Latin American Subnational Innovation Competitiveness Index

For policymakers to bolster the global competitiveness of their nations and regions, they first must know where they stand. This report benchmarks the 182 regions of Brazil, Chile, Colombia, Mexico, Peru, and the United States using 13 commonly available indicators of strength in the knowledge economy, in globalization, and in innovation capacity.

KEY TAKEAWAYS

Key Takeaways

Introduction

Despite Latin America accounting for only 8 percent of the global population and 6.5 percent of global economic output, the region possesses several characteristics that will be influential in the coming decades.[1] Notably, Latin America’s role in global critical mineral reserves is remarkable. The region is responsible for 40 percent of the world’s copper production and 35 percent of lithium production, among others.[2] As the rapid expansion of green technology and the green transition relies on these critical minerals, the region stands to gain significant economic and political advantages by ensuring a reliable supply of these minerals to the global economy, thereby elevating its role in the process.[3] The countries examined in this study—Brazil, Chile, Colombia, Mexico, Peru—represent 35 percent of the region’s population and 40 percent of its economic output, and thus greatly shape the economic reality of the region.[4]

Despite being a vitally important region in the global economy, Latin America lags behind the more-developed parts of the world in terms of economic development. Most countries in the region face the risk of getting trapped in the middle-income category and struggle to advance into high-income economies. As the Information Technology and Innovation Foundation (ITIF) highlighted in a previous publication, in today’s interconnected world, the ability to maintain economic strength and international significance depends greatly on promoting innovation and embracing technological progress, which are essential to achieve growth in per-capita gross domestic product (GDP).[5] Therefore, such countries must develop their own innovation strategies to avoid the middle-income trap.

The significance of an innovation strategy for a country cannot be overstated. In the 21st century, a country’s sustained development and economic growth depend on its ability to develop and transfer knowledge and technology, enhance productivity, and foster resilience. Numerous crucial elements shape a country’s innovation ecosystem, including the quality of education and academic institutions, the level of public and private investments dedicated to research and development (R&D) and innovation, the presence of highly skilled R&D professionals, the economy’s vibrancy, and the entrepreneurial spirit. However, while more developed countries, such as the the United States, typically invest about 3 percent of GDP in R&D activities, Latin America only invests a mere 0.67 percent of GDP.[6] This low level of investment is also reflected in the fact that Latin America contributes only 2.75 percent of the world’s scientific publications on innovation, despite its more-sizeable economic and population representation.[7]

While more developed countries, such as the the United States, typically invest about 3 percent of GDP in R&D activities, Latin America only invests a mere 0.67 percent of GDP.

The Global Innovation Index (GII) is a prominent tool that provides comprehensive assessments of innovation performance on a global and regional scale. The GII offers a multidimensional perspective on innovation, evaluating factors such as R&D investments, human capital, and business sophistication, which collectively contribute to a country’s innovation capacity.[8] In line with the GII, ITIF has contributed significantly to the discourse on innovation competitiveness through its series of insightful subnational innovation competitiveness reports, which provide nuanced insights into the intricate relationships between innovation, economic development, and regional competitiveness, offering valuable perspectives for policymakers, businesses, and researchers alike. For instance, ITIF’s “State New Economy Index” report series delves into the role of innovation in driving U.S. state-level economic growth and highlights the transformation of industries through technological advancements.[9] The “North American Subnational Innovation Competitiveness (NASICI)” report delves into innovation dynamics within the North American region, emphasizing the significance of local ecosystems in enhancing competitiveness. Furthermore, the Global Trade and Innovation Policy Alliance’s (GTIPA) 2022 “Transatlantic Subnational Innovation Competitiveness (TASICI)” report examines the innovation landscapes in Europe (Germany and Italy) and North America (Canada and the United States), shedding light on the interplay between subnational entities and cross-border collaboration.[10]

However, the literature has so far lacked an analysis of innovation capacity and performance specific to the Latin American region. It is certain that the region’s innovation and economic development will have a significant impact on the global economy. Whether countries in the region can evolve and renew themselves will have consequences, as failure to do so will also carry implications. This study aims to showcase the continent’s subnational innovation capabilities, opportunities, and potential future direction through examining the innovation capacity of regions in five influential Latin American countries: Brazil, Chile, Colombia, Mexico, and Peru. The results are compared to U.S. states.

The Index

The Latin American Subnational Innovation Competitiveness Index (“LASICI”) captures the innovation performance of 182 regions across 6 countries and 2 continents: Peru (24 departments), Brazil (27 regions), Chile (16 regions), Mexico (32 states), Colombia (33 departments), and the United States (50 states). In this report, we refer to states and departments as regions to simplify the comparative analysis.

This report consists of 13 indicators representing the relevant determinants of a successful innovation ecosystem, grouped into three categories:

▪ Knowledge-Based Workforce: Indicators measure the educational attainment of the workforce; immigration of knowledge workers; employment in professional, technical, and scientific (PTS) activities; and manufacturing sector productivity.

▪ Globalization: Indicators measure high-tech exports and inward FDI.

▪ Innovation Capacity: Indicators measure a region’s share of households subscribing to broadband Internet, expenditures on R&D, the number of R&D personnel, the creation of new businesses, patent output, the extent of progress toward decarbonization, and VC investment.

The most important category of the LASICI is innovation capacity, which accounts for 56 percent of the index’s weight, while the knowledge economy indicators account for 31 percent of the index’s weight, and the globalization indicators account for the remaining 13 percent.

