technology (ICT) products. Lastly, the Dominican Republic collaborates with its partners in Costa Rica, Ecuador, and Panama as part of the Alliance for Development in Democracy (ADD), an initiative to promote democratic strengthening and economic growth through the tightening of the three countries’ commercial, demographic, and cultural ties.

Another key reason why the Dominican Republic attracts multinationals is that its liberalized trade regime permits exporters duty-free access to more than 900 million consumers across 49 countries.

Exporters are also attracted to the Dominican Republic’s enviable geographical position in the Caribbean and its world-class logistical infrastructure. The country has the third-best maritime connectivity in the region and the seventh-largest multimodal maritime port in Latin America, meaning products can reach the U.S. East Coast in three to four days. The Dominican Republic ranks second in Latin America regarding international connectivity by air transport, with flights servicing U.S. semiconductor-producing locations across the Northeast, Midwest, and South. The country also enjoys the strongest Internet connectivity in the Caribbean, in part due to being home to NAP del Caribe, one of the most significant network access points (NAPs) in Latin America and one of the 220 NAPs located in 26 countries globally. It is one of only three carrier-neutral NAPs in all Latin America. While the country has traditionally been dependent on imported fossil fuels for energy, clean energy generation now accounts for 18.1 percent of the country’s energy supply, with renewable energy expected to account for 25 percent of the country’s energy production by 2025. Moreover, in interviews, manufacturers operating in FZs emphasized they receive power from dual sources and indicated that power outages were uncommon.

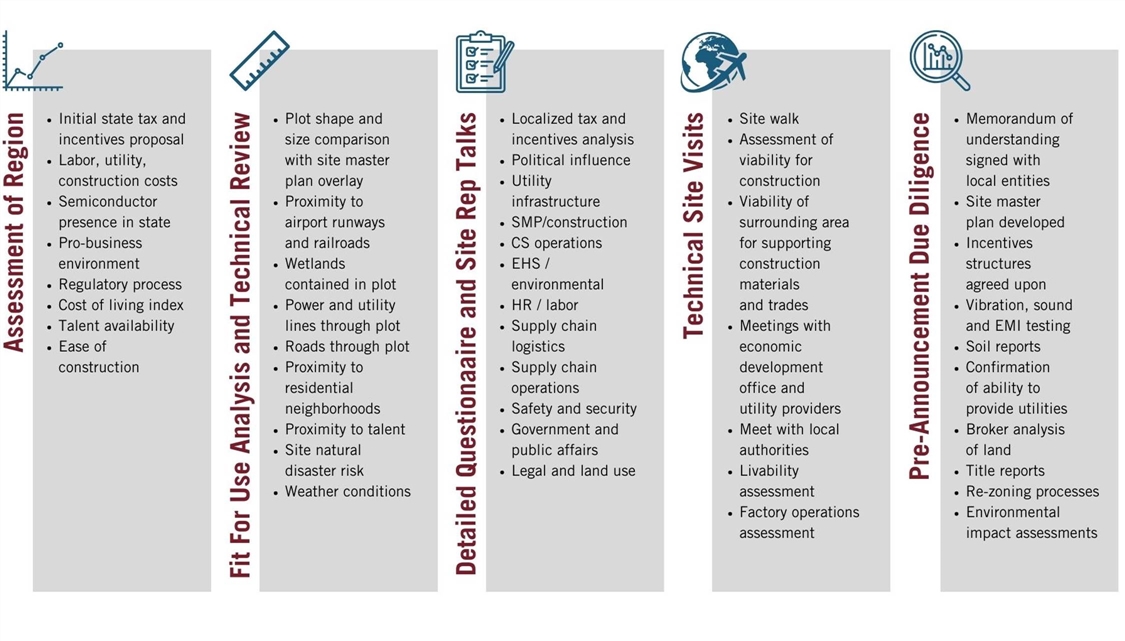

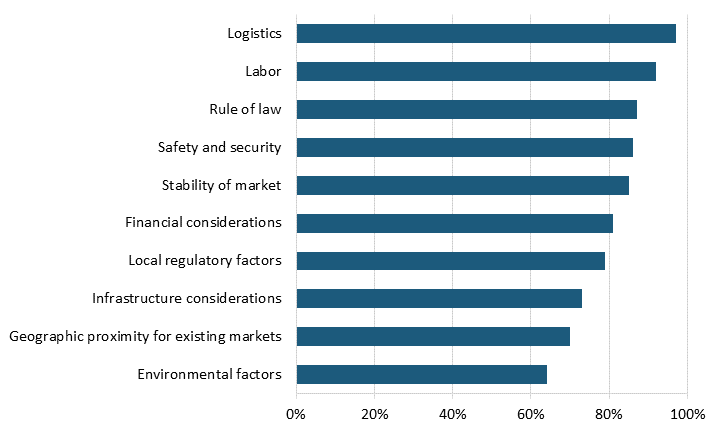

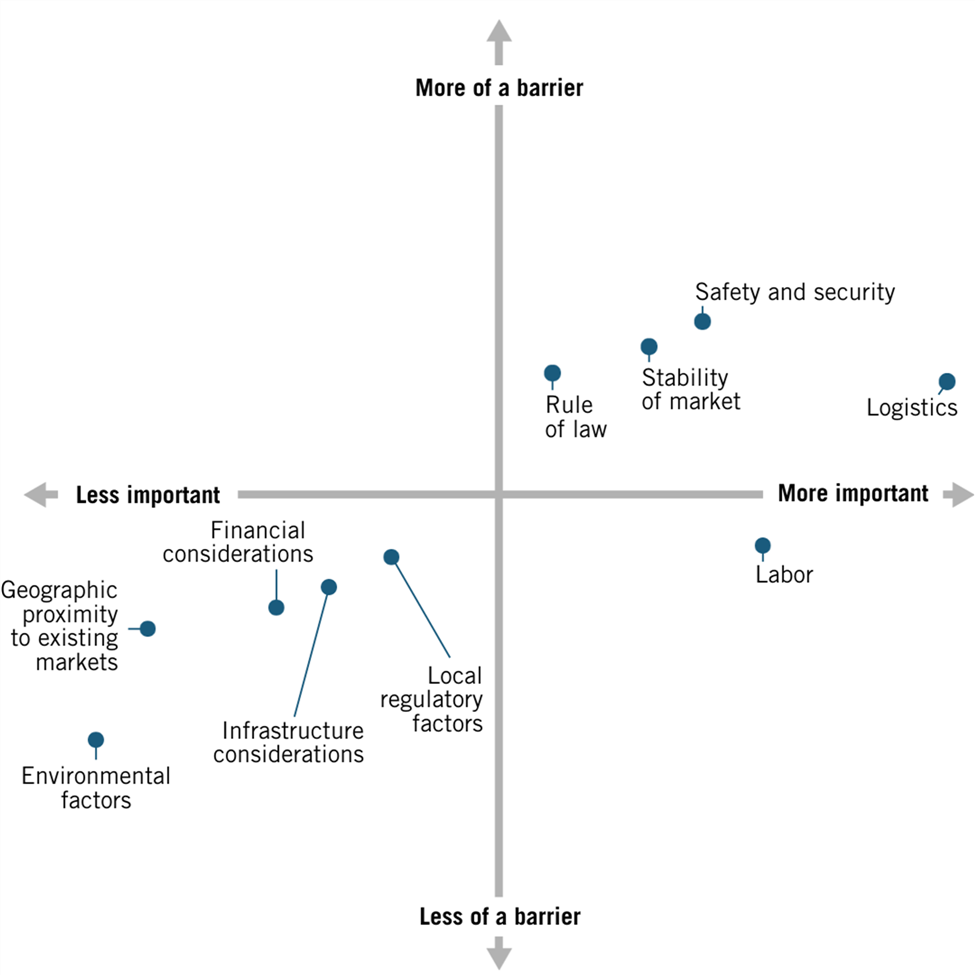

Countries have moved from being “price makers” to “price takers” in the quest to attract globally mobile advanced-technology industry investment. In fact, leading semiconductor manufacturers may consider as many as 500 discrete factors—ranging from countries’ and states’ talent, tax, trade, and technology policies to labor rates and laws and customs policies—as they evaluate where to situate multi-billion-dollar fab, or ATP, investments. In other words, the ease and certainty of doing business in a country matters greatly.

