How Expanding the Information Technology Agreement to an “ITA-3” Would Bolster Nations’ Economic Growth

Completing a second expansion of the Information Technology Agreement (an “ITA-3”) could bring more than 400 unique ICT products under the ITA’s tariff-eliminating framework, which would add more than $750 billion to the global economy over 10 years.

KEY TAKEAWAYS

Key Takeaways

Contents

How ICT Drives Economic Growth. 9

How ITA Participation Benefits Countries. 12

The Logic for Bringing Additional ICT Goods Under ITA-3 Coverage. 18

The Economic Impact of a Proposed ITA-3 Expansion. 26

The Impact of ITA-3 Expansion for the United States. 50

Appendix A: List of Countries by Current ITA Membership. 52

Appendix B: Growth-Revenue Estimates Methodology. 53

Appendix C: ITA Product Codes. 55

Executive Summary

The Information Technology Agreement (ITA) has been one of the World Trade Organization’s (WTO’s) most successful plurilateral trade agreements. Originally signed in 1996 and to which 82 countries are now signatories, it eliminates tariffs on trade in hundreds of ICT products. In 2015, 53 countries joined together in completing (and implementing in 2016) an ITA expansion (ITA-2) that eliminated tariffs on an additional $1.3 trillion in annual global trade in 201 ICT parts, components, and final products.[1] By eliminating tariffs on trade across hundreds of ICT products, the ITA has played an indispensable role in creating “zero-in/zero-out” tariff environments that have fostered the development and diversification of ICT global value chains (GVCs), helping bring developing economies previously locked out by their prohibitively high tariffs on ICT parts, components, and equipment and undeveloped telecommunications networks into GVCs for ICT goods production and assembly. Moreover, by reducing prices through tariff elimination, the ITA has facilitated greater adoption of the ICT products that lie at the core of the global digital economy and power the downstream innovative and competitive capacity of every household, enterprise, and industry that deploys them. This ITA-engendered increase in nations’ ICT capital stock leads directly to greater economic growth and innovation in developed and developing nations alike.

Yet, technologies continue to evolve, and now ICT is found at the core of an ever-increasing range of products, from energy-efficient green technologies, such as storage batteries, to personal fitness monitors to the industrial robots and 3D printers that are driving the global smart-manufacturing revolution. As such, an initial group of companies has come together to identify more than 300 additional ICT six-digit product codes under the Harmonized Commodity Description and Coding System, including over 400 unique ICT products, as candidates for potential ITA inclusion.

This report examines the economic and tariff revenue impacts such an “ITA-3” would have for the European Union and 21 nations: Argentina, Brazil, Cambodia, Canada, China, Costa Rica, India, Indonesia, Japan, Kenya, Lao PDR, Malaysia, Mexico, Nigeria, Pakistan, South Korea, Taiwan, Thailand, the United States, the United Kingdom, and Vietnam.[2] An ITA-3 would include products such as high-definition televisions; energy-efficient technologies such as storage batteries, solar cells, and LED “light sources”; digital manufacturing technologies such as industrial robots and 3D printers; commercial-use drones; and certain medical technologies and devices, such as patient monitoring systems; and semiconductor manufacturing parts and supplies.

The analysis finds that ITA-3 accession would generate tangible economic growth for all nations assessed, and that for many nations, tax revenues generated from enhanced economic growth would more than make up for tariff revenues forgone. A further liberalization of tariffs for the rapidly expanding universe of ICT technologies would also advance the diversification and resiliency of global supply chains, bring more developing economies into the global technology ecosystem, raise household incomes, and support a continued expansion of global technology jobs worldwide. This report begins with an overview of the ITA and global trade in ICT products before moving on to examine how ICT drives economic growth, articulating the logic behind bringing the proposed ICT products into an ITA-3 and then turning to an analysis of the economic impact of ITA-3 accession for the study countries.

Key Findings

Participation in the ITA provides an impetus for countries to reduce tariffs, thereby lowering the prices for, and expanding the consumption of, productivity-enhancing ICT, while deepening countries’ participation in GVCs for the production of ICT goods and services. Moreover, joining the ITA can engender faster economic growth and higher living standards because it gives businesses and individuals access to more-affordable and higher-quality ICT, which is the modern global economy’s chief driver of productivity, innovation, high-wage employment, and economic growth. Moreover, as the world now enters an era of reshaping the structure of technology GVCs, countries that wish to capture a greater share of tech GVC participation need to ensure a competitive tariff and e-commerce customs duty environment that facilitates the cross-border movement of ICT goods and services.

An ITA-3 expansion could help grow U.S. GDP by $208 billion over a decade, increase U.S. exports of ICT products by $2.8 billion, and support the creation of almost 60,000 new U.S. jobs.

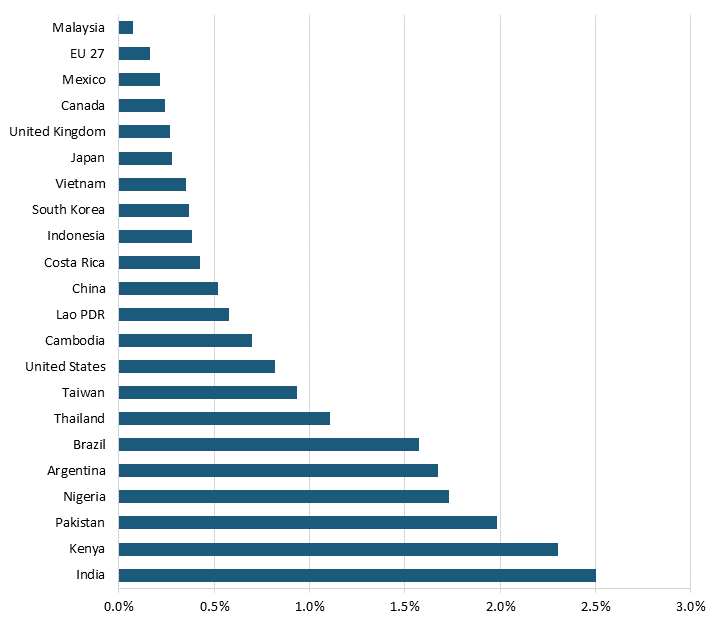

ITA accession, by lowering tariffs on and thus the prices of ICT goods, bolsters countries’ levels of ICT goods consumption and capital stock, the productivity- and innovation-expanding power thereof which in turn drives increased economic and employment growth. Leveraging these dynamics, the Information Technology and Innovation Foundation (ITIF) finds that the proposed ITA-3 expansion would generate positive economic impacts by the 10th year post ITA-3 expansion for all 21 study countries and the European Union. In percentage terms, ITIF finds that India, Kenya, Pakistan, and Nigeria would enjoy the largest economic growth in the 10th year post ITA-3 accession, with cumulative economic growth over that 10-year period equivalent to 2.5 percent of Indian, 2.3 percent of Kenyan, 2 percent of Pakistani, and 1.7 percent of Nigerian gross domestic product (GDP), respectively. (See table 1.)

Table 1: Summary of economic and revenue impacts over 10 years post ITA-3 accession

