How Skeptics Misconstrue the Link Between Drug Prices and Innovation

A recent article in the British Medical Journal contends “high drug prices” are neither necessary nor justified to sustain biopharmaceutical innovation. But it misrepresents and misinterprets the facts, highlighting how faulty the rationale is for drug price controls.

KEY TAKEAWAYS

Key Takeaways

Contents

Marketing and Stock Buybacks. 7

The Purported “Innovation Crisis”. 9

Introduction

A recent article in the British Medical Journal (BMJ) asserted, “High drug prices are not justified by industry’s spending on research and development.”[1] The article, authored by Aris Angelis and colleagues, was the latest salvo in an escalating battle that skeptics have been waging to contend that market-driven drug pricing is neither necessary nor justified to sustain biopharmaceutical innovation.[2] But like the others that have come before it, the recent BMJ article advances a faulty analysis that misconstrues the essential link between drug prices, research and development (R&D), and innovation.

This debate is not just an academic exercise; it has far-reaching implications for policymaking that affects public health. Many policymakers in the United States and other nations around the world have accepted the skeptics’ arguments and have imposed or are considering drug price controls that may provide lower costs for consumers in the near term but reduce the number of new treatments and cures available to citizens in the long term.[3] Against this backdrop, it is important to carefully examine the skeptics’ claims.

The authors of the BMJ article assert that U.S. drug prices are rising precipitously, and that the profits of biopharmaceutical manufacturers are excessive. But they ignore the reality of what America’s biopharmaceutical supply chain looks like today—including the roles played by wholesalers, pharmacies, pharmaceutical benefit managers (PBMs), and insurance companies—and they fail to acknowledge that pharmaceutical manufacturers are retaining significantly less in net prices as a result. In fact, drug manufacturers are no more profitable than the average American company, even though they invest more in R&D than firms in any other sector of the economy. Nevertheless, the authors assert three main reasons they believe high drug prices are unjustified: First, they say companies spend excessively on stock buybacks and marketing. Second, they say too many new drugs provide little therapeutic value. Third, they say companies rely heavily on expensive “niche-buster” drugs.

Each of these claims is either wrong or significantly overstated.

Drug Price Changes

First, the authors argue that average spending on prescriptions for brand name drugs is significantly on the rise in the United States. As evidence, they cite data showing that 1,216 drugs increased in price by an average of 31.6 percent from July 2021 to July 2022.[4] Elsewhere, they cite research asserting that launch prices increased from $1,400 to $150,000, on average, between 2008 and 2022.[5]

But statistics such as those mistakenly rely on Wholesale Acquisition Costs (WAC), which are manufacturers’ list prices for wholesalers, not the net prices that wholesalers actually pay—which include manufacturer discounts and rebates, distribution fees, discounts to hospitals, and other significant purchase discounts such as the 340B Drug Pricing Program. The data the authors provide therefore drastically overestimates drug price increases. Net prices should be the central consideration when examining drug price trends because they reflect manufacturers’ actual revenues (and therefore their capacity to reinvest in R&D and future innovations).

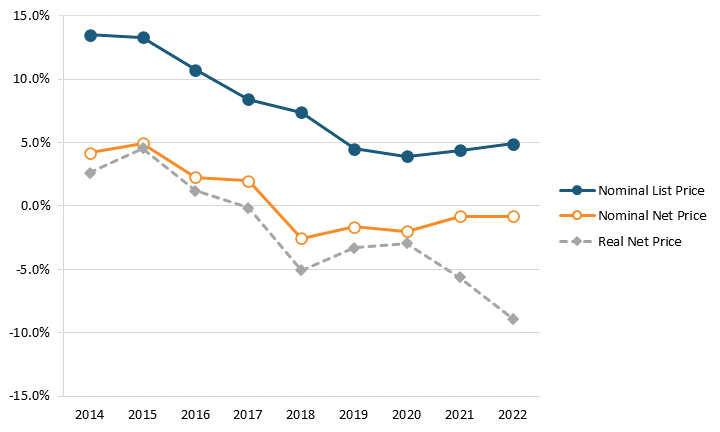

Factoring net prices, contrasting research finds that U.S. drug prices are rising far less than the BMJ article’s authors assert. For instance, Adam Fein at Drug Channels has found that the growth in both list and net prices for drugs decreased from 2014 to 2021 and that net prices actually fell each year between 2018 and 2022. Specifically, the year-over-year growth rate in list prices fell from 13.4 percent in 2014 to 4.3 percent in 2021, and the year-over-year growth rate in net prices fell from 4.6 percent to -1.2 percent.[6] (See figure 1.) Furthermore, a recent report from the IQVIA Institute found, “Net manufacturer prices—the cost of medicines after all discounts and rebates have been paid—were unchanged in 2022 and continued below inflation for the fifth year.”[7] This highlights the expanding difference in the drug prices paid by wholesalers (disregarding any rebates) and prices paid by consumers, which has contributed to the growing misconception that brand-name drug prices are skyrocketing.

