Preserving US Biopharma Leadership: Why Small, Research-Intensive Firms Matter in the US Innovation Ecosystem

America is home to 85 percent of the world’s small, research-intensive biopharma firms. These start-ups are critical to drug development and U.S. competitiveness. Congress should make targeted changes to tax policy to incentivize them and maintain U.S. biopharma leadership.

KEY TAKEAWAYS

Key Takeaways

Contents

Small, Research-Intensive Firms. 3

Small, Research-Intensive Firms in the Biopharma Industry. 5

Small, Research-Intensive Biopharma Firms in the United States. 8

Just the Facts About the U.S. Innovation Ecosystem.. 10

Introduction

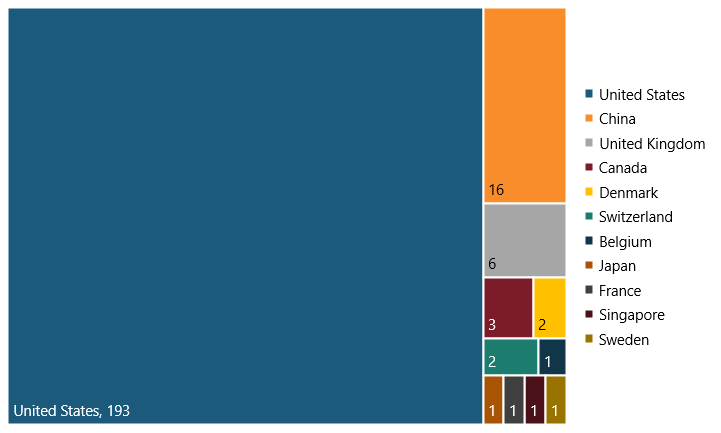

Research and development (R&D) in the biopharmaceutical sector is critical for developing new drugs that can treat and cure diseases. A strong national innovation ecosystem—one that includes supportive policies—is vital for enabling a diverse community of actors in the drug development process to innovate and thrive. The United States is characterized by this complex ecosystem consisting of universities, venture-backed start-ups, and larger biopharma companies. Moreover, it has an array of policies, including strong intellectual property (IP) protection, government funding of basic biomedical research, and a drug pricing system that enables drug companies to invest in R&D.[1] This is important because it helps the United States lead the world in this sector. As a result of these characteristics, the United States is unique in having a vibrant and research-intensive biopharmaceutical start-up system. Indeed, among the firms ranking as the world’s top 2,500 R&D investors in 2021, 260 were small, research-intensive (SRI) firms. And of those 260, an astounding 193 were U.S. biopharmaceutical start-ups. (See table 1.)

Yet, survival for these firms is often daunting. The process from research to market approval is challenging, especially for firms with no or few sales. Most “burn” through invested equity for years while conducting research. According to a study by Richard Thakor et al., biotech companies “typically do not generate revenue … incur much larger losses … consistent with the fact that many biotech companies focus on R&D and do not have lines of commercialized drugs that they actively manufacture and sell.”[2] As a result, these companies often succumb to the “valley of death,” or the stage between the discovery of a new drug and market approval when “cash is flowing out, risks are high, and valuation is low.”[3] Moreover, according to Calza et al., the “pharmaceutical industry is the one in which the [valley of death] phenomenon has been observed more frequently.”[4] Indeed, PhRMA found that only 1 drug succeeds for every 5,000 to 10,000 compounds entering the drug development pipeline.[5]

Despite the risks, these firms (and their investors) are doing exactly what most economic policy analysts and commentators say more firms should be doing: making big bets on activities that could have big, longer-term payoffs, not only for the investors but also for the U.S. economy and global society. Unfortunately, the U.S. tax code is poorly suited to these kinds of risk-takers. In particular, because these firms are usually many years away from making a profit (if they ever do), the R&D tax credit is of little use to them because it is a credit against profits, even though they can carry forward credits for seven years. And other tax provisions make it harder for these companies to invest, especially if they change ownership. As such, Congress should pass the American Innovation and Jobs Act, which would make it easier for pre-profit firms to take the R&D tax credit, restore R&D expensing, and amend sections 469 and 382 of the tax code so that passive investors are allowed to take advantage of the net operating losses and research tax credits and carry net operating losses forward even when ownership changes.

Despite the risks, these firms (and their investors) are doing exactly what most economic policy analysts and commentators say more firms should be doing: making big bets that could have big, longer-term payoffs, not only for the investors but also for the U.S. economy and global society.

This report uses data from the 2022 edition of the EU Industrial R&D Investment Scoreboard, a dataset that lists the 2,500 firms that spend the most in the world on R&D, to examine SRI biopharma firms.[6] References to SRI biopharma firms are to biotechnology and pharmaceutical firms with less than $15 million in revenue or fewer than 500 employees operating at a net loss.