|

Cumulative 10-Year GDP Growth From ITA-3 Expansion (Billions) |

Cumulative 10-Year GDP Growth From ITA-3 Expansion |

Income Tax Revenue Gained (Millions) |

Revenue Gained as a Share of Revenue Forgone |

|

|

Argentina |

$10.0 |

1.67% |

$542.6 |

245% |

|

Brazil |

$31.8 |

1.57% |

$2,241.3 |

181% |

|

Cambodia |

$0.3 |

0.70% |

$14.8 |

35% |

|

Canada |

$4.7 |

0.24% |

$796.5 |

304% |

|

China |

$147.3 |

0.52% |

$7,911.9 |

190% |

|

Costa Rica |

$0.4 |

0.42% |

$16.5 |

72% |

|

EU 27 |

$28.7 |

0.16% |

$3,417.5 |

239% |

|

India |

$101.2 |

2.50% |

$7,795.4 |

192% |

|

Indonesia |

$5.7 |

0.38% |

$218.6 |

108% |

|

Japan |

$12.2 |

0.28% |

$1,234.3 |

241% |

|

Kenya |

$3.2 |

2.30% |

$219.2 |

249% |

|

Lao PDR |

$0.2 |

0.58% |

$3.4 |

43% |

|

Malaysia |

$0.3 |

0.08% |

$26.2 |

58% |

|

Mexico |

$2.7 |

0.22% |

$201.7 |

44% |

|

Nigeria |

$10.3 |

1.73% |

$280.0 |

129% |

|

Pakistan |

$10.8 |

1.99% |

$336.3 |

99% |

|

South Korea |

$7.9 |

0.37% |

$678.6 |

101% |

|

Taiwan |

$10.2 |

0.93% |

$786.6 |

75% |

|

Thailand |

$5.5 |

1.11% |

$313.8 |

35% |

|

United States |

$208.0 |

0.82% |

$24,355.6 |

288% |

|

United Kingdom |

$8.6 |

0.27% |

$983.3 |

299% |

|

Vietnam |

$2.0 |

0.35% |

$117.6 |

23% |

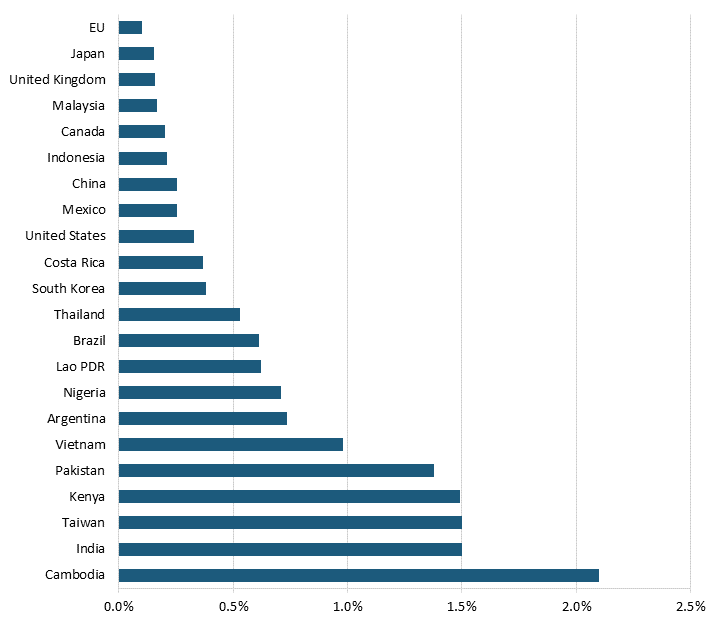

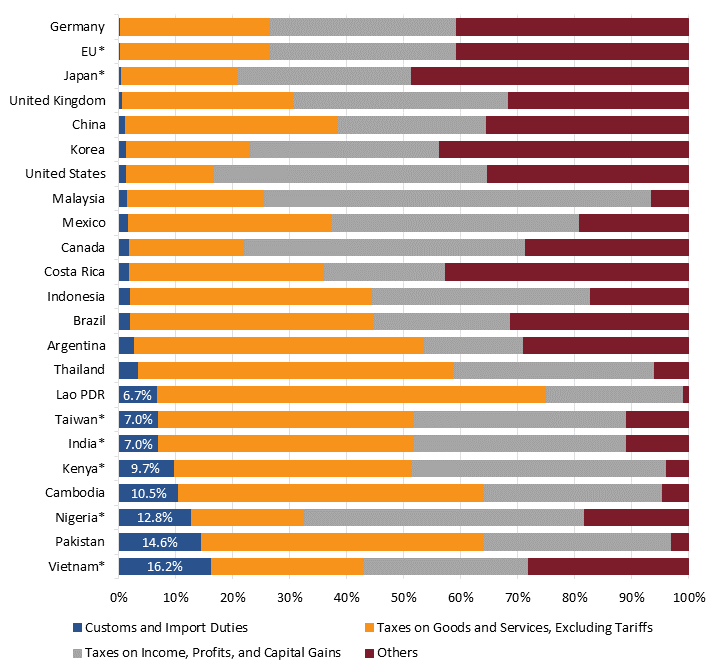

Moreover, if all 82 ITA-1 signatory countries were to join the proposed ITA-3, global GDP could cumulatively grow by $766 billion over the ensuing 10 years. In absolute terms, the United States would be the biggest beneficiary, followed by China. ITA-3 expansion would be poised to deliver a cumulative $208 billion in U.S. GDP growth over 10 years, equivalent to 0.82 percent greater U.S. GDP growth than would otherwise be expected. Moreover, ITIF finds that ITA-3 expansion would increase U.S. exports of ICT products by $2.8 billion, boost revenues of U.S. ICT firms by $6.9 billion, and support the creation of almost 60,000 new U.S. jobs. China’s economy would cumulatively grow by 0.52 percent to be approximately $147 billion greater than would otherwise be the case as a result of ITA-3 expansion. The economic growth generated by an ITA-3 expansion would produce tax income that, for at least 12 study countries and the European Union, would well exceed tariff revenues forgone, and for four more countries would fill more than 50 percent of the revenue gaps 10 years post ITA-3 accession.

For countries contemplating participation in ITA-1, ITA-2, ITA-3, or all three, the time to move is now, as major economies are looking to diversify their sourcing and supply chains in order to promote greater supply chain resilience, security, and sustainability. As a result, large technology and industrial companies are taking a fresh look at potential suppliers and locations for production and assembly, creating an opportunity for new suppliers and economies to break into technology GVCs.

Conversely, countries declining to join ITA-1 and ITA-2, or neglecting to participate in an ITA-3, risk experiencing a technologically deficient economy, reduced productivity, and exclusion from global technology supply chains. Nonparticipation in the ITA also limits an economy’s ability to partake in the expanding universe of industrial products that incorporate semiconductors and other advanced technologies and from participating in the development and provision of services-based products that are delivered cross-border using the Internet and which require efficient telecommunications networks. Ultimately, refraining from ITA participation reduces countries’ wage growth and opportunity because a technologically deficient workforce cannot be in a position to participate effectively in the advanced global technology supply chains that pay higher wages and demand greater technology training and skills.

Finally, the two iterations of the ITA—by promoting the diffusion and availability of productivity- and innovation-enhancing ICT goods—have empowered workers globally by giving them greater opportunities to work remotely (reducing commutes and commuting times); affording greater access to information regarding employment opportunities; expanding educational and training opportunities; creating opportunities to perform remote gig, consulting, and free-lance work; and expanding the potential to provide their services internationally across borders. Labor markets for many types of services (e.g., information technology, educational services, consulting, health care, finance, etc.) are much less constrained by national or international borders today and often don’t require geographic proximity to a physical workplace, but can now be performed remotely over the Internet. All of this increases employment opportunities and employee bargaining power, wages, work-life balance, and ultimately worker satisfaction and fulfillment.

Introduction

In December 1996, 29 WTO member nations launched the ITA, a novel trade agreement in which participating nations eliminated tariffs on eight broad categories of ICT products (e.g., semiconductors, computers, telecommunications equipment, etc.). The ITA-1 now counts as signatories 82 nations, with these nations collectively accounting for approximately 97 percent of global trade in ITA-covered goods.. Countries that have thus far neglected to join the ITA have missed out on tremendous growth opportunities. First, countries not joining the ITA harm themselves by retaining tariffs that add to the cost of key productivity- and innovation-enhancing ICT products, thus constraining their consumption and adoption. Second, those tariffs only serve to diminish the competitiveness of countries’ goods that depend on intermediate ICT inputs. Third, countries not participating in the ITA have seen their participation in GVCs for the production of ICT goods plummet since the ITA was introduced, in large part because of the higher cost they face in the manufacturing and assembly of key parts, components, and delivery systems when they’re subject to tariffs. In total, the evidence shows that ITA accession has been beneficial for both countries’ domestic industries and their broader economies.

In 2012, owing to the tremendous success of the original ITA, member nations initiated negotiations toward expanding the ITA to add innovative ICT products commercialized since 1996 as well as certain categories of ICT goods not included in the original agreement. ITA-expansion negotiations concluded in December 2015, and additional tariff eliminations began on July 1, 2016.[3] The expansion, which the WTO estimated would eliminate tariffs on an additional $1.3 trillion in annual global trade of ICT parts and products, represented the first major tariff-cutting deal completed at the WTO in 19 years.[4] The ITA-2 has produced annual global tariff savings of at least $13.8 billion.[5]

Digital technologies are increasingly powering the global economy. For instance, analysts at Oxford Economics estimated that by 2016 the digital economy already accounted for 22.5 percent of global GDP.[6] Analysts at the research firm IDC estimated that as much as 60 percent of global GDP was digitized (meaning largely impacted by the introduction of digital tools) already by 2022.[7] That aligns with estimates that as much as half of all value created in the global economy over the next decade will be created digitally.[8] And while certainly the digitalization of the global economy has brought entirely new industries, services, and enterprises to the fore—web search, social media, artificial intelligence (AI), cloud, etc.—at least 75 percent of the value of data flows over the Internet actually accrues to traditional industries such as agriculture, manufacturing, finance, hospitality, and transportation.[9]

Moreover, it’s important to remember that the entire global digital economy is underpinned by ICT goods—semiconductors, servers, routers, computers, smartphones, tablets, etc.—that fundamentally power it. And by helping to reduce the price of ICT goods by eliminating tariffs on them, the ITA has played an enormous role in the growth of global production and trade in the very ICT products powering the global digital economy. For instance, the U.S. Bureau of Labor Statistics has estimated that the U.S. consumer price index for “personal computers and peripheral equipment declined 96 percent” between 1997 and 2015.[10] And while certainly Moore’s Law (i.e., semiconductors’ capabilities doubling as their costs halve) and other technological innovations have played a key role here, ITA-inspired tariff reductions and the evolution of efficient ICT GVCs certainly contributed as well.

It’s important to remember that the entire global digital economy is underpinned by the ICT goods—semiconductors, servers, routers, computers, smartphones, tablets, etc.—that fundamentally power it.

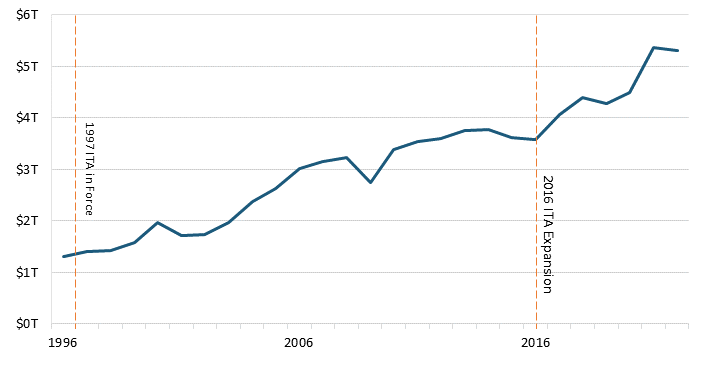

Indeed, global two-way trade in ICT products has grown more than threefold since the ITA entered force in 1997, increasing from $1.4 trillion in 1997 to $5.31 trillion in 2022. (See figure 1.) Further, global two-way trade in ICT products increased 46 percent since the 2016 ITA expansion.[11] While global imports of ICT products did decrease 3 percent from 2018 to 2019, and decreased again with the start of the COVID-19 pandemic, ICT trade grew 19.6 percent from 2020 to 2021, meaning trade in digital technologies has rebounded since the COVID-19 pandemic as businesses relying on these technologies reopened and workplace restrictions drove sales of personal computers, smartphones, and other technologies to support remote work. In fact, sales for semiconductors, a foundational technology enabling all other ICT products, grew in 2020 and another 26.2 percent in 2021 due in large measure to the added demand for ICT products engendered by the rebound since the pandemic and the global chip shortage.[12]

