Why US Trade Policy Needs to Prioritize Advanced Industries for Global Competitiveness

Soybeans are not semiconductors. The former does not fuel innovation, national power, or technological leadership. The latter does. As the U.S. crafts new trade policies—especially those involving China—it must prioritize advanced industries over basic commodities to ensure long-term global competitiveness.

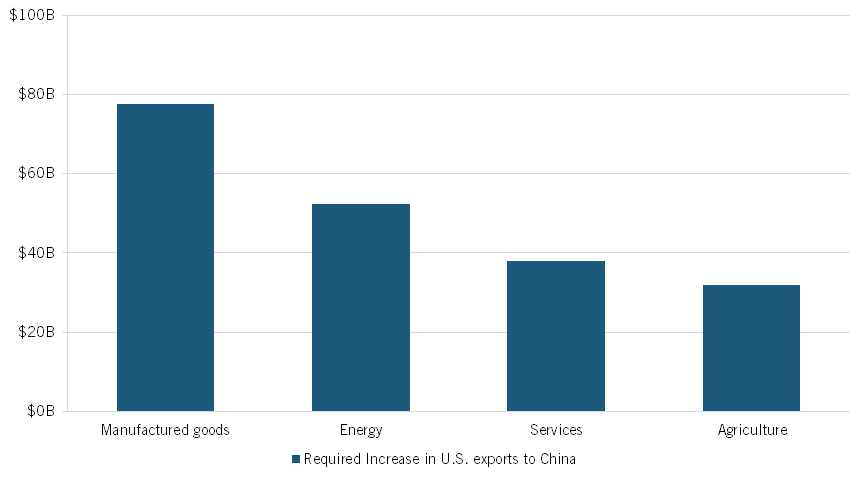

Yet, as indicated by the new executive order “America First Trade Policy,” the Trump administration appears to disagree. The order suggests that the administration will focus on increasing exports of predominantly non-advanced products to reduce the trade deficit between the United States and China. It directs the U.S. Trade Representative to review the 2020 Economic and Trade Agreement (ETA) between the United States and China, partly to determine whether China has fulfilled the provisions to increase the import of manufactured goods, but also agricultural products, energy products, and services by a total of $200 billion between January 2020 and December 2021. While the manufactured goods category includes many advanced industry products, the reality is that the products in the other three categories that the ETA relies on to reduce the deficit are non-advanced—except for cloud and related services within the Services category. The ETA requires China to increase its exports in these three non-advanced categories by $122.3 billion, compared to $77.7 billion in manufactured goods, which are mostly advanced industry products (see figure 1).

Figure 1: Economic and Trade Agreement provision to increase exports to China by $200 billion

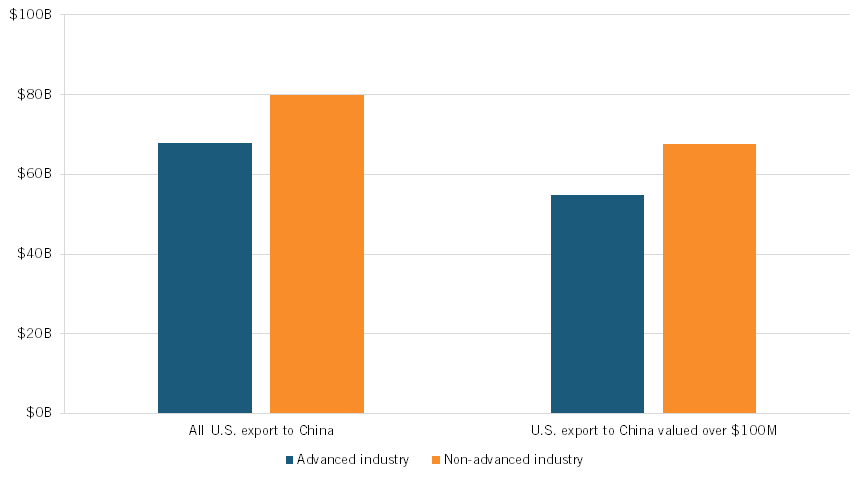

Corroborating this, ITIF found that the United States exported more non-advanced industry products than advanced industry ones. Using the U.S. Census’ USA Trade database, we found that in 2023, the U.S. exported $80 billion in non-advanced products to China and just $68 billion in advanced industry products. When examining the exported commodities that exceeded $100 million, the total value of non-advanced products, at $68 billion, still exceeded that of advanced industry products by $12.9 billion (see figure 2).

