Falling Behind: US Businesses Are Overlooking Emerging Tech That Could Drive Productivity

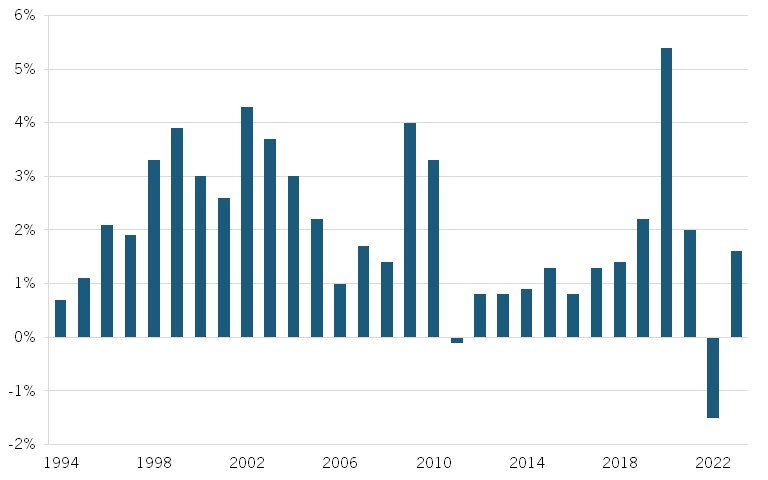

The United States has faced an unprecedented slowdown in labor productivity in the last two decades. While nonfarm business labor productivity grew annually at an average of 3.3 percent from the late 1990s through 2005, the rate has slowed markedly since then. Indeed, as the Bureau of Labor Statistics asserts, the labor productivity “high growth period came to an end during the mid-2000s, when U.S. labor productivity growth rates began to stumble, and in 2006 receded below the long term average” of 2.1 percent from 1947 to 2018. Although the growth rate has exceeded 2.1 percent in recent years—in 2019 and 2020, partly due to COVID-19—the rate has returned to below average since 2021. (See figure 1.)

Figure 1: Labor productivity change from previous year

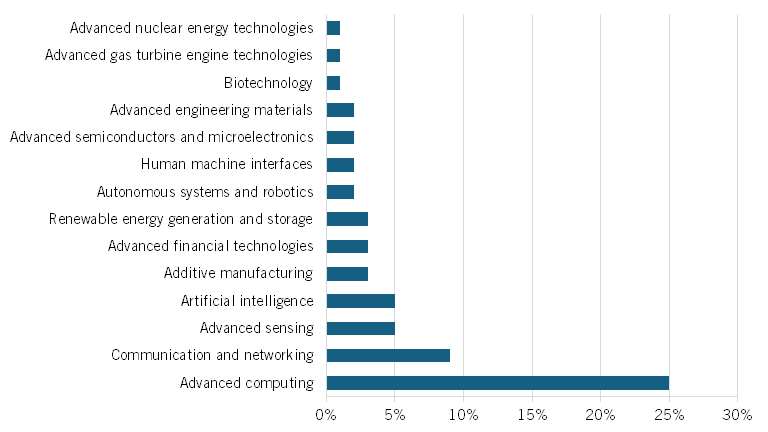

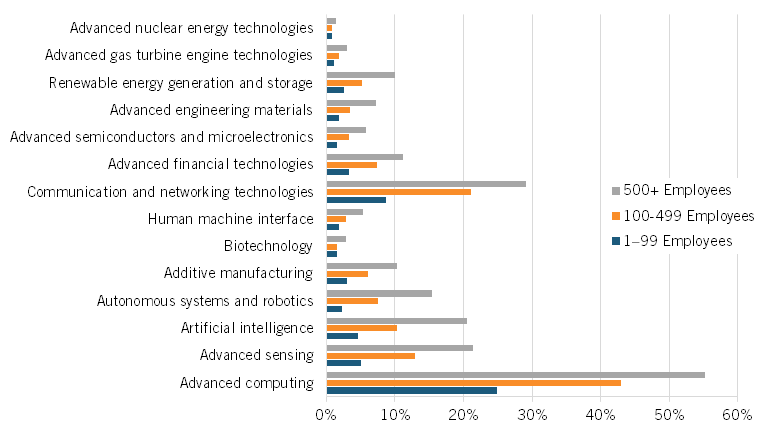

As a result of this slowdown, U.S. firms should adopt advanced technologies that improve productivity. Yet, data from the National Science Foundation’s (NSF) Annual Business Survey (ABS), which examines 14 critical and emerging technologies, shows that, as of 2021 (the latest year), few companies in the United States adopt advanced technologies. (See figure 2 for the list of technologies.) However, large firms are significantly more likely to use these technologies than smaller ones.