Figure 1: Value of two-way global trade in ICT products, 1996–2022[13]

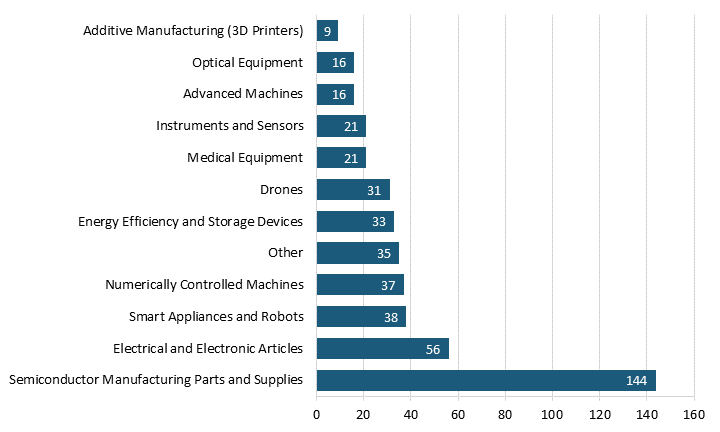

Recognizing that ICT continues to evolve and underpin a much greater range of products—from medical devices and industrial robots to drones and energy-efficient technologies—than they did a decade ago, an initial group of companies has come together to propose an ITA-3 that would bring products included within more than 300 additional six-digit HS2017 product codes under ITA coverage (this would include well over 400 unique ICT products). An ITA-3 would ensure that new technological versions of ICT goods are included: for instance, printers were included in the original ITA, but between the ITA-2 and ITA-3 the full slate of modern 3D (additive manufacturing) printers were not covered. Similarly, just as the ITA-2 included next-generation multi-component semiconductors (MCOs) that were not part of the original ITA, an ITA-3 would include semiconductor-based transducers and other next-generation semiconductor technologies.[14] The ICT products being proposed for ITA-3 inclusion are concentrated in the following categories: semiconductor manufacturing, smart appliances and robots, numerically controlled machines, energy efficiency and storage devices, drones, instruments and sensors, and medical equipment. (See figure 2.) Subsequent sections of this report articulate the rationale for including these ICT products in an ITA-3 expansion and evaluate the economic impacts of the proposed expansion on the 22 aforementioned countries/regions. But first, the report briefly turns to exploring how ICT drives economic growth and to explaining why ITA membership is beneficial for developed and developing countries alike.

Figure 2: Counts of proposed ITA-3 products by ICT category[15]

By trade value at the aggregated six-digit HS-code level, the top 10 product lines being proposed for ITA-3 inclusion feature the following:

▪ Boards, panels, consoles, etc. with electrical apparatus, for electric control or distribution of electricity, for a voltage not exceeding 1,000 volts (HS 853710)

▪ Lithium-ion batteries (HS 850760)

▪ Optical devices, appliances, and instruments (HS 901380)

▪ Reception apparatus for television, color (HS 852872)

▪ Instruments and appliances for medical, surgical, or veterinary sciences; and parts and accessories thereof (HS 901890)

▪ Machines and mechanical appliances having individual functions (HS 847989)

▪ Electrical machines and apparatuses, having individual functions (HS 854370)

▪ Electrical conductors, for a voltage not exceeding 1000 v, fitted with connectors (HS 854442)

▪ Medical etc., needles, catheters, cannulae and the like; parts and accessories thereof (HS 901839)

▪ Parts for electrical apparatus for electrical circuits, boards, panels etc. for electric control or distribution of electricity (HS 853890)

How ICT Drives Economic Growth

Increasing productivity—that is, economic output per unit of input, whether that input is capital, labor, data, or technology—is the principal way economies grow over time.[16] Those productivity gains can come from all enterprises and workers in a country (e.g., banks, farms, manufacturers) becoming more productive or from countries shifting the mix of enterprises in their economy (e.g., replacing lower-value-added sectors with higher-value-added ones, such as call centers with ICT services providers).[17] While both mechanisms are important, as the McKinsey Global Institute (MGI) found in its report “How to Compete and Grow: A Sector Guide to Policy,” the overwhelming source of a country’s productivity growth, and thus economic growth, comes from bolstering the productivity of all the enterprises, workers, and industries that already predominantly comprise an economy.[18]

The vast majority of the economic benefits generated from ICT, especially in developing countries, stem from greater adoption of ICT across an economy.

And the principal way economies can increase their productivity arises from leveraging the power of ICT. ICT involves such powerful tools precisely because it represents a general-purpose technology that enhances the productivity and innovative capacity of every individual, enterprise, and industry it touches throughout an economy—something that holds true for both developed and developing countries alike.

Indeed, ICT represents “super capital” that has a much larger impact on productivity than do other forms of capital. As research performed by Oxford Economics confirms, ICT generates a bigger return to productivity growth than do most other forms of capital investment.[19] For instance, ICT capital has a three to seven times greater impact on firm productivity than does non-ICT capital. ICT workers also contribute three to five times more productivity than non-ICT workers do.[20] In their report, “The Impact of ICT on East Asian Economic Growth,” Ahmed and Ridzuan elucidate upon this dynamic, writing, “The ICT revolution has contributed significantly to the whole economy by raising productivity. First, ICT increases labor productivity in ICT-using industries by making labor produce more or work more efficiently. Second, ICT makes physical capital become more productive.”[21] As a result, revenue collection by nations that “tax” this ICT “super capital” through tariffs and other means is particularly damaging.

It’s vital to emphasize that the central way ICT drives a country’s economic growth is not through the production of ICT goods (e.g., the manufacturing of computers or smartphones). Rather, the vast majority of the economic benefits generated from ICT, especially in developing countries, stems from greater adoption of ICT across an economy.[22] Ultimately, ICTs’ productivity- and innovation-enabling benefits at the individual, firm, and industry levels aggregate to drive productivity and economic growth at an economy level.[23]

This explains why multiple academic studies find strong linkages between ICT consumption (i.e., usage) and economic growth. For example, a December 2010 World Bank report, “Kenya Economic Update,” finds that “ICT has been the main driver of Kenya’s economic growth over the last decade.”[24] Specifically, the report finds that ICTs were responsible for roughly one-quarter of Kenya’s GDP growth during the 2000s. Moreover, ICTs’ contribution to Kenyan economic growth only grew over time, with the ICT sector providing a more than six-times-greater contribution to Kenyan GDP in 2009 compared with 1999.[25] Similarly, ICT accounted for 38 percent of Chinese total factor productivity (TFP) growth and as much as 21 percent of Chinese GDP growth from 1980 to 2001.[26] Likewise, Ahmed and Ridzuan further found “a positive contribution of ICT to economic growth” across eight East Asian countries: China, Japan, Korea, Indonesia, Malaysia, Philippines, Singapore, and Thailand.[27] As Richard Heeks, professor of development informatics at the University of Manchester estimated, “ICTs will have contributed something like one-quarter of GDP growth in many developing countries during the first decade of the 21st century.”[28]

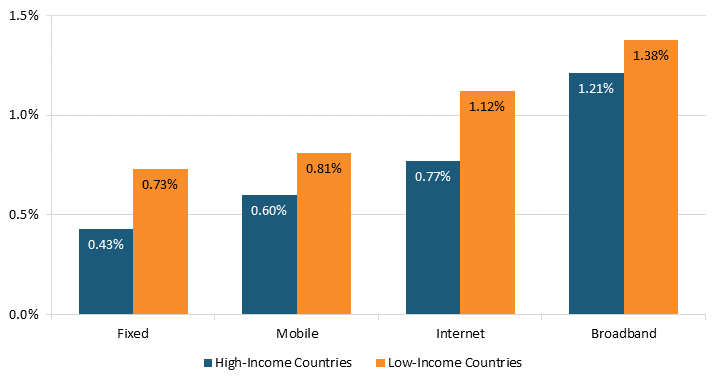

Figure 3: Impact of a 10 percent increase in key ICT penetration on annual percent GDP growth[29]

Indeed, as Farhadi, Ismail, and Fooladi wrote in their report, “Information and Communication Technology Use and Economic Growth,” “The more a country use[s] ICT, the greater is its economic growth.”[30] The authors found that if countries improve their score on the “ICT Use Index” (which measures a country’s number of Internet users, fixed broadband Internet subscribers, and mobile-phone subscriptions per 100 inhabitants), then their economic growth increases by 0.17 percent.[31] The World Bank has likewise documented this effect, finding that a 10 percent increase in high-speed broadband Internet penetration adds 1.38 percent to annual per capita GDP growth in developing countries. Likewise, a 10 percent increase in mobile-phone penetration adds 0.81 percent to annual per capita GDP growth in developing countries.[32] (See figure 3.)

That research has been corroborated by a study by Czernich et al. which analyzes the effects of broadband infrastructure on economic growth for 25 Organization for Economic Cooperation and Development (OECD) countries from 1996 to 2007 and finds that a 10 percent increase in a country’s broadband penetration rate drives annual GDP per capita growth of 0.9 to 1.5 percent.[33] More recently, studies have found that a 10 percent increase in mobile-device penetration increases productivity by 4.2 percentage points.[34]

Developing nations’ investments in telecommunications infrastructure are 10 to 40 percent more effective in generating economic growth than are similar investments made by developed countries.