Figure 1: Change in average list and net prices of brand-name drugs, 2014–2021[8]

The IQVIA Institute report also noted that, “Overall U.S. annual average inflation increased sharpy in 2021 and remains high, but net price growth for drugs is notably not following the same patterns in the wider economy.”[9] This dispels the canard that some drug price control advocates have asserted that drug prices have been a key driver of the spiraling inflation rates that have gripped the United States in recent years. For instance, according to the Bureau of Labor Statistics (BLS), over the 12-month period from May 2021 to May 2022, U.S. consumer prices for all goods increased by 8.6 percent, while prescription drug prices rose only 1.9 percent.[10]

At the individual level, according to BLS, data shows that American consumers’ out-of-pocket drug costs are actually at an all-time low relative to total U.S. health spending.[11] Furthermore, from 2005 to 2020, Americans’ reported expenditures on health insurance increased by over 160 percent while their total health-care expenditures increased 94 percent, yet consumer expenditures on drugs actually fell by almost 9 percent over that period.[12] Of course, this does not necessarily mean overall drug expenditures fell, because health insurance and hospitals also purchase drugs, but it does address consumers’ out-of-pocket costs.

To be sure, there are cases where individuals confront large and sudden medical bills: One study found that nearly 40 percent of commercially insured individuals incurred half of their annual out-of-pocket spending in one day, and 26 percent incurred 90 percent of their annual health-care spending in only one or two encounters.[13] (This is why policies such as “smoothing” Medicare beneficiaries’ out-of-pocket costs over the course of a year so that a beneficiary wouldn’t potentially have to pay as much as $2,000 in a single month, for instance, were certainly warranted.)[14] Yet, overall, the data shows that American consumers’ out-of-pocket expenditures on drugs over the past two decades have grown at a fraction of their overall health-care and health insurance expenditures.

Brownlee’s research shows that less than 50 cents of every dollar Americans spend on drugs goes to the companies dedicated to innovating and manufacturing them.

Furthermore, the distinction between net prices and list prices is critical because while list prices may be on the rise, the share of expenditures being paid to manufacturers is lower than before. For instance, Andrew Brownlee at the Berkely Research Group found that the share of revenues accruing to drug manufacturers for all drugs decreased by over 17 percentage points from 2013 to 2020, from 66.8 percent to 49.5 percent, while the share going to intermediaries (wholesalers, pharmacies, PBMs, and insurance companies) increased from 33.2 to 50.5 percent.[15] In other words, less than 50 cents of every dollar Americans spend on drugs actually goes to the companies innovating and manufacturing them. Overall, Brownlee found that brand manufacturers retain just 37 percent of total spending on all prescription medicines, including brand and generic medicines.[16] Similarly, researchers at the University of Southern California (USC) Schaeffer Center examined the “net price” of insulin, finding that list prices did increase between 2014 to 2018, but that the share of insulin drug sales flowing to manufacturers decreased, with more than half of insulin expenditures going to intermediaries by 2018.[17] Indeed, there has been a 140 percent increase in insulin list prices over the past eight years, but net prices actually declined by 41 percent, casting a new light on Angelis and colleagues’ argument that “old and common drugs” like insulin “have seen inexplicable price increases.”[18]

To be sure, the aforementioned IQVIA Institute report did note that, “New products, including 268 new active substances that launched from 2018 through 2022, contributed $83.5 billion to spending at manufacturer net prices over the past five years.”[19] However, it simultaneously noted that, “Losses of Exclusivity (LOE), or patent expirations, typically result in a dramatic shift of volume to generics and lower brand sales for originator. These contributed to a decline of $82.8 billion to manufacturer net revenues [over that same period.]”[20]

But this underscores the key virtue of the drug pricing system the United States has created over the past four decades, especially since the introduction of the Drug Price Competition and Patent Term Restoration Act, also known as the Hatch-Waxman Act, in 1984. The system allows innovators to recoup their upfront investments in the R&D required to create new drugs (and recover the cost of those that fail) while also generating sufficient revenues to invest in further R&D for future generations of drugs. The system does this while also creating a pathway for lower-priced generics to enter the market when the original patents expire. As Jack Scannell, a senior fellow at Oxford University’s Center for the Advancement of Sustainable Medical Innovation (CASMI), aptly frames this dynamic: “I would guess that one can buy today, at rock bottom generic prices, a set of small-molecule drugs that has greater medical utility than the entire set available to anyone, anywhere, at any price in 1995.” He continues, “Nearly all the generic medicine chest was created by firms who invested in R&D to win future profits that they tried pretty hard to maximize; short-term financial gain building a long-term common good.”[21]

The system allows innovators to recoup their upfront investments in the R&D required to create new drugs (and recover the cost of those that fail) while also generating sufficient revenues to invest in further R&D for future generations of drugs.