Results

Ranking List

Table 1: Overall and component performance of regions in LASICI

|

Overall Rank |

Overall Score |

Knowledge |

Globalization |

Innovation |

|||||

|

Country |

Regions |

Score |

Rank |

Score |

Rank |

Score |

Rank |

||

|

1 |

USA |

Massachusetts |

95.3 |

94.9 |

1 |

62.4 |

15 |

95.5 |

1 |

|

2 |

USA |

California |

90.1 |

87.2 |

5 |

56.2 |

20 |

93.1 |

2 |

|

3 |

USA |

Washington |

81.2 |

75.0 |

9 |

35.8 |

40 |

89.7 |

3 |

|

4 |

USA |

Maryland |

73.3 |

88.7 |

3 |

22.7 |

88 |

69.3 |

6 |

|

5 |

USA |

Oregon |

70.3 |

64.0 |

17 |

78.0 |

11 |

72.0 |

4 |

|

6 |

USA |

New Jersey |

70.1 |

88.0 |

4 |

31.1 |

58 |

62.9 |

10 |

|

7 |

USA |

Michigan |

66.6 |

62.7 |

21 |

48.9 |

24 |

71.4 |

5 |

|

8 |

USA |

Connecticut |

66.4 |

76.9 |

6 |

44.0 |

27 |

62.2 |

12 |

|

9 |

USA |

Delaware |

66.0 |

68.6 |

12 |

43.4 |

30 |

67.2 |

8 |

|

10 |

USA |

New Hampshire |

64.7 |

58.4 |

25 |

80.4 |

9 |

65.9 |

9 |

|

11 |

USA |

Minnesota |

63.4 |

66.9 |

14 |

52.7 |

22 |

62.6 |

11 |

|

12 |

USA |

New Mexico |

61.9 |

56.9 |

29 |

49.4 |

23 |

67.4 |

7 |

|

13 |

USA |

Colorado |

61.0 |

74.5 |

10 |

34.9 |

42 |

56.2 |

15 |

|

14 |

USA |

Illinois |

60.1 |

73.3 |

11 |

66.7 |

13 |

50.4 |

20 |

|

15 |

USA |

Texas |

59.9 |

75.5 |

8 |

84.9 |

4 |

45.7 |

25 |

|

16 |

USA |

Virginia |

58.6 |

90.2 |

2 |

30.6 |

60 |

42.3 |

28 |

|

17 |

USA |

Utah |

58.6 |

63.5 |

18 |

43.6 |

29 |

58.3 |

13 |

|

18 |

USA |

New York |

58.1 |

75.6 |

7 |

31.2 |

57 |

51.3 |

19 |

|

19 |

USA |

North Carolina |

55.2 |

66.1 |

15 |

31.8 |

52 |

52.7 |

16 |

|

20 |

USA |

Pennsylvania |

54.7 |

65.0 |

16 |

35.5 |

41 |

52.1 |

18 |

|

21 |

USA |

Arizona |

53.3 |

60.3 |

22 |

60.3 |

16 |

48.9 |

23 |

|

22 |

USA |

Idaho |

52.6 |

47.9 |

44 |

57.1 |

18 |

56.6 |

14 |

|

23 |

USA |

Wisconsin |

51.7 |

50.4 |

38 |

64.5 |

14 |

52.2 |

17 |

|

24 |

USA |

Ohio |

50.8 |

58.1 |

26 |

42.0 |

33 |

49.2 |

22 |

|

25 |

USA |

Indiana |

48.9 |

51.3 |

36 |

43.7 |

28 |

50.3 |

21 |

|

26 |

USA |

Rhode Island |

48.5 |

59.1 |

23 |

29.4 |

64 |

46.6 |

24 |

|

27 |

USA |

Missouri |

46.2 |

56.9 |

30 |

38.8 |

36 |

42.7 |

26 |

|

28 |

USA |

Kansas |

45.0 |

58.9 |

24 |

32.1 |

50 |

40.5 |

29 |

|

29 |

USA |

Georgia |

44.9 |

62.8 |

20 |

34.5 |

43 |

37.3 |

30 |

|

30 |

USA |

Florida |

44.7 |

67.2 |

13 |

42.5 |

32 |

32.6 |

36 |

|

31 |

USA |

Iowa |

42.9 |

47.5 |

46 |

45.1 |

25 |

42.6 |

27 |

|

32 |

USA |

Tennessee |

41.6 |

53.5 |

34 |

56.1 |

21 |

34.5 |

32 |

|

33 |

USA |

Vermont |

41.2 |

48.9 |

42 |

82.4 |

6 |

32.8 |

34 |

|

34 |

USA |

Nebraska |

38.3 |

55.5 |

31 |

29.4 |

63 |

32.0 |

38 |

|

35 |

USA |

South Carolina |

37.8 |

50.0 |

39 |

42.8 |

31 |

32.7 |

35 |

|

36 |

USA |

Wyoming |

37.6 |

57.4 |

28 |

12.6 |

168 |

32.2 |

37 |

|

37 |

USA |

Nevada |

37.3 |

54.6 |

32 |

37.6 |

39 |

29.7 |

41 |

|

38 |

USA |

North Dakota |

37.0 |

46.4 |

48 |

38.3 |

37 |

34.5 |

33 |

|

39 |

USA |

Alabama |

36.3 |

47.7 |

45 |

18.5 |

113 |

35.7 |

31 |

|

40 |

USA |

Maine |

36.1 |

50.4 |

37 |

38.0 |

38 |

30.4 |

39 |

|

41 |

USA |

Kentucky |

36.0 |

46.2 |

49 |

56.4 |

19 |

30.0 |

40 |

|

42 |

USA |

Louisiana |

34.5 |

63.2 |

19 |

15.3 |

152 |

22.6 |

57 |

|

43 |

USA |

Oklahoma |

33.1 |

47.1 |

47 |

32.9 |

47 |

28.4 |

43 |

|

44 |

USA |

Montana |

32.6 |

49.4 |

41 |

13.4 |

164 |

29.1 |

42 |

|

45 |

USA |

Hawaii |

31.0 |

52.6 |

35 |

7.2 |

179 |

25.3 |

49 |

|

46 |

USA |

Arkansas |

29.5 |

44.6 |

50 |

24.1 |

81 |

25.5 |

47 |

|

47 |

USA |

South Dakota |

28.3 |

39.2 |

55 |

27.4 |

74 |

26.7 |

46 |

|

48 |

Mexico |

Mexico City |

28.2 |

58.0 |

27 |

21.8 |

90 |

14.6 |

104 |

|

49 |

Brazil |

São Paulo |

27.9 |

19.9 |

133 |

95.2 |

1 |

28.0 |

44 |

|

50 |

USA |

West Virginia |

27.1 |

43.8 |

52 |

28.8 |

68 |

21.3 |

65 |

|

51 |

Peru |

Lima |

27.0 |

54.0 |

33 |

25.1 |

79 |

14.8 |

101 |

|

52 |

USA |

Mississippi |

26.7 |

34.0 |

67 |

44.8 |

26 |

24.7 |

53 |

|

53 |

USA |

Alaska |

26.5 |

44.1 |

51 |

13.5 |

163 |

22.5 |

58 |

|

54 |

Colombia |

Bogotá |

23.7 |

35.2 |

65 |

17.2 |

120 |

23.3 |

55 |

|

55 |

Peru |

Arequipa |

23.7 |

48.9 |

43 |

28.6 |

70 |

12.2 |

131 |

|

56 |

Mexico |

Nuevo León |

23.5 |

49.6 |

40 |

19.5 |

109 |

12.9 |

120 |

|

57 |

Brazil |

Rio de Janeiro |

23.1 |

17.8 |

143 |

79.6 |

10 |

24.0 |

54 |

|

58 |

Brazil |

Paraná |

23.0 |

14.3 |

152 |

85.9 |

3 |

25.2 |

50 |

|

59 |

Brazil |

Minas Gerais |

21.9 |

15.2 |

150 |

83.9 |

5 |

23.0 |

56 |

|

60 |

Chile |

Santiago |

21.8 |

33.7 |

69 |

19.8 |

93 |

20.7 |

70 |

|

61 |

Brazil |

Santa Catarina |

21.4 |

16.8 |

146 |

41.3 |

35 |

27.9 |

45 |

|

62 |

Brazil |

Rio Grande do Sul |

20.6 |

14.5 |

151 |

59.1 |

17 |

25.3 |

48 |

|

63 |

Mexico |

Querétaro |

20.3 |

41.9 |

53 |

21.2 |

91 |

12.3 |

129 |

|

64 |

Brazil |

Espírito Santo |

20.2 |

13.0 |

156 |

81.7 |

7 |

22.0 |

61 |

|

65 |

Colombia |

Antioquia |

20.1 |

29.7 |

84 |

17.7 |

117 |

20.9 |

68 |

|

66 |

Colombia |

Vaupés |

19.6 |

23.3 |

115 |

15.5 |

143 |

24.8 |

52 |

|

67 |

Peru |

Ica |

19.0 |

40.8 |

54 |

41.8 |

34 |

7.7 |

174 |

|

68 |

Mexico |

Sonora |

18.9 |

35.9 |

61 |

12.4 |

170 |

15.5 |

98 |

|

69 |

Brazil |

Distrito Federal |

18.8 |

23.2 |

117 |

7.0 |

180 |

24.9 |

51 |

|

70 |

Colombia |

Santander |

18.7 |

27.2 |

96 |

16.6 |

125 |

20.4 |

72 |

|

71 |

Colombia |

Atlántico |

18.3 |

27.7 |

92 |

17.4 |

118 |

19.2 |

78 |

|

72 |

Mexico |

Coahuila |

18.3 |

38.0 |

56 |

18.9 |

112 |

12.0 |

133 |

|

73 |

Colombia |

Amazonas |

18.3 |

31.3 |

76 |

15.5 |

143 |

17.1 |

86 |

|

74 |

Colombia |

Caldas |

18.1 |

26.9 |

98 |

16.3 |

126 |

19.7 |

77 |

|

75 |

Mexico |

Quintana Roo |

18.1 |

33.7 |

68 |

19.0 |

111 |

14.6 |

105 |

|

76 |

Peru |

Moquegua |

18.0 |

36.9 |

58 |

27.3 |

75 |

10.9 |

143 |

|

77 |

Chile |

Los Ríos |

17.6 |

24.1 |

106 |

19.8 |

93 |

20.2 |

75 |

|

78 |

Mexico |

Aguascalientes |

17.6 |

35.5 |

63 |

17.0 |

122 |

12.8 |

122 |

|

79 |

Colombia |

Cundinamarca |

17.4 |

28.2 |

88 |

16.2 |

127 |

17.6 |

84 |

|

80 |

Colombia |

San Andrés y Providencia |

17.3 |

31.3 |

76 |

18.2 |

116 |

15.1 |

99 |

|

81 |

Brazil |

Pernambuco |

17.3 |

10.6 |

166 |

66.7 |

12 |

21.1 |

67 |

|

82 |

Colombia |

Quindío |

17.1 |

23.6 |

110 |

15.5 |

135 |

20.3 |

73 |

|

83 |

Chile |

Antofagasta |

17.0 |

30.5 |

80 |

19.8 |

93 |

14.9 |

100 |

|

84 |

Chile |

Tarapacá |

17.0 |

32.3 |

71 |

19.8 |

93 |

13.6 |

110 |

|

85 |

Colombia |

Norte de Santander |

17.0 |

28.4 |

87 |

15.9 |

130 |

16.8 |

89 |

|

86 |

Colombia |

Risaralda |

16.9 |

27.1 |

97 |

16.0 |

129 |

17.6 |

85 |

|

87 |

Mexico |

Jalisco |

16.9 |

35.5 |

62 |

14.5 |

158 |

12.1 |

132 |

|

88 |

Mexico |

Baja California |

16.6 |

32.3 |

72 |

17.1 |

121 |

13.3 |

115 |

|

89 |

Chile |

Magallanes |

16.5 |

28.0 |

90 |

19.8 |

93 |

15.7 |

97 |

|

90 |

Chile |

Ñuble |

16.5 |

24.2 |

104 |

19.8 |

93 |

18.2 |

80 |

|

91 |

Mexico |

Chihuahua |

16.0 |

32.7 |

70 |

19.3 |

110 |

11.7 |

139 |

|

92 |

Colombia |

Valle del Cauca |

15.9 |

23.4 |

112 |

16.9 |

124 |

18.1 |

81 |

|

93 |

Peru |

Tumbes |

15.8 |

35.9 |

59 |

31.4 |

54 |

7.3 |

178 |

|

94 |

Colombia |

Boyacá |

15.8 |

20.9 |

129 |

15.5 |

140 |

20.0 |

76 |

|

95 |

Peru |

Lambayeque |

15.8 |

34.6 |

66 |

26.8 |

76 |

8.9 |

162 |

|

96 |

Peru |

Tacna |

15.8 |

35.9 |

60 |

25.4 |

78 |

8.2 |

168 |

|

97 |

Peru |

La Libertad |

15.7 |

37.0 |

57 |

23.2 |

86 |

7.7 |

175 |

|

98 |

Colombia |