Figure 2: U.S. exports to China in advanced and non-advanced industry products in 2023

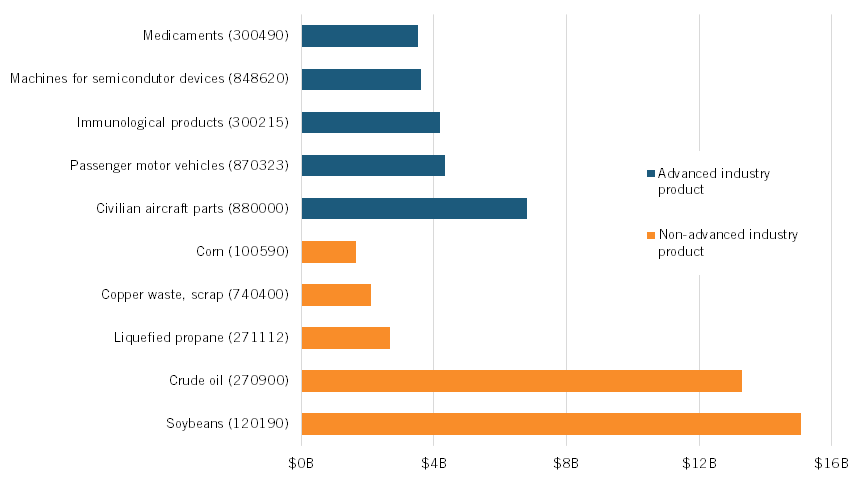

The top five non-advanced commodities exported to China were soybeans, nesoi; crude oil from petroleum and bituminous minerals; propane, liquefied; copper waste and scrap; and corn (maize), other than seed corn. These five commodities accounted for 24 percent of the total U.S. exports to China. Meanwhile, the top five advanced commodities were civilian aircrafts, engines, and parts; passenger motor vehicles with spark-ignition internal combustion; immunological products, machines for manufacturing semiconductor devices; and medicaments nesoi. Collectively, these products contributed to only 15 percent of the total U.S. exports to China (see figure 3).

Figure 3: Top five advanced and non-advanced U.S. industry exports to China, 2023 (by HS code)

This is problematic because exporting soybeans and copper waste will not help U.S. advanced industry firms gain the much-needed access to the Chinese market, which would provide them with more revenue to invest in the next generation of advanced products. As a result, ITIF notes that the smaller market size for these U.S. firms will reduce their scale and potentially harm the United States’ mid- and long-term competitive advantage.

What’s more concerning, this will boost China’s competitiveness because Chinese firms will rely less on U.S. technology and instead develop their own, leading to a smaller Chinese market available to U.S. advanced industry firms. Indeed, according to the Mercator Institute for China Studies, the 2015 export block of U.S. chips for the Tianhe-2 supercomputer prompted China to develop its own high-performance chips as a replacement. As a result, U.S. chipmakers lost revenue and market shares in China. Although exporting fewer advanced industry products than non-advanced ones is not necessarily the same as export controls, it results in the same outcome—the loss of existing or potential market shares in the Chinese market for U.S. firms.

Alexander Hamilton famously warned that the U.S. could no longer be a hewer of wood and drawer of water, especially given that the new republic depended on Great Britain for advanced goods. Today, the situation is no different. China would be more than happy to maintain a trade balance with the United States as long as most of our imports were “wood and water,” rather than machines and software.

As such, the new administration and policymakers should target the U.S.-China trade deficit by increasing exports of advanced industry products and reducing imports of these products from Chinese firms. This will ensure that U.S. firms can gain market shares from the Chinese market, use that revenue to fund the next generation of advanced products, and subsequently boost U.S. competitiveness. Moreover, this is especially important because the United States is already falling behind China in the production of advanced industry products. As ITIF’s Hamilton Index highlights, “As of 2020, China was the leading producer in seven of the ten strategically important industries…China’s gains have come at the expense of the United States and other G7 and OECD economies.” Increasing advanced industry exports will be the first step in catching up to China in these crucial industries.

Editors’ Recommendations

April 11, 2022

Why America Should Compete to Win in Advanced Industries

September 16, 2024

China Is Rapidly Becoming a Leading Innovator in Advanced Industries

August 25, 2023