Comments to the Bureau of Industry and Security Regarding Its Section 232 Investigation of Semiconductor Imports

Introduction

ITIF is an independent 501(c)(3) nonprofit, nonpartisan research and educational institute that has been recognized repeatedly as the world’s leading think tank for science and technology policy. ITIF focuses on a host of critical issues at the intersection of technological innovation and public policy—including economic issues related to innovation, productivity, and competitiveness; technology issues in the areas of information technology and data, broadband telecommunications, advanced manufacturing, life sciences, and clean energy; and overarching policy tools related to public investment, regulation, antitrust, taxes, and trade. ITIF’s goal is to provide policymakers with high-quality information, analysis, and actionable recommendations they can trust. To that end, ITIF adheres to a high standard of research integrity with an internal code of ethics grounded in analytical rigor, original thinking, policy pragmatism, and editorial independence.

ITIF is pleased to offer these comments in response to the Department of Commerce Bureau of Industry and Security Request for Public Comments on Section 232 National Security Investigation of Imports of Semiconductors and Semiconductor Manufacturing Equipment (SME).[1]

(i) the current and projected demand for semiconductors (including as embedded in downstream products) and SME in the United States, differentiated by product type and node size;

Semiconductors represent the heartbeat of the modern global digital economy, a $627 billion industry in 2024 that stimulates another $7 trillion in global economic activity annually by underpinning a range of downstream applications such as artificila intelligence (AI) and big data.[2] Analysts have expeteded the semiconductor sector to grow to a $1 trillion industry by the end of this decade, likely at a compound annual growth rate of 7.5 percent between 2025 and 2030.[3]

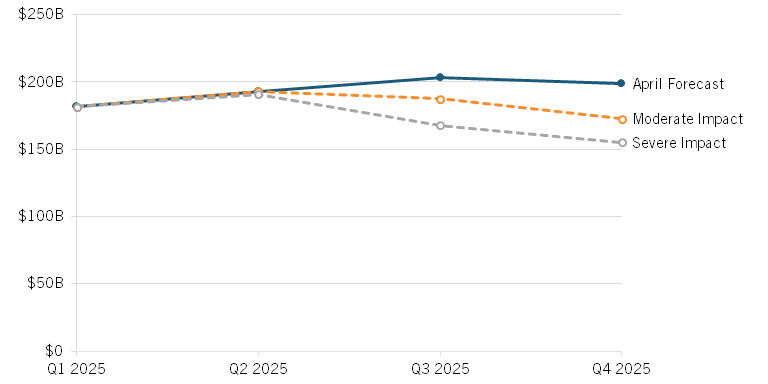

However, the possible U.S. implementation of semiconductor tariffs have disrupted some of these forecasts. According to TechInsights, their baseline global semiconductor sector growth model for 2025 was 9 percent, taking global semiconductor sales from $181 billion in Q1 2025 to $199 billion by Q4 2025. However, TechInsights predicts the introduction of moderate (i.e., potential 25 percent tariffs) to severe (i.e. potential 100 percent) tariffs could lead to as much as a -20 percent growth rate for the sector in 2025, a potential nearly 30 percent negative swing that could potentially knock off some $250 to $300 billion of global semicondutor sales for 2025. (See figure 1.)

Figure 1: Potential impact of tariffs on global semiconductor sales in 2025[4]

(ii) the extent to which domestic production of semiconductors can or is expected to be able to meet domestic demand at each node size for each product type, and similarly the extent to which domestic production of SME can or is expected to be able to meet domestic demand;

The United States still accounts for over half (50.2 percent) of market share in the global semiconductor industry (when all facets of the sector, from research and development (R&D), to design, to manufacturing, to tooling, and assembly, test, and packaging (ATP) are considered).[5] However, the U.S. share of global semiconductor manufacturing has fallen considerably in recent years. In 1990, the United States manufactured 37 percent of the world’s semiconductor chips; by 2022 that share had fallen to 10 percent, a relative decline of over 70 percent.[6]

In 2022, the United States accounted for an estimated 20 percent of global 10–22 nanometer (nm) logic chip production and 10 percent of legacy logic chip (chips greater than 28 nm) production, but virtually no advanced chip production (chips manufactured using process nodes 10 nm or smaller).[7] In 2022, the United States accounted for 14 percent of global discrete, analog, and optoelectronics (DAO) chip production and it accounted for 3 percent of global DRAM memory chip production (a share expected to triple to 9 percent by 2032).[8]

Since 2022, private enterprises have announced $450 billion in semiconductor and electronics industry investment, including plans to launch 17 new semiconductor fabs in the United States.[9] If these investments are fully executed, it could help to bring U.S. production of the most-sophisticated chips to nearly 30 percent by 2032 and to bring the U.S. share of global chip production to 14 percent or higher by that time.[10]

(iii) the role of foreign fabrication and assembly, test and packaging facilities in meeting United States semiconductors demand, and similarly the role of foreign supply of SME in meeting domestic demand;

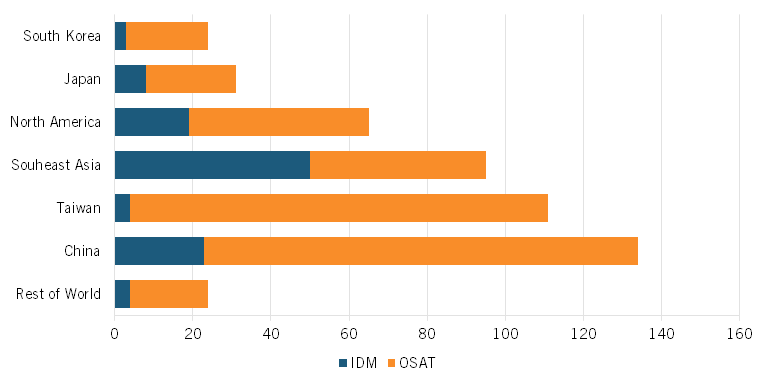

The United States houses less than 3 percent of global semiconductor ATP capacity by revenue.[11] The space is dominated by China and Taiwan. As of 2021, China accounted for 27 percent (134) of the world's 484 ATP facilities. By contrast North America had only 65 such facilities. (See figure 2.) By August 2023, Chinese ATP firms commanded 38 percent of the market, with the five largest OSAT players—JCET, HT-Tech, TF, LCSP, Chippacking—all being Chinese.[12]

Figure 2: Number of ATP facilities per country/region, 2021[13]

(v) the impact of foreign government subsidies and unfair trade practices on United States semiconductor and SME industry competitiveness

China is the world’s leading purveyor of mercantilsit economic pracrices, something which attains across virtually every advanced-technology industry, not the least of which is semiconductors.[14] Indeed, semiconductors represent a central part of Jinping’s “pledge to mobilize all means at [China’s] disposal to wrest technological supremacy from the United States and other nations.”[15]