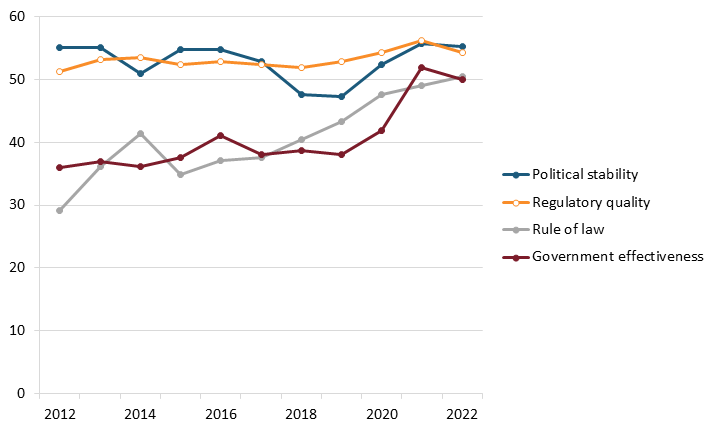

Here, the Dominican Republic has worked to make strides, particularly through its “Burocracia Cero” (“Bureaucracy Zero”) Program, established through Decree No. 640-20, which seeks to enhance public administration efficiency through clear and appropriate regulatory frameworks. To date, 315 procedures from 63 government institutions have been streamlined or reformed. For instance, Law No. 167-21 seeks to promote innovation through the application of regulatory policy tools that help inform the policymaking process with evidence-based analysis, with a goal of raising the quality of policies and legislation. From 2019 to 2002, the Dominican Republic’s score on the World Bank’s “Government Effectiveness” indicator increased from the 38.1 to 50 percent.

The Dominican Republic has also worked assiduously to improve the quality of its customs environment. A flagship initiative has been the 24-Hour Clearance Program, also called Dispatch 24h (or D24H), which seeks to clear containers within 24 hours. To date, the program has cleared over 50,000 containers in 24 hours or less, benefitting more than 6,700 importers. Another critical program for exporters from the Dominican Republic is Exporta Más (or Export +), through which participating companies can export without a physical inspection process and in A fully digital format, eliminating the need for paper documents, thus decreasing the time and costs associated with exporting. Over 250 companies are enrolled in the Exporta Más program, with participating companies making over 177,000 export declarations and the program now covering 58 percent of total exports from the country.

Despite these strengths, if the Dominican Republic is to migrate up the value chain in advanced electronics manufacturing, it will have to be able to educate and field a skilled workforce with the requisite skills to compete in advanced electronics manufacturing. Here, a crucial player will be the National Institute of Professional Technical Training, or “INFOTEP,” whose charter is to organize and govern the Dominican Republic’s national system of professional and technical training. INFOTEP has 245 operational centers nationwide, through which it offers a total of 920 technical courses, including 86 in electricity and electronics; 36 in ICT; and 104 in the manufacturing, installation, and maintenance of machinery and equipment. Companies fund INFOTEP by contributing 1 percent of their monthly payrolls to the program. INFOTEP is active across virtually all the country’s FZs, and manufacturers reported working extensively with INFOTEP to develop customized technical education courses, such as in microelectronics, precision welding, and use of robotics and other “Industry 4.0” automation technologies. Since its inception, INFOTEP has trained 770,914 workers in different competencies and fields via over 40,000 courses and close to 800,000 training hours.

Other important players in the Dominican Republic’s technical education ecosystem include the Technological Institute of the Americas (ITLA), a technical institution of higher education founded in 2000. ITLA specializes in training Dominican youth in fields such as software development, information networks, multimedia, mechatronics, automated manufacturing, and computer security. The Technological Institute of Santo Domingo (INTEC) is considered the leading technical institute in the country, and it offers extensive courses in fields such as electrical and mechanical engineering. In short, the Dominican Republic possesses a robust technical education training infrastructure.

In summary, the Dominican Republic has demonstrated the ability to support a high-tech electronics manufacturing industry and possesses the requisite ecosystem assets—digital and physical infrastructure, technical education institutions to support a microelectronics-skilled workforce, regulatory environment, etc.—needed to support its aspirations to compete in semiconductor ATP and PCB manufacturing. The Dominican Republic should be considered a prime candidate for nearshored, greenfield investment in these sectors. The country should also be considered a leading candidate to be designated a recipient of funding from the U.S. Department of State’s International Technology Security and Innovation (ITSI) Fund, which seeks to enhance and ensure semiconductor supply chain security and diversification and promote the development and adoption of secure, trustworthy telecommunications networks.

The report makes the following policy recommendations:

▪ The Dominican Republic should be considered a leading candidate to be designated a recipient of funding from the U.S. Department of State’s ITSI Fund.

▪ The government of the Dominican Republic should develop an explicit national semiconductor value proposition and broader competitiveness strategy.

▪ The Dominican Republic should launch an awareness campaign reaching out to global investors in advanced electronics industries highlighting the country’s favorable FZs and tax policies.

▪ The Dominican Republic can help address this gap by expanding the availability of degree programs in electrical engineering, computer science, and related courses.

▪ The Dominican Republic needs to increase the number of individuals holding IPC 610 certifications.

▪ The Dominican Republic should consider expanded use of investment incentives to attract semiconductor industry manufacturing activity.

▪ The Dominican Republic should set up a “one-stop-shop” to facilitate the regulatory clearance of all permits and approvals, such as environmental review permits, that would be required to launch a semiconductor ATP or PCB facility in the country.

▪ The Dominican Republic should join the expanded ITA (ITA-2) and join discussions toward promulgating an ITA-3.

▪ The Dominican Republic should champion robust digital trade regulations, and one way it could do so would be by joining the WTO’s Joint Initiative on E-commerce.

▪ The Dominican Republic should explore the possibility of entering into such a protocol with the United States, with the intent of further strengthening the trade and investment environment between the two nations.

Introduction

The global economy is currently undergoing a dramatic reordering, driven by a multitude of factors including COVID-19 pandemic-induced supply chain disruptions; the emergence of breakthrough digital technologies such as AI; and geopolitical tensions, not least between the United States and China. In a quest to enhance the stability, resilience, and cost-competitiveness of their supply chains, advanced electronics manufacturers are considering alternative production locations worldwide. This reshuffling of global value chains affords nations with a unique opportunity to present their distinctive value propositions to attract globally mobile investment in an international economy that’s reorganizing in real time.[1]

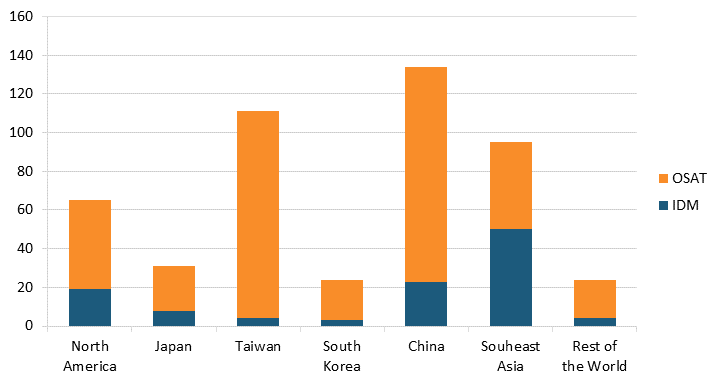

In few sectors is this opportunity greater than in semiconductors, an industry that’s expected to grow 40 percent globally to a $1 trillion by 2030.[2] One study finds that global demand for semiconductor manufacturing capacity will increase by 56 percent in the 2020s decade.[3] Another study estimates that over 70 new semiconductor fabs are expected to be constructed worldwide by 2030 to satisfy the growing global demand for semiconductors.[4] The U.S. government has committed to stimulating the semiconductor industry’s growth in North America through the CHIPS and Science Act, which committed $52 billion in federal investment, including $39 billion in incentives and $11 billion for R&D and workforce training activities, and which has already attracted $230 billion in announced investments across some 70 proposed projects in the United States.[5]

The reshuffling of global value chains affords nations with a unique opportunity to present their distinctive value propositions to attract globally mobile investment in an international economy that’s reorganizing in real time.

The Dominican Republic represents a prime candidate to capture increased North American investment in PCB manufacturing and offers considerable attractiveness as a destination for near-shored semiconductor ATP activity (the step in which semiconductors are tested and assembled into sophisticated packages). That’s in large part because the Dominican Republic represents one of Latin America’s most-attractive destinations for inbound FDI, thanks to its stable, predictable, and business-friendly regulatory, tax, and trade policy environment. This fits well with the Biden administration’s ambition to decrease technological production dependence on Asia while strategically relocating semiconductor manufacturing closer to home.[6]

The Dominican Republic’s 86 FZs anchor the country’s manufacturing economy, supporting over 800 companies that collectively employ nearly 200,000 workers, produce over $7.77 billion in exports annually, and have made cumulative investments of over $7.16 billion into the country. Twenty-five electronics companies, anchored by leaders such as Eaton and Rockwell Automation, manufacture in the Dominican Republic, supporting over 11,200 jobs and producing $1.2 billion of exports in 2022. The country’s extant electronics manufacturing base equips the Dominican Republic with the business expertise and skilled technical workforce requisite to support its aspirations to migrate up the advanced electronics value chain to compete in semiconductor ATP and PCB manufacturing activity, especially at a time when the global reorganization of production chains in these industries is driving a push toward reshored or nearshored manufacturing in the Americas. Indeed, the country has a rich track record of successfully attracting and supporting high-tech companies across a range of advanced technology sectors from medical devices to ICT/electronics.