Guainía |

15.5 |

31.3 |

76 |

15.5 |

143 |

12.5 |

125 |

|

99 |

Colombia |

Casanare |

15.2 |

31.3 |

76 |

16.2 |

128 |

11.8 |

137 |

|

100 |

Brazil |

Ceará |

15.0 |

13.7 |

154 |

29.7 |

61 |

21.2 |

66 |

|

101 |

Colombia |

Meta |

14.9 |

23.0 |

119 |

15.5 |

143 |

17.0 |

87 |

|

102 |

Mexico |

Baja California Sur |

14.9 |

27.6 |

93 |

24.1 |

80 |

12.5 |

126 |

|

103 |

Peru |

Cusco |

14.8 |

27.9 |

91 |

26.3 |

77 |

11.9 |

135 |

|

104 |

Chile |

Valparaíso |

14.8 |

23.4 |

114 |

19.8 |

93 |

16.0 |

93 |

|

105 |

Peru |

Áncash |

14.8 |

35.5 |

64 |

20.2 |

92 |

7.6 |

176 |

|

106 |

Peru |

Junín |

14.6 |

29.8 |

82 |

22.6 |

89 |

10.9 |

144 |

|

107 |

Mexico |

Morelos |

14.6 |

28.5 |

86 |

23.5 |

85 |

11.6 |

140 |

|

108 |

Colombia |

Guaviare |

14.6 |

31.3 |

76 |

15.5 |

143 |

10.9 |

142 |

|

109 |

Colombia |

Putumayo |

14.5 |

31.3 |

76 |

15.5 |

143 |

10.8 |

146 |

|

110 |

Chile |

Arica y Parinacota |

14.5 |

21.5 |

127 |

19.8 |

93 |

16.6 |

90 |

|

111 |

Brazil |

Goiás |

14.4 |

10.8 |

165 |

32.8 |

48 |

21.6 |

63 |

|

112 |

Colombia |

Arauca |

14.4 |

31.3 |

76 |

15.6 |

133 |

10.5 |

149 |

|

113 |

Mexico |

Mexico |

14.2 |

30.1 |

81 |

17.3 |

119 |

10.7 |

147 |

|

114 |

Chile |

Bío-Bío |

14.1 |

23.4 |

113 |

19.8 |

93 |

14.8 |

102 |

|

115 |

Brazil |

Mato Grosso do Sul |

13.9 |

11.7 |

160 |

28.8 |

69 |

20.8 |

69 |

|

116 |

Mexico |

Colima |

13.7 |

26.5 |

99 |

10.8 |

175 |

13.5 |

113 |

|

117 |

Brazil |

Amazonas |

13.7 |

7.6 |

173 |

93.3 |

2 |

12.8 |

121 |

|

118 |

Colombia |

Cesar |

13.5 |

19.7 |

137 |

15.5 |

136 |

16.9 |

88 |

|

119 |

Mexico |

Tamaulipas |

13.5 |

27.6 |

94 |

22.7 |

87 |

10.4 |

150 |

|

120 |

Chile |

Aysen |

13.5 |

22.2 |

124 |

19.8 |

93 |

14.6 |

106 |

|

121 |

Colombia |

Magdalena |

13.4 |

18.3 |

141 |

15.8 |

131 |

17.7 |

83 |

|

122 |

Peru |

Ayacucho |

13.4 |

28.2 |

89 |

32.4 |

49 |

8.3 |

167 |

|

123 |

Colombia |

Bolívar |

13.3 |

20.5 |

131 |

17.0 |

123 |

15.9 |

95 |

|

124 |

Brazil |

Maranhão |

13.2 |

5.1 |

182 |

80.7 |

8 |

15.9 |

96 |

|

125 |

Chile |

Los Lagos |

13.2 |

23.0 |

120 |

19.8 |

93 |

13.5 |

111 |

|

126 |

Chile |

Maule |

13.2 |

23.7 |

109 |

19.8 |

93 |

13.0 |

118 |

|

127 |

Mexico |

Yucatán |

13.1 |

27.3 |

95 |

11.8 |

173 |

11.7 |

138 |

|

128 |

Mexico |

San Luis Potosí |

13.1 |

28.5 |

85 |

18.2 |

115 |

9.8 |

158 |

|

129 |

Brazil |

Sergipe |

12.8 |

7.4 |

174 |

29.0 |

67 |

22.0 |

60 |

|

130 |

Mexico |

Sinaloa |

12.7 |

26.0 |

100 |

12.0 |

171 |

11.8 |

136 |

|

131 |

Mexico |

Puebla |

12.5 |

24.4 |

103 |

23.8 |

84 |

10.8 |

145 |

|

132 |

Brazil |

Bahia |

12.5 |

8.1 |

172 |

33.4 |

45 |

20.2 |

74 |

|

133 |

Peru |

Loreto |

12.0 |

29.7 |

83 |

14.5 |

157 |

7.8 |

173 |

|

134 |

Colombia |

Tolima |

12.0 |

17.0 |

145 |

15.5 |

138 |

16.2 |

92 |

|

135 |

Colombia |

Huila |

11.9 |

16.5 |

147 |

15.5 |

141 |

16.5 |

91 |

|

136 |

Brazil |

Paraíba |

11.9 |

6.8 |

177 |

18.4 |

114 |

22.5 |

59 |

|

137 |

Mexico |

Guanajuato |

11.8 |

25.8 |

101 |

13.6 |

162 |

10.2 |

155 |

|

138 |

Chile |

Araucanía |

11.7 |

19.8 |

136 |

19.8 |

93 |

13.2 |

116 |

|

139 |

Peru |

Piura |

11.7 |

24.6 |

102 |

31.5 |

53 |

7.9 |

171 |

|

140 |

Chile |

O’Higgins |

11.5 |

19.9 |

135 |

19.8 |

93 |

12.8 |

124 |

|

141 |

Peru |

San Martín |

11.4 |

23.5 |

111 |

29.4 |

65 |

8.6 |

164 |

|

142 |

Peru |

Huánuco |

11.2 |

22.2 |

123 |

31.4 |

56 |

8.9 |

161 |

|

143 |

Mexico |

Tabasco |

11.2 |

24.0 |

108 |

14.5 |

156 |

10.3 |

154 |

|

144 |

Brazil |

Rio Grande do Norte |

11.2 |

7.3 |

175 |

14.3 |

160 |

21.7 |

62 |

|

145 |

Chile |

Coquimbo |

11.1 |

19.5 |

138 |

19.8 |

93 |

12.4 |

128 |

|

146 |

Peru |

Ucayali |

11.1 |

23.2 |

118 |

28.1 |

71 |

8.5 |

165 |

|

147 |

Peru |

Amazonas |

11.0 |

21.4 |

128 |

33.3 |

46 |

8.8 |

163 |

|

148 |

Brazil |

Mato Grosso |

11.0 |

12.0 |

159 |

28.0 |

73 |

15.9 |

94 |

|

149 |

Peru |

Apurímac |

10.8 |

20.8 |

130 |

28.0 |

72 |

9.6 |

159 |

|

150 |

Mexico |

Zacatecas |

10.7 |

18.1 |

142 |

29.3 |

66 |

11.1 |

141 |

|

151 |

Mexico |

Veracruz |

10.6 |

22.9 |

121 |

15.0 |

154 |

10.1 |

156 |

|

152 |

Peru |

Puno |

10.5 |

24.1 |

107 |

31.9 |

51 |

6.2 |

180 |

|

153 |

Colombia |

Cauca |

10.4 |

15.3 |

149 |

15.5 |

137 |

14.7 |

103 |

|

154 |

Brazil |

Piauí |

10.3 |

6.0 |

178 |

31.4 |

55 |

18.3 |

79 |

|

155 |

Mexico |

Durango |

10.2 |

21.8 |

125 |

12.9 |

167 |

10.4 |

153 |

|

156 |

Peru |

Cajamarca |

10.1 |

21.8 |

126 |

34.0 |

44 |

6.8 |

179 |

|

157 |

Mexico |

Hidalgo |

10.0 |

24.2 |

105 |

13.3 |

165 |

8.4 |

166 |

|

158 |

Mexico |

Tlaxcala |

9.9 |

18.5 |

140 |

24.0 |

82 |

10.4 |

152 |

|

159 |

Mexico |

Campeche |

9.8 |

22.8 |

122 |

10.6 |

176 |

9.5 |

160 |

|

160 |

Brazil |

Amapá |

9.8 |

5.2 |

181 |

14.8 |

155 |

20.6 |

71 |

|

161 |

Brazil |

Alagoas |

9.7 |

5.4 |

180 |

9.0 |

178 |

21.3 |

64 |

|

162 |

Chile |

Atacama |

9.5 |

19.1 |

139 |

19.8 |

93 |

10.0 |

157 |

|

163 |

Peru |

Madre de Dios |

9.2 |

19.9 |

134 |

29.5 |

62 |

7.3 |

177 |

|

164 |

Brazil |

Tocantins |

9.1 |

8.2 |

171 |

11.6 |

174 |

17.9 |

82 |

|

165 |

Colombia |

Sucre |

8.8 |

12.6 |

157 |

15.5 |

142 |

13.8 |

109 |

|

166 |

Mexico |

Nayarit |

8.8 |

17.4 |

144 |

15.1 |

153 |

10.6 |

148 |

|

167 |

Colombia |

Córdoba |

8.5 |

11.1 |

163 |

15.5 |

143 |

14.4 |

108 |

|

168 |

Colombia |

Nariño |

8.2 |

10.2 |

167 |

15.7 |

132 |

14.4 |

107 |

|

169 |

Colombia |

Caquetá |

8.1 |

11.5 |

161 |

15.5 |

143 |

13.4 |

114 |

|

170 |

Peru |

Pasco |

8.0 |

20.4 |

132 |

23.8 |

83 |

5.9 |

181 |

|

171 |

Colombia |

La Guajira |

7.9 |

10.9 |

164 |

15.6 |

134 |

13.5 |

112 |

|

172 |

Mexico |

Michoacán de Ocampo |

7.9 |

16.2 |

148 |

12.0 |

172 |

10.4 |

151 |

|

173 |

Peru |

Huancavelica |

7.7 |

9.1 |

168 |

31.0 |

59 |

11.9 |

134 |

|

174 |

Colombia |

Vichada |

7.5 |

23.3 |

116 |

15.5 |

139 |

4.5 |

182 |

|

175 |

Colombia |

Chocó |

7.3 |

11.3 |

162 |

15.5 |

143 |

12.2 |

130 |

|

176 |

Brazil |

Rondônia |

6.5 |

8.9 |

169 |

12.4 |

169 |

13.1 |

117 |

|

177 |

Brazil |

Pará |

5.7 |

7.3 |

176 |

14.5 |

159 |

12.4 |

127 |

|

178 |

Brazil |

Acre |

5.4 |

8.4 |

170 |

4.8 |

182 |

12.8 |

123 |

|

179 |

Mexico |

Oaxaca |

5.4 |

14.2 |

153 |

10.0 |

177 |

7.9 |

170 |

|

180 |

Mexico |

Chiapas |

5.3 |

13.2 |

155 |

13.2 |

166 |

8.0 |

169 |

|

181 |

Mexico |

Guerrero |

4.9 |

12.1 |

158 |

14.0 |

161 |

7.8 |

172 |

|

182 |

Brazil |

Roraima |

4.7 |

5.9 |

179 |

6.1 |

181 |

13.0 |

119 |

Index Scores

Overall

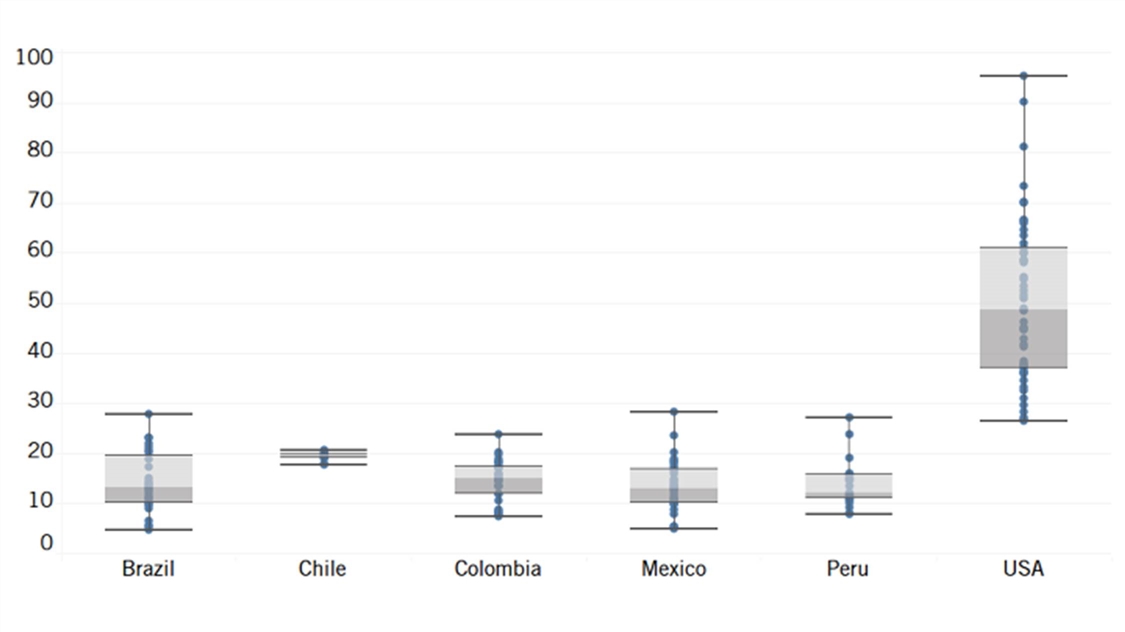

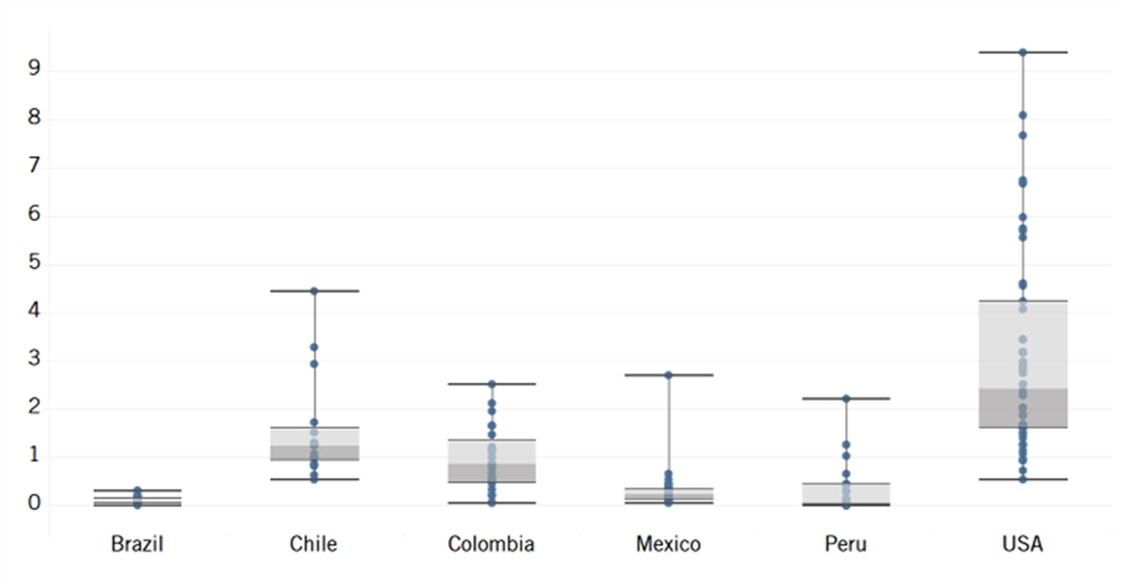

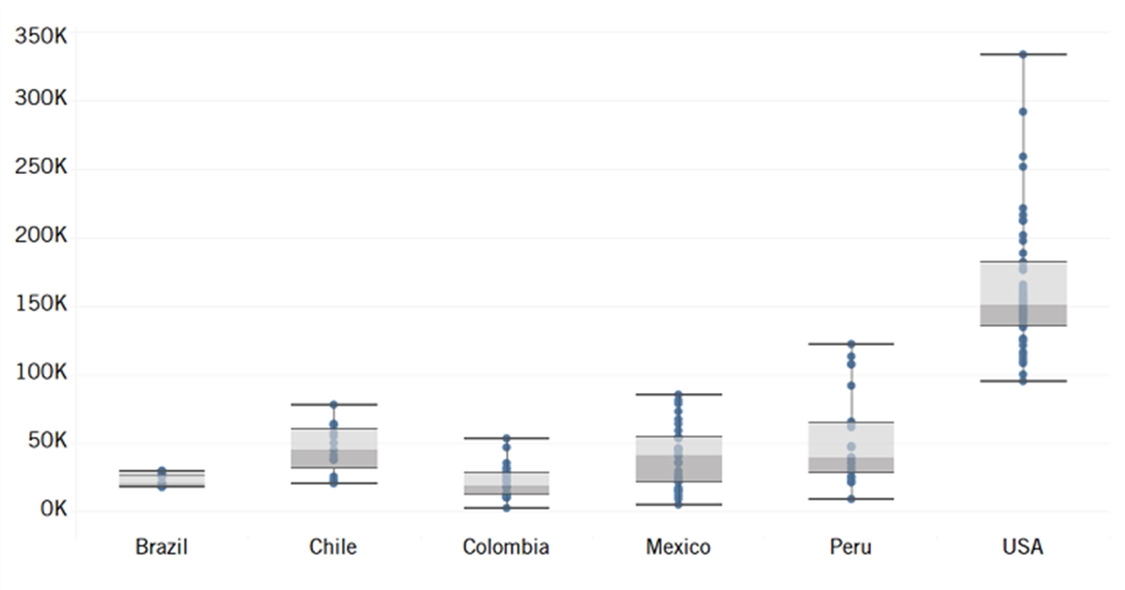

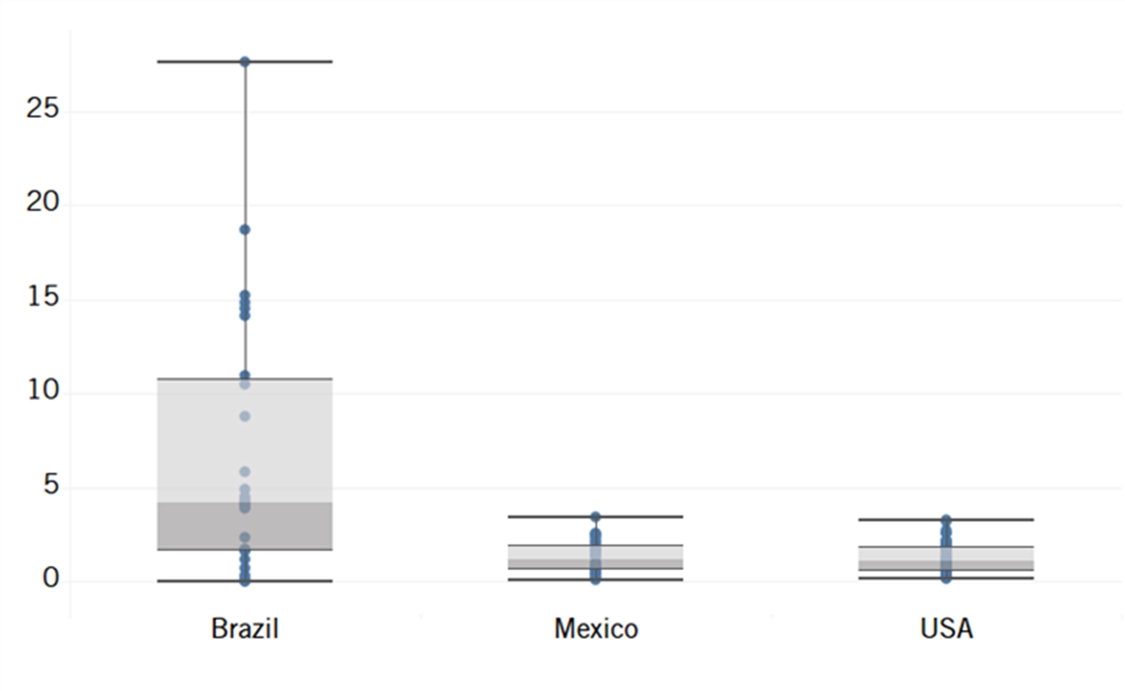

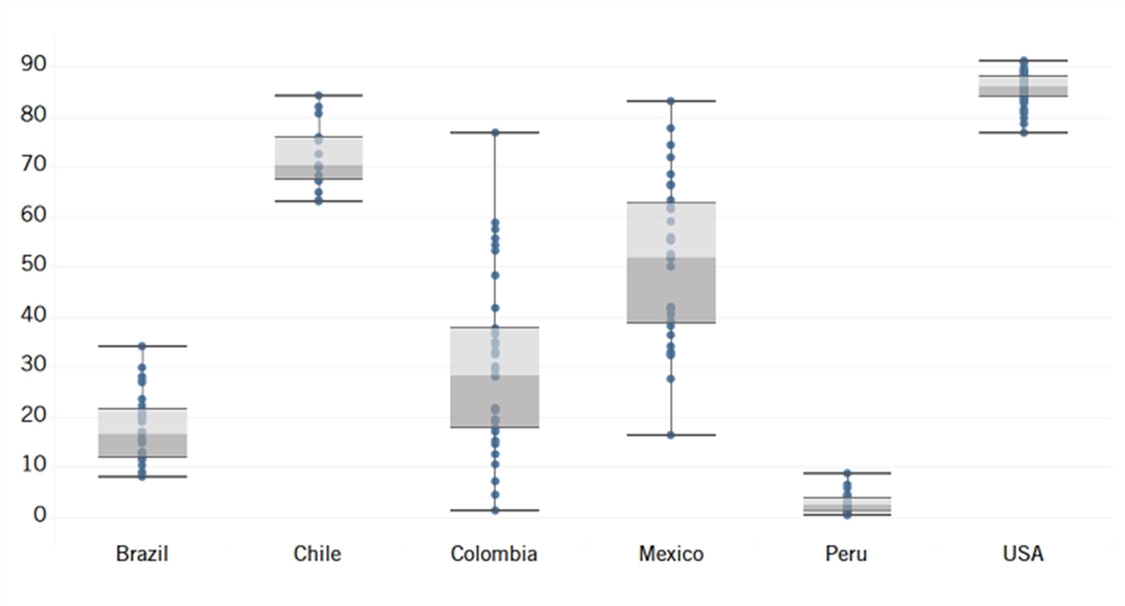

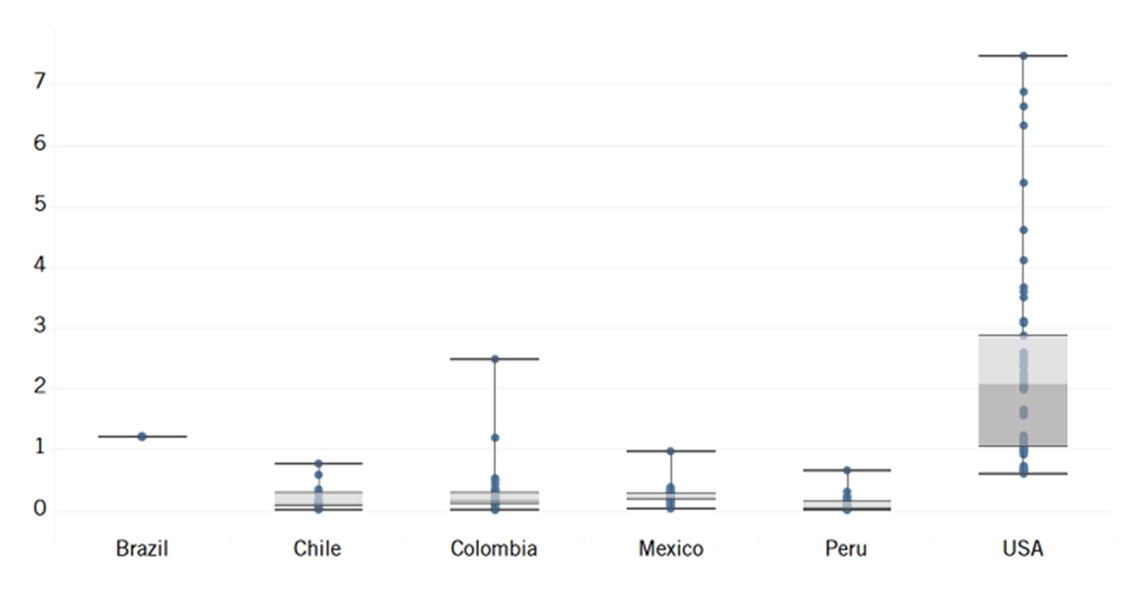

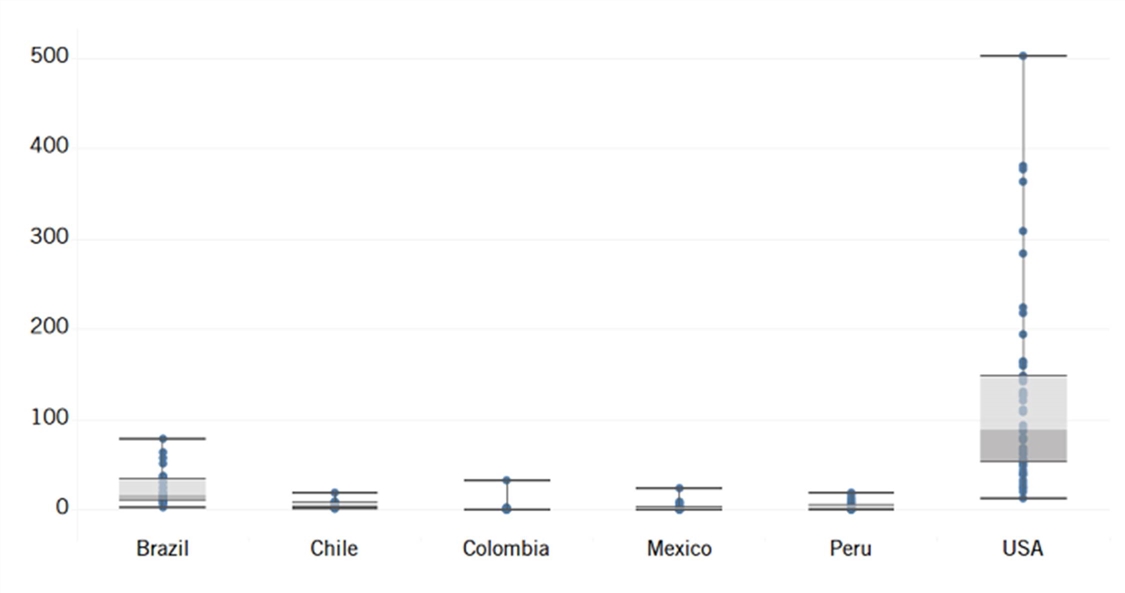

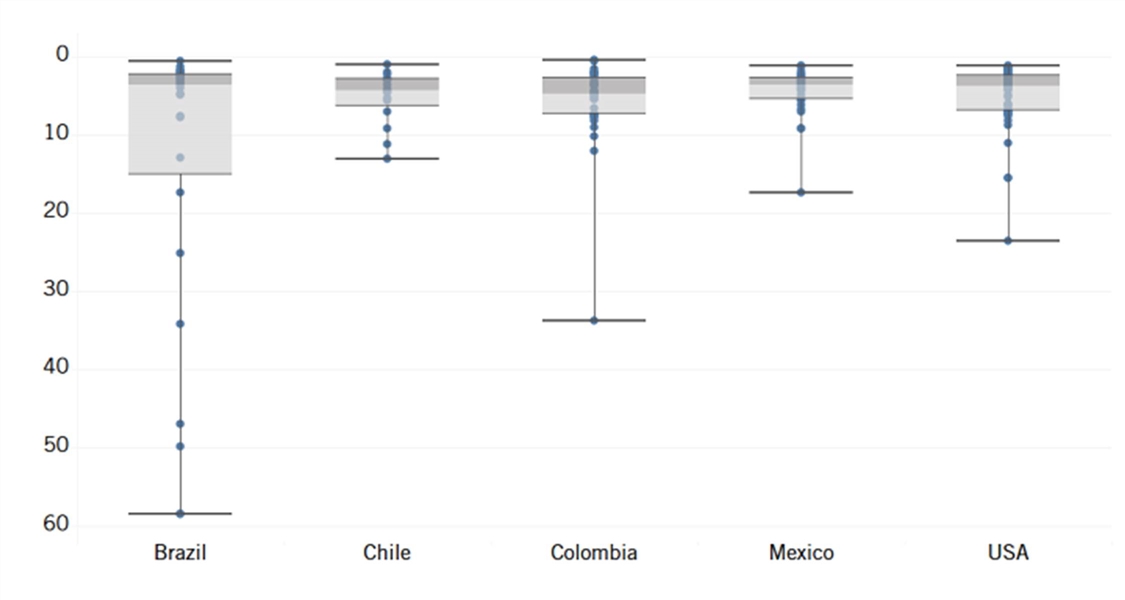

American states lead in this index of subnational innovation competitiveness, with 47 of its 50 states ranked higher than Mexico City, which is the best-performing region in Latin America (see Figure 1). Compared to the United States, the Latin American countries in this study have much less regional variation in their scores. The difference between the maximum and the minimum subnational innovation competitiveness score is the smallest in Chile, and a handful of the very-best-performing regions in Brazil, Mexico, and Peru rank higher than three U.S. states.

Figure 1: Maximum, minimum, quartiles, and median of overall subnational innovation competitiveness scores by country (dots denote the regions)[11]