The National IC Plan became the centerpiece of China’s semiconductor strategy in 2014, with China’s State Council setting a goal of China becoming a global leader in all segments of the semiconductor industry by 2030.[16] In 2015, China released its “Made in China 2025” (MIC 2025) strategy, which refined some of these targets, setting a goal of achieving 40 percent self-sufficiency in semiconductors by 2020 and 70 percent by 2025.[17] (In reality, China is likely to only achieve 30 percent self-sufficiency by the end of 2025.)[18]

Nevertheless, the IC Plan called for at least $150 billion in government subsidies—from central, provincial, and municipal Chinese governments as well as a variety of state-owned enterprises (SOEs, from the technology sector and beyond)—to enable China to become self-sufficient in every facet of the industry.[19] The “Big Fund” was established to function as a national investment fund, offering targeted support for the development of the semiconductor industry.[20] The 2014 fund raised 138.7 billion RMB ($23 billion) and the 2019 fund raised 200 billion RMB ($29 billion). In September 2023, Reuters reported that China is planning to start its most extensive state fund to date, with a target of 300 billion RMB ($41 billion).[21] America’s Department of Commerce estimates China has indeed reached its goal of pumping $150 billion into the sector over the past decade.[22] Renowned semiconductor industry analyst Chris Miller suggested on a recent podcast that, if one adds up semiconductor-sector investments made by Chinese governments at all levels (national, provincial, city), China “has probably invested the equivalent of [America’s] CHIPS Act virtually every year since 2014.”[23]

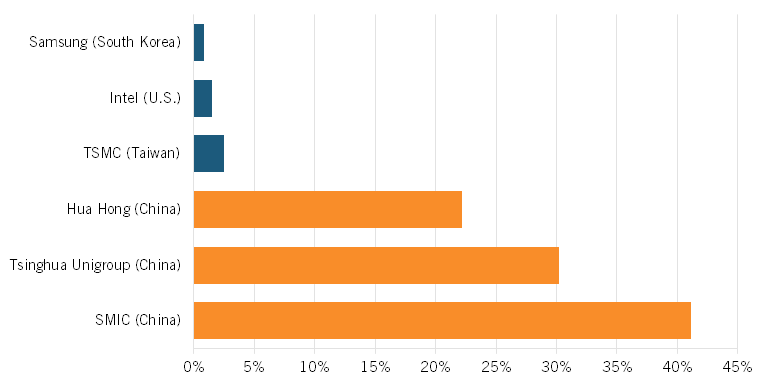

Massive industrial subsidization of Chinese semiconductor firms lays at the core of China’s project. As the Organization for Economic Cooperation and Development (OECD) has found, “Government support through below-market equity appears to be particularly large in the semiconductor industry and concentrated in one jurisdiction.”[24] The OECD’s study of 21 international semiconductor firms over the years 2014 to 2018 found that government support provided through “below-market equity” (i.e., effectively a subsidy) “amounted to $5-15 billion for just six semiconductor firms, four of which are from China” (these being Hua Hong, JCET, SMIC, and Tsinghua Unigroup). The report continued to note that, for SMIC and Tsinghua Unigroup, “total government support exceeded 30 percent of their annual consolidated revenue.”[25] In total, the OECD found that Chinese firms together received 86 percent of below-market equity injections identified in its study. The organization concluded that, “For the four Chinese firms covered by this study, government funds have committed equity funding of about $22 billion in total to date, with the largest share benefitting SMIC and Tsinghua Unigroup, and their subsidiaries. These four firms received about $10 billion of the initial $23 billion tranche of National IC Plan funding.”[26] With regard to SMIC, the OECD report found that state subsidies accounted for slightly over 40 percent of the company’s revenues from 2014 to 2018.[27] Of particular import, the OECD study found that there “notably appears to be a direct connection between equity injections by China’s government funds and the construction of new semiconductor fabs in the country.”[28]

When it comes to state subsidies at the firm level—that is, as a percentage of revenue for semiconductor manufacturers (from 2014 to 2018)—Chinese enterprises clearly led their foreign competitors, by an order of magnitude. State subsidies accounted for slightly over 40 percent of SMIC’s revenues over this period, 30 percent for Tsinghua Unigroup, and 22 percent for Hua Hong. (See figure 3.) In contrast, this figure was minimal for TSMC, Intel, and Samsung, each, for whom revenues identifiable as state subsidies accounted for, at most, 3 percent or less of their revenues over that period.

Figure 3: State subsidies as a percentage of revenue for chip fabs, 2014–2018[29]

Chinese semiconductor companies also benefit from lower taxes, such as corporate income tax exemptions or reductions, tax credits for R&D, and tax or tariff reductions/exemptions for domestically produced or imported equipment and materials.[30] Subnational governments in China also sell land to Chinese semiconductor companies at reduced prices.[31]

As noted, in the seminal Made in China 2025 strategy, China set a goal of achieving 40 percent self-sufficiency in semiconductors by 2020 and 70 percent by 2025.[32] China’s “Information Innovation” project, locally called xinchuang, aims to replace foreign with domestic suppliers of critical ICTs, including semiconductor technology.[33] As one report noted, China is seeking “to establish production processes largely free of Western equipment…This will be a multistage, multiyear process, starting with 40 nanometers and proceeding quickly, likely this year [2024], to 28 nanometers, and then 14, 12/10, and eventually 7 nanometers.”[34] On April 12, 2024, The Wall Street Journal reported that, “China’s push to replace foreign technology is now focused on cutting American chip makers out of the country’s telecommunications systems.”[35] The move would impact a variety of U.S. semiconductor companies, including AMD and Intel. The article noted that, “[Chinese] officials earlier this year directed the nation’s largest telecom carriers to phase out foreign processors that are core to their networks by 2027.”[36] The effort is similar to one articulated in Document 79, which requires state-owned enterprises (SOEs) in finance, energy, and other sectors to replace foreign software in their information technology (IT) systems by 2027.[37]

Elsewhere, the Chinese government has asked electric-vehicle makers from BYD Co. to Geely Automobile Holdings Ltd. to sharply increase their purchases from local auto chipmakers, part of a campaign to reduce reliance on Western imports and boost China’s domestic semiconductor industry.[38] China’s Ministry of Industry and Information Technology (MITI) has directly instructed [Chinese automakers] to avoid foreign semiconductors if at all possible.[39] Such measures leave no doubt that import substitution and achieving self-sufficiency represents an essential goal of China’s semiconductor strategy.

The Chinese government has sponsored “long-running state espionage programs targeting Western firms and research centers (and this) technological espionage has carried over into cyberspace.”[40] Indeed, the acquisition of foreign semiconductor technology through intellectual property (IP) theft has been a key pillar of Chinese strategy. For instance, in November 2018, the U.S. Department of Justice charged China’s Fujian Jinhua Integrated Circuit Co. with working to steal trade secrets from U.S. chipmaker Micron Technologies.[41] The incident spurred the U.S. Department of Justice (DoJ) to launch a new initiative to combat foreign economic espionage and trade secret theft. That effort yielded results when, in June 2020, DoJ found Chinese national Hao Zhang guilty of economic espionage and theft of trade secrets from both Avago, a California-based developer of semiconductor design and processing for optoelectronics components and subsystems, and Skyworks, a Massachusetts-based innovator of high-performance analog semiconductors.[42] Taiwanese-based semiconductor manufacturers TSMC and Nanya Technology Corporation have both experienced attempted or effected thefts of trade secrets, including a 2016 incident in which TSMC engineer Hsu Chih-Pen stole TSMC trade secrets he intended to sell to Chinese state-owned Shanghai Huali Microelectronics Corp.[43] One assessment found that China’s SMIC alone has accounted for billions in semiconductor IP theft from Taiwan.[44] In fact, as early as 2003, TSMC had filed lawsuits in U.S. courts alleging that SMIC had infringed upon its patents and stolen its trade secrets.[45] The acquisition of foreign semiconductor technology through IP theft has been an essential pillar of Chinese strategy to develop its semiconductor industry.