Moreover, it’s time for both policymakers in Washington and corporate leaders worldwide to more seriously consider regional partners in the Americas as candidates for greater levers of advanced electronics manufacturing activity. As Chip Wars author Chris Miller wrote with David Talbot, “The Western hemisphere deserves more focus as Washington seeks to better secure the broader electronics supply chain.”[7] As they continued, “Building regional capacity offers a way to limit Asia-focused supply risks and, in the event of a major China-U.S. conflict, an interhemispheric supply chain would be much less susceptible to interference.”[8] That’s indeed so. Enrolling Western hemispheric partners in semiconductor supply chains can prove beneficial to the United States, regional partners, and global semiconductor enterprises alike, and the Dominican Republic is poised to join other Latin American countries such as Costa Rica and Mexico as leaders in this regard.

The first half of this report examines the Dominican Republic’s economic, business, and policy environment. It starts by providing an overview of the country’s economy and key industrial sectors, before turning to examine its policy environment, considering issues such as the country’s regulatory, trade, customs, taxation, and innovation policies. The business environment section examines the country’s infrastructure, education, and workforce training programs. The remainder of the report explores the Dominican Republic’s potential capacity to compete in semiconductor ATP and PCB manufacturing activity specifically. But before turning to these topics, the report explores why the Dominican Republic should want to get into the competition to attract semiconductor sector investment in the first place.

Why Should the Dominican Republic Seek to Establish a Presence in Semiconductor Value Chains?

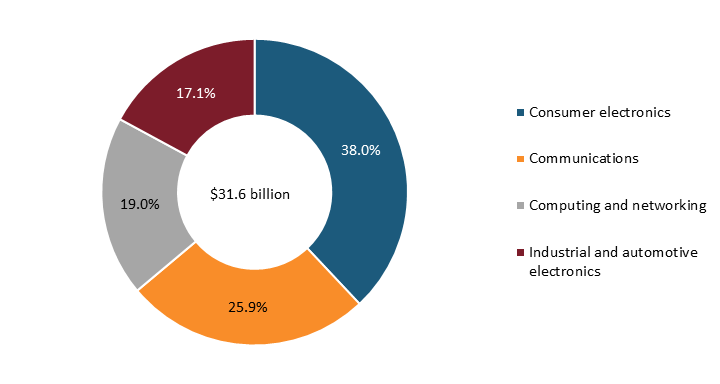

As this report explores, semiconductors represent one of the world’s most important industries. Semiconductors represent the heartbeat of the modern global digital economy, an industry that’s expected to reach $1 trillion in value by 2030 and which stimulates another $7 trillion in global economic activity annually.[9] Semiconductors power (both literally, through power management, and figuratively, through computational capacity) virtually every modern device—from computers and smartphones to electrical vehicles and toaster ovens—and underpins a range of downstream applications from AI to big data analytics. Put simply, semiconductors are foundational to the ability of enterprises and nations alike to compete in the global economy; they truly represent the “commanding heights” of the modern global digital economy.

Moreover, manufacturing semiconductors represents one of the most complex engineering activities humanity undertakes. The most cutting-edge semiconductor fabs, those producing 3 nanometer (nm) chips, can cost $20 billion to build.[10] Semiconductor ATP facilities generally constitute $2 billion to $3 billion investments; for instance, in November 2023 Amkor announced it would launch a new Arizona ATP facility at a cost of $2 billion, while TSMC announced it will spend $2.87 billion to build its next advanced packaging facility in Taiwan by 2027.[11] In fact, the design and operation of semiconductor fabs is so nuanced and sophisticated that it takes into account details as minute and granular as the gravitational effects of the moon on factory lines.

And so, in a like manner, if countries (and states or regions therein) wish to compete successfully for semiconductor-sector investment, then the policy and business environments they foster must be equally finely tuned, well-crafted, and deeply sophisticated as that semiconductor facility itself, a fact that applies equally to the United States as to China, Germany, Korea, Japan, or India—or the Dominican Republic. But global competition for semiconductor investment is fierce, as nations—and the states, regions, and cities therein—have become price takers, not price makers, in the intense quest to attract globally mobile investment in high-value-added, high-tech industries, such as semiconductors.[12] In fact, leading semiconductor manufacturers may consider as many as 500 discrete factors—ranging from countries’ and states’ talent, tax, trade, and technology policies to labor rates and laws and customs policies—as they evaluate where to situate multi-billion-dollar fab investments. To win semiconductor investment, locales not only need to get hundreds of factors “right,” but the strength of their “checkmarks” on those hundreds of variables needs to be stronger than those of the other countries that are courting the same investment.

But why, amidst other sectors it could target or initiatives it could pursue, should the Dominican Republic prioritize trying to compete in the semiconductor industry? There are several compelling reasons.

First, bolstering manufacturing activity in high-tech sectors such as semiconductors not only provides a significant source of high-value-added, high-paying employment opportunities, but can produce significant employment, and economic, multiplier effects. This is certainly true in the United States, where the semiconductor industry’s jobs multiplier is 6.7, meaning that for each U.S. worker directly employed by the semiconductor industry, an additional 5.7 jobs are supported across the wider U.S. economy.[13] (In total, the U.S. semiconductor industry supports 277,000 jobs directly and 1.6 million more jobs indirectly.) Those jobs are highly productive, and thus remunerative, with the average U.S. semiconductor job paying $177,000, compared with the average U.S. wage of $61,900.[14] Semiconductors also produce significant economic multipliers. As one report finds, “Every dollar added to U.S. GDP by the electronics manufacturing sector creates $1.32 elsewhere in the economy. Additionally, every dollar in electronics manufacturing output generates $1.05 of output elsewhere in the economy.”[15] Just as U.S. semiconductor jobs produce and pay more, and deliver significant economic and employment multipliers, so too would such jobs in the Dominican Republic’s economy.

Second, semiconductor manufacturing can produce tremendous spillover and “learning by doing” effects across the rest of the Dominican Republic’s high-tech economy. As Carnegie India’s Konark Bhandari observed, “A robust manufacturing base ensures that the knowledge gained from ‘learning by doing’ is transferred to domestic firms as well.”[16] Or, as Rajat Kathuria, former director and CEO of the Indian Institute for International Economic Relations (ICRIER), explained, “Economic growth is influenced by levels of ‘sophistication’ in a country’s production. The nature of production matters for economic growth. Countries that specialize in the production of goods with higher productivity are better placed to achieve higher growth.”[17]

Kathuria noted how the economists Ricardo Hausmann and Bailey Klinger developed the notion of “product space” to illustrate how a country’s initial pattern of specialization impacts its ability to expand competitiveness in adjacent industries. As Hausmann and Klinger wrote, “The location in the product space is a crucial determinant of a country’s potential to develop comparative advantage in certain products. Countries progress by exploiting the relatedness of products requiring similar inputs including skills and technology.”[18] Thus, countries’ economic development, “is not merely advancement in general attributes such as education, health, rule of law and infrastructure but also the development of ancillary support systems and activities that are specific to an industry.”[19] For the Dominican Republic, its extant capabilities in electronics manufacturing can serve as a platform to enter the manufacturing-oriented elements of semiconductor or PCB production. In turn, if the Dominican Republic can enter the semiconductor manufacturing “product space,” this could power its future ability to compete in other high-tech manufacturing sectors, such as robotics. In other words, getting a foot in the door with PCB or semiconductor ATP manufacturing may open up other opportunities for the Dominican Republic to compete in other sectors of the semiconductor value chain that would have been heretofore unobtainable.

Third, there are significant “learning by doing” effects in the policymaking strategies needed to attract investment in high-tech industries such as semiconductors. Indeed, the knowledge spillovers for Dominican Republic policymakers of what it takes to attract semiconductor manufacturing—to the extent it informs how the Dominican Republic competes for other high-tech sectors (such as translating its strengths in the medical device industry into a novel biopharmaceuticals sector) and how it manages its broader economic policy and business environment—are likely to be far more powerful than even the technical “learning by doing” that occurs on the factory floor.

