Assessing How Brazil Would Benefit From Joining the ITA

The Information Technology Agreement lowers tariffs on ICT products, which lowers their cost and spurs uptake and adoption among businesses and consumers. For Brazil, that could boost GDP nearly a full percentage point in 10 years.

In December 1996, 29 WTO member nations launched the ITA, a novel trade agreement in which participating nations completely removed tariffs on eight categories of ICT products, such as semiconductors, semiconductor manufacturing equipment, computers, and telecommunications equipment. In 2012, owing to the tremendous success of the ITA, member nations started negotiations toward expanding the ITA to add innovative ICT products commercialized since 1996 as well as some categories of ICT not included in the original agreement. ITA expansion negotiations concluded in December 2015, with parties agreeing to bring an additional 201 high-tech products under ITA coverage, such as new-generation multicomponent integrated circuits, touchscreens, GPS navigation equipment, and some medical equipment, such as pacemakers and ultrasonic scanners. The expansion, which the WTO estimated will eliminate tariffs on an additional $1.3 trillion in annual global trade of ICT parts and products—an amount equivalent to approximately 10 percent of world trade in goods—represented the first major tariff-cutting deal completed at the WTO in 19 years.

Developing economies have benefitted tremendously from the ITA. In fact, developing economies’ share of world exports of ITA products more than doubled from 26 percent in 1996 to 63 percent in 2015. This is higher than their share of total world exports, which grew from 27 percent to 43 percent over the same period.

Brazilian ITA accession would produce many of the benefits other developing countries have enjoyed since signing on. Not only would it represent a boon for the Brazilian economy, it would likely have an animating effect in terms of encouraging additional Latin American nations to join the ITA, giving Brazil a leading role in spurring broader adoption of a policy tool that can catalyze economic growth across the region. More importantly, ITA accession would send a strong signal to global markets that Brazil is committed to slashing tariffs and red tape and providing a welcoming environment for investment in ICT goods-producing industries. With a number of ICT-goods producing enterprises looking for alternatives to China (and other nations that employ trade-distorting “innovation mercantilist” policies), Brazilian accession to the ITA could come at an opportune moment giving the current reordering of global supply chains for the production of ICT goods. At the same time, lowering the cost of ICT goods (such as computers, servers, and mobile devices) would only make Brazil’s fast-growing ICT services industries more globally competitive.

The Information Technology and Innovation Foundation (ITIF) has analyzed the economic impact of potential ITA accession for a number of developing nations, including Argentina, Cambodia, Chile, Indonesia, Laos, Kenya, Pakistan, Sri Lanka, South Africa, and Vietnam. As is the case for each of these nations, ITIF finds that ITA accession would considerably bolster Brazilian economic growth over a 10-year period (and beyond), with the economic impact for Brazil being among the strongest of countries studied.

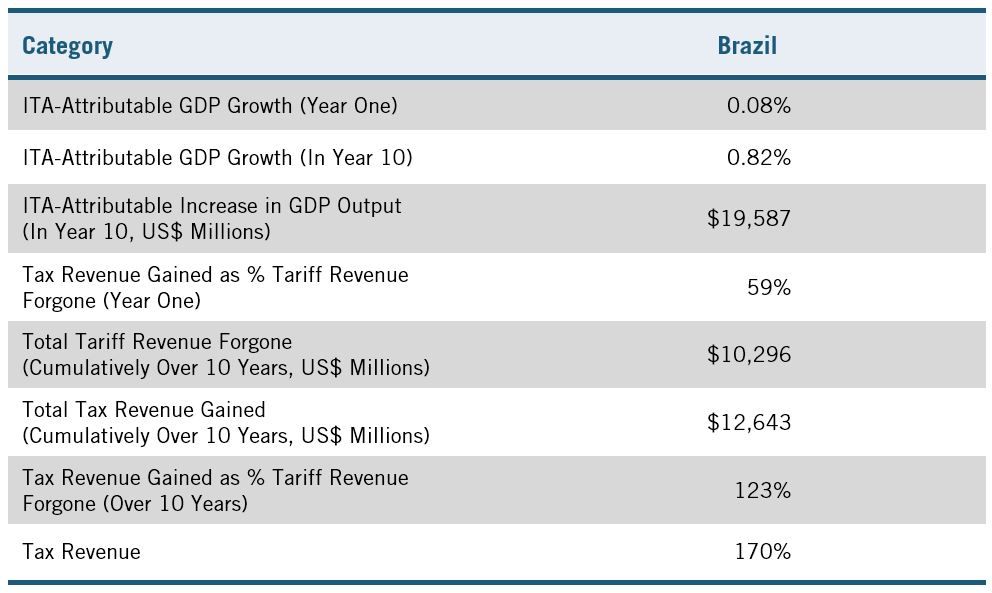

Specifically, as table 1 shows, ITIF’s report finds that Brazil would benefit significantly from ITA accession. Among the highlights:

- Brazil’s economy would immediately grow 0.08 percent in the first year post-ITA accession.

- These economic benefits compound considerably over time, such that in the 10th year post-ITA accession Brazil’s economy would be nearly a full percentage point (0.82 percent) larger than would otherwise be the case.

- Taxes generated from the increased economic growth would more than offset losses from reducing tariffs on ICT goods, with Brazil recouping 123 percent of the revenue level (from taxes) compared to the value of forgone tariffs over a 10-year period, and with tax receipts being 170 percent the level of forgone tariffs in the 10th year post-ITA accession.

- As soon as year four, the expanded economic growth ITA accession would engender would be sufficient to produce tax revenues in excess of tariffs forgone in that year.

- Brazil’s average (bound) tariff rate on ITA-covered-goods imports is 9.7 percent, but its effective applied rate is 3.4 percent.

Table 1: Summary Economic Growth and Tax Revenue Impact of Brazil’s ITA Accession