(vi) the economic or financial impact of artificially suppressed semiconductor and SME prices due to foreign unfair trade practices and state-sponsored overcapacity;

China has especially targeted trying to achieve leadership in larger-node chips, also known as legacy or mature chips.[46] But China’s basis for competitive advantage here is likely to be more predicated on massive scale (supported by massive, state-driven industrial subsidization) that facilitates price-driven, not innovation-driven, competition.[47]

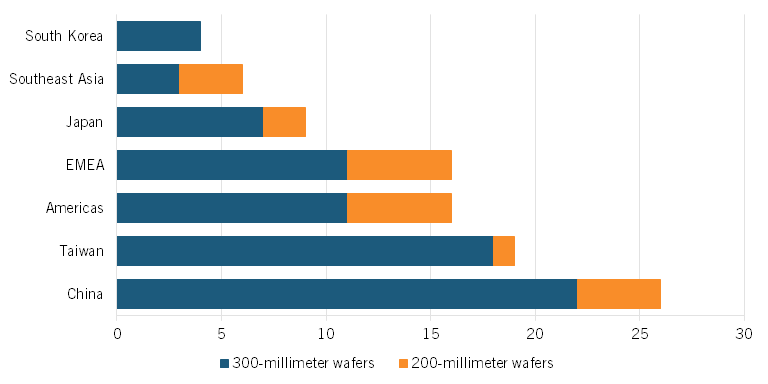

China will account for the most-significant share of new semiconductor capacity coming online over the next several years. Indeed, analysts believe that China added more chip-making capacity than the rest of the world combined did in 2024, with 1 million more wafers a month than in 2023. China’s share of global mature-node production is expected to grow from 31 percent in 2023 to 39 percent in 2027.[48] China currently commands 27 percent of global production capacity for chips in the 20-45 nm range, and 30 percent of global production capacity in the 50-180 nm range. Moreover, analysts expect China to build the most new fabs or major expansions in the 2022 to 2026 time period, with China bringing 26 new facilities online, and Taiwan 19. (See figure 4.) China’s IC output surged 40 per cent to 98.1 billion units in the first quarter of 2024, driven primarily by production of legacy chips.[49]

Figure 4: New fabs and major expansions expected to come online, 2022–2026[50]

The growth of China’s semiconductor industry—especially in the legacy chip segment—has been driven considerably by massive industrial subsidization designed to help its companies reach economies of scale in production. Thus, as one report notes, “Chinese firms—supported by lower costs in China due to government subsidies and other factors—are able to offer significantly lower prices.”[51] For instance, China’s microcontroller processor manufacturer Giga Device was offering its products at prices that were 20 to more than 30 percent lower than non-Chinese competitors, such as the French firm ST Microelectronics, across most of 2022 and 2023.[52] Chinese subsidies allow Chinese semiconductor firms to compete in markets without having to earn market-based rates of return, and thus they can sell their products at much lower prices, which places firms that do have to earn market-based rates of return at a significant disadvantage while also disrupting the economics of innovation in the industry, as companies depend upon the profits from one generation of semiconductor products to finance the R&D expenses that go into innovating the next generation. This has been a significant challenge for global memory chip manufacturers as well, and this dynamic threatens to extend to every semiconductor subsector which China aggressively subsidizes.

China’s aggressive subsidization of larger-node chips contributes to significant overcapacity, artificially lowers prices, and disadvantages firms that must earn market-based rates of return, significantly disrupting the economics of innovation in the global semiconductor industry, with deleterious downstream ramifications not just for mature-node chip makers, but for chip makers at all node sizes.

ITIF has found that Chinese mercantilism in the semiconductor sector contributes to less innovation being produced than would otherwise have been the case. Specifically, in a 2021 report, ITIF found that non-Chinse semiconductor firms had a patent intensity (patents as a share of sales) four times greater than Chinese semiconductor firms. Factoring in these firms’ lower patent intensity and assuming that without unfair Chinese government policies these firms’ global market share would be one-third of what it is today, ITIF calculated that the cost of these policies was a significant reduction in global patenting. For the year 2019, Chinese innovation mercantilism led to approximately 5,100 fewer U.S. semiconductor patents awarded than would otherwise be the case (out of a total of about 19,500 issued).[53]

(ix) the impact of current trade and other policies on domestic semiconductor and SME production and capacity, and whether additional measures, including tariffs or quotas, are necessary to protect national security;

Semiconductors remain one of America’s most-significant exports. U.S. exports of semiconductors were worth $52.7 billion in 2023, sixth-highest among U.S. exports, behind only refined oil, crude oil, airlines, natural gas, and automobiles in that year.[54] In 2024, the United States exported $57.5 billion of semiconductors, although this was offset by $62.8 billion in imports, for a trade balance of -$5.2 billion. While robust U.S. semiconductor exports are great, it should also be noted that in 2005 the United States exported $53 billion worth of semiconductors, so U.S. semiconductor exports have basically been flat for nearly a two decade period. If U.S. semiconductor exports had grown by just the rate of inflation over that time, then U.S. semiconductor exports would have been $85 billion last year.

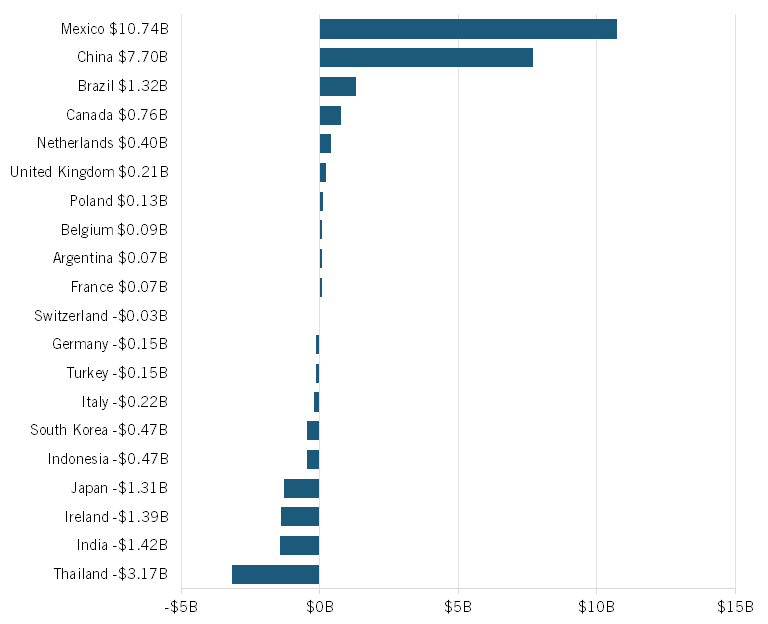

For 2024, the United States ran the most significant semiconductor trade deficits with Thailand (-$3.2 billion), India (-$1.4 billion), Ireland (-$1.39 billion), and Japan (-$1.3 billion); conversely, it ran the most significant trade surpluses with Mexico ($10.7 billion), China ($7.7 billion), and Brazil ($1.3 billion). (See figure 5.)