Fourth, the reality is that this is the Dominican Republic’s, and Latin America’s, moment. As a recent Financial Times article observes, the current interest in the reorientation of global supply chains, push for nearshoring, and opportunity to tap into new pools of skilled labor and natural resources “gives Latin America its best chance in a generation to lift its economies out of stagnation, make its people wealthier, and assume a bigger global role” in “helping to meet some of the 21st century’s biggest challenges” from generating clean energy to extracting critical minerals.[20] This is a unique moment as multinational companies reassess their global value chains in real time, and so the opportunity is now if countries such as the Dominican Republic wish to break into and attract international investment in advanced technology industries such as semiconductors.

The Economy of the Dominican Republic

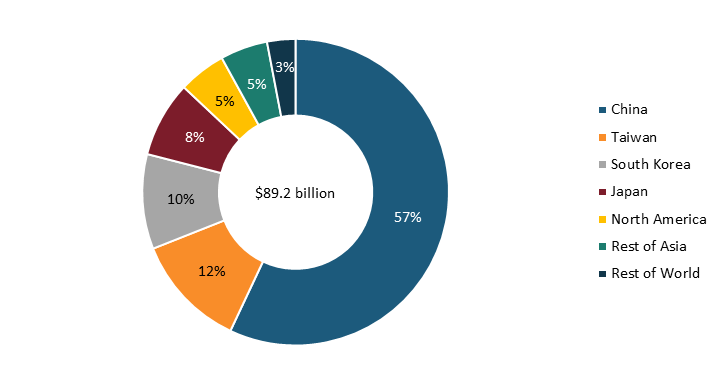

The Dominican Republic is a Spanish-speaking Caribbean nation of 11.3 million citizens whose territory covers 18,700 square miles, about two-thirds of the island of Hispaniola, which it shares with Haiti. The Dominican Republic, whose gross domestic product (GDP) reached $89 billion in 2023 (at official exchange rates), boasts the Caribbean’s largest economy, and the seventh-largest in Latin America overall, in both nominal and purchasing power parity terms. The sixth-largest economy in Latin America, Peru, has three times the population of the Dominican Republic. Since 2010, the Dominican Republic has been the fastest-growing economy in Latin America and the Caribbean. Like Singapore, while small in size, the Dominican Republic’s economy and contribution to hemispheric trade punches well above its weight. In fact, as the IFC noted, “Despite being one of Latin America’s poorest countries in the mid-1960s, the Dominican Republic has made remarkable progress in terms of income convergence [with the United States].”[21]

Moreover, the Dominican Republic has been one of the world’s fastest-growing economies over the past half century. From 1972 to 2022, the Dominican Republic’s real GDP growth averaged 4.9 percent, well outpacing its closest Latin American peers—Panama at 4.5 percent, Paraguay at 4.2 percent, and Costa Rica at 4.1 percent—and well exceeding the Latin American average growth rate of 3.2 percent.[22] As the World Bank has explained, the Dominican Republic’s “remarkable growth” has been underpinned by macroeconomic stability and an array of market-oriented economic reforms that began in the 1990s, including “tax incentives, the liberalization of foreign exchange transactions and trade agreements, and elimination of price controls and of restrictions on foreign direct investment in almost every sector.”[23]

The Dominican Republic’s economic growth has actually accelerated in this century, with the country recording real average GDP growth of 5.8 percent from 2005 to 2019.[24] The Dominican Republic’s per capita GDP is now the sixth highest in Latin America, right after Argentina in fifth and Mexico at seventh. According to the International Monetary Fund (IMF), the Dominican Republic’s per capita GDP (at current prices) reached $27,230 in 2023.[25] The Dominican Republic’s continuing high rates of economic growth have meant its economy has demonstrated the fastest income convergence (toward the U.S. level) of any Latin American country over the past half century, with this “convergence velocity” increasing from an average of 3 percentage points per decade over the last 50 years to almost 8 percentage points per decade more recently.[26] As the IFC observed, “This remarkable performance can be attributed to several factors, including implementation of sound policies, particularly by the central bank, improvements in policy framework, a more diversified export base, and the economy’s structural flexibility to changing global condition.”[27] The IFC expects the Dominican Republic’s economy to grow at about a 5 percent annual clip into the foreseeable future, in which case the organization expects the country to graduate from middle-income to advanced economy status potentially as soon as 2060.[28]

Like Singapore, while small in size, the Dominican Republic’s economy and contribution to hemispheric trade punches well above its weight.

Attracting robust FDI—the vast majority of it into the country’s critically important FZs, as subsequently elaborated upon—has been a critical component of the Dominican Republic’s economic growth story. In the decade from 2013 to 2022, the Dominican Republic attracted a total of $27.7 billion in inbound FDI, with annual investment levels more than doubling from $1.9 billion in 2013 to $4.01 billion in 2022. (See figure 1.) For 2023, inbound FDI reached $2.15 billion through June, putting the country on pace to exceed its 2022 levels. By sector, 26 percent of this FDI has gone toward the Dominican Republic’s energy sector, 25 percent to tourism, and 18 percent to industry/commerce.[29] Spain has long been the Dominican Republic’s leading source of overall FDI investment (including sectors from tourism to manufacturing), accounting over the past decade for 33.6 percent of inbound FDI, followed by the United States with 24.5 percent.[30] However, the United States is by far the largest foreign direct investor into manufacturing industries in the Dominican Republic, and from 2017 to 2019, it was the main originator of Dominican Republic FDI, accounting for 23 percent of total investment over those years. The Dominican Republic’s National Development Strategy as well as its National Competitiveness Agenda “has specifically targeted nearshoring from the United States to facilitate increased sophistication and industrial diversification.”[31] The “2023 Greenfield FDI Performance Index” from fDi Intelligence, which ranks the world’s best FDI performers relative to the size of their economies, ranked the Dominican Republic 5th out of 10 Latin American countries, but noted the country had the fifth-greatest increase in ranking compared to its score the previous year.[32]

Figure 1: Dominican Republic inbound FDI, 2013–2022 (billions)[33]

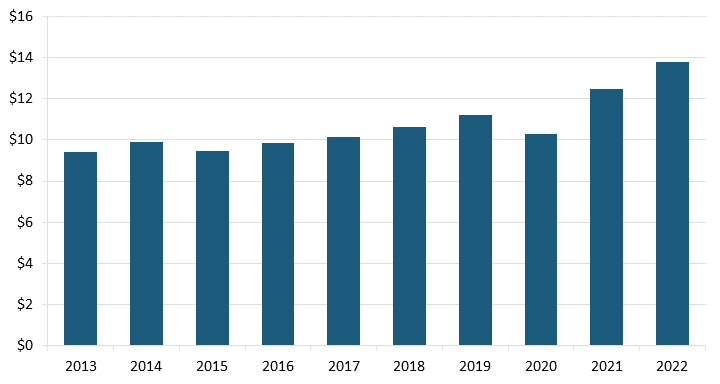

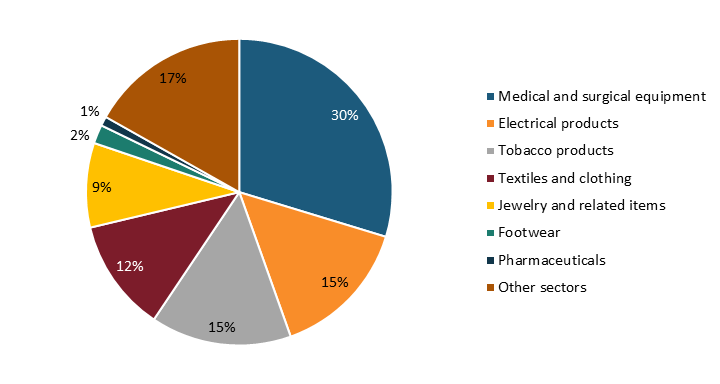

Exports from the Dominican Republic have increased steadily over the past 10 years, totaling $107 billion for the decade, and increasing from $9.4 billion in 2013 to $13.8 billion in 2022, with $6.7 billion more through the first six months of 2023. (See figure 2.) Fifty-nine percent of the Dominican Republic’s exports originate from FZs. With regard to advanced-technology products, manufacturing, medical, and surgical equipment account for 30 percent of the Dominican Republic’s exports, electrical products for 15 percent, and pharmaceuticals 1 percent. (See figure 3.) In 2023, exports from Dominican Republic FZs reached a new record of $8.06 billion. Moreover, from 2020 to 2023, FZ exports grew by 38.4 percent.