This explains why the United States leads the world in the four essential facets of the biopharmaceutical economy: 1) innovating new drugs; 2) getting them to patients first; 3) sustaining a globally competitive industry; and 4) making drugs broadly affordable over time by incentivizing competition and creating generic pathways.

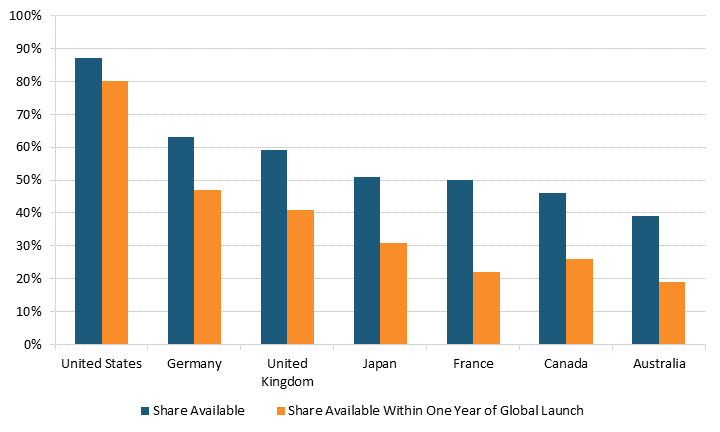

Indeed, in focusing solely on drug prices, the authors of the BMJ article neglect to mention that Americans enjoy access to innovative medicines far earlier than citizens in other nations do.[22] For instance, 87 percent of new medicines launched globally from 2011 through year-end 2019 were available first in the United States, a wide gap over Germany and the United Kingdom, at 63 and 59 percent respectively, with percentages declining to as low as 46 percent in Canada and 39 percent in Australia. (See figure 2.) Considering the percentage of drugs available within one year of their global launch, U.S. residents again enjoyed the greatest access, with 80 percent of drugs available to them first, followed by Germany and the United Kingdom at 47 and 41 percent, respectively, and again Canada and Australia trailing at 26 percent and 19 percent, respectively. For these medicines, the average delay in availability averaged 0 to 3 months from launch in the United States, 10 months in Germany, 11 in the United Kingdom, 15 in Canada, 16 in Japan, 18 in France, and 20 in Australia.

Figure 2: National availability of new medicines first launched globally from 2011 to year-end 2019[23]

Industry Profitability

Data that accurately reflects the R&D-intensive nature of the biopharmaceutical industry further refutes Angelis et al.’s contention that the industry is excessively profitable. While the authors acknowledge that accounting for pharmaceutical profits is complicated, they only offer data that provides an incomplete picture of such comparisons. To wit, they cite an article from the Journal of the American Medical Association Network, which found that 35 “large” pharmaceutical companies were more profitable than non-pharmaceutical public companies between 2010 and 2018. But this assessment suffers from survivorship bias, addressing only 35 companies which by definition are not representative of the over 700 publicly traded U.S. biotech and pharmaceutical firms, some of which went bankrupt during this period because their drugs did not come to market.

Moreover, serious issues arise with the authors’ definition of industry profitability, in particular their treatment of R&D as an expense, which ignores that R&D is fundamentally a long-term investment that should be counted as an asset. Indeed, most economists characterize R&D as a long-term investment, which they capitalize when comparing firms in different sectors. That’s why accounting rules generally specify that operating expenses are those designed to generate income in the current period, whereas capital expenditures are intended to provide benefits over multiple periods.[24] While moving R&D from an expense to the balance sheet doesn’t affect the overall economic value or cashflows of a firm, it does affect the “EBITDA” measure—earnings before interest, taxes, depreciation, and amortization. But measures of operating profit like EBITDA fundamentally ignore the capital that companies put at risk to return that profit, which is particularly important for the pharmaceutical industry given its high cost of capital and the extremely risky nature of the drug development process.