Figure 5: U.S. semiconductors trade balance with select countries (2024)[55]

The Information Technology Agreement (ITA), a WTO agreement which commits participating nations to eliminate tariffs on trade in hundreds of information and communications technology (ICT) products has played a catalytic role in fostering the growth of the global digital economy since the original agreement entered force in 1996.[56] The ITA has benefitted both America’s digital and ICT production industries greatly.

(xiii) where the U.S. workforce faces a talent gap in production of semiconductors, SME or SME

The United States faces semiconductor workforce shortages through the remainder of this decade, especially in the face of robust growth estimates for the industry. The U.S. semiconductor industry is expected to add 114,800 new jobs between 2023 and 2030, but at current graduation and hiring rates, the industry expects 67,000 (or 58 percent) of new jobs across manufacruring and design will go unfufilled by 2030. This would include an estimated 23,000 engineers (including 5,100 PhDs, 12,300 Master’s students, and 9,900 Bachelor’s students) in additon to 26,400 technicans and 13,400 computer scientists.[57] By 2027, the semiconducor industry expects to employ 319,000 workers directly and 2.13 million Americans in total (including also indirect and induced employemnt).[58] The United States needs to expand computer science and electrical engineering programs at U.S. universities and community colleges alike to address this impending skills gap.

Skilled technicians represent a key component of America’s manufacturing workforce. One highly successful program designed to build technician skills is NSF’s Advanced Technological Education (ATE) program, which supports community colleges working in partnership with industry, economic development agencies, workforce investment boards, and secondary and other higher education institutions. ATE projects and centers are educating technicians in a range of fields, including nanotechnologies and microtechnologies, rapid prototyping, biomanufacturing, logistics, and alternative fuel automobiles. Notwithstanding this, ATE funding is quite small, at around $75 million per year. The administration should expand funding for the ATE program, doubling it to at least $150 million annually.[59]

(xiv) any other relevent factors

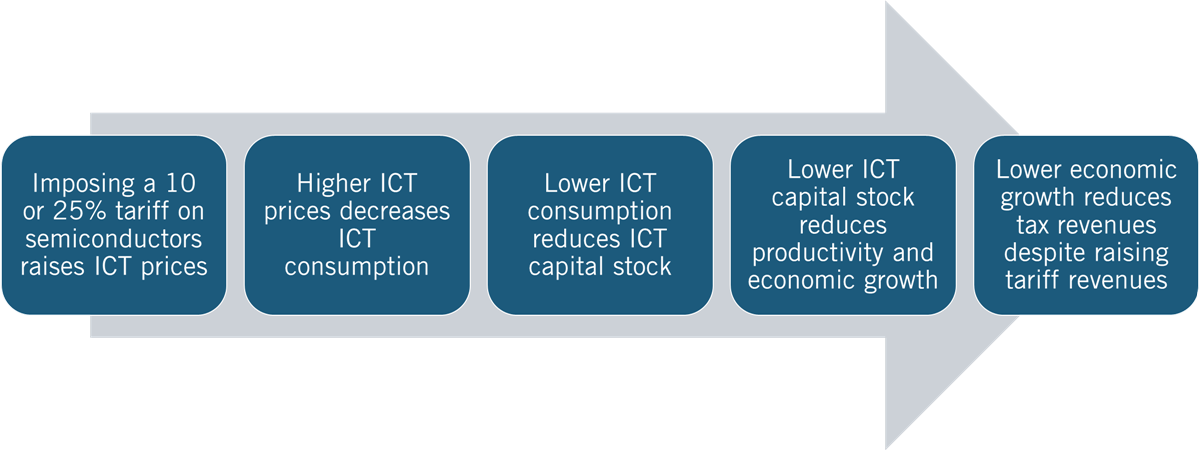

Information and communiation techhnology (ICT) such as semiconductors represent a general purpose technolgogy (GPT) that has profound impacts on nations’ economic growth. ICT generates a bigger return to productivity growth than do most other forms of capital investment.[60] For instance, ICT capital has a three to seven times greater impact on firm productivity than does non-ICT capital. ICT workers also contribute three to five times more productivity than non-ICT workers do.[61] This productivity-enhacing effect explains why economists find that every 1 percent increase in a nation’s net ICT capital stock generates a 0.06 percent increase in a nation’s real gross domestic product (GDP).[62] Yet consumption of ICT goods is considerably price elastic, with economists finding that a 1 percent increase in ICT prices induces a 1.3 percent decline in ICT consumption.[63] As tariffs raise the price of ICT goods, ITIF used these dynamics to model the impact blanket semiconductor tariffs could have on U.S. GDP growth and citizens’ standards of living. (See figure 6.)

Figure 6: ITIF's analytical framework for modeling the deleterious effects of semiconductor tariffs

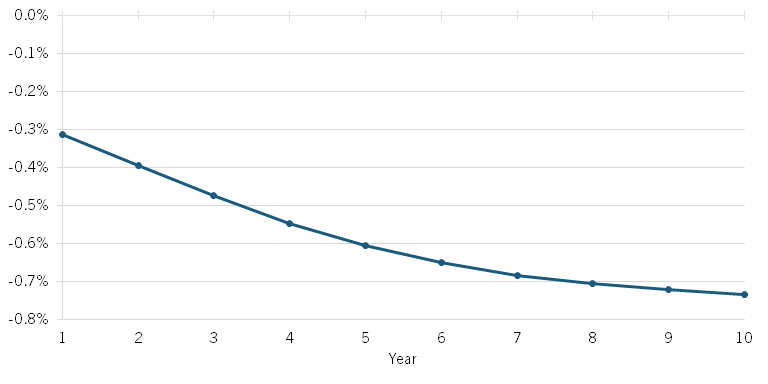

In 2023, the United States imposed an average tariff rate of 2.96 percent on $61.9 billion in semiconductor imports.[64] Therefore, 25 percent semiconductor tariffs would raise applied U.S. semiconductor tariffs by nearly 22 percent. Modeling this increase out, ITIF finds that a blanket 25 percent tariff on U.S. semiconductor imports would produce a 0.24 percent downturn in U.S. economic growth in the first year, and if sustained over 10 years, would result in a 0.73 percent slowdown in U.S. economic growth in the 10th year.[65] (See figure 7.) By year 10, semiconductor tariffs set at 25 percent would translate into a cumulative $1.4 trillion loss in total GDP, or 5.1 percent of U.S. GDP. A 10 percent tariff would result in 0.08 percent of U.S. GDP growth foregone in the first year and 0.19 percent in the 10th year.

