New BEA Data Shows Sharp Increase in Greenfield FDI in 2023

Inward foreign direct investment (FDI) can help grow the U.S. economy. Still, very little is in the form of foreign firms building or expanding facilities (greenfield investment) in the United States. In 2022, around 95 percent of all FDI was to acquire U.S. firms.There is nothing inherently wrong with acquiring firms or facilities; however, greenfield expenditures play an especially important role because they expand domestic capacity, which is crucial for continued growth in the United States.

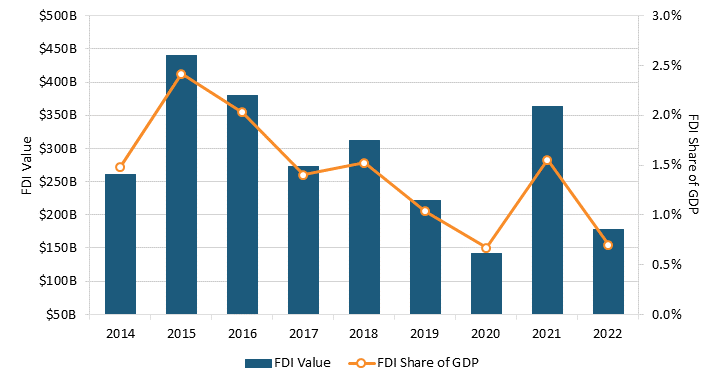

Total FDI has fluctuated, though generally falling, over the past nine years. After falling from 2015 to 2020, it increased from $141 billion in 2020 to $362 billion in 2021 before falling again to $177 billion in 2022 (figure 1).

Figure 1: Total foreign direct investment in U.S. businesses, 2014–2022

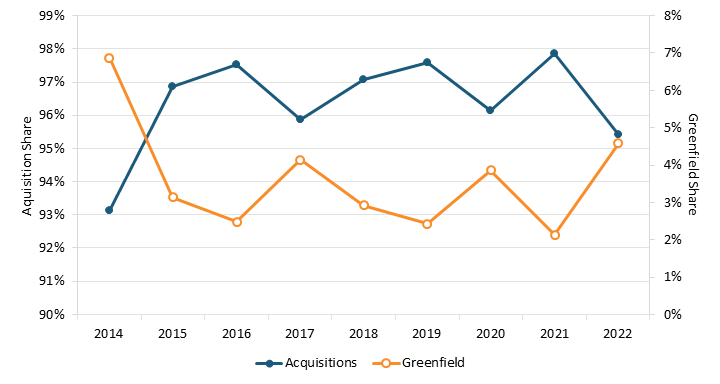

Greenfield FDI has also fluctuated in terms of its share of total FDI. In 2014, greenfield FDI was almost 7 percent of total FDI. However, between 2015 and 2022, its share has hovered around 2 percent and 4.5 percent but has yet to grow to where it was in 2014 (figure 2).

Figure 2: Acquisitions and greenfield investments as shares of total FDI in U.S. businesses, 2014–2022

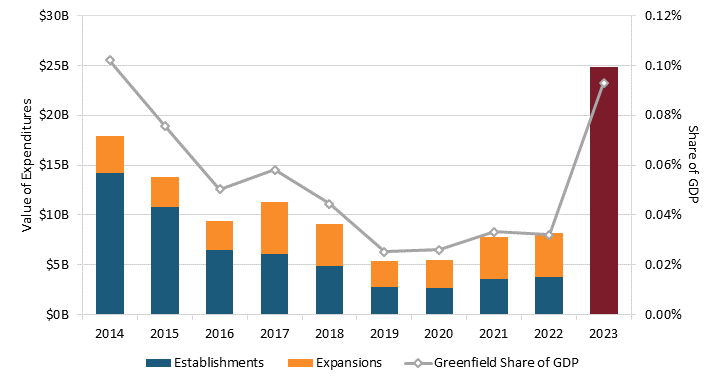

However, new data from the U.S. Bureau of Economic Analysis (BEA) on planned expenditures for 2023 presents a promising picture (figure 3). While inward FDI in 2021 had recovered to its highest value since 2016, greenfield expenditures continued to fall and stagnated at 0.03–0.04 percent of GDP between 2019 and 2022. In 2022 (the latest year for available data), greenfield expenditures were $8.1 billion and 0.03 percent of GDP. However, planned 2023 greenfield expenditures are $24.8 billion and 0.09 percent of GDP. Not only did this figure significantly surpass its 2014 value, but it has almost recovered to the share of GDP it was in 2014 (figure 3).

Figure 3: Greenfield inward FDI expenditures, 2014–2022 (with 2023 as planned)

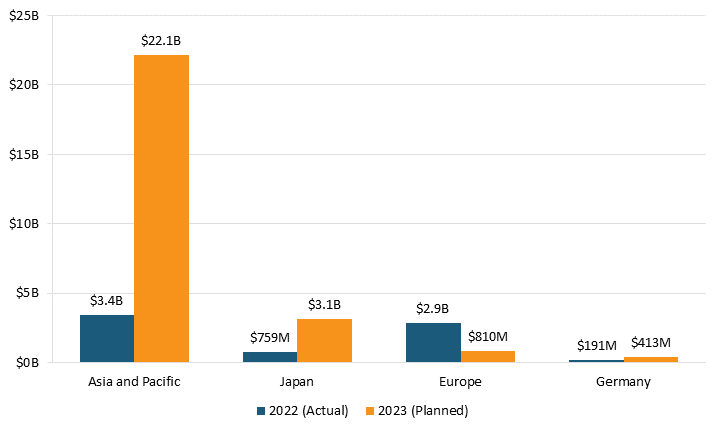

It will be interesting to see how the ongoing boom in greenfield FDI evolves over the next few years. Figure 4 considers how greenfield FDI has changed relative to just last year for major regions. The BEA does not yet have the data on most of the major U.S. trading partners, but it does have data for this year for major trading regions, namely Europe and the Asia-Pacific region. While Germany has doubled its greenfield investments relative to 2022, investments from Europe declined by 72 percent overall. Thus, while German firms contributed around 7 percent of all European greenfield FDI last year, they plan to contribute 51 percent this year. The big increase in this year’s greenfield FDI flows appears to come from Japan and elsewhere in the Asia-Pacific region. Compared to last year, planned greenfield FDI from Japanese investors increased four-fold and from Asia-Pacific overall by over six-fold. The motivation behind the investments from Asia is partly due to national security concerns. Countries like Japan, Taiwan, and South Korea are as interested as the United States in diversifying their supply chains to avoid being too dependent on China.

Figure 4: Greenfield FDI from top U.S. trading partners

These planned investments also seem to be spurred by the passage of the CHIPS and Science Act and the clean energy provisions in the Inflation Reduction Act. For instance, earlier this year, Taiwan’s TSMC made plans to invest $40 billion through 2026 to establish a new semiconductor plant in Arizona. South Korea’s LG has also made plans to invest $5.5 billion to build a new factory for EV batteries.

In the future, two things will be of continued interest. The first will be that the planned greenfield investments for this year will hopefully play out. The second will be that greenfield investment will grow even more in the coming years, both absolutely and as a share of all FDI. Hopefully, the CHIPS Act will not be a one-off, and Congress will recognize the importance of implementing similar policies, including tax policies, to attract investments for advanced industries.