Table 1: Small, research-intensive (SRI) firms among the world’s top 2,500 R&D investors in 2021, by country[7]

|

Countries |

All SRI Firms |

SRI Biopharma Firms |

Biopharma Share of All SRI Firms |

||

|

United States |

211 |

81% |

193 |

85% |

91% |

|

Rest of the World |

49 |

19% |

34 |

15% |

69% |

|

Worldwide |

260 |

|

227 |

|

87% |

Small, Research-Intensive Firms

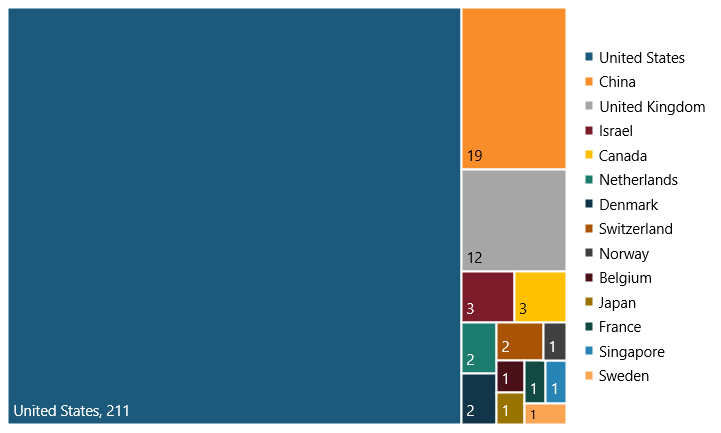

The United States is home to the lion’s share of the world’s 260 SRI firms, thanks to the country’s robust innovation ecosystem. In 2021, the United States had 211 of these firms (81 percent) while, in comparison, the rest of the world had 49 of these firms (19 percent).[8] (See figure 1.) In other words, the U.S. innovation ecosystem fosters the majority of SRI firms, promoting greater innovation and competitiveness for the nation.

Figure 1: Breakdown of the 260 SRI firms among the world’s top 2,500 R&D investors in 2021, by country[9]

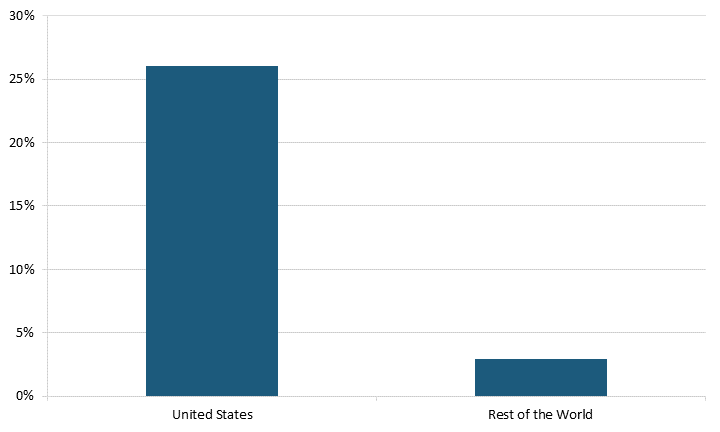

Moreover, SRI firms made up a higher share of domestic firms in the United States compared with the rest of the world in 2021. In the United States, SRI firms made up 26 percent of total high R&D-spending firms, while SRI firms only made up 2.9 percent of these firms in the rest of the world.[10] (See figure 2.) The United States’ favorable innovation system encourages the development of more of these firms than do other nations, encouraging innovation.

Figure 2: SRI firms as a share of all research-intensive firms in 2021[11]

Small, Research-Intensive Firms in the Biopharma Industry

A majority of the world’s 260 SRI firms are in the biopharma sector because the sector is so R&D intensive. Moreover, because of the nature of the life sciences, start-up firms with new ideas and capabilities can more easily enter the market than in other industries that have higher barriers to entry. According to an HBM Partners report, small pharmaceutical companies have historically driven innovation through the introduction of new drugs, finding that small pharmaceutical companies introduced 31 percent of new molecular entities in 2009.[12] By 2018, this figure rose to 64 percent.[13] Another study by Mosab Hammoudeh et al. finds that small firms further improved innovation likelihood when they became licensees of large firms’ abandoned projects.[14] Indeed, the study finds that 37 percent of the licensed projects from large firms to start-ups had experienced some progress into the next Food and Drug Administration clinical trial phase, while only 18 percent of the control drug projects had progressed into the next phase of trials.[15] In other words, SRI firms are critical to the biopharma industry.