Figure 7: Annual 10-year GDP growth foregone from a 25 percent tariff imposed on semiconductors[66]

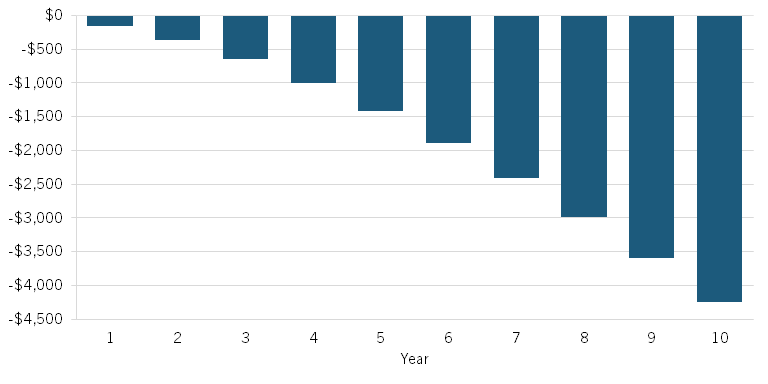

The average American citizen would forego $156 in living standard growth the first year after imposition of 25 percent semiconductor tariffs. By the 10th year, Americans would forego a cumulative total of $4,245 worth of growth in their living standards. (See figure 8.) ITIF also finds the United States would lose billions more in tax revenues due to diminished economic growth than it would collect in tariff revenues—equating to a net loss of $161 billion in the 10th year if 25 percent tariffs were maintained over that duration.

Figure 8: Cumulative loss in GDP per capita from a 25 percent tariff on semiconductor imports[67]

Semiconductors power—both literally, through power management, and figuratively, through their computational and information processing capacity—virtually every modern device, from ICT products such as computers and smartphones to manufactured goods such as autos, appliances, and medical devices. Semiconductor tariffs would considerably raise costs for a host of downstream industries that rely on integrated chips as a fundamental input, and this includes U.S. manufacturing industries such as automobiles and digital industries such as AI and data centers.

Semiconductors power—both literally, through power management, and figuratively, through their computational and information processing capacity—virtually every modern device, from ICT products such as computers and smartphones to manufactured goods such as autos, appliances, and medical devices. Semiconductor tariffs would considerably raise costs for a host of downstream industries that rely on integrated chips as a fundamental input, and this includes U.S. manufacturing industries such as automobiles and digital industries such as AI and data centers.

Consider automobiles. On average, modern vehicles contain somewhere from 1,000 to 3,000 semiconductor chips.[68] Even then, the value of semiconductors installed in cars is expected to grow to as much as $4,000 by 2030, an 800 percent increase from 2020.[69] While obviously not all semiconductors in U.S. cars are imported, a 22 percent increase in the cost of semiconductors could still directly increase the cost of cars sold in the United States by hundreds of dollars.

Or consider data centers. Companies leverage data centers for numerous functions, including facilitating telecommunications, enabling cloud computing, and powering the training and inference of large-language models (LLMs) that underpin America’s AI leadership. While data centers certainly come in different sizes, ITIF finds that the average hyperscale data center deploys 5,000 servers. ITIF calculates that these servers leverage approximately 340,000 individual semiconductor chips, of all types, from core computational chips such as graphics processing units (GPUs) and central processing units (CPUs) to memory chips such as DRAM and NAND to analog chips such as power management chips.[70] Thus, U.S. semiconductor tariffs could significantly increase the cost of operating U.S. data centers, and this would increase the cost of companies developing the LLMs that underpin American AI leadership.

The administration should also be mindful that a core component of the success of the global semiconductor industry has in fact been the advent of specialized, global best-of-breed suppliers in various corners of the world. It’s unclear if semiconductor tariffs would apply only to finished semiconductor imports, or to products that contain semiconductors, or to key inputs in the semiconductor production chain. But if tariffs were applied also to key inputs in the semiconductor value chain, it could considerably raise the cost of semiconductor manufacturing in the United States, which would undermine the administration’s goal of turbocharging that very activity.

Consider semiconductor manufacturing equipment such as the extreme ultraviolet lithography (EUV) machines that print semiconductors: The laser alone in an EUV machine (made by Germany-headquartered TRUMPF) has 457,329 component parts, and the laser itself is just one of more than 100,000 parts in an EUV machine. The EUV equipment also uses light sources developed by San Diego, California-based Cymer and German-produced mirrors developed by Carl Zeiss that are the smoothest lenses in the world. And the EUV machine itself is just one component among thousands in a multi-billion-dollar semiconductor fab. Elsewhere, Japanese suppliers provide over 90 percent of the world’s photoresists and over half the photomasks (these are the materials that contain and imprint the circuit pattern on the wafers).[71]

The key point is that for nations to be competitive at semiconductor manufacturing, they need to ensure that companies have cost-efficient access to the best-of-breed, most-sophisticated components and inputs—such as chemicals, substrates, photomasks, and other materials—that are sourced from suppliers hailing from more than 50 countries worldwide.[72] The specialization that pervades the global semiconductor industry has played a key role in advancing the industry’s rapid innovation while decreasing the unit costs of computer processing. In other words, it’s what’s enabled Moore’s Law—the principle that the speed and capability of computers can be expected to double roughly every two years.[73] America simply does not have the technical or manufacturing capacity by itself to produce the myriad thousands of inputs and components that underpin advanced semiconductor manufacturing. As noted, to place tariffs on key inputs in the semiconductor value chain would only undermine the competitiveness of U.S. semiconductor manufacturing activity.

The administration should also be mindful that America’s introduction of semiconductor tariffs could induce other nations to introduce similar tariffs. ITIF finds that if other nations were to introduce “mirror” tariffs as to the “Liberation Day” tariffs announced on April 2, 2025, then U.S. exports of products that are included in the ITA would decline by $82 billion. And even considering the revised “electronics exceptions” on tariffs announced on April 11, 2025, if peer countries imposed exactly the same tariffs on U.S. ITA product exports, the United States would experience a $56 billion annual decline in the export of those products.[74]

Clearly, if other countries were to introduce reciprocal tariffs, this would make U.S. semiconductor exports far less globally competitive and potentially introduce a “Galapagos Island” effect, whereby U.S. semiconductor manufacturers are competitive only in domestic markets. Indeed, the Trump administration appears to believe that U.S. markets alone are of sufficient size to support globally competitive advanced-technology industries such as semiconductors. But the reality is that U.S. markets alone are simply not large enough to support globally competitive advanced-technology firms, which must have access to global markets of scale to earn sufficient revenues needed to reinvest in the expensive effort of bringing next-generation products to market.[75]