Indeed, evidence that an expanding base of ICT capital stock powers countries’ economic growth increasingly comes from all quarters of the world.[35] For the Middle East, Nasab and Aghaei investigated the impact of ICT investments on economic growth in seven Organization of the Petroleum Exporting Countries (OPEC) nations from 1990 to 2007, finding that ICT “has a significant positive impact on economic growth in the sampled countries,” and underlining the need for countries to adopt proactive policies to encourage ICT investments to boost economic growth.[36] Veeramacheneni, Ekanayake, and Vogel analyzed 10 Latin American countries from 1975 to 2003 seeking a causal relationship between ICT and economic growth and found a two-way causality between ICT and economic growth in two-thirds of the countries and, moreover, that ICT contributed to economic growth in 8 of the 10 countries included in the sample.[37] Zagorchev, Vasconcellos, and Bae, in a study of eight Central and Eastern European countries from 1997 to 2004, found that financial development and increased investment in telecommunications technology contributed significantly to GDP growth per capita.[38] Toader et al. analyzed the effect of using ICT infrastructure on economic growth in European Union countries over 18 years from 2000 to 2017 and found that an increase of 1 percent in the use of ICT infrastructure contributed to GDP per capita growth of between 0.0767 percent (fixed-broadband subscriptions) and 0.396 percent (mobile cell subscriptions).[39] On average, a 1 percent increase in ICT capital stock leads to a 0.06 percent increase in a country’s GDP. This elasticity is crucial in modeling GDP growth associated with countries joining the ITA.

The Latest Evidence Regarding the Economic Growth Impacts From ICT

Despite this impressive body of evidence documenting the powerful impact of ICT on economic growth, some skeptics have questioned the extent to which ICT adoption can increase economic growth in developing nations, arguing that developing countries may lack human capital, governance, or other ICT-complementary factors or that their labor-to-capital cost ratio is too low, making it less economical to add ICT capital.[40] And some research conducted during the late 1990s and early 2000s did appear to suggest as much, or at least that ICTs’ benefits were greater for developed economies. For instance, in 2004, economist Khuong Vu, in analyzing economic growth data between 1990 and 2000, suggested that “the results indicate that ICT plays a more important role in determining the output growth for the developed economies than for the developing ones.”[41] Similarly, Ayoub Yousefi investigated whether ICT contributed to economic growth across 62 countries with different levels of development from 2000 to 2006, finding that ICT exerted a greater impact on GDP growth in upper-middle-income countries than in lower-income countries.[42]

However, while it may have been the case that, in earlier decades, developed countries realized higher rates of return from ICT investments than did developing countries, that is clearly no longer the case. Analyzing ICT investments and economic growth from 1995 to 2010 for 59 countries across various stages of development, economist Thomas Niebel concluded that “the regressions for the subsamples of developing, emerging, and developed countries do not reveal a statistically significant difference of the output elasticity of ICT between these three country groups.”[43] Niebel’s estimates indicate that, on average, regardless of a country’s development status, a 1 percent increase in ICT investment increases economic growth by 0.05 to 0.09 percent annually.[44] Similarly, Majeed and Ayub explored how different ICT indicators influenced economic growth in 149 countries from 1980 to 2015, with the empirical results suggesting the use of ICT infrastructure had a positive and significant impact on economic growth.[45]

An increase in a nation’s ICT capital stock of 1 percent leads to a 0.06 percent increase in a country’s GDP.

And, in fact, it appears that ICT investments now generate higher returns than ever before. In analyzing 29 economic studies that isolate the rate of returns to ICT investment, Cardona, Kretschmer, and Strobel revealed that “ordering the studies by their average year of the data used for the estimation, we find a positive time trend.”[46] Further evidence supports the contention that, going forward, developing countries stand to gain even more from adopting greater levels of ICT than do developed countries. For example, as the European Commission found, developing nations’ investments in telecommunications infrastructure are 10 to 40 percent more effective in generating economic growth than are similar investments made by developed countries.[47] This may be because cell phone structures are cheaper and easier to install than landline infrastructure, and thus offer workers in developing countries with underdeveloped landline communications systems opportunities to perform services that can be delivered domestically or internationally over the Internet. And of course digital technologies enable better dissemination of job opportunities and create a wide range of gig work opportunities.

Put simply, a growing body of evidence documents the positive effects ICT has on economic growth, for both developed and developing countries. Summarizing 58 empirical studies estimating the economic impact of ICT, Stanley, Doucouliagos, and Steel found that “on average, these technologies have contributed positively to growth.”[48] In terms of the magnitude to which ICT spurs economic growth, a review of econometric literature by Cardona, Kretschmer, and Strobel finds that, on average, an increase in ICT capital stock of 1 percent leads to a 0.06 percent increase in a country’s GDP.[49]

How ITA Participation Benefits Countries

The ITA has benefitted participating—and especially developing—countries considerably.[50] In 2010, developing countries accounted for 64 percent of global exports of ICT products.[51] As Xiaobing Tang, a counsellor in the Market Access Division of the WTO, noted, the experiences of Association of Southeast Asian Nations (ASEAN) such as Malaysia and Thailand “show that the ITA has helped their development and economic growth.”[52] ITA participation benefits countries in three principal ways, by 1) lowering costs for and thus spurring adoption of productivity-enhancing ICT, which boosts the productivity, innovative, and competitive capacity of a country’s enterprises and industries (which further creates new job opportunities); 2) deepening countries’ participation in GVCs for the production of ICT goods and services; and 3) promoting technology education and training and a technologically literate work force. In total, these forces can greatly bolster countries’ broader global trade participation.

Deepening Countries’ Participation in ICT GVCs

GVCs represent an increasingly important feature of international trade. In fact, 85 percent of global trade can now be characterized as occurring within the GVC framework.[53] Keeping ICT prices low is paramount if countries wish to participate in GVCs for the production of ICT parts, components, and final products. In contrast, maintaining high ICT tariffs (in part, by not joining the ITA) harms both countries’ ICT-producing and ICT-consuming sectors.[54] In particular, failure to join the ITA has caused nations to be left out of global production networks for ICT products (and services), causing them to miss out on significant growth opportunities.

To elaborate, in the 1970s, and with renewed interest over the past 15 years, countries such as Argentina, Brazil, and India have experimented with import substitution industrialization policies that impose high tariffs (among other trade barriers) on imported ICT products in an effort to spur development of their own nascent ICT-producing industries. Yet, in the interest of favoring one sector (ICT producers), these policies have had the unintended effect of harming the entire economy, as enterprises (large and small alike) in other industries—from finance and education to hospitality, health, and retail—are forced to use fewer, inferior, or more-expensive ICT products, thus hampering their own productivity, innovation potential, and global competitiveness. What’s worse, high tariffs have proven largely ineffective at achieving these countries’ aim of spurring the development of indigenous ICT-producing sectors that require access to global supply chains.

Indeed, it would be prohibitively expensive for even the most-advanced economies, such as the United States or the EU block, to seek to build wholly indigenous supply chains for most ITA products. For example, a recent study by the Boston Consulting Group for the Semiconductor Industry Association estimates that it would take an additional $1 trillion in government subsidies to localize semiconductor supply chains in the United States, resulting in a 35 to 65 percent overall increase in semiconductor prices and ultimately higher costs of electronic devices for end users.[55]

If an indigenous supply chain is unrealistic for an advanced economy such as the United States, it’s even more unrealistic for developing economies (even large ones), since their markets are still far too small to support wholly indigenous domestic production dedicated only to an internal market. In the semiconductor sector, for example, the leading Chinese, European, Korean, Japanese, Taiwanese, and U.S. chip companies are focused on global markets that are necessary to support the scale of production and massive investments required to bolster development and production of cutting-edge chip technologies. Given the higher costs of indigenous production, a localized industry is unlikely to be able to access global markets because of higher costs and substandard technologies. By being shielded from best-of-breed international competitors, domestic firms lack access to a vital impetus for innovation that competition engenders as well as access to key parts, components, and technical expertise. For instance, small business owners in Argentina have complained about the country’s high ICT tariffs, noting that “the lack of competition gives manufacturers an incentive to produce low-quality products and charge high prices.”[56] These effects flow throughout an economy, limiting access to global markets by contributing to the production of substandard goods, particularly ones that increasingly demand that local producers incorporate advanced technologies, (e.g., washing machines, kitchen appliances, motor vehicles, medical equipment, etc.).

Further, high ICT tariffs have precluded many ICT-producing enterprises from effectively participating in GVCs for the production of ICT goods. Because of the interlinkage of global supply chains, manufacturers scour the globe searching for the highest-quality and most cost-competitive production locations. This means global production networks consist of highly fragmented but specialized units of production, predicated on countries being open to trade. To illustrate, in 1962, intermediate goods accounted for 30 percent of total trade within the same industry globally—a percentage that doubled to 60 percent by 2006.[57] (A 2020 United Nations Conference on Trade and Development report estimates that intermediate products represented approximately half of world trade in goods, just under $8 trillion, in 2019).[58] Deficient communications networks limit an economy’s ability to participate in global services trade, as an increasing range of services (e.g., software, accounting, law, semiconductor design, help desks, etc.) are being delivered over the Internet. For example, modern software and semiconductor design development is a 24/7 endeavor as teams around the world collaborate on projects.

Failure to join the ITA has caused nations to be left out of global production networks for ICT products, causing them to miss out on significant growth opportunities.

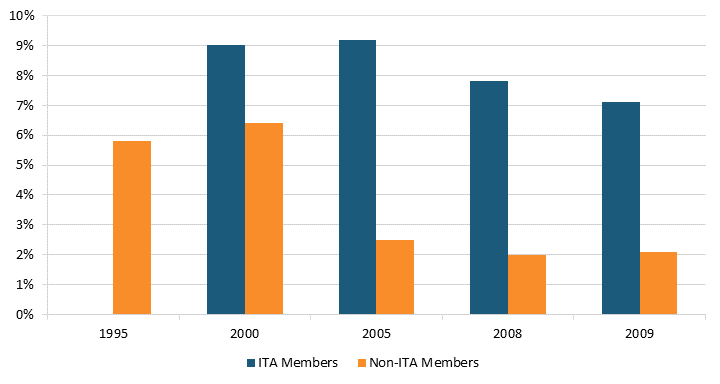

Put simply, countries imposing high tariffs on ICT parts and products only make themselves unattractive to multinational enterprises wishing to seamlessly integrate into global production networks. This explains why OECD has found that countries not participating in the ITA saw their participation in global ICT value chains decline by more than 60 percent from 1995 (two years before the ITA went into effect) to 2009.[59] (See figure 4.)

