International Benchmarking of Countries’ Policies and Programs Supporting SME Manufacturers

An investigation of the programs and policies countries around the world have implemented to boost the productivity, innovation, and competitiveness of SME manufacturers.

Executive Summary

This report builds on ITIF’s recent report The Case for a National Manufacturing Strategy by identifying and analyzing manufacturing support programs and practices for small and medium sized enterprises (SMEs) that have been implemented in ten foreign countries, Argentina, Australia, Austria, Canada, China, Germany, Japan, Korea, Spain, and the United Kingdom (in addition to those of the United States).[1] Specific emphasis is given in the report to Australia, Canada, Germany, Japan, Spain, and the United Kingdom, countries which have created formal agencies, institutions, or programs most like the United States’ Manufacturing Extension Partnership (MEP) program to provide manufacturing extension services to their SME manufacturers (as illustrated in Table ES-1 below).

Table ES-1: Countries’ Manufacturing Support Agencies

|

Country |

Agency |

Centers/Offices |

Staff |

Year Founded |

|

United States |

Manufacturing Extension Partnership (MEP) |

60 State and Regional Centers |

1,300+ |

1988 |

|

Australia |

Enterprise Connect |

12 Centers |

250 |

2008 |

|

Canada |

Industrial Research Assistance Partnership (IRAP) |

150 Offices in 90 Communities |

220 |

1962 |

|

Germany |

Fraunhofer Institutes |

57 Fraunhofer Institutes |

18,000 |

1949 |

|

Germany |

Steinbeis Centers |

750 Steinbeis Centers |

4,600 |

1971 |

|

Japan |

Public Industrial Technology Research Institutes (Kohsetsushi Centers) |

262 Offices (182 Kohsetsushi Centers) |

6,000+ |

1902 |

|

United Kingdom |

Manufacturing Advisory Service (MAS) |

9 Regional Centers |

150 |

2002 |

The report examines program supports in a wide variety of ways, as Table ES-2 illustrates. In particular, the report focuses on the transition many programs have been making from continuous productivity improvements to innovation and growth. As Jayson Myers, President and CEO of Canadian Manufacturers and Exporters, (a national trade association), explains:

Five years ago it was all about lean, quality, Six Sigma, and continuous improvement, but now it is all about innovation and new product development and finding new customers and new markets. A lot of small companies can understand process improvements, but performing research and development, retooling, understanding new customer sensing, designing products for new markets, and understanding standards requirements in global markets are the new challenges.[2]

As evidenced by Table ES-2, the report specifically focuses in on the broad areas of:

Technology acceleration programs and practices including but not limited to:

1. Promoting technology adoption by SMEs;

2. Conducting audits to identify opportunities for improvement in SMEs’ manufacturing and operational processes;

3. Supporting technology transfer, diffusion, and commercialization;

4. Performing research and development (R&D) in direct partnership with SMEs, and/or providing access to research labs; and

5. Engaging SMEs in collaborative research and development and/or technology specific consortia.

For example, staff members at each Kohsetsushi Center in Japan spend up to half their time on research, mainly on applied projects focused toward and often undertaken in direct conjunction with local industries. Small manufacturers often send one or two of their staff members to actually work on Kohsetsushi Center projects, providing opportunities for company research personnel to gain research experience, develop new technical skills, and transfer technology back to their firms. The Kohsetsushi Centers are effectively partnering alongside SME manufacturers to help them research and develop new technologies and products.

Technology acceleration funding mechanisms including:

1. Providing direct research and development grants;

2. Providing loans to scale and grow the enterprise;

3. Providing innovation vouchers to assist SME manufacturers with new product development and innovation efforts; and

4. Funding joint pre-competitive research programs.

Many countries, including Austria, Canada, and Germany, provide innovation vouchers to help jumpstart innovation activities within firms and connect them with researchers at universities or other companies. Seventy percent of countries examined provide innovation-related funding directly to their SME manufacturers (with the United States being one of the few exceptions). Germany has three such models (beyond innovation vouchers) that provide funding for working in consortia, funding for network managers of firm consortia, and funding for single-firm innovation.