In a contrasting assessment to that of the BMJ authors, an article published by Sood, Mulligan, and Zhong in the International Journal of Health Economic Management characterized R&D as an investment rather than an expense and compared excess profits of pharmaceutical companies and S&P 500 firms, instead of absolute profits.[25] Those authors defined excess profit as “higher than expected profits given the risk associated with their investments” and found that pharmaceutical companies’ excess profits were actually 1.7 percentage points lower than the 3.6 percent average among S&P 500 firms.[26]

Others have used tools such as DuPont analysis to examine the efficiency and risk of the capital that is deployed to return a company’s profit. Such analyses use a more appropriate measure not considered by the BMJ authors, specifically return on equity (ROE), or net income divided by average shareholders’ equity each year. Since 2015, the average ROE has fallen every year in the biotechnology and pharmaceutical industries after adjusting for R&D.[27] (There was a modest uptick since 2019 at 7.57 percent, but it was still lower than the 2015 ROE levels of 12.49 percent.) Considering that biopharmaceutical companies rely heavily on their return on R&D investment to generate sales, it is concerning that economic returns continue to fall.

Moreover, an analysis in PLosONE found that biopharmaceutical “returns were substantially lower than [those of] the other eight health care industries,” which tells a drastically different story compared to those who only focus on the price tags of biopharmaceutical “winners.”[28] Not only are pharmaceutical manufacturers’ excess profits lower than those of the average public American company, but returns on their R&D investments are substantially more volatile and riskier than in any other healthcare industry. Based on their DuPont analysis, the authors of the PLosONE article concluded that low profit margins and low asset utilization between 2010 and 2019 reduced ROE in both biotechnology and pharmaceutical industries.[29] Specifically, Bai et al. found that biotech and pharmaceutical companies had median annual returns on equity of -53 percent and -18 percent, respectively.

Since 2015, the average return on equity in both the biotechnology and pharmaceutical industries adjusted for R&D has fallen every year.

Looking beyond the health-care sector, research by New York University’s Aswath Damodaran has found that pharmaceutical industry returns trail those of 23 other sectors in the U.S. economy—such as railroad transportation, shoes, soft drinks, grocery and food retail, paper production, automotive retail, and household products, to name but a few.[30] In summary, contrary to the authors’ claims, America’s pharmaceutical industry trails dozens of other sectors on measures commonly used to compare sectoral profitability; and, if anything, the industry is distinctive not for its excessive profitability, but for its world-leading investment of profits back into R&D, as the subsequent section details.

Marketing and Stock Buybacks

Angelis and colleagues’ primary rationale for contending current drugs prices are unjustified is that industry spends too much on marketing and stock buybacks. The authors refer to research conducted by the Institute for New Economic Thinking to assert that U.S. drug companies spend more on buybacks and dividends than they do on R&D. However, the same report also points out that, “In the United States, massive distributions of cash to shareholders are not unique to pharmaceutical companies.” Furthermore, over the last 10 years, the annualized return on the Standard & Poor’s (S&P) Biotech Index averaged 7.95 percent and the Pharmaceutical Select Index averaged 3.29 percent, both lower than the S&P 500 index return of 12.49 percent, which undercuts the argument that stock buybacks are being used to “prioritize short term financial returns,” as Angelis and colleagues contend.[31]

When combined with the measures on return cited above, there is little evidence that shareholders in large pharmaceutical firms are disproportionately rewarded thanks to stock repurchases. Rather, as Anup Srivastava, Rong Zhao, and Ge Bai have observed:

Over the last decade, investors in biotech and pharmaceutical companies have been taking risks that aren’t commensurate with the rewards… Yet their contributions—and sacrifices—lead to important medical discoveries that benefit society as a whole… When investors’ bets go wrong, they lose their own money. When they bet right, the general public and patients around the world benefit.[32]

Furthermore, the BMJ article’s authors echo others who have asserted that the pharmaceutical industry spends too much on marketing (even while conceding it is not easy to quantify marketing costs). Yet they make no effort to assess marketing cost, instead listing sales, general, and administrative (SG&A) expenses, which include scores of activities central to companies’ operations which are unrelated to promotional efforts (for example, salaries, pensions, and facility costs). The BMJ article provides no data that the top pharmaceutical companies in aggregate overspend on SG&A or that they underspend on R&D. In fact, America’s biopharmaceutical industry is the most R&D-intensive industry in the world, investing over 20 percent of its sales into R&D each year, which accounts for 18 percent of total U.S. business R&D investment. And as the authors concede, R&D as a share of revenue increased between 2005 and 2015 while SG&A spending decreased.

Total spending on marketing activities reached only $6.58 billion in 2020, which pales in comparison to the $122 billion the industry invested in R&D in the United States in 2020.