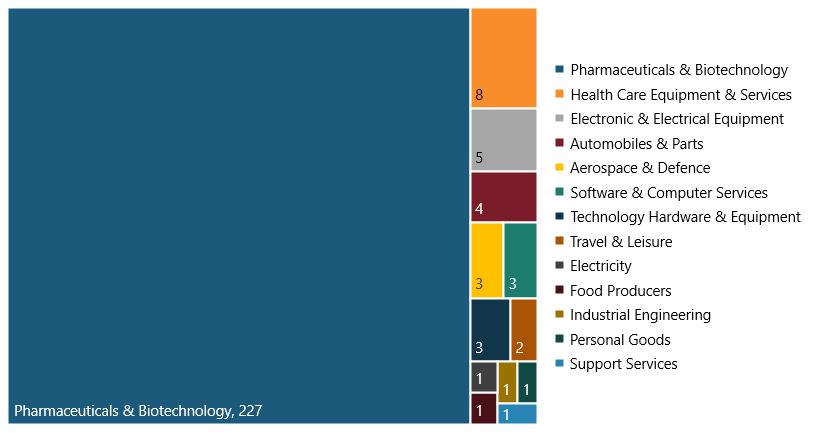

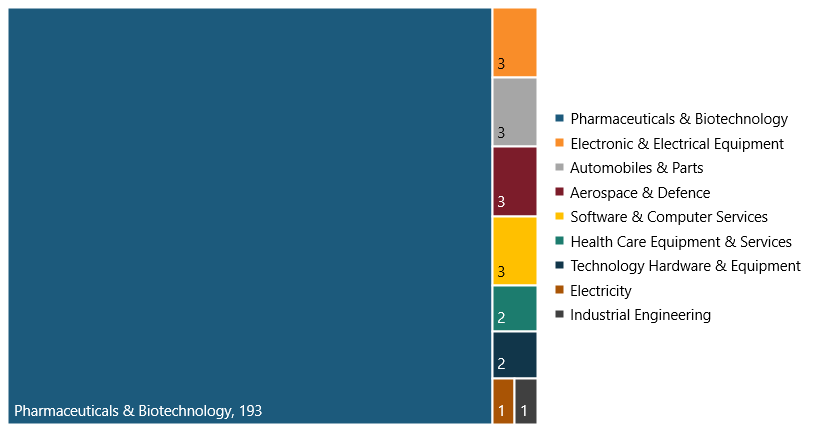

As a result, the biopharma industry had the most SRI firms compared with all other industries. In 2021, the biopharma industry had 227 of these firms (87 percent), compared with 33 in all other industries (13 percent).[16] (See figure 3.)

Figure 3: Breakdown of the 260 SRI firms among the world’s top 2,500 R&D investors in 2021, by industry[17]

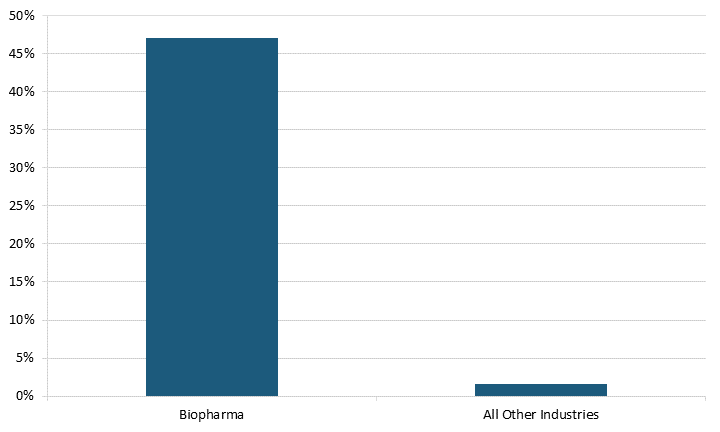

Because of their large numbers, SRI firms also made up a higher share of the biopharma industry compared with all other industries. In the biopharma industry, SRI firms made up 48 percent of the total firms, while these types of firms only made up 1.6 percent of total firms in all other industries, meaning these firms thrive in the biopharma industry compared with all others.[18] (See figure 4.)

Figure 4: SRI firms as a share of all research-intensive firms in 2021 worldwide[19]

The contribution of small firms to the innovation of new drugs means they also increase the sector’s R&D productivity. A study by Mathew Higgins finds that pharmaceutical firms that experience a decline in their internal productivity often “engage in an outsourcing-type acquisition in an effort to replenish their research pipelines.”[20] Higgins found that “71 percent of acquirers in [their] sample either maintain or improve their product pipelines or portfolios post acquisitions.”[21] Another study concludes that “creating innovation centers is another trend for pharmaceutical companies to boost innovation by mixing the internal and external resource including experts within or outside of a company” because of the high cost and long duration to develop a new drug, which Deloitte’s 13th Annual Pharmaceutical Innovation Report estimated to be about $2.3 billion in 2022.[22] In other words, SRI firms’ R&D contributes to the sector’s R&D productivity, promoting competitiveness for nations that support SRI firms’ growth.

SRI biopharma firms also contribute to the sector’s R&D productivity, boosting innovation and competitiveness.

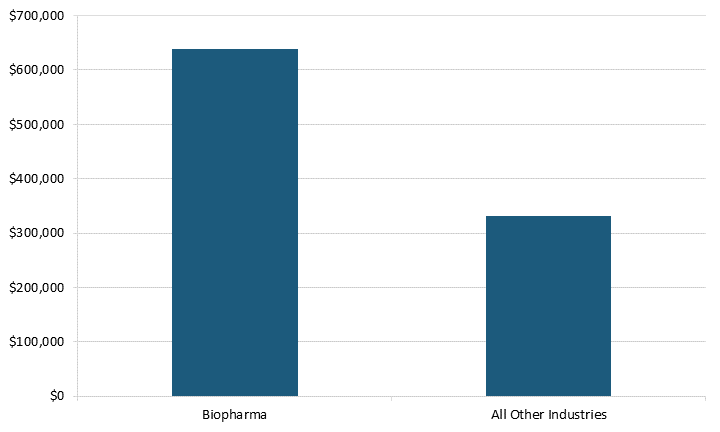

SRI biopharma firms contribute more to R&D spending per employee than do SRI firms in all other industries. In 2021, SRI biopharma firm spent $637,735 per employee on R&D compared with $331,311 for all other industries, meaning these firms dedicate more to R&D.[23] (See figure 5.) This is because these biopharma firms primarily focus on research in their early stages.