Advanced technologies can boost a firm’s labor productivity, but U.S. businesses seldom adopt them. A study by Acemoglu et. al. examining 300,000 employer businesses found that firms that adopted at least 1 advanced technology measured in the 2019 ABS, such as artificial intelligence (AI), had 11.4 percent higher productivity than non-adoptees. The rate increased to 21.2 percent when firms adopted all 5 technologies measured in the survey.

Yet, according to the NSF ABS, only 25 percent of analyzed U.S. firms used advanced computing technologies in 2021. More importantly, less than 10 percent of U.S. companies adopted each of the other 13 technologies. For instance, only 9 percent of U.S. firms adopted communication and networking technologies, and only 5 percent adopted AI. (See figure 2.) While not every U.S. firm can realistically adopt biotechnology, for example, that cannot be said about technologies such as AI. Even a local mom-and-pop shop making muffins can use AI to enhance their recipes. As such, the low rates of adoption are concerning. The rates may be different in 2024 due to recent developments. But even so, it is doubtful that a vast proportion of U.S. firms have adopted AI and these other technologies.

Figure 2: Companies using critical and emerging technologies at least “a little” in 2021

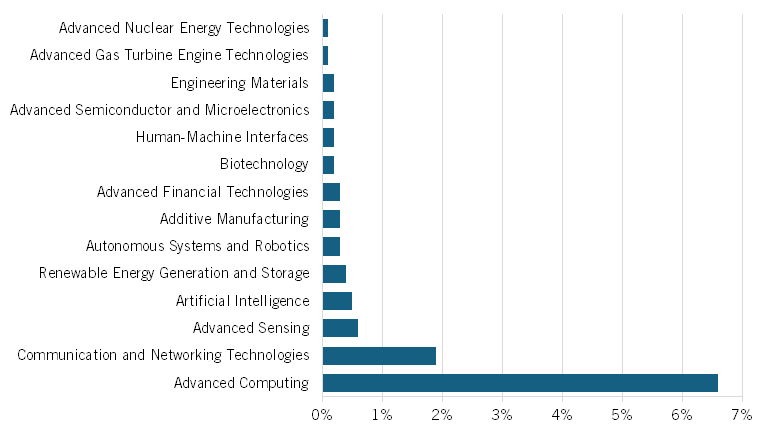

More concerningly, these adoption rates are for firms that have utilized these technologies to the extent of at least “a little.” When examining the rate of adoption for firms that have seriously incorporated these technologies into their business functions, the survey results are even more grim. According to NSF’s ABS, only 6.6 percent of analyzed U.S. firms claimed to use advanced computing technologies “a lot” in 2021. Less than 2 percent of U.S. firms asserted that they have incorporated the remaining 13 technologies by “a lot.” Indeed, only 1.9 percent of U.S. firms incorporated communications and networking technologies by “a lot” and only 0.3 percent adopted advanced financial technologies in their business functions. (See figure 3.)

Figure 3: Companies using critical and emerging technologies “a lot”

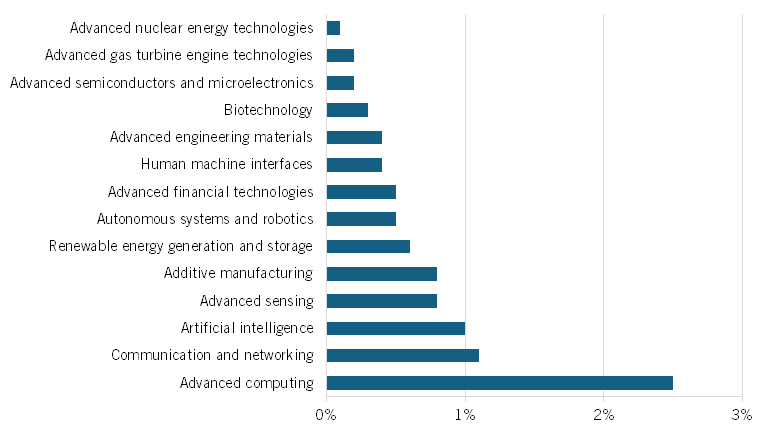

As a result of the low adoption rates, an even lower rate of U.S. companies are investing in the development of these advanced technologies. When asked whether they have performed or funded research and development (R&D) in these technologies, only 2.5 percent of surveyed U.S. firms replied “yes” for advanced computing technologies and only 1.1 percent for communication and networking technologies. Of the firms analyzed, only 1 percent or less performed or invested in R&D for each of the remaining 12 technologies. (See figure 4.)

Moreover, in the manufacturing sector, virtually every single one of these technologies depends heavily on R&D from the computer and electronic products subsector. Firms in this subsector were among the top 3 R&D contributors to all 14 technologies. Corroborating this, the NSF writes, “There are some industries where the percentages [of firms investing in R&D] are higher for certain CETs. Over one-quarter (28%) of software publishers (NAICS 5112) and 15% of companies classified as the computer systems design and related services industry (NAICS 5415) funded or performed R&D in the advanced computing CET.”