Indeed, the notion that America’s life-sciences industry is spending more on marketing and promotion than R&D is fundamentally specious. An analysis in JAMA Network, which included promotional activities, physician education, advertising, and unbranded disease awareness campaigns as “medical marketing” puts the total of these activities (which have significant value to patients) at merely one-third of R&D expenditures.[33]

When looking directly at the category of pharmaceutical advertising, total spending reached only $6.58 billion in 2020, a small fraction of the $122 billion the industry invested in R&D in the United States that year.[34] Moreover, during the period analyzed by the BMJ authors (2000 to 2019), pharmaceutical R&D spending increased by over 450 percent, a 10-fold increase since the 1980s. For any increase in sales over this time, the industry spent more, not less, on research, and as a result the industry’s R&D intensity has nearly doubled from 13 percent in 2000 to 25 percent in 2019. As the U.S. Congressional Budget Office has observed, while “Consumer spending on brand-name prescription drugs has risen, [the industry’s] R&D has risen more quickly.”[35] Indeed, the industry’s increased R&D investments over the past two decades have resulted in a 60 percent increase in the number of U.S. Food and Drug Administration (FDA)-approved medicines available to U.S. patients between 2010 and 2019 as compared to the previous decade.[36]

The Purported “Innovation Crisis”

Finally, Angelis and colleagues assert that the U.S. model of drug development is in an “innovation crisis” as more drugs become approved for small patient populations and receive supposedly lucrative orphan designations while demonstrating unclear therapeutic benefits. To support this, they reviewed several studies that assessed the therapeutic value of new drugs, finding that a large portion cited minor or no meaningful clinical improvements for patients.

The problem with this type of analysis is that it uses clinical trial data that compares new drugs with the most-recent previous iteration of the recommended drug treatment, which may often report only the incremental, relative benefit to patients. However, in doing so, an analysis combining these evaluations discounts the cumulative drug innovation efforts that occur from the moment a first-in-class (FIC) drug gets approved and disregards the benefits of multiple novel mechanisms of action and brand variety for the same indication. For instance, therapeutic value cannot be summed up by clinical trial efficacies alone, as there is also value in new drugs that serve heterogenous populations as well as new drugs that provide different routes of drug administration.[37]

One study found that only 16 percent of drugs in the 1970s and 1980s offered therapeutically important gains and now in 2022 alone over half (54 percent) approved by the FDA last year were first-in-class or had novel mechanisms of action.

While Angelis et al., assert that “most new drugs provide little or no added clinical value,” the reality is that even their own paper references genuine breakthroughs such as gene therapies to treat spinal muscular atrophy and treatments for hemophilia. And they even recognize that “most products under development during 1997–2016 targeted novel mechanisms of action.”[38] Furthermore, one study the authors used in their review found that 16 percent of drugs in the 1970s and 1980s offered therapeutically important gains (a period even they would likely agree was before the so-called financialization of the industry); but just last year, 54 percent of the drugs approved by the FDA were first-in-class or had novel mechanisms of action.[39] So, while the authors assert that expenditures on stock buybacks are mitigating investments in genuine R&D, the reality is the industry is producing more innovative drugs today than in the 1970s and 1980s, when stock buybacks were used much less commonly.

Moreover, the move toward “niche buster” drugs (drugs with smaller target patient populations), which Angelis et al. view negatively, represents the intended successful outcome of government incentives to innovate in these areas, such as orphan drug tax credits. The authors write, seemingly disapproving, that “In 2021, orphan drugs accounted for 52% of all approvals.”[40] Orphan (or rare) diseases are those which afflict patient populations of less than 200,000. Eighty percent of rare diseases are genetic in origin, and more than 90 percent of rare diseases have no treatment. So, the industry is innovating in an attempt to tackle difficult diseases for which there has never been an effective treatment, which contradicts the assertion that the industry isn’t genuinely innovating or working to create drugs delivering real therapeutic value.

The key point is that the direction of drug innovation is highly responsive to incentives. Through this, policymakers have effective tools at their disposal to direct innovation to areas that have historically encountered unmet needs (such as rare diseases), and therefore the same can be achieved with other diseases that have not been fully tackled to date, such as antimicrobial resistance or infectious diseases. The Information Technology and Innovation Foundation (ITIF) agrees with the authors’ recommendation to better align government R&D investment with public health objectives and to incentivize the direction of drug development through a blend of both “push” and “pull” policies.[41] ITIF also supports the recommendation to generate clearer communication of public health priorities in public research strategies and to allocate these federal funds more effectively. But as precision medicine grows and as narrow indications become the norm (meaning fewer sales for particular drugs), policymakers must adapt and implement innovative financing arrangements alongside “push” and “pull” incentives to ensure that the United States sustains a system that balances companies’ need to earn revenues to invest in biomedical innovation alongside American citizens’ need for affordable drugs.