Figure 5: R&D spending per employee in SRI firms in 2021, worldwide[24]

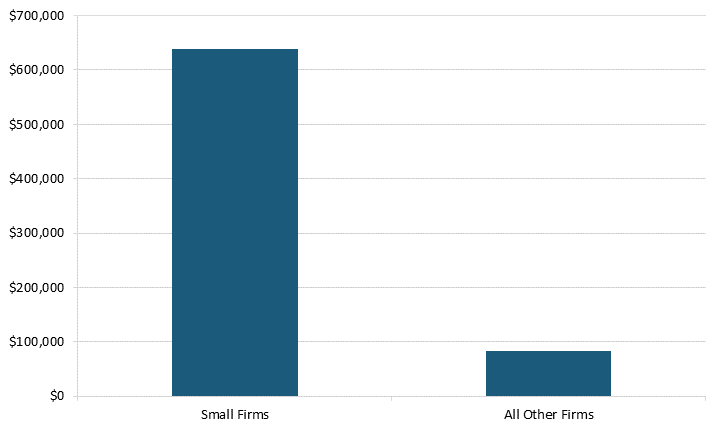

SRI biopharma firms also spent more than their larger counterparts because they had fewer production workers. In 2021, these firms spent almost eight times more than did larger biopharma firms—$637,735 per employee compared with large firms’ $82,515.[25] (See figure 6.) As a result, they also contribute to the sector’s R&D productivity, boosting innovation and competitiveness.

Figure 6: R&D spending per employee in biopharma firms in 2021, worldwide[26]

Small, Research-Intensive Biopharma Firms in the United States

In 2021, there were 227 SRI biopharma firms globally. Of these, 193 were in the United States (85 percent) and 34 were in the rest of the world (15 percent).[27] (See figure 7.) This is because of the United States’ strong biopharma innovation ecosystem and favorable policies (e.g., minimal price controls historically) for the sector.

Figure 7: Breakdown of the 227 SRI biopharma firms in the top 2,500 R&D investors in 2021, by country[28]

The robust biopharma innovation ecosystem means the lion’s share of U.S. SRI firms are in the biopharma sector. In 2021, there were a total of 211 SRI firms in the United States, so the 193 biopharma firms comprised 91 percent and the remaining 18 SRI firms 9 percent.[29] (See figure 8.) This is important because these firms boost R&D productivity, driving the nation’s competitiveness in the sector.

Figure 8: Breakdown of the 211 U.S. SRI firms in the world’s top 2,500 R&D investors in 2021, by industry[30]

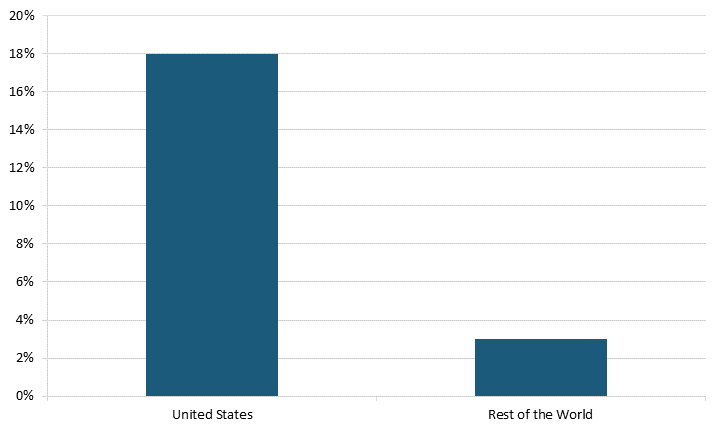

The solid and supportive U.S. biopharma innovation ecosystem incentivizes small firms to contribute more than do other nations to the sector’s R&D activities. In 2021, U.S. SRI firms spent $25.3 billion on R&D, making up 18 percent of the domestic sector’s spending.[31] In comparison, SRI firms in the rest of the world spent $3.7 billion, making up only 3 percent of the sector’s spending (excluding the United States).[32] (See figure 9.)

Figure 9: SRI firms’ share of biopharma R&D spending in 2021, worldwide[33]

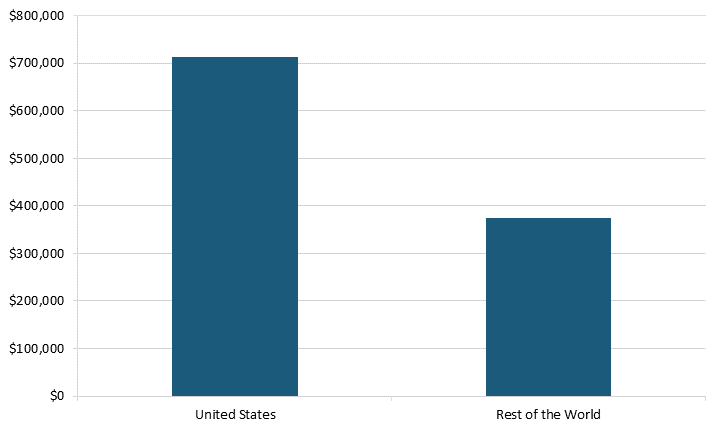

Even when adjusting for firm size, U.S. SRI biopharma firms spent almost two times more on R&D than did those in the rest of the world. In 2021, U.S. SRI firms spent $712,258 per employee on R&D compared with $373,997 for the rest of the world’s SRI firms.[34] (See figure 10.) In other words, U.S. SRI firms’ high R&D spending boosts the sector’s innovation, ensuring the United States’ leadership in the biopharma sector.