Figure 2: Dominican Republic exports, 2013–2022 (billions)[34]

Figure 3: Dominican Republic exports to free trade zones by sector, June 2023 YTD[35]

As noted, electronics and electrical appliances constitute one of the Dominican Republic’s most-important export sectors. The electronics industry is the third-largest among the Dominican Republic’s FZs, accounting for $1.2 billion in exports in 2022, with the sector’s exports growing at an annual rate of 3.8 percent.[36] Twenty-five electronics companies are active in the Dominican Republic’s FZs, led by enterprises such as Eaton, Rockwell Automation, Fenix Manufacturing Solutions, and Cutler Hammer Industries; 16 of these 25 electronics companies are headquartered in North America.[37] Collectively, electronics companies operating in Dominican Republic’s FZs generate 11,120 direct jobs, 6 percent of all employment in Dominican Republic FZs. Additionally, information and communications industries employ around 45,400 individuals, which represents about 1 percent of the country’s nonfarm labor force.[38]

Exports from the Dominican Republic, 59 percent of which originate from FZs, have increased steadily over the past 10 years, totaling $107 billion for the decade.

Two of the most-significant electronics equipment manufacturers in the Dominican Republic are Eaton Corporation and Rockwell Automation.

Eaton Corporation is an intelligent power management company with global operations. Eaton Corporation established its operations in the Dominican Republic in 1985, with its core presence centered at the PIISA Industrial Park in Haina, an industrial suburb west of Santo Domingo. Eaton’s three manufacturing plants in Haina cover 460,000 square feet and employ over 5,000 individuals, manufacturing a variety of electrical products, most notably molded case circuit breakers, electronics/commercial smart breakers, and miniature and residential circuit breakers. The COVID-19 pandemic caused disruptions and backlogs to manufacturing globally, including at Eaton’s manufacturing operations in Haina, but these were the fastest in Eaton’s global network to eliminate the production backlog and return to normal production schedules. Eaton also operates a manufacturing aerospace plant in Santiago, Dominican Republic. In 2019, Eaton was recognized by the Dominican Republic government as one of the companies with the highest contribution to the growth of exports and the generation of foreign exchange in the country, as well as for innovations in the transformation of the productive processes of the FZ sector.[39]

In the early 2020s, Eaton launched a competition among its global manufacturing subsidiaries in developing countries to create proposals for a new R&D and design center for innovative electronic products. Eaton’s team in the Dominican Republic won this contest, and on June 23, 2022, Eaton opened the Santo Domingo Design Center, with the facility adjacent to the Technological Institute of Santo Domingo (INTEC) and near the company’s manufacturing facilities, forging a strategic hub featuring an advanced lab for design and development.[40] The facility will strengthen Eaton’s engineering capabilities in the country by supporting new product development for key product lines, including residential circuit breakers, molded case circuit breakers, and industrial control equipment.[41] The investment is part of the country’s commitment to invest $3 billion in R&D to accelerate the development of sustainable solutions by 2030.[42] The investment will also support Eaton’s commitment to industry education in the region through ongoing partnerships and internship programs with INTEC University as well as other local vocational training schools such as Instituto Politécnico de Haina (IPHA) and Instituto Politécnico Loyola.

Rockwell Automation, a global developer of industrial automation and digital transformation technologies, employs nearly 400 individuals in the Dominican Republic, who manufacture a variety of electrical switches, including safety switches, limit switches, proximity switches, and photo sensors. Rockwell’s Dominican Republic operation produced 12.1 million units in fiscal year 2022, generating $52.8 million in cost of goods sold. Rockwell’s Dominican Republic plant delivers world-class manufacturing standards, achieving 96 percent on-time delivery of products to customers. Over the past four years, Rockwell has invested nearly $5 million into its Dominican Republic operations, with 47 percent of those investments going toward capacity increases, 38 percent to business continuity, 12 percent to asset replacement, and 3 percent to product upgrades and acquisitions.

Dominican Republic electronics exports from FZs flow overwhelmingly to North America, with 98.8 percent going to the United States. By product exports to the United States, circuit breakers lead with 62.5 percent of such exports, followed by cellular phones and wireless network equipment at 9.1 percent, and other devices, such as junction boxes, with a 5.3 percent share.[43]

Table 1 summarizes some of the key electronic product manufacturers operating in the Dominican Republic and the extent of their exports for the first 11 months of 2023.

Table 1: Leading electronics manufacturers/exporters in the Dominican Republic[44]

|

Electronic Products Manufacturer |

Description |

|

Airlink Distribution DR |

Exports of parts for cellular devices, watches, laptops, tablets, and iPads |

|

Amlat PCS Wireless DR |

Manufactures and reconditions smart electronic devices for resale, such as security cameras, tablets, watches |

|

Back & Forth Logistics |

Exports electronic products such as Sony brand video game consoles, speakers, batteries, chargers, etc. |

|

Cutler Hammer Industries Ltd. |

Manufactures and exports electronic switches to multinational clients such as Eaton Corporation |

|

E-Cycling International SRL |

Exporters of printers, circuit boards, hard drives, power cables, and other electronic parts |

|

Fenix Manufacturing Solutions GMBH |

Exporters of switches, computer parts, and wiring for assembly of electrical and electronic products |

|

Johanson Dominicana SA |

Manufactures and exports electrical capacitors to customers worldwide |

|

K&L Microwave DR |

Manufactures and exports radio frequency filters to U.S.-based customers |

|

NAPCO DR SAS |

Exporters of security equipment such as electronic locks, sensors, and alarms |

|

PC Precision Engineering Inc. |

Precision-engineered electronics, such as PCBs, for U.S. defense contractors, industrial, and Original Equipment Manufacturer (OEM) customers |

|

Prime Technology Inc. |

Exporters of panel meters and circuit boards to U.S.-headquartered parent company |

|

RK Power Generator Corp. |

Manufactures power plants, automatic transfer systems, and parts for generator maintenance |

|

Rockwell Automation Technologies |

Manufactures electrical switches, circuit cards, conductive cables, and sensors |

|

Souriau Dominican Republic Ltd. |

Manufactures and exports electrical connectors for Eaton Corporation in the United States |

|

Vishay Hirel Systems International LLC |

Manufactures and exports inductors and electrical circuits for brand labels in Asia, Europe, and U.S. |

Most of the electronics manufacturers in the Dominican Republic are concentrated on the country’s southeastern coast around the provinces of San Cristóbal, Santo Domingo, and San Pedro de Macoris, although there is another important cluster in the northeastern part of the country centered around the Santiago province. (See figure 4.)

Figure 4: Location of leading electronics manufacturers in the Dominican Republic[45]

Regulatory Environment

As the Dominican Republic seeks to migrate up the advanced manufacturing value chain in electronics to potentially capture semiconductor-sector investment, the country recognizes it needs to foster a regulatory environment that provides stability, certainty, predictability, and transparency to investors. This section examines the country’s regulatory policy environment, policies to attract international investment, customs procedures, and trade and innovation policies.

Regulatory Policy

The Dominican Republic has taken strides to fortify its institutions and regulatory policy environment. Decree No. 640-20 established the “Burocracia Cero (B0)” (or “Bureaucracy Zero”) program aimed at enhancing public administration efficiency through clear and appropriate regulatory frameworks that simplify procedures and services while improving the quality of regulations. The coordination of this program has been entrusted to the Ministry of Public Administration, the Ministry of the Presidency, the National Competitiveness Council, and the General Office of Information Technology. To date, 315 procedures from 63 institutions have been reformed, prioritized for the 2020–2024 period.

The specific objectives of the Bureaucracy Zero program are to:

▪ enhance the effectiveness, transparency, and fairness of public administration by streamlining processes;

▪ encourage the utilization of ICT to automate and digitalize public services;

▪ implement tools of the better regulation practices to enhance the quality of regulations, foster increased citizen participation, and instill confidence in the country’s regulatory processes; and

▪ monitor and evaluate the functionality of public services.

Specifically, the program includes the following components:

▪ Better Regulatory Practices and Innovation. This involves regulatory policy tools that help inform the policymaking process with evidence-based analysis, with a goal of raising the quality of policies and legislation. This is Law No. 167-21.

▪ Simplification of Public Service Processes. This includes any action or initiative by public agencies focused on streamlining administrative procedures, making them more accessible and convenient for both the development of procedures and serving the public. This initiative aims to ensure transparency and efficiency in service delivery.

▪ Digital Transformation. This involves the digitization, automation of procedures and services, or both. Leveraging ICT, citizens and companies can access requested services through various digital platforms.