Next-generation manufacturing technical assistanceincluding:

1. Providing export assistance and training;

2. Promoting energy-efficient manufacturing practices;

3. Promoting continuous productivity improvement including lean, Six Sigma, and other methods;

4. Providing information about and assistance with acquiring standards and certifications, and

5. Teaching SMEs about the role of design in manufacturing.

Table ES-2: Range of Services Provided by Manufacturing Support Programs[3]

|

Service |

Australia |

Canada |

Germany |

Japan |

UK |

Argentina |

Austria |

China |

Korea |

Spain |

|

|

Promote Technology Adoption by SMEs |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|

Provide Audits of SMEs’ Lean Mfg. & Innovation Processes & Skills |

√ |

√ |

√ |

√ |

√ |

||||||

|

Business Advisers Work Hands-on with SMEs to Improve Manufacturing & Process Techniques |

√ |

√ |

√ |

√ |

√ |

√ |

|||||

|

Support Tech Transfer & Commercialization |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|

Promote Tech/Knowledge Diffusion from Universities |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

|

Perform R&D in Direct Partnership with SMEs |

√ |

√ |

|||||||||

|

Provide Access to Research Labs/Prototyping Facilities |

√ |

√ |

√ |

√ |

√ |

||||||

|

Get SMEs into Mfg./ Technology Consortiums |

√ |

√ |

√ |

||||||||

|

Provide SMEs Direct R&D Funding Grants |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

||||

|

Provide SMEs Loans to Scale/Grow Businesses |

√ |

√ |

√ |

√ |

|||||||

|

Use Innovation Vouchers |

√ |

√ |

√ |

||||||||

|

Fund Joint Pre-Competitive Research Programs |

√ |

||||||||||

|

Teach Innovation & New Product Development Skills |

√ |

√ |

√ |

√ |

√ |

√ |

√ |

||||

|

Provide SMEs Export Assistance and Training[i] |

* |

√ |

* |

√ |

* |

√ |

√ |

* |

√ |

√ |

√ |

|

Promote Energy-Efficient Manufacturing Skills |

√ |

√ |

√ |

√ |

√ |

√ |

|||||

|

Provide Assistance with Standards |

√ |

√ |

√ |

√ |

√ |

||||||

|

Teach Role of Design in Manufacturing |

√ |

√ |

|||||||||

|

Act as Broker to Other SME Support Services |

√ |

√ |

√ |

√ |

√ |

||||||

|

Host Best Practice Events |

√ |

√ |

√ |

√ |

√ |

√ |

* Export Assistance Provided by Countries’ Manufacturing Extension Service

For example, MEP in the United States has had a focus on providing formal mechanisms for coaching innovation skills and has also developed a Web portal called the National Innovation Marketplace to facilitate relationships between those seeking innovations and those developing innovations.

Connections to and for SME manufacturersincluding:

1. use of multi-firm training and conference events so that firms can learn from and network with one another;

2. disseminating best practices to SMEs and intermediary organizations (such as local MEP centers); and

3. brokering products and services not directly delivered to other public (and/or private) resources that can help the firm increase its competitiveness.

For example, the Manufacturing Advisory Service (MAS) program in England brokers a number of services that it does not directly perform to other government service providers, such as providing SMEs support with regard to financial, human resources, marketing, legal, or environmental issues. In the United States, this brokerage can be to another government entity or even a private solutions provider. A common misconception of SME manufacturing support programs is that they duplicate services in the private sector, but in reality, far from supplanting private market advisory services, manufacturing support services tend to help SME manufacturers understand the value of those services and thus actually perform “market-making” for the private sector.[4]

Other areas that are noteworthy but not easily comparable from country to country include the focus on regional competition. For example, the provision of the budget for Japan’s Kohsetsushi Centers by Japan’s regional governments encourages skills and capability-based competition among Japan’s prefectures, incentivizing the prefectures to realize economic growth by helping locally situated businesses grow. Indeed, Japanese prefectures have the attitude that they cannot co-opt a firm from another prefecture; they can only grow their economy from within through superior technology development, transfer, and commercialization. This is in contrast to the “smokestack chasing” more common in the United States, a “race-to-the-bottom” in which states dangle incentives before businesses to induce them to relocate from one state to another. As Kenneth Thomas finds in his book, Investment Incentives and the Global Competition for Capital, U.S. states spend $60 billion a year on smokestack chasing, and only $2–$3 billion on technology development and transfer, an approach markedly different from Japan’s.[5] The Japanese model invests state money in building firm competencies, not in inducing their relocation.