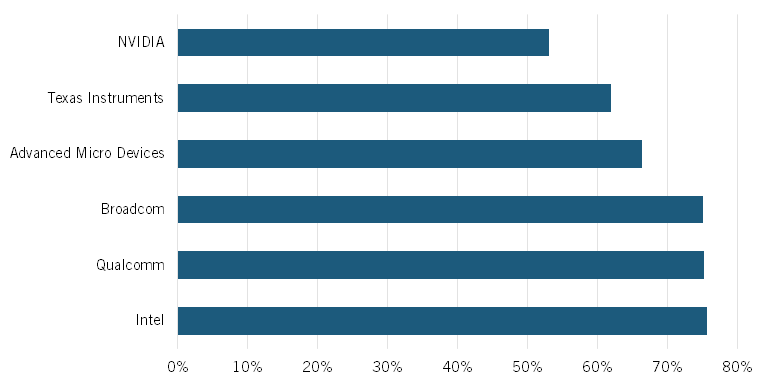

To this point, an analysis of the recent 10Ks of six leading U.S. semiconductor manufacturers—Advanced Micro Devices (AMD), Broadcom, Intel, NVIDIA, Qualcomm, and Texas Instruments—finds that 68 percent of their sales come from non-U.S. sources. (See figure 9.) This ranged from NVIDIA with a 53 percent share of foreign-sourced revenue to Broadcom, Intel, and Qualcomm having 75 percent or higher reliance on global markets for their revenues.

Figure 9: Non-U.S. share of select U.S. pharmaceutical companies’ revenues (2024)[76]

The Trump administration is undoubtedly justified in wishing to continue turbocharging U.S. semiconductor manufacturing and making this a national priority. To be sure, high tariffs on foreign semiconductor imports could in theory induce some shift in semiconductor production to the United States over time (although the costs from higher prices resulting from the tariffs would be experienced immediately); but the reality is the United States can achieve its goals of increasing domestic semiconductor production without having to resort to imposing high tariffs and incurring the economic losses this would inevitably produce.

As noted, since 2022, private enterprises have announced $450 billion in semiconductor and electronics industry investment, including plans to launch 17 new semiconductor fabs in the United States.[77] These investments could push the U.S. share of manufacturing of the world’s most-sophisticated chips close to 30 percent by the end of the decade.[78]

The Trump administration should sustain the commitments that have engendered these investments. The Trump administration should continue to work to ensure that the United States offers the world’s most-competitive locale for semiconductor R&D, design, and manufacturing. The establishment within the Department of Commerce of the the United States Investment Accelerator, dedicated to reducing regulatory burdens, speeding up permitting, and coordinating responses to investor issues across multiple federal agencies is certainly an important step in this regard.[79] Observers contend that each year of delay in receiving environmental permitting review adds roughly 5 percent to the cost of a constructing a semiconductor chip plant.[80]

The 25 percent investment tax credit (ITC) component of the CHIPS Act was one of its most powerful elements—companies could not be certain that they would win a loan or grant, but they were certain that they could take the 25 percent ITC if they put shovels in the ground. As such, Congress should extend the ITC through the end of this decade (it currently attains to planned construction beginning before January 1, 2027). Congress should also extend the 25 percent ITC to firms designing semiconductor chips, not just building semiconductor fabs.[81]

Thank you for your consideration.

Endnotes

[1] Notice of Request for Public Comments on Section 232 National Security Investigation of Imports of Semiconductors and Semiconductor Manufacturing Equipment, Docket No. 250414-0066, April 16, 2025, https://www.federalregister.gov/documents/2025/04/16/2025-06591/notice-of-request-for-public-comments-on-section-232-national-security-investigation-of-imports-of.

[2] Semiconductor Industry Association, “Global Semiconductor Sales Increase 19.1% in 2024; Double-Digit Growth Projected in 2025,” news release, February 7, 2025, https://www.semiconductors.org/global-semiconductor-sales-increase-19-1-in-2024-double-digit-growth-projected-in-2025/; Oxford Economics, “Enabling the Hyperconnected Age: The role of semiconductors” (Oxford Economics, 2013), 20, http://www.semismatter.com/enabling-the-hyperconnected-age-the-role-of-semiconductors/.

[3] Jeroen Kusters et al., “2025 global semiconductor industry outlook” (Deloitte, February 4, 2025), https://www2.deloitte.com/us/en/insights/industry/technology/technology-media-telecom-outlooks/semiconductor-industry-outlook.html.

[4] TechInsights, “Trump’s Tariff Tensions: What’s in store for the Semiconductor Industry?” (Webinar, May 1, 2025).

[5] Semiconductor Industry Association (SIA), “2024 Factbook” (SIA, 2024), 3, https://www.semiconductors.org/wp-content/uploads/2024/05/SIA-2024-Factbook.pdf.

[6] Antonio Varas et al., “Government Incentives and U.S. Competitiveness in Semiconductor Manufacturing” (SIA and Boston Consulting Group, September 2020), 7, https://www.bcg.com/en-us/publications/2020/incentives-and-competitiveness-in-semiconductor-manufacturing.

[7] Raj Varadarajan et al. “Emerging Resilience in the Semiconductor Supply Chain” (Boston Consulting Group, May 2024), https://www.bcg.com/publications/2024/emerging-resilience-in-semiconductor-supply-chain.

[8] Ibid.

[9] SIA, “Semiconductor Supply Chain Investments,” March 7, 2025, https://www.semiconductors.org/chip-supply-chain-investments/.

[10] Varadarajan et al. “Emerging Resilience in the Semiconductor Supply Chain.”

[11] The Trump White House, “Another Historic Investment Secured Under President Trump,” news release, March 3, 2025, https://www.whitehouse.gov/articles/2025/03/another-historic-investment-secured-under-president-trump/.

[12] Chris Miller and David Talbot, “Mexico’s Microchip Advantage,” Foreign Affairs, August 28, 2023, https://www.foreignaffairs.com/mexico/mexicos-microchip-advantage-semiconductor-china; Stephen Ezell, “Assessing the Dominican Republic’s Readiness to Play a Greater Role in Global Semiconductor and PCB Value Chains” (ITIF, January 2024), https://itif.org/publications/2024/01/29/dr-semiconductor-readiness/.

[13] Akhil Thadani and Gregory C. Allen, “Mapping the Semiconductor Supply Chain” (Center for Strategic and International Studies, May 2023), 11, https://www.csis.org/analysis/mapping-semiconductor-supply-chain-critical-role-indo-pacific-region.

[14] Robert D. Atkinson, “Innovation Drag: China’s Economic Impact on Developed Nations” (ITIF, January 2020), https://itif.org/publications/2020/01/06/innovation-drag-chinas-economic-impact-developed-nations/.

[15] Mackenzie Hawkins, “China Urges EV Makers to Buy Local Chips as US Clash Deepens,” Bloomberg, March 15, 2024, https://www.bloomberg.com/news/articles/2024-03-15/china-urges-byd-ev-makers-to-buy-chinese-chips-as-tensions-with-us-escalate.

[16] James A. Lewis, “Learning the Superior Techniques of the Barbarians” (Center for Strategic and International Studies, January 2019), 2, https://csis-website-prod.s3.amazonaws.com/s3fs-public/publication/190115_Lewis_Semiconductor_v6.pdf.