Figure 4: Participation in global ICT value chains, indexed as a share of gross ICT exports[60]

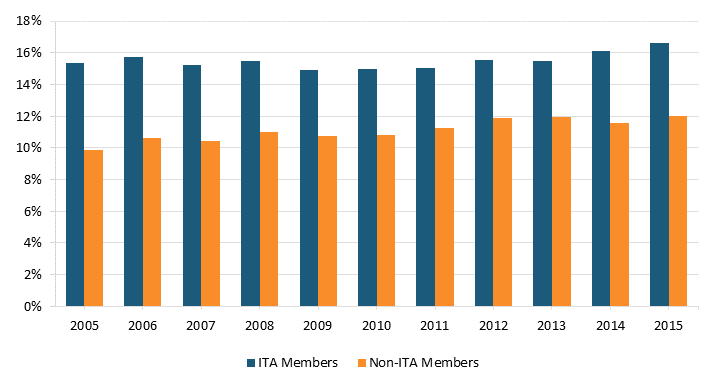

In contrast, countries participating in the ITA saw their participation rise since 1995. Similarly, OECD provides data on countries’ participation in ICT GVCs (considering their forward and backward participation rates in those value chains), and the evidence clearly shows that, from 2005 to 2015, ITA-member nations enjoyed nearly one-third greater participation in ICT GVCs than did non-ITA-member nations. (See figure 5.)

Figure 5: Participation in global ICT value chains, indexed as a share of gross ICT output[61]

Brazil provides a compelling example: Brazilian innovation in ICT has lagged behind that of the rest of the world primarily because the country hasn’t been involved in ICT GVCs and has enjoyed limited market-based technology and skills transfer in the ICT sector. Put simply, if countries wish to participate in GVCs for ICT products, they have to remove the barriers. As OECD’s “Measuring Trade in Value Added” research finds:

The growing fragmentation of production across borders has important policy implications. It highlights the need for countries wanting to reap the gains from value chain participation to have open, predictable and transparent trade and investment regimes as tariffs and other unnecessarily restrictive non-tariff measures impact foreign suppliers, international investors, and domestic producers.[62]

It’s also important to note that it’s not just about producing final goods; countries can derive significant value added from the production of intermediate inputs. A zero-in/zero-out tariff environment can help countries attract production across a wide range of goods; and over time, as countries’ enterprises and their employees develop knowledge, skills, and relationships with international partners, they can move up the value chain to the production of higher-value-added goods.

Another benefit of the ITA, for developed and developing nations alike, is that it has furthered the development of more diversified global supply chains, which can facilitate resilience and resistance to supply chain shocks and provide new opportunities. As MGI found in its report, “Risk, resilience, and rebalancing global supply chains,” that matters because, “[c]hanges in the environment and in the global economy are increasing the frequency and magnitude of shocks. Forty weather disasters in 2019 caused damages exceeding $1 billion each—and in recent years, the economic toll caused by the most extreme events has been escalating.”[63] The report estimates that companies today should expect supply chain disruptions of one to two weeks occurring at least once every 2 years; 2 to 4 weeks occurring once every 2.8 years; 1 to 2 months every 3.7 years; and 2 months or more every 4.9 years. By fostering more diversified and resilient global ICT supply chains, the ITA can help address this challenge.

Countries that don’t participate in open, cross-border flows of ICT products only end up excising themselves from GVCs and production networks for ICT products and services.

As a result, joining the ITA is important for a country’s growth; however, implementation of the agreement is just as important. Poor implementation of the ITA is no different from imposing high tariffs. For example, India is part of the ITA, yet it maintains high tariffs on key intermediate inputs to semiconductor manufacturing and continues to impose a 10 percent duty on printed circuit boards.[64] In April 2023, the WTO found that India imposes tariffs up to 20 percent on specific ICT products, a violation of its WTO commitments.[65] The continued imposition of such tariffs (in contravention of India’s ITA-1 commitments) will only diminish the benefits the nation can gain from its ITA membership.

But the message is clear: Countries that don’t participate in open, cross-border flows of ICT products (by imposing high tariffs on ICT or other restrictive measures such as localization barriers to trade) only end up excising themselves from GVCs and production networks for ICT products and services while reducing opportunities for employment and economic growth.[66]

Boosting Countries’ Exports of ICT Goods and Services

The ITA has helped boost countries’ levels of exports of both ICT goods and services. For instance, from 1996 to 2008, developing-country ITA exports expanded at an annual rate of 33.6 percent, compared with 7.2 percent for developed countries.[67] And the evidence shows that countries that have systematically reduced barriers to trade in ICT goods—including by eliminating tariffs, embracing trade facilitation, and eschewing other nontariff barriers such as localization requirements—have experienced increased ICT goods exports, both as a share of their total goods exports and in absolute value terms.

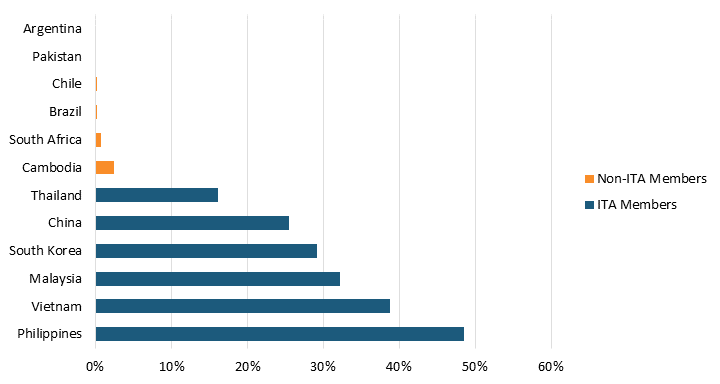

In fact, ICT goods exports as a share of total goods exports are consistently and significantly higher in ITA-member than in non-ITA-member countries. For instance, ICT goods exports account for nearly half of the Philippines’ goods exports, 39 percent of Vietnam’s, 32 percent of Malaysia’s, 29.2 percent of South Korea’s, 25.5 percent of China’s, and 16.1 percent of Thailand’s. (Incidentally, the U.S. figure was 9.1 percent and for India 2.2 percent.) In contrast, ICT goods exports account for a much-lower (and, indeed, incredibly meager) share of goods exports for non-ITA countries, including for just 2.5 percent of Cambodia’s goods exports, 0.7 percent of South Africa’s, and less than half a percent each for Brazil, Chile, Pakistan, and Argentina. (See figure 6.) And it’s not that the first six countries shown in figure 6 are in the ITA because they are strong ICT goods exporters; rather, they are robust ICT goods exporters in considerable part because they have become members of the ITA. This data truly corroborates the argument that countries that have elected not to join the ITA have simply seen themselves excluded from GVCs for the production of ICT goods.

Figure 6: ICT goods exports as a share of total goods exports, select ITA and non-ITA members, 2021[68]

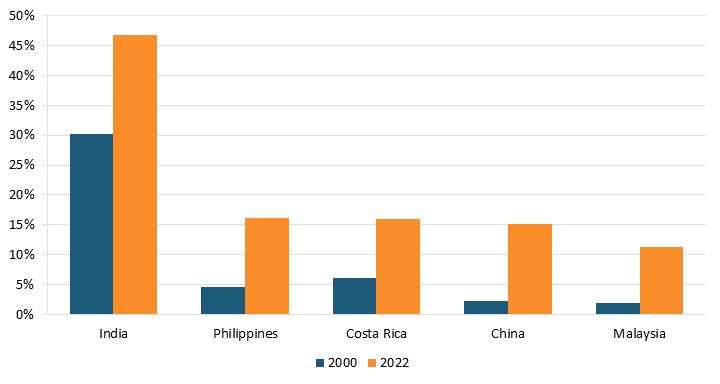

Beyond ICT goods exports, a similar story plays out in ICT services. In 2022, ICT services exports accounted for over 45 percent of India’s total services exports, 16 percent of the Philippines’ and Costa Rica’s, 15.1 percent of China’s, and 11 percent of Malaysia’s. (See figure 7.) In 2020, India’s ICT services sector contributed 8 percent of GDP, a significant increase from the just 1.2 percent it did in 1998, shortly after India joined the ITA.[69] All these countries have experienced significant increases in ICT services exports’ share of total services exports since 2000, and part of the dynamic here is that ITA membership helped to lower prices for key ICT hardware inputs ICT services enterprises depend on, helping them to innovate and become more globally competitive.

Figure 7: ICT services exports as a share of total services exports, select countries, 2000 and 2022[70]

The Logic for Bringing Additional ICT Goods Under ITA-3 Coverage

An ITA-3 would bring a number of emerging (as well as more-modern versions of existing) technologies driving the global digital economy under ITA-coverage. As noted, an ITA-3 would include goods such as next-generation semiconductors, energy-efficient technologies such as storage batteries and LED “light sources,” digital manufacturing technologies such as industrial robots and 3D printers, certain medical technologies such as photographic X-ray plates, and some unmanned aerial vehicles (UAVs), among other products. The following section explores the logic of why several of these specific product categories merit ITA coverage, focusing especially on semiconductors, digital (or “smart”) manufacturing technologies, energy-efficiency technologies, commercial-use drones, and medical devices. These benefits are not limited to technology products, as many traditional industrial products (e.g., cars, appliances, HVAC systems) now incorporate semiconductors and other “smart” technologies, and products that lack such digital brains are losing competitiveness.