Figure 10: R&D spending per employee in SRI biopharma firms in 2021, worldwide[35]

Just the Facts About the U.S. Innovation Ecosystem

The United States has the majority of SRI firms because of its strong innovation ecosystem. A recent 2023 Startup Genome report finds that 13 of the top 30 global regional [start-up] ecosystems are based in the United States.[36] It also finds that the top five ecosystems are based in the United States, with Silicon Valley the top-performing ecosystem, valued at $2.4 trillion.[37] The subsequent four include New York City, Los Angeles, Boston, and Seattle. Collectively, these five ecosystems are estimated to contribute $3.96 billion to the global economy.[38]

The United States’ robust biopharma sector with large pharmaceutical companies creates “demands for new technologies” that incentivize smaller firms to develop in the economy.

The U.S. innovation ecosystem is strong because it incentivizes collaboration. According to Wessner, a strong innovation ecosystem will incentivize the “complex inter-linkages among a variety of participants in an innovation economy … including individual entrepreneurs, as well as corporate actors such as large businesses and universities.”[39] The U.S. Bayh-Dole Act does this. The act incentivizes “the technology transfer from university to industries and enables entities to apply patents based on research funded by the federal government and to license them to the third party.”[40] In other words, the United States promotes an environment wherein universities, start-ups, and large firms can collaborate to develop novel products and processes that benefit society. Indeed, the strong U.S. innovation ecosystem is working and has resulted in university patents increasing “from about 5,000 patents in 1995 to more than 20,000 in 2015 … Licensing income increased from less than $600 million in 1995 to almost $2 billion in 2015 … The number of start-ups formed using university inventions more than quadrupled during the same period, from less than 200 in 1995 to more than 900 in 2015.”[41]

The innovation ecosystem also provides entrepreneurs with the means to successfully enter, with its strong venture capital sector, and exit, either from the acquisition from a larger firm or initial public offerings. According to Aleisa, venture capital firms invest in nations with a large market size and vast exit opportunities.[42] As a result, the Startup Genome report finds that North America’s total seed and Series A funding in tech start-ups is valued at $139 billion.[43] And of that $139 billion, at least $92 billion comes from five innovation ecosystems in the United States.[44] The top five ecosystems by venture capital funding per capita are also in the United States.[45] Moreover, the exit value of tech start-ups in North America is also the highest, worth $1.8 trillion.[46] Of that, the United States accounts for at least $1.36 trillion, meaning the United States has the highest tech start-up exit value globally.[47] In other words, the United States has a robust innovation ecosystem that fosters SRI firms.

More specifically, the vast majority of the world’s SRI biopharma firms are headquartered in the United States because it has an innovation ecosystem with substantial exit opportunities, venture capital, and supportive innovation clusters. Richard Gilbert believes that “some firms are motivated to invest in R&D by the prospect of a buy-out. Venture capitalists invest in many high-tech start-ups with the expectation that, if successful, they will be sold to established companies. The pharmaceutical industry alone witnessed more than 1,200 mergers and acquisitions in the years 2014–2016, totaling more than $750 billion in aggregate total deal value.”[48] A more recent PwC study finds that 231 pharmaceutical and life sciences companies were acquired from mid-2022 to mid-2023; collectively, these deals were valued at 213.4 billion.[49] In other words, the United States’ robust biopharma sector with large pharmaceutical companies creates “demands for new technologies” that incentivize smaller firms to develop in the economy.[50]

The United States is also home to biotech clusters, providing innovation incentives and support to SRI firms.

Moreover, the large companies in the U.S. biotech and pharmaceutical sector provide small firms, particularly start-ups, with more venture capital. According to Dushnitsky, corporate investors, or incumbent firms in an industry that take “equity stakes” in a start-up, are an essential alternative to independent venture capital investors, or those “partnerships that seek purely financial returns.”[51] And H.D. Park and Steensma found that start-ups with corporate venture capital backing also raise a company’s chance of survival and success in innovation.[52] In other words, a strong sector with multiple large incumbent firms interested in R&D and that can provide corporate venture capital is necessary to support SRI firms’ research activities and survival. Indeed, Agrawal has asserted that there is “a large innovation premium in regions where numerous small labs coexist with at least one large lab, compared with regions of a similar size without many small labs or a large lab.”[53] And the U.S. biotech and pharmaceutical sector is one of the largest in the world, with 55 percent of the globe’s firms conducting R&D headquartered in the country, according to the EU R&D 2,500 Scoreboard, meaning it provides vast venture capital opportunities for small firms.[54]

In addition, the United States is also home to biotech clusters, providing innovation incentives and support to SRI firms. According to Ayano, “[T]he Greater Boston area is a place where universities, high tech companies, and startups (especially in biopharmaceutical industries) have accumulated, and it is one of the U.S.’s top two biotech clusters, along with the San Francisco Bay Area. Thus, an innovation and startup ecosystem has formed in this area.”[55] These biopharma ecosystems provide incentives to help small firms thrive. According to another research study, “In addition to the federal grants, Massachusetts states also provide other incentives to biotech industries. In 2008, the state made a $1 billion, ten-year commitment to the life sciences industries.”[56] This commitment, known as the Massachusetts Life Sciences Initiative, provided discretionary investments (e.g., grants for researchers), capital investments, and tax incentives for the sector, fostering innovative SRI firms.[57] Taken together, the United States has a strong innovation ecosystem that supports the “diverse community of actors participating in the drug development process … including research institutions, academic spinoffs, contract research organizations (CRO), biotech firms, big Pharmas, public institutions, venture capitalists and business angels,” while also fostering the development of SRI firms.[58]

As a result of the robust innovation ecosystem, especially for the biopharma industry, the United States hosts the majority of SRI biopharma firms that drive the sector’s innovation and growth while also ensuring the nation’s leadership in the sector.