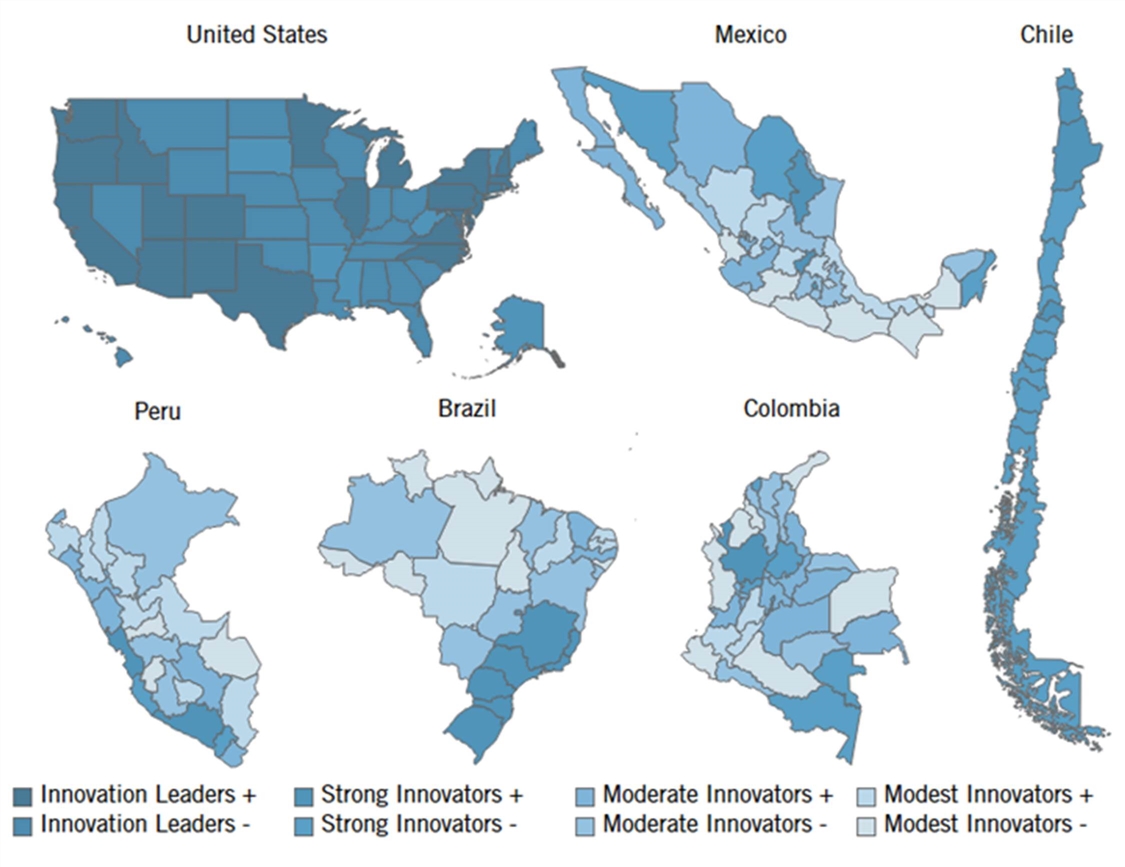

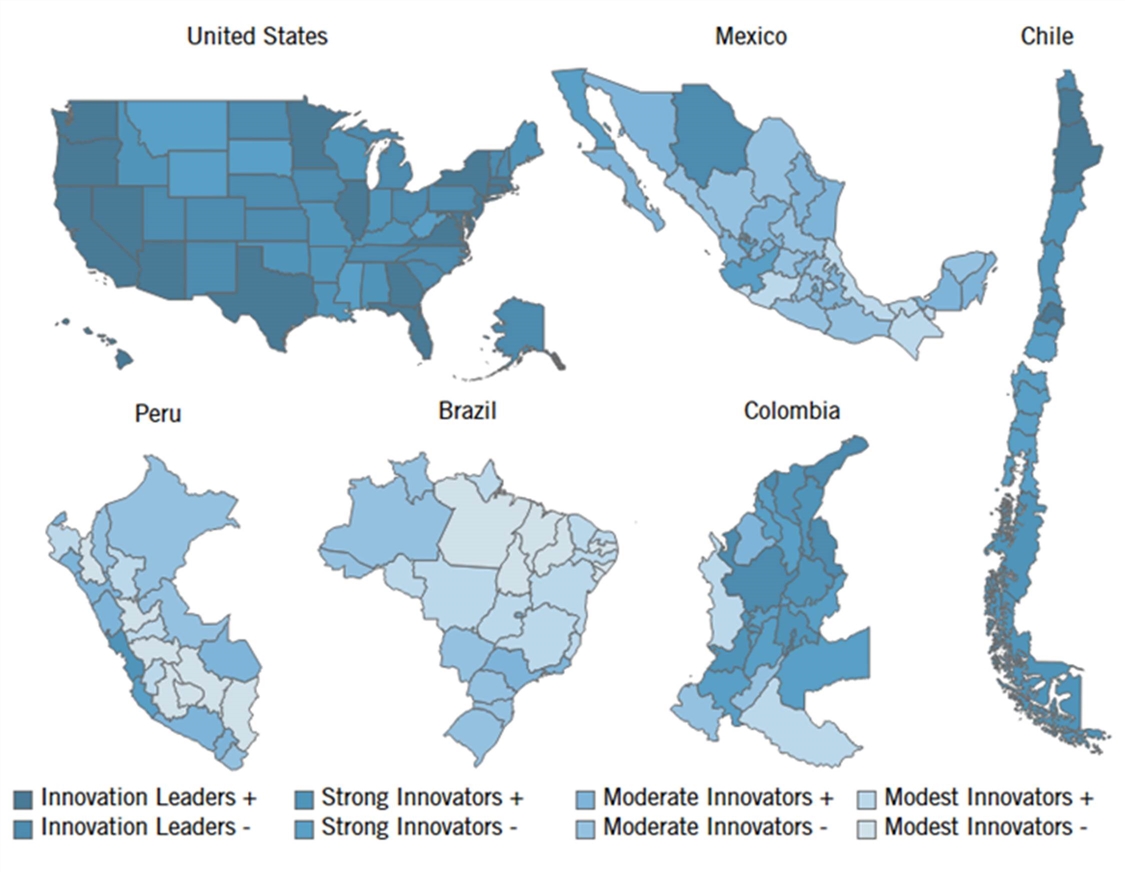

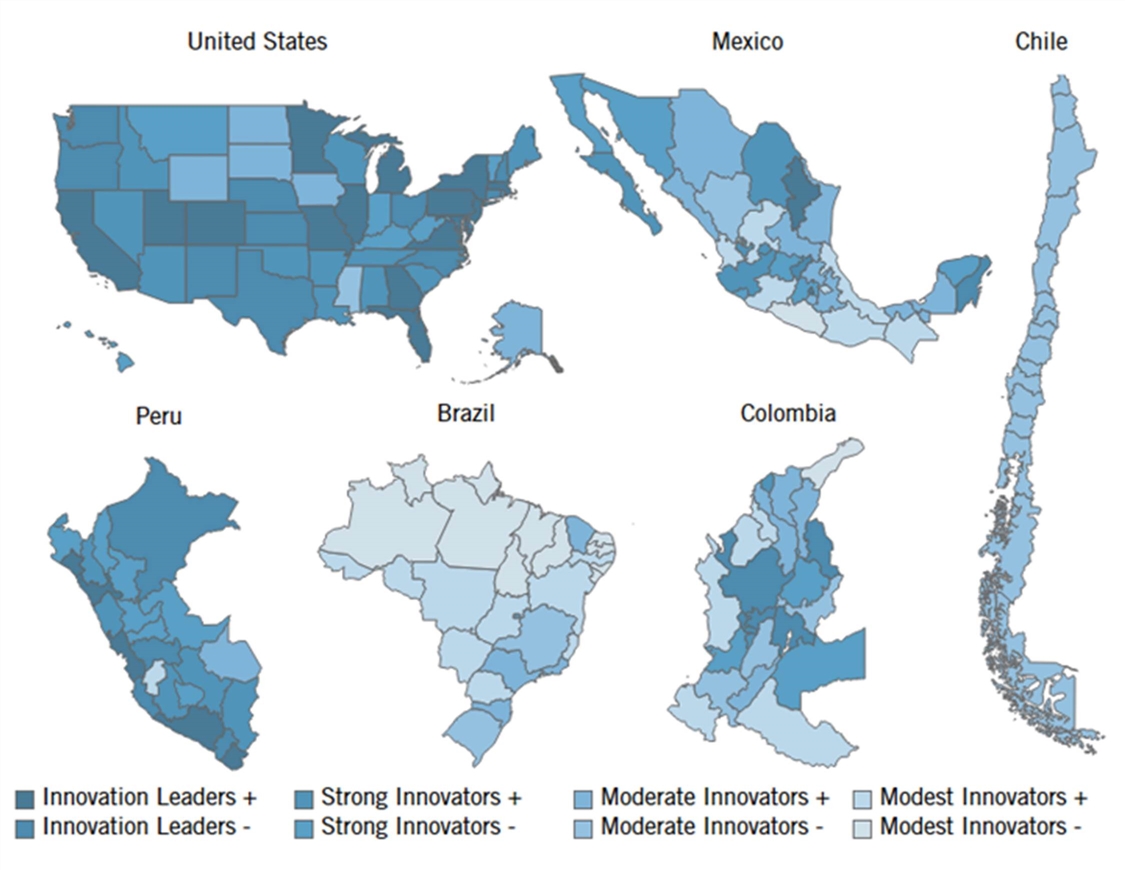

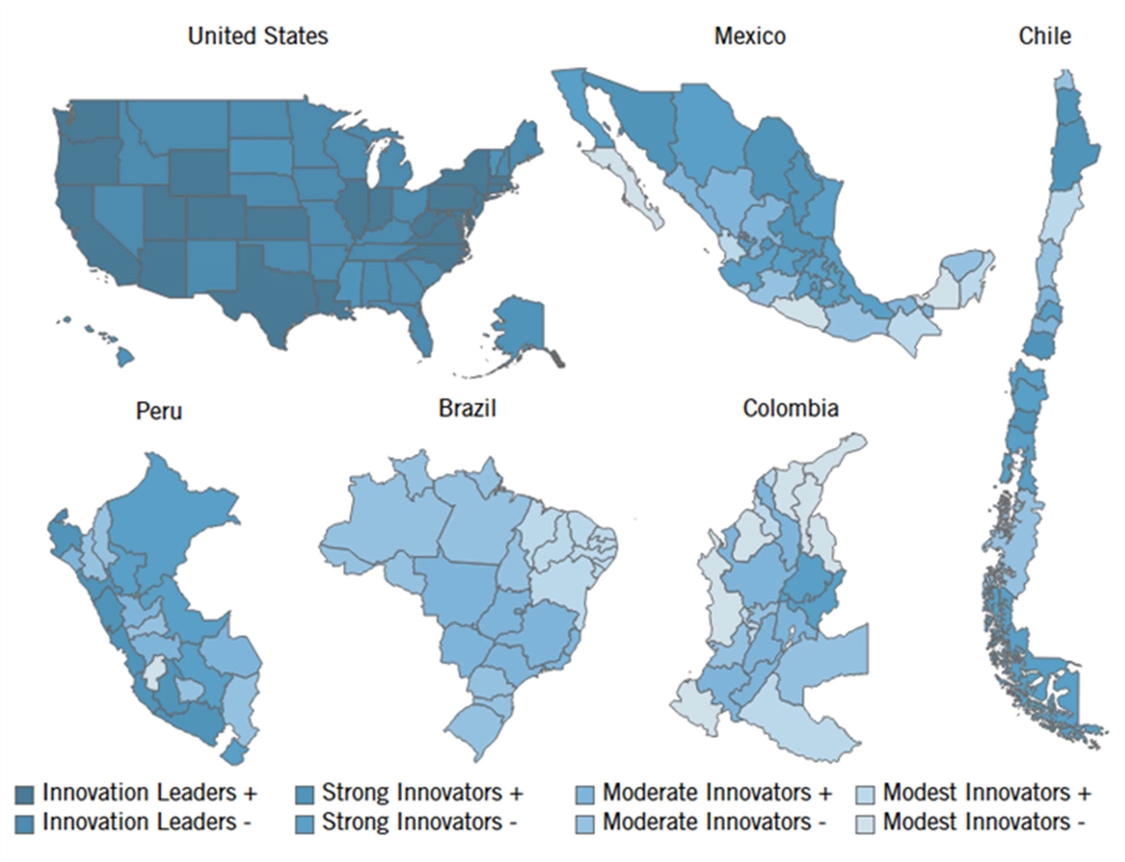

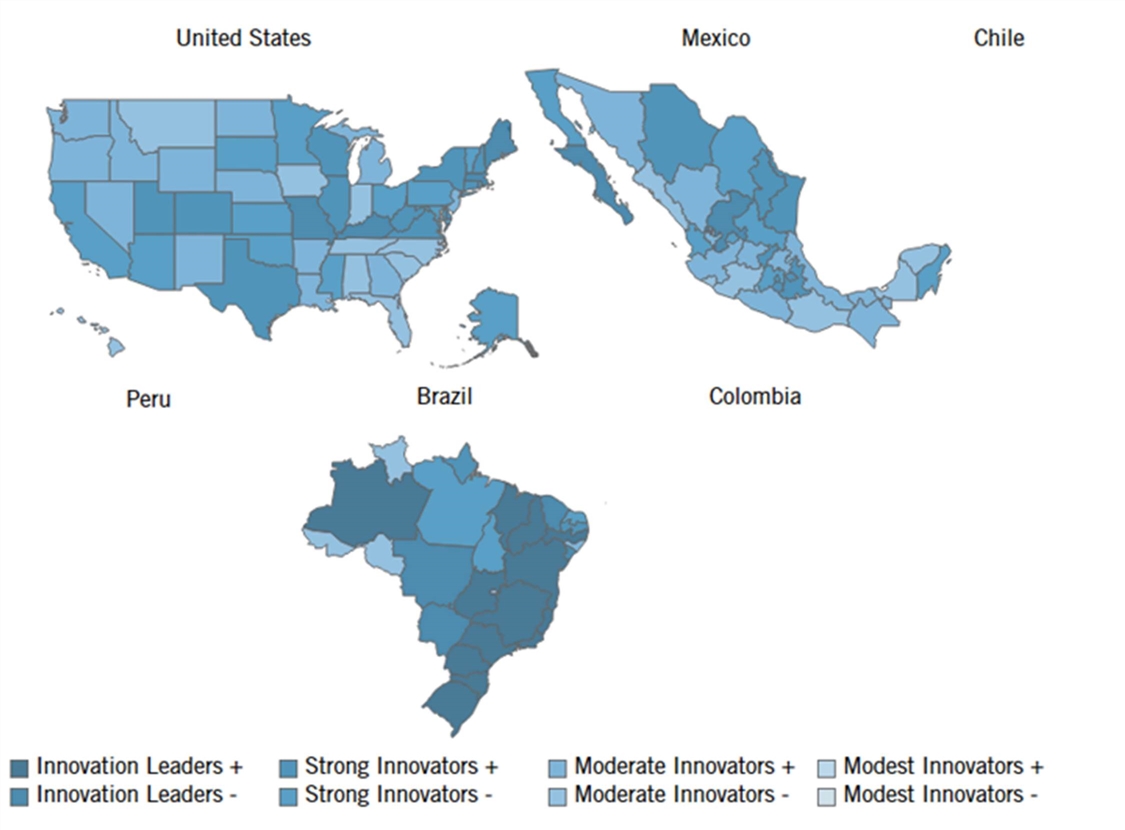

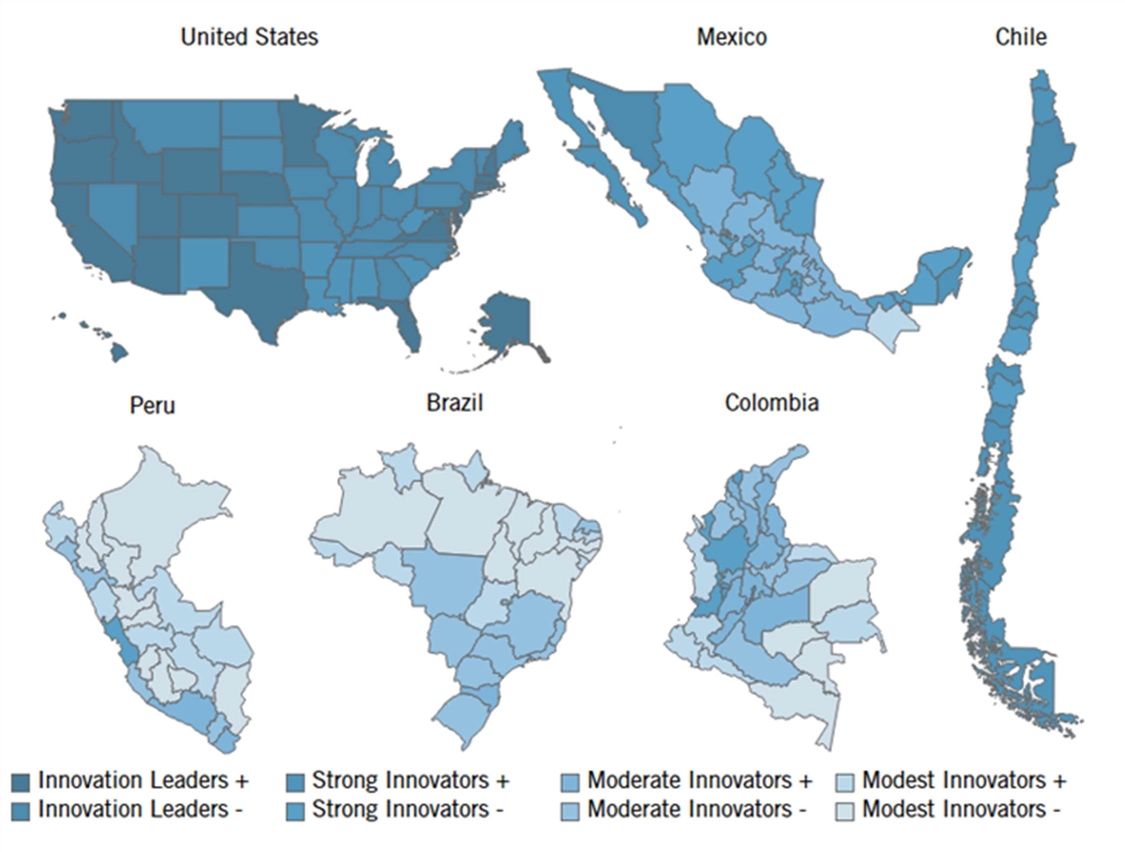

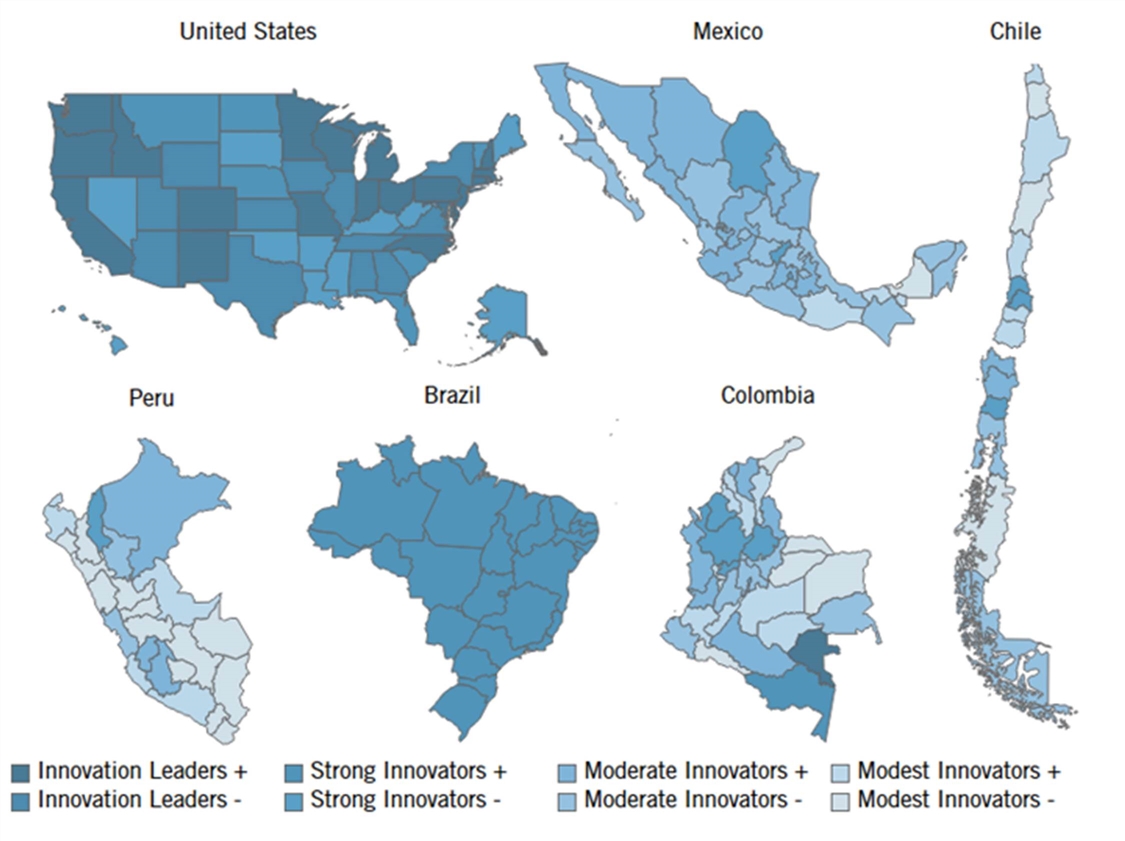

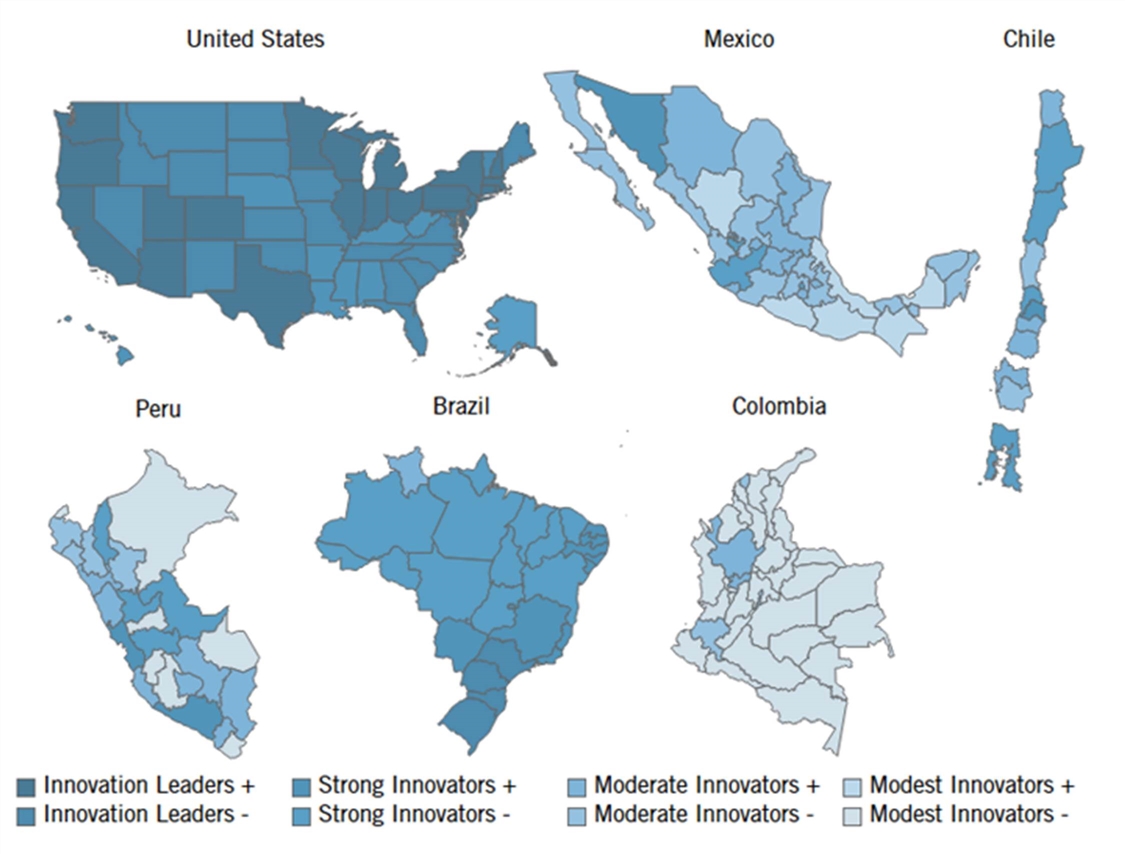

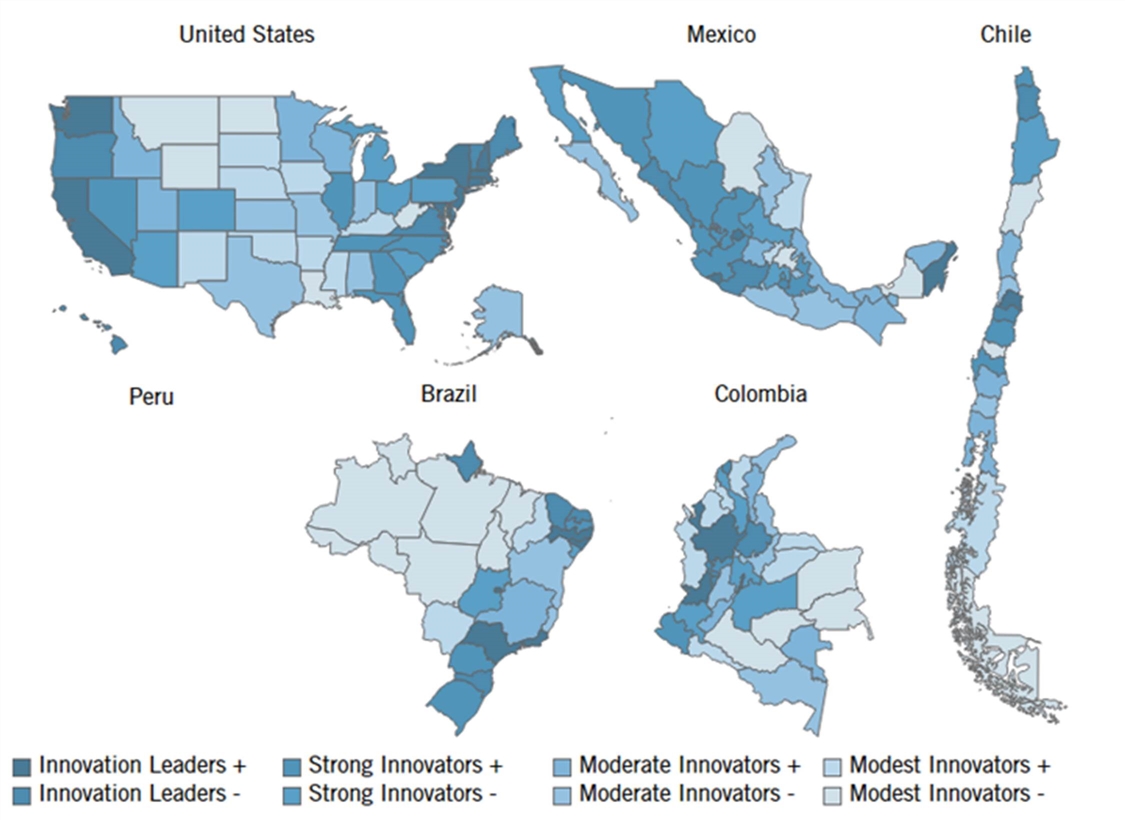

Regions were sorted into eight innovation competitiveness categories: modest innovator -, modest innovator +, moderate innovator -, moderate innovator +, strong innovator -, strong innovator +, innovation leader -, and innovation leader+ based on the regions’ positions in the ranking. The number of regions in each category was selected to be 23 to place an equal number of regions in each category given that there are 182 regions in total.[12] The minus sign in the name of the category indicates that its regions fall into a lower category than those regions that are in the respective category with a positive sign. As the colors of the charts indicate, the categories’ ascending order is modest innovator, moderate innovator, strong innovator, and innovation leader, in line with the rankings in the European Innovation Scorecard.

American states lead in this index of subnational innovation competitiveness, with 47 of its 50 states ranked higher than Mexico City, which is the best-performing region in Latin America.

The east and west coasts of the United States exhibit strong innovation performance, while states in the middle of the country are lagging modest innovators, such as West Virginia or South Dakota (see Figure 2). The United States scores diversely as it has states in all eight innovation categories. Colombia’s best-performing regions are Bogotá and Antioquia. The strong innovator regions in Colombia are Bogotá and Antioquia. In Chile, the strong innovator regions are Santiago and Antofagasta. Many Mexican regions fall in the moderate or modest innovators category; however, Mexico City and Nuevo León are strong innovators due to their globalized economy and strong innovation capacity. Peru’s strong innovator regions are Arequipa and Lima, while the region of Ica is only a moderate innovator. Brazil’s strong innovator regions are Rio de Janeiro and São Paulo, while the region of Ceará is only a moderate innovator.

Figure 2: Overall SASICI subnational innovation competitiveness scores[13]

Knowledge Economy

Highly Educated Population

Why is this important? This indicator measures the share of a region’s 25–64-year-old (“prime age”) population with a bachelor’s degree (or equivalent) or higher. Education provides citizens with the skills and knowledge necessary to compete and innovate in the modern economy. While more time spent in school does not necessarily guarantee sufficient applied skills to compete in the modern global innovation economy—for example, the Council for Aid to Education found that 44 percent of current U.S. university graduates are not proficient in essential career skills—the proportion of highly educated residents remains a strong indicator of human capital.[14] Moreover, evidence suggests that more educated individuals are more likely and willing to adopt new technological innovations.[15]

Figure 3: Share of the 25–64-year-old population with a bachelor’s degree (or equivalent) or higher, 2019 (%)[16]

The rankings: The data highlights Peru’s intriguing trend in education. Regions like Arequipa (18.5 percent) and Lima (17.1 percent) stand out in educational attainment (see Figure 3 and Figure 4). By contrast, the San Martín (6.8 percent) and Ucayali (5.9 percent) regions have comparatively lower educational attainment.

In Mexico, the data showcase a divergence between regions such as Mexico City (37.9 percent) and Chiapas (16.7 percent). This reveals a regional contrast in educational attainment and innovation potential, possibly influenced by varying economic conditions, educational infrastructure, and policy priorities.

Similarly, Chile displays regional variations, with Magallanes (26.6 percent) standing out as a hub of educational achievement compared to Ñuble (12.4 percent). This suggests a divide in educational resources and opportunities, reflecting the impact of regional economic disparities and access to quality education.

Brazil’s education landscape exhibits a mix of patterns. Distrito Federal (14.9 percent) and São Paulo (10.1 percent) stand out in educational attainment, possibly driven by economic activity and cultural attractions. Conversely, regions like Pará (3.3 percent) and Maranhão (2.9 percent) showcase underperformance in education.

In Columbia, regions like Bogotá (21.8 percent), Atlántico (14.3 percent), and Boyacá (12.7 percent) exhibit higher percentages of highly educated populations compared to regions such as Vaupes (0.1 percent) and Vichada (0.1 percent). This disparity mirrors the broader socioeconomic gaps that potentially influence educational access and attainment.

Within the United States, the data unveils a rich tapestry of educational landscapes. States like Massachusetts (48.2 percent) and California (36.2 percent) reflect the influence of renowned universities and tech clusters, contributing to high levels of educational attainment. Conversely, states such as Mississippi (22.8 percent) face educational challenges rooted in socioeconomic disparities and limited resources.

Figure 4: Performance map in highly skilled workforce indicator[17]

Skilled Immigration

Why is this important? Skilled immigration brings together workers with unique educational experiences and backgrounds as a driver of innovative ideas. Level of skill can be difficult to quantify, so this indicator is instead measured via educational attainment, calculated as a region’s share of foreign-born workers with at least some tertiary education relative to the total regional population. A 2016 ITIF study found that foreign-born workers living in the United States are highly represented in the number of scientists and engineers producing meaningful innovations, compared with the overall levels of immigration in the United States.[18] Similarly, half of Silicon Valley’s artificial intelligence (AI) start-ups have foreign-born founders.[19] A separate study found that 52 percent of all Silicon Valley start-ups have at least one foreign-born founder.[20] In addition to contributing to a state’s stock of skilled human capital, highly educated immigrant populations raise wages for both domestic- and foreign-born workers.[21]