Semiconductors, Semiconductor Manufacturing Equipment, and Related Components

To be sure, semiconductors have been included as ITA products since the original agreement. But semiconductors continue to evolve, which is one reason why multicomponent semiconductors—a single semiconductor device that performs complex or multiple functions previously performed by two or more semiconductor devices, thanks to a variety of components integrated into a single unit—were an important part of the ITA-2 agreement.[71] Similarly, an ITA-3 would ensure that the latest next-generation semiconductor technologies, such as semiconductor-based transducers, are part of the agreement. The proposed ITA-3 would also bring a litany of products and materials involved in the manufacture of semiconductors under ITA coverage, including the following:

▪ Circular polishing pads used in the manufacturing of semiconductor wafers (HS 3919.90)

▪ Nonelectrical articles of carbon fiber used for the production or processing of semiconductor parts (HS 6815.10)

▪ Diamond blades for sawing semiconductor wafers (HS 8202.39)

▪ Liquid pumps used to blend and deliver process slurries used in polishing wafer surfaces (HS 8413.81)

▪ Filtering or purifying machinery used in the manufacturing of semiconductor devices (HS 8421.21)

Ensuring inclusion of the vast majority of inputs that comprise semiconductor manufacturing equipment—the machines and their components that make the actual semiconductors—matters because semiconductors are foundational to the modern global economy. Semiconductors underpin everything from AI systems, cloud computing, and the Internet of Things to advanced wireless networks, smart grids, smart buildings, smart cities, digital health care devices, and even the next generation of quantum computing.[72] Moreover, semiconductors lie not only at the heart of every piece of ICT equipment, from desktop or laptop computers to tablets, servers, and smartphones, but to an increasingly wide variety of consumer goods from automobiles to home appliances to fitness monitors— something vividly illustrated by the global semiconductor shortage that hit in the wake of the COVID-19 pandemic.[73]

In addition to powering consumer goods, semiconductors also play a crucial role in addressing global climate change. Multiple industries, including transportation, manufacturing, construction, and agriculture, rely on semiconductors to enable their energy efficient or clean energy production, which in turn reduces emissions. For example, the United Nations Environment Programme noted that the building and construction sector accounts for 37 percent of carbon emissions.[74] However, the implementation of semiconductor-enabled smart devices could drastically reduce energy consumption in that sector. Indeed, the American Council on Energy Efficient Economy found that “smart devices” could reduce energy consumption by inefficient commercial buildings by at least 30 percent.[75] As a result, the World Economic Forum found that semiconductor-enabled technologies can reduce global emissions by up to 15 percent, or one-third of the needed reduction by 2030.[76]

The semiconductor sector itself represents a $470 billion highly globalized industry that helps create $7 trillion in global economic activity and is directly responsible for $2.7 trillion in total annual global GDP.[77] Broadening the set of semiconductor production inputs and end products covered by the ITA would help lower semiconductor prices—and makes perfect sense for the global economy.

Energy-Efficient Technologies

The ITA-3 expansion proposal includes numerous ICT-powered energy-efficiency technologies, such as the following:

▪ Solar water heaters (HS 8419.19)

▪ Photovoltaic generators (HS 8501.31, 8501.33, 8501.34, 8501.61, 8501.62, 8501.63, 8501.64)

▪ Wind-powered generating sets (HS 8502.31)

▪ Lithium and lithium-ion batteries (HS 8506.50, 8507.60)

▪ Light-emitting diode (LED) light sources (HS 8539.50)

Semiconductors not only move bits (1s and 0s), but they also help control flows of electricity (i.e., power). Whether it comes to a nation’s power grid or the electrical flow within a factory, computer, smartphone, or even a single LED light bulb, they all rely on microchip systems that control, measure, and convert electricity. In fact, 80 percent of the energy generated globally passes through some kind of power electronics.[78] And in the United States, more than half of all electricity flows through some form of semiconductor-controlled motor.[79]

As semiconductors—and thus the devices they power and control—have become more powerful and more energy efficient, they portend the ability to deliver significant energy efficiencies across not only a variety of industries but even entire national economies and thus reduce carbon emissions. Indeed, ICT such as semiconductors represents a powerful technology that enables other sectors of an economy to become more energy efficient.[80] For instance, a 2009 study by the American Council for an Energy Efficient Economy (ACEEE) estimates that the United States could realize 1.2 trillion kilowatt-hours (kWH) in energy savings by accelerating the adoption of semiconductor-enabled technologies by just 1 percentage point per year.[81] According to ACEEE estimates, that would translate to 22 percent less electricity consumed than the then-prevailing U.S. Department of Commerce Reference Case, resulting in 733 million metric tons less carbon dioxide emitted in 2030, as many as 296 energy plants that wouldn’t need to be built to deliver that power, and $1.3 trillion in cumulative savings from 2010 to 2030.[82] Driving these gains, ACEEE identified more than two dozen semiconductor-enabled technologies, including commercial and residential lighting, high-efficiency industrial motors and motor systems, programmable thermostats, and residential water heaters.[83] Several of these items are now proposed for ITA-3 expansion.

Semiconductors are driving power efficiencies across a wide range of products, enabling computing efficiency (the number of computations per kilowatt hour of electricity) to double approximately every 1.6 years, a phenomenon known as “Koomey’s law.”[84] For instance, data centers can reduce energy demand by 56 percent by using semiconductor-enabled technologies such as efficient uninterruptible power supplies, variable speed fans and pumps, and server virtualization.[85] In 2010, data centers consumed 194 terawatt hours (TWh) of electricity, about 1 percent of global electricity consumption. Since then, the global installed base of servers has increased by 30 percent; compute instances have increased more than sixfold; data center Internet protocol traffic has increased by a factor of 11; and data center storage capacity has experienced a 25-fold increase.[86] However, over this time, greater storage-drive efficiencies and densities have reduced storage energy use by nearly 90 percent. Overall, the energy intensity of data centers has decreased about 20 percent annually since 2010.[87] Elsewhere, semiconductors enable solar panels to harvest up to 57 percent of power normally lost to real-world conditions such as clouds, dirt, and animal interference.[88]

Semiconductor-powered sensors, controllers, and meters—several specific types of which are herein proposed for ITA-3 inclusion—will have a tremendous impact on the energy efficiency of commercial buildings and residential homes. For instance, one study finds that integrating smart sensors and controls throughout the commercial building stock has the potential to save as much as 29 percent of building energy consumption.[89] Smart sensors and controls can enable buildings to reduce their peak electricity load by 10 to 20 percent, for example, by shifting some energy services to times of day when energy demand is low.[90] Likewise, smart thermostats that help households and building managers monitor and regulate heating and cooling can reduce electricity demand by 15 to 50 percent, depending on the building and control technology.[91]The U.S. Department of Energy has estimated that sensor and control technologies alone could reduce building energy consumption in the United States by 1.7 quads (~500 billion kWh) by 2030, generating $18 billion in annual energy savings.[92]

As semiconductors—and thus the devices they power and control—have become more powerful and more energy efficient, they portend the ability to deliver significant energy efficiencies across not only a variety of industries but even entire national economies.

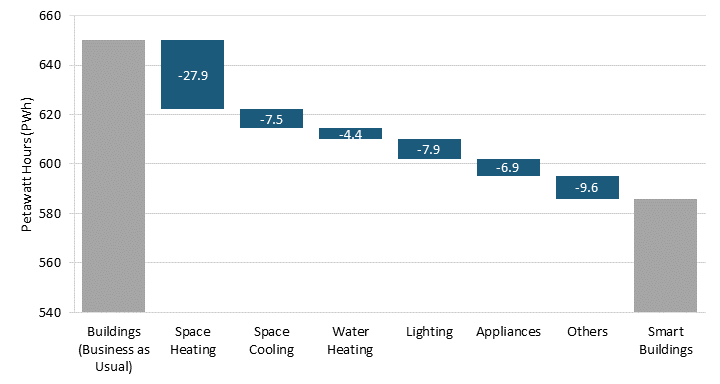

Similarly, the International Energy Agency’s 2017 report, Digitalization & Energy, identifies the global potential energy savings from smarter energy use in buildings, finding that ICT integration can reduce annual electricity use by up to 4.65 petawatt hours (PWh), or nearly 25 percent, over the next two decades with energy savings realized across a range of applications including lighting, water heating, metering, application of smart thermostats, etc. (See figure 8.) Given their potential to save energy, save costs, and help the environment—especially as the world attempts to meet the Paris Agreement’s climate goals—the energy-efficient technologies identified as candidates for ITA-3 coverage certainly merit inclusion.

Figure 8: Cumulative energy savings in buildings from widespread digitalization, by energy use (2017–2040)[93]

Smart Manufacturing Technologies

Smart manufacturing—the application of ICT (such as industrial robots, 3D printers, the Internet of Things, AI, big data, etc.) to every facet of modern manufacturing—is in the midst of transforming how products are designed, fabricated, used, operated, and serviced post sale, just as it’s transforming the operations, processes, and energy footprint of factories and the management of manufacturing supply chains.[94] MGI has estimated that this advent of manufacturing digitalization may increase global manufacturing productivity by 10 to 25 percent, with the potential to create as much as $1.8 trillion in new value per year across the world’s factories by 2025.[95] This concords reasonably well with a General Electric report, “Industrial Internet: Pushing the Boundaries of Minds and Machines,” that estimates the Industrial Internet could boost annual U.S. productivity growth by 1 to 1.5 percentage points and add $10 trillion to $15 trillion to global GDP over the next 20 years.[96] The ITA would promote global manufacturing digitalization by bringing more products, such as industrial robots and 3D printers, under ITA coverage. Adding up global imports in 2020 for both the components and end products representing industrial robots and 3D printers that are proposed for ITA-3 inclusion shows that the total import value for such products exceeds $70 billion.[97]

Industrial Robotics

Industrial robots will be a critical driver of this transformation. As of October 2022, there were 3.5 million industrial robots operating across the world’s factories, with the 517,385 new industrial robots installed in 2021 representing a 31 percent increase over the prior year.[98] Seventy-four percent of the newly deployed industrial robots deployed globally in 2021 were fielded in Asia, led by China, Japan, and Korea.[99] The global industrial robot marketplace was valued at $14.6 billion in 2020 and is expected to grow to $31.1 billion by 2028 at a compound annual growth rate (CAGR) of 10.4 percent.[100]