Policy Recommendations

The key challenge for these U.S. innovation incubator firms is that their promise of revenue is in the future while their costs are in the present. And the U.S. tax code is not designed for such firms, despite their contributions to the nation’s innovation and competitiveness. There are four changes Congress should make.

First, Congress should pass, and the president should sign, the American Innovation and Job Act (S.866) to incentivize SRI biotechnology and pharmaceutical firms to continue investing in R&D. The legislation would expand R&D tax credits for start-ups and small businesses, incentivizing them to invest in more R&D. Some of the key provisions of the bill include 1) immediately doubling the credit limitation for small businesses’ payroll tax offset to $500,000 and further raising it $750,000 over 10 years, 2) increasing the gross receipts from $5 million to $15 million for companies using the R&D tax credits against social security tax, and 3) increasing the payroll tax offset from 5 years to 8 years.[59] These key provisions and others in the bill are essential to reducing the expenses SRI biotech and pharmaceutical firms face, boosting their willingness to spend more on R&D.

Policymakers should amend the provision in the Tax Cuts and Jobs Act that forces businesses to capitalize and amortize their section 174 R&D expenses over five years instead of allowing them to deduct their expenses in the year incurred.

Congress should also reform the tax code to help bridge the funding gap from drug discovery to market approval, or the valley of death. Policymakers should amend section 469 of the tax code so that passive investors are allowed to take advantage of the net operating losses and research tax credits.[60] This would enable investors to use their share of net operating losses and other credits on R&D, incentivizing more investors to fund small biotech and pharmaceutical companies in each phase of the drug development process while also increasing the sector’s R&D spending.[61]

Moreover, policymakers should amend section 382 of the tax code to allow small companies to carry their net operating losses forward even as they attract new investors.[62] Section 382 stipulates that “the taxable income of a loss corporation for a year following an ownership change that may be offset by pre-change losses cannot exceed the section 382 limitation for such year.”[63] In other words, section 382 limits the use of net operating losses and credits to offset taxable income when a company’s ownership or 5 percent of shareholders changes.[64] Yet, this provision fails to consider that SRI biotech and pharmaceutical companies rely heavily on outside funding from different sources. As a result, amending this section of the tax code would only reduce the losses these firms experience while increasing their cash flow for drug R&D activities.

Amending the tax code and supporting the American Innovation and Jobs Act is a key step Congress can take to help improve the emergence and survival of start-up biopharmaceutical companies that contribute to the innovation of new drugs.

Lastly, policymakers should amend the provision in the Tax Cuts and Jobs Act that forces businesses to capitalize and amortize their section 174 R&D expenses over five years instead of allowing them to deduct their expenses in the year incurred. This is harmful to SRI biopharma firms, especially ones that are making a profit, because it means they will be paying higher taxes in earlier years, thereby harming their chances of survival.

In short, amending the tax code and supporting the American Innovation and Jobs Act is a key step Congress can take to help improve the emergence and survival of start-up biopharmaceutical companies that contribute to the innovation of new drugs. These new drugs will promote a more competitive sector, and in turn, a more competitive sector will increase venture capital funding that incentivizes the formation of these SRI firms. In other words, the survival of SRI biotech and pharmaceutical firms will boost the sector’s competitiveness, playing a pivotal role in U.S. biopharma international leadership.

Conclusion

SRI biotechnology and pharmaceutical firms are key contributors to the R&D of novel drugs and, subsequently, U.S. global competitiveness in the sector. Using the EU R&D 2,500 Scoreboard, which lists the top 2,500 companies with the highest R&D spending, our report finds that the majority of SRI firms are located in the United States because of the nation’s robust innovation ecosystem. Of the SRI firms globally, the majority are found in the biopharma sector. And of the SRI biopharma firms globally, the majority are in the United States.[65] This is because the United States’ innovation ecosystem provides robust entry and exit opportunities for SRI firms in the sector that are hard to find in other nations. As a result, these U.S. SRI biopharma firms contributed 18 percent to the U.S. biopharma R&D spending in 2021. Moreover, when adjusted for firm size, these U.S. firms also spent more on R&D than did larger U.S. biopharma firms. In other words, U.S. biopharma leadership and competitiveness depend on the development and survival of these firms.

Policymakers need to support the American Innovation and Jobs Act and reform the tax code to incentivize these firms to continue their R&D efforts while simultaneously reducing the expenses these firms face so they do not succumb to the valley of death. Failing to do so would diminish the new drugs available in the future and weaken the U.S. biopharma sector’s competitiveness.

Appendix

Although some small firms in the pharmaceutical sector may not report their R&D spending, sales, or profits, the Scoreboard represents 90 percent of the globe’s private R&D expenditures, meaning the dataset will still provide insight into SRI biotech and pharmaceutical firms’ R&D spending, location, and profitability.[66]

It should be noted that the Scoreboard does not specify where each firm locates its R&D activities.[67] Therefore, R&D spending by U.S. firms is not solely for R&D activities taking place within the United States.

Acknowledgments

The author would like to thank Robert D. Atkinson for his guidance on this report. Any errors or omissions are the author’s responsibility alone.