Figure 5: Share of population that is foreign-born and has some tertiary education, 2019 (%)[22]

The rankings: The United States has the highest level of skilled immigrants, with Chile being a distant second. On the other hand, countries like Brazil and Peru generally exhibit lower levels.

While the United States leads in attracting skilled immigrants, there are varying levels of skilled immigration across its states. New Jersey and California lead the way with higher skilled immigration indicators (9.4 percent and 8.1 percent, respectively), but other areas like Mississippi and West Virginia display relatively lower indicators (0.5 percent and 0.7 percent). This diverse trend underscores the United States’ mixed appeal to skilled migrants, with certain regions standing out as magnets for skilled professionals.

Chile’s skilled immigration landscape exhibits a mix of patterns. Regions like Santiago (4.4 percent) and Tarapacá (3.3 percent) stand out in skilled immigration, possibly driven by economic activity and cultural attractions. Conversely, regions like Ñuble (0.6 percent) and Araucanía (0.5 percent) showcase underperformance in skilled immigration.

Mexico’s skilled immigration landscape portrays more consistent patterns. Chihuahua (2.7 percent) stands out with higher skilled immigration indicators, while others show less allure to skilled migrants, such as Colima and Tlaxcala (0.1 percent and 0.1 percent). Latin regions that are close to the United States attract more skilled immigrants.

The data highlights Peru’s similar trend in attracting skilled migrants. Lima (2.2 percent) stands out as a hub for skilled immigrants. Other regions, like Cusco (0.02 percent), Cajamarca (0.02 percent), and Apurímac (0.01 percent), attract essentially no skilled immigrants at all.

Colombia’s skilled immigration trend showcases regional disparities. Bogotá (2.5 percent), La Guajira (2.1 percent), and Norte de Santander (2.0 percent) demonstrate relatively high skilled immigration, potentially due to economic opportunities in urban centers. Meanwhile, Caquetá (0.1 percent) and Chocó (0.1 percent) reflect comparatively lower levels of skilled immigration.

Brazil’s skilled immigration trends are the lowest of all the countries. Regions like Rio de Janeiro (0.3 percent) and Sao Paulo (0.3 percent) present the highest skilled immigration levels, indicating their status as hubs for skilled migrants. Other regions, like Maranhão (0.01 percent) and Piauí (0.01 percent), attract very little skilled immigration.

Figure 6: Performance map in skilled immigration indicator[23]

Professional, Scientific, and Technical Employment

Why is this important? This indicator measures the share of employees working in PTS activities in each region. This includes, for example, engineers, researchers, and lawyers. PTS services include those needed to facilitate the development, implementation, and commercialization of innovations. Automation and globalization also make high-value-added professional services increasingly important in the modern economy. These occupations are highly knowledge-intensive and therefore harder to offshore. States with greater concentrations in these occupations are thus somewhat less threatened by increased levels of globalization.

Figure 7: Share of employees in professional, technical, and scientific services fields, 2019 (%)[24]

The rankings: The data reveal a range of PTS employment across Peru’s regions. Regions such as Lima (6.2 percent), Tacna (4.8 percent), and Arequipa (4.4 percent) showcase higher levels of skilled employment. These regions demonstrate Peru’s growing capacity to attract and accommodate skilled professionals in diverse fields.

Brazil exhibits a similar trend with certain regions leading in PTS employment. Notably, Distrito Federal (4.9 percent), São Paulo (4.4 percent), Santa Catarina (3.9 percent), and Rio de Janeiro (3.8 percent) stand out as hubs for skilled labor. These regions’ higher percentages signal Brazil’s allure as a destination for professionals seeking advanced career opportunities.

Chile’s employment landscape reflects varying degrees of PTS employment. Regions like Santiago (3.4 percent) lead in this aspect, indicating their role as economic and cultural centers. The data underscore Chile’s capacity to provide skilled opportunities in sectors ranging from technology to the arts.

Colombia presents a dynamic picture, with regions such as Norte de Santander (6.8 percent), Caldas (6.6 percent), and Risaralda (6.6 percent) featuring prominently in PTS employment. These regions highlight Colombia’s renowned research and innovation ecosystem, contributing to a robust employment landscape.

The United States’ PTS employment trends vary across its states. Virginia (12.3 percent), Massachusetts (11.0 percent), and Maryland (10.0 percent) stand out with high PTS employment scores, signifying the country’s technological and economic prowess. The data underscore the United States’ appeal to professionals seeking diverse career opportunities.

Figure 8: Performance map in professional, technical, and scientific employment indicator[25]

Manufacturing Labor Productivity

Why is this important? Gross value added (GVA) measures the contribution to GDP made by an individual producer, industry, or sector. This indicator measures the average GVA per manufacturing worker on a purchasing power parity (PPP) basis. Within manufacturing, high-value-added firms are most often capital-intensive, producing more technologically complex products and organizing their workers to take better advantage of their skills. They typically pay higher wages because their workers are more productive, generating greater value for each hour worked. All else being equal, firms with higher value-added levels are more likely to be able to meet global competitiveness challenges. Unfortunately, U.S. manufacturing labor productivity has been in decline for some time, falling by 1.34 percent between 2012 and 2019.[26]

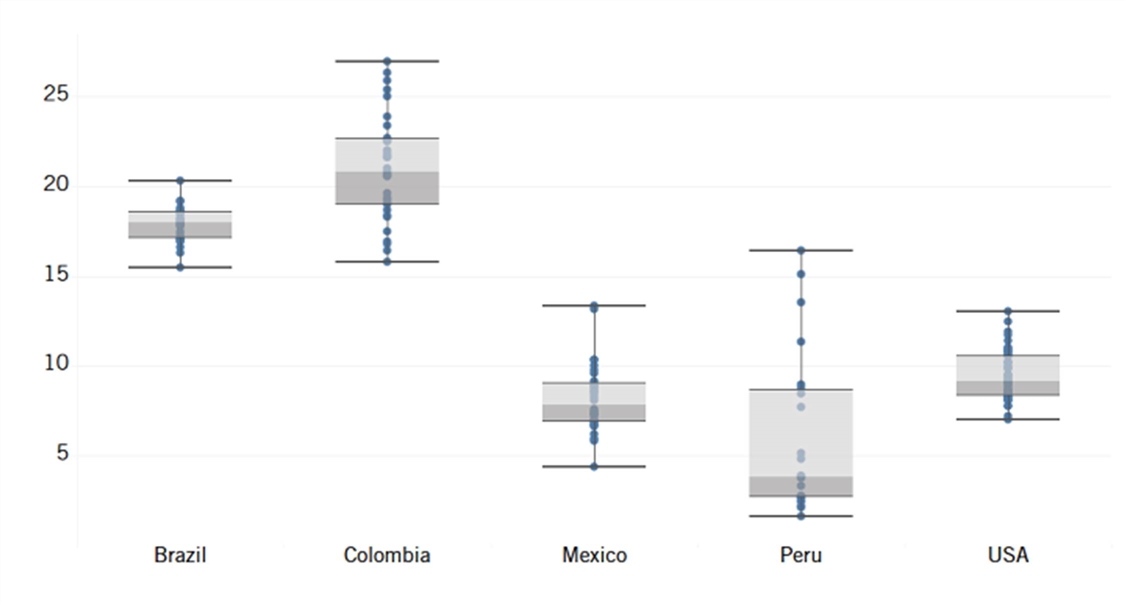

Figure 9: PPP-adjusted gross value added per worker in the manufacturing sector, 2019 (USD)[27]

The rankings: Manufacturing labor productivity in Peru showcases regional differences. Tumbes ($121,726) and Ica ($113,133) among others demonstrate strong productivity, underlining Peru’s industrial prowess, while regions such as Cajamarca ($21,086) and Huancavelica ($8,658) lag significantly behind.