Conclusion

The authors of the BMJ article argue that it is possible to reduce the pharmaceutical industry’s profits without harming innovation. They contend that if profits were lowered it would come out of expenses such as executives’ salaries, stock buybacks, or marketing activities. Yet many other studies raise considerable doubts about the authors’ diagnosis of the problem, and moreover Angelis et al. do not offer any examples of how and where this shift could be achieved in practice. For instance, they do not explore an equilibrium between R&D and SG&A expenses in any of their cited data, which leaves unsubstantiated the argument that lower SG&A spending is desirable, or even possible as a goal for the entire industry, while they ignore the evidence proving and indispensable link between prices, R&D, and innovation.

The myriad flaws in the recent BMJ article illustrate the extent to which proponents’ calls for drug price controls rest on unsubstantiated suppositions and assertions. Whereas, a large body of academic and scholarly reports have concluded that pharmaceutical price controls are quite deleterious, as they reduce pharmaceutical revenues, which then reduces R&D investment, undermining future generations’ access to new novel treatments for diseases such as cancer, Alzheimer’s, and heart disease.[42] Indeed, price-control measures in the Inflation Reduction Act (IRA) have had a significant impact on America’s biopharmaceutical industry.[43] One analysis found that in the first four months of 2023, at least 24 companies announced they would curtail drug development because of the IRA.[44]

The global pharmaceutical industry’s sizable investments in R&D have made tremendous contributions to public health, accounting for 73 percent of the increase in life expectancy at birth across 30 countries from 2000 to 2009.[45] Ultimately, any meaningful discussion of drug pricing must address the crucial underlying dynamics that shape the biopharmaceutical landscape, such as the increasing capture of drug expenditures by non-innovation-producing intermediaries, lower returns on R&D investment (i.e., the need to enhance R&D productivity), and the need for payment mechanisms for a growing pipeline of high-value, high-cost precision medicines to ensure Americans can access them affordably.

Acknowledgments

The authors would like to thank Robert Atkinson and Ian Tufts for their guidance and assistance on this report. Any errors or omissions are the authors’ responsibility alone.

About the Authors

Stephen Ezell is vice president for global innovation policy at the Information Technology and Innovation Foundation (ITIF) and director of ITIF’s Center for Life Sciences Innovation. He also leads the Global Trade and Innovation Policy Alliance. His areas of expertise include science and technology policy, international competitiveness, trade, and manufacturing.

Kelli Zhao was an ITIF policy analyst focusing on the economics of biopharmaceutical innovation. She holds an M.Sc. in international health policy (health economics) from the London School of Economics and Political Sciences and a B.A. in economics from the University of Sydney.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent 501(c)(3) nonprofit, nonpartisan research and educational institute that has been recognized repeatedly as the world’s leading think tank for science and technology policy. Its mission is to formulate, evaluate, and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit itif.org/about.

Endnotes

[1]. Aris Angelis et al., “High drug prices are not justified by industry’s spending on research and development,” British Medical Journal (February 2023), 380:e071710. https://doi.org/10.1136/bmj-2022-071710.

[2]. See, for example: Benjamin N. Rome, Alexander C. Egilman, and Aaron S. Kesselheim, “Prices for New Drugs Are Rising 20 Percent a Year. Congress Needs to Act,” The New York Times, June 8, 2022, https://www.nytimes.com/2022/06/08/opinion/us-drug-prices-congress.html; I-MAK, “Overpatented, Overpriced” (I-MAK, 2018), https://www.i-mak.org/wp-content/uploads/2018/08/I-MAK-Overpatented-Overpriced-Report.pdf.

[3]. Trelysa Long and Stephen Ezell, “The Hidden Toll of Drug Price Controls: Fewer New Treatments and Higher Medical Costs for the World” (ITIF, July 2023), https://itif.org/publications/2023/07/17/hidden-toll-of-drug-price-controls-fewer-new-treatments-higher-medical-costs-for-world/.

[4]. Angelis et al., “High drug prices are not justified by industry’s spending on research and development,” 1. Citing: Assistant Secretary for Planning and Evaluation (ASPE), “Trends in Prescription Drug Spending, 2016-2022” (ASPE, September 2022), https://aspe.hhs.gov/sites/default/files/documents/88c547c976e915fc31fe2c6903ac0bc9/sdp-trends-prescription-drug-spending.pdf.

[5]. Benjamin N. Rome et al., “Trends in Prescription Drug Launch Prices, 2008-2021” Journal of the American Medical Association Vol. 327, Issue 21 (2022): 2145–2147, DOI:10.1001/jama.2022.5542.

[6]. Adam Fein, “Brand-Name Drug Prices Fell for the Fifth Consecutive Year—And Plummeted After Adjusting for Inflation,” Drug Channels, January 4, 2023, https://www.drugchannels.net/2023/01/brand-name-drug-prices-fell-for-fifth.html.