The manufacturing support agencies and programs implemented by a number of countries have achieved unequivocal and substantial economic impact in boosting sales, employment, and growth of their SME manufacturers.

Also, while the report does not focus on the manufacturing and technology workforce at length, it is important to note a model that appears to be working well in different countries. Several German states, including Brandenburg, seek to facilitate the transfer of new knowledge from universities to SMEs by co-financing the placement of recent Ph.D. graduates with SME manufacturers. In Brandenburg’s program, the state covers 50 percent of the cost for an SME manufacturer to employ a recent Ph.D. graduate for up to two years.[6] Australia’s Researchers in Business grants allow businesses to bring a researcher from a university or public research agency into the business to help develop commercial ideas. Australian businesses selected to receive a Researchers in Business grant receive funding for up to 50 percent of salary costs, to a maximum of $53,000, for each placement for between two and twelve months.[7] In a similar program, Canada’s Industrial Research Assistance Program (IRAP) provides direct financial support for Youth Employment in Canadian SMEs, funding up to $30,500 in salary for six to twelve months for recent college or university graduates employed by SMEs. Productivity Alberta organizes mentoring programs in which local MBA students are assigned to local SMEs to identify and to help solve innovation, technical, and scientific challenges in the SMEs by connecting them to resources available at their graduate schools.[8] Likewise, Korea’s Small and Medium Business Administration (SMBA) encourages the linkage of enterprises with technical high schools and junior colleges that produce graduates especially suited to SME requirements.

Funding and Impacts

The report analyzes how robustly countries fund their manufacturing extension services and assesses the different models they use to fund their SME manufacturing support programs. Countries’ funding models range from cost-share models, such as those in the United States and United Kingdom that balance the funding between federal government and businesses (plus local governments in the case of the United States), to the local government model in Japan where each Kohsetsushi Center receives funding from its local prefectural government. Much of Canada’s model includes direct funding to SME manufacturers, and in Germany much of the funding goes to institutions such as universities.

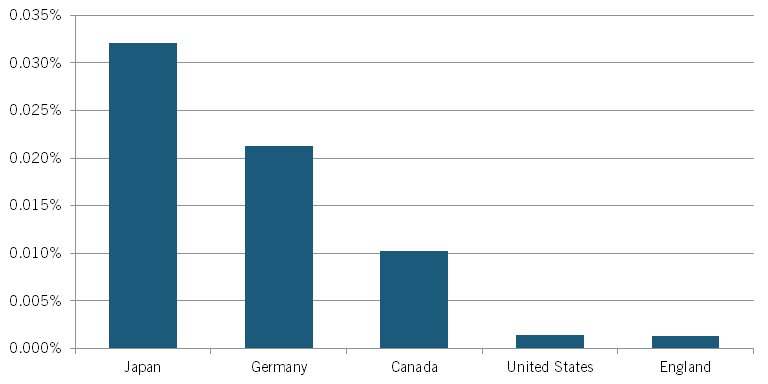

Figure ES-1: Country Investment in Manufacturing Extension Services/Programs as a Percentage of GDP[9]

Overall funding for the United States’ MEP program as a share of U.S. GDP has decreased since 1998. In fact, as a share of GDP, the federal government invested 1.28 times more in MEP in 1998 than it did in 2009. But not only has recent federal funding of the MEP program trailed the historical norm, it has begun to fall significantly behind the levels of funding that competitor countries provide their manufacturing extension services. Figure ES-1 shows countries’ investment in their manufacturing extension service or programs as a percentage of GDP. As a share of GDP, Japan invests thirty times more than the United States, Germany invests over twenty times as much, and Canada almost ten times as much as the United States in their principal SME manufacturing support programs.

Global best practices respond to where the majority of a nation’s SME manufacturers stand with regard to their manufacturing process, technology adoption, R&D, and innovation capabilities; identifies the gaps; and seeks to take firms to the next level.