About the Author

Trelysa Long is a policy analyst for antitrust policy with ITIF’s Schumpeter Project on Competition Policy. She was previously an economic policy intern with the U.S. Chamber of Commerce. She earned her bachelor’s degree in economics and political science from the University of California, Irvine.

About ITIF

The Information Technology and Innovation Foundation (ITIF) is an independent 501(c)(3) nonprofit, nonpartisan research and educational institute that has been recognized repeatedly as the world’s leading think tank for science and technology policy. Its mission is to formulate, evaluate, and promote policy solutions that accelerate innovation and boost productivity to spur growth, opportunity, and progress. For more information, visit itif.org/about.

Endnotes

[1]. Stephen Ezell, “Ensuring U.S. Biopharmaceutical Competitiveness” (ITIF, July 2020), https://www2.itif.org/2020-biopharma-competitiveness.pdf.

[2]. Richard Thakor et al., “Just how good an investment is the biopharmaceutical sector?” Nature Biotechnology 35 (2017), https://www.nature.com/articles/nbt.4023.

[3]. Brian Miller, “Financing the ‘Valley of Death’: An evaluation of incentive schemes for global health businesses” (research paper, Harvard-MIT Division of Health Sciences and Technology, June 2009), https://dspace.mit.edu/handle/1721.1/54591; Christopher Calhoun, “Escaping the ‘Valley of Death’: The Funding Process for Biotechnology Companies,” PharmaExec.com, January 4, 2022, https://www.pharmexec.com/view/escaping-the-valley-of-death-the-funding-process-for-biotechnology-companies.

[4]. Francesco Calza et al., “Moving drug discoveries beyond the valley of death: the role of innovation ecosystems,” European Journal of Innovation Management 24, no. 4 (2021), https://www.emerald.com/insight/content/doi/10.1108/EJIM-11-2019-0342/full/pdf?title=moving-drug-discoveries-beyond-the-valley-of-death-the-role-of-innovation-ecosystems.

[5]. Ibid.

[6]. European Commission, EU Industrial R&D Investment Scoreboard (World 2500) (R&D spending, sales, profit, capex, and profits for top 2,500 companies for 2021, accessed April 20, 2023), https://iri.jrc.ec.europa.eu/data; International Monetary Fund, Representative Exchange Rate for Selected Currencies for January 2012, 2017, and 2021 (exchange rate for euros to U.S. dollars, accessed April 20, 2023), https://www.imf.org/external/np/fin/data/rms_mth.aspx?SelectDate=2021-01-31&reportType=REP.

[7]. Ibid.

[8]. Ibid.

[9]. Ibid.

[10]. Ibid.

[11]. Ibid.

[12]. Robin Robinson, “Small Pharma Driving Big Pharma Innovation,” Pharma Voice, January 1, 2020, https://www.pharmavoice.com/news/2020-01-pharma-innovation/612330/.

[13]. Ibid.

[14]. Mosab Hammouden, Joshua Krieger, and Jiajie Xu, “Dusting Off the Old Ones: Drug Licensing to Startups, Innovation Success and Efficiency” (research paper, California State University, Fullerton, 2023), https://tippie.uiowa.edu/sites/tippie.uiowa.edu/files/2023-03/Dusting%20Off%20the%20Old%20Ones_HammoudehKriegerXu_2022.pdf.

[15]. Ibid.

[16]. European Commission, EU Industrial R&D Investment Scoreboard (World 2500), op. cit.; International Monetary Fund, op. cit.

[17]. Ibid.

[18]. Ibid.

[19]. Ibid.

[20]. Matthew Higgins, “The Outsourcing of R&D through Acquisitions in the Pharmaceutical Industry,” Journal of Financial Economics 80, no. 2 (2006), https://www.researchgate.net/publication/222794739_The_Outsourcing_of_RD_through_Acquisitions_in_the_Pharmaceutical_Industry.

[21]. Ibid.

[22]. “Deloitte’s 13th Annual Pharmaceutical innovation Report: Pharma R&D Return on Investment Falls in Post-Pandemic Market,” press release, February 8, 2023, https://www2.deloitte.com/us/en/pages/about-deloitte/articles/press-releases/deloittes-thirteenth-annual-pharmaceutical-innovation-report-pharma-r-and-d-return-on-investment-falls-in-post-pandemic-market.html; Ayano Kagami, “Analysis and Comparison of the Biotech Startup Ecosystem in the United States and Japan” (master’s thesis, Massachusetts Institute of Technology, June 2019), https://dspace.mit.edu/handle/1721.1/122248.

[23]. European Commission, EU Industrial R&D Investment Scoreboard (World 2500), op. cit.; International Monetary Fund, op. cit.

[24]. Ibid.

[25]. Ibid.

[26]. Ibid.

[27]. Ibid.

[28]. Ibid.

[29]. Ibid.

[30]. Ibid.

[31]. Ibid.

[32]. Ibid.

[33]. Ibid.

[34]. Ibid.

[35]. Ibid.

[36]. Startup Genome, “The Global Startup Ecosystem Report 2023: Insights, Rankings & Ecosystem Pages” (industry report, 2023), https://startupgenome.com/article/north-america-insights-rankings-and-ecosystem-pages-1.

[37]. Ibid.

[38]. Ibid.

[39]. Charles Wessner, “Entrepreneurship and the Innovation Ecosystem Policy Lessons from the United States” (chapter in book), https://link.springer.com/content/pdf/10.1007/0-387-23475-6_5.pdf.