Brazil exhibits notable regional differences in manufacturing labor productivity. Rio de Janeiro ($29,541) and Paraná ($25,695) lead, reflecting their advanced manufacturing sectors. At the bottom are Sergipe and Bahia (both $17,856).

Mexico’s regions display mixed productivity figures. Coahuila ($85,131), Querétaro ($80,815), and Nuevo León ($78,830) are the leading regions in Mexico. By contrast, the regions of Campeche ($8,535) and Guerrero ($5,040) significantly lag behind the rest of Mexico’s regions.

Chile’s manufacturing productivity varies widely across its regions. Tarapacá ($77,949) and Antofagasta ($63,479) excel, spearheaded by their leading mining industries. . Regions like Atacama ($19,967) and Arica y Parinacota ($22,295) exhibit lower productivity, potentially indicating challenges in their manufacturing sectors.

Colombia showcases considerable variation in manufacturing productivity across its regions. Santander ($53,158) and Boyacá ($46,235) lead, reflecting the strength of these regions. Regions like Nariño ($9,915) and La Guajira ($2,295) also stand out as significantly lagging.

U.S. states exhibit significant diversity in their levels of manufacturing productivity. The data reports that states such as Louisiana ($333,712) and Wyoming ($291,511) have the highest levels of manufacturing productivity, although this data is significantly skewed by the prevalence of the oil and gas sectors (such as refining) in these states’ economies. (Unfortunately, to maintain the international comparisons needed for this study, it was not possible to back out the distortive effects of these states’ large energy sectors.) Indiana, Ohio, and Michigan were more indicative of the actual performance of the more manufacturing-oriented U.S. states (with values of $176,518, $152,458, and $147,100, respectively). States like Hawaii ($108,148) and Vermont ($100,084) display comparatively lower manufacturing output, possibly due to their smaller industrial bases.

Figure 10: Performance map in manufacturing labor productivity indicator (no data on Moquegua)[28]

Globalization

High-Tech Exports

Why is this important? This indicator measures a region’s exports in the machinery manufacturing; computer and electronic products manufacturing; and electrical equipment, appliances, and components manufacturing industries (North American Industry Classification System “NAICS” 333–335 or equivalent) as a share of GDP. These represent high-value-added goods that are crucial in the modern global economy. Considering a region’s exports of these goods as a share of its GDP shows to what extent a region has a comparative advantage in high-tech production and export. Moreover, this indicator represents a region’s position in global value chains for the production of these goods.

Figure 11: Exports in NAICS 333–335 (or equivalent) as a share of GDP, 2017 (%)[29]

The rankings: High-tech exports in Peru showcase interesting regional disparities. Lima (0.3 percent) and Ica (0.1 percent), while not a powerhouse in this regard, stand out as scoring highest. Most other regions like Junín (0.001 percent) and Pasco (0.001 percent) have almost no high-tech exports.

Brazil exhibits diverse high-tech export distribution. Regions like Rio de Janeiro (0.6 percent) show potential in technology export, while Sao Paulo (0.8 percent) and Amazonas (0.7 percent) lead the way. By contrast, regions including Pará (0.001 percent) and Bahia (0.002 percent) have hardly any high-tech exports.

Colombia also showcases regional diversity in high-tech exports, with regions such as San Andrés y Providencia (0.2 percent), Atlántico (0.1 percent) and Bogotá (0.1 percent) leading the way. Regions like Boyacá (0.001 percent) and Huila (0.001 percent) have hardly any high-tech exports.

The United States demonstrates a wide range of high-tech export levels among its states. States such as Oregon (5.8 percent) excel due to their technology-driven sectors. However, there are variations, with states like Alaska (0.1 percent) and Wyoming (0.3 percent) indicating room for technological expansion. Wyoming’s very weak performance on this indicator reinforces the point that its high performance on the prior manufacturing labor productivity indicator is highly distorted by its energy sector.

Data was not sufficiently available at the subnational level to include analysis for Chile and Mexico on this indicator.

Figure 12: Performance map in high-tech exports indicator[30]

Inward FDI

Why is this important? This indicator measures the inward FDI a region receives relative to its GDP, measured as the funds an entity in the region receives from a foreign-based entity to purchase, establish, or expand enterprises. Inward FDI not only spurs domestic economic activity but also facilitates technology transfer between foreign-owned enterprises and local establishments. Foreign owners can also introduce domestic firms to new international markets and help regions carve out positions in global supply chains. Inward FDI has also been associated with greater economic growth in market economies and tends to be more productive and induce greater levels of investment by domestic firms.[31]

Figure 13: Inward foreign direct investment as a percentage of GDP, 2017–2018 (average) (%) [32]

Because FDI can be very volatile from year to year, regions’ averages over three years are considered. Measures for each country required varying degrees of estimation; the methods are described in the appendix. This report does not include Colombia, Peru, and Chile for this indicator because regional data was not available for those countries.

Brazil’s FDI trends show very divergent outcomes. Notably, Amazonas (27.6 percent), Paraná (18.7 percent), Minas Gerais (15.2 percent), and São Paulo (14.9 percent) lead the way. By contrast, regions like Rondônia (0.16 percent) and Roraima (0.03 percent) attract essentially no foreign investment.

Mexico showcases a diverse FDI picture across its regions. Zacatecas (3.4 percent) and Baja California Sur (2.6 percent) stand out as the most attractive regions for foreign investors. However, Oaxaca (0.1 percent) and Colima (0.3 percent) show a significantly lower FDI inflow.

The United States, being a major global player, exhibits diverse FDI trends across its states. States like Maine (3.3 percent) and Missouri (3.2 percent) evince high attractiveness to foreign investors. However, some states like Montana (0.2 percent) and Iowa (0.2 percent) show slightly less FDI inflow.

Figure 14: Performance map in inward FDI indicator[33]

Innovation Capacity

Broadband Adoption

Why is this important? This indicator measures broadband adoption—that is, the share of households within each region that subscribe to a broadband Internet connection, either mobile or fixed. (All measures of broadband adoption used include satellite adoption as well). The Internet is now essential to full participation in today’s increasingly digitalized global economy. The COVID-19 pandemic vividly demonstrated how crucial widespread Internet adoption is for societies, enabling telework, tele-education, telehealth, etc. Increased access to the Internet has also been associated with greater productivity and economic growth.[34]

Figure 15: Share of households that have adopted broadband Internet, 2019 (%)[35]

The rankings: Peru showcases a relatively low level of broadband adoption across its regions. Lima (8.7 percent) leads the way, followed by Arequipa (6.3 percent) and Tacna (5.8 percent). These numbers highlight Peru’s need for greater investment in digital connectivity and the accessibility of broadband Internet services.

Brazil’s regions display considerable variation in digital infrastructure. Santa Catarina (34.0 percent) and São Paulo (29.9 percent) stand out as leaders in broadband adoption. By contrast, regions like Maranhão (8.0 percent) and Pará (8.6 percent) lag.

Mexico’s broadband adoption levels vary across its regions. Sonora (83.0 percent) and Baja California Sur (77.7 percent) lead the way, highlighting their focus on digital connectivity. However, regions like Chiapas (16.4 percent) and Tlaxcala (27.5 percent) suggest a need for enhanced efforts to improve broadband access.

Chile’s regions evince mixed broadband Internet adoption rates. Regions like Antofagasta (84.3 percent), Santiago (82.0 percent), and Magallanes (80.6 percent) lead the way, while others like Araucanía (63.1 percent) and Maule (63.2 percent) show room for improvement in digital infrastructure.

Colombia exhibits significant regional diversity in digital connectivity, with many regions showcasing low broadband adoption rates, like Vaupés (1.3 percent) and Vichada (4.5 percent). Bogotá (76.9 percent) and Antioquia (58.8 percent) stand out as leaders in digital integration.

The United States showcases a less-diverse range of broadband adoption rates across its states. Washington (91.2 percent), Colorado (91.0 percent), and California (89.8 percent) lead the way, indicating their strong digital infrastructure. States like Mississippi (76.8 percent) and Louisiana (80.6 percent) show room for improvement in broadband adoption, but still perform considerably ahead of most Latin American regions.

Figure 16: Performance map in broadband adoption indicator[36]

R&D Intensity

Why is this important? This indicator measures R&D expenditures in a region relative to its GDP considering R&D expenditures by all sectors: business, government, and higher education. R&D lies at the heart of innovation, as it represents the source of the new knowledge needed to discover, design, and implement innovative technologies and products. R&D results in slightly higher private returns and much larger social returns than other types of investment as new knowledge and technology spill over to the rest of an economy.[37]

Figure 17: R&D expenditures as a share of GDP, 2019 (%)[38]

The rankings: Peru’s regions display varying levels of R&D intensity. Amazonas (0.7 percent) and Ayacucho (0.3 percent) lead in prioritizing research and innovation, while Tacna (0.01 percent), Huánuco (0.01 percent), and Apurímac (0.02 percent) have almost no R&D activity, suggesting potential areas for increased focus on research-driven growth.

Brazil displays noticeable variation in commitment to R&D across most of its regions. Rio de Janeiro (1.2 percent) and São Paulo (1.2 percent) lead the way, indicating potential in R&D.

Mexico’s regions demonstrate varying degrees of R&D intensity. Coahuila (1.0 percent) leads in research intensity, while regions like Oaxaca (0.1 percent) and Chiapas (0.1 percent) exhibit lower emphasis on research activities.

Chile’s regions reflect a diverse approach to R&D. Los Ríos (0.8 percent) and Santiago (0.6 percent) lead in innovation efforts, while regions like Atacama (0.03 percent) and Aysen (0.01 percent) have room for improvement in boosting research activities.

Colombia varies in research and development across its regions. Vaupés (2.5 percent) leads in R&D intensity. By contrast, Putumayo (0.02 percent) and Vichada (0.01 percent) have almost no R&D activity.

The United States exhibits varied R&D intensity across its states. New Mexico (7.5 percent), Washington (6.9 percent), and Massachusetts (6.6 percent) lead in research emphasis, while states like Louisiana (0.6 percent) and Oklahoma (0.9 percent) have comparatively lower focus on research activities.

Figure 18: Performance map in R&D intensity indicator[39]

R&D Personnel

Why is this important? This indicator measures the number of R&D personnel as a share of all employees in each region. R&D personnel are indispensable to conducting R&D activities and turning investments into new productivity-enhancing knowledge and technologies.

Figure 19: R&D personnel as a share of total employees, 2017–2018 (%)[40]

The rankings: Peru’s regions exhibit varying levels of R&D personnel. Ucayali (0.1 percent) leads in terms of human resources dedicated to R&D in Peru, while Lambayeque (0.002 percent), Cajamarca (0.001 percent), and Huánuco (0.001 percent) have lower levels, suggesting potential areas for increased investment in skilled researchers.

Mexico’s regions display differing levels of R&D personnel. Nuevo León (0.2 percent) and Querétaro (0.2 percent) lead in allocating human resources to research, while regions like Chiapas (0.03 percent) and Oaxaca (0.02 percent) have comparatively fewer personnel dedicated to R&D.

Chile’s regions showcase diverse approaches to R&D personnel. Santiago (0.3 percent) and Los Ríos (0.2 percent) stand out with comparatively greater human resources allocated to research, while regions like Atacama (0.02 percent) and Aysen (0.01 percent) trail.

Colombia’s regions exhibit a commitment to research with substantial human resources allocated. Boyacá (0.6 percent) and Bogotá (0.5 percent) have the highest levels of R&D personnel, while Córdoba (0.1 percent) and Cauca (0.1 percent) have comparatively fewer R&D personnel.

The United States showcases varying levels of R&D personnel across its states. Washington (3.2 percent) and Massachusetts (2.6 percent) lead in human resources dedicated to research, while states like Alaska (0.4 percent), Arkansas (0.5 percent), and West Virginia (0.7 percent) have relatively fewer personnel engaged in R&D activities.

Figure 20: Performance map in R&D personnel indicator[41]

Patent Applications

Why is this important? This indicator measures international Patent Cooperation Treaty (PCT) patent applications filed by residents or entities within a region per one million residents. Patent output measures the “inventiveness” of a population. Patents also secure private returns on investment in R&D activities, which are necessary to incentivize these activities and their socially desirable spillover effects. By considering PCT patents, this indicator focuses on internationally filed patents to mitigate differences in patent qualifications between countries’ patent offices.

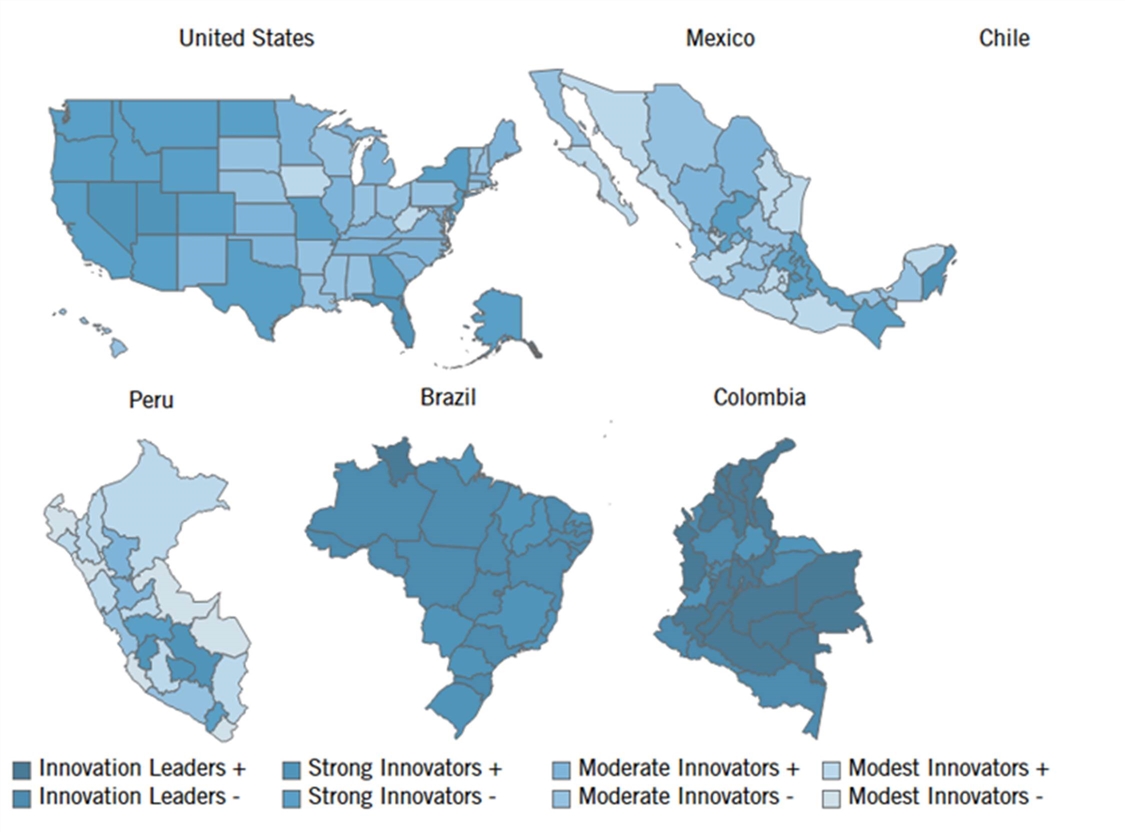

Figure 21: PCT patent applications per million residents, 2015[42]

The rankings: Patent applications vary across Peru’s regions, with Lima (18.1) and Arequipa (17.5) leading in terms of innovation activity, at least as expressed through patent filings. Cajamarca (0.6) and Piura (0.5) have very few applications, suggesting potential areas for increased focus on innovation.

Brazil’s regions vary in terms of patent application intensity. Santa Catarina (78.9) and Rio Grande do Sul (64.0) are standout regions in terms of patent filings, showcasing comparatively strong efforts in intellectual property (IP) creation and technological advancement.

Mexico demonstrates varying levels of patenting activity across its regions. Sonora (23.9) leads in patent filings, while regions like Durango (0.3), Guerrero (0.1), and Chiapas (0.03) show room for potential improvement in innovation efforts.

Chile’s regions exhibit diverse scores in patenting activity. Santiago (18.3) and Valparaíso (9.0) lead in patent applications, while Araucanía (1.0) and Coquimbo (1.1) show lower levels, suggesting opportunities for increased focus on IP creation.

Colombia displays significant variation in innovation across its regions. San Andrés y Providencia (32.6) leads in patent applications, while regions like Cauca (0.7) and Atlántico (0.4) evince very few patent applications.

The United States demonstrates varying levels of innovation across states. Massachusetts (502.4) and California (379.9) lead in patent applications, while states like Arkansas (32.4), Mississippi (20.0), and Alaska (12.2) have comparatively fewer patent filings, highlighting areas with potential for growth in IP creation.

Figure 22: Performance map in patent applications indicator[43]

Business Creation

Why is this important? A thriving business ecosystem should experience a high volume of business start-ups. This indicator measures the share of a region’s business enterprises that were established in the past year. The business creation indicator is limited in scope to new businesses, without capturing business turnover resulting from the market disruption and creative destruction that forces incumbents to innovate or leave the market. Thus, the full impact of business competition on innovation is not captured. Moreover, this metric does not differentiate between industries, so there is no differentiation between creation rates in advanced, innovative industries and those in less-advanced industries. Absent a better alternative at the cross-national regional level, this indicator reflects a region’s overall economic resilience and regional competitiveness.

Figure 23: Economy-wide enterprise birth rate, 2016–2018 (%)[44]

The rankings: Business creation rates in Peru vary across regions, with Cusco (16.4 percent) and Huancavelica (15.1 percent) leading in fostering new businesses. Tumbes (1.6 percent) and Tacna (2.1 percent) show relatively lower rates, suggesting potential for increased entrepreneurial efforts.