[7]. IQVIA Institute, “The Use of Medicines in the U.S. 2023: Usage and Spending Trends and Outlook to 2027,” (IQVIA Institute, April 2023), 35, https://www.iqvia.com/insights/the-iqvia-institute/reports/the-use-of-medicines-in-the-us-2023.

[8]. Fein, “Brand-Name Drug Prices Fell for the Fifth Consecutive Year—And Plummeted After Adjusting for Inflation.”

[9]. IQVIA Institute, “The Use of Medicines in the U.S. 2023,” 35.

[10]. Bureau of Labor Statistics, “Consumer Price Index,” (accessed June 10, 2022), https://www.bls.gov/cpi/.

[11]. Bureau of Labor Statistics, “Consumer Expenditure Surveys,” (accessed August 2023), https://www.bls.gov/cex/.

[12]. Bureau of Labor Statistics, “Consumer Expenditure Survey (Healthcare expenditures, 2005-2020),” https://www.bls.gov/cex/.

[13]. Alan Goforth, “Time to revisit out-of-pocket expenses calculations? Consumers burn through their share in a matter of days,” ALM Benefits Pro, February 4, 2021, https://www.benefitspro.com/2021/02/04/time-to-revisit-out-of-pocket-expenses-calculations-consumers-burn-through-their-share-in-a-matter-of-days/.

[14]. Stephen Ezell, “Testimony to the Senate Finance Committee on ‘Prescription Drug Price Inflation’,” (ITIF, March 2022), https://itif.org/publications/2022/03/16/testimony-senate-finance-committee-prescription-drug-price-inflation/.

[15]. Andrew Brownlee and Joran Watson, “The Pharmaceutical Supply Chain, 2013-2020,” (Berkeley Research Group, 2022), 3, https://www.thinkbrg.com/insights/publications/pharmaceutical-supply-chain-2013-2020/.

[16]. Ibid.

[17]. Karen Van Nuys et al., “Estimation of the Share of Net Expenditures on Insulin Captured by US Manufacturers, Wholesalers, Pharmacy Benefit Managers, Pharmacies, and Health Plans From 2014 to 2018” Journal of the American Medical Association Vol. 2, Issue 11 (2021), https://jamanetwork.com/journals/jama-health-forum/fullarticle/2785932.

[18]. Adam Fein, “Drug Channels News Roundup, March 2020: Sanofi’s Gross-to-Net Bubble, Drug Pricing Findings, Amazon Replaces Express Scripts, and Drug Channels Video,” Drug Channels, March 31, 2021, https://www.drugchannels.net/2020/03/drug-channels-news-roundup-march-2020.html.

[19]. IQVIA Institute, “The Use of Medicines in the U.S. 2023: Usage,” 34.

[20]. Ibid.

[21]. Jack Scannell, “Four Reasons Drugs Are Expensive, Of Which Two Are False,” Forbes, October 13, 2015, http://www.forbes.com/sites/matthewherper/2015/10/13/four-reasons-drugs-are-expensive-of-which-two-are-false/.

[22]. Kevin Haninger, “New analysis shows that more medicines worldwide are available to U.S. patients,” The Catalyst, June 5, 2018, https://catalyst.phrma.org/new-analysis-shows-that-more-medicines-worldwide-are-available-to-u.s.-patients; Patricia M. Danzon and Michael F. Furukawa, “International Prices And Availability Of Pharmaceuticals In 2005” Health Affairs Vol. 7, No. 1 (January/February 2008), https://www.healthaffairs.org/doi/abs/10.1377/hlthaff.27.1.221.

[23]. PhRMA analysis of IQVIA Analytics Link, U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), Japan's Pharmaceuticals and Medical Devices Agency (PMDA), Health Canada and Australia’s Therapeutic Goods Administration (TGA) data. June 2020.

Note: New active substances approved by FDA, EMA, PMDA, Health Canada and/or TGA and first launched in any country between January 1, 2011 and December 31, 2019.

[24]. Aswarth Damodaran, “Research and Development Expenses: Implications for Profitability Measurement and Valuation,” (NYU Working Paper No. FIN-99-024, 1999), https://ssrn.com/abstract=1297092.

[25]. Neeraj Sood, Karen Mulligan, and Kimberly Zhong, “Do companies in the pharmaceutical supply chain earn excess returns?” International Journal of Health Economics and Management Vol. 21, No. 1 (2021), https://doi.org/10.1007/s10754-020-09291-1.

[26]. Ibid.

[27]. New York University, “Return on Equity by Sector (US).” (accessed, August 2023), https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/roe.html.