Robots improve productivity when applied to tasks wherein they can reduce error and execute tasks at high levels of efficiency and consistency. In this way, robots help produce goods more economically, expanding the range of global access to a wide variety of manufactured goods—from automobiles to refrigerators to smartphones—and thus have played an instrumental role in enhancing global standards of living and driving global economic growth more broadly.[101] Their impact has been enormous. Georg Graetz and Guy Michaels of the Centre for Economic Performance concluded that robot densification increased annual growth of GDP and labor productivity between 1993 and 2007 by about 0.37 and 0.36 percentage points, respectively, across 17 countries studied.[102] Their study finds that robots accounted for 10 percent of GDP growth in studied countries, and that productivity in robot-enabled industries in these countries increased by 13.6 percent.[103] As the authors concluded, “For the industries in our sample, robot adoption may indeed have been the main driver of labor productivity growth.”[104] They also found that robot densification is associated with increases in both TFP and wages and reductions in output prices.[105] To put the power of industrial robots in context, Graetz and Michaels estimated that industrial robots exerted a greater economic impact over that 14-year study period than did the steam engine from 1850 to 1910, a harbinger of the impact the newest generation of far more capable industrial robots—and indeed digital manufacturing technologies more broadly—may have in the future.[106] To that end, MGI has predicted that up to half of the total productivity growth needed to ensure a 2.8 percent growth in global GDP over the next 50 years will need to be driven by automation.[107] And in that regard, the Boston Consulting Group has forecasted productivity improvements of 30 percent over the next 10 years, spurred particularly by the uptake of robots in small to medium-sized enterprises as robots become more affordable, more adaptable, and easier to program.[108]

The ITA would promote global manufacturing digitalization by bringing more products, such as industrial robots and 3D printers, under ITA coverage.

In other words, the competitiveness of a nation’s manufacturing enterprises—both large and small—will increasingly hinge on their ability to deploy and leverage industrial robots. And, if industrial robots are included in an ITA-3, then countries joining such an agreement will be at an advantage because eliminating tariffs on these productivity-enhancing goods will lower their prices and put domestic manufacturers at a competitive advantage. Industrial robots represent an obvious choice for ITA-3 inclusion.

3D Printing

Additive manufacturing, or 3D printing, refers to a manufacturing process in which successive layers of material are built up to synthesize a three-dimensional solid object composed in a digital file, with each layer a thinly sliced horizontal cross-section of the eventual object.[109] 3D printing enables fundamentally new shapes and even mechanical linkages that simply can’t be achieved through traditional subtractive manufacturing techniques, while offering many applications for improving speed and efficiency, reducing errors, and eliminating as much as 70 percent of waste generated from traditional subtractive manufacturing processes.[110]

The current $12.6 billion global marketplace for 3D printers is expected to grow to $62.8 billion by 2028, at a 21 percent CAGR.[111] Especially as 3D printing becomes cost competitive across a range of materials—from plastic to metals such as titanium—it heralds the potential to transform manufacturing by “democratizing it” (i.e., making it more globally achievable), enabling the production of goods closer to final markets (thus reducing transportation costs), and permitting mass customization (i.e., production lot sizes of one, as opposed to one million). A recent report from ING Bank estimates that the rise of 3D printing could see the share of 3D printed goods in global manufacturing rise to 5 percent over the next two decades—a significant increase from the current share of 0.1 percent—and that the greater extent of manufacturing closer to final consumption would at most decrease global trade flows by a modest rate of 0.2 percentage points less trade growth per year.[112] A growing market for 3D printing therefore would bring positive economic benefits to importing countries but would not impose a disincentive to trade flows at large. Moreover, digital manufacturing technologies such as 3D printing could actually cause international trade flows to increase by enabling the creation of new and innovative products for export. For instance, a 2019 study by the World Bank’s Caroline Freund, Alen Mulabdic, and Michele Ruta finds that the use of 3D printing in the hearing aid industry increased trade in that field by 58 percent over nearly a decade compared with what would otherwise have been expected.

As with industrial robots, 3D printers represent a device ripe for ITA-3 inclusion, and the manufacturers that have access to the lowest-cost, most-innovative 3D printers will find themselves at a competitive advantage.

Drones for Commercial and Personal Use

The global UAV marketplace stands at $27.4 billion and is projected to reach $58.4 billion by 2026, at a 16.4 percent CAGR. But far from being playful toys, drones represent a productivity-enhancing tool that is already delivering beneficial impacts across a range of industries, from agriculture to energy to medicine.

The United Nations Food and Agricultural Organization has projected that global food production will need to increase by 70 percent by 2050 to meet the world's food needs.[113] Precision agriculture leverages a variety of ICT including GPS-enabled UAVs, Internet of Things, AI, and big data to enable targeted interventions designed to enhance agricultural output and quality.[114] Indeed, UAVs are increasingly enabling a sustainable agriculture-management approach that allows agronomists, agricultural engineers, and farmers to help streamline their operations, using robust data analytics to gain effective insights into their crops. For instance, drones can facilitate the monitoring of large areas of farmland, considering factors such as slope and elevation, for instance, to identify the most suitable seeding prescriptions or to identify regions where irrigation needs to be provided, fertilizer applied, or crops pruned.[115] Drones are much more efficient and cheaper than the satellites or manned aircraft traditionally used to monitor agriculture, and can produce high-quality imagery over a wide expanse of terrain more safely, efficiently, and regularly. As such, analysts expect the agriculture drone market alone to reach $32.4 billion by 2025, indicating a growing global technology platform ripe for ITA inclusion.

Drones have also proven instrumental in the real-time delivery of urgent medical supplies. In October 2016, the start-up Zipline partnered with the Rwandan government to facilitate the real-time delivery of urgent medical supplies, such as blood and vaccines, to patients in remote locations via drones (named “Zips”).[116] The Zips, which have a 75-kilometer service radius and can carry 1.5 kilograms of payload per sortie and operate in most weather conditions, seamlessly fly over treacherous terrain in as little as 30 minutes—a trip that traditionally took as much as four hours to cover in a vehicle.[117] By May 2017, Zipline averaged more than 20 weekly deliveries, providing near-real-time access to life-saving medical supplies for more than 8 million Rwandans, or nearly two-thirds of the country’s total population of 12 million.[118]

Countries joining an ITA-3 expansion would give their domestic manufacturing enterprises a competitive advantage by reducing the prices of capital goods such as industrial robots and 3D printers that powerfully drive industrial productivity.

Commercial-use drones also played an important role in combatting COVID-19. In 2020, Zipline partnered with a North Carolina hospital to become the first emergency drone logistics operation to help U.S. hospitals respond to the pandemic.[119] Elsewhere, America’s United Parcel Service (UPS) teamed up with the CVS drugstores to begin delivery of prescription medicine via Matternet’s M2 drones to Florida residents.[120] Similarly, the Alphabet subsidiary Wing and Nevada-based start-up Flirtey are working to pioneer drone delivery of groceries and household goods, with customer demand for the service increasing 350 percent during the pandemic.[121] A June 2021 GlobeNewswire report noted that “rising demand for contactless deliveries of medical supplies and other essentials using drones owing to COVID-19 are some of the factors driving the growth of the UAV market [in 2020].”[122] Drones are playing increasingly important roles in ensuring individuals’ health, improving quality of life, and enhancing the productivity and innovation capacity of a wide variety of industries, and therefore certainly merit ITA-3 inclusion.

Medical Technologies

Medical devices play critical roles in health care, from devices that directly protect patient health (e.g., implantable cardiac devices) to those that facilitate diagnosis (e.g., magnetic resonance imaging (MRI) machines) to remote patient monitoring devices (e.g., fall monitors) or ones that improve quality of life (e.g., personal fitness trackers). Medical devices contribute to improved quality of life, to a greater ability to productively work, and to longer lives, all of which contribute to nations’ economic growth. For instance, economists Kevin Murphy and Robert Topel estimated that increases in life expectancy between 1970 and 1990 contributed $57 trillion, or $2.8 trillion per year, to the U.S. economy, with the average additional year of life estimated to be worth $150,000 per person (although this varies with age).[123] Moreover, in the United States, advanced medical technology helped reduce the number of days spent in hospitals by 59 percent from 1980 to 2010, and the use of key medical technologies in four disease areas alone (diabetes, colorectal cancer, musculoskeletal disease, and cardiovascular disease) expanded U.S. GDP by $106.2 billion, providing a net annual benefit of $23.6 billion to the economy due to better treatment, reduced disability, and increased productivity.[124] No doubt, nations around the world similarly realize both patient health and broader economic benefits from the greater availability and cost efficiency of medical devices.

The 2016 ITA-2 introduced for the first time a variety of medical devices, including MRI machines and computed tomography (CT) scanners, into ITA coverage.[125] The ITA-3 expansion again proposes widening the range of medical devices and equipment receiving coverage, including, among others, Cameras designed for internal organ exams (HS 9006.30) and Medical etc., needles, and catheters (HS 9018.39).

These items should be included in an ITA-3. Moreover, with the world still reeling from the consequences of the COVID-19 pandemic, nations should be considering doing all they can to reduce the costs of medical goods and equipment—and by bringing those with heavy ICT components under ITA coverage, they can further such aims.

The Economic Impact of a Proposed ITA-3 Expansion

For most countries that have joined the ITA, participation has succeeded in fostering ICT-driven economic growth. ICT boosts productivity, supports innovations, empowers workers, and expands access to digital services that improve quality of life and productivity. Since less-economically developed nations may suffer a shortfall in their stock of ICT capital, an effective way to grow their ICT capital stock is by joining the ITA and increasing participation in global technology supply chains. As noted, this report examines the economic impact of 22 countries and regions joining the proposed ITA-3. (A subsequent section will examine the economic impact for countries not in the ITA-1 and/or ITA-2 joining the ITA all the way through the first two agreements as well as the proposed ITA-3.)