▪ Omnicanality. This refers to the availability of public services through multiple channels (e.g., virtual windows, telephone assistance, PuntosGob, and chatbots) all integrated into a single portal (www.gob.do). This integration ensures consistency in the design and delivery of public services, allowing citizens to initiate and complete any request through their preferred channel.

▪ Interoperability. This involves the integration of public procedures and services utilizing the country’s interoperability platform (X-ROAD). It facilitates the interconnection of data and processes, enabling the sharing of information and knowledge among public institutions. This integration adheres to principles of data protection, ethics, and cybersecurity.

▪ Monitoring and Evaluation. This is facilitated through a dashboard, which offers a visual representation of data, consolidating various metrics, key performance indicators, and other crucial information within a single interface or display. The dashboard comprises charts, graphs, tables, and other visual elements, aiding users in swiftly grasping complex data trends, patterns, and insights.

Thanks to these types of efforts, the Dominican Republic has made strides in improving the quality of its ease of doing business environment over the past decade. Such progress is clearly apparent when looking at data from the World Bank’s World Governance Indicators dataset.[46] For instance, from 2019 to 2022, the Dominican Republic’s score on the “Government Effectiveness” indicator increased from 38.1 to 50 percent. Likewise, its score on “Rule of Law” increased from 48.3 to 50.5 over this period, while its score for “Political Stability” increased from 47.2 to 55.2. The country has performed consistently well on regulatory quality over the past decade, with scores ranging from 51.2 in 2012 to 54.2 by 2022. In total, the below scores (see figure 5) paint a picture of a country working to steadily improve its ease of doing business environment.

Figure 5: Dominican Republic scores on select World Bank Worldwide Governance Indicators[47]

Free Zones

FZs constitute an integral component of the Dominican Republic’s economy. In total, the Dominican Republic hosts 87 FZ industrial parks, situated across 28 of the country’s 32 provinces, which support 820 companies in operation. Enterprises located in the Dominican Republic’s FZs support over 197,600 direct jobs, produce over $8.1 billion in exports annually (constituting the main export sector of the economy), and have made cumulative investments of over $7.16 billion in the country. The United States remains the principal economic partner in the FZs, accounting for around 40 percent of total FDI. About 77 percent of the Dominican Republic FZs exports go to the United States.[48]

Medical devices constitute the country’s leading export sector, accounting for $2.25 billion in annual exports, with 5 of the world’s top 10 medical device manufacturers operating in the Dominican Republic, and the sector enjoying an annual growth rate of 17.7 percent in 2022. The Dominican Republic is the world’s third-largest exporter of medical devices, the leading exporter of ostomy applications to the United States, the third-largest global exporter of ostomy applications, and the third-largest Latin American exporter of medical and surgical instruments and apparatus to the United States. As noted, electronics exports represent the second-largest sector in the Dominican Republic’s FZs, accounting for $1.2 billion in exports in 2022. Other significant sectors operating out of the Dominican Republic’s FZs include business process outsourcing, IT support, and call centers, supporting 33,200 jobs with 97 companies in operation. Over 20 companies, supporting close to 1,000 jobs, offer logistics services such as warehousing, packaging and labeling, and distribution services.

Enterprises located in the Dominican Republic’s FZs support over 197,600 direct jobs, produce over $8.1 billion in exports annually, and have made cumulative investments of over $7.16 billion in the country.

The Dominican Republic originally introduced FZs in the 1960s to foster job creation and local industrial development. The flourishing of the Dominican Republic’s FZs has been made possible by Law 8-90, which exempts beneficiaries from paying 100 percent of:

▪ income taxes;

▪ export or re-export taxes;

▪ value-added taxes;

▪ taxes on the transfer of industrialized goods and services;

▪ import taxes and customs duties on machinery, raw materials, equipment, and construction materials;

▪ taxes on patents, assets, or estates; and

▪ municipal, consular, local, or other taxes.

In short, the Dominican Republic offers 100 percent exemptions for virtually all national and local taxes, ranging from income taxes to duties and construction taxes to taxes on assets or intellectual property such as patents. The Dominican Republic has offered these tax incentives consistently for nearly half a century.

The Dominican Republic’s Law 8-90 establishes that the FZs are approved by the National Council of Export Free Zones (CNZFE) of the Dominican Republic, which grants permission to operate for a period of 20 years in the frontier and 15 years in the rest of the country. This period may be subsequently extended by the approval of the CNZFE. The government of the Dominican Republic sets a sectorized minimum wage across the FZs and offers companies operating in the FZs simplified customs processes, with an exclusive customs office dedicated to each FZ operation. INFOTEP operates a facility within many of the largest industrial parks, offering customized training courses suited to meet the needs of the workforces of the firms in the respective FZs. The Dominican Republic’s FZ operators compete with one another to attract companies, offering services and business solutions that facilitate companies’ operations, with many offering value-added services such as hiring, energy provision, food service, security, back office accounting/bookkeeping, etc.

Two of the leading FZs in the Dominican Republic are the PIISA Industrial Park and the Las Americas Industrial Park. The PIISA Industrial Park spans 170 acres in Haina (west of Santo Domingo), with core tenants including electronics firms such as Eaton, Johanson, and Signal Transformer and a host of medical product/components/instruments companies including Accumed, Arjo, Baxter, Biomerics, Convatec, Edwards Lifesciences, Fenwal, Fresenius Kabi, LG, and Jabil. For instance, Fresenius Kabi has satellite R&D support teams in the Dominican Republic to assist the corporation’s main R&D facilities in Italy, Germany, and the United States.[49] The Las Americas Industrial Park covers 2.5 million square feet of space to the east of Santo Domingo, near the city’s international airport and the Caucedo container port, supporting 35 multinational companies in operations that employ over 21,000 workers.[50] Companies operating in the park include B. Braun, Cardinal Health, Remington Medical, Rockwell Automation, and Oscor. Other large nearby FZs also host world-renowned companies. For instance, Medtronic has carried out major expansions of its manufacturing operations in San Isidro Industrial Park. Meanwhile, the Santo Domingo Cyber Park hosts DRE Global (an electronics repairer and remanufacturer) and PC Precision Engineering (focused on machinery automation) in close proximity to NAP del Caribe, the country’s national access point, and Las Americas Technological Institute. Looking forward, a growing industrial park in Punta Cana promises to leverage the destination city’s privately-owned international airport—the country’s largest by air traffic—as a major air cargo hub.

Other Foreign Direct Investment Policies

The Dominican Republic’s Law No. 16-95 addresses legal and tax matters pertinent to FDI into the country. The law establishes a territorial tax regime and affirms most-favored nation treatment for investors, meaning that all investors are granted equal treatment of their investments regarding establishment, acquisition, expansion, or operations. It stipulates that foreign payments are subject to a withholding tax of 25 percent and that for payments of loans contracted with foreign credit institutions, the withholding rate is 10 percent.

Customs

The Dominican Republic has made tremendous strides to improve the quality of its customs regime in recent years as part of its effort to make the country the leading regional logistics hub in the Americas. In particular, on August 14, 2021, a new Customs Law (Law No. 168-21) came into effect, strengthening the autonomy of the General Directorate of Customs, establishing more efficient procedures and clearer timelines, and trying to promote an export culture among small and medium-sized enterprises (SMEs) by simplifying and transparently streamlining the processes of export and goods clearance.

The Dominican Republic continues to make concerted attempts to improve its logistics environment, with the effort spearheaded through a new Logistics Cabinet, coordinated at the presidential level, and led by the Ministry of Industry, Commerce, and SMEs (MICM) in coordination with the General Directorate of Customs (DGA). The effort seeks to work hand-in-hand with the private sector to identify customs bottlenecks or impediments and streamline customs procedures to facilitate increased levels of imports and exports.

A flagship initiative has been the 24-Hour Clearance Program, also called Dispatch 24h (or D24H), which seeks to clear containers within 24 hours. To date, the program has cleared over 50,000 containers in 24 hours or less, benefitting more than 6,700 importers. Moreover, over 65,000 import manifests have been submitted in advance, resulting in savings of almost $20 million for taxpayers.

The Dominican Republic’s accelerated customs clearance procedures have been made possible by technical, operational, and procedural improvements. For instance, the DGA has implemented a new, comprehensive Risk Management System that seeks to direct customs agents’ attention to cargo of the most-pressing concern. Using tools including AI, DGA has developed 158 new dynamic indicators, which have allowed an almost 60 percent reduction in physical inspections of containers, decreasing from 49.6 percent of containers being inspected in 2020 to 20.1 percent in 2023. Moreover, the DGA has accelerated use of nonintrusive technologies, such as X-ray machines, which can inspect up to 1,000 containers daily. The use of such nonintrusive technologies has significantly advanced the security and control of imports, with 96 percent of imported containers having undergone inspections using this technology. The streamlining of customs procedures has been further abetted by the implementation of over 160 technological enhancements in the DGA’s IT systems, including the launch of a new DGA web interface that offers 85 services, 25 of which are fully automated.