[28]. Ge Bai et al., “Profitability and risk-return comparison across health care industries, evidence from publicly traded companies 2010–2019,” PLoS ONE Vol. 17, Issue 11 (November 16, 2022), 1, https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0275245.

[29]. Ibid.

[30]. New York University, “Return on Equity by Sector (US).”

[31]. S&P Biotechnology Select Industry Index (accessed August, 2023), https://www.spglobal.com/spdji/en/indices/equity/sp-biotechnology-select-industry-index/#overview; S&P Pharmaceuticals Select Industry Index (accessed August, 2023), https://www.spglobal.com/spdji/en/indices/equity/sp-pharmaceuticals-select-industry-index/#overview.

[32]. Anup Srivastava, Rong Zhao and Ge Bai, “The conundrum of biopharma investing: low rewards and high risks — but a big social benefit,” Statnews, November 16, 2022, https://www.statnews.com/2022/11/16/conundrum-biopharma-investing-low-rewards-high-risks-but-big-social-benefit/.

[33]. Lisa M. Schwartz and Steven Woloshin, “Medical Marketing in the United States, 1997-2016” Journal of the American Medical Association Vol. 321, Issue 1 (2019): 80–96, DOI:10.1001/jama.2018.19320.

[34]. Beth Snyder Bulik “The top 10 ad spenders in Big Pharma for 2020,” Fierce Pharma, April 19, 2021, https://www.fiercepharma.com/special-report/top-10-ad-spenders-big-pharma-for-2020.

[35]. Congressional Budget Office, Research and Development in the Pharmaceutical Industry (April 2021), https://www.cbo.gov/publication/57126.

[36]. Ibid.

[37]. Claudio Lucarelli et al., “Price Indices and the Value of Innovation with Heterogenous Patients,” Journal of Health Economics Vol 84 (July 2022), https://www.sciencedirect.com/science/article/abs/pii/S0167629622000443.

[38]. Angelis et al., “High drug prices are not justified by industry’s spending on research and development,” 5.

[39]. Kenneth Kaitin et al., “Therapeutic ratings and end-of-phase II conferences: initiatives to accelerate the availability of important new drugs,” J Clin Pharmacol Vol. 31, Issue 1 (January 1991):17-24. DOI: 10.1002/j.1552-4604.1991.tb01882.x; Cynthia A. Chellener, “Many First-in-Class Drugs Approved by FDA in 2022, but Overall Approval Numbers Down,” Pharma’s Almanac, March 2023, https://www.pharmasalmanac.com/articles/many-first-in-class-drugs-approved-by-fda-in-2022-but-overall-approval-numbers-down.

[40]. Angelis et al., “High drug prices are not justified by industry’s spending on research and development,” 5.

[41]. For an exploration of the types of “push” and “pull” policies that can further stimulate biomedical innovation, see: Margaret K. Kyle, “The Alignment of Innovation Policy and Social Welfare: Evidence from Pharmaceuticals,” Innovation Policy and the Economy Vol. 20 (2019), https://doi.org/10.1086/705640.

[42]. Joe Kennedy, “The Link Between Drug Prices and Research on the Next Generation of Cures” (ITIF, September 2019), https://itif.org/publications/2019/09/09/link-between-drug-prices-and-research-next-generation-cures; Trelysa Long and Stephen Ezell, “The Hidden Toll of Drug Price Controls: Fewer New Treatments and Higher Medical Costs for the World” (ITIF, July 2023), https://itif.org/publications/2023/07/17/hidden-toll-of-drug-price-controls-fewer-new-treatments-higher-medical-costs-for-world/.

[43]. Kelli Zhao, “White House Names the First 10 Drugs Up for Medicare Price Negotiations: Yet Misguided Attempt to Control Drug Prices Only Hurts Patients Long-Term,” The Innovation Files, August 30, 2023, https://itif.org/publications/2023/08/30/white-house-names-the-first-10-drugs-up-for-medicare-price-negotiations-yet-misguided-attempt-to-control-drug-prices-only-hurts-patients-long-term/.

[44]. Tomas J. Philipson, “The Deadly Side Effects of Drug Price Controls,” The Wall Street Journal, April 5, 2023, https://www.wsj.com/articles/medicare-drug-price-controls-will-make-america-sicker-research-innovation-negotiations-private-insurers-b503b4ba.

[45]. Frank R. Lichtenberg, “Pharmaceutical Innovation and Longevity Growth in 30 Developing and High-income Countries, 2000–2009,” Health Policy and Technology Vol. 3, Issue 1 (March 2014): 36–58, https://www.sciencedirect.com/science/article/abs/pii/S2211883713000646.