[17] Andrew David et al., “Foundational Fabs: China’s Use of Non-Market Policies to Expand Its Role in the Semiconductor Supply Chain” (Silverado Policy Accelerators, October 2023), 15, https://silverado.org/news/report-foundational-fabs-chinas-use-of-non-market-policies/.

[18] Michael Schuman, “China Is Losing the Chip War,” The Atlantic, June 6, 2024, https://www.theatlantic.com/international/archive/2024/06/china-microchip-technology-competition/678612/.

[19] Robert D. Atkinson, Nigel Cory, and Stephen Ezell, “Stopping China’s Mercantilism: A Doctrine of Constructive, Alliance-Backed Confrontation” (ITIF, March 2017), 15, https://itif.org/publications/2017/03/16/stopping-chinas-mercantilism-doctrine-constructive-alliance-backed.

[20] David et al., “Foundational Fabs,” 15.

[21] Julie Zhu, “Exclusive: China to launch $40 billion state fund to boost chip industry,” Reuters, September 5, 2023, https://www.reuters.com/technology/china-launch-new-40-bln-state-fund-boost-chip-industry-sources-say-2023-09-05/.

[22] “China is quietly reducing its reliance on foreign chip technology,” The Economist, February 13, 2024, https://www.economist.com/business/2024/02/13/china-is-quietly-reducing-its-reliance-on-foreign-chip-technology.

[23] “Silicon Supremacy,” Financial Times (podcast), https://www.ft.com/content/7bf0f79b-dea7-49fa-8253-f678d5acd64a.

[24] Organization for Economic Cooperation and Development (OECD), “Measuring distortions in international markets: The semiconductor value chain” (OECD, November 2019), 8, https://www.oecd-ilibrary.org/docserver/8fe4491d-en.pdf.

[25] Ibid.

[26] Ibid., 77.

[27] Dan Wang, “A Bumpier Road to Semiconductor Supremacy,” Gravel Dragonomics, July 14, 2020.

[28] OECD, “Measuring distortions in international markets: The semiconductor value chain,” 9.

[29] Saif M. Khan and Carrick Flynn, “Maintaining China’s Dependence on Democracies for Advanced Computer Chips” (Brookings Global China in Partnership With the Center for Security and Emerging Technology, April 2020), 7, https://www.brookings.edu/research/maintaining-chinas-dependence-on-democracies-for-advanced-computer-chips/. Citing: OECD, “Measuring distortions in international markets: The semiconductor value chain,” 84.

[30] David et al., “Foundational Fabs,” 14.

[31] Ibid.

[32] Ibid., 15.

[33] “China is quietly reducing its reliance on foreign chip technology,” The Economist.

[34] Paul Triolo, “A New Era for the Chinese Semiconductor Industry: Beijing Responds to Export Controls” American Affairs Vol. VIII, No. 1 (Spring 2024): 38, https://americanaffairsjournal.org/2024/02/a-new-era-for-the-chinese-semiconductor-industry-beijing-responds-to-export-controls/.

[35] Liza Lin, “China Tells Telecom Carriers to Phase Out Foreign Chips in Blow to Intel, AMD,” The Wall Street Journal, April 12, 2024, https://www.wsj.com/tech/china-telecom-intel-amd-chips-99ae99a9.

[36] Ibid.

[37] Liza Lin, “China Intensifies Push to “Delete America” From Its Technology,” The Wall Street Journal, March 7, 2024, https://www.wsj.com/world/china/china-technology-software-delete-america-2b8ea89f.

[38] Hawkins, “China Urges EV Makers to Buy Local Chips as US Clash Deepens.”

[39] Ibid.

[40] Lewis, “Learning the Superior Techniques of the Barbarians,” 23.

[41] Makena Kelly, “China state-owned company charged with stealing US tech trade secrets,” The Verge, November 1, 2018, https://www.theverge.com/2018/11/1/18052784/china-chip-stolen-trade-secrets-justice-department-semiconductor.

[42] United States Department of Justice, “Chinese Citizen Convicted of Economic Espionage, Theft of Trade Secrets, and Conspiracy,” news release, June 26, 2020, https://www.justice.gov/opa/pr/chinese-citizen-convicted-economic-espionage-theft-trade-secrets-and-conspiracy.

[43] Chuin-Wei Yap, “Taiwan’s Technology Secrets Come Under Assault From China,” The Wall Street Journal, July 1, 2018, https://www.wsj.com/articles/taiwans-technology-secrets-come-under-assault-from-china-1530468440.

[44] Fuller, Paper Tigers, Hidden Dragons, 137.

[45] Chad Brown, “How the United States marched the semiconductor industry into its trade war with China,” (Peterson Institute for Economics, December 2020), 16, https://www.piie.com/publications/working-papers/how-united-states-marched-semiconductor-industry-its-trade-war-china.

[46] China Tech Threat (CTT), “Every Chip Matters,” (CTT, April 2023), 5, https://chinatechthreat.com/wp-content/uploads/2023/05/CTT-EveryChipMatters-Final-Paper.pdf.

[47] Zeyi Yang, “Chinese chips will keep powering your everyday life: The war over advanced semiconductors,” MIT Technology Review, January 4, 2023, https://www.technologyreview.com/2023/01/04/1066136/chinese-legacy-chips-advantage/.

[48] Megha Mandavia, “How China Could Swamp India’s Chip Ambitions,” The Wall Street Journal, March 16, 2024, https://www.wsj.com/tech/how-china-could-swamp-indias-chip-ambitions-b01c4fcc.

[49] Coco Feng, “China’s semiconductor output jumps 40% in first quarter amid growing dominance in legacy chips,” South China Morning Post, April 16, 2024, https://www.scmp.com/tech/tech-war/article/3259221/chinas-semiconductor-output-jumps-40-first-quarter-amid-growing-dominance-legacy-chips.

[50] Andrew David et al., “Foundational Fabs,” 19.

[51] Ibid., 31.

[52] Ibid.

[53] Stephen Ezell, “Moore’s Law Under Attack: The Impact of China’s Policies on Global Semiconductor Innovation” (ITIF, February 2021), https://itif.org/publications/2021/02/18/moores-law-under-attack-impact-chinas-policies-global-semiconductor/.

[54] SIA, “2024 Factbook,” 3.

[55] Semiconductor Spreadsheet: “United States Census Bureau, USA Trade (imports and exports for semiconductors (HS8541 and HS8542),” accessed April 30, 2025), https://usatrade.census.gov/.; World Bank, “World Development Indicators (GDP (current $),” accessed April 30, 2025), https://databank.worldbank.org/source/world-development-indicators.

[56] Stephen Ezell and Trelysa Long, “How Expanding the Information Technology Agreement to an “ITA-3” Would Bolster Nations’ Economic Growth” (ITIF, September 2023), https://itif.org/publications/2023/09/11/how-expanding-the-information-technology-agreement-to-an-ita-3-would-bolster-nations-economic-growth/.