The Dominican Republic’s 24-Hour Clearance Program, also called Dispatch 24h (or D24H), seeks to clear containers within 24 hours.

A critical program for exporters from the Dominican Republic is Exporta Más (or Export +), through which participating companies can export without a physical inspection process and in a fully digital format, eliminating the need for paper documents and thus decreasing the time and costs associated with exporting. Over 250 companies are enrolled in the Exporta Más program, with participating companies making over 177,000 export declarations and the program now covering 58 percent of total exports from the country.

The World Customs Organization (WCO) has introduced the Authorized Economic Operator (AEO) program, which seeks to enhance international supply chain security and facilitate legitimate trade.[51] The AEO constitutes an international accreditation created under the regulatory guidelines of the WCO SAFE framework in 2005. Nearly 600 (596) companies operating in the Dominican Republic have received AEO certification, with 374 AEO Standard and 212 AEO Simplified certifications. In total, AEO companies account for 31.7 percent of imports coming into the Dominican Republic.

Furthermore, the Dominican Republic is one of the 168 signatory companies to the WTO’s Trade Facilitation Agreement (TFA), through which member nations commit to efforts toward process simplification, transparency, and cooperation. The Dominican Republic was 8th among the Latin America and the Caribbean’s 33 signatories to achieve 100 percent compliance with TFA guidelines, and the 80th country in the world to do so.[52]

It should also be noted that the Dominican Republic works closely with the United States on the flows of goods and individuals. For instance, the DGA has signed an agreement with the U.S. Department of Homeland Security to optimize risk detection, through which information is exchanged to detect potentially risky cargo and to detect and track cargo that might pose risks to national security or consist of counterfeited goods. The Dominican Republic also was the 15th country (and 6th in Latin America) to be admitted to the U.S. Global Entry program, enabling expedited entry for travelers to the United States.

Trade Policy

The Dominican Republic-Central America-United States Free Trade Agreement (CAFTA-DR) liberalizes the Dominican Republic’s trade in goods and services with the United States and five Central American countries: Costa Rica, El Salvador, Guatemala, Honduras, and Nicaragua. CAFTA-DR also contains other disciplines and standards pertinent to customs administration and trade facilitation, technical barriers to trade, government procurement, investment, telecommunications, electronic commerce, intellectual property (IP) rights, transparency, and labor and environmental protection.[53]

The Dominican Republic is also the main trading partner and the main recipient of European investment in the Caribbean region. Since entering the European Union-CARIFORUM Economic Partnership Agreement (EPA) of 2008, bilateral trade in goods between these entities has grown by 231 percent, reaching an all-time high of $4.65 billion in 2022.[54] As the European Union has written, “The Dominican Republic has stood out for its punctual implementation of the assumed commitments in the EPA, including the tariff reduction schedule.”[55]

In 2022, two-way trade between the Dominican Republic and the United States totaled $30.5 billion, including U.S. exports of $17 billion and imports of $13.5 billion.[56] The total stock of U.S. FDI in the Dominican Republic reached $2.5 billion in 2022, a 3.7 percent increase over the previous year.

In total, the Dominican Republic has several favorable trade agreements with strategic partners, ranging from smaller economies, such as the Caribbean Community (CARICOM), Central America, and Panama, to major economies, such as the United States, European Union, and United Kingdom. These partnerships have allowed exporters duty-free access to more than 900 million consumers in 49 countries, reduced trade barriers, and increased export potential for both local and foreign companies.[57]

The Dominican Republic initiated a partnership with Costa Rica, Ecuador, and Panama known as the ADD to promote democratic strengthening and economic growth through the tightening of the countries’ commercial, demographic, and cultural ties. The ADD is predicated on the belief that democracy and development are mutually reinforcing, wherein democracy creates favorable conditions for investment and growth.[58] On July 25, 2022, the ADD signed a Memorandum of Understanding (MOU) with the U.S. Department of State to advance a consultative dialogue on supply chains and economic growth, and it is also working with the U.S. Chamber of Commerce to identify opportunities, challenges, and areas of collaboration for supply chain resilience. The ADD thus seeks to position its partners as prime destinations for U.S. nearshoring.[59] To these ends, the Dominican Republic chairs the ADD Business Council, based in Washington, D.C.

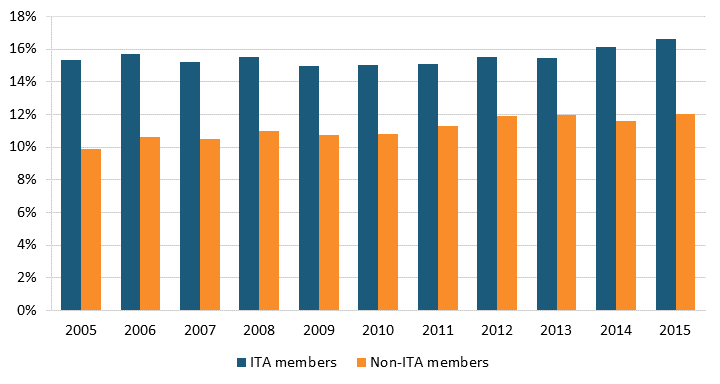

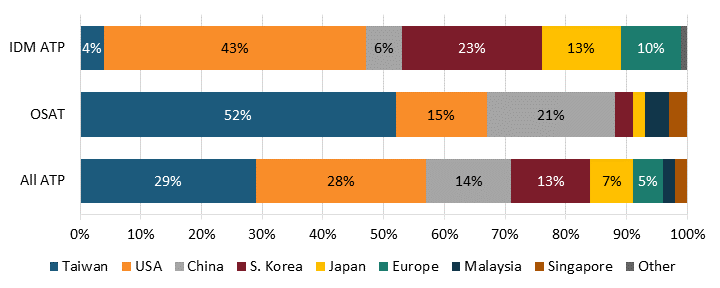

Countries that offer “zero-in/zero-out” tariff environments for the parts, inputs, and components that flow through semiconductor value chains position themselves well for competition in the global ICT industry. The WTO ITA—implemented in 1996 and to which the Dominican Republic is an original signatory—has played a catalytic role in this regard, eliminating tariffs on trade in hundreds of ICT products.[60] Nonsignatories of the ITA saw their participation in global ICT value chains decline by more than 60 percent from 1995 (two years before the ITA went into effect) to 2009.[61] And from 2005 to 2015, ITA-member nations enjoyed nearly one-third greater participation in ICT global value chains than did non-ITA-member nations.[62] (See figure 6.) However, it’s not just that ITA membership makes nations more attractive for ICT manufacturing by lowering costs of inputs and components used in ICT manufacturing, it’s that by reducing the cost of these productivity- and innovation-enhancing capital goods (by not imposing tariffs on them), countries can also boost their stock of ICTs in use by individuals and businesses, which further drives countries’ economic growth.[63]

Figure 6: Participation rates in global ICT value chains, indexed as a share of gross ICT output[64]

National Innovation Policy

As the Information Technology and Innovation Foundation (ITIF) has extensively documented, at least six dozen nations throughout the world have articulated national innovation strategies that explicitly link science, technology, and innovation with economic and employment growth, effectively creating a game plan to compete and win in innovation-based economic activity.[65] Such policies matter because, as Finland’s National Innovation Strategy framed it, “piecemeal policy measures will not suffice in ensuring a nation’s pioneering position in innovation activity, and thus growth in national productivity and competitive ability.”[66]

In this regard, the Dominican Republic is to be commended for promulgating its National Innovation Policy 2030 (PNI 2030) which aims to establish a general framework for the promotion and coordination of innovation, creativity, and scientific and technological research from a shared vision of an ecosystem that integrates human talent, institutional capabilities, and the sectors involved in order to enhance the creation of useful knowledge, competitiveness, and sustainable productive transformation and inclusion, contributing to sustainable development and improvements in quality of life.