Figure 4: Companies funding or performing critical and emerging technologies R&D by technology in 2021

Despite the low adoption and R&D investment rates, a saving grace for productivity growth is that the United States is home to many large companies. Despite what the anti-corporate neo-Brandeisians would have us believe, large companies are usually more productive, partly because they have more capabilities and are more willing to adopt novel technologies. Indeed, a greater share of companies with more than 500 employees adopted the usage of each of these 14 technologies compared to their smaller counterparts. For example, 55.2 percent of surveyed U.S. companies with more than 500 employees adopted advanced computing technologies compared to 25 percent for firms with 1 to 99 employees. Similarly, 5.3 percent of firms with 500 or more employees adopted human machine interface technologies compared to 2.9 percent for firms with 100 to 499 employees. (See figure 5.) As a result, the low U.S. productivity growth rate could be reversed as more large firms adopt these new technologies.

Figure 5: Companies using critical and emerging technologies by company size and technology in 2021

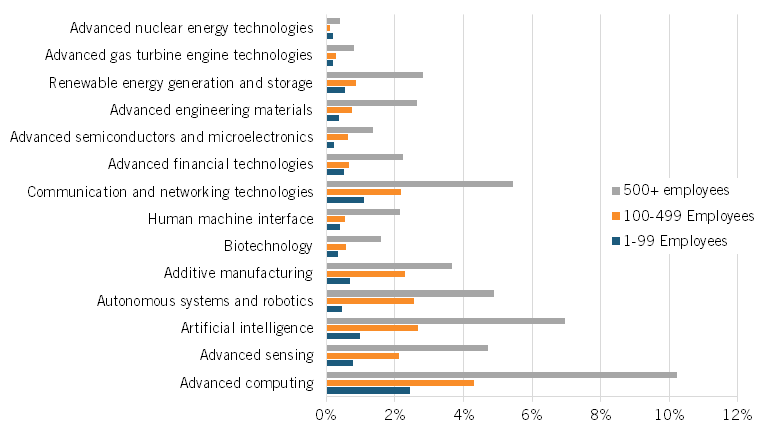

Not only do large businesses maintain higher adoption rates, but they are also more likely to invest in R&D for these technologies. In 2021, U.S. firms with more than 500 employees were more likely to invest in these 14 advanced technologies than their smaller counterparts. Indeed, 7 percent of surveyed firms with more than 500 employees affirmed they have invested in R&D for AI, compared to 1 percent for firms with 1 to 99 employees and 2.7 percent for firms with 100 to 499 employees. Meanwhile, 4.9 percent of firms with more than 500 employees invested in R&D for autonomous systems and robotics technologies, while only 0.5 percent of firms with 1 to 99 employees and 2.5 percent with 100 to 499 employees invested. (See figure 6.) Corroborating this, NSF also asserted that “a higher proportion of larger companies than smaller companies performed or funded R&D in most CET…For example, 2 percent of microbusinesses fund or perform R&D in advanced sensing [compared to] 20 percent of business with 25,000 or more employees.” As a result, these investments by large firms will likely lead to the advancement and creation of more productivity-enhancing technologies, contributing to the reversal of the U.S. productivity growth rate slowdown.

Figure 6: Companies funding or performing critical and emerging technologies R&D by company size and technology in 2021

These numbers should be a wake up call for Washington. Policymakers must incentivize businesses to adopt and invest in the development of critical and emerging technologies. To start with, they can encourage greater investment in R&D by doubling the R&D tax credit rate from 20 to 40 percent for the regular credit and 14 to 28 percent for the Alternative Simplified Tax Credit. Moreover, policymakers should restore full expensing of R&D expenditures in order to reduce the after-tax cost of R&D investment, further encouraging firms to invest in these technologies, as well as adopting other pro-innovation tax reforms.

In addition, Congress should expand funding for NIST’s Manufacturing Extension Partnership (MEP) and ensure that NIST broadens the MEP scope to include the adoption of critical and emerging technologies. It should also expand funding for Manufacturing USA centers, which work with companies to develop and adopt advanced technologies.

Finally, policymakers should provide tax incentives to companies incorporating these technologies into a significant portion of their business functions, incentivizing more firms to adopt them. Higher adoption rates and investments will boost U.S. competitiveness, especially in advanced industries. This is essential because the United States is falling behind China in advanced industry production, as a recent ITIF report shows. To help maintain global techno-economic dominance, the next Congress should restore first year expensing of capital investment. In sum, while U.S. firms have not seriously incorporated critical and emerging technologies into their business functions, if policymakers can encourage them to do so, multiple economic and geopolitical challenges could be tackled.

Editors’ Recommendations

September 25, 2024

Twelve Tax Reforms to Spur Innovation and Competitiveness

Related

December 16, 2022

Adoption of Advanced Technologies Was Associated With 11.4 Percent Higher Labor Productivity in 2016–2018

April 8, 2025

AI Can Improve US Small Business Productivity

June 22, 2015