Brazil demonstrates a balanced entrepreneurial environment, with all regions having moderate business creation rates. Roraima (20.3 percent) and Amazonas (19.2 percent) have relatively higher rates, indicating favorable conditions for startups.

Mexico exhibits consistent entrepreneurial efforts across its regions. Quintana Roo (13.1 percent) and Tlaxcala (13.4 percent) stand out, showing a strong commitment to new business ventures.

Colombia’s regions exhibit balanced entrepreneurial activities. Magdalena (26.3 percent) and Sucre (26.9 percent) lead, highlighting their vibrant startup ecosystems, while San Andrés y Providencia (16.8 percent), Santander (16.4 percent), and Bogotá (15.8 percent) show potential for further development.

The United States displays diverse entrepreneurial dynamics. Nevada (13.1 percent) and Florida (12.5 percent) lead in business creation, showcasing their entrepreneurial appeal, while Ohio (7.8 percent) and Iowa (7.2 percent) have comparatively lower rates, indicating scope for growth in their startup activity.

Figure 24: Performance map in business creation indicator[45]

Carbon Efficiency

Why is this important? As the world endeavors to combat climate change, decarbonization is of paramount importance. Regions’ ability to innovate sustainably to achieve a reduction in and the efficient use of carbon and other greenhouse gases will determine their long-term competitiveness, as well as their national economic prosperity. This indicator measures carbon dioxide (CO2) and other greenhouse gas efficiency per unit of output (as measured by PPP-adjusted GDP). It is noted that more-developed regions may have a slight advantage in this indicator due to their somewhat-more service-oriented economies. As policymakers look to improve efficiency and reduce overall emissions, they will take their lead from those regions that are devising new solutions and innovative technologies.

Figure 25: Metric tons of greenhouse gas (measured in CO2 equivalents) emitted per $10,000 of PPP-adjusted GDP, 2018[46]

The rankings: Brazil exhibits significant variation in carbon efficiency across its regions. Regions like Distrito Federal (0.5) and São Paulo (1.2) lead in carbon efficiency, displaying a national commitment to environmental responsibility. By contrast, regions like Acre (58.4) and Rondônia (58.5) exhibit a need for greater investment in reducing greenhouse gases.

Mexico displays diverse carbon efficiency levels across its regions. Regions like Colima (1.1) and Aguascalientes (1.3) exhibit the lowest carbon footprints. By contrast, Coahuila (17.4), Hidalgo (9.2), and Campeche (9.1) have much higher levels of greenhouse gases.

Chile demonstrates a range of carbon efficiency levels. Regions like Santiago (0.9) and O’Higgins (2.0) display lower greenhouse gas emissions, while Atacama (13.1) and Ñuble (11.2) exhibit a much-greater carbon footprint.

Colombia showcases varying carbon efficiency across its regions. Regions like Bogotá (0.4) and San Andrés y Providencia (0.5) exhibit the lowest greenhouse gas emissions, while regions like Vichada (33.7) display a need for more investment in this regard.

The United States presents a diverse range of carbon efficiency levels across its states. While states like Massachusetts (1.2) and California (1.4) demonstrate strong carbon efficiency, states like Wyoming (23.5) and North Dakota (15.6) face more significant challenges in reducing their carbon footprint.

Figure 26: Performance map in carbon efficiency indicator[47]

Venture Capital

Why is this important? This indicator examines a region’s total venture capital investment (measured as VC-receiving firms) relative to the size of its GDP. VC represents a form of business financing wherein investors provide funds to early-stage companies in exchange for equity in their firms. Given the considerable uncertainty regarding start-ups’ success potential, VC investment assumes higher risks than other forms of investment. Accordingly, VC investment is often intended for companies with real or perceived high-growth potential, often associated with their innovative technology use or business model design. A region’s receipt of VC investment reflects both the innovativeness of its start-up ecosystem as well as the commitment of its firms to lead in crucial technologies such as AI, biotechnology, clean energy, advanced manufacturing, and robotics. Due to the volatility of VC investment from year to year, this report considers regions’ average scores between 2017 and 2019.