ITIF selected these countries both because they are among the most important in ICT goods production and trade and because they provide a sample set of large and small economies to model impacts of the proposed ITA-3 expansion. This section proceeds by briefly describing the economic framework and methodology used in the analysis, applying the model in order to estimate the anticipated 1-year and 10-year economic impacts of full ITA accession for study countries, and then assessing the impact ITA accession would likely have on government income.

Summary Explanation of Methodology and Data Sources

Data for calculating trade in ITA goods comes from the UN Comtrade Database. International trade accounts for products using HS2017 codes detailing imports with the specificity of six digits to categorize items. A six-digit code, however, still encompasses multiple items. Many countries, including the United States, distinguish product codes based on the HS categorization beyond six digits. The United States maintains HS codes at the eight-digit level, allowing ITIF to approximate the percentage of products within an HS6 code incorporated into the proposed ITA-3 expansion. Applied tariff rates at the six-digit level per country for each trading partner are available via the World Bank’s World Integrated Trade Solution (WITS) database. By multiplying the corresponding effective tariff rates (while accounting for most favored nation and preference agreements) with a given country’s import value data (excluding reimports) for the 301 proposed HS6 codes comprising the proposed ITA-3, ITIF calculated a country’s average effective applied tariff rate on ITA-3 goods by dividing the sum of effective ITA-3 tariff revenue by the sum of ITA-3 total import value. This average tariff rate under the ITA-3 expansion would be reduced to zero for participating countries. The removal of tariffs on ITA-3 products would effectively function as a price cut on ICT products to the benefit of domestic consumers (organizations and individuals alike) that could then afford more ICT at a reduced price.

Moreover, economists have found that demand for ICT products is price elastic, whereby ICT consumption rises by a factor greater than its price reduction. ITIF’s model for estimating the economic impacts of ITA-3 accession uses a price elasticity of 1.3 for ICT products based on research findings pioneered by Cette et al. in 2012.[126] A country’s imports, however, could be inhibited in part by domestic producers’ ability to respond competitively by lowering costs and maintaining an advantage against imports when tariffs are eliminated. ITIF opted for this estimate regarding the price elasticity of ICT imports because it was estimated controlling for a substitution effect on imports that comes from competing domestic firms after ITA accession. This resulting price elasticity for ICT demand allows one to estimate the annual growth in imports of ICT goods anticipated by eliminating tariffs on ITA-3 products, whereby a 1.0 percent decrease in ICT price (via removed tariffs) induces a 1.3 percent increase in consumption of those goods, with this heightened consumption further increasing the extent of a country’s ICT capital stock.

Economists have found that demand for ICT products is price elastic, with a 1 percent decrease in ICT price inducing on average a 1.3 percent increase in consumption of ICT products.

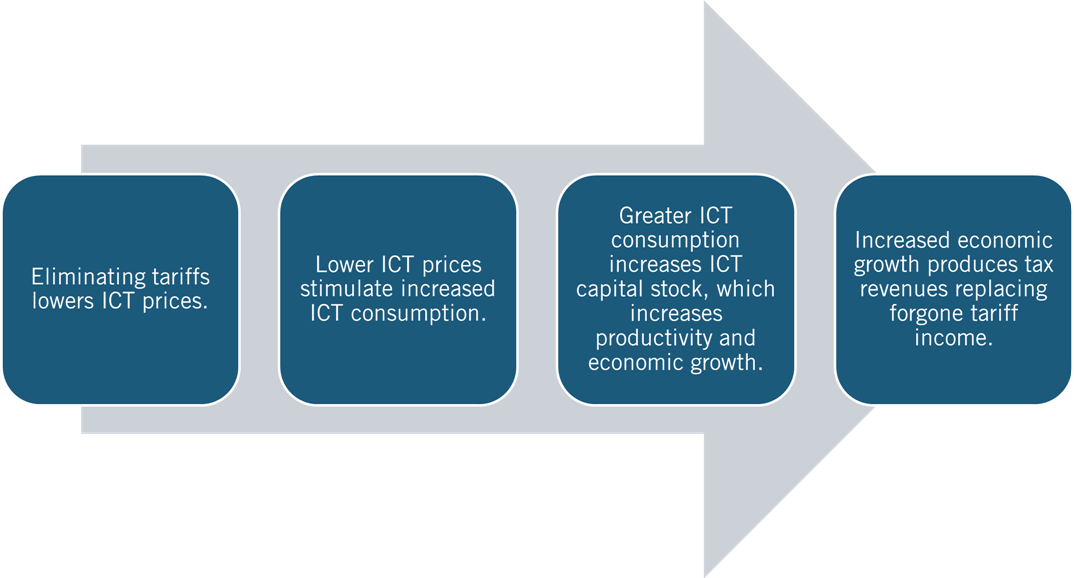

Over time, increased ICT consumption and the resulting growth in a nation’s ICT capital stock creates widespread positive externalities. A proliferation of ICT allows workers to provide services more efficiently and businesses to innovate their products and operations, thus raising overall productivity and economic growth. Leveraging Cardona et al.’s research, ITIF applied a growth factor suggesting that a 1 percent increase in a nation’s net ICT capital stock generates a 0.06 percent increase in a nation’s real GDP.[127] Multiplying a country’s estimated annual net growth in ICT capital stock by this growth factor provides an estimate of the potential GDP growth from extending ITA coverage onto proposed ITA-3 products. ITIF computed 10-year average growth rates for real GDP and imports specific to each country. Yearly net ICT capital stock and GDP growth estimates enable forecasting of the total cumulative GDP growth a nation may experience over 10 years due to joining the proposed ITA-3 expansion. The following flowchart summarizes the analytical framework ITIF’s model uses to estimate the economic impacts of ITA-3 on the study countries. (See figure 9.)

Figure 9: ITIF’s analytical framework for modeling the benefits of ITA accession

As the model illustrates, while tax revenues fall in the short run (e.g., one year post ITA-3 accession) due to tariffs on products that would come under ITA coverage reducing to zero, additional tax revenue is recovered in the long run (e.g., 10 years post ITA-3 accession) through standard means of taxation as economies grow. A growing economy means businesses increase revenues and workers earn higher incomes (thus consuming more goods and services), a dynamic that helps countries recover some, if not all, tariff revenues initially lost due to joining the ITA.

Modeling the Economic Impacts of ITA-3 Accession

ICT Import Profile of Countries

Despite global digitalization trends, many countries still vary widely in their ICT import profile. Using the common base year for available import data of 2021, ITIF calculated the total value of ITA-3 imports per country. Table 2 provides the ICT import profile of each country, showing the full value of ITA-3 imports per country as well as total tariff revenue raised from ITA-3 imports alongside officially reported trade statistics to control for any unobservable inconsistencies between model and official reporting of import findings.

Table 2: ICT imports for ITA-3 products[128]

|

Country |

Total ITA-3 Imports (Millions) |

Total of All Imports (Millions) |

ITA-3 Share of Total Imports |

Total ITA-3 Tariff Revenue (Millions) |

Official Sum of Tariff Revenue Across All Imports (Millions) |

Average Effective Applied Tariff Rate on ITA-3 Imports |

|

Argentina |

$2,178 |

$63,184 |

3.45% |

$228 |

$3,902 |

6.17% |

|

Brazil |

$9,047 |

$219,408 |

4.12% |

$1,165 |

$11,464 |

5.22% |

|

Cambodia |

$470 |

$28,703 |

1.64% |

$19 |

$566 |

1.97% |

|

Canada |

$19,560 |

$489,703 |

3.99% |

$70 |

$4,296 |

0.88% |

|

China |

$85,668 |

$2,675,680 |

3.20% |

$3,839 |

$45,086 |

1.69% |

|

Costa Rica |

$1,028 |

$18,431 |

5.58% |

$4 |

$286 |

1.55% |

|

EU 27 |

$121,002 |

$3,118,390 |

3.88% |

$1,559 |

$17,188 |

0.55% |

|

India |

$14,871 |

$570,402 |

2.61% |

$1,151 |

$47,255 |

8.28% |

|

Indonesia |

$6,660 |

$195,694 |

3.40% |

$79 |

$2,492 |

1.27% |

|

Japan |

$30,477 |

$773,721 |

3.94% |

$14 |

$7,707 |

1.00% |

|

Kenya |

$527 |

$19,288 |

2.73% |

$46 |

$1,635 |

8.47% |

|

Lao PDR |

$199 |

$5,871 |

3.38% |

$1 |

$117 |

1.99% |

|

Malaysia |

$8,321 |

$238,321 |

3.49% |

$360 |

$619 |

0.26% |

|

Mexico |

$36,388 |

$506,565 |

7.18% |

$299 |

$3,819 |

0.75% |

|

Nigeria |

$1,487 |

$52,442 |

2.83% |

$152 |

$3,126 |

5.96% |

|

Pakistan |

$1,727 |

$73,107 |

2.36% |

$145 |

$4,803 |

6.57% |

|

South Korea |

$23,157 |

$615,034 |

3.77% |

$371 |

$7,540 |

1.23% |

|

Taiwan |

$12,677 |

$382,961 |

3.31% |

$323 |

$11,672 |

3.05% |

|

Thailand |

$12,704 |

$269,102 |

4.72% |

$492 |

$2,680 |

3.87% |

|

United States |

$162,625 |

$2,935,314 |

5.54% |

$1,551 |

$86,719 |

2.95% |

|

United Kingdom |

$26,990 |

$695,578 |

3.88% |

$118 |

$7,165 |

1.03% |

|

Vietnam |

$18,311 |

$330,752 |

5.54% |

$114 |

$3,584 |

1.08% |