[57] Semiconductor Industry Association and Oxford Economics, “Chipping In,” (SIA and Oxford Economics, May 2021), https://www.semiconductors.org/wp-content/uploads/2021/05/SIA-Impact_May2021-FINAL-May-19-2021_2.pdf.

[58] Ibid., 4.

[59] Stephen Ezell, “Policy Recommendations to Stimulate U.S. Manufacturing Innovation” (ITIF, May 2020), https://itif.org/publications/2020/05/18/policy-recommendations-stimulate-us-manufacturing-innovation/.

[60] Oxford Economics, “Capturing the ICT Dividend: Using Technology to Drive Productivity and Growth in the EU” (Oxford Economics, September 2011), http://danielelepido.blog.ilsole24ore.com/files/oxford-economics.pdf.

[61] Robert D. Atkinson and Andrew S. McKay, Digital Prosperity: Understanding the Economic Benefits of the Information Technology Revolution (Information Technology and Innovation Foundation, March 2007), 3, http://www.itif.org/files/digital_prosperity.pdf.

[62] M. Cardona, T. Kretschmer, and T. Strobel, “ICT and Productivity: Conclusions From the Empirical Literature” Information Economics and Policy Vol. 25 (2013): 109–125, https://www.sciencedirect.com/science/article/abs/pii/S0167624513000036.

[63] Gilbert Cette and Jimmy Lopez, “ICT Demand Behavior: An International Comparison” Economics of Innovation and New Technology Volume 21, Issue 4 (September 2011), https://www.tandfonline.com/doi/abs/10.1080/10438599.2011.595921.

[64] United States Census Bureau, “USA Trade (US imports for 8541 and 8542 in 2023),” accessed February 28, 2025), https://usatrade.census.gov/index.php?do=login; International Trade Center, “List of importers for the selected products (imported value for total all products,” accessed February 2025), https://www.trademap.org/Country_SelProduct_TS.aspx?nvpm=1%7c%7c%7c%7c%7cTOTAL%7c%7c%7c2%7c1%7c1%7c1%7c2%7c1%7c2%7c1%7c1%7c1; OECD, “Global Revenue Statistics Database (tax revenue; taxes on income profits, and capital gains; general taxes on goods and services; and customs and import duties,” accessed February 2025), https://data-explorer.oecd.org/vis?fs[0]=Topic%2C1%7CTaxation%23TAX%23%7CGlobal%20tax%20revenues%23TAX_GTR%23&pg=0&fc=Topic&bp=true&snb=150&df[ds]=dsDisseminateFinalDMZ&df[id]=DSD_REV_COMP_GLOBAL%40DF_RSGLOBAL&df[ag]=OECD.CTP.TPS&dq=..S13._T..PT_B1GQ.A&lom=LASTNPERIODS&lo=10&to[TIME_PERIOD]=false.

[65] Stephen Ezell, Trelysa Long, and Meghan Ostertag, “Short-Circuited: How Semiconductor Tariffs Would Harm the U.S. Economy and Digital Industry Leadership” (ITIF, forthcoming May 2025).

[66] United States Census Bureau, “USA Trade (US imports for 8541 and 8542 in 2023”; OECD, “Global Revenue Statistics Database”; UN Stats, Country Profile (GDP at constant 2015 prices (US$).”

[67] United States Census Bureau, “USA Trade (US imports for 8541 and 8542 in 2023”; OECD, “Global Revenue Statistics Database”; UN Stats, Country Profile (GDP at constant 2015 prices (US$).”; World Bank, World Development Indicators (United States, population, total, in 2023), accessed March 10, 2025, https://databank.worldbank.org/source/world-development-indicators#.

[68] Polar Semiconductor, “How Many Semiconductor Chips Are in a Car? [Infographic],” November 30, 2023, https://polarsemi.com/blog/blog-semiconductor-chips-in-a-car; Stephen Ezell, “Short-term Chip Shortages Don’t Merit Government Intervention; Long-term Competitiveness in the Semiconductor Industry Does” (ITIF, February 18, 2021), https://itif.org/publications/2021/02/18/short-term-chip-shortages-dont-merit-government-intervention-long-term/.

[69] Sher Zhang, “EV and ADAS Trends Drive Carmakers in the Semiconductor Arena,” EV Design & Manufacturing, July 16, 2024, https://www.evdesignandmanufacturing.com/news/semiconductor-testing-pivotal-meeting-quality-cost-time-to-market-demands/#.

[70] Ezell, Long, and Ostertag, “Short-Circuited: How Semiconductor Tariffs Would Harm the U.S. Economy and Digital Industry Leadership.”

[71] Varadarajan et al. “Emerging Resilience in the Semiconductor Supply Chain.”

[72] Accenture and Global Semiconductor Alliance (GSA), “Globality and Complexity of the Semiconductor Ecosystem” (Accenture and GSA, February 2020), 6, https://www.gsaglobal.org/wp-content/uploads/2020/02/GSA-Accenture-Globality-and-Complexity-of-the-Semiconductor-Ecosystem.pdf.

[73] Stephen Ezell, “Chipping Away at Competitiveness: Why Tariffs Won’t Save U.S. Semiconductor Manufacturing,” Innovation Files, December 10, 2024, https://itif.org/publications/2024/12/10/chipping-away-at-competitiveness-why-tariffs-won-t-save-u-s-semiconductor-manufacturing/.

[74] Rodrigo Balbontin, “Retaliatory Tariffs Could Cut US ITA Exports by $56 Billion,” Innovation Files, April 23, 2025, https://itif.org/publications/2025/04/23/retaliatory-tariffs-could-cut-us-ita-exports-by-usd56-billion/.

[75] Daniel Castro and Stephen Ezell, “Overly Stringent Export Controls Chip Away at American AI Leadership,” Innovation Files, May 5, 2025, https://itif.org/publications/2025/05/05/export-controls-chip-away-us-ai-leadership/.

[76] Author’s analysis of these companies’ most recent 10K reports (analysis conducted the week of April 28, 2025).

[77] SIA, “Semiconductor Supply Chain Investments.”

[78] Pete Singer, “U.S. Aims for 20% of World’s Leading Edge Semiconductor Production by 2030,” Semiconductor Digest, March 5, 2024, https://www.semiconductor-digest.com/u-s-aims-for-20-of-worlds-leading-edge-semiconductor-production-by-2030/.

[79] The Trump White House, “Fact Sheet: President Donald J. Trump Establishes the United States Investment Accelerator,” news release, March 31, 2025, https://www.whitehouse.gov/fact-sheets/2025/03/fact-sheet-president-donald-j-trump-establishes-the-united-states-investment-accelerator/.

[80] Yuka Hayashi, “Eager for Economic Wins, Biden to Announce Billions for Advanced Chips,” The Wall Street Journal, January 27, 2024, https://www.wsj.com/politics/policy/eager-for-economic-wins-biden-to-announce-billions-for-advanced-chips-7e341e30.

[81] Stephen Ezell, “How Innovative Is China in Semiconductors?” (ITIF, August 2024), https://itif.org/publications/2024/08/19/how-innovative-is-china-in-semiconductors/.

Related

January 16, 2026