PNI 2030 is based on five foundational pillars: human talent, effective governance, investment in innovation, a mentality and culture of innovation, and sustainability, transition, and energy efficiency. Through the PNI 2030, the Dominican Republic seeks to promote innovation-oriented mindsets and capabilities, the more sustainable management of natural resources, and the promotion of the transition to clean and efficient energies. Another objective of the PNI 2030 is to bolster the country’s R&D intensity, which matters, as one report found Dominican Republic investment in R&D of just 0.01 percent of GDP in 2015, below even the already-low average level of Latin America and the Caribbean at 0.7 percent.[67]

In addition to formulating a national innovation strategy, the Dominican Republic has articulated a National Artificial Intelligence Strategy (ENIA), which addresses the transformation of the country’s institutional infrastructure and productive work models that can position the country as a regional leader in leveraging AI. The strategy comprehensively lays out how the Dominican Republic can leverage AI across key sectors of the economy, including the following:

▪ Public sector: Use of AI to improve the efficiency and effectiveness of government services, such as health care, education, and transportation

▪ Private sector: Use of AI to boost productivity and innovation in businesses of all sizes

▪ Education: Use of AI to improve the quality of education and make it more accessible

▪ Society: Use of AI to address social challenges, such as poverty, inequality, and climate change[68]

Business Environment

This section examines the workforce training environment in the Dominican Republic, key infrastructure supporting industry in the Dominican Republic, and factors impacting the cost environment in the Dominican Republic.

Workforce Training and Education

Ensuring that the Dominican Republic can supply a sufficiently skilled workforce will be absolutely vital to supporting the country’s aspirations in the PCB/semiconductor ATP sectors. Here, a crucial player will be the National Institute of Professional Technical Training, or “INFOTEP.” INFOTEP’s charter is to organize and govern the Dominican Republic’s national system of professional and technical training, focusing on the full development of human resources, increasing the productivity of companies across all sectors of economic activity, and advancing social equity by enhancing workforce skills.[69]

Companies fund INFOTEP by contributing 1 percent of their monthly payrolls to the program. This amounts to the contribution of 0.5 percent of the annual profit bonuses that workers receive. Organizationally, INFOTEP has three national centers: a Teaching Development Center, a Virtual Training Center, and an Innovation and Business Development Center. These national assets are supported by six regional directorates, which house 16 community technology centers and 56 mobile workshop programs. In total, INFOTEP has 245 operational centers across its system nationwide. Critically, most of the leading FZs in the country have an INFOTEP office on-site, which works hands-on with employees of the companies operating in the FZ to build tailored skill sets. INFOTEP works hand-in-hand with companies to understand the specific skillsets that companies need and then builds technical training programs accordingly. For instance, for Convatec, a medical products manufacturer that operates out of the PIISA FZ employing 1,500 workers and shipping 185 million units annually, INFOTEP developed custom courses on ultrasonic welding and the application of radio frequency technologies.[70]

INFOTEP works hand-in-hand with companies to understand the specific skillsets that companies need and then builds technical training programs accordingly.

INFOTEP offers a total of 920 technical courses, including 86 in electricity and electronics, 36 in ICT, and 104 in the manufacturing, installation, and maintenance of machinery and equipment. Since its inception, INFOTEP has trained 770,914 workers in different competencies and fields via over 40,000 courses and close to 800,000 training hours.

INFOTEP offers a number of courses directly relevant to the country’s goals of competing in PCB/ATP. Consider, for instance, the core subjects studied by students taking the 290-hour course “Basic Electronics Product Assembler”:

▪ Assembly with passive and active electronic devices (teaches PCB principles) (80 hours)

▪ Assembly with linear integrated circuits (85 hours)

▪ Assembly with digital integrated circuits (85 hours)

▪ Integrative project (20 hours)

▪ Human training (20 hours)

Similarly, the 685-hour industrial electronics technician course consists of the following subjects:

▪ Installation of passive and active electronic devices (80 hours)

▪ Installation of operational amplifiers (90 hours)

▪ Printed circuits and soldering processes (90 hours)

▪ Construction of cards with logic, sequential circuits, and memories (70 hours)

▪ Installation of power electronic devices (70 hours)

▪ Installation of industrial electronic devices and pneumatic valves (95 hours)

▪ Repair of electrical and electronic controls of industrial machines (95 hours)

▪ Programmable logic control (PLC) programming and installation (95 hours).[71]

In the industrial electronics training course, basic knowledge of the design of electronic cards (PCBs) is taught, simulated, and then built in a classroom project. From 2021 to 2023, 7,817 individuals took electronics training/coursework from INFOTEP. In short, INFOTEP provides a vital and effective mechanism to upskill the workforce of the Dominican Republic to compete in PCB/semiconductor ATP manufacturing.

Las Americas Institute of Technology (ITLA)

The Dominican Republic government established the Las Americas Institute of Technology (ITLA) as a technical institution of higher education in 2000.[72] Its mission is to educate professionals in high technology, promoting specialized education based on innovation and entrepreneurship, contributing to the development of the nation’s productive sectors. ITLA’s main areas of specialization aremechatronics, automated manufacturing, medical device manufacturing, industrial design, software development, information networks, multimedia, computer security, and data science, but in total it offers training across 15 technology areas. ITLA’s mission is to prepare students to become technology professionals in two years, enrolling about 4,500 students per quarter. The education takes a practical, active learning approach, with hands-on laboratories and workshops at the core of the pedagogical approach, which is delivered by nearly 330 professors in total. Over 400 companies operating in the Dominican Republic employ ITLA graduates, and 92 percent of ITLA graduates receive employment offers upon graduation. Since its inception in 2002, over 50,000 students have received an education from ITLA. The Institute also recently launched an Innovation Solution Factory focused on the digital transformation of government and private sector entities to take a qualitative leap toward Industry 4.0 practices.

INTEC

The Technological Institute of Santo Domingo (INTEC) is considered the leading technical institute in the country, and it offers extensive courses in fields such as electrical and mechanical engineering.[73] INTEC offers a very robust set of engineering courses, including degrees in Data Science, Biomedical Engineering, Engineering in Logistics and Transport, Civil Engineering, Software Engineering, Mechatronics Engineering, Industrial Engineering, Systems Engineering, Industrial Design, Electronic and Communications Engineering, Electric Engineering, Mechanical Engineering, and Cybersecurity Engineering.[74] INTEC also operates partnerships with Penn State University, Southwest Minnesota State University, Texas A&M University, the City College of New York, and Western Michigan University to afford engineering students opportunities for international study.[75] Over each of the past two years, INTEC has been named the Dominican Republic’s leading university in the QS World University Rankings report.[76]

MESCYT

The Dominican Republic’s Ministry of Higher Education, Science, and Technology (MESCyT) plays an important role as the government institution that regulates higher education in the country and which also disburses research grants and contributes to technology development and diffusion. MESCyT has focused on developing research for the improvement of manufacturing and industry in the different institutions that make up the national science and technology system, allowing the generation of new knowledge that can be transferred and applied to industry. MESCyT has been heavily involved in promoting the development and adoption of “Industry 4.0” technologies in the Dominican Republic, including funding of research and training into areas such as AI, automation, robotics, additive manufacturing/3D printing, big data and analysis, advanced materials, and augmented/virtual reality. In its funding of Dominican Republic higher education institutions and research centers, MESCyT supports 1) training of students and workers; 2) collaborative research; 3) technology transfer; 4) establishment of joint R&D centers; and 5) disbursement of scholarships and grant programs to companies.

Many research programs are funded by the Dominican Republic’s National Fund for Innovation and Scientific and Technological Development (FONDOCYT), including research initiatives pertinent to microelectronics. For instance, Dr. Fabrice Piazza of the of the Pontificia Universidad Católica Madre y Maestra (PUCMM) completed pioneering work on nanocrystalline diamond thin films, diamond crystals, and carbon nanotubes targeting emerging technologies in electronics, bio-nanoprobes, and innovative coatings. They were the first to successfully report on the low-temperature synthesis of diamond nanocrystals on polymers for electronics and thin film coating applications.[77] Mr. Luis José Quiñones Rodríguez of Universidad APEC (UNAPEC) has received several patents for innovative microchip design. Dr. Melvin Arias and his team at INTEC received a patent for technology for the manufacture of rechargeable lithium-ion batteries that improved their efficiency by nearly 95 percent while making their manufacturing process more sustainable.[78]

In the fall of 2023, a delegation from the Dominican Republic—including representatives from government, academia, private industry, and the investor community—participated in the MIT Regional Entrepreneurship Accelerator Program (REAP). REAP is a support program organized by MIT experts to advance entrepreneurship and innovation in emerging economies through sessions, methodologies, and practical cases. In the case of the Dominican Republic, participation in the program was based on the need to design investment schemes that strengthen public-private efforts in innovation processes that promote continuous improvement in the country's main industries, strengthening quality of products and services and promoting greater access to global value chains and the competitive positioning of Dominican Republic products and services in the region and the world.

Infrastructure

The following addresses key attributes of the Dominican Republic’s physical and digital infrastructure across areas including logistics, energy/electricity, and digital infrastructure.

Energy