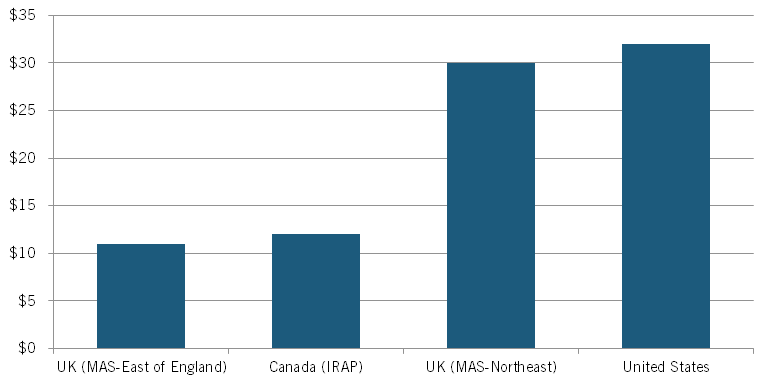

Despite the funding challenges, the MEP program continues to achieve very high level impacts. For instance, for every $1 of federal investment, MEP generates $32 of return in economic growth (see Figure ES-2), translating into $3.6 billion in total new sales annually for U.S. SME manufacturers.[10] (By comparison, the United Kingdom reports that, across their entire Manufacturing Advisory Service program, $1 of investment generates $6 in gross-value added, although specific MAS centers such as MAS Northeast are generating returns comparable to MEP levels). Moreover, client surveys indicate that MEP centers create or retain one manufacturing job for every $1,570 of federal investment, one of the highest job growth returns out of all federal funds.[11] In fact, 2009 impact data show that the MEP program created and retained over 70,000 jobs.

Figure ES-2: Return on $1 Investment in Manufacturing Extension Programs

Overall, this study finds that global best practice in supporting SME manufacturers accomplishes two primary goals. These are:

1. Global best practices respond to where the majority of a nation’s SME manufacturers stand with regard to their manufacturing process, technology adoption, R&D, and innovation capabilities; identifies the gaps; and seeks to take firms to the next level.

2. Global best practices have seen the manufacturing support agencies become the central hub, or delivery mechanism, for a comprehensive suite of services, some of it provided by the agency itself and some of it brokered by others, all designed to boost the competitiveness of SMEs.

Moreover, this study finds that the manufacturing support agencies and programs implemented by a number of countries have achieved unequivocal and substantial economic impact in boosting sales, employment, and growth of their SME manufacturers, and thus having a clear positive impact on broader economic and employment growth in their countries.

In summary, there are many insights that the United States can learn from successful and integrated programs such as those in Canada, Germany and Japan, or even in specific examples in any of the countries examined in this report. Perhaps the strongest of these is that the path of current SME manufacturing support programs towards growth and innovation is validated and substantiated by the fact that every other country has moved in a very similar direction, even if they have started from different points or are serving slightly different markets. Continuous productivity improvements serviced through single organization, point-in-time solutions are necessary but no longer sufficient to the long-term competitiveness of U.S. and world SME manufacturers.

Read the full report. (PDF)

Endnotes

[1]. Stephen Ezell and Robert D. Atkinson, “The Case for a National Manufacturing Strategy (ITIF, April 2011), https://itif.org/publications/2011/04/26/case-national-manufacturing-strategy/.

[2]. Phone interview with Jayson Myers, President and CEO Canadian Manufacturers and Exporters Association, July 5, 2011.

[3]. Indicates documented presence in country of that type of SME manufacturing support service.

[4]. The European Commission, A Study of Business Support Services and Market Failure, July 2002, 6, http://ec.europa.eu/enterprise/newsroom/cf/_getdocument.cfm?doc_id=4160.

[5]. Kenneth Thomas, Investment Incentives and the Global Competition for Capital (New York, Palgrave MacMillan, 2011).

[6]. In-person interviews with Jens Unruh and Susanne Knappe-Kruege, Brandenburg Economic Development Board, May 25, 2011.

[7]. Australian Department of Innovation, Industry, Science and Research, “Our Services,” http://www.enterpriseconnect.gov.au/about/Pages/default.aspx.

[8]. Interview with Lori Schmidt, Senior Director, Productivity Alberta, July 6, 2011.

[9]. Data used in figure is from FY 2010 for Canada, Germany, the United Kingdom, and the United States. Data for Japan is for FY 2009 as this is the most recent year available. The investment of Germany’s federal government in the Fraunhofer Institute and its investment in the Central Innovation Programme (ZIM) is used to calculate the German figure.

[10]. National Institute of Standards and Technology, “The Manufacturing Extension Partnership: Partnering for Manufacturing Innovation and Growth,” June 2011, http://www.nist.gov/mep/upload/MEP-PARTNERING-IMPACTS-FEB2011.pdf.

[11]. Ibid.

Editors’ Recommendations

January 21, 2015