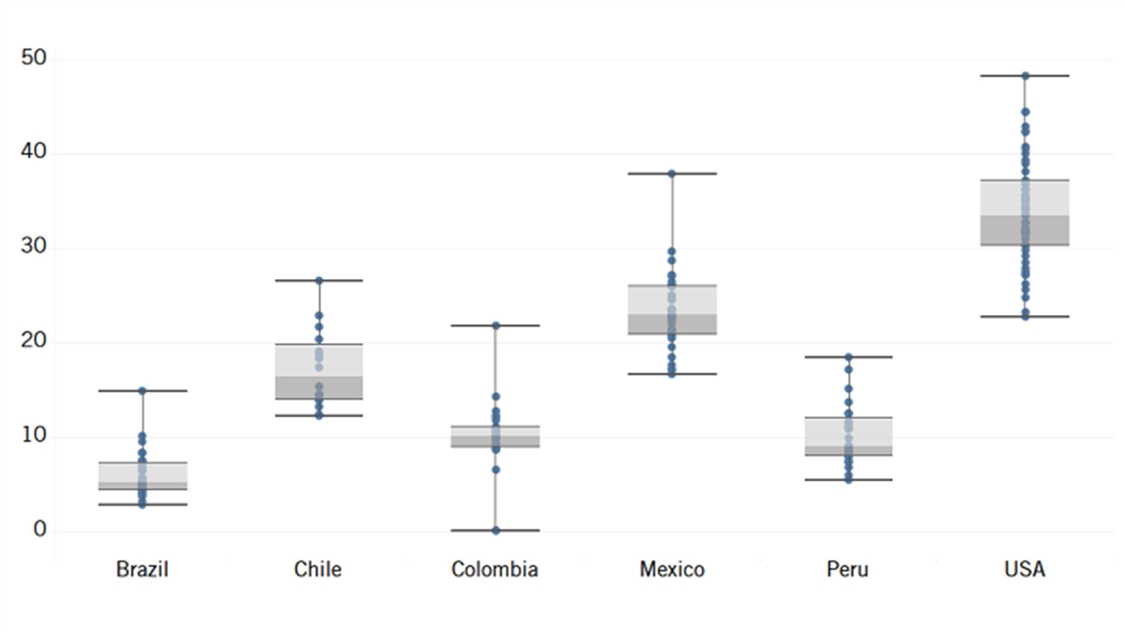

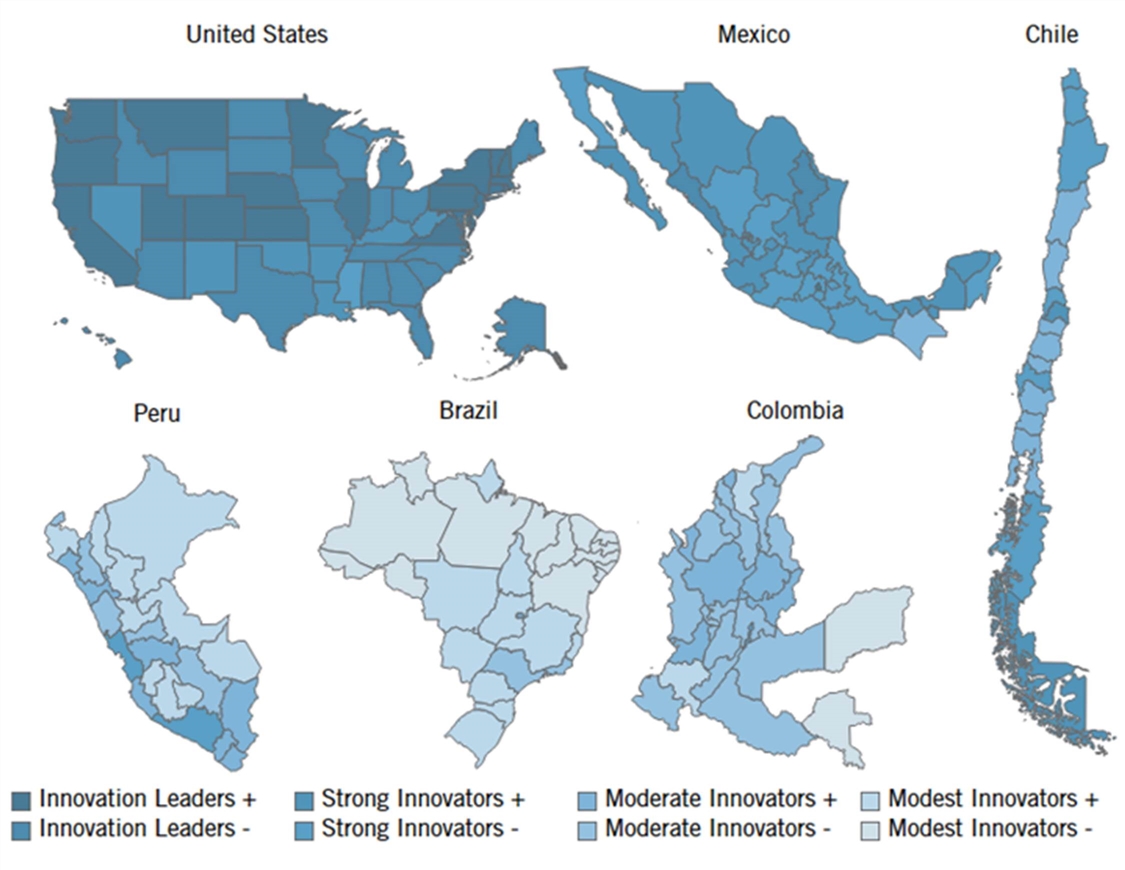

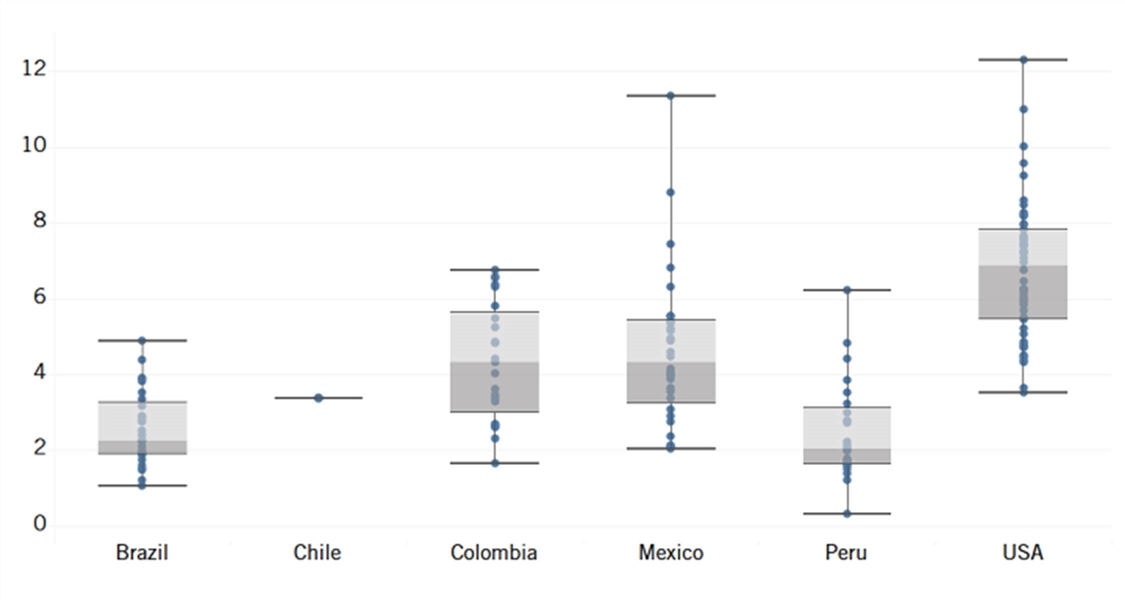

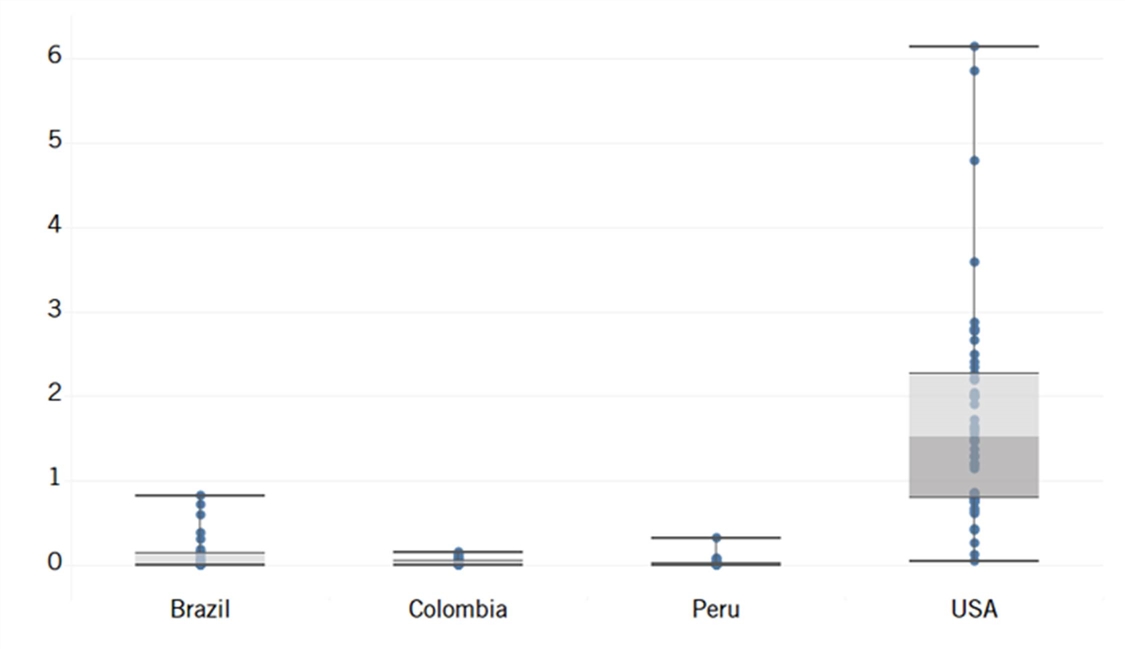

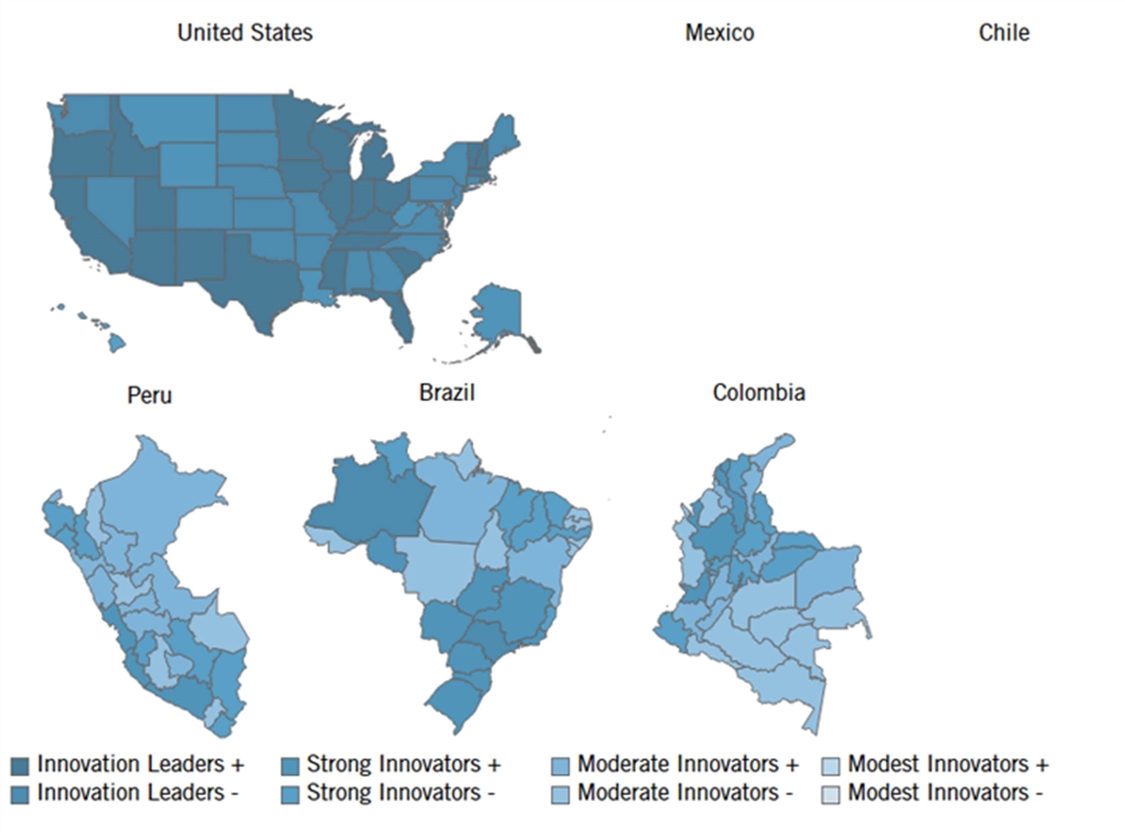

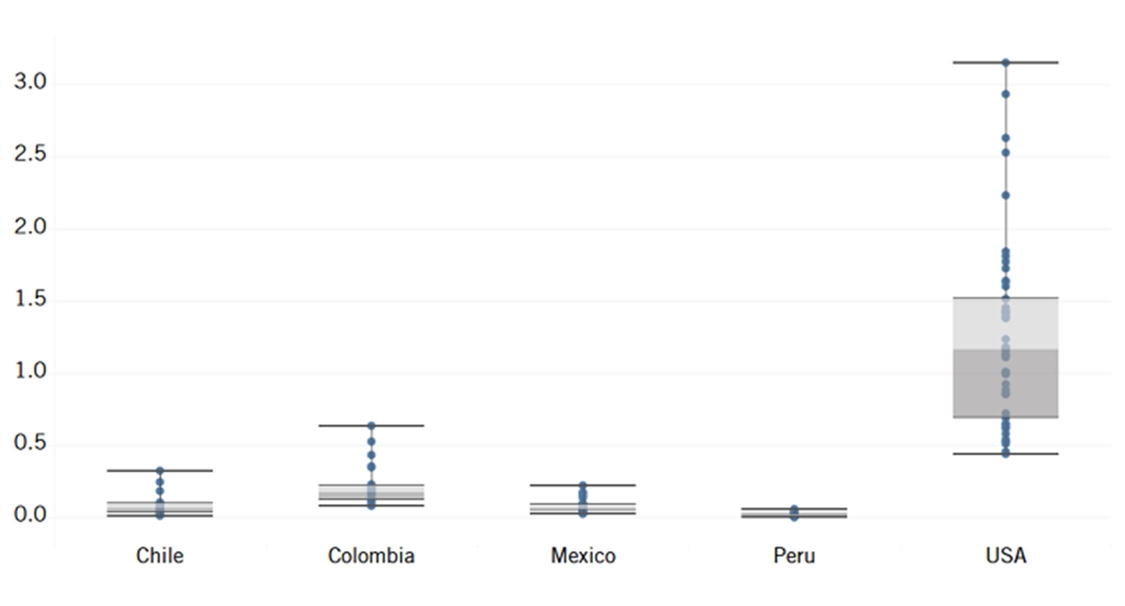

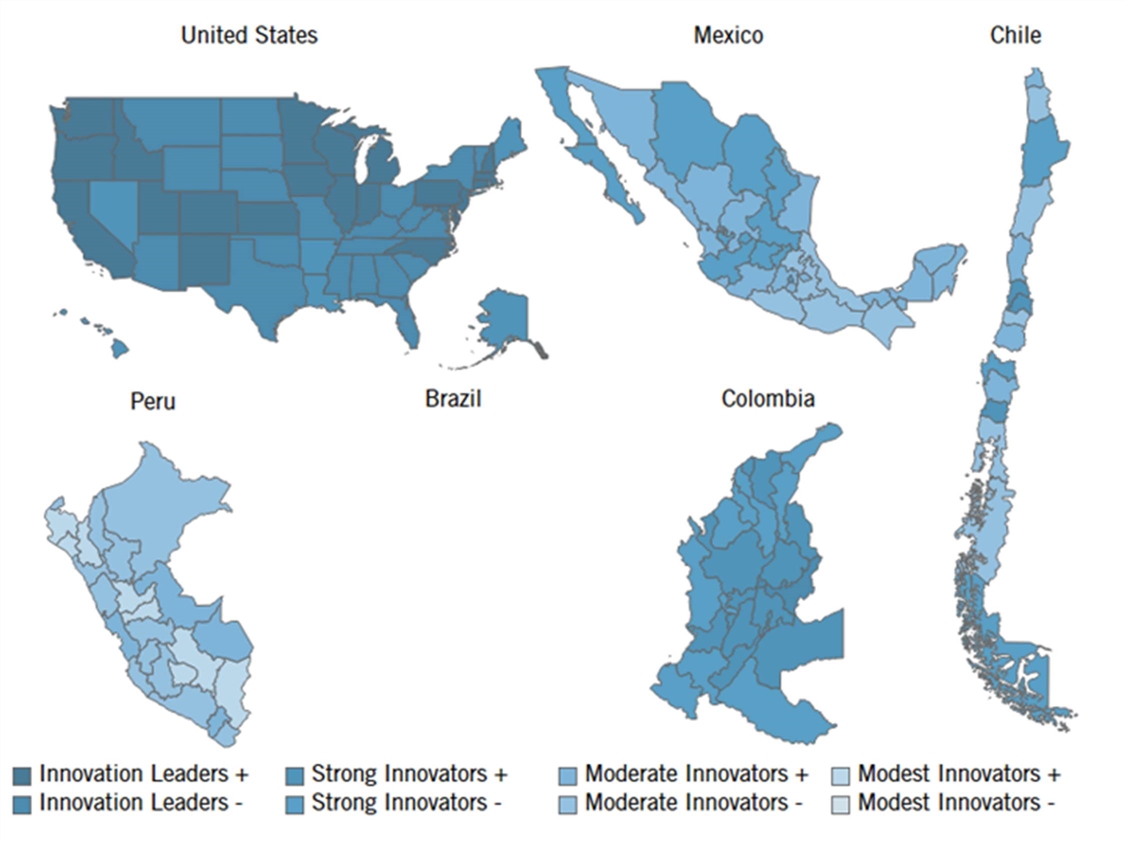

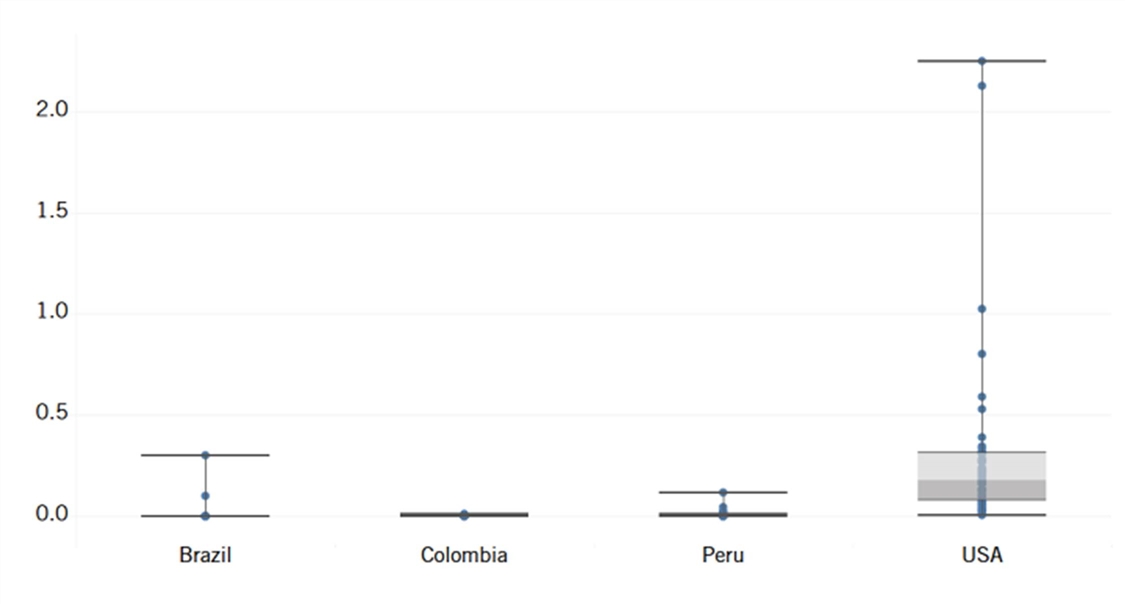

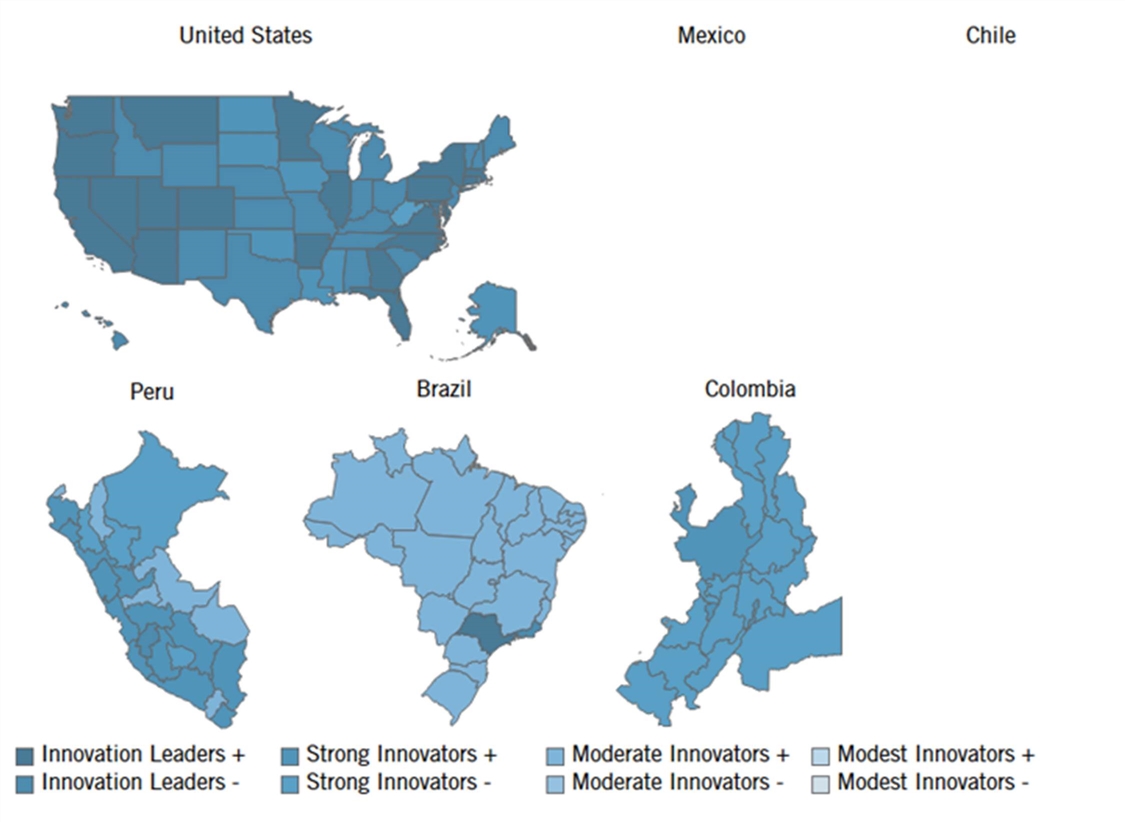

Figure 27: Venture capital investment received as a percentage of GDP, 2017–2019 (average) (%)[48]

The rankings: Peru’s regions exhibit varying levels of venture capital attraction. Huancavelica (0.12 percent) leads the way in venture capital influx. Meanwhile, many regions like Apurímac (0.004 percent) and Loreto (0.003 percent) attract almost no venture capital at all.

Brazil displays venture capital attraction in only a couple of areas. São Paulo (0.30 percent) and Rio de Janeiro (0.10 percent) lead the country, indicating robust entrepreneurial activities. However, most of the other regions show essentially no venture capital involvement.

Colombia demonstrates varying degrees of venture capital engagement across its regions. Bogotá (0.01 percent) leads the way for start-ups and innovative ventures, while regions like Cauca (0.0002 percent) and Magdalena (0.0003 percent) attract very little venture capital.

The United States showcases a robust venture capital landscape. States like Massachusetts (2.13 percent) and California (2.25 percent) lead the nation in attracting venture funding, reflecting their status as global tech and innovation hubs. Other regions like New York (1.03 percent), Utah (0.80 percent), and Texas (0.20 percent) also display substantial venture capital activities.

Figure 28: Performance map in venture capital indicator[49]

Policy Recommendations

Brazil

Knowledge Economy

Analysis of the knowledge economy component brings to light troubling trends concerning Brazil’s subpar indicators related to a highly educated population and its lackluster manufacturing labor productivity.

To effectively tackle these challenges and cultivate a heightened sense of competitiveness and innovation within the knowledge economy, it is imperative to adopt a focused and specific policy strategy. Addressing the shortcomings in highly educated population indicators and manufacturing labor productivity demands a comprehensive approach that underscores the importance of educational excellence, continuous lifelong learning, robust collaboration between industries and academia, all while embracing technological advancements. Additionally, promoting greater trade openness can invigorate industry competition, subsequently fostering remarkable strides in productivity gains.

Globalization

Brazil possesses the potential within its subnational regions to foster innovation, cultivate economic diversification, and bolster its global competitive standing. This transformation can give rise to a more harmoniously integrated and thriving business ecosystem at the subnational level, thereby making a substantial contribution to the country’s growth trajectory and its resilience on the international stage.

Within this context, the globalization component of the analysis has shed light on substantial challenges, including the country’s struggling indicators of high-tech exports and the uneven distribution of inward FDI across its states. Considering these obstacles, there arises a pressing need to adopt a strategic and focused policy approach that can galvanize Brazil’s international competitiveness.

While Brazil has made notable strides in business creation, the metrics concerning broadband adoption, R&D intensity and personnel, patent applications, carbon efficiency, and venture capital indicate areas warranting attention.

This should entail a comprehensive strategy that includes the promotion of high-tech exports, the orchestration of targeted trade missions, bolstering the capabilities of high-tech industries through capacity-building initiatives, nurturing collaborative industry clusters and special economic zones, aligning and coordinating policies across various levels of governance, and establishing regional investment promotion agencies.

Innovation Capacity

The innovation capacity component underscores a diverse spectrum of challenges and opportunities among Brazilian states. While Brazil has made notable strides in business creation, the metrics concerning broadband adoption, R&D intensity and personnel, patent applications, carbon efficiency, and venture capital indicate areas warranting attention.

Brazil possesses the potential to bolster its subnational innovation capacity, cultivating an environment conducive to sustainable growth, technological progress, and inclusive development. To achieve this, a comprehensive approach encompassing improved infrastructure, heightened R&D investment, fortified IP protection legislation and IP culture, sustainable practices (particularly in the Amazon region, the mining sector, and the agribusiness sector), tailored support for start-ups beyond São Paulo and Rio de Janeiro, and amplified access to venture capital is all imperative. These strategic measures would undoubtedly fuel innovation and empower states across the nation to flourish amidst the swiftly evolving global landscape.

Chile

Knowledge Economy

Despite Chileans acceding to higher education as no previous generation had, there is still an important percentage of the labor force that does not have a bachelor’s degree. On the other hand, the quality of school education is below the level of most Organization for Economic Cooperation and Development (OECD) members.[50] Both are reasons that explain the low labor productivity in Chile when compared with developed countries.[51]

To cope with these problems, the government should promote measures to improve the quality of education, especially in math; increase the percentage of formal workers by making the labor market more flexible—Chile has one of the highest costs for hiring and firing employees—and; in general, promote macro- and microeconomic conditions to elevate the labor productivity.

Regarding the attraction of talent from abroad, the percentage of immigrants with tertiary education is less than 3 percent. There exists tremendous room for improvement in advancing incentives to attract more skilled immigrants by targeting visas and simplifying the current process of receiving work authorizations. Moreover, the maximum of 15 percent of workers of a firm that can be foreigners is a restriction that should be removed.

Globalization

Chile has free trade agreements with most of the major economies in the world and recently joined the Comprehensive and Progressive Transpacific Partnership (CPTPP). However, its percentage of high-tech exports remains under 1 percent. In turn, exports of high-quality professional services have exhibited a significant increase in recent years and successive legal reforms have facilitated this development.

Chile has an open and transparent institutional framework to receive foreign investment and the government provides support to be able to manage the corresponding permits to materialize the investment.

The current administration has announced tax and permit management reforms to facilitate the entry of new foreign investment, which should be put in place as soon as possible.[52]

Innovation Capacity

Chile ranks higher than its peers in broadband adoption due to a competitive market of providers. The R&D activity in Chile is like in Peru, Colombia, and Mexico, and reflects the structure of the Chilean economy based on exploitation of natural resources.

The current government is trying to push more investment in R&D, but the incentives proposed are small and incoherent with other policies—such as the significant increase in tax collection that has been discussed recently. Chilean policymakers should consider working toward an easier tax scheme and reduction of firms’ taxes to spur a rising interest in investing in VC.

The government has a program that seeks to increase advanced human capital for the development of science and technology in the country by financing postgraduate scholarships in Chile and abroad for graduates or professionals demonstrating academic excellence. Graduates are mainly incorporated into universities, and it is desirable that there is more hiring in private companies.

Ten years ago, a reform was implemented that created a digital platform to create a company in one day and at no cost. However, it is still necessary to reduce the bureaucracy in other kinds of authorizations that are necessary to run a business, such as those required by local governments.

On the other hand, the disparity in carbon efficiency among the regions reflects the main industries in each region and the availability of renewable sources of energy. Chile has a real chance to be an important player in the green hydrogen industry and remain an important producer of copper and lithium, which are key elements to the energy transition. However, there are bottlenecks in lithium production and the green hydrogen strategies that the government needs to solve soon to take advantage of its benefits.

Chile has free trade agreements with most of the major economies in the world and recently joined the Comprehensive and Progressive Transpacific Partnership (CPTPP).

VC investment has experienced remarkable growth in recent years. The VC funds, the number of deals, and success stories are increasing, and each year the VC ecosystem in Chile consolidates and expands. This has allowed the creation and development of great opportunities, recently highlighting several startups that are raising rounds at high valuations—including a couple of unicorns—reflecting an explosive and unprecedented growth for Chile.

It is very important to promote the participation of institutional investors in local private investment funds without the current restrictions. Chile should transition from the current intensive scheme of governmental contributions to a system where private investment is encouraged, but also allow private pension funds—among other institutional investors—to be released from regulatory restrictions and have the incentives to invest in VC.

Colombia

Knowledge Economy

Colombia faces low levels of access to tertiary education among its population. This issue is a direct consequence of the significant challenge of expanding the tertiary educational coverage in Colombia. Particularly, this has led to the concentration of the educated population in a few cities in Colombia. This can be seen in regions like Bogotá, Atlántico, Valle, and Antioquia. This challenge might be addressed through public policies aimed at allocating a larger budget for education in regions away from major cities. This will help generate a larger pool of professionals for the labor market.