[40]. Ayano Kagami, “Analysis and Comparison of the Biotech Startup Ecosystem in the United States and Japan” (master’s thesis, Massachusetts Institute of Technology, June 2019), https://dspace.mit.edu/handle/1721.1/122248.

[41]. Ashish Arora, Sharon Belenzon, and Andrea Patacconi, “A theory of the US innovation ecosystem: evolution and the social value of diversity,” Industrial and Corporate Change 28, no. 2 (2019), https://academic.oup.com/icc/article-abstract/28/2/289/5375424?redirectedFrom=fulltext.

[42]. Eisa Aleisa, “Startup Ecosystems: Study of the ecosystems around the world; Focusing on Silicon Valley, Toronto and Moscow” (academic study, Summer 2012-2013), http://www.janrecker.com/wp-content/uploads/2013/02/20130213_FinalReport_Startup-Ecosystems.pdf.

[43]. Startup Genome, “The Global Startup Ecosystem Report 2023: Regional Insights” (industry report, 2023), https://startupgenome.com/article/regional-insights.

[44]. Startup Genome, “The Global Startup Ecosystem Report 2023: Insights, Rankings & Ecosystem Pages,” op. cit.

[45]. Ibid.

[46]. Startup Genome, “The Global Startup Ecosystem Report 2023: Regional Insights” (industry report, 2023), op. cit.

[47]. Startup Genome, “The Global Startup Ecosystem Report 2023: Insights, Rankings & Ecosystem Pages,” op. cit.

[48]. Richard Gilbert, Innovation Matters: Competition Policy for the High-Technology Economy (MIT Press: MA, 2020), 105.

[49]. “Pharmaceutical and life sciences: US Deals 2023 midyear outlook,” PwC, https://www.pwc.com/us/en/industries/health-industries/library/pharma-life-sciences-deals-outlook.html.

[50]. Ayano Kagami, “Analysis and Comparison of the Biotech Startup Ecosystem in the United States and Japan.”

[51]. Fatima Shuwaikh and Emmanuelle Dubocage, “Access to the Corporate Investors' Complementary Resources: A Leverage for Innovation in Biotech Venture Capital-Backed Companies,” Technological Forecasting and Social Change 175 (February 2022), https://www.sciencedirect.com/science/article/pii/S0040162521008052.

[52]. Ibid.

[53]. Ajay Agrawal et al., “Why are some regions more innovative than others? The role of small firms in the presence of large labs,” Journal of Urban Economics 81 (May 2014), https://www.sciencedirect.com/science/article/abs/pii/S0094119014000266.

[54]. European Commission, EU Industrial R&D Investment Scoreboard (World 2,500).

[55]. Ayano Kagami, “Analysis and Comparison of the Biotech Startup Ecosystem in the United States and Japan” (master’s thesis, Massachusetts Institute of Technology, June 2019), https://dspace.mit.edu/handle/1721.1/122248.

[56]. Ibid.

[57]. Ibid.

[58]. Francesco Calza et al., “Moving drug discoveries beyond the valley of death: the role of innovation ecosystems,” op. cit.

[59]. Jonathan Cardella, “The American Innovation and Jobs Act is Good for Business,” Strike Tax Advisory, https://www.striketax.com/journal/the-american-innovation-and-jobs-act-is-good-for-business; Margaret Hassan, S.866 - American Innovation and Jobs Act (United States Senate, 118th Congress, 2023), https://www.congress.gov/bill/118th-congress/senate-bill/866/text.

[60]. Joe Kennedy, “Tax Proposals Attempt to Bridge the “Valley of Death” for Small Research Firms” (ITIF, March 24, 2015), https://itif.org/publications/2015/03/24/tax-proposals-attempt-bridge-%E2%80%9Cvalley-death%E2%80%9D-small-research-firms/.

[61]. Ibid.

[62]. Ibid.

[63]. Internal Revenue Service, Application of Section 382 To Loss Corporations Whose Instruments Are Acquired By The Treasury Department Under The Capital Purchase Program Pursuant To The Emergency Economic Stabilization Act Of 2008 (Washington DC: United States Internal Revenue Service), https://www.irs.gov/pub/irs-drop/n-08-100.pdf.

[64]. Jennifer Menendez, “Use NOLs and Credits When You Need To: Keep an Eye on IRC Section 382,” Moss Adams, June 11, 2021, https://www.mossadams.com/articles/2021/06/credits-and-nols-under-section-382.

[65]. European Commission, EU Industrial R&D Investment Scoreboard (World 2500), op. cit.; International Monetary Fund, op. cit.

[66]. European Union, EU R&D Scoreboard: The 2014 EU Industrial R&D Investment Scoreboard (Luxembourg: EU, 2014), https://publications.jrc.ec.europa.eu/repository/bitstream/JRC92506/ipts%20jrc%2092506%20%28online%29.pdf; European Union, EU R&D Scoreboard: The 2018 EU industrial R&D Investment Scoreboard (Luxembourg: EU, 2018); European Union, “2021 EU Industrial R&D Investment Scoreboard, European Union, press release, December 17, 2021, https://ec.europa.eu/commission/presscorner/detail/en/IP_21_6599.

[67]. Ibid.

Editors’ Recommendations

July 17, 2023

The Hidden Toll of Drug Price Controls: Fewer New Treatments and Higher Medical Costs for the World

July 16, 2020

Ensuring U.S. Biopharmaceutical Competitiveness

November 22, 2021